Economic and Political Monthly Roundup

Investment companies | Monthly | January 2023

A collation of recent insights on markets and economies taken from the comments made by chairs and investment managers of investment companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

“Your money is not charity, it’s an investment in the global security and democracy.” – Volodymyr Zelenskyy addressing US Congress

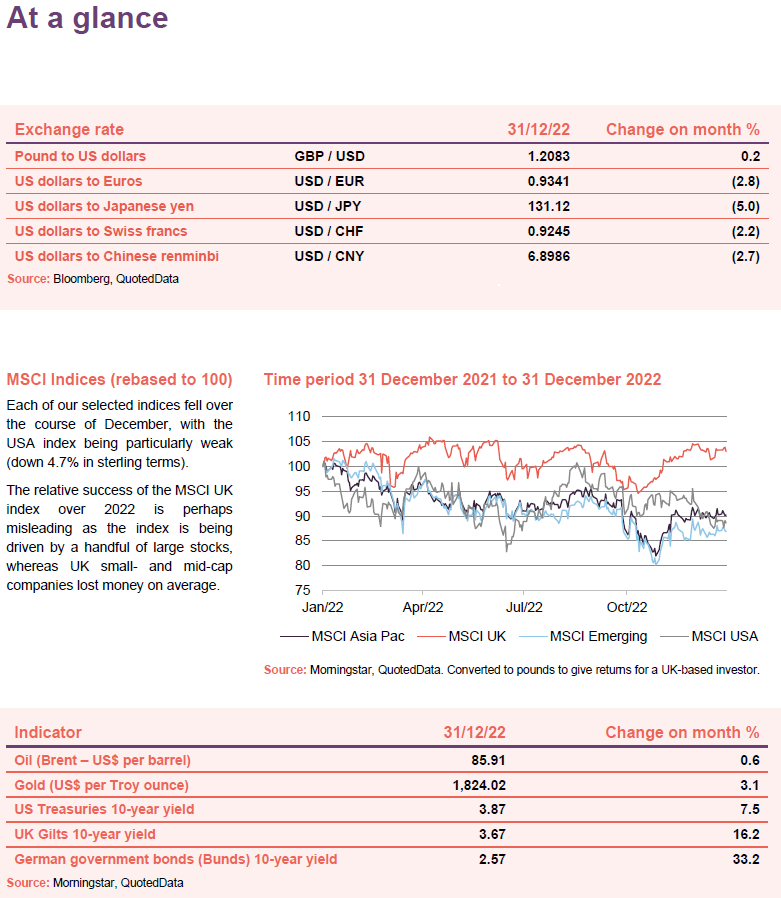

The pace of interest rate rises slowed, but central bankers seemed keen to highlight that more needs to be done to tackle inflation despite a bigger-than-expected fall in the US inflation rate in November. Long bond yields rose (as shown on page 3).

China surprised us by going much further and faster with its abandonment of its zero-COVID policy during December, while trying to pretend that this was not leading to a sharp rise in hospitalisations and deaths. There is thought to have been some impact on the country’s economic output in December.

Japan’s central bank caught markets off-guard when it made an unexpected change to its yield curve control policy (one tool for controlling interest rates). The main effect was a sharp strengthening of the Japanese yen.

China and Russia are said to have been big buyers of gold in recent months, underpinning its price rise. Oil prices were flat over the month.

Global

(compare global and flexible investment funds here, here, here and here)

Davina Walter, chairman, Aberdeen Diversified Income and Growth – 20 December 2022

Markets continue to face considerable risks. These include higher inflation rates fuelling a cost of living crisis, economic recession in major economies, rising interest rates and the Russia/Ukraine conflict showing no resolution in sight. Although markets have adjusted to reflect the likely damage to corporate earnings, there is little good news on the horizon to encourage investors back into the markets. It is encouraging that markets have staged a recovery following the falls witnessed around the year end in September.

. . . . . . . . . . .

The global economy continues to face many headwinds, which is likely to lead to a deeper and earlier global recession than previously forecast. The UK and EU economies are facing a commodity price induced real income squeeze, amplified by central bank actions. We expect interest rate hikes from the US Federal Reserve, the European Central Bank and the Bank of England, as they seek to control inflation. To a degree, markets have already responded to this uncertainty: equity valuations are cheaper and credit spreads wider than they were at the start of the year – as such, many asset classes look more attractive now on a 5-year view. However, the compounding effects of these various shocks will mean that the investment environment will remain volatile and we may see further weakness across asset classes in the shorter-term.

While fundraising has reduced in the second half of the year, there already exists a high level of cash available to be invested in Private Markets (also known as ‘dry powder’). While we expect a lower level of private equity transactions, there will still be competition for quality assets.

Investor appetite for infrastructure remains stable, especially for social and economic infrastructure where there is potential for long-term, inflation-linked contracts providing yield and inflation protection. In addition, as the world goes through the energy transition, demand for climate and renewable infrastructure is ever increasing, remaining supportive of investment opportunities in this space.

In Private Credit, we believe that there will be opportunities for private financing as companies face a slightly tighter lending environment. However, the quality of deals remains crucial, as company earnings are reduced, the ability to cover interest payments is tested, and default levels increase.

Within real estate, residential markets are expected to come under strain with mortgage burdens weighing on consumers. However, a reduction in mortgage affordability will mean that many people will remain in rented accommodation, to the benefit of the Build To Rent sector.

. . . . . . . . . . .

J William Barlow, CEO, Majedie Investments – 19 December 2022

Markets have bounced from the lows in September as investors’ expectations, particularly in the bond market, are beginning to discount the peak of inflation. Central Banks have raised interest rates aggressively and the distortions of the pandemic are easing, particularly in the global supply chain. For equities, earnings expectations have yet to catch up with slowing economic growth forecasts into 2023, but looking into the next five years, the economic background will be different from that which prevailed in the last decade of quantitative easing, low inflation and stagnant nominal GDP Growth. Interest rates will be higher offering an alternative to equities for investors and long duration growth stocks will be less attractive. Careful stock selection based on good fundamental analysis of equities and credit opportunities should offer shareholders good returns.

. . . . . . . . . . .

Peter Ewins, manager, Global Smaller Companies – 12 December 2022

Looking ahead, the near-term prospects for global economic growth have deteriorated due to the impact of tighter monetary policy. As we have seen recently in the UK, some countries are now having to impose tougher fiscal policies to address their budgetary shortfalls. This is feeding through into a poorer prognosis for company earnings into 2023. It’s unclear at this stage how much further interest rates will need to rise and when inflation will fall back to more normal levels around the world, not least due to the complications of the ongoing war in Ukraine. China’s approach to Covid-19 is continuing to create challenges for global supply chains and the local economy, while at the same time leading to social unrest in the country.

While the underlying background for equities is hardly ideal, this is already well recognised. Many share prices have fallen a long way from their peaks, especially in the more cyclical parts of the markets. We think that there are some good opportunities to take advantage of in this environment. In a period where cost pressures will remain in focus, we will continue to closely monitor how the managements of our holdings are faring in addressing these.

. . . . . . . . . . .

James Harries, manager, Securities Trust of Scotland – 5 December 2022

Investors face the unwelcome combination of a weaker economic outlook combined with elevated valuations in equity markets. A widespread repricing of fixed income markets and a less favourable policy backdrop makes for a more challenging environment for equity investment until greater value is apparent.

When returns are plentiful, as they have been for years, the incremental return from income becomes less prized by investors. In more straitened times it becomes valuable once more. This is especially the case for those with irreplaceable capital and seeking a certain return to cover rising day to day expenses without having to dip into capital at times of stress.

. . . . . . . . . . .

Jimmy McCulloch, chairman, Momentum Multi Asset Value Trust – 2 December 2022

Past experience suggests the best strategy when markets are depressed and sentiment is low is to stay invested and rely on diversified portfolios to navigate volatile markets. This enables [you] to capture the recovery that will inevitably come, probably beginning when hopes are at their lowest. History shows that investors tend to over-pay for certainty – or at the least the illusion of it – and under-price uncertainty. In other words, taking considered risk is a good thing and indeed essential to making good returns over time.

. . . . . . . . . . .

UK

(compare UK funds here, here, here and here)

John Dodd, Kartik Kumar, managers, Artemis Alpha – 19 December 2022

Equities are attractive owing to highly depressed valuations and to their inflation-linking. High inflation, interest rates and recession have undermined investor sentiment and equity prices. These forces have depressed most notably UK equities, which have most recently suffered relative to other markets from severe instability in bond markets as a result of government policies.

Appetite for risk capital has fallen sharply. This is most telling from IPO and bond issuance volumes, which have almost entirely dried up. It is also clear from the fall in valuations in early-stage companies and investor sentiment indicators that are close to 2009 lows. Adjusted for inflation, declines have been even greater than they first appear.

The recent series of confusing and negative macro events has diminished the stature of equities, although they have always been and are likely to remain, the best long-term hedge against inflation.

This is because equities are priced in nominal terms and provide owners with a claim on cash flow of productive assets in perpetuity. Over the long-term, this means that the prospective return on equities should be a function of earnings yields (cash generated by the security relative to the price you pay), inflation, and corporate earnings growth, which is a function of real GDP growth.

All crises and recessions are different, but the reaction of asset prices tends to be similar because it is driven by human behaviour which fundamentally does not change. It is at times like these, that it is particularly important to recognise that natural tendencies, such as loss aversion, can be harmful in the field of equity investing. Loss aversion creates a propensity for investors to become more pessimistic in falling markets, even though falling prices mean investing in the future is more attractive.

For all these reasons, we are of the view that prospective returns from equities are very compelling, not only in absolute terms, but especially relative to bonds.

. . . . . . . . . . .

Ashe Windham, chairman, Miton UK Microcap – 13 December 2022

During 2022, global equity valuations have fallen considerably, and in the case of growth stocks from very elevated levels. Whilst UK equity asset valuations have reflected the global trend, generally they started at more modest levels, so UK valuations overall currently stand at even more attractive levels. During Brexit, UK microcaps tended to be overlooked, and since November 2021 have remained out of the limelight suffering a steady downward trend. As I write, it is a source of some comfort to see glimmers of life in microcap stocks, helped by the recent equity rally, which may or may not turn out to be a bear market bounce. Although our stocks are cheap and some might postulate that they are ripe for takeover, I know that it is the managers’ view that, in general terms, the companies in our universe are too small for larger corporates to be bothered going through a great deal of due diligence that a takeover involves. It is more likely that some of our holdings will be able to pick up distressed assets from the receiver or when those companies are in desperate straits. We would rather not lose companies to takeovers when their valuations are so depressed.

The UK stock market, which has a high proportion of stocks generating a cash surplus, is distinct from most other global markets. With the constraint on capital that comes with inflation, the relative strength of UK quoted company balance sheets should be a considerable advantage, especially compared to those with substantial debt burdens. Furthermore, if economic conditions remain unsettled, quoted companies can often rescue many of the jobs in the over-indebted, but otherwise viable businesses by acquiring them debt-free from the receivers given that this yields the full cash payback on their prior investment.

. . . . . . . . . . .

Gervais Williams and Martin Turner, managers, Miton UK Microcap – 13 December 2022

During 2022, inflation was persistent and valuations fell considerably. Even prior to this year, with the uncertainties of Brexit, the valuation of UK equities was already relatively undemanding. Following the share price weakness in 2022, UK microcaps have fallen to what we consider to be exceptionally attractive valuations.

As inflationary pressures peak, investors are starting to look forward to a time when asset values stop falling. Indeed, some are starting to look across the recessionary valley in earnings, to an improving trend some quarters hence.

In our view, the prospects for global recovery still range between a recession that may persist for longer than expected to a scenario where inflationary pressures may have been conquered. Either way, with elevated energy prices and the cost of mortgages rising, in our view consumers, governments and corporates will become much more price sensitive in their purchases and moderate their consumption rate. This implies that profit margins will come under pressure which coupled with limited global growth, will hinder earnings growth.

Whilst this period could be challenging for all businesses, those with over-levered balance sheets, or those making persistent losses, will be at risk of bankruptcy. In contrast, quoted companies tend to have relatively strong balance sheets. Better still, they have the potential to acquire overindebted, but otherwise viable businesses from the receiver, debt-free, at distressed valuations. In our view, these transactions will actively improve the potential for these companies to generate surplus cash at a time when most others are short of capital.

Since mainstream stocks will typically be large compared to the scale of any acquisitions, in general they will only deliver incremental improvements. In contrast, the scale of these acquisitions will often be very significant relative to quoted microcaps, and consequently some will have the potential to generate transformational returns.

In short, in terms of the price/book metric, many UK-quoted microcaps are currently standing at unusually low valuations. And yet, even if economic conditions remain challenging, prospects are expected to be superior to many others. Furthermore, if they make acquisitions at distressed valuations, their returns may be substantially better.

. . . . . . . . . . .

Robert Robertson, chairman, Lowland – 12 December 2022

SmallCap and AIM companies

There are a host of factors which have combined to render this part of the UK market out of favour. Reasons for this include:

- The revenue of companies of this size is far more weighted to the UK than in the case of larger companies.

- The UK market as a whole is trading at a significant discount to other developed equity markets (for example, UK equities were trading at a near 40% discount to the MSCI World Index). The UK’s near pariah status has pertained since before Brexit, and has been confirmed by a succession of ‘events’, the most recent being what can fairly be characterised as political chaos.

- The best performers on the UK market have been broadly among the twenty largest companies, often in commodities businesses which have benefitted from the consequences of Putin’s war.

- In times of nervousness smaller companies are often perceived to be inherently risky and sold off indiscriminately.

Outlook

Despite the UK and other developed economies being blighted by recession and high inflation, we see value in the areas in which we are invested. Investee companies do not generally see downturns in their prospects which would justify their low valuations. While some companies will be hit by unpleasant surprises, by and large we believe that earnings and dividend prospects are not properly priced into the market. It is therefore reasonable, in our view, to look to a recovery in UK valuations and a return to dividend growth.

We are encouraged to see signs of improving sentiment in the mid-cap area, and hopeful that this will permeate down to small-caps.

. . . . . . . . . . .

James Henderson and Laura Foll, managers, Lowland – 12 December 2022

Valuations of companies are guided by the cash flows they are expected to achieve over time. When expectations change, share prices will alter. The movement in the share price can then feed on itself – when a stock price falls, sentiment towards the company can deteriorate leading to a downward spiral of pessimism. This may be happening in the UK with the macroeconomic concerns drowning out an appraisal of individual companies’ prospects, leading investors to question the strengths of even the best. Downturns will create opportunities for the better ones to position themselves to prosper in the next upturn.

During this phase of despondency about the UK it is important to remember it is a place to find innovation, world leading companies and strong management teams.

Companies are dealing with changes in consumer behaviour and advances in technology. Some will not keep pace but the belief is many will prosper and grow. We believe there will be substantial share price appreciation when these strengths come to be more recognised.

. . . . . . . . . . .

Robert Talbut, chairman, Schroder UK Mid Cap – 5 December 2022

The period under review has undoubtedly been a challenging one with sentiment towards the UK deteriorating as global and domestic headwinds strengthened. The prospect of high and sustained inflation, rising interest rates, and a looming recession will undoubtedly present a challenging backdrop at least in the short term for companies, investors, and households looking forwards. Political and policy chaos has only heightened the economic uncertainty. There can be no hiding from the fact that the challenges facing the UK have not been this substantial for many a year. However, out of adversity can come considerable opportunity.

Looking forwards at the prospects for UK mid-caps, there are reasons for optimism despite the turbulent backdrop and recent equity market weakness. Current valuations would suggest that the market has already priced in a lot of the prevailing bad news with small and mid cap stocks having underperformed large caps meaningfully during the period. Valuations remain extremely attractive relative to history.

In addition, M&A activity is likely to continue as overseas firms see opportunity to expand their operations into the UK at extremely attractive valuations with domestically focused mid-caps likely to attract the most attention. Shareholders in many companies will continue to benefit from ongoing share buyback programs as management teams recognise the value in their own shares at current levels and indeed management are also personally buyers of their own company stock.

In short, the Board believes that weakness in the UK mid-cap area over the last twelve months should be seen as presenting attractive investment opportunities over the medium and longer-term.

. . . . . . . . . . .

Jean Roche and Andy Brough, managers, Schroder UK Mid Cap – 5 December 2022

There has been no respite this year as a UK mid cap investor. Companies have seen 1970s-style pressure on supply chains and inflation rates in their cost bases. Investors have responded by adopting a risk off approach, moving into the largest capitalised stocks for “safety”. This has had a disproportionate impact on the SMID area of the market as share prices have sold off aggressively.

We note that three types of market participants seem most willing to take advantage of this opportunity. These are private equity and strategic corporate acquirors, particularly North American ones, management teams via share buybacks, and company directors.

Insider share purchases are becoming more frequent and may be considered a significant indicator of management confidence in their business.

Turning back to the UK economy, the big question is where inflation goes from here and whether unfilled job vacancies outnumbering those actively seeking work translates into rising wage growth. Although energy and food inflation are widely anticipated to ease next year, domestically driven inflation remains a concern. It is notable that the Bank of England now appears to be managing down expectations of further significant rate rises. If this comes to pass, it should help to quieten financial markets. Meanwhile, the consumer will be cushioned to some extent by the government’s energy package and residual excess savings.

. . . . . . . . . . .

Andrew Watkins, chairman, CT UK High Income Trust – 2 December 2022

There is no doubt that we are facing a combination of economic and political challenges which makes any forward-looking statements precarious. It is probably fair to say that, at the very least, the medium-term outlook is wholly dependent on an early resolution to the war in Ukraine.

The consumer is being squeezed from all angles due to global inflation, supply line shortages and rising prices and there is no simple answer. The Government support packages will help on energy prices, but with the Bank of England anxious to make up lost ground in the fight against inflation, interest rates are likely to continue to rise into 2023. This picture makes it very hard to gauge whether we get a soft or hard landing, and whether company earnings’ expectations for 2023 have bottomed, or whether we have more downgrades to come.

. . . . . . . . . . .

Thomas Moore, manager, abrdn Equity Income – 30 November 2022

The global economy is slowing as Central Banks try to control inflation leading to a high risk of recession in the UK and other major countries. This is a challenging backdrop, but we remain confident that we can navigate this environment successfully for the following reasons:

- Broad universe of stocks: As they are starting with high levels of dividend cover, we expect many UK stocks to deliver attractive dividend growth despite the uncertain economic situation. The UK equity market is highly diverse, allowing us to access a wide range of companies with different income drivers. Some companies will struggle in an inflationary environment, but others will thrive. Furthermore, the UK equity market provides exposure to different parts of the world. It seems likely that economic outturns will differ widely in the coming year. For example, the US will be far less affected by the Ukraine war than Germany, as a result of their radically different energy policies

- Tendency of share prices to price in recessions early: Recent research by Stifel has mapped the performance of the S&P 500 index to each US recession post-1945 and found that the stock market bottoms out 4 months before the end of the recession. While it is not possible to know in advance with any certainty when a recession will start or end, this is a reminder that recessions can provide opportunities to buy well-managed companies at attractive valuations.

- Style rotation: Rising interest rates are up-ending stock markets. Loose monetary policy was a boon for highly valued growth stocks, as falling interest rates mechanically drove up their discounted cash flow valuations. As we enter an inflationary era with higher rates, investors are shifting their focus to the cash-generative value stocks that our investment process favours. This is a more favourable environment for us as it enables the delivery of both income and capital growth.

We are aware that the stock market is currently heavily affected by macro drivers and that it is difficult to know how the coming year will play out in that regard. For this reason we have segmented the portfolio into three discrete baskets:

- Inflation Protection: Stocks with inflation hedge characteristics; potentially benefiting from rising prices. We expect inflationary conditions to provide a tailwind to these companies, helping them to grow their cash flows and dividends.

- Mispriced Yield: Stocks whose high yields indicate that the market is pricing in bad news. We believe these stocks are more resilient than their valuation implies.

- Latent Growth: Stocks that are capable of delivering operational progress, driving growth on a medium-term view once the current period of uncertainty abates. This change is being overlooked by the market.

We expect each of these baskets to perform best in different scenarios. Inflation Protection stocks should perform best in an inflationary environment, driven by high commodity prices and rising interest rates. The Mispriced Yield basket should perform best in a rotation out of growth stocks into value stocks. Latent Growth stocks should perform best on any easing in inflationary pressures, perhaps triggered by a resolution to the Ukraine war. We would see the most adverse scenario for the portfolio as a prolonged and synchronised global recession, as this could drive down large swathes of the market. For now we see this as a low probability scenario given the variations in economic conditions around the world.

The UK is a particularly unloved stock market due to a series of political crises since the 2016 Brexit referendum. The scale of the UK’s furlough and energy bill support schemes have caused the UK’s debt/GDP ratio to approach 100%, although it should be noted that this is still the second lowest in the G7. The arrival of Rishi Sunak as the third Prime Minister in as many months heralds an era of more conventional economic policies. This has already calmed the markets, helping to drive a reduction in Gilt yields and a recovery in sterling. Amongst all the political ‘fear and loathing’, it is worth keeping in mind that the UK has many enduring strengths that make it a highly attractive destination for international capital. As has been demonstrated by all the recent M&A activity in our own portfolio, some international investors are coming to the view that UK companies are now attractively priced. It would not take much for broader attitudes to the UK to improve dramatically.

. . . . . . . . . . .

Robert Talbut, chairman, Shires Income – 30 November 2022

Recent months have been challenging for financial markets and there are a number of economic dark clouds impacting the investment outlook, with the Bank of England now predicting a “prolonged recession”. While this is certainly a challenging time for equities, there are reasons to be more constructive. Firstly, a recession is now largely expected by financial markets; and secondly many companies are significantly cheaper than they were at the start of the year. In addition, there are reasons to support a view that we are close to the peak of inflation and interest rate fears, and as these factors moderate, valuations can find support. Hence a time of widespread gloom could well be providing investors with attractive opportunities, and we have already seen signs of this with the strong rally across global equity markets since the middle of October.

In the shorter term, there is the likelihood of continued market turbulence. However, for those willing to take a longer-term view, there are strong supportive arguments that UK equity valuations look attractive. The market is on a multi-year high discount to other developed markets and has a record high yield premium. Furthermore, as the majority of company earnings come from overseas, any earnings downgrades will largely be offset by the currency benefit of weak Sterling. Importantly, from an income perspective the Investment Manager does not consider there to be a material risk of dividend cuts, with the UK distribution ratio at a seven year low. That will compress as earnings expectations likely fall, but there is plenty of headroom for most companies to maintain their dividends. That income should be helpful to many investors in these difficult market conditions.

. . . . . . . . . . .

Jonathan Cartwright, chairman, CT UK Capital and Income – 30 November 2022

The immediate economic, domestic political and geopolitical backgrounds look at least as challenging as anything experienced in the last several decades. In this context, investment markets are necessarily forward looking, worried less by the past, but focusing on how the future will develop. Domestic political stability had largely been taken for granted in the UK and it will be necessary in future to avoid further losses in confidence in the UK as a country in which to carry out business.

Inflation, which is driving the cost-of-living crisis, has arisen from a variety of sources, with each of these perhaps starting to be addressed. Some inflation stemmed from the disruption to supply chains caused by the pandemic and this has been easing. Central Banks have been increasing interest rates and the Bank of England has started to implement some Quantitative Tightening as loose monetary policy is unwound. This will help to reduce some inflationary pressure. Additionally, some indices of energy prices are now lower than in the first half of this year; if this trend continues it will be positive for consumers’ disposable income and also reduce inflation.

Valuation is a further indicator of expectations for future investment returns. The UK equity market has not been popular with international investors for a while, leading to the UK market standing at an undemanding valuation, both in absolute terms and when compared with many international markets. On the plus side the relatively low valuation and attractive dividend yield should give some good protection from current and future uncertainties.

. . . . . . . . . . .

Asia Pacific

(compare Asia Pacific funds here, here and here)

Bronwyn Curtis, chairman, JPMorgan Asian Growth and Income – 15 December 2022

It is difficult to recall a time when the uncertainties permeating global financial markets have been greater or more varied. Yet despite the near-term gloom, Asia’s long-term growth prospects remain bright. With share price valuations now at historical lows in many regional markets, we share the Investment Managers’ excitement about the many opportunities now available to purchase interesting, world-class companies in various sectors across Asia, at particularly attractive prices.

. . . . . . . . . . .

Ayaz Ebrahim and Robert Lloyd, managers, JPMorgan Asian Growth and Income – 15 December 2022

In our view, the past year’s sharp share price declines mean markets across the region now mostly reflect the deterioration in the economic environment and the many uncertainties and risks ahead. This view is supported by current valuations. The MSCI AC Asia ex Japan Index is trading at a price to book ratio of 1.25x, close to the previous historical lows seen in 2008 and 2016, and looking more deeply into the Index’s geographical constituents, valuations in South Korea, Hong Kong and China are also either close to or below their historical lows in price to book terms. India remains the sole market trading above its ten-year historical average valuation levels.

Despite the myriad of near-term uncertainties underpinning current low valuations in many markets, we stand by our conviction that Asian equities continue to provide attractive long-term investment opportunities. From a top-down perspective, Asian countries have large and growing economies, accounting for roughly 40% of the world’s GDP. Major structural and social changes will ensure the region continues to grow rapidly, with domestic demand supported by the increasing prosperity of Asia’s burgeoning middle class. Furthermore, the region is also home to many innovative and dynamic companies that are leading the world in a wide range of industries, including semiconductor manufacturing, healthcare, renewable energy, next generation automotive production and financials.

. . . . . . . . . . .

Donald Workman, chairman, abrdn New Dawn – 13 December 2022

The combination of rising interest rates, the strong US Dollar, currency depreciation and an increasingly fragile global economy will continue to create uncertainty in the months ahead, but Asia is starting from a better position than many developed economies in the West. A number of countries in South-East Asia are recovering after their post-Covid-19 re-opening, which should help to support earnings growth. The resilient performance of the equity markets in India and Indonesia is another source of optimism, and the Investment Manager is also seeing potential signs of recovery in South Korea and Taiwan as the stock markets in those countries recover from significant selling in the technology sector. In China, the economy should benefit from any action taken by the government to address flagging growth, such as further loosening of Covid controls and increasing fiscal support.

Whilst the headwinds experienced in the period are likely to continue to cause market volatility in the short term, it is important to note that this potentially creates some good opportunities to invest at more attractive valuations, and the longer-term advantages of having exposure to growing Asian economies remain very much in place.

. . . . . . . . . . .

James Williams, chairman, Schroder AsiaPacific – 6 December 2022

It would be easy to be pessimistic in view of the current uncertainty seen in markets around the world. There is no question that the global repricing of the cost of capital which has followed increased US interest rates continues to be a headwind. It is unclear when these moves will have had the desired effect on inflation but there are signs that we may be nearing the end of this tightening cycle.

In the past few months share prices have continued to adjust and in many cases now reflect the current economic reality and aggregate valuations for the region are trading at or below long-term averages. It is the case now more than ever that Asian markets will continue to provide opportunities for those who can identify the winners.

. . . . . . . . . . .

Managers, Schroder AsiaPacific – 6 December 2022

Slowing global and weak Chinese growth, elevated geopolitical tensions around Ukraine and Taiwan and rising interest rates, combined with ongoing downward revisions to earnings, mean that headwinds for markets are likely to continue. However, some areas of the markets are starting to look more attractive from a longer term perspective having derated markedly.

Globally, consumption is under pressure as rising prices eat into real incomes. This, allied with the shift away from consumption of goods to consumption of services as the majority of economies open up post-pandemic, has seen the demand for goods falter. This in turn has started to see inventories accumulate across supply chains globally, leading to a fear that we will see a painful period of inventory adjustment on top of an already slowing global economy. From an Asian perspective, this is likely to have an impact on exports and from our portfolio’s perspective is most likely to evidence itself in the technology hardware sector. To an extent, markets have already started to discount this with technology names in both Korea and Taiwan already underperforming despite earnings holding up relatively well for now. In our view, valuations are now starting to factor in a slowdown but not yet a “hard landing” which, although not our base case, is a possibility. In general, the stocks we own in this sector are leaders in their area with high market shares and strong balance sheets on attractive valuations, so in our view should prove to be relatively resilient.

The other trend that the pandemic and Ukraine crisis have reinforced has been the need for increased self sufficiency. The need for diversified supply chains was something that the COVID crisis had highlighted, given the disruption the pandemic caused. With security of supply already a focus in areas such as semiconductor production, thanks to ongoing US-China tensions and the concentration of advanced manufacturing in Taiwan, the Ukraine conflict has also highlighted the vulnerability of nations to energy supply dependency. The recently concluded Party Congress in China saw President Xi mention ‘security’ 91 times in his opening speech (according to Bloomberg) compared with 55 mentions five years ago, reinforcing a view that China will continue to intensify efforts around ‘self sufficiency’ in core technologies and strategic industries. All this will likely lead to further localisation of supply chains and an era of reduced globalisation.

Geopolitics will continue to remain a risk, including surrounding Taiwan as highlighted by the recent visit by Nancy Pelosi to the island, which has resulted in increased tensions between the US and China. Other actions, such as the recent moves by the US to restrict China’s ability to purchase and manufacture high-end semiconductors, combined with the mid-term elections in the US mean it is unlikely we will see any meaningful relaxation in tensions near term and this is likely to continue to weigh on sentiment.

From an Asian perspective the biggest impact on growth is coming from the ‘zero COVID’ policy in China, where the lockdowns have had a severe impact on growth as well as exacerbating the weakness in the property sector. It is not clear how long this policy will remain in place but for now there is unlikely, in our view, to be any major volte-face in the near term. The recent Party Congress gave no indication when the policy might be eased and, whilst vaccination rates in China are high and comparable to most developed nations, a large tranche of the elderly still remain unvaccinated making it difficult for them to open up until this is rectified. Although a wholesale opening up is unlikely near term, it is likely that some more incremental easing measures occur. But in our view, China’s consumption and growth will continue to remain lacklustre as uncertainty over the path of COVID weighs on sentiment.

Given this, we have started to see a number of actions to loosen policy including rate cuts, easing of property purchase restrictions and increases in infrastructure spending and fiscal incentives. We consider it likely that we will see further easing measures but, whilst the ‘zero COVID’ policy remains, their impact for the large part is likely to resemble pushing on a string. Nevertheless, given how poorly the market has performed, together with the move to an easing bias there (whilst most of the rest of the world are tightening), as well as a tentative easing of the severity of lockdowns, there is potential for the market to experience better periods of performance. From our positioning perspective we have been very underweight China for some time and although we continue to look for new opportunities given the falls, we remain so and believe that the challenges that were there for the market remain.

Longer term – although Xi’s confirmation at the Congress as the Party’s General Secretary for his third five year term was not a surprise, the make up of the Politburo Standing Committee (and Politburo) was decidedly one-sided being dominated by Xi loyalists, further cementing his power within the Party. The lack of countervailing voices within the new PSC potentially heightens policy risk and likely means that many of the challenges brought about by increased regulation will persist, with the narrative around areas such as ‘common prosperity’ continuing to weigh on the potential returns of parts of the private sector. All this means one should not necessarily use a mean reversion argument alone when it comes to valuation.

Nearer term, although we are likely to see a stabilisation of the economy, it is hard for it to recover to pre-pandemic growth rates whilst the strict ‘zero COVID’ policy remains in place. The infectious nature of the Omicron variant means it is still likely we will see ongoing rolling restrictions. However, we could start to see a relaxation of some of the ‘zero COVID’ measures after the party congress but these are likely, in our view, to be incremental rather than wholesale. All this continues to mean we look for bottom up stock opportunities in China, consistent with our process, rather than move money into the market on a macro, top-down driven allocation.

India has been one of the best performing markets over the period, due not only to the economy benefiting from a post-COVID recovery, but also to domestic flows into the market in part on optimism about economic prospects following progress on reforms. Whilst on a long term basis the market continues to look attractive, valuations are now at extremes versus the rest of the region, which has led us to temper our position in some of the more domestic orientated names. Historically, the relatively weak external accounts have seen India suffer in a strong US dollar, strong commodity price environment and this could yet see domestic interest rates rise faster than expected, impacting valuations. Given the long term attractions of the market, we would likely use any correction in favoured names to increase positions.

Sector-wise, aside from information technology, financials remain an important overweight. Here banks, in our view, still remain attractive in aggregate on the back of benefits from rising rates and low valuations. However, given the backdrop of rising rates in most markets combined with slowing growth there is a risk that if rates move up faster than expected it could start to impact asset quality, offsetting the benefit of expanding margins, so we remain selective. Underweights are largely found in some of the more ‘defensive’ areas such as utilities, consumer staples and healthcare where valuations are generally, in our view, quite full.

While recent events described above do not paint a particularly optimistic picture, this has in part been reflected in market action with valuations today looking much less frothy than they did a year ago. Nevertheless, the US Federal Reserve being more aggressive on rates near term is clearly a headwind, given its near term impact on growth and earnings. However, this in turn should start to cap long-term inflationary expectations which will pave the way for lower rates at some point in the future. Until then, it is likely that we see further downward revisions to earnings and a period of inventory adjustment amongst companies to reflect the slower growth and hopefully put them in a position to start to grow earnings once more. Given overall aggregate valuations for the region are now trading at or below long-term averages, this does set up a more constructive backdrop for Asian markets next year, barring a global hard landing or a more extreme geopolitical risk event.

. . . . . . . . . . .

Europe

(compare European funds here and here)

Marc van Gelder, chairman, JPMorgan European Discovery – 13 December 2022

Geopolitical tensions, elevated market volatility, and the fastest pace of central bank tightening in decades are meaningful economic headwinds contributing to an unusually uncertain environment at the moment. In Europe, inflation is being acutely felt as the Russia-Ukraine conflict has pushed gas prices to new highs, triggering a cost of living crisis. It seems probable that equity markets will continue to struggle until higher interest rates appear to be working and bringing inflation under control. Nonetheless, European equities continue to trade at a discount to global peers, providing attractive investment opportunities. It is likely that the macroeconomic environment may remain uncertain over the coming months.

. . . . . . . . . . .

Francesco Conte and Edward Greaves, managers, JPMorgan European Discovery – 13 December 2022

We started the year believing (like many market participants) that inflation would prove to be transitory. The sad events in the Ukraine and more recently the lockdowns in China make it highly unlikely that the high levels we are currently seeing will quickly revert to Central Bank targets. The positive aspect of equities, unlike bonds, is that there are companies and sectors that can still perform in inflationary environments and those are the companies which we have been increasingly investing in. For instance, companies with high barriers to entry and pricing power should be able to pass on inflation. Certain areas of insurance combine a positive exposure to rising bond yields and defensive business models. Companies who see demand greatly exceeding their potential to supply, such as the high voltage cable manufacturers, or those companies exposed to the electrification theme, should also find themselves well placed to raise their prices.

While it is difficult to predict when the current inflationary environment will end, historically European smaller companies have been one of the best performing asset classes globally, and we do not see the fundamentals that drove this changing. Innovation has powered smaller companies and will continue to do so long into the future.

. . . . . . . . . . .

Vicky Hastings, chair, Henderson European Focus Trust – 7 December 2022

War in Europe, an acute energy and cost of living crisis, and lingering Covid-related supply chain disruptions have conspired to stoke the fierce inflationary forces we see today, constituting some of the most difficult operating – and therefore investing – conditions in a generation. The European Central Bank, having sought to protect against the worst of the Covid crisis, has been slow to react with tighter monetary policy but is now doing so, with both higher interest rates and the end of quantitative easing. Unlike a year ago, there is no longer talk of whether inflation is transient or structural – markets are now trying to assess how long it will take to get inflation under control, the length and severity of ensuing recessions, how long it will take to get back to long-term ‘core’ targets, and indeed whether these are even still relevant.

In addition to the macro headwinds, rising bond yields have prompted a fundamental reappraisal of valuations hitherto favouring rapidly growing companies. The style rotation we have seen in the leadership of our markets in the last twelve months has been extreme: from ‘growth’ stocks in the latter part of 2021, to ‘value’ stocks in the first half of calendar 2022, through to those with a ‘quality bias’ now that recessionary fears are rising.

While there are many sources for concern for investors, our Fund Managers make a strong case for a European equity market that has to a large extent already priced in a ‘normal’ recession. In the near term there could well be further tumult, not least as central banks test the resilience of the global financial system by reversing over a decade of loose monetary experimentation. But, on any longer-term horizon – for which the closed-end structure is designed – Europe now abounds with opportunities to invest in quality, cash-generative companies, which are able to pass through the scourge of inflation.

Most importantly, if as we think, the price of money does warrant a return to valuations based on realism rather than euphoria, then these investment opportunities come at attractive valuations.

. . . . . . . . . . .

Tom O’Hara and John Bennett, managers, Henderson European Focus Trust – 7 December 2022

The investment landscape does not always develop in the way one, cautiously, argues that it might. Often, it has been our futile lament of the growth style’s dangerous dominance in equity investment; that is, the tendency over the last few years for all things technology, unprofitable and ‘disruptive’ to bulldoze through valuation levels that already made little sense to us. The market saw heroes where we saw literal zeroes. Other times it has been the bemusement at perfectly good companies bestowed with the hallowed ‘bond-proxy’ label, as the market sought a narrative to justify ever-higher multiples. That bemusement has not always been benign, not when it has ultimately forced our hand. Could a style-agnostic, pragmatic, valuation-conscious team of European stock-pickers really own no shares at all in benchmark titans, solely on the basis of valuation? That would be exactly the kind of dogmatic investment approach that we eschew. The pause for reflection then, before once again putting pen to paper, serves to remind us: never dig in.

Inflation is real

This time around we can claim some consistency between what we said last year and what we see today. Inflation has proven to be more durable, as we suspected it might, bringing with it a central bank retreat from the monetary largesse of the past decade. Accordingly, being valuation conscious has served us well relative to a predominantly ‘growthy’ peer group. We believe this should continue to be the case. However, we could not have foreseen the contribution to inflation from Russia’s invasion of Ukraine, nor the aggression with which central banks would then proceed to tighten financials conditions once they finally conceded and retired the ‘transitory’ trope. The global financial system has been forced to go ‘cold turkey’ in monetary rehab, by the very institutions that spent half a generation enabling our growing addiction to cheap money. This combination of factors – representing an unprecedented squeeze on household finances through higher energy, food and finance costs – has largely put paid to the ‘consumer V-shape’ thesis we detailed last year.

People simply will not have the means to let loose in the way we all hoped we would after our long period of enforced confinement.

A responsible reckoning

Most worryingly of all perhaps, ‘ESG by exclusion’ appears to have neglected a primary duty of active management: portfolio construction. The losses inflicted in both bond and equity markets have been severe and highly correlated, such has been the dependence of almost all asset valuations on the continuation of a historically loose and unconventional monetary policy regime. Many ESG-labelled funds have faced a similar performance fate because, in essence, they were ‘growth’ funds with a trendy label. We are not so sure investors were fully aware that such a rate-sensitive risk profile was inherent in their investments. There is also the issue of ‘greenwashing’ – given the regulator’s interest in the activities of many of these funds that purport to be ‘doing good’, we expect this to change. 2022 is therefore likely to prove a pivotal year in the development of responsible investing. We welcome this.

It does not feel excessive to suggest that the war has jolted us all out of this fallacy, whether it is the practitioners who are frantically re-writing their investment policies to allow ownership of oil companies on the basis that they are critical energy enablers (the market-leading share price performance of these stocks in 2022 is surely mere coincidence…), or those passively endorsing the movement because that was simply the way the industry was heading. Asset management is often a fashion industry; growth investing and ESG investing were the future. We take the view that they are now the past, at least in their current guise. Strand 4 of our Investment DNA is ‘believe in cycles’. The cycle that enabled the investing fashions and the many excesses of the last decade – the price of money – has turned.

The era of energy insecurity

We believe there is another profound cycle underway, this one within the oil and gas industry. A lack of upstream investment in oil and gas extraction – for which ESG damnation of these businesses is partially responsible – has tightened the market. OPEC is firmly back in control and its leader, Saudi Arabia, appears committed to protecting a price of $90 per barrel. The European-listed oil companies we hold in size are exceptionally cheap on 15-20% free cash flow yields. This provides us with a significant valuation margin for error, all the more important when the price of money has increased. Of course, this is a sector with a reputation for profligacy. And deservedly so. You don’t have to go back too far in history to find evidence of value-destructive behaviour through misallocations of capital. So, what has changed this time? Through our meetings with the management teams of each of our investee companies, there is a resounding consistency: unwavering capital discipline. Those prodigious free cash flows are largely being delivered directly to shareholders through dividends and buybacks.

The risk of material windfall taxes is limited in our view, as these are globally diversified businesses across many tax jurisdictions. They have little appetite to grow upstream volumes when the stock market doesn’t reward it and when government, media and various climate movements vilify them for doing so. Change is often borne of pain and here we see a strong parallel with the listed mining sector’s transformation over the last six years: near-death experiences, equity raises and dividend cancellations were followed by a period of rapid deleveraging and generous returns to shareholders, a new-found capital discipline that persists even to this day. A cursory glance at the share price chart of any major mining company is sufficient to see just how lucrative that journey has been for shareholders since 2016. Likewise, from the dark days of negative oil prices in 2020 and widespread public condemnation, we believe a new, more disciplined listed oil sector emerges, one which incidentally nurtures globally significant renewable energy portfolios. It is interesting to note that since 2000 the oil sector peaked at almost 14% of the global equity market in 2008, then troughed at 2.5% in 2020. It is currently back to only 5%. As a result of both the monetary cycle and the oil sector cycle, we believe we are in the midst of a multi-year rehabilitation of oil majors within global equity portfolios.

Outlook

There are more reasons than ever to dismiss Europe as a region worthy of equity investment. And dismissed it is. We have never known it to be more disliked than it is now, which is quite a feat. The constraints to doing business we have referenced since the onset of Covid are now even more acute due to Russian aggression next door. Consumers face a tougher set of disposable income choices than they have for decades, with the further possibility of winter blackouts leaving households without heat and power and our industrial complex compromised.

Added to this, we cannot rule out the potential for an accident in a financial system increasingly under stress due to: 1) the speed of retreat from the free money era, and 2) the multiples of debt now in existence compared to the last time interest rates reached these levels. The tantrum caused in UK gilts and sterling by the fiscal ill-discipline of the uniquely short-lived Truss premiership, may well just be a dress rehearsal for something bigger on other shores. It goes without saying that such an event would be bad news for most assets in the short term.

And so, taking a dispassionate view of what is in front of us today, while acknowledging the many short-term tangible and tail risks, we can only conclude one thing: Europe is too cheap. Not all of it, of course, certainly not many of the darlings of the low interest rate paradigm, where investors appear to be in denial as to just how seismic the shift in the valuation regime really is. Muscle memory exerts strong influence in markets and we expect many investors to keep returning to the familiarity of what made them warm and cosy before. Eventually they will learn new behaviours. Where we see opportunity is in the sectors so brutally jettisoned that they already price in a ‘normal’ recession and worse in some cases: quality, cash generative champions across energy, materials and industrials, with strong management teams and, most importantly, pricing power. This latter point is critical for us since we continue to believe inflation will settle at structurally higher rates than pre-Covid, driven by socio-political and geo-political factors; labour will command a bigger share of the economic pie as the Western world ‘onshores’ critical aspects of industrial supply chains, energy included.

Strand 3 of our Investment DNA is ‘believe in change’. We believe we are seeing profound change: in inflation, in the price of money, in the energy complex and ultimately in asset valuation. Europe is not easy to love, but it is not broken. And it is now exceptionally cheap in pockets. The investment trust structure offers shareholders the perfect vehicle to look through the short-term tumult, to the medium-term value that is increasingly on offer. As your Fund Managers, it is our duty to be resolutely focused on that opportunity, regardless of how tempting it is to become intoxicated by the bleakness of current public discourse.

. . . . . . . . . . .

Japan

(compare Japanese funds here and here)

Noel Lamb, chairman, Atlantis Japan Growth – 20 December 2022

We enter the second half of the financial year with domestic demand picking up due to reduced pandemic restrictions and foreign visitor flows booming once more. Inflation is still far lower than other developed markets and there is a growing likelihood of nuclear plant restarting. The Bank of Japan has started the process of monetary policy tightening confirming the end of the depreciation cycle. Against a backdrop of global growth slowing and rates likely to continue to rise for a prolonged period, the Company maintains its focus on growth companies that have a sustainable earnings outlook. Political stability, despite the assassination of the former Prime Minister, Shinzo Abe, has supported continued government focus on the stimulus packages helping drive growth. The Prime Minister, Fumio Kishida, has now been in office for just over a year and continues to focus on the “Kishidanomics” policy of spending on Japan’s digital transformation, domestic infrastructure projects and on tackling the cost-of-living crisis. Pent-up demand is helping to drive consumer spending higher and there have been positive signs of sustained wage price increases filtering through corporate Japan, given the competitive labour recruitment market. Having reopened their economy at a slower pace than other countries, Japan is now seeing a positive impact from inbound tourist and business demand. Whilst the pressures from the 40-year lows on the Japanese yen against the dollar still cause concern, corporate governance changes continue to have a positive effect on driving company share buybacks, rising dividend levels and healthy domestic M&A activity.

. . . . . . . . . . .

The managers, Atlantis Japan Growth – 20 December 2022

With the latest national headline CPI for September at 3.0% YoY – unchanged from August – headline inflation in Japan has been gradually rising, though remains low compared to other developed economies. Moreover, the GDP deflator – – a measure of general inflation in the domestic economy – remains negative. The Bank of Japan appears to be waiting for a broader confirmation of inflation before looking to raise rates.

We saw inbound tourism start to return after entry restrictions eased on 11 October, which was enough to favourably impact monthly same-store trends at department stores and other retailers. While a full return to pre-COVID tourism levels may depend on the increasingly remote expectations of border reopening in China, the weak currency is clearly having an impact on Japan’s attraction as a destination.

While a shortage of workers in the hospitality industry may constrain capacity in the short term, this does bode well for employment. The September job offers to applicants ratio increased from 1.32x in August to 1.35x, and retail sales (also in September) rose 4.5% YoY compared to the prior month’s 4.1%. The Kishida government has also announced a fresh economic stimulus package worth JPY 39tn to help offset the impact of the weaker yen and rising prices of imports, particularly for energy. We remain encouraged with the outlook for the Japanese domestic economy and corporate earnings.

Although inflation remains the key concern, we note that many commodity prices are now lower than their peak earlier in the year. The recent bounce in markets and in the Japanese yen, triggered by a more moderate print for US inflation, suggests that the weight of market expectations remains to the downside as participants start discounting weak global growth.

Japan’s underlying economic and corporate fundamentals remain attractive. Japanese companies are cash rich, allowing continued improvement in shareholder returns, and have significantly reduced costs and increased operational efficiency during the COVID pandemic. Valuations are also relatively attractive in Japan with the Topix Prime Index forward PER on 13.3x, PBR on 1.15x and an average weighted dividend yield of 2.56% as of 31 October.

. . . . . . . . . . .

Nicholas Weindling and Miyako Urabe, managers, JPMorgan Japanese – 13 December 2022

The portfolio is constructed entirely on a stock-by-stock basis as we seek out the best, most attractive companies. Nonetheless, certain themes tend to underpin our investment decisions. In fact, COVID-19 accelerated several tech-based trends in which we were already invested, strengthening the appeal of sectors such as online shopping and gaming and cloud computing. However, Japan remains well behind most other advanced economies in these and many other areas, leaving plenty of scope for such trends to continue developing over the coming years. For example, the penetration of e-commerce within the Japanese retail market is just over 10% and remains much lower than in China, the UK, South Korea or the US.

Standardised cloud-based software for businesses is another digital theme. Historically, many Japanese companies have used internal software solutions, but now that the first generation of software engineers is reaching retirement age, there is an imperative for businesses to switch to standardised software solutions. Japan’s poor demographics will add impetus to this as a structural shift over time.

Deglobalisation is another trend gathering momentum. The pandemic, and subsequent events such as widespread supply chain shortages, the conflict in Ukraine and mounting US/China trade tensions, have increased companies’ desire to move production nearer to end customers. With wage inflation now an issue in the US and other markets, businesses establishing new production plants and warehouses have a stronger incentive to incorporate factory automation into these facilities wherever feasible. Japan is fortunate to be home to some of the world’s leading automation companies.

Even before the outbreak of hostilities in Ukraine, there was already a clear need for Japan, along with many other Asian and European countries, to shift its energy mix away from a heavy reliance on imported fossil fuels. The war only highlighted the need for Japan to speed up its transition to renewable energy sources, and to make faster progress towards realising its commitment to reduce carbon emissions to net zero by 2050.

Japan is only at the beginning of its journey towards digitalisation and renewable energy, but these trends are already spawning many exciting new businesses, especially in the small and mid-cap space. Such growth-oriented companies are set to gather momentum over time and provide resilient, long-term sources of returns for investors.

Outlook

Japan’s near-term economic outlook has improved since our last report. With the vaccine programme having been rolled out effectively, the Government has recently lifted the last of its Covid restrictions and the country is now fully reopened to foreign tourism. Furthermore, exporters will receive a fillip from the yen’s recent depreciation. The yen/dollar rate was c ¥136.9/$ on l December 2022, thanks to the wide disparity between US and Japanese interest rates. While the US has rapidly increased rates, the Bank of Japan (BoJ) has so far maintained an ultra-loose monetary policy stance.

Conversely, the weak yen makes imports more expensive – a particular problem for Japan as it has almost no natural resources, so it must import energy and other commodities. The weaker yen has increased the cost of these imports, adding to price increases triggered by pandemic-related shortages and the war in Ukraine. As a result, inflation has begun to rise in Japan, but remains lower than in most other developed countries.

Despite a tight labour market, wage growth remains low and there has been no significant increase in property rents. While we do not expect these developments yet to elicit any change in BoJ policy, we continually monitor available data and will reappraise our views if circumstances change. In particular, we are aware that policy may shift with the likely appointment of a new BoJ governor next spring.

Improvements in Japan’s corporate governance continue, with more companies focused on improving shareholder returns. The country is in the process of a major technological transformation that should deliver growth and productivity gains over the medium term. Japanese equity markets are more vibrant than some investors appreciate, with many new and interesting listings on the Tokyo Stock Exchange each year.

Thus, Japan offers a strong environment for the kind of dynamic, quality businesses in which we invest and Japan is an attractive market in which to build a differentiated portfolio. This is particularly true for active, bottom-up investors like us, supported by a large, Tokyo-based team of researchers.

We are optimistic about the long-term prospects of our portfolio holdings and will continue our search for exciting companies ‘at the heart of Japan’s new growth’ and those capable of thriving regardless of the near-term macroeconomic environment. Most importantly, we remain confident that our investment approach will ensure the Company continues to deliver outperformance over the long term.

. . . . . . . . . .

Global emerging markets

(compare global emerging markets funds here)

Paul Manduca, chairman, Templeton Emerging Markets – 8 December 2022

It is likely that economic and market turbulence will continue for some time and the risk of further political and economic shocks remains elevated, not least as Russia’s war on Ukraine continues. The effects of high inflation, the resulting increases in interest rates and strains on currency exchange rates are foremost in many investors’ minds. Uncertainties also continue in China where growth and sentiment are being impacted by the continued zero-COVID policy of the government which is currently resulting in widespread social unrest. We will continue to focus on the Chinese government’s “common prosperity” agenda which has potential effects on the profitability of some companies and on overall economic growth. Geopolitical concerns, and particularly relations between China and United States, also remain a key issue.

At the time of writing the value of the US dollar against a basket of other currencies has moved down from the high levels reached in September and equity markets are showing some signs of recovery. Commentators often say that markets attempt to look 12-18 months into the future and it is possible that they are beginning to reflect an eventual economic recovery. Our aim is to produce attractive returns over the long term. Countries making up the emerging markets currently contribute a large proportion of the world’s economic growth, and this appears likely to continue. The markets in which our Investment Manager seeks opportunities have many advantages, including relatively young and growing populations, growing wealth and expanding economies. Further, many of the companies in which we are able to invest are highly innovative, and in some cases have world leading products and are able to leapfrog their competitors in developed markets. Your Board remains optimistic for emerging market equities over the long term.

. . . . . . . . . . .

Audley Twiston-Davies, chairman, BlackRock Frontier Markets – 7 December 2022

Many of the developed markets are experiencing soaring inflation and the spectre of recession. As governments and central banks grapple with the challenges brought about by the COVID-19 pandemic and the effects of the Russia-Ukraine conflict, our diverse and uncorrelated investment universe looks ever more attractive.

We have long extolled the diversification benefits of the frontier markets. This relative economic stability and, in many cases, countries which are in the growth phase of their economic cycles, in our view further strengthens the investment case for exposing an investment portfolio to the frontier markets. We believe that, collectively, these factors and attributes provide the long-term shareholder with a compelling investment opportunity.

. . . . . . . . . . .

Sam Vecht and Emily Fletcher, managers, BlackRock Frontier Markets – 7 December 2022

The world today is a drastically different place from when we last wrote this report. If we gave you two year-on-year inflation figures of 8% and 3% at the start of 2022 and asked you to tag them as Vietnam vs Germany, you would likely laugh at a rather obvious question. Alas, the macro environment today has turned a lot of conventional wisdom and common knowledge on its head. We are seeing most of the developed world edge towards double digit inflation while many emerging and frontier markets generally have trundled along with much more mundane price increases. Whilst the inflation seen across the developed world is the highest in seven decades, the majority of frontier markets are just experiencing a normal economic cycle, a situation that is pretty remarkable.

To understand the impacts of the current high inflation environment, we should split frontier markets into three groups. Firstly, there are a number of countries across frontier markets where inflation remains muted. The meteoric rise in energy prices that we have seen across Europe has not been reflected globally. For many of the countries where we invest, energy prices have seen little change over the past year.

For energy exporting countries, the current boom in energy prices offers them the fiscal resources to support their domestic populations and protect them from the global increases in food and other commodity prices. Inflation in Saudi Arabia is currently at 2.9%, Indonesia at 5.9% and Vietnam at 3.9%. These countries are not currently seeing and are unlikely to see inflation outside their normal expected levels.

Secondly, there are a number of countries which are currently experiencing high inflation. However, in stark contrast to the western world, we have seen governments and central banks take dramatic action to try to bring price levels back under control across these countries. To put this in historical context, in Chile, the policy rate of 10.75% is the highest since 1996 (with the exception of a three month period in 1998). Interest rates in Hungary are at a 19-year high and in Colombia, at a 14-year high. Inflation levels are unprecedented, but so has been the stock market reaction to the extent where we now believe these levels present attractive yield opportunities and could start to drive flows into the region.

There is a third group of countries where inflation is currently very high, policy approaches are either unorthodox or significantly behind the curve and we remain concerned about their future economic trajectory. Luckily these are few and far between within the frontier market universe.

Regionally, the Middle East has been the strongest performer, with Qatar, Saudi Arabia, the United Arab Emirates (UAE) and Kuwait all delivering positive returns. The region has been buoyed by elevated oil prices following Russia’s incursion into Ukraine. The Gulf Cooperation Council region is currently on track to report the highest current account and fiscal account surpluses for nearly a decade.

In contrast, Eastern Europe has had a challenging year. While the year started with optimism about a post COVID-19 recovery and disbursement of EU Recovery funds, Russia’s invasion of Ukraine marked a drastic turn of events for the region. In addition to the tragic loss of life, it has also led to a significant disruption to exports, higher energy prices and import bills, and cast a large cloud of uncertainty over geopolitical stability for the entire continent.

In Southeast Asia, the story is more nuanced. On the one hand, Indonesia and Malaysia have benefited hugely from commodity price strength as well as the accelerating tourism recovery. On the other hand, in Thailand and the Philippines we are concerned that the current high inflation will cause their respective central banks to raise interest rates substantially whilst economic recovery remains relatively weak.

In Latin America, performance has been strong, albeit volatile, given the commodity-heavy nature of the region. Chile has been in the news for constitutional reform for most of this year. It culminated in early September 2022 with voters overwhelmingly rejecting the new changes. We believe this is a positive outcome for the market but expect political noise to continue.

Notes from the road

One of our highlights of the past year was our ability to get back out on the road and meet the management of the companies in which we invest, as well as government officials, economists and other parties with local knowledge.

We travelled to Southeast Asia over the summer. In Indonesia, we see clear activity recovery and a pass-through of higher commodity prices into domestic recovery as well as external accounts. In addition, long-term structural improvements in tax and labour market legislation bolster our positive outlook towards the country. We are also seeing an improvement in foreign direct investment after a long period of underinvestment. In Malaysia, one of the key themes is supply chain recalibration away from China. There is a nascent, but interesting, start-up ecosystem emerging in the country.

On the tourism front, Malaysia has significant room for recovery, particularly if and when China’s borders re-open given China made up 12% of all tourist arrivals in 2019. For Thailand, the outlook has been marred to some degree by inflation, currency weakness, and unorthodox monetary policy. 28% of Thailand’s tourists came from mainland China in 2019 and the lack of recovery has weighed on the country’s economy.

We also travelled to the Middle East, namely Qatar and Kuwait. They continue to be relatively attractive in the current environment of oil price tightness. In August, we travelled far south to Colombia, Peru and Argentina. While we have not had exposure to Argentina for the last few years, we are excited by the work that Argentina is currently undertaking to increase its pipeline capacity for oil exports, seeing a significant increase in export earnings as a game changer for the country.

Most recently, we visited Poland and Hungary. We prefer Hungary on a relative basis. The extent of corrective actions taken by the central bank over the past nine months is unprecedented, with policy rates now a very punchy 18%. We will be watching closely how inflation fares (currently hovering close to 20%) and how they close the fiscal gap. In Poland, valuations are looking very attractive, with the market currently trading at similar levels to where it was in 2003.

We believe that frontier and smaller emerging markets are very well-positioned as global inflation starts to peak out. We have started seeing early lead indicators of this with circa 30%+ decreases in memory chip (DRAM) pricing and shipping freight rates. That said, many countries in the developed world have seen more than two years of excess money creation which is only just starting to drain from the system. That adjustment period still has some ways to go. In contrast, countries in our investment universe have shown commendable fiscal and monetary discipline which creates relative opportunity.

. . . . . . . . . . .

Frances Daley, chairman, Barings Emerging EMEA Opportunities – 7 December 2022

Equity markets are likely to continue to be volatile over the coming months, as investors pay attention to economic growth data and any signs that inflation may be peaking, whilst central banks remain steadfast in raising rates, even as the global economy slows. Whilst our investment region will undoubtedly be impacted by these global trends, there are reasons to be positive.

High energy prices have significantly strengthened the fiscal backdrop across Middle Eastern economies. Many of these countries are now forecast to experience strong economic growth whilst at the same time benefitting from low inflation, a combination that is extremely rare in the current climate.

Similarly, there are a number of exciting stock specific opportunities in South Africa, particularly amongst companies with a role to play in the energy transition as we move towards a greener planet. Inflationary pressures are less severe in the region than in many other parts of the world, and the monetary policy backdrop is stable.

The outlook in Eastern Europe is understandably less rosy, given the proximity of the region to the ongoing conflict. Stock market valuations are largely reflecting a deterioration in investor sentiment, which, over the medium term, may provide good opportunities.

These factors should help contribute to the increasing attractiveness of emerging EMEA equities.

. . . . . . . . . . .

Managers, Barings Emerging EMEA Opportunities – 7 December 2022

Energy Security

Following the events in Ukraine, oil and gas prices have seen significant volatility, with oil rising as high as $120 a barrel before falling back below $100. This has served to push energy security up the agenda, most notably in Europe, which received approximately 40% of its piped natural gas imports from Russia prior to the conflict. This situation has created both areas of concern and opportunity. Eastern European nations reliant on this energy supply are now subject to price pressures in the near term, and face a supply enigma over the medium term as global supply lines are redrawn. We believe this will lead to governments meaningfully reducing their exposure to Russian energy, replacing this supply via significant investment into renewable infrastructure.

Supplying the Green Revolution