Fundamentals shine despite discount

In common with the other funds in the renewable energy sector, the last six months have continued what has been a challenging period for the Bluefield Solar Income Fund (BSIF), with its ongoing fundamental performance (including strong revenue and earnings growth) failing to reverse a steady slide in its shares which began back in May 2023. Despite this, the company has continued to deliver solid NAV growth and market-leading shareholder distributions thanks to a range of contractual arrangements (discussed on page 6) that underpin its assets.

Whilst the falling share price remains frustrating for investors, positively, this does not appear to be a reflection on the company itself, but rather broader macro-economic conditions and negative sentiment surrounding UK companies, the investment companies sector and renewable energy infrastructure in particular. The board has signalled its dissatisfaction with the situation by authorising a £20m share buyback, which is currently underway.

With growth accelerating and a recently announced strategic partnership providing an avenue for the ongoing development of its pipeline, the outlook remains attractive, as does a well-covered dividend yield approaching 9%.

Focus on value accretive renewable investments

BSIF aims to pay shareholders an attractive return, principally in the form of regular sector-leading income distributions, by being invested primarily in solar energy assets located in the UK.

| Domicile | Guernsey |

|---|---|

| Inception date | 12 July 2013 |

| Manager | Bluefield Partners |

| Market cap | 601.4m |

| Shares outstanding (exc. treasury shares) | 607.0m |

| Daily vol. (1-yr. avg.) | 1.05m shares |

| Net gearing1 | 41% |

At a glance

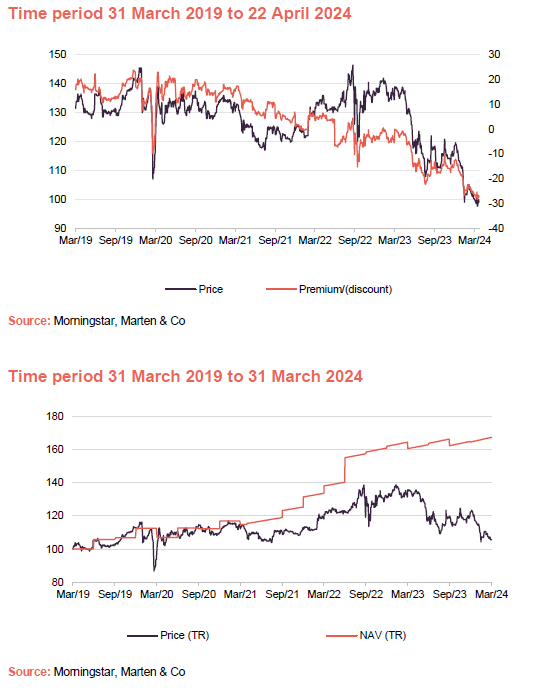

Share price and discount

This is the first period in the company’s history where it has traded at a sustained discount. Early in 2023, a period of positive performance saw shares trade close to par before a sharp decline over the next 12 months resulted in the discount widening to 26% at the time of publishing. The sell-off became particularly steep at the beginning of 2024. Frustratingly, there does not appear to be a particular catalyst driving the recent selloff, with BSIF remaining one of the standout performers in the sector in terms of NAV growth.

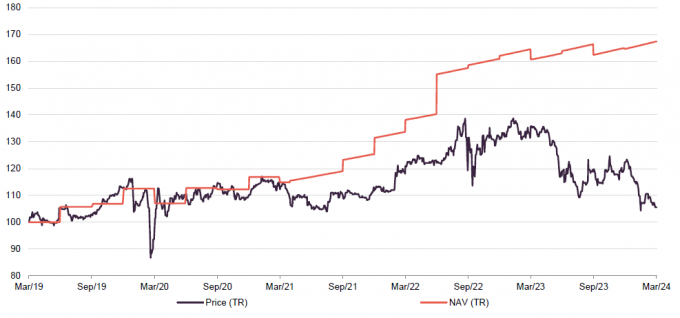

Performance over five years

Many companies in the renewable energy sector reliant on debt financing (which increases their exposure to interest rate volatility) and without sufficient cashflows have seen their share prices fall dramatically, with median sector discounts at one point falling through 30%.

| Financial year ended | Share price total return (%) | NAV total return (%) | Earnings per share (pence) | Dividend per share declared (pence) | Target dividend per share (pence) |

|---|---|---|---|---|---|

| 30/06/2019 | 19.9 | 5.4 | 11.0 | 8.31 | 7.68 |

| 30/06/2020 | 5.1 | 12.8 | 12.0 | 7.90 | 7.90 |

| 30/06/2021 | (4.1) | 3.6 | 11.3 | 8.00 | 8.00 |

| 30/06/2022 | 15.1 | 32.7 | 12.0 | 8.20 | 8.16 |

| 30/06/2023 | (2.5) | 5.6 | 17.7 | 8.60 | 8.40 |

Market Background

BSIF’s share price may be reflecting broader macro-economic conditions and negative sentiment surrounding UK companies and renewable energy infrastructure in particular

As has been exhaustively documented, the renewable energy sector has been a victim of the rapid rise in global interest rates that began back in 2022. At its peak, risk-free returns (essentially the rate earned on secured bank deposits or government debt) climbed above 5%, impacting negatively on the appeal of renewable energy assets, which had traditionally boasted significantly higher yields. Compounding the issue was the rise in discount rates and financing costs, which weighed on the ability to drive capital returns. These dynamics have added to the pain caused by the general underperformance of the entire UK equity market, which has suffered from slowing growth, stubborn inflation, and a lame duck government (exemplified by the ‘mini budget’ debacle). This led to suggestions that the economy may be staring down the barrel of stagflation, which would be close to the worst-case scenario for the Bank of England.

Improving outlook for the UK

For the moment, the fortunes of the renewable energy sector appear tied to those of the broader economy and, given the depth of the economic despair over 2023, it was difficult to see where a positive catalyst might emerge from. However, in recent months we have seen some signs of improvement.

The positive news is headlined by February’s inflation data, which was down sharply, falling to 3.4% from 4.2% the month prior

The positive news is headlined by continued progress on inflation which, after a steep decline in February, fell to 3.2% in March. The reading marking the slowest annual rate since September 2021. Promisingly, the data shows many of the underlying components of the CPI index are also falling including the closely watch service sector figure which typically reflects domestic rather than imported pricing pressures.

Figure 1: UK inflation – CPI

Source: ONS

Promisingly, steady wage growth suggests that we are beginning to see some stability in the labour market, and sustained real earnings (earnings after inflation) should provide a much-needed boost for gross domestic product (GDP). Even so, economic growth remains a concern, and with the ECB (European Central Bank) still at the cyclical high for interest rates, there appears to be considerable headroom to lower interest rates.

With the renewable energy sector one of the worst-affected by the previous rise in rates, it was hoped that any interest rate cuts would result in a sustained uplift. However, despite gilt yields falling by almost 50 basis points (0.5%) from their peak, the share prices of both BSIF and the broader sector have continued to deteriorate. This suggests that there remain other factors at play.

Power Prices

One possible explanation is falling power prices. Despite appearing to undergo a structural resight higher post-COVID, these have retreated from their highs, which has impacted on NAVs as medium to longer-term forecasts are reduced, as shown in Figure 2.

Figure 2: UK baseload power prices

Source: Bloomberg,

However, as we covered in detail in our last note, BSIF has maintained strategies that greatly limit the impact of swings in power prices.

As a recap, BSIF’s strategy is to lock in power sale contracts for individual assets not covered by long-term contracts for periods between 12 and 36 months. This helps to mitigate much of the volatility seen in energy markets, which has become particularly elevated in recent years due to escalating geopolitical tensions and ongoing supply disruptions (given their impacts of supply and demand). Entering 2024, the company had more than 78% of its merchant revenue (power sold into wholesale markets) sold forward to March 2025, with the strategy securing power price fixes at levels that are materially higher than the latest industry forecaster expectations, as highlighted in Figure 3 below:

Figure 3: BSIF’s PPA fixed prices versus average power price forecasts for same period as at 31 December 2023

| Jan 2024£/MWh | Jul 2024£/MWh | Jan 2025£/MWh | Jul 2025£/MWh | |

|---|---|---|---|---|

| BSIF portfolio weighted average contract price (£/MWh) | 170.98 | 147.13 | 158.41 | 136.81 |

| Blended average of independent forecasts | 104.97 | 104.97 | 98.06 | 98.06 |

In addition to its power price management, BSIF also benefits from a range of inflation-linked contracts, which account for almost two-thirds of the company’s revenues. This means that increases in RPI (retail price index) have the effect of boosting both earnings and the valuation of BSIF’s assets. In combination with the company’s price-fixing strategy, this structure provides both the advisors and investors with excellent visibility over BSIF’s medium-term revenues, while providing a hedge against an increasingly uncertain interest rate environment.

The success of these strategies is highlighted in the company’s recent interim results with strong revenue growth and dividend cover well in excess of 2x, consolidating BSIF’s position as one of the more reliable income options for investors in the UK.

It is possible that another potential overhang is the ongoing issues surrounding investment trust cost disclosures, which we have written about in detail on our website. There is currently a campaign to reform these regulations, which, it is hoped, will help improve sentiment towards the entire investment trust sector.

With the UK’s economic outlook steadily improving, and BSIF continuing to execute on its fundamental performance, we believe that current discounts provide a very attractive entry point for a trust that has consistently delivered and appears due for a significant re-rating.

Interim results

As noted, BSIF has continued to generate solid returns despite its falling share price, with the fundamentals of the portfolio as good as they have ever been in the 10-plus years that the fund has been operating. The company’s recent interim results, released on February 28 for the six-month period ending 31 December 2023, show no signs of this momentum slowing, with a number of record returns and a full-year outlook that continues to improve.

BSIF’s headline revenue return was 91.6m, a 17% year on year increase and more than double that of the equivalent period in 2021.

Despite solar irradiation levels, some 13% below those experienced in the second half of calendar 2022, the company’s headline revenue return was £91.6m, a 17% year on year increase and more than double that of the equivalent period in 2021. Total funds available for distribution reached a record high of 70.2m and, as noted, dividend cover is now well in excess of 2x with a total dividend of almost 9%, one of the highest in the sector.

BSIF’s NAV over the six-month period fell slightly from 139.7p at 30 June 2023 to 136.0p at 31 December 2023 with the positive impact of inflation and power price forecasting offset by dividend payments, highlighted in Figure 4.

Figure 4: NAV bridge for 6 months ended 31 December 2023

Source: Bluefield Solar Income Fund

Development pipeline

As we have seen in recent years, the company has also maintained its focus on the build out of its development pipeline, the extent and value of which we believe is significantly underappreciated by the market.

During the second half of 2023, the company secured planning consents on 137MW of solar projects and 90MW of battery projects, while post period end one project of 50MW solar received consent. The wider pipeline grew to approximately 968MW of solar and 563MW of battery storage (with a full breakdown available on page 10 of this report). Of these developments, over 600MW are consented solar sites, with a significant share of this capacity holding valuable 15-year CPI indexed linked contracts.

These investments not only establish a significant growth ramp for BSIF, but also provide the portfolio with considerable financial flexibility. In the event that funding markets remain closed in the near term due to the company’s stubborn discount and broader economic challenges, BSIF has the option to sell some of this pipeline to third parties. With these assets predominantly held at a value that reflects their early stage, such a strategy would likely provide an immediate boost to NAV while generating additional liquidity for the portfolio to either refocus on other developments or pay down debt.

GLIL Infrastructure strategic partnership

Given the challenges present in the current market, the board has been evaluating how best to continue this development programme while maximising value for its shareholders over the long term. Having explored various options, BSIF has announced a strategic partnership with GLIL Infrastructure in December 2023. GLIL is a partnership of UK pension funds that invests into core UK infrastructure and has a £3bn portfolio of infrastructure assets.

The partnership is a significant development and allows BSIF to deliver on a number of key areas. Primarily, it allows the company to maintain its investment momentum in what continues to be a difficult time for public infrastructure funds. The deal also increases the diversification of the company’s revenue base, provides external validation of its assets, reduces debt, and creates additional liquidity for the fund.

The partnership can be broken down into three main phases, the first of which occurred post-period-end in January 2024, with BSIF investing £20m alongside £200m from GLIL to acquire a 247MW portfolio of UK solar assets from Lightsource bp. BSIF’s ownership stake in the portfolio is 9%.

BSIF announced a strategic partnership with GLIL Infrastructure in December 2023

The Lightsource bp portfolio is predominantly diversified across southern and central England and comprises 58 operating sites: 184MW backed by feed in tariff subsidies, 15MW by renewable obligation certificates and two subsidy-free projects totalling 48MW. Through the period 2023 to 2035, the proportion of fixed and regulated revenues from the portfolio is projected to be approximately 80%. The acquisition raises the level of regulated revenues in the BSIF portfolio whilst also increasing the proportion of feed-in-tariff type subsidy (FiT) income. The deal also facilitated a £10m repayment of BSIF’s revolving credit facility, which is discussed on page 16.

Phase 2 comprises a provisional agreement for GLIL to acquire a 50% stake in a portfolio of more than 100MW of BSIF’s existing solar assets, at a price which is in line with the company’s existing valuation. The proceeds of this partial sale will be used in part to fund BSIF’s participation in the rollout of its development pipeline and, as appropriate, to reduce debt. This phase is expected to be completed in the first half of 2024.

In phase 3, Bluefield Solar and GLIL intend via the strategic partnership to commit capital jointly to a selection of the company’s development pipeline, assuming market conditions are supportive. The identified development assets are expected to be grid-connected over the next two to three years.

Altogether, the relationship shapes as an important development at a crucial juncture for BSIF. In an ideal world, the company would have the financial flexibility to develop some of these assets under its own steam. However, this is unrealistic given current conditions, and the agreement appears to be the next best alternative, particularly bearing in mind the time pressures attached to some of the existing consents in BSIF’s pipeline. The deal also removes some of the development risk associated with the pipeline at a time when the industry has been faced with dramatic cost blowouts, while the added financial flexibility should allow the company to achieve keen pricing on any future projects given discounts across the rest of the sector.

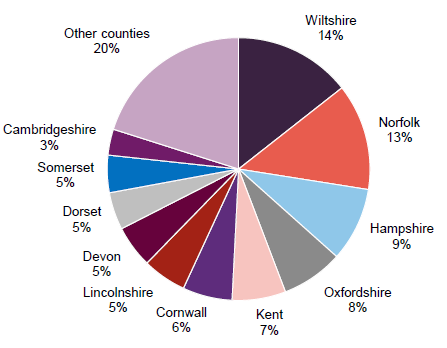

Portfolio

BSIF operational portfolio as of 31 December 2023, consisted of 812.6MW, which was made up of 754.2MW solar and 58.4MW onshore wind. This encompasses 129 solar PV projects (87 large-scale sites, 39 micro-sites and three rooftop sites), six wind farms and 109 single-stick wind turbines, spread across England, Wales, Scotland and Northern Ireland.

During the period to 31 December 2023, the combined solar and wind portfolio generated an aggregated total of 376.05GWh (31 December 2022: 391.8GWh), representing a generation yield of 462.8 MWh/MW (31 December 2022: 511.4MWh/MW)

Figure 5: Revenue by type as at 31 December 2023

Source: Bluefield Solar Income Fund

Figure 6: Technology split as at 31 December 2023

Source: Bluefield Solar Income Fund

Figure 7: Locations of BSIF’s solar plants at 31 December 2023

Source: Bluefield Solar Income Fund, Marten & Co

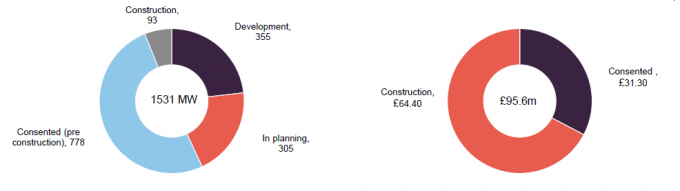

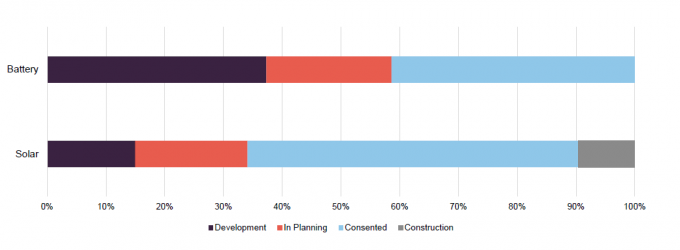

Construction and development pipeline

As discussed, BSIF also maintains a sizeable pipeline of assets. As of 31 December 2023, this stood at a total of 1,531MW, made up of 968MW of solar and 563MW of battery storage. As Figure 8 shows, this is broken down into various stages of development, noting that BSIF has a 5% investment limit in pre-construction development stage activities, of which less than 1% is currently committed.

Figure 9 highlights the current value of the construction projects and consented projects in the BSIF valuation. Currently, no value is attributed to projects without planning consent. Once developments receive planning consent and move from the development stage to pre-construction, the investment adviser believes it is appropriate to reflect this change in the company valuation. At this point in their lifecycle, the projects will have received all the necessary planning consents, land rights and valid grid connection offers and so have discernible value beyond the direct costs of development.

Figure 8: Development pipeline (MW)

Figure 9: Development pipeline value (£m)

Source: Bluefield Solar Income Fund, Marten & Co

Source: Bluefield Solar Income Fund, Marten & Co

Figure 10: Project progress by technology

Source: Bluefield Solar Income Fund, Marten & Co

Performance

Of all the AIC investment trust sectors, renewable energy infrastructure has been one of the hardest-hit by the economic challenges faced by the UK over the last few years. In many cases, a degree of repricing was justified, given the extent of the inflation surge and the ensuing tightening of monetary policy which took place over 2022 and 2023. As we have discussed, many companies in the sector reliant on debt financing and without sufficient cashflows have seen their share prices fall dramatically, with median sector discounts at one point falling through 30%.

For the most part, BSIF had managed to steer clear of the carnage, operating throughout this period with one of the narrowest discounts in the entire sector. This was a clear reflection of the resilience of the portfolio and the ability of its advisors to navigate what has been one of the most challenging and uncertain periods of the company’s 11-year history.

Figure 11: BSIF NAV and share price total return over five years to 31 March 2024

Figure 12: BSIF cumulative total return performance over periods ending 31 March 2024

| 3 months (%) | 6 months (%) | 1 year (%) | 3 years (%) | 5 years (%) | |

|---|---|---|---|---|---|

| BSIF NAV | 1.6 | 3.0 | 4.1 | 45.7 | 67.3 |

| BSIF price return | (13.7) | (11.8) | (22.3) | (6.0) | 5.6 |

| Peer group median NAV | 1.5 | 1.1 | 1.5 | 35.8 | 52.2 |

| Peer group median price | (9.8) | (9.4) | (22.7) | (10.1) | 6.8 |

Little has changed in that regard, and as we have noted, the trust’s fundamentals have remained just as good as ever. Despite this, the discount has continued to widen, particularly since the end of 2023. Frustratingly, there does not appear to be a particular catalyst driving the recent selloff, with BSIF remaining one of the standout performers in the sector in terms of NAV growth. As shown in Figure 12, the company has comfortably outperformed its peer group median over the past 12 months, suggesting again that the recent fall is driven more by market sentiment than any fundamental weakness.

You can access up-to-date information on BSIF and its peers on the QuotedData website.

Peer group comparison

There are now 22 companies that make up the AIC’s renewable energy sector, although we have removed the Asia Energy Impact Trust (formerly Thomas Lloyd Energy Impact) from our analysis, given that its shares were suspended for much of the past year.

Figure 13: AIC renewable energy infrastructure sector comparison table, as at 23 April 2024

| Market cap (£m) | Premium/(discount) (%) | Yield(%) | Ongoing charge (%) | |

|---|---|---|---|---|

| Bluefield Solar Income | 619 | (25.3) | 8.6 | 1.00 |

| Aquila Energy Efficiency | 63 | (32.9) | 8.7 | – |

| Aquila European Renewables Income | 234 | (27.3) | 7.7 | 1.10 |

| Atrato Onsite Energy | 113 | (18.7) | 7.3 | 1.80 |

| Downing Renewables & Infrastructure | 131 | (37.5) | 7.9 | 1.60 |

| Ecofin US Renewables Infrastructure | 58 | (39.3) | 6.7 | 1.80 |

| Foresight Solar | 494 | (28.0) | 8.8 | 1.15 |

| Gore Street Energy Storage Fund | 314 | (43.2) | 12.1 | 1.37 |

| Greencoat Renewables | 843 | (23.8) | 7.9 | 1.18 |

| Greencoat UK Wind | 3248 | (13.6) | 7.1 | 0.92 |

| Gresham House Energy Storage | 262 | (64.8) | 12.0 | 1.18 |

| Harmony Energy Income | 100 | (57.7) | 0.2 | – |

| HydrogenOne Capital Growth | 59 | (55.8) | 0.0 | 2.56 |

| JLEN Environmental | 609 | (22.0) | 8.2 | 1.18 |

| NextEnergy Solar | 441 | (31.0) | 11.2 | 1.06 |

| Octopus Renewables Infrastructure | 399 | (33.7) | 8.5 | 1.16 |

| SDCL Energy Efficiency Income | 640 | (35.2) | 10.6 | 1.02 |

| Renewables Infrastructure Group | 2480 | (22.2) | 7.5 | 1.04 |

| Triple Point Energy Efficiency Infrastructure | 68 | (29.2) | 8.1 | 1.94 |

| US Solar Fund | 121 | (42.2) | 12.5 | 1.39 |

| VH Glob Sustainable Energy Opps | 284 | (40.6) | 8.2 | 1.39 |

| Peer group median | 284 | (32.9) | 8.2 | 1.18 |

| BSIF rank | 5/21 | 6/21 | 8/21 | 2/19 |

Of the remainder, most are focused on solar or wind or some combination of the two; however, there are several more-targeted funds which provide a different risk profile to BSIF. Three focus exclusively on battery storage assets. Three funds are focused on energy efficiency projects. Two funds invest exclusively in US projects, which tend to have long-term PPAs. One invests in hydrogen-related assets and has more of a capital growth focus.

BSIF is a large, liquid fund, offering an attractive yield and one of the most competitive ongoing charges ratios within the peer group.

Figure 14: AIC renewable energy infrastructure sector NAV performance comparison table, periods ending 31 March 2024

| 3 months(%) | 6 months(%) | 1 year(%) | 3 years(%) | 5 years(%) | |

|---|---|---|---|---|---|

| Bluefield Solar Income | 1.6 | 3.0 | 4.1 | 45.7 | 67.3 |

| Aquila Energy Efficiency | (2.6) | (1.3) | (2.0) | n/a | n/a |

| Aquila European Renewables Income | 0.0 | (4.2) | (8.2) | 14.0 | n/a |

| Atrato Onsite Energy | 1.5 | 1.1 | 3.8 | n/a | n/a |

| Downing Renewables & Infrastructure | 1.1 | 2.9 | 7.3 | n/a | n/a |

| Ecofin US Renewables Infrastructure | 2.0 | (5.9) | (7.5) | n/a | n/a |

| Foresight Solar | 1.6 | 3.5 | 1.5 | 55.8 | 48.9 |

| Gore Street Energy Storage Fund | 1.8 | 1.0 | 4.1 | 38.2 | n/a |

| Greencoat Renewables | 0.2 | 0.7 | 4.7 | 35.8 | 46.1 |

| Greencoat UK Wind | 1.6 | 1.8 | 4.3 | 57.6 | 75.6 |

| Gresham House Energy Storage | 0.6 | 1.9 | (2.0) | 59.8 | n/a |

| Harmony Energy Income | (9.3) | (7.2) | (12.2) | n/a | n/a |

| HydrogenOne Capital Growth | 0.0 | 1.5 | 3.0 | n/a | n/a |

| JLEN Environmental | 1.7 | 3.2 | 3.4 | 56.8 | 58.1 |

| NextEnergy Solar | 2.0 | 3.4 | 1.5 | 33.9 | 36.5 |

| Octopus Renewables Infrastructure | 1.4 | 1.8 | 4.0 | 26.9 | n/a |

| Renewables Infrastructure Group | 1.8 | (7.5) | (4.8) | 5.1 | n/a |

| SDCL Energy Efficiency Income | 1.5 | 0.3 | 0.1 | 32.7 | 52.2 |

| Triple Point Energy Efficiency Infrastructure | 1.5 | 0.8 | 1.2 | n/a | n/a |

| US Solar Fund | 2.8 | (7.4) | (13.6) | 5.7 | n/a |

| VH Glob Sustainable Energy Opps | 1.2 | 13.0 | 9.0 | n/a | n/a |

| Peer group median | 1.5 | 1.1 | 1.5 | 35.8 | 52.2 |

| BSIF rank | 7/21 | 5/21 | 5/21 | 5/13 | 3/7 |

As we have highlighted throughout this note, BSIF remains one of the most consistent performers in terms of NAV growth across the entire sector, both long-term and more recently. Notably, the NAV performance has been steady despite the selloff in the company’s shares over the last 12 months, with the discount compounded by the 4.1% NAV return.

Dividend

BSIF pays quarterly dividends. For a given financial year, the first interim dividend is paid in February, with the second, third and fourth interims paid in May, August and October/November respectively (dividends are usually declared the month before payment).

Figure 15: BSIF’s dividend history

Source: Bluefield Solar Income Fund, Marten & Co

In the 2023 financial year, BSIF paid a total of 8.6p, 0.2p ahead of the target dividend following a jump in its underlying earnings. Within its peer group, BSIF has consistently delivered the highest dividend on a pence per share basis (or euro equivalent).

The target dividend for the 2024 financial year (FY24) has been set at not less than 8.8p, an increase of 2.3% on the total dividend for FY23. Whilst this may look like a small uplift in the context of recent adjustments, the existing dividend remains one of the highest in the sector. In addition, given current challenges present in funding markets, there is an obvious long-term benefit to shareholders if BSIF balances underlying and carried earnings between dividend payouts and other uses of capital such as the development of its pipeline. The nature of the current discount also presents an opportunity to buy back shares, which now presents an increasingly attractive option.

Balance sheet

Since its 2013 IPO, BSIF has focused on a simple and deliberate strategy of ensuring, outside of its revolving credit facility (RCF), that all debt within the structure is secured at portfolio level with fixed interest rates on fully amortising terms. As of 31 December 2023, the current average cost of debt is c.3.5% on £410m of long-term borrowings, highlighting that the company continues to be well insulated from today’s higher-interest-rate environment. Notably, whilst BSIF has a modest amount of index-linked debt, it also has significant levels of RPI-linked revenues, leaving the company a net beneficiary of inflation.

At the group balance sheet level, BSIF has access to a £210m revolving credit facility and an uncommitted accordion feature that allows for a further £30m of borrowing. This facility matures in May 2025 and is provided by Lloyds Bank, RBS International, and Santander UK. The cost of this is 190 basis points (1.9%) over SONIA. As at 31 December 2023, the company had drawn £167m from its RCF. This is a reduction of £10m from our last note, which was published in October 2023 following a repayment stemming from the GLIL partnership. It is hoped that further reductions will be possible as the GLIL relationship progresses, as we discuss on page 8.

Fund profile

BSIF is a Guernsey-domiciled sterling fund, with a premium main market listing on the London Stock Exchange (LSE). At launch on 12 July 2013, it focused primarily on acquiring and managing a diversified portfolio of large-scale (utility-scale) UK-based solar energy assets, to generate renewable energy for periods of typically 25 years or longer. BSIF owns and operates one of the UK’s largest diversified portfolios of solar assets, with a combined installed power capacity of 813MWp.

In July 2020, shareholders approved proposals to expand the remit and BSIF began making investments in onshore wind and energy storage projects soon after.

BSIF is designed for investors looking for a high level of income with regular distributions.

Further information regarding BSIF can be found at: www.bluefieldsif.com

BSIF’s primary objective is to deliver to its shareholders stable, long-term sterling income via quarterly dividends. The majority of the group’s revenue streams are regulated and non-correlated to the UK energy market.

The underlying investments are held in special purpose vehicles (SPVs) which, in turn, are held through BSIF’s wholly-owned and UK-domiciled portfolio holding company, Bluefield Renewables 1 Ltd (BR1).

Bluefield Partners LLP – an experienced investment adviser

Bluefield Partners LLP was established in 2009 as an investment adviser to companies and funds investing in solar-energy infrastructure. It has been BSIF’s investment adviser since launch. Its business comprises the investment adviser, an asset manager (Bluefield Services Ltd), a maintenance manager (Bluefield Operations Ltd), a solar project developer (Bluefield Development) and a construction management services division for new build projects (Bluefield Construction Management Ltd).

Disclaimer

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited

. . . . . .

Accuracy of Content:

Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice:

Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty:

No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability:

To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction:

These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

. . . . . .

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.