Protect your investment – get out and vote

On 18 December 2024, CQS Natural Resources Growth and Income (CYN) received a requisition notice from a nominee of Saba Capital Management LP (Saba) requiring it to convene a general meeting for shareholders to consider resolutions proposed by Saba to remove the existing completely-independent board of non-executive directors and replace it with two directors of Saba’s choosing.

On 7 January 2025, CYN’s board issued a comprehensive rebuttal of Saba’s proposals when it published a circular (a formal document sent to shareholders) in relation to the requisitioned meeting – it describes Saba’s proposals as “self-interested and misleading.” The board’s position is very clear – it is unanimous in recommending shareholders vote against Saba’s resolutions.

From the outset, we have cautioned shareholders against giving full control of the trust to one dominant shareholder that would be free to act entirely in its own interests. Saba has made clear its intention to get itself appointed as manager and merge the seven targets into one large vehicle with a mandate to attack other investment companies. The FCA’s (Financial Conduct Authority) Listing Rules make it clear that the board of directors of an investment company must be able to act independently of any investment manager. We are not comfortable that Saba’s proposals meet this requirement.

With so much at stake, we thought we should take a deeper look at Saba’s proposals and CYN’s board’s response to these, to see what the merits are. Our conclusion is that Saba’s plans for CYN are so poor for all shareholders other than itself that its proposals deserve to be voted down comprehensively. We urge all shareholders: protect your investment and get out and vote.

Capital growth and income from mining & resources

CYN aims to provide investors with capital growth and income by investing in a portfolio that predominantly comprises mining and resource equities, as well as mining, resource and industrial fixed-interest securities.

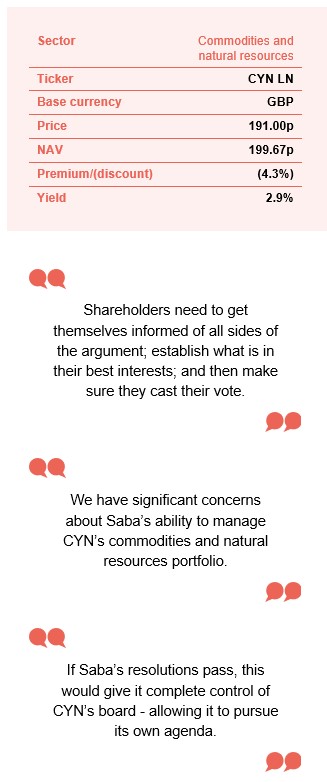

At a glance

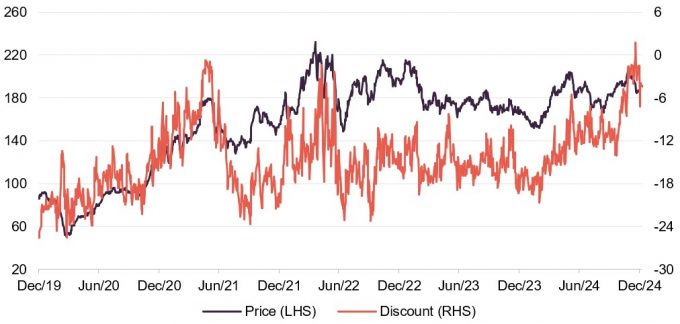

Share price and discount

CYN has recently been trading at discount levels that are narrow in terms of its recent history, likely in part due to Saba’s activities. However, Saba has not achieved meaningful closing of the discounts of the US funds in which it has previously attempted this approach (there is an extensive discussion in CYN’s circular, which we suggest shareholders read) and we would caution shareholders against the risk of getting themselves locked into a fund that Saba controls, that is stuck at an enduring discount, and that Saba has no incentive to rectify as it will be benefitting from investment management fees.

Time period 31 December 2019 to 7 January 2025

Source: Morningstar, Marten & Co

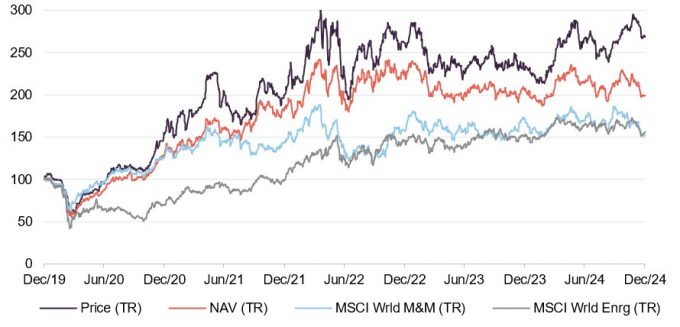

Performance over five years

CYN has shown strong performance, with 167.0% total return in NAV and 220.0% total return in share price since the current joint fund managers were appointed in October 2015 (source: Bloomberg as at 31 December 2024. Manager inception date: 26 October 2015. As we explored in our last note in May 2024, Poised for the starting gun, we believe that the sector is in a very strong position to outperform again, as inflation and interest rates subside. We think that CYN shareholders run the risk of missing out on significant potential upside if Saba’s proposals are approved.

Time period 31 December 2019 to 31 December 2024

Source: Morningstar, Marten & Co

Voting information

In addition to its main website (see link in fund profile section) CYN has set up a website specifically for its shareholders that is dedicated to Saba’s requisition.

We think that shareholders should study its contents before making their voting decisions, particularly the circular that has been issued in relation to the requisition.

This website can be found at: cynprotectyourinvestment.com.

Key dates

- The deadline for returning forms of proxy to the registrar is 11am on 31 January 2025. cynprotectyourinvestment.com has details of all of the ways that shareholders can vote. The website says that, should shareholders have any questions, please contact Craig Cleland (Head of Product Development, Investment Trusts, at Manulife | CQS Investment Management). He can be reached at [email protected].

- Shareholders should note that platform deadlines for voting are likely to be earlier than the 31 January 2025. Any shareholders that hold their shares through platforms should engage with their platform as early as possible to establish the arrangements.

- The Requisitioned General Meeting will be held at 11am on 4 February 2025 at the offices of Dentons UK and Middle East LLP at 1 Fleet Place, London EC4M 7RA.

- CYN’s board has begun a strategic review. It expects to announce the results of this during the current financial year – so no later than 30 June 2025.

Seeking to take full control of CYN’s board

Saba has built a stake in CYN that, at 6 January 2025, was disclosed at 29.07% of CYN’s outstanding share capital. This is above the 5% threshold that allows a shareholder to requisition notice to a company, requiring it to convene a general meeting for all shareholders to consider proposals it has put forward.

Saba proposes to sack all five members of CYN’s existing board and appoint two directors of its choosing.

Saba has requisitioned the meeting to put forward individual resolutions to remove all five members of CYN’s current independent board, followed by resolutions that seek to replace them with two directors of Saba’s choosing – these being Paul Kazarian and Marc Loughlin (brief biographies are provided further on).

If Saba’s resolutions pass, this would give it complete control of CYN’s board – at least in the short term and probably the long term (see below) – allowing it to pursue its own agenda, which may not be in other shareholders’ interests.

It also seems to us that, by aggressively building substantial stakes in the funds it has requisitioned but keeping all of these below 30%, Saba is deliberately skirting around the Takeover Panel rules (regulations governing mergers and acquisitions in the UK) that would require it to launch a bid for one of these funds. Despite not being prepared to launch bids for these trusts, it is nonetheless trying to gain full control of them, which we think is morally questionable.

Plans to appoint more directors offer scant protection

In its statement to fellow shareholders that it issued alongside the requisition notice to CYN on 18 December 2024, Saba said that it intended to appoint one or more further independent directors “as soon as reasonably possible following the Trust’s General Meeting”. We think that this statement, while designed to allay other shareholders’ concerns, offers scant assurances and protections in its current form.

If Saba wants to be CYN’s manager, it should have zero representation on the board.

If Saba plans to make itself the manager, as it has suggested, we are firmly of the view that it should not have any representation on the board, let alone control these boards, even for the briefest of periods. We also think that it would be difficult for external shareholders to hold Saba to this commitment once it has control of the board, and certainly not without expense or with a lag.

We also believe that, if Saba is serious about protecting other shareholders’ interests, these protections should have been built into the foundations of its proposals. The fact that this is not the case is a major red flag for us and we think that external shareholders should, at the very least, vote down the current proposals and make Saba offer improved assurances.

Shareholders should be highly concerned that Saba is trying to force their hands.

We think that, if Saba wanted to legitimately install itself as manager of these funds for the benefit of all shareholders, it could have approached the boards separately and put forward proposals for it to take over the management contracts. All of the funds’ boards would have then considered these proposals on their merits. We think that shareholders should be highly concerned that Saba is trying to force their hands and those of their boards.

Saba is proposing a partially executive board with no independence

Given that Saba has already indicated its intention to appoint itself manager of CYN’s portfolio (see below), we fear that, if Saba’s proposals are successful, these would leave CYN with a tiny board with no real independence of the intended manager and, in an additional retrograde step, at least one executive director in the form of Paul Kazarian.

Saba’s proposals represent a huge leap backwards for CYN in terms of corporate governance.

CYN currently has a completely non-executive board (board members not involved in daily management) and so is much better able to hold a manager to account than one that has executive directors, given the inevitable conflict of interests that result from having representatives of the manager on a board. It is clear to us that Saba’s proposals therefore represent a huge step backwards for CYN in terms of corporate governance (systems to ensure accountability and transparency).

We would also reiterate the point highlighted on the front page that the FCA’s Listing Rules make it clear that the board of directors of an investment company must be able to act independently of any investment manager. Can this realistically be achieved with a two-man board, one of whom works for Saba and the other of whom was nominated by it? In addition, we note that the proposed board clearly fails the FCA’s diversity targets.

Valid concerns regarding experience and commitments of proposed directors

At QuotedData, our view is that the concerns raised by CYN’s board around Saba’s proposed directors’ other commitments, as well as neither of them having any board level experience in relation to UK investment trusts, are valid.

Saba’s offering lacks commodities and natural resources experience

As detailed on both the front page and the fund profile section of this note, CYN is a dedicated commodities and natural resources strategy with a portfolio that is biased towards mid-cap stocks (companies with medium-sized market capitalisations). This is a very specialist investment area that, in our view, benefits from both deep expertise and a robust network in that space. We strongly believe that the existing management team and board can offer CYN these, while noting that they are worryingly absent from Saba’s offering.

Saba’s approach looks opportunistic, and shareholders could forego significant upside.

We note that, in recent years, CYN’s performance has lagged broader markets in an environment where concerns about the macroeconomic outlook have weighed on this very cyclical sector. However, whilst performance has been more challenging during the last couple of years (this followed a period of very strong outperformance for the sector), there have been periods in CYN’s history where its returns have been incredible (high double-digits) and, as we explored in our last note in May 2024, Poised for the starting gun, we believe that the sector is in a very strong position to outperform again, as inflation and interest rates subside.

Distinct danger of throwing the baby out with the bath water with Saba’s proposals.

We think this is particularly true once the attractive valuations on offer are factored in; metals and mining are trading at a 25% discount to broader global equities, while energy is on a 41% discount. CYN, with its focus beyond the large caps, has traditionally performed very strongly in more favourable environments, but we think that it requires the expertise of a specialist commodities and natural resources team. We think there is a serious risk of foregoing significant upside if control is handed over to a generalist US closed-end fund team.

We believe Saba is significantly underestimating the expertise required to manage CYN’s portfolio.

We would also reiterate that CYN offers a markedly different exposure to both ETFs and the major natural resource-focused indices. The biographies provided by Saba for its two proposed directors highlight their ETF experience (alongside their US closed-fund experience) but CYN is not, and does not behave like, an ETF. We think there is a significant concern that Saba is significantly underestimating the expertise required to manage CYN’s portfolio.

Saba’s offering lacks UK investment trust experience

CYN’s board says that “despite Saba’s misleading claims, [the new directors] appear to have no experience of directing investment trusts”. We think this is a fair criticism as, from what we can see, the bulk – if not all – of Paul Kazarian’s and Marc Loughlin’s closed-end-fund experience has been gained in US funds, with nothing in the UK beyond their very recent adventures.

Saba’s nominees experience comes from the US where boards are much more beholden to investment managers.

Our concern is that the US closed-end-fund space is very different to that of the UK, in terms of the regulatory environment, legal requirements, market practice etc. Specifically, the UK market benefits from a higher standard of corporate governance and much greater emphasis on boards protecting the interests of shareholders and holding managers to account. In comparison, the US closed-end-fund market has a tendency for the boards of funds to be much more influenced by, and therefore operate more in the interests of, fund managers.

Saba’s proposals and approach show a deep lack of understanding of the UK investment trust market.

We think that Saba’s proposals that it shrinks the boards of seven funds it has requisitioned to just two directors related to it, exemplifies this lack of understanding, but is not the only example – we would highlight the fact that it was initially slow to disclose the levels of its holdings as they crossed key thresholds, along with submitting an initially-invalid requisition request to Edinburgh Worldwide (this did not include all of its holdings in the that trust) as clear examples of its not understanding the system or its obligations within it.

A real danger of over-boarding

Paul Kazarian has never acted as a director of a UK investment trust, nor as a director of a UK company of any sort.

CYN has pointed out that, according to Companies House records, Paul Kazarian has never acted as a director of a UK investment trust. Neither has he ever acted as a director of a UK company of any sort. If Saba were to be successful in all of its requisition attempts, Paul would find himself on the board of six UK quoted companies very quickly – a clear case of over-boarding – and this would be in addition to the three US-listed funds that Paul is already a director of, as well as his day job of managing Saba’s portfolios. Most voting advisory bodies would consider membership of six UK quoted company boards alone to be a breach of the usual standards of corporate governance.

Who is Paul Kazarian?

Saba describes Paul Kazarian as the principal executive officer of its publicly traded investment trusts. It says that he leads its investment trust and exchange-traded fund strategy and products and has extensive experience as an investment trust director. It adds that Paul is a partner and closed-end fund portfolio manager at Saba and that he serves on the board of trustees of various publicly traded trusts.

Who is Marc Loughlin?

Saba describes Marc Loughlin as an investment and exchange-traded fund expert with nearly three decades of experience on the buy- and sell-side of the sector. He is a director of closed-end fund and exchange-traded fund trading solutions at WallachBeth Capital, a provider of institutional execution services. Marc was also formerly the head of non-standard arbitrage at Société Générale in London, where he spent 13 years, and head of US closed-end fund sales at Canaccord Genuity.

Saba has indicated its intention to appoint itself as manager

Alongside the requestion requests that it issued to CYN and six other trusts on 18 December 2024, Saba published an explanatory statement in connection with its proposals, a copy of which can be found on Saba’s website and in part 3 of the circular published in relation to the requisition (click here to access the circular).

In this statement, Saba says it has a “clear plan” to “deliver substantial liquidity & long-term returns to CYN shareholders”, claiming that it can “deliver greater value for shareholders than could otherwise be realised under the current board and investment manager”. It adds that this will be “alongside the opportunity for greater long-term returns under a new investment strategy and manager”.

Saba set out the key elements of its proposals as follows:

- Offering liquidity events (e.g. tender offers, share buybacks) so all shareholders immediately have the opportunity to receive substantial liquidity near NAV, if they wish.

- Terminating the trust’s current investment management agreement.

- Replacing Manulife | CQS Investment Management as the trust’s current investment manager.

– The newly reconstituted board may select Saba as the new investment manager, considering its strong track record of delivering attractive returns to shareholders.

- Refocusing the trust’s investment mandate on purchasing discounted trusts and/or combining it with other investment trusts, where appropriate, to realise scale benefits and synergies.

Saba also says that, if elected, its new directors “intend to first assess options to provide shareholders the opportunity to achieve substantial liquidity near NAV if they do not wish to remain in the trust with a new manager and mandate”.

Our thoughts on these proposals

- As noted above, we cannot see a valid reason why Saba needs to get rid of the current board to put forward these proposals or even to enact them, if they were in the best interests of all shareholders.

- We also have significant concerns about Saba’s ability to manage CYN’s commodities and natural resources portfolio, but its statement suggests that it has no intention of doing so.

- Instead, Saba says that it will refocus CYN’s investment mandate on purchasing discounted trusts and/or combining it with other investment trusts, where appropriate, to realise scale benefits and synergies (cost and efficiency advantages). This is important, as this is something that Saba has said that it proposes to do with the other trusts it has requisitioned.

- It seems likely that Saba will use its control of the boards of the funds that it is able to secure through its requisitions to merge all of the trusts into one large fund of investment companies.

- It seems to us that the shareholders of the trusts that Saba has requisitioned were looking for quite different things in selecting their investments and that the resultant combination is unlikely to work for all – if any – of these investors.

- We also note a lack of supporting material to suggest that Saba’s fund of investment trust’s strategy will be able to outperform CYN’s existing strategy in the future (the same applies to the other funds that Saba is pursuing), so we think that Saba’s claims that its strategy will outperform are, for now, baseless.

- To achieve its goals, Saba would need to dispose of all of CYN’s current portfolio. We think that, if shareholders want the portfolio to be liquidated, the existing management team is far better placed to achieve this in the most efficient and least value-destructive way for all shareholders.

- We also think that, if CYN shareholders did want to invest in a fund of investment trusts, there are better investment firms with a superior understanding of the UK investment trust market that the trust could award a management contract to – AVI Global Investors, for example.

- We think that Saba’s talk of offering “long-overdue liquidity options” suggests a distinct risk that it sells assets at depressed, cyclically-low valuations, with shareholders missing out on significant potential upside as a result.

- We agree with CYN’s board’s assessment that Saba has not achieved meaningful closing of the discounts of the US funds in which it has previously attempted this approach (there is an extensive discussion in CYN’s circular, which we suggest shareholders read).

- We therefore feel that there is a valid reason for CYN shareholders to be concerned that they could get themselves locked into a fund that Saba controls, that is stuck at an enduring discount, and that Saba has no incentive to rectify as it will be benefitting from investment management fees.

- Saba has provided no indication of what the level of fees might be on its super fund, but in the absence of an independent board, Saba’s appointees could presumably lock CYN into any structure that they like. We note that the annual management fee on Saba’s closed-end ETF product in the US is 1.1% and other ongoing costs add a further 1.39% to that.

- Saba’s proposals clearly put it in conflict with other shareholders. It has not offered any meaningful resolution to this in its proposals, which it could have done.

- We presume that “assess options to provide shareholders the opportunity to achieve substantial liquidity near NAV” means some form of cash for shareholders that do not want the new strategy, which we would welcome. However, we note that it does not say this explicitly, when it could have done, so once again, we think shareholders should not rely on this statement as we think it would be difficult to enforce after the event.

CYN’s board urges shareholders to “reject Saba’s self-interested and misleading proposals”

CYN’s board has set out the following highlights for why it believes shareholders should vote against Saba’s proposals.

The existing board:

- has overseen strong performance, with 167.0% total return in NAV and 220.0% total return in share price since the current joint fund managers were appointed in October 2015 (source: Bloomberg as at 31 December 2024. Manager inception date: 26 October 2015);

- believes Manulife | CQS and the joint fund managers, who are widely recognised as being leading investors in their field, are the team best placed to continue this strong performance in the natural resources sector that CYN’s shareholders have chosen to invest in;

- is fully independent and has deep experience in investment trusts, natural resources, the UK investment management sector, finance and accounting, and as directors of quoted companies;

- in line with the highest standards of corporate governance, maintains an annual continuation vote which facilitates 100% cash return should that be the wish of the majority of shareholders voting; and

- is committed to creating and preserving value for all shareholders.

In CYN’s board’s view Saba:

- has failed to state how much cash they will return to shareholders;

- is expected to appoint itself as manager, as set out in its statement to CYN’s shareholders; which CYN’s board believes is for Saba’s own economic gain, rather than for the interests of all shareholders;

- is expected to change CYN’s investment policy from the natural resources-focused strategy that existing shareholders have selected, to an approach of investing in other trusts for which no track record has been provided;

- has failed to narrow the discounts of the funds that they have taken control of in the US, compared with their long-term averages, and CYN’s board believes the trust’s shareholders could see their investment potentially become trapped at a long-term discount; and

- has proposed directors that CYN’s board does not believe to be independent of Saba, with no experience in natural resources, and who – despite Saba’s misleading claims – appear to have no experience of directing investment trusts.

Fund profile

Diversified natural resources exposure

Further information can be found at: ncim.co.uk/city-natural-resources-high-yield-trust.

CYN’s aim is to provide investors with capital growth and income by investing in a portfolio that predominantly comprises mining and resource equities, as well as mining, resource and industrial fixed interest securities.

Investments are typically made in securities that the manager has identified as undervalued by the market (both equities and fixed income) and that it believes will generate above-average income returns relative to their risk, thereby also generating the scope for capital appreciation.

CYN’s portfolio is biased towards mid-cap stocks.

CYN’s portfolio is biased towards mid-cap stocks; meaning that it offers a more idiosyncratic exposure when compared against its large-cap-focused peers. It also offers a markedly different exposure to ETFs and the major natural resource-focused indices.

CYN’s portfolio is not constructed with reference to any benchmark.

CQS Group and New City Investment Managers

New City Investment Managers (NCIM) has been CYN’s investment manager since June 2003. NCIM is part of Manulife | CQS Investment Management, which is part of Manulife Financial Corporation. The combined group has an AUM of US$14bn.

Ian Francis, Keith Watson and Rob Crayfourd are responsible for the day-to-day management of CYN’s portfolio. Keith and Rob focus on CYN’s equity holdings, while Ian primarily focuses on its fixed income holdings.

Previous publications

Readers interested in further information about CYN, such as investment process, fees, capital structure, trust life, the management team and the board, may wish to read our annual overview note Poised for the starting gun, published on 8 May 2024, as well as our previous update note and our initiation note (details are provided in Figure 1 below). You can read the notes by clicking on them in Figure 1 or by visiting our website.

IMPORTANT INFORMATION

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on CQS Natural Resources Growth and Income Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it. Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.