Economic and Political Monthly Roundup

Investment companies | Monthly | November 2022

A collation of recent insights on markets and economies taken from the comments made by chairs and investment managers of investment companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

White House spokesperson Karine Jean-Pierre: it is “clear” that Opec+ is “aligning with Russia”

October was a month of reversals. Opec+ agreed a production cut, upsetting the US which thought it had secured a promise to keep oil prices low ahead of the US mid-term elections, which are likely to dominate the headlines in November.

Warm weather, full storage facilities and LNG tankers stuck offshore unable to unload their cargoes helped drive European gas prices into negative territory for a brief period in October.

In China, Xi Jingping consolidated his grip on power. Foreign investors sold Chinese stocks as moderate voices were side-lined. China’s GDP growth has been disappointing, largely because of its rigid zero-COVID policy which is still locking down major Chinese cities.

In the UK, Liz Truss resigned as Prime Minister having seen the majority of her mini budget proposals rejected by her new Chancellor, Jeremy Hunt. That seemed to calm the UK bond market for a while.

In the race to replace her, Boris Johnson broke his holiday in the Caribbean for a few days but then retreated after, according to some sources, failing to secure sufficient backing. Rishi Sunak won the contest and promptly delayed the Chancellor’s autumn statement. This extended a period of pain for renewable energy generators, who were told that they would face a price cap, but not at what level, and are now awaiting more concrete proposals.

At a glance

Global

(compare global funds here)

Simon Jeffreys, chairman, Henderson International Income – 27 October 2022

Economic growth is slowing and, until inflation peaks, central banks look likely to have to keep raising interest rates. It is not an easy investment environment for investors to navigate. The events of this year have surprised everyone, but to some extent they are now known, and the question is what happens next? If, in a year’s time, China has found a way to deal with Covid, the conflict in Ukraine has ceased and the Federal Reserve has finished raising rates, then things could feel very different, although the pain getting there may remain very uncomfortable.

. . . . . . . . . . .

Ben Lofthouse, manager, Henderson International Income – 27 October 2022

The long-term impact of 2022’s events will likely be felt for years to come. From a financial market perspective, they have certainly caused volatility and uncertainty and markets are in the process of digesting this. Interest rate expectations have increased significantly, and the valuations of many assets have fallen as a result. This has presented some opportunities, but the impact on consumers and companies has still to be fully recognised. As a result, consensus earnings forecasts have not yet been significantly downgraded, nevertheless many sectors and companies have already seen substantial falls and some very attractive valuations are starting to appear.

. . . . . . . . . . .

After a sluggish start to the year, global equity markets rebounded in March. In the US, the Purchasing Manager’s Index (PMI) signalled an uptick in private sector output growth and consumer confidence indicators also edged upward. Crude oil prices rallied, driven by the global supply concerns since Russia’s invasion of Ukraine and the ensuing sanctions imposed on Russia. The US Federal Reserve (Fed) raised the target rate by 0.25% in March, its first increase since 2018 and the Bank of England (BoE), following a first hike in December and a second in February, further raised the policy rate by 0.25%.

Equity and fixed income markets came under pressure in April, as the war in Ukraine, lockdowns in China and the prospect of substantially tighter monetary policy continued to weigh on investor sentiment. In the US, headline inflation stood at 8.5%, its highest level since 1981 while the labour markets continued to be the bright spot, as unemployment rates across both the UK and euro area stood close to multi-decade lows.

Global equity markets continued to trade lower in May and June as high inflation, an overheating US economy and tightening monetary policy all continued to plague market sentiment. In the US, inflation displayed some signs of cooling but remained uncomfortably above the Fed’s inflation target rate of 2.0%. Economic releases were mixed, with weak housing data in the US but continued strength in its manufacturing data. Outside of the US, inflation prints remained elevated in Canada, Europe and the UK, while in China promising news about a drop in Covid infections and the anticipation of the easing of lockdowns lead to improving growth expectations across emerging markets. In June economic releases continued to be weaker as headline manufacturing figures in the US and Europe, where price pressures were most pronounced, saw the biggest declines.

Markets staged a recovery in July as economic news in the US revealed business activity was still in expansionary territory, US job prints were strong and the reopening in China continued. Inflation remained stubbornly high with US inflation at 9.1%, its highest level in 41 years. In response, the Fed raised rates by 0.75%, although there were signs that growth had slowed. The ECB delivered its first rate hike in over a decade in July, the magnitude of which at 0.5%, surprised some market participants, while the Bank of Canada hiked by 1% and became the first major central bank to hike that aggressively in the current economic cycle.

The recovery in equity markets proved short-lived. Central banks’ narrative around their commitment to bring inflation under control, despite the inherent risks to the growth outlook, led to further declines in equity and bond markets. However, economic data in general was slightly better than market expectations, as shown by economic surprise indices, and there were signs that global inflation pressures were starting to ease on the back of lower commodity prices. Eurozone second-quarter GDP surprised on the upside, but the data revealed important divergences among member states. The BoE raised its policy rate by a further 0.5% and warned of further tightening to contain inflation. In the US, even though the economy recorded two consecutive quarters of negative economic growth this year, US employment data was surprisingly strong. The Fed chair, Jerome Powell, remained committed to curbing inflation, as evidenced by the rather hawkish speech at Jackson Hole at the end of August.

Looking ahead, the level of uncertainty about the outlook for the global economy remains elevated. Our expectation of an earnings downgrade cycle and weaker growth has increased. The key risks that we are monitoring continue to be the persistence of inflation, consumer weakness, central banks over-shooting as they continue to tighten and geopolitics – any of which could push the global economy more deeply into recession. We retain a cautious stance in the portfolio with equity levels close to historical lows, we are closely following bond markets and should growth concerns dominate markets in the coming months, will look for opportunities to add duration.

. . . . . . . . . . .

Christopher Russell, chairman, Ruffer Investment Company – 4 October, 2022

Portfolio diversification is more than avoiding all eggs in one basket, which simply averages the risk that any one specific investment might go wrong. Such a policy can in fact lead to ‘diworsification’ – a term coined by the legendary fund manager Peter Lynch to describe assets moving together (positively correlated) which adds unnecessary risk to a portfolio without the benefit of higher returns.

It was Nobel Laureate Harry Markowitz who in the 1950s demonstrated that in markets where prices zig-zag over time, if one asset zigs while the other zags, yet each has exactly the same prospective total long term return, then combining the two assets in one portfolio can reduce portfolio risk without sacrificing expected return. Furthermore, of two portfolios which have exactly the same annual arithmetic return as each other, that which zig-zags less than the other (has lower volatility) will compound more wealth over time than the other.

The Investment Manager demonstrated last year that the correlations of asset classes in the future may not reflect those of the past. How right they were. The classic 60/40 equity/bond portfolio has proved to be diworsification. The return on a 60/40 model portfolio was 17% negative in the second half of the Company’s financial year to 30 June 2022.

After forty years of declining bond yields, it is easily forgotten that in the previous sixteen year period, from 1966 to 1981, a systematic rise in inflation, interest rates and bond yields meant that the best performing asset class over this period out of US bonds, equities and cash was not equities or bonds – it was cash.

In the ‘Economic Consequences of the Peace’, Keynes commented: ‘By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens.’ He went on to comment that the confiscation is arbitrary and strikes at the security and confidence in the equity of the existing distribution of wealth.

The current level of inflation is clearly no longer unobserved and was unanticipated. Confidence in the equity of wealth distribution is fraying the edges of political concern. Like Hans Christian Andersen’s Emperor, Central Banks are seen to have been short on clothes for the current economic and financial environment and have at last begun to tighten policy.

If it is true that markets are barometers rather than thermometers, reflecting how investors feel about the future rather than the present, then the financial weather outlook seems to be set fairer than might yet prove to be the case. The Board therefore endorses the Investment Manager’s observation: ‘There are times for a get rich quick portfolio and times for a stay rich portfolio. This is definitely the latter sort of time’.

. . . . . . . . . . .

Manager, Ruffer Investment Company – 4 October, 2022

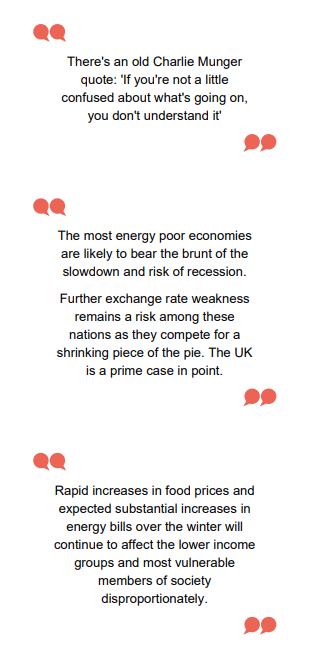

There’s an old Charlie Munger quote: ‘If you’re not a little confused about what’s going on, you don’t understand it’.

That sums up the fog of war, literal and metaphorical, we find the global economy immersed in. We have never had higher conviction on the long term – that we have moved into a new regime of inflation volatility and those conventional portfolios are not going to fare well. In the short term – the outlook is far murkier and path-dependent as policymakers try to navigate a narrow path without either tipping the economy into a wage-price spiral or over the other side into recession. In the meantime, liquidity continues to drain from the system.

The long term – an era of inflation volatility

So what does the new regime look like? We think we return to spasmodic bouts of inflation volatility like we saw after the World War 2 period or indeed again in the 1970s. The long-term chart of UK and US inflation makes it clear that the last 30-40 years has been something of an aberration.

We expect an extended period of accelerating financial repression – where interest rates are below the rate of inflation, forcing negative real returns upon savers. ‘Stealing money from old people, slowly’ as Russell Napier has memorably described it. We believe we are evolving into a staccato, stop-start world of higher inflation and faster economic growth. This will be driven by targeted government stimulus to tackle the big societal issues of the day; inequality, climate change and now the containment of the geopolitical aspirations of China and Russia.

‘Ketchup inflation’

With these trends will come much greater economic and market volatility – the great moderation of inflation, growth and geopolitics enjoyed over the last 40 years is over. Having spent a decade trying in vain to create inflation, like an impatient child slapping on a ketchup bottle, central bankers have now got too much, all at once, in an uncontrolled splat. Inflation was desired as a palliative treatment for the system, the least painful method of debt default and wealth redistribution from old to young and rich to poor – but this ketchup inflation is too hot to handle. The political imperative is that something must be done.

The short term – the impossible tightrope walk

Given that some inflation is desirable but too much is political suicide, perhaps the critical question is: how hard will central bankers fight inflation?

Monetary tightening is a little like going on a diet; easy to talk about and make detailed plans for, but difficult when it comes to the reality of the hard choices and abstinence.

From the current starting point of inflation at 40-year highs in both Europe and the US and a surging, fizzing jobs market – there are no good choices. Central bankers resemble quivering funambulists facing an impossible tightrope walk as they try to meet their objectives – full employment alongside low and stable inflation. Complicating matters further they have politicians breathing down their necks as inflation has spurred a cost of living crisis which now dominates the headlines. On one side, tighten conditions too much and unemployment will surge, probably tipping the economy into recession and crushing asset markets. On the other side, do not tighten enough and risk inflation getting embedded into wages, beginning the dreaded wage-price spiral of previous inflationary episodes.

To make an impossible situation worse the tightrope walker appears a little short-sighted. In May 2021 the Bank of England thought inflation in summer 2022 would be around 2.5%. The actual result? 9.2%.

So, we must conclude that nobody has a clue – particularly not academic economists. Despite their recent mistakes they remain highly confident that inflation will drop back to around 2% by 2024 and stay there.

By June 2022, central bankers began the gradual process of rate rises in the UK and US. Indeed the Federal Reserve (Fed) is engaging in the multi-variate experiment of simultaneous rate hikes and quantitative tightening.

We are now starting to see what happens when more than a decade of easy money is removed from the system. As ex-Federal Reserve Governor Jeremy Stein said, ‘the thing about monetary policy is that it gets in all the cracks’. There is no hiding from the reality of higher interest rates. Every tightening cycle throughout history has ended with a recession, a market crisis or both. ‘The Fed hikes until something breaks’ as the old adage goes.

The punchbowl is being taken away. Quantitative easing is melting away and quantitative tightening is beginning. Combined with rapid-fire rate hikes, it’s a recipe for financial market sobriety.

It IS different this time

The policy reaction function has changed. For the last decade or so, downside risk was limited because investors knew that once equity markets declined 20% the Fed put would kick in and there would be policy easing. Today, given the need to dampen demand to tame inflation, the market upside is capped; rise too much and it will be met with more hikes and tighter financial conditions. The Fed wants higher risk premiums, and that means a lower market.

If it were to come, another Fed U-turn, similar to 2018’s Powell Pivot or last November’s abandoning the word “transitory”, would be confirmation central bankers have lost control and America has entered an era of structurally high inflation.

The Bezzle

The economist John Kenneth Galbraith coined the idea of ‘The Bezzle’, a form of psychic wealth that can be created by mistake or self-delusion. The theory goes that if a collector has a Picasso painting (or should it be an NFT these days?) worth US$10 million and someone steals it, there is a period of time, potentially years, where both the collector and the thief believe they have a US$10 million asset and act accordingly. The effective wealth in their micro economy is US$20 million. Half of the wealth that exists in this moment is illusory and will be destroyed only when the collector identifies the crime. Today’s bezzle is the trillions of dollars of assets held in crypto, profitless technology and venture capital funds globally. Although these sectors have felt significant pain already, we believe there is potentially much more to come as opacity, illiquidity and discretion around asset pricing allows the bezzle to be revealed slowly rather than with a bang.

The bear is only mid grizzle

How does an asset fall 95% in value? First it falls by 90% and then it halves!

Investors under the age of 60 have been conditioned to buy the dip. Central bank easing has always been just around the corner and the market recoveries are swift and steep. A look further back in history shows that the pattern many bear markets take is a steep drop, followed by a more prolonged, grind lower over a number of years. In these scenarios, buying the first downward lurch leaves your capital almost as impaired as buying at the top. Let me explain why we have high conviction that the bear market is not over, and stocks are not (yet) a buying opportunity.

The Fed is tightening into an economic slowdown.

Valuations have come down to something more reasonable but are based on earnings estimates that remain too optimistic, still forecasting growth when flat would be a good result.

Valuations have fallen because bond yields have risen, not because the equity risk premium has widened.

Earnings reflect record high margins at a time of rising debt service, labour and energy costs and supply chain disruptions.

Consumer and CEO confidence is at multi year lows, suggesting demand reduction and recession.

So far we have seen limited signs of capitulation. In fact, flows have remained strongly positive into equity and credit throughout the sell-off. ARK Innovation ETF has suffered no net redemptions despite declining 71% in price since the peak. The ‘buy the dip’ mentality is alive and well.

But the old rules no longer apply. Now that the cost of living crisis is front page news, the political imperative is to bring down inflation, not to support asset prices as in previous market sell-offs. Rather, we are in a negative feedback-loop, where any bear market rally sows the seeds of its own demise by loosening financial conditions, which in turn forces Central Banks to counteract.

Lastly, liquidity is the driver of market prices at the margin and this is likely to evaporate in coming months -as quantitative tightening takes hold, while rising short term rates creates a legitimate alternative to risky assets. The plumbing of the financial system exacerbates this liquidity squeeze by steering cash from banks to money market funds, which have less of a money multiplier effect in the economy. Banks, though not in danger, want to shed deposits and are not keen to expand their balance sheets, while money market funds reflect rate rises quickly and will attract flows.

Hard hats on!

In an episode of surprisingly and persistently high inflation, no allocation to risk escapes repricing. Investors in the Company delegate to Ruffer the task of assessing the economic and market landscape, evaluating the opportunity set and then deciding about how much risk to take.

We do not think this is a good environment to be risking our shareholders’ capital.

Rather, we see the coming months as a period to survive, given the extent of the uncertainty around the Ukraine war, central bank policy, inflation, corporate earnings and the consequences of rising interest rates.

This is all happening as the tide of easy money recedes, and we strongly suspect that some people will be found to have been swimming naked.

In this environment, an allocation to cash is an underrated decision – it provides the certainty of a slow erosion by inflation, but it also gives you the option value of being able to move quickly. This is clearly reflected in our portfolio construction.

As our CIO Henry Maxey wrote in the Ruffer Review at the turn of the year: ‘Winter is coming for liquidity, it’s coming for narcissism, it’s coming for crypto, it’s coming for retail punting, and it is definitely coming for businesses which depend on any of these things’.

There are times for a get rich portfolio and times for a stay rich portfolio. We believe this is the latter. There will be better moments and better prices in the future.

In The Science of Hitting by legendary baseball slugger Ted Williams, the key observation was that you don’t have to swing your bat at every pitch, only at the ones which look sufficiently attractive. That insight applies in spades to investing in risky assets at this juncture. We would rather lose half of our clients, than half of our client’s money.

. . . . . . . . . . .

UK

(compare UK funds here)

Susannah Nicklin, chair, Schroder BSC Social Impact Trust – 21 October, 2022

The environment remains challenging, and the UK government’s fiscal proposal in September 2022 led to significant disruption in the markets, alongside concerns that the announced budget will lead to increasing pressure on public sector finances.

Rapid increases in food prices and expected substantial increases in energy bills over the winter (despite significant subsidy by Government) will continue to affect the lower income groups and most vulnerable members of society disproportionately. In this context, the focus on social needs and positive impact strategies are more vital than ever. Investments in community renewable assets contribute to an equitable transition to a low-carbon future in the UK and align with the global de-carbonisation trends. Investments in High Impact Housing continue to contribute to increasing the availability of much-needed affordable homes, built and maintained with respect for the dignity of the people living in them.

We recognise that increasing costs and the volatile inflation environment also bring risks, as the charities and social enterprises the Company invests in may experience changes to government funding or policies, pressures on margins and potential labour and supply chain disruptions. Big Society Capital, the Portfolio Manager, is actively working with the portfolio companies to understand and mitigate the risks specific to this environment.

. . . . . . . . . . .

Andrew Impey, chairman, JPMorgan UK Smaller Companies – 14 October, 2022

As we anticipated in the interim outlook, the invasion of Ukraine has had a detrimental effect on ordinary citizens across the globe and particularly those that are less well off. However, we did not anticipate the severity of the cost of living crisis and the level of government support that would be necessitated. Governments and policy makers are having to grapple with an unusually uncertain and complex set of economic and geopolitical situations which are requiring a significant re-evaluation of the globalisation of previous decades and the source of supply of essential commodities and goods. Many of these issues will take a number of years to resolve but in the short-term the very real cost of living crisis driven by inflation and interest rate increases not previously experienced by many needs to be addressed. This is particularly so in the UK where immediate and significant intervention is required to alleviate the prospect of ‘sticky inflation’ driven by a wage/price spiral and the damage caused by the expectation of further inflation.

Following the recent change of Prime Minister, her new Chancellor’s mini budget has caused turmoil in the UK markets. Whilst the desire to make a dramatic and immediate impact on the UK economy and aid those suffering from the rising cost of living is understandable, the manner in which it has been done is not. The poor communication, lack of obvious consultation with the Bank of England and absence of independent guidance from the OBR has led to a significant loss of investor confidence reflected in crashing bond prices, equities and the value of sterling. The public criticism from the International Monetary Fund is almost unprecedented and does not aid government credibility. The government’s cost of borrowing, as reflected in sharply rising gilt yields (falling prices), has dramatically increased as investors demand a premium for financing UK plc. The Bank of England has been set at odds with the government as it attempts to counter the potential inflationary effects of the current government policy, weakened sterling and high gilt yields. The Bank has already intervened in bond markets, attempting to lower yields by buying gilts, and will almost certainly have to increase the base rate further than previously anticipated. This will cause a significant increase in mortgage payments and put pressure on property valuations all to the detriment of the embattled consumer. In short, the outlook is as uncertain as it has been in a long time and we and the Managers anticipate continued, significant volatility in markets.

The share prices of UK domestic and smaller companies have been hit hard in actual and relative terms in anticipation of uncertainty and the challenging outlook for the UK.

. . . . . . . . . . .

Georgina Brittain, Katen Patel, managers, JPMorgan UK Smaller Companies – 14 October, 2022

As we write this report, we have a new Prime Minister. There are too many unanswered questions to enumerate at this time but it seems clear that her absolute priority is to help UK citizens and UK companies to deal with the energy price crisis, which would otherwise threaten to overwhelm many. Among the many things we do not know, key questions include: How long will energy costs remain elevated? How much will the proposed energy cap cost the UK? While it will lower inflation in the short term, will it prove of itself to be inflationary? When will the Russian war with Ukraine end? Will there be gas shortages in Europe and the UK this winter? How high will interest rates need to go? The answers to these questions will have a direct impact on the looming recession in the UK – small and short, or long and severe, as suggested by the recent Bank of England forecast.

Our present view is that there is likely to be a recession in the UK in 2023. Currently, key metrics in the UK such as employment levels, PMIs (purchasing manager indices), the housing market and retail sales are all holding up to a greater or lesser extent – and indeed that is the message we are receiving from talking to our companies. However, both we and they are obviously aware of the many risks on the horizon. These include significantly higher interest rates, higher mortgage rates impacting the consumer and house prices, inflation remaining elevated for longer and the impact of sterling’s devaluation. But the key metric we are focusing on is inflation, and in particular a fall in core inflation. If this eventually starts to emerge, then we believe stock markets will start to rally. If history provides a reliable guide, markets will rally prior to the GDP data turning more positive.

The last year has been a painful one for all investors. However, we believe that the structural drivers that have driven the superior performance in the small cap arena over longer time frames have not changed. Over the last many years we have seen periods of extreme volatility and drawdowns, such as we experienced during the Brexit referendum and the onset of COVID, and now once again in 2022, when the domestic UK market has fallen dramatically out of favour. These have proven historically to be very advantageous buying opportunities in this area of the market, and we do not believe this will prove to be different in this economically challenging time.

. . . . . . . . . . .

Jonathan Brown and Robin West, managers, Invesco Perpetual UK Smaller Companies – 7 October, 2022

The outlook is clouded by very high energy prices following the Russian invasion of Ukraine. Economic growth in the UK and other countries will slow over the coming months, potentially resulting in recession, and while interest rates are likely to increase further, there are signs that inflation may soon peak. The oil price is 20-25% below the high it reached in June, and as we annualise the gas price shock from earlier in the year, the inflation rate should begin to moderate.

Although this gloomy economic prognosis may appear unappealing, following the market decline so far this year, the UK market is trading at its lowest valuation for quite some time. It is an old stock market adage that one should be greedy when others are fearful. Conflicts and recessions come and go, and with hindsight, these periods may represent excellent buying opportunities.

. . . . . . . . . . .

Asia Pacific

(compare Asia Pacific funds here)

Nigel Cayzer, chairman, abrdn Asia Focus – 14 October 2022

The past year has been difficult for financial markets as the world emerges unevenly from the pandemic, with global stock markets suffering from bouts of weakness as investors digest the implications of a European war while facing inflation and the rising prospects of a global recession. But amidst this, some of the stock markets of Asia, in particular those not under the direct influence of China, have been relatively resilient; India being an example where headline indices remain relatively unchanged.

In addition, inflation in most parts of Asia has been mild compared with elsewhere in the world with Asian Central Banks being more accommodating; commodity prices, with the exception of coal, have retreated from the highs of earlier in the year and wage inflationary pressures in Asia are not as great as those anticipated in Europe. However, Asia has not been immune to the fallout from Covid, with parts of the Chinese economy still suffering from lockdowns and there remain pressures in global supply-chains.

As we look forward, investing in Asia has advantages over both the short and long term. The region is proving to be less vulnerable to the current environment than other emerging markets – inflation is less of an issue, while current account and fiscal discipline has been more resilient to the deep downturns. In the longer term, there are several strong trends that should support economic growth, notably rising affluence, increased urbanisation, growing infrastructure demand and commitment from policymakers to a greener and lower-carbon future. Geopolitics, on the other hand, remain a thorny issue, but diversification might be investors’ best hedge against a polarising world.

Valuations currently appear attractive, with the MSCI AC Asia ex Japan trading at a forward price-to-earnings ratio of 12.4x (below its five-year average), with the portfolio trading at similar multiples. At these levels, your Manager believes many of the prevailing risks, such as slower growth and higher inflation, could be largely priced in.

Looking specifically at the Trust’s niche, we believe that Asia’s rapidly developing economies continue to provide fertile ground for quality smaller companies. Asia is home to a wealth of under-researched yet high-performing companies which are often family-run, conservative businesses with low debt levels. For the most part, these companies are leaders in their field, and have growth rates that can be divorced from global macro conditions.

. . . . . . . . . . .

Flavia Cheong, Gabriel Sacks, Neil Sun & Hugh Young, managers, abrdn Asia Focus – 14 October 2022

We expect Asian markets to remain volatile as the prevailing stress points of rising inflation – aggravated by the Ukraine conflict − and monetary policy normalisation continue to raise the probability of a global economic recession. China’s economy also remains weak and although Beijing has adopted a more pro-growth stance of late, continued monetary and fiscal support will be required to revive economic activity and much will depend on the extent to which the government decides to loosen its ‘zero-Covid’ measures. Elsewhere across the region, the recovery in Southeast Asia is gathering pace amid further progress in the reopening of economies.

Despite serious macroeconomic and geopolitical pressures, we have yet to see significant deterioration in company fundamentals across the region. Corporate Asia will continue to battle the twin challenges of higher input costs and rising interest rates.

Despite the more uncertain near-term outlook, our confidence in the long-term growth prospects for the Asian region remains undimmed. The opportunities for growth are plentiful, especially within the smaller companies’ space, and we remain positioned around structural growth themes like domestic consumption, technology and green energy. Indeed, the turbulence in markets has resulted in more palatable valuations, creating enticing opportunities for investors like us who are here for the long run.

. . . . . . . . . . .

Kate Bolsover, chairman, Fidelity Asian Values – 11 October, 2022

The long-term outlook for Asia Pacific ex Japan equities remains positive and the region’s relatively higher growth prospects should continue to attract investors. Also, at a time when the world is becoming increasingly protectionist, Asia’s robust domestic demand from an expanding middle class supports the outlook for the region. Nonetheless, the region remains vulnerable to a global slowdown and tightening of global financial conditions.

China’s near-term growth outlook remains skewed to the downside due to sporadic COVID-related lockdowns across the country. Government stimulus has so far prevented a contraction in annual growth, but a weakening external backdrop is weighing on exports, previously a key driver of activity. Elsewhere, most Asian countries have actively eased international border controls, and a significant improvement in vaccination rates has helped to bring local restrictions to a close. As a result, pent-up consumption demand is making its way into their economies.

Persistently high and broadening inflation remains one of the stiffest economic headwinds confronting the US, Europe and several other major economies. But so far, for most of Asia, the picture has been rather different. China is, in fact, in a monetary easing cycle while rates in developed markets are likely to continue rising. Other Asian economies are also close to the end of their tightening cycles and they should have room to cut rates when inflationary pressures ease.

We therefore continue to maintain our positive view on the region. Overall, Asian equities continue to trade at attractive valuations compared to long-term historical averages and developed markets.

. . . . . . . . . . .

Europe

(compare European funds here)

Christopher Casey, chairman, The European Smaller Companies Trust – 4 October, 2022

We warned of the risk of revived inflation in last year’s annual report and the Fund Manager was rightly sceptical of the market consensus that any inflation would be ‘transitory’. Markets failed to anticipate the return of war in Europe which has acted as a catalyst to inflationary pressure and badly dented markets.

The global energy crisis is a reminder that an enormous capital expenditure cycle is required, both for the creation of a renewable energy green future, but also for the construction of nuclear power stations and improved gas provision that is not dependent upon authoritarian regimes. Much of the inflationary dynamic is due to bottlenecks in supply chains that often look brittle due to their concentrated exposure to China and its ‘Zero Covid’ policies. It seems likely that European companies will aim to diversify their supply chain risk by investing in Eastern Europe and North Africa to build resilience into their system. All of this should be good for the European smaller companies market which is heavily exposed to the capex required to deliver these agendas.

The environment appears ripe for bottom-up fundamental stock picking, with the spread between the most expensive and the cheapest stocks remaining wide. As rising interest rates drive an increase in the cost of capital, the fund management team anticipate the positive attributes of cash generative businesses will be better recognised by the market.

. . . . . . . . . . .

Japan

(compare Japanese funds here)

Managers, Schroder Japan Growth – 13 October, 2022

Following the Tokyo Olympics in July 2021, the Japanese government extended Covid-related restrictions throughout August and September. Public dissatisfaction with the government’s approach ratcheted up again and the approval rate for Prime Minister Suga and his cabinet fell to the lowest levels seen during his 12 months in office. On 3 September 2021, the Prime Minister unexpectedly announced his intention to resign without contesting the LDP leadership election scheduled for later that month. This inevitably led to a brief period of political uncertainty before Mr Kishida ultimately emerged victorious in the party leadership election.

As the new LDP leader, Mr Kishida became Japan’s 100th prime minister and was essentially seen as a safe, if unexciting, choice to guide Japan through its post-Covid recovery. Mr Kishida also inherited a stronger position in the vaccination programme which sustained strong momentum in the second half of 2021 after the very slow start.

Under Mr Kishida’s leadership, the expectations for the LDP’s performance in the subsequent general election in October 2021 were modest at best but, in the event, the party retained a solid majority.

With the election out of the way, and the Covid related state of emergency lifted, the political focus shifted to a substantial fiscal stimulus package, details of which became clearer in November. However, Japan imported its first known case of Omicron in December, followed by a sharp pick-up in infections from January 2022. While we must continue to emphasise that the absolute number of infections in Japan has remained remarkably low throughout the pandemic, the emergence of new variants again demonstrated a higher level of risk aversion, and each wave of infections has led to renewed concerns about hospital capacity. In late May 2022, Mr Kishida did finally announce that the government would relax some Covid border measures and resume acceptance of overseas tourists from 10 June, for the first time in around two years. Although this generated lots of media attention, in reality the practical constraints on travel will remain significant for some time and we will probably need to wait until at least the fourth quarter of the year to see any real impact from inbound tourism.

In the first half of 2022, aside from the ongoing human tragedy unfolding in Ukraine, Japan’s equity market was primarily driven by news flow on monetary policy and currency markets, together with concerns over the growing possibility of a US recession. Comments from the US Federal Reserve ahead of April’s interest rate increase clearly pointed to a widening interest rate differential with Japan materialising earlier than expected. This view was reinforced by the results of the Bank of Japan’s own policy meeting on 18 April, which confirmed no change in policy and the maintenance of the existing target of +/- 25bps for the 10-year bond yield. There was some surprise in the degree of commitment to this target shown by Governor Kuroda when he announced more details around the central bank’s operation of fixed-rate bond purchases. Prior to March, these operations had been extremely rare, and generally only deployed at specific moments of significant market stress. However, Mr Kuroda stated that these fixed-rate operations would be conducted every day throughout May, virtually guaranteeing no rise in bond yields, which quickly pushed the yen through the key psychological 130 level against the US dollar.

Although the sharp weakening of the yen has prompted several public statements, the Bank of Japan’s room for manoeuvre on the exchange rate is, in reality, very limited. Shortly after the end of the review period, however, the Ministry of Finance did intervene directly in currency markets to support the yen. While such action could yield short-term results it is unlikely to create a long-term trend change in the absence of a fundamental shift in policy from the Bank of Japan. Throughout Japan’s two decades of deflation, investors have generally viewed yen weakness as positive for Japan since the benefits for exporters were seen to outweigh any potential inflationary impact, and it seems that Bank of Japan Governor Kuroda clearly remains very much in favour of this view. Since May 2022, however, the yen’s weakness has coincided with a reversal of several other factors, especially mobile telecom charges, which had been suppressing the year-on-year inflation rate in the previous 12 months. This soon became evident in the headline inflation numbers, which showed core CPI (excluding only fresh food) jumping to 2.2% in June as the significant reduction in mobile phone charges finally dropped out of the year-on-year numbers. Although this level is slightly above the Bank of Japan’s 2% target, the real question remains whether longer-term inflation expectations move higher in response, leading to more substantial wage growth as part of Japan’s normalisation after decades of deflation. Nevertheless, underlying inflationary pressure in Japan does now appear to be creeping up, and the year-on-year increase in producer prices continues to run well ahead of consumer prices.

In July, market events were overshadowed by the shocking assassination of former Prime Minister Shinzo Abe on 8 July. Mr Abe, who resigned in August 2020 as Japan’s longest serving prime minister, was shot while delivering a campaign speech in Nara, two days ahead of nationwide Upper House elections. Although Japan has had two Prime Ministers since Mr Abe, he remained a hugely influential figure within the ruling Liberal Democratic Party (LDP) and his absence will alter the internal dynamics of the party. In the immediate aftermath, however, the resulting strong support shown for the LDP in the Upper House elections on 10 July has solidified the position of current Prime Minister Kishida and has improved political stability.

Despite successive delays in Japan’s domestic economic recovery, and heightened global uncertainty, Japanese corporations appear to be performing well and quarterly results announced during the fiscal year ended March 2022 were consistently ahead of expectations. This has been particularly true for manufacturing sectors that have benefitted from the global recovery, but non-manufacturing and service sector profits have also held up despite the successive restrictions imposed on domestic activity in this period. Around the end of the fiscal year, there was a further pick-up in global uncertainty so it was not surprising to see some companies making overly conservative forecasts for the new fiscal year. Overall, however, the tone of results and guidance was still slightly better than expected.

The recent rebound in Japan’s industrial production, after some Shanghai-lockdown induced weakness, has underlined the relative strength of manufacturing sectors in Japan. The successive delays in a domestic consumption recovery has mainly impacted non-manufacturing sectors, although we would still look for Japan to grow above its long-term trend rate this year as the large fiscal package, agreed in late 2021, is implemented. However, we still need to carefully watch the development of Covid infections as the high level of risk aversion in Japan could still dictate a more cautious approach than that seen in Europe. This is likely to be particularly evident in the very gradual approach to the reopening of Japan’s borders to foreign travellers.

The strong result for the ruling LDP in July’s Upper House elections has reinforced the position of Prime Minister Kishida but, beyond the election, the government faces a range of key long-term policy decisions. These include fundamental, and constitutional, questions on defence and a particularly difficult balancing act on energy policy. The war in Ukraine has thrown into sharp relief Japan’s dependence on imported energy and its relative lack of energy security over the long-term, with almost all nuclear plants remaining offline since the Fukushima earthquake in 2011. Although Tokyo has narrowly avoided power cuts during record high temperatures in the early summer 2022, Mr Kishida has nevertheless felt empowered to open up a public discussion on the restarting of nuclear plants.

Looking further ahead, equity investors will need to adjust gradually to the change in governor at the Bank of Japan as Mr Kuroda’s term comes to an end in March 2023. With Mr Kuroda so closely associated with the current policy of yield curve control, it is hard to envisage any substantive changes in the near-term. However, before the end of 2022 we could see technical changes in the way the policy is implemented, which could indicate more clearly the direction of travel likely to be seen under his successor.

The main upward pressure on prices in Japan comes from a combination of higher imported energy costs, coupled with the sharp weakening of the yen so far this year. Although these factors could gradually fade from the year-on-year inflation rate going into 2023, Japan does seem to be heading into a period of moderate but sustainably positive inflation. While producer prices have been rising for some time, we have recently seen more anecdotal evidence of companies looking to pass on these increases to end-product prices, but consumers remain very price sensitive after two decades of deflation. Although some particular sectors may struggle in this environment, overall margins do appear to be resilient so far and we are comfortable that aggregate corporate profits for the listed sector continue to grow. In the immediate future, however, the heightened global uncertainty may mean that relative market valuations remain at a discount against this longer-term outlook for corporate profits. We are also very positive on the ongoing improvements in corporate governance and the scope for this to generate real value for investors. Although this is partly a qualitative assessment through our discussions with company managements, there are also measurable impacts such as improving return on equity and a record level of share buybacks announced in the early part of the current fiscal year.

. . . . . . . . . . .

Global emerging markets

(compare global emerging markets funds here)

Sarah Fromson, JPMorgan Global Emerging Markets Income Trust – 26 October, 2022

After a brief summer rally, global equity markets have once again weakened and are transitioning away from the wild boom triggered by the post pandemic fiscal and monetary stimulus. Concerns about interest rate rises, inflationary pressures and geo-political tensions are reflected in an increasingly challenging economic backdrop, with a potential recession looming.

This said, economic activity in many of the Emerging Market economies remains strong and their debt to GDP levels are less stretched than those in several major developed countries. Lower debt levels will also make Emerging Market economies more resilient to the impact of a stronger US dollar than in past cycles. Over the longer term, many emerging economies should continue to show higher growth underpinned by several positive structural trends such as generally favourable demographics which support growing working-age populations and rising incomes.

. . . . . . . . . . .

The market’s decline over the past year reflects the impact of several particularly challenging events. Foremost of these was Russia’s invasion of Ukraine in February 2022. In addition to the tragic and disturbing human toll this war continues to take, it also has had wide ramifications for the global economy. The constraints it has imposed on the supply of energy and other commodities added to already concerning inflationary pressures and forced central banks, led by the US Federal Reserve, to take a more aggressive monetary policy stance. Sharply higher rates will create an inevitable drag on growth this year and next, and potentially drive some countries into recession. The dramatic shift in the US interest rate environment has also resulted in a major upward move in the US Dollar, which has strengthened against both developed and emerging market currencies. These developments had a detrimental impact on global equity markets. In particular, stocks with high valuations (which in many cases were dependent on high growth assumptions far into the future) saw those valuations decline.

The other important and surprising development over the past year was China’s continued harsh enforcement of its zero COVID policy. At the start of the year, our base case scenario assumed that we would see some relaxation of restrictions, and that this would be positive for the economy. Instead, as we write, Chengdu, a city of 21m people, is in another lockdown, and, if anything, the government appears to have doubled down on its efforts to eradicate COVID. This approach would appear unsustainable in the long term, yet events over the past year suggest that we should not assume the Chinese government will necessarily soften its severe anti-COVID stance any time soon.

Global financial markets are presently processing a number of considerations. In addition to the rising risk of recession in the US, and elsewhere, as discussed above, China’s property market contraction, while apparently manageable, must inevitably have an impact on the country’s growth outlook. The way in which China manages its zero COVID policies in coming months will be an equally important influence on near-term growth, and indications are that restrictions could be maintained for some time, creating a further drag on activity. The impact from the Russian invasion of Ukraine will continue to be felt globally, whether via energy prices or further geo-political tensions. In our view, Emerging Markets have begun to discount these risks, and overall market valuations look low relative to historical levels, although not excessively so. For example, the trailing price-to-book ratio for Emerging Markets is presently around 1.5x, compared to a historical average of 1.8x.

. . . . . . . . . . .

China

(compare Chinese funds here)

Manager, Baillie Gifford China Growth – 3 October 2022

Over the six months to 31 July 2022 the weakness in Chinese equities has continued. Positive developments on the regulatory front were swamped by macroeconomic concerns domestically and geopolitical concerns regarding Taiwan.

On the macroeconomic front, Covid lockdowns in a number of the major cities, including Shanghai, resulted in disruption to businesses and to consumers. This exacerbated an already weak economic backdrop. We saw the property market slump and weak manufacturing and consumption numbers. The quarterly meeting of the Politburo disappointed investors by offering little additional support to the economy. This in turn led to concerns resurfacing regarding financial risk to the broader economy. Our view is that these risks are exaggerated for the following reasons:

- Whilst debt to GDP remains elevated, it’s important to note that it has stabilised and that the quality of debt has markedly improved. Indeed, the government has done a good job of substantially reducing exposure to the most risky debt within the system1. In addition, funding conditions have improved, and the People’s Bank of China (PBOC) continues to provide iron clad liquidity support for the banking system. As such, the risk of a Lehman’s style moment in China is very low.

- The property market is weak with sales down 30-40% from their 2020 peak. However, it’s important to note that this peak resulted from stimulus provided by the government in 2020 in the wake of Covid. If we compare sales figures to 2018, numbers are down but not drastically so. More importantly, the loan to value ratio is sitting at only c.25%2. Most people are still paying for the majority of their properties out of cash. This contrasts markedly with most other housing booms and busts we’ve seen in emerging or developed markets where loan to value ratios tend to reach c.90%.

- Some property developers are impaired, but the majority are not, and the system itself is both incredibly large and incredibly fragmented. China Evergrande, one of the largest developers, and one that is facing serious difficulties, represents less than c.2% of total system assets. The next 10 combined do not even add up to 10% of the total.

So whilst China has dropped and is unlikely to achieve its previous target for GDP of 5.5% growth in 2022, the risk of financial instability is low in our view.

The second factor that has weighed on Chinese equity markets is geopolitical. Here, we saw China respond to Nancy Pelosi’s visit to Taiwan with obvious displeasure leading to concerns that the risk of military action has increased. Whilst acknowledging the complexity of the issue and the limitations of our own predictive powers, we would say that we believe the risk of military action remains low.

There are a number of factors that lead us to this view:

- Firstly, we think it’s important to remember what China itself has said on Taiwan. Here there has been no significant divergence from its longstanding policy. This was reiterated post Pelosi’s visit in a White Paper. This White Paper is significant because it is only the third such White Paper on Taiwan and the first since 2000. In the paper, China reiterated its longstanding policy and preference which is for peaceful reunification. The paper made clear that military action was an absolute last resort. Indeed, this makes sense to us given the incredibly high risks involved. For example, if military action were to occur and the Chinese Communist Party (CCP) fail, it would have devastating consequences for the CCP’s legitimacy, for economic growth, and potentially also for China’s territorial integrity.

- In addition, and contrary to popular opinion, we’d also note that Xi Jinping has not specified an imminent date by which reunification must occur. Instead, he has loosely linked it to a date that’s 25 years away, namely national rejuvenation or 2049. In terms of Xi’s personal legacy, we’d note that it appears as closely tied, if not more so, to the success of domestic policies such as Common Prosperity, Made in China 2025, and the China Dream. Indeed, we think it’s significant for example that the principal contradiction, or the most important problem for the CCP to solve during Xi’s reign, isn’t anything to do with Taiwan or with foreign policy. Instead, it’s overwhelmingly focused on building a domestic growth model that continues to benefit all members of society and actively makes consumers lives better i.e. they want to tackle ‘uneven and unbalanced growth’ and to deliver ‘the people’s desire for a better life.’ These domestically focused policies would be severely disrupted by an incursion into Taiwan, regardless of the outcome. The global response to Russia’s invasion of Ukraine has made this abundantly clear. In the face of crippling economic sanctions, the ‘people’s desire for a better life’ would be set back decades.

- Finally, the work that we have commissioned from our third party research providers suggests that, even if China wanted to act militarily, it could not do so. It does not have the military capability. Indeed, Russia’s travails in Ukraine have thrown this into stark relief and the difficulty of an amphibious assault on Taiwan over c.100 miles of water is a multiple of that of a land assault on Ukraine.

On balance, therefore, we continue to think that the likelihood of military action is low. That being said, we do acknowledge that this is a rapidly evolving issue and one that requires continued monitoring. It goes without saying that if military action were to occur, it would have very serious consequences for Chinese equities.

More positively, we have seen a marked improvement on the regulatory front within China. Over the last six months, significant political capital has built up behind the idea that regulation needs to be better signalled and more transparent. This culminated most recently with Xi Jinping stating that ‘normal supervision’ of the platform economy will resume and that specific measures to support it will be rolled out.

In Baillie Gifford’s two decades of investing in China, we have experienced numerous regulatory cycles, significant volatility and, at times, painful periods of adjustment. However, whilst investment in China may prove volatile over a short term time horizon, we continue to believe that a combination of a vast and growing domestic market, significant investment in research and development, and private and public equity markets that are poorly understood and very short term, give long-term growth investors a real opportunity to generate returns.

. . . . . . . . . . .

India

(compare Indian funds here)

Andrew Watkins, chairman, Ashoka India Equity – 5 October 2022

2022 marks the 75th anniversary of India’s independence. In that time, India has become a dynamic democracy competing on the world stage with a young, well-educated, aspirational workforce. In a direct comparison with the growth of an autocratic China, being a democracy has likely held back the pace of growth but the world is a better place for the path India has chosen to follow, albeit with the usual challenges when an emerging economy allows its people free choice.

With war in Europe exacerbating global inflationary pressures and supply line shortages, the Modi government continues to successfully tread a fine line between competing global interests; it imports approximately 85% of its oil requirements but, at the same time, wants and needs to maintain and grow its trade globally.

Opinion polls suggest the Modi government looks set to be returned to power in 2024. Modi retains a business-friendly approach and it’s arguable that continued stability has material benefits for an entrepreneurial nation seeking to escape the tag “emerging”.

We all hope that 2023 will see an easing of hostilities in Europe, restored supply lines, reduced inflationary pressures and lower interest rates. Not too much to hope for, surely? If achieved, the signs are already emerging that India’s economy will gather strength as the world returns to growth.

Manager, Ashoka India Equity – 5 October 2022

The sharp recovery in equity markets in 2021 was punctuated by a volatile start to 2022 with geopolitical tensions resulting in a supply squeeze leading to near-record high resource prices, monetary tightening by global central banks, and fears of a recession in the US and Europe.

Despite the rising concerns over sharp input cost inflation and global growth slowdown, India’s high frequency indicators continue to remain healthy. The Manufacturing Purchasing Managers’ Index (“PMI”) remained in an expansionary zone, averaging at 54.2 between June 2021 to June 2022. The Index of Industrial Production (“IIP”) was up by 8% year on year, and the core sector grew by 14% over the last year to June 2022. The latest survey by the central bank, The Reserve Bank of India, indicates improving utilisation levels, which along with accelerating end demand, is leading to higher capacity additions across sectors. Management guidance for capacity expansion is higher than pre-Covid levels for sectors such as automotives, cement, and metals.

While private sector capital expenditure (“capex”) is indicating early signs of revival, government’s spend on roads, railways, defence, and housing have remained buoyant. In this context, it is worth highlighting the key takeaways from the financial year 2023 (year ending March 2023) budget announced in February 2022. Whilst the budget signalled policy continuity with a thrust on capex, additional announcements were made towards enhancing the ease of doing business and boosting exports and manufacturing. There was an added emphasis on new areas such as sustaining digital ecosystems and urbanisation. The budget follows the previously announced measures by the government to improve the ease of doing business in India. In addition, there is an added emphasis on digitisation, and streamlining the compliance process. Overall, tax collections have been ahead of the usual run rate and this is likely to support higher government spending on infrastructure. In this regard, investors will keenly monitor the progress of the US$80 billion National Monetisation Pipeline program.

Rising energy prices have been a cause of concern globally. However, a greatly underappreciated aspect of this has been the structurally declining vulnerability of Indian economy to rising crude oil prices. India imports 85% of its crude oil requirements and this has attracted much attention over the years. Nevertheless, there is little evidence to suggest that India is disproportionately affected by rising oil prices – the sensitivities of macro variables to oil prices are in-line with what is observed for most other emerging market economies.

In any case, our view is that it is logical to expect that the impact of higher oil prices on macroeconomic variables plays out in a continuum, and no specific price point can be considered as a particularly bad threshold. Furthermore, the vulnerability of these macro variables at a given oil price level has reduced materially over the years due to faster economic growth and more exports than oil consumption. If one were to take a specific level of Current Account Deficit (“CAD”) to Gross Domestic Product (e.g., 2%) as a benchmark, then the price of oil at which such CAD level is estimated to be breached has been rising over time. At the turn of the century, this oil price threshold was considered to be US$40 per barrel of crude oil and is now estimated to be in the range of US$90 – $100 per barrel. However, perception might take longer to catch up. Furthermore, an adequate level of foreign exchange reserves (US$574 billion as of June 2022, nine months import cover) provides policy levers to navigate the prevailing macro environment.

The pandemic and geopolitical tensions over the last few years have accelerated supply chain diversification across various industries, a phenomenon that has already been underway for many years. Heightened boardroom focus on supply chain flexibility at Fortune 500 companies bodes well for market share gain by the Indian manufacturing sector. Our interactions with corporates in both listed and unlisted segments suggest that inquiry levels and focus on order books are healthy, despite the lingering supply chain issues. There is also early evidence of India benefiting from disruptions in China, with India’s market share of US imports rising to 2.0% from 1.6% two years prior. Despite the recent strong growth, India’s global share in many sectors such as chemicals and engineering goods is still small (approximately 2% to 4%). Even a 1% to 2% incremental market share gain from China, could result in high-teens growth rates for these sectors.

India’s exports remained a bright spot with 25.6% growth on a two-year Compound Annual Growth Rate (“CAGR”) basis (between June 2020 to June 2022). This has been supported by tailwinds such as: a faster pace of formalization catalysed by The Goods and Services Tax; the government’s focus on ‘Make in India’ with the implementation of a US$30 billion Production Linked Incentive scheme, changing global trade dynamics which includes diversification of supply chains away from China; and favourable demographics with a technically skilled labour force.

The recent uptick in inflation (7.8% in April, 7.0% in May and 6.7% in June) prompted the Reserve Bank of India (“RBI”) to hike the repo rate by 0.4% in an off-cycle policy meeting in May, followed by a 0.5% increase in the June and August monetary policy meetings. To reduce the pass-through of elevated global prices into domestic inflation, the government announced measures such as lowering excise duties on diesel and petrol, restricting agricultural exports and increasing fertilizer subsidies. Despite the near-term spike, India’s Consumer Price Index is not much above the upper end of the RBI’s tolerance band (between 2% and 6%). Besides, India’s core services inflation is at a reasonably contained level of approximately 4%. With monetary and fiscal policy working in tandem, India’s inflation trajectory should remain under control over the medium term.

India’s corporate earnings continue to be strong. Nifty earnings for the financial year 2022 grew by 33% year-on-year, at its highest pace since 2004. Earnings are further projected to grow by 16% CAGR for the next two years. In the context of rising concerns about global growth, it is worth re-iterating that given its well-diversified corporate mix, India’s earnings have generally been more resilient than its emerging market peers during previous downcycles.

. . . . . . . . . . .

Vietnam

(compare country specialist funds here)

VinaCapital Vietnam Opportunity – 24 October 2022

While we are aware of the risks posed by the challenges facing the global economy, we remain of the view that Vietnam’s economy can grow at a stable rate of 6% to 7% over the next five years

While Vietnam was one of the few economies in the region to deliver positive GDP growth in both 2020 and 2021, this growth was restrained by the COVID-19 pandemic. In the first half of 2022, Vietnam showed clear signs that growth is now returning to levels seen prior to the pandemic. Most economists project Vietnam’s GDP growth in 2022 to be one of the strongest in the region, with the World Bank recently raising their GDP growth forecast for Vietnam to 7.5% this year. The surge in GDP growth as VOF’s financial year progressed culminated with 7.7% annualised GDP growth in the 2Q22. This was driven by a dramatic rebound in domestic demand as the economy reopened and by factory workers in Vietnam returning to their jobs on the assembly line.

Compared to the alarming global inflationary pressures, Vietnam has experienced relatively tame inflation averaging 2.4% in the first half of 2022, but with a likelihood of it increasing by the end of 2022, though well below the central bank’s average inflation target of 4% for 2022. Vietnam did not exacerbate the inflationary pressures spawned by sharp increases in global commodity prices with excessive fiscal stimulus, unlike many other countries around the world.

The sanctions applied to Russia as measures against the conflict in Ukraine will undoubtedly contribute to inflationary pressures, as commodity prices rise. Fortunately, Vietnam’s direct trade and investment ties with Russia are very small (at less than 1% of GDP), and the country is not adversely impacted directly by the conflict. Vietnam has been fortunate to be a substantial agricultural producer and exporter and to have a reasonably small component of energy in its Consumer Price Inflation basket. The fact that Vietnam is a net exporter of food helped limit the country’s food price inflation to just 2.3% y-o-y at the end of June 2022. This in-turn helped limit the increase in Vietnam’s headline CPI rate, since food accounts for 36% of Vietnam’s CPI basket. Furthermore, one of the largest importers of Vietnam’s agricultural products is China and amidst China’s zero-COVID-19 strategy, inflationary pressure from rising prices of agricultural and aquaculture products has been muted. Clearly, inflation is a risk on which Vietnam needs to keep a close eye as China re-opens its economy.

While consumers in Vietnam are certainly impacted by higher global commodity prices (we estimate that crude oil/petrol accounts for about 6% of the CPI basket), they are not suffering from additional domestic price pressures because of the relative stability of the VND. Confidence in the VND is also supported by the relatively low level of government debt.

To fight the alarming levels of inflation, the US and European governments are increasing interest rates and practicing tighter monetary policy. Given the aggressive nature of the rate hikes in the US, the USD has strengthened significantly against global currencies. Since Vietnam effectively applies a “soft peg” against the USD, the local currency has shown only a very small depreciation, while many currencies within the region have devalued significantly more, implying that the VND has in fact appreciated against these other currencies. The implication of rising interest rates, a stronger USD (and VND), and tightening liquidity around the world has had little impact on Vietnam’s economy over the 12 months to 30 June 2022.

Vietnam does benefit from unique tailwinds that will continue to propel its economy forward and, if managed properly, maintain its steady rate of growth in the coming years. The continuing recovery of all industrial activities is supported by increasing FDI. One of the most important drivers of Vietnam’s economic growth – which is likely to remain the country’s most important in the medium term – is the FDI-funded build out of the country’s industrial base. This is one critical factor that is helping fuel the rise of Vietnam’s emerging middle class by offering attractive employment opportunities to the country’s workforce.

Prior to the pandemic, Vietnam emerged as a key country to which multinational companies diversified their manufacturing activities away from China.

Vietnam is clearly benefiting from the nascent “friend-shoring” phenomenon, in which multinational companies are increasingly sourcing products from countries that are designated as “friendly” by the US government. US policy makers have made it clear that the US wants to have very friendly economic relations with Vietnam, and this is one reason why an increasing number of companies are diversifying and relocating some of their production facilities from China to Vietnam – although China’s commitment to its “zero-COVID-19” policy has also contributed to this trend. There is clear evidence that some companies are relocating production facilities from China to Vietnam.

Furthermore, a strong recovery of the service sector after the relaxation of all COVID-19 related restrictions in Vietnam, coupled with a moderate USD15 billion fiscal package, including USD2 billion of interest rate subsidies, will support the economic recovery.

There are signs that demand for “Made in Vietnam” products is slowing as economic growth in the US slows, and therefore our optimistic GDP forecast for 2022 is not predicated on the continued strong performance of Vietnam’s manufacturing sector (which accounts for just over 20% of the country’s economy), but is instead supported by strong consumption growth, given that consumption accounts for about two-thirds of Vietnam’s GDP. Vietnam’s retail sales, which are a close proxy to domestic consumption, accelerated continuously in the first half of 2022 from just 1.7% y-o-y growth in February 2022 all the way up to 27% y-o-y growth in June 2022.

The financial year started in Vietnam with the highest levels of movement restrictions and social distancing to combat COVID-19 since the start of the pandemic. Most businesses found themselves closed for three to four months from May 2021 and it was not until September 2021 that the Government became more comfortable with allowing the economy to re-open. This was only possible thanks to the successful and aggressive roll-out of the vaccination program using vaccines from Europe, the United Kingdom, and the United States, which allowed Vietnam to embrace the idea of “living with COVID-19”.

We continue to hold the view that market and economic volatility will remain with us for at least two to three years not only as a result of the recovery from the COVID-19 pandemic, but also from global economic sanctions imposed on Russia and from anti-inflationary policies.

. . . . . . . . . . .

Manager, Vietnam Holding – 3 October 2022

Resilience in the face of adverse conditions is an ongoing theme in Vietnam. Not only did Vietnam maintain an enviable level of economic GDP growth of approximately 3% per annum through the pandemic years, but also economic growth has resumed to pre-pandemic levels quickly. Vietnam has seen resilient Foreign Direct Investment (“FDI”) disbursement, USD 19.7bn in 2021 and USD 10.6bn for the first six months of 2022. Vietnam has remained a very open economy, and its overall trade reached more than USD 668bn in 2021, representing more than 200% of GDP – levels seen by only a few countries globally. The country has maintained its strong export growth during the first half of 2022, increasing by 17% year-on-year, and although import growth was 16% year-on-year, the country managed to generate a Trade Surplus of USD 710m. Retail sales also have recovered strongly from the lows of the pandemic period, and in June 2022 were 27% higher than the previous year. The country now has foreign reserves of more than USD 100bn. This is down 10% in the first half of 2022 as the State Bank of Vietnam has intervened in the foreign-exchange market to provide some stability. It is worth noting that the Vietnam Dong has been relatively stable against the USD over the last five years, particularly when contrasted against some other regional currencies. However, in the first half of 2022 as the USD strengthened, the Vietnam Dong weakened by 2.6%. This should be looked at in the light of much sharper declines in several global currencies including the ‘safe-haven’ Yen, which has fallen by 20%, and the Euro and Sterling, which are both down by about 10%. Often, a weakening currency can have inflationary pressures, however, Vietnam runs a USD 40bn trade surplus with the US (a strengthening currency), a USD 28bn trade deficit with China (whose currency has weakened by 3.3% against the USD) and a USD 18bn trade deficit with South Korea (whose currency has weakened by 7% against the USD), so in this regard there is some natural hedging. On a broader front, inflation is increasing in Vietnam and Core CPI rose to 2% year-on-year in June 2022. That said, inflation is not at the worrying levels seen in the US, UK and Europe, in part due to the different driving forces in the economy. An important differentiating factor between Vietnam and some other emerging economies is in the energy mix. Vietnam’s domestic renewable sources of energy – hydropower, solar and wind – account for about 43% of its energy generation. It also has some domestic sources of Oil, Gas and Coal, however it is a net importer of each of these sources of hydrocarbon.

Industrialisation

Vietnam’s pace of industrialisation continues to progress as it has done dramatically over the past three decades. Last year, Vietnam overtook Bangladesh to become the second largest garment producer in the world. It is also very well-known as a major producer of footwear, furniture, agriculture, and aquaculture, and less well-known but an increasingly key supplier of hi-tech hardware and software to customers around the world. Recently on a visit to the US, the Vietnamese Prime Minister met with the CEOs of several large global technology companies, including Apple and Intel, who re-affirmed their plans to produce more goods in Vietnam. Although Apple does not have its own facilities in the country, it is umbilically linked to 35 key manufacturers who are present. Following the PM’s visit, Apple announced it was moving more production, including the assembly of iPads, to Vietnam.

Urbanisation

Despite delays in domestic infrastructure expenditure (the 2022 disbursement level is behind plan) and delays to Vietnam’s metro systems becoming operational (the HCMC metro is likely delayed by a further year until 2023) – the pace of urbanisation is a fast one. Vietnam’s urbanisation level in 2018 was about 36%, the level of Western Europe in 1945. According to a forecast1, its urban population is expected to reach 44% by 2030. We have written in previous reports about the multiplier effect of investments in domestic infrastructure. In May 2022, a new bridge across Ho Chi Minh City’s Saigon River was opened, and a short drive or walk across it connects down-town District 1 to the Thu Thiem peninsular, a region already demarcated to be a new ‘metropolis’. Developments like this can lead to a dramatic growth in the build-out of commercial and residential real-estate.

Domestic Consumerism

Vietnam’s ‘middle income’ population is projected to expand at a rate of 18%1 annually, adding a further 35 million people to this group of consumers by 2030. The nature of the consumer continues to evolve. In the 1990s, for a brand to be really successful it had to be foreign and manufactured overseas. By the 2000s, locally manufactured global brands continue to dominate, however, several niche local brands developed locally and owned by Vietnamese businesses in sectors ranging from shampoos, soft drinks, sauces and condiments to baked goods and coffee started to garner strong local appeal. In a recent survey, it appears that in the 2020s Vietnamese consumers now prefer and trust home-grown brands over foreign brands.

Outlook