No shortage of targets

AVI Global Trust (AGT) offers a distinct investment proposition from its peers, focusing on opportunities to extract value from undervalued companies where structural reform could potentially unlock value. The weighted average discount on the underlying portfolio is close to historically wide levels, reflecting a number of opportunities that the manager has identified.

Activism in holdings such as Chrysalis, Gerresheimer, and Third Point Investors, and the ability to capitalise on “special situations” such as Vivendi might suggest that AGT’s strong run of performance could continue. AGT has also initiated positions in Korean companies following recent regulatory reforms that address corporate inefficiencies – echoing AVI’s earlier successes in Japan.

Extracting value from discounted opportunities

AGT aims to achieve capital growth through a focused portfolio of investments, particularly in companies whose shares stand at a discount to estimated underlying net asset value. It invests in quality assets held through unconventional structures that tend to attract discounts; these types of companies include holding companies, closed-end funds, and asset-backed special situations.

| 12 months ended | Share price total return (%) | NAV total return (%) | MSCI ACWI total return (%) | MSCI ACWI ex US TR (%) |

|---|---|---|---|---|

| 31/07/2021 | 40.9 | 39.9 | 25.7 | 20.6 |

| 31/07/2022 | 1.6 | 1.8 | 2.3 | (3.2) |

| 31/07/2023 | 3.2 | 6.3 | 6.8 | 7.3 |

| 31/07/2024 | 27.2 | 19.9 | 15.5 | 8.4 |

| 31/07/2025 | 8.6 | 9.6 | 14.1 | 13.0 |

A wealth of attractive opportunities?

AGT is, in essence, an activist value investor, focused on extracting value from stocks valued at a significant discount to Asset Value Investors’s (AVI’s) estimate of underlying net asset value. This approach provides shareholders a return profile that is differentiated from peers, as well as exposure to a portfolio with a high active share relative to global benchmarks.

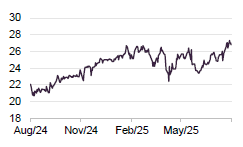

There have been some notable outcomes within the portfolio that have helped push AGT’s NAV and share price to all-time highs. One might have expected that this would mean that the weighted average discount on AGT’s portfolio would have narrowed meaningfully on the back of this, but until recently this has been close to the bottom end of its range over the past 10 years. This is because AVI has been busy reallocating the portfolio into a number of new investments.

Figure 1: Weighted average discount on AGT’s underlying portfolio

Source: AVI Global

Market backdrop

Whilst stock-specific factors such as discount narrowing are the major influence on AGT’s returns, 2025 has nonetheless been marked by major macroeconomic developments and increased market volatility. The chief cause of this may have been President Trump’s tariff announcements. The “Liberation Day” proposals announced on 2 April appeared to surprise markets; they represented the most extensive trade measures imposed by the US in over a century. The decision to put a 90-day pause on these proposals and the subsequent extension of this have alleviated some concerns. It may have helped, too, that some countries – such as the UK and Japan – have secured trade deals. The inflationary impact appears to have been muted by stockpiling of goods, but the US Federal Reserve remains sufficiently wary of this to have paused interest rate cuts. Trump’s attacks on its chair, Jerome Powell, seem to have also unnerved bond investors.

Fortunately, AVI’s Tom Treanor notes that few of AGTs holdings had direct exposure to the tariff issue. With one example being Toyota Industries, though this this was masked by a takeover bid for the stock.

Another notable macroeconomic story this year has been a broad devaluation of the US dollar. The USD trade-weighted index has fallen fairly steadily throughout 2025. Relative to its benchmark index, AGT has an underweight exposure to US assets, which has been working in its favour. Markets in the UK, Europe, and Japan have outperformed the S&P500 over 2025. However, interest in AI-related stocks has driven the US index to new highs in recent weeks.

Japan

At the end of June 2025, 18% of AGT’s portfolio was allocated to Japan. Whilst Japan continues to benefit from improvements in corporate governance (which can be read about in more detail here), it is also experiencing increases in inflation and interest rates.

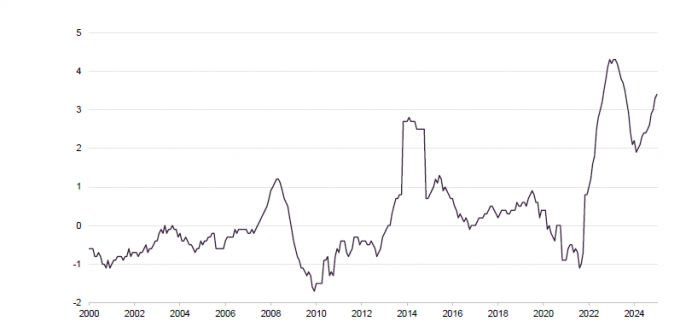

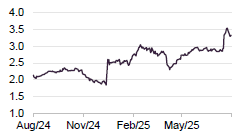

Figure 2: Japan year-on-year CPI less energy and fresh foods

Source: Bloomberg

As shown in Figure 2, Japan has, for the first time in decades, experienced a sustained period of inflation (exceeding 2%). This has brought with it a rise in interest rates, but also an increase in equity inflows, particularly from domestic investors.

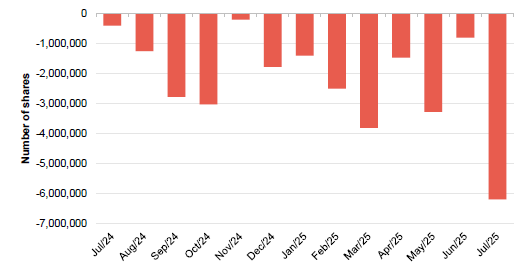

Japanese households, who hold approximately 50% of their assets in cash (compared with 12% for Americans and 34% for Europeans), seem to be seeking alternatives to maintain the purchasing power of their savings. This shift may be driving greater participation in investment products, as inflation erodes the value of idle cash. Recent fund flow data already reflects this behavioural change, with households moving capital out of traditional bank deposits and internet savings accounts into equities and other financial assets.

South Korea – AGT’s newest frontier

Having long been an activist investor in Japan, AVI has recently turned its attention to a new frontier in corporate governance reform: South Korea.

Despite ranking as the world’s 13th-largest economy by nominal GDP and the significance of Korean firms in the global economy, its equity markets remain largely irrelevant by global standards, accounting for less than 1% of the MSCI ACWI. One contributing factor is that it is classified as an emerging market, mainly because of restrictions on the convertibility of the Korean Won. This is one reason why stock market valuations are low but so, too, may be perceived poor corporate governance practices.

AVI highlights that 70% of KOSPI-listed stocks trade below book value, with 40% trading at less than half their book value. In contrast, the respective figures for Japan, the US, and Europe are markedly lower.

Figure 3: Contrasting valuations of stocks on a price/book basis

| Percentage that are less than book value | Percentage that are less than half book value | |

|---|---|---|

| South Korea | 70 | 40 |

| Japan | 45 | 8 |

| US | 4 | 4 |

| Europe | 15 | 4 |

This persistent undervaluation – commonly referred to as the “Korea discount” – has become a defining feature of the market.

The roots of this discount might be traced to Korea’s powerful chaebols, family-controlled conglomerates that have a significant presence in the corporate sector through intricate cross-shareholding structures. Among dozens of such families, seven control groups with assets exceeding KRW100trn (about £54bn). These include globally recognised names such as Samsung, Hyundai, and LG, with the Jae-Yong family – which controls the Samsung group – being the largest.

Historically, these groups have resisted efforts to improve corporate governance or enhance the rights of minority shareholders, preserving family control and prioritising insider interests.

In Samsung’s case, despite high-profile scandals (Lee Jae-yong, now executive chairman, was at one point jailed on charges of bribery, embezzlement, and concealment of criminal proceeds), activist campaigns and legal action have not resulted in changes to the family’s level of control.

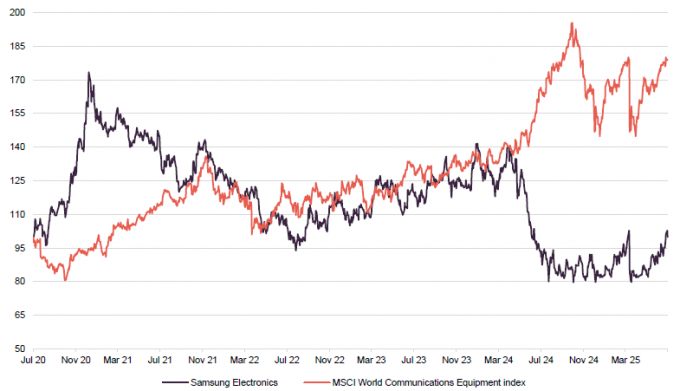

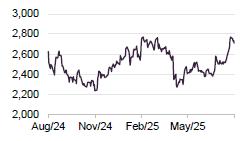

Despite its central role in the global tech supply chain, Samsung has significantly underperformed its international peers over the past five years. This underperformance stems in part from a decline in its semiconductor competitiveness, particularly its failure to capture the surge in demand from AI developers, which has weighed heavily on earnings.

Figure 4: Samsung share price performance versus global peers

Source: Bloomberg

The opportunity today

South Korea previously introduced corporate governance reforms in February 2024, with the launch of the “Corporate Value-Up Program”. Whilst this initiative initially prompted AVI to explore the region’s potential, leading to an on-the-ground visit by the investment team, AVI ultimately concluded that the voluntary nature of the reforms was insufficient to challenge the entrenched power of the chaebols.

Korea’s new president may mark a turning point in corporate governance and shareholder returns

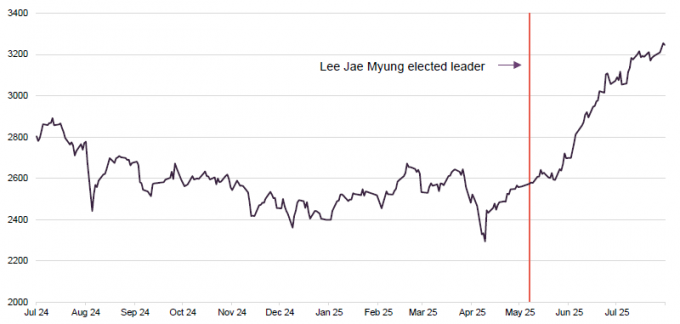

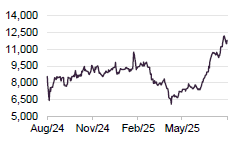

However, 2025 has marked a turning point, following the election of Lee Jae Myung after the impeachment of former president Yoon Suk Yeol. Lee has adopted a more active position on corporate reform, vowing to tackle the chaebol system and eliminate the “Korea discount” as part of his agenda.

He has gone so far as to set public targets for the KOSPI, aiming for the index to surpass 3,000 within the first six months of his term, and ultimately reach levels where it trades consistently above 5,000. As of 04 August 2025, the KOSPI stands at 3,148, already exceeding his initial benchmark.

Figure 5: KOSPI index performance over last 12 months

Source: Bloomberg

Lee’s administration has introduced changes related to corporate governance in Korea. In July 2025, his administration amended the Commercial Act – the legislation governing South Korean commerce, including the duties of corporate directors. The revision expands the fiduciary responsibilities of board members, explicitly requiring them to consider the interests of minority shareholders and to support efforts aimed at improving corporate valuations.

There has already been a notable increase in shareholder activism in Korea

AVI notes that these changes could compel boards to adopt stronger independent oversight. In addition, further reforms are being pursued, including enhanced disclosure requirements proposed by the Financial Services Commission and planned tax system overhauls.

AVI also highlights that this wave of regulatory reform has been accompanied by an increase in shareholder activism. It says that the number of listed companies receiving shareholder proposals has risen from just 10 in 2020 to over 60 in 2024. Drawing on their experience in Japan, AVI observes that corporate change is more likely when pressure comes from multiple stakeholders simultaneously.

AVI’s recent activity

AGT has already initiated a modest position in Korean equites

Although it remains early days for Korea’s corporate governance reforms, AVI is already making efforts to capture the emerging opportunity. At the end of June 2025, AGT had 3% allocation across a select group of Korean companies, trading at an average 51% discount to their estimated intrinsic NAV, and expects AGT’s exposure to the country will rise further.

These holdings also exhibit the typical attributes that have characterised some of AVI other investments: earnings that it feels are durable, that come with some form of protection (e.g. economic moats or competitive advantages), strong balances, an alignment of interest with key shareholders or families, and a focus on competent management teams. Whilst these attributes are typically associated with higher-quality companies, each also presents a tangible governance re-rating opportunity.

Asset allocation

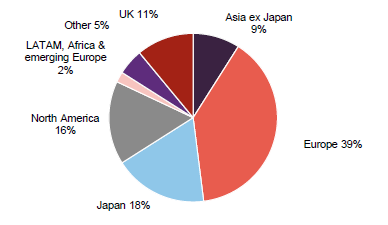

AGT’s asset allocation is determined by the manager’s stock selection decisions. Since we last published, using data from October 2024, the main change in AGT’s geographical position has been an increase in its European exposure, from 32% to 39%. This was matched by a corresponding reduction in AGT’s North American exposure, down from 22% to 16%.

Figure 6: AGT geographic breakdown as at30 June 2025 as a percentage of NAV

Source: AVI Global Trust, Marten & Co

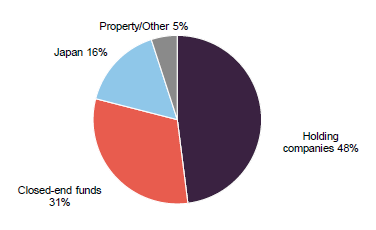

Figure 7: AGT portfolio exposure as at 30 June 2025 as a percentage of the portfolio

Source: AVI Global Trust, Marten & Co

AGT’s portfolio exposures (Figure 7) are largely in line with the levels of our previous note. The noteworthy change is a 6% reduction in its exposure to Japan and a 4% increase in its holding company exposure.

Gearing was 9.8% at end June 2025

AGT’s net gearing was 9.8% as of end June 2025, which is broadly in line with the 7.1% net gearing at the time of our previous note (which used data as of end September 2024). The level of AGT’s gearing reflects the magnitude of the opportunity set presented to the manager, which is often determined by the extent of the discount their universe trades on, rather than changes in market sentiment.

Recent activism

Chrysalis

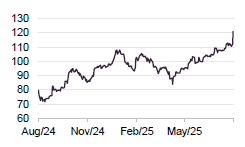

Figure 8: Chrysalis (GBP)

Source: Bloomberg

Chrysalis (CHRY) is a UK-listed private equity investment trust focused on providing access to growth-stage private companies. Like many peers in its sector, it currently trades at a wide discount, 30.7% at the time of writing.

AVI has increased its exposure to CHRY by 1.8% since our last update, in connection with planned shareholder engagement targeting the trust. Alongside other shareholders representing approximately 27% of the share register, AVI wrote to CHRY’s board requesting that the trust’s continuation vote be brought forward by one year, to be held at the 2026 AGM. While additional shareholders expressed support for the initiative, some were unable to formally endorse AVI’s letter.

In response, CHRY’s board proposed a resolution at the 2026 AGM to reaffirm its existing capital allocation policy. If this resolution does not pass, no new investments will be made prior to the 2027 AGM, when the formal continuation vote will take place – effectively turning the 2026 vote into a de facto vote of confidence in the trust’s current strategy.

CHRY recently announced a decent uplift to its NAV, which has helped drive the share price higher to AGT’s benefit.

Gerresheimer

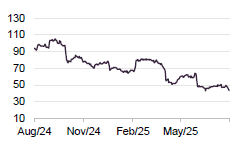

Figure 9: Gerresheimer (EUR)

Source: Bloomberg

Gerresheimer is a German-listed conglomerate currently undertaking a strategic review. The company is comprised of a Moulded Glass packaging business (under-review) and a pharmaceutical primary packaging business (the core). The latter designs and manufactures a range of Containment Solutions (“getting drugs to the patient”) and Delivery Systems (“getting drugs into the patient”).

AVI believes significant value can be unlocked through divesting the non-core operations and focusing the company around its pharmaceutical segment. This latter business has reported underlying growth and AVI feels it benefits from an attractive industry structure and margins, whilst it says that the former is lower growth and more capital intensive.

In February 2025, management disclosed preliminary talks with a private equity consortium regarding a potential sale. However, in April, global private equity firm KKR announced it was withdrawing from the bidding group. Despite the initial interest, Gerresheimer’s share price has declined over the course of 2025, following revised revenue and profit guidance, attributed to softness in the cosmetics and liquid medications markets.

AVI believes the company’s current valuation discount is unjustified. Given continued private equity interest, there is a risk the business could be sold at a price below its assessed value. AVI has written to the board, urging immediate measures to restore market confidence and improve shareholder returns.

Specifically, AVI is calling for:

- the appointment of new financial leadership, with a new CFO seen as critical to restoring credibility and deterring opportunistic private equity bids;

- the creation of a capital allocation committee to support debt reduction and reinvestment into the core pharmaceutical business; and

- a swift divestment of the underperforming Moulded Glass division.

AVI believes that with the right reforms, Gerresheimer has the potential to more than double in the coming years.

Third Point Investors

Figure 10: Third Point Investors (GBP)

Source: Bloomberg

UK-listed hedge fund Third Point Investors (TPOU) has been the focus of ongoing engagement by AVI, which first issued a public letter to the board in July 2021, urging steps to improve shareholder returns. Whilst AVI’s initial concerns centred on weak performance and an opaque structure, the situation took a surprising turn in 2025.

In May 2025, Third Point announced plans to restructure itself into a reinsurance platform by reversing into Malibu Life Reinsurance, a US-based reinsurer focused on the fixed annuity market. As part of the proposed transaction, existing shareholders were offered a partial liquidity event, at a price AVI considered unfavourable.

AVI has strongly opposed the proposed restructuring, describing it as an “odious related-party deal” and a “poster child for appalling corporate governance”. AVI has joined other shareholders (representing a total 14% of the outstanding shares) to advocate for terms they consider more equitable for TPOU’s investors, with the group’s response detailed here.

Several concerns have been raised by AVI and the wider market regarding Third Point’s attempted reinvention, including:

- Third Point Reinsurance (now named SiriusPoint) has delivered annualised returns of less than 4% since its launch in 2013 – only marginally ahead of the UK 10-year gilt yield, which averaged around 2% over the same period. This performance calls into question the value creation prospects of the proposed strategic shift.

- The proposed transaction involves potential conflicts of interest. Notably, Dimitri Goulandris, who led the strategy review that resulted in the merger proposal, is expected to chair the newly combined entity. Meanwhile, Dan Loeb, manager of Third Point, has already declared his intention to vote his 25% stake in favour of the deal. Whilst he is a major shareholder, he has a vested interest in maximising assets under management and may not be acting in the best interests of all shareholders. Given this, AVI stated that there should be a vote of independent shareholders (i.e. excluding Third Point) to approve the transaction.

- AVI believes that the size and pricing of the proposed exit tender are inadequate. Third Point initially proposed a $75m tender offer, at a 12.5% discount to NAV – though given the negative response from shareholders, they have now increased the tender offer to £100m at a 4.8% discount to NAV. Despite the improvement, AVI’s maintains its position; that the proposed shift in strategy represents a fundamental change to the trust’s investment profile, and as such, investors should be given the option of a full exit at NAV.

- In AVI’s view, the transaction will effectively see Third Point handed control of the company without making a bid for it. AVI is continuing to engage with the regulators and TPOU’s board as to ensure that shareholders interests are appropriately considered.

Top 10

AGT’s current top 10 is presented below. Compared to the data used in our last note, there have been three noteworthy new entrants: Gerresheimer, Vivendi, and HarbourVest Global Private Equity – the latter two being described below. Note that Aker, while a new entrant, has long been one of AGT’s major positions, and frequently a top 10 holding for AGT.

Figure 11: 10 largest holdings at 30 June 2025

| Holding | Industry | Country/region | Percentage of NAV 30/06/25 (%) | Percentage of NAV 31/10/24 (%) | Change(%) |

|---|---|---|---|---|---|

| Chrysalis Investments | Closed-end Fund | UK | 7.8 | 5.4 | 2.4 |

| D’Ieteren | Holding company | Belgium | 7.3 | 9.6 | (2.3) |

| News Corp | Holding company | US | 7.0 | 8.3 | (1.3) |

| Vivendi | Media | France | 6.6 | – | 6.6 |

| Gerresheimer AG | Holding company | Germany | 5.3 | – | 5.3 |

| Oakley Capital Investments | Closed-end Fund | UK | 5.1 | 6.5 | (1.4) |

| Harbourvest Global PE | Closed-end Fund | UK | 5.1 | 3.3 | 1.8 |

| Partners Group PE1 | Closed-end Fund | UK | 4.8 | 5.4 | (0.6) |

| Cordiant Digital Infrastructure | Closed-end Fund | UK | 4.7 | 5.0 | (0.3) |

| Aker | Oil & gas | Norway | 4.5 | 3.9 | 0.5 |

| Total | 58.2 | 60.1 |

Vivendi

Figure 12: Vivendi (EUR)

Source: Bloomberg

Vivendi is a French media and entertainment conglomerate that now operates primarily as an investment holding company, with a portfolio of seven media-related businesses. In December 2024, the firm completed a four-way split, spinning off Canal+ (pay-TV), Havas (advertising), and the Louis Hachette Group (publishing), all of which were listed as separate public entities.

As a result, Vivendi now functions largely as a holding vehicle for listed equity stakes, with only one of its seven investments being a wholly owned private company. The bulk of Vivendi’s residual value is attributed to its 10% stake in Universal Music Group.

AVI believes that Vivendi has little reason to exist, with the company trading at a market capitalisation of approximately half its estimated NAV. This substantial discount, in AVI’s view, makes the company a potential candidate for activist intervention and may signal that a full wind-up of the company is only a matter of time.

One potential route for realising value, according to Tom, lies with Vincent Bolloré, Vivendi’s largest shareholder, who controls approximately 30% of the company. Were Bolloré to pursue a squeeze-out of minority shareholders via share buybacks, he could potentially secure majority backing for a take-private transaction at a premium to the current share price, delivering value to all shareholders while consolidating control.

HarbourVest Global Private Equity

Figure 13: HVPE (GBP)

Source: Bloomberg

HarbourVest Global Private Equity (HVPE) is a UK-listed private equity investment company that provides access to funds managed by HarbourVest Partners. HVPE forms part of AGT’s broader allocation to listed private equity, but is considered a particularly noteworthy position, with the AVI team recently increasing their exposure.

Like many peers in the listed private equity space, HVPE trades at a significant discount to NAV currently 35%. However, what distinguishes HVPE is its upcoming continuation vote, scheduled for its 2026 AGM (typically held in July).

Given the persistence of the discount and the board’s continued failure to address or close it, Tom has stated that it may now be in shareholders’ best interests to vote in favour of a wind-up. He argues that HVPE is effectively facing a “perform or wind-up” scenario, and in the absence of meaningful improvement in recent NAV performance or in the discount, the case for continuation is increasingly difficult to justify.

Other noteworthy portfolio moves

Toyota Industries

Figure 14: Toyota Industries (JPY)

Source: Bloomberg

Toyota Industries is a nearly-century-old Japanese machinery manufacturer and a historic cornerstone of Japan’s post-war industrial recovery. It is also the original parent company of Toyota Motor Corporation. On 3 June 2025, Akio Toyoda – the grandson of the founder and current chairman – announced a proposal to take the company private, offering a total consideration of $33bn.

The transaction, which would rank among the largest take-private deals in history, is structured through a special purpose vehicle backed by funding from Toyoda Fudosan, Toyota Motor Corporation, and a modest personal contribution from Akio Toyoda himself.

However, the proposed offer price of JPY16,300 per share represented an 11% discount to Toyota Industries’s share price on the day of announcement. Tom noted that this valuation was only slightly above the company’s accounting book value, and approximately a 35% discount to its estimated intrinsic value. As the deal remains subject to shareholder approval, Tom has stated there is a possibility that the offer price may be revised higher to secure sufficient support.

AVI cut AGT’s exposure to Toyota Industries by 50% by the end of June, from 4% of NAV to 2%, selling at a premium to the offer price, with Toyota Industries trading at c. JPY18,000 per share over May, though it has since fallen to the offer price.

SoftBank Group

Figure 15: SoftBank Group (JPY)

Source: Bloomberg

AGT has fully exited its position in SoftBank since our last update, having previously held a 5.8% weighting, making it the trust’s fourth-largest holding at the time. SoftBank, one of Japan’s largest publicly listed companies, is closely aligned with the interests of its founder and largest shareholder, Masayoshi Son, who owns approximately one-third of the company. Whilst SoftBank holds stakes across the energy, financial, and technology sectors, known for its flagship Vision Fund – the world’s largest technology venture fund.

AVI sold AGT’s position in SoftBank for two key reasons. First, to raise capital for more attractive opportunities during the April 2025 market sell-off, and secondly, due to a deterioration in the investment case, particularly related to a strategic shift at SoftBank.

Tom cited the group’s increasingly expanded approach to AI investing, which signals a reduced emphasis on shareholder returns, particularly in the form of buybacks – previously a central element of the investment thesis.

Performance

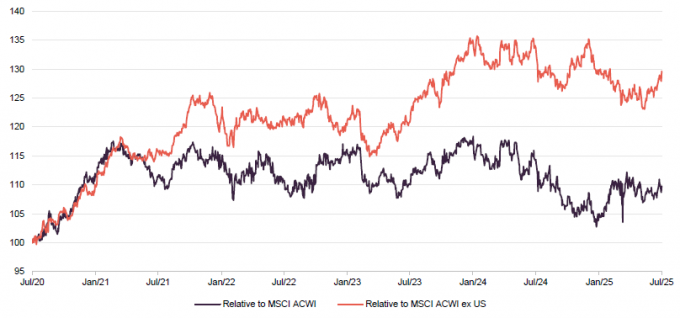

Figure 16: AGT NAV total return performance versus objective over five years ending 31 July 2025

Source: Morningstar, Marten & Co

Over the five-year period ended 31 July 2025, AGT delivered outperformance of its MSCI ACWI benchmark, with an NAV total return of 98.8%, surpassing the 81.0% return of the MSCI ACWI.

AGT has achieved this over a period when many active managers have underperformed (as is evidenced in the peer group returns) and without holding any of the (largely US) mega-cap technology stocks which have been driving global markets. The impact of this small cohort of companies can be seen in the lower returns generated by AGT’s former benchmark, the MSCI ACWI ex US index, relative to the MSCI ACWI.

Figure 17: Total return cumulative performance over various time periods to 31 July 2025

| 3 months(%) | 6 months(%) | 1 year(%) | 3 years(%) | 5 years(%) | |

|---|---|---|---|---|---|

| AVI Global Trust share price | 15.1 | 6.4 | 8.6 | 42.5 | 104.0 |

| AVI Global Trust NAV | 12.0 | 5.9 | 9.6 | 39.6 | 98.8 |

| MSCI ACWI | 13.0 | 1.3 | 14.1 | 40.8 | 81.0 |

| MSCI ACWI ex US | 8.8 | 6.1 | 13.0 | 31.3 | 53.4 |

| Peer group1 median share price | 13.1 | (0.1) | 6.8 | 29.4 | 30.7 |

| Peer group1 median NAV | 11.5 | 0.1 | 9.6 | 35.1 | 57.1 |

Peer group

Up-to-date information on AGT and its peers is available on our website

AGT is a constituent of the AIC’s Global sector, which is comprised of trusts investing predominantly in listed equites.

AGT’s discount remains towards the lower end of the peer group table. Its dividend yield sits in the middle of the pack, though none of these trusts are focused on providing a high dividend yield. Its market cap also sits in the middle of the group, though at over one billion pounds, AGT is among one of the largest listed equity investment trusts.

AGT’s ongoing charges is the highest amongst its peers, but not elevated in the context of the wider investment company sector. The manager would observe that its investment approach is a higher degree of operational engagement compared to most equity investors, and this is reflected in the fees that it charges.

Figure 18: Peer group comparative data as at 1 August 2025

| Premium / (discount) (%) | Dividend yield(%) | Ongoing charge(%) | Market cap(£m) | |

|---|---|---|---|---|

| AVI Global Trust | (9.0) | 1.4 | 0.87 | 1,065 |

| Alliance Trust | (4.4) | 2.1 | 0.56 | 4,954 |

| Bankers | (10.2) | 2.3 | 0.51 | 1,251 |

| Brunner | (4.3) | 1.8 | 0.63 | 602 |

| F&C | (6.7) | 1.3 | 0.45 | 5,571 |

| Franklin Global | (2.0) | 1.2 | 0.65 | 190 |

| Lindsell Train | (12.9) | 5.0 | 0.80 | 168 |

| Manchester & London | (16.5) | 1.6 | 0.47 | 337 |

| Mid Wynd | (2.3) | 1.1 | 0.60 | 292 |

| Monks | (9.5) | 0.0 | 0.44 | 2,447 |

| Scottish Mortgage | (9.0) | 0.4 | 0.31 | 12,280 |

| Sector median | (9.0) | 1.4 | 0.56 | 1,065 |

| AGT rank | 7/11 | 6/11 | 11/11 | 6/11 |

AGT has generated the highest five-year NAV returns of any global equity trust and ranks in second over three years; it also in the middle of the pack over one year. Manchester & London’s returns in recent years reflect its extreme bet on AI.

Figure 19: Peer group cumulative NAV total return data as at 31 July 2025

| 3 months | 6 months | 1 year | 3 years | 5 years | |

|---|---|---|---|---|---|

| AVI Global Trust | 12.0 | 5.9 | 9.6 | 39.6 | 98.8 |

| Alliance Trust | 11.5 | (1.6) | 8.1 | 38.0 | 77.9 |

| Bankers | 13.9 | 1.6 | 11.0 | 29.8 | 57.1 |

| Brunner | 9.5 | (0.5) | 6.8 | 35.1 | 89.1 |

| F&C | 11.4 | 0.1 | 14.0 | 39.3 | 85.2 |

| Franklin Global | 10.7 | (4.1) | 0.7 | 14.6 | 19.2 |

| Lindsell Train | (1.6) | (6.0) | 0.5 | (0.4) | 9.1 |

| Manchester & London | 48.2 | 22.5 | 39.5 | 134.3 | 95.9 |

| Mid Wynd | 7.8 | (5.8) | 0.1 | 13.6 | 37.2 |

| Monks | 19.4 | 1.7 | 17.6 | 37.7 | 46.1 |

| Scottish Mortgage | 18.4 | 3.3 | 30.3 | 34.9 | 45.5 |

| Sector median | 11.5 | 0.1 | 9.6 | 35.1 | 57.1 |

| AGT rank | 5/11 | 2/11 | 6/11 | 2/11 | 1/11 |

Fund profile

Holding companies, closed-end funds, and asset-backed special situations

AGT aims to achieve capital growth through a focused portfolio of investments, particularly in companies whose shares stand at a discount to estimated underlying net asset value. It invests in quality assets held through unconventional structures that tend to attract discounts; these types of companies include family-controlled holding companies, closed-end funds, and asset-backed special situations such as asset-rich Japanese operating companies.

The company uses the MSCI All Country World Total Return Index, expressed in sterling terms, for performance measurement purposes. The performance benchmark has no influence over portfolio construction and that AGT’s active share is always likely to be close to 100%.

AGT’s AIFM is Asset Value Investors (AVI). AVI was established in 1985, when the trust’s current approach to investment was adopted. At that time, AGT had assets of just £6m and was known as the British Empire Securities and General Trust, later shortened to British Empire Trust. The trust adopted its current name on 24 May 2019.

Previous publications

Readers interested in further information about AGT may wish to read our previous notes listed below. You can read them by clicking on the links in Figure 24 or by visiting our website.

| Title | Note type | Date |

|---|---|---|

| Double discount on quality-focused portfolio | Initiation | 25 January 2021 |

| Focused high conviction portfolio | Update | 5 August 2021 |

| Bargain hunting | Annual overview | 20 May 2022 |

| Doubly blessed | Update | 8 March 2023 |

| An historic opportunity | Annual overview | 21 November 2023 |

| Thriving under pressure | Update | 6 June 2024 |

| Building on solid foundations | Annual overview | 5 December 2024 |

| IMPORTANT INFORMATION | ||

|---|---|---|

| Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on AVI Global Trust Plc.This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.Marten & Co is not authorised to give advice to retail clients. The research does not have | regard to the specific investment objectives financial situation and needs of any specific person who may receive it.The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note | until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited. |

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.

| QuotedData is a trading name of Marten & Co, which is authorised and regulated by the Financial Conduct Authority. 50 Gresham Street, London EC2V 7AY 0203 691 9430 www.QuotedData.com Registered in England & Wales number 07981621, 2nd Floor Heathmans House, 19 Heathmans Road, London SW6 4TJ |

|---|