The Bureau of Labor Statistics issued a weak jobs report at the start of the month and the White House responded by sacking the boss of the agency. US inflation data came in slightly below expectations – defying fears that tariffs would be pushing up prices – that raised hopes of an interest rate cut in September. However, when the Producer Price Index was published later the same week, the data did suggest a tariff impact.

Towards the end of the month, Trump tried to fire Lisa Cook, a governor of the Federal Reserve.

“President Trump has no authority to remove

Federal Reserve Governor Lisa Cook. His attempt to fire her, based solely on a

referral letter, lacks any factual or legal basis. We will be filing a lawsuit

challenging this illegal action.”

Abbe David Lowell, Federal Reserve Governor Lisa

Cook’s attorney

The US agreed to allow Nvidia to sell its chips to China provided it paid a 15% levy on revenues to the US government.

German GDP figures were weak, suggesting that it had fallen back into a recession, and more trouble was brewing in Europe as France’s government borrowing costs rose and political turmoil threatened to collapse its government.

The UK economy slowed, too, and this was accompanied by resurgent inflation.

Scottish American Investment Co

Investors seem to be holding two conflicting ideas: that corporate earnings will keep rising, but that growing deficits and protectionism may cause problems in the long term. Currently, optimism is still priced in, even as unease quietly builds.

Global Opportunities Trust

Hitherto, equity markets have been willing to shrug off the twists of policy and the increasingly bellicose rhetoric. If the US economy begins to deteriorate, one can expect the political attacks to increase but for market tolerance to move in the opposite direction.

The Diverse Income Trust,

We believe that the economic trends that drove the outstanding returns of the US technology megacaps have come to an end. Furthermore, we also believe there will be weighty consequences to come from the introduction of US trade tariffs. Indeed, given the scale of the proposals, we anticipate equally meaningful unintended consequences.

At a glance

| Exchange rate | 31 August 2025 | Change on month % | |

|---|---|---|---|

| Pound to US dollars | GBP / USD | 1.3504 | 2.2 |

| Pound to euros | GBP / EUR | 1.1555 | (0.1) |

| US dollars to Japanese yen | USD / JPY | 147.05 | (2.5) |

| US dollars to Swiss francs | USD / CHF | 0.8005 | (1.5) |

| US dollars to Chinese renminbi | USD / CNY | 7.1307 | (1.0) |

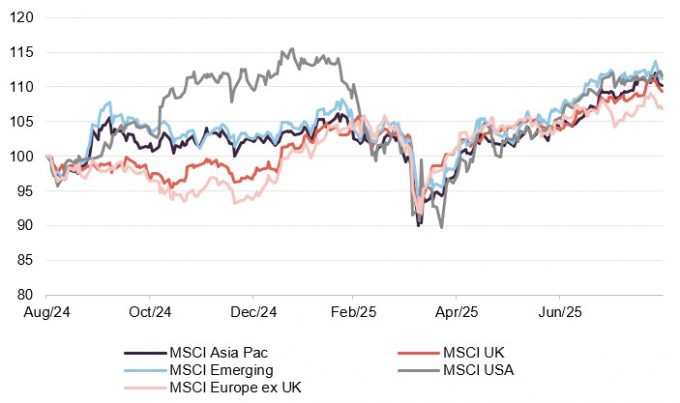

MSCI Indices (rebased to 100)

In some ways, it felt as though August was the quiet month everyone expects it to be. Market moves were muted, with Europe doing best in sterling terms and emerging markets the laggard. However, the two were only separated by 2.2 percentage points.

More dramatically, the oil price fell and gold hit new highs. The latter move likely reflecting the attacks on the Fed. UK government borrowing costs continued to climb and speculation has started about the contents of November’s budget.

Time period 31 August 2024 to 31 August 2025

| Indicator | 31 August 2025 | Change on month % |

|---|---|---|

| Oil (Brent – US$ per barrel) | 68.12 | (6.1) |

| Gold (US$ per Troy ounce) | 3447.95 | 4.8 |

| US Treasuries 10-year yield | 4.23 | (3.3) |

| UK Gilts 10-year yield | 4.72 | 3.3 |

| German government bonds (Bunds) 10-year yield | 2.72 | 1.1 |

Global

Dr Sandy Nairn, executive director, Global Opportunities Trust, 21 August 2025

Global equity markets remained focused on AI as the core area of interest. Although the shares largely paused for breath, such has been the movement that the US market now accounts for 72% of the world’s equity market capitalisation with the top 10 technology companies alone exceeding over 25%. Attention has turned to the build out of AI infrastructure with the Stargate project targeting expenditure of $500bn on data centres. The expenditure in AI and AI-related fields accounts for much of US current capital expenditure. As a result, there appears a two tier economy with one characterised by capital inflows, growing valuations and inflating salaries. The other appeared reasonably robust, but recent data revision have begun to undermine that view. The White House has reacted by shooting the messenger, claiming recent data revisions are either not accurate or politically inspired. At the same time, the attacks on the Federal Reserve Chairman continue. Undermining the core financial institutions and government bodies is not designed to inspire the confidence of international investors already concerned at the ongoing tariff dramas and reversals. Hitherto, equity markets have been willing to shrug off the twists of policy and the increasingly bellicose rhetoric. If the US economy begins to deteriorate, one can expect the political attacks to increase but for market tolerance to move in the opposite direction.

There are many reasons why this is likely, the most important being the lags that exist in the economic system. The impact of the tariff-induced uncertainty together with the actual rises will soon begin to feed through in prices and volumes. Whilst it is highly likely that some interest rate cuts will follow, it is also likely that these will be limited reflecting the merging inflationary pressures. With markets at historically high valuations and accompanying political stress, it does not make for an appetising cocktail. This does not mean no investment opportunities will emerge, particularly given the current narrowness of markets and the focus on technology.

. . . . . . . . . . .

Virginia Holmes, chair, Murray International, 14 August 2025

Global equity markets are navigating a complex macroeconomic environment. Although there was resilient performance in the first half of the year, there have also been periods of volatility and weakness, and the path ahead is likely to remain uneven. Despite these challenges, compelling opportunities exist. Earnings growth is gradually expanding beyond just the mega-cap technology companies. Central banks, particularly the European Central Bank, have implemented modest rate cuts, and there are expectations that the Federal Reserve will follow suit. This should support valuations and sustain investor sentiment. In emerging markets, lower interest rates and a weaker U.S. dollar may attract capital inflows, especially in Asia and Latin America. However, risks remain. Geopolitical tensions could lead to potential shocks, and concerns about the fiscal position of the United States persist. Trade tensions may also influence market dynamics and have a spillover effect on inflation, which could restrict central banks’ ability to ease monetary policy as currently anticipated. In this environment, investors will benefit from a patient, globally diversified, and risk-aware approach.

. . . . . . . . . . .

Martin Connaghan & Samantha Fitzpatrick, managers, Murray International, 14 August 2025

The first half of 2025 proved to be a rollercoaster for global markets, underscoring both their vulnerability to shocks and their capacity for opportunity and recovery. Investors were whipsawed by a volatile mix of political developments, economic uncertainty, and geopolitical flashpoints that tested confidence across asset classes. Markets kicked off the year on a high note, lifted by renewed investor enthusiasm following President Trump’s return to office. Hopes for sweeping tax reforms and deregulation sparked a wave of optimism. But that sentiment quickly soured. April’s dramatic “Liberation Day” marked a turning point, as markets reacted sharply to a flurry of destabilising signals: tariff threats, fiscal instability, friction with the Federal Reserve, and erratic policy moves from Washington. Tensions abroad added to the unease. A brief but intense military confrontation between Israel and Iran rattled global investors, though the fact that it did not escalate and a ceasefire was agreed very quickly helped contain the fallout.

Unfortunately, efforts to broker peace in other conflict zones-namely between Russia and Ukraine, and Israel and Hamas-have not progressed at the same rate, casting a shadow over broader geopolitical stability. Despite the turbulence, a shift in tone emerged by mid-year. A surprise trade détente between the U.S. and China, along with a new framework agreement with the UK, helped ease fears of a global trade breakdown. Additional trade negotiations were reported to be underway, further lifting sentiment. By summer, risk appetite had returned, and equity markets across the globe-particularly in the U.S. and Asia-rallied to new highs. The first six months of 2025 serve as a vivid reminder of the risks and opportunities that global equity markets offer.

. . . . . . . . . . .

J. Rothschild Capital Management Limited, managers, RIT Capital Partners

Looking ahead to the second half of 2025 and beyond, we believe the portfolio is well positioned to benefit from two megatrends, technology diffusion and a multi-polar world.

The first half of 2025 brought turbulence across global markets against a backdrop of trade policy uncertainty and geopolitical tensions. While we expect to see some of this uncertainty continue into the second half of the year, the global economy is still growing, albeit at a slower pace, creating investment opportunities.

Ongoing trade tariff negotiations continue to impact markets and influence the direction of inflationary pressures. Valuations remain historically high, and price risk may linger in the near-to-medium term, especially for US equities.

In this environment, we believe that companies, whether private or public, with strong competitive advantages such as pricing power and effective management teams will outperform.

Technological adoption is accelerating, with AI and digital transformation extending well beyond the boundaries of the traditional tech sector. We believe this area is well placed to benefit from further M&A and IPO activity in the near term.

. . . . . . . . . . .

Baillie Gifford & Co, Scottish American Investment Co, 4 August 2025

As perhaps should have been expected, the first half of the year was anything but quiet.

President Trump’s return to office triggered a storm of executive orders and policy shifts. Markets are still trying to make sense of the upheaval, but one thing seems clear: the old world order is changing. The result has been a sharp uptick in uncertainty for businesses and investors alike.

In Europe, Germany’s decision to suspend its long-standing “debt brake” marks a major turning point. A €1 trillion stimulus plan, half earmarked for infrastructure and half for defence, is a significant policy shift and could well pave the way for other countries to loosen the purse strings. Meanwhile, China has stayed cautious. It’s offering some support to its private sector and tech firms but is holding back on major consumption stimulus-at least for now.

From mid-February to early April, U.S. equities dropped around 19% as investors took profits on previously high-flying tech stocks. European and Chinese equities, by contrast, rallied, buoyed by improving growth prospects and more attractive valuations.

During the second quarter, things reversed. After a rocky start in April, global equity markets staged a sharp rebound-once again led by U.S. tech giants. Investors seemed largely unfazed by the continued wave of executive orders. The market appeared to be saying: policy chaos is just noise, and the economy will carry on regardless.

Underneath the optimism, there are cracks. The U.S. has now imposed average tariffs at their highest level since 1937; a massive new fiscal bill will add over $3 trillion to U.S. debt over the next decade; and the dollar has weakened by approximately 10% despite rising bond yields-an odd and possibly troubling combination.

Add it all up, and the picture is a strange one. Investors seem to be holding two conflicting ideas: that corporate earnings will keep rising, but that growing deficits and protectionism may cause problems in the long term. Currently, optimism is still priced in, even as unease quietly builds.

For investors, this can be troubling. Faced with uncertainty and volatility, the temptation is to withdraw from the equity market and park money in cash. But experienced investors know this is a high risk strategy: often the market rebounds before the investor feels comfortable returning, with hindsight it becomes apparent that the right strategy for the long-term was to remain invested in the market.

. . . . . . . . . . .

Sue Inglis, chair, Invesco Global Equity Income Trust, 1 August 2025

The constant barrage of geopolitical tensions and tariff disputes has weighed on the global growth outlook, though levels of uncertainty have eased somewhat since the financial year end. Nonetheless, forecasting the year ahead remains inherently difficult, particularly given the US president’s unpredictable approach to policymaking.

Despite these headwinds, global equity market volatility has largely normalised since the height of the ‘tariff tantrum’ as investors appear more sanguine. While further bouts of equity market volatility are likely, corporate fundamentals, particularly in the US, remain broadly supportive. Valuations in other regions, notably Europe and the UK, also appear relatively attractive, offering compelling opportunities for selective investment.

. . . . . . . . . . .

Stephen Anness, manager & Joe Dowling, deputy manager, Invesco Global Equity Income Trust, 1 August 2025

Uncertainty still exists as to the end game for US tariffs and potential retaliation and countermeasures from other countries. This has an impact on investment and hiring decisions for many businesses. While slowing growth and economic uncertainty are the focus for market participants today, any resolution on tariffs or evidence that the US administration is to be successful in igniting the private sector would shift the emphasis. We choose not to second guess these outcomes, rather focusing our time and energy on building a diversified portfolio of high-quality businesses, trading at attractive valuations from the bottom-up. Diversification is key in this market as we can’t rely on one definitive economic outcome.

. . . . . . . . . . .

Dean Buckley, chair, Alliance Witan, 31 July 2025

With the returns from equities broadening out and if geopolitical tensions continue to ease, we look forward to markets behaving more rationally. But there are still many risks ahead, including slowing growth in the US, the possibility of tariffs feeding through to higher inflation and further policy surprises from the White House. With events moving so quickly and unpredictably, we believe that this reinforces the need to keep gearing mostly unchanged, to invest broadly and to focus on high-conviction stock picking to add value.

The Board is confident this approach will ultimately produce better long term returns for shareholders than chasing the latest macroeconomic trend or trying to avoid the next obstacle. As the first half of the year showed, sentiment and market leadership can shift quickly over short periods of time from one investment style, sector or country to another and back again, but it’s the performance of individual companies that determine share prices in the long run.

. . . . . . . . . . .

Craig Baker, Stuart Gray, Mark Davis, managers, Alliance Witan, 31 July 2025

The outlook for stock markets over the rest of the year is finely balanced. There are both bullish and bearish signals: strong earnings and a still healthy economic backdrop supported by hoped-for reductions in interest rates may support continued share price gains. But there are risks from slowing growth in the US, high, and in some cases, frothy valuations, and tariffs. Although the threat of a crippling trade war may have receded, tariffs are still much higher than they were at the start of the year despite concessions. There are also geopolitical issues simmering under the surface, such as the war in Ukraine, and the Middle East is far from stable. In addition, Trump’s “One Big Beautiful Bill Act”, which promises tax cuts, is making global bond markets edgy about the size of the US government’s budget deficit. This is putting downward pressure on the dollar and nervousness about the deficit could spill over into equity markets, although Trump argues that the revenue generated by tariffs will more than pay for the Bill. Against this backdrop, we expect continued market volatility, as the tug of war between bull and bear market forces plays out.

Though unsettling, this volatility is likely to be a rewarding environment for active managers. The increasing divergence of returns between countries, sectors and investment styles creates opportunities for global managers with the skill to identify fundamentally strong companies who are being under or overpriced relative to their earnings power. We don’t know what the future holds. However, we strongly believe that stock selection, rather than aggressive country or sector positions will deliver superior long-term returns for shareholders, despite anticipated market turbulence.

. . . . . . . . . . .

Beatrice Hollond, chairman, F&C Investment Trust, 31 July 2025

The first half of 2025 has been characterised by significant geopolitical uncertainty, with President Trump’s April announcement, on ‘Liberation Day’, of widespread tariffs on US trading partners representing a shock for markets. The breadth and scale of proposed tariffs caught investors by surprise, as they had begun the year with expectations of market-friendly deregulation and tax cuts designed to stimulate US economic growth. While market conditions stabilised following the announcement of a 90-day pause for those countries that avoided retaliation, persistent uncertainty remained throughout the second quarter, further heightened by conflict in the Middle East. Economic and geopolitical uncertainty led to a substantial rise in equity market volatility and contributed to weakness in the US dollar, which suffered its worst first-half of the year since 1973, declining by 9.7% against sterling.

US equities materially lagged returns from non-US markets, with Europe a standout performer, led by strong returns in the first quarter. Indeed, the underperformance of the US equity market, relative to the rest of the world, over the six-month period was one of the widest for decades. Divergence in interest rate policy helped non-US markets, as the US Federal Reserve held interest rates steady across four consecutive meetings, adopting a data-dependent approach to assess the economic impact of the administration’s trade policies. Meanwhile, the Bank of England cut rates by 0.5% and the European Central Bank by 1.0%.

Sentiment towards Europe also benefited from a significant shift in fiscal policy orientation, particularly following the German election in February. The incoming coalition’s proposals to reform the constitutional debt brake to accommodate higher defence spending, coupled with the European Commission’s initiative to exempt such expenditures from deficit calculations, represent a notable evolution in the European fiscal framework with potentially far-reaching implications for markets.

Despite recent volatility and uncertainty introduced through tariff policy and military conflict, the fundamental outlook for the global economy remains relatively sound. While earnings expectations for developed markets have seen downgrades, there are now signs that markets are expecting improving growth in 2026. This, coupled with expected cuts in interest rates, provides a constructive backdrop for global equity markets.

Actions of the new US administration, coupled with relatively rich valuations in US equities and the currency, have led to increasing discussion amongst market participants over whether US outperformance, in economic and market terms, will persist. Our portfolio holds a majority of its exposure in US assets and so has a substantial weighting to both the US equity market and the US dollar. Our Manager has, at the margin, been reducing US exposure in recent months and we remain vigilant around the risk of further underperformance from this region. Despite this, our Manager continues to see attractive opportunities in terms of individual stocks within the US and other markets.

. . . . . . . . . . .

UK

Richard Wyatt, chairman, Temple Bar Investment Trust, 19 August 2025

The new government has been in place in the UK for over a year and faces a number of challenges. Domestically it has the difficult task of trying to balance the need for public sector investment and prudent management of the UK’s fiscal position without stifling business and consumer confidence, while internationally it navigates continued geopolitical uncertainty alongside apparently capricious shifts in global tariffs and trade policy.

Despite global macroeconomic uncertainty, including uneven global growth and differing monetary policy paths, the UK market benefits from political stability, attractive valuations, and ongoing corporate activity.

The timing and pace of interest rate cuts also remains unclear, despite continued weakness in the UK economy and a relatively subdued level of inflation. However, the Board believes that any concerns here are reflected in current valuations.

. . . . . . . . . . .

Ian Lance and Nick Purves, co-managers, Temple Bar Investment Trust, 19 August 2025

The start of 2025 was tumultuous in many respects, but nevertheless stock markets were able to finish the first half of the year solidly in positive territory. April, in particular, was marked by extreme volatility, as Donald Trump announced his much-anticipated reciprocal tariffs. Although stock markets had been fretting over these since the start of the year, they went well beyond what had been expected and thereby triggered an aggressive sell-off as investors repriced the likelihood of a US recession and the likely knock-on effects on the global economy more generally. In the two days following the so-called ‘Liberation Day’, US equities fell by more than 10%, marking its fifth biggest two-day decline since World War 2. This equity market sell-off followed through into the US bond market where long-term yields briefly surpassed 5%. Driven by fears of a bond market rout, Donald Trump then announced a 90 day pause in the tariffs, triggering a huge rebound in global stock markets. In just one day, the US stocks rose by almost 10%, their best one-day performance since October 2008. The rebound continued into May and June, enabling the US market to fully recover a more than 15% drawdown in a record short period of time and finishing the half year at a record level.

In June, longer-term fears around the US government deficit were further exaggerated as the Trump administration sought to pass its tax bill through Congress. This bill will extend the Trump tax cuts from his first term and according to some estimates will add around US$3 trillion to US debt levels in the coming years.

Despite the earlier fears that tariff induced uncertainty would undermine confidence and result in a deterioration in the global economy, so far there is little evidence that this is the case. Activity and employment indicators in both the US and Europe indicate that the economy is proving to be resilient, and that inflation remains relatively subdued.

In the UK however, the signs are more mixed, and activity seems to be cooling somewhat following a stronger first three months. This is likely due to the tax rises announced in last year’s budget starting to take effect. The weakness in the economy is most obviously visible in weak employment numbers and is likely to pave the way for more interest rate cuts later in the year.

. . . . . . . . . . .

Victoria Stewart, chairman, JPMorgan Claverhouse, 13th August 2025

UK equity markets outpaced their US and global counterparts during the review period. While domestic economic activity remains subdued and the implications of the Employers National Insurance Contributions increases, work their way through the economy, UK stock markets over the period under review drew support from some easing in UK inflation pressures and two quarter point interest rate reductions by the Bank of England taking the base rate to 4.25%.

Subsequent to the period end, there has been a further quarter percentage point reduction in taking the rate to 4.0%. The Bank has signalled that, dependent on factors such as inflation and the strength of the labour market, additional cuts may follow, which should support household incomes and corporate profit margins. Although in a less parlous starting position than many countries, UK investors welcomed news that the UK Government reached agreement with the new US administration to limit initial new tariffs on many goods including cars, steel and aluminium and struck new deals with the European Union and India to ease the process of UK exports to those destinations.

. . . . . . . . . . .

Gervais Williams and Martin Turner, managers, The Diverse Income Trust, 12 August 2025

Traditionally, global economies have periods of expansion, with intervening periods of recession. Investment in productivity improvement is tested during recessions, such that only the genuinely productive survive. The cycle of expansion and setback usually favours better managed corporates and in doing so drives long-term improvement. Importantly, ongoing long-term productivity improvements are then reflected in wage growth that exceeds inflation.

The economic pattern has been different during globalisation. In general, the near unlimited surge of low-cost imports has offset local service price inflation, such that in many developed economies inflation has been benign for decades.

During economic setbacks, for instance the Global Financial Crisis in 2008, and Covid in 2020, inflationary pressures were not generally feared, and central banks resolved these crises by injecting substantial financial stimulus, with the result that relatively few corporates failed. The net effect was that during globalisation, global productivity improvement was sub-normal. Furthermore, following the widespread introduction of the policy of Quantitative Easing in 2009, the additional distortion this brought to market prices may explain why productivity has generally flatlined subsequently.

Furthermore, given the absence of meaningful productivity improvements since 2008, the wages of many staff have not increased ahead of inflation. In our view it is the absence of wage improvement that explains why, even prior to Covid, many of the electorate started voting against the status quo. Over recent years, with the surge in inflationary pressures, many voters now believe that a major change in government policy is even more urgent.

Given this background, we believe that the economic trends that drove the outstanding returns of the US technology megacaps have come to an end. Furthermore, we also believe there will be weighty consequences to come from the introduction of US trade tariffs. Indeed, given the scale of the proposals, we anticipate equally meaningful unintended consequences.

Whilst the timings of specifics are somewhat unknowable, we believe that in the absence of near-unlimited deflating goods, central banks will routinely have to address periods of both excess inflation and deflation. These will lead either to a major setback in corporate profit margins or a derating of equities, possibly both. From a business perspective this implies a much more severe period of corporate insolvency, with even some of the survivors potentially delivering poor returns.

Equity income stocks have a disproportionate advantage when equity market liquidity is tight. Whilst most corporates need to focus on cashflow survival, companies generating surplus cashflow can acquire overindebted, but otherwise solvent companies, debt-free from the receiver, for almost nothing. As a result, during recessions we anticipate many quoted equity income stocks will accelerate their earnings growth via acquisition. And as the maths works so much better down the market capitalisation range, certain small caps will make relatively substantial acquisitions at almost no cost, potentially delivering transformational upgrades in their earnings.

. . . . . . . . . . .

Andrew Hosty, chairman, Rights and Issues, 6th August 2025

After another period of significant volatility, it feels like markets have found their feet again over recent weeks and seem to have become less susceptible to reacting to every announcement coming out of Washington. While we remain alert to the potential negative consequences of US trade policy, we note that a degree of pragmatism seems to be emerging and therefore the risks of a significant global slow-down have moderated somewhat.

In the UK we recognise that many economic challenges remain and that the government’s room for manoeuvre continues to be limited despite its large majority in parliament. The bigger picture, however, is that inflation has remained under control and interest rates have stabilised at a level which we view as compatible with improved confidence and hence a recovery in growth. Meanwhile, the government has wisely abandoned its policy of deliberately talking the UK down in order to lower expectations.

There may also now be stronger macroeconomic forces that could result in a fundamental reassessment of the pricing of the UK’s smaller companies’ sector.

. . . . . . . . . . .

James Will, chairman, BlackRock Throgmorton Trust, 1 August 2025

The first half of the financial year has been challenging, and uncertainty remains around the outlook for growth. There are a number of trends within the UK small and mid-cap market that may have a profound impact on market dynamics going forward, notably the continued de-equitisation of the UK market (from M&A and share buy backs) and the absence of IPO activity. The UK small and mid-cap market has seen sustained and consistent outflows since 2021, driving some investors to focus on short-term returns. It is notable that the UK market saw just 35 IPOs in 2024, fewer even than in the depths of the Global Financial Crisis.

Notwithstanding these challenging dynamics, the outlook for UK equities is not wholly negative. The strong performance of the FTSE 100 Index over the period under review has been delivered despite outflows from UK-focused open-ended funds, implying demand from international investors and global funds. The FTSE 100 Index performance potentially bodes well for the future absolute and relative performance of UK smaller companies, whose performance quite often lags rallies in their larger peers.

UK small and mid-cap stock valuations are trading at historically low levels. Our asset class (as defined by the Benchmark Index) is trading at a forward price-to-earnings ratio of just over 10x, well below its long-term average of 12.7x and significantly lower than international peers. Our Manager views these valuations as making the type of high-quality businesses that your Company invests in well positioned for reappraisal by the market and a significant rally when the economic environment stabilises.

. . . . . . . . . . .

Dan Whitestone, manager, BlackRock Throgmorton Trust, 1 August 2025

The UK small and mid-cap sector is undoubtedly cheap, with myriad undervalued opportunities where we think the upside is significant on any medium-term view (be it “recovered profits” or just higher earnings base). However, we are concerned over the UK macroeconomic backdrop and in the near term the risk of earnings downgrades have increased as recovery is delayed. Lower growth and weak productivity leaves the UK with a fiscal Gordian knot that tightens by the day.

While many commentators are saying that taxes will inevitably rise to meet growing deficit, it is hard to see where the UK Government can raise another +£20bn whilst committing to their three main electoral promises. The stealth tax of freezing income seems almost unavoidable and may plug half the fiscal shortfall but would still leave them roughly +£11bn short. We must brace ourselves therefore for daily speculation about what else will be taxed, an environment we think will only create further dents to sentiment already reeling from last years ‘fiscal event’.

The prospect of rate cuts by the Bank of England is promising, yet recent inflation data may give them more pause for thought. They will feel torn between inflation and a weakening jobs market, though clearly some members of the Monetary Policy Committee (MPC) seem more sensitive to growth and labour market weakness. A recession in the UK can be avoided, but we may be faced with a prolonged period of anaemic growth. The U-shaped recovery continues to elongate and demand growth continues to be pushed out.

We’ve long argued that we think the UK is cheap with myriad mid-cap opportunities (housebuilders, building materials, RMI, brick manufacturers, selective real estate) where we think the upside on any medium-term earnings recovery leads to at least a doubling if not tripling in equity values for so many companies trading on depressed multiples on depressed earnings. However, given the macro issues outlined above, there is more risk to both EPS and multiples across the mid-cap sector. In a world increasingly dominated by algos, quant funds and hedge fund platforms, these mechanical EPS downgrades are highly likely to lead to further share price weakness, particularly in a backdrop of persistent institutional and retail outflows.

. . . . . . . . . . .

Asia ex Japan

Ian Cadby, chairman, Aberdeen Asian Income Fund, 13 August 2025

Asia continues to offer fertile ground for income investors. Quality companies of the type sought after by the investment manager have robust financials, capable management teams and globally competitive businesses that have enabled them to weather past shocks well. Many are now recognising the strategic value of dividends – not merely as shareholder appeasement, but as a signal of confidence and financial strength.

This mindset shift is evident in China, where state-owned enterprises and internet giants are embracing dividend policies. In addition, South Korea’s ‘Value Up’ reforms are moving companies toward greater transparency and shareholder return discipline.

Despite prevailing macro risks, including the impact of US trade tariffs, the Company’s portfolio remains invested in high-quality companies with resilient earnings and robust dividends. The Investment Manager continues to view market volatility as a way to selectively buy into companies with attractive yields and sustainable fundamentals.

Looking ahead, we remain cautiously optimistic. Dividend cuts appear unlikely given the earnings stability of holdings in the portfolio, and the potential for US Dollar weakness and monetary easing by the Federal Reserve could further support flows into Asia.

. . . . . . . . . . .

North America

Ruper Morley, chairman, Pershing Square Holdings, 20 August 2025

The complex macroeconomic and geopolitical dynamics that have defined recent years continued to play a role in the first half of 2025, contributing to an environment marked by broad uncertainty. On the economy, much of the volatility stemmed from evolving U.S. tariff policy. In addition, market sensitivity around the path of interest rates persisted, even as inflation in the U.S continued to moderate, at least in the short-term. From a geopolitical perspective, ongoing conflicts in Eastern Europe and the Middle East added another layer of instability to an already complicated global backdrop.

. . . . . . . . . . .

Robert Talbut, chair, JPMorgan American, 14 August 2025

The first six months of 2025 were marked by volatility in the US stock market, driven by geopolitical tensions and fluctuating economic indicators. Despite some initial optimism following the new US administration’s economic policy announcements, concerns over potential trade conflicts only added to market uncertainty, which peaked in early April. Despite these challenges, some companies managed to report positive earnings growth, which helped to lift markets back to near record levels at the end of the period.

. . . . . . . . . . .

Felise Agranoff, Jack Caffrey, Eric Ghernati and Graham Spence, managers, JPMorgan American, 14 August 2025

We are optimistic about the prospects for US equities for the rest of this year and beyond. Market expectations have improved in recent months, with investors no longer focused on worst-case scenarios.

As 2025 started, markets were buoyed by expectations of pro-growth policies from the new administration, which fuelled a surge in optimism. However, worries about cracks in the AI growth narrative, the threat to economic activity posed by US tariffs and geopolitical tensions soon emerged, adversely impacting global markets, and causing a growth scare that culminated in a pronounced market sell-off in April.

‘Big Tech’, particularly the so-called ‘Magnificent 7’, fell into bear market territory, significantly contributing to the downturn. Meanwhile, Treasuries rallied, although 10-year yields remained sensitive to fluctuations in the economic data. Investors also began to fret about stagflation, as the US Federal Reserve’s economic projections indicated upward revisions in both the unemployment rate and core inflation to 4.4% and 2.8%, respectively, by the end of 2025.

Despite these setbacks, US equities showed resilience as the year progressed with investor fears of worst-case scenarios diminishing. An easing in trade tensions, combined with resilient employment and corporate earnings reports, and persistently tame inflation data, helped restore investor confidence. The S&P saw the fastest ever rebound from a drawdown of more than 15%, although the recovery was not universal as only some members of the Magnificent 7, Meta Platforms, Microsoft, and NVIDIA outperformed, while other names lagged. As the sectors expected to be beneficiaries of AI broadened, the industrials sector emerged as the top performer so far this year, rising by 12% in the review period, closely followed by communication services (+11%) and financial stocks (+9%). Consumer discretionary was the worst-performing sector, declining by 4%, and health care also ended in negative territory, declining by 1%.

. . . . . . . . . . .

US Equity Growth Team, Baillie Gifford US Growth Trust, 11 August 2025

As long-term investors, we anchor our approach on patience through volatility, conviction-led investing, and relentless focus on growth. While identifying tomorrow’s exceptional companies is challenging, we know that holding onto them through inevitable setbacks is even harder. History confirms that even the greatest investments – NVIDIA, Amazon, Netflix – have required unwavering patience through multiple drawdowns exceeding 30%. Success rarely unfolds smoothly.

The same lesson governs our handling of today’s headlines. President Trump’s second-term trade volleys and tariff threats move markets week by week, yet predicting his next tweet is not our edge. Instead, we must double down on the things we believe matter, the things we believe we have an edge in analysing, and the forces whose trajectories remain largely price-indifferent. Like the structural drivers of lasting growth – declining battery costs underpinning electric vehicles, falling inference costs fuelling artificial intelligence (‘AI’), and unprecedented biological insights reshaping healthcare, to name a few. Or the resilience and adaptability of the companies we invest in. Resilience to navigate the short term – the macroeconomic environment, the changes in administration, and the ebbs and flows of geopolitics. Adaptability to navigate the long run – embracing paradigm-shifting technologies and traversing changing cultural trends.

Yet, tailwinds and resilience alone are insufficient. The true differentiator underpinning adaptability and sustained long-term growth is a company’s culture. Ask any structural engineer: steel reinforcement makes concrete resilient and permits daring shapes. Inside companies, culture plays the same role, supporting companies in building into their opportunities.

. . . . . . . . . . .

Global emerging markets

Maria Luisa Cicognani, chairman, Mobius Investment Trust, 4 August 2025

The most significant driver of recent volatility has been President Trump’s aggressive and unpredictable tariff policy which escalated on 2 April – ‘Liberation Day’ – with the announcement of extraordinarily high, sweeping tariffs. The subsequent pause of the tariffs until 9 July seemed only to confirm the erratic nature of U.S. policies, a sentiment further validated by the recent extension to 1 August. The initial 90-day window, and then the additional month, were intended to provide the U.S. with time to negotiate trade deals.

While the global economy has felt the ripple effects, it increasingly appears that the U.S. may end up bearing a greater share of the negative consequences than intended. Inflationary pressures are mounting, unemployment risks are rising, and consumer confidence, GDP growth, and President Trump’s approval ratings have all seen notable declines. This shift has weighed on the U.S. dollar, potentially marking the beginning of a broader reversal in the decade-long trend of dollar strength-a dynamic that could offer renewed tailwinds for emerging markets.

This uncertain environment has been challenging for investors. Smaller, high quality companies have been disproportionately affected by weak market sentiment, particularly in the technology sector. Despite strong fundamentals, these businesses have shown greater vulnerability to recent market volatility.

. . . . . . . . . . .

Biotechnology and healthcare

Paul Major and Brett Darke, Bellevue Healthcare Trust, 6 August 2025

In the face of so much uncertainty, one must try to take a step back, consider the current position and assess the likely future paths forward. While this type of exercise is time consuming and fraught with inherent uncertainty, it is a very worthwhile endeavour in the current situation.

Firstly, let us consider where we are. The healthcare sector has materially underperformed the wider equity market since December 2022, delivering a total absolute return in sterling over the period of -9%, compared to +31% for the wider market. One hesitates to go out on a limb and say “sentiment couldn’t get much worse”, but it feels like it is close to a bottom already.

This translates into valuation metrics, as Figure 2 in the Half-yearly report illustrates; the healthcare sector looks cheap relative to the market on a long-term historical basis and is cheaper today in absolute terms than it was a decade ago.

Then we have the underlying fundamentals. There are four structural drivers of long-term industry growth: a growing population, an ageing population, continued medical innovations and increasing global GDP/capita in frontier markets. Have these changed? The answer is clearly “no”.

Indeed, an investor can surely be more confident in the demand outlook for healthcare products and services than they can be over, say, big tech spending into AI delivering a positive internal rate of return (“IRR”) for shareholders.

Having concluded in very general terms that the sector does not face an existential long-term threat to structural growth, we can turn our attention to the specific short-term headwinds that are weighing on sentiment, and which predominantly impact the US operations of pharma/biotech companies within the sector:

- Tariffs. Trump has repeatedly said that the report into pharma tariffs will be released “imminently” (most recently in mid-June). However, even 25% tariffs on key ingredients are likely to have only a low single-digit impact on margins. A 50% tariff could more significantly affect some products, cutting operating margins by high single digits. Trump has repeatedly indicated any “232” tariffs will be phased in, to give the industry time to adapt supply chains (a process which is well underway). This will further blunt the ultimate impact of the final tariff rate.

- Drug pricing. As noted previously, there is not really a policy to assess here and more than one self-imposed deadline for more detail to emerge has passed without comment, perhaps because there is not really a coherent plan at all (as was arguably the case in Trump’s first term when he also tried to address drug pricing). His latest epistle seems to ask the industry to implement these proposals on itself, or face as yet unspecified consequences (the implementation and legality of which remain highly uncertain).

- Is the FDA “broken”? FDA leadership changes are understandably a focus for healthcare investors. The DOGE-led chaos earlier in the year, much of which is since undone, and the resignation of Peter Marks, a pro-innovation industry favourite, caused unease. Opinions were divided: some praised his pro-innovation stance, while others flagged concerns around regulatory laxity. The new leadership may be less permissive, but it is not all negative. Both new FDA Commissioner Martin Makary and the FDA’s Chief Medical and Scientific Officer and Director of the Center for Biologics Evaluation and Research (“CBER”), Vinay Prasad, made supportive comments around innovation and reform of the approvals process, which is long overdue. However, Prasad has recently departed, re-igniting investor concern about operational disruption, even if there is little evidence of it thus far. Even so, sentiment seems to be stabilising, but confidence is likely to depend on a further period of smooth operations and continued lack of regulatory surprises.

When one notes that the Bloomberg World Pharma Index fell almost 15% from early March to the week after “Liberation Day”, and only recovered around a third of this lost value by the end of May, one can argue tariff and pricing headwinds are priced in to a large extent. We expect clarification on pricing mechanisms and tariff rates to be a catalyst for renewed interest in the sector, even if the headlines on the day(s) are negative; at least investors will have clarity, and can then make a comparison of the earnings to other industries; one that will surely end up looking favourable.

The Healthcare sector has faced an uphill battle against perceptions of additional risks emerging that are hard to quantify. We believe generalist investors have been avoiding areas of uncertainty in what is already a very uncertain overall market dynamic. Whilst relative and absolute valuations now look very compelling in a historical context, this has not been enough to catalyse renewed excitement over the sector. Perhaps the re-imposition of the Liberation Day tariffs, which will impact all sectors, might itself be a catalyst for a relative re-appraisal of the healthcare’s defensive characteristics, especially as we are getting more clarity on the plans to phase in pharma tariffs and companies have been preparing for these as a highly probable outcome that looks increasingly manageable.

When sentiment and valuation is depressed because of what are essentially short-term concerns, many of which are likely to resolve as tangible realities or disappear from the horizon, yet long-term fundamentals remain intact, there is no reason why active managers should not return to their historical position of being more overweight in healthcare, given its compelling structural growth dynamics.

Whilst policy announcements continue to trickle out, their lack of substantive clarity on implementation and further lack of legislative policy support leaves us feeling that it is more bluster than Realpolitik winning through. We remain confident in the long-term return potential of the sector and optimistic these headwinds will dissipate in the short term.

. . . . . . . . . . .

Commodities and natural resources

Richard Horlick, chair, Riverstone Energy, 27 August 2025

The new U.S. Administration has placed energy at the heart of its economic strategy, viewing it as a lever for competitiveness, reindustrialisation, and growth from AI and its digital strategy. More than any in recent decades, President Trump’s team has pursued a strongly pro-conventional energy supply agenda, with a stated aim of returning oil prices to $50 per barrel. While lower energy costs are a clear economic objective, this price point is not sustainable for much of the U.S. oil industry and poses challenges for capital deployment and long-term strategy.

At the same time, the Administration has introduced growing uncertainty into the renewables and EV sectors. Elements of the Inflation Reduction Act are now under review or rollback, and recent regulatory reversals, including the temporary suspension of offshore wind permitting and increased regulatory hurdles for solar and onshore wind, have further shaken investor confidence. Together, these developments risk undermining the policy clarity and subsidy stability that previously underpinned momentum in U.S. clean energy investment.

Commodity Price Volatility

As ever, oil markets have proved sensitive to both geopolitical risk and sentiment around global growth. WTI crude began the year at $71.72 before falling sharply to an intra-period low of $55.30 in early May, mirroring equity market declines amid fears of a global economic slowdown. Prices spiked in June following Israeli strikes on targets in Iran and heightened tensions across the Middle East, before retreating again to end the period at $65.11. The faster than anticipated unwinding of OPEC+ production cuts has also dampened oil prices.

Natural gas prices were somewhat less volatile but still trended modestly lower, with Henry Hub prices falling from $3.66 per million BTU at the start of the year to $3.46 at period end. These price movements underscore the continued sensitivity of energy markets to macro policy shifts and geopolitical flashpoints, reinforcing the strategic importance of energy security and diversified supply.

The environment for conventional energy has become more challenging in 2025, with weaker macroeconomic sentiment, softer commodity prices and persistent inflationary pressures. Against this backdrop the Investment Manager has focused on opportunities to crystallise value. There were two notable events in the period, with Veren completing its combination with Whitecap Resources, while Permian Resources advanced its growth strategy with two bolt-on acquisitions, including a $608 million deal with APA Corporation.

The investment climate for decarbonisation has deteriorated further, particularly in the U.S. where policy and subsidy uncertainty has impacted investor confidence. It has become apparent that renewable energy, even while the long-term drivers remain strong, has entered a significant downturn.head.

. . . . . . . . . . .

Adrian Brown, chairman, BlackRock Energy and Resources Income, 1 August 2025

At the start of the Company’s financial year on 1 December 2024 and through the first half of 2025, markets were impacted by both geopolitical tensions and the US announcements of trade tariffs on its key trading partners which resulted in significant equity market volatility. Equity market investors sought alternative assets such as gold and money market funds, reducing exposure to US equities and bonds in favour of UK and European securities. Global markets recovered towards the end of the period as negotiations between the US and China appeared to progress more positively.

Increased power demand from artificial intelligence (AI) applications are likely to spur increased demand on electricity grids and the materials and fuels that power them. The investment mandate [grants] the ability to shift exposure between Mining, Traditional Energy and Energy Transition sectors. The Board considers that all three sectors have an important role to play as the energy system continues its transition to a lower carbon economy; the Mining sector provides the material supply chain for low carbon technologies from steel for wind turbines to lithium for electric cars; traditional energy is needed to support base load energy to continue to power economies during the transition; and the path to a lower carbon economy is expected to disrupt many industries and business models.

In April 2025, Spain and Portugal experienced a prolonged electricity blackout, as large parts of the power grid went offline, whilst in the UK, a fire at one of the sub-stations serving London Heathrow Airport led to a power outage. California has experienced rolling power blackouts in the past, most notably during a heatwave in August 2020, due to a combination of high demand and insufficient power supply. These events are underpinning a need for substantial investment in aged European (and US) power and grid infrastructure, providing exciting growth opportunities to investors.

As the global economy navigates a complex landscape of geopolitical uncertainty, the focus of the portfolio is on the long-term demand drivers, such as green infrastructure, AI-driven data centres, and demographic shifts in emerging markets, alongside constrained supply. Mining and traditional energy equities are currently trading at attractive valuations relative to other sectors and to their own history, while Energy transition offers growth possibilities and more now more reasonable valuations.

. . . . . . . . . . .

Environmental

Jon Forster, Fotis Chatzimichalakis, Bruce Jenkyn-Jones, Impax Environmental Markets, 5 August 2025

Despite a backdrop of geopolitical conflict, trade uncertainty and mixed economic indicators, global equities remain buoyant. Driving this is the continued resilience of the US economy. In June, US unemployment data fell to 4.1%, with downward revisions to prior months. Likewise, at 2.4%, US inflation remains slightly above the Federal Reserve’s target, but well below expectations immediately after Liberation Day.

Yet investors still have plenty of reason to be cautious. While negotiations are likely to mean a worst-case scenario for global trade is avoided, it is clear that we are entering a higher tariff (and therefore potentially inflationary) environment. Donald Trump’s One Big Beautiful Bill Act is expected to raise the US fiscal deficit by around US$3 trillion, similarly boosting inflationary pressures. Israel’s military conflict with Iran has so far provoked no meaningful market response, but any closure of key oil trading routes would have an immediate impact on inflation and the global economy.

A fragile balance therefore holds.

. . . . . . . . . . .

Technology and technology innovation

Tim Scholefield, chairman, Allianz Technology Trust, 8 August 2025

The outlook for the technology sector over the remainder of 2025 and beyond is shaped by a complex and evolving set of macroeconomic, geopolitical and structural factors. While the long-term growth potential of the sector remains compelling, the near-term environment is likely to remain volatile, with many variables influencing both company fundamentals and investor sentiment.

From a macroeconomic perspective, the trajectory of global interest rates remains a key determinant. While inflation has moderated in many regions, the pace and extent of any monetary easing remain uncertain. Geopolitical developments also continue to cast a long shadow. The re-escalation of trade tensions under the Trump administration, including the threat and partial implementation of new tariffs, has introduced renewed uncertainty into global supply chains and cross-border investment flows.

At the same time, structural trends within the technology sector remain robust. The rapid evolution of artificial intelligence continues to drive innovation and investment across a wide range of industries. Demand for computing power, data infrastructure, cybersecurity and productivity-enhancing software remains strong, even if near-term spending patterns may be influenced by macroeconomic caution. The secular shift toward digital transformation, automation and cloud-based services is far from complete, and we believe the long-term beneficiaries of these trends will continue to deliver attractive returns.

However, it is important to acknowledge that the market’s response to these dynamics may not always be linear. Investor enthusiasm for AI and related technologies has at times led to elevated valuations and narrow market leadership. Periods of consolidation or rotation are to be expected, particularly if earnings growth fails to keep pace with expectations or if macroeconomic conditions deteriorate. In this context, we believe that a disciplined, bottom-up investment approach is essential.

. . . . . . . . . . .

Debt

Tim Scholefield, chairman, Invesco Bond Income Plus, 14 August 2025

President Trump had promised he would move quickly to implement his economic agenda and financial markets began the year in a nervous mood as investors struggled to keep up with the pace and scale of announcements coming from the White House. Three main policy priorities dominated the news flow. First, the somewhat ‘on-off’ imposition of tariffs on foreign goods, particularly from China. Secondly, reductions in income tax combined with cuts to Medicaid, the health insurance programme for low income families, and thirdly a drive to reduce the size of federal government.

Market nervousness surrounding the economic impact of this radical policy mix reached a peak in early April. The US dollar fell sharply while fixed income yields rose. Uncertainty was compounded by the unprecedented volume of executive orders issued by President Trump and by his attacks on Jay Powell, the chair of the Federal Reserve. Markets then regained some poise as President Trump backtracked on some of his threatened tariffs.

The direction of high yield markets over the next six months will undoubtedly be shaped by the unfolding impact of President Trump’s dramatic shake-up of the US economy since taking office. The consensus outlook is broadly one of some weakening in economic growth followed by a resumption in interest rate cuts leading to a possible uptick in growth in 2026. This would turn out to be a largely supportive environment for high yield securities given that a protracted or deep recession would be avoided.

Nevertheless, we can certainly anticipate that markets are set to remain jittery over the reminder of the year and investors will be watching closely for any possible signs of risk to the economic outlook, including for example any evidence of stubborn or rising price pressures, trade disruption or deterioration on the fiscal position. Heightened uncertainty typically creates opportunities for the fundamental, long term investor.

. . . . . . . . . . .

Rhys Davies and Edward Craven, managers, Invesco Bond Income Plus, 14 August 2025

As always for bonds, the starting yield has been an important driver of returns. But prices have also risen modestly as the macroeconomic environment has remained supportive. The Bank of England and the European Central Bank have cut rates, by 0.5% and 1.0% respectively. Market expectations are that they will both cut at least once more this year.

The credit markets have also been supported by economic growth (albeit the level is modest), which has underpinned corporate earnings. Other credit fundamentals, such as the level of indebtedness and the degree to which earnings cover interest, remain within their longer-term ranges.

These factors are certainly positive. However, when we take a broader view, the market’s resilience has been impressive, not to say surprising. The new US administration has introduced an extraordinary level of policy uncertainty which has impacted on sentiment. There is a high probability that we are entering a period of significantly increased tariffs, which will directly affect corporate sales and earnings. At the same time, the fiscal position in many of the major developed economies is concerning. On top of this, geo-political risks are high. For now, investors seem content to wait and see – to see if weakness in sentiment leads to weakness in demand, if threats turn into the imposition of tariffs and if those tariffs lead to inflation or weaker earnings or both.

One reason for this resilience is market technicals. Corporate bond valuations are benefitting from strong demand relative to supply. On the supply side, bond issuance has risen from the low level of 2022 but remains well below the levels of 2020 and 2021iv. On the demand side, more money has flowed into the asset classiv. Asset flows are not immune to sentiment – there was some outflow in April, when the market sold-off immediately after ‘Liberation Day’, but there has been a strong recovery since. Overall, money is seeking out yield.

. . . . . . . . . . .

Private equity

Hamish Mair, manager, CT Private Equity, 28 August 2025

The private equity market has not been immune to wider economic events such as tariff fluctuations. The principal effect of this so far has been to heighten uncertainty, which manifests itself in deals being delayed, cancelled or renegotiated. This explains the lower-than-expected volumes of both exits and new deals so far this year. We continue to believe that many of the ingredients for a recovery are in place; however, greater stability and certainty are required for momentum to build.

The generally adverse economic effects of reduced free trade globally will take time to manifest, but combined with lower forecast economic growth, they will create a challenging environment. However, the underlying growth in the markets our companies address, and the competence of management teams to capture this growth profitably, means that value creation in the portfolio will continue over the long term.

. . . . . . . . . . .

Peter McKellar, chair, Partners Group Private Equity, 28 August 2025

After the geopolitical and macroeconomic challenges of H1 2025, we seem to have entered a less volatile environment, with a more positive outlook for interest rates, growth, equity markets and, as a result, improving expectations for M&A. While this has the potential to help drive increasing unrealised valuations and exit activity, the position remains susceptible to broader shocks.

. . . . . . . . . . .

Renewable energy infrastructure

Richard Morse, chair, The Renewables Infrastructure Group, 7 August 2025

Political support for the energy transition across Europe remains; however, in recent times the UK has suffered from the uncertainty caused in the sector linked to potential changes to future electricity market arrangements by the UK Government. We are pleased with the announcement that the government intends to continue with a single national wholesale market and look forward to this bringing greater liquidity to the transaction market.

Of fundamental importance for investment companies to succeed in this uncertain environment is a close attention to risk management, with diversification and scale being important components, and the execution of a growth strategy, to provide the risk and reward balance that shareholders seek.

. . . . . . . . . . .

IMPORTANT INFORMATION

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it. Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.