Looking oversold

Rights and Issues Investment Trust (RIII) is experiencing several challenges. UK small caps appear to be affected by a weak UK economy, an upcoming budget that may be contributing to market uncertainty, and what seems to be limited interest from both domestic and international investors. In addition, a large shareholder appears to be opposing efforts by RIII’s board to implement changes intended to benefit investors. This situation has likely contributed to a widening of RIII’s discount, and the trust has been among the lowest-performing UK small-cap trusts over the past 12 months.

RIII currently trades at a discount relative to peers and its historical levels, and the portfolio also appears discounted. There may be significant potential for upside if conditions improve.

Concentrated exposure to UK small- and mid-caps

RIII’s objective is to exceed the FTSE All Share total return over the long term, while managing risk. RIII invests in equities with an emphasis on small- and mid-cap companies. UK smaller companies include both listed securities and those admitted to trading on the Alternative Investment Market (AIM).

| Year ended | Share price total return (%) | NAV total return (%) | Small cap benchmark1 TR (%) | HSBC FTSE All-Share TR1 (%) |

|---|---|---|---|---|

| 31/10/2021 | 44.7 | 59.1 | 42.7 | 34.6 |

| 31/10/2022 | (26.2) | (22.6) | (25.1) | (2.6) |

| 31/10/2023 | (0.8) | (8.5) | (5.8) | 6.3 |

| 31/10/2024 | 34.9 | 28.4 | 20.3 | 15.4 |

| 31/10/2025 | (11.2) | 2.1 | 11.0 | 22.6 |

Fund profile

Rights and Issues Investment Trust (RIII) aims to generate a total return that exceeds its benchmark index, the FTSE All Share, over the long term while managing risk. The company invests in equities with an emphasis on UK smaller companies, which will normally constitute at least 80% of its investment portfolio. For the purposes of RIII’s portfolio construction, “UK smaller companies” is deemed to include both listed securities and those admitted to trading on the Alternative Investment Market (AIM). The benchmark does not influence portfolio construction.

More information is available on the manager’s website

For the purposes of this note, we have used the HSBC FTSE All-Share Index Class C Accumulation as a proxy for the FTSE All-Share and added a comparison to the Deutsche Numis Smaller Companies ex Investment Companies plus AIM Index, which we believe is more representative of the stocks in RIII’s portfolio.

RIII’s AIFM has delegated investment management of the trust to Jupiter Asset Management Limited. Dan Nickols and Matt Cable took over responsibility for the trust in October 2022. Dan retired at the end of July 2024 and Matt became lead manager, supported by Tim Service.

Investment process

A collegiate approach

Most of the team are both portfolio managers and sector analysts meaning that they work collegiately, inputting into each other’s portfolios. The team is tasked with researching and investing in UK-listed businesses outside the FTSE 100. Stock ideas are put forward to the wider team for consideration and are discussed in weekly team meetings, with ideas challenged in an open forum.

Driven by fundamental analysis

As is discussed in greater detail in the stock selection section below, the manager’s investment process incorporates a mixture of top-down and bottom-up considerations, and is driven by extensive fundamental analysis of potential portfolio candidates.

Concentrated high-conviction portfolio

20 to 30 high conviction best ideas

RIII has a concentrated portfolio that comprises 20 to 30 stocks, representing the team’s highest-conviction ideas (the other funds that the team manages tend to have about 60 positions).

The Jupiter team operates with a self-imposed 20% maximum position in a single investment, and the creation of any position size greater than 10% automatically triggers an internal approval process. In constructing RIII’s portfolio, position sizes are determined primarily by the manager’s level of conviction in a stock, while also taking into account factors such as market cap and liquidity.

Focusing on the small and mid-cap segments

RIII’s portfolio is focused on SMID stocks as its manager feels that it has more of a competitive edge in this less-researched segment.

The stock selection process

The investment process is a mixture of both bottom-up and top-down considerations

RIII’s portfolio is managed using a mixture of bottom-up and top-down inputs. In the top-down element of the process, the team considers macroeconomic factors, industry trends and similar factors to identify sectors and themes for allocation. When selecting stocks within these areas, the process is based on bottom-up fundamental analysis of companies. The team states that there is no single approach to small-cap investing, as companies’ individual characteristics prevent a uniform approach to analysis.

The Jupiter team observes that the key decision makers within a SMID company may have a significant impact, while the more complex structures frequently seen within larger companies can reduce this impact. The team also states that analysis of a business’s financials and its strategic direction is important.

Understand a company’s business model, its financial structure and the sustainability of its earnings

Jupiter states that it seeks to gain an understanding of a company’s business model, its financial structure, and the sustainability of its earnings. According to Jupiter, sustainability can take different forms; for example, market leaders with strong balance sheets may be better positioned to withstand economic downturns, and adaptable management may create opportunities during periods of adversity.

The team seeks to identify potential positive surprise opportunities by analysing sell-side forecasts that are intended to represent current market consensus views. The team aims to find instances where companies appear to be under-forecast, which may provide opportunities to be positioned ahead of forecast upgrades that are not widely anticipated. The team typically uses a short, two-year time horizon, and prefers simple metrics (such as P/E) when valuing a company. However, the team states that this approach is not always appropriate, and that a balanced and flexible approach is considered important in all aspects of the investment process.

Investments being considered for inclusion within the portfolio are assigned into three broad categories based on their potential for growth, rerating, or profit upgrades. These categories are not mutually exclusive, and a company may demonstrate qualities of all three categories. The team’s research output is applied to a range of funds and RIII, with its closed-end structure, is included within this range.

ESG

Jupiter states that it has a role in the allocation of capital, both as active owners and long-term stewards of the assets in which it invests on behalf of clients. According to Jupiter, analysis of ESG issues is embedded within its investment process and it does not intend to outsource this function to third parties.

Investee companies are expected to exhibit high standards of corporate governance, and where the managers believe that companies may be falling short in this area, the team may engage with those companies.

With respect to environmental factors, the manager supports the Task Force on Climate Related Financial Disclosures (TCFD) and encourages companies to provide disclosure in line with the four thematic pillars of the TCFD framework.

The manager states a preference for quality over quantity in engagement. The manager believes engagement should be focused and have well-defined targets, objectives, and outcomes.

When considering ESG aspects as part of its investment process, the manager may consult Jupiter’s in-house stewardship and data science teams, as well as the SMID team’s dedicated ESG investment director. The data science team maintains a proprietary desktop tool – the ESG hub – which enables the investment teams to apply multi-factor ESG screening to their investment universe and to build custom reports.

Utilising RIII’s closed end structure

Closed-end structure allows for more illiquid positions, but the trust does not use gearing

The team states that the investment trust structure complements the open-ended funds that it manages. For example, the team believes that RIII is able to hold larger positions in less-liquid stocks, which may increase the ability to find companies that the team considers attractive but mispriced. However, the team states that it does not consider it appropriate to use leverage as part of its investment approach and will not seek to add value through borrowings or the use of derivatives.

Market background

Given the UK market’s apparent bias towards large cap value stocks, it appeared to perform relatively well as interest rates were rising through 2022. When interest in AI increased, investors’ growing focus on US mega-cap AI companies appears to have coincided with the UK market underperforming relative to the US. In early 2025, the DeepSeek development in the AI sector appears to have prompted some investors to rotate out of the US. However, the UK market’s relative recovery has diminished in recent months.

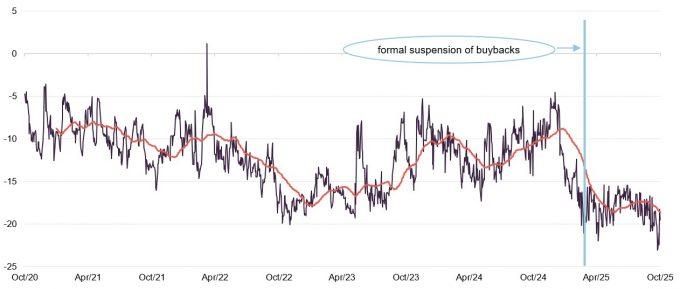

Figure 1: UK market relative to the world market

Figure 2: UK SMID stocks relative to the UK market

Source: Bloomberg, MSCI UK relative to MSCI All Countries World Index in sterling

Source: Bloomberg, Deutsche Numis ex Investment Companies plus AIM Index relative to MSCI UK Index

A large part of the issue appears to be domestic investor flows out of the UK market into global or US index-trackers. Those investor flows may have had a significant impact on small- and mid-cap stocks, as Figure 2 illustrates.

The UK’s inflation outlook appears less positive than when we previously reported on RIII, reaching 3.8% in September, close to January 2024’s figure of 4%. This is above the Bank of England’s current target of 2%, and interest rates remain at 4%. There is a possibility that rates could be cut in the Bank of England’s November meeting. September’s inflation figure was lower than expected, which may increase the likelihood of a change early next year. Since the new government has been in power, the national minimum wage and national living wage have increased.

Wages have grown more than inflation, which may have benefitted purchasing power for UK consumers; average employees’ total earnings grew by 5% from June to August. Despite this, consumer sentiment appears less positive, with concerns seemingly focused on inflation and anticipation of the government’s upcoming Autumn budget. Proposals such as a curtailment of cash ISA allowances in favour of some requirement to favour domestic equities are reportedly being resisted by some groups, including building societies and platforms, who may be concerned about making changes to their systems.

UK stocks that appear relatively inexpensive are attracting the attention of corporate and private equity buyers. M&A activity appears to have influenced returns.

Macroeconomic considerations are not the primary driver of portfolio construction.

Asset allocation

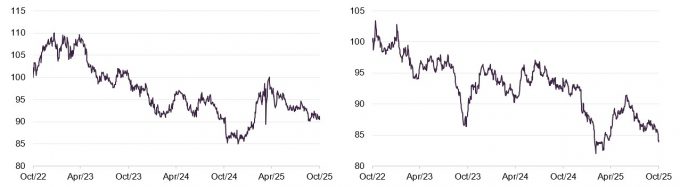

Figure 3: RIII style skyline analysis as at 31 August 2025

Source: Jupiter Asset Manag

An analysis of the portfolio carried out by Style Analytics indicates that the manager has expressed a preference for quality within the portfolio. Matt states that he intends to maintain this over the long term without sacrificing the portfolio’s bias to value, noting that the two are not mutually exclusive.

The analysis suggests that the portfolio is biased towards value, growth, and quality. Management believes this demonstrates that the UK small-cap market may be undervalued, as companies in RIII’s portfolio that are considered good-quality and growing also appear to be inexpensive.

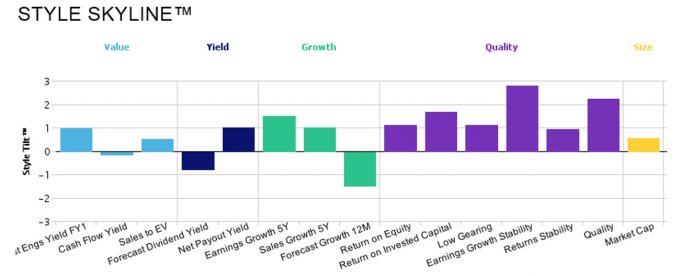

The trust’s allocation to industrials remains its largest, although its exposure to financials appears to have grown with M&A activity.

As of 30 September 2025 (the last data available), the top 10 holdings accounted for 53.4% of the trust, down from 55.9% at the end of 2024.

Portfolio changes

RIII’s sector exposures have changed since the previous report (using data as at the end of December 2024). According to the manager, these changes are a result of stock selection decisions rather than targeting a specific weighting to any particular sector.

The exposure to telecoms has decreased as Gamma Communications left the portfolio (see below), and RIII now has exposures to energy and utilities that were not present in the portfolio at the end of 2024.

The cash weighting is slightly higher than previously.

Figure 4: RIII sector allocation at 30 September 2025

Figure 5: RIII sector allocation at 31 December 2024

Source: Jupiter Asset Management

Source: Jupiter Asset Management

Top 10 holdings

Figure 6: 10 largest holdings at 30 September 2025

| Holding | Industry | Percentage of NAV 30/09/2025 (%) | Percentage of NAV 31/12/2024 (%) | Change (%) |

|---|---|---|---|---|

| Hill and Smith | Industrials | 6.1 | 6.0 | 0.1 |

| OSB Group | Financials | 6.1 | 4.6 | 1.5 |

| Telecom Plus | Communication services | 5.9 | 5.9 | – |

| JTC | Financials | 5.8 | 5.2 | 0.6 |

| Colefax Group | Consumer cyclical | 5.7 | 5.2 | 0.5 |

| IMI | Industrials | 5.3 | 6.0 | (0.7) |

| Eleco | Communication services | 4.7 | 5.2 | (0.5) |

| Macfarlane Group | Consumer cyclical | 4.7 | 6.2 | (1.5) |

| VP | Industrials | 4.6 | 6.2 | (1.6) |

| Jet2 | Consumer cyclical | 4.5 | 5.1 | (0.6) |

| Total | 53.4 | 55.9 |

Since we last published, OSB Group, JTC and IMI have all moved up into the top 10. Exits from the top list include Renold, Gamma Communications, formerly its second-largest holding, and Treatt.

OSB Group

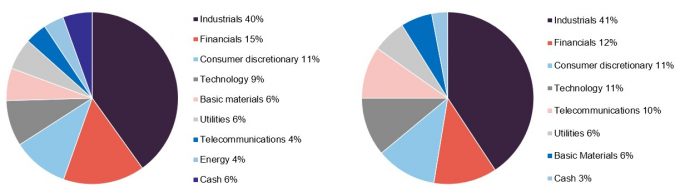

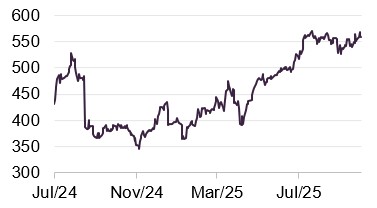

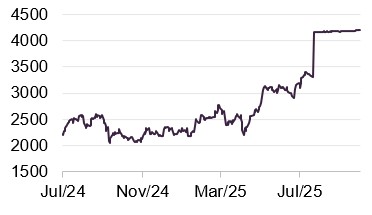

Figure 7: OSB Group

Source: Bloomberg

OSB Group (osb.co.uk) is a mortgage lender that focuses on areas including buy to let, commercial and semi commercial, and development finance. It operates through eight brands, including Kent Reliance and Charter Savings Bank, which OSB uses to fund a large part of its lending. The company holds £23.8bn in statutory retail deposits and diversifies its finances through MREL qualifying debt and funding schemes through the Bank of England. OSB’s wholly owned subsidiary, OSB India, also provides credit assessment and case management services.

Interest rate rises since 2021 appear to have affected mortgage volumes and may have contributed to increased competition among specialist lenders. OSB’s share price experienced declines in 2023 and 2024 following profit warnings related to forecasts that did not meet expectations. Since then, the company has reported improved performance. In August, OSB’s management stated that it would maintain its current guidance and expressed the view that the company was making progress, with its shares up 42% in a year.

The company has recently focused on its higher-yielding areas such as commercial, asset finance and development finance. Management has decided to prioritise returns rather than growth in its mortgage book, which may have contributed to this relative turnaround. It is also noted that OSB has been adding to its £100m share buyback programme, which is due to be completed in March 2026.

IMI

Figure 8: IMI

Source: Bloomberg

IMI (imiplc.com) is an engineering company that specialises in fluid and motion control, providing customised solutions for clients in sectors such as life sciences and industrial automation. It operates in over 50 countries, employs around 11,000 people and is a constituent of the FTSE 100.

In its recent half-year results, IMI reconfirmed its guidance, reporting increases in revenues and dividend growth. The company reported that process automation saw its order book rise by 5% and its aftermarket organic order intake rise by 10%. For context, aftermarket sales are a core revenue stream for the company and, as of the end of last year, represented around 45% of overall sales.

At the end of 2024, IMI’s process automation arm was expanded with the €25m acquisition of Netherlands-based TWTG. TWTG provides hardware and software to industries in sectors such as energy and petrochemicals to monitor assets for safety, efficiency, and predictive maintenance through real-time data and analytics. IMI’s management states that there are multiple synergies between the companies as well as potential benefits for its aftermarket growth.

For RIII, IMI provides exposure to diversified growth across a range of sectors, in addition to dividend growth, indicated by an interim dividend increase of 10%. As discussed, its aftermarket sales appear to demonstrate a consistent trajectory, supported by the company’s 11% CAGR over the last six years. The company has also completed a £200m share buyback programme.

JTC

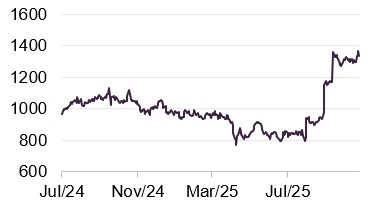

Figure 9: JTC

Source: Bloomberg

JTC (jtcgroup.com) is a financial services company that provides operational and strategic assistance, including wealth management and fund administration, to industries such as private equity and venture capital. The company has over $160bn of fund assets under administration, 16 funds under depositary, and $67bn depositary assets. The company reports that it has experienced growth in the US, with revenues in 2024 rising by 49%, and the US now accounting for over 30% of JTC’s sales. During the first half of 2025, JTC’s revenues were up 17.3% from the first half of last year.

In July, shares reached an all-time high following the rejection of a non-binding cash offer from private equity firm Permira. A share price rise of 17% could partly attributed to a reaction to Permira’s valuation of JTC at £2bn. Since then, continued interest from Permira and another PE firm, Warburg Pincus, appears to have contributed to JTC’s share price remaining elevated, increasing over 51% in the last three months. As of 12 September, JTC has received four offers from Permira, with a decision required by 24 October.

JTC has segmented its strategy into multiple “eras”, which are described as multiyear business plans. From January 2024, JTC has been in its “Cosmos” era, which is scheduled to run until 2027. The stated core focus of this period is to double the size of the company, which would be the third time since JTC went public in 2018. Management believes this can be achieved through organic performance and by taking advantage of increasing M&A opportunities.

Other holdings

Gamma Communications

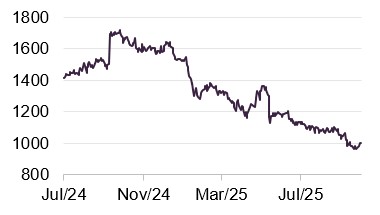

Figure 10: Gamma Communications

Source: Bloomberg

Gamma Communications (gammagroup.co) is a telecommunications company that provides unified communications as a service (UCaaS). This involves operating different communication pathways such as voice technology and messaging through one standalone platform. When we last published, Gamma was RIII’s second largest holding, but it no longer appears in its top 10. Since then, the company has consistently de-rated, with its share price down 40% this year. Investors may have reacted less positively than anticipated to Gamma’s move from the AIM to listing on the main market.

Despite challenges in the UK, Matt highlights what he describes as better performance in Germany, where the company recently acquired STARFACE through an all-cash offer of £165m. Gamma’s German business represents about 20% of the wider company’s profits. Matt considers STARFACE to be a significant participant in the German telecommunications market and a challenger to the two largest incumbents, Deutsche Telekom and Vodafone.

Ashtead Technology

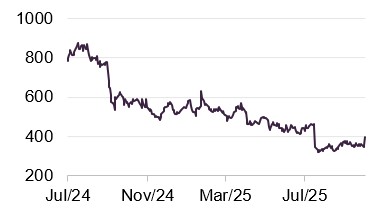

Figure 11: Ashtead Technology

Source: Bloomberg

Ashtead Technology (ashtead-technology.com) is a subsea equipment rental and services provider for the offshore energy sector. It has over 650 employees and operates globally from 13 offshore facilities. It has three core service lines: survey and robotics, mechanical solutions, and asset integrity. The company provides custom solutions and assists in the installation, maintenance, repair and decommissioning of equipment.

Matt states that since Ashtead’s IPO in late 2021, the company has reported early growth. The company plans to move from AIM to the main market, partly to avoid pressure from the effect of IHT increases on 18% of its capital. With the announcement of its intention to move to the main market on 26 August, Ashtead’s shares rose 12.8%. Additionally, in the same update, management indicated revenue growth, citing performance in both oil, gas and renewable markets.

The integration of Seatronics and J2 Subsea, completed in November 2024, has expanded the group’s survey and robotics rental assets by around 30%. Matt also states that there is scope for further bolt-on acquisitions.

Keller Group

Figure 12: Keller Group

Source: Bloomberg

Keller Group (www.keller.com) describes itself as a specialist geotechnical contractor. It provides ground engineering services that enable construction on sites with challenging conditions. Operating in more than 40 countries, it uses techniques such as piling, grouting, and ground improvement to stabilise soil and manage ground risk, which may assist clients in building foundations. Its projects range from small local works to major infrastructure developments, including bridges, railways, ports, and wind farms. Keller states that it focuses on reducing the carbon footprint, cost, and material intensity of its projects. The group operates across five continents and is a constituent of the FTSE 250.

Keller is a long-established business that has experienced periods of share price volatility over its history. Under former CEO Mike Speakman, operational improvements were implemented and the company reported consistent earnings upgrades over a five-year period. After his departure, the company experienced market downgrades, which may reflect both cyclical elements and the leadership transition. In the UK, Keller trading conditions have been more challenging, although management notes that this market accounts for only 2-3% of group revenues.

As of early August, Keller had completed a £25m tranche of its multiyear share buyback programme, with a further £25m expected by year end. Its near debt-free balance sheet supports cash generation of around £100m annually. Matt states that at current valuation levels, buybacks are highly accretive and could deliver EPS growth even if profits remain flat. He and the team consider Keller to be a fit for RIII’s long-term value-driven investment approach.

Alpha Group International

Figure 13: Alpha Group International

Source: Bloomberg

Alpha Group International (alphagroup.com) is a financial services company that offers foreign exchange risk management services for its corporate clients, which are mainly investment managers. The company describes itself as “half fintech, half consultancy”, operates in over 50 markets and is a constituent of the FTSE 250 Index.

As mentioned above, the company agreed to an all-cash acquisition by Corpay for £1.8bn in July, with the announcement of the sale appearing to contribute to a 25.6% increase in its share price. According to Corpay, Alpha’s position among alternative accounts providers for investment managers was a major attraction, along with the company’s FX segments, which may have benefited from geopolitically-linked currency volatility.

Performance

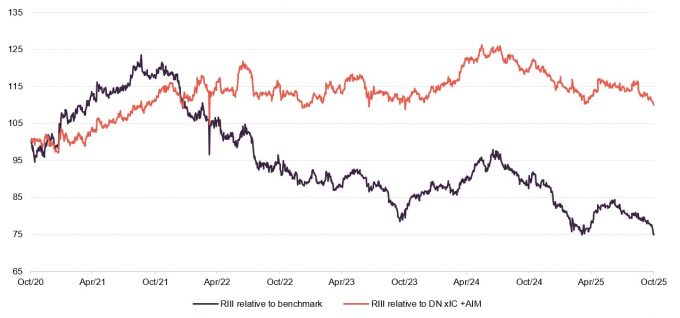

Figure 14: RIII NAV total return performance versus HSBC FTSE All-Share and Deutsche Numis ex Investment Companies plus AIM over five years ending 31 October 2025

Source: Bloomberg, Marten & Co. NB, As before, we have substituted the HSBC FTSE All-Share Fund Class C for the trust’s benchmark

As Figure 14 shows, the last 12 months have been mixed for RIII’s performance. Pressure on the company’s share price in the first six months may be partly attributed to the rise in bond yields. Higher inflation and increased government spending appear to have contributed to higher gilt yields, which may have affected growth-orientated UK small caps. From January, RIII’s share price started a gradual decline until April. This coincided with a 10-year bond yield of 4.84% on 6 January, which remained elevated for much of the year. RIII’s share price has risen 20% from its low point in April (around the time of Trump’s tariff announcements).

Figure 15: Total return cumulative performance over various time periods to 31 October 2025

| 3 months(%) | 6 months(%) | 1 year(%) | 3 years(%) | 5 years(%) | |

|---|---|---|---|---|---|

| RIII share price | (4.5) | 14.1 | (11.2) | 18.8 | 26.8 |

| RIII NAV | (1.8) | 11.8 | 2.1 | 19.9 | 47.7 |

| Deutsche Numis ex IC plus AIM | 2.5 | 14.5 | 11.0 | 25.7 | 34.3 |

| HSBC FTSE All-Share | 6.3 | 16.3 | 22.6 | 50.4 | 97.2 |

| Peer group1 median NAV | 0.0 | 11.7 | 4.4 | 28.5 | 45.0 |

Peer group

We have put together a peer group for RIII that is drawn from the AIC’s UK smaller companies sector but excludes companies with very small market caps, Marwyn (which has an unusual investment approach), and the split capital trust, Aberforth Geared Value & Income.

Figure 16: Peer group snapshot as at 3 November 2025

| Premium/(discount) (%) | Dividend yield (%) | Ongoing charges ratio (%) | Market cap (£m) | |

|---|---|---|---|---|

| Rights and Issues | (17.3) | 2.0 | 0.90 | 102 |

| Aberforth UK Smaller Companies | (11.1) | 2.8 | 0.78 | 1,240 |

| Abrdn UK Smaller Companies Growth | (8.8) | 2.6 | 0.85 | 286 |

| Artemis Future Leaders | (12.2) | 3.9 | 1.03 | 116 |

| BlackRock Smaller Companies | (12.8) | 3.3 | 0.80 | 535 |

| BlackRock Throgmorton | (10.0) | 3.0 | 0.56 | 458 |

| Crystal Amber | (17.1) | 7.4 | 1.26 | 94 |

| Henderson Smaller Companies | (11.2) | 3.3 | 0.45 | 519 |

| JPMorgan UK Small Cap Growth & Inc | (10.2) | 4.7 | 0.76 | 406 |

| Montanaro UK Smaller Companies | (8.4) | 6.6 | 0.91 | 126 |

| Odyssean | (2.2) | 0.0 | 1.47 | 225 |

| Oryx International Growth | (30.7) | 0.0 | – | 183 |

| River UK Micro Cap | (18.3) | 0.0 | 1.72 | 69 |

| Rockwood Strategic | 2.2 | 0.0 | 1.83 | 142 |

| Strategic Equity Capital | (9.1) | 1.1 | 1.26 | 167 |

| Peer group median | (11.1) | 2.8 | 0.9 | 183 |

| RIII rank | 13/15 | 10/15 | 7/15 | 13/15 |

There are smaller UK trusts than RIII, including some that were not included in the peer group, but RIII is on the smaller side within the sector. The discount is currently wide; only Oryx, which is effectively controlled by its manager and is therefore described as “bid-proof,” trades on a wider discount. RIII’s discount control issues are discussed below.

The wide discount increases the dividend yield, but the yield does not appear to be high. The company’s expenses appear to be competitive relative to RIII’s size.

Figure 17: Peer group NAV total return performance over periods to end October 2025

| 3 months(%) | 6 months(%) | 1 year(%) | 3 years(%) | 5 years (%) | |

|---|---|---|---|---|---|

| Rights and Issues | (1.8) | 11.8 | 2.1 | 19.9 | 47.7 |

| Aberforth UK Smaller Companies | (1.9) | 14.6 | 8.8 | 41.6 | 102.0 |

| Abrdn UK Smaller Companies Growth | (1.6) | 8.3 | 3.9 | 27.0 | 6.9 |

| Artemis Future LKeaders | (1.6) | 8.1 | (7.1) | 3.0 | 9.8 |

| BlackRock Throgmorton | 2.3 | 11.7 | 3.6 | 30.0 | 21.7 |

| Crystal Amber | 0.0 | 0.0 | 69.2 | 85.6 | 175.5 |

| Henderson Smaller Companies | 1.6 | 13.5 | 4.9 | 24.8 | 22.5 |

| JPMorgan UK Small Cap Growth & Inc | 0.1 | 9.0 | 9.2 | 37.7 | 42.4 |

| Montanaro UK Smaller Companies | (0.8) | 4.9 | (0.4) | 18.6 | 6.2 |

| Odyssean | 3.4 | 28.4 | 8.4 | 13.1 | 58.7 |

| Oryx International Growth | 0.9 | 17.5 | 8.6 | 37.5 | 48.0 |

| River UK Microcap | 5.3 | 25.3 | 21.6 | 43.6 | 69.4 |

| Rockwood Strategic | 2.3 | 11.7 | 3.6 | 30.0 | 21.7 |

| Strategic Equity Capital | (1.8) | 11.8 | 2.1 | 19.9 | 47.7 |

| Peer group median | 0.0 | 11.7 | 4.4 | 28.5 | 45.0 |

| RIII rank | 12/15 | 6/15 | 11/15 | 10/15 | 6/15 |

Within the peer group, RIII’s NAV returns are second or third quartile over most time periods.

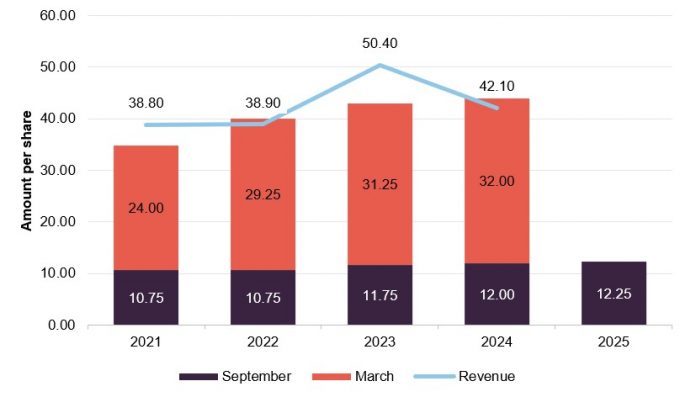

Dividend – biannual payments

RIII’s accounting year ends on 31 December. It pays an interim dividend in September and a final dividend in March. The board states that it continues to operate a progressive dividend policy. RIII’s interim payment for the 2025 financial year was 12.25p per share, compared to 12.00p per share for the prior year.

As was the case last year, the board has indicated that it is prepared to use RIII’s revenue reserves to maintain its progressive dividend policy where necessary. At the end of 2024, RIII’s revenue reserve per share stood at 0.55p.

Figure 18: RIII five-year dividend history

Source: Rights and Issues Investment Trust

Capital structure and life

As at 3 November 2025, RIII has 4,780,643 shares in issue. Following the withdrawal of Resolution 10 in March 2025, RIII’s share buyback programme was suspended.

RIII’s year end is 31 December and its AGMs are typically held in March.

During 2024, the board considered a potential share split, but after consultation with shareholders, decided that the potential costs may outweigh any benefits for shareholders or the trust’s liquidity.

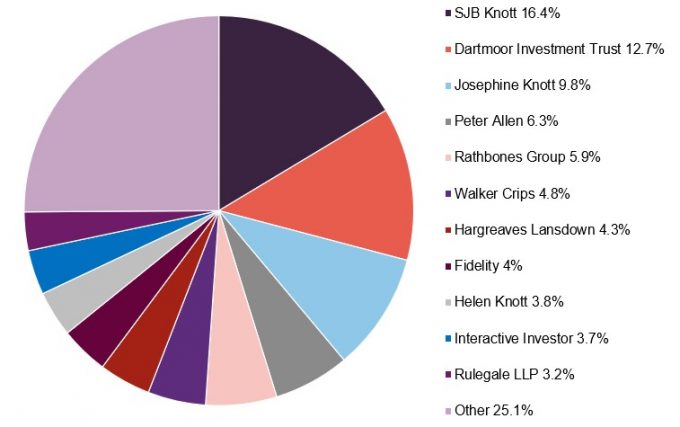

Major shareholders

Figure 20: RIII shareholders as at 24 October 2025

Source: Bloomberg

Gearing

The company has not historically used any form of gearing, nor does the Jupiter team intend to in the future. The manager highlights the already-high level of volatility associated with SMID investing compared to other strategies.

Board

RIII has four directors, all of whom are non-executive and require re-election at each AGM. Three are considered independent, while Simon Knott is not regarded as independent due to his previous position as investment director. The other directors have had no material connection with the company other than serving as directors. The board delegates all investment matters to the investment manager but retains decision-making authority concerning unquoted investments. Previous chairman David Best retired from his role on 31st August 2023 and was replaced as chairman by Dr Andrew Hosty on the same day.

Only two of the four directors have made an investment in the company.

Figure 21: Directors’ length of service, fees and shareholding

| Role | Appointed | Length of service (years) | Fees | Shareholding | |

|---|---|---|---|---|---|

| Dr Andrew Hosty | Chairman | 01/07/2017 | 8.2 | 39,900 | 498 |

| Helen Vaughan | Chair of the audit, risk and compliance committee | 01/01/2023 | 2.8 | 34,385 | – |

| Jonathan Roper | Chairman of nomination sand remuneration committee | 05/04/2016 | 9.5 | 29,925 | – |

| Simon Knott | Director | 03/10/2022 | 3.0 | 29,925 | 785,062 |

Dr Andrew Hosty (chairman)

Andrew is a Chartered Engineer and Fellow of the Royal Academy of Engineers. He is an international business leader with over 20 years of non-executive board experience and 30 years of executive and management experience, spanning private equity, UK Plc and global blue-chip corporates. From 2016 to 2018 Andrew was the CEO of the Sir Henry Royce Institute, the UK’s national institute for advanced materials research and innovation. Andrew was chief operating officer of Morgan Advanced Materials and served on the Plc board as an executive director from 2010 to 2016. These experiences and his current work with other operating companies mean that he can contribute to a range of business matters over a wide spectrum of end markets.

Helen Vaughan (chair of the audit, risk and compliance committee)

Helen is a Chartered Accountant and a certified independent fund director. She has over 30 years of investment management experience. As the chief operating officer for the J O Hambro Capital Management Group, Helen oversaw the transformation of its operating model to one which supported rapid growth and also significantly reduced operational risk to the business. She retired from this company in September 2019. Prior to this, Helen was director of business development at Credit Suisse Asset Management, and before that, head of investment operations at SLC Asset Management and head of client accounting at Framlington Group Limited.

Jonathan Roper (chairman of the nomination and remuneration committee)

Jonathan is a solicitor and, until his retirement from practice, was a partner in Eversheds Sutherland (formerly Eversheds LLP). He has more than 35 years’ experience of commercial practice in the City, advising primarily on public and private company mergers and acquisitions, joint ventures and equity and other financing arrangements for UK and overseas clients, including many in the financial services sector, and often at a strategic board level. Until recently, Jonathan was a member of the Council of the London School of Hygiene & Tropical Medicine and chair of its Audit & Risk Committee.

Simon Knott (director)

Simon served as investment director of the company from 1983, focusing on UK smaller companies. Following the appointment of Jupiter as investment manager on 3 October 2022, Simon retired as investment director but remains a non-executive director of the company.

Previous publications

Readers interested in further information about RIII may wish to read our previous notes (details are provided in Figure 24 below). You can read the notes by clicking on them in Figure 24 or by visiting our website.

| Title | Note type | Publication date |

|---|---|---|

| Under new management, same high conviction approach | Initiation | 18 April 2023 |

| Old dog, new tricks | Update | 19 December 2023 |

| Lights and tunnels | Annual overview | 20 August 2024 |

| Normal programming to resume | Update | 4 February 2025 |

IMPORTANT INFORMATION

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Rights and Issues Investment Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it. Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.