The road ahead

Chrysalis Investments (CHRY) is seven years old, and its portfolio is increasingly mature. Since we last published, good progress with Starling and signs of a recovery at wefox have translated into NAV gains. A run of realisations has freed up sufficient liquidity to fulfil CHRY’s commitments under its capital allocation policy, and with Klarna’s IPO complete, there is the prospect of more to come.

Over 16% of CHRY’s share capital has been bought back and the discount has narrowed – but there is much more to go for on this front. Some investors have been asking for an opportunity to exit close to asset value, others – encouraged by CHRY’s NAV growth since launch – would like to see new investments. Having consulted shareholders, the board is now mapping out the road ahead.

Supporting growing businesses

CHRY aims to provide access to returns available from investing in later-stage private companies with long-term growth potential, an investment class that has traditionally been difficult to access for individual investors. CHRY also benefits from the flexibility to continue to support these businesses after they IPO.

| Year ended | Share price TR (%) | NAV total return (%) | MSCI UK TR (%) | NASDAQ TR (%) | S&P 500 TR (%) |

|---|---|---|---|---|---|

| 30/11/2021 | 55.7 | 56.5 | 17.6 | 33.3 | 28.8 |

| 30/11/2022 | (71.3) | (41.3) | 13.9 | (16.5) | 0.8 |

| 30/11/2023 | 1.0 | (8.9) | 2.3 | 26.6 | 7.7 |

| 30/11/2024 | 39.4 | 4.9 | 15.1 | 31.2 | 32.8 |

| 30/11/2025 | 17.1 | 21.5 | 21.4 | 17.7 | 10.5 |

Source: Bloomberg, Marten & Co

Portfolio

Recent investment activity

InfoSum was sold to WPP for £49.8m in April 2025. The exit valuation came at a 16.4% premium to the valuation in CHRY’s end-December 2024 NAV. However, since making the investment, CHRY had invested £53.3m in the company (including $3m or £2.4m in Q1 2025, which was connected to a dual track equity funding round and trade sale process) and, therefore, the MOIC on InfoSum was 0.93x. The advisers reasoned that taking advantage of the opportunity to sell InfoSum and using the proceeds to fund CHRY share buybacks offered a better risk-adjusted return than retaining the investment.

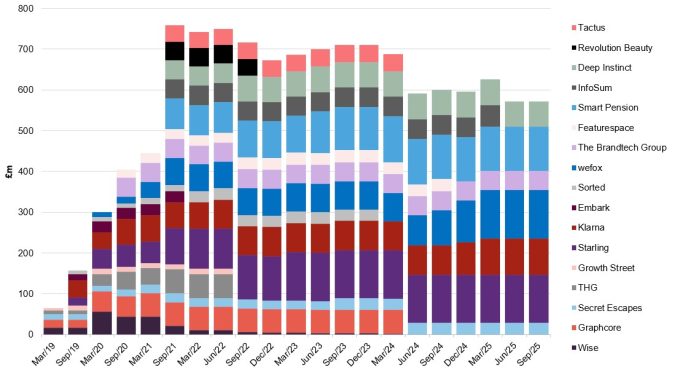

Figure 1: Portfolio progress since launch – amounts invested in companies in the portfolio to end September 2025

Source: Marten & Co

Klarna’s long-expected IPO finally happened on 9 September 2025. Ahead of this, CHRY invested a further £8m into the company. CHRY elected not to sell any shares as part of that process and is now locked into its shareholding until the six-month anniversary of the IPO date.

The advisers were uncomfortable with committing to sell shares in the IPO process at an unknown IPO price. In addition, they believe that Klarna has “a robust growth path in the medium term, which would drive significant profits”. One of the benefits of CHRY’s growth capital approach is that it has the option to remain invested where it sees a good opportunity, whereas many similar funds would be under more pressure to exit.

The advisers also made a small investment into Deep Instinct (sub $1m) recently.

Since the end of September, CHRY has repaid £10m of its £70m term loan, to leave £60m outstanding.

The advisers highlight that in recent years their focus has been on restructuring companies to position them to stand on their own feet and paring back the portfolio to those investments that show the most promise. That is an ongoing process that could still see more of the tail exited over time. We feel that now would be a good time to be exploring potential new investment opportunities, but that needs a resolution to the capital allocation question.

Portfolio as at last quarter end

Figure 2: Portfolio as at 30 September 2025

| Business description | % of portfolio 30 Sep 2025 | Value 30 Sep 2025 £m | Amount invested £m | MOIC (x) | |

|---|---|---|---|---|---|

| Starling | UK challenger bank | 46.4 | 406.6 | 118.3 | 3.4 |

| Smart Pension | Workplace/automatic enrolment pension schemes for SMEs | 14.1 | 123.4 | 108.6 | 1.1 |

| Klarna | Online payments business with buy now pay later option | 13.2 | 115.3 | 87.9 | 1.3 |

| wefox | Europe’s largest digital insurance platform | 10.4 | 91.5 | 119.7 | 0.8 |

| Brandtech | Digital advertising and marketing services | 4.2 | 36.8 | 46.4 | 0.8 |

| Deep Instinct | A US cybersecurity company | 3.0 | 26.7 | 62.2 | 0.4 |

| Secret Escapes | Travel company that helps minimise unsold inventory | 1.8 | 15.7 | 28.0 | 0.6 |

| Featurespace1 | Financial crime risk management using real-time learning | 1.0 | 9.2 | n/a | n/a |

| Wise | Online foreign exchange | 0.4 | 3.1 | 0.7 | 4.4 |

| Sorted | SaaS company with a delivery management platform | 0.0 | 0.3 | n/a | n/a |

| Total investments | 94.5 | 828.6 | 572.2 | 1.4 | |

| Gross cash | 13.5 | 118.1 | |||

| Debt | (8.0) | (70.0) | |||

| Net assets | 100.0 | 876.7 |

Source: CHRY, Marten & Co. Figures may not add up due to rounding. Note 1) This just represents the deferred proceeds from this disposal. Assuming the deferred proceeds are received in full, CHRY will have earned a 3.0x MOIC on Featurespace.

Looking at a couple of these in more detail:

Starling

In May, Starling (starlingbank.com) released its 12-month results to end March 2025. This was a period where the bank had taken its foot off the growth accelerator as it responded to fines for lax client onboarding processes and made provisions related to COVID-era loans. Nevertheless, revenue grew by 4.7% to £714m, customer deposits grew by £1.1bn to £12.1bn, and 400k new accounts were opened to reach a high of 4.6m. The fines and provisions helped cut profits to £223m from £301m, but this is a one-off hit to Starling’s results.

As part of its commitment to tackling legacy issues, Starling has been investing in its management team, including the recruitment of a new COO (Joe Gordon) and chief banking officer (Raghu Narula). Group CEO Raman Bhatia has added eight senior appointments since he joined in June 2024.

As Starling puts its problems behind it, there is scope to ramp back up the marketing spend and grow its market share. There is also an opportunity to broaden its service offering.

Starling Bank stopped paying interest on its current accounts in February but introduced a new “easy-saver” account that paid 4% on balances (since reduced to 3.0%).

Starling has a strong capital position – at the interim stage, CHRY was saying that Starling had excess capital of £400m, which can be used to support the continued growth of the business. That could include buying books of business or even bolting on entire companies.

In what we believe was a relatively small deal in August, Starling acquired Ember, an accounting and tax software provider for SMEs. The thinking is that with “Making Tax Digital” due to be enforced by HMRC in April 2026, Ember will help Starling’s SMEs to comply with these new regulations.

The advisers think that Starling might want to consider gaining a toehold in the US market through the acquisition of a small bank in that market. The US banking market is highly fragmented and beset with legacy systems.

On 4 November, CHRY noted that Starling’s Engine SaaS business had secured a major 10-year contract with Canadian digital bank Tangerine, a wholly-owned subsidiary of Scotiabank. Tangerine becomes Engine’s third customer (after Salt Bank in Romania and AMP’s Bank GO in Australia) and CHRY’s advisers are encouraged by the effective endorsement of Engine’s service by a major North American bank and the potential that this underscores for Engine to tap into the global banking market.

As an indication of the importance of this new contract to Engine, CHRY’s advisers say that it has the potential to match the entire revenue of Engine’s competitor Thought Machine (which we think is valued at about $2bn). They feel that Engine’s ability to offer end-to-end solutions to its customers and the credibility that its provenance gives it, puts it in a powerful position to win new business.

Engine now sits in a separate legal entity from the UK bank, so there is the possibility of splitting the businesses if that made sense. Given the potential to scale Engine, and the valuation multiples that fast-growing software businesses tend to have, the advisers believe that it could be a major driver of CHRY’s future NAV growth.

Smart Pension

The advisers say that while the valuation of CHRY’s stake in Smart Pension (smart.co) has been fairly flat in recent quarters, there is a still a lot going on within the company.

Smart Pension said it had over 1.5m members and £6.5bn of AUM in its Master Trust in March. It is anticipating further consolidation within the UK pension industry.

Part of the impetus for growth at Smart Pension is the Pension Schemes Bill, which is currently working its way through the legislative process (readers may be aware of it as the AIC has pushed back strongly against a notion that investment companies holding private investments – such as CHRY – would be excluded from the definition of eligible investments for pension funds looking to meet their quota of private assets).

For Smart Pension, more relevant is a minimum size threshold for multi-employer defined contribution schemes of £25bn of AuM by 2030. The government has determined that these schemes need to be big to be efficient. However, recognising that the £25bn target may be too ambitious, it has introduced the notion of “transition pathway relief”, whereby a scheme that has £10bn of AuM by 2030 and a credible plan to achieve £25bn by 2035 will be exempt.

The net effect of this is a push for consolidation within the industry. Small-scale schemes cannot realistically hope to meet the threshold and are therefore both M&A targets and effective price-takers. As an acquirer, Smart Pension is in a strong position to set the terms of deals.

The advisers think AUM could hit £9bn by the year end, helped by Smart Pension’s acquisition of Options (that is up from £2.5bn when CHRY first invested). As money rolls in from contributions and markets rise (at an assumed rate of just 2% per annum), the advisers think that, even without new acquisitions, AUM could hit about £18bn by 2030. Gross margins are running at about 80%, so the additional revenue is going to transform Smart pension’s bottom line.

In addition, Smart Pension also has its own in-house software business – Keystone – which eases integration of new books of business and has the potential to be valuable in its own right (it is already EBITDA positive).

Figure 3: Klarna (USD)

Source: Bloomberg

Klarna

Klarna’s (klarna.com) IPO finally got away on 2 September 2025, having been postponed from April in the wake of the market volatility that surrounded Trump’s “Liberation Day” tariff announcements. At $40 per share, the company raised $1bn and the IPO valued the company at about $15bn. As Figure 3 shows, the share price has come off since, partly in response to Klarna’s Q3 numbers, which showed it had made a loss for the quarter. At the time of publication, the share price was $30.6, giving Klarna a market cap of $11.5bn.

CHRY’s adviser opted not to sell any shares in the IPO (it would only have been able to sell a relatively small proportion in any case) and the trust’s 4.2m shares in Klarna are now subject to normal six-month lock-up arrangements from the date of listing. The structure of the IPO process meant that it was not possible to know what price the IPO would take place at, but the adviser’s sense at the time was that Klarna had further upside to come, especially as a number of agreements that it concluded in the run-up to September, start to bear fruit.

In addition to existing partnerships with major players such as Stripe and ApplePay, Klarna’s recent tie-ups include partners ranging from worldpay to GooglePay and JPMorgan Payments. The advisers suggest that the new business generated by these partnerships could be maturing and expanding for seven-to-10 years.

The company’s Q3 figures showed that it had 114m active consumers and 850,000 merchants using its services (both figures up by more than 30% year-on-year). Gross merchandise value was $118bn, up 23% like-for-like.

The advisers also see potential in Klarna’s US Fair Financing product, which offers larger loans to customers than Klarna’s Buy Now, Pay Later (BNPL) product. However, as new product line grows quickly (at 30 September 2025, the value of these loans was up 139% year-on-year) this is depressing Klarna’s numbers in the short-term, as it needs to recognise impairment provisions up front (which may not crystallise) before it recognises the income from these loans. Klarna is also selling packages of loans onto Elliott. When it does so, it is able to both recognise the revenue sooner and reduce the impairment provision, which implies that this hit is temporary.

That extra revenue should boost its profitability as Klarna is making use of technology, including AI, to keep its cost base down. CHRY’s advisers see the potential for Klarna to generate c.$3bn of pre-tax earnings within about three years, which they feel ought to drive it to a multiple of its current valuation.

Performance

Figure 4: CHRY NAV and share price total return performance since launch

Source: Morningstar, Marten & Co

At the end of September 2025, CHRY’s NAV was 171.65p, up 9.6%% over 2025 as a whole. The initial fall in Klarna’s share price following its IP was captured in the end September NAV. However, adjusting for the move since might imply that CHRY’s NAV has fallen by a further 4p.

What we can get a clear sense of from the chart is that the sharp rise in the NAV over 2020/21 was followed by an equally sharp fall over 2022. This reflects the easy-money, low interest rate environment of the COVID era giving way to inflation and them interest rate rises. The share price anticipated the NAV fall but overreacted to the downside.

It is worth remembering that five-year performance figures now capture very little of the upside but all of the downside. If we strip this period out, the NAV has been climbing fairly steadily since launch. However, the discount, which we discuss later in this note, still weighs on the share price returns.

Figure 5: Cumulative total returns for periods ending 30 November 2025

| 3 months (%) | 6 months (%) | 1 year (%) | 3 years (%) | 5 years (%) | |

|---|---|---|---|---|---|

| NAV1 | (1.1) | 12.5 | 21.5 | 16.1 | 6.6 |

| Share price | (3.1) | 12.8 | 17.1 | 64.9 | (26.2) |

| MSCI UK | 6.5 | 12.7 | 21.4 | 43.0 | 91.6 |

| NASDAQ | 11.0 | 21.6 | 17.7 | 95.3 | 117.5 |

Source: Bloomberg, Marten & Co. Note 1) NAV based on last published as at 30 September 2025.

As in previous reports, we have included the MSCI UK and NASDAQ as comparators. However, none of these would make an ideal benchmark.

Figure 6: Major contributions to changes in valuation of CHRY’s portfolio since our last note

Source: CHRY, Marten & Co

Figure 6 above shows the notable changes in valuation for each of CHRY’s assets since our last note, which used valuations as at 31 December 2024.

Reflecting CHRY’s buyback activity, which is discussed in the next section, the overall valuation of the fund fell slightly from about £888m to £877m over the first nine months of 2025. However, on a pence per share basis the NAV was up 9.6%. The main drivers of this were uplifts in the valuations of Starling and wefox, offset by falls in the valuations of Brandtech and Klarna. Starling and Klarna were discussed earlier. Looking at the other two:

Brandtech

Brandtech (thebrandtechgroup.com) has been demonstrating progress with its Gen-AI advertising solutions and has announced a plan to integrate Google’s video-generation model into its service. However, falls in the valuations of listed peers such as WPP led to a reduction in CHRY’s carrying value for the company.

The advisers feel that many advertisers can see the potential for AI but there has been a pause in the take up of Brandtech’s services as these advertisers evaluate how best to use it. Brandtech’s Pencil and Oliver businesses ought to be well-placed to pick up business as confidence returns.

wefox

Last year, it was clear that wefox (wefox.com) needed to be restructured. That process began in July last year with its exit from the German market. In September, a process of radical change within the company’s management team took a step forward with the appointment of a new CEO, Joachim Müller. In December, it sold its Lichtenstein-based insurance carrier to a consortium of Swiss companies led by BERAG. Then, in January 2025, wefox sold a portfolio of run-off German, Italian and Swiss contracts to DARAG. In May, wefox’s Italian units were sold to JC Flowers.

The focus of the business now is on developing its asset-light Managing General Agent (MGA) and smart insurance distribution businesses. The initial focus is on wefox’s core markets of Netherlands, Austria, and Switzerland.

To pursue this, in July 2025, wefox announced that it had secured €151m of financing, €76m of that was as additional equity from existing investors and €75m in the form of debt.

CHRY took a leading role in that restructuring, which enabled CHRY to introduce more downside protection into its investment, improve its position within wefox’s capital structure, and increase its stake in the business. This underpinned the increase in wefox’s valuation.

The advisers say that wefox is expected to be profitable for 2025. They see scope for an expansion of the business into Germany and the UK.

Premium/(discount)

Over the 12 months ended 30 November 2025, CHRY’s shares traded between a discount as wide as 45.0% and as narrow as 23.7%; the average discount over that period was 33.9%. As of publishing, CHRY’s discount was 35.3%.

Figure 7:CHRY premium/(discount) since launch

Source: Bloomberg, Marten & Co

The discount continues to narrow, helped by the buyback programme and, we think, the rising NAV. Since the programme began on 30 September 2024, CHRY has bought back 96,465,497 shares into treasury or 16.2% of its issued share capital.

Figure 8: CHRY share buy backs

Source: Marten & Co (NB data to 30 November 2025)

Fund profile and management arrangements

Investors may wish to consult the fund’s website at chrysalisinvestments.co.uk

CHRY’s investment objective is to generate long-term capital growth through investing in a portfolio consisting primarily of equity or equity-related investments in unquoted and listed companies. Having the ability to back fast-growing companies, regardless of whether or not they are listed, is core to CHRY’s investment strategy.

At launch, the company’s name was Merian Chrysalis Investment Company Limited (ticker MERI). That changed in December 2020, following Jupiter’s acquisition of Merian Global Investors Limited. The advisory team of Nick Williamson and Richard Watts moved across from Merian. Then, with effect from 1 April 2024, the team formed a new investment adviser – Chrysalis Investment Partners LLP – which entered into a tripartite contract with CHRY’s board, under which it took over investment advisory services from Jupiter and G10 Capital Limited took over as AIFM. As a result, Richard and Nick are solely focused on CHRY’s portfolio. They are supported by lead investment analyst Mike Stewart, investment specialist Carmen Azad, legal counsel James Simpson, and head of finance and operations Bekki Whiting.

The debt facility

In September 2024, CHRY announced it had secured a two-year, £70m debt facility with Barclays Bank. It comes with an uncommitted accordion facility of £15m. Interest is charged at a margin over SONIA. The loan was immediately drawn down and can be repaid after one year with no penalty to CHRY. £10m of this has been repaid in recent weeks.

Previous publications

Readers interested in further information about CHRY may wish to read our previous notes listed below. You can read them by clicking on the links in Figure 9 or by visiting our website.

Figure 9: QuotedData’s previously published notes on CHRY

| Title | Note type | Date |

|---|---|---|

| Shepherding its portfolio through the storm | Initiation | 9 September 2022 |

| Putting growing pains behind it | Update | 26 July 2023 |

| Turned a corner | Update | 7 February 2024 |

| Return to form | Update | 27 February 2025 |

Source: Marten & Co

IMPORTANT INFORMATION

This marketing communication has been prepared for Chrysalis Investments Limited by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.