Chrysalis Investments

Investment companies | Update | 7 February 2024

Turned a corner

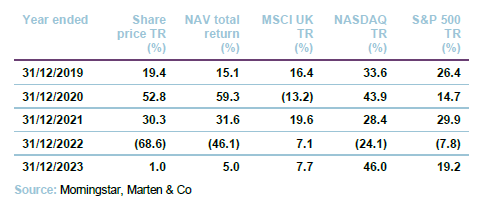

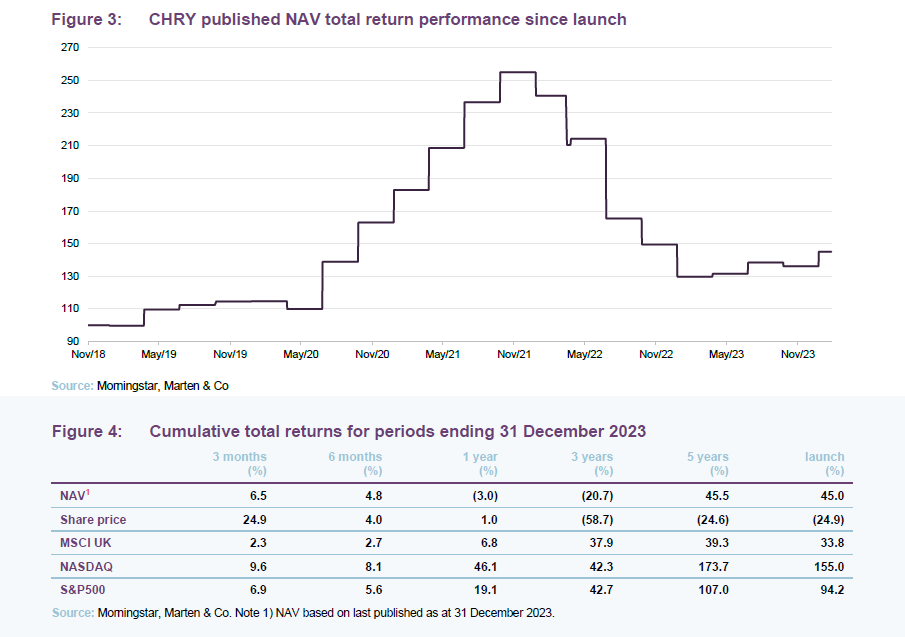

Chrysalis Investments (CHRY) seems to have turned a corner. The welcome 6.5% jump in the NAV over the final quarter of 2023, encouraging news from many portfolio companies, a NAV enhancing (but unnamed) disposal in the works, and the prospects of a more supportive interest rate environment all help underscore the trust’s attractions. We expect that shareholders will be happy to support the continuation vote scheduled for the AGM in March.

CHRY’s share price may be a long way off its low from last March, but with the discount sitting at 46.2% and the chance of NAV-enhancing exits freeing up cash to fund NAV-enhancing share buybacks, there is scope for it to move significantly higher.

Supporting growing businesses

CHRY aims to provide access to returns available from investing in later-stage private companies with long-term growth potential, an investment class that has traditionally been difficult to access for individual investors. CHRY also benefits from the flexibility to continue to support these businesses after they IPO.

Fund profile and management arrangements

CHRY’s investment objective is to generate long-term capital growth through investing in a portfolio consisting primarily of equity or equity-related investments in unquoted and listed companies. Having the ability to back growing companies, regardless of whether they are listed or not, is core to CHRY’s investment rationale.

Investors may wish to consult the fund’s website at chrysalisinvestments.co.uk

At launch, the company’s name was Merian Chrysalis (ticker MERI). That changed in December 2020, following Jupiter’s acquisition of Merian Global Investors Limited. The advisory team of Nick Williamson and Richard Watts (the adviser) moved across from Merian. They are supported by research analyst Mike Stewart, legal counsel James Simpson, and finance director Bekki Whiting.

Lead managers will be focussed solely on CHRY’s success

At the end of November 2023, CHRY’s board announced that it had agreed, in principle, to enter into a tripartite contract with a new investment adviser formed by the managers – Chrysalis Investment Partners LLP – which will take over investment advisory services from Jupiter, and with G10 Capital Limited, which will take over as AIFM. The change will take effect from 1 April 2024. As a result, Richard and Nick will be solely focused on CHRY’s portfolio.

CHRY’s investment advisory fee will be comprised of (i) 50bps of NAV per annum (unchanged from that paid to Jupiter); and (ii) an additional AIFM fee of 5bps on the first £1bn of NAV plus 3bps on any net assets above that level.

Annual performance fee capped at 2.75% of NAV, and subject to same high watermark

Details of the performance fee were discussed in our last note, but to summarise:

- subject to approval by shareholders at the forthcoming EGM, the adviser will be able to earn a performance fee calculated as 12.5% of NAV total return outperformance of an 8% hurdle and subject to a high watermark (currently 251.96p per share);

- there is a cap on performance fees paid in any one financial year of 2.75% of NAV (reduced from 3.75% as proposed earlier in 2023);

- the fee will be paid mostly in shares; and

- 75% of the fee will be deferred and released subject to criteria based on the company’s long-term performance.

The new investment adviser will have a 12-month minimum initial term, following which the new agreement will be terminable on six months’ notice.

Capital allocation policy

Having consulted shareholders, CHRY’s board has decided that it would like to introduce a new capital allocation policy. The aim is to return the first £100m of cumulative future realisations to shareholders subject to it retaining a liquidity buffer.

Prospect of share buy backs following disposals under new capital allocation policy

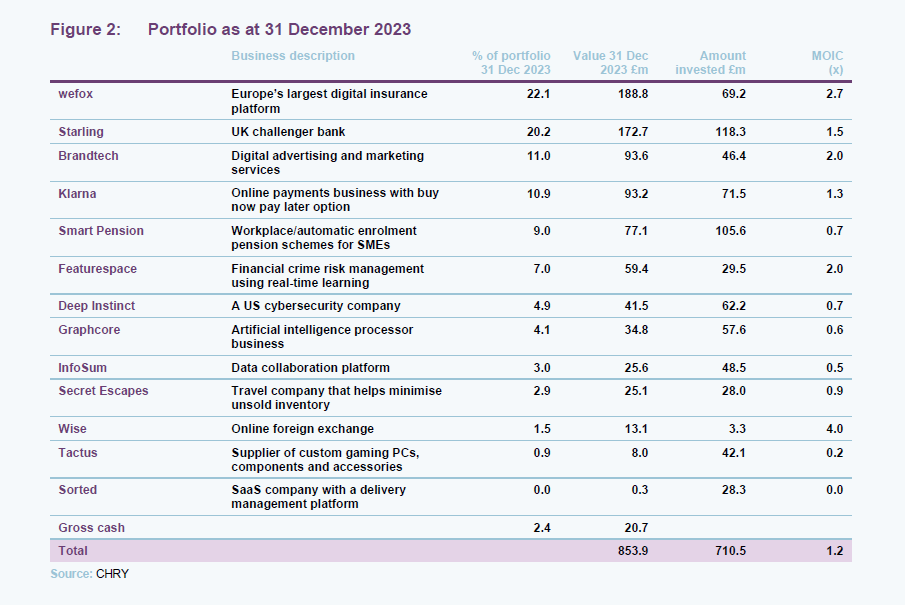

CHRY would maintain a liquidity buffer of up to £50m to ensure funds are available to support portfolio companies if needed. As Figure 2 on page 6 shows, CHRY had liquid assets (cash plus shares in Wise) of about £34m at the end of December 2023.

While the discount remains wide, the £100m would be returned by way of share buybacks. It seems likely to us that concrete news of a meaningful potential disposal (such as that discussed on page 5) would lead to a re-rating in any case and the buybacks would accelerate that process.

CHRY has the usual permissions to repurchase up to 14.99% of its shares in issue and would ask shareholders for permission to buy back more if that authority was exceeded.

Aiming to distribute up to 25% of net cash profits on realisations longer term

Once £100m has been handed back, the plan would be to balance CHRY’s capital allocation between further distributions to shareholders and portfolio investments, aiming to distribute up to 25% of net cash profits on realisations.

We think that this is a sensible move by the board and one that should give comfort to shareholders as they consider whether to support the company’s continuation (see page 12).

Portfolio activity

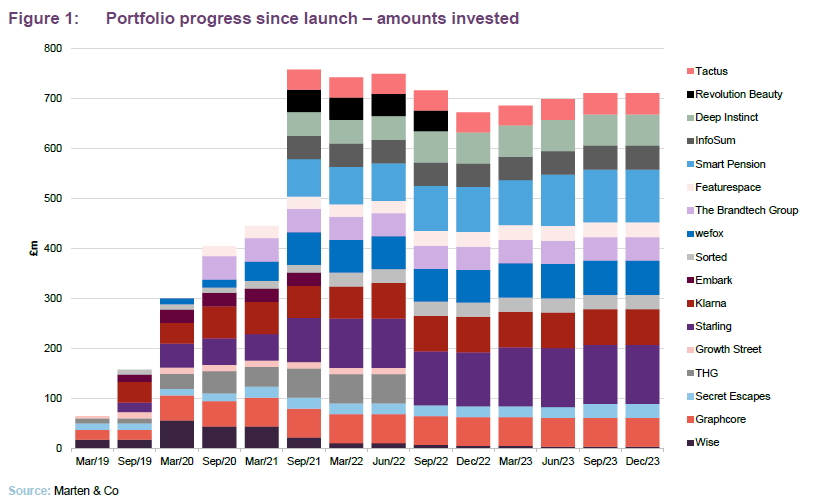

As Figure 1 shows, CHRY has continued to invest in its portfolio.

In the quarter ended 30 June 2023, CHRY invested £12.5m into Smart Pension as part of its $95m Series E fundraising and put a further £2m into Tactus. The position in Wise was trimmed again as its share price continued to climb. Then, in the next quarter, CHRY invested £6.5m into Secret Escapes to help recapitalise it and fund its growth. The company is generating meaningful levels of EBITDA. Travel is continuing its post-COVID recovery. The managers say that this is a business that they might be ready to exit in about 12-18 months’ time.

Portfolio increasingly mature

Interestingly, we think, there was no investment activity in the final quarter of 2023 on the grounds that most investments are now well-funded. This may be an indication of the increasing maturity of the portfolio.

Potential disposal

On 5 December 2023, CHRY said that it had visibility over a likely disposal at a valuation that would add about 5.5p per share to its end September NAV. That uplift is equivalent to about £33m, implying (we think) that the value of the whole disposal would be at least twice that; likely more. This looks, therefore, more than sufficient to fund CHRY’s first buybacks under the new capital allocation policy.

Likely disposal to kickstart buyback programme?

That disposal is not a potential IPO, but – as we discuss later when looking at Klarna – after a long hiatus, the prospects of an IPO of a portfolio holding are improving.

Case against Revolution Beauty

CHRY’s recently-published annual results note that it has potential claims against Revolution Beauty, in relation to the shares that it bought in July 2021 for approximately £45m and finally sold in late 2022 for approximately £5.7m in total.

CHRY says that the original share purchase was made on the basis of information provided to the company by Revolution prior to the company’s purchase of the shares in Revolution, and during the period in which the shares were held prior to their sale, that contained misstatements and material omissions. CHRY wrote a formal letter of claim to Revolution Beauty on 22 November 2023, which requested a response within 28 days. A response has recently been received asking for a further 28 days to provide a response. CHRY is now considering next steps with its retained lawyers, Travers Smith.

Current portfolio

Looking at some of these in more detail:

Wefox

The managers say that Wefox (wefox.com) is still one of the fastest-growing companies in the portfolio although, given the larger base, the rate of growth is slowing. They feel that the company is capable of generating very attractive levels of organic growth and continued M&A will accelerate this (Wefox has been buying businesses as one way of expanding its business into new territories). New hires have strengthened the management team.

Organic growth of about 35% is achievable and continued M&A will accelerate this

The focus has shifted away from using data collected by the business to write its own D2C insurance. Instead, it is launching a platform in April 2024. Wefox says that the platform uses artificial intelligence, data analytics, and automation to streamline insurance processes, improve risk assessment, and enhance customer experiences, whether the client is an insurance company, a broker, a partner or customer.

New platform launching in April 2024 – will use AI, data and automation to streamline insurance processes

Wefox has secured some interesting new affinity insurance partners. One example is a project with WINDTRE, one of Italy’s largest telecoms businesses, which is selling a range of insurance policies, not just covering phones.

Wefox has been raising debt finance recently, with $110m of funding from four banks secured in 2023, on top of the $55m extension of the Series D round that we discussed in our last note. The equity of the business is valued at $4.5bn. CHRY’s managers say that Wefox was profitable over the month of December 2023.

Starling

Starling’s (starlingbank.com) profitability has increased significantly as interest rates have risen and its interest rate margin has widened. The managers note that Starling’s initiative to pay 3.25% on the first £5,000 of current account balances and 5.53% on one-year fixed saver accounts has attracted sizeable inflows. Starling now has over 4.1m customer accounts.

Starling has attracted sizeable inflows and profitability has increased as interest rates have risen

Part of Starling’s business model is to monetise the investment that it has made in its software. Engine, its SaaS division, secured its first two customers in November – Salt Bank in Romania and AMP in Australia.

CHRY’s managers sees substantial upside to Starling’s current £1.16bn valuation

We discussed Starling’s FY23 results in our last note, however, there is reason to believe that the company’s carrying valuation for Starling is conservative. The managers recently noted that the company is currently generating a pre-tax ROE of 40%. We believe that this implies c£300m of PBT. A £3bn valuation seems reasonable, which would add over £270m to the value of CHRY’s stake, making it about 48p per share. Alternatively, the managers note that Monzo, which is a similar size to Starling, is rumoured to be worth about £4bn, which would suggest an even bigger uplift is achievable.

Brandtech

With the Jellyfish acquisition done, Brandtech (thebrandtechgroup.com) has been extracting substantial cost savings as the integration progresses; 370 jobs have gone and CHRY’s managers say that the combined business has great potential.

Substantial cost savings coming through

More recently, Brandtech has been building its capabilities in AI (its Acorn-i proprietary SaaS technology was already one of the fastest growing parts of its business) with the acquisition of Pencil AI, a tool for creating ads faster and cheaper using generative AI. CHRY’s managers say that it also allows firms to better-target customers. Take-up of the service is said to have been ‘incredible’. Brandtech CEO David Jones says that he has never seen such interest in a product and Pencil AI is ahead of the competition.

CHRY’s managers acknowledge that there has been some weakness in luxury goods advertising, and leadership changes at some big brands have delayed spending decisions. Nevertheless, they are still looking for Brandtech to deliver 20% organic growth over the long term. They suggest that Brandtech is currently generating in excess of $1bn of revenue on a pro-forma basis and that the business should be capable of generating a c20% EBITDA margin in the medium-term.

Klarna

Klarna (klarna.com/uk) has been releasing positive updates and may release another later this month. The Q3 2023 results published in November 2023 showed that the group is now profitable, with an operating profit of SEK130m in the quarter (about SEK500m excluding restructuring costs, share-based payments, related payroll taxes, depreciation and amortisation). The company noted that its US business has now recorded gross profits for four consecutive quarters.

Klarna is now profitable

The rate of growth has been accelerating, with 30% revenue growth, and profitability has been helped by a fall in credit losses as a percentage of gross merchandise value (0.33% in Q3 2023 versus 0.74% a year earlier). Klarna is accessing new markets and new categories. One that CHRY’s managers are excited by, for example, is its tie-up with Air BnB (customers in seven countries can now use Klarna’s services to spread the cost of their trips). With a much higher ticket size and access to a differentiated customer base, this relationship has good potential.

Klarna is accessing new markets and new categories

The managers envisage that Klarna could be worth about $18bn based on Klarna trading on the same gross profit multiple as closest-listed peer, Affirm. CHRY has a 1% stake. On those figures, a Klarna sale could add about 8p to the NAV. (NB: In the original draft this said 30p, the result of a drafting error on our part.)

Klarna CEO says US IPO quite likely soon – aspires for a triple-digit-billion-dollar valuation

Klarna’s CEO Sebastian Siemiatkowski was interviewed recently by Bloomberg and talked about his thoughts on an IPO of the company. He said that an IPO, probably in the US, was likely ‘quite soon’; he also added that the aspiration was for a triple-digit-billion-dollar valuation. That may be wishful thinking, but it makes CHRY’s managers’ valuation target look reasonable.

Smart Pension

As we discuss on page 11, there was a down round for Smart Pension (smartpension.co.uk) three or four months ago. However, CHRY’s managers think that the UK business alone justifies the carrying value and the rest is in for free. A peer – Cushon, with £2bn of AUM – was recently acquired by NatWest for an EV of £169m, which the managers think represents a multiple of about 12.5x current year revenue.

Smart Pension is cost cutting as it integrates recent acquisitions

At Smart Pension, a programme of cost cutting is underway some of which reflects efforts to integrate recent acquisitions, which include Evolve Pensions – a workplace pension provider – and ProManage LLC offering managed accounts and other personalised retirement solutions to plan sponsors and plan participants in the US. Smart Pension has also launched a pension solution product in connection with Mercer, which the managers could generate significant AUM inflows in the coming years.

As of November 2023, the Smart Pension Master Trust had AUM of £4bn and was seeing monthly contributions to its schemes of £100m. CHRY’s managers say that the wider Smart Pension group has total AUM of about £12.5bn.

Featurespace

Featurespace’s (featurespace.com) accounts for calendar year 2022, published in November 2023, show an acceleration in the company’s ARR growth, up 40% on 2021 and accounting for 70% of all revenue in 2022 and 80% over the first nine months of 2023.

Featurespace board sys it will not be needing to raise additional equity or debt capital

The loss for 2022 was £20.9m. However, operational cash generation in 2023 is said to be very strong and, at the end of September 2023, Featurespace had cash of £25.2m, not much changed from the position at the start of the year. The company’s board has said that given the trajectory of growth and cash generation, it will maintain a strong financial position, without the need for additional equity or debt capital.

Featurespace is shifting to profitability while still winning additional business

CHRY’s managers note that the company’s focus on a SaaS sales model helps margins. They feel that the business is at an inflexion point – shifting to profitability while still winning additional business. Research published by Featurespace shows that financial fraud rates continue to rise and the proportion of false positives – transactions that get blocked but should not have been – is also climbing. Featurespace’s solutions can combat this.

Deep Instinct

CHRY’s managers say that Deep Instinct (deepinstinct.com) is still growing strongly and organically and remain convinced that the business has great potential, saying it could generate one of the strongest returns across the portfolio if management successfully execute their strategy.

Demand for Deep Instinct’s services is being accelerated by rapid growth in AI-powered cyberattacks

Demand for its services is being accelerated by rapid growth in AI-powered cyberattacks. However, they note that the business is still lossmaking. CEO Lane Bess has been in the job almost a year. He is focused on building the team. The company’s sales strategy has pivoted more towards storage providers rather than endpoint users. In October 2023, it launched its Deep Instinct Prevention for Storage (DPS) business to be used wherever data is stored.

Deep Instinct’s is in discussions with AWS

The managers say that traditionally, cloud storage providers have treated threat prevention as a problem for end customers, but there has been a shift in attitudes to accountability and the agile defence provided by Deep Instinct’s product is appealing.

Deep Instinct’s is a potential acquisition target

The company has secured other contract wins and may be an attractive acquisition target, given that it offers a unique play on the use of deep learning for cybersecurity. The managers feel that there is considerable value in its IP. However, a sale is not on the agenda in the short term – the company is only just getting going.

Sorted

Sorted (sorted.com), which operates a SaaS business that supports retailers’ deliveries and collections, is being acquired by Location Services Limited for a nominal sum. CHRY had already written down the value of its position in the company over 2022 and 2023 so that at CHRY’s year end in September 2023, the position was valued at around £0.3m.

Sold for a nominal sum following write downs

Performance

CHRY’s NAV for end December 2023 came in at 143.37p, up 6.5% on the figure as at 30 September 2023, and 10.3% higher than the end-March 2023 NAV figure that we used in our last note.

Up-to-date information on CHRY and its peers is available on our website

The trend does seem to be upwards and the encouraging noises about NAV-enhancing disposals, revenue and earnings growth, and potential IPOs all suggest that this will continue. Further support comes from the likelihood of interest rate cuts to come, which eases the pressure on growth company valuations.

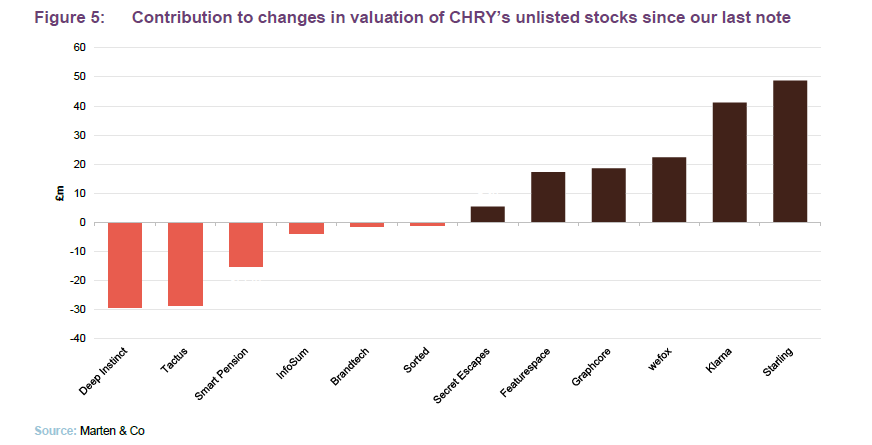

Figure 5 below shows the changes in valuation for each of CHRY’s assets since our last note, which used valuations as at 31 March 2023.

Figure 5 below shows the changes in valuation for each of CHRY’s assets since our last note, which used valuations as at 31 March 2023.

The overall valuation of the fund rose from about £776m to £854m over the period from 31 March 2023 to 31 December 2023. Despite its promise, Deep Instinct was the largest detractor, but this could change dramatically if the company succeeds in winning business from one of the large cloud service providers.

Tactus Holdings has been affected a tougher trading environment.

Smart Pension’s Series E funding round was conducted at a discount to previous valuations, likely reflecting the more difficult funding environment.

However, these negative moves are more than offset by good news elsewhere in the portfolio. The jump in Starling’s profitability that accompanied the rise in interest rates, and the shift to towards profitability at Klarna and Wefox that we discussed earlier, were the main drivers of this.

The excitement around the potential IPO of Klarna underscores the potential for this portfolio as sentiment improves and the IPO market warms up. In addition, there is the potential disposal of one of the assets in the portfolio to consider. This could not be through an IPO given the degree of certainty that was implied in the announcement. More likely, this reflects a bid for one of CHRY’s holdings.

Premium/(discount)

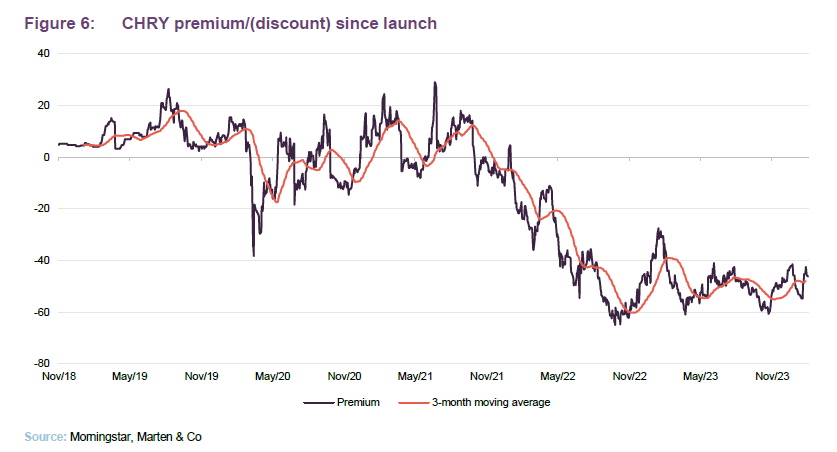

Over the 12 months ended 31 January 2024, CHRY’s shares traded between a discount as wide as 61.0% and as narrow as 33.4%; the average discount over that period was 50.3%. As of publishing, CHRY’s discount was 46%.

We have discussed the reasons for CHRY’s shares shifting from trading at a premium to a wide discount in previous notes. The main driver has been the market’s response to rising interest rates and the associated possibility of a recession.

Over 2023, the discount settled into a range of about 60% to 40%. The recent trend has been of discount narrowing, but it is worth noting that this would have looked more impressive but for the impact of CHRY’s higher NAV figure as at end December, which was announced on 29 January and so is only now starting to feed through into the share price.

Another factor at work was the surprise uptick in UK inflation for December, which raised fears of a delay to interest rate cuts. Since then, grocery price inflation has come in below expectations, that figure may have just been a blip.

We think that the upward momentum in the NAV should gradually drive down the discount. However, a sizable disposal and the subsequent implementation of the capital allocation policy discussed on page 5 could have a more dramatic impact.

Forthcoming AGM and EGM

With five years under its belt since the IPO in 2018, CHRY is, as promised, holding a continuation vote at the AGM scheduled for 15 March 2024. Thereafter, shareholders will get to vote on the continuation of the company every three years.

First continuation vote at March AGM as promised

As we have discussed elsewhere in this note, after a period of setbacks linked largely to macroeconomic events outside the managers’ control, CHRY’s performance is picking up. The managers have demonstrated their ability to identify and back promising businesses and we see no reason why shareholders should want to call time on the company.

In our last note, we set out the proposed adjustments to CHRY’s performance fee – notably the reduction from 20% to 12.5% outperformance and the retention of the high watermark. At an EGM scheduled to follow the AGM, shareholders will be asked to approve this arrangement.

Previous publications

Readers interested in further information about CHRY may wish to read our initiation note, Shepherding its portfolio through the storm, published in September 2022, or our update note, Putting growing pains behind it, published in July 2023.

IMPORTANT INFORMATION

This marketing communication has been prepared for Chrysalis Investments Limited by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.