Over the trough?

It has been another tough six months for abrdn New Dawn (ABD) as the Asia Pacific region has had to face new challenges from the Russo-Ukrainian conflict to what appears to be China’s deadliest COVID-19 wave yet (which has reportedly been heightened by Xi Jinping’s zero-COVID policy and a refusal, so far, to deviate from this). This has only exacerbated headwinds already in place such as rising inflation. Manager James Thom believes the worst is behind us, but uncertainty and volatility remain. The trust itself has underperformed in the short-term but still boasts strong long-term numbers and, if a new dawn is indeed rising over the region, with India finally enjoying its reformation and the vaccine rollout (mostly) underway, now might prove to be an attractive entry point. The trust is also trading on a 12.4% discount.

Capital growth from Asia Pacific ex Japan

ABD aims to provide shareholders with a high level of capital growth through equity investment in the Asia Pacific countries, excluding Japan. The trust holds a diversified portfolio of securities in quoted companies spread across a range of industries and economies. ABD is benchmarked against the MSCI All Countries Asia Pacific ex Japan Index (in sterling terms).

Fund profile

abrdn New Dawn (ABD) aims to provide shareholders with a high level of capital growth through equity investment in the Asia Pacific countries, excluding Japan. ABD holds a diversified portfolio of securities in quoted companies spread across a range of industries and economies.

Investments may also be made through collective investment schemes and in companies traded on stock markets outside the Asia Pacific region, provided that over 75% of their consolidated revenue is earned from trading in the Asia Pacific region, or they hold more than 75% of their consolidated net assets in the Asia Pacific region.

ABD is benchmarked against the MSCI All Countries Asia Pacific ex Japan Index (in sterling terms). We have also included comparisons against the MSCI AC World Index and its peer group within this report.

The manager is abrdn, which has delegated the investment management of the company to abrdn Asia Limited. On 1 June 2022, the trust changed its name from Aberdeen New Dawn to abrdn New Dawn.

abrdn’s approach is to manage money using a team approach. We spoke to James Thom, a senior investment manager in the team, for the purposes of preparing this note.

Market overview

Since our last note, published in October 2021, the Asia Pacific region has struggled against a number of headwinds including COVID-19 outbreaks, supply shortages, inflation concerns and the impact of the Russo-Ukrainian war. Year-to-date the MSCI AC Asia Pacific ex Japan index is down by 4.1%, although this is superior to the 6.2% fall from by the MSCI World over the same period.

In April 2022, The US Federal Reserve (Fed) raised its lending rate by 50 basis points (bps), the highest increase since 2000, which had already followed a 25 bps increase in March – the first increase since December 2018. Many commentators believe that further rises are on the way, with the Economist Intelligence Unit projecting another seven raises in 2022, reaching 2.9% by early 2023. Some countries, such as China, have been able to lower interest rates while most central banks in Asia Pacific have had or are poised to raise policy rates.

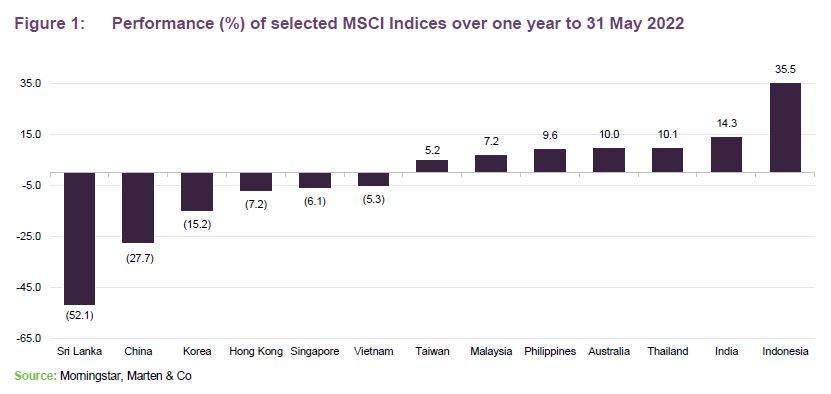

At the same time, countries across Asia Pacific are appearing to become more sharply delineated into winners and losers because of surging energy and commodities costs, a consequence of the Russia-Ukraine conflict. The hit is likely to be hardest on the largest net energy importers (relative to GDP) such as India, the Philippines, Korea and Taiwan, but it is a plus for the net energy exporters of Australia, Indonesia, and Malaysia. The impact of this can already be seen in

Figure 1 which shows these three countries among the best performers over one year to 31 May 2022.

Meanwhile, it may be that businesses unable to pass higher input costs onto consumers will see margin compression. Coupled with tighter financing conditions and risk repricing, the pain could be especially pronounced for highly leveraged industries and borrowers including small and mid-cap companies and households. Many appear to have not yet to fully recovered from the COVID-related economic shock of the past few years and are now having to deal with the knock-on effects of China’s zero-COVID policy.

A combination of higher geopolitical uncertainty, cost inflation and accelerating monetary tightening by major central banks appears to be pressing down on regional and global economic growth. The risk of a global slowdown appears to have increased, and it is increasingly difficult to see China avoiding a sharp landing, which could have an impact on the wider region.

Manager’s view

Looking over the past 12 months, James said Asia Pacific has suffered from a challenging backdrop. While it is better-positioned than much of the rest of the world with regards to the Russo-Ukrainian conflict (neighbouring China and India abstained from condemning the invasion), he says it has been subject to its own homegrown issues.

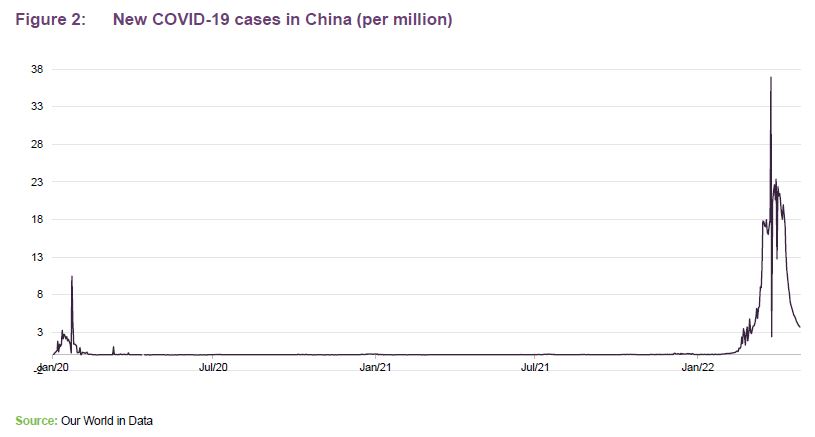

He adds that higher commodity and food prices threaten the outlook for certain countries while the region’s COVID-19 vaccine programmes are still well behind those in the west. China’s zero-COVID policy stands out as being particularly restrictive, but James says this arguably reflects that, while China has fully vaccinated some 87% of its population, its efforts were initially focused on younger people rather than the elderly who are more vulnerable.

Chinese COVID-19 backlash

James says the Asia Pacific region is not where western countries are in terms of reopening, which is a result of the west’s success in its vaccination rollouts. He highlights India, which had a late start to its vaccination programme and consequently was ill-prepared and suffered heavily from a deadly second wave in May last year. The manager says India has accelerated its programme since and today a large part of the population is either vaccinated or had a prior infection. India is almost ‘back to normal’ he adds.

Meanwhile, Singapore, where James is based, only last month removed most of its lockdown restrictions. Australia, New Zealand and most of south-east Asia have reopened with the only real exceptions being China, Hong Kong and Taiwan. In China, he points out, the issue is two-fold. Firstly, he says, Chinese president Xi Jinping is finding it difficult to deviate from the zero-COVID policy he sold to the public and state media has reported that he has called on officials to “resolutely fight” against all questioning of virus control policies. Secondly, the Chinese COVID-19 vaccine, Sinovac, has been proved to offer inadequate protection from the virus despite vaccination rates being high. James says the government is now accelerating the rollout of its own mRNA vaccine, but this is taking time.

According to Reuters’ COVID-19 tracker, as at 6 June, there have been 224,341 infections and 5,226 coronavirus-related deaths reported in mainland China since the pandemic began.

To make matters worse, James says the government’s total lockdown of Shanghai, its largest city and financial hub, has created economic chaos and engendered social backlash from tens of millions of residents who have been unable to go outside to obtain food or even to seek healthcare. Despite such protocols, hundreds of thousands of new cases of the virus have emerged and a similar problem threatens Beijing, the capital.

Meanwhile, the manager adds that the China A-share market has also been weak due to the potential delisting of US-listed Chinese companies over accounting standards. Last month, Chinese regulators revised a long-standing rule that restricted data sharing by mainland companies listed offshore. The revised draft rules removed a requirement that on-site inspections should be mainly done by Chinese regulatory agencies or rely on their inspection results. James says this potentially removes a key hurdle for US regulators in accessing more fully the auditing reports of US-listed Chinese companies, which had been a short-term overhang for these stocks.

Bullish on India’s fundamentals

James says that India, which represents 14.7% of ABD’s portfolio as at 30 April 2022, is working through its own issues, though he remains bullish on the country’s fundamentals.

He believes India is one of the countries that is most economically vulnerable to the ongoing conflict in Ukraine due to its being a large net importer of oil. He says that the higher – and still increasing – price is weighing on the country’s current account deficit even though inflation figures are still relatively low.

Furthermore, rising interest rates in the US tend to be negative for Asia as they drive outflows of hot money, deflating these economies. James highlights that India, however, has built up strong foreign exchange reserves and the Reserve Bank of India (RBI) has shown that it is willing to use these to defend the currency. When the Fed made its most recent 50bp increase, the RBI increased its base rate by 40 basis points (0.4%) in response. Despite this, there have been strong outflows, but these have been readily replaced with local investment and both the Indian equity market and rupee have been relatively resilient.

James also points out that India was forced to delay reaping the rewards of years of reform due to COVID, but it has since proved domestic growth is strong while it remains one of the fastest earnings growth stories globally, even after the deadly coronavirus outbreak it experienced in the second quarter of last year.

Investment philosophy and process

ABD’s portfolio is managed by abrdn Asia Limited. Stock selection is key to portfolio construction, but thematic insights (such as technological developments) and structural changes to industries influence stock selection. The core tenets of the abrdn approach to managing money are as follows:

- a, long-term, buy and hold strategy;

- a research-intensive process with an emphasis on meeting management; and

- a bias towards high-quality companies (where quality is determined by an assessment of management, business focus, the health of the balance sheet and corporate governance).

A preference for and the promotion of good corporate governance is an important part of the approach. In recent times, abrdn has broadened this to include an evaluation of both the environmental and social impacts of a potential investment. However, the importance of ESG considerations has reportedly seen a marked uplift during the last 12 months as abrdn has expanded the resources that it is allocating to this area (see below). ESG analysts continue to be embedded within the investment management team. abrdn is not an activist investor but sees the value of engaging with companies.

No stock is bought unless the manager has met management and follow up meetings are held at least six-monthly. The team had over 1,600 meetings with companies last year.

Any member of the team can put forward a new investment idea, but initial research tends to be carried out by the relevant sector and geographic specialist. Ideas are circulated internally and discussed at team meetings until a consensus has been reached.

With respect to assessing the potential reward available from a stock, an analysis is made of key financial ratios, the market that the company operates within, the peer group and the company’s business prospects.

Risk assessment is focused on ensuring that the portfolio is adequately diversified (on a range of metrics) rather than formal sector or geographic controls. Little attention is paid to market capitalisation, but an evaluation of liquidity does have a role.

New additions to the portfolio tend to be introduced at a 0.5% weighting and will be increased only after they have been tracked for a while and the investment thesis appears to be working. Thereafter, position sizes are driven by conviction and the manager’s assessment of portfolio diversification.

In the day-to-day management of the portfolio, the manager seeks to take advantage of anomalous price movements to either top-up or top-slice positions. This typically accounts for the bulk of turnover activity. Sales are often also triggered by M&A activity; the manager believes that its emphasis on high-quality companies results in selecting stocks for portfolios that are also likely targets for takeovers. Sales will also be made when the manager’s investment thesis does not go to plan.

The trust’s current gearing level is around 9-10% (net gearing is 7.8%) and it uses gearing conservatively where opportunities arise. ABD does not hedge currency risk on a continual basis but may, from time to time, match specific overseas investment with foreign currency borrowings.

Approach to ESG

As evidence of the company’s strong ESG credentials, ABD’s portfolio was rated AA for ESG at the end of April 2021 (the period-end under review in ABD’s last published annual report) by independent data provider MSCI on a scale of CCC to AAA.

This represents an upgrade versus the rating achieved one year prior and ranks the company ahead of the broader Asia Pacific ex-Japan market as represented by the MSCI All Countries Asia Pacific ex-Japan Index.

The benchmark, in comparison is BBB. More information on MSCI’s rating system can be found here, however, to summarise:

- Companies rated as AA and AAA are defined as ‘Leaders’ – a company leading its industry in managing the most significant ESG risks and opportunities;

- BB, BBB and A are defined as ‘Average’ – a company with a mixed or unexceptional track record of managing the most significant ESG risks and opportunities relative to industry peers; and

- CCC and CC are defined as ‘Laggards’ – a company lagging its industry based on its high exposure and failure to manage significant ESG risks.

The portfolio has more ESG leaders and fewer ESG laggards than the broader market, as assessed by MSCI, and also has a lower carbon intensity as compared to the market as verified by another third-party data provider, Trucost.

abrdn has been improving the ESG processes and data collection in recent years and as illustrated above, now has access to MSCI’s ESG data. James says that the team still does its own ESG work, but will then use MSCI’s system to compare and contrast and highlight where there may be differences in their analysis that would benefit from additional work. abrdn also purchases carbon data and analytics from Trucost through which it can analyse its portfolios and potential investments. Trucost offers a “verified and complete 10-year time-series carbon emissions data and disclosure metrics across company operations and supply chains representing 93% of global markets by market capitalisation”. This is enhanced by in-depth energy data from coal power production and fossil fuel reserves to energy transition, carbon price risk exposure, physical risk impacts and ”2-degree” alignment assessment.

abrdn selects and manages investments by embedding ESG into its process in four key ways:

- Assessing risk and enhancing value – a core element of the abrdn investment process appraises environmental, social and governance factors with the aim of generating the best long-term outcomes for the Company’s shareholders.

- Researching companies – abrdn conducts extensive and high-quality fundamental and first-hand research to understand the investment case for every company in its global universe more fully. A key part of the process involves focusing its extensive resources on analysis of ESG issues.

- Rating company ESG credentials – a systematic and globally-applied approach to evaluating stocks allows abrdn to compare companies consistently on their ESG credentials – both regionally and against their peer group.

- Corporate engagement – abrdn actively engages with investee companies to maintain or raise their ESG standards further and to deliver long-term, sustainable value consistent with the Company’s investment objectives.

ABD’s board supports abrdn’s commitment to, and participation in, framing policies, regulations and industry standards with the intention of delivering a better future for the company’s shareholders, the environment and society.

Although ESG factors are not the over-riding criteria in relation to the investment decisions taken, significant prominence is placed on ESG and climate-related factors throughout the investment process. These processes are reviewed regularly and liable to change.

abrdn also considers climate change as a key factor when assessing any financially material impact on returns. The related physical and transition risks are considerable and are becoming increasingly financially material for many companies. Not only for those in the obvious high-emitting sectors, such as energy, utilities and transportation, but also for those along the supply chain, providers of finance and in those reliant on agricultural outputs and water.

The manager is supportive of the Task Force on Climate-related Financial Disclosures (TCFD) framework to strengthen climate reporting globally. Regular engagement with high-emitting investee companies allows abrdn to better understand its exposure and management of climate change risks and opportunities. In actively managed investments, ownership provides a strong ability to challenge companies where appropriate.

Meanwhile, abrdn aims to influence the management of climate-related risks through engagement and voting and is part of Climate Action 100+ having signed the 2018 Just Transition statement last year.

It is worth noting that abrdn has historically been strong in its focus on corporate governance, as it sees this as being key to companies’ commercial success and for shareholders receiving the benefits of that commercial success. However, it has been focusing on advancing its ‘E’ and ‘S’ credentials, and there is clear evidence that this improved approach to ESG is impacting both research and portfolio construction.

Asset allocation

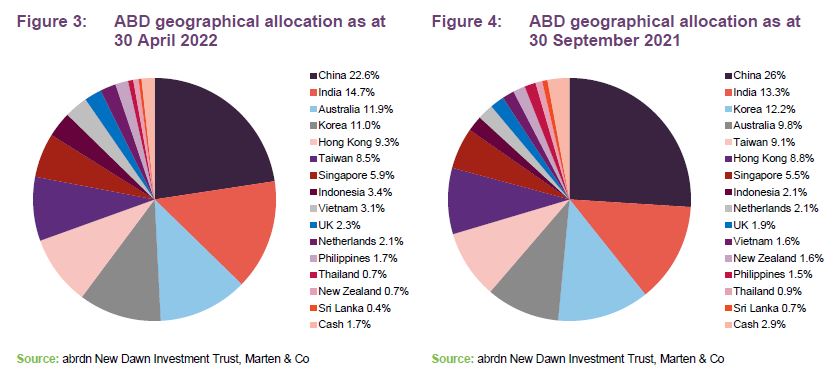

Comparing Figures 3 and 4 shows that ABD’s geographical allocation has changed slightly between 30 April 2022 (the most recently available data) and 30 September 2021 (this being the most recently available data when we last published). Exposure to China has continued to decrease, now sitting at 22.6%, down from 26% just six months prior and from 31.3% in January 2021. Meanwhile, exposure to India and Korea has continued to increase while Korea has been cut back slightly from 12.2% to 11.0%.

The reduction in Chinese exposure has been an ongoing decision by the team for some time in response to the changing regulatory environment which has spooked investors and caused the ABD team to approach China with more caution. As noted above, the country has been suffering another COVID-19 outbreak and some regions remain under a strict lockdown regime.

Another notable allocation change since our last note is the cash holding which has reduced from 2.9% to 1.7%. This is a result of the manager initiating some new positions.

Top 10 holdings

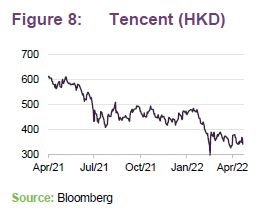

Since our last note there have been two new entries to ABD’s top 10. These are Singaporean banks DBS and Oversea Chinese Banking. Both are long-term holdings for the trust and often fall in and out of the top 10. Their reintroduction saw Yunnan Energy New Material and Wuxi Biologics fall out of the top 10. While Tencent remains one of the trust’s largest holdings, exposure has decreased by 1.5 percentage points since our last update note in September 2021 and a total of 5.2 percentage points since our last annual overview in January 2021.

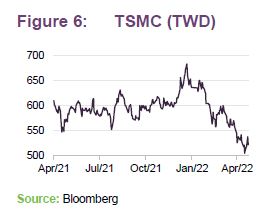

TSMC

Taiwan Semiconductor Manufacturing Company Limited (www.tsmc.com), or TSMC, is the world’s biggest contract chipmaker and the second largest holding in ABD’s portfolio. It has been one of ABD’s longest positions for almost 15 years, and James describes it as having robust fundamentals. However, the manager said there is a growing level of uncertainty on the outlook for the company, and similar names such as ASML. While these have both shown strong numbers, they could be impacted by a slowing demand environment, he adds, while commenting that TSMC is also likely to enter a mini down cycle after having such a strong 2021. The manager says the company had warned clients in May 2022 for the second time in less than a year that it plans to raise prices, citing looming inflation concerns and its own expansion plans to help alleviate a global supply crunch.

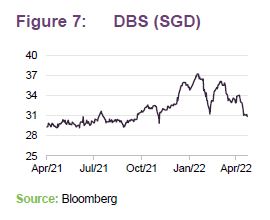

DBS

DBS Bank (www.dbs.com) is Singapore’s leading consumer bank headquartered in the Marina Bay Financial Centre in Singapore. Along with fellow Singaporean bank OCBC, it is one of the company’s longest holdings, bought well before James took over managerial leadership. It has shifted in and out of ABD’s top 10 holdings over the years and was added back in as a call on a rising rate environment. James says both banks should be beneficiaries through widening net interest margins and the broader reopening of society post lockdowns. He adds that DBS has an edge under its current CEO and has been ‘evangelical’ over digitalising what was once a ‘sleepy bank’ riding on a low-cost deposit base. James also says the company is managed well and that any asset quality concerns should ease and credit costs should come down.

Tencent

Tencent Holdings (www.tencent.com) is a Chinese multinational technology and entertainment conglomerate headquartered in Shenzhen. It is one of the highest grossing multimedia companies in the world and the fifth-largest company in ABD’s portfolio. James says he is confident in the medium-term outlook of the company as it remains a dominant business with great growth potential, though he is still concerned about the near-term regulatory adjustment it appears to be going through.

New additions to the portfolio

Since our last note, James has initiated a number of new positions in the trust, including a select few names in China despite his cautiousness of the country. These are all longer-term structural growth stories that James thinks are more immune from the current broader slow growth environment than other Chinese companies.

Zhongsheng

Zhongsheng Group Holdings Limited (en.zs-group.com.cn) – is an automotive retail and services company headquartered in Beijing. According to the manager, it currently has around 140 dealerships across China and markets brands including Xpeng, Audi, Honda, Infiniti, Lexus, Mercedes-Benz, Nissan, Porsche, Toyota and Volvo. James describes the company as “old school” but says that it has a strong position in the high-end luxury car sector with its premium brands. He adds that it benefits from recurring cashflows, derived from its aftersales business, and a scale advantage with its ability to make accretive acquisitions. He bought the company as a play on the continued aspirational consumption theme in China, which he says hasn’t been derailed despite the slowing growth environment. The manager says Zhongsheng has continued to show good numbers even though its share price took a knock and he took this as an opportunity to buy it at a cheap valuation in March.

Techtronic Industries

Techtronic Industries (www.ttigroup.com) is a Hong Kong-listed but global business that designs, produces, and markets power tools, outdoor power equipment, hand tools, and floor care appliances. James says it is a strong player in its sector and has been taking market share from big global names like Black & Decker. Meanwhile, numbers show that in the last five years, the returns generated on capital employed have grown considerably to 19% while the amount of capital has increased too, by 107%. The company saw a sell-off in its share price recently, which the manager saw as an opportunity to initiate a position.

OZ Minerals

A newcomer to ABD that isn’t a Chinese company is Australian mining company OZ Minerals (www.ozminerals.com). Though James already holds big names such as BHP and Rio Tinto, OZ Minerals provides a different offering in that its focus is on mining copper. The manager says the company has a strong structural long-term growth story and that it is well-run with good resources.

Sales

There have also been some notable sales from ABD since our last note. Nanosonics is an Australian-listed healthcare company which manufactures and distributes ultrasound probe disinfectors and other related technologies. James says it was first added to the portfolio in early 2021 but was sold in March 2022 in response to concerns over a change in the distribution agreement of its core product with partner General Electric, and on delays to the launch of its second product. Despite Australia doing well in recent months (which has in turn hurt the portfolio as it is underweight the country), growth stocks such as Nanosonics have had a hard time which also prompted the manager’s decision to sell.

Other recent sales were Chinese shopping platform Meituan, which James says faced broader regulatory issues, and Raffles Medical Group, which the manager felt would face both a slowdown in Covid-related revenue streams as the pandemic eases and slower-than-expected execution on its China expansion.

Performance

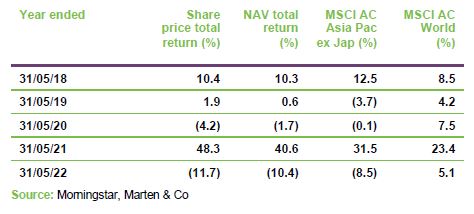

As highlighted in our previous annual overview, a broad trend of modest outperformance accelerated in the first half of 2019, when the portfolio’s bias to quality stocks made it defensive in falling markets, and again in H2 2020. However, the sell-off in growth stocks in 2021, which was repeated again earlier this year has dented returns.

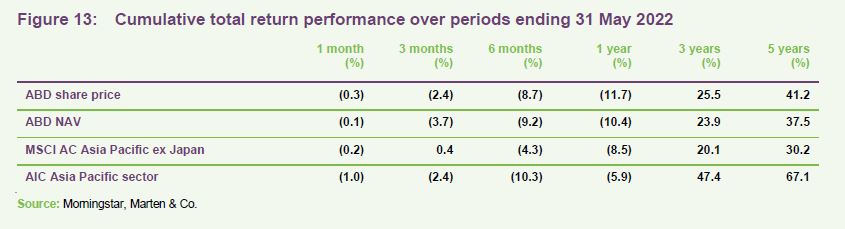

As shown in Figure 13, ABD has, in both NAV and share price total return terms, underperformed its AIC Asia Pacific sector peer group and MSCI AC Asia Pacific ex Japan benchmark over the past 12 months. Over one year to 31 May, the trust’s share price is down by 11.7% while its NAV is down by 10.4%. This compares with an 8.9% loss from its benchmark and a sector average loss of 5.9%. However, over the long-term, ABD has fared much better, outperforming the benchmark though still lagging its peers.

Peer group comparison – Asia Pacific sector

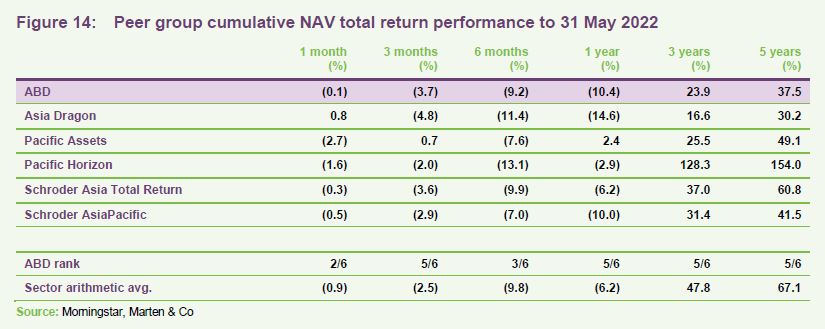

ABD is a constituent of the AIC’s Asia Pacific sector. The Asia Pacific sector is comprised of six members, which are detailed in Figures 14 and 15.

Members of Asia Pacific sector will typically have:

- over 80% invested in quoted Asia Pacific shares;

- less than 80% in any single geographic area;

- an investment objective/policy to invest in Asia Pacific shares;

- a majority of investments in medium to giant cap companies; and

- an Asia Pacific benchmark

Most trusts in the sector have seen negative returns over the past 12 months for reasons already explained in the market overview. ABD’s cumulative NAV total return performance averages at around mid-table over all of the time periods provided.

One of the key reasons for this is likely the reduced exposure to China compared to its peers as already discussed. However, a further consideration is that the performance of the peer group average has been dragged up significantly by the exceptional performance of Pacific Horizon (PHI). The trust’s investment approach is very heavily growth-focused, with considerable allocations to technology and healthcare, which have been key to the very strong returns it provided in recent years, particularly in 2020, during the outbreak and first few months of the coronavirus pandemic. All of sector’s members have been left behind by PHI, which illustrates the extent to which it offers a different proposition and is therefore not an ideal comparator for the rest. Our analysis shows that, if PHI is excluded from the peer group, ABD’s NAV performance is otherwise comparable to the peer group average over all periods provided up to five years, although it is markedly behind over 10 years for the reasons discussed above.

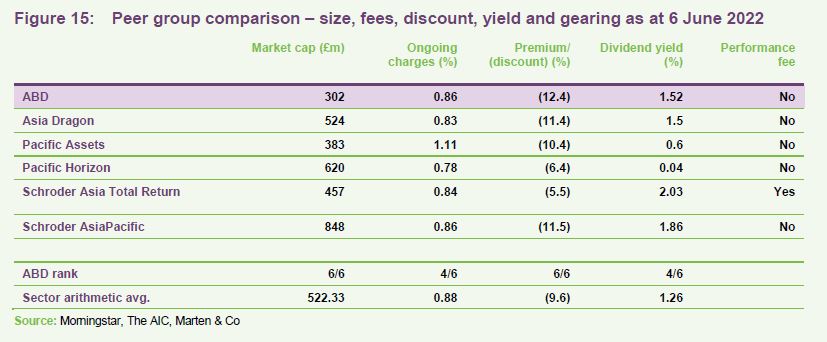

With a market cap of £302m as at 6 June 2022, ABD is a decent size, although as is illustrated in Figure 15, it is the smallest within this peer group. This has fallen from being the second-smallest 12 months ago as Invesco Asia has since moved to the Asia Pacific Income sector. ABD’s ongoing charges ratio is among the lowest in the sector and, like most of its peers, it does not incur a performance fee. The only exception in this regard is Schroder Asia Total Return, which charges a performance fee of 10% of the excess annual NAV total return of the fund above a 7% hurdle, subject to a high water mark.

ABD’s discount has continued to widen out since our last note and the trust now sits on the widest discount in the sector (all members are currently trading on discounts). This is most probably a reflection of its NAV performance relative to peers. In absolute terms, ABD’s yield is modest, reflecting its focus on capital growth and because – unlike a couple of its peers – it does not make distributions from capital.

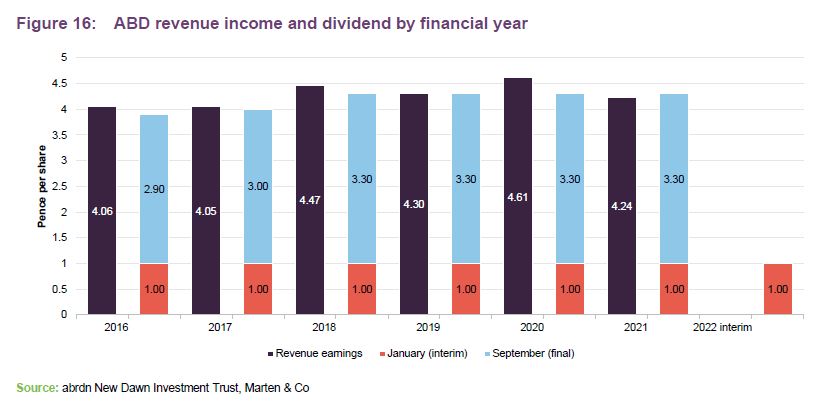

Biannual dividends

ABD’s focus is on generating capital growth rather than income. It pays two dividends a year, an interim in January and a final in September, from surplus income (unlike some of its peers, which pay a large part of their dividend from capital). As illustrated in Figure 16, ABD’s revenue return per share has generally been on an upward trend during the last five years, although there has been some volatility.

For the year ended 30 April 2021 (the most recently available data), revenue income was 4.24p per share, below the 2020 figure of 4.61p per share.

ABD’s revenue reserves stood at £13.3m as at 30 April 2021 (2020: £13.4m). While figures for 2022 are not yet available, indications so far would suggest that ABD’s revenue income does not appear to have been significantly affected by the pandemic. However, the level of the trust’s revenue reserves means that the board has significant capacity available to it to maintain or even increase the dividend, without the need to pay these out of capital, if necessary.

Premium/(discount)

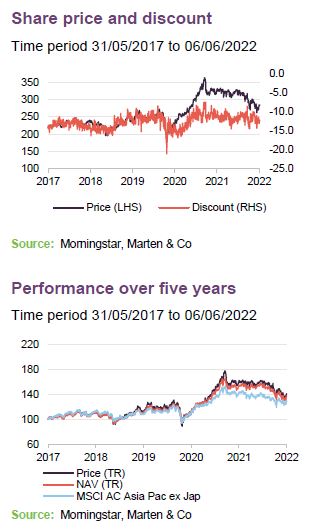

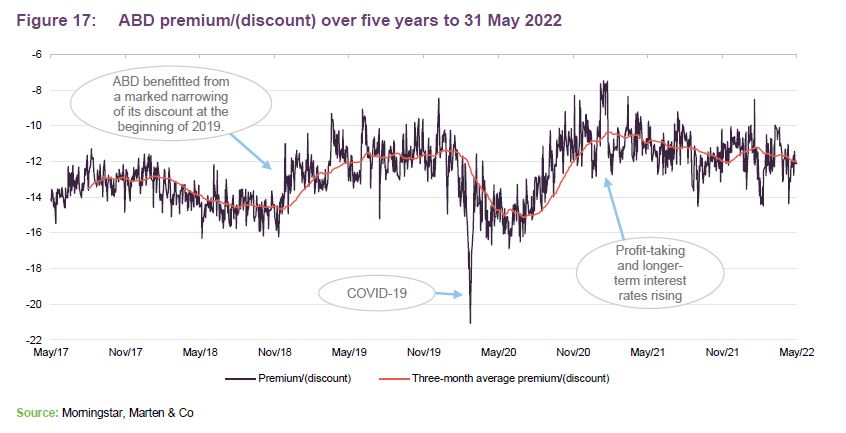

As we have discussed in previous notes, ABD’s discount underwent a marked narrowing at the beginning of 2019, which was sustained throughout the rest of the year and through most of the first quarter of 2020. However, the coronavirus outbreak in March 2020 saw ABD’s discount, along with that of its entire peer group, widen, with ABD hitting its five-year discount high of 21.1% on 23 March 2020. Unsurprisingly, the discount narrowed again quickly, so that ABD was trading at a discount of around 14% by the end of March 2020, but as is illustrated in Figure 17, ABD’s discount has still been wider than its pre-pandemic discount range.

Figure 17 also shows that markets corrected early last year through a combination of investors taking profits in the face of rising long-term interest rates (a potential signal of rising inflation expectations, which can lead to higher near-term rates, all of which can be negative for equities) that have taken the steam out of markets globally.

During the last 12 months, ABD has traded within a discount range of between 8.5% and 14.5%, with a one-year average discount of 11.6%. As at 6 June 2022, ABD was trading at a discount of 12.4%. This is wider than that of its Asia Pacific sector peers. The sector is trading on an average discount of 9.6%.

ABD is authorised to repurchase up to 14.99% and allot up to 10% of its issued share capital, which gives the board a mechanism with which it can influence the premium/discount. In normal market conditions, ABD repurchases shares when the discount is wider than the board would like. However, the board has no specific discount target in mind. Instead, its aim is to provide a degree of liquidity for shareholders. The authority to repurchase shares is renewed at each AGM (and more frequently, if necessary).

As we have previously discussed, ABD’s discount has tended to trade at tighter discounts when it has been displaying strong outperformance of its benchmark. The trust has suffered more heavily in the recent market setback than the average of the peer group, which may have contributed to the recent discount widening. However, if ABD is able to provide decent performance as the Asia Pacific ex Japan region continues to recover, and investors’ confidence around Asian markets improves, the discount could tighten from here, but the reverse may also be true.

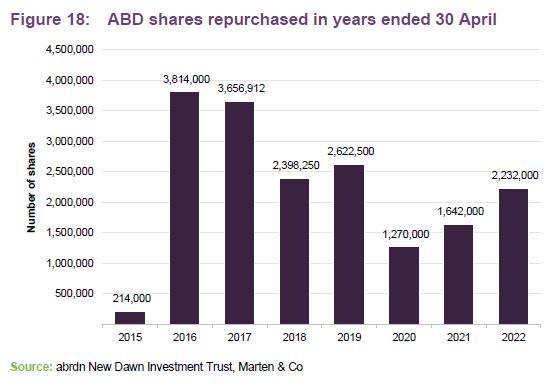

As illustrated in Figure 18, 2.23m shares were repurchased for the year to 30 April 2022. This is much higher than the past two years (1.64m in 2021, 1.27m in 2020), which is positive given the high level of uncertainty present during that time.

Fees and costs

The management fee is payable monthly in arrears based on an annual rate of 0.85% of NAV. There is no performance fee. The fee is adjusted so that there is no additional fee charged on other funds managed by the manager. The management agreement is terminable by either side on not less than 12 months’ notice.

All expenses are charged fully to revenue with the exception of management fees and finance costs, which are charged 50% to revenue and 50% to capital. This allocation reflects the board’s long-term return expectations in terms of income and capital respectively. In addition to the management fee, the company pays an amount each year to the manager for its promotional activities in relation to the trust. This was £161k for the year ended April 2021 and £146k for 2020.

For the year ended 30 April 2021, ABD’s ongoing charges ratio, including look-through costs for collective investment schemes, was 1.09%. Excluding look-through costs, ABD’s ongoing charges ratio was 0.86%.

Capital structure and life

ABD has a simple capital structure with one class of ordinary share in issue. Its ordinary shares have a premium main market listing on the London Stock Exchange, and as at 24 May 2022, there were 117,099,049 in issue with 10,574,701 of these held in treasury and 106,524,348 otherwise in general circulation.

The board determines the gearing strategy for the company subject to a current maximum limit of 25% of net assets. Borrowings are short- to medium-term and particular care is taken to ensure that any bank covenants permit maximum flexibility of investment policy. ABD has a £40m multi-currency loan facility provided by The Royal Bank of Scotland International Limited for this purpose. This includes a five-year fixed rate loan of £20m, with an interest rate of 2.626%, which matures on 14 December 2023. As at 30 April 2022, ABD had gross gearing of 9.7% and net gearing of 7.8% of net assets respectively.

ABD’s financial year end is 30 April. Its annual results are usually published in June (interims in December) and its AGM is usually held in September of each year. ABD pays biannual dividends in in January and September.

Discount triggered by continuation vote

ABD does not have a fixed life. However, under its articles of association, if in the 90 days preceding ABD’s 30 April year end its average discount exceeds 15%, notice will be given of an ordinary resolution to be proposed at the following AGM to approve the continuation of the company.

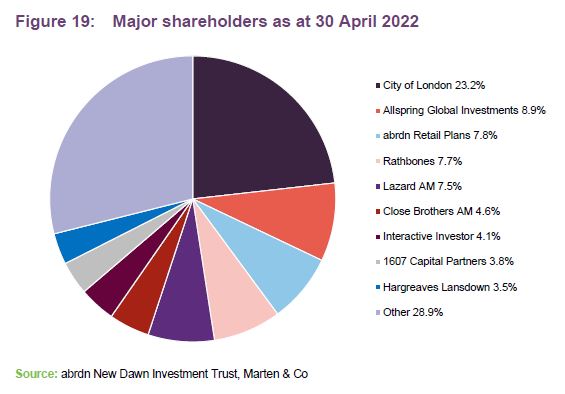

Major shareholders

Management team

abrdn Asia Limited’s investment directors James Thom and Gabriel Sacks are the lead managers on ABD’s portfolio.

abrdn is a global asset management company with offices in over 40 locations and more than 20 investment centres. Within the Asia Pacific region, it has nine offices.

Flavia Cheong heads up a team of over 40 investment managers in Asia and the Singapore office is the manager’s largest. This is where James Thom, Gabriel Sacks and ABD director Hugh Young (see board) are based.

Board

ABD’s board currently has five directors, all of whom are non-executive and who do not sit together on other boards. The majority are independent of the manager, with the exception of veteran fund manager Hugh Young (see below), who is a director of various entities connected with or within the abrdn Plc, which owns the manager. Hugh is the longest-serving director, with a tenure of 33 years. Neither Hugh nor abrdn earns a director’s fee from Hugh’s service as a director of ABD.

Directors’ fees are capped at £200,000, but as the table shows, total fees are well within that limit.

Donald Workman (chair)

Donald had an executive career until 2016 at The Royal Bank of Scotland Plc, where over a period of 23 years he held a number of senior positions. Latterly, this included as executive chairman of the group’s Asia Pacific business. Donald was a member of the RBS Group Executive Committee from 2014. He was also an independent non-executive director of Standard Life Private Equity Trust Plc between 2006 and 2013. Donald is currently non-executive chairman of JCB Finance Limited.

Stephen Souchon (chair of the audit committee)

Stephen is a chartered accountant. He had an executive career until 2015 at Morgan Stanley, where he was latterly head of the EMEA Corporate Financial Control Group. Stephen was a non-executive director and chair of the audit committee of Morgan Stanley’s Swiss Bank, during which time he oversaw the development of the Swiss wealth management business within Asia. Stephen is currently a non-executive director and chair of the audit committee of SMBC Nikko Capital Markets Limited and a non-executive director of TD Bank Europe Limited.

Marion Sears (senior independent director)

Marion had an executive career in stockbroking and investment banking and was latterly an MD of investment banking at JPMorgan. She is also a non-executive director of Dunelm Group Plc, Keyword Studios Plc, WH Smith Plc and Fidelity European Values Plc.

Hugh Young (director)

Hugh is chairman of abrdn Asia Limited. He was previously head of Asia Pacific for Aberdeen Standard Investments (before its rebrand to abrdn), a main board director, and head of investments for Aberdeen Asset Management (before its merger with Standard Life Plc and rebrand to abrdn).

Hugh joined the company in 1985 to manage Asian equities from London, having started his investment career in 1980 which included investment manager roles at Fidelity International and MGM Assurance. He founded Singapore-based ASI Asia (now abrdn Asia Limited) in 1992 as the regional headquarters. Hugh is a director of a number of group subsidiary companies and group-managed investment trusts and funds including abrdn Asian Income Fund Limited and The India Fund Inc.

Nicole Yuen (director)

Nicole is a Hong Kong national and a graduate of the University of Hong Kong and Harvard Law School. She had an executive career initially in law and subsequently in equities with UBS and latterly Credit Suisse (Hong Kong) where she was chief operating officer for the Greater China region and subsequently managing director, head of equities, North Asia until 2018. Nicole is currently a non-executive director of Interactive Brokers Group, Inc.

Previous publications

Readers interested in further information about ABD may wish to read our previous notes listed below.

| Title | Note type | Date |

| Market setback creates opportunities | Initiation | 4 October 2018 |

| Moving up the league table | Update | 8 July 2019 |

| Illuminating value | Annual overview | 7 February 2020 |

| COVID positive | Update | 20 August 2020 |

| An ESG Leader in Asian equities | Annual overview | 18 March 2021 |

| Caution wins out in the end | Update | 4 November 2021 |

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on abrdn New Dawn Investment Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.