Economic and Political Monthly Roundup

Investment companies | Monthly | September 2023

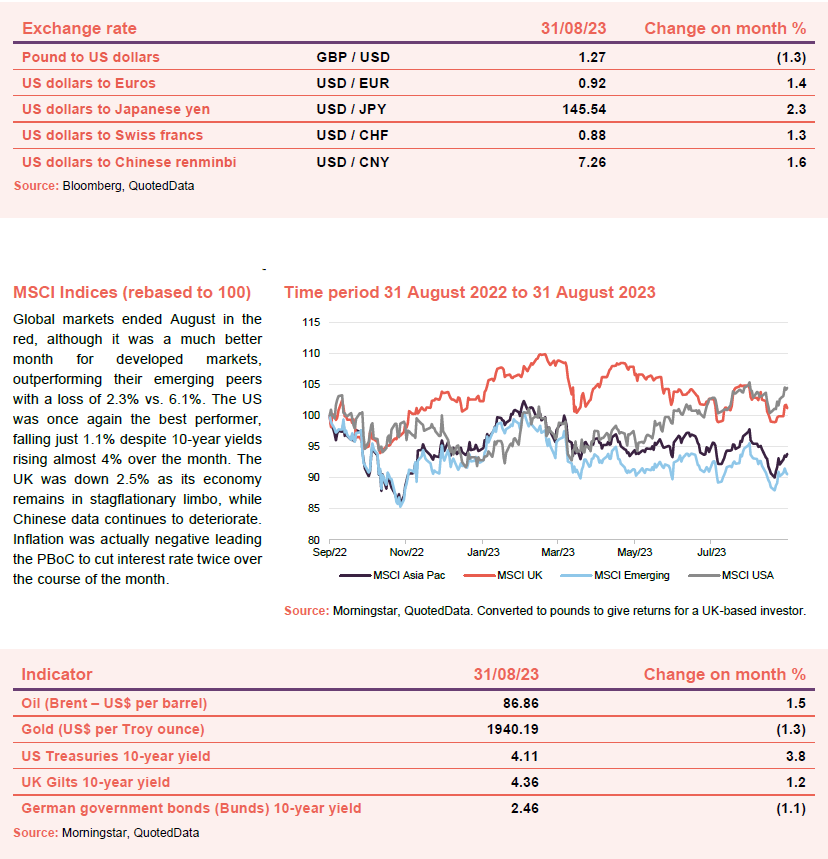

August was a moderately volatile month for markets as the economic picture in China worsened. Developed markets held up better than emerging markets. Yields on US government debt rose. Oil prices edged up, but the big jump was in natural gas prices as fears grew about the impact of a strike at Australian liquified natural gas (LNG) plants.

Despite much prognostication, fireworks were avoided following the downgrade by Fitch of the US government’s credit rating due to its unsustainable debt trajectory and concerns about the state of US politics. As it turned out, this proved to be nothing more than a distraction from the ongoing resilience of the broader economy, notably consumer spending. Markets are pricing one more hike for the year before the easing cycle is expected to begin midway through 2024. Although this should be taken with a large grain of salt if recent history has shown us anything.

“Global investors should agnostically assess all possible outcomes, including one that we think is more likely – that things may become worse before getting better.” – Marko Kolanovic, JP Morgan

The picture was not so rosy across the pond. While failing to deteriorate further, inflation in the Eurozone remained flat at 5.3%, nearly three times the ECB’s target and hotter than expectations. That coincided with business activity data that recorded one of its worst readings in a decade. The picture was equally dreary in the UK. Although inflation fell in line with expectations to 6.8%, the expected peak of rates remains close to 6%, and with GDP growth a rounding error from zero, both the UK and EU economies appear to be teetering, if not fully ensconced in stagflation.

At a glance

Global

(compare global and flexible investment funds here, here, here and here)

Andrew Ross, chairman, Witan Investment Trust – 14 August 2023

So far in 2023, equity markets have taken encouragement from a more positive growth environment, weathering the consequence that central banks have had to tighten monetary policy more than expected, owing to the resilience of inflation. Headline inflation (affected by 2022’s rises in energy costs dropping out) has peaked but improvement at the underlying level has been more elusive.

There are several plausible reasons (including the prevalence of fixed-rate mortgages, US fiscal easing and consumer savings built up during the pandemic) why higher rates have taken longer to affect economic growth than in the past. However, central banks who lost credibility in 2022 by failing to anticipate the inflationary surge may now be oversensitive to the slow progress in reining it back and risk overestimating its persistence. If they raise rates sufficiently to accelerate the fall in inflation, there is a risk of overkill and having to reverse course in 2024.

. . . . . . . . . . .

Bruce Stout, manager, Murray international– 10 August 2023

Cracking a nut with a sledgehammer seldom delivers the desired results. The shell usually breaks but the kernel invariably gets pulverised in the process. Faced with stubbornly high inflation in the Developed World, discredited and detached Central Banks continue to follow a similar Pavlovian practice which, in their world, involves hiking interest rates until demand subsides. This is theoretically logical if it is assumed that excessive consumer demand is the root of all price inflation. However, it is woefully misguided if rigidity of labour markets, deglobalisation, rising global protectionism or “doing whatever it takes” through printing money are structurally influencing the overall cost of living. Against such a backdrop, religiously following such a one-dimensional dogma appears at best foolhardy, at worst downright destructive.

In the meantime, the lagged effects of the monetary tightening implemented so far are beginning to emerge. For the G7 nations, drowning in a deluge of self-inflicted debt dynamics, servicing existing borrowings at higher interest rates has become the daily priority. The tougher and more politically unpopular conditions become for the indebted world, the greater the pressure to “bend” will mount on policymakers accustomed and conditioned to “choosing” the popular way out. However, the days of bailing out all and sundry through the public purse and supporting the ill-disciplined and indebted at the expense of the responsible saver are over. The re-emergence of inflation, tighter liquidity and acute competition for available funds has seen to that. For the Developed World’s Monetary Authorities, what they might want to do versus what they can actually do this time around appears profoundly different.

Against such a backdrop great caution is warranted. Investment focus will continue to emphasise quality companies, maintain a diversified portfolio of both income and growth opportunities, and seek to avoid sectors, businesses and geographical areas where both secular and cyclical headwinds are deemed to be most hostile. The medium-term outlook poses numerous unfamiliar challenges for policymakers, politicians and investors alike, with uncertainty likely to be a constant companion. For many, the process of getting comfortable with feeling uncomfortable has only just begun.

. . . . . . . . . . .

Nick Greenwood, managers, MIGO Opportunities Trust – 3 August 2023

Looking forward we remain cautious. Investors had enjoyed “free” money since the global financial crisis. Abundant liquidity supported a widespread rise in asset prices during that period. This largesse has now come to an end and the process will move into reverse suggesting mainstream indices will drift. The tide will be against us although the authorities will be limited in respect of how fast liquidity can be drained from the financial system given the fragility of markets. Should the global economy prove resilient, this will only increase the risk of further interest rate increases. Rate rises recently put in place will take time to take effect. Notwithstanding these challenges, there will be many opportunities for us to exploit in overlooked corners of the closed end world. On past occasions when discounts within our portfolio became as wide as they are presently, it proved to be the precursor of the next explosive run up in the value of our portfolio, although there is no guarantee that this pattern could be repeated.

The challenges facing investment trusts generated by oversupply and consolidation of wealth managers won’t be resolved quickly but there are self-help measures that can be taken. Buybacks reduce the oversupply. Investment trusts that still have ambitions to appeal to the wealth management industry can merge with likeminded vehicles to become large enough for the major chains to support. Such initiatives should help narrow discounts allowing share prices to outperform underlying portfolios. There are new audiences such as self-directed individuals and smaller wealth managers which are still investment-led. These remain attracted to investment trusts. Over decades we have repeatedly been warned that the investment trust industry has been under threat. Nevertheless, the sector has thrived. The law of natural selection is alive and well within the trust world. We will lose funds that no longer attract an audience, but the investment trust sector has constantly evolved over the years and will continue to do so.

. . . . . . . . . . .

Beatrice Hollond, chairman, F&C Investment Trust – 2 August 2023

While equity markets have delivered strong gains in recent months investors may have become too complacent about the potential near term risks. Although it appears that inflation rates are moderating, we may not have yet seen the peak in interest rates in most developed markets. In addition, the recent economic resilience may not last given the long lag time associated with monetary policy tightening. Furthermore, the enthusiasm for the big technology stocks in the US suggests that valuations there give limited room for disappointment. All these factors may give rise to some near-term caution for equity markets but looking further out there are grounds for optimism. The valuation excesses in markets overall appear relatively contained and it now seems likely that the US may avoid recession. In addition, although there is clearly some near term hype around the immediate benefits of AI, in the longer term there are likely to be significant benefits from the adoption of technology which will benefit both productivity and profitability. Of course disruptive trends create the potential for tremendous gains for the corporate winner as well as substantial challenges.

. . . . . . . . . . .

Victoria Muir, chairman, Invesco Select Trust – 1 August 2023

Global supply chains have returned to some normality and as a consequence in developed markets the momentum of increasing inflation appears to be weakening. Forward looking indicators suggesting that inflation is likely to moderate, as it has already in the US where it is on a downward trajectory. Central banks are walking an interest rate tight-rope, as they balance inflation control with maintaining economic growth. In Emerging Markets, the inflation picture is mixed with a chance of China going into deflation and inflation levels improving elsewhere.

UK equities, in general, have experienced a prolonged period of being rather unwanted, unfashionable and unloved, and share prices have been affected by a significant withdrawal from this market. Their value is being very gradually recognised and we expect an uptick in M&A. In the US, it has been striking to note how narrow the market has been, with performance concentrated across a handful of names and a marked difference between the S&P 500’s returns versus that minus its seven dominant stocks. We are starting to see some signs of this normalising.

. . . . . . . . . . .

Peter Hewitt, investment manager, CT Global Managed Portfolio – 2 August 2023

Developed economies and equity markets have done better than expected in the first half of calendar 2023. Growth has been stronger than anticipated and this fed through to profits and earnings from the corporate sector also being more resilient than had been estimated. Looking ahead, however, prospects appear fraught with uncertainties. Inflation everywhere, but especially in the UK, has proved much more sticky. In the biggest economy, the US, interest rates may be within one or two more rises of being at a peak. However, in the UK and Europe, Central Banks have more work to do and interest rates have further to rise. The big uncertainty is whether this reduces demand enough to lead to recession and if so the likely depth and duration of any slowdown. This has led to extreme caution amongst investors.

Against this background, the UK stock market has once again underperformed and whilst this may continue in the near-term, valuations of UK equities are discounting the most pessimistic of outcomes and are substantially below long-term averages. There is no doubt that patience is required, and will likely be tested. However, there is a significant opportunity for positive returns from UK equities which is reflected in both Portfolios increasing exposure to UK equity-focused investment companies, particularly those with exposure to medium and smaller companies. The other key theme is remaining invested in secular growth investment companies exposed to the technology, biotechnology, healthcare and digital platform sectors. Taking a longer view, it is from these type of investment companies that strong performance will most likely be achieved. Meantime, it is important to exercise caution in terms of investment strategy and only holding the highest quality investment companies with strong balance sheets and experienced, proven management.

. . . . . . . . . . .

UK

(compare UK funds here, here, here and here)

Abby Glennie and Amanda Yeaman, managers, abrdn UK Smaller Companies Growth Trust – 25 August 2023

Stock markets continue to be dominated by macro conditions, predominantly the pathway of inflation and interest rates, globally. The UK appears to be showing stickier inflation than many other key markets. Whilst energy prices have stepped back, we are seeing areas such as food inflation in the UK remain at high levels, and wage inflation and a strong labour market continue to support consumer spending. Without a recession, there remains the challenge of how inflation gets controlled; interest rates having already been increased significantly, but often taking some time to have an impact. UK valuations have derated significantly and are at attractive levels relative to other regions, providing an opportunity for investors to look at the value inherent in the UK market. If UK inflation reduces to a lower level, comparable to the Eurozone and the US, this could drive UK markets to recover and refocus on company fundamentals. Falling inflation could be that catalyst for our style to perform better and cause flows to shift into the UK market. In a period of more positivity in markets, small and mid-cap stocks tend to lead, and the outlook for the asset class should be attractive. Small and mid-caps in the UK have lagged large companies in the market moves since the start of 2022.

We continue to believe there are opportunities for businesses which deliver well on earnings expectations, to outperform, with many currently trading on undemanding valuations. The valuations currently being paid for growth companies in UK small mid-cap markets remain significantly below historic levels, whereas in other regions the market is now paying a 10 year median valuation for growth businesses again. We therefore believe there is a re-rating opportunity.

Since our appointment as Investment Manager in 2003, including the current downturn, there have been falls in the market of over 40% on three occasions. Markets anticipate improvements, and indeed turning points in the past have always been when the outlook is bleakest. In the UK small and mid-caps sector, the turn of the calendar year looks to have seen the direction of earnings revisions change positively. This isn’t out of line with previous market rotations where, on average, markets start to recover a few months before the turn in earnings. We take this as a positive indicator of market direction, although the risks of recession still remain given the macro-economic challenges. Smaller company markets have higher levels of risk and volatility, which in part reflects the potential for higher returns in the long run. Thus, Smaller Companies as an asset class should be viewed as a long-term multi-year investment to achieve these potential strong returns that have historically been available. Market timing is challenging, particularly in the small cap area, and often it is “time in” rather than “timing” which is critical.

As mentioned in last year’s Annual Report, but sadly still an important factor, UK markets really need to see inflation come under control and the shape of any potential imminent recession. The UK is already pricing in a lot of negativity; therein lies the longer term opportunity

. . . . . . . . . .

Ian Lance and Nick Purves, managers, Temple Bar Investment Trust – 17 August 2023

The relatively muted performance of the UK equity market in the first half of the year contrasts with strong returns elsewhere. In the US for example, the Nasdaq index of Technology shares had its best first six months in 40 years. The UK therefore remains very out of favour with many investors who continue to sell UK assets to channel money overseas. Here investment prospects are seen to be more exciting even though a large portion of the profits of companies listed in the UK are derived from outside the UK.

The result of this negative sentiment towards the UK however is that UK listed stocks are valued at a significant discount to their overseas listed peers for no other reason than they happen to be listed in the UK. For example, Shell is valued at just 6.5x 2023 estimated earnings, whereas the US listed Exxon Mobil is valued at over 11x. In banking, Barclays is valued at just 0.5x the value of its shareholder equity, whereas the US investment banks are valued at around 1x. Whilst many are taking a dim view of UK economic prospects, it is important to remember that we buy companies and not economies. The companies in which the Trust is invested are sound, conservatively run businesses with good balance sheets and capable management teams.

Many of the CEOs that we talk to express frustration with the low multiples that their businesses attract, and clients often ask what is likely to cause these shares to re-rate. The answer of course is that we don’t know for sure, except to say that one doesn’t need the shares to re-rate to get a very attractive investment return. We should remember that a company on a p/e of 6x, which turns 90% of its profit into cash (a typical conversion rate), offers a free cash flow yield of 15% and that all that cash can be used to drive shareholder returns either in the form of dividends or share buybacks, whilst holding debt at a constant level.

If said company paid out one third of its free cash as a dividend (dividend yield 5%) and used the remaining two thirds to buy back shares, the company would retire 10% of its shares in issue. This in turn would mean that for the same level of profits, earnings per share (and therefore dividend per share) would increase by 10% in the following year and the shareholders’ total return would be 15%. If the shares were to re-rate to 8x, this would drive an additional return of over 30%! These are perhaps obvious points to make, but it is nevertheless surprising how many investors seem to forget them.

Whilst it is somewhat frustrating that UK listed shares continue to attract such miserly valuations, the attraction for the long-term investor is significant as stock market history has shown that the best predictor of long-term future investment return is starting valuation. Time and time again, those that have invested in highly valued assets have been rewarded with suboptimal returns. Conversely, those that have invested in lowly valued, but fundamentally sound businesses, which did not happen to fit with the prevailing investment narrative at the time of purchase, have enjoyed outsized gains. Whilst we cannot know when the improved fundamentals of many of the Trust’s holdings will be reflected in share prices, the Trust’s shareholders should take much comfort from the fact that the lessons of stock market history are very much on their side.

. . . . . . . . . . .

David Fletcher, chairman, JPMorgan Claverhouse – 10 August 2023

Good news has been scarce since our last report. The geopolitical and economic environment remains worrying, exacerbated by the weight of global governments’ debt to be financed. The war in Ukraine drags on, with no prospect of resolution in sight, while China’s post-lockdown economic rebound has disappointed expectations. At home, UK inflation has surprised on the upside although the latest inflation rate figures have shown improvement, while growth has been disappointingly weak. This is beginning to impact corporate margins, and profits are likely to decline this year. The recent interest rate rises have increased the risk of recession, as higher rates begin to bite and mortgage holders and others struggle to meet their monthly repayment commitments. There are also concerns by some that the current widespread industrial action will fuel a wage/price spiral that may see the UK revisit the stagflation of the 1970s. The government’s finances are also weak, due in part to generous support packages implemented during the pandemic and more recently in initiatives to help households cope with sharply higher energy prices. This means that there is currently limited scope for the government to implement fiscal stimulus measures to boost activity.

However, looking beyond the gloomy near-term macroeconomic outlook, there are still encouraging reasons to be positive about the longer-term prospects of UK equities, and of the Company. As the Portfolio Managers observe in their report on the following pages, much of the bad news is now discounted by the market, and UK equity valuations are still extremely attractive in absolute terms and relative to other markets. This represents a rare opportunity for investors to enter this market at historically low valuations and suggests there is scope for significant market gains, as and when the economic backdrop improves, and investors once again focus on long-term fundamentals.

. . . . . . . . . . .

Andrew Bell, chairman, The Diverse Income Trust – 8 August 2023

Underlying stock market trends often persist for many years, but then change without fanfare. In the late 1960s and early 1970s, as the decades of low inflation came to an end, certain US mega cap stocks (known at the time as the Nifty Fifty) outperformed, with their perceived growth credentials attracting ever-rising valuations. The enthusiasm for US technology stocks in recent years (tempered by a setback in 2022) shows some parallels.

In that earlier era, when central banks faced high inflation, interest rates rose sharply and economic growth was disappointing and volatile. This put pressure on profit margins and led to a derating of the most optimistically valued stocks. Some went on to further success while others fell by the wayside.

At such times, investors may be driven to find something more reassuring than adrenaline. Equity earnings visibility and cash income count for more if 4-5% can be earned on cash deposits, whereas zero rates encourage investment in more speculative ideas, not all of which will come true. Growth has a major part to play in human progress and economic productivity but, when there is less liquidity around, enthusiasm is likely to be allocated more sparingly.

The UK market fell out of favour in recent decades, partly due to perceptions that it consisted of dull, mature companies and was under-represented in faster growth sectors. International investors were also deterred by the uncertainty over Brexit, with the UK economy and politics yet to adjust fully to be comfortable with the new structures. In addition, over the longer-term, regulatory changes encouraged progressive equity disinvestment by the UK pension fund industry, reducing its UK equity holdings from around 50% of fund assets twenty-five years ago to 6% in 2021. This removed a key domestic source of support from companies’ growth plans. As a result, the UK has become both lowly-rated and under-owned. When this will change is open to debate but there are some signs of hope from recent policy announcements encouraging investment in growing UK companies and reviewing potential obstacles to companies deciding to list in the UK.

With UK mid-cap and smaller stocks currently cheaply rated compared with a UK market that is itself lowly rated internationally, our Managers are particularly excited about the opportunity.

As the past two years reminds us, going against the crowd is not always rewarded in the short-term but the longer-term is more reassuring. It is worth recalling Warren Buffett’s aphorism that in the short run the stock market is a voting machine but in the long run it is a weighing machine.

. . . . . . . . . . .

Neil Hermon, fund manager, Henderson Smaller Companies Investment Trust – 2 August 2023

With inflation staying elevated against official targets, central banks, led by the US Federal Reserve, have remained hawkish. We have seen significant rises in interest rates globally and a move from quantitative easing to tightening. The market is forecasting further modest rises in interest rates globally although it is clear we are much closer to the end rather than the start of the monetary policy tightening cycle. Oscillating confidence levels in central bankers’ willingness and ability to strike the right balance between containing inflation and supporting economic growth are driving heightened levels of uncertainty and volatility in global bond and equity markets.

The rapid rise of inflation, driven by energy prices but also by a wider number of other components, and rising interest rates are putting pressure on consumers and businesses alike. Although the labour market is strong and wages are rising, real net disposable income is falling and consumer confidence is low. The delayed transmission mechanism of rising interest rates and their impact on the economy mean that economic conditions are likely to worsen in the short term.

Geopolitics remain challenging with the ongoing conflict in Ukraine and heightened tensions between China, the US and Europe. The longer-term economic implications of these are material. There is an urgent need to reduce European dependence on Russian oil and gas supplies and a requirement to decrease China’s influence on the global supply chain through investment in nearshoring capability. We expect capital spending to increase as a result and pockets of inflation to remain as bottlenecks appear in the process of supply chain reorganisation.

In the UK corporate sector we are encouraged by the fact that conditions are intrinsically stronger than they were during the Global Financial Crisis of 2008-2009. In particular, balance sheets are more robust. Dividends have been recovering strongly and we are seeing an increasing number of companies buying back their own stock.

After an active 2021, the IPO market has become considerably quieter as equity market confidence has diminished. There are no signs this is likely to change in the short term. Merger and acquisition activity (“M&A”) has remained robust as acquirors, particularly private equity, look to exploit opportunities thrown up by the recent equity market falls. We expect this to continue in the coming months as UK equity market valuations remain markedly depressed versus other developed markets.

In terms of valuations, the equity market is now trading below long-term averages. Corporate earnings rebounded sharply following the pandemic-induced shock in 2020. Lead indicators suggest this rebound is likely to continue to fade as economic activity weakens further. Rising interest costs and increasing tax burdens are putting further pressure on corporate earnings growth. The view that the UK economy is entering a moderate recession is now consensual and the debate is now focused on whether the trough will be deeper than expected.

Although uncertainty remains around short-term economic conditions, we think that the portfolio is well positioned to withstand an economic downturn and exploit any opportunities it presents. The movements in equity markets have thrown up some fantastic buying opportunities. However, it is important to be selective as the strength of franchise, market positioning and balance sheets will likely determine the winners from the losers.

. . . . . . . . . . .

Dan Nickols, manager, Rights and Issues Investment Trust – 1 August 2023

While inflation in the UK remains stubbornly high, it is hard to see a short-term catalyst to bring the market back into favour with investors. However the UK, and smaller companies in particular, remain very modestly valued compared to both international peers and their own history. Meanwhile economic conditions do not appear to be causing significant problems for companies beyond moderately weaker growth rates in the near term. As such, we see the current valuation environment as an opportunity for investors with a longer investment horizon and the patience to wait for the market to change.

. . . . . . . . . . .

Asia

(compare Asian funds here)

Donald Workman, chairman, abrdn Asian Income Fund – 16 August 2023

Growth forecasts in the Asia-Pacific region are ahead of many other parts of the world, as domestic demand has remained robust in a tighter global monetary environment. What lingers in investors’ minds is whether these forecasts will hold, in an environment that is becoming increasingly uncertain, with rising geopolitical tensions, recessionary fears and higher interest rates slowly making more of an impact.

In times like these, where markets are volatile and unsettled, an investment process focused on quality can provide resilience. The benefits of an active investment approach can bring opportunities and enable investors to sidestep parts of the market that are most exposed to risks, help navigate turbulent market conditions and take advantage of the strong structural secular trends across Asia.

These long-term regional drivers include the aspirations of a growing middle class, urbanisation, clean energy, and digitalisation, which are likely to reward patient investors in a region where individual countries typically have different outlooks. Despite short-term ebbs and flows, China and India, the two most populous nations worldwide, offer attractive long-term growth opportunities with the likelihood of positive effects on the other countries in Asia.

. . . . . . . . . . .

James Thom and Xin-Yao Ng, managers, abrdn New Dawn Invest Trust – 16 August 2023

Investors continue to navigate uncertain times due to global macroeconomic challenges and geopolitical volatility. That said, inflation is more benign in Asia, especially in China, providing support to the region’s economic health. Furthermore, Asian banks have not had any direct impact from the banking sector events in the US and Europe. While China remains a challenging market, we expect its re-opening to increase consumer confidence and consumption, as well as support Southeast Asian economies.

The technology sector would benefit from re-opening tailwinds and an increase in consumer spending. We think the technology cycle will bottom out in the near future and see the potential for a meaningful recovery in this calendar year. While there has been a lag of re-opening tailwinds translating into earnings growth, markets expect technology companies to produce higher earnings in the next financial year. Therefore, we are confident of the portfolio’s sizable exposure to the sector and continue to add to companies with strong fundamentals and potential for outperformance.

Elsewhere, we are optimistic that a surge in consumption would support the holdings in the consumer discretionary and healthcare sectors. Within India, we expect the holdings in the commodities and financials sectors to benefit from cyclical tailwinds and policy support. In Australia, the inflationary effects on commodity prices should continue to help mining and energy companies, despite a challenging macroeconomic backdrop.

. . . . . . . . . . .

Europe

(compare European funds here and here)

Sam Cosh, investment manager, European Assets Trust – 5 August

The recent economic news is troubling with rising interest rates finally starting to impact aggregate demand. The key from here is whether central banks can achieve a relatively benign cooling of activity or whether they will continue to tighten, potentially curtailing activity too far pushing the economy into a deeper recession. The market is now, however, starting to discount more of the latter, taking their cue from the rapidly deteriorating business surveys, and has therefore weakened recently. This has left European equities and smaller companies, in particular, looking good value. While a deteriorating economy certainly is not good news, central banks now have the tools to respond to this, and were they to pivot away from raising rates, the market would be able to look favourably towards recovery. In that environment smaller companies will thrive.

.. . . . . . . . . . .

Sam Morse, portfolio manager, Fidelity European Trust – 1 August

There are plenty of reasons to be bearish. More than a year ago, the two-year treasury yields rose above the ten-year treasury yields in the US bond market (it is normally the other way around). This ‘yield curve inversion’ has, historically, been a lead indicator of recession about 80% of the time, but the lag between the date of inversion and recession can be six months to three years. It is a bit like seeing a big dark cloud on the horizon and predicting it will rain soon! To date, the global economy and corporate earnings have been resilient while stock markets have recovered quite dramatically since the lows in October, such that share prices are now back in the middle of their normal valuation ranges. It is hard to imagine that this will not be tested in the months ahead.

Having said that, the pandemic and subsequent monetary and fiscal policies have made this an unusual cycle. At present, investors seem to be expecting a soft landing or no global recession at all. Earnings forecasts for 2023 are similar to earnings delivered for 2022 but analysts are still forecasting growth in 2024. The capacity of consumers (the most important contributors to GDP) to maintain spending levels has surprised many. But, in general, they still have jobs and pandemic savings to burn. The cost-of-living crisis may ease too as commodity prices lead general pricing downwards on goods and services. This disinflation may also be helped along by governments ‘encouraging’ corporates to abandon ‘greedflation’ (which might hinder company margins). So maybe the consumer will keep the global economy bumbling along.

Having said that, credit conditions are tightening (post SVB) and the US Federal Reserve and government are draining liquidity via quantitative tightening and short term bond issuance, and there is a multi-year refinancing requirement ahead for consumers and corporates alike. Geopolitical risks remain elevated too with the war in Europe and continued tensions between the US and China. Whatever our views on the outlook, we will maintain the current level of gearing and will continue to focus on attractively valued companies with strong balance sheets that should be resilient and able to grow dividends, even in a more difficult economic environment

.. . . . . . . . . . .

Japan

(compare European funds here)

Paul Folkes Davis, investment advisor, Nippon Active Value – 31 August 2023

This is the easiest section of any report I have ever written. The outlook is the brightest since NAVF’s IPO in 2020. METI’s M&A review, the Tokyo Stock Exchange’s announced intention to name and shame all companies trading below PBR and requiring them to generate comprehensive plans to plot a path to trading at multiples, and the Corporate Governance programme generally, have never provided a stronger regulatory wind at our back. Where the standard answer to our first entreaties with a new subject used always to be a polite ‘no’, now they are routinely saying ‘let’s talk’. We know there continue to be doubters, and that ‘I’ve heard it all before’ is a refrain that will take a long time to fade, but, on the ground, we are really beginning to see a sea change.

. . . . . . . . . . .

David Graham, chairman, Fidelity Japan Trust – 3 August 2023

Japan currently has the presidency of the G7 group of developed economies, and the Hiroshima Summit in May allowed the country to showcase its position as an increasingly entrepreneurial culture at the centre of Asia. Moves to tackle the bureaucratic nature of some of Japan’s corporates, which began under the late Prime Minister Shinzo Abe, have built up steam under current leader Fumio Kishida, with the Tokyo Stock Exchange setting out an agenda for a more shareholder-focused approach. This is starting to feed into an increased pace of share buybacks by major companies, more diverse boards of directors, and an emerging venture capital ecosystem where companies pushing into new markets and industries could become the stock market stars of the future. With many listed Japanese companies having built up significant excess cash – sometimes as much as 20-30% of their market capitalisation – during the long years of deflation, we believe the deployment of this cash could have a meaningful impact on the relative performance of Japan versus other markets in the months and years ahead. These factors and the lower valuation of Japanese stocks relative to other markets have all helped to garner significant interest from international investors which should result in a further rise in the Japanese stock market during the second half of 2023.

. . . . . . . . . . .

Nicholas Price, portfolio manager, Fidelity Japan Trust – 1 August 2023

Japan’s delayed reopening and the return of inbound tourists are driving growth in consumption and services demand. At the same time, the economy is transitioning to a moderately inflationary state, as companies are finding it easier to raise prices and are increasing wages. There is growing pressure on firms to enhance their corporate value and utilise excess cash to fund growth investments and shareholder returns. While signs of weakness in China’s recovery and the risk of a US recession represent potential headwinds that could prompt a near-term adjustment, this accumulation of positive factors is supportive of the mid-to-long term outlook for the Japanese market.

. . . . . . . . . . .

North America

(compare North American funds here and here )

Don San Jose, JPMorgan US Smaller Companies Investment Trust – 22 August 2023

We remain constructive on the case for small caps in the intermediate and long term. While multiple signs such as persistent inflation, stretched labour markets, a stubbornly hawkish Fed and tightening bank lending standards point to reasons for caution, none of these concerns are new. Valuation versus large caps continues to look favourable, especially with such a thin slice of the mega cap technology names driving the overall market. We are cognisant that the earnings picture for small caps is not poised for an immediate rebound and recent earnings revisions have been negative. However, the stocks will react positively before earnings hit bottom and our natural leaning towards high quality companies should provide downside protection in the interim. We expect that macro factors will continue to dominate investor focus in the short term, but we believe our process can outperform over the cycle.

. . . . . . . . . . .

Managers, JPMorgan American Investment Trust – 9 August 2023

While the US economy has so far held up, perhaps better than expected, the outlook is for slower growth across demand, profits, jobs and inflation. The tightening in credit conditions has so far been modest, but we would expect it to drag on economic activity, hiring and inflation in coming quarters. Meanwhile, the Fed has remained steadfast in its determination to keep monetary policy restrictive for longer than previously anticipated, and it has kept the door open for additional tightening if necessary. However, while the risks for the economy are mainly focused on slower demand, slower job gains and slower profit growth, recession is still not a foregone conclusion.

It is worth bearing in mind that, similar to the situation in the late 1980s/early 1990s, the economy has been experiencing something of a rolling recession: existing home sales have been extremely weak, due to the adverse impact of higher mortgage rates, and the pull-forward of demand during the pandemic; auto production is still recovering from the intense supply chain challenges and the car fleet has aged significantly, which should support demand over the next couple of years at least; while transportation companies have been through a harsh recession as inventories have corrected across multiple industries.

Meanwhile, much of the speculative excess experienced in the stock market during the period of extremely cheap money and massive government largesse during Covid-19 has been flushed out. Unprofitable growth stocks, cryptocurrency, the SPAC phenomenon, and Cathie Wood’s ARK fund have all come back down to earth. So now the market is back to climbing its ‘wall of worry’ as caution prevails, and heavy cash balances wait for the ‘All Clear’.

In our view, the best strategy is to look through these short-term fears and uncertainties and take the long view. We believe it is equally important to remain focused on the highest quality companies; be mindful of valuations but be willing to pay for truly sustainable growth.

. . . . . . . . . . .

Emerging Markets

(compare emerging market funds here)

Managers, Fondul Proprietatea SA– 15 August 2023

The World Health Organization announced in May that it no longer considers COVID-19 to be a “global health emergency”. According to the IMF , the global economy experiences a gradual recovery from the powerful blows of the COVID 19 pandemic and Russia’s unprovoked war on Ukraine, with supply-chains largely recovered and inflation still at high rates that continue to affect purchasing power. Global growth is projected at 3.0% for both 2023 and 2024. For Romania, according to April 2023 World Economic Outlook published by IMF, the real GDP growth for 2022 was 4.8% and this is expected to drop to 2.4% in 2023 and increase to 3.7% in 20241 . IMF projections from July 20231 forecast global inflation to fall from 8.7% in 2022 to 6.8% in 2023 and 5.2% in 2024.

According to Eurostat, the EU annual inflation rate was 5.5% in June 2023, down from 6.1% in May. For Romania, according with National Statistics Institute1 the annual inflation rate in June 2023 was 10.3%. According to the monthly BVB report2 for June 2023, the capital market in Romania increased by 10.0% in the first six months, taking into account the BET-TR index, but this development took place against the backdrop of decreased liquidity.

Also, at the end of June 2023 the number of investors in the Romanian capital market reached 141,000, a level that represents an all-time high. On 11 January 2023, the Board of the National Bank of Romania once again raised its key monetary policy rate by 0.25% to 7.0%, the eighth consecutive rate hike, in line with the trend followed by most central banks across the world. Whilst the potential for further interest rates increases is high, we expect inflationary pressure to be more subdued through the second semester of 2023. With the right mix of fiscal and economic policy, Romania once again has strong prospects to become one of the best performing economies in the European Union.

. . . . . . . . . . .

Maria Luisa Cicognani, chairman, Mobius Investment Trust– 2 August 2023

Despite the volatility in the first six months, there are positive signs in the market today.Monetary policy is working and inflation is falling, and while there is still some uncertainty about when US interest rates will start to come down, we believe that we are close to the peak. Investors confidence is rising, and the volatility index (“VIX”) is at a three-year low. The pandemic has spurred technological innovation and the use of new technologies is growing exponentially. Recently, there has been much talk of a new super-cycle in artificial intelligence (“AI”), which has the potential to boost economic productivity across all sectors.

Many emerging markets have proven to be more resilient than during previous crises, thanks to prudent central bank policies. I believe that after a decade of lacklustre performance, emerging markets may be at an inflection point with low valuations, a weakening dollar and highly innovative companies founded by talented entrepreneurs. While there is still some uncertainty about a possible recession in the US and Europe, the economic data seems to suggest that it will be shallow rather than deep and later rather than sooner, giving central banks some room to react.There’s a lot we don’t know, or to say it with ChatGPT, “we don’t have the ability to predict specific future events”. There could be further interest rate hikes. There could be a shallow recession in the US and Europe. There could be a deep recession. There could be no recession. There could be more geopolitical tension. There could be further fallout in the banking sector. There could be another pandemic. We don’t know.

But let’s focus on what we think we know. We know that interest rates are nearing their peak. We know that inflation is falling. We know that investor confidence is rising and volatility is falling. We know that emerging markets, and Asia in particular, will grow faster than developed markets. We know that emerging markets are under-owned and undervalued. We know that China will recover, albeit more slowly than expected. We know that the semiconductor cycle will turn sooner or later. We know that megatrends such as digitalisation, cybersecurity and artificial intelligence will continue to grow exponentially. And we believe that as they accelerate, so will the markets for MCP’s portfolio companies.

The market for artificial intelligence (AI), for example, is expected to grow strongly over the next decade. Its value of nearly $100 billion is expected to increase twentyfold to nearly $2 trillion by 20305. AI-based products and services will transform industries ranging from health care and finance to transportation and logistics. AI runs on computer processing power and data, so specialised semiconductor manufacturers (and those that provide essential products and services to them) are likely to be beneficiaries, as are companies with access to large amounts of computing power, cloud storage and data.

. . . . . . . . . . .

Commodities and natural resources

(Compare commodities and natural resources funds here)

David Cheyne, chairman, BlackRock World Mining Trust – 24 August

Central banks in most parts of the world have aggressively tightened monetary policy to restrictive levels and the way forward remains uncertain as they try to strike a delicate balance between fighting inflation and maintaining financial stability. Headline inflation rates are currently falling in the developed world, driven by lower energy prices and normalising supply chains. However, core inflation, which excludes items frequently subject to volatile prices like food and energy, does not appear likely to fall to many central banks’ 2.0% inflation target due to ongoing strength in wage growth.

Uncertainty on the interest rate path, reflecting inflation concerns, weighs on the outlook for economic growth. However, there has never been greater demand for metals and minerals and the mining sector must increase production to supply businesses with the materials, such as lithium and copper, they need in enabling the global economy to shift to a carbon-free future. The mining and metals industry as a whole is also confident that it can reconcile rapid output growth with sustainability goals.

. . . . . . . . . . .

Richard Horlick, chair, Riverstone Energy Limited – 5 August

Despite the continued uncertain outlook for the global economy, the IEA expects oil demand to grow by 2.2 mb/d in 2023, which was 99.9 mb/d in 2022. However, the demand picture contrasts sharply with the outlook for global oil supplies which are expected to see fractional growth for the full year. This weak performance is due to the energy landscape still being impacted by continued tight production following decades of Upstream under-investment and reduced supplies from OPEC+ led by Saudi Arabia. In addition, Russia’s invasion of Ukraine has resulted in oil volumes being diverted to India and China.

The theme that succinctly captures the challenge for society and our industry is the imperative to balance the competing demands of the energy trilemma: sustainability, security and affordability.

While decarbonising the energy system as the world transitions to net zero must remain the core aim, the recent volatility in energy markets serve as an important reminder that the transition also needs to take account of the security and affordability of energy for the end consumer.

With that in mind, hydrocarbons will continue to play an important role in the energy system for the next decade or two at least. The past 12 months have demonstrated the need for an orderly energy transition. If the world transitions away from hydrocarbons too quickly, as the impact of Russian volumes exiting the market has served to illustrate, the result will be energy shortages, price spikes and economic damage. It is critical, therefore, that demand for, and available supply of, hydrocarbons are consistent. We have seen some tepid increases in Upstream investment this year, but the rate of natural declines in existing production sources mean there needs to be greater investment.

At the same time, the necessity for decarbonisation is becoming more urgent, as evidenced by the unprecedented high temperatures during the month of July 2023. At the same time, CO2 emissions have increased every year since the Paris COP in 2015, except in 2020 when they decreased due to the impact of the Covid-19 pandemic. We have seen some progress on Government support for the energy transition, including passing the Inflation Reduction Act last year in the US. The war in Ukraine has undoubtedly changed the energy system for the long term with heightened focus on energy security increasing demand for domestically produced energy. This will hasten investment into renewables and other non-fossil fuels and technologies such as bioenergy, carbon capture and energy storage providing REL with further opportunities.

But while the decarbonisation of the global power system continues at pace, there are potential challenges ahead. The growth in highly cost competitive variable power sources such as wind and solar means there needs to be an acceleration in the financing and building of new grid capacity, as well as reform in planning and regulation. In the UK for example, network owners are under pressure to reduce multi-year delays for new projects wanting to connect to the grid. These delays threaten to derail the UK’s target to decarbonise electricity supplies by 2035 and similar pressures exist in the US and EU.

I believe that the general public market malaise and sentiment toward decarbonisation stocks in 2023 thus far is transitory and is not reflective of the inherent long-term value creation occurring within this segment of REL’s portfolio. Fundamentally, the need to balance security, affordability, and sustainability will continue to drive strong operating performance across REL’s portfolio and will underpin our ability to continue to drive returns for shareholders.

. . . . . . . . . . .

Tom Holl and Mark Hume, managers, BlackRock Energy and Resources Income Trust – 7 August

Concerns over a global economic slowdown have percolated financial markets for much of this year as the US Federal Reserve continues to drive a hard line on Quantitative Tightening (QT) to help stave off rampant inflation. Yet, if one were to simply look at the S&P 500, which year-to-date is up 8.6% through to 31 May 2023, you might be forgiven for thinking that everything was back to normal. However, the dispersion in returns is notable as six US mega-cap stocks account for all of this years’ gains. Amazon, Apple, Google, Microsoft, Nvidia and Tesla are up by 46% in aggregate since the start of the year. The remaining 494 stocks i.e. Everything Else is, on average, down (see Figure 12 on page 18 of the Half Yearly Financial Report). This reflects a quite extreme crowding effect and one which more often than not portends trickier times ahead. Coupled with sticky inflation and a Chinese economy that thus far has underwhelmed our expectations in terms of the pace and breadth of its post-COVID-19 recovery, this leaves us somewhat cautious as we look ahead for the next six months.

On the positive side, there is scope for China to lean on stimulus measures to support its real estate sector, which would bode well for mined commodity and materials demand. This would be additive to mobility trends which continue to grind upwards as more people choose to travel post-COVID-19 restriction easing. On the negative side, higher-for-longer interest rates may well be required to properly blunt western economies that continue to ‘run hot’. The effect on aggregate demand has yet to be fully felt, but the risks that rapid QT carries have already been evident in the US banking system with the collapse of Silicon Valley Bank and First Republic Bank. So, whilst we see an increasingly supportive policy backdrop for the energy transition over the next two decades, we consider that near-term caution is warranted.

. . . . . . . . . . .

Adrian Brown, chairman, BlackRock Energy and Resources Income Trust – 3 August

A higher interest rate environment to combat inflation has led to market concerns about the prospect of a global recession. In addition, with the continuation of the war in Ukraine and sanctions on Russia, commodity prices remain elevated putting pressure on inflation at the same time as tight labour markets are driving higher wages higher. Although more recently inflation appears to be slowing, all these factors are likely to result in central banks maintaining rates at higher levels relative to the last few years with risks of a global economic slowdown remaining.

Despite the current uncertainty, the ongoing drive by governments to address climate change and decarbonize the energy supply chain remains an important backdrop for the Company’s three pillars, of Traditional Energy, Mining and Metals and Energy Transition. The Board considers that all three sectors have an important role to play as the energy system transitions to a lower carbon economy. Traditional energy is needed to support base load energy to continue to power economies during the transition. The Metals and Mining sector provides the material supply chain for low carbon technologies from steel for wind turbines to lithium for electric cars. The path to a lower carbon economy is also expected to disrupt many industries and business models with scope for the Company to invest directly in opportunities in the Energy Transition space.

. . . . . . . . . . .

Environmental

(compare environmental funds here)

Managers, Impax Environmental Markets – 2 August

The macroeconomic picture remains challenging, with residual uncertainty regarding the trajectory of inflation. There is potential for interest rates to remain elevated beyond current market expectations, which would create headwinds for the growth-oriented equities where IEM focuses. However, it is likely that we are towards the end of the tightening cycle, and there is considerable potential for an uplift in performance caused by investors rotating back into growth stocks and into the small- and mid-cap companies in which IEM invests.

We are also encouraged by continued strong policy support for environmental markets, even against a challenging macroeconomic backdrop. The long-term investment case, based on the ongoing and increasingly urgent need to address environmental challenges, remains firmly intact, with compelling valuations contributing to our support for putting in place long term borrowings and increasing the Company’s gearing.

. . . . . . . . . . .

Infrastructure securities

(compare infrastructure securities funds here)

James Smith, Premier Miton Global Renewables Trust – 7 August 2023

European power prices have now fallen back to more normal levels although remain substantially higher than levels seen historically. I believe that higher power pricing is a structural shift, brought about by changes in the gas market, carbon pricing, and a higher cost of capital for energy companies.

Given share price movements, it is evident that this is not necessarily a view held by financial markets, and this creates potential opportunities for renewable energy investors.

Further, the climate agenda is only increasing in importance, and governments have acted to increase targets for renewable energy production, not least the EU’s RePower EU programme, the UK Government’s ambitions for offshore wind, and the US Government’s targets contained within the Inflation Reduction Act.

Macroeconomic headwinds remain for the time being, but leading indicators give hope that inflation pressures are now easing, including deflationary trends in China and sharply falling money supply in the West.

. . . . . . . . . . .

Technology

(compare technology funds here)

Mike Seidenberg, portfolio manager, Allianz Technology Trust – 1 August 2023

Our expectation is that the recent macro challenges could translate to an attractive opportunity for long-term investors as the technology sector is likely to continue benefitting from secular tailwinds which should drive capital appreciation over time. Having said this, we are cognizant of the scrutiny on IT budgets and the potential challenge near term. In addition, many companies continue to struggle to find workers to meet customer demand and are likely to further leverage technology-based solutions to improve productivity of limited staffs. As companies need to reduce costs and improve productivity, particularly in light of a potentially uncertain macroeconomic outlook, we expect to see accelerating demand for innovative and more productive solutions such as cloud computing, software-as-a-service, artificial intelligence, and cyber security.

Lastly, we are excited about artificial intelligence (AI) and what it means to the companies who trial and embrace these new models. Like many secular themes in technology, we would expect the companies which both enable AI and benefit from the use of AI to have good long term revenue growth and profitability characteristics but caution investors to expect volatility in this emerging sector. This is yet another example of technology solving a difficult problem and providing companies with a competitive advantage over time. We are in a period of rapid change, where technology is key to the prosperity of most industries. This environment is likely to provide attractive growth opportunities in many technology stocks over the next several years.

We continue to believe the technology sector can provide some of the best absolute and relative return opportunities in the equity markets-particularly for bottom-up stock pickers with long-term selection capabilities.

. . . . . . . . . . .

Private Equity

(compare private equity funds here)

Hamish Mair, CT Private Equity Trust – 23 August 2023

The slight decline in this overall valuation and the limited change seen in the latest June valuations is not surprising given the ongoing challenges in most economies where there is a background of high inflation and rising interest rates and sluggish growth at best. Most businesses within our portfolio continue to grow both revenues and profits at rates which are consistent with achieving the original investment theses. There are specific exceptions, generally but not exclusively, in consumer facing sectors, where we are relatively lightly invested, and where pressures on demand have been anticipated for some time. For a significant number of companies forecasts have shifted to the right which again is unsurprising given the post covid slowdown. Business confidence is the key determinant of the deal making environment in the private equity sector and while this has definitely moderated, it remains for the most part robust.

After a number of very active years a reduction in deal making is to be expected and in the latest figures it can be seen that this is clearly happening. At the micro level this manifests itself as transactions taking longer to conclude than usual or dropping away completely often when financing fails to materialise. We have seen a few postponements of much heralded exits and this trend may well continue. The vast majority of our investee companies are involved in markets where there is long term growth and where they have some form of advantage over their competitors. These factors coupled with strong management supplemented by experienced private equity leadership gives our portfolio an excellent chance of overcoming current challenges and delivering strong returns for our shareholders over the long term.

. . . . . . . . . . .

Mangers, Pantheon International – 3 August 2023

The first six months of this year have been an extension of much of last year, in terms of continued concerns about inflation, interest rate rises and geopolitical turbulence. We have also witnessed some localised bank crises earlier this year although they were reasonably well contained.

However, compared with this time last year, we believe we are closer to a point of stabilisation. Inflation has shown signs of moderation in most develoeconomies, with the exception of the UK, and economists believe inflationary pressures are beginning to wane.

As a result, the pace of interest rate increases has slowed, and market observers are anticipating a peak for interest rates in the coming months.

On the other hand, the global economy is not out of the woods yet. The fundamental macro issues have not gone away and sticky inflation is likely to make the job of central banks more difficult in the future. While public markets have rebounded this year, the recovery has been led by a narrow band of large US-based tech companies, and it has not been broad-based. The IPO market has cracked open slightly in the USA but it is nowhere near back to normal.

Uncertainty is the biggest deterrent for deal making, because deal underwriting and pricing need a stable near-term outlook, otherwise a “wait and see” approach prevails. The largest exit route for private equity-backed companies is corporate M&A, but in general strategic buyers have remained on the sidelines with deal activity continuing to be subdued. Sales of small and mid-sized private equity-backed companies to larger private equity funds have also been dampened, for similar reasons. As a result, the volume of private equity exits has declined and distribution rates have been low. Combined with a reduction in fundraising activity, the result has been a slowdown in new deal investment activity.

According to Bain & Co1, buyout deals (which comprised the bulk of the private equity deal volume) amounted to US$202bn during the first half of 2023, down 58% year-on-year. In the first half of 2023, buyout realisations fell 65% year-on-year to US$131bn.

. . . . . . . . . . .

Property

(compare UK property funds here, here, here, here, here, here and here)

Colin Godfrey, chief executive of Tritax Big Box REIT

Occupier leasing has moderated after the exceptional pandemic-driven activity of recent years, with underlying demand remaining healthy. Leasing volumes for the period totalled 10.0 million sq ft, in line with the pre-pandemic average of 12.8 m sq ft. This reflects current economic conditions, with occupiers taking a slower and more cautious approach to capital expenditure. Demand across the market remains diverse, with third-party logistics providers (44% of leasing activity in the last 12-months) and manufacturers (16%) being prominent.

Underlying demand for space remains strong with 10.4 million sq ft under offer at the period end, while Savills reported a 64% rise in occupier enquiries since Q4 2022. This is consistent with enquiries to our occupier hub, which are the highest in the last two years.

Companies continue to evolve their supply chains with greater resilience, selective reshoring, and decarbonisation amongst their ongoing priorities. Additional catalysts for network evolution exist in the UK such as further growth of the already large e-commerce sector, challenges posed by high inflation, and the country’s revised global trading position. Companies continue to adjust their supply chains accordingly and in doing so, generate new and additional demand for logistics buildings.

The amount of ready to occupy space rose in the period and market vacancy stood at 3.4% at the end of the period (Q4 2022: 2.0%). New speculative announcements have declined through the first half of 2023, with Savills reporting 5.2 million sq ft of announcements in H1 2023 (H1 2022: 7.9 million sq ft).

Barriers to new supply remain significant, in particular the need to control suitable sites and the time to secure planning consents. Capital market conditions mean financing costs have increased markedly on a year ago, while construction costs have levelled off but not fallen. Importantly, well capitalised investor-developers control significant land portfolios and remain incentivised to obtain the best possible terms for new leases to protect the value of their existing investments.

Vacancy remains low by historic standards and continues to support rental growth. Prime headline rent index (regional headline rents weighted by stock) increased by 4.9% in the period with all UK regions experiencing growth.

H1 2023 transaction volumes totalled £1.6bn (H1 2022: £4.1bn) with buyers from a variety of capital sources completing deals. After the very rapid pricing adjustment in H2 2022, yields stabilised during the period. CBRE and MSCI monthly indices both reported modest positive capital growth of 1.4% and 0.3% respectively in H1 2023.

While wider capital market conditions are likely to weigh on investment volumes in the near term, we believe high quality logistics real estate remains a compelling investment in the medium term. The long-term structural drivers that underpin occupier demand remain in place and investment capital is committed to the sector.

. . . . . . . . . . .

Ian Hawksworth, chief executive of Shaftesbury Capital

There has been continued improvement in trading over the period, with certain categories such as performance wear, premium and luxury outperforming significantly. We closely monitor trends in consumer demand to target brands and concepts relevant to our consumers with a strong omni channel presence, across a broad mix of categories.

There is strong demand from British, independent and global brands ranging from start-ups to established retailers seeking global flagships, which are attracted by the seven-days-a-week footfall and trading environment. With a broad range of unit sizes and rental tones on offer we can cater for a variety of retailers and provide flexibility for expansion within our portfolio.

Retailers are increasingly focusing on fewer stores, placing greater emphasis on global location, consumer experience, service and flagship retailing with better digital engagement. The West End, and particularly our portfolio, continues to be a destination of choice for both market entry and retail expansion.

Currently, the retail leasing market is strong, with various units attracting interest from multiple occupiers. Recent signings across the retail portfolio include luxury watch brand Tissot on James Street and the re-location and upsizing of the Arc’teryx store from Long Acre to King Street creating a new London flagship in Covent Garden, whilst in Carnaby, Hollister and OG Kicks have opened on Foubert’s Place. There has been a number of openings including the new flagship Uniqlo store, Sessun, Mejuri and Gramicci in Covent Garden and Farah in Soho.

The portfolio offers a diverse range of food concepts, from accessible casual to premium dining. In our experience, an innovative hospitality and leisure offering provides a halo effect on footfall, increasing dwell time, and drives improved trading in our areas. Competition for available hospitality accommodation has been strong throughout the period. With availability of restaurant and leisure space being constrained by strong trading prospects together with local planning and licensing policies, and we are seeing a high rate of renewals from existing customers.

. . . . . . . . . . .

Will Fulton, investment manager of UK Commercial Property REIT

Having just agreed its latest base rate increase to 5.25%, we believe the Bank of England will have to push rates to at least 5.5% to tackle underlying inflation pressures. Looking forward, given the risks of significantly overtightening policy, we remain sceptical rates will follow the market curve which currently sees rates climbing close to 6%. With the interest rate regime likely to tip the UK economy into recession, our base case forecast sees an easing of monetary policy to begin during 2024, reducing rates. Risks to this base case exist around both a surprise burst of stronger inflation than expected, forcing the Bank into a more aggressive rates stance, and mounting pressure on the government to ease fiscal policy, particularly around introducing substantial mortgage relief. This would make the Bank’s monetary policy less effective, exacerbating the UK’s inflation problems, resulting in interest rates needing to stay higher for longer. This weaker macroeconomic backdrop continues to weigh on UK real estate performance with any improvement in the economic environment likely to support a recovery.

Following the value correction of late 2022, UK real estate pricing has experienced a period of stabilisation through 2023 particularly in those areas of the market that saw the greatest capital declines. Those declines were, by and large, a yield correction driven by rising interest rates rather than a reflection of underlying occupational strength. Indeed, modest capital value growth has been recorded in sectors that benefit from structural tailwinds, such as industrial/logistics.

According to the MSCI Monthly Index, all property capital values fell by 0.4% in Q2 2023, though this hides sector variance. Industrial recorded growth of 1.2% over the quarter followed by Retail growing by 0.3%; Office values remain under pressure and saw capital value declines of 4.1%.

Transaction activity remained muted in the second quarter of 2023, as investors continued to take a more cautious approach to UK real estate. Transaction volumes were £5.6bn in the second quarter, down 64% on the same period a year earlier and 63% below the 10-year quarterly average. Limited good-quality investment stock has come to market so far in 2023, which has suppressed transaction volumes. Given lower conviction in the market, on the back of a weaker macroeconomic environment, we are likely to see a further slowdown in activity during the summer months.

Investment into the industrial sector accounted for the largest proportion of total investment volume over the quarter at approximately 32%. Total volumes were dominated by overseas investors accounting for approximately 52% with private capital trending upwards.

The office sector remains under structural pressure as evolving working habits and economic uncertainty weigh on the sector. In London, supply levels are rising and over 10 million sq ft of new accommodation is expected to be completed this year according to Deloitte – the highest level in over 20 years. Rising supply and weakening demand are forcing the vacancy rate higher, with the Central London vacancy rate now more than 9% according to CoStar data, the bulk of which relates to old stock as occupiers increasingly seek prime modern space with strong environmental credentials. We expect this to dampen rental growth prospects and expediate the bifurcation in performance between new and old. Investor demand for UK offices remains weak amid a poor outlook for the sector. Further capital value declines, particularly for secondary office assets, are expected across the sector.

Improved sentiment returned to the industrial and logistics sector during the second quarter of 2023 with pricing and performance demonstrating tentative signs of stabilisation. Whilst short-term pressure as a result of the weaker macroeconomic environment and rising debt costs are expected to dent investor confidence, the sector continues to benefit from structural and thematic tailwinds. We expect continued longer term positive performance, principally driven by robust rental growth. Supporting this, and despite an increase since the start of the year, UK industrial vacancy remains near historic lows, with any new supply unlikely to satisfy current occupational demand.

The retail sector has proven to be more resilient than many had expected over the first half of 2023. According to the Office for National Statistics (ONS), retail sales in the UK unexpectedly expanded in May, boosted by spending on summer clothing and outdoor goods. While the presence of discount retailers in the UK is not new, changes in consumer shopping behaviour have propelled them to the top of the wish list for many UK retail schemes. Discounter retailers have been a key beneficiary of a more cost-conscious UK consumer illustrated by B&M’s recent results, reporting like-for-like sales growth of 9.2% in its UK business over the first quarter of 2023. As a result, retail parks with a strong discount-orientated line-up remain in high demand for UK institutional investors.

Investor sentiment towards the purpose-built student accommodation (PBSA) sector remains positive and underlying occupational demand for the sector is robust, as illustrated by strong booking momentum for the 2023/2024 academic year. Like build-to-rent residential, there is an acute shortage of supply, particularly for the strongest university towns, which supports rental value growth for the sector. Investment volumes are down over 80% year-on-year for the sector. However, this is primarily due to a limited amount of investment stock being brought to the market, as opposed to any softening in investor sentiment towards the sector.

While more positivity returned to the market in the first half of 2023, the shorter-term outlook for the direct UK real estate market remains clouded on the back of a weaker macroeconomic climate. Gilt yields are anticipated to remain volatile in the third quarter of 2023 and any further rise in gilt yields will result in a tightening margin between UK real estate and gilts, though softened by the previous repricing of UK real estate. Heightened interest rates will also maintain pressure on real estate pricing. On a positive note, debt financing remains available and lender appetite remains for good-quality accommodation. Investors are likely to remain risk-off with good-quality accommodation providing more resilience in the face of weaker economic conditions and benefiting from more robust supply/demand dynamics. Polarisation within sectors is expected to intensify, with secondary rental and capital values under more pressure than prime. Occupational performance is expected to be the predominant driver of real estate returns in the near term and so the resilience of income will be paramount.

An improvement in real estate performance is anticipated in 2024, subject to the path of UK monetary policy which we expect at that time will be designed to stimulate economic growth.

. . . . . . . . . . .

Richard Shepherd-Cross, investment manager of Custodian Property Income REIT

The listed property market is acutely sensitive to broader economic news with inflation, interest rates and potential recession all impacting investors’ confidence. Interest rate outlook bites the hardest and at the start of the previous quarter there was a belief that interest rates might have been close to topping out. This optimism saw yields harden in some sectors following a market rerating in the second half of 2022, but by the end of the quarter that confidence had been eroded with the 50bps rise in the base rate to 5% and the expectation of more to come. On the back of the rate rise listed real estate prices fell sharply, but there has been some recovery since then on the back of the most recent inflation numbers.

This volatility suggests that investors are keen to upweight to real estate but are waiting for a more certain economic future to be revealed before we see share prices really rally. There is a strong logic for investing in real estate in the current market as real assets should be a good store of value in an inflationary environment as rents grow over time. In the current market, occupational demand is continuing to drive rental growth which is positive for interest cover and dividends.

. . . . . . . . . . .

Simon Laffin, chairman of Impact Healthcare REIT

The UK has a growing, ageing population. The demand for care home beds is therefore rising. There is also a growing realisation that a key way to take the strain off hospital beds would be to provide more care home facilities and step down care. However, the supply of care homes is fairly static. New build care homes are expensive, usually in excess of £200,000 per bed, compared to about £70,000 for older, early generation homes. Residents’ fees therefore have to be much higher for new build homes than for existing homes. The number of residents prepared and able to pay those higher fees is limited and so this puts a severe constraint on new care homes being built. The state-funded sector, in particular, is reluctant to raise fees to these levels.

The second constraint on the sector is the current high interest rates. With 20-year gilt rates now around 4.5%, the gap has fallen significantly against typical sector rental yields of 6%. This is a key reason why healthcare REIT share prices have fallen below net asset value, although healthcare has suffered less than other REIT sector

There should be more recognition of the importance of the care home sector to the health and well-being of this country. There are nearly 0.5 million vulnerable people in care homes in the UK today. The government needs to review how elderly peoples’ residential care is funded and how it can contribute to meet rising demand from an aging population, release hospital beds and provide post-operative care. This however will need also to address local authority fee rates, which are too low to provide incentives for the sector to build new homes and increase capacity. The private sector wants to play its role in providing more elderly care, both in making available buildings and capital (through REITs and other property investment company structures) and offering quality care and accommodation (through care home operators). We would like to work with government to deliver and expand this promise.

. . . . . . . . . . .

Fredrik Widlund, chief executive of CLS Holdings