The fruits of diversification

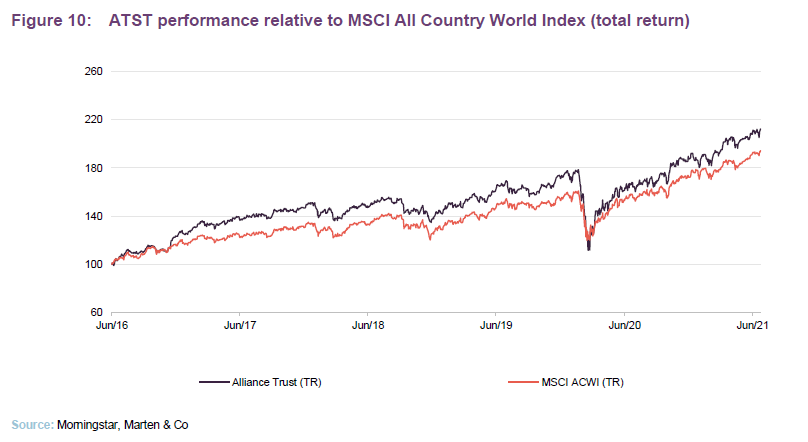

More than four years after it refocused its global equity portfolio, Alliance Trust (ATST) has proven the merits of blending different expertise across different investment styles. Since the overhaul in April 2017, it has matched its peers and beaten its benchmark. In particular, over the past 14 months, which have been clouded by the uncertainty created by the coronavirus pandemic, its strategy has outperformed.

The manager, Willis Towers Watson, reiterates the importance of diversification to the trust, and this is what has helped the trust turn around losses made when the virus seriously hit markets in March 2020, and continue to thrive when investors’ attention turned to value stocks last November.

Global stock-picking portfolio

Alliance Trust aims to be a core equity holding for investors that delivers a real return over the long term through a combination of capital growth and a rising dividend. It invests primarily in global equities across a range of industries and sectors via a ‘manager of managers’ approach. This is intended to reduce the risk often taken by investors selecting a single, star manager or one particular style that can move in and out of favour.

Market outlook

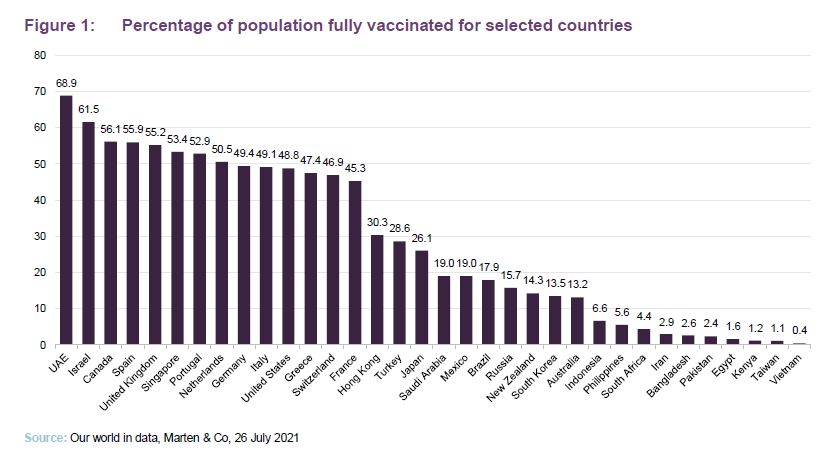

As was the case when we wrote our initiation note for ATST in November 2020, COVID-19 remains the dominant factor affecting markets this year, though the outlook appears more positive as vaccination programmes are in full swing, economies are reopening, and industries are in recovery mode. Whilst new variants of the virus and the uneven distribution of vaccines globally means the crisis is far from over, most economies have demonstrated their ability to address these challenges to build a better future.

China continues to be among those countries that have handled the pandemic well, and its economy has almost completely returned to normal. However, the government has alienated some investors by clamping down on some of the country’s most-promising companies. Japan also came through 2020 relatively well compared to other developed markets, but a failure to vaccinate the population has allowed a second wave of cases to gain traction. Though the US and Europe were hit hard with significant numbers in both deaths and cases, lockdowns taking their toll on businesses and jobs, and substantial fiscal stimulus being needed to save their economies, these regions appear to be on the mend thanks to successful vaccination programmes and falling case numbers – particularly in the UK.

It is also yet to be seen how long this recovery phase will last along with the level of subsequent growth rates, not to mention whether new waves of the virus could hit. The new, highly-stimulative economic policy regime is not evenly spread across countries, which will likely lead to wide dispersion in market pricing and returns, but creates greater opportunities for global investors.

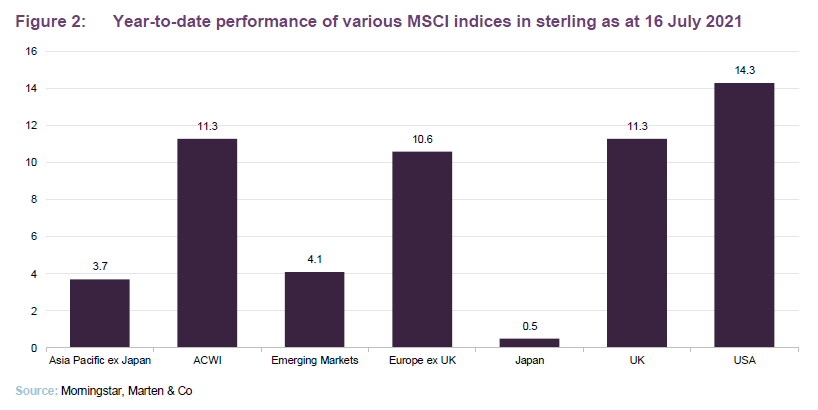

Year-to-date, the US remains the best-performing market, with the S&P 500 up 15.5% as technology and growth stocks continue to lead the way, despite a minor hurdle earlier this year on the back of inflation fears. The UK market is up 12.5%, as it seems Brexit woes are finally behind us, and with around 70% of adults (55% of the population) fully vaccinated. The Japanese market has been one of the weakest of all developed markets. China’s recent stock market weakness has weighed on global emerging market indices. Since the start of 2021, the Association of Investment Companies (AIC)’s Global sector (ATST’s peer group) has returned an average of 8.3%.

Manager’s view

Willis Towers Watson (WTW), manager of ATST, notes that rising inflation is partly being driven by sectors which are experiencing a mismatch between supply-side bottlenecks and rapidly accelerating demand as economies re-open. Sustained high inflation could prove disruptive, but the company’s central forecast is that any increase in inflation will be temporary and will fade over the next year. However, it is also possible that Covid-related risks and/or fading positive impacts from the fiscal stimulus could slow the recovery and create disinflationary risks.

Sustainability is also a key risk as well as an opportunity, particularly in relation to climate change. ATST has committed to managing the portfolio to achieve net zero greenhouse gas emissions by 2050 (see more detail later) and will be devising a road map to help achieve that goal as well as pushing harder for better data by which to measure progress.

Given the risks and range of potential outcomes, ATST believes it is best to take an approach that does not try and time markets in terms of macro risks, sectors, styles or regional exposures, but instead focuses on the highest conviction ideas of skilled stock pickers. In the first six months of 2021, as markets broadened out, the trust has seen solid returns and believes that this will continue as the economic recovery plays out.

Furthermore, the reopening of the economy and recovery in corporate earnings have led to some companies resuming dividend payments, which augurs well for a rebound in income for ATST’s portfolio.

Thoughts from the chair – crisis is far from over

Meanwhile ATST’s chairman, Gregor Stewart, recently shared some thoughts on the pandemic’s developments.

Although great progress has been made in some countries, vaccination distribution across the globe has been uneven, and new variants of the virus mean the COVID-19 crisis is far from over. The board of ATST feels that extremely low interest rates and massive fiscal stimulus by governments are helping to generate an economic recovery, but they could also lead to a sustained rise in inflation.

It’s equally possible that the recovery could falter and inflationary pressures abate if measures to control the virus lead to new restrictions on economic activity. Given the risks and wide range of potential outcomes, the trust’s managers believe the best results will be achieved by focusing on stock picking rather than trying to time markets and macro factors. Meanwhile, if the recovery continues to broaden out, there will likely be further attractive opportunities for ATST’s individual stock pickers.

The outlook for 2021 and beyond creates many opportunities for investors to uncover companies that they think are best-placed to benefit from the current market conditions. There are many challenges facing the market, but there are also great companies that are not only able to navigate the current climate but also capitalise on it.

Manager allocation

The lead manager working on ATST’s portfolio is WTW’s global CIO, Craig Baker. He chairs an investment committee comprised of Stuart Gray and Mark Davis, who are co-portfolio managers. Maria Musiela is senior client lead. Between the four, they have over 85 years of investment experience. They are backed up by a team of 108 global research associates, 250 operations and support associates and 21 portfolio management team associates (as at end 2020).

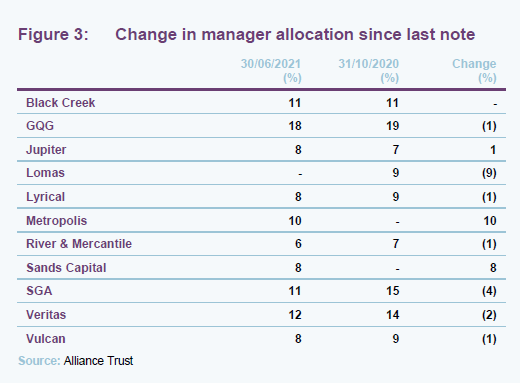

There are currently 10 underlying managers who make up 11 separate mandates (GQG manages an EM and a global portfolio). Lomas Capital Management joined the cohort in October 2020, as highlighted in our initiation note, but were removed in February as the New York-based company decided to wind down after two of its senior portfolio managers, who were also partners, announced their intention to retire. Metropolis and Sands Capital were added as new managers earlier this year. We discuss their investment styles in more detail later.

Metropolis – value focused style

London-based Metropolis Capital has a value-focused investment style, that draws upon the approaches and methodologies of Warren Buffett. It searches for businesses with strong franchises in their particular markets but which have fallen out of favour with the market because of perceived short-term problems or market risk. Metropolis looks at each investment on a long-term basis with no specific time horizon for achieving a return, although average holding periods are 5+ years.

The stock pickers look to invest a meaningful proportion of the portfolio in a few very good opportunities where such gaps are significant, typically at least 30% below their view of the company’s intrinsic value. It then waits for the market to reappraise the value of the company.

Metropolis is long-term-focused and considers each investment as if buying the whole business which involves a deep, private equity style of due diligence on the business, management quality and risks. The firm seeks out companies with strong cash flows and balance sheets that are easy to understand and have enduring moats as well management teams that have a significant stake in the business.

Sands – pure growth philosophy

Based in Arlington, Virginia in the US, Sands Capital follows a pure growth-orientated philosophy which is rooted in the belief that over the long term, a company’s share price appreciation follows the earnings power and the growth of the underlying business. The firm focuses on finding high-quality, wealth-creating growth businesses using a fundamental, bottom-up research approach, with the view that these businesses will have higher long-term growth than the market.

The fundamental characteristics of companies are assessed using six key criteria which have to be satisfied throughout the investment horizon (generally three to five years or longer). These are:

• sustainable above-average earnings growth;

• leadership position in a promising business space;

• significant competitive advantage/unique business franchise;

• clear mission and value-added focus;

• financial strength; and

• rational valuation relative to the market and business prospects.

Sands focuses on the sustainability of a business’s future earnings growth, and belief in which companies are benefiting from structural change and secular trends – distinct from cyclical economic factors – that provide select industries and businesses with powerful growth tailwinds

Asset Allocation

ATST’s asset allocation is driven largely by the stock selection decisions taken by the underlying managers. However, WTW can adjust the portfolio’s exposures by reallocating money between the managers, if it feels that this is warranted.

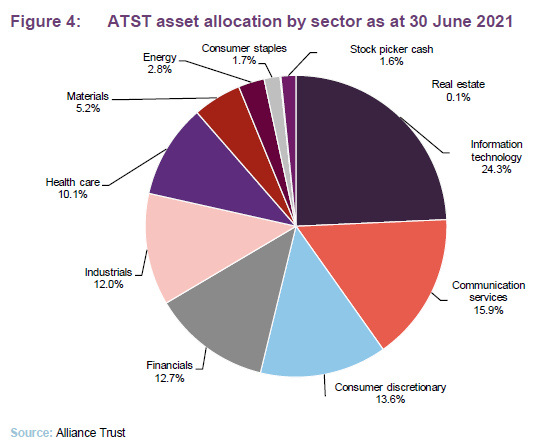

As was the case when we published our last note in November 2020, ATST continues to have low exposure to sectors that were hit hardest by COVID-19, such as energy and real estate. It has increased its allocation towards financials slightly as the sector has bounced back since the start of 2021. The company remains overweight towards areas that have generally flourished during the pandemic, such as informational technology, communication services and consumer discretionary.

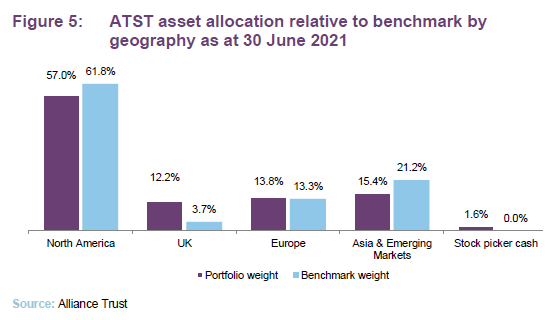

ATST’s geographical allocation has changed marginally since our initiation note, which showed the figures as at 31 October 2020. Exposure towards North America and the UK has increased by 0.4 percentage points while exposure towards Europe and Asia & Emerging Markets has fallen by 0.7 and 1.6 percentage points respectively. The biggest change can be seen in ATST’s allocation towards the UK which has increased by 3.2 percentage points in the last 8 months. Meanwhile, the amount of cash held by the stock pickers has fallen from 2.9% to 1.6%.

Top 10 holdings

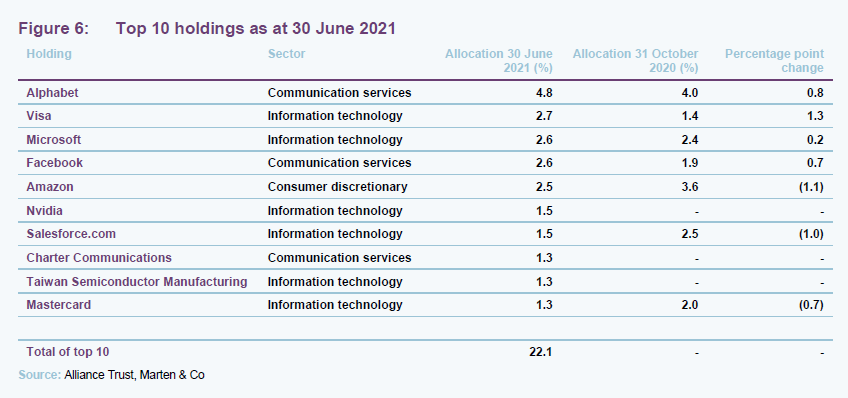

Figure 6 shows ATST’s top 10 holdings as at 30 June 2021 and how this has changed since 31 October 2020 (as published in our November 2020 initiation note). New entrants to the top 10 since then are Nvidia, Charter Communications and Taiwan Semiconductor Manufacturing. Names that have moved out of the top 10 since then are Alibaba, Tencent and Baidu, all of which are Chinese stocks. Alibaba and Baidu are still the 15th and 12th largest holdings in the trust respectively. Tencent’s share price has dropped sharply since ATST reduced its position, as the Chinese government clamps down on its music streaming business and new user registrations for its WeChat service have been suspended. We discuss some of the more interesting changes in the following pages.

WTW says the portfolio faced a headwind when the pandemic first hit on a global scale in March 2020, by not being overly exposed to US large-cap technology, such as the FANGs stocks. Exposure was increased slightly when we published our initiation note in November 2020, and this is the case even more so today.

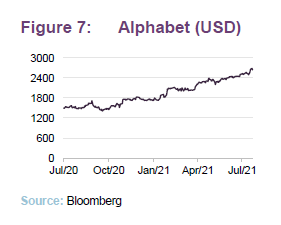

Alphabet

Alphabet (www.abc.xyz) is an American multinational conglomerate, which was formed through the restructuring of household name Google, of which it subsequently became the parent company, alongside several other former Google subsidiaries. It is a long-term holding of ATST’s, the largest holding, and the greatest contributor to absolute returns. Over the six months to 30 June 2021, it returned 41.6% and – according to WTW – better-than-expected earnings for the first quarter of 2021, with solid revenue growth on the back of impressive results for its search business.

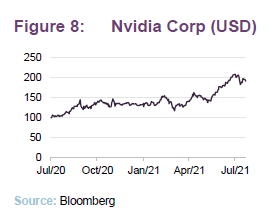

Nvidia

Nvidia (www.nvidia.com) joined ATST’s top 10 in March 2021, but has been a holding for much longer. The American company designs graphics processing units for the gaming and professional markets, as well as ‘system on a chip’ units for the mobile computing and automotive market. Over June 2021, it was ATST’s most significant single contributor to returns, having delivered an absolute return of 26%. During the month, it received key stakeholder support for its proposed acquisition of Arm Holdings, which, if successful should accelerate Nvidia’s expansion in Artificial Intelligence computing and open up new markets for the firm.

Other notable portfolio developments

In June 2021, ATST established a new position in Restaurant Group – a British chain of restaurants and public houses – which following significant business restructuring is, in the stock picker’s view, well-placed to outperform analyst consensus expectations as the UK eases restrictions on the hospitality sector. Meanwhile, the company’s position in Prada was sold following a period of strong performance which took its valuation to the top of its historic range and in excess of the stock picker’s assessment of intrinsic value.

Net zero emissions by 2050

This year, ATST set itself a target to transition the portfolio to net zero greenhouse gas emissions by 2050, reinforcing its commitment to investing responsibly.

WTW says climate change is one of the defining issues of our times and is at the forefront of developing and implementing the highest standards of environmental best practice in the investment industry.

The manager has more than 70 experts focusing exclusively on the risks of climate change and is a signatory to the Net Zero Asset Managers Initiative (as well as the Principles for Responsible Investment and the UK Stewardship Code). ATST will closely monitor and report to investors on progress, as well as continuing to update them on a quarterly basis on the voting and engagement activities of its stock pickers across the broad range of ESG aspects of the portfolio.

Exclusion approach

There are, however, some areas where ATST believes that engagement is likely to be less effective, and therefore exclusion is warranted. The board recently approved the exclusion from the portfolio of companies with significant exposure to thermal coal and tar sands. The board said this will not impact the portfolio composition in a significant way, nor is it going to lead to a meaningful reduction of the stock pickers’ opportunity set.

Committing to net zero does not mean the portfolio will not be invested in any companies which currently have high carbon emissions, as stock pickers will also consider a company’s plans with regards to ESG best practice and how it is exposed to, and manages, ESG risks and opportunities, including climate-related ones. ATST managers will also actively engage with businesses it invests in, to try and effect change at a key stakeholder level. The company says that by doing this, it can create a positive change for society at the same time as benefitting from a return and risk perspective. The value-add of engagement, as well as thorough analysis of a company’s fundamental strengths, future prospects and ESG risk and opportunity positioning, means that holding less conventionally ‘green’ stocks can also play an essential role in being a strong advocate for net zero emissions.

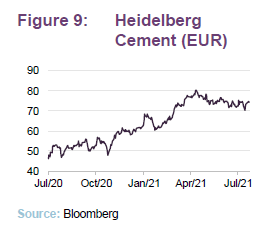

ESG case study: HeidelbergCement

A prime example of a stock held by the company that has high current emissions is HeidelbergCement (www.heidelbergcement.com/en), which is the highest contributor to carbon emissions in its portfolio.

HeidelbergCement is a global leader in aggregates, cement and ready-mixed concrete production. The main component in cement is clinker, a by-product of sintering limestone, and its production is carbon-emissions intensive. Unsurprisingly, the carbon problem is one felt across the entire cement/concrete industry, with cement production accounting for 8% of the world’s carbon emissions. However, cement is also the most widely-used construction material globally and its use will likely increase due to growing urbanisation and increased infrastructure spending globally. As a result, engaging with companies such as HeidelbergCement is important for ATST to ensure these pillar industries are taking steps to transition to low-carbon resilience.

To date, HeidelbergCement has made progress and has been increasingly focused on growing its share of the market’s sustainable low-carbon products. It is designing factories that operate with alternative raw materials and fuels. Currently, HeidelbergCement allocates about 80% of its research and development spend on reducing energy consumption in its manufacturing process. In June 2021, it announced plans to build the world’s first carbon-neutral cement plant in Sweden which is expected to start operations in 2030.

Black Creek, along with EOS at Federated Hermes, has actively worked with HeidelbergCement on many ESG-related topics. ATST says that steering companies towards better practices exemplifies the benefits of engaging rather than excluding all carbon-heavy industries.

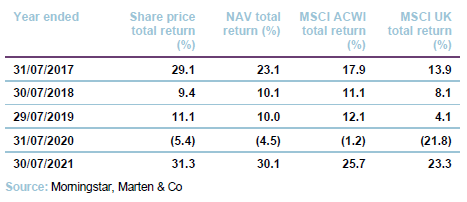

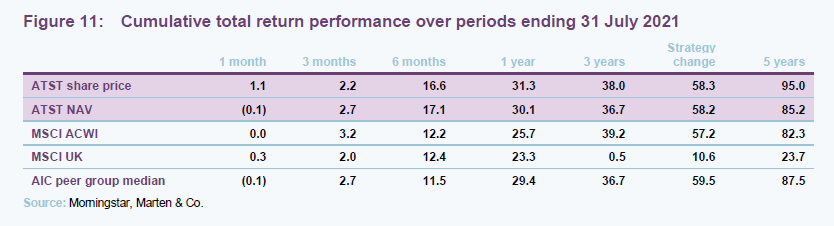

Performance

Performance has picked up for ATST over the past 12 months, and especially so since the start of 2021. This is largely down to having fallen so much in March 2020 when COVID-19 hit global equity markets. However, over the past six months to one year, the company is outperforming both its global peer group median and the MSCI ACWI index.

Since WTW took over the strategy in April 2017, it has performed in line with its index, however the manager notes that the portfolio was negatively impacted by the drag from non-core assets which have now all been sold. The last of the legacy assets sold was Alliance Trust Savings in June 2019, and so ATST says the NAV return since this date is the true reflection of WTW’s investment performance.

It also worth noting that ATST’s peer group (Morningstar global sector) performance has been impacted in recent years by the particularly strong performance of Scottish Mortgage (SMT), which has a notably different investment approach to ATST.

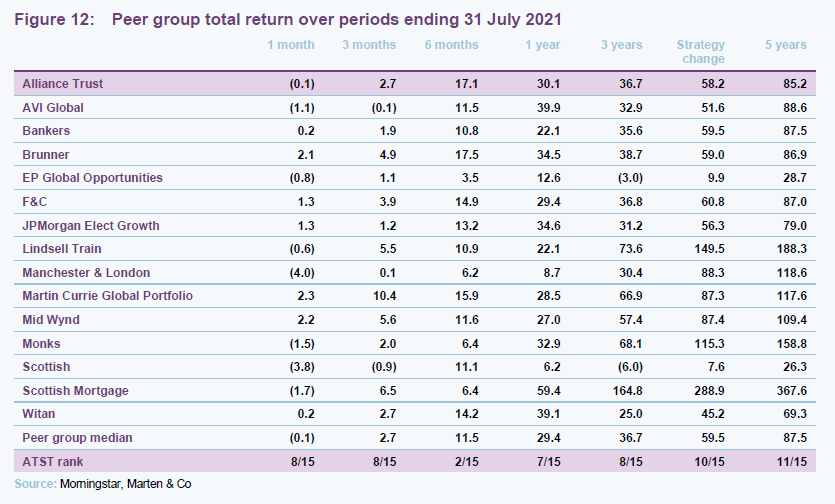

Peer group

Figure 12 shows how ATST’s total return compares with its peers over different periods. As mentioned earlier, it has been one of the global sector’s winners since the start of 2021 and ranks in second place, behind only Brunner (BUT). With its low concentration and manager of manager’s approach, ATST considers Bankers, F&C and Witan its closest competitors. Since the company’s strategy change in April 2017, performance is broadly in line with Bankers and F&C, but it has significantly outperformed Witan.

Attribution

Over the six months to 30 June 2021, seven out of the 10 stock pickers for ATST outperformed the index. Lyrical was the best-performing manager and is up by around 40% over the past year. This is particularly interesting, as it has historically been one of the trust’s laggards.

WTW says that even six months ago, Lyrical was probably ATST’s worst-performing manager, but is now one of the best. It is a fundamental value investor, looking to buy businesses at a discount to their true value. However, WTW does not feel that the reason for the turnaround is a simple case of the market becoming more in favour of value stocks over growth stocks. Vulcan, which is another value stock picker, for example, has been performing strongly since appointment and has outperformed in both value and growth environments.

Stock pickers with more of a growth or quality focus, such as GQG, have struggled more in recent months, though over the long term they have still outperformed. Meanwhile, SGA – which does indeed look for companies with strong growth characteristics – hasn’t pulled back as much, due to its more style neutral approach. WTW says that overall, it isn’t about style but rather stock selection, and that the changes we have seen in market trends, reinforce the importance of ensuring diversification in the portfolio. This ensures that regardless of market swings, outperformance can still be realised through superior stock selection.

As mentioned earlier, WTW says the portfolio faced a headwind when the pandemic first hit, by not being overly exposed to US large-cap technology such as the FANGs stocks. At a time when this sector seemed to be the only one making any gains (as nationwide lockdowns were imposed and working from home hit record levels), ATST kept up with the benchmark but did not outperform. It was around November 2020, when vaccination programmes kicked off globally, that the trust started racking up outperformance and turning around its earlier losses.

Stock selection was the key driver of returns for ATST over the six months to 30 June 2021, with key contributors including Alphabet, as discussed on page 9. The manager says in relative terms, not holding Apple was a boost to returns given the stock rose by only 2.4% in the six months to 30 June 2021, underperforming the benchmark by 8.8%.

Santen Pharmaceutical, a Japanese-based global pharmaceutical company, was one of the biggest detractors to both absolute and relative performance, with the stock down 15.3% since the start of the year. The company announced on 9 April 2021 that it would book an impairment loss related to its glaucoma treatment device, Preserflo, due to the US approval process taking longer than anticipated.

Dividend

ATST pays quarterly dividends in June, September, December, and March, and has just announced its second interim dividend for 2021 of 3.702p, an increase of 3% on the payment for the same time last year.

Each year, shareholders are asked to approve the trust’s dividend policy. In accordance with this, subject to market conditions and the company’s performance, financial position and outlook, the board will seek to pay a dividend that increases year on year.

Last year, the board introduced a dividend reinvestment plan (administered by the Registrar), designed to enable shareholders to increase their holding in the trust in a cost-effective way. More recently, the board announced plans to review the way in which the trust’s dividend is funded to make it more sustainable and attractive to investors. It hopes to report back to shareholders by the end of October 2021.

ATST already boasts a track record of 54 consecutive years of increasing dividends, and at the end of June 2021, had revenue reserves of £98,106,000. It also has substantial distributable capital reserves, which has grown further since the company received shareholder approval at its April 2021 AGM to convert its £645.3m merger reserve into a distributable reserve. The conversion was completed on 9 July 2021.

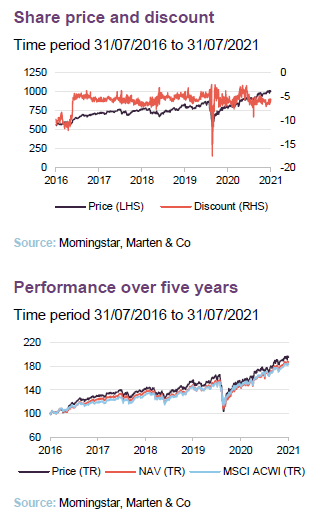

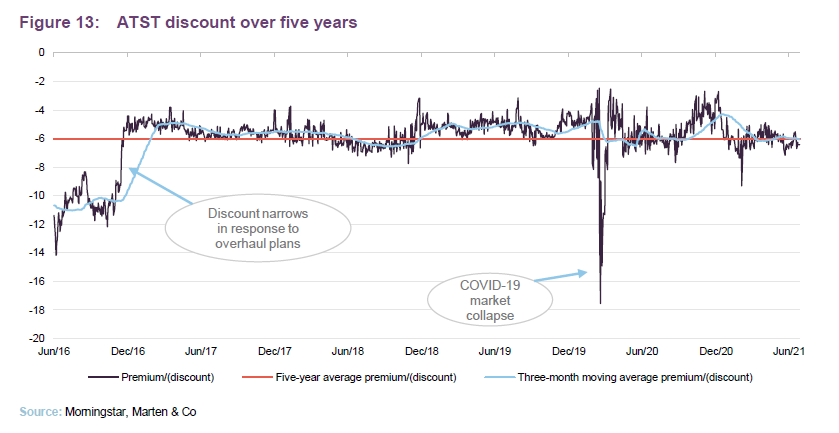

Premium/(discount)

Over the year ended 30 June 2021, ATST’s shares have traded consistently on a discount, ranging from 17.6% to 2.5%, with an average discount of 6%.

As at 3 August, ATST’s shares were trading at a discount of 5.6%.

Like many other funds, ATST’s discount was impacted by the onset of the pandemic around March 2020. Since then, its discount has remained at a single digit, and even narrowed to almost 2% late last year.

Fund profile

Alliance Trust aims to be a core equity holding for investors that delivers a real return over the long term, through a combination of capital growth and a rising dividend. The company invests primarily in global equities across a wide range of industries and sectors. The investment manager, Willis Towers Watson (WTW), has appointed a number of stock pickers with different styles, who each ignore the benchmark and only buy a small number of (around 20) stocks in which they have strong conviction. For performance measurement purposes, the trust is benchmarked against the MSCI All Countries World Index in sterling terms (MSCI ACWI). The board also monitors ATST’s returns relative to similar investment companies.

ATST has a long history dating back to 1888. It is an AIC Dividend Hero, having increased its dividend in each of its last 53 financial years. The trust merged with its sister trust, Second Alliance Trust in 2006.

‘Manager of managers’

The ‘manager of managers’ investment approach, described in more detail in our initiation note, was announced in late 2016 and adopted with effect from 1 April 2017. Alliance Trust Investments (the trust’s internal management company, which also ran 11 funds and had AUM ex-ATST of £2.5bn) was then sold to Liontrust. WTW was appointed as the new external investment manager and, initially, eight new sub-managers were allocated portfolios.

In adopting this style of investing, the board sought to avoid being beholden to the success of a single manager and the popularity of a particular investment style. Instead, individual investors in ATST get to profit from the expertise of a range of managers, many of which they would not be able to access in any other way.

Previous publications

Readers interested in further information about ATST may wish to read our initiation note published in November 2020.

The legal bit

This marketing communication has been prepared for Alliance Trust Plc by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from

receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the

period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.