The tortoise triumphs

Within the AIC’s Japanese smaller company sector, the period since AVI Japan Opportunity Trust (AJOT) was launched in October 2018 has resembled the fable of the tortoise and the hare. The majority of competing funds are invested in high growth stocks whose valuation multiples had been soaring. However, these have tumbled in recent weeks as investors fret about the prospect of interest rate rises. Meanwhile, AJOT has been steadily chalking up successes in unlocking value from a range of Japanese companies. It is now the best-performing Japanese smaller company trust over the period since it was launched. The manager points to the considerable latent value within AJOT’s portfolio; it is confident of further uplifts to come.

In its December 2021 quarterly newsletter, the manager said that it had identified six high-conviction opportunities – three new and three existing positions – that it wanted to back with new money. AJOT is actively seeking to raise additional capital under its current placing authority (see page 13) to capture this opportunity.

Unlocking value in Japanese smaller companies

AJOT aims to achieve capital growth in excess of the MSCI Japan Small Cap Index by investing in a focused portfolio of over-capitalised small-cap Japanese equities. Asset Value Investors leverages its three decades of experience investing in asset-backed companies to engage with company management and help to unlock value in this under-researched area of the market.

Good progress within AJOT’s portfolio

The companies in AJOT’s portfolio have a large portion of their market capitalisation in cash, listed securities or other realisable assets. The manager seeks to engage proactively with these companies to unlock their value potential. Readers might want to refer to our initiation note which describes the investment approach in some detail.

As we explore in more detail from page 10 onwards, AJOT has been delivering some of the best returns in its peer group recently and tops the Japanese small cap league table over the period since it was launched. It has been helped in this by good progress within a number of positions, where it has been actively working to unlock value.

It can take some time to achieve progress on corporate governance issues. It is important, therefore, that the underlying businesses to which AJOT is exposed are robust. The manager (AVI) is encouraged by decent earnings and sales growth within many of the stocks in AJOT’s portfolio. It stresses that its focus on value opportunities does not mean that it is investing in poor quality companies.

Daibiru

AJOT recently scored another success as real estate business Daibiru (daibiru.co.jp/english/ir/) was bid for (via a tender offer for shares) by its parent company at JPY2200 per share, a 50% premium to the share price ahead of this announcement. AVI feels that the tender price undervalues the company, however.

AJOT first invested in the company in September 2020 when the share price was around JPY1200. AVI had not engaged in a public debate about strategy with Daibiru ahead of the announcement of the bid, but spent considerable time engaging with the company privately, sending letters and presentations which they threatened to make public in the absence of progress to address Daibiru’s undervaluation and corporate governance failings.

Daibiru is a subsidiary of Mitsui OSK Lines (MOL). The parent company had appointed three of the four directors to Daibiru’s board and had also appointed an auditor (not a corporate auditor, but an auditor who sits on the board in what is a quasi-director function). AVI notes that the MOL directors had no prior experience of the real estate industry. The directors and auditors had, however, served in similar capacities at MOL. This is a practice known as ‘Amakudari’ – re-employing retiring senior management in subsidiaries owned by the parent company, or re-employing bureaucrats in non-governmental organisations that fall under the jurisdiction of the ministry that they retired from. It clearly creates a conflict of interest and, in this case, AVI suggests that the board were perhaps too eager to accept the JPY2200 offer and should have held out for more.

The tender price represents a near 30% discount to Daibiru’s net asset value – MOL is clearly getting a bargain. AVI has called for the offer price to be lifted to around JPY3000. The meeting to approve the offer is scheduled for 14 February, and the outcome of that will probably be known just after we finalise this note. It seems unlikely that MOL will raise its offer, but AVI has garnered good publicity from its campaign on behalf of minority shareholders, which may help in other cases.

New investment opportunities

As we highlighted on the front page, AVI has identified six potential investments where it has high conviction of capitalising on an attractive discount opportunity and unlocking value. Altogether, these six investments could account for up to 35% of AJOT’s NAV. A fundraise is ongoing and, as we discuss on page 13, the trust is issuing shares as and when to meet demand. The resilience of AJOT’s premium rating in a time of market uncertainty (no doubt underpinned by the trust’s sector-leading performance) gives some encouragement that the trust’s ambitions can be realised. Failing that, there is also the possibility of increasing the level of borrowing on the portfolio and/or reducing some existing positions to fund these opportunities.

AJOT has named three of the six potential investments as Shin-Etsu Polymer, Fujitec and Locondo. The other three are a parent/listed subsidiary opportunity with an estimated 70% upside potential from end December 2021 valuation; a “stable highly cash-generative business” with a £45m market cap (at end December 2021) with greater than 90% potential upside; and potentially an 18% stake in a £52m (December 2021) market cap company being sold by a distressed seller.

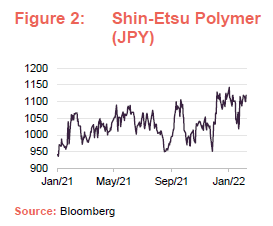

Shin-Etsu Polymer

Shin-Etsu Polymer (shinpoly.co.jp/en/ir) is a listed subsidiary of Shin-Etsu Chemical. The parent owns a 54% stake in the subsidiary. Shin-Etsu Polymer evolved from a manufacturer of PVC products to a global moulded plastic product company, with particular exposure to the automotive, electronic device, semiconductor and the construction industries. At the end of December 2021, it was trading at 4.7x EV/EBIT, net cash accounted for 53% of its market cap and it had been growing its EBIT at an estimated 13% compound annual growth rate. AVI sees 69% potential upside from its end-December share price.

The business is making a strong recovery from the effects of COVID-19 on trading, and seeing continued growth in its product for carrying semiconductor wafers. Over the nine months to the end of December 2021, revenue was up 23.5% year-on-year and operating profit was 60% higher.

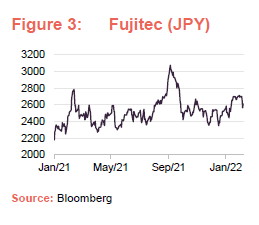

Fujitec

Global lift and escalator business Fujitec (fujitec.com/ir) was discussed in our initiation note (see page 13 of that note). AVI was pleased to secure a strategic review of the company, following which Fujitec committed to abandoning its poison pill arrangements. AVI is convinced of the potential for consolidation within Fujitec’s industry, but Fujitec’s management is also conscious of the need to increase the profitability of the business and the efficiency of its balance sheet.

AVI highlights that Fujitec was trading on about a 50% discount to listed peers at the end of December 2021, despite ambitions to grow its profits more than twice as fast as peers over the next three years.

AVI would like to take AJOT’s stake in Fujitec up to 5% of the company ahead of Fujitec’s 2022 annual general meeting (AGM) as a means of increasing its bargaining power.

In December 2021, the company announced its ‘Vision 24’ management plan, which promised a focus on improving profitability – targeting JPY22bn of operating income by its 2024 financial year (FY24), 58% above the forecast for FY21 – and a return on equity of 10% or more, while maintaining a 50% dividend pay-out ratio. The company will focus on new installations in growth markets while building on its aftermarket (repairs and maintenance) business in more mature markets.

In January 2022, Fujitec announced an overhaul of its corporate governance guidelines with commitments around issues of sustainability, diversity and assessing the effectiveness of the board.

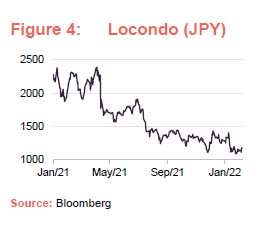

Locondo

Japanese online footwear and fashion marketplace Locondo (locondo.co.jp/ir) is a relatively new position in the AJOT portfolio but is now a top 10 holding – see page 8. It currently offers same-day access to around 4,000 products, free size exchange and free returns. The Japanese retail market is still rooted in physical stores and online retail has relatively low penetration. The pandemic helped push things in the right direction, but currently Locondo’s sales growth has stalled, and this has weighed on its share price, providing AJOT with an attractive entry price. It now has more than a 5% stake in the company, and funds managed by AVI own more than 8%. AVI says the stock trades on about 8x EV/EBITDA and net cash on the balance sheet accounts for over 20% of its market cap.

Locondo plans to push ahead with the consolidation of its market. AVI feels that it can achieve benefits of scale as it adds more retailers and products, which in turn attracts more customers in a virtuous circle.

Backdrop

In our last note, we highlighted the slow start to vaccinations in Japan. Subsequently, the country got to grips with the problem and can now boast the highest vaccination rates of any G7 country. Prime Minister Yoshihide Suga was ousted in October 2021 and replaced by Fumio Kishida. This is not expected to have much impact on government policy, however. Both have long been prominent members of the Liberal Democratic Party, which has been in power for much of the past 68 years.

Inflation is creeping back into the Japanese economy but in a far more modest way than we have seen in the US and UK (a rate of 0.5% in December 2021). The prospect of higher rates in the US to choke off inflation there has led to a relative weakening of the Japanese Yen. This is good news for exporters but feeds into rising energy costs.

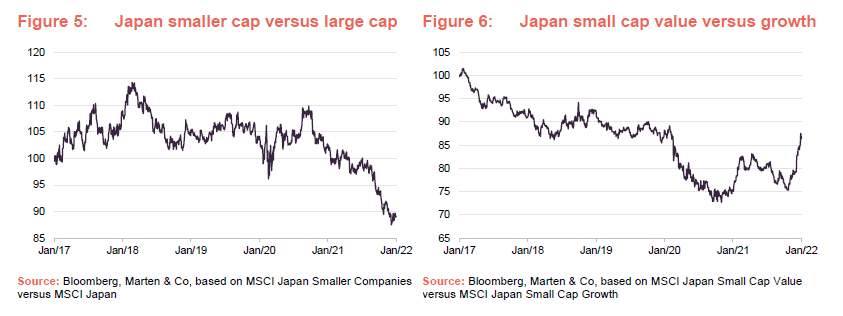

As Figure 5 shows, Japanese smaller companies have been underperforming larger stocks since October 2020 and, until recently, value-style investments in Japanese smaller companies were underperforming growth-style investments as is evident in Figure 6. It should be noted that AJOT’s bias to good quality companies means that it has performed much better than the MSCI Japan Small Cap Value index (23 percentage points ahead over the period from launch to end December 2021).

Asset allocation

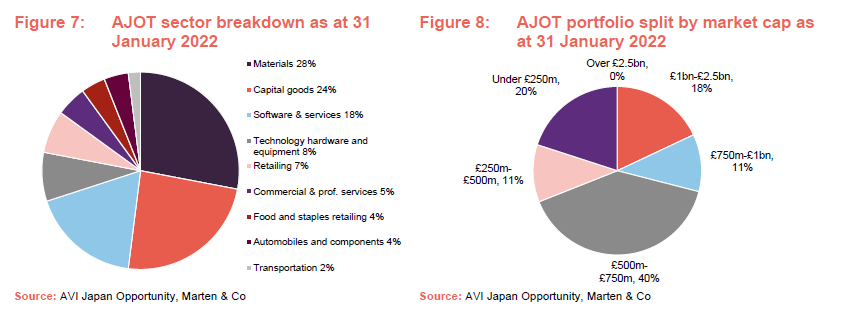

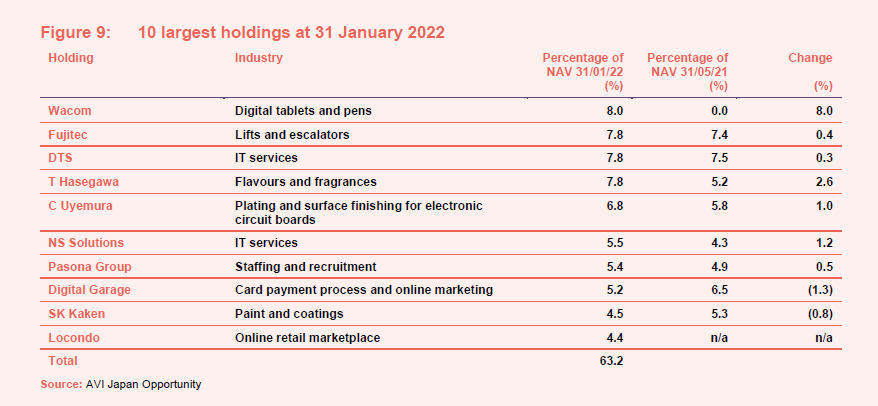

At 31 January 2022, AJOT had 26 holdings. The portfolio has become a little more concentrated since end May 2021 (the data we used when we last published on AJOT), with three less holdings overall and a higher percentage of the portfolio accounted for by the top 10. This is part of a deliberate strategy by the manager to exert greater influence over the companies in its portfolio.

The sector breakdown is a function of the manager’s stock selection decisions and changes since our last note was published reflect that (mainly increases in exposure to real estate and retailing at the expense of exposure to capital goods and commercial & professional services).

Likewise, the shift towards smaller, small companies is also a consequence of stock selection. However, as AJOT focuses on smaller companies, it is able to take larger, more influential stakes in these businesses.

As a measure of the undervaluation of the stocks within AJOT’s portfolio, at the end of December 2021, on average 40% of the market cap of stocks held within AJOT’s portfolio was represented by cash on the companies’ balance sheets. Adding in holdings in investment securities and other financial assets, the ratio of net financial value to market capitalisation was around 76% (this is very high by developed market standards).

On average, AJOT’s portfolio vas valued on 5.1x EV/EBIT at end December (compared to 17.2x for MSCI Japan Small Cap), and its free cash flow as a percentage of enterprise value was 21.2% (more than double that of MSCI Japan Small Cap). The dividend yield on the portfolio at that date was 1.8%.

10 largest holdings

Many of these companies were discussed in our previous note.

Since we last published on AJOT using data as at the end of May 2021, Secom Joshinetsu and Kato Sangyo have dropped out of the list of the 10-largest holdings to be replaced by Wacom and Locondo. Secom left the portfolio following the bid from its parent, which was discussed in our last note.

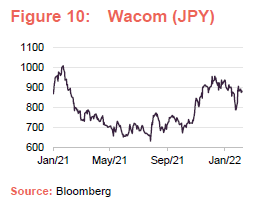

Wacom

Wacom (wacom.com/en-jp) is a large position new to the portfolio since we last published. The company is a leading manufacturer of digital tablets and pens, and is a substantial supplier to Samsung. Its products are used for a range of purposes from educational to industrial applications. The business was a beneficiary of the surge in demand for IT hardware and services that accompanied 2020’s COVID-related lockdowns. Sales and profits have held up fairly well in 2021 even as lockdowns were eased, but the company is forecasting a small (around 5%) drop in sales and profits for its financial year ended March 2022.

Investment in research and development is a priority to maintain its market position. The manager says that Wacom has developed a pen that can be used in a 3D virtual reality environment, for example.

The company instituted a share buy back in May and has since repurchased around JPY3bn worth from a target of JPY10bn by May 2025. The full-year dividend is currently forecast to be JPY15, which at 24.6% is a lower pay-out ratio than the previous year, but the company says the dividend decision may be revised depending on prevailing conditions. It has also said that it will target a consolidated dividend pay-out ratio of 30% over the medium- to long-term. The company is also targeting a return on invested capital of 25%-30%.

The share price has come off a little since the end of the year. The manager says that it is trading on less than 10x EV/EBIT.

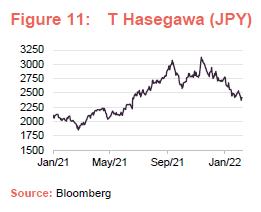

T Hasegawa

AVI highlights the big valuation discount at which flavours and fragrances business T Hasegawa (t-hasegawa.co.jp/en) is trading relative to global peers. It thinks that historically poor sales growth figures may be behind the problem and has called for a more entrepreneurial approach to the business from senior management. The company’s president agreed and recruited from outside the company to re-energise its sales efforts.

Helped by good progress in its US operations (building on an acquisition made in 2020) and higher profitability in China, T Hasegawa achieved a welcome 11% uplift in sales and 28% increase in operating profit for the year ended 30 September 2021. The company is pushing ahead with plans for a second factory in the US. COVID-19 has had an adverse impact on revenue, but this should unwind in time. It sees opportunities in areas such as plant-based meat.

T Hasegawa is now targeting a dividend pay-out ratio (the ratio between dividends and profits) of 35% and has begun to make disposals from its securities portfolio – with a view to improving capital efficiency. It says that at 30 September 2021, 18.2% of its net assets was attributable to its securities portfolio (down from 21.5% over its financial year). It is targeting 10% or less by FY26. However, there is little reason why it should not move faster and further on this.

AVI thinks that the company is starting to demonstrate its potential and a re-rating should follow.

Other portfolio changes

Since we last published, AJOT has completed the sale of its position in Softbank, crystalising a 31% profit on the investment, and the stock’s share price has fallen back since then. AJOT also reduced exposure to construction company Hazama Ando, having decided that the risk/reward opportunity did not merit its place in AJOT’s portfolio. AJOT also trimmed positions in Daiwa Industries and Sekisui Jushi, using the proceeds to help build the position in Wacom.

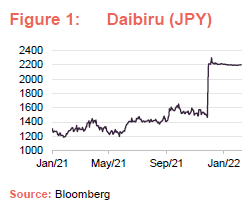

Performance

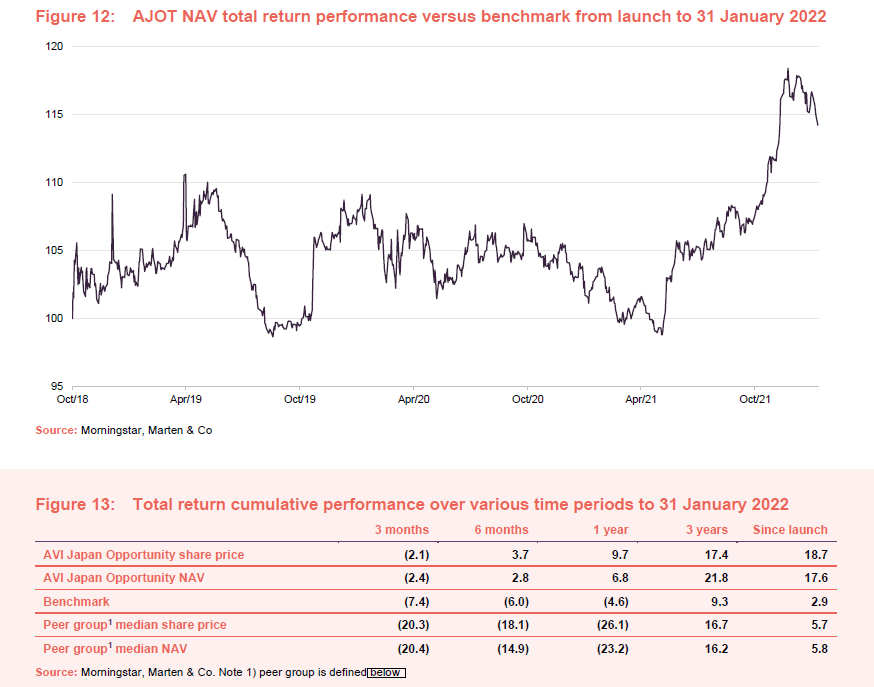

AJOT held its own against its performance benchmark over the first few years following launch, but since May 2021, its relative performance has accelerated. In particular, it has held up relatively well in the market sell-off of the last few weeks.

It has been pleasing to see the hard work that AJOT’s managers have been putting into unlocking the value within its portfolio start to pay off. Success with stocks such as Daibiru has driven NAV uplifts. Daibiru was the fifth buyout of a stock in AJOT’s portfolio since AJOT was launched, following on from Secom Joshinetsu, NuFlare, Toshiba Plant and Nittofc (see our initiation note for more detail).

In addition, AJOT has held up relatively well during the period of the sharp valuation correction in the Japanese smaller companies market that has been ongoing over the last couple of months.

Daibiru was the second-largest contributor to returns in the third quarter of 2021 (Q3) and the leading contributor in Q4 (as the bid materialised).

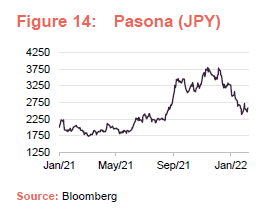

Pasona (pasonagroup.co.jp/english/ir/) was cited by the manager as the biggest contributor to AJOT’s returns over Q3 2021. It was helped by an increase in the share price of Benefit One, in which – as we described in our last note – Pasona owns a sizeable stake.

In its Q3 update, AJOT said that Pasona was still trading at a 77% discount to its underlying value. Since then, Pasona’s share price has retrenched by 19.5% while Benefit One’s share price has fallen by over 43% as market sentiment turned against growth stocks. In Benefit One’s nine-month figures, covering the period to end December 2021, revenue was flat (held back in part by the response to COVID-19) but net profit was up almost 40%. Pasona’s share price is still far from reflecting the full value of its Benefit One stake, although the discount has narrowed.

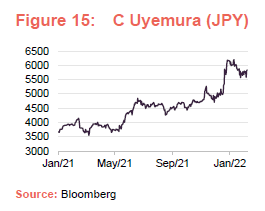

C Uyemura (uyemura.co.jp/en/ir/), which makes plating- and surface finishing-related chemicals for electronic circuit boards, was the second-largest contributor to AJOT’s returns in Q4 2021. The company has been reporting strong sales and profit growth – helped by the adoption of 5G and demand for semiconductors. AVI hopes to encourage the company to increase the efficiency of its balance sheet by redeploying its sizeable cash pile.

Detractors to AJOT’s NAV in Q4 included NS Solutions and Toagosei. At NS Solutions, AVI has been talking to both the company and its parent Nippon Steel about a higher dividend, share buybacks and incentivising management through stock-based compensation. The manager is taking advantage of the share price weakness to increase AJOT’s stake. Toagosei’s cash and securities account for almost 70% of its market cap.

Peer group

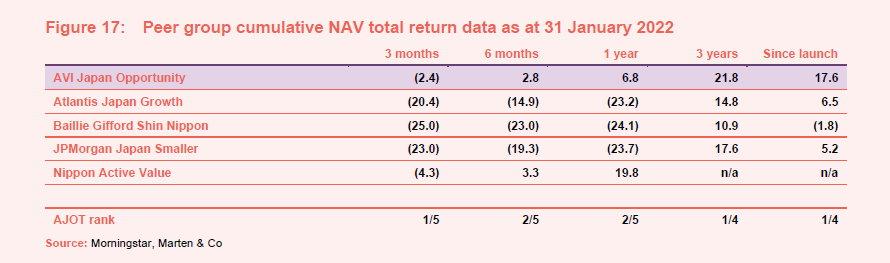

AJOT is a constituent of the AIC’s Japanese smaller company sector. Within this peer group, the closest comparator is Nippon Active Value, which has a similar investment approach to AJOT. The other three are more focused on growth stocks, and this accounts for much of the disparity in the performances of these funds.

Relative to Nippon Active Value, AJOT is about the same size and has a similar ongoing charges ratio, but trades on a higher rating. As we show on page 13, AJOT has been expanding in recent months. All else being equal, this should be helping to lower its ongoing charges ratio as its fixed expenses are spread over a wider base.

As Figure 17 shows, AJOT now leads the sector over most time periods and is the best-performing Japanese Smaller Companies Trust over the period since it was launched.

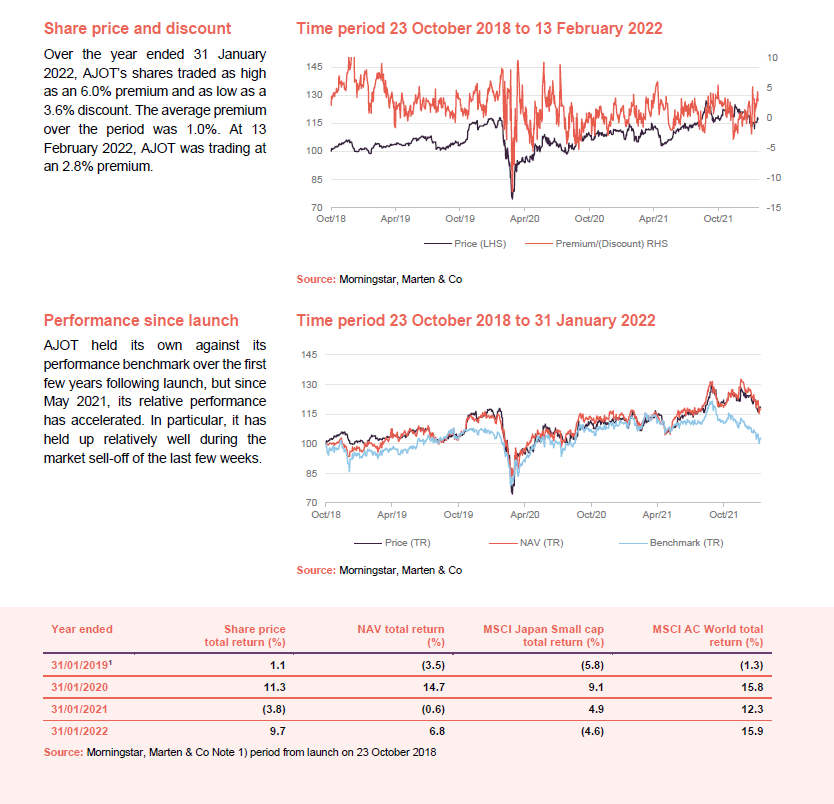

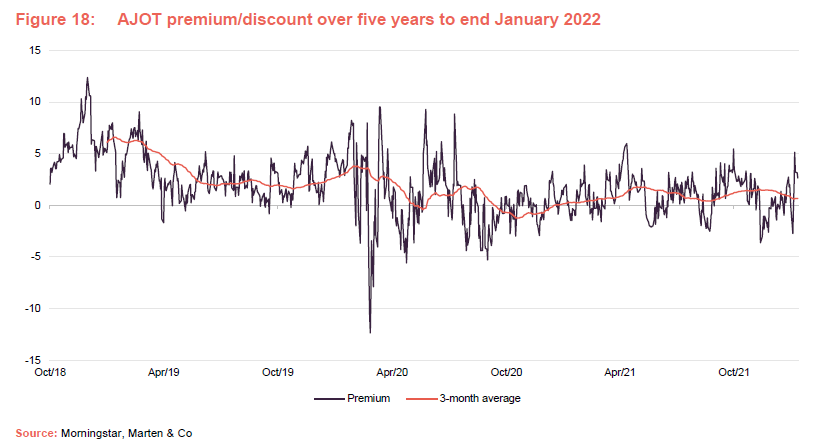

Premium/(discount)

Over the year ended 31 January 2022, AJOT’s shares traded as high as an 6.0% premium to net asset value and as low as a 3.6% discount. The average premium over the period was 1.0%. At 13 February 2022, AJOT was trading at an 2.8% premium.

The board recognises that it is in the interests of shareholders to maintain a mid-market price for the ordinary shares that is as close as possible to NAV. The board monitors the discount over rolling four-month periods and will buy back stock if the average discount exceeds 5%.

AJOT has an unlimited life, but the directors intend to offer shareholders an opportunity to exit the company at a price close to NAV in October 2022 and every two years thereafter. The exact mechanism for this will be determined around six months in advance following consultations with shareholders.

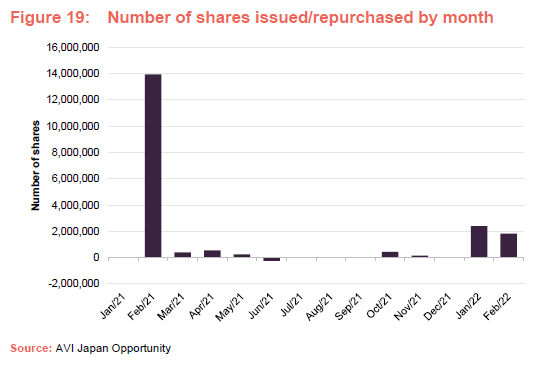

At the AGM held in April 2021, shareholders gave the directors authority to issue up to 26,286,000 ordinary shares (then, 20% of AJOT’s issued share capital) over the following 15 months (or up to the next AGM, whichever is the earlier). Shares are only issued (or reissued from treasury) at a price equal to NAV plus a premium at least sufficient to cover the costs associated with issuing the shares.

Figure 19 shows the pattern of recent share issuance (and in June 2021 share buybacks) up to 13 February 2022.

In February 2021, in response to demand, 12,107,323 new ordinary shares were placed with investors at 115.07p. The pace of share issuance has picked up again in recent months as AJOT seeks to fund potential investment opportunities.

The board was also granted permission to repurchase up to 14.99% of the ordinary shares in issue as at 15 March 2021. Shares repurchased may be held in treasury.

Fund profile

AJOT is an investor in Japanese companies. Its focus is on good-quality small and mid-cap listed companies that have a large portion of their market capitalisation in cash, listed securities or other realisable assets. AJOT’s manager seeks to engage proactively with these companies to unlock their value potential.

AJOT’s AIFM and investment manager is Asset Value Investors Limited (AVI). The lead manager working on AJOT’s portfolio is Joe Bauernfreund, one of a six-strong team focused on Japan, one of whom is based permanently in Japan, and the majority of whom are Japanese-speakers.

AVI was established in 1985 to manage what is now AVI Global Trust (AGT) and has assets under management of about £1.2bn. AVI began investing in Japan over two decades ago and AJOT was launched in October 2018 to focus on the opportunities presented by that market. At the end of December 2022, AVI and its employees owned 2.1m shares in AJOT.

AJOT compares its performance to the MSCI Japan Small Cap Total Return Index, expressed in Sterling terms. The index does not inform AJOT’s portfolio construction. AJOT will have a high active share relative to the performance benchmark.

Previous publications

QuotedData’s initiation note on AJOT – Progress on a number of fronts – was published on 20 July 2021 and can be accessed by clicking the link or via the QuotedData website.

AVI Japan Opportunity Trust – Progress on a number of fronts

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on AVI Japan Opportunity Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.