BlackRock Throgmorton – AGM update

Investment companies | Flash note | 20 March 2024

Has Throgmorton’s fuse been lit?

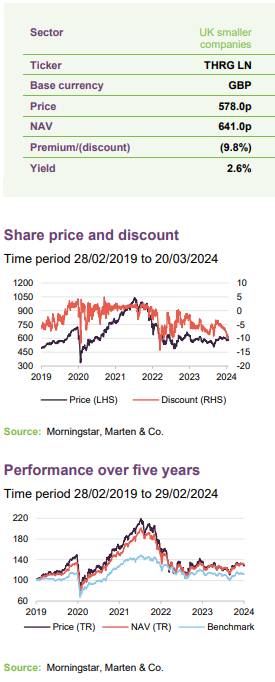

In yesterday’s BlackRock Throgmorton (THRG) annual general meeting, manager Dan Whitestone outlined what he sees as the significant potential for a surge in UK small and mid-cap valuations to outstrip those in the large cap sector when the macroeconomic backdrop in the UK improves.

Dan says that UK companies’ share prices have become increasingly detached from their earnings potential, through a combination of political uncertainty, sticky interest rates, strength in overseas markets (in particular in a handful of big AI-related US tech names), and consistent outflows from UK-focused funds has weighed on valuations.

Following this, Dan believes that the UK small and mid-cap sector is at one of its most attractive entry points in recent memory. We observe that Dan may not be alone in this view, with the UK market being subject to elevated levels of takeover activity.

Despite this backdrop, THRG has still been able to generate long-term out outperformance versus its peers and benchmark.

THRG’s board, have increased its share buyback activity but THRG’s discount remains at a historically wide level and so could potentially offer investors a way to capitalise on a near-term bounce in UK equities, if this occurs as Dan expects.

Could UK equities be ripe for a recovery?

Dan believes that the UK equity market trades at a wide disconnect from its earnings potential

UK equity markets have experienced a difficult period for relative performance , during which, in the view of Dan Whitestone, share prices have become increasingly detached from their earnings potential. Following this, Dan believes that UK markets are ripe for a sharp bounce and feels that could happen very quickly.

Dan’s investment approach favours what he believes are high-growth, high-quality companies. Nevertheless, he says that the earnings figures for his holdings have often surprised him on the upside over the last year and he has become increasing bullish regarding THRG’s prospects.

Falling inflation and a forthcoming election may be catalysts for a UK rebound

Dan has identified two potential near-term catalysts that he thinks could trigger a rebound in UK equities, with small caps being amongst the strongest beneficiaries in his view. The first is a return to target UK inflation, and the scope that should create for interest rate cuts, and the second is the forthcoming election.

Estimates from the Office for Budget Responsibility indicate that UK inflation will fall further to an average of 2.2% over 2024 and 1.5% in 2025, bringing it below the 2% target of the Bank of England. This, combined with sub 1% GDP growth expectations for the UK, may place pressure on the Bank of England to cut interest rates, potentially stimulating a recovery. It is worth nothing that, at 3.4%, the latest UK inflation figure came in below expectations.

Lower inflation, and by extension interest rate expectations, could be very positive for THRG, as it appeared to get caught up on the growth-stock selloff of late 2021 and 2022, which seemed to be a result of rising interest rate expectations.

While it could be argued that there is little uncertainty about the outcome of the general election in the UK, policy announcements from the Labour leadership suggest it may be following a fairly centrist and fiscally responsible approach. This suggests that, after an extended period where political infighting, numerous policy missteps and U-turns have provided some investors an excuse to avoid the UK, the election could give way to a period with reduced political risk.

UK businesses and consumers remain positive

Even without a catalyst for a reversal, Dan believes that much of the negative sentiment around the UK economy is overstated. He notes that UK business confidence has seen a rebound over 2023, with the Lloyds Bank Business barometer (a metric that tracks business confidence) having reported a net positive of 35%, comfortably above its 25-year average of 28% (a period which averages out much of the recent challenges).

He also comments that the UK consumer is showing signs of sustained strength, highlighting that the average UK household income increasing almost consistently over 2023, topping out at a 10% year-on-year on year increase (based on weekly sampling).

Dan also points to the upsurge of M&A activity over 2022 and 2023 as further evidence of the relative attractiveness of UK valuations, as larger companies and private equity have appear to have taken advantage of undervalued UK stocks. THRG’s recent performance has already benefitted from the takeover of some of its holdings, with Dechra Pharmaceuticals being one such example.

Meanwhile, UK companies are also net buyers of stock, with 13% of large UK companies buying back at least 5% of their shares over 2023, according to research by Schroders. This compares with 9% in the US, which has often been viewed as the major market for buyback activity. Not only have these activities been supportive of THRG’s NAV but they could also be indicative of the opportunity presented by UK companies.

The market has already started to move

THRG has generated both short and long-term outperformance thanks to Dan’s stock picking skill

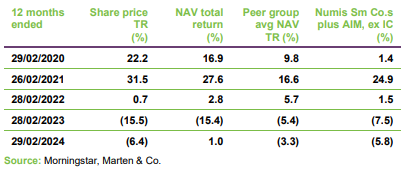

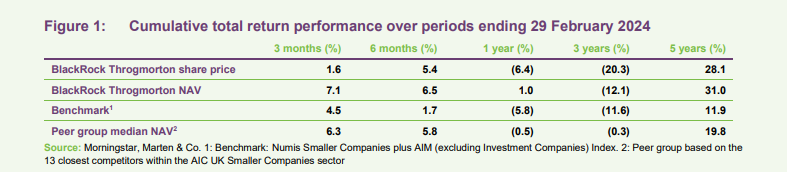

In retrospect, it looks as though the turning point for market may have been the growing realisation in October 2023 that interest rates had peaked. While it has not been a smooth ride since, a possible result of a few disappointing inflation figures, we have already begun to see a potential reversal of previous trends, with THRG generating sector and benchmark beating performance since then and over the last 12 months, as can be seen in Figure 1. We note that despite the drawdown during 2022, THRG’s long-term performance remains sufficiently positive to place it ahead of its benchmark and peers over longer time periods.

THRG’s recovery may align with Dan’s notion that its underperformance during 2022 was primarily the result of the rise in interest rates, rather than structural weaknesses in his companies.

While Dan believes that there are clear near-term tailwinds behind THRG, he has positioned the portfolio to benefit from long-term structural growth trends that he believes will continue to drive the trust’s performance. He believes that majority of THRG’s long-term outperformance should come from successful stock selection and not attempts to game the macroeconomic environment.

Anomalous discount?

THRG’s board has been buying back shares

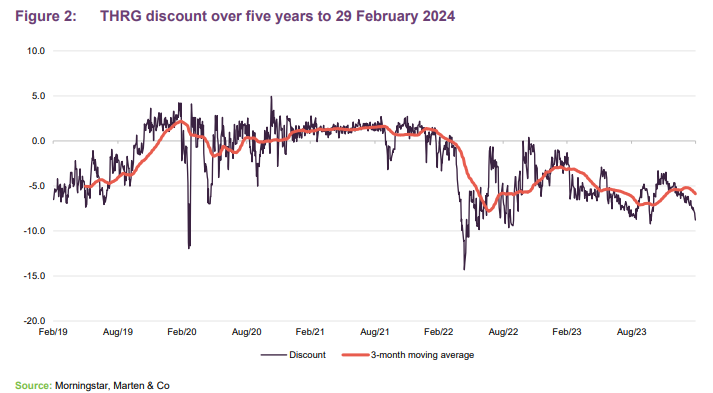

THRG’s board has increased its share buy-back activity since the start of 2023. Over the last 12 months THRG’s board has repurchased about 7% of the trust’s outstanding shares. Yet despite this effort, THRG’s discount does not appear to have not been immune to the general weakness seen in investment company discounts, with THRG trading on a 9.9% discount currently.

THRG’s discount has a 12-month z-score of -2.67 (a score below -2 implies that its discount is more than 2 standard deviations below its 12-month average, which is considered to be a wide level by statistical standards).

It could be argued that THRG’s wider than average discount, combined with the potential near-term opportunities in the UK small cap equity market and THRG’s trend of historic out-performance, might offer an opportunity for investors looking to capitalise on a possible bounce in the UK markets, if this occurs as Dan expects.

IMPORTANT INFORMATION

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on BlackRock Throgmorton Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication.

Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.