Look past the short-term noise

Look past the short-term noise

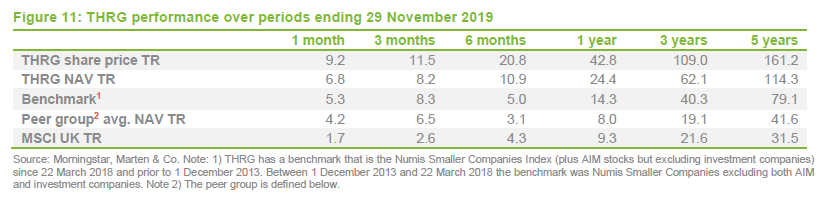

Helped by a positive contribution from its short positions, BlackRock Throgmorton (THRG) continues to turn out benchmark-beating returns and leads its peer group, the AIC’s UK Smaller companies sector, over the medium term. A share price return of 46.5% over the year to the end of November is the best among all AIC investment trusts.

This is all the more impressive when you consider the backdrop for these returns – a paralysis in politics, slowing global growth and a major trade war. Dan Whitestone, THRG’s manager, points out that there is always something to worry about, but by focusing on businesses that have control over their own destinies and shorting troubled companies, THRG can look past the noise and thrive regardless.

Both long and short positions in UK small-and-mid-cap companies

Both long and short positions in UK small-and-mid-cap companies

THRG aims to provide shareholders with capital growth and an attractive total return by investing primarily in UK smaller companies and mid‑capitalisation companies traded on the London Stock Exchange. It uses the Numis Smaller Companies Index (plus AIM stocks but excluding investment companies) as a benchmark for performance purposes, but the index has no bearing on the way that the manager constructs the portfolio. Uniquely among listed UK smaller companies trusts, THRG’s portfolio may include a meaningful allocation to short as well as long positions in stocks.

|

|

In an uncertain world, focus on stocks

In an uncertain world, focus on stocks

For years now, investors in the UK have had to contend with uncertainty around Brexit and a hung parliament, at least now we have clarity on the latter and, hopefully soon too on the former. Nevertheless, global economic growth appears to be slowing and, in response, central bankers have been cutting interest rates and reinstating quantitative easing programmes.

THRG’s manager, Dan Whitestone, would not claim to have any special insight into macroeconomics or politics, and he feels that it is futile to try to base investment decisions solely on such factors. He does think that the US/China trade dispute may have had more of a real-world impact on UK companies than Brexit has, to date. The new Government’s strong majority should help break the log jam on Brexit, but there will be much to-ing and fro-ing before the negotiations on the UK’s future trade relationships are complete.

Whilst some poor companies are using Brexit as an excuse to cover other failings, many individual companies are not much affected by all of this. Even some consumer-focused stocks seem to be trading relatively well. Howden Joinery released an upbeat trading statement early in November, for example.

Dan’s investment approach has been outlined in previous notes. By focusing on differentiated companies that are masters of their own destiny and disrupters creating change within their industries, THRG has been able to generate attractive returns, almost regardless of the political and economic backdrop.

In September and early October, the value style of investing (where stocks are targeted principally on the basis of how cheaply they are valued by the market) seemed to be more in favour. In addition, sterling rallied and this had an impact on companies with overseas earnings. In Dan’s opinion, the share prices of some poor-quality companies were unduly uplifted in this environment and he is not seeing this as a sign of a renaissance of the value style.

Dan says there many companies that are masquerading as “value” investments on the basis that they trade on a low price to adjusted earnings ratio. Closer inspection often reveals a large disconnect between their earnings and their cashflow. The manager adds that in many cases these companies are over-distributing, paying dividends that they cannot really afford, and the funding of the dividend has been at the expense of investment into the businesses.

In many cases, global growth has been able to mask a lack of pricing power and under-investment, whilst low interest rates have enabled the companies to borrow cheaply and delay their day of reckoning. Dan believes that many overindebted companies with no pricing power that have persistently underinvested in order to fund a dividend will be the first and real victims of any global slowdown or disruptive change within their industry.

THRG has generated impressive absolute and relative NAV gains over the past 12 months, which have been amplified for shareholders by a narrowing discount. Investors who were nervous about the UK and small caps, and therefore underweighted the area, have been missing out. Dan acknowledges that, in retrospect, THRG could have done even better had it not been managed with a net exposure to the market of less than 100% since Q4 2018. Nevertheless, he is maintaining his relatively cautious stance for the time being.

Even after such a strong run, Dan says that he is still excited about the long-term prospects for the companies in the portfolio. Rumours and sentiment swings are influencing the market. This provides opportunities to profit by both adding to and trimming positions as appropriate. He has been increasing the trust’s domestic exposure, as we discuss in the asset allocation section of this note.

Asset allocation

Asset allocation

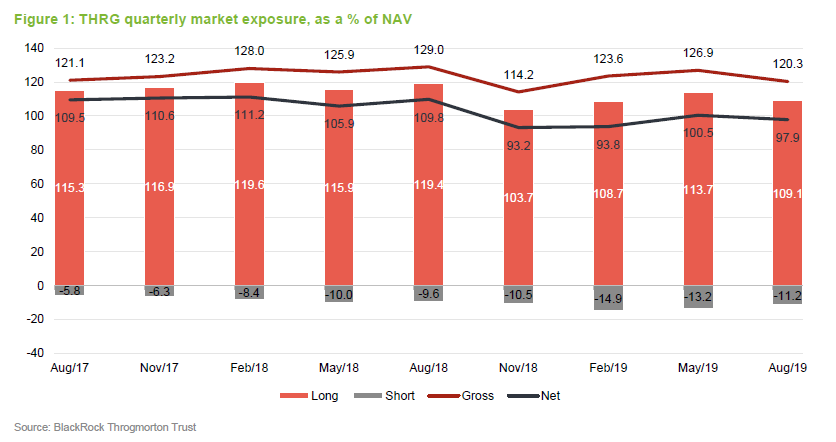

At the end of August 2019, the trust was running with gross exposure of 120.3 (109.1% of the fund’s net assets were invested in long positions and 11.2% in short positions, giving a net exposure of 97.9% and a gross exposure of 120.3%). Dan says this was closer to 118 at the end of October. The net exposure is below 100, where it has been for most of the past year. THRG’s gross market exposure has trended down over the past 18 months, as the manager has reduced the relative weight (as a % of NAV) of the ‘long’ positions. This provides the manager with room to increase risk exposure in the event of market-friendly outcomes from potential catalysts such as the US/China trade dispute.

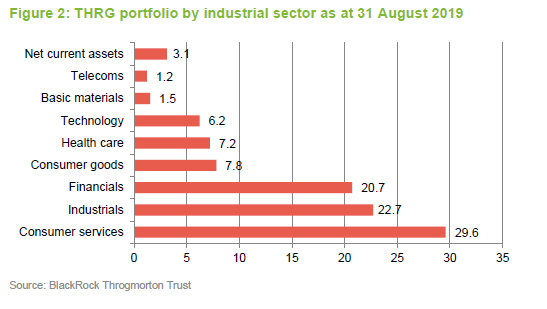

The distribution of the portfolio by sector did not alter much over the quarter ended 31 August 2019. The notable moves were an increase in net current assets and consumer services and reductions in financials and technology. These moves, as ever, were driven by stock selection decisions.

Top 10 holdings

Top 10 holdings

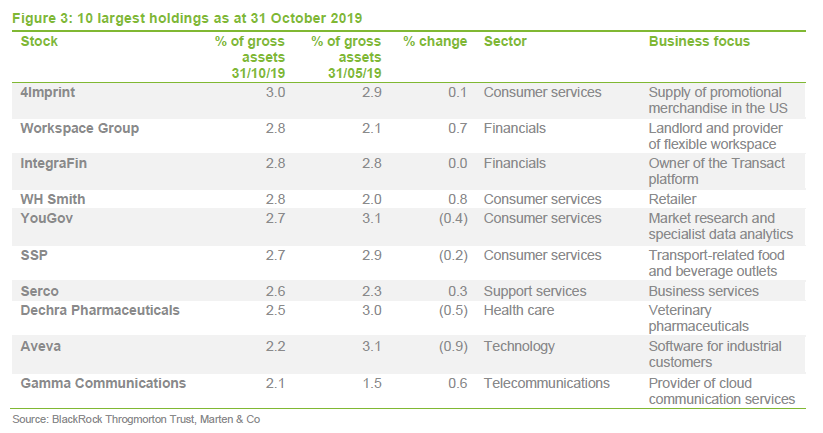

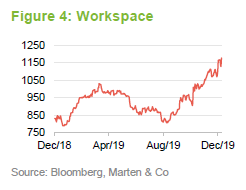

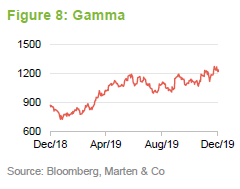

Figure 3 shows the top 10 holdings in the portfolio as at the end of October 2019 compared to the position at the end of May 2019 (the data we used in our last note). Workspace has been held for some time and moved up into the top 10 during this period. We discussed the addition of WH Smith to the portfolio in our last note. Gamma is another position that has been increased. Profits have been taken in JD Sports, which has performed well and is now a FTSE100 company. Another former top 10 holding that Dan has been reducing is Bodycote.

A number of recent additions to the portfolio could be construed as plays on the UK’s domestic economy. Dan says this was not a deliberate attempt to play any outcome of the election or subsequent Brexit negotiations. As usual, the investment decisions are based on stock-specific factors.

Workspace (www.workspace.co.uk)

Workspace (www.workspace.co.uk)

London-focused flexible office provider Workspace has been in the portfolio for some time. It owns more than 4m sq ft of office, studio and industrial space and rents this to more than 3,000 businesses. Workspace’s share price fell between March and August, possibly as the mooted flotation of WeWork garnered negative headlines. Dan says that the two companies were not competing directly. Nevertheless, the abandonment of the WeWork IPO and its subsequent decision to curtail its expansion plans at least reduces the competition for suitable office space. Dan added to the position on weakness. He likes the company’s modest loan-to-value ratio (a measure of how indebted the company is) and the long-term structural story as employers seek to make their businesses more flexible. He thinks that there is scope for Workspace to raise its rents.

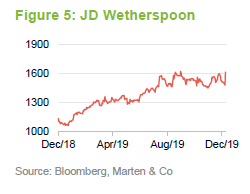

JD Wetherspoon (www.jdwetherspoon.com)

JD Wetherspoon (www.jdwetherspoon.com)

From an industry standpoint, Dan thinks that the pub and restaurant industries face significant challenges. However, JD Wetherspoon’s approach to the business is differentiated from its competitors. The company is a market leader, which gives it advantages when it comes to purchasing. Rather than using this to boost its margins, it passes on this benefit in the form of lower prices for its customers, which drives footfall, which leads to greater purchasing power – a virtuous spiral. Dan draws an analogy with the cash and carry business Booker, which was acquired by Tesco. Wetherspoon is not just about lower prices, however. It also spends more than its peers on refurbishments (things such as loos and carpets). Providing add-ons such as WiFi and free coffee refills increases dwell time (Wetherspoon is now one of the UK’s largest retailers of coffee, behind Greggs and McDonalds). All of this makes for a winning formula – like-for-like sales have been compounding at around 5% a year since 2013.

The company has been buying the freeholds of some of its pubs and is still expanding in some areas while shedding less profitable outlets. There is a growing price gap versus competitors, which makes it more defensive if we experience a tougher consumer environment.

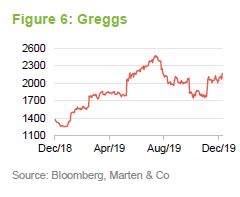

Greggs (www.greggs.co.uk)

Greggs (www.greggs.co.uk)

Greggs was a new addition to the portfolio a few months ago. It was a stock that Dan had been following for some time. In its half-year results, published at the end of July, it reported strong sales and profits growth. However, a decision to accelerate planned capital expenditure and a statement that its pace of like-for-like growth might normalise led to a 35% fall in its share price over the next few months. Dan took advantage of this price weakness to build a position and THRG has been rewarded as the price has rallied. An upbeat trading statement on 11 November (discussing a like-for-like sales increase in excess of 9% and the prospect of profits exceeding analysts’ expectations) was the catalyst for the recent re-rating, but it is still well below its summer share price high.

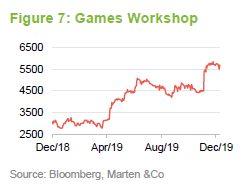

Games Workshop (www.investor.games-workshop.com)

Games Workshop (www.investor.games-workshop.com)

Wargaming miniature retailer Games Workshop is the owner of the Warhammer brand. Dan reassessed his stance on the company following a site visit to the company’s Nottingham headquarters. Dan feels that Games Workshop should be viewed as a consumer brand rather than a retailer. Three-quarters of its sales are to international markets. The customer base is loyal, but traditionally its size was constrained by the high price point of the company’s products. By introducing lower price point games, the company has been able to appeal to a wider range of consumers. International expansion has been carried out in conjunction with local retailers, through preferred supplier agreements. Recent trading statements have been positive. Dan thinks that Warhammer is a brand that could be monetised in a variety of other ways.

Gamma Communications (www.gamma.co.uk)

Gamma Communications (www.gamma.co.uk)

Gamma Communications is a provider of voice over internet protocol (VoIP), data and mobile communications services to the business market. The customer base is mainly small and medium-sized enterprises (although Gamma has notched up some contract wins with various government departments, including HMRC) and mainly located in the UK, but Gamma has been making inroads into the Dutch market as well (it acquired DX Groep in 2018 and bolted on a competitor, Nimsys, early in 2019). Outsourcing this area improves functionality and can provide cost savings. Gamma’s share price has more than doubled over 2019 as the company continues to report strong sales and profit growth.

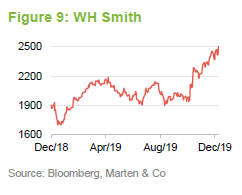

WH Smith (www.whsmith.co.uk)

WH Smith (www.whsmith.co.uk)

We discussed WH Smith in our last note. Since then, it has announced an acquisition in the US: Marshall Retail Group. When the deal was announced in October, the company had 170 stores across North America, including 59 in airports. A programme to open a further 33 stores underpins growth in that business. Another attraction was a high level of ongoing cost savings (estimated at $11m a year by year three – this on a purchase price of approximately $400m).

A trading update published at the end of November said that the company’s year-to-date performance was in line with expectations and Marshal Retail Group was expected to generate annual adjusted earnings before interest, tax, depreciation and amortisation of about $31.5m.

Performance

Performance

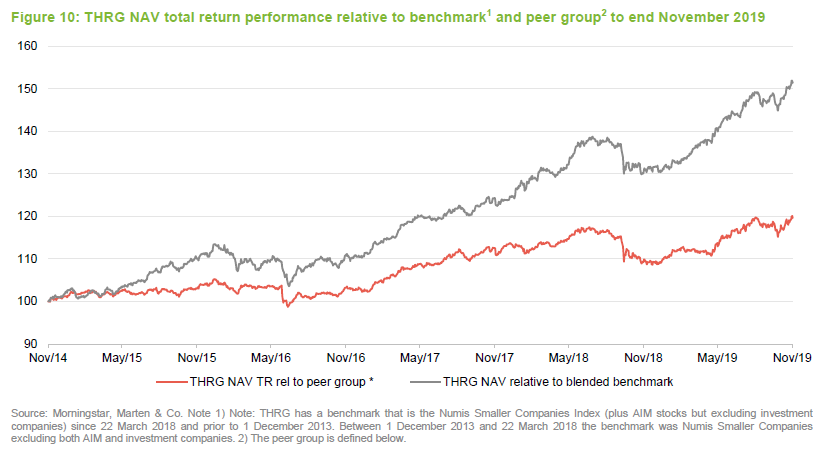

THRG’s strong run of outperformance of both its benchmark and its peers paused in September/October as value stocks staged a minor rally and sterling strengthened. THRG had another leg-up in November, however, surpassing previous relative highs.

Peer group

Peer group

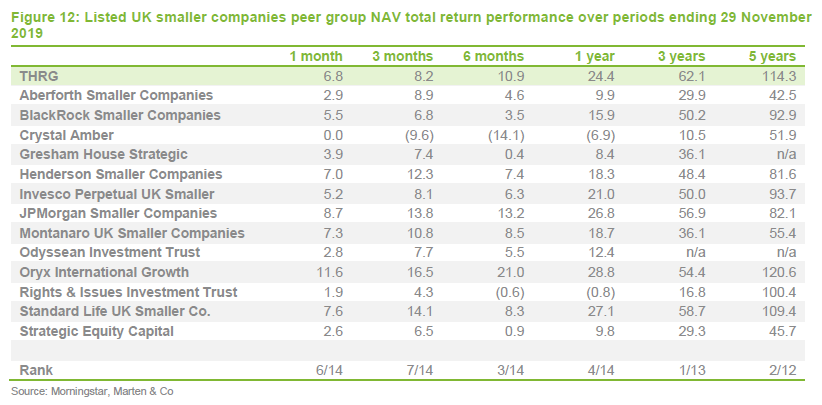

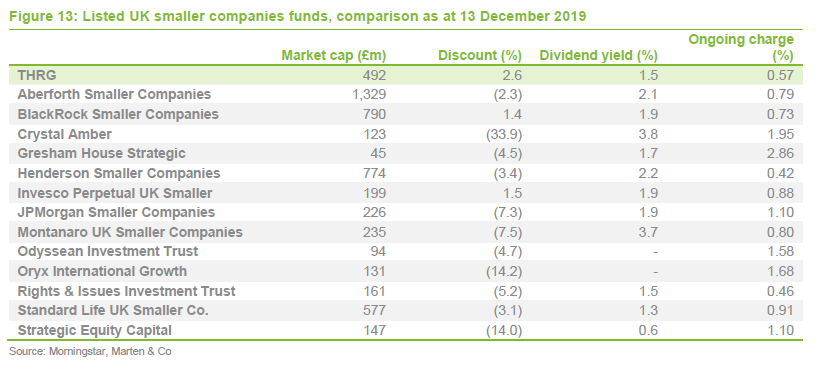

For comparison purposes, we have used a subset of funds in the AIC’s UK smaller companies sector. We have excluded split-capital companies, trusts with a small market capitalisation, and those that focus exclusively on micro-cap companies. A complete list is provided in Figures 12 and 13.

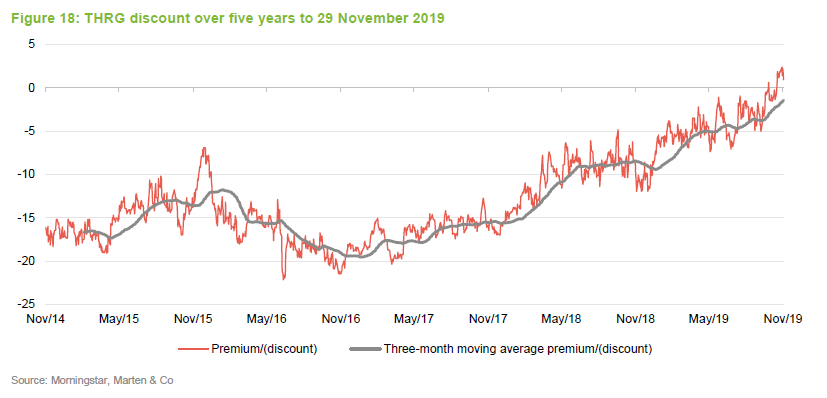

Notwithstanding a recent surge in performance by activist fund Oryx International Growth, THRG remains the best-performing UK small cap trust over three years in NAV terms, and ranks highly over most time periods. This strong track record has helped attract new investors. THRG’s discount has been eliminated and the fund is expanding.

One other thing to highlight from the table in Figure 13 is that THRG’s ongoing charges ratio is very competitive for its size. However, in accordance with standard practice, the ratio is calculated excluding any performance fee. Readers should note that the manager can earn a performance fee, which is calculated as 15% of the outperformance of the benchmark index over a two-year rolling period with an effective cap of 0.9% of average gross assets, resulting from a cap on total management fees of 1.25% over a two-year period.

Performance attribution

Performance attribution

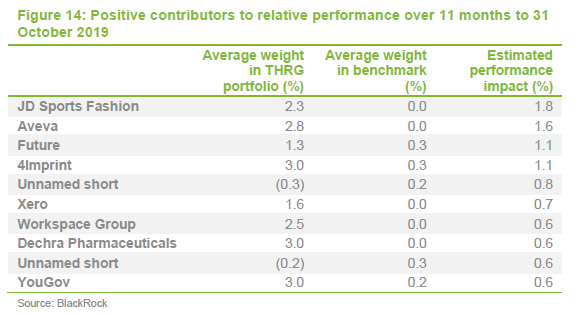

The performance attribution date that we have covers THRG’s financial year (which runs from 1 December each year) to the end of October. Both long and short positions have contributed to the trust’s good returns.

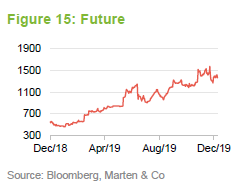

JD Sports Fashion has performed well and the position has been sold down to fund new purchases. Engineering and industrial software business Aveva has been generating good revenue growth, with a higher proportion coming from recurring revenue. Future delivered revenue and earnings growth ahead of analysts’ expectations and says that the integration of the US acquisition it made last year is going to plan. 4Imprint, which we discussed in our July note, has continued its strong run, boosted by year-on-year organic revenue growth of 16% announced in July.

Positive contributions from short positions included a finance litigation company, a listed investment trust and a contractor. The manager notes that the overall positive contribution to performance from short positions is proportionately greater than the contribution from long positions – in other words, the shorts have been punching above their weight.

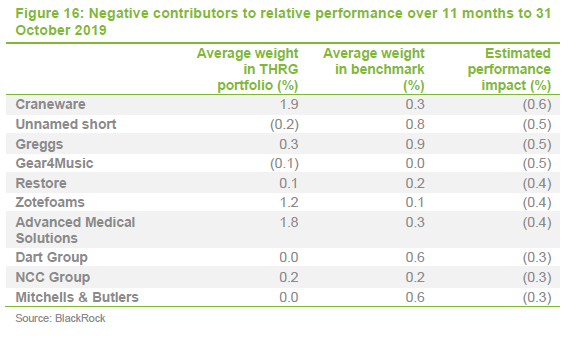

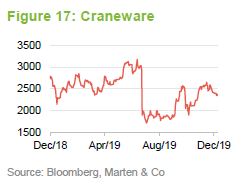

Medical IT specialist Craneware saw its shares fall sharply in June after it announced a shortfall in its targeted sales revenue. This was attributed to the rollout of new products on its Trisus platform (which was also associated with a rise in research and development spend). The share price has recovered much of its fall. Greggs performed well before THRG bought a position in it. Gear4Music was discussed in our last note. UK office services business Restore has been sold. Zotefoams issued a profit warning in October. It makes both industrial foam and higher-margin product which is used to make trainers and similar items. The company found that demand was weak in Asia, which was unfortunate as the company had built new facilities to cope with an anticipated uplift in sales. The shares have recovered the worst of the falls.

THRG lost money shorting an IT reseller; its business was stronger than Dan had foreseen, and the position has been closed.

Premium/(discount)

Premium/(discount)

As illustrated in Figure 18, THRG’s discount has been eliminated. Over the year to the end of November 2019, the discount moved within a range of 12.0% to a premium of 2.4%, averaging a discount of 4.7% over this period. As at 13 December 2019, the premium was 2.6%. Demand for the shares has been such that the trust has been able to reissue shares from treasury at a premium to asset value (enhancing the NAV for existing shareholders). Over 1.4m shares have been issued since the middle of October 2019.

Fund profile

Fund profile

BlackRock Throgmorton Trust (THRG) aims to generate capital growth and an attractive total return, by investing primarily in UK smaller companies and mid‑capitalisation companies traded on the London Stock Exchange. It uses the Numis Smaller Companies Index (plus AIM stocks but excluding investment companies) as a benchmark for performance purposes, but the index does not influence portfolio construction.

For the period between 1 December 2013 and 22 March 2018, the benchmark was Numis Smaller Companies Index, excluding both AIM stocks and investment companies. There used to be a restriction on the trust’s exposure to AIM companies, but this was removed in March 2018 and, at the same time, the manager was given permission to invest up to 15% of the portfolio in stocks listed on exchanges outside the UK.

Both long and short positions

Both long and short positions

Uniquely among listed UK smaller companies trusts, THRG’s portfolio may include a meaningful allocation to short as well as long positions in stocks. Up to 30% of the portfolio may be invested in CFDs (contracts for difference), both long and short. Under normal market conditions, the net exposure will account for 100–110% of net assets.

The manager

The manager

BlackRock Investment Management (UK) Limited was appointed manager of the trust in July 2008. Dan Whitestone, head of the emerging companies team at BlackRock, has been sole manager of the trust since 12 February 2018 (he had been co-manager alongside Mike Prentis since March 2015). Dan heads a team of four. All members of the team manage portfolios, and between them manage or advise on about £4.0bn across a variety of different funds. This includes £516m in a hedge fund and £621m in institutional funds. The team shares research responsibilities between them.

Previous publications

Previous publications

Readers may be interested in our previous publications on THRG, which are listed in Figure 19 below. These are available to read on our website or by clicking the links in the table.

The legal bit

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on BlackRock Throgmorton Trust plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.