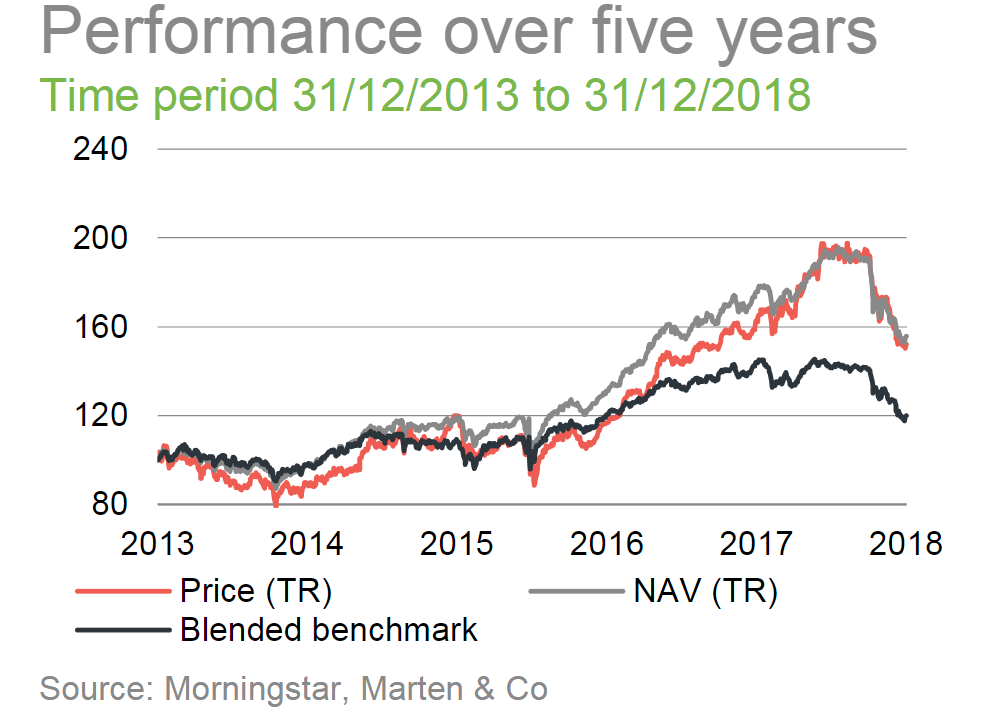

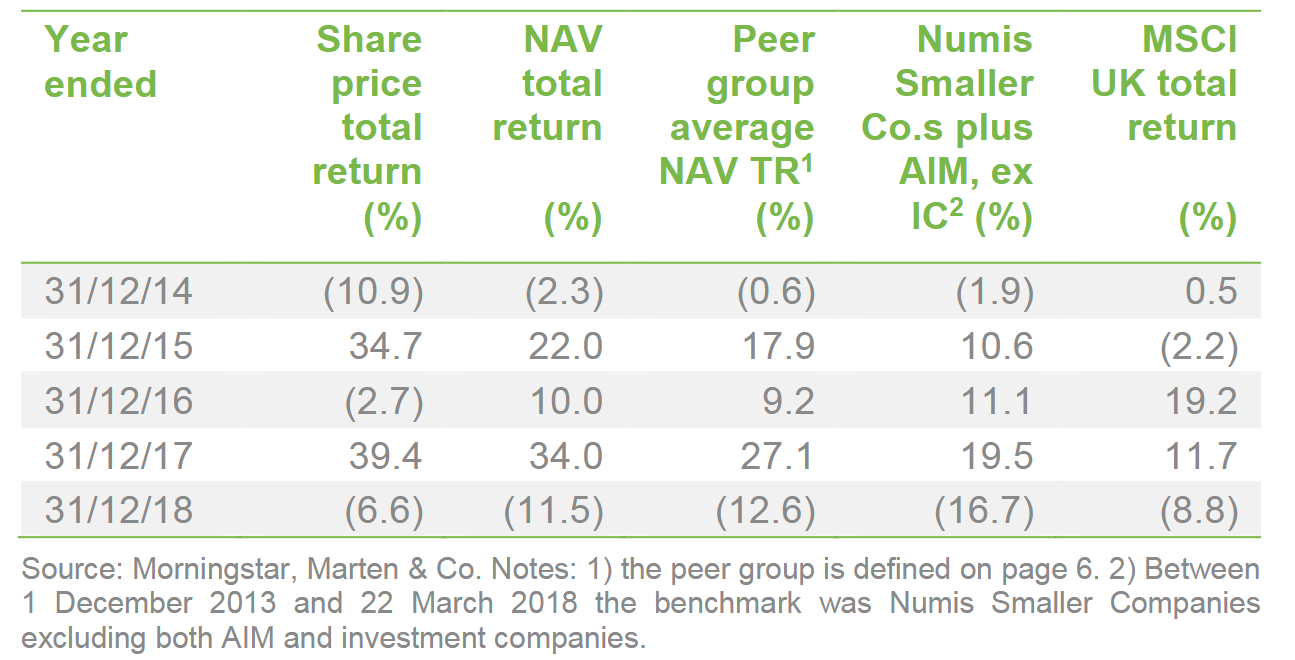

BlackRock Throgmorton Trust – Throg’s shorts shine – With a decision on Brexit looming and US rates climbing, many investors appear to have adopted a more defensive stance. Dan Whitestone, manager of BlackRock Throgmorton Trust (THRG), has reduced the portfolio’s net exposure to markets to well below 100%, taking profits on some positions. Otherwise, Dan’s focus remains on the long-term drivers of growth. His ability to short (taking a negative exposure to) companies with unsound business models gives him another way of making money even when markets are falling. Over the year to 30 November 2018, short positions added 1.4% to returns.

Both long and short positions in UK small-and-mid-cap companies

THRG aims to provide shareholders with capital growth and an attractive total return by investing primarily in UK smaller companies and mid‑capitalisation companies listed on the main market of the London Stock Exchange. It uses the Numis Smaller Companies Index (plus AIM stocks but excluding investment companies) as a benchmark for performance purposes, but the index does not influence portfolio construction. Uniquely among listed UK smaller companies trusts, THRG’s portfolio may include a meaningful allocation to short as well as long positions in stocks.

THRG : BlackRock Throgmorton Trust – Throg’s shorts shine