Sitting pretty

Sitting pretty

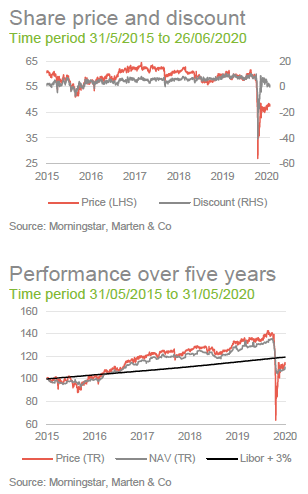

At the height of the market turmoil in March, CQS New City High Yield (NCYF) saw its share price fall faster and further than its NAV (to 27p), before rapidly recovering.

The market has been concerned about the ability of the issuers of the bonds held by NCYF to meet their obligations in the face of the covid-19 pandemic. However, with one small exception, all of NCYF holdings have met their obligations in full (no missed interest payments and no failures to repay loans when they fall due).

NCYF’s manager acknowledges that challenges lie ahead but he observes that the world is making tentative steps to re-open for business, thereby avoiding some of the worst economic scenarios, and he expects that, with minimal exceptions, the prices of NCYF’s holdings will trend back towards their face value over time. If he is correct, this suggests that there remains significant capital appreciation potential on top of the attractive yield (9.4%) the fund currently offers.

High-dividend yield and potential for capital growth

High-dividend yield and potential for capital growth

NCYF aims to provide investors with a high-dividend yield and the potential for capital growth by investing mainly in high-yielding fixed interest securities. These include, but are not limited to, preference shares, loan stocks, corporate bonds (convertible and/or redeemable) and government stocks. The company also invests in equities and other income-yielding securities. The manager has a strong focus on capital preservation and is conservative in his approach to growing NCYF’s capital.

Keep calm and don’t panic

Keep calm and don’t panic

No crystal ball, but portfolio was as conservative and comfortingly boring as described

No crystal ball, but portfolio was as conservative and comfortingly boring as described

As QuotedData has discussed in its previous notes, NCYF’s manager, Ian “Franco” Francis, felt, prior to the onset of the pandemic, that the global economic cycle was peaking, having observed many examples of what he calls “typical top of the market stuff”. Pointing to a range of challenges and uncertainties, Ian had said that there were many reasons for investors to be very wary of markets and that some investors forget that, eventually, the ride must end. Whilst Ian does not have a crystal ball, and could not have predicted the outbreak of the covid-19 virus, the damage that this would do the global economy and the scale of the market rout that would follow, his concerns about markets meant that he continued to keep the portfolio “conservative and boring”, and so he was partly prepared for what followed.

Don’t panic, and know your limits!

Don’t panic, and know your limits!

As the infection rate accelerated, and investors tried to gauge the impact on the global economy and individual stocks, financial markets collapsed. Ian says that in these circumstances, not panicking and keeping a cool head are absolutely crucial. While increased volatility inevitably throws up opportunities, Ian tries not to trade the portfolio too much as trading at the wrong price can cost you a lot of money. He cites the example of NCYF’s shares which briefly hit a low of 27p on 18 March 2020 but were back up to 38.2p two days later and were 47.50p as at 26 June 2020. Ian says that what drove the price to this extreme was panicky selling by retail investors (and not institutional investors) who had failed to put price limits on their trades. For a small number of individuals, this will have proven to be a very expensive mistake.

Central bank intervention re-opened credit markets

Central bank intervention re-opened credit markets

As financial markets collapsed, liquidity dried up across the board. The credit markets in which NCYF predominantly invests were not immune to this, however, as equity holders took pain through dividend cuts and in some cases equity raises, credit markets began to strengthen, aided by government and central bank support across the globe. This process was given a major boost on 9 April when the Federal Reserve announced that it would take additional measures that included up to $2.3 trillion in loans to support the economy. This included US$750bn in corporate bond purchases that also extended to fallen angels in high-yield markets. The effect was powerful, opening up the credit markets for new issues as well as trading in existing issues.

Pull to par potential leaves room for strong NAV uplift

Pull to par potential leaves room for strong NAV uplift

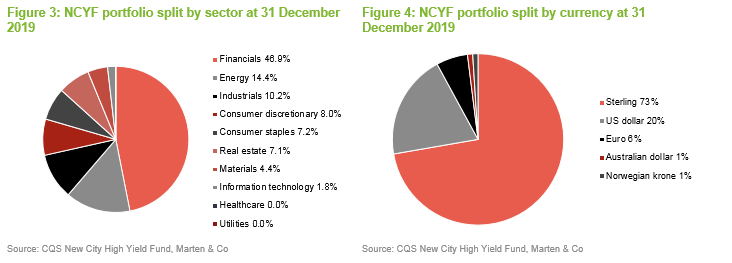

While the initial reaction appears to have been significantly overdone, and NCYF’s NAV has recovered strongly from its low, it is not unreasonable to think that there may be problems with some of NCYF’s holdings down the line. As illustrated in Figure 3, NCYF has considerable exposure to credits with economically cyclical companies that are affected by the current slowdown. For example, it has 46.9% in financials (this is discussed further below), 8.0% in consumer discretionary, and 14.4% in energy and 10.2% in industrials.

However, as illustrated in Figure 4, NCYF’s credit investments are generally located in developed market economies which are being supportive of businesses in the current climate (73% of NCYF’s portfolio is in sterling and 20% is in US dollars, for example). Furthermore, the manager believes that the underlying companies in NCYF’s portfolio are robust and, while there may be challenges ahead, he believes that the overwhelming majority of these, and certainly NCYF’s major holdings, have the ability to weather the covid-19 storm for a prolonged period. Ian is not expecting any defaults and believes that these credits should overwhelmingly pull back to par over time. He says that, with the exception of one very small position, all of NCYF’s holdings have continued to meet their obligations; there have been no missed interest payments and no failures to repay loans when they fall due. The manager also comments that the diversification within the portfolio (as noted in the asset allocation section, NCYF’s portfolio had exposure to 108 issues as at 30 April) has been key to navigating the crisis.

Financials – market dislocation used to tilt exposure towards higher quality names

Financials – market dislocation used to tilt exposure towards higher quality names

As QuotedData has discussed in its previous notes, NCYF’s portfolio has a consistently high allocation to financials stocks (46.9% of the portfolio as at 30 April 2020 – see Figure 3), which are primarily issues from banks and insurance companies, with names such as Clydesdale Bank, Domestic and General Insurance (Galaxy Finco), Lowell Insurance (Garfunkelux Holdco), OneSavings Bank, Barclays, Shawbrook and Virgin Money. There is also a significant allocation to other diversified financial companies. The manager says that banks and insurance still represent an opportunity: these institutions are now much better-capitalised than they were as we approached the top of the last cycle in 2007-08, but the market’s attitude towards them has seen remarkably little change. Consequently, their issues tend to pay a relatively high yield for their level of risk, which makes them natural candidates for NCYF’s portfolio.

The manager says that diversification within NCYF’s financials has been very helpful during the recent market turmoil and, while the suspension of dividends and share buybacks has been negative for equity holders, it has upgraded the credit quality of all of their paper, including the Tier 1 notes (financial institution’s core capital), which has been a major positive for the holders of these issues. The manager used the disruption to rotate the portfolio towards higher-quality names, adding to NCYF’s position in notes from both Co-operative Bank Finance and Virgin Money. Ian says that there has been some reduction in yield, but that these holdings offer superior risk-adjusted returns in the current environment.

Asset allocation

Asset allocation

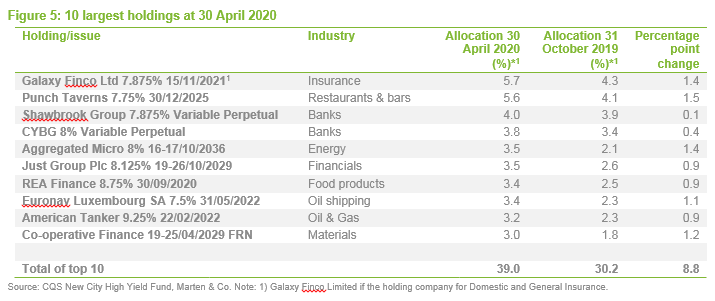

As at 30 April 2019, NCYF’s portfolio had had exposure to 108 issues (up from the 106 issues it had exposure to six months prior) and, as illustrated in Figure 5, the top 10 issues accounted for 39.0% of the portfolio as at 30 April 2020 (up from 30.2% as at 31 October 2019). The increase in concentration reflects, in part, recent market disturbance (there has been a divergence whereby certain significant credits have become stronger, while others have become weaker – although the manager expects that all should pull to par over time. However, it also reflects the fact that, until recently there was an increased scarcity of high-yield credits at a yield that the manager felt to be commensurate with the risk. As existing holdings matured, or were called, the manager reinvested these in existing holdings that he felt to be good value, but this led to an uplift in concentration within the portfolio.

Following significant intervention by governments and central banks globally, in response to the pandemic, credit markets, including high-yield, have quickly re-opened. While the market still has a thirst for yield (lower interest rates for longer), recent events have served to remind investors that, despite low interest rates reducing the probability of bankruptcy) there is risk attached to these investments, which will hopefully lead to better pricing of risk going forward that does not lead to yields being bid to such low levels, creating the opportunity for better risk-adjusted returns.

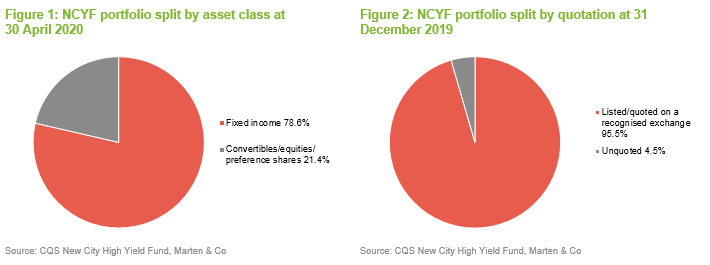

Figures 1 to 4 show various splits of the portfolio (asset class, quotation, sector and currency), with the data provided being the most recent data that is publicly available.

These charts continue to illustrate a number of themes:

• The portfolio is overwhelmingly invested in pure fixed income securities.

• All but a tiny percentage of the portfolio is quoted on a recognised exchange (although around 70% trades ‘over the counter’ rather than on an exchange and so will be relatively illiquid).

• The portfolio has exposure to issues from companies in a diverse range of sectors, with a heavy concentration in financials that reflects the manager’s views on bank and insurance issues.

• The portfolio is predominantly exposed to sterling (around 70%), but also has a significant US-dollar exposure (around 20%).

Top 10 holdings

Top 10 holdings

Figure 5 provides a summary of the top 10 issues within NCYF’s portfolio as at 30 April 2020. Reflecting the manager’s long-term, low-turnover approach, most of the securities will be familiar to regular followers of NCYF’s portfolio announcements and our notes on the company. Details of the rationale underlying some of these and other positions can be found in QuotedData’s previous notes. For example, readers who would like more detail on the Euronav and American Tanker will find that these were discussed in QuotedData’s July 2019 note (Ian says that both continue to do a great job). Some of the more interesting developments are discussed below.

Just Group Plc 8.125% 19-26 October 2029

Just Group Plc 8.125% 19-26 October 2029

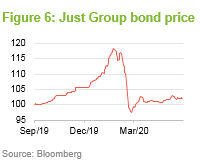

Just Group Plc (www.justgroupplc.co.uk) is a UK-based financial services group that specialises in retirement income products and services. It provides financial advice, guidance, products and services to individuals, financial intermediaries, corporate clients and pension trustees. It operates through a number of different brands. The company has a premium main market listing on the London Stock Exchange, is a constituent of the FTSE 250 index and has a key objective of being “organically capital generative by 2022”. Its 8.125% bonds, maturing October 2029, were issued in October 2019 with a 10-year life and an issue size of £125m. The bonds are listed in Luxembourg, pay semi-annual coupons and have been rated BBB by Fitch.

£37.5m of the issue proceeds was used to finance a tender offer for the companies 9.5% notes that are due 2025. All valid tender requests for the notes, which were originally offered by Partnership Assurance Group Plc, were met in full. Ian says that Just Group is very well managed and is well positioned to benefit from the structural trend of an ageing population that should see growing demand for its services. With a reasonably high coupon, these notes are exactly the sort of boring paper that Ian likes.

Aggregated Micro Power Holdings 8% 16-17 October 2036

Aggregated Micro Power Holdings 8% 16-17 October 2036

Aggregated Micro Power Holdings Limited (www.ampcleanenergy.com) describes itself as a distributed energy company. It funds and develops low carbon heat and power solutions (biomass heat installations, solar PV and flexible energy plants) for UK businesses and organisations (typically local authorities – for example pellet-burning boilers that are used in schools, hospitals, etc). Its aim is to unlock the potential of decentralised, sustainable energy for its customers, which supports the UK’s transition to a net zero carbon economy. The company has access to a funding vehicle which provides finance for its biomass heat services and low carbon development projects. It says that over £80m has been raised for its clean energy projects through this vehicle.

NCYF has had a holding in this sterling-denominated bond since the first tranche was issued in October 2016. The bond is unrated, pays quarterly coupons and has a sinkable call feature whereby it can be called at a price of 125p on 30 July 2020. Ian describes it as a “great boring business with an 8% coupon”. He likes the predictability and reliability of the cash flows (these assets are critical to the organisations that use them, and some of them are quasi-government backed), as well as the long-lived nature of the contracts and assets.

Co-operative Bank Finance 19-25/04/2029 fixed rate reset callable subordinated Tier 2 notes

Co-operative Bank Finance 19-25/04/2029 fixed rate reset callable subordinated Tier 2 notes

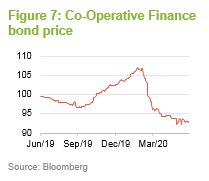

These sterling-denominated subordinated bonds are issued by the Co-Operative Bank (www.co-operativebank.co.uk), which offers a range of retail banking services (current accounts, savings accounts, credit cards, mortgages, insurance etc.) to customers in the UK. The bonds were issued in April 2019, with an issue size of £200m and an initial coupon of 9.5%. The coupon, which is paid semi-annually in April and October, has a reset on 24 April 2024. While the bonds have a maturity date of 24 April 2029, they can be called at par on 24 April 2024.

Ian considers that, from an environmental, social and governance (ESG) awareness perspective, this is the best UK bank that you can invest in. He added to the position as he sought to reallocate some of NCYF’s exposure to financials to higher quality names, while they were trading more cheaply following the outbreak of the virus.

Diversified Gas & Oil (2.9%) – new holding that should benefit from reduced gas output from US shale oil producers

Diversified Gas & Oil (2.9%) – new holding that should benefit from reduced gas output from US shale oil producers

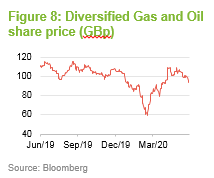

Diversified Gas & Oil (www.dgoc.com) owns and operates natural gas & oil wells that are primarily located in the Appalachian Basin in the United States. DGOC’s production operations are concentrated within Tennessee, Kentucky, Virginia, West Virginia, Ohio, and Pennsylvania, where it describes itself as being one of the largest independent conventional producers. The company has grown its output in recent years, both through acquisition (it has been acquiring assets from industry players who have been refocussing their businesses on shale production) and by enhancing the efficiency of its existing operations. Its assets typically have predictable production rates, long-lives (40 to 50+ years), and relatively low rates of decline in output.

DGOC is a holding that CYN has in common with its sister fund, CQS Natural Resources Growth and Income (also a client of Marten & Co – click here to see our most recent note). Ian added it to NCYF’s portfolio when it was trading around its March low of 60p per share and it is now trading around 100p per share (although it has closed as high as 110p during the last month). Ian describes it as a very sensible holding that pays around a 10% yield. The NCIM team say that DGOC’s low cost of production means that it is well positioned to weather the current low oil price environment (its geographical focus affords it economies of scale). It should also benefit from a reduction in the output of gas from shale production as this has become uneconomic for many producers at present.

The managers also observe that DGOC is very cash-generative and its significant land bank offers it the opportunity to grow organically through infill drilling. As a recognised player, DGOC benefits from good deal flow, which has been strong given the current market backdrop. Furthermore, with both experienced management and its efforts concentrated in resource rich locations that are well known to the company, DGOC’s operations tend to be reasonably low-risk. The company says that, where the commodity pricing environment is favourable, it can activate a low-risk development program that ensures a quick return on its investment. This could offer significant potential upside should oil markets tighten. In the meantime, DGOC continues to offer an attractive yield (11.9% as at 29 June 2020 – Source: Bloomberg).

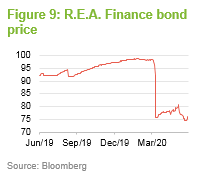

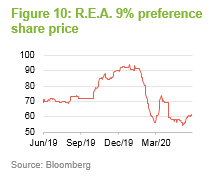

R.E.A. Holdings (3.4%) – preference shares dividend continues to be deferred, but this is expected to return later this year

R.E.A. Holdings (3.4%) – preference shares dividend continues to be deferred, but this is expected to return later this year

R.E.A. Holdings (www.rea.co.uk) is engaged in sustainable cultivation of oil palms in the Indonesian province of East Kalimantan and in the production and sale of sustainable crude palm oil, and associated palm products, from the fruit harvested from its oil palms. NCYF has long held R.E.A.’s bonds and cumulative preference shares within its portfolio. These are also held in the portfolio of NCYF’s sister fund, CQS Natural Resources Growth & Income (also a Marten & Co client – click here to read our most recent note), which also holds the company’s ordinary shares.

In its annual report for 2019, published on 28 May 2020, R.E.A. said that its preference dividends will continue to be deferred until there is a recovery in crude palm oil prices and greater certainty as to the future. Reflecting this, the half yearly payment that falls due on 30 June 2020 will be deferred and that the half yearly payments that were due on 30 June 2019 and 31 December 2019 will continue to be deferred. The team at CQS say that R.E.A.’s management has been cautious because of a low palm oil price, but this is recovering and it now expects preference share dividends to resume later this year.

It should be noted that the team at CQS do not generally hold exposure to soft commodities. Palm oil is the exception, but the managers will only hold sustainable palm oil. R.E.A. obtained Roundtable on Sustainable Palm Oil (RSPO) supply chain certification in 2012. This allows it to sell the crude palm oil and crude palm kernel oil produced by its RSPO-certified estates to buyers that look to purchase RSPO-certified sustainable palm oil. The managers say that in addition to the environmental and reputational benefits of taking a sustainable approach, sustainable palm oil achieves a higher price because of its superior environmental credentials. Furthermore, environmental considerations limit the development of new supply and sustainable producers, such as R.E.A., are best positioned to benefit from this. More information is available at http://www.rea.co.uk/sustainability/certification.

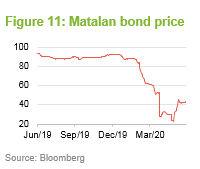

Matalan Finance 9.5% 31 January 2024 – all stores have reopened

Matalan Finance 9.5% 31 January 2024 – all stores have reopened

We last discussed Matalan (www.matalan.co.uk), the British fashion and homeware retailer, in our November 2018 note (see page 6 of that note). This credit is a long-term NCYF holding and Ian had added to the position earlier in 2018 on weakness and NCYF had benefitted as the price had recovered, pushing it into its top 10 holdings. At that time, UK high-street retail was suffering from a combination of higher inflation, lacklustre wage growth and ever-growing pressure from online retail, but Matalan (a private company) was outpacing the market on the back of a revamp of its stores and the launch of a new website. Ian believed that Matalan would continue to survive the downturn in high street retail, and derived comfort from the fact that the company’s owners also hold about £65m, or around half, of the £130m bond issue – a fact that remains highly relevant today.

Following the outbreak of covid-19, all of Matalan’s 230 UK stores were temporarily closed; its online offering did remain open, albeit deliveries took longer than usual. With a significant part of its business suspended, the market became concerned about the company’s ability to service its debt, which was reflected in the pricing of this second lien bond. However, the company did not stand idle: it furloughed both shop staff and staff at its warehouses; and reportedly cancelled orders with suppliers.

Ian felt the market’s reaction was over-bearish. He considers that there is strong underlying demand for Matalan’s offering and, through its online store, this could be boosted as people sought to improve their home environments, as a consequence of being forced to spend more time there. He also felt that the business was sufficiently well-capitalised to weather the covid-storm for some time and that the banks should also be supportive. Ian’s view appears to be correct; following a phased re-opening during the last few weeks, all of its stores are now open again. The ongoing restrictions will continue to be disruptive for some time and, while he would not rule out a financial restructuring at this stage, Ian considers that Matalan should be able to recover as restrictions are eased.

Wittur International 8.5% 15 February 2023 – called

Wittur International 8.5% 15 February 2023 – called

We last discussed Wittur International and its bonds in our July 2019 annual overview note (see page 11 of that note). Wittur is a German engineering business with various subsidiaries in Europe, Asia and Latin America that produces components, modules and systems for the elevator industry. In our July 2019 note, we commented that Ian considers Wittur to be a very solid, well-managed business that is well-capitalised and that he felt that the credit quality was high relative to its yield. It would appear that Wittur’s management share this view. On 24 September 2019, the company announced that it was exercising its right to call (repay) the bonds early. The euro-denominated bonds were called with effect on 4 October 2019 at a price of 102.13.

Barclays Bank 7% Variable Perpetual – called at first reset date

Barclays Bank 7% Variable Perpetual – called at first reset date

NCYF first invested in Barclays Bank 7% Variable Perpetual bonds shortly after they were issued in June 2014. Whilst the bonds were perpetual, they also had a feature whereby they could be called on 15 September 2019 and every five years thereafter at the issue price. The bonds were called on this first reset date, and have consequently left NCYF’s portfolio.

DAZN Group Financing 8.5% 15 November 2020 – called in July 2019

DAZN Group Financing 8.5% 15 November 2020 – called in July 2019

DAZN Group Financing (formerly Perform Group Financing) was a long-term NCYF holding that QuotedData last discussed in its November 2018 note (see page 6 of that note). At that time, we noted that it had moved back up NCYF’s rankings in May 2018, when the holding was added to following some updated in-house analysis that reinforced the quality of the credit. This served NCYF well; the credit was subsequently called in July 2019 at 102.13.

When the credit was called, Ian would have preferred that it had remained in the portfolio, as he felt it had a higher credit quality than its yield suggested. However, moving forward to the present, DAZN’s focus is on sports streaming is a major Achilles heel; many fixtures have been cancelled as leagues have been suspended. Whilst there is talk of reopening some leagues, there is still much uncertainty which may still remain when the credit is due to be refinanced in November this year. Ian thinks that many of NCYF’s depressed holdings will be fine and pull back to par. However, the timing of the maturity may have been problematic and so July 2019 turns out to have been a welcome liquidity opportunity.

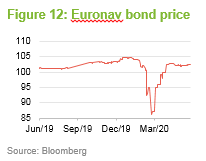

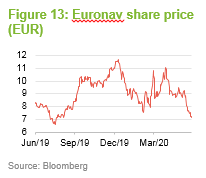

Update on Euronav – strong earnings growth as day rates spike, Q1 2020 started very strongly

Update on Euronav – strong earnings growth as day rates spike, Q1 2020 started very strongly

Euronav (www.euronav.com) is an international crude oil shipping company that describes itself as the largest NYSE-listed independent crude oil tanker company in the world. It owns and operates a fleet that primarily comprises very large crude carriers (VLCCs), but it also owns V-Plus and Suezmax tankers, and can supply and operate floating, storage and offloading (FSO) vessels.

Euronav experienced very strong earnings in Q4 2019 (it posted a profit of around US$160m, versus a break-even result in Q4 2018, with a similar cost base in both years). This surge in profitability followed the US administration’s decision to impose sanctions on the Chinese shipping conglomerate, Cosco Shipping Corporation, on 25 September 2019 (as well as four other Chinese companies and several individuals). The company’s Dalian tanker unit was accused of continuing to transport Iranian crude after sanctions waivers lapsed in May 2019 (China is the world’s only major importer of Iranian oil and the US is trying to halt Iran’s nuclear programme).

The sanctions spooked oil traders and tanker day rates saw a sharp increase; VLCC freight rates reportedly reached $300,000 a day in October and, whilst they quickly dropped again, remained elevated through to the end of January 2020. In Euronav’s results, the company said that the rates for both VLCCs and Suezmax were the highest seen for a quarter since 2008.

VLCC freight rates have since retrenched significantly, both in the face of the covid-19 outbreak and as sanctions have been lifted on one of Cosco’s Dalian units bringing supply back into the market (the sanctions are reported to have removed at least 25 VLCCs from the market for a three-month period). Nonetheless, Euronav has said that Q1 2020 started very strongly (it has booked around 60% of the quarter at close to $90,000 per day for its VLCCs and $57,000 per day for its Suezmax). Covid-19 aside, Euronav believes that the signing of the phase 1 trade deal between China and the US is positive for its business. It believes that, if quotas are achieved, the deal will lead to an increase in shipping demand, particularly for energy shipping firms.

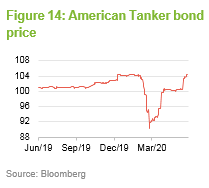

Update on American Tanker Inc 9.25% US dollar drop lock bonds 2017 (2020/22) 22 February 2022

Update on American Tanker Inc 9.25% US dollar drop lock bonds 2017 (2020/22) 22 February 2022

These bonds were highlighted as being a new holding in our July 2019 (see pages 11 and 12 of that note). To summarise, the bonds effectively provide finance to American Shipping Company ASA, which is a ship finance company (and yieldco) established in 2005 that is focused on the intercoastal US Jones Act market. It owns a fleet of “nine modern handy size product tankers and one modern handy size shuttle tanker” that it charters on long-term bareboat charters. The American Shipping fleet services the crude oil and refined petroleum products logistics needs of oil majors and refiners in the US coastal trade.

As illustrated in Figure 14, although the price of the bond collapsed during March, it has recovered strongly since. The company continues to perform well, aided by strong demand for storage capacity, which has calmed investors’ fears, and the bond is now back trading above par.

Performance

Performance

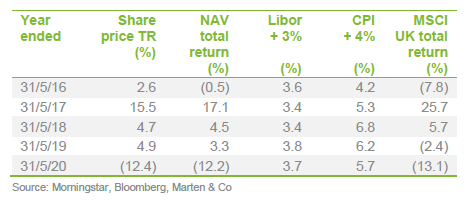

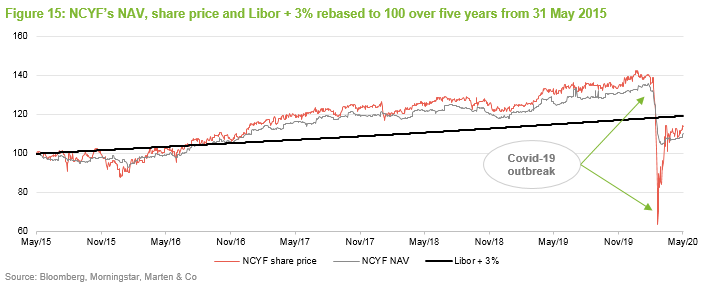

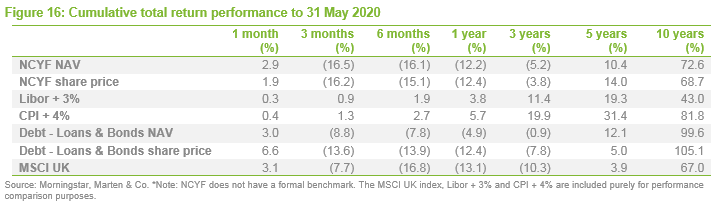

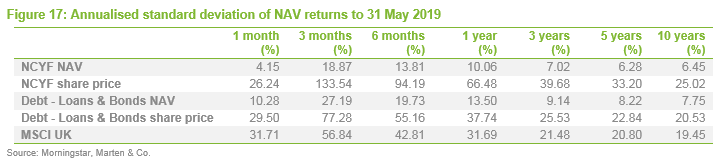

As illustrated in both Figures 15 & 16, despite the manager’s strong focus on preserving capital, NCYF was not immune to the sharp market declines seen in March and, while there was a strong recovery performance in April, which has continued into May, the crisis has eaten into NCYF’s long-term performance record. When we have previously written on NCYF, we have been able to say that NCYF has provided NAV and share price total returns, over the longer-term 10-year period, that outperformed both the UK equity market (as represented by the MSCI UK Index), and targets set with respect to interest rates and inflation (as measured by Libor + 3% and CPI + 4%) – all by some margin, while also being ahead over the three and five-year periods. However, while it has still outperformed Libor + 3% and the MSCI UK over the 10-year period, it has fallen modestly behind CPI + 4%. Furthermore, the picture becomes more mixed as the timeframe becomes shorter.

Nonetheless, we would reiterate that a strategy such as NCYF’s (one that is focused on generating a high level of income while protecting and modestly growing capital) might best be assessed by looking at the size and consistency of its total returns over longer-term horizons. It is inevitable that NCYF will lag equities, particularly when these markets surge ahead in risk on phases, yet it will also likely lag cash returns in difficult periods when both fixed income and equity markets are struggling. It is still too early to tell whether the pandemic has led to a permanent loss of capital for NCYF. However, if its manager is correct in his expectation that, with limited exceptions, most of the credits should pull to par over time, there could be significant upside potential. The signs are that the world is tentatively re-opening and, if a relapse into another severe lockdown can be avoided, it seems reasonable that issuers should be able to continue to meet their obligations to NCYF, which would be reflected in an improving NAV over time.

Quarterly dividend payments

Quarterly dividend payments

Subject to market conditions and the company’s performance, financial position and financial outlook, the board intends to pay an attractive level of dividend income to shareholders on a quarterly basis. The company intends to pay all dividends as interim dividends.

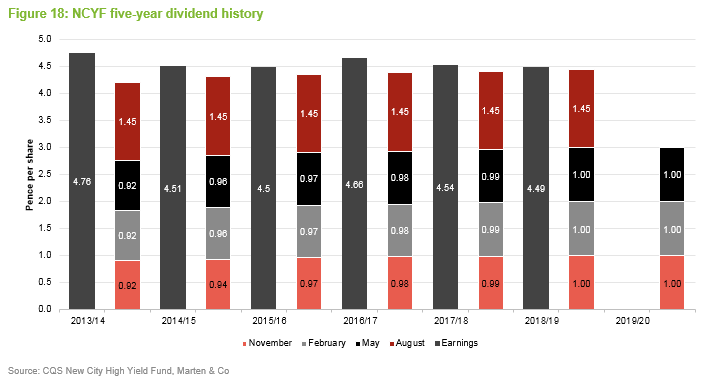

For a given financial year, the first interim dividend is paid in November (2019: 1.00p) with the second, third and fourth interims paid in February, May and August. As illustrated in Figure 18 overleaf, the quarterly dividend rate paid for the first quarter has been maintained for the second and third interims in December and March, which has traditionally been followed by a larger ‘balloon payment’ for the fourth quarter.

In its interim accounts, NCYF’s chair, Caroline Hitch says that “since its launch in 2007, dividends paid by the company have increased every year. Looking ahead, it may be that this trend is not sustainable but as things stand, the board expects this year’s dividend will be at least the same as the total annualised rate of 4.45 pence that was declared last year”. As discussed below, NCYF pays covered dividends, but it has accrued a significant revenue reserve that the board may choose to draw upon.

87% of one year’s worth of dividends in reserve

87% of one year’s worth of dividends in reserve

As Figure 18 shows, NCYF’s revenue income has also exceeded its dividend in recent years, allowing the company to build on its revenue reserve; although, as noted overleaf, NCYF has consistently traded at a premium allowing it to issue a significant number of shares. Whilst this is NAV-accretive for existing holders, it has a tendency to dilute the revenue reserve. This is something that the board is very mindful of, and therefore it avoids issuing stock close to ex-dividend dates. However, although NCYF’s revenue reserve per share has seen a modest reduction during the last couple of years, as at 31 December 2019, NCYF had a revenue reserve of £16.4m, equivalent to 3.85p per share (30 June 2019: £17.3m or 4.09p per share).

The 3.85p per share is equivalent to 87% of one year’s worth of dividend payments. Although the board has not indicated an intention to do so, these reserves could be used to maintain the dividend if it became uncovered should income fall as a result of the pandemic.

Premium/(discount)

Premium/(discount)

Reverted to a premium rating

Reverted to a premium rating

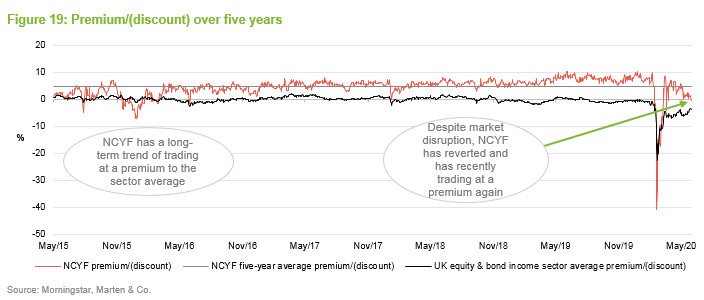

As illustrated in Figure 19, NCYF has traded at a marked premium (an average of 4.8%) during the last five years. The premium reflects strong demand for NCYF’s strategy, which has allowed it to undertake an ongoing programme of share issuance. This has seen an additional 34.9m shares issued during the last five years, equivalent to an increase in its issued share capital of 8.8% over that time.

The outbreak of covid-19, and the market retreat that has accompanied this, briefly disrupted this consensus, pushing NYCF’s discount to an all-time high of 40.7% on 18 March 2020. This initial movement was severe; it far exceeded the depths plumbed even in the immediate aftermath of the global financial crisis of 2008, where NCYF’s discount hit a maximum of 6.1% in mid-October 2008. However, the discount has since reverted sharply and, as at 26 June 2020, NCYF was trading at a discount of 0.2% (having recently been trading at a premium). This is a little narrower than its five-year average premium of 4.8%, so NCYF is relatively cheap compared to history.

NCYF was not alone in seeing its discount widen during its period. As is illustrated in Figure 19, NCYF’s peer group, the Debt – Loans & Bonds sector, also saw a marked widening in its average discount, although NCYF’s widening markedly exceeded this. However, since the discounts reverted, NCYF is once again trading at a premium to the sector average.

The abrupt widening of NCYF’s discount in the face of the covid-19 outbreak almost certainly reflected market concerns around the abilities of the underlying credits, in NCYF’s portfolio, to continue to meet their debt obligations, and consequently what impact this would subsequently have on NCYF’s NAV. As illustrated in Figure 15, the market’s reaction appears to have been significantly overdone. NCYF’s NAV has taken a hit, but this has been nowhere near as severe as the initial market reaction, and it has been on a recovery trend since the beginning of April.

However, it should be noted that many of NCYF’s holdings are relatively illiquid even in normal market conditions (as noted earlier, whilst all but a tiny percentage of NCYF’s portfolio is listed on a recognised exchange, around 70% of NCYF’s portfolio trades OTC). In periods of distress, when already-limited liquidity dries up, NCYF is unlikely to be able to exit its holdings easily.

Although no comment has been made by the board on NCYF’s income generation, its ability to continue to pay a covered dividend and the board’s view on whether it is prepared to utilise the company’s dividend reserves if necessary, shareholders may have taken some comfort from the board’s decision to maintain the third quarterly dividend at 1.0p per share. This suggests that they have confidence in NCYF’s income generation. Shareholders might also take some additional comfort from the recent share issuance (see below). As we have noted previously, while it is NAV accretive for existing holders, share issuance has a diluting effect on revenue reserves and the board and manager keep a very close eye on this. It seems reasonable that if the board had any materials concerns about the outlook for NCYF’s income, that equity issuance would not have been resumed.

Share issuance has resumed

Share issuance has resumed

As noted above, NCYF’s premium rating has allowed it to grow steadily for a number of years. Importantly, NCYF has been able to achieve this growth without adversely affecting its strategy, and so we have welcomed this new issuance: it is NAV accretive to existing shareholders (shares are issued above a 5% premium); it improves liquidity in NCYF’s shares; and, all things being equal, it lowers NCYF’s ongoing charges ratio (as it allows NCYF to spread its fixed costs over a larger asset base). However, reflecting the sharp move to a discount as the pandemic set in, there was a gap in NCYF’s share issuance between mid-February and the end of May. Despite this, with NCYF once again trading at a premium, it has been able to recommence its modest equity issues. The first of these was on 28 May 2020: 750k shares at 47.5p per share.

Fund profile

Fund profile

A predominantly higher yielding fixed income exposure

A predominantly higher yielding fixed income exposure

NCYF’s aim is to provide a high level of quarterly income, with the prospect of capital growth, through investment in a portfolio of predominantly higher-yielding fixed income securities, with the flexibility to invest in equities and equity-related securities.

Investments are typically made in securities that the manager has identified as undervalued by the market and which it believes will generate above-average income returns relative to their risk, thereby also giving the scope for capital appreciation. The manager seeks to exploit opportunities presented by the fluctuating yield base of the market and from redemptions, conversions, reconstructions and takeovers to generate capital growth.

Dividends are paid on a quarterly basis with the first interim dividend, for a given financial year, paid in November with the second, third and fourth interims paid in February, May and August. Although not a formal aspect of NCYF’s dividend policy, the total annual dividend has increased every year since launch.

CQS Group and New City Investment Managers

CQS Group and New City Investment Managers

New City Investment Managers (NCIM) has been NCYF’s investment manager since its launch in March 2007. NCIM also managed NCYF’s immediate predecessor from 2004 until its assets were rolled over into NCYF in March 2007 (see page 21 of our July 2019 annual overview note for more details).

On 1 October 2007, NCIM joined the CQS Group, a global diversified asset manager running multiple strategies with AUM of US$16.9bn as at 29 May 2020.

Ian “Franco” Francis

Ian “Franco” Francis

Ian Francis, a partner at CQS and Head of New City, has day-to-day responsibility for managing NCYF’s portfolio. Ian joined NCIM in 2007. He has over 35 years’ investment experience, primarily in the fixed interest and convertible spheres, having worked for Collins Stewart, West LB Panmure, James Capel and Hoare Govett. Ian is able to draw on the expertise of a 16-strong credit analysis team at CQS.

Constructed without reference to a benchmark

Constructed without reference to a benchmark

Reflecting its fixed income focus, the manager’s absolute return mindset and the diversity of its holdings, NCYF’s portfolio is not constructed with reference to any benchmark index. NCYF uses the FTSE 100 index for performance comparison purposes in its reports but its board explicitly says that this is used in the absence of a meaningful benchmark index. The performance of the MSCI UK Index has been included in this report to provide a comparison of returns. NCYF may provide both a real return (one that exceeds inflation), as well as a return that exceeds cash on deposit. Therefore, the Libor (a measure of interbank interest rates) + 3% and the UK measure of consumer price inflation (CPI) + 4% are included in this report. These are not formal benchmarks for NCYF.

Previous publications

Previous publications

Readers interested in further information about NCYF, such as investment process, fees, capital structure, life and the board, may wish to read QuotedData’s previous notes by clicking on the links.

“Conservative and boring”, initiation, published March 2018

Escalators do not go to the sky, update note, published November 2018

Same as it ever was…, annual overview, published July 2019

The legal bit

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on CQS New City High Yield Fund Limited.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.