Downing Renewables and Infrastructure Trust

Investment companies | Annual overview | 17 May 2024

Fundamental story to drive returns

By almost every measure, Downing Renewables and Infrastructure Trust (DORE) has delivered above expectations since its IPO in December 2020. A net asset value (NAV) total return of 33% over this period highlights the already strong performance of the trust and there remains significant scope for the asset value to compound further as the portfolio develops.

Negative sentiment towards renewable infrastructure and the UK market more broadly has meant this performance is yet to translate into meaningful returns for shareholders. However, given the already impressive development of the portfolio, a progressively increasing dividend, and its growth prospects going forward, we believe there is a significant opportunity for shares to re-rate.

Diversified renewable energy and infrastructure

DORE aims to provide investors with a sustainable level of income, with an element of capital growth, through a diversified portfolio of renewable energy and infrastructure assets located in the UK, Ireland and Northern Europe.

Positive progress in 2023

On 11 April, DORE released its annual results for the year ended 31 December 2023. The performance highlights both the ongoing development of the portfolio and its resilience in the face of increasingly challenging economic conditions throughout 2023.

The company saw a NAV total return of 3.5%, during a period where the average return for the renewable energy sector was negative. Operating profit was £24.7m, up 27% from the year prior, showcasing impressive profitability metrics given the portfolio is yet to fully mature. The company also announced a 7.85% increase in the target dividend for 2024, supported by a forecast cash coverage ratio of 1.35x, further highlighting the stability of its earnings.

In addition, the managers have continued to make excellent progress on the buildout of the portfolio, deploying £47m into 11 investments. This included;

- £18m into electricity grids and grid stability infrastructure projects in Sweden and the UK;

- £13m into a portfolio of 1,600 operational rooftop solar installations in the UK; and

- £16m into nine hydropower plants, including the company’s first investment in Iceland.

Operating profit was £24.7m, up 27% from the year prior

These investments, which are discussed in more detail on page 7, continue to increase the resilience and visibility of the trust’s earnings and mean the company now generates revenue from four different technology sources. With the bulk of its available capital now invested, the managers are able to shift their energy towards the development of the portfolio, with a particular focus on the optimisation of the company’s hydro assets which, as we cover in detail on page 9, are expected to add significant value going forward.

Despite the impressive results, the company’s discount to NAV continues to widen, and has fallen to 36.7% at the time of publishing. This remains difficult to reconcile given the fundamental performance of the portfolio. In response to the widening discount, the company has repurchased over £6.5m in shares since the beginning of 2023, with the managers recognising the current share price is in no way a fair reflection of its underlying value.

Market background

Power prices

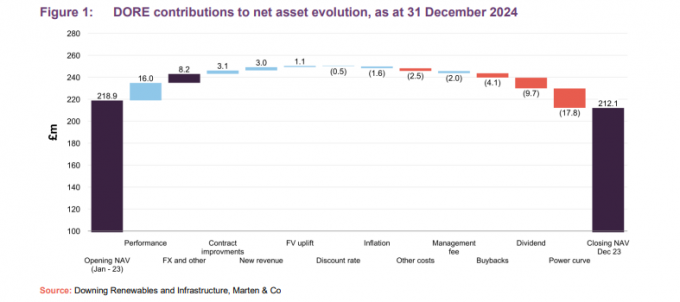

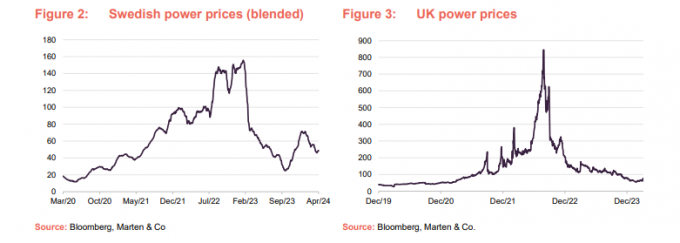

While the company was still able to deliver a positive NAV total return for the year, one of the key factors weighing on the performance of both DORE and the broader renewable energy sector is the trajectory of future power prices which are now forecast to return to normalised levels more rapidly than anticipated at the start of the year.

The fall in prices caused a 9.6pps (pence per share) drag on DORE’s NAV in 2023, by far the largest negative contributor, and the power price fall appears to have contributed towards the negative sentiment towards the sector.

With volatility increasing dramatically across energy markets over the last couple of years, (due to a range of factors including the COVID-19 epidemic and the Russian invasion of Ukraine) the managers have significantly reduced the company’s exposure to merchant pricing (taken directly from the wholesale market). Notably, they have made several new investments in non-generation assets (discussed on page 7) while identifying new markets such as Iceland where electricity producers benefit from 100% inflation-linked take-or-pay offtake arrangements with no exposure to merchant power pricing. In total, the company increased its fixed price exposure over 2023 by almost 30% and the portfolio now offers an attractive combination of highly visible baseline earnings with solid upside via hydropower capture pricing (the average price a particular project achieves over a given period of time).

Almost 50% of the company’s revenue is now fixed over the next 10 years

The impact on DORE of recent power price falls would have been significantly greater were it not for its long-term price fixing strategy, with almost 50% of the company’s forecast revenues now fixed over the next 10 years through a range of power purchases agreements (PPAs), subsidies such as feed in tariffs, and other measures. The bulk of these fixed revenue contracts are situated in the UK where the company has much less control over the output of its assets (due to the intermittent production of solar and wind assets) and is therefore more exposed to day-to-day price fluctuations. This has become especially relevant since the Russian invasion of Ukraine and the disruption this has caused to natural gas markets, which set the marginal price of power in the UK.

In comparison, DORE’s hydro assets in Sweden (and now Iceland) are able to benefit from this volatility and leverage storage capabilities to drive premiums through capture pricing – these assets operate much like a battery, allowing hydro plants to capture periods of higher power prices (such as times when wind resources are not available), but crucially they can discharge power for a much longer period than a conventional lithium-ion battery could.

Inflation – a net positive

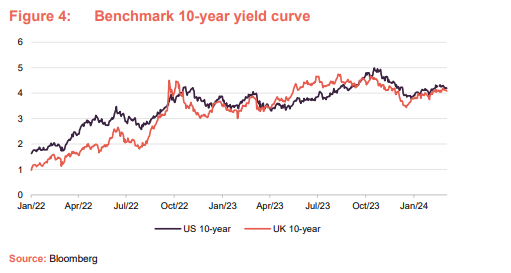

Falling power prices remain a relatively recent phenomenon and should have a progressively lower impact on the company’s bottom line going forward. However, the effects of rising interest rates have been much longer lasting.

In total, the company increased its fixed price exposure over 2023 by almost 30%

In addition to the direct financial impact of rising discount rates and the dramatic increase in financing costs, one of the most significant challenges faced by DORE and the renewable energy sector has been the renewed appeal of money market funds (high quality, short term debt) and risk-free government debt. With yields persisting between 4-5%, premiums traditionally offered by high yielding renewables all but vanished, while more defensive market positioning saw significant flows away from sectors where capital was deemed more at risk.

In many cases however, this proved to be a misconception, particularly in the UK where renewable energy subsidy contracts are linked to the RPI. The net effect was that for DORE, rising inflation actually had a positive impact on its NAV. In addition, the company’s diverse revenue base meant that earnings have continued to grow, allowing dividend payout growth to comfortably outstrip inflation, as shown by the almost 8% increase in target dividend for 2024.

The company’s diverse revenue base has meant that earnings have continued to grow

Positively, for trusts such as DORE which have been able to navigate these challenges without suffering any significant financial mishaps, the upside appears significant as economic conditions improve and yield premiums re-establish, driven by underlying portfolio growth.

Asset allocation

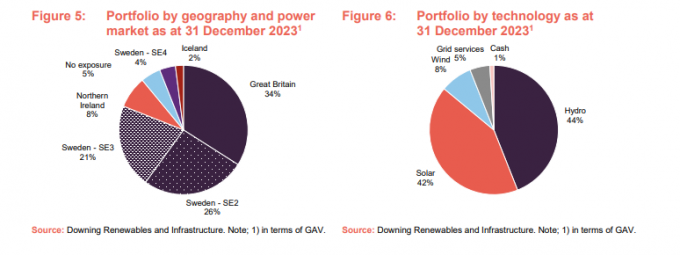

DORE has been steadily building out its portfolio across a diverse range of assets since its IPO in December 2020. As Figures 5 and 6 show, the bulk of the portfolio is now invested in hydropower and solar with the balance in wind and grid services. This spans a geographical footprint across Great Britain, Sweden, Iceland, and Northern Ireland. In total this represents 203 MW of installed capacity with expected annual generation of around 424 GWh.

Recent investment activity

Over the past 12 months the manager successfully deployed £47m in capital

As noted, the managers have remained proactive in the development of the portfolio over the past 12 months despite broader economic challenges, successfully deploying £47m in capital in 2023. Notably, the company added a new geographical segment with its first investment in Iceland, while also adding additional technological exposure with its investment in a UK shunt reactor (discussed on page 8) and Swedish grid infrastructure operator. The company also made significant additions to its solar assets in the UK.

Icelandic hydro

In December 2023, DORE acquired its first Icelandic asset, Urðafellsvirkjun, an 8 GWh (1.1 MW) hydropower plant located in south-central Iceland, for £5.0m. The asset is the first of what the managers believe could be a series of lucrative opportunities in the region, particularly given the availability of attractive long term offtake contracts for generating assets. The Urðafellsvirkjun plant adds long-term, fixed price, inflation-linked revenues to its portfolio, reducing the proportion of the company’s revenues that are exposed to variable power prices.

Discussing the acquisition, the managers note Iceland’s unique energy market which is shaped by abundant renewable energy resources, primarily geothermal and hydroelectric power, making it one of the cleanest and most sustainable energy markets globally.

Given the increasing demands of the energy transition and the intermittency challenges associated with solar and wind power, the ability to supply consistent, low-cost electricity is an attractive proposition. These conditions continue to attract energy-intensive industrial consumers ranging from aluminium production to data centre relocation. As a result, Iceland now has the highest per capita generation/ consumption of renewable energy in Europe, and the managers of DORE see a significant and lucrative opportunity to increase exposure to the region as capacity increases.

Grid infrastructure

In June, DORE signed an agreement to acquire a UK-based, fully operational 200 MVAr shunt reactor for c.£11m

In June, DORE signed an agreement to acquire a UK-based, fully operational 200 MVAr shunt reactor for c.£11m, which was approved by the regulator in October 2023. The asset, the first of the company’s grid infrastructure investments, helps support the UK’s electricity system in voltage management, providing increased network resilience, reducing costs to consumers, and lowering carbon emissions. It has an initial fixed priced, inflation-linked, availability-based contract with National Grid ESO until 2031, reducing DORE’s exposure to generation assets.

In July, DORE acquired Swedish grid infrastructure Operator, Blåsjön Nät AB for £8.5m

In July, DORE acquired Swedish grid infrastructure operator, Blåsjön Nät AB for £8.5m, the company’s second acquisition in the grid and grid stability services sector. The investment further supports its strategy of constructing a diversified portfolio designed to increase the stability of revenues and consistency of income to shareholders.

Blåsjön is a regulated electricity distributor which delivers 16-18 GWh per annum of electricity through medium and low voltage lines to its c.1,500 domestic and business customers in Strömsund, northern Sweden. Its revenues are set by the Swedish regulator, providing consistent, predictable cashflows that are correlated to Swedish inflation and interest rates. Its assets are also very long life (which tend not to be steadily depreciated) and are expected to operate and generate substantial yields for generations.

The managers have committed significant resources to the investigation of grid and grid infrastructure projects, viewing it as an attractive sector for DORE and one which they believe has huge potential to unlock value.

Hydropower buildout and optimisation

In addition to its recent investments, DORE continues to invest in the buildout and optimisation of its hydropower assets. This has been a major focus for the managers and appears to be an increasingly attractive and unique opportunity to drive long term value in the portfolio. As we have discussed in detail in previous notes, DORE’s managers have identified a lucrative niche developing smaller, long life hydro plants across Sweden (with the potential to expand the geographical footprint as evidenced by the recent Icelandic investment). Its strategy has focused on acquiring standalone hydro assets which can then benefit from the network effects of the broader DORE portfolio. In many cases, these individual assets attract limited interest from other investors, with the relatively uncompetitive market then providing excellent value for DORE.

DORE is able to leverage the storage capability of its hydropower plants which can operate much like a battery energy storage system

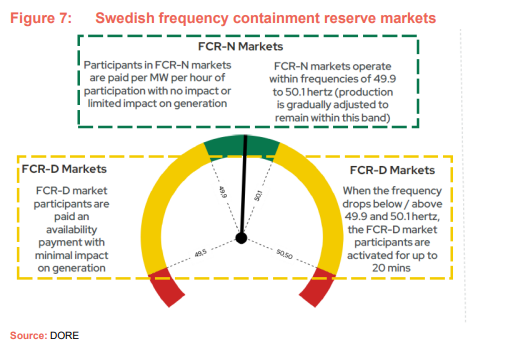

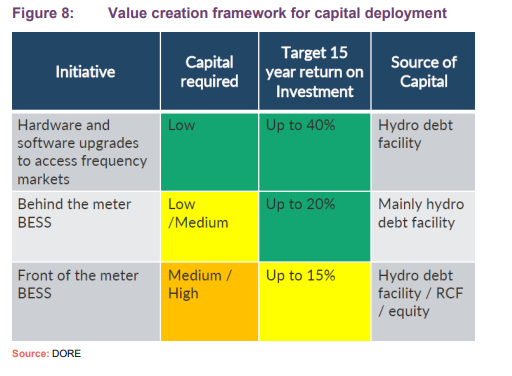

While the fundamental opportunity is an attractive one, the real opportunity exists through the modernisation programme implemented by DORE. The company has built out significant technological and intellectual expertise, developing its collection of individual hydro assets into a centrally operated system. Through a range of software and hardware upgrades, this system will allow the company to regulate its power production to such an extent that it can bid to participate in Sweden’s lucrative frequency containment reserve (FCR) market. These markets have become increasingly attractive, helping to stabilise the increased intermittency of energy production due to Sweden’s reliance on generation from renewables such as wind and solar.

DORE is essentially able to leverage the storage capability of its hydropower plants which can operate much like a battery energy storage system (BESS). Once upgraded, these systems mean hydropower production can be adjusted relatively quickly (up or down) to assist in stabilising the grid, allowing DORE to capture intraday as well as seasonal variations in power prices.

It is now anticipated that the first of the Swedish hydropower plants will be able to participate in the FCR markets by Q2 2024

The company continues to develop the additional functionality required to participate in these markets, and it is now anticipated that the first of the Swedish hydropower plants will be able to participate in the second quarter of 2024.

In addition to the potential value add from the ongoing optimisation, the manager notes that these hydro plants are valued on a perpetual life basis due to the nature of the asset class which includes the ownership of the land. This differs from assets such as solar and wind which are generally depreciated over their useful life, meaning, for example, in 30 years’ time they will be worth nothing, while the value of the hydro assets will most likely have increased.

DORE has also identified a significant pipeline of opportunities related to its hydro investments including bolt on investments and further geographic diversification. The co-location of BESS systems at existing hydro plants is also possible. In many cases, this could be achieved “behind the meter”; not requiring material changes to existing grid connection agreements, while also utilising existing fixed assets, greatly reducing the development risk and costs of any investments.

The co-location of BESS systems at existing hydro plants is also possible

Performance

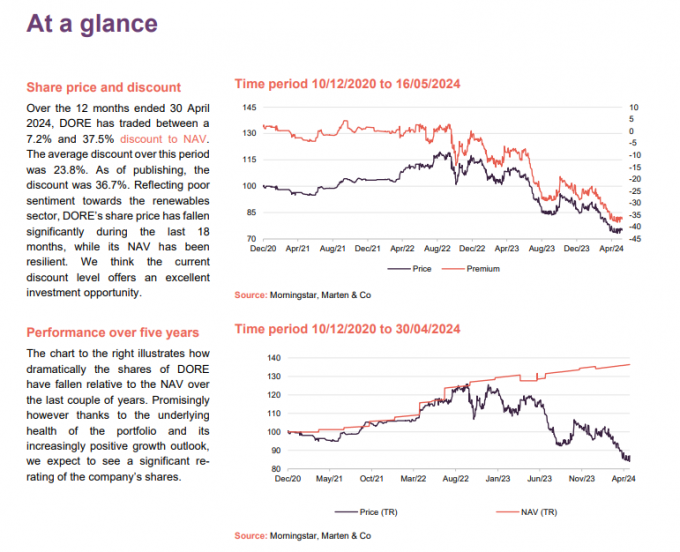

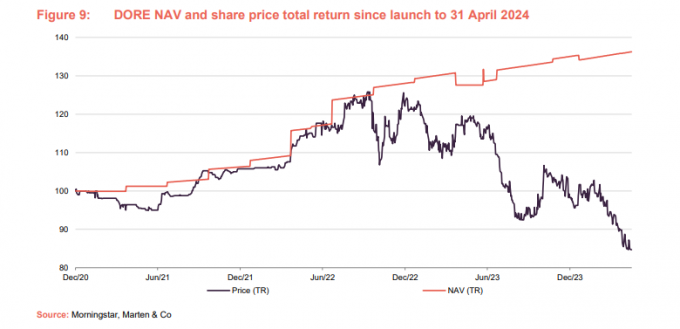

Figure 9 illustrates how dramatically the shares of DORE have fallen relative to the NAV over the last couple of years. In many cases, a degree of repricing was justified given the extent of the inflation surge and the ensuing tightening of monetary policy (rising interest rates) which took place over 2022 and 2023. As discussed, additional pressure from energy market volatility and an underperforming UK economy has created further headwinds, while the cost disclosure issues affecting the entire investment companies market, which we have written about in detail on our website, provide another layer of uncertainty. However, the magnitude of the current sell-off is now well past the mechanical impact of these events. This is especially true when considering the ongoing execution of the DORE managers regarding both the build out of the portfolio and its already impressive fundamental performance.

The silver lining for investors is that many of these factors are now trending in a positive direction. Inflation and interest rates appear to be falling, economic growth in the UK is staging a steady recovery, and we are much closer to the end than the beginning regarding the long overdue reforms for trust cost disclosure.

Considering the underlying health of the DORE portfolio and its increasingly positive growth outlook, we expect that the improving conditions will lead to a significant re-rating of the company’s shares. Promisingly, when swings in sentiment have occurred in the past, this has happened quickly, as witnessed during the rally towards the end of 2023, where DORE’s shares jumped 12% in just a handful of days.

Peer group

Up to date information on DORE and its peer group is available on the QuotedData website

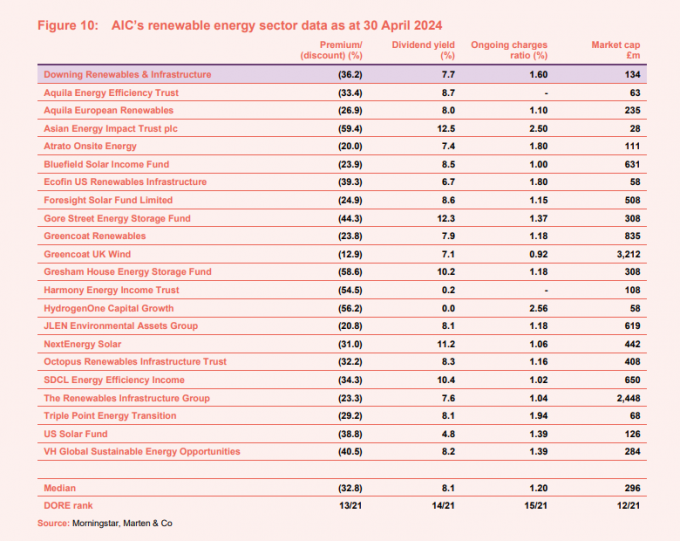

DORE is a constituent of the AIC’s renewable energy sector which holds a diverse section of funds ranging from growth orientated companies such as green hydrogen technology, to more conservative energy utilities. DORE sits towards the centre of the spectrum with its focus on delivering sustainable income with an element of capital growth. Both its discount and dividend yield sit roughly in line with the sector median.

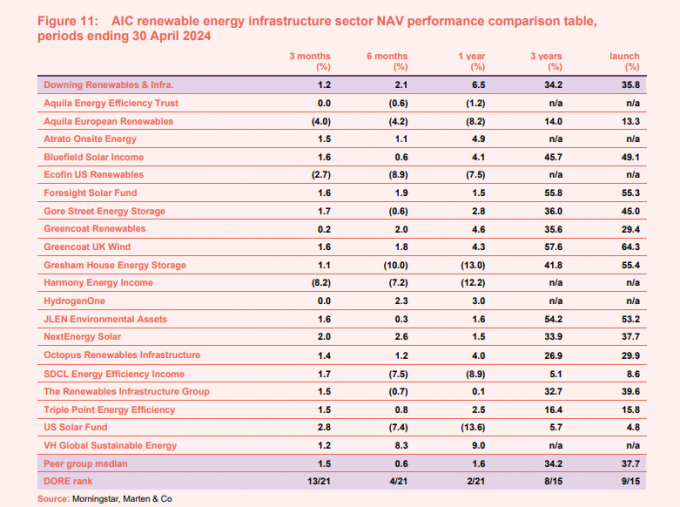

In Figure 11, we have excluded Asia Energy Impact, which was suspended for many months and has now decided to implement a managed wind down.

As Figure 11 shows, DORE’s NAV growth over the past year has been one of the best in the sector. This highlights the fundamental resilience of the portfolio while also hinting at its longer-term potential as the company’s assets mature and its optimisation strategy beds in. Longer term, performance is roughly in line with the peer group median, a reasonable return given the age of the portfolio.

Dividend

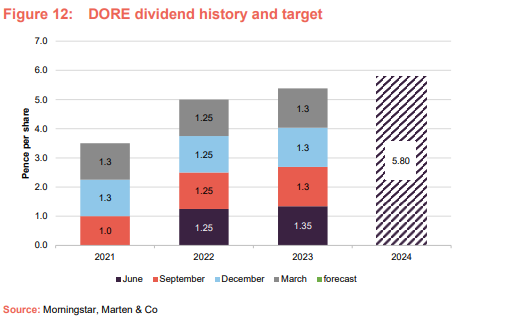

DORE paid a total dividend of 5.38 pence during its 2023 financial year, made up of four quarterly payments. This was in line with its target at the beginning of the year. Its cash dividend cover was 1.21x (2022: 1.17x), which increases to 1.78x when measured using pre debt service cashflows.

DORE is targeting a dividend payout of 5.80 pence per share in 2024, a 7.85% increase

The company is targeting a dividend payout of 5.80 pence per share in 2024, a 7.85% increase, reflecting improving cashflow generation from the portfolio as the assets mature. The increased dividend is expected to be covered by cash in excess of 1.35x.

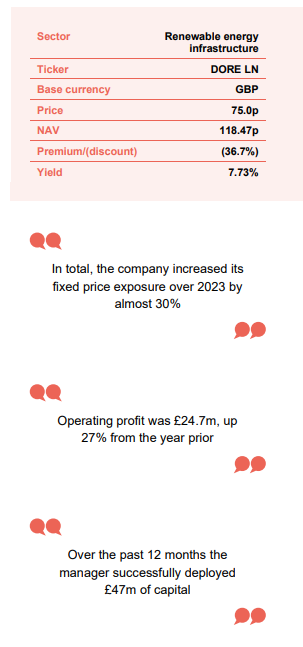

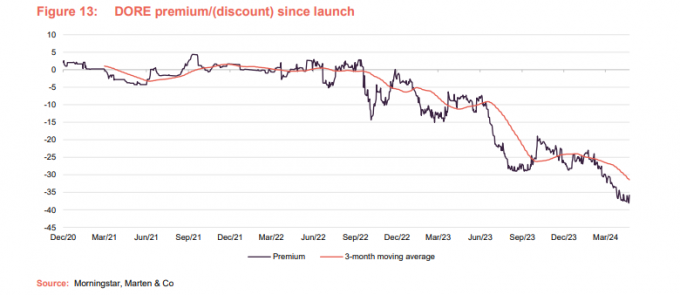

Premium/(discount)

Over the 12 months ended 30 April 2024, DORE has traded between a 7.2% and 37.5% discount to NAV. The average discount to NAV over this period was 23.8%. As of publishing, the discount was 36.7%.

As discussed throughout this note, the current discount is not a fair reflection of the underlying quality of the DORE trust and appears to be driven by several external factors outside the company’s control. Given current market dynamics, it is unclear how long this will persist however investors should be reassured that the company remains well insulated from much of the broader volatility and continues to make excellent progress towards its long-term targets. Fundamental execution remains well ahead of the levels expected at IPO, and we firmly believe investor patience will be rewarded going forward with the current level of discount offering an excellent investment opportunity.

As of 30 April 2024, the company has repurchased £6.5m shares

The company has taken steps to address the level of the current discount, repurchasing 4,375,363 shares over the course of 2023, and an additional 3,019,899 post year end, to 30 April 2024, for a total of £6.5m. The company has balanced these purchases against ongoing acquisitions and revenue optimisation initiatives.

Gearing and hedging

As at 31 December 2023, DORE’s total gearing (borrowing – expressed as a loan to value ratio) was 40%, up from 30% in 2022. The company has access to a £40m revolving credit facility (RCF) of which £18.6m is drawn. There are two additional long term debt facilities at asset level, a £78.8m facility which is fully drawn and a €68.5m facility of which €49.4m was drawn as at 31 December 2023. In total, the sterling value of debt was £140m at 31 December 2023.

The weighted average cost of debt across the borrowings is 2.5% with all of its asset level debt fixed. The RCF which has a floating rate makes up less than 6% of gross asset value (GAV), therefore the company is not considered to be materially exposed to interest rate risk.

Fund profile

More information is available on the fund’s website at www.doretrust.com

DORE aims to provide investors with an attractive and sustainable level of income returns, with an element of capital growth, by investing in a diversified portfolio of renewable energy and infrastructure assets located in the UK, Ireland, and Northern Europe.

The company aims to accelerate the transition to net zero through its investments. DORE believes that its actions should directly contribute toward climate change mitigation.

DORE’s strategy focuses on diversification by geography, technology, revenue and project stage

The strategy focuses on diversification by geography, technology, revenue, and project stage. The investment manager believes that by investing in a range of renewable energy sources, DORE can reduce the seasonal volatility of revenues and reduce dependency on any single technology to provide more consistent income. There may also be some investments in other infrastructure, whose principal revenues are not derived from energy generation, thus reducing DORE’s exposure to merchant power prices. In addition, diversifying the portfolio geographically should help reduce the portfolio’s regulatory and political risk.

The portfolio will also blend operational projects with construction-ready projects and those under construction. The manager says that investment in construction-phase projects offers the potential for higher returns. The amount invested in construction-ready assets or assets under construction will be limited to 35% of gross asset value, as construction projects tend to have more risk associated with them. The company will not acquire assets that are not construction-ready.

From launch to end April 2022, DORE has generated annualised returns of 9.9% in share price terms and 11.4% in NAV terms, well ahead of target

DORE is targeting a NAV total return of 6.5% to 7.5% per annum over the medium to long term. From launch to end April 2024, DORE has generated annualised returns of 9.9% in share price terms and 11.4% in NAV terms, well ahead of target.

DORE’s AIFM is JTC Global AIFM Solutions Limited. It has delegated portfolio management services to the investment manager Downing LLP (Downing or the manager). Downing had assets under management of over £2bn at December 2023, and an extensive team of investment and asset management specialists focused exclusively on energy and infrastructure transactions.

DORE raised £122.5m at IPO and topped that up in October 2021 with a £14.9m issue of shares at 102.5p.

Previous publications

Readers interested in further information about DORE may wish to read our previous notes (details are provided in Figure 14 below).

Figure 14: QuotedData’s previously published notes on DORE

| Title | Note type | Date |

| Targeting attractive and sustainable income returns | Initiation | 20 November 2020 |

| Ahead of expectations | Update | 4 August 2021 |

| Proving its mettle | Annual overview | 24 May 2022 |

| Powering ahead | Update | 14 November 2023 |

Source: Marten & Co

IMPORTANT INFORMATION

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Downing Renewables and Infrastructure Trust.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it. Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.