Ecofin US Renewables Infrastructure Trust

Investment companies | Update | 6 September 2023

Storm damage reparable

Ecofin US Renewables (RNEW) has been impacted by tornado damage to a substation in Texas, cutting off its wind farm’s connection to the local power grid. This is going to act as a temporary constraint on cash flows generated by this particular investment. As we explain on page 4, insurance will cover much of the loss. Nevertheless, the board has prudently reduced the company’s dividend for the third and fourth quarter of 2023.

Unsurprisingly, this has impacted on the company’s efforts to narrow its excessive discount to net asset value (NAV). However, solutions have already been identified to address much of the revenue shortfall and, once RNEW has put this behind it, there may be opportunities to boost income meaningfully by repowering the wind farm. That reinforces our belief that RNEW is meaningfully undervalued.

Long-term, progressive income from diversified portfolio of US renewables

RNEW aims to provide its shareholders with an attractive level of current distributions by investing in a diversified portfolio of mixed renewable energy and sustainable infrastructure assets predominantly located in the United States with prospects for modest capital appreciation over the long term.

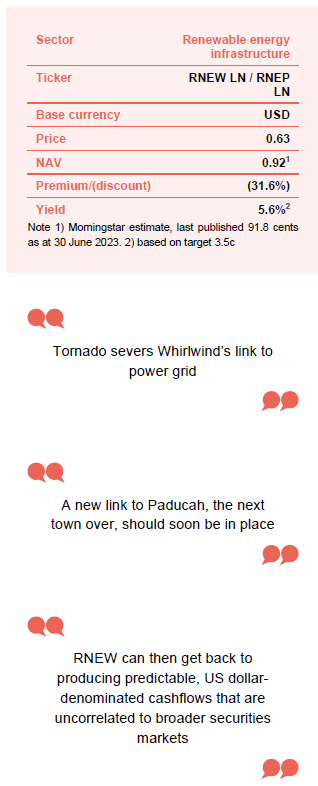

At a glance

Whirlwind – unhelpful irony

Whirlwind is a 59.8MW Texan wind farm that has been operating since December 2007. The site has 26 Siemens 2.3MW wind turbine generators. Operations and maintenance are performed by Siemens Gamesa under a long-term service and maintenance agreement. Whirlwind benefits from a fixed-price power purchase agreement with Austin Energy, an investment grade electric utility, which has about four and a half years left to run.

In October 2021, RNEW announced that it had made a contractual commitment to acquire Whirlwind for US$49m. For RNEW, part of the attraction of the asset was sustained growth in electricity demand within Texas due to population growth and corporations migrating to this business-friendly state. RNEW also saw an opportunity to re-power the site with larger more efficient turbines. As at 31 March 2023, Whirlwind represented 38% of RNEW’s NAV.

Tornado impact

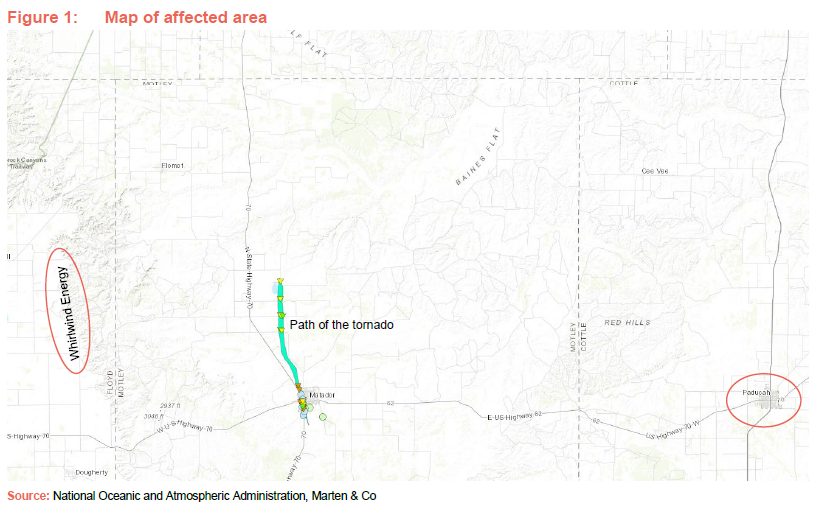

On 21 June 2023, a tornado with a width of a third of a mile and peak wind gusts of 145–165mph hit Matador, Texas, killing four people and injuring 15 others, making it the deadliest Texan storm since 2015.

Tornado severs link to power grid.

The tornado brought down the last five poles in RNEW’s transmission line that linked Whirlwind to the substation in Matador, but it also destroyed that substation, severing Whirlwind’s link to the local power grid. RNEW was forced to declare a force majeure event with Austin Energy.

New link to Paducah, the next town over.

American Electric Power (AEP), which owns the Matador substation, wants to rebuild it, but upgrade it at the same time. That process will take about 18 months, rather than the 9–12 months that RNEW was expecting for a straightforward replacement. In the meantime, AEP has offered to connect Whirlwind via an alternative route that runs past Matador to a substation in Paducah, the next town over (about 30 miles further east). That could be achieved before the end of the year (it involves a relatively short connection to an existing line to Paducah, but requires the installation of some extra switching and relay equipment). However, the maximum output that it can handle is 50 MW, and this will impact on RNEW’s cash flows.

The company and its insurance provider are working together to file claims, where applicable, for business interruption and necessary repairs to the damaged project-owned transmission poles. The claims are yet to be finalised with the insurers, but it is expected that the insurance policy will provide coverage, at a minimum, for both the damaged transmission poles and for 120 days of business interruption losses that occur from outages (following a 45-day waiting period).

45 days from 21 June takes us to 5 August. 120 days from then takes us to 3 December 2023. It looks, therefore, as though the likely hit to overall cashflows will reflect just the 45-day waiting period, plus the 18-month curtailment. Whirlwind’s output was curtailed somewhat during 2022 anyway, as excessive generation threatened to overload the grid.

The impact of this on RNEW’s NAV is discussed on page 8.

Other operations

The remainder of RNEW’s portfolio appears to be operating reasonably well, with one exception.

In its end-June NAV announcement, RNEW referred to an adverse impact attributed to partial downtime at one of its solar assets for extended corrective maintenance, which was expected to be remedied during the third quarter of 2023.

This was a problem with a rodent infestation at one solar farm – they were chewing through wires, and this was causing short-circuits and power interruptions. The manager feels that the local operations and maintenance provider should have picked this up and dealt with the problem sooner than it did. The relationship with the operations and maintenance provider is under review.

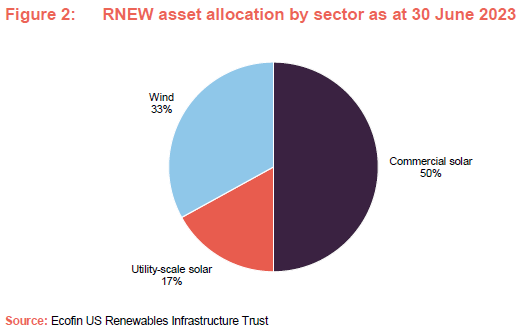

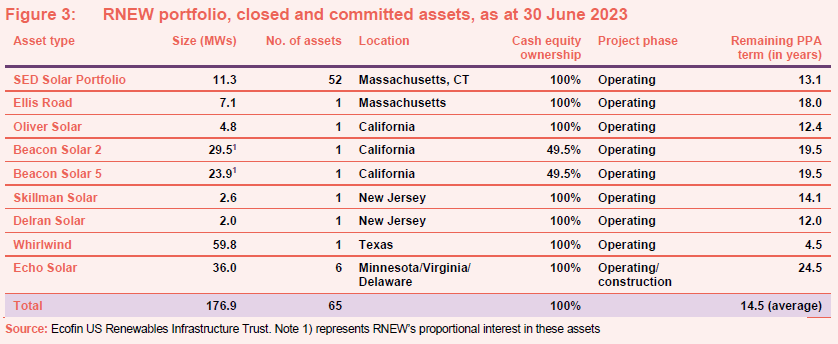

Asset allocation

At 30 June 2023, RNEW’s portfolio comprised 65 projects spread across eight American states with a total capacity of 177MW. All of RNEW’s portfolio is operational with the exception of four of the six Echo Solar projects, whose construction has been completed and will commence commercial operations over the course of the third quarter of 2023. The company said recently that several tax equity milestone fundings (see page 12 of our last note for an explanation of typical project structures used by RNEW) were completed over the second quarter of 2023, and that it was nearing completion of a back-leverage debt facility for these projects (see financing on the next page).

Financing

RNEW has a US$65m revolving credit facility with KeyBank. RNEW recently amended and extended this facility which now comprises:

- a US$50m tranche expiring in October 2024 at SOFR + 2.00% to 18 October 2023 and SOFR + 2.125% thereafter; and

- a US$15m tranche expiring in October 2025 at SOFR + 2.25% to 18 October 2023 and SOFR + 2.375% thereafter.

At 1 September, following a tax equity funding on the Echo Solar portfolio, RNEW had drawn down US$28.8m of the revolving credit facility. This equates to a loan to value ratio of 18.5%.

Performance

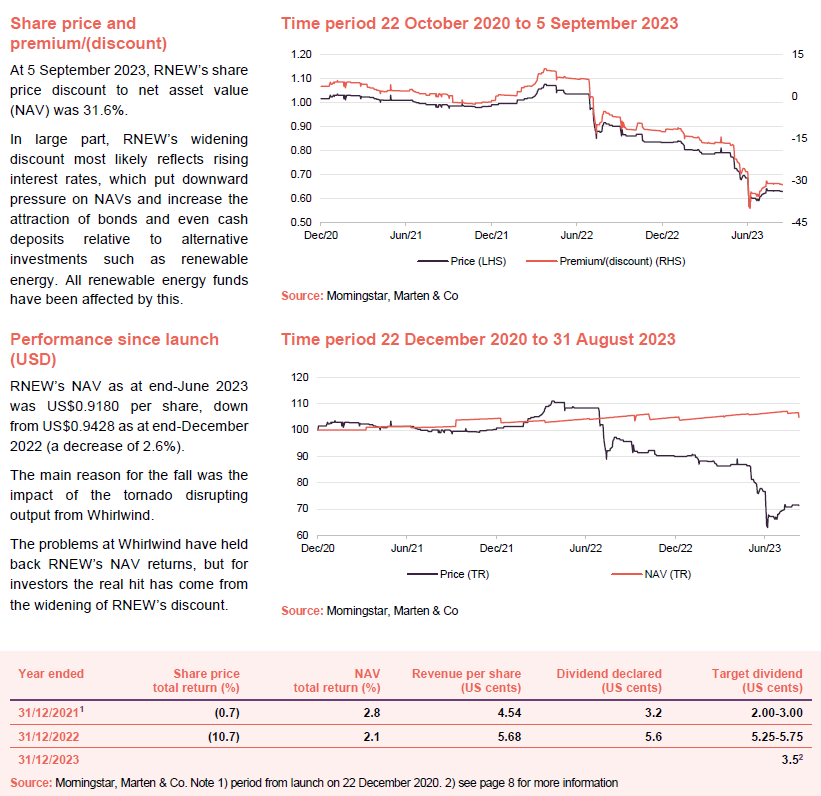

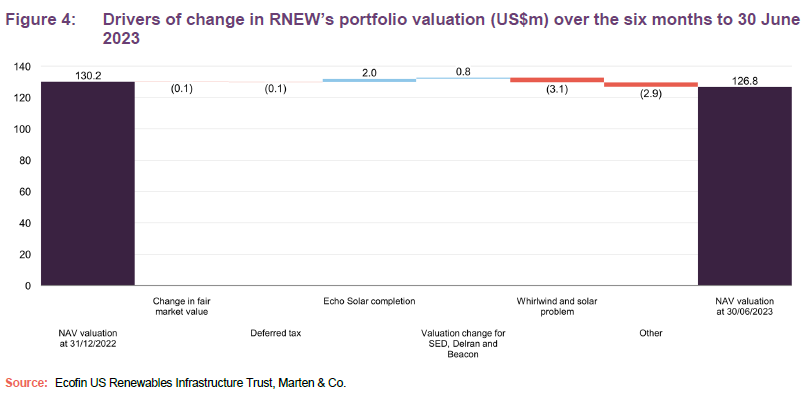

On 7 August 2023, RNEW announced that its NAV as at end-June 2023 was US$0.9180 per share, down from US$0.9428 as at end-December 2022. Figure 4 shows the drivers of the change in the NAV over the six months ended 30 June 2023.

The net change in fair market value of -US$0.1m over the first half of 2023 reflects, amongst other things, uplifts in merchant curve power prices in the first quarter, the normal roll-off of distributable cash flows in the discounted cash flow calculation and debt amortisation at Beacon Solar 2 and 5.

The commissioning of Echo Solar projects that were previously under construction provided a boost to the NAV. The discount rates applied to the SED Solar and Delran Solar projects were reduced to bring them into line with the rest of the operational solar portfolio. At Beacon Solar 2 and 5, forecast merchant power prices were updated.

The major negative impact on the NAV came from the problems at Whirlwind and the corrective maintenance needed at the solar project described above. We note that the US$3.1m overall hit from these factors is an order of magnitude less than the hit to US Solar’s market cap, which is US$29m lower than when we last published.

Ironically, one other contributing factor to the NAV fall was lower-than-expected wind resource at Whirlwind. RNEW says that this was a nationwide problem, but we note that wind farms in Europe have been similarly affected.

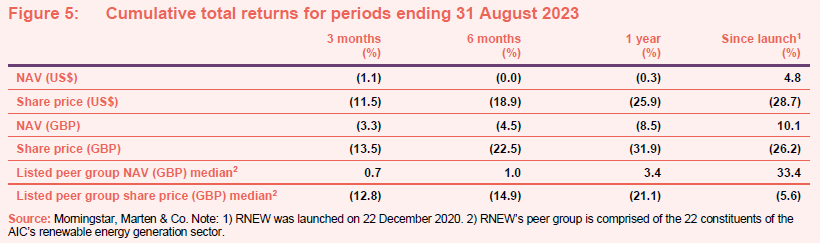

The problems at Whirlwind have held back RNEW’s NAV returns, but for investors the real hit has come from the widening of RNEW’s discount.

Dividend

RNEW pays quarterly dividends in May, August, November and February in respect of its calendar year accounting periods.

2023 dividend target reduced to 3.5 cents.

RNEW was targeting a full-year dividend for the current financial year of between 5.25 and 5.75 cents per share. However, the board had to respond to the cash flow impact of Whirlwind and has chosen to declare a reduced dividend of 0.70 cents per share in respect of the quarter ending 30 June 2023 (half the US$1.40 quarterly payments that it was making). This level of quarterly dividend is expected to be maintained for each of the quarters ending 30 September 2023 and 31 December 2023. In total, this implies a dividend target of 3.5 cents per share for the 2023 financial year.

The board says that it is conscious of the importance of dividend income to shareholders, and it will look to see if it and the manager can work together to cut costs to improve net income.

Premium/(discount)

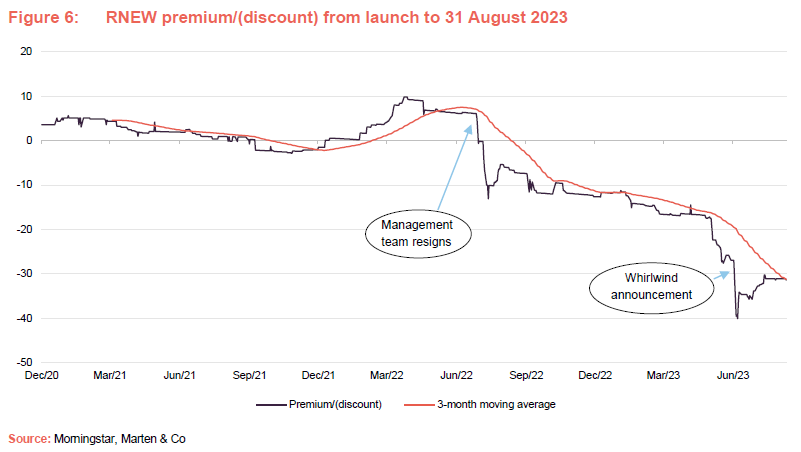

Over the 12 months ended 31 August 2023, RNEW’s shares traded between a 40.1% discount to NAV and 6.6% discount, with an average of 17.8%. At 5 September 2023, RNEW’s discount was 31.6%.

In large part, RNEW’s widening discount most likely reflects rising interest rates, which put downward pressure on NAVs and increase the attraction of bonds and even cash deposits relative to alternative investments such as renewable energy. All renewable energy funds have been affected by this.

In Figure 6, the impact on RNEW’s premium of the resignation of the previous management team is obvious, but – as yet – the market has not given RNEW any credit for the recruitment of a highly credible replacement.

The impact of the problems at Whirlwind is obvious too. However, we feel that the negative reaction is overdone.

Fund profile

You can access the fund’s website at: uk.ecofininvest.com/funds/ecofin-us-renewables-infrastructure-trust-plc.

RNEW is an investment company that was established to invest in a diversified portfolio of renewable assets. Predominantly, these are in the United States, but it may also invest up to 15% of gross assets in other OECD countries. The company is being managed to qualify as an investment trust. Since 20 December 2020, RNEW has had a premium listing on the main market of the London Stock Exchange.

RNEW’s principal focus is on solar photovoltaic (including ground-mount utility scale and commercial rooftop solar, but excluding residential) and onshore wind. Within these target sectors, RNEW’s focus is on the middle market segment (avoiding very large and very small projects), where Ecofin feels that the balance of risk and reward is optimised. Solar and wind assets will account for at least 90% of RNEW’s portfolio. However, RNEW is also permitted to invest up to 10% of its portfolio in battery storage, biomass, hydroelectric and microgrids, water and waste-water and related renewable assets.

The power generated by RNEW’s investments is sold predominantly under long-term fixed-price power purchase agreements (PPAs) to investment-grade quality purchasers. This helps to give RNEW predictable, US dollar-denominated cashflows that are uncorrelated to broader securities markets.

Strong ESG credentials

RNEW is an Article 9 Fund.

RNEW is an Article 9 Fund under SFDR, is aligned with the TCFD framework, and aims to achieve positive impacts that align with five of the UN’s Sustainable Development Goals by addressing pressing global issues surrounding climate action, clean energy, decent work and economic growth, industry innovation and infrastructure, and sustainable communities.

The company’s functional currency is US dollars, but if they choose, investors may hold shares that are quoted in and pay their dividends in sterling (ticker RNEP), which have the same legal status as the dollar shares.

Ecofin Advisors LLC – the manager

RNEW’s investment manager and AIFM is Ecofin Advisors LLC (Ecofin), which is headquartered in Overland Park, Kansas. That and Ecofin Advisors Limited, manager of Ecofin Global Utilities and Infrastructure, are indirect wholly-owned subsidiaries of TortoiseEcofin Investments LLC, a privately-owned US-based firm with offices across the US and in London, which owns a family of investment management companies. At the end of June 2023, TortoiseEcofin had approximately US$9.1bn of client funds under management.

Ecofin’s mission is to generate strong risk-adjusted returns while optimising investors’ impact on environment, society and in its communities.

Previous publications

Readers may wish to view our earlier notes on RNEW. These are available through our website or by clicking the links in Figure 7.

Figure 7: Previously published notes on RNEW

| Title | Type of note | Publication date |

| Sunny outlook | Initiation | 18 May 2021 |

| Clear path to growth | Update | 25 March 2022 |

| Back on track | Annual overview | 26 January 2023 |

Source: Marten & Co

Legal

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Ecofin US Renewables Infrastructure Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.