Ecofin US Renewables Infrastructure Trust

Investment companies | Annual overview | 26 January 2023

Back on track

Ecofin US Renewables Infrastructure Trust (RNEW) moved from a premium to a discount in July 2022 as the original fund management team resigned. The portfolio assembled is solid, performing well and delivering on expectations. A new fund management team, led by Eileen Fargis, is now in place and the opportunity available to RNEW is considerable.

We believe that the trust’s predictable US dollar-denominated cash flows (which are also uncorrelated with equity markets) and high yield are attractive to investors. The shares should be re-rated, and the fund should continue to grow.

Long-term, progressive income from diversified portfolio of US renewables

RNEW aims to provide its shareholders with an attractive level of current distributions by investing in a diversified portfolio of mixed renewable energy and sustainable infrastructure assets predominantly located in the United States with prospects for modest capital appreciation over the long term.

New management team

RNEW’s future looked rosy at 30 June 2022 – and still does – but investors were unnerved when the previous management team walked out.

At 30 June 2022, the halfway mark in RNEW’s financial year, its shares were trading at a healthy premium; a portfolio of 62 (now 65) assets spread across seven (now eight) US states with a total generating capacity of 162 MW (now 177MW); returns and dividends were on track; and the Inflation Reduction Act – which should help underpin considerable growth in RNEW’s sector for many years to come – was on the verge of approval (it was signed into law on 16 August – see page 7). In short, the future for RNEW looked rosy.

However, on 19 July 2022, the investment management team of Jerry Polacek, Matthew Ordway and Prashanth Prakash walked away from the management company and RNEW’s share price fell sharply.

No reason why the discount should not close now.

It was perhaps reasonable that investors were unnerved by the announcement, although even at the time, the share price reaction looked overdone given that the asset management team (which ensures the smooth running of the existing portfolio) remained in place. Now, though, a new leadership team is in charge, and we see no reason why the shares should not move back to trading at a premium and the growth of the fund resume.

Eileen Fargis – experienced portfolio manager now in place

Eileen Fargis took on the job of Ecofin group lead and portfolio manager for RNEW with effect from 24 October 2022, becoming one of 21 investment professionals working on Ecofin’s private sustainable infrastructure team, which includes Ed Russell, senior managing director of Ecofin, and Jason Benson, director of private renewable energy at Ecofin.

Eileen Fargis has over 20 years’ industry experience.

Eileen has over 20 years’ industry experience, most recently as head of investments for InterEnergy Holdings, an independent developer, owner, and operator of 2.1 GW of energy generation assets and a utility in the Caribbean and Latin America. She is also the former co-head of the $1bn IFC African, Latin American and Caribbean Fund LP, a private equity fund.

Eileen started her career in energy and infrastructure with Skadden Arps and spent nine years at GE Capital Markets, GE Energy Financial Services and GE Structured Finance. She is a graduate of Hamilton College and the John Hopkins School of Advanced International Studies.

Eillen Fargis interview on 27 January 2023 weekly show.

James Carthew will be interviewing Eileen on QuotedData’s weekly show on 27 January 2023 at 11am. Viewers will be able to put questions to Eileen and a recording of the interview will be available on the QuotedData website and our YouTube channel following the show.

Why RNEW?

You can access the fund’s website at: uk.ecofininvest.com/funds/ecofin-us-renewables-infrastructure-trust-plc.

RNEW is an investment company that has been established to invest in a diversified portfolio of renewable assets. Predominantly, these will be in the United States, but it may also invest up to 15% of gross assets in other OECD countries. The company is being managed to qualify as an investment trust. Since 20 December 2020, RNEW has had a premium listing on the main market of the London Stock Exchange.

RNEW’s principal focus is on solar PV (including ground-mount utility scale and commercial rooftop solar but excluding residential) and onshore wind. Within these target sectors, RNEW’s focus is on the middle market segment (see page 9). Solar and wind assets will account for at least 90% of RNEW’s portfolio. However, RNEW is also permitted to invest up to 10% of its portfolio in battery storage, biomass, hydroelectric and microgrids, water and waste-water and related renewable assets.

Soon to be a unique play on the US renewables market

Likely the only fund offering pure play exposure to the wider renewable energy generation industry in the US.

Of the 22 funds in the AIC’s renewable energy infrastructure sector (see page 19), only two are focused exclusively on the vast US renewable energy generation industry, and the other has, for reasons that we find hard to fathom, launched a strategic review which may result in it being taken over. This will likely leave RNEW as a unique pure play on the considerable opportunity presented by the US renewables market (described from page 6 onwards).

Virtually 100% of the power generated by RNEW’s investments is sold under long-term fixed-price power purchase agreements (PPAs) to investment-grade quality purchasers. This helps to give RNEW predictable, US dollar-denominated cashflows that are uncorrelated to broader securities markets.

Strong ESG credentials

RNEW is an Article 9 Fund.

RNEW is an Article 9 Fund under SFDR, is aligned with the TCFD framework, and aims to achieve positive impacts that align with five of the UN’s Sustainable Development Goals by addressing pressing global issues surrounding climate action, clean energy, decent work and economic growth, industry innovation and infrastructure, and sustainable communities. More information about the way that RNEW addresses issues of sustainability is available on page 13.

The company’s functional currency is US dollars but, if they choose, investors may hold shares that are quoted in and pay their dividends in sterling (ticker RNEP), which have the same legal status as the dollar shares.

Ecofin Advisors LLC – the manager

RNEW’s investment manager and AIFM is Ecofin Advisors LLC (Ecofin), which is headquartered in Overland Park, Kansas. That and Ecofin Advisors Limited, manager of Ecofin Global Utilities and Infrastructure, are indirect wholly-owned subsidiaries of TortoiseEcofin Investments LLC, an $8.8bn AUM business with offices across the US and in London. The two subsidiaries had $1.9bn of AUM between them at the end of September 2022.

Ecofin’s mission is to generate strong risk-adjusted returns while optimising investors’ impact on environment, society and in its communities.

Market background

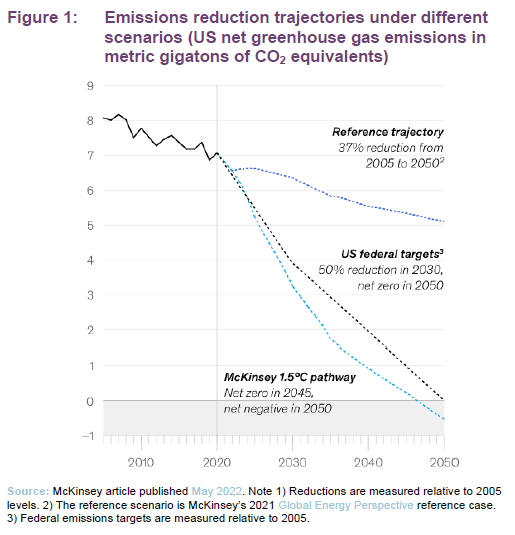

In 2016, under the Paris Agreement, the US was one of a number of countries that pledged to achieve net zero carbon emissions by 2050 and it is also targeting a 50% reduction in 2005 levels of greenhouse gas emissions by 2030. President Trump gave notice to withdraw from the Agreement (which did not take effect until after he left office), but the process of decarbonising the US economy continued through the Trump era, and under President Biden the US formally re-entered the Agreement in January 2021.

$810bn in renewables investment needed by 2030.

Ecofin quotes from a McKinsey article published in May 2022, which highlighted the degree to which the US needs to step up its efforts if it is to meet its 2050 deadline. It suggests that just to reach its 2030 target, the US would need to cut emissions by 6.0% per year – nearly 10 times faster than the 0.8% average annual reduction of the previous decade. The implication is that the share of renewables in the US energy mix must increase from 37% today to 70-85% in 2030, equivalent to an additional 235GW of solar and 200GW of wind, requiring approximately $810bn in investment by 2030.

The Inflation Reduction Act

One aim of the Inflation Reduction Act, which was signed into law by President Joe Biden on 19 August 2022, is to reduce the US economy’s exposure to inflation caused by externally-sourced volatility in fossil fuel prices. In pursuit of that aim, it seeks to fully decarbonise the US power grid by 2035. Ecofin points out that this represents an addressable market for RNEW that is 12x the size of that of the UK.

The Act directs about $370bn of federal funding – in the form of tax incentives, grants and loan guarantees – towards the adoption of clean energy. Renewable energy and storage credits could account for $120bn of that. The Act builds on $70bn of funding provided by the Bipartisan Infrastructure Law, which includes investment in upgrading the country’s power transmission infrastructure, supporting the shift to renewable energy.

Investment tax credits

The Act addresses the problem of uncertainty over the levels of support available for new renewable energy projects by committing to provide a tax credit equivalent to 30% of the cost of a project up to H2 2032 or whenever emissions fall to 25% of 2022 levels. As before, RNEW would be able to sell on the tax credit to a third party. The Act applies to projects that began/begin construction after 1 January 2022.

Production tax credits

From 31 December 2024, production tax credits are available for the first 10 years of a project’s life, set at a rate of $27.50/MWh for solar and wind assets. As before, the availability of these will be phased out by H2 2032 or whenever emissions fall to 25% of 2022 levels. Production tax credit will now also be available for other forms of renewable generation that RNEW may consider including geothermal, hydropower, marine and hydrokinetic, biomass and municipal waste-fuelled plants.

There is a 10% bonus available if the project is located on a brownfield site or in an area of fossil fuel production with high unemployment. If the project is less than 5MW in size, a 10% bonus is available for projects in low-income communities and on tribal lands. There is also a 10% bonus if at least 40% of steel, iron or manufactured products used in the projects is sourced within the US.

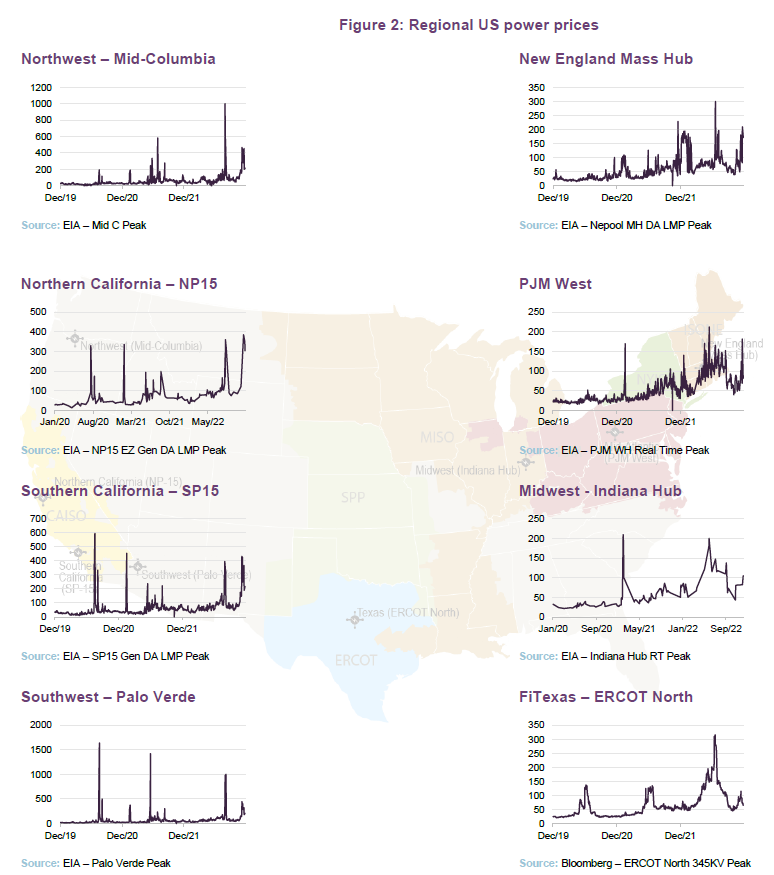

Limited exposure to power prices

US power prices have been volatile in recent years (as the charts overleaf show). There is no national market for power; instead – as illustrated – the price for power varies regionally and is influenced by a range of factors local to that region. For example, power prices in the ERCOT region in Texas are heavily influenced by natural gas prices.

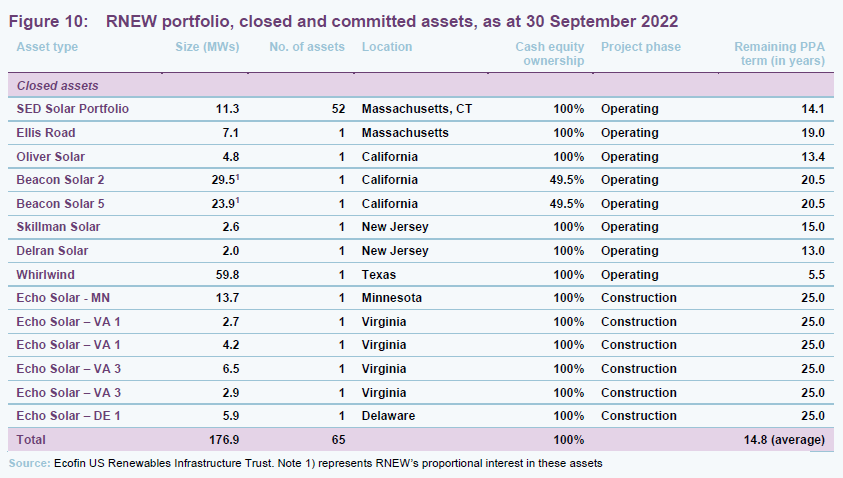

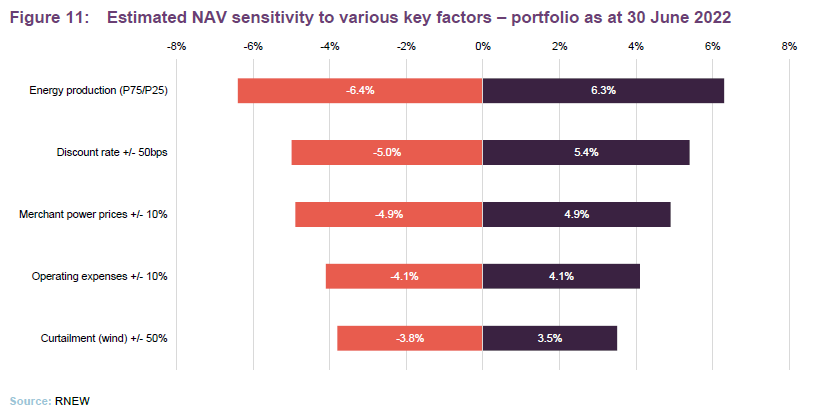

In marked contrast to the majority of funds in the London-listed renewable energy sector, these volatile power prices have little impact on RNEW’s revenues. Its long-term PPAs, struck at fixed prices, give it clear visibility over its revenues. At 30 September 2022, the weighted average unexpired term of its PPAs was 14.8 years (see Figure 10 on page 16). The shortest contract relates to the wind portfolio (located in the ERCOT region) and this still had 5.5 years to run at end September. This limits the sensitivity of RNEW’s NAV to merchant power prices – as Figure 11 on page 17 shows.

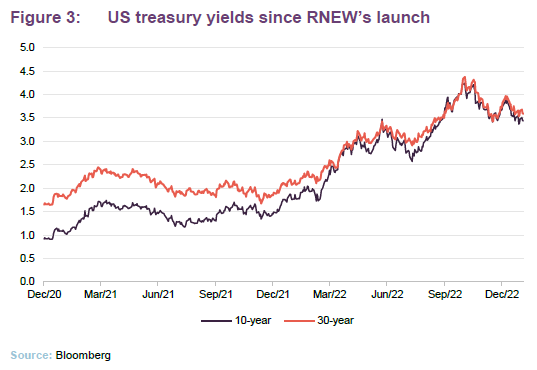

Interest rates (discount rates)

Over the past year, the fight against inflation has necessitated increases in US interest rates. Longer-term rates have risen too, although the hope is that these peaked in October now that the rate of US inflation is moderating.

As with other renewable energy funds, there is no linear relationship between long-term interest rates and the discount rates applied to RNEW’s projected cash flows when calculating its NAV. Many factors go into determining the appropriate discount rate, chief of these is the valuation that market forces ascribe to renewable energy assets. At 30 June 2022, the board chose to increase RNEW’s weighted average discount rate from 7.2% to 7.5%.

Conservative investment approach

Return rises for smaller projects

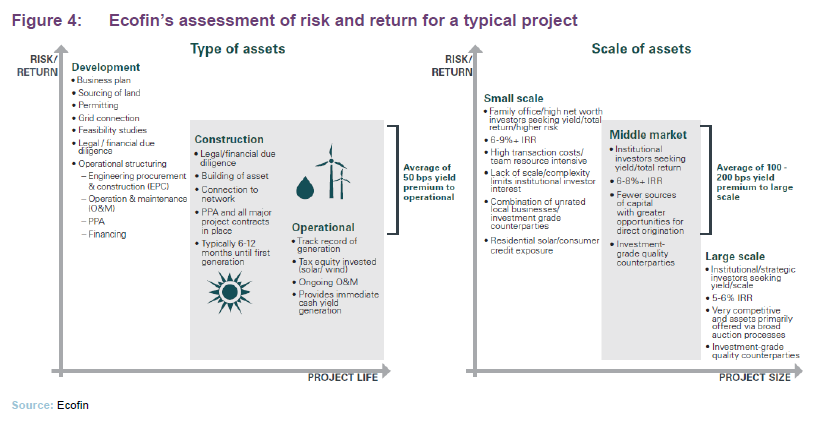

RNEW focuses predominantly on construction-ready and operational assets in the middle market, where Ecofin feels that the balance of risk and reward is optimised. Figure 4 shows Ecofin’s assessment of the risk/returns based on project maturity and size.

Portfolio effect on valuation.

Ecofin says that mid-market deals are priced less keenly than larger transactions, reasoning that for vendors of assets smaller than $50m, it is hard to justify the extra cost of hiring an external advisor to conduct an auction process. It is simpler and cheaper to negotiate a bilateral deal. This focus on smaller assets also creates an opportunity for RNEW’s shareholders as, collectively, RNEW’s portfolio could be worth more than the sum of its parts.

Predictability of income

RNEW sells virtually 100% of the power that it produces under long-term (an average of at least 15 years) PPAs. The creditworthiness of the counterparties to these PPAs is a key consideration for the manager. Ecofin has in-house expertise in the analysis of credit risk. RNEW’s portfolio includes PPAs with diverse investment grade purchasers including utilities, corporates, schools, universities and municipalities.

Project structures

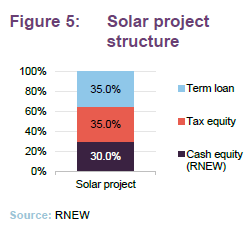

A typical US solar project may be funded with cash equity, tax equity and non-recourse project debt.

RNEW’s investment will typically be via cash equity, although it is permitted to gain its exposure through debt-type structures.

The tax equity is provided by the likes of US banks, insurers and corporates, who effectively buy the right to use the tax credits associated within a project to offset against their own tax liabilities.

Lenders are comfortable with the risks associated with financing solar assets and are prepared to lend on the basis of a 1.3x debt service coverage ratio, which typically translates into 40%–50% of the capital structure.

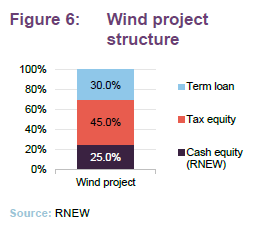

Investment structures for wind projects look similar. However, the proportion supplied by tax equity investors is higher. Tax equity investors get the benefit of production tax credits (which may be as high as 2.5 cents per kilowatt) over a 10-year period. They may also benefit from tax depreciation and a modest level of cash distributions.

Again, lenders are prepared to lend on the basis of a 1.3x debt service coverage ratio.

In both cases, the tax equity element of project financing is not available in the construction phase. Some projects in the construction phase may also seek bridge financing in addition to cash equity and loan finance.

While we have assumed a 30% investment tax credit, the Inflation Reduction Act could provide significant upside to this. As discussed on page 7, if a project is able to get additional credit (for example through major domestic content) the investment tax credit could be higher and even as high as 60%.

Investment process

Sourcing deals

Ecofin sees a strong advantage from having a team on the ground in the US. The Ecofin team has considerable expertise in acquisition origination, underwriting, structuring, construction, financing and asset management.

Preference for bilateral deals.

This gives Ecofin access to a significant pipeline of opportunities, many of which can be negotiated on a bilateral basis, securing assets at more attractive prices and avoiding the cost and frustrations associated with buying assets at auction.

Buying projects in the construction phase

When RNEW is buying assets that are in the construction phase, an important part of the manager’s job is to assess the suitability of the engineering, procurement and construction (EPC) contractor. Having the experience to negotiate attractive and watertight terms, warranties and protections in the event of default (the risks associated with construction such as cost overruns and delays will remain with the contractor) is essential. Payments to contractors will be made in relation to mutually-agreed milestones, typically with a material retention price that is only payable following completion.

Investment structures

Investments will be made either directly or through one or more project SPVs, which may in turn be held by a wholly-owned US subsidiary of the company. Such investments will typically be structured as equity investments or partnership interests, but the company may also invest through debt instruments or other structures.

The company will usually aim to take a 100% or a controlling interest in a project. Where it is a minority investor, Ecofin will seek customary rights in any shareholder or partnership agreement to protect the company’s investment.

The investment approval process

Having identified a potential acquisition, preliminary research and modelling are conducted on the business plan, economics and the project management team.

A private sustainable infrastructure management committee reviews the overall investment process, procedures and practices necessary to ensure the portfolio is in compliance with the company’s investment strategy, policy and investment restrictions (see page 14).

Proposed investments that pass these initial reviews will then be subject to detailed due diligence, often in conjunction with outside contractors, before being put before Ecofin’s private sustainable infrastructure investment committee. This committee is also responsible for reviewing and monitoring all of the company’s investments in renewable assets, and gets first sight of proposed investments.

An ESG risk assessment and an independent credit review and underwriting of an offtaker’s credit are fundamental parts of the due diligence process. Ecofin, along with its legal and technical advisors, reviews offtake agreements to ensure that they are enforceable and the project is capable of meeting its obligations under the contract to mitigate revenue risk.

This committee is responsible for approving investment decisions, monitoring investments and providing strategic oversight (including asset allocating between different classes of renewable assets).

Restrictions

RNEW will invest subject to the following investment limitations which, other than as specified below, shall be measured at the time of the investment and once the net initial proceeds are substantially fully invested (at least 75% of IPO proceeds). Percentages relate to gross assets as follows:

- a minimum of 20% will be invested in solar;

- a minimum of 20% will be invested in wind;

- a maximum of 10% of will be invested in renewable assets that are not wind or solar;

- exposure to any single renewable asset will not exceed 25%;

- exposure to any single offtaker will not exceed 25%;

- investment in renewable assets that are in their construction phase will not exceed 50%,

- exposure to renewable assets that are in the development (namely pre-construction) phase will not exceed 5%;

- exposure to any single developer in the development phase will not exceed 2.5%

- the company will not typically provide forward funding for development projects. Such forward funding will, in any event, not exceed 5% in aggregate and 2.5% per development project and would only be undertaken when supported by customary security;

- future commitments and developer liquidity payments, when aggregated with forward funding (if any), will not exceed 25%;

- renewable assets in the United States will represent at least 85%; and

- any renewable assets that are located outside of the United States will only be located in other OECD countries.

The company expects that construction will be primarily focused on solar in the shorter term until the portfolio is more substantially invested, and may thereafter include wind assets in the construction phase.

Sustainability

Over the period from IPO to 30 September 2022, RNEW generated 430 GWh of power, which is equivalent to 246,000 tonnes of CO2e emissions avoided and 40,000 households supplied. RNEW has been awarded the London Stock Exchange’s Green Economy Mark.

RNEW is clearly well-suited to an investor concerned with sustainable investing. Its ambition is to contribute towards the reduction of carbon and other greenhouse gas emissions, and reducing pollution, while not compromising investors’ desire for stable cash yields and attractive total returns.

Ecofin is a PRI signatory and conducts its business in alignment with the UN-supported Principles for Responsible Investment (PRI). The strategy seeks to achieve positive impacts that align with the following five UN Sustainable Development goals: affordable and clean energy; decent work and economic growth; industry, innovation and infrastructure; sustainable cities and communities; and climate action.

The investment manager integrates ESG criteria into its investment process to enhance overall governance. All of RNEW’s investments are analysed through Ecofin’s proprietary ESG due diligence risk assessment framework for suitability prior to commitment.

ESG criteria and impact of the company’s investment activities are measured, analysed and reported to investors on an ongoing basis, culminating with an annual ESG impact report.

In the due diligence phase of the investment process, Ecofin engages third-party environmental consultants to produce reports that assess environmental impacts of each asset. From a governance standpoint, it also engages legal counsel and independent engineering firms to confirm project compliance with all permitting and regulatory requirements.

Environmental factors affecting climate risk are reviewed to determine an investment’s impact and ability to reduce GHG emissions, air pollution and water consumption. The manager also considers the impact that the investment will have on land use and may implement mitigation plans when issues are identified.

Analysis of social issues may encompass an investment’s impact on the local community and consider health and safety together with the counterparties to be engaged to construct and operate the assets. Ecofin also analyses the extent to which its activities contribute a positive economic impact through tax related payments and recurring lease revenue to landowners.

Ecofin hires experienced O&M, project asset management, and construction firms which will be held responsible for reporting on health and safety incidents related to the assets.

Ongoing management

The framework of O&M contracts is agreed during the due diligence phase. The private sustainable infrastructure management committee is responsible for portfolio oversight and risk management. Renewable energy production figures are reviewed on a monthly basis. Existing investments are reviewed at quarterly management/partner meetings. The team may conduct site visits as well as engaging in regular dialogue with project stakeholders.

RNEW also benefits from a skilled operations team, based in Overland Park, Kansas City. It engages regularly with the operators to proactively address and mitigate technical and commercial issues. Keeping assets working optimally can help boost returns. It also helps that equipment comes with long-term warranties.

Hedging

The group may use derivatives for the purposes of hedging, partially or fully, as follows:

- electricity price risk relating to any electricity or other benefit, including renewable energy credits or incentives, generated from renewable assets not sold under a PPA, as further described below;

- currency risk in relation to any sterling (or other non-US dollar) denominated operational expenses of the company; and

- other project risks that can be cost-effectively managed through derivatives (including, without limitation, weather risk); and interest rate risk associated with the company’s debt facilities.

In order to hedge electricity price risk, the company may enter into specialised derivatives, such as contracts for difference or other hedging arrangements, which may be part of a tripartite or other PPA arrangement in certain wholesale markets where such arrangements are required to provide an effective fixed price under the PPA.

Hedging not to be used for speculative purposes.

Members of the group will only enter into hedging or other derivative contracts when they reasonably expect to have an exposure to a price or rate risk that is the subject of the hedge. Currently, the group has no hedging in place.

Asset allocation

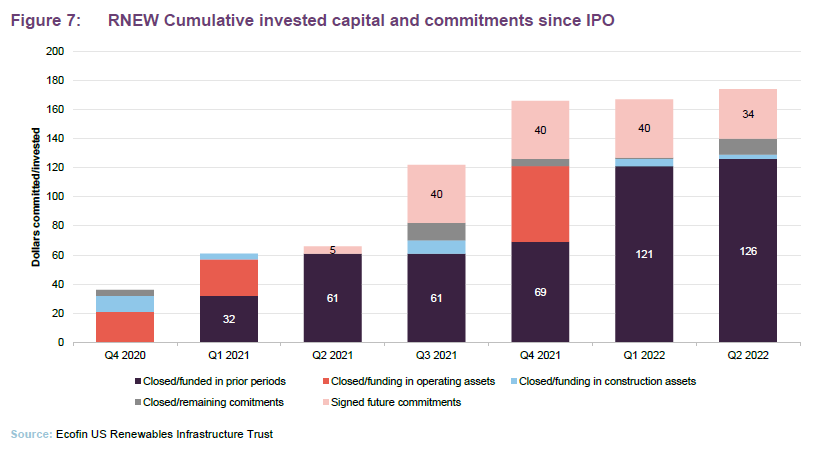

As Figure 7 shows, RNEW made good progress with deploying its initial IPO proceeds so that, in May 2022, it was able to proceed with an additional fundraise and have that money deployed or committed by 30 June 2022.

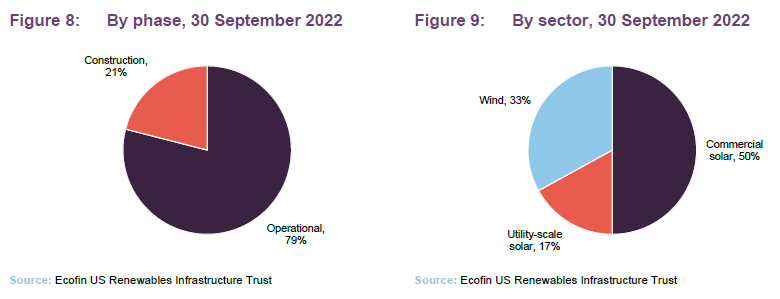

At 30 September 2022, RNEW had invested in 65 projects with a total capacity of 177MW and was committed to five additional projects under the Echo Solar agreement accounting for a further 25.4MW. The projects are spread across eight American states. All of the projects under the Echo Solar agreement are in the construction phase – equivalent to 21% of RNEW’s portfolio. Construction across the six Echo Solar projects that RNEW has invested in to date is expected to be completed between Q4 2022 and Q2 2023.

Valuation

Ecofin values the assets on a quarterly basis and these valuations will be reviewed twice a year by an independent valuation firm.

The fair value of renewable assets is derived from a discounted cash flow (DCF) methodology. Assets which have not yet been placed into service will be valued at cost.

The choice of discount rate reflects inputs such as:

- available discount rates used by competitors;

- discount rates applicable to comparable infrastructure asset classes;

- available discount rates for comparable market transactions;

- discount rates recently provided by the third-party valuation provider; and

- capital asset pricing model outputs and implied risk premium over relevant risk-free rates.

A broad range of assumptions is used in valuation models. Where possible, these assumptions are based on observable market and technical data and independent third-party data. Ecofin also engages technical experts such as long-term electricity price consultants to provide long-term data for use in its valuations.

Assets are not ascribed any terminal value. Termination dates tend to be associated with factors such as the expiry of grid connection permits and land leases.

Geographic diversification of the portfolio provides some mitigation against local adverse weather conditions, which can affect production.

Sensitivities

RNEW’s interim report included a chart showing the likely sensitivity of RNEW’s cash flows to various factors. We have reproduced this above. The sensitivity to merchant power prices is higher than in the chart we used in our initiation note. This reflects the relatively short duration (5.5 years) of the wind portfolio’s PPAs.

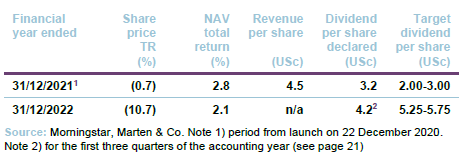

Performance

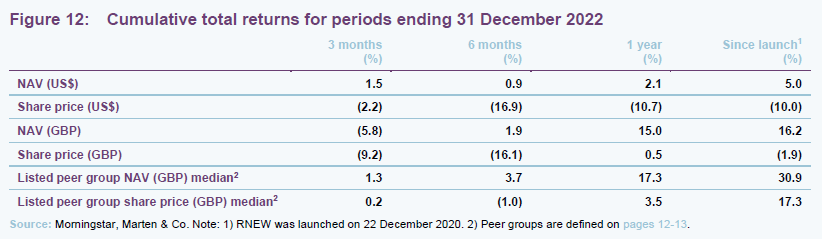

RNEW has achieved or exceeded most of its targets from its dividend to the target date for the deployment of its IPO proceeds. Currency movements have had a significant influence on the trust’s returns relative to peers and so in Figure 12 we show returns in both US dollars and sterling.

In US dollar terms, RNEW has returned 5.0% in NAV terms since launch. However, following the announcement of the departure of the previous management team, a discount opened up which is yet to close. We discuss this in more detail on page 21

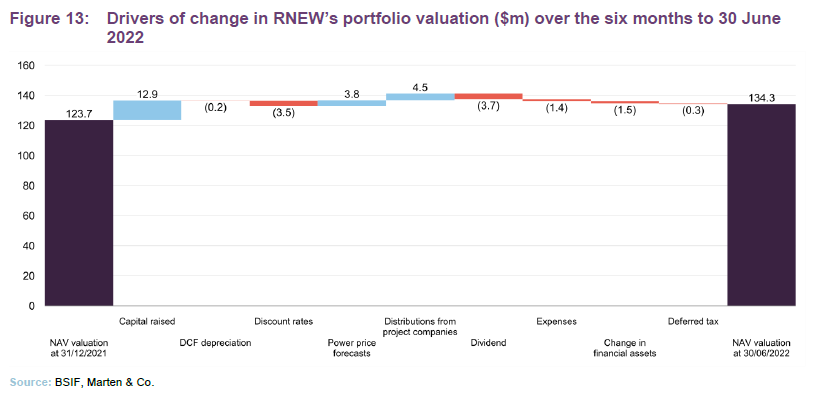

As discussed on page 9, at the valuation point at 30 June 2022, the weighted average discount rate used to calculate RNEW’s NAV was increased from 7.2% to 7.5%. The negative impact of this was more than offset by increases in regional market forward prices forecasted by the US Energy Information Administration (EIA).

Operational influences on RNEW’s returns are discussed below. Over the 12-month period ended 30 June 2022, the portfolio generated net revenue sufficient to cover the dividend approximately 1.0 times.

Operating performance

RNEW’s operating performance over the course of 2021 was discussed in our last note. For the period ended 30 September 2022, output from the solar portfolio was 2.8% above budget at 119GWh. The 138.4GWh generated by the wind portfolio was 5.2% below budget principally due to lower wind resource than anticipated in Q1 and Q3 2022.

Cash flow from Beacon 2 and 5 was held back by higher operating expenses, while Skillman Solar performed 5.1% over budget in Q3. The SED Solar portfolio also exceeded expectation by 6.4% due to higher insolation.

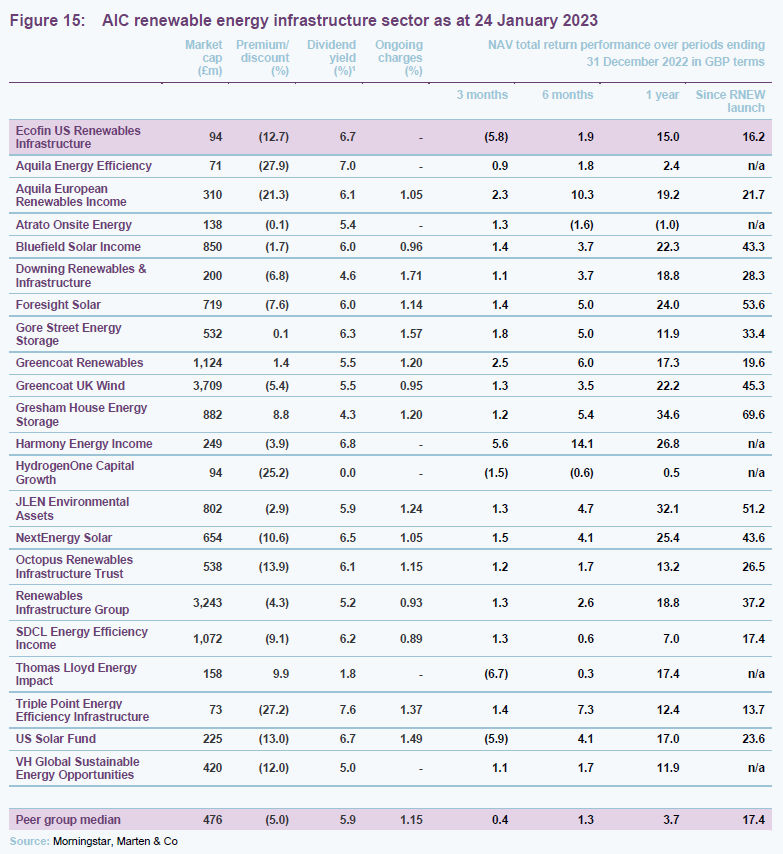

Peer group

Up-to-date information on RNEW and its peer group is available on the QuotedData website.

RNEW is a member of the AIC’s renewable energy infrastructure sector, which has 22 constituents. The peer group is reasonably diverse, however, and RNEW is differentiated from most of its peers, primarily by its focus on the US (and hence US dollar-denominated cashflows) and its long-term PPAs, which give it much greater visibility over its future cash flows than many of its peers.

The closest comparator to RNEW is US Solar Fund. However, for reasons that are hard to comprehend (the excuse given was the difficulty of raising fresh capital, which we feel is likely to be a temporary problem), its board opted to initiate a strategic review in October 2022, which may result in the sale of its portfolio.

A comparison of RNEW’s returns versus those of the majority of the peer group reflects the very different risk and reward characteristics of RNEW (and US Solar Fund) as compared to funds with a much greater sensitivity to volatility in power prices and inflation. Over the past year, soaring power prices and much higher inflation have flattered the returns of funds with UK and EU exposure.

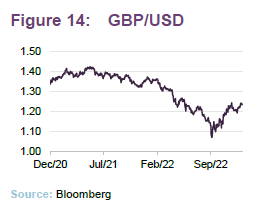

Fluctuations in the sterling/dollar exchange rate have also had an impact. Between May 2021 and September 2022, dollar strength worked in RNEW’s favour. However, since 26 September 2022 the trend has reversed.

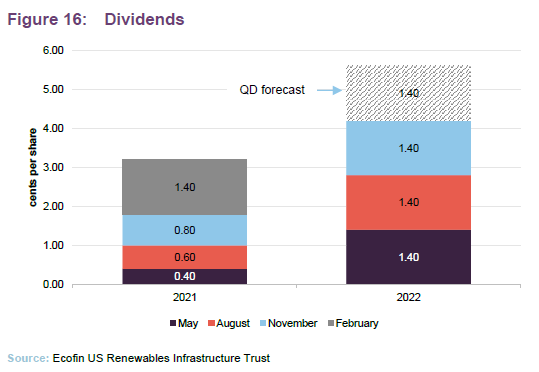

Dividend

RNEW pays quarterly dividends in May, August, November and February in respect of its calendar year accounting periods.

For the accounting period ended 31 December 2021, RNEW generated revenue earnings per share of 4.54USc and used that to fund dividends totalling 3.2USc. At the end of December 2021, RNEW had a revenue reserve of $1.95m or about 1.4USc per share. In addition, following the cancellation of the share premium account, RNEW had a special distributable reserve amounting to $121.25m.

The board’s target dividend for 2022 was for between 5.25USc and 5.75USc. Currently, RNEW is paying quarterly dividends of 1.4USc per share, which might imply a full-year dividend of 5.6USc (this is what Morningstar is using in its yield calculation on the front page of this note and on our website). Revenue earnings per share for the first six months of RNEW’s financial year ended 31 December 2022 were 2.55USc. We expect that RNEW’s board will want to at least maintain the quarterly dividend at 1.4USc per share.

Premium/(discount)

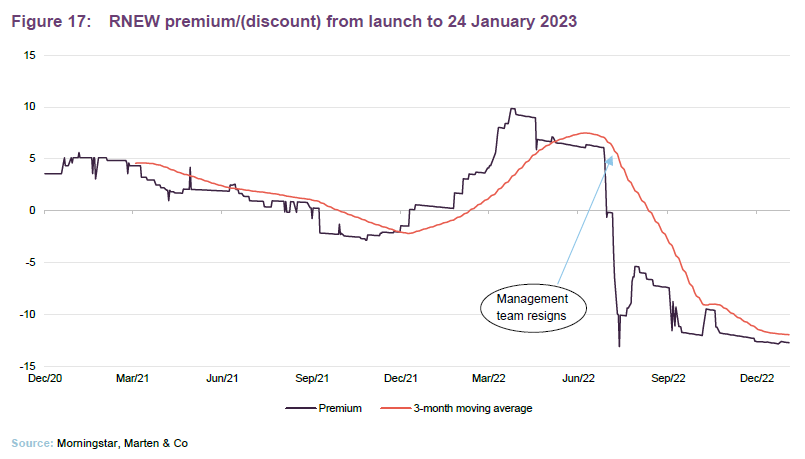

Over the 12 months ended 31 December 2022, RNEW’s shares traded between a 13.1% discount and a 9.8% premium and averaged a 1.7% discount. At 24 January 2023, RNEW’s discount was 12.7%.

In Figure 17, the impact of the resignation of the previous management team on RNEW’s premium is obvious and, logically, now that the new management team is in place, the share price should revert to trading close to asset value.

The past six months has been an eventful period for RNEW’s peer group. Uncertainties associated with volatile power prices, high inflation, rising discount rates, windfall taxes and power price caps have combined to shift the median fund in the sector to trading at a discount. However, we would note that RNEW is unaffected or only lightly affected by these factors. RNEW’s predictable cash flows may have made it harder for the fund to attract attention in an environment of soaring NAVs earlier in 2022. Now, they look like a strength.

We feel that RNEW deserves to be re-rated, and that may happen relatively quickly now the uncertainty around the management team has been resolved.

Premium and discount management

At the June 2022 AGM, shareholders granted the board permission to allot up to 10% of the company’s then-issued share capital without pre-emption. Any shares would only be issued at a premium to NAV, enhancing the NAV for existing shareholders and improving liquidity.

In the event that the shares trade at a discount, the directors have discretion to authorise share repurchases with a view to managing any imbalance between the supply of and demand for shares. At the June 2022 AGM, shareholders granted the board powers to buy back up to 14.99% of RNEW’s then-issued share capital. Shares would only be repurchased at a discount. Any shares bought back may be held in treasury and later re-sold at a premium.

In May 2022, RNEW raised gross proceeds of $13.1m from a placing and a retail offer (made via Peel Hunt LLP’s REX platform). 12,927,617 shares were issued at $1.015 per share.

Fees and costs

Ecofin is entitled to a management fee calculated as 1.0% per annum of the first $500m of net assets, 0.9% per annum on the next $500m of net assets and 0.8% on any net assets in excess of $1bn. The investment management agreement may be terminated by either party giving notice of not less than 12 months, such notice not to expire less than 36 months from 11 November 2020.

On a quarterly basis, Ecofin reinvests 15% of its fee in RNEW shares, which will then be subject to a rolling 12-month lock-up. At 1 November 2022, the investment manager and relevant associates held a total of 287,791 management fee shares.

For the accounting period ended 31 December 2021, the only other substantial overheads were £257,000 for the directors’ fees (see page 25), £223,000 for the secretary and administrator, £185,000 for the auditor, and £168,000 to cover the FCA and listing fees.

RNEW’s ongoing charges ratio for the accounting period ended 31 December 2021 was 1.47%, but at the interim stage (30 June 2022) the ongoing charges ratio was estimated at 1.90%. For the period from launch to 30 September 2021, the investment management fee was only charged on the committed capital of the company. By the end of September 2021, with at least 90% of the net initial proceeds of the IPO committed, the fee was changed on the whole NAV, as it will continue to be in future periods.

Capital structure

Simple capital structure which allows investors to buy shares in dollars or pounds.

RNEW has 138,078,496 ordinary shares in issue and no other classes of share capital. Shares can be bought and sold in either dollars or sterling, but both lines of stock have equal rights and relate to the same pool of capital. The sterling quote allows RNEW to qualify for index inclusion.

RNEW does not have a fixed life. However, shareholders will have an opportunity to vote on the continuation of the company at five-yearly intervals.

The company’s accounting year ends on 31 December. In 2022, it held its annual general meeting in June.

Gearing

RNEW is permitted to use gearing, although long-term debt shall not exceed 50% of gross assets and the short-term debt shall not exceed 25% of gross assets, provided that the total consolidated debt shall not exceed 65% of gross assets. Long-term debt would be used to provide structural leverage for investment in renewable assets.

On 19 October 2021, RNEW Capital, LLC, entered into a $65.0m secured revolving credit facility (RCF) with KeyBank, one of the premier lenders to the US renewable energy industry. The RCF comprises a $50.0m, two-year tranche priced at LIBOR plus 1.75% and a $15.0m, three-year tranche priced at LIBOR plus 2.00%. The RCF is secured upon certain of RNEW’s investment assets and offers the ability to substitute reference assets. The RCF also includes an accordion option which provides access to an additional $20.0m of capital which can be accessed subject to certain conditions.

Financing provided by tax equity investors, and any investments by the company in its project SPVs or intermediate holding companies that are structured as debt, are not considered gearing for this purpose and are not subject to these restrictions.

As at 30 June 2022, the US subsidiaries at a project level had debt balances of $48.4m ($2.1m of a $15.9m facility related to Echo Solar and $46.3m related to Beacon 2 and 5) and no funds had been drawn down under the RCF. This total debt balance corresponds to approximately 26.5% of GAV.

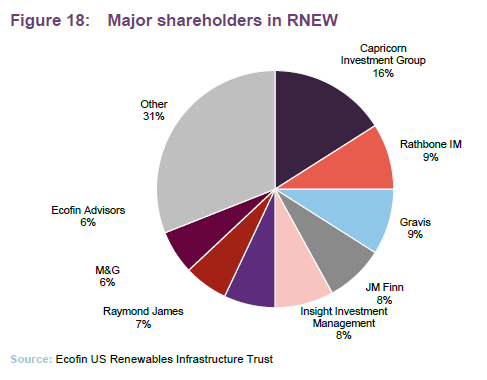

Major shareholders

Board

RNEW’s board consists of four non-executive directors, all of whom are independent from the manger and do not sit together on other boards. Each director stands for re-election annually.

The company’s Articles cap the total fees payable to the directors at £400,000, but in practice the figure should be much lower than that, as Figure 19 shows.

Patrick O’Dennell Bourke

Patrick is an experienced board member with 25 years of experience in energy and infrastructure, especially renewable energy. He also has significant international investment experience, particularly in Europe, US and Australia.

Patrick is chairman of the audit committee of Harworth Group Plc, a leading regenerator of land and property for development and investment and chair of the audit committee of Pantheon Infrastructure Plc.

Patrick qualified as a chartered accountant at Peat Marwick, Chartered Accountants (now KPMG). After that he held a variety of investment banking positions at Hill Samuel and Barclays de Zoete Wedd. In 1995, he joined Powergen Plc, where he was responsible for mergers and acquisitions before becoming group treasurer. In 2000, Patrick joined Viridian Group Plc as group finance director and later became chief executive. In 2011, he joined John Laing Group, a specialist international investor in, and manager of, greenfield infrastructure assets, as CFO before retiring in 2019. While at John Laing, he was part of the team which launched JLEN Environmental Assets Group in 2014. From 2013 to September 2020, Patrick served as chair of the audit committee at Affinity Water, the UK’s largest water-only company. He also served as chairman of the audit and risk committee at Calisen Plc, an owner and operator of smart meters in the UK, from February 2020 until it was taken private in March 2021.

Patrick is a graduate of Cambridge University.

David Fletcher

David was group finance director of Stonehage Fleming Family & Partners, a leading independently-owned multi-family office, having joined in 2002.

Prior to that, he spent 20 years in investment banking with JPMorgan Chase, Robert Fleming & Co. and Baring Brothers & Co Limited, latterly focused on financial services in the UK (asset management and life insurance).

David started his career with Price Waterhouse and is a chartered accountant. He is also an independent non-executive director of Aquila Energy Efficiency Income Trust Plc, JP Morgan Claverhouse Investment Trust Plc – where he is the senior independent director and chairman of both the audit committee and the remuneration committee – and abrdn Smaller Companies Income Trust Plc, where he is the audit committee chairman.

David is a graduate of Oxford University.

Tammy Richards

Tammy is an experienced risk management professional with expertise in structured finance and a history of leadership in a global financial services business. She spent over 30 years at GE Capital in the risk management function, with more than 10 years in the energy sector.

While at GE Capital, Tammy held an array of risk leadership roles both in the US and in Europe serving as the European risk leader for the structured finance and capital markets units. She served as the deputy chief credit officer of the energy finance unit, a global $15bn business focused on complex debt and equity investments in the energy sector. Most recently, she moved to the GE Capital headquarters unit as managing director, credit risk and portfolio analytics where she provided risk oversight of GE Capital’s aviation leasing and energy financial services units, developing risk appetite, credit delegations and governance and reporting frameworks.

Tammy holds a BS degree in Economics from Cornell University and an MBA from the Amos Tuck School at Dartmouth College.

Louisa Vincent

Louisa has had a 30-year career in financial services, working globally in institutional, wholesale and retail financial services, most recently at Lazard Asset Management Limited where she was managing director and head of institutions, and in which she had overall responsibility for the firm’s institutional clients.

Prior to that, she was with State Street Global Advisors in both its Sydney and London offices. Louisa also chairs Fight For Sight, the UK’s leading eye research charity, taking up the role in March 2020, having been a board member since 2015. She is particularly committed to clear communication, bringing the customer’s voice to the boardroom and ensuring business sustainability through ESG.

Louisa began working in the investment field in 1988 in Sydney, Australia and has an MBA (Exec) from the Australian Graduate School of Management.

Previous publications

Readers may wish to view our earlier notes on RNEW. These are available through our website or by clicking the links in Figure 20.

Figure 20: Previously published notes on RNEW

| Title | Type of note | Publication date |

| Sunny outlook | Initiation | 18 May 2021 |

| Clear path to growth | Update | 25 March 2022 |

Source: Marten & Co

Legal

This marketing communication has been prepared for Ecofin US Renewables Trust Plc by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this not.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.