European Opportunities Trust

Investment companies | Initiation | 1 November 2023

‘Special’ growth companies

With its strong focus on growth, European Opportunities Trust (EOT) has faced significant headwinds during the last couple of years as, in the face of higher inflation and interest rates, investors have favoured more value and defensive exposures over growth stocks. Inflation now seems to be coming under control, but with growing signs of a recession in Europe, sentiment in financial markets is poor. Consequently, valuations of European equities are cheap relative to their history and global markets.

EOT’s portfolio is made up of ‘special’ growth companies that typically benefit from strong intellectual property (IP), an advantageous industry structure, strong balance sheets, high recurring revenues, and multiple avenues for growth. These should be able to weather an economic downturn and outperform over the longer-term. If so, the current discount to net asset value (NAV) could offer a particularly attractive entry point, especially as EOT’s board intends to provide shareholders with a 25% tender offer in 2026, assuming the continuation vote passes (as seems likely) at the upcoming annual general meeting (AGM).

Capital growth from ‘special’ European companies

The objective of the company is to achieve long-term capital growth by investing in a portfolio of securities of European companies and in sectors or geographical areas which are considered by the investment manager to offer good prospects for capital growth, considering economic trends and business development. The manager looks for ‘special’ companies – these are niche winners in their respective fields that can flourish in a range of economic scenarios.

At a glance

Fund profile

EOT aims to achieve long-term capital growth by investing in a portfolio of European companies and in sectors or geographical areas which are considered by the investment manager to offer good prospects for capital growth, considering economic trends and business development. The manager looks for ‘special’ companies – these are niche winners in their respective fields that can flourish in a range of economic scenarios. Such companies will typically benefit from an advantageous industry structure, multiple protections and multiple avenues for growth.

The manager believes its special companies’ products will not be commoditisable and that, over the long-term, their results will outweigh growth versus value considerations, market fashions, geographic influences, political risks, and the risk of unconstrained supply.

The approach is long-term in nature – EOT’s board considers five years as a reasonable holding period for investment in equities – and the portfolio is reasonably focused (typically 26-35 holdings). The portfolio is concentrated but the risk of this is managed by having a strong focus on company fundamentals to understand the risks involved, as well as high diversification by activity and geography across the holdings.

More information can be found at the manager’s website: www.devonem.com/european-opportunities-trust-plc

Management arrangements

The trust was launched in November 2000 and has had the same lead portfolio manager, Alexander Darwall, since launch. Originally, EOT (then called Jupiter European Opportunities) was part of the Jupiter stable of investment trusts, but EOT’s board took the decision to follow Alexander when he left that firm, moving the management contract to Devon Equity Management Limited in November 2019, after Alexander had founded that business. EOT’s investment manager also acts as its AIFM. The manager had a total assets under management (AUM) of £1.62bn as at 31 May 2023.

Benchmark

EOT’s performance benchmark is the MSCI Europe Index (total return in sterling). However, the composition of the index has no bearing on the manager’s choice of stocks or position sizes. As evidence of this, the active share at the end of July 2023 was about 95%.

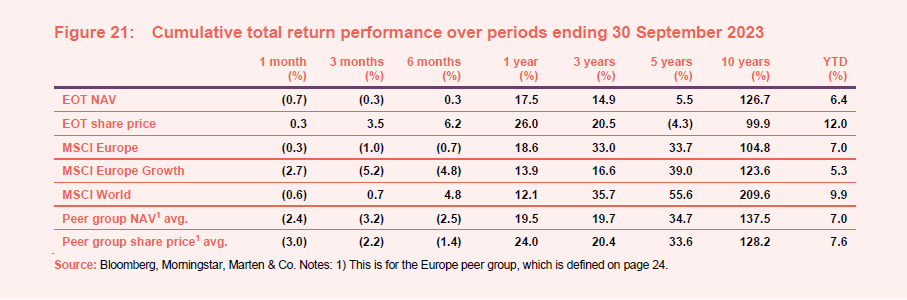

Reflecting EOT’s growth focus, we have also included performance numbers for the MSCI Europe Growth Index as we feel it offers a useful comparison, as well as numbers for the MSCI World Index to provide a comparison against global equities more generally. However, it should be noted that neither of these are indices that the trust compares its own performance to. A peer group comparison is also included on pages 24 to 28.

Market Outlook and valuations

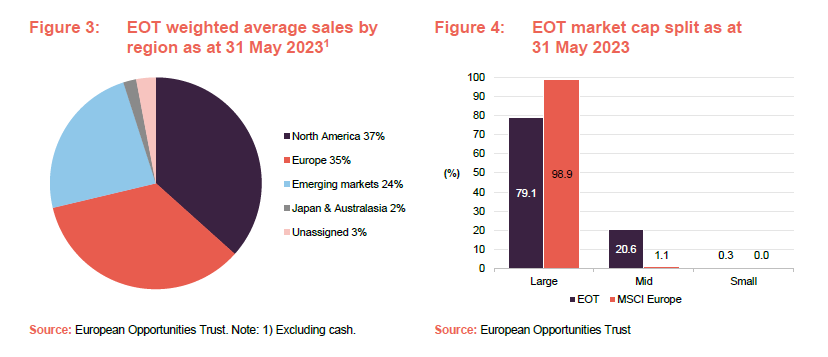

Figure 1 shows the performance of European equities, European growth equities and broader global equities over the last five years. European growth equities were outperforming global equities and broader European equities in the period running up to the COVID-related market collapse of March 2020, a pattern that continued, albeit with some volatility, as investors favoured growth stocks in the lower for longer interest rate environment that followed during the remainder of 2020 and the bulk of 2021. However, as we moved into the closing stages of 2021, there were signs that, at least in the developed world, the massive stimulus that had been injected to prop up economies in the face of the pandemic was starting to rear its head in the form of inflation.

Moving into 2022, the invasion of Ukraine and the sanctions and supply restrictions that followed, most notable in energy where costs were pushed to extreme levels, pushed up inflation expectations dramatically, bringing the prospect of interest rate rises. Growth stocks sold off heavily as the market switched its focus to more value and defensive styles, but all equities were affected, reflecting the fact that rising interest rates are negative for most equities.

Supply chains have adjusted, and Europe has made progress in addressing its energy security. This triggered a recovery, but there has been considerable volatility during the last couple of years. Sentiment has ebbed and flowed as markets have fretted about where inflation and interest rates will peak, as well as the growing risk of recession. During the last few months, evidence of a slowdown (reflected in falling purchasing manager indices – PMIs) has been a key factor in Europe’s performance relative to global equities, which have been held up by the better economic data coming out of the US. The result is that, while both global and European equities look like reasonable value relative to their own history, European equities are trading at a bigger discount to their long-term averages.

To illustrate this point, the forward12-months price-earnings ratio (F12m P/E) of the MSCI Europe Index is 12.5x, which is 24.3% below its five-year average, and 53.7% below its five-year high; the MSCI Europe Growth Index is trading at 22.5x, which is 13.1% below its five-year average and 44.9% below its five-year high; and the MSCI World Index is trading at 17.8x, which is 11.7% below its five-year average and 41.9% below its five-year high.

Manager’s view – signs of a recession, market sentiment is poor

As with other developed markets, there are signs that inflationary pressures are now easing in Europe but there are also clear signs of recession, with the European powerhouse that is Germany predicted to be at the sharp end of this due to the impact of higher interest rates and weaker global trade.

EOT’s manager comments that a strong narrative from the companies the team met on a recent research trip to Germany was that economic activity was slowing and that Germany, which is particularly exposed to the slowdown in China, may already have moved into a mild recession. Time will tell how protracted this slowdown becomes but the manager observes that it is exceptionally difficult to predict with great accuracy how the macroeconomic picture will unfold. It prefers to look through the macro noise and focus on long-term structural growth opportunities.

The manager comments that in most European markets, earnings expectations are being revised down, with higher costs, particularly higher interest and energy costs, being a significant challenge. Reflecting this, sentiment towards European equities is poor (the manager highlights that Europe-focused funds have seen US$53bn of outflows from active equity funds during the first nine months of 2023). This has shut the market for new fundraises but is also giving private equity funds, which are able to take a longer-term view, the opportunity to buy assets at heavily discounted prices.

The manager comments that there are signs that luxury goods spend, which can be surprisingly resilient, is now faltering in many countries and this has driven the reversal of some of the previously strong performance that these companies had provided. Traditional energy companies have been buoyed by higher oil prices this year, but support for companies exposed to the energy transition has faltered, particularly since August, as the focus has shifted away from the opportunities it creates towards its costs, at a time that the economic clouds are darkening.

Another consideration is tax burdens, which are already at a 25-year high as a proportion of GDP. Borrowings, which spiked during the pandemic, are now incurring higher interest costs and cash strapped governments need to try to balance their books. It cites the example of the French government, which is proposing to introduce taxes designed to accelerate the transition to green energy – toll roads and airports are first in the firing line, but others are likely to follow. Although there has been a shift away from the government’s green commitments in the UK, this may prove transitory and other European governments are proposing similar measures.

Against this challenging backdrop, it is worth remembering that EOT’s manager looks for special companies that will be structural winners through the economic cycle (this is explored further in the investment process section). This is not to say that its portfolio companies will not see their share prices retrench during periods of poor market sentiment but, at an operational level, these companies should continue to make progress and periods of weak share prices may provide opportunities to add to positions at attractive valuations.

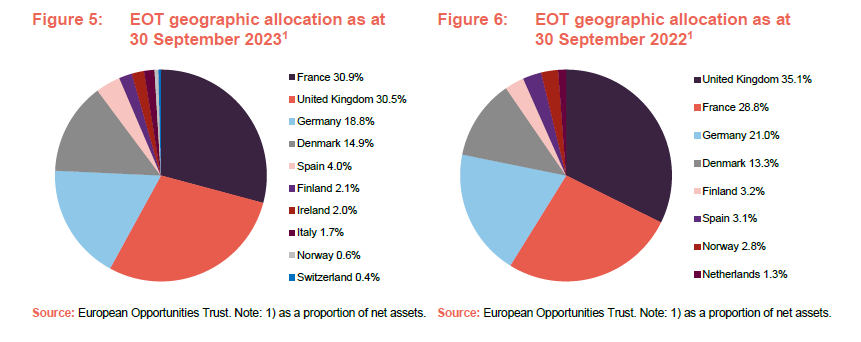

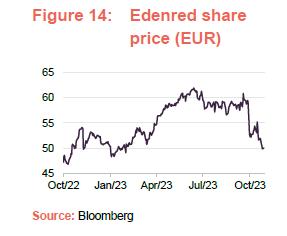

The manager also focuses on companies with a global revenue base and as is illustrated in Figure 3 on page 10, around 65% of EOT’s portfolio’s revenues come from outside of Europe. The manager highlights EOT’s look-through exposure to countries such as Brazil and India, which have both seen growth forecasts upgraded by the IMF for 2023. For example, Experian and Edenred have significant businesses in Brazil and with agricultural production surging, companies such as Bayer could also benefit. Dassault Systèmes reports that its Indian business is growing faster than its global average, driven by growing demand for precision and quality manufacturing.

Overall, while EOT’s manager recognises the economic challenges ahead and the risk to the portfolio that this presents, its focus on quality will be beneficial if markets stumble. For example, the net debt of EOT’s portfolio as a proportion of EBITDA is around 60% of that of its benchmark. The portfolio is IP intensive rather than capital intensive and it also has a high level of recurring revenues.

The manager feels that the consumer continues to look exposed but EOT’s portfolio, with its business-to-business (B2B) focus, has low consumer sensitivity and by focusing on structural ‘game changing’ opportunities, the manager believes that the portfolio has an asymmetric risk profile that is skewed heavily to the upside over the longer term – it describes this as high index risk, low real-world risk.

Reflecting this, commodities, banks and utilities are not a feature of the portfolio. Instead, positions in technology, healthcare, industrials and media are the key areas of focus. The manager believes that change often provides opportunities and the key themes within the portfolio at present are:

- ‘Special’ foods – Genus.

- Alternative finance – Intermediate Capital, Grenke, BFF Bank, Deutsche Boerse, Network International, Edenred and Worldline.

- Digital technologies (specifically the internet of things and cyber security) – Infineon, Soitec, Suse, Prysmian, RELX, Experian and Darktrace.

- Healthcare – Novo Nordisk, Grifols, Hikma, bioMérieux, Genmab, Merck and Bachem.

EOT’s own gearing level is low relative to its own history. Crucially, the manager is being consistent in its approach and is not changing the process that has served EOT well over the longer term.

Investment process – simple, but not easy

In managing EOT’s portfolio, Devon Equity Management (www.devonem.com) is looking for what is describes as ‘special companies’. These are businesses that the manager believes, based on its analysis, can generate higher than average revenue growth and superior returns for investors, for longer than the market expects.

While not a pre-requisite, these businesses often have some niche IP or other advantage that allows the superior returns to persist. The conventional wisdom is that, in competitive markets, areas that are generating supernormal returns will either attract new entrants, or the attention of regulators, so that returns are diluted back to more normal levels. EOT’s ‘special companies’ will typically have some sustainable defence against this, allowing them to surprise the market.

Alexander and team describe their process as being simple to understand, but that does not make it easy to execute. Considerable research is required to identify and then validate suitable opportunities. The process also has a strong emphasis on risk control and, typically, the manager has satisfied itself that an investment has an asymmetric risk-return profile that is skewed towards the upside

Bottom-up stock selection based on fundamental research

Reflecting the manager’s focus on finding ‘special companies’, the investment process is overwhelmingly driven by bottom-up stock selection based on extensive fundamental research. There are four key steps to the stock selection process:

- The right company – these will have a shareholder friendly ownership structure as well as successful, proven business models.

- The right management – management must be open and honest with shareholders and prepared to be accountable for their actions.

- Exposed to long-term structural trends – the company must benefit from long-term structural trends. These need to be clearly identifiable and will be expected to continue to develop over many years.

- Valuation – this must be attractive given a company’s growth prospects, but given the focus on risk management, the manager is looking for companies with defensive characteristics (discussed below) that protect the company and limit losses on the downside and therefore offer an asymmetric risk/reward profile that is skewed to the upside.

Reflecting the emphasis on special companies, the manager actively avoids businesses with commoditised products. The broader investment process incorporates the following key elements:

- Stock screening – this is more than quantitative screening as it also includes a qualitative overlay that allows the team to get to understand a business.

- Idea generation – the manager analyses daily news, conducts over 200 company meetings/presentations annually across all sectors to identify patterns and triggers.

- Maintenance and development of ideas – the manager continually checks investment ideas and cross-references these ideas against other data sources to verify its thesis.

- Board engagement and governance – the manager regularly meets with board representatives of investee companies.

- Total market coverage – the manager meets a lot of companies. This not only helps with idea generation but allows the manager to better understand a company’s competitive position, vis-à-vis its peers, and to anticipate emerging trends. The manager says that it is often interested in companies that were previously ‘me too’ but where something has changed that gives the business an advantage allowing it to earn much higher margins. An example would be the US restricting Chinese companies, giving an advantage to western companies.

Timeless defensive characteristics

As noted above, in selecting stocks for the portfolio, the manager is looking for companies that have a number of what it describes as ‘timeless defensive characteristics’. These are:

- Independence

- Structural advantage (this provides a real barrier to entry)

- Differentiated product or service (gives a company pricing power)

- Measurable and monetizable value (gives a company pricing power)

- Cost and revenue flexibility

- More IP and less capital expenditure (capex) (financial flexibility)

- Recurrent, visible demand (allows for good risk management)

Reflecting the above, EOT’s companies tend to have strong balance sheets with low debt versus peers and strong free cash flow generation.

In managing EOT’s portfolio, the manager is looking for high growth, compounding businesses that it can hold for the long term. This can be summarised as growth at an attractive valuation.

ESG research is fully integrated into its investment process.

ESG incorporated into investment and monitoring procedures

Environmental, social and governance (ESG) criteria are central to the manager’s approach. The manager believes that companies acting ‘in the collective interest’ will provide superior returns over the longer term and, when searching for its ‘special investee companies’, it seeks to identify businesses that operate in a sustainable and efficient manner.

Companies should also be characterised by high-quality board decision-making and governance. There should be a long-term strategic vision that aligns with the company’s long-term goals. Companies should have a culture that embraces transparency, accountability, diversity, ethical conduct, robust risk management, stakeholder management and a focus on long-term sustainability.

ESG research is fully integrated into its investment process.

Investment restrictions

EOT operates with the following investment restrictions:

- no single holding to constitute more than 10% of the company’s total assets (calculated at the time of investment) and the board will pay particular attention to holdings which grow to represent more than 10% of total assets;

- it will not invest in unlisted securities;

- it will not invest in derivative instruments, whether for efficient portfolio management, gearing or investment purposes;

- it will not invest in other listed closed-ended investment funds;

- it is not to take legal or management control over any investments in its portfolio; and

- not more than 50% of the company’s investments may be in securities which are not qualifying securities or government securities for the purposes of the UK ISA Regulations.

Asset allocation

Concentrated portfolio of European equities

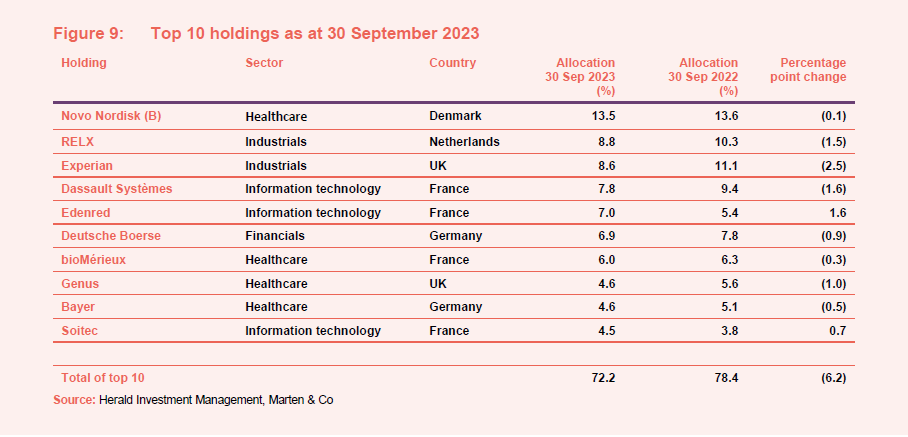

As at 30 September 2023, EOT’s portfolio had exposure to 30 securities (up from 27 securities a year prior). EOT’s portfolio is concentrated: it typically has exposure to between 26 and 35 securities (an average position size of around 3%) but actual position sizes can vary quite markedly (depending on valuation and the manager’s level of conviction). The top 10 holdings tend to account for around 70-80% of the portfolio, with a tail of smaller positions. As illustrated in Figure 9, the top 10 holdings accounted for 72.2% of EOT’s portfolio (as a proportion of net assets) as at

30 September 2023, down from 78.4% a year prior.

The portfolio is distinctly different from its benchmark, the MSCI Europe, with an active share in the region of 95%. While EOT’s portfolio is focused on companies in developed Europe, these have a global reach as is illustrated in Figure 3. As is illustrated in Figure 4, EOT’s portfolio also has a much greater allocation to small cap stocks versus the benchmark.

EOT’s portfolio is distinctly different from its benchmark.

Geographic allocation

A comparison of Figures 5 and 6, which show EOT’s geographic allocation as at

30 September 2023 and 30 September 2022, illustrates that the main changes have been an increase in exposure to Ireland, Italy, Denmark and Spain (up by 2.0, 1.7, 1.6 and 0.9 percentage points respectively) with reductions to the UK, France, Germany, Norway and Finland (4.6, 4.2, 2.2, 2.2 and 1.1 percentage points respectively) – these figures are calculated on a net assets basis and so the reduction in overall allocation reflects a reduction in net gearing between the two points. The UK, France, Germany and Denmark remain the largest allocations, while the Netherlands has been exited altogether and Switzerland makes a new appearance. It should be remembered that, like the sectoral allocations below, the geographic allocations are a result of the manager’s stock selection decision, and the manager is not targeting weights in any region or sector.

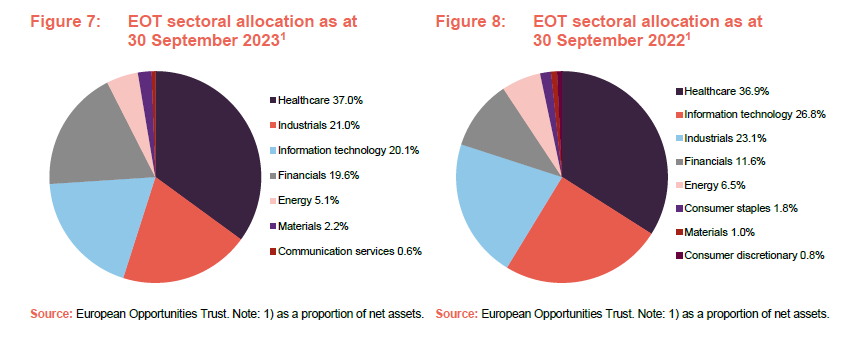

Sectoral allocation

Comparing Figures 7 and 8, which show EOT’s sectoral allocations as at

30 September 2023 and a year prior, the main differences are an increase in the allocations to financials (up by 8.0 percentage points) and materials (up by 1.2 percentage points); and decreases in the allocations to information technology (down by 6.7 percentage points), industrials (down by 2.1 percentage points) and energy (down by 1.4 percentage points). All other changes are less than one percentage point.

Healthcare, industrials and information technology continue to be EOT’s largest sectoral allocations and have been for some time. The increase in financials is more optical than real as it reflects a reclassification by MSCI of the three payments companies that are held in EOT’s portfolio (Edenred, Network International and Worldline). EOT’s holding in Network International has also been sold (this was a 0.8% position) and the manager initiated a small position in BFF Bank. It is worth noting that EOT’s financials exposure is overwhelmingly alternative finance – there is no exposure to mainstream banks or insurance companies.

Recent portfolio activity

Portfolio activity during the last six months has largely involved selling down strongly performing holdings and adding to positions where the manager sees better value. The overall trend has been one of a reduction in net gearing as the manger has been cognisant of the broader impact on growth companies of an environment of higher interest rates for longer and, more recently, growing signs of a recession in Europe.

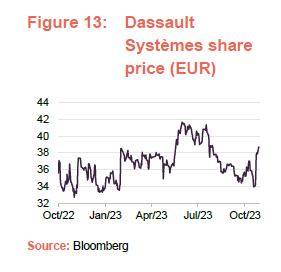

Broadly speaking, the manager has been trimming holdings such as Novo Nordisk and RELX, reflecting their respective strong performances; and has also trimmed Experian reflecting tightening credit conditions in the US that are hampering the growth of both its credit bureau business and its consumer facing products. Dassualt Systèmes and Infineon were both reduced into strength, while Network International was in its entirety sold following an agreed takeover. The position in Hikma was also disposed of.

The manager established a new position in CT Eventim in August on share price weakness during that month. The manager comments that, while the business is consumer facing (it is a major ticketing and live entertainment business), it has been a resilient business in previous downturns.

New positions in Ryanair and Prysmian were established in May. The manager comments that Ryanair’s cost advantage is a major benefit in the current environment that is allowing it to increase its market share and extend its lead over its rivals. Prysmian is a global supplier of energy and telecoms cable systems. The manager believes it should be a major beneficiary from the significant investment required to upgrade the electricity transmission system in the US.

The manager has also added to its positions in Worldline, Grenke, Oxford Instruments, Genus and ICG, on the back of share price weakness. The manager comments that Worldline’s results have been good this year and it is gaining market share. The company has positioned itself well strategically and has the benefits of cost cutting to come through, but this is not being reflected in the share price. This could leave it vulnerable to a low-ball offer from private equity.

Top 10 holdings

Figure 9 shows EOT’s top 10 holdings as at 30 September 2023, and how these have changed since 30 September 2022 (12 months prior). All the top 10 holdings as at 30 September 2023 were constituents of EOT’s top 10 at the end of September 2022, although some of the relative positions have changed. Reflecting the long-term nature of the manager’s investment approach, changes in the composition of the top 10 tend to reflect the relative performance of EOT’s large holdings.

We discuss some of the more interesting developments in the next few pages.

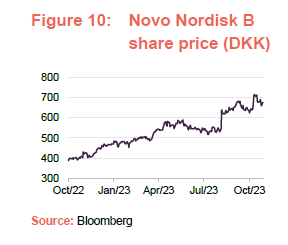

Novo Nordisk B (13.5%) – Dominating markets for diabetes and obesity treatments

Novo Nordisk (www.novonordisk.com) is a Danish pharmaceutical company that has a strong focus on treatments for Type 1 and Type 2 diabetes and obesity, as well as treatments for haemophilia and growth disorders. It is a long-time EOT holding that has also been EOT’s largest investment for some time, and employs some 55,000 people, in 80 offices around the world marketing its products in 170 countries. The company has 16 production sites (in nine countries) and 10 research and development (R&D) centres in five countries.

The company contributed 0.75% to EOT’s performance during the year ended 31 May 2021 but, for EOT’s 2022 financial year, it was the biggest single contributor – its share price rising sharply as prescriptions for three of its new diabetes and obesity drugs grew strongly in the US. EOT’s manager believes that Novo Nordisk, along with its principal competitor Eli Lilly, will dominate these two therapeutic areas globally for many years. The market for obesity treatment, while presently limited, looks set to expand enormously, not just in North America but globally as governments start to appreciate the tremendous benefits (including cost savings) of the latest drugs. EOT’s manager believes that Novo Nordisk’s products are sufficiently and positively differentiated to give them a strong market over the long term.

RELX (8.8%) – a play on digitalisation and AI

RELX (www.relx.com) is a business-to-business (B2B) data company that describes itself as a global provider of information-based analytics and decision tools for professional and business customers, enabling them to make better decisions, get better results and be more productive. It employs over 35,000 people, serving customers in over 180 countries and focuses on four market segments: risk; scientific and medical; legal; and exhibitions.

For EOT’s 2022 financial year, RELX was the second largest positive contributor to EOT’s NAV performance, adding 1.8% to the NAV return. During 2021, growth rates for all RELX’s divisions picked up (except exhibitions, which was still being weighed down by COVID), which provided some confidence that RELX would continue to benefit from well-established trends seen prior to COVID. For the year ended 31 December 2022, RELX provided strong revenue growth of 18% to £8.6bn, with operating profit increasing by around 20% to £2.7bn. Management attributes the growth to its increasingly sophisticated analytics and decision-making tools, a result of considerable investment in recent years.

EOT’s manager thinks that, recently, the market has become concerned that RELX could be a loser from the advent of artificial intelligence (AI), particularly within its legal business, where there are concerns that it could suffer from disintermediation. However, EOT’s manager thinks that the market has got a misread on this, noting that, like Experian, RELX is steeped in domain knowledge and that recent case experience has shown that AI is not yet a substitute. Furthermore, RELX’s risk division is a play on the growth in digitalisation and artificial intelligence – authentication services for both governments and businesses are increasingly important to counter fraud and RELX is a leader in this area.

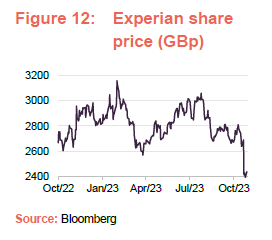

Experian (8.6%) direct to consumer – (D2C) business a major advantage during slowdowns

Experian (www.experian.co.uk) is the world’s biggest credit bureau and credit analytics company. It is a core holding within EOT’s portfolio and has been a major position for some time. EOT’s manager says that to be successful in the market for credit scoring, you need to be a top three player. Experian is strong in the UK, but its biggest markets are the US and, perhaps surprisingly, Brazil, where it occupies dominant positions. Anecdotally, Europe is still a very closed market and China is still closed to Experian (the authorities will not let them have the data), but the company is making progress elsewhere, for example in India (a very big market) where Experian’s paid for service has taken off. It was wrong footed by Credit Karma’s free service a decade ago and has been playing catch up, but now dominates the paid-for space.

EOT’s manager thinks that, perhaps contrary to expectations, Experian is well-positioned for a slowdown, with its D2C business (something that its primary competitors in the UK do not offer). In a recessionary environment, where credit can be harder to come by, consumers can obtain their credit score from Experian but can then boost this by submitting additional information into the company’s website. With this improved score, consumers can then look at additional financing options through Experian’s website. This means that, even in a slowdown, Experian can offer consumers something that other providers cannot.

For the year ended 31 May 2022, the company did not make a significant contribution to EOT’s performance, was a mild negative during the 2021 financial year and was a significant positive during the 2020 financial year. EOT’s manager says that Experian is a high-quality company that it expects to deliver good returns whatever the macroeconomic conditions. Experian’s business is well aligned with policymaker objectives: greater consumer protection and control.

Dassault Systèmes (7.8%) – breath-taking ambition

Dassault Systèmes (www.3ds.com) is a French multinational software company that develops software for 3D product design, simulation, manufacturing and other 3D related applications. A long-time holding, it has been a constituent of the portfolio since 1996, when EOT invested during the company’s initial public offering (IPO). EOT’s manager says that the scale of the company’s ambition is breath-taking.

The original computer aided design (CAD) systems were highly unsophisticated by today’s standards, but the company has continually developed its product set as computing power has increased (moving from 2D to 3D – and expanding into different sectors – from aerospace to autos and now medical applications), with fluid dynamics being a more recent addition. The company’s software can now create a digital twin for a product (for example, a simulation of aircraft blades for Boeing), which allows a digital experience to be run in parallel and for users to see instantly the ramifications of changes in design.

As part of the manager’s ongoing research, it regularly meets competitors (for example Siemens and Unigraphics) and it thinks that Dassault Systèmes’ platform is superior to those of competitors. The basic software is open source, but the paid-for system is better, and users will pay for the additional functionality. EOT’s manager thinks that Dassault Systèmes’ platform should effectively become the operating system for the industry and that it will be able to charge for this.

Edenred (7.0%) – high growth from ‘specific purpose money’

Edenred (www.edenred.com/en) describes itself as a leading digital platform for services and payments for employees and employers (in essence, employers load credit onto the platform for their employees to use for specific purposes), that connects over 60m users with 2m merchants in 45 countries for its close to 1m corporate clients. Its specific purpose payment solutions cover food (meal benefits), incentives (gift cards, employee engagement platforms), mobility (such as multi-energy, maintenance, toll, parking and commuter solutions) and corporate payments (such as virtual cards).

EOT’s manager comments that it would be easy to assume the company (formerly Accor Services) which grew out of the old ‘Luncheon Vouchers’ business, would have seen its products become obsolete; but it is in fact a significant beneficiary of consumer regulation and consumer technology. For example, Edenred offers customers a ready-made Cycle to Work scheme package for employers that allows employees to benefit from tax and national insurance contribution (NIC) savings on the cost of a new bike and/or accessories. This encourages a healthier and more environmentally friendly commute which also boosts the employer’s corporate social responsibility (CSR) credentials.

EOT’s manager comments that, aided by technology, special purpose money has become significantly more sophisticated in recent years and that with governments increasingly offering incentives to encourage positive outcomes, Edenred is well positioned to benefit from the long-term structural trend. There is a further near-term tailwind from the need to find cost savings.

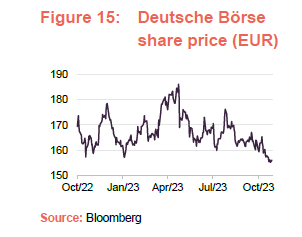

Deutsche Börse (6.9%) – benefiting from higher interest rates and volatility

Deutsche Börse (deutsche-boerse.com) is a German-listed international stock exchange organisation whose business covers the full financial market transaction process (admission, clearing, trading) and the provision of indices, data and analytics.

EOT’s manager comments that higher interest rates and greater volatility are good for Deutsche Börse’s business (as these will tend to stimulate trading) and, reflecting this, it was a negative contributor to EOT’s performance during the 2021 financial year when interest rates and volatility were lower. However, the manager thought that these conditions would change and retained the position, which allowed EOT to benefit during the 2022 financial year (during which it was the fifth largest contributor to EOT’s NAV returns adding 0.9%).

EOT’s manager comments that Deutsche Börse’s exchanges ensure safe and transparent trading, which it sees as an important driver as financial pressures increase on market participants. It believes that higher interest rates and volatility are likely to persist for the time being and that the company will continue to benefit from long term structural tailwinds from increasing regulation, demands for greater transparency and the need for strong execution.

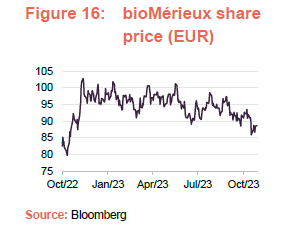

bioMérieux (6.0%) – long-term growth from testing platforms

bioMérieux (www.biomerieux.com) is a French multinational biotechnology company that is focused on in vitro diagnostics – tests done on samples such as blood or tissue that have been taken from the body. Not surprisingly, the company was the second-best performing stock in the 2020 financial year as medical diagnostics companies, particularly those with exposure to COVID-19, came into vogue (its share price moved from €80.40 on 3 January 2020 to a peak of €140.90 on 7 August 2020). However, the general trend has been one of share price softening since, albeit with marked periods of volatility, over the last couple of years so that it currently trades in the €90-95 range.

Sales growth was slow in 2022 (0.2% in constant exchange rate terms) but the prior year included significant COVID-related activity and so the fact that sales have not retrenched is seen as a positive. Looking forward, EOT’s manager sees last year’s acquisition of Specific Diagnostics as a strong strategic move that will support long term growth as it provides exposure to the market for products that address antimicrobial resistance.

Antimicrobial resistance is a global threat and Specific Diagnostics has developed a rapid antimicrobial resistance susceptibility test (AST) – the SPECIFIC REVEAL Rapid AST system – which provides actionable results from positive blood cultures in an average of five hours. This helps clinicians to better address bloodstream infections, allowing for either quick de-escalation to a more focused lower-cost therapy, or switch to a more effective therapy where a multidrug-resistant infection is present. In addition, the company is seeing good momentum from several other platform launches that should also support growth in the coming years.

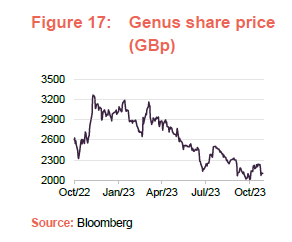

Genus (4.6%) – regulatory approval for PRRSv programme could transform the business

Genus (www.genusplc.com) describes itself as a world-leader in animal genetics with a strong focus on porcine and bovine genetics. Genus analyses animal DNA to look for markers associated with desirable characteristics (such as feed efficiency, disease resistance, growth rate, protein and fat content, and fertility), so that these can be accurately selected and then used to breed future generations. Genus aims to help its customers raise healthier and more productive animals (for example, allowing farmers to produce high-quality meat and milk more efficiently and sustainably), which it sees as being important to building a sustainable future (agriculture is inherently a ‘dirty’ business from an environmental perspective and so there is strong pressure to improve its sustainability).

EOT’s manager considers that Genus is exposed to a number of long-term structural growth drivers. With growing populations and a need for greater efficiencies, the manager expects to see continued demand across all of Genus’s major business lines and in all its main global markets. Genus has consistently reinvested in its business, which has driven innovation that not only supports Genus’s long-term growth but has also provided it with a large defensive moat.

Genus has, for a number of years, been working on the introduction of gene editing for one of the main porcine respiratory diseases (the second biggest killer of pigs globally) and trials for what is a proprietary technology are well advanced. Its porcine reproductive and respiratory syndrome virus (PRRSv) programme, which effectively switches off a gene that can lead to the animal’s death, is progressing towards regulatory approval. If successful, this will open a significant commercial opportunity that could transform the business.

The company has a significant exposure to China’s pork markets, having invested heavily in its local presence there in recent years. This was a benefit during FY 2021 but during the 2022 financial year Genus’s sales of porcine genetics fell sharply due to low pork prices caused by a supply glut stemming from high slaughter rates (this because of African Swine Fever) and lockdowns (although a lifting of restrictions was expected to stimulate demand). The first half of 2023 has also been challenging. The pig price decreased to 15 RMB/kg from a peak of 28 RMB/kg in October 2022. EOT’s managers consider these factors to be temporary and expect pork prices to recover, which should catalyse demand for Genus’ services.

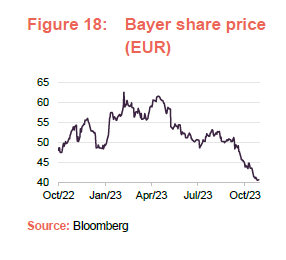

Bayer (4.6%) – B2B revenues should weather economic slowdown better than B2C

Bayer (www.bayer.com/en) is a German multinational pharmaceutical and biotechnology company, one of the largest globally. In addition to pharmaceuticals, its products include consumer healthcare, agricultural chemicals, seeds and biotechnology products.

Bayer’s crop science business has faced a number of lawsuits in the US relating to its well-known herbicide, Roundup (reportedly the most popular and profitable weed killer ever sold – according to Forbes), which it is alleged can cause cancer. Bayer purchased Roundup in 2018 by which time thousands of lawsuits had already been filed although there is some debate as to whether Roundup is carcinogenic (The International Agency for Research on Cancer (IARC) categorises glyphosate – the active ingredient – as possibly carcinogenic to humans, although EOT’s manager notes that, according to the scientific studies, it is not). Monsanto, which previously owned Roundup, has already settled over 100,000 cases, and most cases against it and Bayer have been settled, although there are still some high-profile cases outstanding. EOT’s managers expect Bayer will work through these and that, once this cloud is removed, it will get proper recognition for its superior range of products.

Bayer’s shares rallied on a change of CEO earlier this year but have been weaker since. There have been calls for a break-up of the business, selling off the consumer division (which owns Aspirin and Claritin), for example.

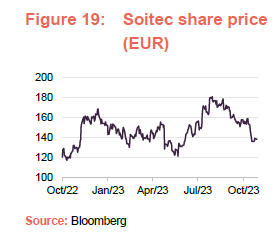

Soitec (4.5%) – 20% revenue growth expected for 2023 with 36% EBITDA margin

Soitec (www.soitec.com/en) is a French multinational that manufactures high performance substrates that are used in the manufacture of semiconductors. Soitec’s semiconductor materials are used to manufacture chips which equip smartphones, tablets, computers, IT servers, data centres, cars and other connected devices. In a world of a rapidly growing internet of things, Soitec benefits from strong long-term growth drivers. This is bolstered by a substantial defensive moat from its significant IP. It has also been making significant investments to increase its production capacity leaving it in a strong position to take advantage of the growth opportunity.

The company performed strongly during 2022 with revenue increasing 50% (using constant exchange rates) surpassing US$1bn for the first time, while current operating income more than doubled to €195m, with operating cashflow up 46% to €255m. EBITDA also improved by 5.1 percentage points to 35.8%. The company expects to see revenue growth for 2023 to be in the region of 20%, with an EBITDA margin of around 36%.

Performance

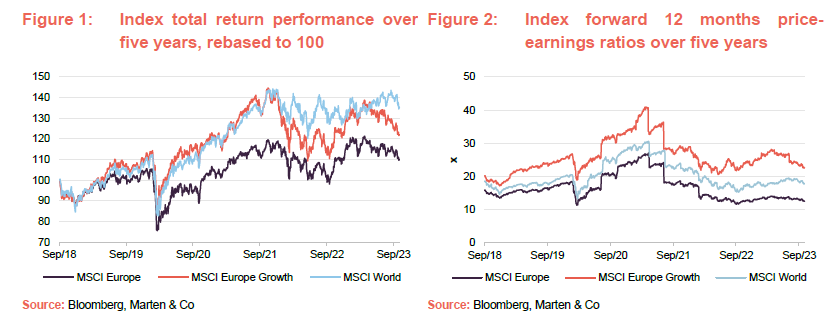

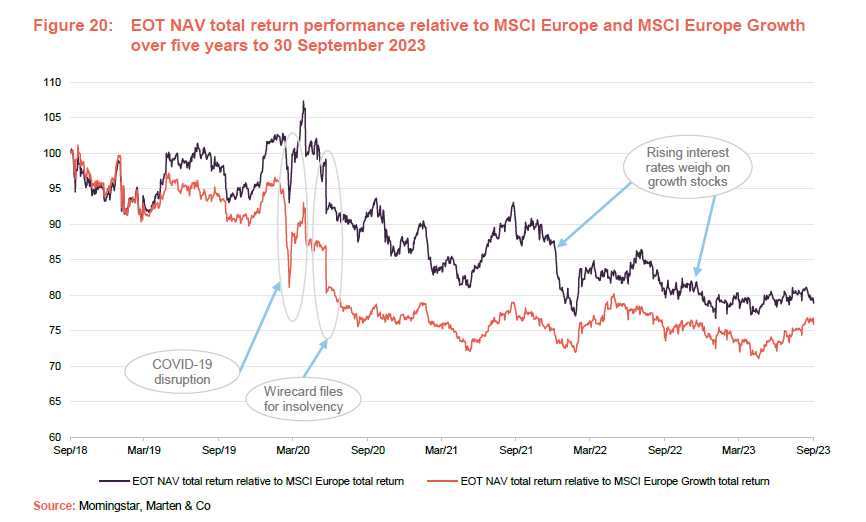

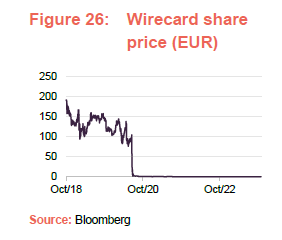

As is illustrated in Figure 20, in the period prior to the onset of the pandemic, EOT outperformed the MSCI Europe Index and broadly matched the MSCI Europe Growth Index. EOT’s NAV initially underperformed both indices during the COVID-related market collapse of March 2020 before outperforming in the second quarter as markets recovered on the back of the massive fiscal and monetary stimulus injected by governments globally to try and prop up their economies. However, while many growth-focused strategies continued to benefit from an environment that favoured growth, EOT’s NAV took a significant hit in June 2020 when Wirecard collapsed (see below).

Since then, EOT’s NAV has largely held its own versus the MSCI Europe Growth Index, albeit with some volatility, but has exhibited a general trend of gradual underperformance versus the MSCI Europe Index. This has been due to both its bias to growth and smaller companies (see Figure 30 in the peer group section), as rising interest rates tend to affect sentiment towards these disproportionately, which has weighed on EOT’s relative performance during the last 18 months.

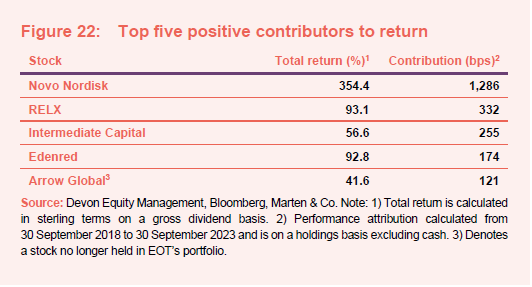

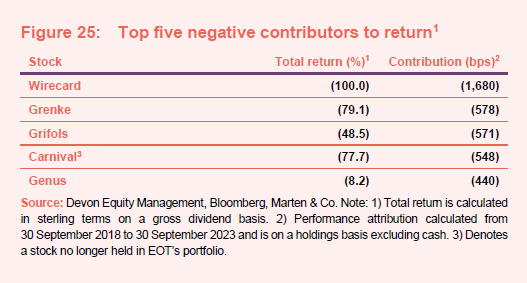

Performance attribution over five years

EOT’s manager has kindly provided some longer-term term (five years) performance attribution data that covers the period from 30 September 2018 to

30 September 2023. This aligns with EOT’s board’s view that five years is an appropriate time horizon for equity investing. This period captures the impact of the collapse of Wirecard (discussed on page 22), which was an extreme event the like of which has not been seen at any other point in EOT’s history, and we would urge readers to be aware of this.

During the period, EOT provided NAV and share price total returns of 5.5% and –4.3% respectively (in sterling terms). In comparison, the MSCI Europe (EOT’s benchmark), provided a total return of 33.7%.

Over the period, positive contributions in absolute terms came from industrials, healthcare and technology (all significant overweight exposures); financials (a modest overweight) as well as consumer staples (a significant underweight), real estate and energy (small underweights). All the negative contributions came from areas that the portfolio had moderate underweight exposures to – materials, utilities, communications services and consumer discretionary.

Anecdotally, over the three years to 30 September 2023, EOT generated NAV and share price total returns of 14.9% and 20.5% respectively and while these were less than the 33.0% return from the MSCI Europe, they are more comparable to the return of the MSCI Growth Index, which returned 16.6%. Over three years, the top five contributions come from the same five stocks, albeit in a different order, which make up the top five contributors over five years that are discussed below, which we thinks illustrates the long-term nature and consistency of the manager’s approach.

Top positive contributors to performance from 30 September 2018 to 30 September 2023

Figure 22 provides the top five contributors to performance from 30 September 2018 to 30 September 2023. Arrow Global and Intermediate Capital are discussed below, while Novo Nordisk, RELX and Edenred are discussed in the asset allocation section on pages 13, 14 and 15 respectively.

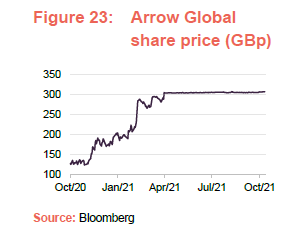

Arrow Global – sold due to takeover

Arrow Global (www.arrowglobal.net) describes itself as a leading vertically integrated alternative asset manager specialising in private credit and real estate in Europe. It was previously listed on the London Stock Exchange but delisted in October 2021 following its takeover by TDR Capital IV in a £565m acquisition that was announced in March 2021. TDR Capital was successful in its fifth bid for the company at 307.5p per share (250p and 265p in December 2020, 290p in January 2021 and 305p in February 2021), which was a 33.4% premium to the closing price of 224p on 4 February 2021 (the day before TDR Capital indicated its interest in taking over the company in what was to become the final bid).

While Arrow Global was about a 4% holding in EOT’s portfolio at the point of disposal, across all its portfolios, EOT’s manager held 9% of the company and would have otherwise held it for the long term. The manager was disappointed with the takeover price, which it considers undervalued the long-term growth prospects of the company. It comments that this is one of a number of situations where private equity has been able to buy quality assets from disgruntled public market investors on the cheap.

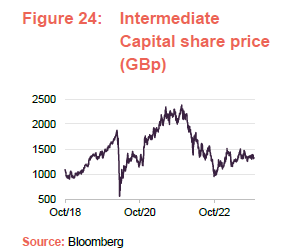

Intermediate Capital – benefiting from growing allocations to private assests

Intermediate Capital (www.icgam.com) is an asset management firm that focuses primarily on private equity, credit, and debt investments. It offers a range of strategies that includes real assets (infrastructure and real estate), credit strategies (alternative credit, liquid loans and multi-asset credit) and corporate (Europe, North America, Asia Pacific and global). EOT’s manager observes that, globally, there is a trend of investment institutions allocating more capital to private markets, which Intermediate is well positioned to benefit from.

Intermediate Capital was the single biggest contributor to EOT’s performance during the year ended 31 May 2021, benefiting from an environment of lower interest rates. More recently, it has weighed on EOT’s performance (it was a significant detractor during the year ended 31 May 2022) as the low interest rate environment has reversed.

EOT’s manager considers that Intermediate Capital benefits from long-term structural growth trends coupled with the advantage of funds that are committed for the long-term, which gives it the confidence that Intermediate Capital will continue to deliver good returns.

Top negative contributors to performance from 30 September 2018 to 30 September 2023

Figure 25 provides the top five detractors from performance between 30 September 2018 to 30 September 2023. Wirecard, Grifols, Grenke and Carnival are discussed below, while Genus is discussed in the asset allocation section on page 17.

Wirecard – quick sale preserved some value

Wirecard (www.wirecard.com) was a German payment processing and financial services company that offered electronic payment transaction and risk management services as well as providing both physical and virtual cards. In what is widely cited as Germany’s largest post-war fraud, the company collapsed in June 2020 after its auditors, Ernst & Young, declined to sign off on its year end accounts. It transpired that €1.9bn was missing from its accounts (effectively wiping out any previous profits it had made) and the company owed €3.2bn of debt. The company was largely dismantled in November 2020 after its main business unit was sold to Santander Bank for €100m.

EOT’s entire holding was sold on 18 June 2020 – the day that the company announced the shortfall in its accounts. This meant that EOT realised a profit over the term of this investment, despite the events leading up to the sale. However, at the time of its collapse, the position was EOT’s largest holding by a substantial margin (accounting for around 15% of the portfolio), and with the shares down by just over 65% on the day of the announcement (from €104.24 to €36) EOT lost 7.5% of its NAV on the day. Nevertheless, the decision to sell quickly was prescient. A week later, Wirecard’s share price closed at €3.01 (on 25 June 2020) meaning that failure to sell the position in its entirety would have seen EOT book a 97.1% loss on the holding, rather than the 65.5% noted above. Shareholders that hung on beyond that were effectively wiped out in their entirety.

It is important to stress that EOT’s managers have preserved their investment process that has been successful in adding value for the trust over the long-term, while risk management has been strengthened significantly so that it is a key pillar of the approach. This means that a repeat of a Wirecard-like event, while never impossible, is much more unlikely.

Grenke – leasing business benefits from higher interest rate environment

Grenke (www.grenke.com) is a manufacturer-independent leasing company that is focused on small ticket items, specialising in office communications products, such as printers, copier machines, telephone systems, servers and laptop computers. As is illustrated in Figure 27, the company’s share price took a significant hit in September 2020 when it came under a short seller attack from Viceroy Research.

In a 64-page report, Viceroy made some very serious allegations against the company (blatant accounting fraud, dozens of related party transactions, a complete lack of internal controls and, for its banking business, hiding fake cash, laundering money that was actively used to launder money for binary options, scams, crypto scams and a fraudulent unregulated trading platform). Whilst Grenke was effectively vindicated, with an unqualified auditor’s report in 2021, the shares have never fully recovered their poise.

Grenke’s share price has been making progress recently, albeit with some volatility. Historically, rising interest rates have been good for Grenke. As banks become stricter on their lending criteria, leasing can become a more attractive alternative for corporate customers.

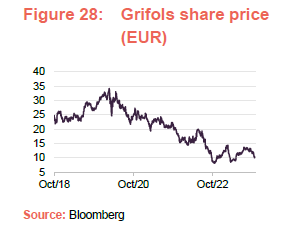

Grifols – Global Leader in blood plasma derivatives

The Spanish pharmaceutical and chemicals manufacturer Grifols (www.grifols.com/en/home) is a global leader in the manufacture and marketing of blood plasma derivatives. It has faced a number of headwinds in recent years. Key amongst these was that COVID-19 lockdowns and furlough payments in the US had the effect of reducing incentives for potential plasma donors, creating supply issues for the company, while new medical advances have threatened to displace Grifols’ IgG fractionated products (used to treat problems with immune systems). This has been a key product area for the company in which it has previously benefited from a strong competitive advantage.

EOT’s manager comments that the US is an important market for the company but observes that it is one of a small number of players licensed to sell into this market and that blood plasma collections should normalise – a tougher economic environment will have the effect of incentivising donors to return. With regards to increasing competition for its fractionated blood products, EOT’s manager comments that the industry supplying these is very tight (and needs to be). Scale is crucial and to be effective companies need an international footprint – different markets have different demand profiles which tend to differ from their supply profiles. It thinks that demand for fractionated blood plasma will remain strong, and observes that the company is beating its numbers. The recent appointment of the new CEO ends the founding family’s leadership, and his substantial (€400m) cost reduction plan is seen as a key positive. Finally, the manager feels that the company has a good international strategy and benefits from great visibility of earnings.

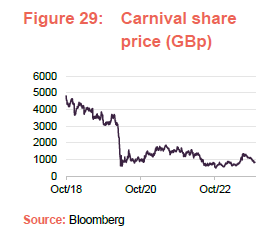

Carnival – quickly sold during the pandemic

Carnival Corporation (www.carnivalcorp.com) is dual listed in both London and New York and is the only company to feature in both the FTSE 250 and S&P 500 Indices. It is the world’s largest cruise operator with a fleet of more than 90 ships visiting over 700 ports around the world with totalling 223,000 lower berths. Its brands comprise Carnival Cruise Line, Princess Cruises, Holland America Line, Seabourn, P&O Cruises (Australia), Costa Cruises, AIDA Cruises, P&O Cruises (UK) and Cunard. Carnival Corporation also operates Holland America Princess Alaska Tours, which is the leading tour company in Alaska and the Canadian Yukon. Carnival has a total of eight new ships that are scheduled to be delivered to its brands between now and 2025.

During the year ended 31 May 2020, Carnival was one of the stocks that detracted most from EOT’s performance following the onset of COVID. Inevitably, Carnival was an early casualty of travel restrictions with the additional complication that its cruises were not compatible with the social distancing requirements that were rapidly put in place, and remained for some time, around the world. EOT’s manager quickly sold the entire position on the view that Carnival’s recovery would depend to a great extent on a return to a normal way of operating – freedom to travel, high occupancy levels and ancillary revenue opportunities. Another concern was the very heavy debt burden that the company was carrying and that EOT’s manager felt would weigh heavily on results even its operations had restarted. Figure 28 validates the managers thinking regarding Carnival. While many companies that were affected by the pandemic have seen their share prices recover to pre-pandemic levels, Carnival’s has never regained the lost ground and is currently less than a third of its pre-pandemic share price.

Peer group

Please click here for an up-to-date peer group comparison of EOT versus its Europe sector peers.

EOT is a constituent of the AIC’s Europe sector, which comprises seven members, all of which are illustrated in Figures 30 to 33. Members of the Europe sector will typically:

- have over 80% invested in quoted European shares;

- less than 80% in any single geographic area;

- an investment objective/policy to invest in European shares;

- a majority of investments in medium to giant cap companies; and

- a European benchmark.

It should be noted that there are some notable differences in strategy within the peer group. For example, Baillie Gifford European Growth, BlackRock Greater European and Henderson Eurotrust are managed with strategies that favour growth and so should be more relevant peers when compared to EOT. Fidelity European and Henderson European Focus have more of a bias to value, while JPMorgan European Growth and Income operates a fairly balanced strategy.

Baillie Gifford European Growth was European Assets. Baillie Gifford took over the management of the trust from F&C, with effect from 29 November 2019 (the implication is that the returns for periods above three years in Figure 31 and 32 below do not relate solely to the current investment strategy).

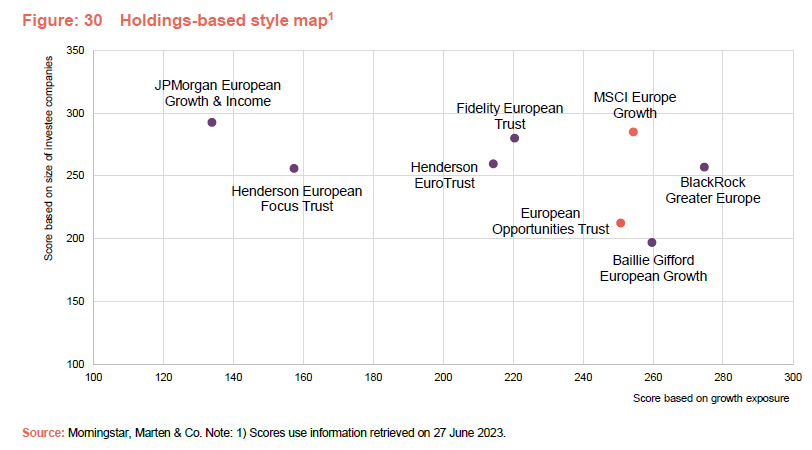

The map in Figure 30 provides a graphical representation of EOT’s investment style versus its Europe peers as well as the MSCI Europe Growth Index.

The Y-axis (or vertical axis) is a size score – the larger the score, the larger the underlying investments in the portfolio, while the X-axis (or horizontal axis) is a measure of the growth and value factors (the larger the score, the more growth orientated the trust’s portfolio).

Looking at Figure 30 versus its peers, EOT and Baillie Gifford European Growth have portfolios that are the smaller end of the large cap spectrum and EOT, Baillie Gifford European Growth and BlackRock Greater Europe are the most growth focused strategies (of all of the peers, EOT’s growth score is the closest to that of the MSCI Europe Growth Index).

It is also apparent that the Europe sector offers a range of different propositions in terms of their value-growth tilt, with JPMorgan European Growth and Income and Henderson European Focus Trust having much more of a value tilt, while Fidelity European and Henderson EuroTrust offer value-growth exposures that are much more middle of the pack.

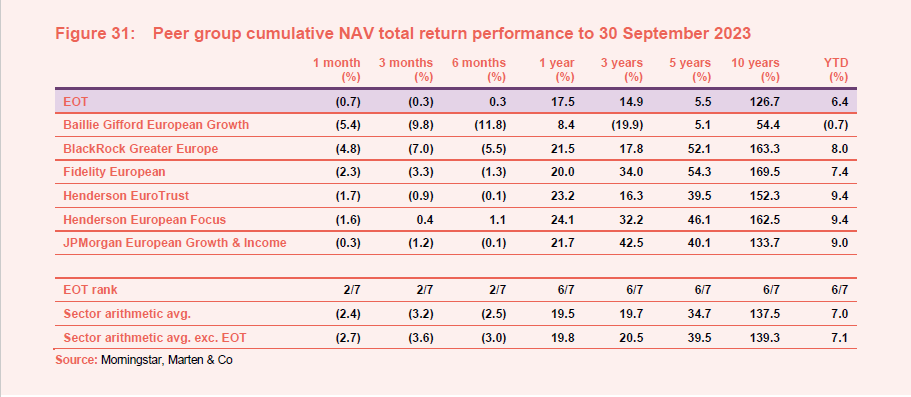

If we had constructed the NAV total return peer group comparison table in Figure 31 prior to the announcement in June 2020 of the collapse of Wirecard, it would have been observed that EOT was one of the top-performing trusts within the peer group over the long-term. However, as discussed, Wirecard had a marked impact on EOT’s NAV, and has pushed it down the peer group rankings.

Growth sell-off has eaten into EOT’s longer-term performance record.

It is also worth noting that, reflecting its above average focus on growth, EOT and its growth-focused peers have been at the sharper end of the sell-off in growth stocks during the last 18 months. However, there is strong recovery potential should inflation cool and rates stabilise/fall.

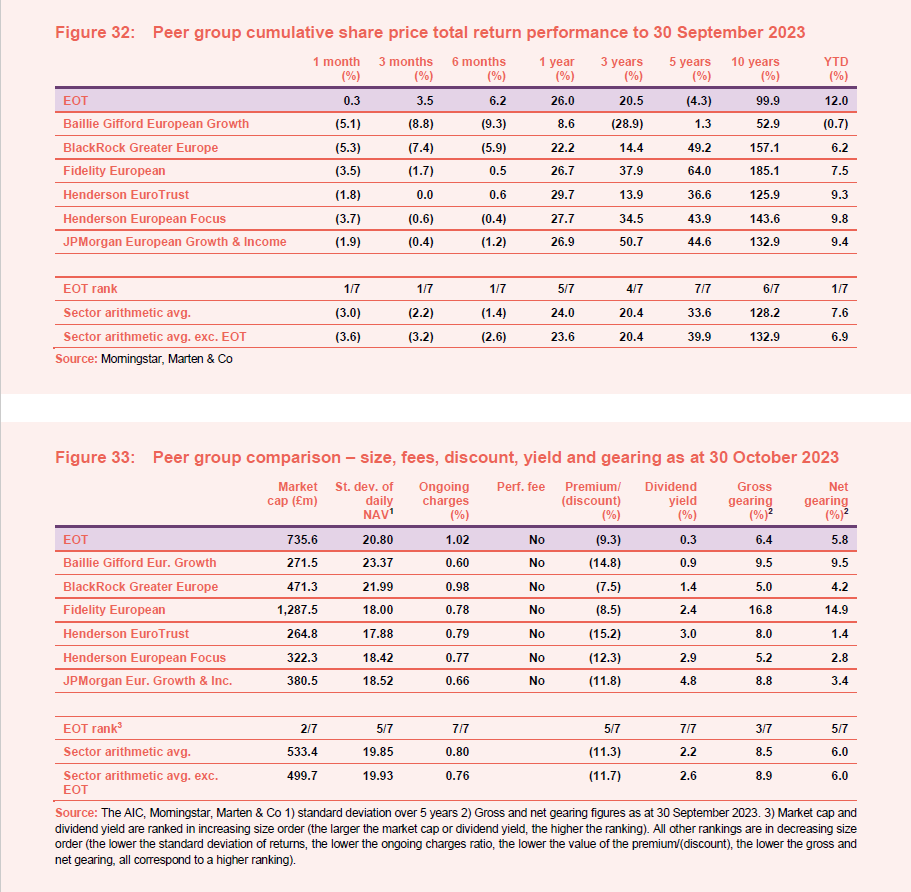

Looking at Figure 32, the relative positions of the funds are largely unchanged from Figure 31, although the absolute share price performances are generally poorer over all time frames, reflecting a general trend of widening discounts to NAV during the last year. At the margin, EOT appears to have suffered from a greater degree of discount widening versus its peers, although this suggests that there is an above average prospect for a rerating when conditions are more favourable.

While all the funds are a respectable size, there are significant differences between them. EOT is the second largest in the group and has a market cap above the sector average.

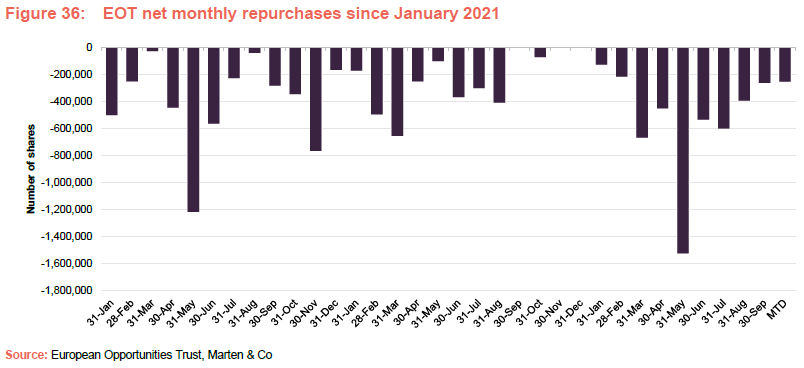

In terms of ongoing charges ratio, EOT’s is the highest within the peer group, but not out of line with wider industry comparisons. It is worth bearing in mind the fee changes outlined on page 32 which we think would cut the ongoing charges ratio by 10bp. Another consideration is that, in response to a widening discount, EOT’s board has stepped up and repurchased shares to provide liquidity to exiting shareholders. However, at the margin, this puts upward pressure on EOT’s ongoing charges as its fixed costs are spread over a slightly smaller asset base. None of the peer group pays a performance fee.

Repurchases have been helpful for liquidity but EOT’s ongoing charges ratio has edged up at the margin.

Interestingly, the three most growth focused funds are those that have experienced the highest volatility in their returns, although EOT’s has the lowest volatility of these, and its volatility is only a little above the sector average.

Reflecting their growth focus, EOT and Baillie Gifford European Growth have the lowest yields in the sector. Unsurprisingly, the more value-orientated funds have higher yields. As is discussed in the dividend section below, reflecting its growth focus, EOT’s primary reason for paying a dividend is to maintain its investment trust status.

EOT’s discount is fractionally above the sector average, although this is pulled up by the discounts of Baillie Gifford European Growth (with its strong growth focus) and Henderson EuroTrust (which, outside of the more growth focused funds, is the most-poorly performing of the more value-orientated trusts during the last year.

EOT ranks as one of the more geared funds within the peer group although, in absolute levels, both gross and net gearing are at quite sensible levels. EOT’s gross gearing is in line with the sector average, which is pulled up by Fidelity European’s gearing level. It is a similar story with net gearing, although EOT’s net gearing is around two percentage points higher than the sector average.

Dividend

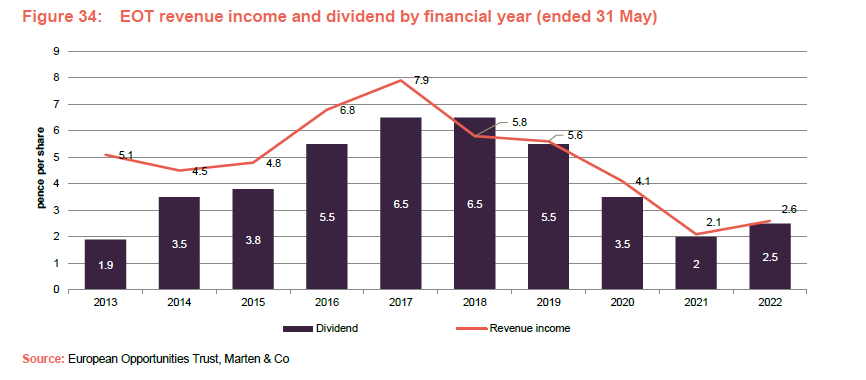

EOT is focused primarily on generating capital growth, rather than income, and so dividend income makes up a relatively small part of its overall returns (EOT paid a dividend of 2.5p per share for the year 31 May 2022, which is a yield of 0.3% on the trust’s share price of 763.0p per share on 30 October 2023). The consequence of this is that EOT’s primary reason for declaring a dividend is to ensure that it meets the requirements to qualify for approval as an investment trust (a UK investment trust is not permitted to retain more than 15% of eligible investment income arising during any accounting period).

Capital growth focused so dividend income is a relatively small part of overall returns.

The dividend is paid as a final, usually towards the end of November each year, following its approval at the company’s AGM. Figure 34 shows that EOT has paid a dividend for each of the last 10 accounting years and, while the level has fluctuated, the dividend has always been covered, except for FY2018. This has allowed EOT to gradually build its revenue reserve over time. As at 30 November 2022, EOT had a revenue reserve of £9.22m or 9.09p per share (2021: £8.52m or 8.16p per share), which is 3.6x the total dividend for the 2022 year. EOT is not permitted to pay dividends out of capital.

One dividend annually, primarily to maintain investment trust status.

Premium/(discount)

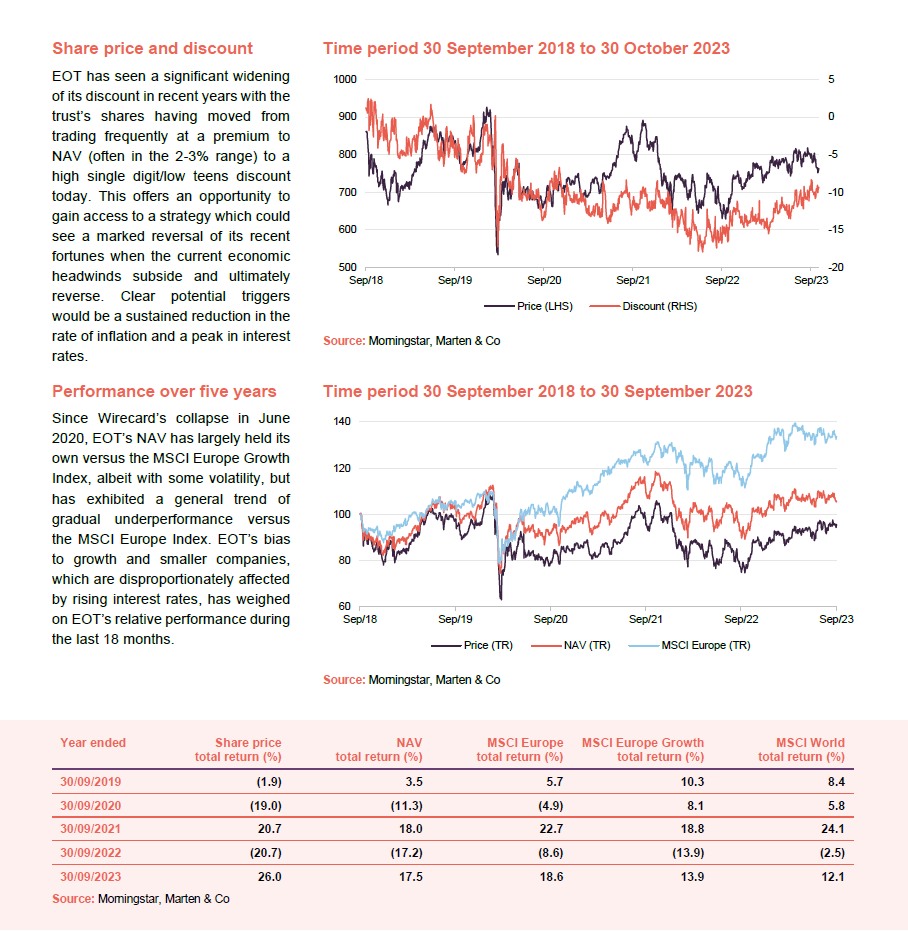

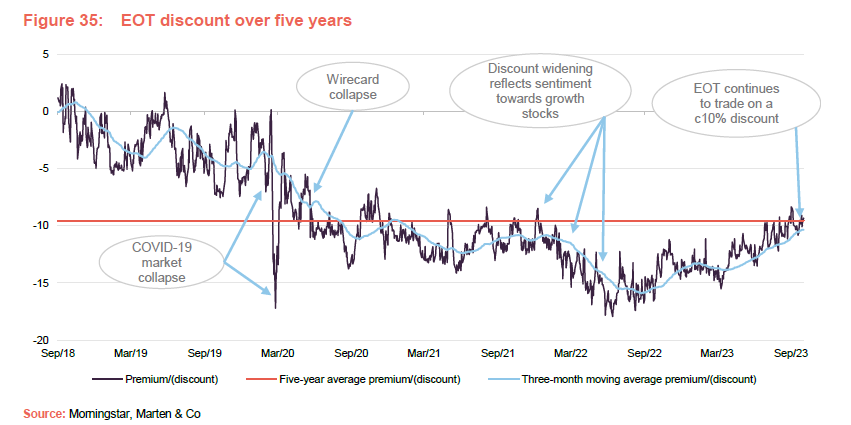

EOT has seen a significant widening of its discount to NAV in recent years with the trust having moved from trading frequently at a premium (often in the 2-3% range) to a high single digit/low teens discount today.

We think that a key driver behind EOT’s historic premium was its long-term record of strong absolute performance and performance relative to its peers. This took a jolt when Wirecard collapsed in June 2020. EOT’s discount widened during the first half of 2022 as growth stocks sold off. However, there has been some discount narrowing during the last twelve months, which reflects EOT’s active share buyback programme.

Over the last 12 months, EOT has traded at discounts between 8.3% and 15.5%, with an average of 12.4%. As at 30 September 2023, EOT was trading at a discount of 9.3%, which is 3.1 percentage points narrower than its three-year average of 12.4%, and 0.2 percentage points narrower than its five-year average of 9.5%.

Current discount may provide an opportunity

It seems reasonable that the current discount may offer an opportunity to gain access to a strategy which could see a marked reversal of its recent fortunes when the current headwinds subside and ultimately reverse. One clear potential trigger would be a sustained reduction in the rate of inflation and a peak in interest rates. We note that EOT’s portfolio should also prove resilient in the face of a more pronounced economic slowdown.

Board acting on the discount with NAV accretive purchases

Each year, the board asks shareholders for permission to buy back up to 14.99% and issue up to 10% of EOT’s issued capital. Repurchased shares may be held in treasury and reissued when demand returns. Shares will only be issued or reissued at a premium to asset value, thereby enhancing the NAV for existing shareholders. The board has an active discount management policy whose primary objective is to reduce discount volatility and aims to maintain the discount in single digits in normal market conditions.

Conditional tender offer in 2026 if EOT’s NAV underperformance the benchmark

On 12 October 2023, EOT announced the board’s intention to introduce a performance related tender offer in 2026. The decision to offer this conditional tender was a result of an extensive shareholder consultation ahead of the forthcoming continuation vote at the upcoming AGM on 15 November 2023.

Conditional 25% tender at prevailing NAV less 2% in 2026.

EOT’s board proposes that, if its NAV total return does not equal or exceed that of its benchmark, the MSCI Europe Index, over the three-year period beginning 1 June 2023 and ending on 31 May 2026, EOT will undertake a 25% tender offer that will be held as soon as is practicable following the conclusion of the 2026 AGM. The tender will be priced at the prevailing NAV at the time of repurchase (adjusted for the costs associated with the tender offer) less two per cent, which will make it NAV accretive for remaining shareholders. EOT’s board says that the introduction of the conditional tender offer will not change the board’s current approach to discount management that is discussed above.

The implementation of the conditional tender is subject to shareholders approving the continuation resolutions to be proposed at both the 2023 and 2026 AGMs and, if the performance hurdle is not achieved, approval of the relevant resolutions at a general meeting to be convened following the 2026 AGM to approve the tender offer.

EOT’s board says that, despite the trust’s share price performance over recent years, it is confident in the core investment strategy, which is upheld by EOT’s long term track record. The board believes that the manager has the potential to provide superior returns over the medium term and encourages shareholders to vote for continuation at the AGM.

EOT’s board encourages shareholders to vote for continuation.

Activist agitating for full exit tender

Saba Capital Management, a US-based activist investor, has been building stakes in quite a large number of investment companies over the last 18 months and has recently announced a 5% holding in EOT. It issued a statement on

23 October 2023 opposing the proposals for both the tender offer and continuation. Fundamentally, having recently built its stake at a discount, Saba is looking to make a quick profit by agitating for a 100% tender offer, which would allow it to exit at close to NAV (it says that it will vote against continuation “unless a full liquidity option at NAV is provided to shareholders”). This is a strategy that Saba has long pursued in the US and while EOT is the first UK-based investment company on which it has commented on publicly, we expect you will see more activity in the coming months with other London-listed funds.

Saba Capital is now pursuing a similar strategy in the UK as it has in the US.

We do not have to go back too many years to a point when EOT was the best performing fund in the sector by some margin. However, the combination of Wirecard and the adverse sentiment towards growth companies means that it is currently out of favour. Sentiment can change quite quickly and there is the risk that Saba’s actions result in the liquidation of all or a substantial part of the fund at the bottom of the cycle.

In requesting a full exit, Saba’s approach does not appear to be aligned with traditional value players in the investment companies space, who generally take a longer-term view and have a greater interest in these vehicles surviving. The traditional discount players tend to request specific improvements but are prepared to wait and profit from some discount closing and some partial exits at close to NAV. Given that a 100% tender offer could significantly shrink the fund, making it less liquid, less efficient and less relevant to the wealth management community, which wants companies of this size, coupled with the low valuations that European equities are currently trading at, a full tender at the current time does not seem to be in shareholders’ long-term interests

A full tender at the current time does not seem to be in shareholders’ long-term interests.

Fees and expenses

New improved management fee structure

With effect from 1 June 2023, EOT’s investment manager, Devon Equity Management Limited, is entitled to receive a basic management fee of:

- 8% per annum of net assets up to £1bn;

- 7% per annum of net assets in excess of £1bn and less than £1.25bn; and

- 6% per annum of any net assets in excess of £1.25bn.

This new fee structure is already providing cost savings to shareholders versus the previous fee structure (a basic management fee of 0.90% per annum of net assets up to £1bn and 0.80% per annum of any net assets over this amount), with further cost savings available as EOT grows.

The management fee is paid quarterly in arrears, and the management agreement can be terminated on six months’ notice by either side. There is no performance fee element. The ongoing charges ratio for the year ended 31 May 2023 was 1.02% (2022: 1.02%, 2021: 0.99). However, if the new fee structure was in place for the last financial year, we estimate the ongoing charges ratio would have been in the region of 0.92%.

On 1 July 2022, Devon Equity Management Limited was appointed as AIFM in place of FundRock Partners Limited. The Fees that FundRock received as AIFM were met from Devon’s management fee and Devon’s services as AIFM are covered by the investment management fee.

Fund administration, company secretarial and custody services

Devon Equity Management Limited is named as EOT’s company secretary at UK Companies House, although all day-to-day company secretarial and administration services are undertaken by J.P. Morgan Europe Limited (the board says that independence from the investment manager in company secretarial matters, administration and shareholder relations are considered to be key governance issues for the company). J.P. Morgan Europe Limited also acts as EOT’s depositary (for cash monitoring, safekeeping of financial instruments and other assets and oversight).

Audit fees

PricewaterhouseCoopers LLP is EOT’s auditor. The auditor’s fees for the year ended 31 May 2023 were £54,000, up from £49,000 for the prior year and £43,000 the year before that. The increase over the last couple of years is due to the additional audit work that is required to provide appropriate audit quality.

Capital Structure

EOT has a simple capital structure with one class of ordinary share in issue. EOT’s ordinary shares have a premium main market listing on the London Stock Exchange and, as at 30 October 2023, there were 112,875,331 of these in issue with 16,460,440 held in treasury. The number of shares in issue with voting rights was 96,414,891.

EOT has a simple capital structure.

Gearing and derivatives

EOT’s board believes that long-term capital growth can be enhanced by the use of gearing through bank borrowings, although it also believes that gearing should be maintained at appropriate levels, with sufficient flexibility to allow EOT to adapt at short notice to changing market conditions. Reflecting this, EOT tends to maintain a relatively low level of gearing and has always remained comfortably compliant with its loan covenants. EOT’s board regularly reviews the level of gearing with the manager and does not expect gearing to exceed 20% of total assets (at the time of borrowing) in normal market conditions.

EOT has a £100m loan facility which is provided by The Bank of Nova Scotia, London Branch and expires in September 2023. The trust also has credit approval for an additional accordion amount, available upon application, for an additional £50m. As at 30 September 2023, EOT had gross and net gearing of 6.4% and 5.8% respectively. EOT does not invest in derivative instruments, whether for efficient portfolio management, gearing or investment purposes.

Unlimited life; continuation vote in 2023

EOT does not have a fixed life but offers shareholders a continuation vote at every third AGM. Shareholders last approved the continuation of the company at its AGM in November 2020 and the next continuation vote is scheduled for this year’s AGM (see financial calendar below).

Corporate history

EOT was launched in November 2000 as Jupiter European Opportunities Trust Plc, changing its name to European Opportunities Trust Plc in November 2019. Alexander Darwall has been EOT’s portfolio manager since launch. Alexander left Jupiter Asset Management in July 2019 to found Devon Equity Management and, at that time, EOT’s board took the decision to serve notice to Jupiter and move the management contract to Alexander’s new management company. This allowed Alexander to be retained as EOT’s portfolio manager and Devon became EOT’s manager in November 2019 when the management contract with Jupiter came to an end. The trust was renamed European Opportunities Trust in November 2019 to coincide with the change of investment manager.

Financial calendar

EOT’s year-end is 31 May. The annual results are now usually released in September (interims in February) and its AGMs are now usually held in November of each year. The next AGM is scheduled for 15 November 2023.

Management team

Alexander Darwall (CIO and lead portfolio manager of EOT)

Alexander founded EOT’s manager, Devon Equity Management Limited, in 2019. Prior to this, he worked at Jupiter Asset Management (from 1995 to November 2019) where he was head of strategy for European equities. Before joining Jupiter, Alexander trained as an investment analyst with de Zoete & Bevan (BZW) before moving in 1987 to Enskilda Securities in Paris, where he became head of French equity research. He joined Goldman Sachs in London in 1992, where he worked as a French equity analyst. Alexander has a degree in History from the University of Cambridge.

Luca Emo (senior fund manager)

Prior to joining Devon Equity Management in November 2019, Luca worked for Jupiter Asset Management, initially in a business development role (between April 2006 and October 2009) and then as a fund manager with European equities (November 2009 to November 2019). Prior to Jupiter, he worked in European private banking for Lloyds TSB. Luca has a degree in Modern Languages from the University of Oxford and a postgraduate diploma in Law (BPP).

Charlie Southern (fund manager)

Prior to joining Devon Equity Management in November 2020, Charlie was an executive director for seven years at Indus Capital Partners (May 2013 to March 2020), with primary responsibility for investment research in Asian equity markets. He started his career on the sell side with JP Morgan in 2009, before working as an associate at Goldman Sachs for three years between 2010 and 2013. Charlie has a degree in Modern History from the University of Oxford.

James Bird (analyst)

James joined Devon Equity Management in July 2021. He has both a bachelor’s degree and a Master’s degree in Natural Sciences from the University of Cambridge.

Angus Denison-Smith (analyst)

Angus is the newest addition to the investment team, having joined Devon Equity Management in May 2023. Prior to this, he worked for Cartesian as business analyst, having gained his degree in Engineering Science from the University of Oxford in 2022.

Board

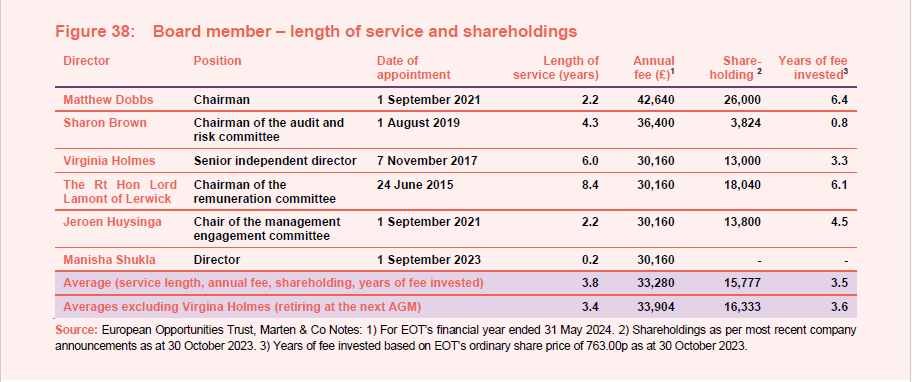

EOT’s board is comprised currently of six directors, all of whom are non-executive and considered to be independent of the investment manager. However, once the various retirements and appointments described below have taken place, its number will return to five. It is board policy that all directors will retire and offer themselves for re-election each year. Other than EOT’s board, its directors do not have any other shared directorships.

All directors retire and offer themselves for re-election annually.

In terms of length of tenure, EOT’s board does not consider it appropriate that directors should be appointed for a specific term but says that, in normal circumstances, all directors, chairmen included, will not serve in excess of nine years.

As is illustrated in Figure 38, Lord Lamont has now served just over eight years on EOT’s board and is therefore approaching the end of his tenure as a director if this is not to exceed nine years, while Virgina Holmes has also indicated her intention to retire at the next AGM.

Reflecting these developments, Manisha Shukla, EOT’s newest director, was appointed to the board with effect from 1 September 2023. The intention is that Lord Lamont will take over the role of senior independent director following Virgina Holmes’ retirement.

Directors’ fees

Total directors’ fees are capped at £250,000 per year (shareholders approved an increase in the cap from £200,000 at the 2022 AGM) to allow for the possibility of hiring an additional director, should a suitable candidate be identified, and provide the capacity for directors to overlap as part of a managed succession programme.

Recent share purchase and disposal activity by directors

Two directors have purchased EOT shares during the last 12 months: Matthew Dobbs purchased 26,000 shares at a price of 712.5p per share; and Jeroen Huysinga purchased 4,000 shares at a price 735.0p per share on 29 July 2022. None of the directors have disposed of any shares during the last year.

Board well-aligned with external shareholders

With the exception of Manisha Shukla, who has only very recently joined the board, all of the directors have personal investments in the trust, which we consider to be favourable as it helps align directors’ interests with those of shareholders. The average level of fees invested is a very respectable 3.5 years (4.2 years excluding Manisha), which suggests a strong degree of alignment.

The directors have an average of 3.7 years’ worth of fees invested in EOT

Matthew Dobbs (chairman)