Rebased dividend

Rebased dividend

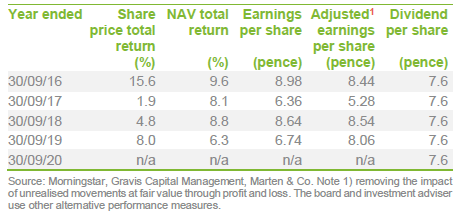

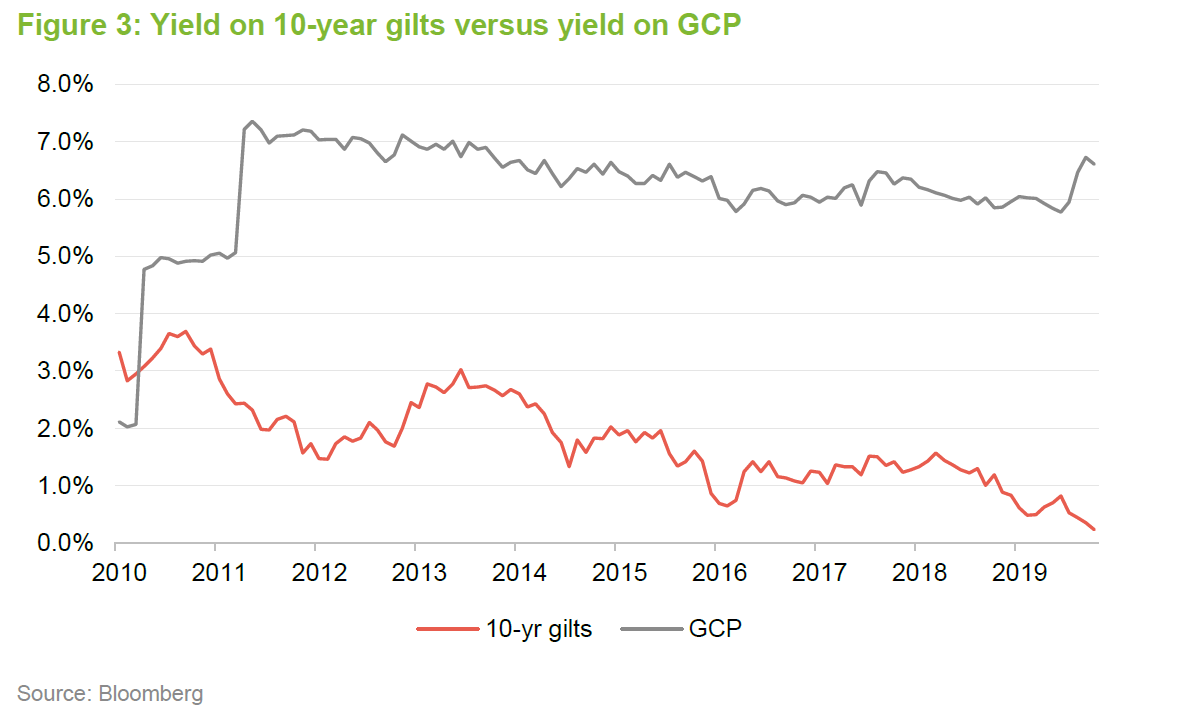

GCP Infrastructure will be 10 years old in a few weeks. Since 2012, it has paid a stable 7.6p per year dividend backed largely by UK public sector cashflows and achieved modest growth in net asset value (NAV). The yield premium that GCP delivers relative to UK government debt securities has increased significantly over the past decade.

GCP’s board wants to ensure that the company’s next decade is as successful as the last. That has meant reassessing the fund’s objectives and risk tolerances. The board has determined that, following an extensive review of the sustainability of the dividend, the company will target a dividend of 7.0p from 1 October 2020.

Public sector-backed, long-term cashflows from loans used to fund UK infrastructure

Public sector-backed, long-term cashflows from loans used to fund UK infrastructure

GCP aims to provide shareholders with regular, sustained, long-term distributions and to preserve capital over the long term by generating exposure primarily to UK infrastructure debt and related and/or similar assets which provide regular and predictable long-term cashflows.

GCP primarily targets investments in infrastructure projects with long term, public sector-backed, availability-based revenues. Where possible, investments are structured to benefit from partial inflation-protection.

Lower for longer

Lower for longer

GCP was launched in the summer of 2010, at a time when risk-adjusted returns were relatively low from most asset classes and the UK government’s finances were constrained. GCP’s initial investment focus was on subordinated debt in PFI projects.

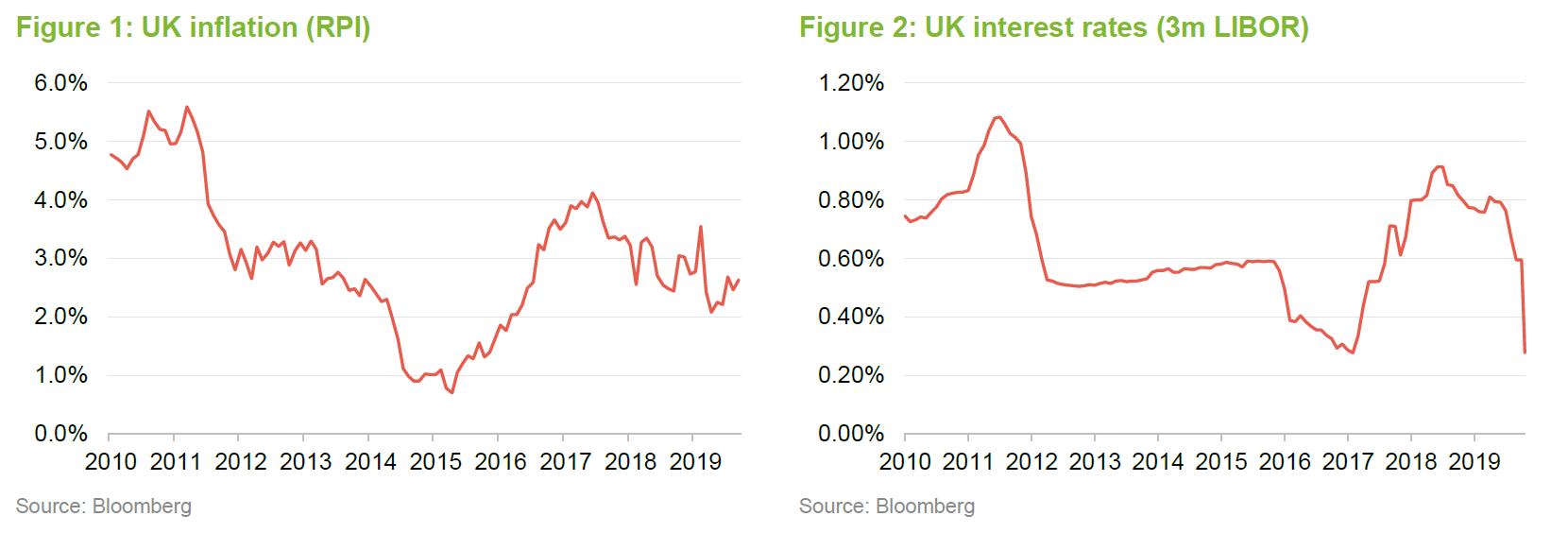

Around the world, central bank’s response to the financial crisis a couple of years earlier had been a reduction in official short-term interest rates and quantitative easing, which had the effect of reducing interest rates on longer-term debt. Banks were still rebuilding their balance sheets and this restricted their desire and ability to lend. In addition, many investors were averse to the sorts of structures that were being used to finance PFI/PPP projects.

The UK coalition government was focused on austerity. George Osborne’s June 2010 budget set out a target of reducing both public spending and national debt as a percentage of GDP. He was prepared to continue the PFI/PPP model that had been embraced by previous Labour governments, but was unwilling to countenance financing infrastructure projects on the government’s own balance sheet.

GCP was designed to take advantage of the void that this situation created. It was able to lend at attractive rates against relatively safe credits, which were in turn backed by long-term commitments from UK public sector bodies. It could also lend at attractive rates that were considerably higher than those available from UK government debt.

The reasonable expectation of most investors at this time was that, over the course of the next few years, market rates of return would normalise. This did not prove to be the case, however, as Figures 1 to 3 illustrate.

As risk-free returns fell, so did the returns available to GCP on the PFI/PPP projects that were its initial focus. As markets grew more comfortable with the risk on these projects, they were able to refinance at lower rates, GCP benefitted in these circumstances, receiving prepayment penalty payments. However, GCP needed to reinvest the money that was flowing back to it at attractive risk-adjusted rates of return. This got harder as a wider group of investors recognised the attractions of the sector.

The investment adviser has done well to generate earnings sufficient to pay a steady 7.6p dividend since 2012 and generate a modest uplift in the NAV. As we discussed in our initiation note, GCP’s investment policy gave the adviser the ability to adopt a whole of market approach to identifying suitable opportunities for the portfolio. GCP has, therefore, been able to adapt, by tapping into other areas backed by public sector payments including renewable energy and social housing. It did so while these markets were relatively early in their development. However, once again, as the market reprices these risks, GCP must either identify new areas for investment or accept that market rates of return have changed.

Expectations of higher global growth and rates rises grew towards the end of 2018, but these were dashed by the US/China trade war, which helped trigger the Fed’s policy pivot early in 2019. The policy response to the outbreak of COVID-19 has been lower interest rates and more quantitative easing. Central banks have become even more interventionist.

The net result for the UK is that inflation is at 0.8%, the Bank of England base rate is 0.1% and, for the first time, investors have been prepared to buy new gilts at negative rates of interest; the yield on a new three-year gilt issued on 20 May 2020 was -0.003%.

At the same time, the promised reforms to infrastructure finance in the UK, which we discussed in our initiation note, are yet to materialise and are likely to be further delayed by the response to COVID-19. There does seem to be cross-party consensus of the need to invest in infrastructure, however. There may also be encouraging signs in respect of renewable energy subsidies (see below).

Against this backdrop, the board has determined that it will rebase the dividend to 7p for the financial year ended 30 September 2021 onwards, rather than instruct the adviser to take on additional risk in search of returns. This still leaves GCP trading on a prospective yield of 5.9%, based on the share price at the close of business on 28 May 2020.

Government considering new subsidies for renewables

Government considering new subsidies for renewables

Ahead of the Chancellor’s March 2020 budget, as part of its commitment to meeting net zero emissions by 2050, the government said it was considering the reintroduction of subsidies for new onshore wind projects. On 2 March, the Department for Business, Energy and Industrial Strategy (BEIS) announced that it would consult on whether 2021’s auction of contracts for difference (CFDs), the fourth auction round for these types of subsidy, should be open to onshore wind and solar projects. The hope is also that floating offshore wind projects will also be developed, allowing the exploitation of wind resource in deeper water than has been the case for conventional offshore wind. Further conversions of power stations from burning coal to biomass will be excluded from the auction.

The consultation has just closed. There is a strong message in the statement that accompanied the launch of the scheme that local communities will still have control over whether planning approval is given to new onshore projects. Lead adviser, Philip Kent feels that the difficulties of securing planning, particularly for wind turbines, may restrict the number of projects available.

The government’s proposal acknowledges the growth of unsubsidised solar and onshore wind generation in the UK but seeks to encourage greater investment in that area than would be supported by prospective long-term power prices alone. This commitment has implications for long-term power prices, as we discuss on page 5.

Including onshore wind and solar in a single CFD auction (where subsidies go to the generators that bid the lowest rates until all the available funding is used) would likely crowd out other generation that the government believes should form part of the UK’s generation mix, such as offshore wind. The government’s approach is to split the available subsidy into two ‘pots’. Onshore wind and solar projects will compete against energy from waste with combined heat and power (CHP) schemes, hydropower, landfill gas and sewage gas projects. The other pot will be for offshore wind (including floating offshore wind), dedicated biomass with CHP, geothermal, remote island wind, tidal stream and wave technologies. However, one of the questions posed by the consultation was whether the offshore wind projects should be in a pot of their own (because the government sees considerable potential to achieve its renewable generation targets from this technology).

COVID-19’s practical effects have been manageable

COVID-19’s practical effects have been manageable

GCP’s NAV was 109.83p at the end of March 2020, higher than the level at the end of December 2019 but down from the level at the company’s last financial year end on 30 September 2019. The reasons for this are explored on page 10. The pandemic had started to have a material impact on the UK economy by the end of March.

The company has stated that GCP’s focus on availability-based assets has meant that the loan interest income accruing for the benefit of the company has not been – and is not expected to be – materially impacted by the COVID-19 lockdown.

In the short term, two direct effects of the measures taken to check the spread of the virus have been a reduction in volumes of waste wood available to fuel three of GCP’s biomass plants dedicated to this area, which has forced the temporary closure of one of these plants, and delays in the construction phase of certain PFI assets. A resumption of construction work should benefit both areas.

Generally, projects have had to find new ways of working to accommodate lockdown provisions. The supply of parts and materials has been affected in some areas.

Falling economic activity has been accompanied by a reduction in interest rates. It has also affected demand for power, with negative implications for short-term power prices. What we cannot tell yet is how long-lasting the reduction in demand will be.

Power prices weigh on NAV

Power prices weigh on NAV

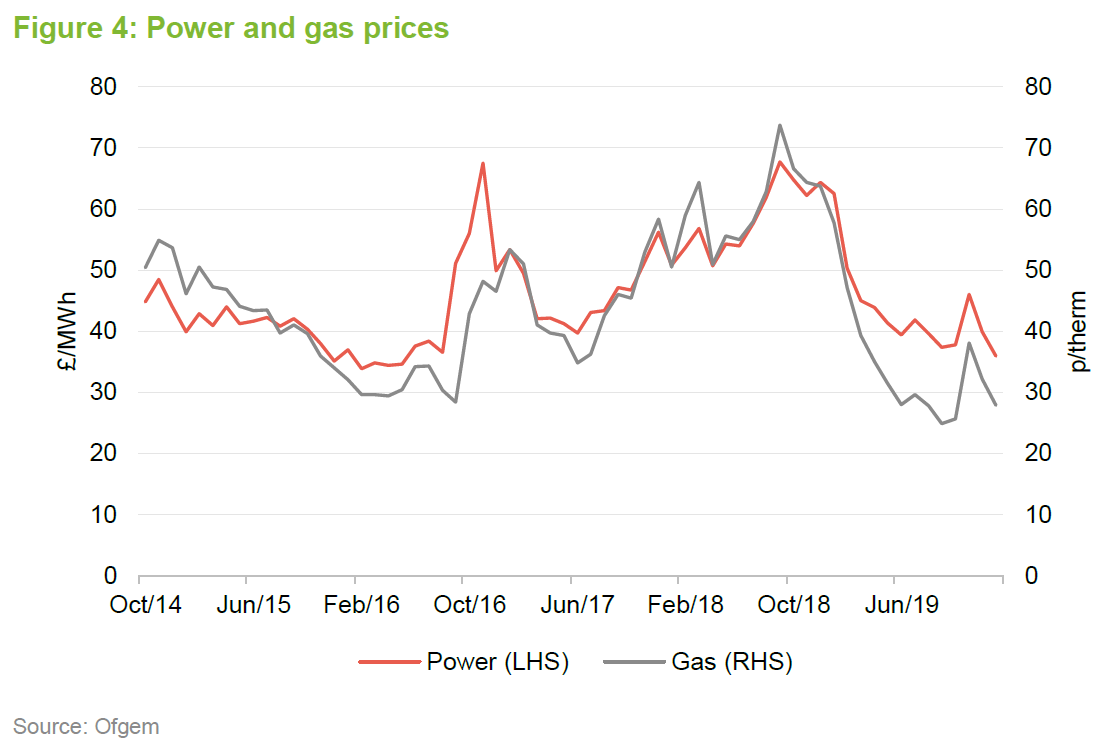

Today, the UK’s electricity price is heavily influenced by natural gas prices, reflecting the importance of gas-fired plants within its generation mix. However, renewables account for an ever-greater proportion of generation, and concern has been building in some quarters that the success of renewables may put further downward pressure on electricity prices. A reduction in forecast economic activity related to COVID-19 could also weigh on prices.

The decline in power and gas prices has accelerated since COVID-19 lockdown measures depressed demand (a warm winter was another factor). The average day-ahead power price in the UK on 21 May 2020 was £27.2MWh, according to Nord Pool, and the price of the June 2020 UK natural gas daily future was 9.27 pence per therm, according to ICE Futures Europe.

GCP’s valuation model uses a blend of the last four quarterly forecasts for power prices by a leading independent market consultant, Afry.

In practice, generators of renewable energy point out that they will not invest in new plant unless it offers an acceptable rate of return. The UK government’s decision to countenance new subsidies may be in recognition of that. This could put a floor on the returns earned by new renewable energy projects.

Asset allocation

Asset allocation

Reflective of falling interest rates and increased interest in the area that GCP is focused on, the pace of refinancing in the portfolio has been brisk. £300m was repaid to the company over the two years ending March 2020, £133.5m of this since 30 September 2019 (see page 8). The company has an active pipeline of potential investments equivalent to about £50m.

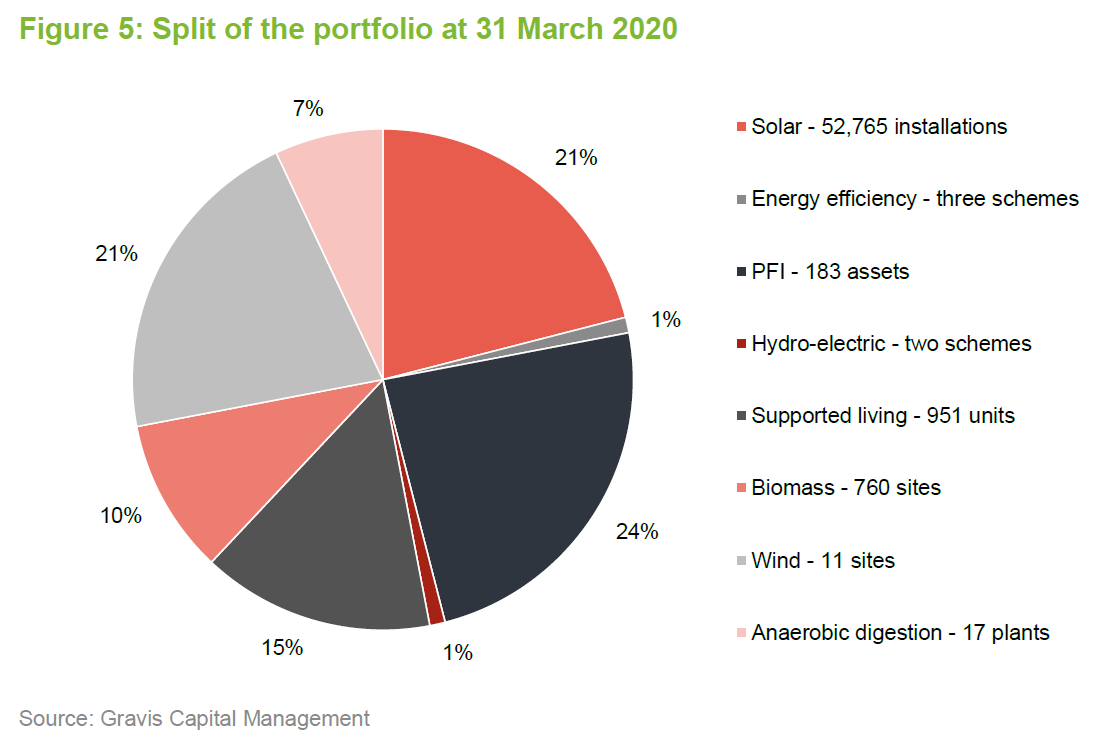

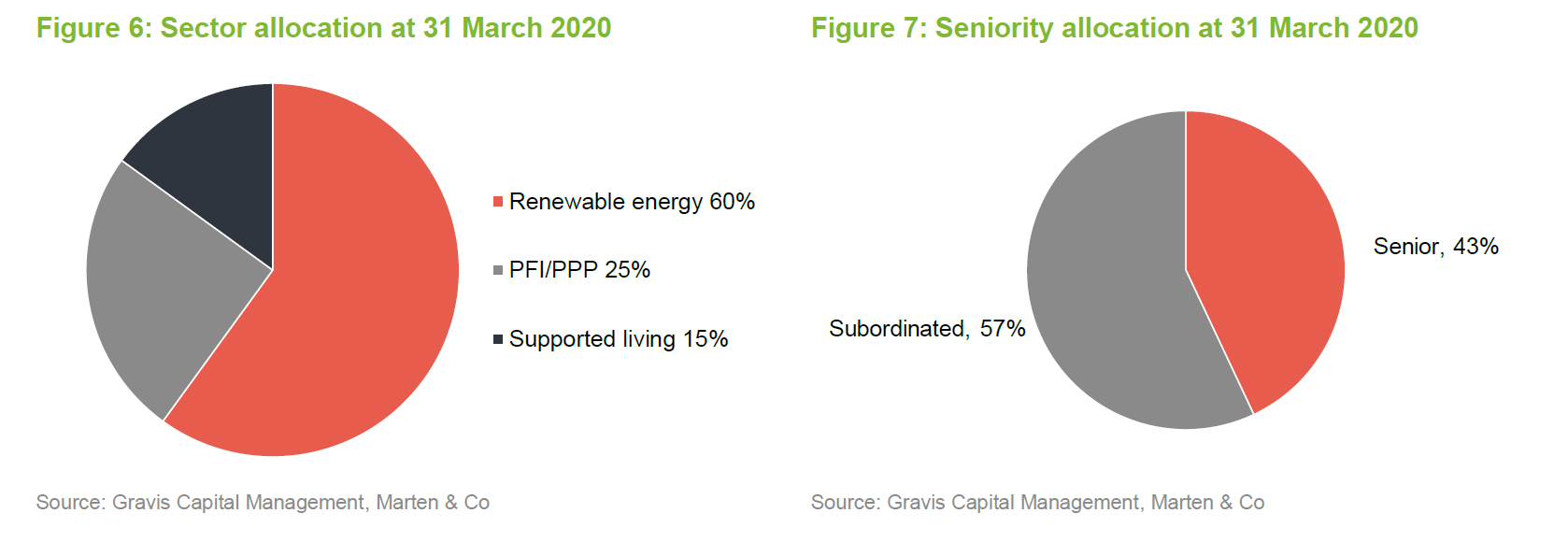

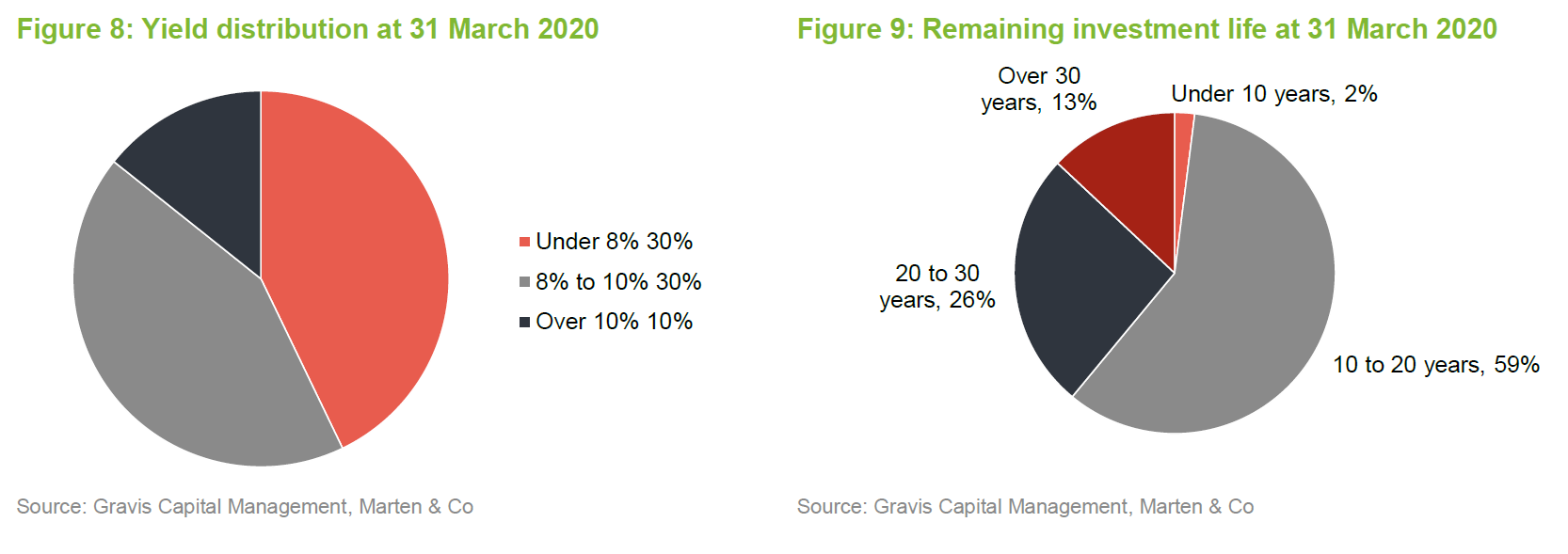

At the end of March 2020, there were 49 holdings in GCP’s portfolio, producing an annualised yield of 8.1% and with an average life of 14 years. 39% of the portfolio was partially inflation-protected.

GCP was using £153m of its revolving credit facility at the end of March 2020.

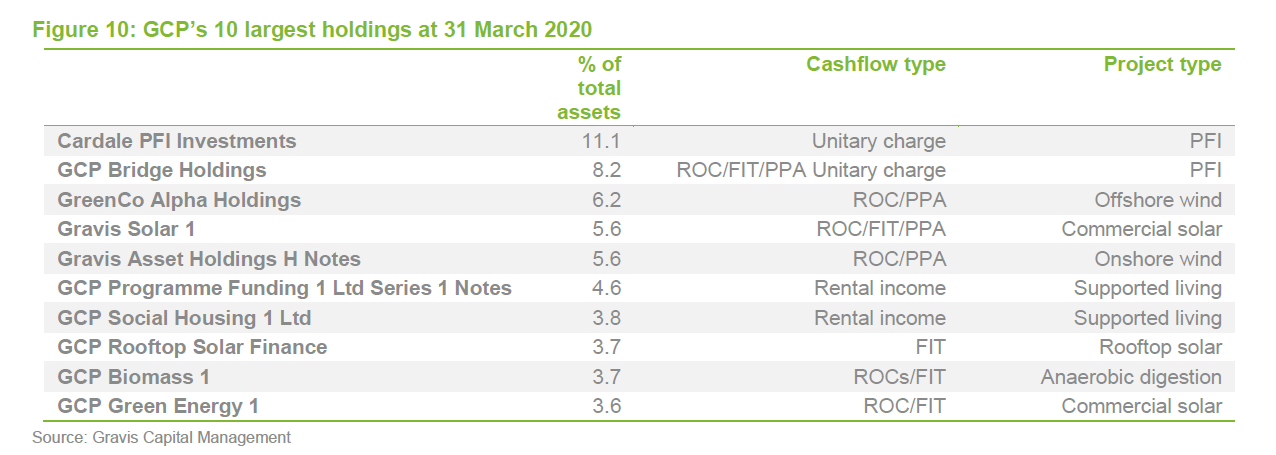

Top 10 holdings

Top 10 holdings

The most significant changes to GCP’s portfolio between 30 September 2019 (the data that we used in our initiation note) and 31 March 2020 were a reduction in the number of wind (from 37 sites to 11 sites – although the exposure to wind fell by a much smaller amount) and anaerobic digestion (from 23 plants to 19 plants) investments.

GCP advanced loans totalling £98.2m during the period. £72.3m of this related to new investments. Of the £133.5m repaid to the company, £9.6m related to scheduled payments and the balance to six unscheduled repayments, two of these loans were repaid in full. After the end of the period, an £8.5m loan secured against a basket of PFI assets was repaid in full.

One of GCP’s anaerobic digestion plants has been sold since the period end. The sale price has not been disclosed. In addition, GCP made additional finance available to cover capital improvement works for the anaerobic digestion plants it took control of last year (see our previous note). There was no change to the value of those assets at the end of the period.

Onshore wind

Onshore wind

The bulk of the activity in the portfolio during the period related to GCP’s onshore wind portfolio. Four onshore wind farms were refinanced, taking advantage of the market’s increased willingness to finance these assets (based on their operating history and a general repricing of onshore wind risk). A further £26m came in from the sale of a portfolio of small renewable investments that had been acquired as part of the Green Investment Bank deal back in 2017 (mentioned on page 18 of our initiation note). That transaction netted GCP a 10% annualised rate of return.

Ofgem audit

Ofgem audit

In our initiation note (page 18), we discussed an ongoing audit by Ofgem of various GCP projects. These audits relate to the validity of the initial accreditation (under the previous ownership) and ongoing compliance with the applicable subsidy regulations. The directors and the investment adviser have stated that they currently believe that the outcome of the Ofgem audits will not have a material impact on the NAV once concluded.

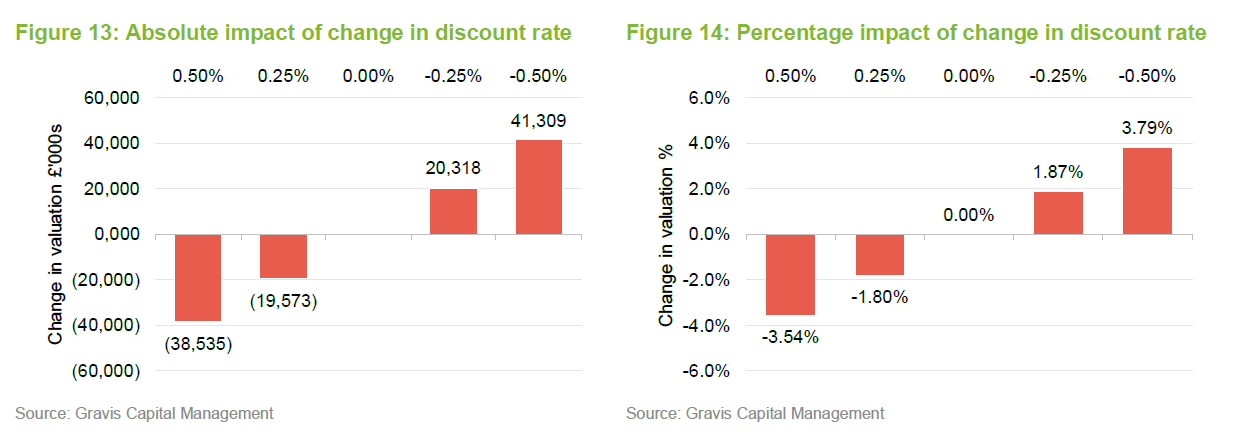

Sensitivities

Sensitivities

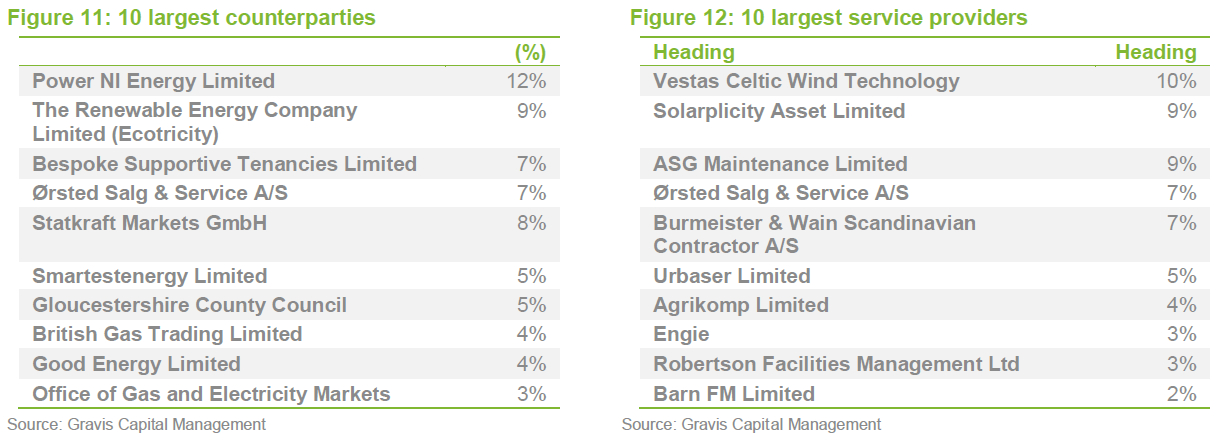

The investment adviser provides sensitivity analysis to a range of factors. Figures 13 and 14 look at the impact of a change in the weighted average discount rate. In practice, at 31 March 2020, the discount rates used in the valuation of financial assets ranged from 5.00% to 10.38%.

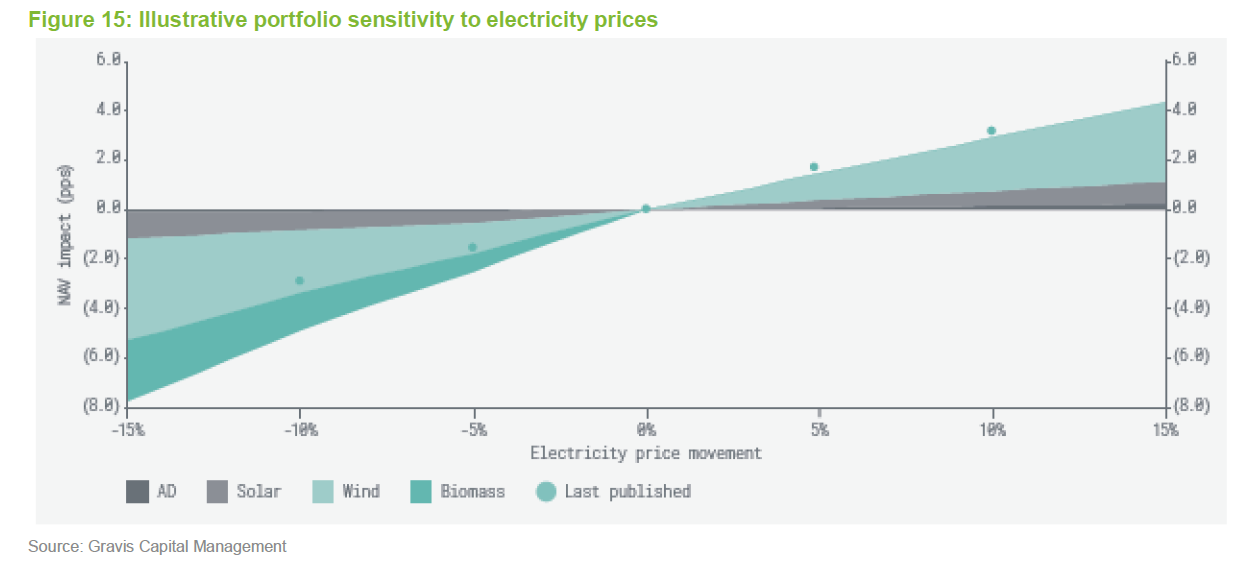

GCP has some direct exposure to changes in power prices (and some indirect exposure as a significant fall in power prices might affect the ability of some renewable energy projects to service their debt). Figure 15 shows the expected impact of changes in the electricity price on GCP’s NAV. Since the end of March 2020, forecast electricity prices have fallen further as a result of the measures taken to control the spread of COVID-19. This is estimated to reduce power prices by approximately 1.3%, with the impact focused on the next five years.

Performance

Performance

NAV progression

NAV progression

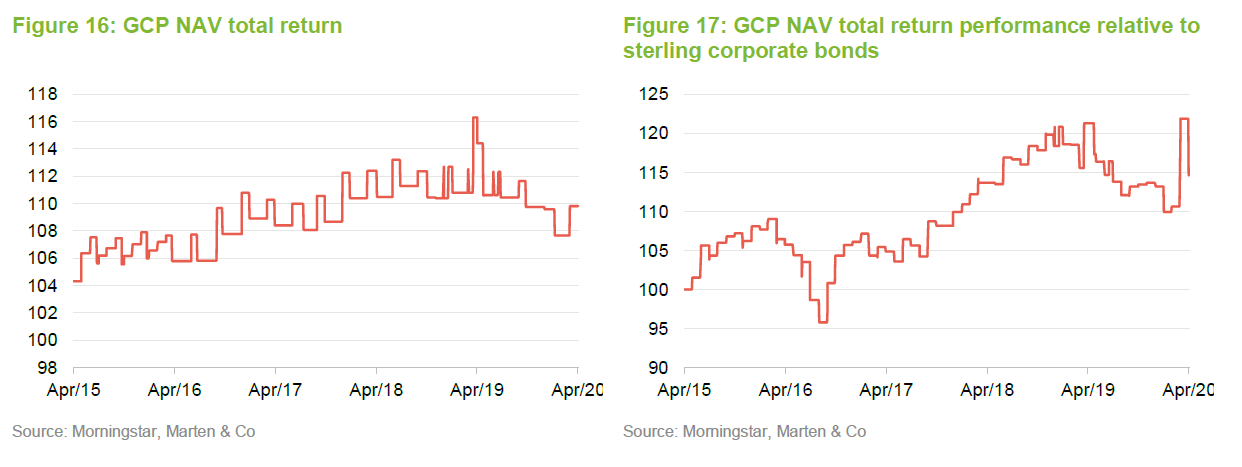

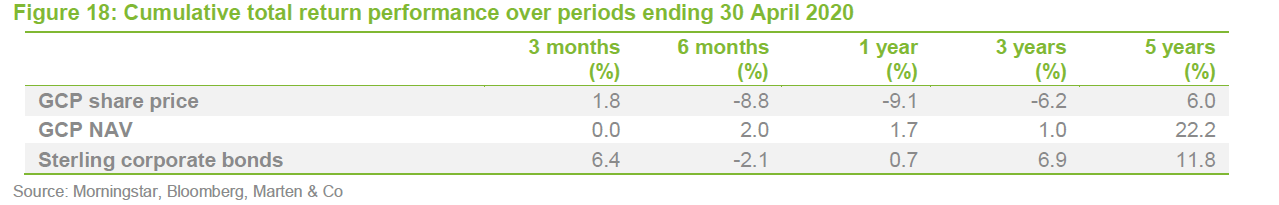

GCP does not have a formal benchmark, but the board chooses to compare its returns to those of a sterling corporate bond index, and we have done so here.

March 2020 results

March 2020 results

GCP generated a profit of £17.2m from total income of £25.4m over the six months ended 31 March 2020. This translated into earnings per share of 1.96p.

Dividends for the period totalled 3.8p, on track to meet GCP’s full-year payment of 7.6p, which puts it on a yield of 6.4%.

Over the first quarter of 2020, the NAV increased from 109.58p to 109.83p.

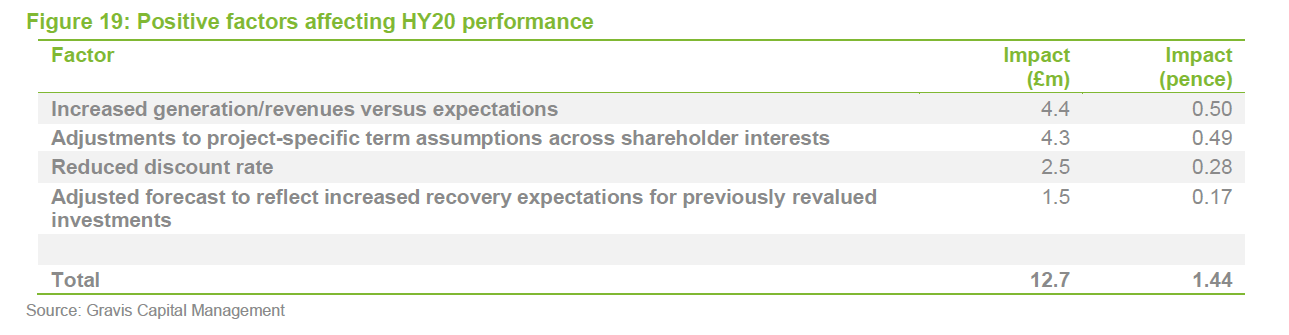

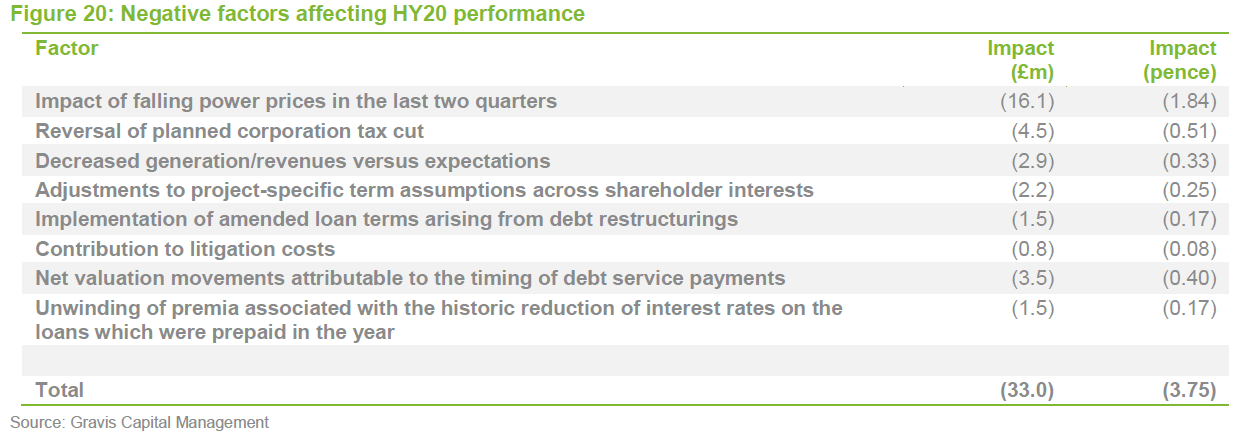

Factors affecting performance over the six-months to the end of March 2020

Factors affecting performance over the six-months to the end of March 2020

As is clear from the following tables, the reduction in power price forecasts was the principal reason for the fall in GCP’s NAV over the six months ended 31 March 2020. Overall, generation revenues exceeded budget.

Peer group

Peer group

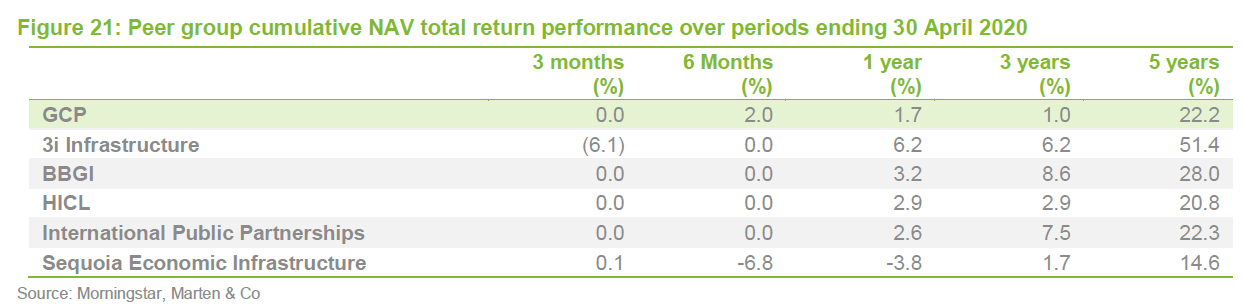

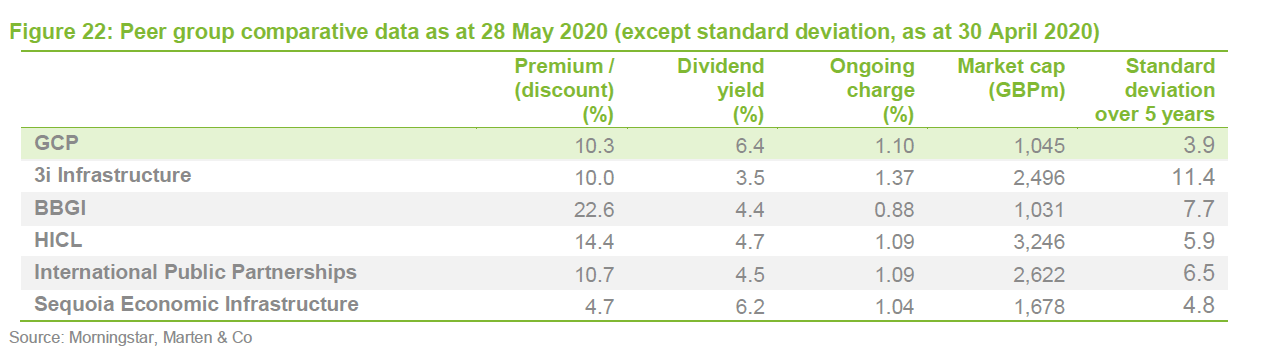

GCP sits in the infrastructure sector alongside four funds (3I Infrastructure, BBGI, HICL and International Public Partnerships) which invest primarily in project equity and one fund (Sequoia Economic Infrastructure) which, like GCP, invests primarily in project debt. We have excluded Infrastructure India (which has a very different risk/reward profile to the rest of the peer group) for the purposes of this note. A couple of the equity-focused funds have generated higher long-term returns than GCP, but – as is evidenced in the higher standard deviation of their returns – at the cost of higher risk.

GCP’s premium is in-line with similar investment companies in its peer group. Its dividend yield is the highest in the sector on an historic basis. HICL Infrastructure has already indicated that it is looking just to maintain its dividend for the current financial year, as a consequence of COVID-19. GCP’s ongoing charges ratio is not out of line with the other funds.

Premium rating

Premium rating

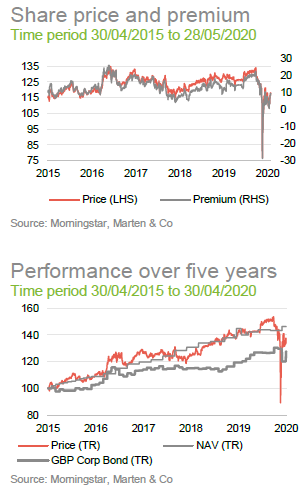

Over the year ended 30 April 2020, GCP’s share price has moved within a range of a 28.8% discount to a 22.3% premium and has averaged a premium of 14.0%. At 28 May 2020, the premium was 10.3%.

In common with many other investment companies and stocks within the wider UK market, GCP’s share price fell sharply on 19 March 2020. In retrospect, this was a fantastic buying opportunity. The shares swiftly returned to trading at a premium, albeit not at as high a level as in previous years. As discussed above, GCP’s premium is in-line with those of other infrastructure investment companies.

Fund profile

Fund profile

GCP Infrastructure Investments Limited (GCP) is a Jersey-incorporated, closed-ended investment company whose shares are traded on the main market of the London Stock Exchange. GCP aims to generate a regular, sustainable, long-term income while preserving investors’ capital. Since its launch in 2010, it has provided its investors with a high and stable stream of quarterly distributions (totalling 7.6p per year, for the last seven years). The fund’s income is derived from loaning money at fixed rates to entities which derive their revenue, or a substantial portion of it, from UK public-sector backed cashflows. Wherever it can, it tries to secure an element of inflation-protection.

In practice, GCP has exposure to renewable energy projects (where revenue is part subsidy and part linked to sales of power), PFI/PPP-type assets (whose revenue is predominantly based on the availability of the asset) and specialist supported housing (where local authorities are renting specially-adapted, residential accommodation for tenants with special needs).

The investment adviser

The investment adviser

Gravis Capital Management Limited (Gravis) is the fund’s AIFM and investment adviser. It is also investment manager of GCP Student and GCP Asset Backed, and advises VT Gravis Clean Energy Income Fund, VT Gravis UK Listed Property Fund and VT Gravis UK Infrastructure Income Fund. Assets under management are about £3bn.

Philip (Phil) Kent is the portfolio manager, and he is supported by an extensive team which includes Rollo Wright (Gravis Capital’s CEO, who was co-lead portfolio manager until May 2018).

Phil joined Gravis from Foresight Group, where he had responsibility for waste and renewable projects. He has also worked for Gazprom Marketing and Trading (latterly in its Clean Energy team) and PA Consulting’s Energy practice.

At the end of March 2020, directors of the investment adviser held 9.4m shares in GCP, demonstrating a strong alignment with other shareholders.

Previous publications

Previous publications

Readers may be interested to read our initiation note – Stable income, uncertain times – which was published on 30 January 2020.

The legal bit

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on GCP Infrastructure Investments Limited.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.