Improving outlook and room to grow

GCP Infrastructure Investments Limited (GCP) recently published its half-yearly report covering the six months ended 31 March 2022. It was a period that saw GCP’s net asset value (NAV) hit a new high, and the end June NAV is higher still. Record electricity prices and stronger than forecast inflation contributed to this, but so too did the actions of the adviser. We look at the drivers of GCP’s returns in this note.

The adviser sees potential for further NAV progression in coming months. The need to decarbonise the UK economy provides a supportive backdrop, and the adviser has identified a substantial pipeline of potential investments that should underpin the continued success of the fund.

Public-sector-backed, long-term cashflows from loans used to fund UK infrastructure

GCP aims to provide shareholders with regular, sustained, long-term distributions and to preserve capital over the long term by generating exposure primarily to UK infrastructure debt and related and/or similar assets which provide regular and predictable long-term cashflows.

GCP primarily targets investments in infrastructure projects with long-term, public-sector-backed, availability-based revenues. Where possible, investments are structured to benefit from partial inflation-protection.

At a glance

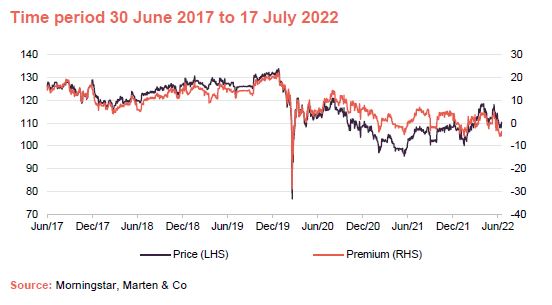

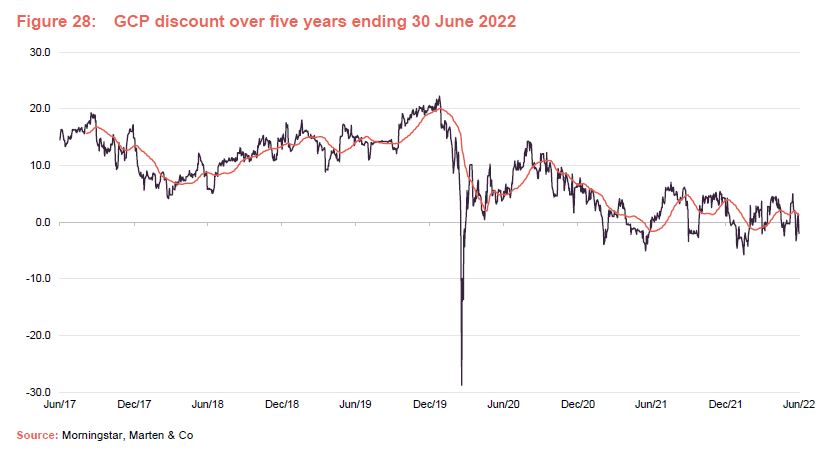

Share price and discount

Over the year ended 30 June 2022, GCP’s shares traded on an average premium of 1.7% and high of a premium of 7.1% and a low of a discount of 5.7%. At 17 July 2022, the discount to the end June NAV was 3.4%.

Over the past couple of years, GCP’s shares have traded much closer to asset value than they had historically. It may be that a continuation of the trend of NAV growth encourages the premium to move back towards its previous trading range.

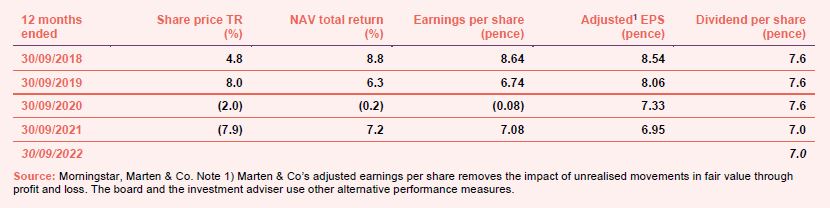

Performance over five years

GCP’s NAV has recovered the ground lost over 2020, when amongst other factors, long-term power price estimates were being reduced.

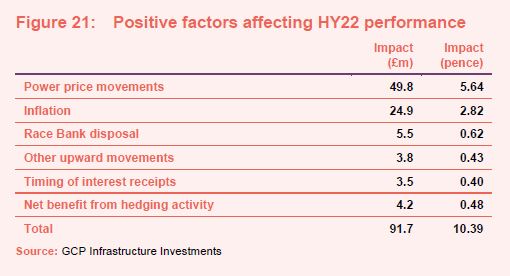

Power price movements and higher than forecast inflation had the greatest positive impacts on the NAV.

Results for the six months ended 31 March 2022

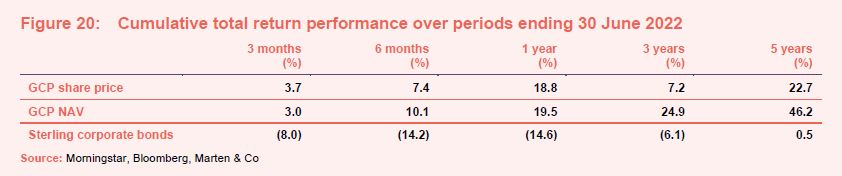

Over the six months ended 31 March 2022, GCP’s NAV rose by 8.5% to 112.75p. The NAV total return for the six-month period was 12.2% and in share price terms the return was 13.7%.

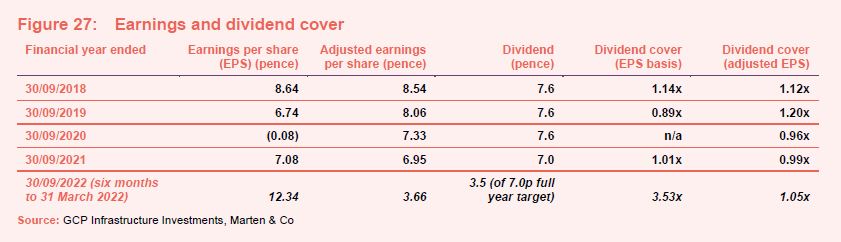

Dividends are running at an annualised rate of 7.0p per share, so that GCP is trading at a yield of 6.3%. Over the period, on an adjusted earnings basis (taking out the impact of changes in unrealised profits/losses), dividend cover was 1.05 times.

The main factors affecting the NAV were rising power prices, higher inflation forecasts and some changes to the discount rates used to value GCP’s assets (readers may be interested to read our annual overview note, which describes – on page 18 – the approach taken to valuing the portfolio). Each of these is discussed in more detail in this note.

Higher electricity market prices fed through into increased cash generation from renewable energy generation projects (where GCP’s loan finance is structured in such a way that returns reflect the profitability of these assets). An electricity price hedging arrangement that had been put in place to mitigate NAV volatility matured on 31 March 2022 and was paid shortly afterwards in April 2022. GCP does not have any hedging in place currently, but a proportion of sales of power are being made under medium-term power purchase agreements (PPAs).

The Birmingham bio power plant, which GCP took control of during the pandemic when it was starved of feedstock, is operational and running reasonably well. There are still some reliability issues, but these are reflected in GCP’s valuation; a negative valuation adjustment equivalent to 0.5p per share was implemented in the end March 2022 NAV. However, the adviser says that it remains positive about the long-term value in this project.

Further NAV progression over Q2

At the close of business on 30 June 2022, the unaudited NAV was 114.31p, an increase of 1.56p per share over the figure at end March 2022.

The announcement says that the continued rise in market electricity prices has resulted in increased actual and forecast cash distributions contributing about 1.9p per share. This was partially offset by various downward movements across the portfolio totalling about 0.4p, including the actual performance of the portfolio.

Predictable, government-backed cashflows

GCP’s focus on lending to assets/projects with predictable, government-backed cashflows has worked in its favour over the 12 years since launch. GCP’s ability to preserve capital value is highlighted by aggregate annualised downward revaluations of just 0.24% over this period. That is much lower than the annualised default rate on sterling corporate loans. It should give investors some comfort as we approach what may be a difficult period for the UK economy.

In our last note, we outlined some of the potential new investment opportunities open to GCP. Phil Kent, GCP’s investment adviser, reiterates his belief that the need to decarbonise the UK economy will likely provide GCP with the best opportunities for new investments. These may range beyond power generation and storage to areas such as the decarbonisation of transport and agriculture, and carbon sequestration (finding ways to take CO2 out of the atmosphere or prevent it being released). Phil is less keen on digital infrastructure (things like telecoms towers and data centres), which he thinks is a fairly competitive sector (dampening returns) and where returns are more sensitive to demand fluctuations. He also has some concerns over the potential impact of technological obsolescence.

As noted on page 12, GCP has sold its interest in the Race Bank offshore wind farm. GCP has often been a pioneer in lending to emergent sectors; it was an early financial investor into offshore wind, for example. This was an investment that GCP made in 2018 when the offshore wind market was less well-developed. Today, commercial banks and large institutions are more comfortable with the risks, pricing has tightened, and it seems unlikely that a similar opportunity will present itself, given the shift in pricing.

Phil says that there may be opportunities to enhance the NAV by extending asset lives and adding new revenue streams to existing projects. For example, there may be opportunities to produce hydrogen and food-grade carbon dioxide from biomethane.

Market backdrop

The underlying drive to decarbonise the UK economy and meet legally-binding commitments to achieve net zero carbon emissions by 2050 remains. However, Phil highlights the increased emphasis being placed on energy security as a consequence of the events of the past few months. The war in Ukraine and Russia’s threat to turn off gas supplies has led to some governments prolonging the use of coal-fired plants, for example.

Phil feels that renewable energy has a significant role to play in the UK’s drive to become less reliant on imports of gas and power. Logically, this should ensure a continuation of a supportive environment for renewables and energy storage. It should also encourage measures to conserve energy as well.

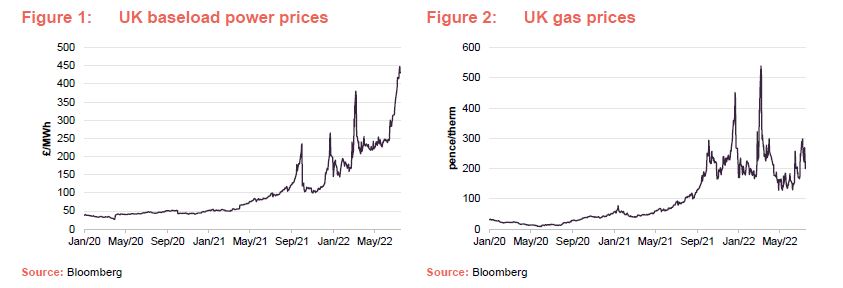

Power prices

Figures 1 and 2 show just how sharply UK power and gas prices have risen.

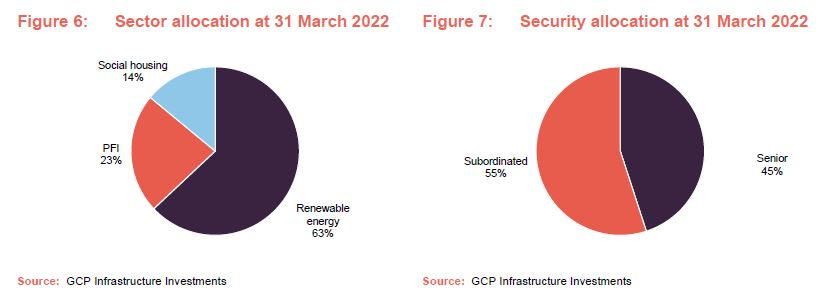

In recent years there has been pressure on NAVs in the renewable energy sector (which accounts for about 63% of GCP’s portfolio) as long-term forecasts of power prices have fallen.

As we have discussed in previous notes, in the UK the spot price for power tends to be set by the price of gas, with gas-fired power plants typically being the marginal generator. However, gas prices are extremely high and likely to remain elevated for some time as a consequence of the war in Ukraine and the associated Russian sanctions, and increased demand for gas from Asia as more countries emphasise gas over coal.

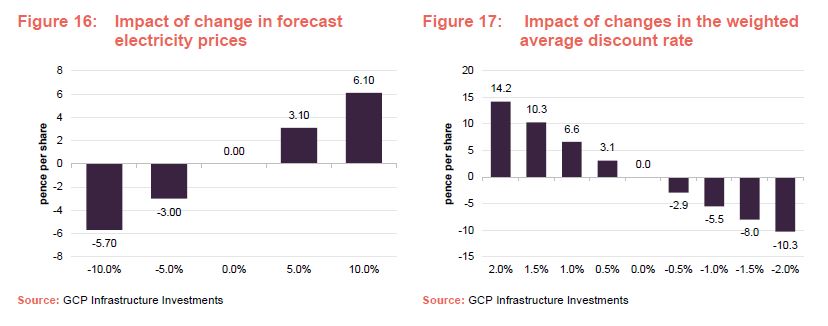

The net effect has been a considerable increase in power prices, and as yet there is little sign of these easing. The sensitivity of GCP’s NAV to power prices is shown in Figure 16 on page 14. Phil notes that forecasts of power prices two and three years out appear to be rising.

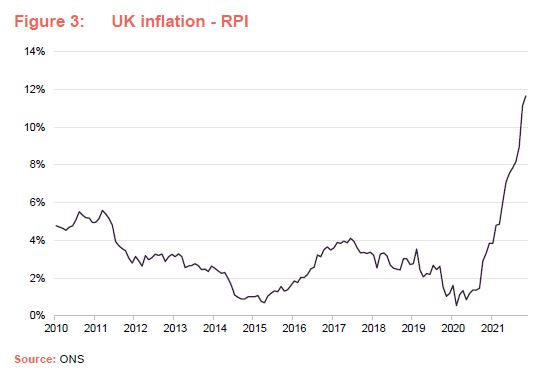

Inflation

The recent surge in inflation has had a significant effect on markets. Broadly, higher inflation is positive for GCP, given that at end March 2022, 52% of its portfolio had some inflation linkage in returns. However, the current market environment could have some implications on feedstock for some anaerobic digestion plants. Sharply-higher fertiliser prices have changed the economics for some arable farmers.

Inflation is also affecting capital expenditure costs and this needs to be factored into GCP’s assessment of the profitability of potential new investments.

Figure 3 shows inflation as measured by RPI. The government tends to emphasise CPI now, but older arrangements, such as subsidies for renewable generation, are still linked to RPI.

UK government policy

Despite an initial resistance to the idea of a windfall tax, on 26 May, the government introduced an energy profits levy – a 25% surcharge on the profits of the oil and gas sector. Its energy profits levy factsheet, published the same day, made it clear that, while its new levy did not apply to the electricity generation sector, certain parts of it had seen extraordinary profits, partly due to record gas prices pushing spot prices for power. It said that a longer-term consultation is underway ‘to drive forward energy market reforms and ensure that the price paid for electricity is more reflective of the costs of production’.

There is a clear threat to the pace of investment in renewables were a windfall tax/levy to be introduced. For example, RWE warned recently that it would reconsider £15bn of investment it has planned to make in the UK’s renewable generation sector in such circumstances.

There would also be considerable complexity to levying a tax, given the PPAs and hedging that are prevalent in the sector.

However, it seems reasonable to expect that the sector would benefit from the same investment-linked relief from the tax that has been made available to the oil and gas sector. This gives businesses an effective 91p tax saving for every £1 that they invest.

For the moment, at least, the government appears to have ruled it out. On 11 July, a government spokesperson said that there were no plans to extend the energy profits levy to electricity generators. However, policy may change in September under new leadership.

Phil believes that the energy market reforms referred to above would likely be intended to link the price paid for power more closely to its cost of production, and might also be linked to generation capacity rather than the amount of power produced. GCP’s portfolio contains a mixture of intermittent (wind and solar) and baseload (anaerobic digestion and biomass) assets.

Risk analysis

Gravis compiles a matrix of their perception of risks across the various asset classes that GCP invests in.

Recent changes to the risk matrix are highlighted in the boxes, but in summary these are:

- As discussed above, higher feedstock prices/risk of feedstock shortfall as fertiliser prices (which are linked to gas prices) rise.

- Uncertainty around windfall taxes. We think that there is a reasonable chance that these will not be imposed on renewable energy generators or will be offsettable against new investment, minimising their impact.

- Power price volatility. Clearly this has been working in generators’ favour in recent quarters, but prices will eventually normalise. GCP’s cautious long-term power price estimates (see page 13) mitigate any potential impact from this.

In addition, Phil says that the Gravis team are keeping an eye on the ongoing discussions between the UK and the EU about the Northern Ireland protocol, given the trust’s 18% exposure to the region.

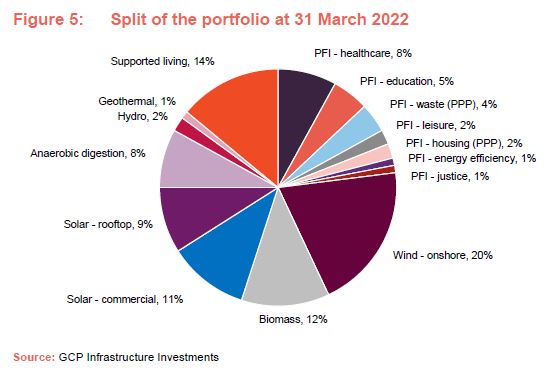

Asset allocation

At 31 March 2022, there were 48 investments in GCP’s portfolio (unchanged from a year earlier). The average annualised portfolio yield at 31 March 2022 was 7.9%, and the portfolio had a weighted average life of 11 years.

At 31 March 2022, about 1% of the portfolio was exposed to assets in their construction phase. Historically, having some exposure to assets under construction has allowed GCP to capture higher returns. Today’s construction projects come with acceptable risks. Installation of battery storage projects or rolling out electric vehicle charging infrastructure, for example, are less technically complex than commissioning an anaerobic digestion plant.

The exposure to renewable energy continues to grow relative to the social housing and PFI/PPP segments, reflecting the availability of new investment opportunities and the adviser’s investment activity.

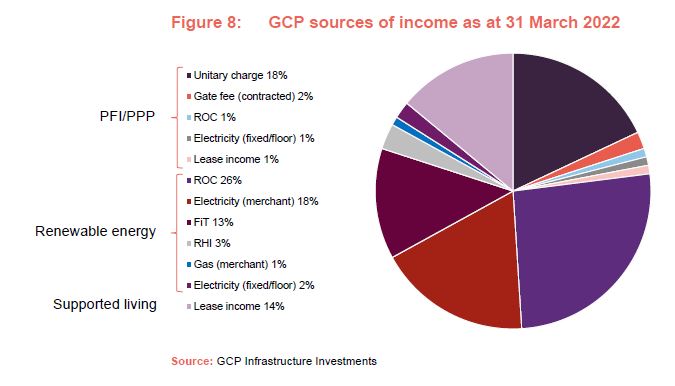

Figure 8 looks at GCP’s sources of income. Merchant power and gas accounted for 19% of income at 31 March 2022. 52% of loans by value benefit from inflation protection.

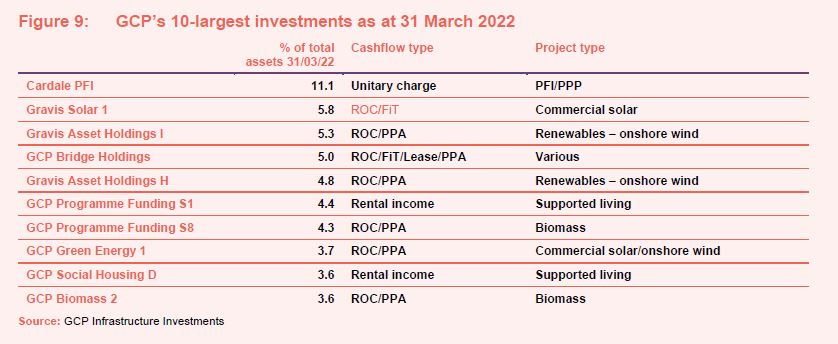

Top 10 investments

There is little change to the list of the 10-largest investments and even less to the underlying exposures. Most changes from our last note are the consequence of refinancing of investments, on the social housing portfolio, for example (see below).

The sales of GCP’s interest in the Race Bank offshore wind farm (see below) means that Ørsted A/S no longer features in the above tables.

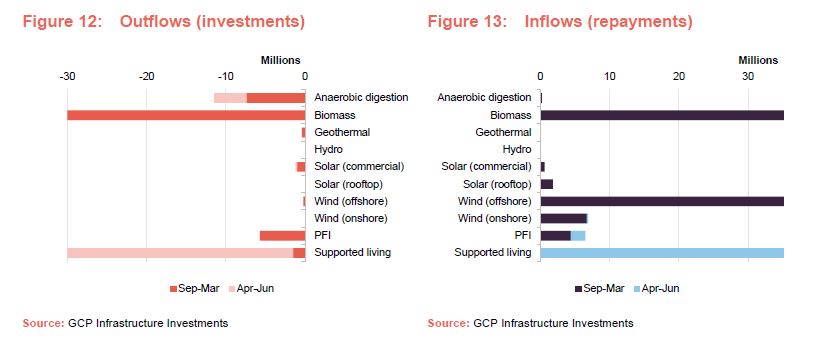

Recent investment activity

A notable recent transaction was the sale of GCP’s loans to the Race Bank offshore wind farm. GCP was able to sell its interest at a 12% premium to its last valuation.

The adviser was able to complete a refinancing of the supported living portfolio, reducing exposure to the sector but achieving a higher yield.

The figures also reflect a restructuring of a loan secured against a waste wood power station in Northern Ireland. £52.1m was advanced, increasing GCP’s exposure to the asset (net new investment of £23.1m) and GCP moved from a subordinated (junior) position to a senior position within the capital structure.

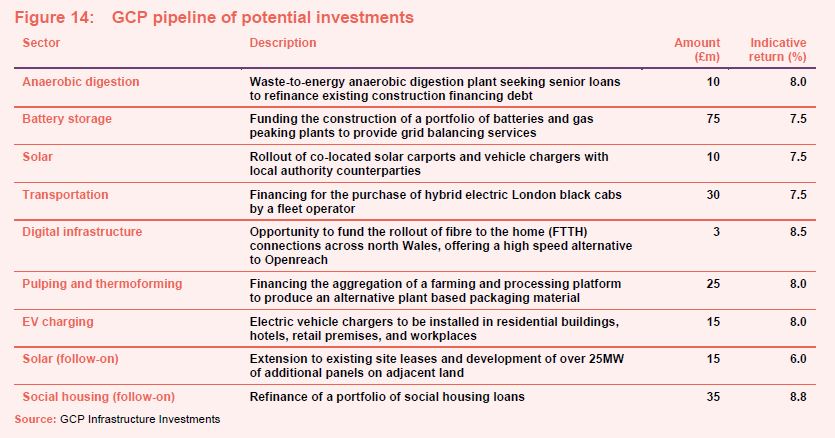

Pipeline of potential new investments

GCP’s adviser has an active pipeline of around £218m of potential investment opportunities under consideration that would provide further diversification and support to the dividend.

These offer annualised indicative returns ranging between 6.0% and 8.5%, and are in a range of sectors, offering the chance to further diversify GCP’s revenue streams.

Notable within these, are the pulping and thermoforming plant – using plant-based material to make an alternative to plastic packaging – and the considerable opportunity in battery storage investments to store electricity.

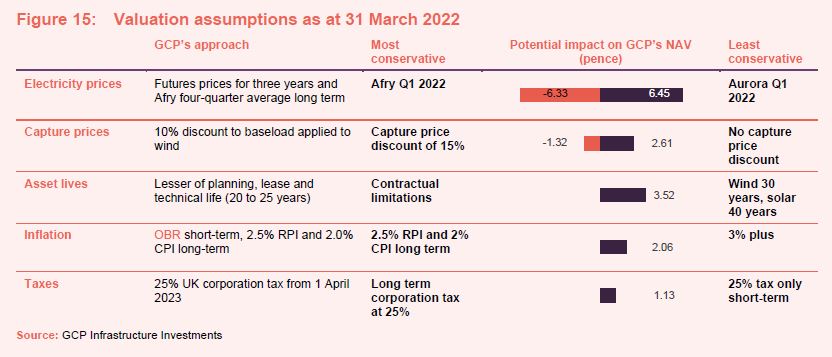

Conservative assumptions

We have updated Figure 15 from our last note. As it shows, the assumptions used in the calculation of GCP’s NAV continue to be conservative relative to those used by many of its peers. The net effect of this is that, were GCP to assume the most conservative assumptions in every category, the end March NAV of 112.75p would be reduced to 105.10p. By contrast, were GCP to assume the least conservative assumptions in each category, the NAV would have been 128.55p.

Note that every quarterly NAV published by GCP has been signed off by an independent valuer, Mazars, as well as the independent board of directors.

Sensitivities

The investment adviser provides sensitivity analysis to a range of factors. Figures 16 and 17 show the impact of changes in power prices and changes in the weighted average discount rate on the NAV.

Performance

NAV progression

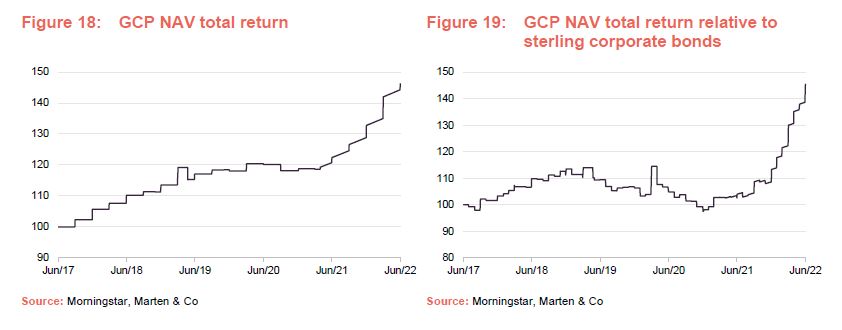

GCP’s NAV has recovered the ground lost over 2020, when amongst other factors, long-term power price estimates were being reduced.

GCP does not have a formal benchmark, but the board chooses to compare its returns to those of a sterling corporate bond index, and we have done so here. GCP’s outperformance of this comparator has accelerated over 2022.

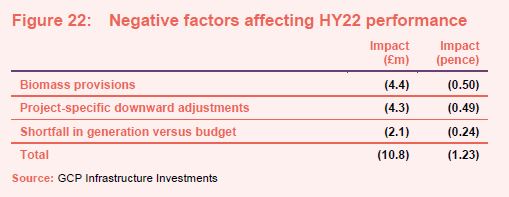

Factors affecting performance over the six months to the end of March 2022

We have discussed many of these factors, including power prices and inflation, elsewhere in this note.

The Race Bank disposal discussed earlier was made at a 12% premium to the end December valuation (perhaps reflective of the conservative nature of GCP’s valuation).

On the downside, storms had a minor impact on GCP’s Scottish anaerobic digestion plants, but the effect was not material.

The additional provision made against the biomass asset that GCP took control of during the pandemic reflects a reassessment of the likely availability of that asset.

Peer group

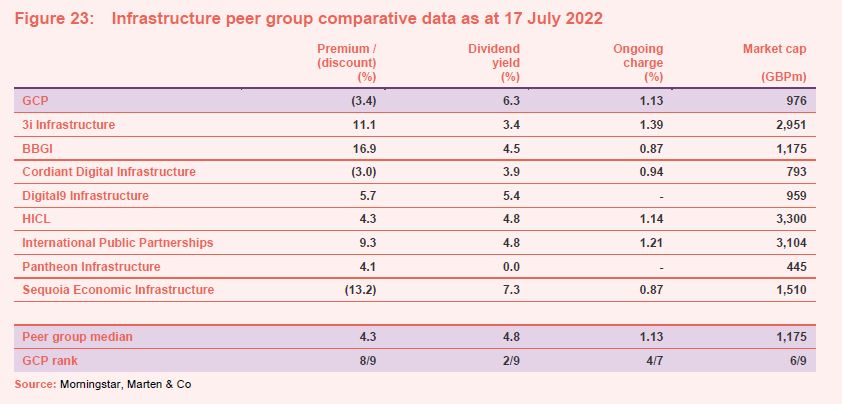

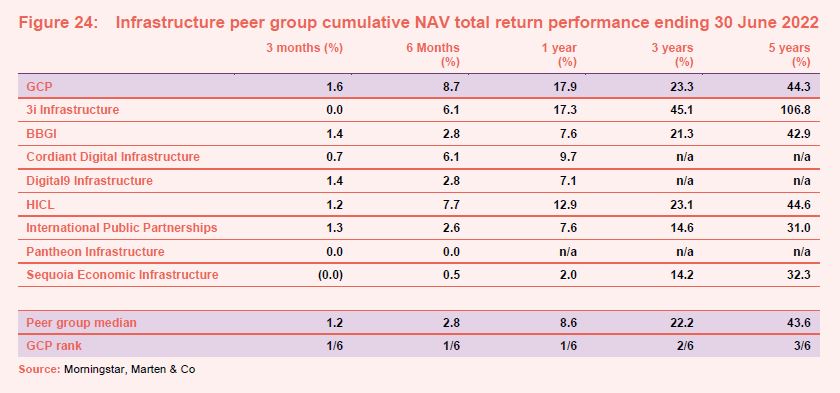

GCP sits in the infrastructure sector alongside four funds (3I Infrastructure, BBGI, HICL and International Public Partnerships) which invest primarily in public/private partnership project equity, two digital infrastructure funds (Cordiant Digital Infrastructure and Digital 9 Infrastructure) and one fund (Sequoia Economic Infrastructure) which, like GCP, invests primarily in infrastructure debt, but using a much broader definition of what constitutes infrastructure. We have excluded Infrastructure India (which has a very different risk/reward profile to the rest of the peer group).

Within its AIC peer group, GCP’s recent discount widening makes it one of the more attractively valued funds. Sequoia Economic Infrastructure’s NAV has been hit by its exposure to Bulb Energy Limited and this appears to have unnerved its investors. There is no read across to GCP.

GCP’s dividend yield is towards the top end of this group. Its ongoing charges ratio is competitive, and it is a reasonable size.

GCP’s recent strong performance has pushed it to the top of its infrastructure peer group over most time periods.

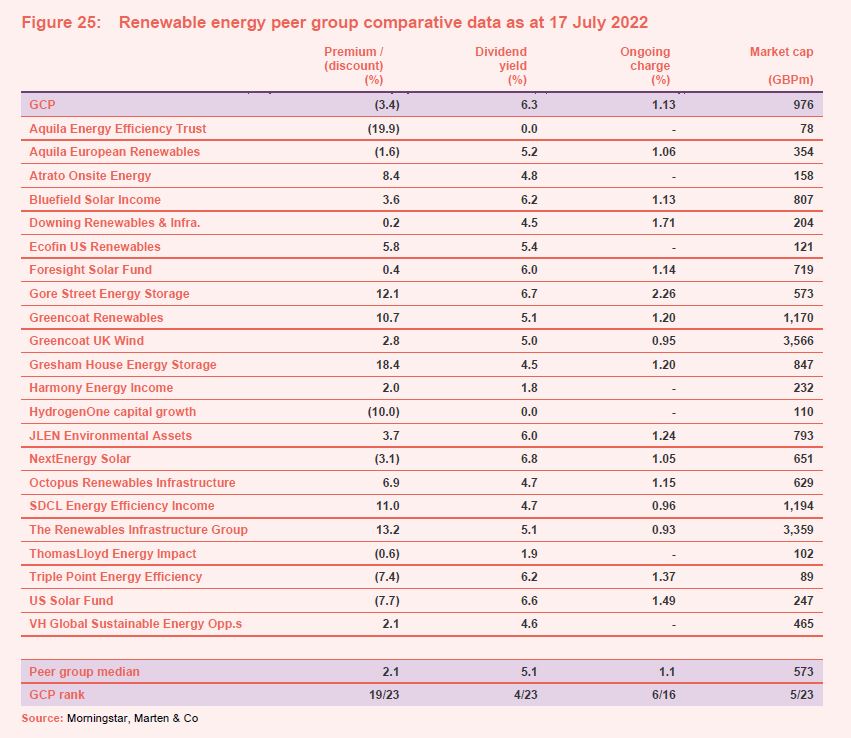

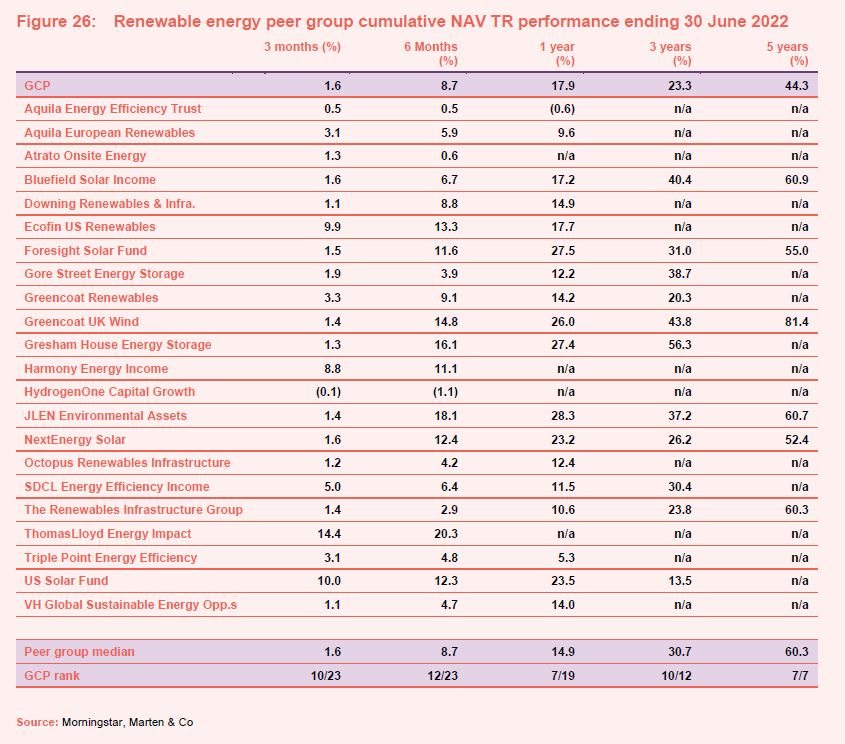

Alternative peer group – renewable energy funds

We feel that, given the increasing importance of renewable energy within GCP’s portfolio, it is relevant to compare GCP to the constituents of the renewable energy sector. The sector has been expanding rapidly and consequently many of these funds have not yet built up much of a track record.

Ecofin US Renewables and US Solar Fund are somewhat cushioned from weak power prices by having much longer-term PPAs, which are typical of the US market. The energy storage funds – Gore Street and Gresham House – and the energy efficiency funds – Aquila, SDCL and Triple Point – are also much less exposed to shifts in power prices. Many of these funds have also been impacted by foreign exchange movements, which GCP is not exposed to.

We think the best comparators are probably Bluefield Solar, Foresight Solar, Greencoat UK wind, JLEN Environmental, NextEnergy Solar, Octopus Renewables and The Renewables Infrastructure Group.

Figure 25 shows how GCP stacks up against the renewable energy sector. Again, GCP trades on one of the lowest ratings, which we feel is unjustified. GCP’s dividend yield is one of the highest in this peer group; again, its ongoing charges are competitive, and it is one of the larger funds in this group.

GCP’s conservatively valued NAV most likely drags down its returns relative to that peer group median, but so, too, does its asset mix and its bias to debt rather than equity.

Dividend cover

Loans made by the company are valued on a discounted cash flow basis. When a loan is first made, it is typically valued using the interest rate charged to the borrower. However, loans are often revalued by the valuation agent to reflect changes in the market rate of interest or for project specific reasons, for example.

As market rates of interest have fallen since GCP was launched, higher values have been attributed to many of the loans that it has made, uplifting the NAV. That has the effect of pulling forward the recognition of income from these loans and, on an IFRS accounting basis, reduces GCP’s earnings per share and dividend cover in subsequent years (a pull-to-par effect). For this reason, the board and the investment adviser have calculated a range of alternative performance measures.

Figure 27 shows GCP’s dividend cover ratios on two bases – normal (IFRS) earnings cover, and an adjusted figure which strips out the impact of unrealised fair value adjustments on the company’s earnings, and better contrasts GCP’s revenue and dividend payout.

The investment adviser cautions that looking at measures of cashflow coverage of the dividend can be misleading. Interest accrued on loans can either be paid in cash or added to the outstanding principal and repaid when the loan matures (payment in kind or PIK). This gives rise to timing differences that affect cashflow divided coverage measures.

Premium rating

Over the year ended 30 June 2022, GCP’s shares traded on an average premium of 1.7% and high of a premium of 7.1% and a low of a discount of 5.7%. At 17 July 2022, the discount to the end June NAV was 3.4%.

Over the past couple of years, GCP’s shares have traded much closer to asset value than they had historically. It may be that a continuation of the trend of NAV growth encourages the premium to move back towards its previous trading range.

Currently, GCP’s 3.4% discount (3.7% based on Morningstar’s estimate, which includes estimated income accrued since end June) looks unjustified to us, given its high dividend yield, exposure to inflation-linked revenues and good track record relative to its immediate peer group. The market seems to have been slow to factor in GCP’s recent good NAV growth.

Fund profile

GCP Infrastructure Investments Limited (GCP) is a Jersey-incorporated, closed-ended investment company whose shares are traded on the main market of the London Stock Exchange. GCP aims to generate a regular, sustainable, long-term income while preserving investors’ capital. The fund’s income is derived from loaning money at fixed rates to entities which derive their revenue, or a substantial portion of it, from UK public-sector-backed cashflows. Wherever it can, it tries to secure an element of inflation-protection.

In practice, GCP is diversified across a range of different infrastructure sectors. It has exposure to renewable energy projects (where revenue is part subsidy and part linked to sales of power), PFI/PPP-type assets (whose revenue is predominantly based on the availability of the asset) and specialist supported social housing (where local authorities are renting specially-adapted, residential accommodation for tenants with special needs).

GCP has had a focus on social infrastructure since launch and also has a high degree of exposure to assets that have a significant positive environmental impact.

The investment adviser

Gravis Capital Management Limited (Gravis) is the fund’s AIFM and investment adviser. It is also investment manager of GCP Asset Backed Income, and advises VT Gravis Clean Energy Income Fund, VT Gravis UK Listed Property Fund, VT Gravis UK Infrastructure Income Fund, and VT Gravis Digital Infrastructure Income Fund. Gravis has assets under management of approximately £3bn.

Philip (Phil) Kent is the lead fund adviser, and is supported by an extensive team which includes Rollo Wright (Gravis’s chief executive officer (CEO), who was co-lead adviser until May 2018).

Phil joined Gravis from Foresight Group, where he had responsibility for waste and renewable projects, including large waste wood combustion projects and a pipeline of anaerobic digestion projects across the UK. His 11-year experience of the energy sector includes periods at Gazprom Marketing and Trading (latterly in its Clean Energy team) and PA Consulting’s Energy practice.

At 14 June 2022, the directors of the investment adviser – together with their family members – held 917,403 shares in GCP, up from 785,501 shares at end September 2022.

Gearing

Mizuho Bank has been introduced as a new lender under the existing revolving credit facility, which has been expanded from £165.0m to £190.0m. £156m was drawn down at 31 March 2022. The margin and commitment fees payable under the revolving credit facility remain unchanged.

The board

As flagged in advance, with effect from 20 June 2022, Ian Reeves has stood down as chairman of the company and has been replaced by Andrew Didham, who also assumes the chairmanship of the nomination committee. Ian will remain on the board as a non-executive director until a replacement has been recruited. It is expected that this process will be completed no later than the end of December 2022.

Previous publications

Readers interested in further information about GCP may wish to read our previous notes. You can read the notes by clicking on the links below or by visiting our website.

| Title | Note type | Publication date |

| Stable income, uncertain times | Initiation | 30 January 2020 |

| Rebased dividend | Update | 1 June 2020 |

| Compelling yield | Annual overview | 11 January 2021 |

| Penalised for being conservative? | Update | 1 July 2021 |

| The future is brighter and greener | Annual overview | 18 January 2022 |

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on GCP Infrastructure Investments Limited.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.