Supply deficit unsustainable

Supply deficit unsustainable

2018 saw a strong recovery in the uranium price. This has stalled this year, but with the uranium market now seeing more demand than supply, Geiger Counter’s (GCL’s) managers see the potential for a resurgence in the uranium price, as more nuclear reactors come online (particularly in China and India), while major producers hold off from returning mothballed mines to production.

An announcement by the Trump administration in July, in relation to its section 232 investigation into the uranium security of supply, has created uncertainty for US-based customers. They are unsure whether there might be import quotas, for example – see page 3. This has put a break on purchases and is suppressing the uranium price. However, it is also leading to significant pent-up demand, creating the potential for a sharp reversal of the uranium price once things are clarified. The managers see the current situation as unsustainable.

Capital growth from a diversified global portfolio of uranium stocks

Capital growth from a diversified global portfolio of uranium stocks

GCL aims to provide investors with capital growth by investing in a portfolio of securities of companies involved in the exploration, development and production of energy, as well as related service companies. Its main focus is the uranium sector, but up to 30% of assets can be invested in other resource-related companies. These include, but are not limited to, shares, convertibles, fixed-income securities and warrants.

| wdt_ID | Year ended | Share price total return (%) | NAV total return (%) | URAX Index total return (%) | Cameco share price total return (%) | Global X Uranium ETF total return (%) |

|---|---|---|---|---|---|---|

| 1 | 31 Oct 2015 | -34.50 | -33.20 | -36.70 | -13.50 | -33.30 |

| 2 | 31 Oct 2016 | 35.70 | 26.30 | 35.30 | -29.30 | 3.30 |

| 3 | 31 Oct 2017 | -7.90 | -16.70 | 2.50 | 0.10 | -9.20 |

| 4 | 31 Oct 2018 | 17.10 | 17.70 | 18.00 | 38.40 | 4.70 |

| 5 | 31 Oct 2019 | -20.00 | -32.40 | -0.90 | -17.40 | -10.80 |

Market outlook

Market outlook

QuotedData’s March 2019 initiation note provided a detailed overview of the outlook for the global uranium market (see pages 5 to 8 of that note) and we would suggest that readers review this. However, to recap:

- Power production is the key driver of the long-term uranium price on the demand side (more than of 99% of uranium produced is used to produce fuel for nuclear power plants).

- Demand for uranium tends to be price-inelastic (in other words, higher prices do not choke off demand), at least in the short-to-medium term (nuclear power plants are high-capital-expenditure, long-term investments, with uranium supply typically tied to long-term contracts. This, and the fact that nuclear power stations are expensive to ramp up and down, makes demand insensitive to price in the near term).

- Concentrated production leaves the market open to supply side shocks – events that constrain the amount of uranium produced (the top nine uranium producers collectively control around 85% of production globally, whilst over 40% of production is located in regions of some geopolitical risk – primarily Kazakhstan and Russia).

- There are significant supply-demand imbalances in the market (for example, the US accounts for around 3% of newly-mined uranium supply but represents around 30% of global demand). The aftermath of the 2007 flooding of Cameco’s Cigar Lake mine saw a major spike in the uranium price.

- The industry is also exposed to demand risks – events that lead to a sharp reduction in demand for uranium (as illustrated by the aftermath of the March 2011 Fukushima Daiichi disaster, when a tsunami overwhelmed a nuclear reactor on Japan’s east coast). This occurred as Kazakhstan was nearing the end of a five-year development programme that nearly quadrupled its uranium output. Japan instantly shut all its reactors, prompting an industry-wide safety review across the globe, denting demand from the developed world and creating a significant supply imbalance.

- The subsequent poor pricing environment has choked off uranium supply (as more expensive mining projects have been taken out of production) and curtailed capital investment. Data from Uranium Participation Corporation suggests that supply close to 35 million lbs per annum has been removed from the uranium market since 2016.

- Despite its issues, nuclear power has a key advantage in that it is a clean technology that does not emit CO2 into the atmosphere in an increasingly carbon-conscious world. It is also an established technology that can provide a consistent supply 24 hours a day, whatever the weather, making it suitable for baseload power in a way that other low carbon technologies, such as solar, wind or tidal generation, are perhaps not.

Current situation is not sustainable

Current situation is not sustainable

There is evidence to suggest that the current situation is not sustainable over the longer term. Specifically:

• In Japan, Prime Minister Shinzo Abe’s pro-nuclear government (re-elected in September 2018) has seen it slowly switching its reactors back on (although there has been a recent pause).

• The US government is now offering nuclear plants a zero-emission credit in recognition of their zero carbon emissions. This helps to level the playing field against renewables and fossil-fuelled generation.

• Having faced government proposals to close them, South Korea and Taiwan have now voted to retain their nuclear power stations.

• France has extended its time frame for de-emphasising nuclear within its power mix (it was targeting a reduction to 50% by 2025 but this has been extended by 10 years to 2035).

• Higher-priced long-term supply contracts to utilities are also running off rapidly. This is forcing a market rebalancing as mine supply is curtailed and in some cases utility supply contracts are being fulfilled by U3O8 purchased in the market, as is the case with Cameco.

Lack of clarity over allowable jurisdictions has stalled demand for uranium in the short term

Lack of clarity over allowable jurisdictions has stalled demand for uranium in the short term

In recognition of the concentration of uranium supply outside the US, the US government initiated a section 232 investigation into the security of supply (US section 232 investigations look at the effects of imports on national security). UR-Energy USA and Energy Fuels Resources, the companies that made the original submission that led to the investigation, requested that the Trump administration impose an import quota requiring that 25% of domestic uranium consumption be met by US producers.

On 12 July 2019, the Trump administration issued a memorandum saying that it did not agree that uranium imports threaten to impair the national security of the United States, but that the Secretary of Commerce’s findings raised significant concerns regarding the impact of uranium imports on the national security with respect to domestic mining. The announcement said that “a fuller analysis of national security considerations with respect to the entire nuclear fuel supply chain is necessary at this time”.

The fact that the US government initiated the investigation suggests that nuclear continues to be seen as part of the long-term power mix, despite the advent of cheap shale gas. Furthermore, although no quota has been imposed as yet, the results of the fuller analysis are yet to be determined and this has led to concerns for US-based purchasers as to whether a quota could still be imposed and, if so, what might be classed as domestic production (for example, it is unclear how purchases from Canadian producers might be treated). GCL’s managers say that, while the market has otherwise moved to a supply deficit, this uncertainty has put a break on purchases and is suppressing the uranium price. However, this is leading to significant pent-up demand and could lead to a sharp reversal as the situation is clarified and unwinds.

Managers’ view

Managers’ view

GCL’s managers maintain their view that the fundamentals of the uranium industry are showing a marked shift in fortunes following a 10-year bear market, with 2018 marking the point when uranium supply-demand fundamentals swung from surplus to deficit. The extended bear market period has left the valuations of underlying mining equites at extremely attractive levels, in their opinion. The main surprise, since QuotedData published its initiation note, has been the additional uncertainty created by the Trump administration’s response to the section 232 investigation into the security of uranium supply (discussed above).

The manager’s view on the sector was set out in detail in our initiation note (see pages 8 to 10 of that note), and we would suggest that readers review this. However, to recap:

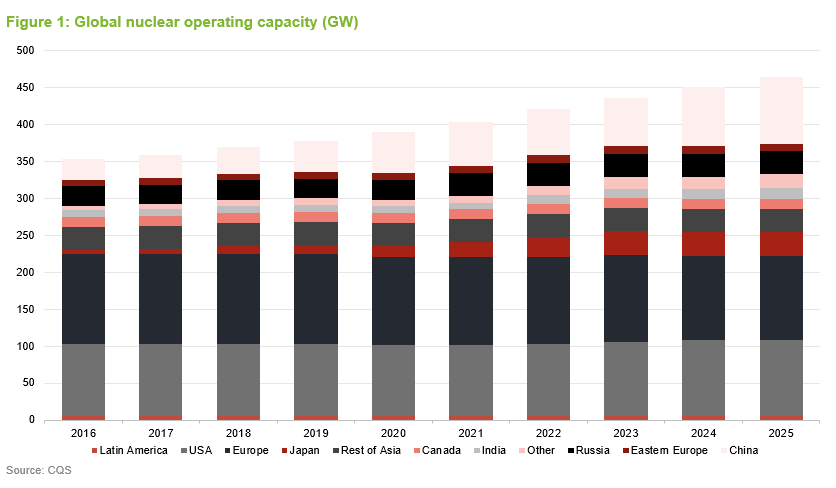

• Emerging markets are driving demand growth, particularly in China. Global nuclear operating capacity is expected to expand from around 350 gigawatts (GW) in 2016 to around 465GW by 2025 (an increase of 33%). Emerging markets are driving this expansion (developed markets are generally flat or down) with China, India and Russia at the forefront.

- Declines in North American and Western European nuclear generation capacity are expected to be more than offset by the Asian build-out.

- This new nuclear generation is generally displacing polluting coal fired power generation, driven by the need to improve air quality. Figure 1 provides an illustration of the anticipated growth trajectory.

- The market’s rapid shift to deficit production has seen production cuts by major producers such as Kazakhstan and Cameco. Both have stated the need for materially higher pricing before increasing output. Data from Uranium Participation Corporation suggests that by 2021, approximately 20% of demand will be uncovered, increasing to approximately 50% in 2025 and 65% by 2030 and beyond. The managers think that this is unsustainable and will drive a continued recovery in the uranium price.

- Current uranium prices are considerably below the levels required to incentivise new supply. Furthermore, current market uncertainties are making it difficult for new projects to advance.

- Nuclear power generation is capex-intensive, with uranium only constituting a small proportion of the cost per KWh. This results in a very low elasticity of demand to pricing with a greater strategic emphasis being placed on certainty of supply.

- The managers believe that renewables are unable to displace this portion of the global power supply primarily due to their higher output variability.

- Although there is limited clarity on timing, the programme of nuclear reactor restarts in Japan – whilst slow to get going – should also increase demand for uranium. There has been a pause this year, the managers expect the pace to pick up. Five reactors were restarted during 2018, whilst only four had previously restarted since the Fukushima Daiichi disaster and, with some 54 reactors in total, there are many more to potentially come back online.

- The performance of uranium equities and the spot price appear to have disconnected, with equities lagging. The managers see the potential for a strong recovery in equities as the market regains confidence. The managers also believe that many investors feel that they do not need to have an allocation to uranium and, with the uranium price recovery stalling this year, many have turned away from the sector. However, the managers believe that a virtuous circle of increased investor interest driving equity prices, as the uranium price recovers, is a distinct possibility.

Asset allocation

Asset allocation

As at 30 September 2019, GCL’s portfolio had exposure to 46 issues (securities), up from 42 issues as at 30 November 2018 (the most recently available data when QuotedData last published). GCL’s portfolio is highly concentrated (the top five holdings continue to account for around 55% of the fund – see Figure 6) and to protect the company from being unduly exposed to aggressive investors, details of its holdings are limited to the top five largest positions in its monthly factsheets. Greater detail is provided in its annual and interim reports, some of which has been utilised in the charts and tables that follow, but this data is inevitably more dated by the time these reports are released.

Concentrated and low turnover portfolio of uranium stocks

Concentrated and low turnover portfolio of uranium stocks

As illustrated in Figure 6, the top five issues accounted for 54.9% of the portfolio as at 30 September 2019, which is a modest increase from when QuotedData last wrote (53.3% as at the end of November 2018). This increase reflects both the performance of some of GCL’s larger positions as well as the reinvestment of proceeds from the sales of Greenland Minerals and Alkane Resources (both strong performers – see pages 6 and 7) into GCL’s largest holding NexGen Energy, which has underperformed (see page 9). In part reflecting the managers’ investment style, but also reflecting the concentrated nature of the industry (nine producers control around 90% of supply between them), GCL’s portfolio is inherently low-turnover. Four of the top five holdings at the end of September 2019 comprised the same five stocks that held the top five positions as at the end of November 2018 (the most recently available data when QuotedData published our initiation note), albeit in a slightly different order.

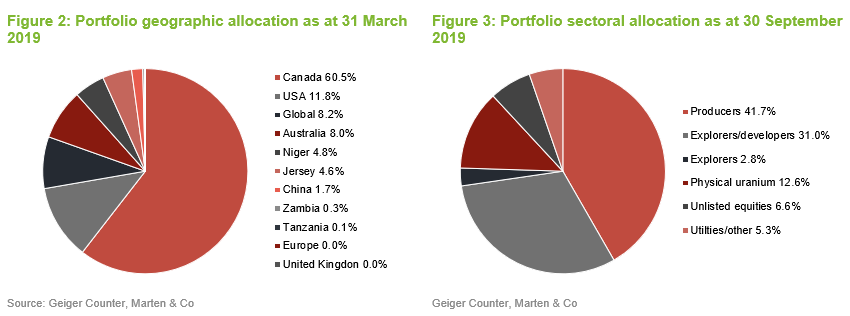

Figures 2 and 3 show the portfolio’s geographical allocation and sectoral allocations as at 30 September (this being the most recent publicly available data). These highlight a number of themes:

- Whilst GCL has a global mandate, North America (particularly Canada) and Australia dominate the portfolio. These are viewed as politically safer regions that have ‘extractable pounds’; that is, they have good geology and mining-friendly environments.

- Over half of GCL’s portfolio continues to be invested in safer assets; i.e. producers or companies backed by physical uranium.

- Pure exploration plays are a limited component of the portfolio.

Although not illustrated in Figures 2, 3 and 4, GCL’s portfolio continues to have a strong bias towards small and mid-cap uranium mining companies. For example, GCL does have an investment in Cameco, but this accounted for some 2.6% of net assets as at the end of March 2019 (down from 4.7% as at the end of September 2018). The bias towards small and mid-cap companies reflects the managers’ view that these generally have superior growth prospects (for example, production improvements or improvements in reserves) and, generally being less well-researched, it is also where the managers are more likely to find a mispriced security.

As at 31 March 2019, GCL had five unlisted investments, which accounted for 6.2% of its net assets (up from four investments that accounted for 5.5% as at the end of September 2018). It also held five warrants (up from three), which accounted for 1.7% of net assets (previously all of the three that were held were at nil value).

As discussed above, GCL has a significant exposure to physically backed uranium entities through its holdings in Uranium Participation Corporation and Yellow Cake Plc.

However, in comparison to alternatives such as the URA index-tracking exchange-traded fund (ETF), GCL is relatively underweight Cameco.

Greenland Minerals – beneficiary of a Trump tweet

Greenland Minerals – beneficiary of a Trump tweet

Greenland Minerals (ggg.gl), formerly Greenland Minerals and Energy Limited, is an Australian company whose primary focus is the development of the Kvanefjeld rare earth project in south west Greenland. This project, which is centred on the Ilimaussaq alkaline complex, is the only major mining project in Greenland, and is thought to be one of the world’s biggest undeveloped resources of rare earth elements (it measures approximately 8km x 15km). The company claims that the field “is positioned to be a future cornerstone to global rare earth supply” and that, when developed, “will be a large-scale, low-cost, long-term supplier of products which are at the centre of the unfolding revolution in the efficient use of energy”.

The company has seen strong share price performance this year and, following a small retrenchment, benefitted following Donald Trump’s (in)famous tweet that he wanted to buy Greenland. Although this is Greenland’s only major project, the country’s mineral wealth has made it of interest to other mining companies, particularly as global warming has seen a retrenchment of the ice sheets that cover much of the country, thereby making these resources more accessible. In this instance, Greenland Minerals would be an obvious takeover candidate.

While they continue to like the company, GCL’s managers felt that, following President Trump’s tweet, the share price had increased to a level whereby it was factoring in an unduly positive outlook. They therefore took the opportunity to sell down the position into market strength.

Alkane Resources – uplift following Boda prospect drilling results

Alkane Resources – uplift following Boda prospect drilling results

Alkane Resources (alkane.com.au) describes itself as “a gold production company with a multi-commodity exploration and development portfolio”. Its projects are located predominantly in the Central West region of New South Wales, in Australia, but extend throughout the country.

The company’s share price saw a significant uplift in September following the announcement of drilling results that recorded the discovery of significant porphyry gold-copper mineralisation at the company’s Boda Prospect (located within its Northern Molong Porphyry Project) in New South Wales. GCL’s managers say that the company’s small gold project has also benefitted from an increasing gold price. The effect of the share price increase was to move the position from being a circa 0.5% position to around a 2.5% position, and the managers considered it prudent to sell down the position and reinvest the proceeds in better-value names.

Top five holdings

Top five holdings

Since QuotedData last published, Fission Uranium has moved out of GCL’s top five holdings to be replaced by NAC Kazatomprom. These moves do not reflect specific action by the manager, rather the relative performance of these holdings during the period since QuotedData last published. Details of the rationale underlying the remaining top five positions, along with that of Fission Uranium, can be found in our initiation note (see page 12 of this note). For example, readers who would like more detail on NexGen Energy, Denison Mines, UR-Energy and Uranium Participation should see pages 13–15 of QuotedData’s March 2019 initiation note. An update on NexGen Energy has also been provided in the performance section.

NAC Kazatomprom (8.6%) – resilient share price

NAC Kazatomprom (8.6%) – resilient share price

NAC Kazatomprom (kazatomprom.kz/en) is the world’s largest uranium producer; its production accounts for 35-40% of global uranium supply (this includes production attributable to its joint-venture partners, although Kazatomprom typically owns at least 50% of such projects). A Kazakhstan stated-owned enterprise, Kazatomprom describes itself as the national operator for the import and export of uranium, rare metals, nuclear fuel for nuclear power plants. Crucially, Kazakhstan has extensive uranium reserves and Kazatomprom has priority rights to these. While GCL’s managers like the company, they have not been actively trading the position. The move up GCL’s rankings is largely a consequence of Kazatomprom’s share price proving to be more resilient than some of GCL’s other holdings, arguably reflecting the scale of its operations.

Performance

Performance

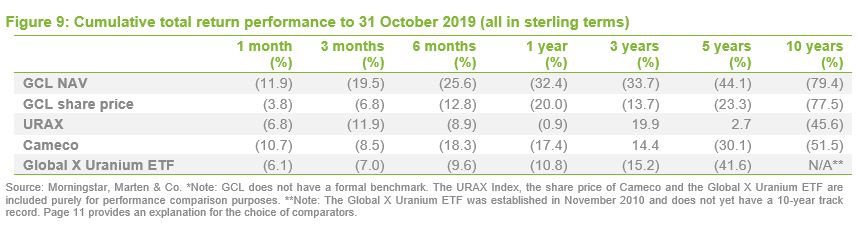

As discussed in our initiation note, GCL and the broader uranium market suffered heavily in the aftermath of the Fukushima Daiichi disaster, as the world’s focus shifted away from nuclear power as a low-carbon solution (see pages 6 and 7 of that note for more discussion). However, as capacity has been taken out of the market and the spot price has recovered, the fortunes of the sector have improved, albeit with periods of marked volatility. As discussed on page 3, and illustrated in Figures 8 and 9, the last 12 months have been surprisingly challenging for the sector, particularly given the backdrop of the uranium market moving into supply deficit. Uncertainty for purchasers of uranium in the US, following the administration’s announcement following the section 232 investigation, is suppressing demand and the uranium price for now, but there could be a sharp reversal as these seemingly-deferred purchases reach the market.

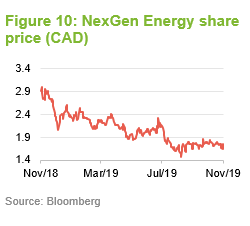

A significant detractor during the last 12 months has been NexGen Energy (see discussion overleaf), which has been GCL’s largest holding during this period (for example, NexGen accounted for 16.8% of GCL’s portfolio as at 30 September 2018 and 18.5% as at 30 September 2019). NexGen has seen its share price fall by 40.4% during the last 12 months (as at 19 November 2019) and as a major component of the portfolio, this has been a significant drag on GCL’s performance.

NexGen Energy (18.5%) – market’s expectations beatable

NexGen Energy (18.5%) – market’s expectations beatable

As discussed in our initiation note (see page 13 of that note), NexGen Energy (nexgenenergy.ca) is a uranium exploration and development company with a portfolio of projects that are centred on the Athabasca Basin in Canada. Its Athabasca Rook 1 property hosts the Arrow Deposit, the South Arrow discovery, the Harpoon discovery, the Bow discovery and the Cannon area, all of which are 100% owned by NexGen. GCL’s managers say that the arrow project is incredibly high-grade (typically 10–20x similar projects) and so much better recoveries are achievable.

As illustrated in Figure 10, NexGen has suffered from significant share price weakness during the last 12 months. The managers felt that much of this weakness was technically led, rather than being based on company fundamentals. Share price weakness saw NexGen moved out of the YSX Composite Index (its market capitalisation had dropped below the minimum required), prompting the sale of 12m shares by ETFs. This pushed NexGen’s share price down further and GCL’s managers took the opportunity to increase their holding in NexGen.

GCL’s managers like NexGen’s assets, its management team and its financial strength. They consider that NexGen is well positioned to bring the Arrow Deposit into production and are confident that the timeline expectations of the market are beatable by NexGen.

Premium/(discount)

Premium/(discount)

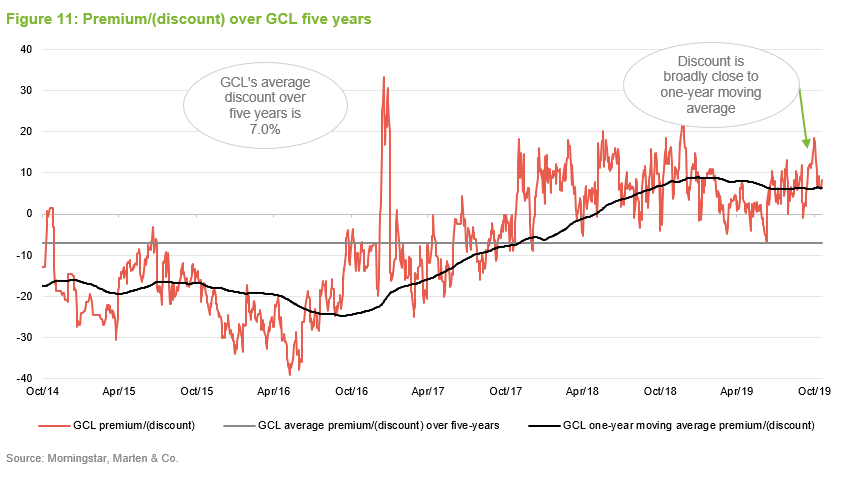

As illustrated in Figure 11, having previously traded at a discount to its net asset value (NAV), GCL has predominantly traded at a premium during the last two years, albeit with marked volatility in the premium/discount. The tightening during 2016 and 2017 coincided with a recovery in the broader uranium market as supply conditions tightened, the uranium price recovered, and sentiment towards the sector improved.

GCL has previously issued stock when it has been trading at a premium (stock was last issued in December 2018 at a premium of around 11%). With the recent expansion of the premium, this may be possible again. We reiterate that this should be beneficial to existing shareholders, as it should – all things being equal – support liquidity in GCL’s shares and lower GCL’s ongoing charges by spreading its fixed costs over a larger asset base.

GCL’s premium is in marked contrast to the broader natural resources sector, which was trading at an average discount of 25.4% as at 18 November 2019, but this reflects GCL’s narrow focus and the resurgence of interest in the uranium market. During the last 12 months, GCL has traded between a discount of 6.7% and a premium of 25.2%, with an average premium of 6.4%.

GCL does not have an explicit discount management policy, but it is authorised to repurchase up to 14.99% and allot up to 10% of its issued share capital, which gives the board a mechanism with which it can influence the premium/discount. However, whilst it has used its authorities to moderate the premium, GCL has not made any repurchases to date. This is reasonable in our view, given its size. We think that share repurchases might have a limited impact on the discount as they would also serve to reduce liquidity and put upward pressure on GCL’s ongoing charges ratio (i.e. reversing the benefits of growing GCL, as discussed above). GCL may therefore be better served by focusing its efforts on increasing awareness of it among investors.

Fund profile

Fund profile

Diversified global uranium exposure

Diversified global uranium exposure

GCL aims to provide investors with attractive returns, primarily in the form of capital growth, by investing in a portfolio of securities of companies involved in the exploration, development and production of energy and related service companies in the energy sector. Its main focus is uranium, but in order to allow for some diversification beyond this highly concentrated sector, up to 30% of assets can be invested in other resource-related companies.

As discussed overleaf, GCL does not have a formal benchmark and is not managed with the aim of providing outperformance relative to an index. Instead, the portfolio is managed with a more absolute return mindset, with the managers selecting the securities that they believe will provide the best risk-adjusted returns over the longer term. Although the managers consider uranium to benefit from long-term structural growth drivers, the portfolio is focused on securities that the manager has identified as being undervalued by the market. The expectation is that such securities will benefit from a re-rating over time, and therefore provide the scope for a capital appreciation beyond what the market expects.

GCL has a global remit but its portfolio tends to be biased towards North American- and Australian-listed equities. The portfolio is predominantly invested in equities, but it is not restricted to these and can also invest in convertible securities, fixed-income securities and warrants.

CQS Group and New City Investment Managers

CQS Group and New City Investment Managers

New City Investment Managers (NCIM) has been GCL’s investment manager since its launch in July 2006. On 1 October 2007, NCIM joined the CQS Group, a global diversified asset manager running multiple strategies with assets under management of US$18.5 billion as at 31 October 2019. Keith Watson and Rob Crayfourd are responsible for the day-to-day management of GCL’s portfolio.

No formal benchmark index

No formal benchmark index

Reflecting both its specialist investment proposition and a relatively small universe, GCL does not have a formal benchmark. However, for the purpose of performance evaluation, the manager has traditionally made comparisons against the price of Cameco, the URAX Index and the spot price of triuranium octoxide (U3O8 – the most stable uranium compound and consequently one of the more popular forms of the product).

Cameco is the largest listed uranium producer in the world and the second-largest uranium producer globally. It also provides the processing services needed to produce fuel for nuclear power plants. Cameco has a Canadian listing and its share price and the associated total return series are readily available, so this has been included in this report.

Comparisons against the spot price of U3O8 have not been included in this note. Whilst a potentially useful comparator, visibility of the U3O8 spot price reduced dramatically from June 2017 onwards, making it much harder for market practitioners to observe and, arguably, reducing its relevance. An additional concern regarding the validity of the U3O8 spot price, for the purposes of performance comparison, is that the majority of market practitioners cannot invest directly in this commodity.

This note also includes comparisons versus the URAX Index. This index consists of the 10 largest global companies operating in the fields of uranium mining or processing. It is constructed by Société Générale Index and aims to reflect the development of the uranium mining and processing sectors. Index components are ranked according to their free float market capitalisation and market liquidity. They are re-weighted on a quarterly basis, each to a minimum of 5% and a maximum of 15%.

Finally, the Global X Uranium ETF (URA) has also been used as a comparator in this note. This is a reasonably large (net assets of around US$192.1 million as at 19 November 2019) and liquid ETF that provides investors with access to a broad range of companies involved in uranium mining and the production of nuclear components (this includes companies involved in extraction, refining, exploration, or manufacturing of equipment for the uranium and nuclear industries). Its objective is to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Global Uranium & Nuclear Components Total Return Index.

Previous publications

Previous publications

Readers interested in further information about GCL, such as investment process, fees, capital structure, life and the board, may wish to read QuotedData’s initiation note “Nuclear exposure”, published on 20 March 2019.

The legal bit

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Geiger Counter.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.