Gulf Investment Fund

Investment companies | Update | 17 April 2023

On the gulf of a new economy

The team behind the Gulf Investment Fund (GIF) has more than proven its worth as an active manager, having negotiated the turbulent markets of 2022 to deliver truly impressive outperformance of both GIF’s peers and its benchmark. In particular, in recent trading activity, it has eschewed some of the more highly-valued regions, and the globally exposed petrochemical sector (as at 31 December 2022, GIF had no direct exposure and limited indirect exposure), in favour of more-attractively-valued opportunities focused on the domestic economies of the Gulf. This includes a substantial investment into local companies in Saudi Arabia. GIF continues to offer significant diversification benefits for global portfolios, thanks to the Gulf’s idiosyncratic markets.

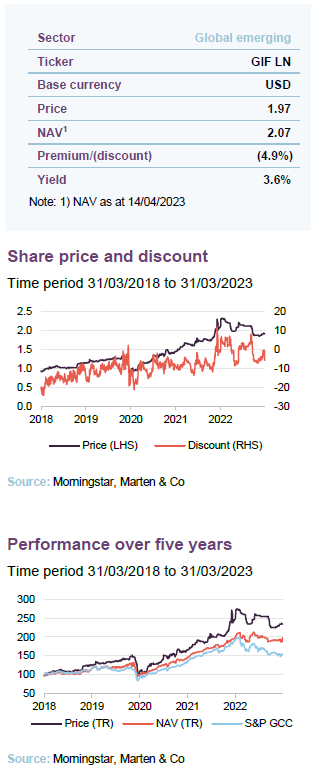

With this strong performance has come a positive re-rating of GIF’s share price and a narrowing of its discount. The trust has traded at asset value on average over the last 12 months, and is currently trading on a 4.9% discount. It also has an enhanced dividend policy targeting a total annual dividend equivalent to 4% of the preceding year’s NAV.

Exposure to growth within the GCC economies

GIF aims to capture the opportunities for growth offered by the GCC economies of Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates by investing in listed or soon-to-be-listed companies on one of the GCC exchanges.

The Gulf region – more than just black gold

In what has been a particularly turbulent period for global equity markets, parts of the Gulf region have stood out as being one of the few safe havens for investors, with GIF itself being a shining example of the potential of the GCC economies.

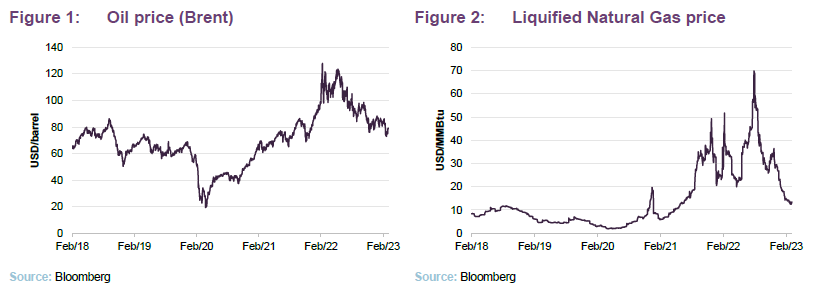

One of the biggest developments since we published our initiation note written in August 2022, has been the volatility in the price of oil, as is illustrated in Figure 1. In August, oil was trading at close to five-year highs, thanks to the fallout of the Ukrainian war, as well as the ongoing effects of increased demand as economies have re-opened post-COVID. Since then, the oil price has fallen markedly, albeit to a level that remains significantly above that prior to the invasion of Ukraine, and oil price volatility has also reduced. This largely reflecting the West’s adaptation to the changes in the supply-demand balance as a result of the conflict. Specifically, weaning itself off of Russian oil and gas.

The fall in price does not mean we have returned to the days of pre-pandemic pricing, with oil having once traded at a negative-future value. Instead, in the eyes of some professional commentators, it has returned to a more realistic level. This is one where the oil price will remain elevated relative to its pre-pandemic level, thanks to both shifting supply dynamics and the ongoing support from the post-COVID surge, especially from Asia, helped by the reopening of China’s economy. We believe that tailwinds from this re-rating in oil are self-evident for the Gulf states, given the ever-present importance of the oil and gas industries to their economies.

Despite these tailwinds, the Gulf regions saw their equity markets recede in the final quarter of 2022. This was in part a reflection of the reversal in the oil price, but also due to the Gulf regions being impacted by the global risk-off environment (something which appeared to impact the GCC region, although global emerging markets appeared to be less affected). This in turn was a consequence of rising inflation and interest rates, largely caused by the steeply rising energy costs, which gave markets the jitters around the prospects for global growth and the potential for a global recession.

The GCC – a valuable diversifier

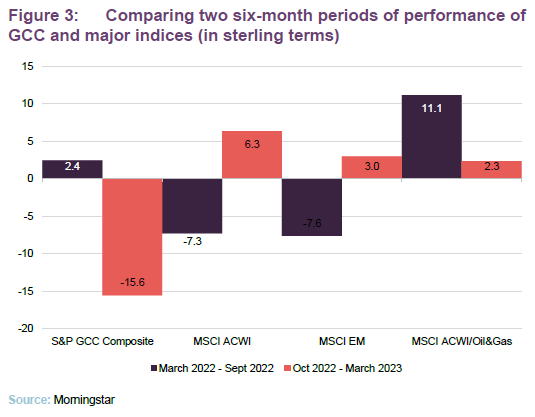

Middle Eastern markets have seen a sharp reversal in the last six months.

Despite the apparently strong relationship between the performance of the GCC markets and the price of oil, there is evidence to suggest that the Gulf region, and GIF’s portfolio, offer investors a compelling source of diversification, that warrants their inclusion within a global equity portfolio.

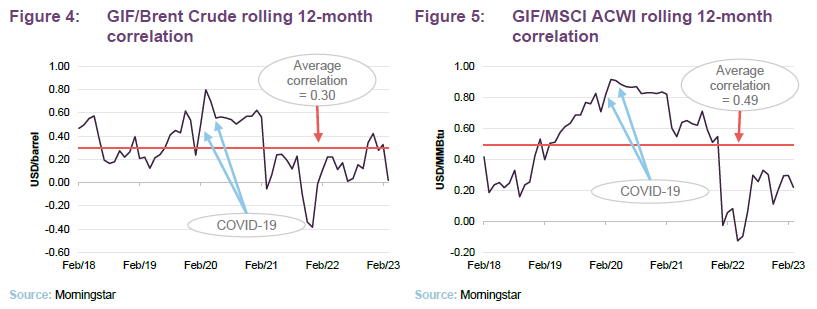

This is illustrated in Figures 4 and 5, which show the rolling 12-month correlations of GIF’s portfolio versus the Brent crude oil price in Figure 4 and MSCI ACWI in Figure 5. Using monthly data over five years, the average correlation between GIF’s portfolio and Brent is just 0.30 and this period includes the COVID-related market collapse of March 2020 that saw the correlations between almost all asset classes increase, as is common during periods of extreme market distress.

Figure 5 illustrates a similar situation for the performance of GIF’s portfolio versus global equities, although in this situation the correlation is higher at 0.49. Similarly, the correlation peaks during the market collapse of March 2020.

Sell-off has created disparities

We recently caught up with Jubin Jose, lead manager of GIF, where he outlined his views around the current dynamics at play within the Gulf market. Jubin believes that the opportunity set presented by the Gulf has evolved since our last note. The recent sell off in global equities has not impacted all of the GCC countries equally, which has led to a shift in relative valuations within the region. He also notes that the structural opportunities within the Gulf continue to evolve, with the current long-term tailwinds favouring large scale corporate investing and tourism.

The GIF team foresee major tailwinds supporting domestically-focused companies.

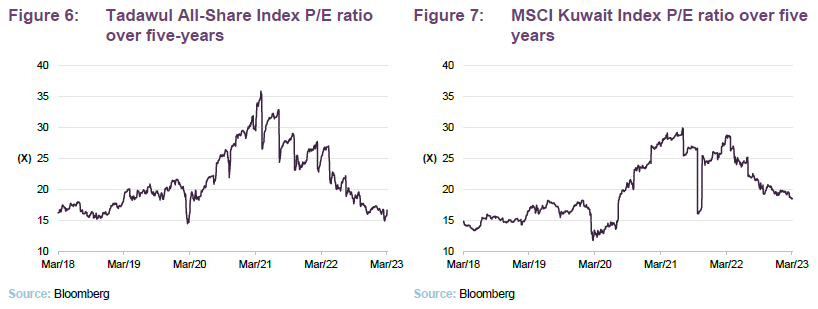

One of the most dramatic shifts in sentiment has been Jubin’s increased bullishness around Saudi Arabia, previously GIF’s largest underweight. This is in part because Saudi Arabia (as represented by the Tadawul All-Share Index) found itself at the sharper end of the global equity selloff during the third and fourth quarter of 2022. As illustrated in Figures 6 and 7, having peaked at 35.5x in April 2021, the Saudi Arabian market’s P/E ratio has fallen to far more attractive levels, while regions such as Kuwait, while cheaper than they were, do not offer as attractive valuations (18.5x for the MSCI Kuwait as at 31 March 2023, versus 16.6x for the Tadawul All-Share). In addition, Jubin believes that, along with Qatar, Saudi Arabia will likely offer superior GDP growth in the coming years, especially when compared to UAE and Kuwait. Reflecting this, Jubin has been reducing exposure to the latter two regions.

Jubin thinks that, while an elevated oil price is helpful in the near-term, over the longer-term, Saudi Arabia’s growth will be less dependent on oil and driven by the country’s increased focused on non-oil projects, such as tourism and large-scale infrastructure. While readers may be aware of some of the headline grabbing projects like The Line, an enormous linear super-city currently under construction, much of Saudi Arabia’s growth will likely come as the result of its ‘Saudi Vision 2030’ plan, a government initiative to reduce the region’s dependence on oil, and diversify its economic base.

Saudi Arabia offers one of the most attractive valuation opportunities.

This includes a variety of projects that, while not as ambitious as ‘The Line’, broaden the range of investment opportunities that are available. For example, Vision 2030 has already seen the first cinema being built in Saudi Arabia in over 35 years, as well as the construction of an F1 race circuit. These investment initiatives have gone hand-in-hand with policy changes designed to improve the region’s growth prospects. For example, a new visa approval system has been put in place that the Saudi government describes as an historic milestone in opening Saudi Arabia to tourism. The new system includes a tourist eVisa for GCC residents as well as a ‘Visa on Arrival’ that holders of US, UK and Schengen area passports are eligible for. These improvements are expected to provide a substantial long-term tailwind for travel and tourism-exposed activities within the country.

Looking to GCC domestically-focused companies

Zero direct exposure to petrochemical companies.

On a sector level, Jubin has become more bullish around corporate banks, insurance companies and restaurant chains, while becoming more bearish on retail banks and energy. His adjustments to GIF’s portfolio reflect this and Jubin says that recent trades have been designed to shift GIF’s exposure to domestically focused opportunities, rather than globally exposed companies, so that GIF can capitalise on the structural trends presented by the Gulf regions. What may come as a surprise is that GIF’s direct exposure to petrochemical companies is nil and its indirect exposure is relatively limited (around 9% of the portfolio is in transport companies which have some exposure and there is also some exposure to fertiliser producers).

After a very strong first half of the year, Jubin began to doubt the ability for Gulf petrochemical companies to continue what would be a super-normal period of growth, on the back of surging oil prices. He therefore took the decision to exit all of GIF’s petrochemical holdings and this was achieved by the end of Q2. He currently remains sceptical on the share price prospects for these companies, unsure if there will be sufficient support for oil prices to justify the current valuations they are trading on. However, GIF does retain some indirect exposure to the sector via a number of industrial firms as he thinks their valuations are more compelling and their profitability is less sensitive to the oil price.

The GIF team favour corporate banking over retail.

Jubin highlights the bifurcation of banking prospects. While rising interest rates are generally seen as a positive for banks as it should boost their net interest margins, Jubin thinks that retail banks in the GCC region are likely to struggle as rising interest rates are making their loans less affordable. However, he thinks that the corporate banks, being at the vanguard of the government’s efforts to diversify the Saudi economy, will be better able to expand their loan books and benefit from a higher rate environment.

Jubin believes that local insurance firms benefit from long-term structural growth tailwinds, driven by improving demographics within the Gulf as populations expand, wealth rises, and more generous employment benefits increase demand for insurance. At the same time, the Gulf states are also generally reducing their support for state-provided healthcare, which should increase demand for health insurance as households look to fill the gap.

Jubin also notes that if we have reached peak inflation growth, then we may see a number of specific tailwinds for insurers, such as a peak in claim costs, higher investment income, and a reversal of asset value erosion that has occurred in the past year as markets have adjusted to higher interest rates. The recovery in travel could also benefit insurers due to the mandatory requirement to have travel health coverage in the region.

As noted above, Jubin has become more bullish on the outlook for restaurants, especially fast-food chains, which should benefit from both the rise in tourism and improving demographics. This sentiment is not held solely by Jubin, as he has participated in two restaurant chain IPOs (Americana Restaurants International and Alamar Foods, which listed on the Saudi Arabian Stock Exchange – see page 10), as IPO activity reflects the increasing confidence in the sector by company management.

The IPO market in the region remains robust, with the team expecting over 70 IPOs for 2023. A robust IPO market is important as it not only shows the improving maturity of the Gulf region, as more companies grow to a sufficient size to justify raising capital via share issuance, but it is also a strong signal of market confidence.

Asset allocation

There has been substantial turnover since our last note.

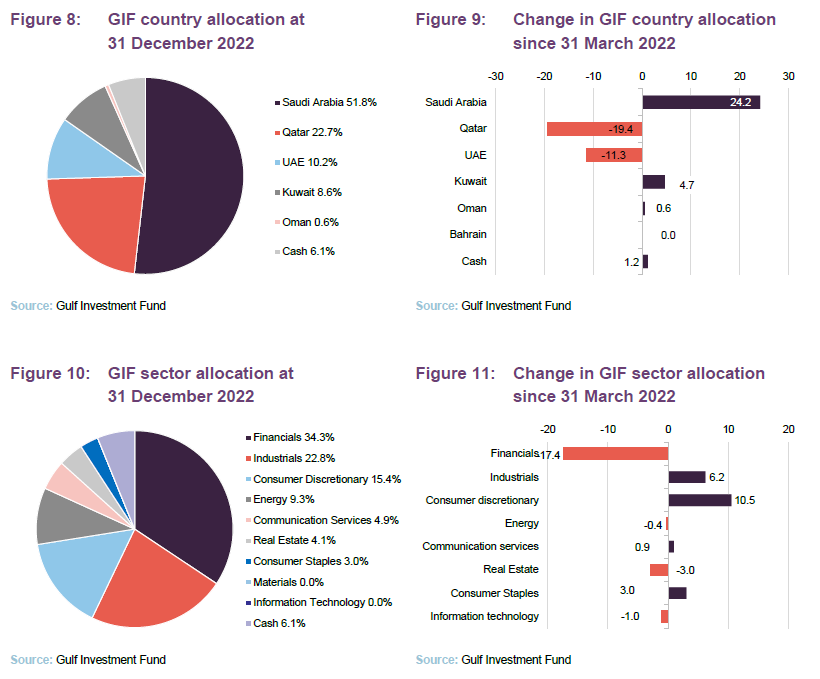

As we highlighted above, the opportunity set being presented to the GIF team has expanded, thanks to both valuations shifts and structural changes. The effects of this are made most apparent in the evolution of GIF’s portfolio since our last note, shown by Figures 7 and 9. GIF’s manager estimates turnover has been in the region of 200% during the last 12 months, a high figure for many listed equity strategies.

One of the quirks of the recent activity undertaken by the team is that GIF’s overall allocation has moved closer to that of its benchmark, with many of its regional deviations being reduced. As illustrated in Figure 9, the key change has been a reduction in GIF’s substantial underweight to Saudi Arabia, reflecting the manager’s more positive outlook for that jurisdiction.

GIF’s portfolio is not managed with reference to the benchmark; its sectoral and country allocations are the result of the manager’s stock selection decisions, rather than the manager seeking to achieve specific allocations. GIF still retains a substantial active share, which underlines the manager’s approach.

Top 10 holdings

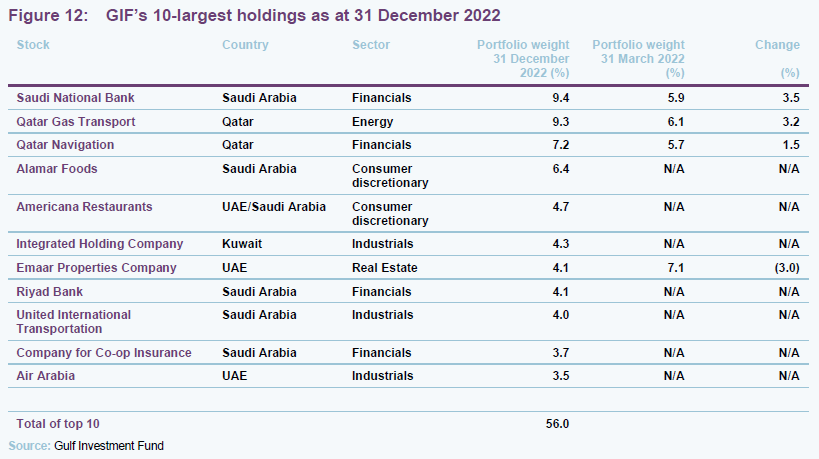

Like its sector and region exposures, GIF has seen a fair amount of change in its top 10 holdings since our last note, with 7 new holdings added. We outline some of the recent trades below.

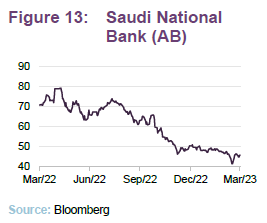

Saudi National Bank (9.4%) – exposed to government expenditure on corporate projects

Saudi National Bank (SNB – www.alahli.com), whilst not a brand-new holding, has been added to substantially. The increase in the position reflects both the manager’s view on an improving outlook for corporate banking – discussed on page 6 – as well as a move to take advantage of valuation discrepancies between Gulf states (SNB was trading on a historically low P/B ratio when the team began adding to it).

GIF’s manager believes that the next leg of growth for Saudi Arabia will be driven by government expenditure on corporate projects, in particular those which will be part of the delivery of Saudi Arabia’s Vision 2030 (discussed on page 5). Jubin thinks that many of these projects which will be channelled through the nation’s largest bank, one which is also majority owned by the government. Beyond SNB’s proximity to state-sponsored projects, the bank is also making greater use of its sale and digital offerings to expand its product suite and ensure customer loyalty.

Alamar Foods (6.4%) – Major franchisee for Domino’s in MENA

Alamar Foods (alamar.com) is another new addition to GIF’s portfolio. It listed on the Saudi Arabia exchange in August 2022 and GIF participated in the IPO.

Alamar Foods is the master franchisee for Domino’s in 16 countries across MENA and for Dunkin’ in Egypt and Morocco, with 619 stores as of Sep 2022 (including corporate, JV and sub-franchisees). The company is expected to benefit from a combination of increasing store count (c.10% annual incremental stores) and higher sales per store backed by the favorable demographics, growing wealth and current low quick service and fast casual restaurant (QSR) penetration.

Integrated Holding (43%) – position increased on weakness

Headquartered in Kuwait City, Integrated Holding provides services for logistics, heavy lift, engineering and equipment to the oil & gas, petrochemical, and power industries in Kuwait, Qatar, Oman, and Saudi Arabia. The company’s principal activities are split into five operating divisions: general transportation; equipment hire: heavy lift handling: forwarding and custom clearing: and contracting.

figure15

GIF’s manager added to the fund’s holding on share price weakness. Jubin comments that GIF’s trading habits around Integrated Holdings might appear a little unusual, as it is his preference to take smaller positions in companies and then add to them as he grows in confidence. However, in the case of Integrated Holding, the manager quickly established a sizeable position because the significant discount that the company was trading at during 2022 was too great an opportunity to pass up.

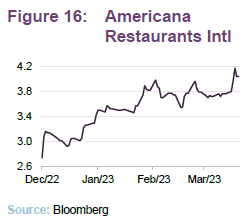

Americana (4.7%) – leading restaurant operator in MENA

Americana Restaurants International (www.americanarestaurants.com) is a new addition to GIF’s portfolio. It listed on the Saudi Arabia exchange in December 2022 and GIF participated in the IPO.

Americana is MENA’s leading restaurant operator, with 2,050 stores as of H1 22. The company has 12 brands across 12 markets, of which the key markets are UAE (28% of revenue), Saudi Arabia (22%), Kuwait (16%) and Egypt (11%). It has four “power brands” that are at the core of its expansions (1H22): KFC (60% of revenue), Hardee’s (18%), Pizza Hut (11%) and Krispy Kreme (4%).

GIF’s manager expects to see sustained revenue growth driven by structural growth within its underlying markets (a function of favourable consumer demographics, a low QSR penetration rate across GCC region and an improving outlook for tourism) coupled with a portfolio of high-quality brands and strong operational excellence. Jubin believes that the company should benefit from store expansion of 250-300 restaurants a year as well as higher like-for-like growth rate from its existing portfolio.

Sales

As discussed above, there has been a significant amount of turnover within the portfolio, reflecting the changing valuation landscape since we last published, with a significant number of sales made to fund the new positions.

From a sectoral perspective, the most obvious change has been the sale of the previously large financial holdings, with GIF’s exposure to the sector falling by around 20 percentage points. Specific sales include: Masraf Al Rayan, Dubai Islamic Bank, Emirates National Bank of Dubai and Saudi Tadawul Group. All four of which are financial institutions which GIF’s manager felt were either overvalued going into the market downturn or were reduced reflecting the manager’s views around the relative strength of the corporate banking sector versus retail.

Performance

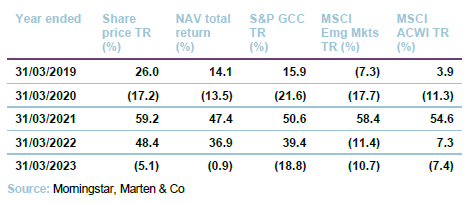

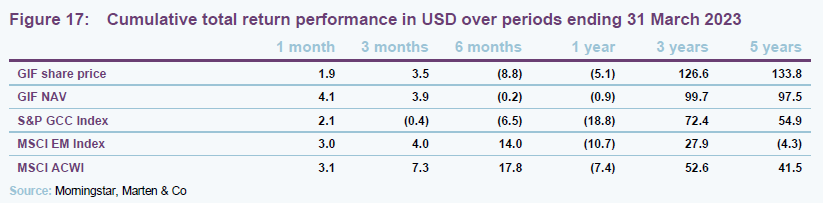

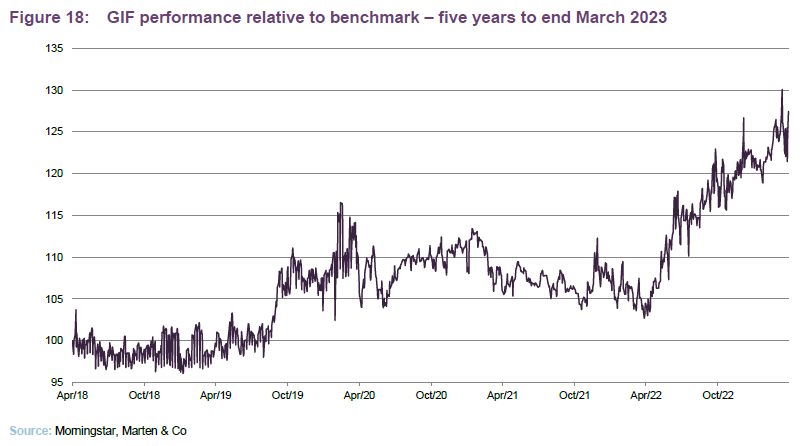

As is illustrated in Figure 17, GIF has during the last five years been able to capitalise on the considerable nominal returns the Gulf has generated (powerful tailwinds have seen the S&P GCC Index beat the MSCI ACWI over both three and five years by significant margins), while also achieving considerable alpha relative to the S&P GCC Index. The combined result of these effects is that GIF has returned 97.5% over the last five years, in comparison to its benchmark which has returned just 54.9%.

As can be seen in Figure 16, the majority of GIF’s outperformance during the last five years has been generated since the end of March 2022 onwards. This is a period that aligns relatively well with the manager’s decision to rotate out of the more highly-valued sectors, including the oil & gas majors, into more attractively valued and structural growth opportunities.

This illustrates how the manager has not just benefitted from being exposed to rising markets, but has also been able to add value in what is an incredibly idiosyncratic and under-researched region, highlighting the attractions of an active approach in such markets.

The GIF team have demonstrated substantial value-add as managers.

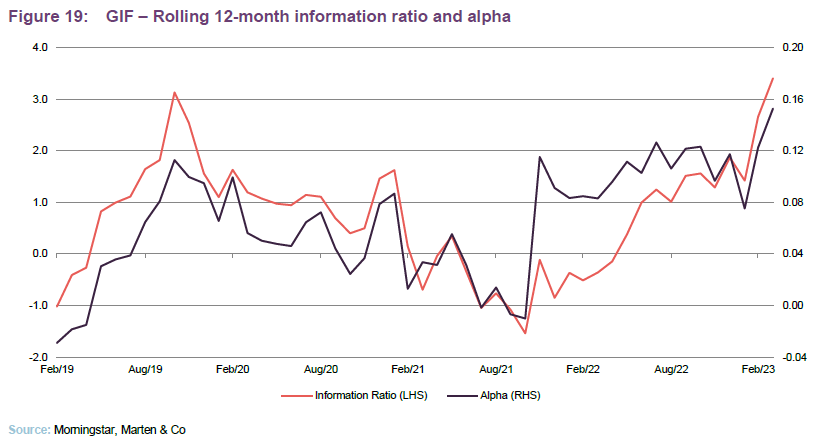

GIF’s manager has been able to generate a largely consistent positive 12-month alpha since mid-2018, as well as a very strong historic information ratio, as shown by Figure 17. Both of these data points are amongst the standard metrics in which analysts can determine if the manager has been able to add value via the use of active management, with a positive figure indicating some form of value-add relative to their benchmark. We note that GIF’s most recent alpha and information ratio are particularly high, meaning their most recent trading activity has been the most successful for the last five years.

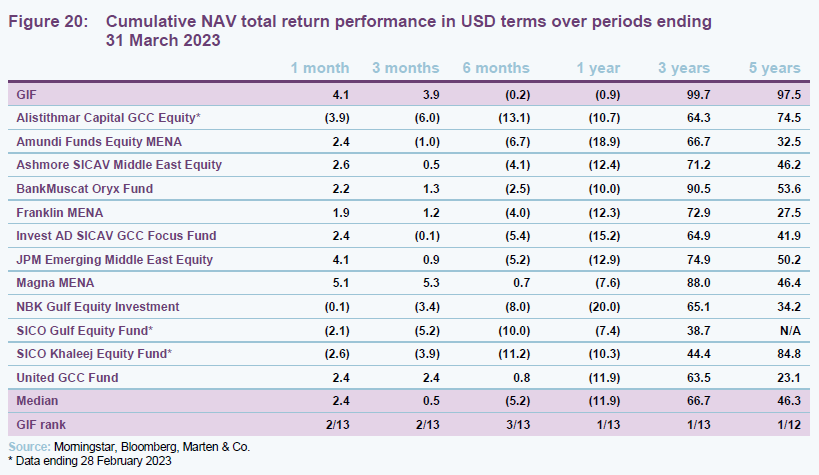

Peer group

GIF sits within the AIC’s global emerging markets sector. However, with no direct closed-end comparators, GIF tends to compare its returns to an open-ended peer group. The peer group that we have assembled comprises GIF’s five chosen comparators plus other funds investing in GCC equities. However, it should be noted that some of these funds may not be easily accessible by UK-based investors – SICO Khaleej Equity Fund is only registered for sale in Bahrain, for example.

GIF remains the best performing Middle Eastern strategy compared to its closest peers.

GIF’s recent strong performance has lifted its performance over longer-term time horizons, placing it at or close to the top of the pack over all time periods. Given that GIF is the sole listed closed-ended Middle Eastern strategy available to UK investors, it places the fund in an enviable position of offering a unique or difficult to access investment proposition, backed up by compelling investment performance.

Despite the region’s increasing maturity, the Gulf remains situated within the ‘emerging markets’ group of countries, with some even being classed as ‘frontier’ (Oman, for example). Given that one of the characteristics associated with such countries is a lack of market liquidity, compared to the equivalent developed market peer, GIF’s closed ended structure is a clear advantage here. The mid-cap bias of GIF’s current portfolio is also something that would be less well-suited to a mutual fund.

We feel that for an investor considering an investment in the region, GIF offers a strong combination of successful active management, favourable investment structure, and increasingly resilient dividend (as we point out on page 15).

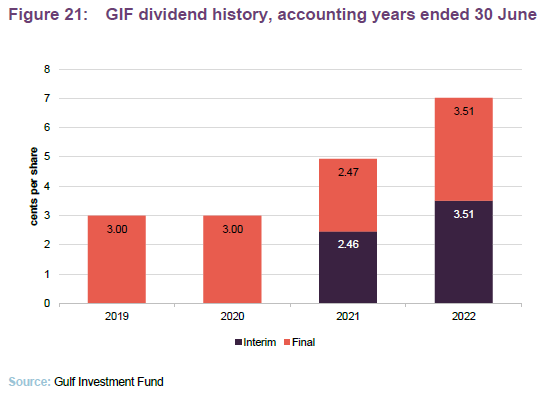

Dividend – 4% of NAV paid semi-annually

The portfolio is not managed to produce a target level of income, although GIF has tended to pay one dividend per year historically. However, in 2021, the board introduced an enhanced dividend policy targeting semi-annual payments of a total annual dividend equivalent to 4% of NAV at the end of the preceding year.

The unaudited NAV at 30 June 2022 was $2.0261, which implies a total dividend of 8.1 cents for the accounting year ended 30 June 2023. This is a yield of 4.1% on the share price of $1.97 as at 17 April 2021, which would place it amongst the highest yielders in its sector.

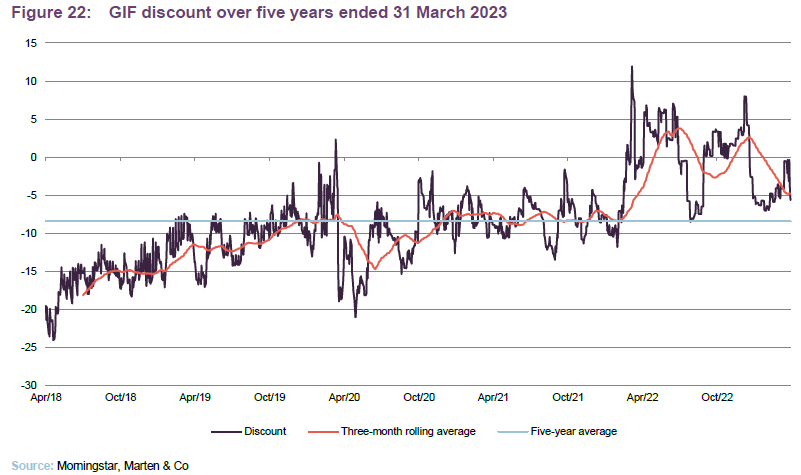

Premium/(discount)

Over the 12-month period ending 31 March 2023, GIF’s shares traded between a 8.5% discount and an 8.0% premium. Over this period the average discount was 0.4%, and finished the period on a 5.7% discount. At 17 April 2023, the discount was 4.9%.

Since the start of 2022, the GIF has largely traded between a 5% discount and 5% premium, as is reflected in its moving average. GIF’s board has previously shown a very proactive approach to managing its discount. In recent years, this has been primarily through the periodic tender offers.

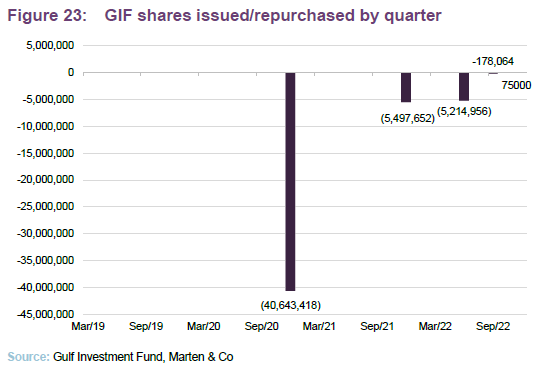

GIF has recently completed a tender offer, closing on 6 April 2023. Roughly 0.6% of its share capital was tendered. Such a small tender likely reflects the market’s increase confidence in GIF, as is also seen by its discount narrowing. The board will continue to offer the opportunity for shareholders to tender their holdings, in light of the ongoing shareholder support, with the next offering being made in September 2023. If GIF can continue to demonstrate a resilient discount, then the presence of a tender offer may reflect a convenient way for the board to enhance GIF’s liquidity without the risk of the fund materially shrinking (as it has done in the past).

Board hopeful of a re-expansion of the fund

GIF offered shareholders a 100% tender offer in 2020 and that led to significant shrinkage of the fund. Following this, GIF adopted a policy of biannual tender offers. Two subsequent tender offers reduced the size of the fund further, but the board’s hope is that the renewed interest in GIF, on the back of strong investment performance, will lead to a re-expansion of the fund in time. Should the number of shares in issue fall below 38m, the directors will put forward a continuation vote.

GIF’s share rating showed considerable strength in the second half of 2022 and, with the fund trading at a premium, the board was able to issue shares in the fourth quarter. However, the discount widened significantly during December, bringing an end to issuance activity, although it has showed signs of stabilising YTD.

GIF’s discount tighter than five-year average.

The recent discount narrowing has brought GIF’s discount back below its longer-term five-year average. However, if the manager is able to continue to provide decent NAV growth from here that is attractive to investors, there is the potential for GIF to return to trading at a premium, which could allow for further expansion of the fund.

Given the small size of the company (a £79m market cap, currently) an increase in its capitalisation could not only place downward pressure on its ongoing charges ratio by spreading its fixed costs over a larger asset base, but could also lead it to appearing on the radar of larger investors who require greater liquidity, which could be a further catalyst for increased demand, potentially creating a virtuous circle.

Fund profile

More information is available at the fund’s website www.Gulfinvestmentfundplc.com.

GIF aims to capture the opportunities for growth offered by the Gulf Cooperation Council (GCC) economies of Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates. It is permitted to invest in listed or soon-to-be-listed companies on one of the GCC exchanges. In practice, the company does not make pre-IPO investments.

GIF makes its investments through its wholly-owned, British Virgin Islands domiciled subsidiary Epicure Qatar Opportunities Holdings Limited.

GIF was admitted to trading on the AIM segment of the London Stock Exchange on 31 July 2007 and moved across to the Main Market on 13 May 2011. However, following a growing concentration within its share register (see page 19 of our initiation note for more details), the company moved to the Specialist Fund Segment (which can make it harder for ordinary investors to buy shares) on 19 May 2021. A more diversified share register might allow it to switch back to the Main Market again.

GIF’s initial focus was on the Qatari market. In 2017, the remit was broadened to encompass the whole of the GCC region.

GIF’s investment adviser is Qatar Insurance Company SAQ (QIC) and GIF’s investment manager is Epicure Managers Qatar Limited, a wholly-owned subsidiary of QIC. QIC’s investment team has total assets under management of approximately $8bn.

GIF has recently released its interim results, which can be read here.

Previous publications

Readers interested in further information about GIF, such as investment process, fees, capital structure, fund life and the board, may wish to read our initiation note Much more than just oil & gas, published on 18 August 2022. You can read the note by clicking on the link.

Legal

This marketing communication has been prepared for Gulf Investment Fund Plc by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this not.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.