Gulf Investment Fund

Investment companies | Annual overview | 23 January 2024

In good hands

In terms of both its alpha generation and NAV returns, Gulf Investment Fund (GIF) has been one of the best-performing strategies focusing on the Gulf region. The management team has recently increased exposure to the healthcare sector, which it believes benefits from both government initiatives and the growing wealth of the GCC consumer. The management team also note the success of local financial institutions, which it says reflects the increasing mass affluence of the region.

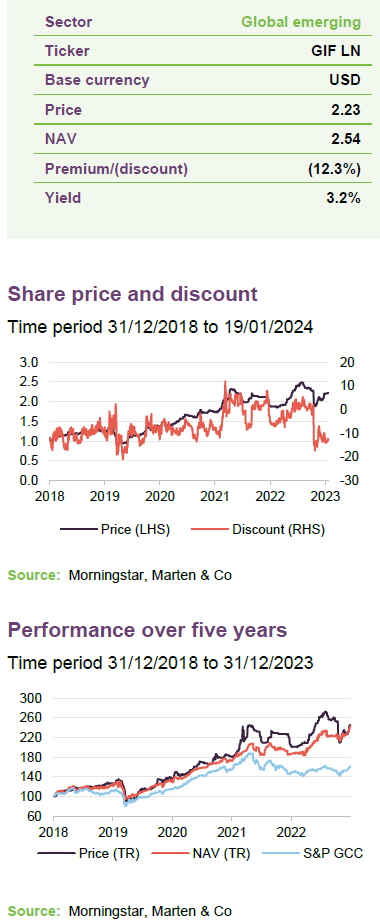

Jubin Jose stepped down at the end of last year as GIF’s portfolio manager, and has been replaced by Bijoy Joy, who was previously the assistant portfolio manager. Bijoy has worked with Jubin for the past 10 years so the team expects this transition to be smooth. We note that GIF is currently trading at a large discount (12.3%), versus a long history of trading at a premium rating.

Exposure to growth within the GCC economies

GIF aims to capture the opportunities for growth offered by the GCC economies of Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates by investing in listed or soon-to-be-listed companies on one of the GCC exchanges.

A Fund profile

More information is available at the fund’s website www.gulfinvestmentfundplc.com

GIF aims to capture the opportunities for growth offered by the Gulf Cooperation Council (GCC) economies of Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates. It is permitted to invest in listed or soon-to-be-listed companies on one of the GCC exchanges. In practice, the company does not make pre-IPO investments.

GIF makes its investments through its wholly-owned, BVI-domiciled subsidiary Epicure Qatar Opportunities Holdings Limited.

GIF was admitted to trading on AIM on 31 July 2007 and moved across to the Main Market on 13 May 2011. Following a growing concentration of the share register (see page 18), on 19 May 2021 the company moved to the Specialist Fund Segment. A more diversified share register might allow it to switch back to the Main Market again.

Current remit adopted in 2017

GIF’s initial focus was on the Qatari market. In 2017, the remit was broadened to encompass the whole of the GCC region.

The investment adviser

GIF’s investment adviser is Qatar Insurance Company SAQ (QIC) and GIF’s investment manager is Epicure Managers Qatar Limited, a wholly-owned subsidiary of QIC. QIC’s investment team has total AUM of approximately $8bn. The core management team (see page 6) is based in Doha and manages about $800m in discretionary mandates for local institutions. The advisors believe that having a local presence makes it easier to access companies’ management and makes them less reliant on third-party sell-side research. The team aims to meet holdings at least twice each year.

The management team is not invested in the fund, but QIC is.

Managers – changing of the guard

One notable change to GIF since our last note has been Jubin Jose stepping down as GIF’s portfolio manager at the end of last year. He has been replaced by Bijoy Joy, who stepping up from being assistant portfolio manager.

Jubin’s departure comes after a decade-long tenure as GIF’s portfolio manager, during which time the performance of the fund has been very strong – for the period from December 2017 (marking the adoption of GIF’s GCC-wide mandate) to end June 2023, GIF’s annualised NAV performance exceeded that of its performance benchmark by 8.4 percentage points. Bijoy has worked alongside Jubin for most of the last decade, so the team believe that he is in a strong position to assume the leadership of the fund. They say that investors should not expect to see any deviation from GIF’s investment process and underlying approach.

Bijoy Joy (lead portfolio manager)

Bijoy is the newly appointed lead manager, responsible for the management of GIF, DGC QIC GCC Equity Fund, QIC proprietary portfolios and various institutional discretionary mandates. He has around 14 years of experience in investment management and research, with the majority of that working with Jubin as the assistant portfolio manager on GIF. Bijoy joined QIC in 2014 and expanded the capacity and capabilities of the investment research division. He follows a blended top-down and bottom-up investment approach to build portfolios with long term return potential. Prior to QIC, Bijoy worked for more than four years with a investment research firm in India, covering multiple sectors in India and the GCC region. He holds an MBA in Finance from Bharathidasan University, India and is currently pursuing his CFA.

Robin Thomas (assistant portfolio manager)

Robin Thomas has been with QIC Group investment team for over 10 years. He has an active involvement in the areas of investment idea generation, portfolio decision making, trading, risk management and in the marketing strategy and client communication. He has an MBA from Esade Business School and a Bachelor’s degree in Computer Science Engineering from Mahatma Gandhi University. He is currently pursuing his CFA studies.

Wei Nien Chow, CFA (senior analyst)

Chow joined QIC as an investment analyst in 2021 and is involved in equity analysis and research of most major sectors across the GCC markets. He has over six years of experience in equity and industry research, mainly covering the consumer and petrochemical sectors. Prior to QIC, Chow was a sell-side equity analyst with a leading local investment bank, based in Kuala Lumpur, Malaysia. He holds a Bachelor’s degree in Actuarial Science from Heriot-Watt University, Scotland and is a CFA charterholder.

Izzul Molob (senior analyst)

Izzul joined QIC as a senior analyst in 2022 and is involved in the equity analysis and research of insurance, real estate and capital goods sectors across the GCC markets. He has over 10 years of experience working in the investment industry and corporate strategy. Prior to joining QIC in September 2022, he was a senior analyst at KAF Equities, an investment bank based in Kuala Lumpur, Malaysia. As an equity analyst, he has covered several sectors including insurance, diversified financials, property, and REITs. He holds an MSc in Finance and Investment from the University of Edinburgh.

In addition to the managers and senior analysts, there is a team of 10 analysts covering both equities and macroeconomics, based in India.

Market update

The Gulf could be described as a tale of two regions, one in which its fortunes are driven by the ebbs and flows of the global energy market, and the other a secular growth story as the region’s various governments implement policies and investment initiatives designed to diversify their economies away from oil and gas, towards other industries. These two trends may continue to dominate the GCC economies over the medium term, given both how exposed the Gulf is to the petrochemical and gas industries, and the weight of political and economic capital being devoted to new initiatives in the region.

There has been clear progress in the growth of the GCC region

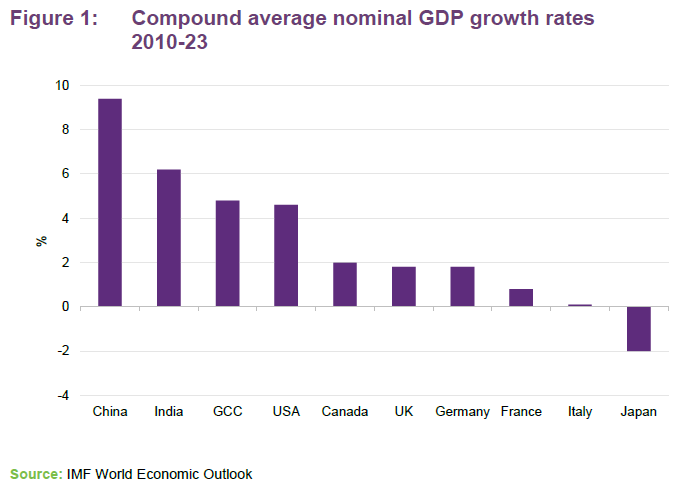

When we met with Bijoy, he highlighted some macro and market developments that he believes emphasise both the opportunity within the GCC region, as well as its advantages relative to the wider global economy. As can be seen from Figure 1, the GCC region (comprising Saudi Arabia, Kuwait, the United Arab Emirates, Qatar, Bahrain, and Oman) has been growing faster than the developed world since the dust settled on the global financial crisis (GFC).

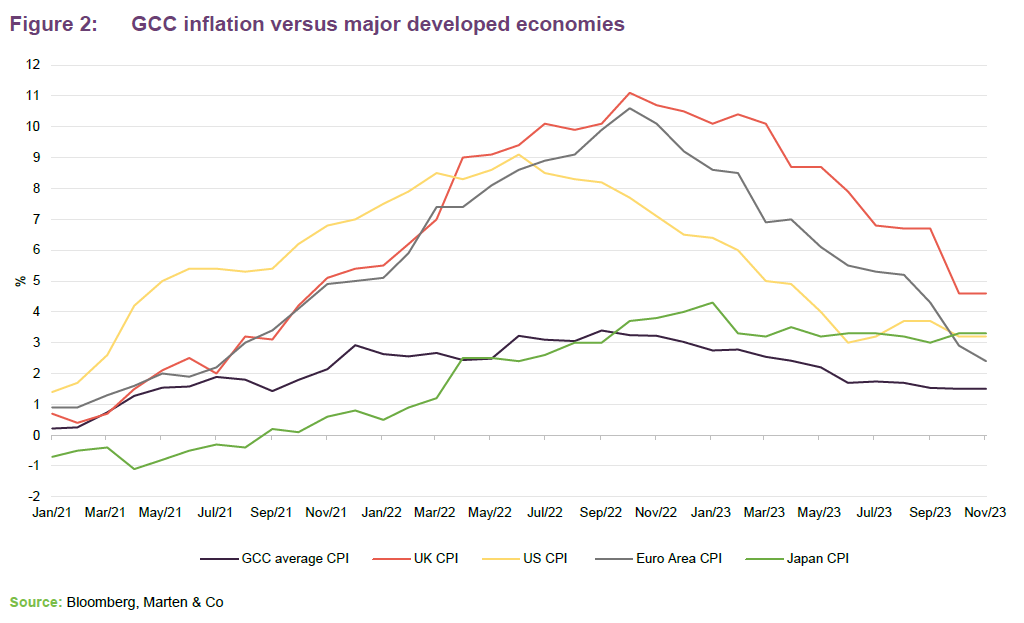

Inflation appears to have had a significant influence on global markets during the last two years. However, the GCC region seems to have been a partial haven from the woes of global inflation. As is illustrated in Figure 2, which shows annualised inflation figures, the GCC’s sample average inflation having remained below that of the Western world during the rate-hiking cycle. This could give the GCC governments greater leeway to utilise fiscal stimulus, in addition to them having sovereign wealth and oil revenues available to fund these endeavours. GIF’s manager says that there is increasing political will to diversify away from petrochemicals, which will likely require significant government investment.

GCC nations benefit from substantial sovereign wealth funds

The GCC nations may have war chests of capital available to them, both through their vast sovereign wealth funds, or through their unlevered government balance sheets (i.e. a low debt-to-GDP ratio).

Both Saudi Arabia and Kuwait have low debt-to-GDP ratios, while as can be seen in Figure 3, three of the major GCC countries have funds that rank amongst the world’s largest sovereign wealth funds. This gives their governments plenty of leeway to increase public expenditure to bolster economic stability, which would appear to put them in contrast to many other parts of the world, particularly more developed markets.

The region may also benefit from a number of tailwinds that can apply to emerging economies. For example, 40% of the Saudi Arabian population, which is the GCC’s largest country by GDP, population, and landmass, is under the age of 24.

Elsewhere. there appears to be evidence of the evolution of consumption and working habits that can come with an increasingly developed economy, such as the increased affordability of healthcare and financial products like insurance, deposits, and lending.

Investment process

A focused, stock-picking approach.

The investment adviser is a stock picker: whilst GIF’s returns are compared to the S&P GCC Index, index weightings do not influence portfolio construction.

The investment universe encompasses all listed stocks in GCC markets; the fund is permitted to make pre-IPO investments, but in practice these will not feature within the portfolio.

The adviser applies a liquidity screen to the universe; in theory, the adviser would like to construct a portfolio that could be liquidated within five trading days. The remaining stocks will be modelled by the team, and the team will seek to meet management and may also source research from external analysts.

From this, a watch list of stocks that the advisers feel are attractive is constructed. To progress into the portfolio, stocks will have to be attractively valued relative to the wider market and to peers. Valuations are assessed based on the adviser’s discounted cash flow models and using metrics such as EV/EBITDA.

The size of an individual position depends on the adviser’s view of the balance of risk and reward offered by a stock. GIF operates with a focused portfolio of between 20 and 25 stocks. The adviser is comfortable with a single stock accounting for about 10% of the portfolio, but would not seek to have more than 15% in an individual position. The portfolio will typically include at least eight to 10 core holdings, and at least four to six lower-conviction positions.

The team comment that turnover has been high in recent years, reflecting market volatility – a number of stocks kept hitting target prices. In more normal conditions, the adviser would expect to hold a position for about two to three years on average.

The high market volatility means that the adviser is not comfortable with using leverage. GIF does not have a borrowing facility currently.

GIF does not seek to hedge its market or currency exposures.

ESG

The adviser acknowledges that there is room for improvement in all areas of ESG

A consideration of environmental, social and governance (ESG) aspects forms part of the adviser’s investment research process. The adviser acknowledges that there is room for improvement in all these areas, and the additional risk associated with any failings in these areas is factored into investment decisions. Things are said to be improving: independent non-executive directors are more commonplace but not mandated, for example. Attitudes towards greater female participation in the economy are changing too.

With respect to the environment, the region’s hydrocarbon extraction is a significant contributor to climate change. Ahead of the 2021 United Nations Climate Change Conference (COP 26), net zero emissions commitments were made by countries such as the UAE (2050), Saudi Arabia (2060), and Bahrain (2060). Qatar is aiming for a 25% reduction in greenhouse gas emissions by 2030.

Asset allocation

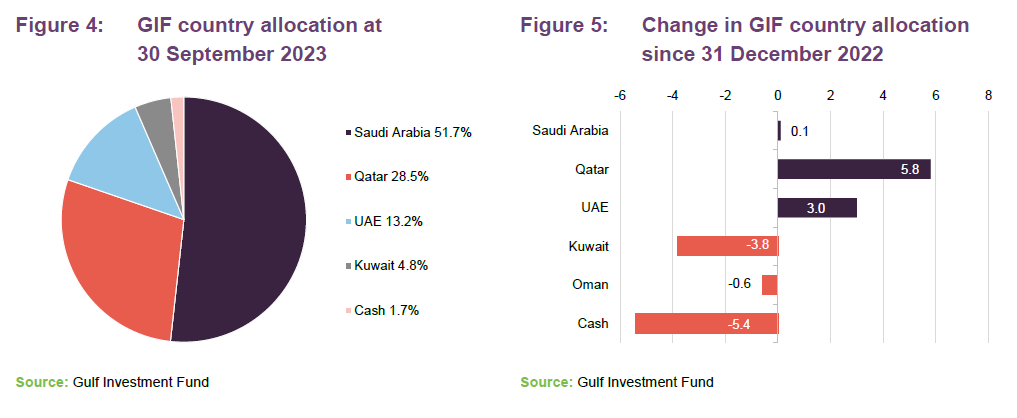

In our last note we pointed out the shift in regional allocation back towards Saudi Arabia, with the team aiming to take advantage of the fall in the relative valuations of Saudi equities. The team funded this by reducing its exposure to Qatar and the UAE. As can be seen in Figure 5, the manager has retained GIF’s allocation to Saudi Arabia; however, it has also reallocated capital back to Qatar and the UAE, funded from GIF’s cash allocation and reducing the fund’s Kuwait exposure. Despite these more recent additions, though, the allocations to these two regions still remain below their average levels during 2022.

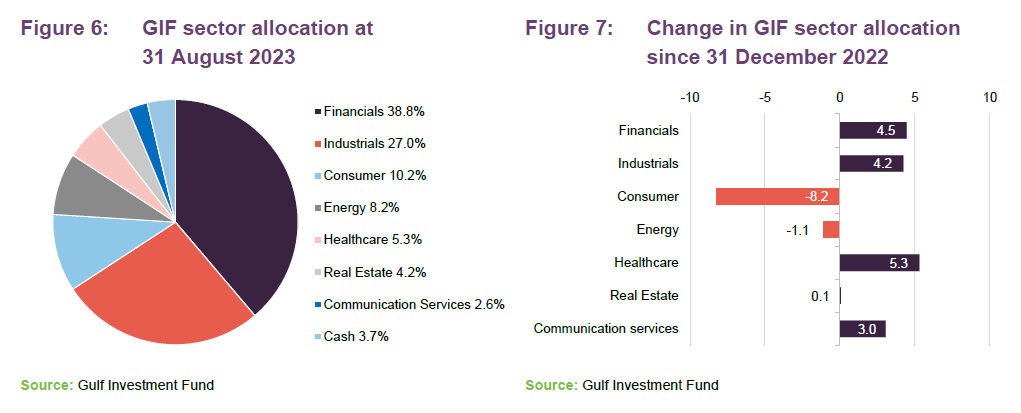

At a sector level, one noteworthy shift is the new allocation to dedicated healthcare stocks, reflecting the increasing opportunities the team believe are present in the sector. There has also been a fall in consumer stocks within GIF, reflecting the manager’s weakening confidence in the sector.

Top 10 holdings

Like its sector and region exposures, GIF has seen an amount of change in its top 10 holdings since our last note, with seven new holdings added. We discuss some of the recent trades below.

Trends underpinning new entrants

Banking

GCC banking offers a well-valued opportunity to tap into the region’s wider structural growth

The largest change in GIF’s top 10 has been the several banking stocks that have entered the group, with financials now the most common in the list. The manager says that there are several reasons it being bullish across the GCC banking sector. It sees opportunities both at a stock and sector, thanks to the banks’ exposure to some of the sectoral trends that the manager sees as defining the GCC region. Banking stocks are considered a top valuation opportunity by the team, and its projections imply that all of the banks within its top 10 have P/E ratios in the low teens (if not single digits), which it says is a reflection of its increased earnings rather than price contraction.

Financials is the largest weighting within the MSCI Emerging Markets and emerging market strategies tend have a large allocation to banks. These can serve as gateways to their economies through the key role they play in raising capital for new businesses, where there tends to be inherently a lack of sophistication in local capital markets. These factors could also be, to some extent, present within the GCC region, as the team note that the majority of the revenues generated by GCC banks are from lending to consumers and small businesses.

GIF’s manager says that the average consumer within the GCC continues to show increased credit demand, even in the face of higher interest rates, a combination which it thinks is seldom found in developed countries.

The rise in consumer demand for financial products can be seen from the increasing levels of home ownership within Saudi Arabia, which is in turn driving demand for mortgages. There is currently a shift happening in ownership within Saudi Arabia; in 2017 only 47% of the country owned a home, against 65% today, with a 2030 target of 70%. This equates to a compounded average annual growth rate in mortgages of 29% between 2017 and 2023.

These banks may also benefit from the powerful, and region-specific, opportunities presented by the region’s mega-projects., such as the line, a linear smart city project designed to house 9 million people, and Trojan, a mountain tourist destination. Saudi Arabia is expected to spend more than $175bn annually on industrial and mega projects between 2025 and 2028.

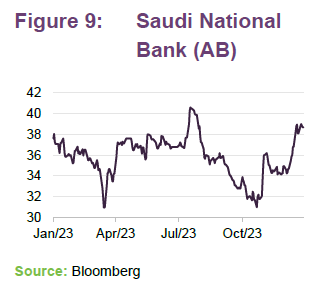

GIF’s manager comments that Saudi National Bank (SNB) is an example of a bank positioned to capitalise on the surging investment in Saudi Arabia. SNB commands a 30% market share, and with has as a healthy balance sheet and balanced risk profile, the manager adds. It thinks that this could leave it well-placed when it comes to financing the delivery of the region’s Vision 2030 project, as well as potentially capitalising on the general growth in business and consumer borrowing.

Healthcare

The Middle East still lags behind much of the world in key healthcare metrics. However, GIF’s manager observes that GCC governments are increasingly prioritising healthcare provision for their citizens, with Saudi Arabia looking to expand its provision of universal healthcare services, for example.

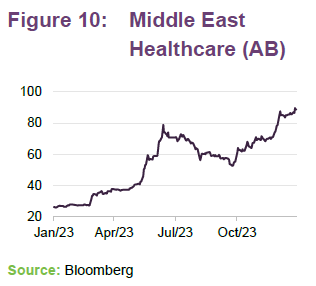

GIF’s team had previously avoided the sector due to the high valuations it was commanding but says that, recently, healthcare company valuations fallen to a level that it deems attractive. MEH remains one of the top holdings, and the team continues to like the name on the back of growth in patient volumes, better pricing and higher utilisation on its new facilities.

Other noteworthy companies

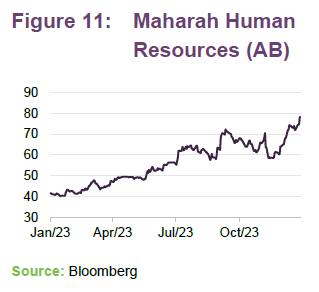

Maharah Human Resources

Maharah Human Resources (MHR) is a staffing company that provides employee solutions for home services, medical, industrial, retail, and hospitality sectors. The manager says that, given its sensitivity to employment and economic demand, the investment in Maharah is seen as a way to play the macroeconomic developments within Saudi Arabia. In its recent interim results, gross profits were up 16% year on year and revenues up 13%. New strategic contracts signed by the company saw a 25% increase in average workforce and underpinned the increased earnings of the company.

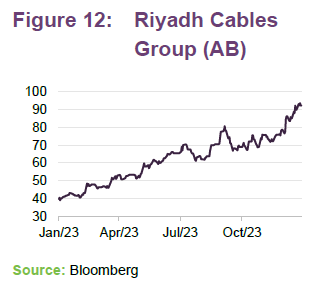

Riyadh Cables Group

Riyadh Cables Group is the largest cable company within Saudi Arabia. It manufactures electoral and telephone cables and wires as well as offering power transmission and communication services. The company’s improving fortunes may be the result of the GCC region’s economic expansion, benefitting from large scale infrastructure projects as well as the expansion of residential real estate and corporate growth. The demand for its services means that the company is operating at c.95% capacity, even as the largest player in the GCC cable market, which could give it strong pricing power. The wider market may now be taking greater notice of Riyadh Cables, as its share price increasing by 98% over 2023. The team decided to crystalise their gains in the last quarter, exiting the position and using to capital to invest into what it believes are more attractive opportunities.

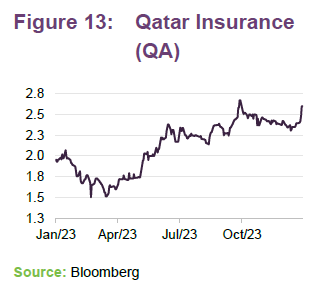

Qatar Insurance

As with the banking sector, the growth in the GCC consumer wealth also has to potential to increase the demand for insurance products. With the momentum behind insurance companies, there has been some turnover in GIF’s insurance holdings recently as the manager has trimmed some holdings that have performed well and rotated the proceeds into holdings that it believes have better upside potential. The team sold out of BUPA Arabia and Tawuniya on the back of strong performance, with the companies having seen substantial share price momentum in the first half of 2023. They crystalised their gains in these stocks and rotated them into other insurance companies, with one of the new entrants into GIF’s top 10 being Qatar Insurance (GIF’s investment advisor). Qatar Insurance has seen growth in its profitability over the years, with a 445% increase between Q3 2023 and Q3 2022. Qatar Insurance’s strength may be a reflection of the structural growth in the demand for its products, but GIF’s manager comments that there have also operational improvements within the company and a withdrawal from lower margin elements of the business.

Performance

GIF has demonstrated substantial outperformance vs its benchmark

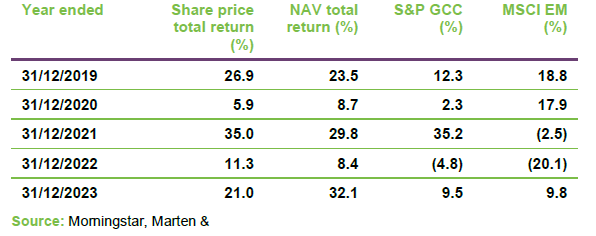

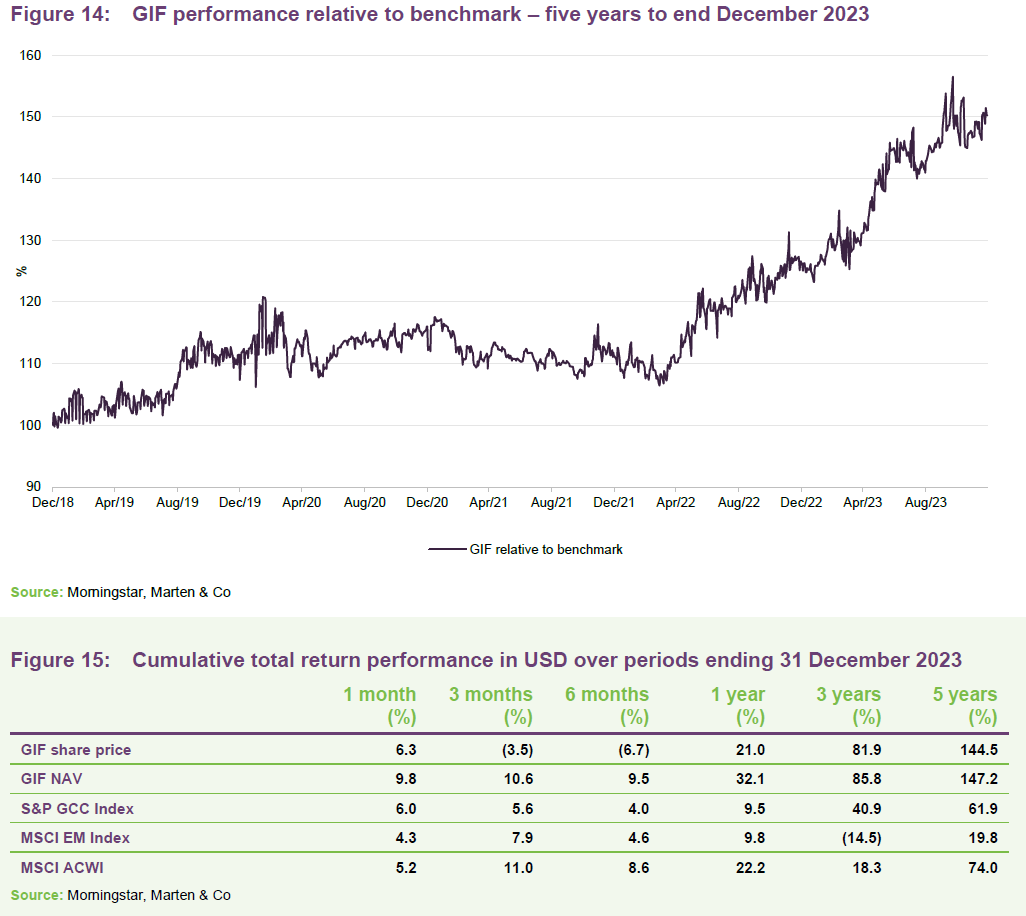

Since we last published in April 2023, GIF has continued to demonstrate NAV outperformance, beating not only the S&P GCC Index, its benchmark, but also the wider emerging market and global equity universe, as can be seen in Figures 14 and 15. This outperformance extends over multiple time periods, with GIF outperforming over both the short (i.e. 1 year) and long term. GIF has been able to more than double its shareholders’ capital over the last five years.

As can be seen in Figure 15, much of GIF’s outperformance can be attributed to the period from March 2022 onwards. This is a period that aligns with the team’s rotation out of highly valued sectors, including the oil and gas majors, into what the team believe were more attractively valued and structural growth opportunities, with the portfolio increasingly reflecting the non-energy opportunities within the GCC region. We note that the majority of the difference between GIF’s share price returns and NAV returns over the last 12 months can be attributed to sudden widening of GIF’s discount in October, which may be a quirk of its low trading volumes and the outbreak of the Israel – Hamas conflict, as we describe on page 17.

While the Gulf region has been a source of NAV returns over the sampled time period, outperforming even the MSCI ACWI over the long term, one could view GIF’s performance as possibly being more to do with the skill of GIF’s mangers than the tailwinds behind the region, given the growth trajectory of GIF’s NAV relative to that of its benchmark. Over the last five years GIF has been able to demonstrate positive stock and sector selection, with the team’s investments in industrial, information technology, consumer staple stocks being the main drivers of GIF’s returns.

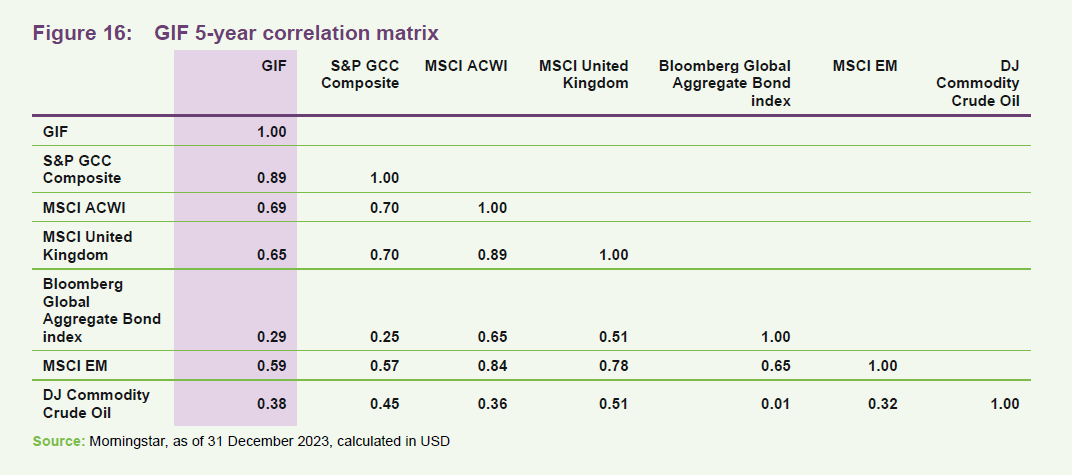

Another potentially attractive feature of GIF, beyond its performance track record, is the diversification benefits it offers. As can be seen from Figure 16, GIF has provided a sub-0.7 correlation to major global equity market regions, and a lower correlation to global bonds than global equities.

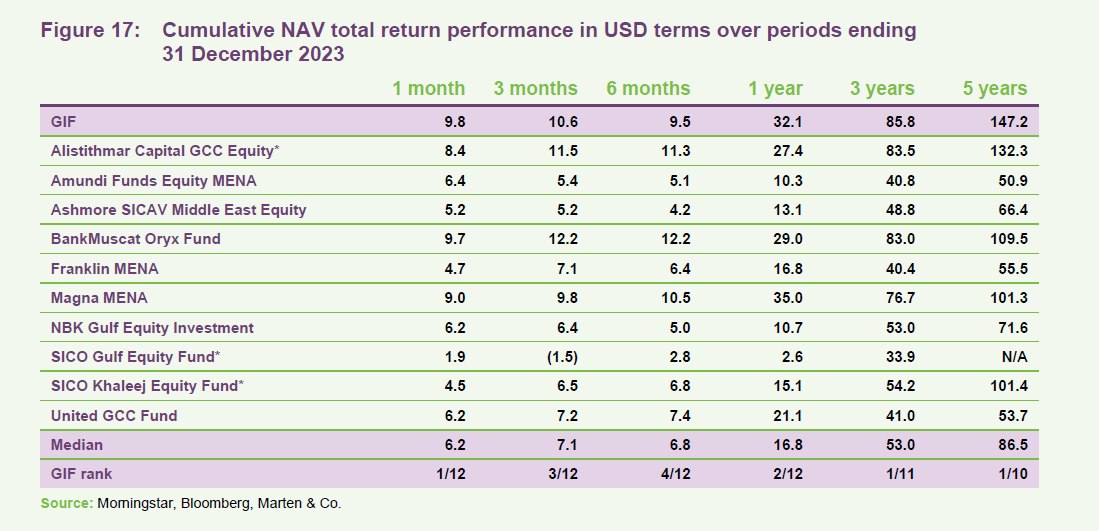

Peer group

GIF sits within the AIC’s Global Emerging Markets sector. However, with no direct closed-end comparators (based on its investments style), GIF tends to compare its returns to an open-ended peer group. The peer group that we have assembled comprises GIF’s five chosen comparators plus other funds investing in GCC equities. However, it should be noted that some of these funds may not be easily accessible by UK-based investors – SICO Khaleej Equity Fund is only registered for sale in Bahrain, for example.

GIF remains the best performing Middle Eastern strategy compared to its closest peers

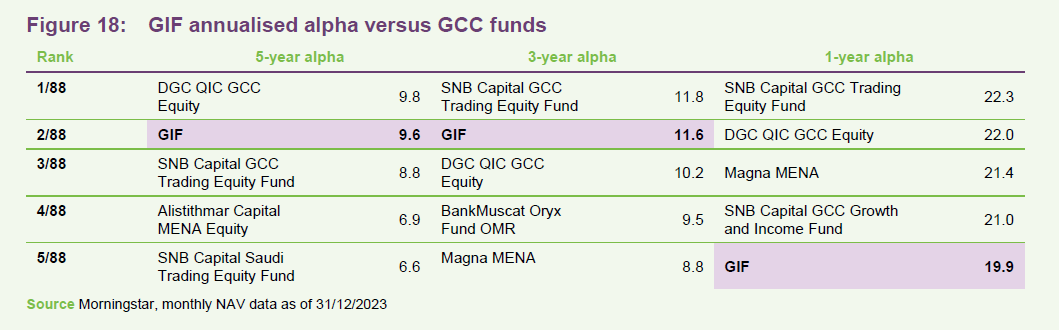

GIF has been one of the highest alpha-generating strategies of any Gulf-focused fund over the last five years, and this is reflected in its high rankings in the time periods shown in Figure 18 below.

A strong track record of generating alpha

The GIF team have demonstrated a strong track record of generating alpha when compares to tis wider peers. In our previous note we looked at GIF’s performance in isolation; in this note we examine GIF’s historic value-add against the wider universe of Middle Eastern funds. By filtering out the global universe of funds based on those with a minimum of 90% invested in the Middle East region and a five-year track record, we can compare GIF against a universe of 88 funds. Note that only a sliver of these will be available to UK investors, and we chose this wide cohort to simply ensure that our analysis is sufficiently robust.

As can be seen from Figure 18 GIF is amongst the highest alpha generators in its wider peer group. Its alpha is one of the most consistent however, ranking second over five and three years, and fifth over five. Note that the benchmark utilised in these alpha calculations is the S&P GCC index, GIF’s benchmark, and other funds may use different benchmarks.

GIF’s alpha generation may not only reflect the team’s skill at picking GCC equities, but also the potential benefits of its closed-ended structure, which frees it from the requirements of daily liquidity. In addition, this could be seen as a less-well-researched segment of the market, where a manager could find it easier to find mispriced securities.

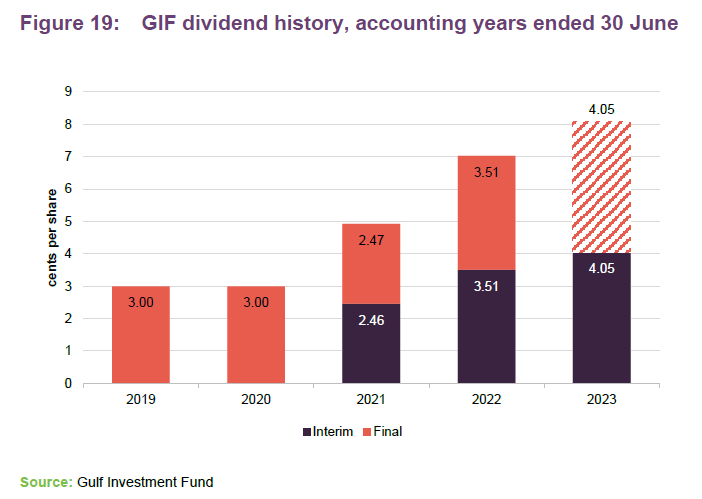

Dividend – 4% of NAV paid semi-annually

While the portfolio is not managed to produce a target level of income, GIF used to pay one dividend per year historically. In 2021, the board introduced an enhanced dividend policy targeting a total annual dividend equivalent to 4% of NAV at the end of the preceding year, paid semi-annually.

The unaudited NAV at 30 June 2023 was $2.0261, which implies a total dividend of 8.1 cents for the accounting year ended 30 June 2024. This is a yield of 3.7% based on the share price of $2.20 as at 19 January 2023, which would place it amongst the highest yielders in its sector.

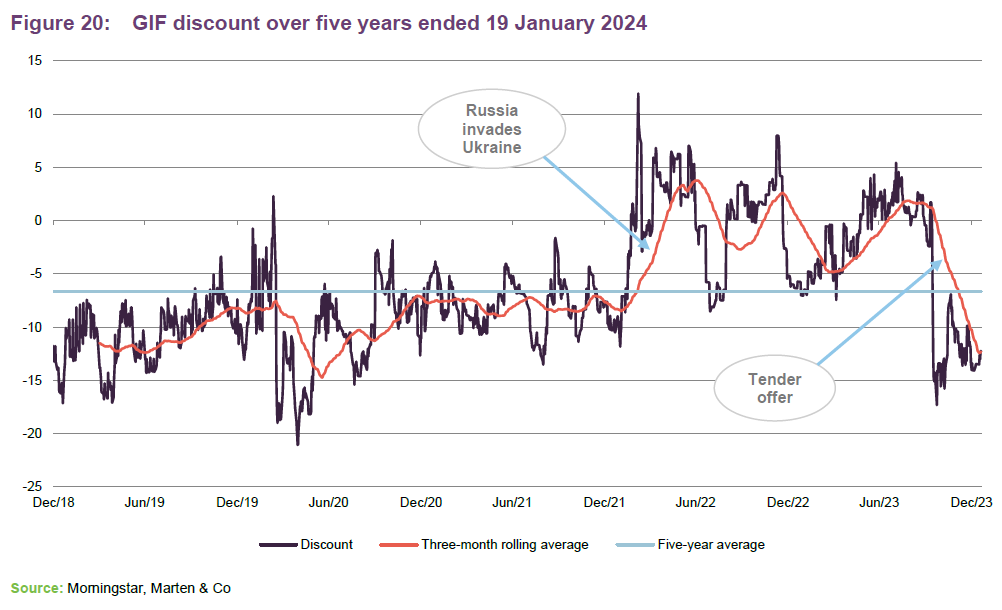

Premium/(discount)

Over the 12-month period ending 31 December 2023, GIF’s shares traded between a 17.3% discount and an 5.4% premium. Over this period the average discount was 3.7% and finished the period on a 11.8% discount. At 19 January 2024, the discount was 12.3%.

GIF has largely traded between a 5% discount and 5% premium over 2023, as is reflected in its moving average. We note that the sudden widening of GIF’s discount in October of this year, which could have been triggered by an article suggesting that GCC markets could be impacted by a widening of the conflict between Israel and Hamas. Modest selling pressure widened the discount significantly (it is worth noting that the NAV has been steady). Trading volumes have also remained low when compared to its historical average (25,986 a day on average over the last year compared to 51,396 over the last five years). The lack of trading volumes may also reflect the high concentration of ownership of GIF, whereby only four parties own the large majority of the outstanding shares.

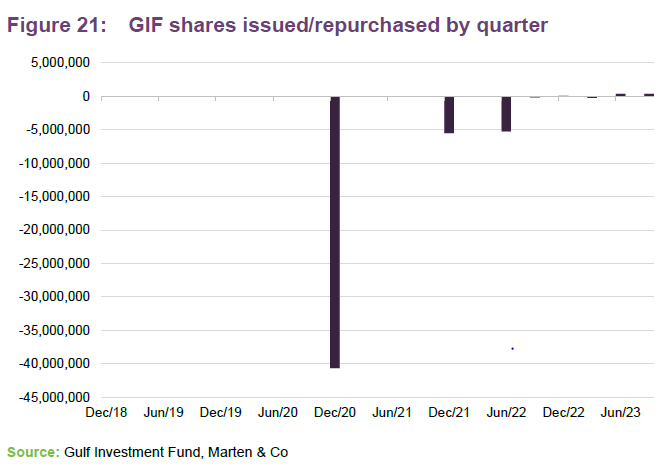

Hopeful for an expansion of GIF, on the back of strong performance

GIF offered shareholders a 100% tender offer in 2020 and that led to significant shrinkage of the fund. Following this, GIF adopted a policy of biannual tender offers. Two subsequent tender offers reduced the size of the fund further, but the board’s hope is that the renewed interest in GIF, on the back of potentially strong investment performance, will lead to a re-expansion of the fund in time. Should the number of shares in issue fall below 38m, the directors will put forward a continuation vote.

At GIF’s recent tender offer 1.4m shares were repurchased; roughly 3.5% of its share capital, another small uptake. This may reflect the market’s confidence in the potential of GIF. The next tender offer could be announced around the end in March 2024. The tender offer is also conditional on there being at least 38m shares in issuance.

Fees and costs

The investment manager is entitled to a fee of 0.8% of NAV, calculated monthly and payable quarterly in arrears. This fee arrangement has been in place since

1 January 2021, when the fee rate was reduced from 0.9% of NAV.

The other significant expenses incurred by the fund over the year to end June 2023 were fees of $160,000 for the administrator and registrar (FY22 $161,000) and $139,000 (FY22 151,000) for the directors’ fees (see page 22).

GIF’s ongoing charges ratio for the accounting year ended 30 June 2023 was 1.89%. This was up from 1.67% in the year prior, which the board notes is a reflection of increased marketing costs associated with raising GIF’s profile amongst a wider range of investors.

Capital structure

GIF has 40,103,204 ordinary shares in issue and no other classes of share capital. None of these shares are held in treasury and therefore the number of shares with voting rights is 40,103,204.

GIF does not have a fixed life, but the board considers it desirable that shareholders should have the opportunity to review the future of the company at appropriate intervals. To give shareholders the opportunity to exit at close to NAV, shareholders are able to participate in bi-annual tender offers for up to 100% of the share capital.

GIF passed it recent continuation vote, held during its December 2023 AGM. Such votes are scheduled for every third year, with the next to be held in 2026.

Financial calendar

GIF’s financial year end is 30 June. The most recent annual results were released in September, while interim results are typically released in February. The most recent AGM was held on 22 December 2023. GIF usually pays dividends in March and October of each year.

Gearing

GIF does not currently employ any gearing. Any borrowing would be limited to 5% of NAV.

Board

GIF has three non-executive directors, all of whom are independent of the manager and do not sit together on other boards.

GIF’s board has shrunk as the size of the company has reduced. At the end of June 2023, GIF had three non-executive directors, as is its norm. Over the last year Neil Benedict stepped down as director and was replaced with Paddy Grant (see biography below).

It is the board’s policy that non-independent directors stand for re-election every year and independent directors stand for re-election every three years.

The maximum annual remuneration payable to the directors permitted under the Articles of Association is £200,000, but the current figure is well within that.

Anderson Whamond (chairman)

Anderson has over 30 years’ experience in the banking and financial services sector. He is a non-executive director of The International Stock Exchange Group Limited, and a non-executive director of the Irish-domiciled Magna Umbrella Fund and the OAKS Emerging & Frontier Umbrella Fund. Previously, he was a non-executive director of Cayman Islands-domiciled OCCO Eastern European Fund.

David Humbles (chairman of the audit committee)

David worked in the downstream oil industry for 25 years and relocated to the Isle of Man in 1998 as a director of Total. In 2003, he purchased Abbey Properties Ltd, which owns and manages a property complex in the north of the Isle of Man. David also owns Westminster Properties Ltd which manages a large portfolio of residential and commercial properties on the isle of Man. David was managing director of Oakmayne, a residential developer in London. He has previously served as non-executive directors at Speymill Deutsche Immobilien Company plc and South African Property Opportunities plc, both AIM-listed companies.

Patrick (Paddy) Grant (director)

Paddy has over 20 years of experience working in the Middle East, having held the position of head of Middle East for JPMorgan Asset Management between 1997 and 2007, and then the same position for Schroders between 2007 and 2020. Paddy gained a BA in Modern History from University College, Oxford in 1984 and then spent six years in the British Army, achieving the rank of Captain. This was followed by six years as a country manager for John, Swire and Co, before joining JPMorgan. Paddy is currently head of international business development for Armistice Capital LLC. He has been a trustee for the Gurkha Welfare Trust since January 2021 and has sat on the investment committee for the old members trust for University College, Oxford since January 2019.

Previous publications

Readers may be interested in our previous publications on GIF, which are listed in Figure 23 below. These are available to read on our website or by clicking the links in the table.

Figure 24: Previous publications

| Title | Note type | Publication date |

| Much more than just oil and gas | Initiation | 18 August 2022 |

| On the gulf of a new economy | Update | 18 April 2023 |

Source: Marten & Co

IMPORTANT INFORMATION

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Gulf Investment Fund Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.