Ahead of the curve

Henderson Diversified Income (HDIV) is managed with a focus on good quality issuers of debt securities operating in growing industries. Sustainability is an important factor in any assessment of quality. On 25 February 2022, shareholders overwhelmingly approved a new investment objective and policy that seeks to better define and highlight the trust’s approach to environmental, social and governance (ESG) issues.

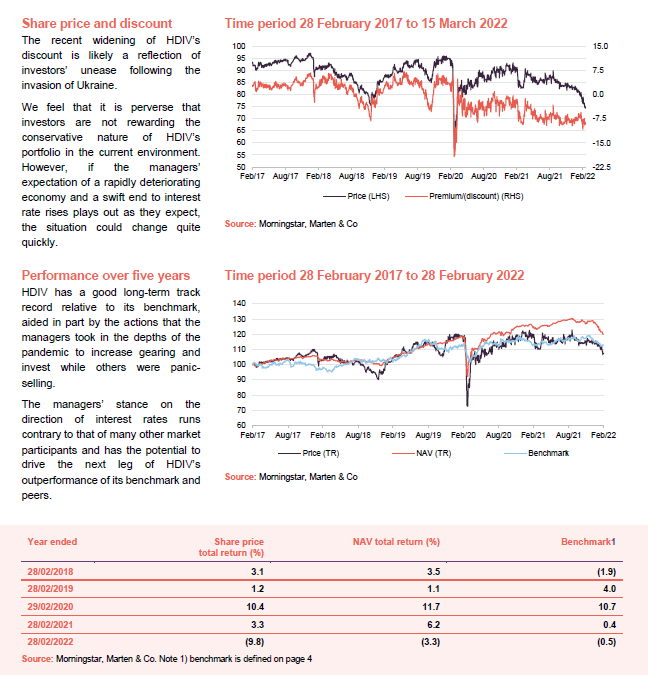

Recent market jitters triggered by the war in Ukraine have left HDIV trading on a much wider discount to NAV and higher dividend yield than its long-run averages.

Markets were already pricing in a number of interest rate rises this year as central bankers look to choke off inflation. As we explain in this note, the managers have positioned the trust’s conservative and quality-focused portfolio in anticipation of a swift end to this process. That could help trigger the next phase of outperformance by the trust, as bond yields compress and their price rises to reflect lower than expected interest rates.

High income and capital preservation from a diversified fixed income portfolio

HDIV aims to provide its shareholders with a high level of income and preservation of capital, through the economic cycle.

It invests in a diversified portfolio of global fixed income and floating rate asset classes. The company may use gearing (borrowing and synthetic – see page 12) to enhance returns. Dividends, which make up the bulk of returns for investors, are paid quarterly.

Fund profile

Henderson Diversified Income Trust (HDIV) seeks to provide its shareholders with a high level of income and preservation of capital, through the economic cycle.

To achieve this, it invests in a diversified portfolio of global fixed income and floating rate securities. The company uses a dynamic approach to portfolio allocation across asset classes and is permitted to invest in a single asset class if required. The company seeks a sensible spread of risk at all times (which is reflected in the number of holdings within the portfolio).

A consideration of ESG issues has long been at the centre of the managers’ investment approach. With effect from 25 February 2022, this is now formalised within the investment policy – see page 8 for more detail. As the circular published in advance of the meeting highlighted, this change to the policy does not indicate that there will be any material change to the company’s investment process or strategy.

HDIV now compares its performance to a benchmark comprised of 60% global high yield credit (represented by the ICE BofA Global High Yield Constrained Index), 25% global investment grade corporate credit (represented by the ICE BofA Global BBB Corporate Bond Index) and 15% European loans (represented by the Credit Suisse Western European Leveraged Loan Index), in sterling. Prior to 16 September 2021, the benchmark was LIBOR+2%; please see our last note, which discussed the change. Throughout this note, we have used the new benchmark as a comparative index. HDIV has a global mandate, and the managers use gearing to enhance returns. The company was redomiciled to the UK from Jersey with effect from 27 April 2017.

The managers

Henderson Investment Funds Limited is HDIV’s AIFM and Henderson Global Investors Limited (Henderson) is the delegated investment manager. Parent company Janus Henderson Investors had $419.3bn of assets under management at the end of September 2021. The named fund managers for HDIV are John Pattullo, Jenna Barnard and Nicholas Ware. John and Jenna head up the Strategic Fixed Income team at Janus Henderson. They are supported by Janus Henderson’s wider fixed-income team including its specialist secured-loan team. Responsibility for the selection of suitable secured loans is delegated to the specialist secured-loan team, led by David Millward.

Market background – rate rises are transitory

In March 2020, HDIV’s managers went against the herd, gearing up the trust and buying good quality credits on attractive yields while others appeared to be panic-selling on fears of COVID-triggered defaults. The defaults never materialised and have remained extremely low ever since. The trust was rewarded with decent returns and a much healthier revenue account.

However, the economic recovery from COVID was associated with shortages of semiconductors, commodities and gas, and supply chain disruption; this drove a spike in inflation. More recently, unexpected constraints within the labour market have given rise to fears that this inflation might not be transitory.

At the end of January, after months of inaction and even being beaten to the post by the Bank of England, the Federal Reserve (the US central bank) signalled that it was minded to raise rates in March. The European Central Bank (ECB) reversed its position overnight. As at 15 March 2022, the market was pricing in seven, quarter-point (0.25%) rate rises, the first of these was announced on 16 March. The managers acknowledge that central bankers were inevitably going to be behind the curve on rates. With economies looking so fragile in the wake of COVID, no central banker was going to raise rates until necessity demanded it. Whilst no one wants to let the inflation genie out of the bottle, there is also a natural fear of a repetition of former ECB governor Trichet’s policy mistake in 2011, when he helped accelerate a slowdown in the European economy.

In addition to interest rate rises, we are also likely to see a trend of quantitative tightening – the opposite of quantitative easing. However, the pace of this is uncertain. Some commentators have noted that when the Federal Reserve shrank its balance sheet in 2018/19, 10-year treasury yields fell.

For HDIV’s managers, this capitulation by central bankers creates a new opportunity to get ahead of the curve. The managers believe that the direction of bond yields reflects the rate of change in the economy – a slowing economy triggers lower bond yields, and vice versa.

The managers believe that the economy is heading for a downturn and the chances of avoiding a hard landing are slim. John says that in the UK, the National Insurance increase and soaring energy bills will be brutal on lower incomes, as demand is literally destroyed to constrain inflation. He also thinks that Europe is heading for a recession. Fears of stagflation will unnerve central bankers. Before the year is out, the managers think rate rises will be back off the agenda again, and the yield curve may even invert, so that short-term interest rates are higher than long-term interest rates.

It is important to note that the bulk of HDIV’s portfolio is in global companies, many of which are based in the USA. These are much better placed to weather the storm and John feels that HDIV’s US/global bias will be a great help given the outlook.

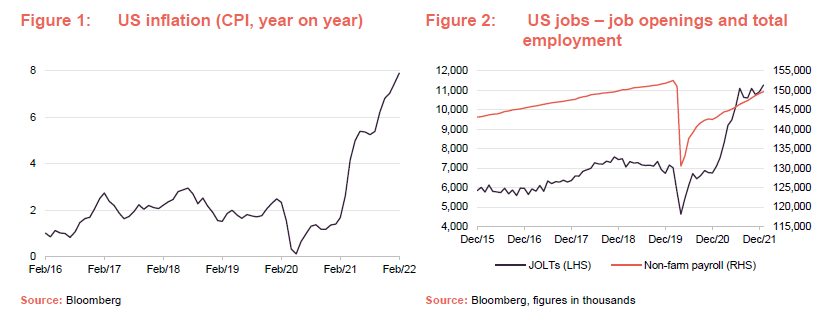

Inflation hitting multi-decade highs

The year-on-year change in US consumer price inflation (CPI) hit 7.9% in February 2022, and inflation is elevated in many other parts of the world too.

One reason why central bankers have decided to act now may be a fear of a wage-price spiral. Figure 2 shows that in the US, a spike in job opportunities has not been met by people returning to work. Early retirements, changing working habits and a surge in new business creation may all be factors in this. This pattern has been repeated in other economies, such as the UK.

A slower global economy would alleviate inflation caused by excessive demand for goods and services. Against that, the war in Ukraine is maintaining upward pressure on oil and gas prices – feeding through into higher energy prices – and may have a knock-on effect on some supply chains.

Inflation may remain above-trend for a few quarters yet. In the long-term, however, the managers expect that the deflationary factors that we have identified in previous notes – demographic shifts in many developed countries that are restricting the working population; technological developments, notably those in robotics and artificial intelligence, that threaten many jobs; and high debt levels that restrain consumer spending – will reassert themselves.

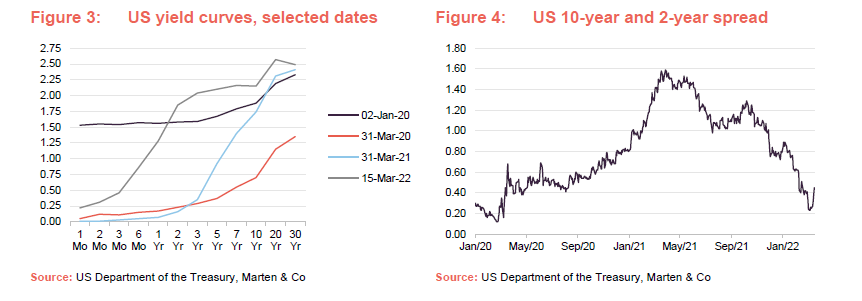

Yield curve to flatten?

Figure 3 shows the US yield curve as it was at the start of 2020, before COVID was recognised as a problem. Central banks slashed interest rates as the pandemic hit, and by the end of March 2020 yields had fallen across the board, but particularly at the short-end of the yield curve. A year on, as economies were re-opening, the curve was much steeper, with longer-dated maturities back at pre-pandemic yields.

Figure 4 takes the yield curve data and just looks at the gap between the yield on 10-year maturities and two-year maturities. Today, however, as central banks start to raise interest rates again, the yield curve is starting to flatten. If the spread between 10-year maturities and two-year maturities dips into negative territory, it tends to indicate an economic recession.

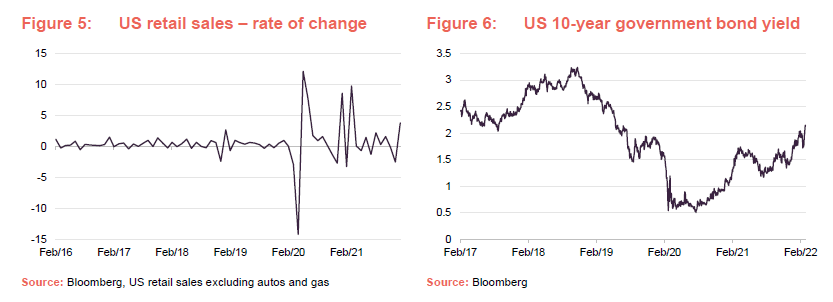

Economy is late cycle

A year ago, we were looking forward to synchronised global recovery from the effects of COVID. Now, the managers think we are close to the end of this economic cycle. They highlight a number of base effects that will give rise to slower growth figures. In March 2021, we had the final fiscal stimulus in the US (a huge injection of money into the US economy by its government), a re-opening economy and the anniversary of the initial COVID-19 shock to economies and markets in March 2020. That makes it very hard for the pace of growth in March 2022 to match that of March 2021.

In the US in particular, many consumers appeared to spend their stimulus cheques on goods, exacerbating shortages and supply chain problems and, the managers think, pulling forward demand. As this situation reverses, and goods move more freely, inventories may be too high. Inflation is one factor that is impacting on consumers’ spending power.

Long-dated bond yields have been rising, as Figure 6 shows. If the pace of rate rises comes to an abrupt halt or even goes into reverse as the downturn materialises, possibly accelerated by events in Ukraine, bond yields should tighten again. This is the opportunity that HDIV’s managers have been waiting for.

HDIV’s duration shifts naturally through the managers’ asset allocation decisions. At the back end of 2021, they felt that loans did not offer attractive returns. The dramatic shift in market sentiment has now created an opportunity here, however.

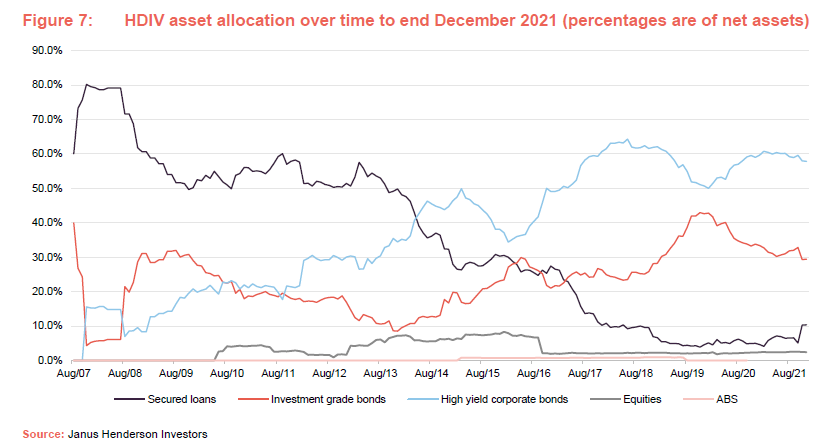

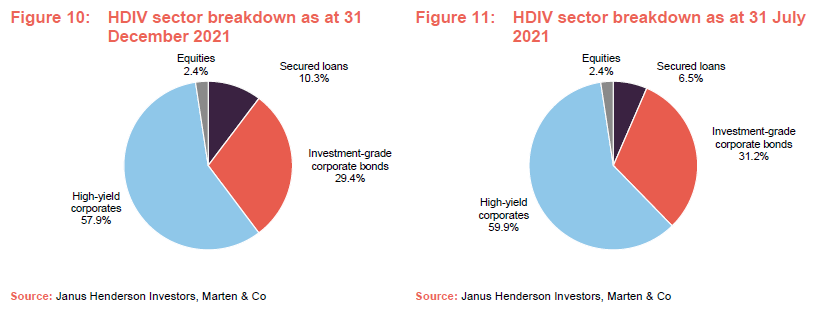

Figure 7 shows how HDIV’s asset allocation has evolved since its launch in 2007. A recent uptick in the exposure to loans and a modest shift from investment grade to high yield is evident. Overall, the managers think that the portfolio, with a bias to good-quality, BB-rated debt, is well-positioned should we see a hard landing. They are happy to maintain the level of gearing, which makes a significant contribution towards the trust’s revenue account.

Defaults are still running at historically low levels. However, the managers are not unduly worried about the prospects of a significant spike in defaults as the economy slows. They point out that, compared to the global financial crisis – when we saw the last spike – base rates are much lower, and interest cover covenants (protections built into debt structures triggered by a fall in the ratio of earnings to scheduled interest payments) are set at lower levels.

Investment process – unchanged

The managers are responsible for the portfolio’s asset allocation and have the freedom to invest across the whole spectrum of debt markets. However, unlike the vast majority of professional credit investors, the managers have adopted an investment style which emphasises an analysis of the long-term sustainability of the business that is borrowing the money.

The large credit investors tend to have teams of analysts covering the whole market, invest in line with the index and – subject to their credit analysis – buy whatever is being issued without a filter.

However, HDIV’s managers actively avoid issuers operating in commoditised and declining/strategically challenged industries, those with economically cyclical and operational leverage and issuers heavily exposed to emerging markets. This means that around half of the high-yield market and a third of the investment-grade market is un-investable, in their view.

The managers are influenced by the thinking of people like Terry Smith and Aswath Damodaran (of NYU Stern), who emphasise cash generation over profitability, returns on capital employed, and backing businesses in sectors delivering secular growth.

Theoretically, the portfolio will be biased to fixed income at the top of the interest-rate cycle and secured loans towards the bottom of the interest-rate cycle. In practice, rates fell sharply early in the fund’s life and have not recovered. This has had an impact on portfolio construction ever since.

Emphasis on capital preservation

The emphasis of the team is on preserving capital as well as generating attractive income returns. That means focusing on the quality of credit, security and collateral. Chasing yield by investing in poor-quality credits may appear to be an attractive strategy in the good times, but these can be difficult to trade out of when the market turns – sometimes there is no bid.

The portfolio is weighted towards defensive businesses that can cope with low economic growth rates and away from investments that might be described as ‘value traps’ – companies with declining business models, no pricing power and excessive leverage.

The managers will look to exploit mispricing opportunities when they arise, switching between junior and senior tranches of debt in the same issuer, for instance – senior tranches get repaid first.

Proprietary, fundamental credit analysis

The management team carries out proprietary fundamental credit analysis with the aim of preserving capital by minimising default losses.

The managers’ focus is on identifying good-quality credit and exploiting opportunities for carry, given the spreads available over HDIV’s borrowing costs.

Indices play no part in informing portfolio construction. The US offers the deepest markets, but this is not a factor in determining HDIV’s asset allocation. The managers are firmly of the view that bond markets need stock pickers. Passive investment in bond markets – through bond ETFs, for example – results in having your largest exposures to the biggest borrowers, and this is not a recipe for success.

Risk management

Non-sterling assets are hedged back to sterling using rolling, forward foreign currency contracts.

The managers emphasise the importance of a strong sell discipline, saying that avoiding the worst-performing bonds is key to performance. They also point out that towards the end of the cycle in bonds, rates are squeezed and covenants eased, debt is issued to fund mergers and acquisitions at the top of the market; and balance sheets are stretched thin through buybacks and special dividends. The managers try to avoid ‘investing with the crowd’ in these situations. Areas that they consider to be riskier include emerging market debt and the energy, mining, materials, automotive and shipping sectors. Wherever possible, they like to keep the portfolio invested in ‘vanilla’ lower-risk and liquid debt.

Investment restrictions

HDIV invests in unlimited amounts of secured loans, government bonds, and investment-grade and high-yield bonds. Up to 10% of gross assets may be invested in unrated corporate bonds; up to 40% may be invested in asset-backed securities; and up to 10% may be invested in high-yielding equities. No more than 10% of NAV will be invested in any one issuer.

ESG

The managers’ focus on credit issued by good-quality companies naturally requires that those companies rank highly on ESG factors. Towards the end of 2021, the board decided that, in the light of the introduction of new EU rules relating to the introduction of sustainability-related disclosures, it would formalise some of the ESG principles adopted by the trust within the investment objective. Under the new policy:

- the company will not make any direct investments in corporate issuers who derive more than 10% of their revenue from oil and gas generation and production, oil sands extraction, shale energy extraction, thermal coal extraction and power generation, and Arctic oil and gas extraction;

- the company will not make any direct investments in corporate issuers that the board, as advised by the investment manager, deems to have failed to comply with the UN Global Compact principles;

- the company will not directly invest in sovereign bond issuers that have been sanctioned by the European Union or United Nations and/or that do not score ‘free’ by the Freedom House Index (or other such similar index as determined by the board as advised by the investment manager) that promotes political rights and civil liberties; and

- the company will not make any direct investments in issuers who derive any of their revenue from the production or distribution of fur or from the production or distribution of controversial weapons.

In addition to adhering to the above investment restrictions, as part of its portfolio construction process the investment manager also applies the following measures.

- Seeking to manage the company in a way that means it will have a lower carbon intensity in the corporate bond portion of its portfolio compared to the relevant reference investment universe.

- Under normal market conditions, seeking to exclude sovereign bond issuers that have not ratified the Paris Agreement. However, should the US choose to exit the Paris Agreement during a future political cycle, the investment manager will consider whether excluding US Treasuries from the company would be excessively detrimental to returns and/or whether it would change the risk-return profile of the company.

The investment manager monitors the portfolio against the formal investment restrictions and additional measures set out above on an ongoing basis. If an existing investment becomes ineligible based on exclusionary screens, it will be divested within a reasonable period.

Sustainability Risk Policy

The investment manager aims to ensure that the companies in which the company invests follow good governance practices. The good governance practices of investee companies are assessed by the investment manager prior to making an investment on behalf of the company and periodically thereafter in accordance with the investment manager’s Sustainability Risk Policy, which sets minimum standards against which investee companies will be assessed and monitored by the investment manager prior to making an investment and on an ongoing basis. Such standards may include, but are not limited to: sound management structures, employee relations, remuneration of staff and tax compliance. In addition, the investment manager is a signatory to the UN Principles for Responsible Investment. The Sustainability Risk Policy can be viewed in full here.

In practice

Janus Henderson has a proprietary framework for assessing the ESG characteristics of each issuer. HDIV’s managers will actively avoid investment in credit issued by companies with material ESG risks where those risks are not being addressed. Credits with non-material ESG risks and those that are on an improving path may be considered for inclusion within the portfolio.

An assessment carried out on the portfolio as at the end of March 2021 showed that almost 64% of HDIV’s portfolio was exposed to businesses with both non-material ESG risks and a stable/improving trajectory of addressing ESG risks. HDIV had no exposure to credit issued by companies with material ESG risks where those risks are not being addressed.

The stance that HDIV has adopted means that its portfolio is far less carbon-intensive than that of comparable indices.

Derivatives

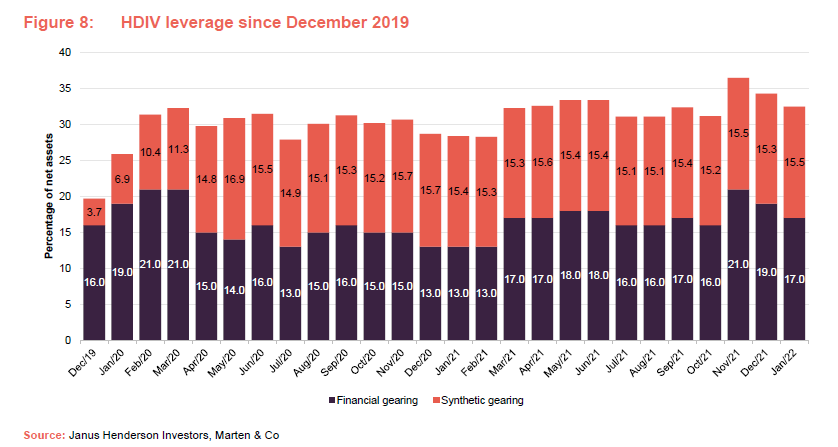

Gearing is used to arbitrage between the cost of debt and the yields available from investments. HDIV can also boost its income through investment in credit default swaps (CDS). These can be used to provide gearing to the portfolio alongside the trust’s borrowing facilities.

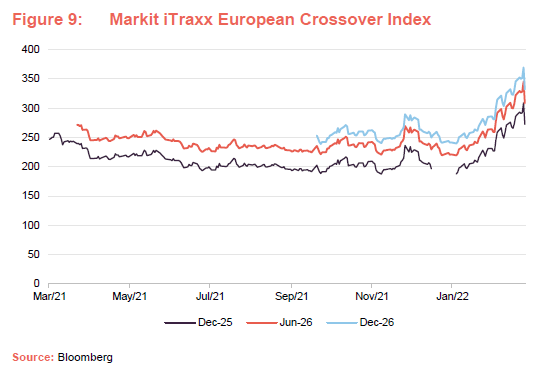

The trust’s synthetic gearing is achieved by buying the Markit iTraxx European Crossover Index. This index comprises 75 equally weighted credit default swaps on the most liquid sub-investment grade European corporate entities. The index rolls every six months, in March and September.

Asset allocation

There were 219 holdings in HDIV’s portfolio at 31 January 2022. The portfolio has more exposure to secured loans than it did at the end of July 2021 (at the time of our last note). This reflects the opportunities that have become available in this part of the market.

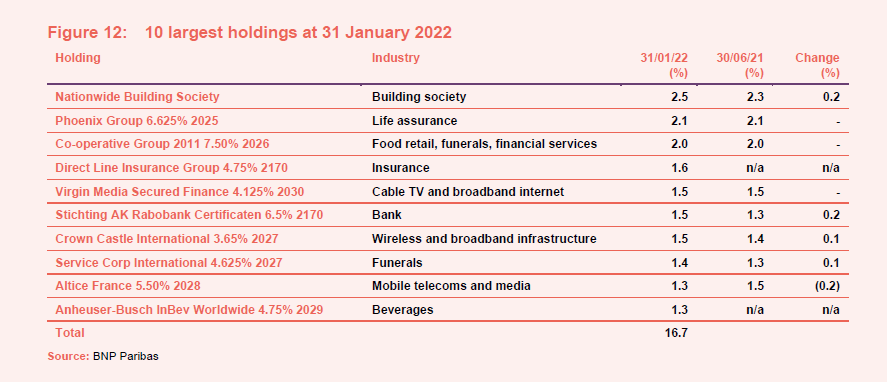

10 largest exposures to individual issuers

Consistent with the managers’ approach, there have been few changes of note to HDIV’s list of the 10-largest holdings. Since the end of June 2021, cable TV company CSC has fallen out of the list, to be replaced by Direct Line Insurance and, during January 2022, healthcare and clinical trials company IQVIA was replaced by brewer Anheuser Busch InBev.

Portfolio commentary

The managers have reduced the position in Altice in response to a fall in its equity share price, which more than halved over the second half of 2021. The weak share price increases the likelihood of a take-private deal, which could conceivably be associated with a significant weakening of the company’s credit quality (as debt is issued to fund the deal).

The managers try to avoid companies with possible mergers and acquisitions related debt issuance, those on particularly tight spreads, and those being targeted by corporate raiders who often encourage companies to raise debt to fund share buy-backs and distributions to equity investors to the detriment of bond holders.

The two new entrants to the list of the 10-largest holdings are longstanding constituents of the portfolio, and exhibit the typical characteristics that the managers look for from their positions (as detailed earlier in this note).

Oliver Bardot joined the team as an associate portfolio manager in 2021 (transferring from the secured credit team at Janus Henderson). The managers say that he brought some fresh ideas that are being reflected within the portfolio.

The increase in exposure to loans that we noted on page 7 reflects the availability of yield in excess of 400 basis points (4%) over LIBOR.

Online security business McAfee is a company that the fund has had exposure to in the past. In November 2021, it was taken private in a $14bn deal (equivalent to about 13x EV/EBITDA) led by Advent International and Permira. The managers felt that the yields on offer were attractive relative to the leverage (about 5x for the senior debt and 7x for the subordinated debt). The loan acquired by HDIV offered a yield of 425 basis points over LIBOR on leverage of 5.8x. The managers feel that McAfee did well over the period of the pandemic, taking market share and benefitting from the jump in technology sales.

On 7 September 2021, T-Mobile Netherlands was the subject of a leveraged buy-out. Deutsche Telekom and Tele2 sold the business to a consortium led by Apax Partners and Warburg Pincus for an enterprise value of €5.1bn (about 8.7x historic adjusted EBITDA). HDIV acquired both bond and loan exposure to the company on what the managers felt were attractive terms.

The Dutch mobile telecoms market is a three-player oligopoly (T-Mobile plus KPN and Vodafone). HDIV’s managers feel that such markets exhibit much greater price stability and higher margins than those with four or more competitors. The EU had sought to encourage greater competition with the aim of driving down prices for consumers. However, recognising the degree of investment needed to support the introduction of 5G, they seem happier to accept three-player models.

Another relatively recent investment was debt issued by GLP Capital, operating partner to Gaming and Leisure Properties, Inc. The company raised finance in December to fund the purchase of the real property assets of Live! Casino & Hotel Maryland, Live! Casino & Hotel Philadelphia, and Live! Casino Pittsburgh. The managers think that the company’s leverage is reasonably conservative. It also helps that rental payments are a high priority for such businesses. It is notable that despite COVID-related casino closures, no rental payments due to the company were missed during the pandemic.

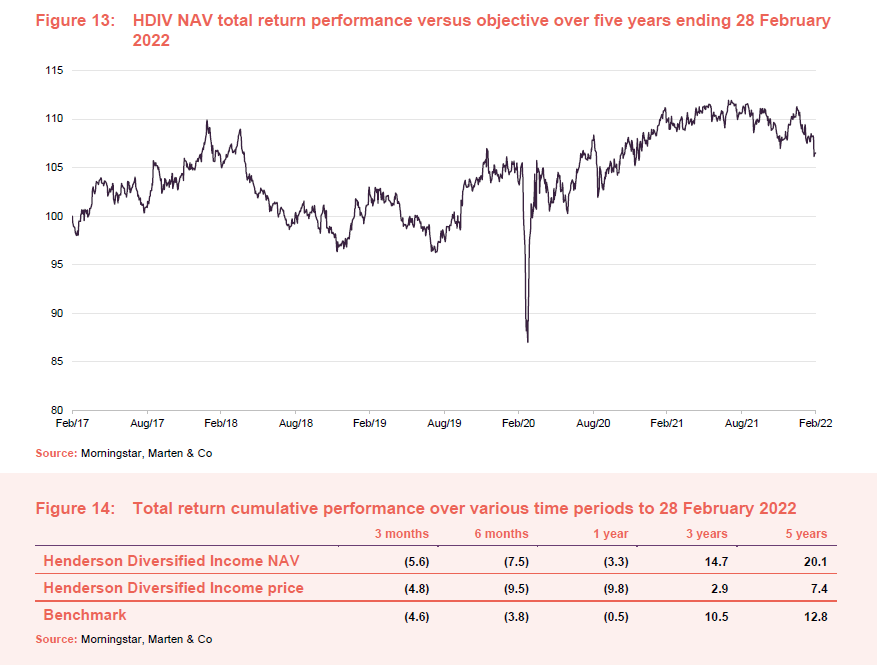

Performance

HDIV has a good long-term track record relative to its benchmark, aided in part by the actions that the managers took in the depths of the pandemic to increase gearing and invest while others were panic-selling.

The managers’ stance on the direction of interest rates runs contrary to that of many other market participants and has the potential to drive the next leg of HDIV’s outperformance of its benchmark and peers.

Another factor that will likely play in HDIV’s favour is its focus on good quality companies operating in growing markets. More challenged businesses may find the coming year tough and that could be reflected in the price of their debt. Having said that, the managers are not expecting to see a significant uptick in defaults.

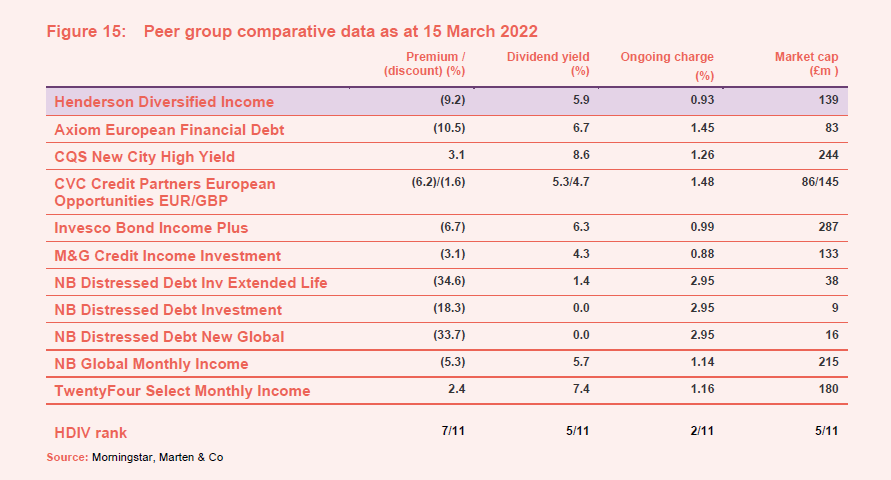

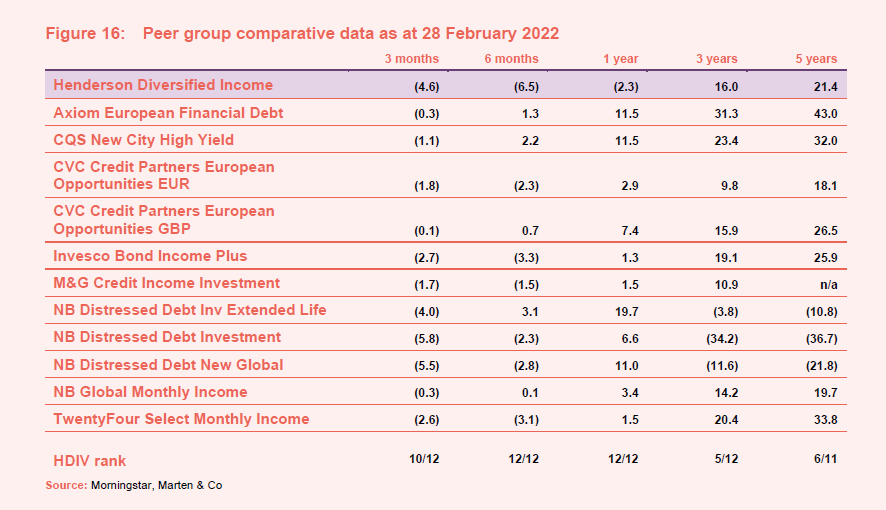

Peer group

HDIV is a constituent of the AIC’s debt – loans and bonds sector, and we have used this as a comparator. The funds within the debt – loans and bonds sector encompass a variety of investment objectives and strategies, not all of which compare well with HDIV’s investment strategy.

HDIV’s discount is currently one of the widest of its peer group, which as we discuss on page 18, seems unjustified to us.

HDIV’s dividend yield is, at the current share price, about middle of the pack.

The trust’s ongoing charges ratio remains very competitive, especially given the size of the trust.

The managers’ focus on quality meant that the portfolio lagged some competing funds when more cyclical names rallied. In particular, the absence of exposure to the energy and mining sectors, which have fared well over the past year or so, has held back HDIV’s short-term returns relative to its peers.

Nevertheless, over the longer term, HDIV’s focus on credit issued by companies with sustainable business models has worked well and despite its short-term underperformance, HDIV remains about middle of the peer group over the longer term.

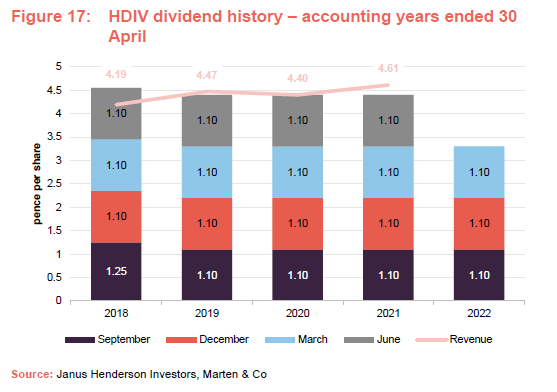

Quarterly dividend

HDIV’s accounting years end on 30 April, and it pays quarterly dividends in September, December, March and June. The rebasing of HDIV’s dividend to 1.1 pence per quarter, which took effect for payments made in December 2017, was the main topic of our November 2017 note. The actions that the managers took to increase the fund’s gearing in the depths of the market panic in March 2020 have boosted the revenue account.

At 30 April 2021, HDIV’s revenue reserve stood at £2.74m (equivalent to 1.46p per share).

The managers remain confident of maintaining HDIV’s dividend in the medium term.

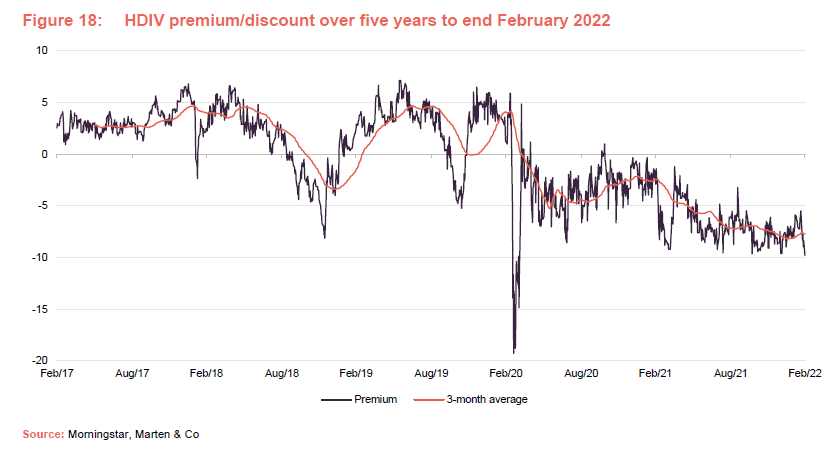

Premium/(discount)

The trend towards a wider discount over the past year or so may reflect HDIV’s yield and short-term performance relative to its peer group. The recent further widening is likely a reflection of investors’ unease following the invasion of Ukraine.

We feel that it is perverse that investors are not rewarding the conservative nature of HDIV’s portfolio in the current environment. However, if the managers’ expectation of a rapidly deteriorating economy and a swift end to rate rises plays out as they expect, the situation could change quite quickly.

Each year, the directors ask shareholders for permission to allot new shares and buyback existing ones. At the Annual General Meeting (AGM) in September 2021, shareholders approved the issuance of up to 10% of HDIV’s then-issued share capital and the repurchase of up to 14.99% of its then-issued share capital.

The managers say that it is not always easy to repurchase shares at times when the discount is wide. Nevertheless, HDIV has bought back almost 3m shares since our last note was published and it seems likely that repurchases will be made while the discount is as wide as it is.

HDIV does have the option to hold shares that it buys back in treasury, and re-issue them at a later date. However, shares will only be issued at a premium to asset value.

Fees and costs

Janus Henderson provides HDIV with investment management, accounting, administrative and company secretarial services. BNPPSS has been subcontracted by Janus Henderson to provide some of the accounting and administration services. HDIV pays Janus Henderson a fee of 0.65% of net assets (calculated and paid quarterly in arrears). There is no performance fee. The trust also makes a contribution to the manager’s marketing expenses. The contract with the managers can be terminated on six months’ notice.

The only other expenses of note in the year ended 30 April 2020 were the directors’ fees (see below) and the auditor’s remuneration of £54,000. The annualised ongoing charges ratio at 31 October 2021 was 0.91%, down from 0.93% for the prior year. As noted on page 16, this is one of the lowest of any fund in HDIV’s peer group.

The trust’s management expenses are charged 50% against capital and 50% against revenue. All other expenses are charged against revenue.

Capital structure and life

HDIV has 187,434,303 shares in issue of which 760,000 are held in treasury. The number of voting rights in the company is 186,674,303, therefore. HDIV has no other classes of security.

Gearing is provided through a £45.5m multicurrency overdraft facility provided by BNP Paribas Securities Services which expires on 30 June 2022, and through the use of derivatives (synthetic gearing, as described on page 11).

HDIV’s year end is 30 April and its AGMs are held in September. It has an unlimited life.

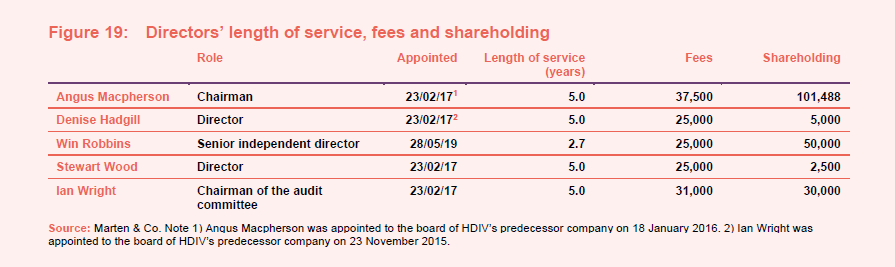

Board

HDIV has five directors, all of whom are non-executive, independent of the manager and who do not sit together on other boards. The board was refreshed when the company moved onshore in 2017, and only two pre-existing directors (the chairman and Ian Wright) were appointed to the new board.

Angus Macpherson

Angus is chief executive of Noble & Company (UK) Limited. He is also chairman of Pacific Horizon Investment Trust Plc, a director of Schroder Japan Growth Fund Plc, and trustee of The Scottish Policy Foundation. Previously he worked for Merrill Lynch in London, New York, Singapore and Hong Kong, latterly as head of Capital Markets and Financing in Asia. Angus was also chairman of JP Morgan Elect Plc until January 2018, chairman of the Belhaven Hill School Trust Limited, and a member of the Scottish Government’s Financial Services Advisory Board.

Denise Hadgill

Denise was managing director and head of the UK Product Strategy Group at BlackRock until 2015, and was responsible for delivering the firm’s investment message and economic outlook to an extensive range of UK pension fund and charity trustee boards. Prior to this, she spent 14 years at Schroder Investment Management Limited where she was UK equity fund manager and director responsible for the firm’s relationship with 21 UK pension fund and charity clients with multi-asset portfolios valued at £2bn.

Win Robbins

Win has extensive investment management experience, having held various senior positions including eight years as director of Credit Suisse Asset Management Limited from 1996 until 2004, and managing director and head of Non-US Fixed Income at Citigroup Asset Management from 2004 to 2006. She is a non-executive director and chairman of the remuneration committee at Polar Capital Holdings Plc, and a non-executive director of BlackRock Income & Growth Investment Trust Plc. Win is also a non-executive member of the Investment Committee of St. James Place Partnership Plc and an independent trustee of the Institute of Cancer Research Pension Fund. She holds a Diploma in Investment Management from the London Business School, and was formerly a non-executive director of City Merchants High Yield Trust Limited.

Stewart Wood

Stewart has been a Labour member of the House of Lords since 2011 and is a member of its Select Committee on the European Union. He was Shadow Minister without Portfolio and a strategic adviser to Ed Miliband (leading Ed Miliband’s Labour leadership campaign). Prior to that, he was a special advisor to the Chancellor of the Exchequer and led the assessment of the UK’s entry to the euro. He then served as senior special adviser on foreign affairs, culture and media policy, and Northern Ireland between 2007 and 2010.

In 2016, Stewart became the chair of the United Nations Association (UK), was appointed to the board of the Marshall Scholarships Commission, and is a director of the Good Law Project. He has been a Fellow at Magdalen College, Oxford University since 1995, and is Professor of Practice at the Blavatnik School of Government at the University of Oxford.

Ian Wright

Ian is a Chartered Accountant, a director of the Jersey Heritable Property Company Limited, and a policeman in the Parish of St. Brélade. Previously he was an audit partner in Price Waterhouse and then PricewaterhouseCoopers, including serving as the senior partner of the firm’s international accounting consulting group. A founder member of the IFRS Interpretations Committee, he has also served on professional committees of the ICAEW and FEE. Ian was deputy chairman of the Jersey Financial Services Commission, and was also a panel member of the Financial Reporting Review Panel, which is part of the UK Financial Reporting Council. He is resident in Jersey, having previously worked in the Channel Islands, London and Bahrain.

Previous publications

Henderson Diversified Income Trust – Death rattle for bull market

Henderson Diversified Income Trust – Favourable style and structure

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Henderson Diversified Income Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.