Sticking to its guns

Henderson Diversified Income Trust (HDIV) focuses on high-quality companies with sustainable business models. It was resilient in the face of COVID-19-related market falls, but, unlike some of its peers, has not benefitted from the bounce in the prices of debt issued by low-quality borrowers and those whose business models are sensitive to shifts in the economic cycle that has occurred since last November’s vaccine news. Nevertheless, its three-year figures are well-ahead of those of competing funds.

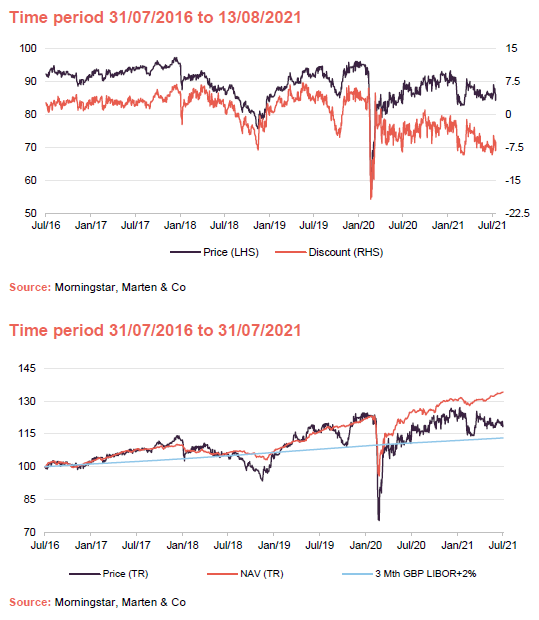

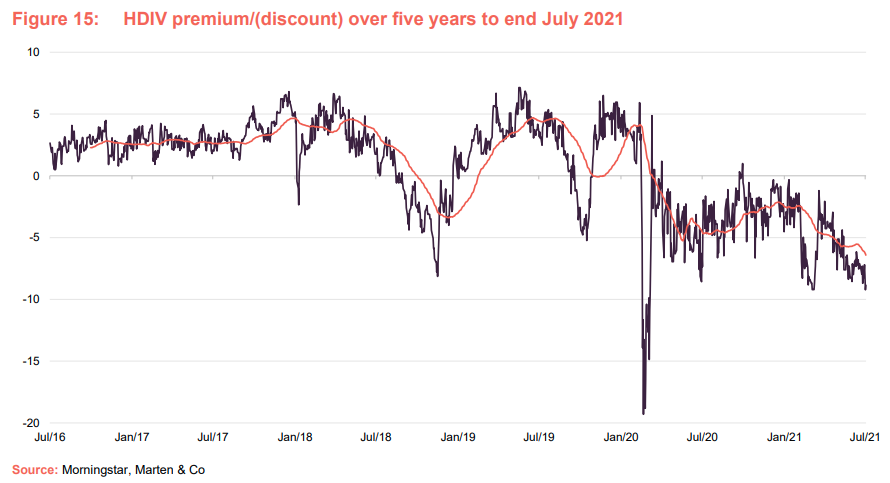

Over 2021 to date, HDIV’s shares have moved to trade at a discount to NAV. We think that this is unjustified, given HDIV’s longer-term track record. As we discuss later, the managers highlight the disruptive changes underway in many industries that have accelerated recently. They are convinced that the inflation we have been experiencing this year is transitory, that fundamentals will soon reassert themselves, and that HDIV’s portfolio positioning will be rewarded.

High income from a flexible fixed income portfolio

HDIV’s current objective is to seek income and capital growth such that, on a rolling annual basis, the total return on the NAV exceeds three-month sterling LIBOR plus 2%. Details of HDIV’s proposed new benchmark are on page 15. It invests in a diversified portfolio of fixed income assets. The trust may also invest in high-yielding equities and derivatives. The managers use gearing to enhance returns. Dividends, which make up the bulk of returns for investors, are paid quarterly.

HDIV has been buying back stock to help address the widening discount. Since we last published, HDIV has bought back 1.7m shares.

Last year’s panicky markets hit almost all funds, but the strengths of HDIV’s portfolio were soon reflected in its NAV and, for it, the hit proved short-lived. The actions that the managers took to ramp up leverage and pick up good quality credits at attractive prices helped spur subsequent returns.

To recap – a focus on sustainability

Our last note – Grounds for optimism – set out the managers’ investment philosophy and approach to managing HDIV’s portfolio, and readers may wish to refer back to it. However, to recap, HDIV’s portfolio is differentiated from peers because the team emphasises preserving capital as well as generating attractive income returns.

Its managers focus on the long-term sustainability of the issuers that they are funding. In practice, this means excluding whole segments of the market where the underlying business is in structural decline, commoditised industries, those with cyclical and operational leverage, and issuers heavily exposed to emerging markets. The managers also avoid distressed credits and illiquid issues (those less than £250m).

When assessing issuers, the managers focus on metrics based on free cash flow over accounting profits, and returns on capital employed.

An analysis of environmental, social and governance (ESG) issues is factored into all investment decisions. Businesses that score poorly on ESG metrics and show no signs of tackling this will not make it into the portfolio. One indication of this working in practice is that, on average, HDIV’s portfolio has far less emissions exposure than the global corporate and high-yield index, aligning it to the 1.5˚C by 2050 carbon budget within the IEA Sustainable Development Scenario.

Market background

As we described in our last note, HDIV’s portfolio held up relatively well during the COVID-19-related period of market volatility in March and April 2020. The emphasis on the quality of the underlying businesses meant that HDIV was not exposed to sectors such as airlines, high street retailers, and oil and gas companies which were particularly badly affected.

The managers felt confident enough to buck the trend of panic selling, take on additional leverage (borrowing) – with the support of the board – and pick up exposure to good-quality credits on attractive yields. This greatly strengthened the revenue account and enabled a modest increase in revenue reserves as earnings exceeded dividends declared.

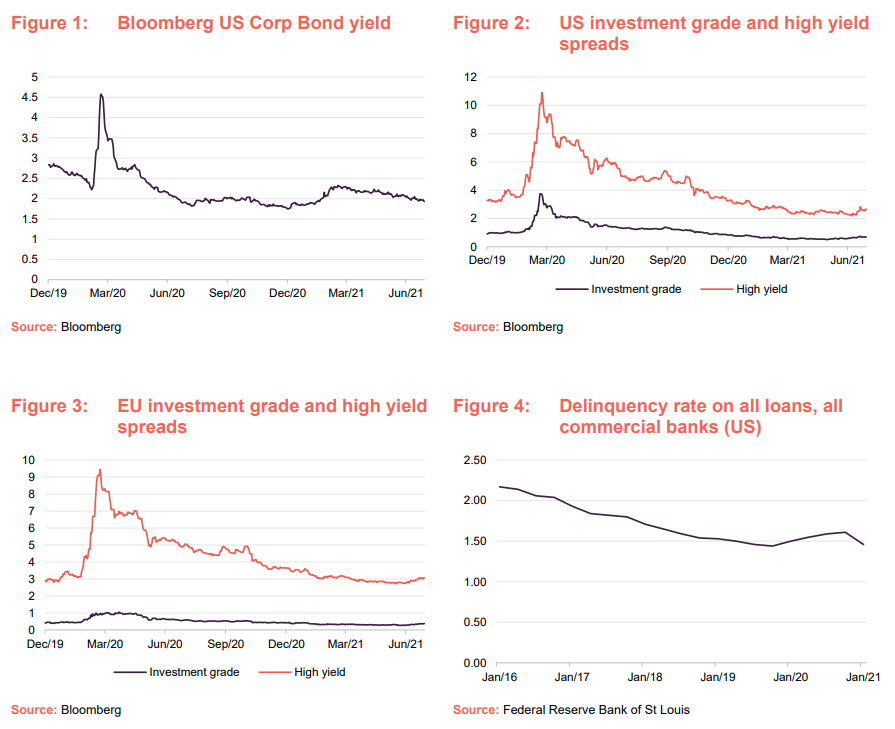

The pandemic panic last March is obvious in each of the charts in Figures 1 to 3. Figure 1 shows how US corporate bond yields have changed since the end of December 2019. Here, an in each of these charts, the spike in yields (as bond prices fell) is obvious. Figures 2 and 3 show the gap (spread) between the yields on investment grade debt and the yields on equivalent government bonds.

The government and central bank policy response to the virus was lower interest rates, more quantitative easing and significant fiscal stimulus (furlough schemes, hand-outs and new spending initiatives, for example). The effect has been to supress volatility in financial markets and push bond yields below pre-pandemic levels. Spreads have tightened, although at the margin they have widened in recent weeks, perhaps as investors fear the potential effects of new variants of the virus. Within HDIV’s portfolio, the exposure to investment grade bonds has fallen as the managers feel that they no longer offer attractive yields.

Figure 4 shows the percentage of all US loans where borrowers were late making payments. This has been falling despite the economic hit from the virus.

Once vaccines offered the prospect of a reopening of economies, more cyclical and lower-quality names rallied strongly and CCC-rated issues did particularly well. By contrast, HDIV’s portfolio remained relatively stable and this has held it back relative to its peer group in the short term. HDIV’s managers have stuck to their guns. They remain convinced that over the medium term the structural challenges faced by many lower-quality businesses will be reflected in higher defaults by these companies. However, systemic default rates may continue to be low – JPMorgan has slashed its forecast high-yield default rate to 3.5% (it was forecast to be as high as 14% in March 2020).

Inflation is transitory, disruption has accelerated

From November 2020 onwards, as markets recovered, some investors became fixated on rising inflation numbers and the yield curve steepened. HDIV’s managers have kept the duration of the portfolio relatively long. They anticipated that US treasury yields (yields on US government bonds) would tighten once again (as they have since early June 2021). In their view, inflation is not permanent and not sustainable.

The managers say that, overall, the global economy is still stagnating, albeit with a few bottlenecks. Their model notes that 7m people have not yet returned to work in the US, there is seemingly no real demand for credit, and stimulus cheques have been saved rather than spent.

The managers also note that the recovery has been ‘K’-shaped (i.e. some sectors are recovering much faster than others) and inequitable (the gap between the richest and poorest has widened).

One principal argument that the managers have against inflation is that labour has no bargaining power. Artificial intelligence and automation are destroying jobs in a wide range of sectors. Technological innovation enables more people to participate in the workforce while simultaneously destroying jobs. The same technology that enabled working from home also allows jobs to shift to lower wage economies.

Disruption is everywhere. The shift to online retail justifies the managers antipathy towards physical retailers, for example. Question marks over the future of business travel threaten the future of airlines and hotels. Streaming and online gaming are replacing cinemas.

However, it is not all bad news. The managers note that low defaults and stringent regulation mean that bank balance sheets are relatively strong, for example. The surge in pet ownership during lockdowns is supporting growth in a range of related businesses. The shift to working from home triggered a short-term increase in demand for tech equipment, but the market for cyber security is likely to remain strong for a long while yet, in the face of threats such as the SolarWinds hack. As we describe later, this thinking is reflected in HDIV’s portfolio.

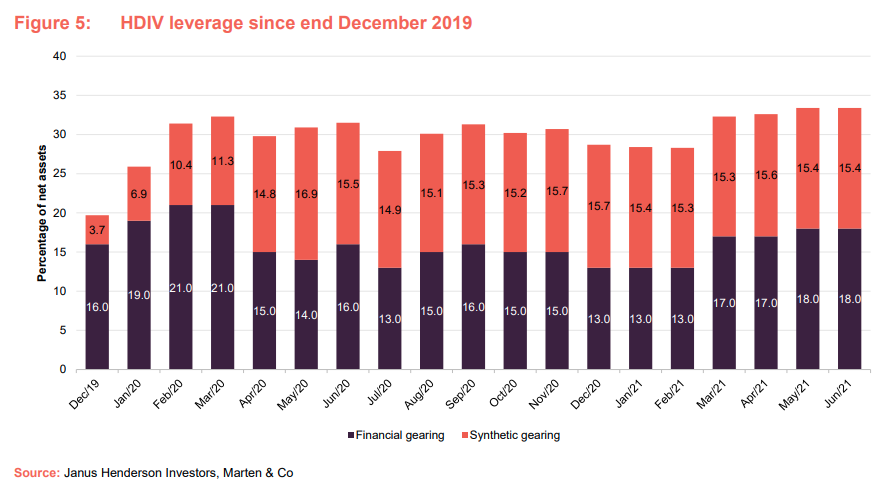

Leverage

HDIV operates with a mixture of real and synthetic gearing. In addition to gearing provided through a borrowing facility, credit default swaps (CDS) are used to provide gearing to the portfolio. The managers can use derivatives (CDS, interest-rate futures and swaps) in the management of the portfolio – this lets them manage exposures without buying or selling the underlying securities.

Leverage levels, which were raised substantially in Spring 2020, have been fairly stable since, although the managers did increase gearing in March 2021 when many others were worrying about inflation.

Asset allocation

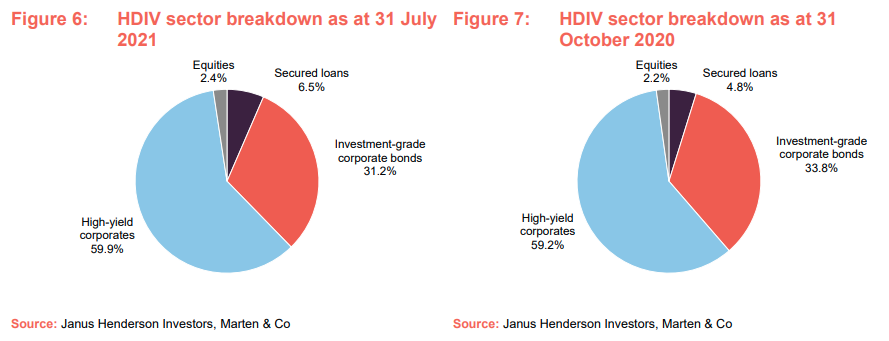

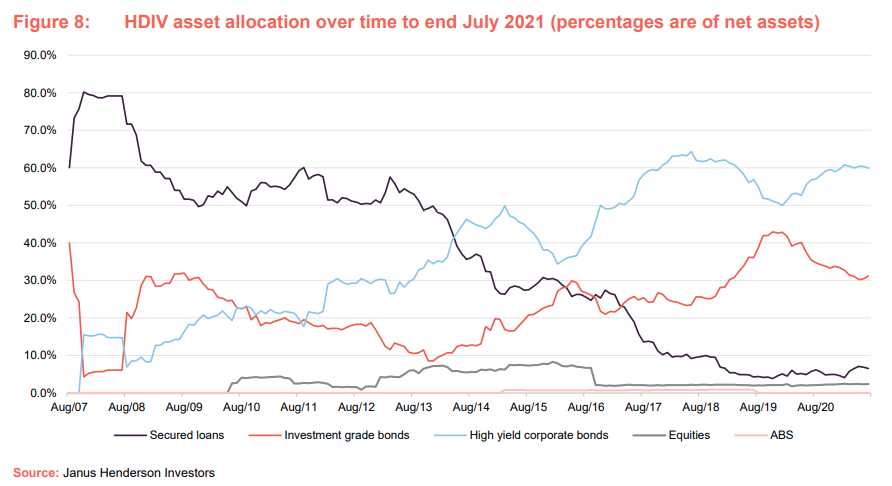

The bias of the portfolio is towards high-yield and non-financials issuers. Since we last published, the main change in asset allocation is an ongoing switch away from investment grade loans – as spreads have tightened – into secured loans. This trend is more obvious in Figure 8.

Figure 8 shows how HDIV’s asset allocation has evolved since its launch in 2007 and illustrates the dramatic reduction in secured loans and the corresponding increase in exposure to high-yield bonds.

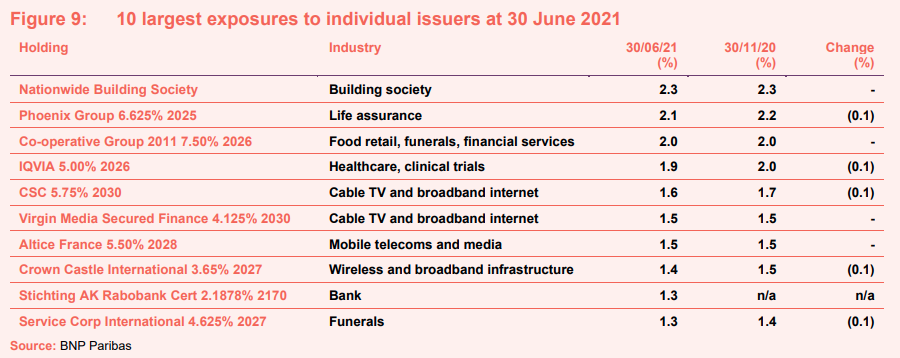

10 largest exposures to individual issuers

HDIV’s list of its 10 largest exposures to individual issuers is remarkably stable, reflecting the managers’ long-term focus. There are no changes of note since we last published. Aramark has fallen out of the list, to be replaced by Rabobank. The former is still held within the portfolio.

Rabobank

Rabobank is a co-operative bank based in the Netherlands, with strong ESG credentials – it has specialisms in financing sustainable agriculture, measures to tackle climate change, and the transition to a more inclusive society (including the provision of affordable housing).

In July 2021, Moody’s Investors Service announced that it had upgraded Rabobank’s long-term deposits and senior unsecured debt ratings to Aa2 from Aa3 and with a stable outlook.

New additions to the portfolio

In their search for alpha, the managers have been targeting ‘rising stars’ – issues that have a good prospect of being upgraded from non-investment grade to investment grade. Such a move is often accompanied by a rising price/lower yield as the bond becomes suitable for investment by a much deeper pool of capital.

The managers note that the proportion of rising stars relative to ‘fallen angels’ (issues going the other way – from investment grade to non-investment grade) has been rising in recent quarters.

Issuers that have been added to the portfolio in recent months include Ball Corporation, Centene Corporation, Crowdstrike, IVC, Kraft Heinz, LPL Holdings, MSCI and T-Mobile.

Ball Corporation

Ball Corporation (ball.com) describes itself as the world’s leading provider of innovative, sustainable aluminium packaging. It is a listed company with a market cap of $29.1bn. HDIV owns its 5.25% bonds maturing on 1 July 2025. Over H1 2021, Ball Corp generated positive cashflow from operations. At the end of June, it had long-term debt of $7.0bn, other long-term liabilities of $2.6bn, and equity of $3.7bn.

Centene Corporation

Centene Corporation (centene.com) is a healthcare management company serving over 25m Americans. It is a listed company with a market cap of $36.8bn. HDIV owns its 2.5% bonds maturing on 1 March 2031. At June 30, 2021, Centene had a debt to capitalisation ratio of 38.9%.

Crowdstrike

Crowdstrike (ir.crowdstrike.com) is a cloud security company which aims to detect cybersecurity threats and stop breaches. It is a listed company with a market cap of $55.6bn. HDIV owns its 3% bonds maturing on 15 February 2029. The fast-growing company had cash and cash equivalents of $1.7bn at end April 2021 and generated record positive free cash flow in Q1 2021.

IVC Evidensia

IVC Evidensia (ivcevidensia.com) is Europe’s largest veterinary services company, operating around 1,500 clinics and animal hospitals across 12 countries. The company is backed by private equity firms including EQT and Silver Lake. The last funding round in February 2021 valued the company at €12.3bn. HDIV owns floating rate bonds maturing in February 2026.

Kraft Heinz

Kraft Heinz (ir.kraftheinzcompany.com) owns some of the world’s most recognisable consumer brands. It is a listed company with a market cap of $46.4bn. HDIV owns four of its long-dated bonds maturing in 2042, 2045, 2046 and 2049. The panic-buying associated with the COVID-19 outbreak pulled forward sales of its products, but it is achieving organic growth when compared to 2019 figures. Free cash flow is strong at $1.6bn for H1 2021 and its net leverage has fallen from 4.4x EBITDA in 2019 to 3.1x at 30 June 2021.

LPL Financial

LPL Financial (lpl.com) is the largest independent broker-dealer in the US with over $1trn in brokerage and advisory client assets. It is a listed company with a market cap of $11.7bn. HDIV owns 4% bonds maturing on 15 March 2029. Lower interest rates have put pressure on margins but the business remains profitable. The company’s net debt/EBITDA ratio rose in Q2 to 2.26x from 2.11x at end March 2021. However, the rise was associated with an acquisition and the ratio is still towards the lower end of its target 2x–2.75x range.

MSCI Inc

MSCI (ir.msci.com) is the company behind the eponymous range of indices and associated products and services. It is a listed company with a market cap of $51.2bn. HDIV owns two of its bonds maturing in 2029 and 2030. Q2 2021 was its best-ever quarter for total net new recurring subscription sales. At 30 June 2021, net debt/EBITDA was 1.8x, while net debt of just under $2bn compares with guidance towards free cash flow of $840m–$890m for 2021.

T-Mobile

T-Mobile (investor.t-mobile.com) is a US telecoms company. It claims to own America’s largest, fastest and most reliable 5G network. T-Mobile is a listed company with a market cap of $180.9bn. HDIV owns three of its bonds maturing in 2026, 2028 and 2050. T-Mobile’s net debt, excluding tower obligations, at the end of Q2 2021 was $69.9bn, equivalent to 3.0x EBITDA (down from 3.1x at 31 March 2021).

Exits

The managers sold out of HDIV’s position in Credit Suisse AT1 on governance grounds. The manager found repeated due diligence failures – including exposure to Greensill Capital and Archegos Capital Management – to be concerning and decided to exit the position.

They also sold HDIV’s 4.625% booking.com 2030 bonds on valuation grounds. The price of the bonds rallied by 17 percentage points as investors anticipated a post-COVID return to leisure travel. HDIV also benefitted from the coupon on the bonds.

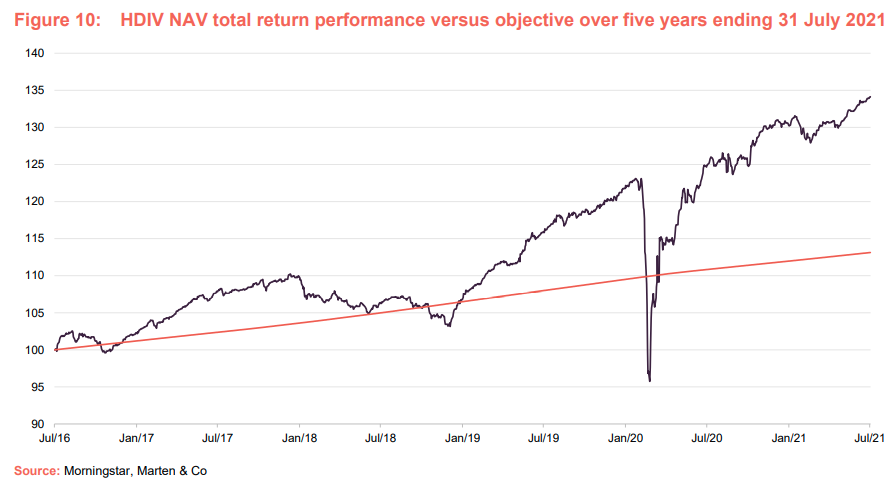

Performance

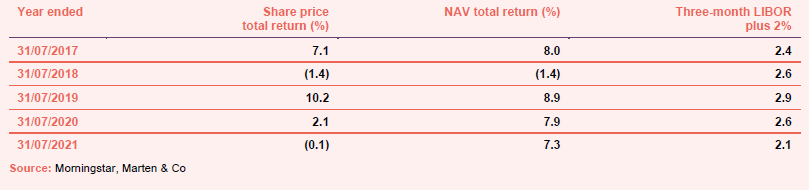

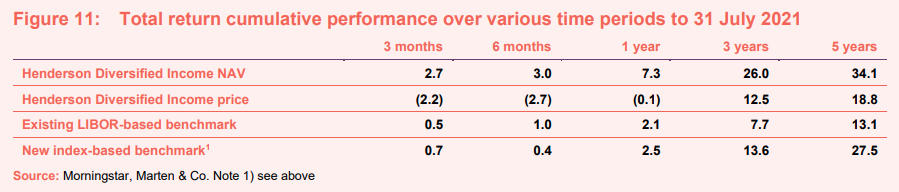

Relative to its existing LIBOR-based benchmark, HDIV’s long-term record is one of impressive long-term outperformance. As we have discussed in previous notes, in 2018, yields rose across HDIV’s portfolio in anticipation of inflation which did not materialise. Being resolute in their thinking and keeping the portfolio’s duration long; set the seeds for subsequent strong returns. There is an echo of this today.

Last year’s panicky markets hit almost all funds, but the strengths of HDIV’s portfolio were soon reflected in its NAV and, for it, the hit proved short-lived. The actions that the managers took to ramp up leverage and pick up good quality credits at attractive prices helped spur subsequent returns.

As we described in our last note, the board feels that the present benchmark does not reflect the risks and rewards of investing in bonds and other instruments across the cycle. It proposes the adoption of a benchmark comprised of 60% global high-yield credit (represented by the ICE BofA Global High Yield Constrained Index), 25% global investment grade corporate credit (represented by the ICE BofA Global BBB Corporate Bond Index) and 15% European loans (represented by the Credit Suisse Western European Leveraged Loan Index). Returns will be calculated in sterling.

As Figure 11 shows, had the new benchmark been in place over the previous five years, it would have proved a more challenging target than the previous benchmark, but HDIV would still have outperformed it by a decent margin.

Peer group

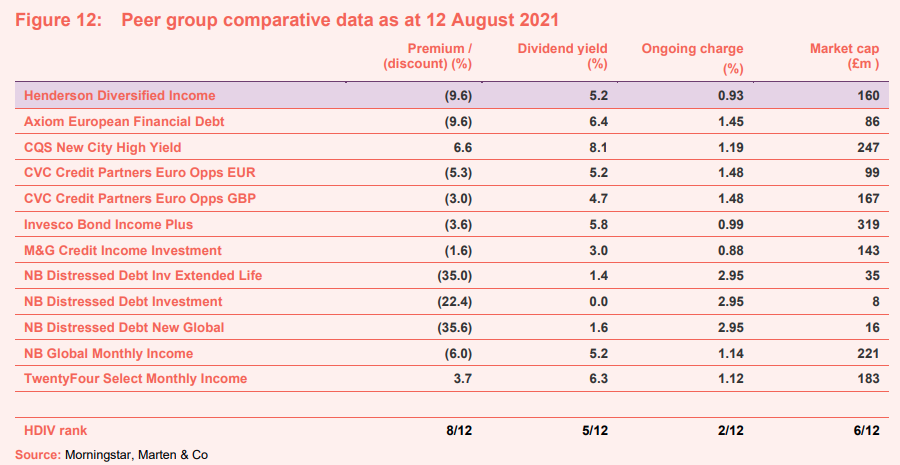

HDIV is a constituent of the AIC’s debt – loans and bonds sector, and we have used this as a comparator. The funds within the debt – loans and bonds sector encompass a variety of investment objectives and strategies not all of which compare well with HDIV’s investment strategy.

Since we last published a note on HDIV, City Merchants High Yield and Invesco Enhanced Income have merged to become Invesco Bond Income Plus.

HDIV’s share price discount to NAV is around the middle of the peer group. Currently, only two funds are trading on premiums to net asset value and these are amongst the highest-yielding funds in the sector. HDIV’s ongoing charges ratio is one of the lowest in the sector.

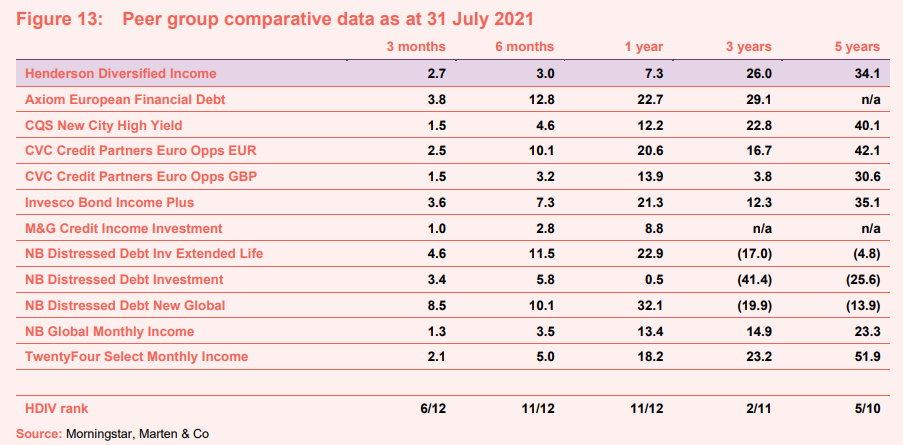

The peer group performance data in Figure 13 illustrates the narrative of the past two years. HDIV’s focus on the quality of its issuers has stood it in good stead over the longer term. However, in recent months, having fallen less last year, its portfolio has not participated in the rally in cyclical and lower-quality issues that has occurred since last November.

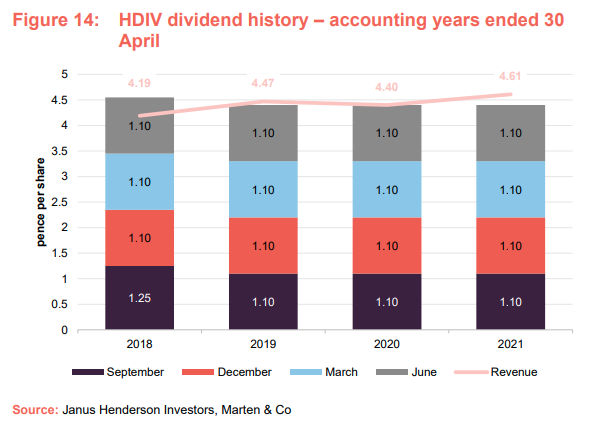

Quarterly dividend

HDIV’s accounting years end on 30 April, and it pays quarterly dividends in September, December, March, and June. Against dividends totalling 4.4p for the year ended 30 April 2021, the revenue per share was 4.61p (up from 4.40p for the prior year). The revenue reserve stood at £2.7m at the end of April 2021 – enough to cover about a third of the annual dividend.

The managers believe that the actions that they took last year should mean that the dividend is sustainable for the immediate future. However, in the longer term, if their secular stagnation theory holds true then it could come under pressure. All similar funds would be likewise affected.

The managers say that, whilst not seeking to forecast the trust’s financial results for the current year, the actions that they took in Spring 2020 to increase the trust’s gearing and lock in attractive yields should help ensure that the dividend is covered by earnings this year, allowing it to increase its revenue reserve.

Premium/(discount)

Over the 12 months ended 31 July 2021, HDIV’s discount moved within a range of a discount of 9.2% to a premium of 1.0% and averaged a discount of 4.2%. At 12 August 2021, HDIV was trading at a discount of 9.6%.

HDIV has been buying back stock to help address the widening discount. Since we last published, HDIV has bought back 1.7m shares. Unusually, the repurchased shares have been cancelled rather than being held in treasury. At the annual general meeting (AGM) on 15 September 2020, shareholders approved the issuance of up to 10% of HDIV’s then-issued share capital (19,131,824 shares) and the repurchase of up to 14.99% of its then-issued share capital (28,678,604 shares). Shares will only be issued at a premium to NAV and bought back at a discount.

Fund profile

Henderson Diversified Income Trust (HDIV) invests selectively across the full spectrum of fixed-income asset classes, including – but not limited to – secured loans; government bonds; asset-backed securities; investment-grade corporate bonds; high-yield corporate bonds; unrated bonds; preference and selective high-yield equity shares; hybrid securities; convertible bonds; and floating-rate notes.

Its objective is to seek income and capital growth such that, on a rolling annual basis, the total return on the NAV exceeds three-month sterling LIBOR plus 2% (but see below). It has a global mandate and the managers use gearing to enhance returns. The company was redomiciled to the UK from Jersey with effect from 27 April 2017.

As described earlier, the board feels that the present benchmark does not reflect the risks and rewards of investing in bonds and other instruments across the cycle. It proposes the adoption of a benchmark comprised of 60% global high yield credit (represented by the ICE BofA Global High Yield Constrained Index), 25% global investment grade corporate credit (represented by the ICE BofA Global BBB Corporate Bond Index) and 15% European loans (represented by the Credit Suisse Western European Leveraged Loan Index). Returns will be calculated in sterling.

Shareholders will be asked to approve this proposal at the AGM scheduled to be held on 16 September this year.

Previous publications

Readers interested in further information about HDIV may wish to read our last note, which was published on 6 January 2021, as well as our previous notes:

Onshore, on-message, on-form, initiation note, published May 2017

Dear Prudence, update note, published November 2017

Winter is coming, annual overview, published October 2018

Death rattle for bull market, update note, published April 2019

Soft landing likely…, annual overview, published November 2019

Favourable style and structure, update note, published July 2020

Grounds for optimism, annual overview, published January 2021

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Henderson Diversified Income Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.