Favourable style and structure

Favourable style and structure

Henderson Diversified Income (HDIV) is managed with a distinct investment style which favours businesses with sustainable cash flows. Some of the sectors that have been worst affected by the pandemic, such as airlines and energy, were therefore absent from the portfolio. The managers took advantage of HDIV’s closed-end structure to take on additional leverage close to the bottom of markets and to make some opportunistic investments. These transactions help lay the foundations for future outperformance and underpin HDIV’s dividends at a time when equity dividends are under pressure. Given this, HDIV’s discount looks odd and presents a buying opportunity.

High income from a flexible fixed income portfolio

High income from a flexible fixed income portfolio

HDIV’s objective is to seek income and capital growth such that, on a rolling annual basis, the total return on the NAV exceeds three-month sterling LIBOR plus 2%. It invests in a diversified portfolio of global assets including secured loans, government bonds, high-yield (sub-investment grade) corporate bonds, unrated corporate bonds, investment grade corporate bonds and asset-backed securities. The trust may also invest in high-yielding equities and derivatives. The managers use gearing to enhance returns.

Dividends, which make up the bulk of returns for investors, are paid quarterly.

Riding the COVID-19 rollercoaster

Riding the COVID-19 rollercoaster

The team has been working from home successfully, which the managers say has been made easier by the fact that they have been working together as a team for many years.

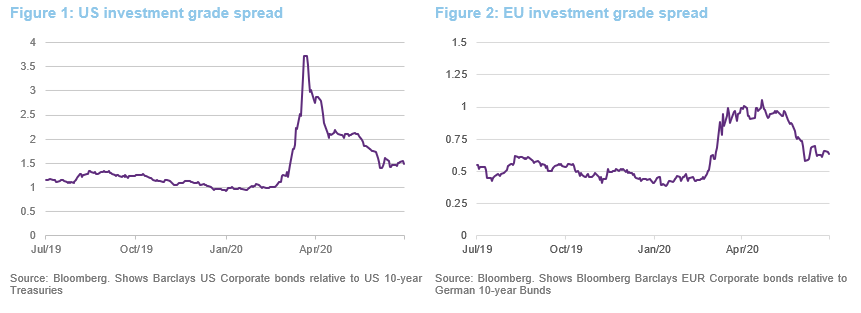

When the scale of the pandemic became apparent, panic took hold of the bond market for a few days as some investors ran for the exit. Many parts of the debt market then saw a relatively swift recovery in prices as central banks stepped in to calm markets. However, defaults have risen (albeit not as fast as might have been expected – see below) and credit spreads have widened (although note the different scales on the US and EU charts).

Investment style worked in HDIV’s favour

Investment style worked in HDIV’s favour

HDIV did not survive unscathed but it was shielded from some of the worst effects thanks to the managers’ distinct investment style. We described this in some detail in our November 2019 note and readers might want to refer to that.

As the managers point out, most professional credit investors have no investment style as, for example, an equity investor would recognise it. The large credit investors tend to have teams of analysts covering the whole market, invest in line with the index and, subject to their credit analysis, buy whatever is being issued without a filter.

However, HDIV’s managers actively avoid issuers operating in commoditised and declining/strategically challenged industries, those with cyclical and operational leverage and issuers heavily exposed to emerging markets. This means that around half of the high-yield market and a third of the investment grade market is un-investable in their view.

This investment style meant that HDIV did not have any exposure to some of the sectors that have suffered badly over the past few months such as energy, airlines and high street retail.

HDIV’s structure was also beneficial

HDIV’s structure was also beneficial

For the managers, the beauty of running a closed-end fund in an environment such as this is the freedom to take on additional risk at the bottom of the market, as opposed to the manager of an open-ended, who might feel compelled to maintain high levels of liquidity, or – worse – have to sell investments at the bottom of the market to meet redemptions.

The managers took full advantage of this and were able to make investments at attractive yields, which will help underpin HDIV’s capital and income returns for some time to come.

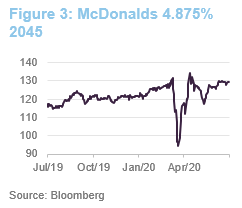

The portfolio has not experienced any defaults. The wild swings in HDIV’s share price and NAV reflected moves in the underlying prices.

For example, McDonalds 4.875% 2045 traded between 130c and 90c in March and had returned to trading at 130c by the second week of April.

Macro thesis played out

Macro thesis played out

The economic slump associated with COVID-19 has led to the realisation of the managers’ ‘lower for longer’ stance on inflation and rates – the ‘Japanification’ of economies. The central bank response to the crisis has been to slash rates, which are now close to zero everywhere and reinvigorate QE programmes with the aim of injecting liquidity into the economy.

Fiscal measures were also necessary. Governments have injected huge stimulus already, and more is likely. The UK government is rejecting the idea of a return to austerity; it will not be alone in this. The managers think that tax hikes to recover the cost of stimulus efforts are unlikely.

The managers believe that fiscal deficit will persist for years. The counterpoint to this is likely to be that household and corporate savings rates rise, ushering in a Japanese-style balance sheet recession. Policymakers will want to keep rates close to zero for the foreseeable future – the managers say that it is possible we will not see meaningful rate rises for a decade.

The corollary of this is that investors will remain starved of income. In this environment, a fund such as HDIV that can maintain a yield well in excess of risk-free returns should be in demand.

The managers think that we may see volatility in prices but no engrained inflation. We could see a repeat of 2010, when, as economies recovered from the economic shock associated with the financial crisis, inflation briefly touched 5%. However, a lack of pricing power, for labour in particular, will prevent any inflation from becoming entrenched.

Against that backdrop, government bond yields may be volatile but within a relatively narrow range. The managers do not foresee a self-sustaining bear market in government bonds.

They think that the talk of yield curve control by the Fed, possibly centred on moderating three-year rates, may become reality. Australia is doing this already.

Credit markets have remained open for business, in contrast to 2008 when the EU high-yield market effectively shut for about 18 months and the US for 6 months. There has been more than $1trn of issuance year to date, most of this in April and May. When we talked to the managers, they cited just two deals that failed to get away neither of which they would have been interested in given their style.

Borrowers have been taking advantage of open markets to build a war chest of liquidity in case of a second wave. The managers expect them to hand some of this liquidity back if it is not needed. In the medium term, this may mean that some of the issues that HDIV has been buying recently at attractive yields may be refinanced. Investors should bear in mind that the money flowing back to HDIV at this point may need to be reinvested in lower-yielding investments.

The managers note that, for most sectors, default rates have been suppressed by the direct intervention in the economy by central banks and government bonds. They also reiterate a point that we made in previous notes: the high-yield market has not been funding the riskiest credits/unproven business models. Those areas have been funded by the loan and private credit markets.

Asset allocation

Asset allocation

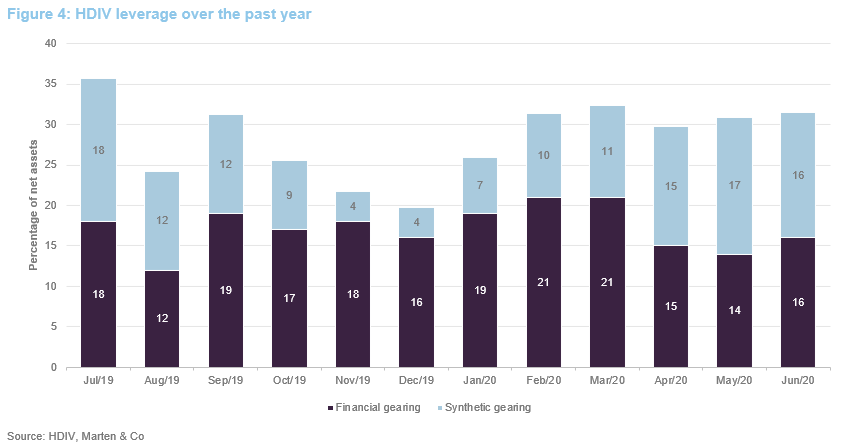

In the relatively frothy markets of the latter part of 2019 and in January 2020, HDIV’s managers reduced the leverage on the portfolio. However, in the face of the market sell-off and comforted by HDIV’s closed-end structure, the managers used leverage to take advantage of weak prices.

At the peak, total gearing was around 35%. However, after a sharp bounce, at the end of June 2020, total net gearing (bank borrowings and synthetic gearing less cash) was 31.5%.

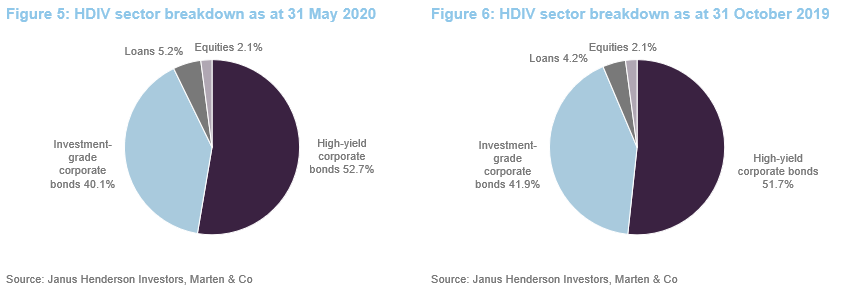

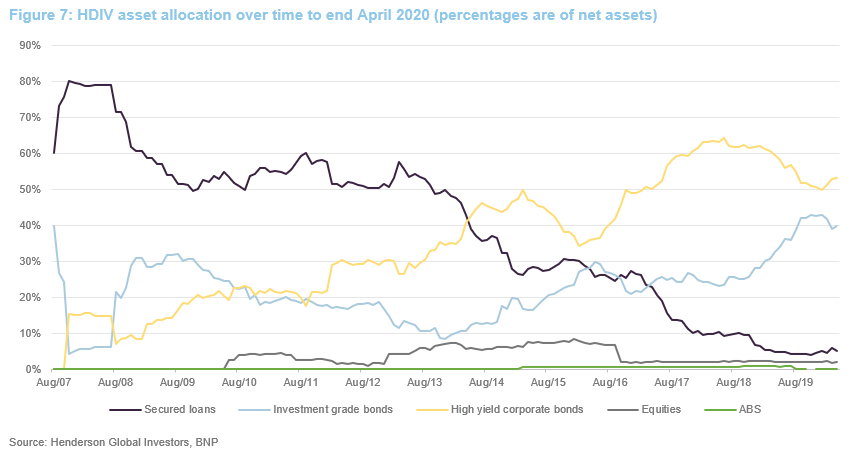

There were 171 holdings in the portfolio at the end of June 2020. Figure 5 shows how the portfolio was split between various types of credit at the end of May and Figure 7 shows how this has varied through time.

HDIV’s asset allocation has not changed much since we last published on the trust (using data as at 31 October 2019). The managers did take advantage of the sell-off to add to investment grade bonds at attractive yields, rebuilding the allocation to this area after some profit-taking in the early part of the year. These included the likes of HSBC and Disney. These issues came with higher coupons than would have been typical for investment grade issuance earlier in the year.

As a quick way of adding credit exposure, the managers purchased the Markit iTraxx Europe Crossover 5yr synthetic CDS, which gives exposure to a basket of the 75 most-liquid sub-investment grade entities. However, the managers had also been looking closely at a range of other bonds that fitted their investment style. Some of these are discussed later on.

NB the ‘equities’ exposure is Nationwide.

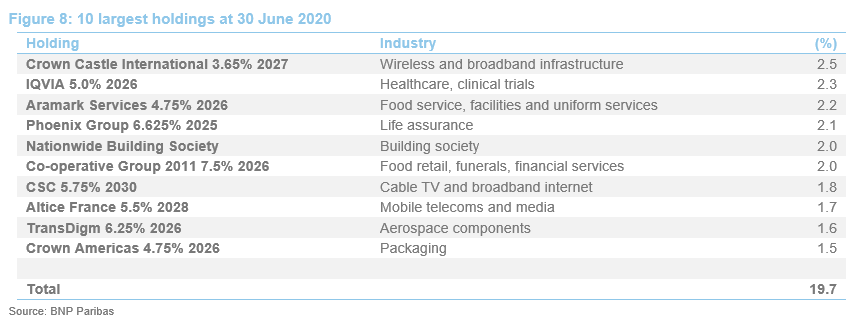

10 largest exposures to individual issuers

10 largest exposures to individual issuers

The composition of the list of the 10-largest exposures to individual issuers has been remarkably stable, given the turmoil in markets.

The managers like the predictable, stable cash flow generation of telecom tower business such as Crown Castle (which owns and leases telecoms towers in the US). The advent of 5G will underpin the expansion of such businesses as the shorter wavelength requires more towers. This is a large company with substantial equity. Crown Castle shares are close to their all-time high. The portfolio has more exposure to this area, through debt issued by Arquiva, a UK telecom tower business, for example.

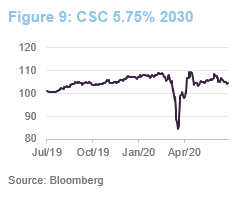

Similarly, the managers like the strong cashflows of digital and cable media businesses such as Comcast, Virgin Media, iHeartCommunications (formerly Clear Channel) and two of the new names that have appeared in the list – CSC and Altice France. One other new entrant to the top 10 was TransDigm. The portfolio has had exposures to each of these issuers for a while.

CSC Holdings

CSC Holdings

CSC Holdings is better known as Altice USA (www.alticeusa.com), an American cable television and broadband internet company. It serves 4.9m residential and business customers across 21 US States. Its customer-facing brands include Optimum, Suddenlink, Altice Mobile, Altice Business, A4, Cheddar, News12 Networks and i24NEWS. Altice USA is listed on the New York Stock Exchange (ticker: ATUS). It was spun out of Altice NV (a Dutch company) in 2018. Altice USA reported revenue of $9.8bn for 2019 and EBITDA margin of 43.7%, considerably in excess of capex.

Altice France

Altice France

Altice NV was then renamed Altice Europe. Altice France is a 100% subsidiary of Altice Europe. Its operations include SFR, France’s second-largest mobile telecoms provider (23m customers), which is starting to roll out its 5G network. It also owns the media brands BFM and RMC. Altice France had revenue of €10.8bn in 2019.

TransDigm

TransDigm

TransDigm (www.transdigm.com) is a designer, producer and supplier of components to the commercial and military aerospace sectors. It is listed on the New York Stock Exchange (ticker: TDG). It has a high degree of recurring revenue (about 55% of revenue is accounted for by aftermarket sales). For the quarter to the end of March 2020, its revenue and EBITDA were up 23.5% and 19.3%, respectively. TransDigm has acknowledged that COVID-19 will have a significant adverse impact on the revenue from its commercial aviation business and has been cutting overheads aggressively. It had cash on hand of $2.7bn at the end of March and raised a further $1.5bn in April, including $400m of 6.25% Senior Secured Notes due 2026.

Nationwide – the managers’ favourite financial institution

Nationwide – the managers’ favourite financial institution

Nationwide is the best financial institution in the UK in the opinion of the managers. They like the conservative way that the business is managed. Nationwide, whose debt book is all mortgages, has a core Tier 1 ratio of 32%, a multiple of those of the major UK banks that it competes with. The distinct characteristics of Nationwide meant that it was excluded from the dividend suspensions imposed on other financial services businesses by the Bank of England.

Nationwide is mutually owned, but to comply with Basel III rules, it had to have some equity in its balance sheet. In 2013, it issued core cap deferred shares (CCDS). These were largely sold to debt investors and trade like bonds, but are classified as equity for the purposes of the rules.

HDIV is a longstanding holder of the CCDS, which it bought at issue.

Additions to leisure sector exposure

Additions to leisure sector exposure

Although spared the worst of the carnage in the energy and transportation sectors, HDIV’s portfolio already had some exposure to the leisure sector, which has also been impacted severely by lockdown measures, notably gaming and live entertainment (through Live Nation).

Boyd Gaming featured in the list of the 10-largest exposures to individual issuers when we last published and has since dropped out, although HDIV still has some exposure. Boyd Gaming raised $500m recently through the issue of 8.625% senior notes dated 2025.

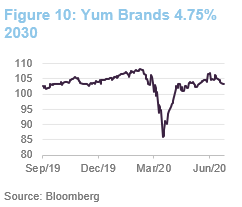

In March, the managers bought Yum Brands 4.75% bonds due in 2030. Yum is the owner of the KFC, Pizza Hut and Taco Bell restaurant brands. Lockdown measures had a severe impact on its business. However, the managers reasoned that Yum’s cash-generative, franchise-based business model made it more resilient, lockdown measures were not affecting every territory to which it was exposed and an increase in takeaway business and the resilience of drive-thru would cushion the blow. Early in April Yum boosted its liquidity position with the issue of $600m of a five-year senior note with a coupon of 7.75%.

The portfolio also has exposure to bonds issued by McDonalds and Restaurant Brands International (Burger King, Tim Hortons and Popeyes), the latter being a new name in the portfolio.

Centre Parcs (CPUK Finance), held in the portfolio ahead of the crisis, was forced to close its doors during lockdown but was able to raise additional funding, helped by a large equity cushion. Another company in the same position was theme park operator Merlin Entertainments (operator of a number of sites including Legoland, Madame Tussauds and Warwick Castle). It raised $500m recently in the form of 5.75% bonds due 2026. HDIV added some exposure to this issuer.

One more name that has been added to the portfolio is the cruise line operator, Carnival Corp. The pandemic has had a huge effect on its industry. Early in April, Carnival issued $4bn of new secured bonds with a yield close to 12%. The managers decided that the yield justified the risk, for what had been an investment grade credit, and bought a small position.

Performance

Performance

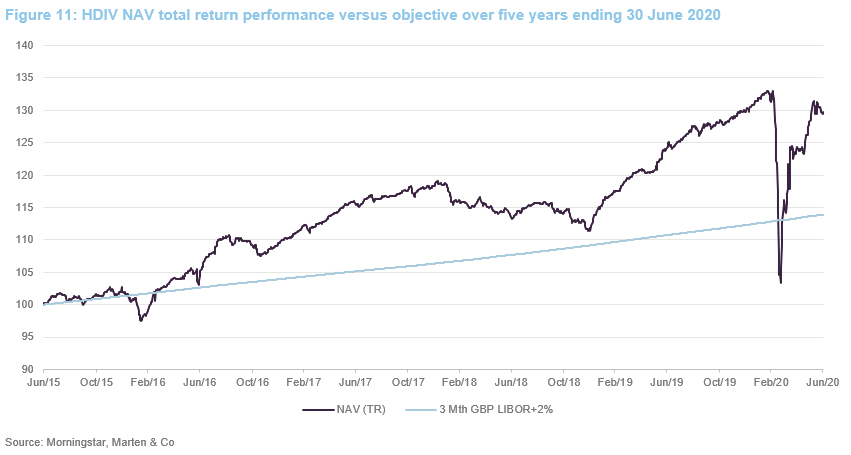

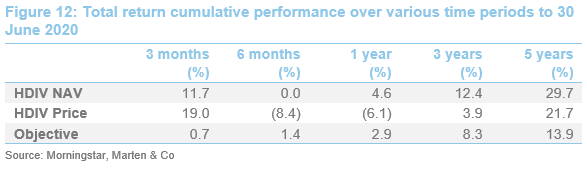

March’s sell-off was dramatic but the recovery in HDIV’s performance was swift. HDIV’s returns continue to be well-ahead of those of the performance objective.

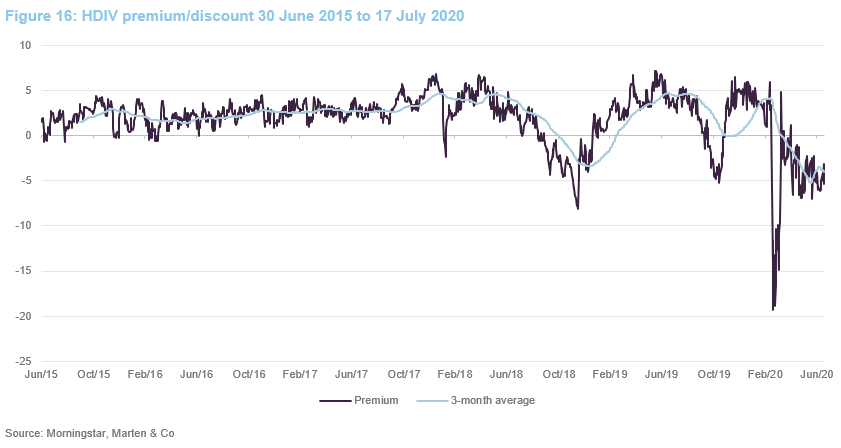

HDIV’s avoidance of challenged business models, commodities and over-leveraged companies has driven its relatively strong performance. The portfolio has not been immune to the widening of credit spreads, however. More markedly, the shares have moved from trading at a premium to a modest discount. As we discuss later, we feel this to be unjustified.

Peer group

Peer group

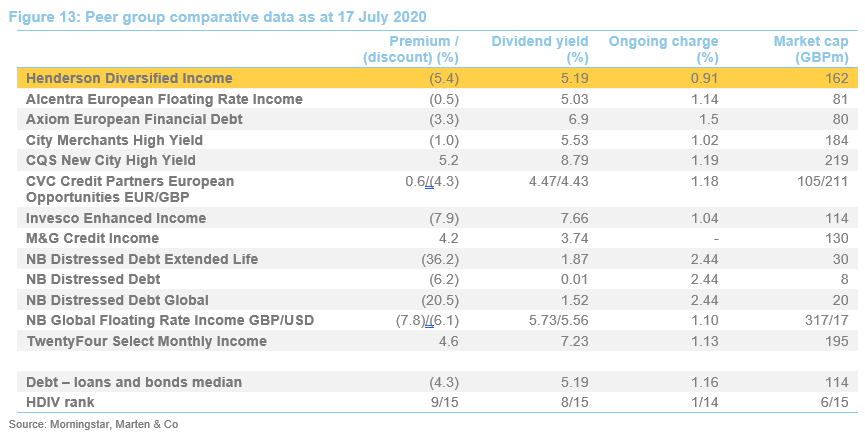

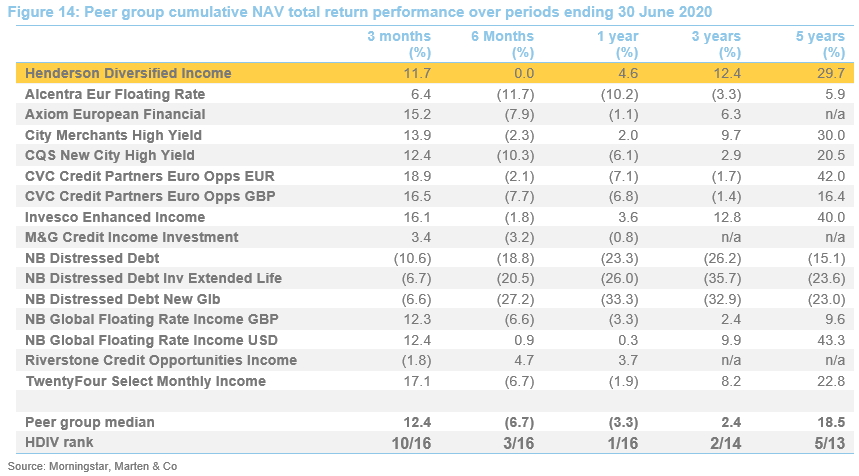

HDIV sits within the AIC’s debt – loans and bonds sector. The peer group has 13 constituents but two of these have two separate currency classes. There are some differences in approach that should be borne in mind when comparing the companies. Since we last published on HDIV, Riverstone Credit Opportunities has been reclassified from this sector to the direct lending sector.

HDIV’s managers believe that their focus on debt owed by high-quality, growing companies helps separate them from the rest of their peer group and from the vast bulk of debt funds, globally.

The three NB Distressed Debt portfolios operate in a distinct sector of the loans and bond market. Alcentra, Axiom and CVC restrict themselves to European debt, while HDIV takes advantage of what its managers see as a wider choice of higher-quality credits offered by the US market.

HDIV’s discount, while not excessive in absolute terms, appears anomalously wide, especially given HDIV’s strong performance over the past year and its focus on quality at a time when many borrowers are facing acute challenges.

In an environment where investors are increasingly fixated on fees, HDIV offers the lowest ongoing charges ratio of any fund in this peer group. HDIV is the sixth-largest fund in this group, but it has ample scope to expand.

HDIV’s long-term performance is respectable against this peer group, but particularly impressive over the past year and it leads the sector over one year and is second over three years.

Quarterly dividend

Quarterly dividend

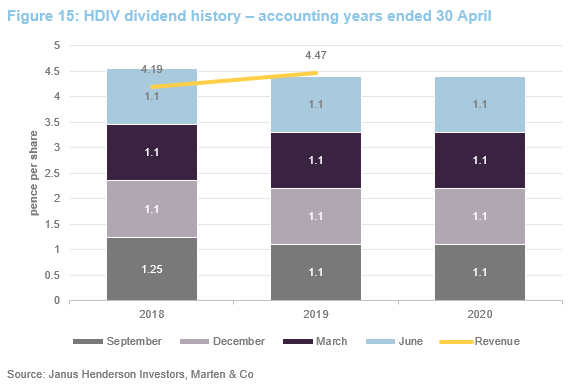

HDIV pays quarterly dividends in March, June, September and December. The rebasing of HDIV’s dividend to 1.1 pence per quarter was the main topic of our November 2017 note. The low yields available in the market left the managers with a stark choice between cutting the dividend or raising the risk profile of the fund (at an increased risk of a permanent loss of capital). They chose the former route.

Against dividends totalling 4.4p, the revenue per share for the accounting year ended 30 April 2019 was 4.47p (up from 4.19p for the prior year). The revenue reserve stood at £2.3m at the end of April 2019 – enough to cover one quarter’s dividend. Revenue per share for the six months ended 31 October 2019 was 2.16p.

Premium

Premium

The COVID-19-related panic in markets that occurred in March caused a brief spike in the discount. In recent months, despite its strong relative performance and attractive yield, HDIV’s discount has widened again. Whilst some nervousness might have been expected in the general market panic, we see nothing that would justify the persistence of the discount today.

Over the year ended 30 June 2020, the shares ranged between a 19.3% discount and a 6.6% premium and averaged a 0.3% premium. On 17 July 2020, the trust was trading at a discount of 5.4%.

Each year, the directors ask shareholders for permission to allot new shares and buyback existing ones. At the AGM on 3 September 2019, shareholders approved the issuance of up to 10% of HDIV’s then issued share capital (18,961,824 shares) and the repurchase of up to 14.99% of its then-issued share capital (28,423,774 shares). HDIV may hold repurchased shares in treasury and re-issue them at a later date. Shares will only be issued at a premium to asset value.

In response to demand from investors, over the course of January 2020, HDIV issued 1m shares and it issued a further 700,000 shares in February.

Fund profile

Fund profile

Henderson Diversified Income Trust (HDIV) invests selectively across the full spectrum of fixed-income asset classes, including – but not limited to – secured loans; government bonds; asset-backed securities; investment-grade corporate bonds; high-yield corporate bonds; unrated bonds; preference and selective high-yield equity shares; hybrid securities; convertible bonds; and floating-rate notes.

Its objective is to seek income and capital growth such that, on a rolling annual basis, the total return on the NAV exceeds three-month sterling LIBOR plus 2%. It has a global mandate and the managers use gearing to enhance returns. The company was redomiciled to the UK from Jersey with effect from 27 April 2017.

The managers

The managers

Henderson Investment Funds Limited is HDIV’s AIFM and Henderson Global Investors Limited (Henderson) is the delegated investment manager. Parent company, Janus Henderson Investors had around £237bn of AUM at the end of March 2020. The named fund managers for HDIV are John Pattullo and Jenna Barnard. They have been managing the fund since it was launched in 2007, and have been working together at Henderson since 2002. They are part of a six-strong Strategic Fixed Income team, including Nicholas Ware, who has been working closely with John and Jenna on HDIV since he joined the team in 2012. They are supported by Janus Henderson’s wider fixed-income team and its seven-strong specialist secured-loan team. Responsibility for the selection of suitable secured loans is delegated to the specialist secured-loan team, led by David Millward.

Previous publications

Previous publications

Readers interested in further information about HDIV may wish to read our last note, which was published on 28 November 2019, as well as our previous notes:

Onshore, on-message, on-form, initiation note, published May 2017

Dear Prudence, update note, published November 2017

Winter is coming, annual overview, published October 2018

Death rattle for bull market, update note, published April 2019

Soft landing likely…, annual overview, published November 2019

The legal bit

The legal bit

This marketing communication has been prepared for Henderson Diversified Income Trust by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.