Grounds for optimism

Last year, as COVID-19-related panic took hold of markets, Henderson Diversified Income’s (HDIV’s) managers increased HDIV’s exposure to the market by borrowing money to invest and increasing the trust’s holdings of credit derivatives (see page 8 for an explanation). This enabled the trust to pick up some bargains and lock in an attractive income stream.

The discovery of a number of vaccines for COVID-19 has since injected hope into markets and triggered a sharp recovery in stock and bond prices for many struggling companies. However, the managers think that this relief for structurally challenged companies will likely prove temporary.

HDIV’s focus on high-quality companies with sustainable business models may have held it back relative to its peers in the very short term. However, as 2021 progresses, we anticipate that reality will set in, while HDIV will continue to build upon its long-term record of outperformance. The discount may reflect a buying opportunity.

High income from a flexible fixed income portfolio

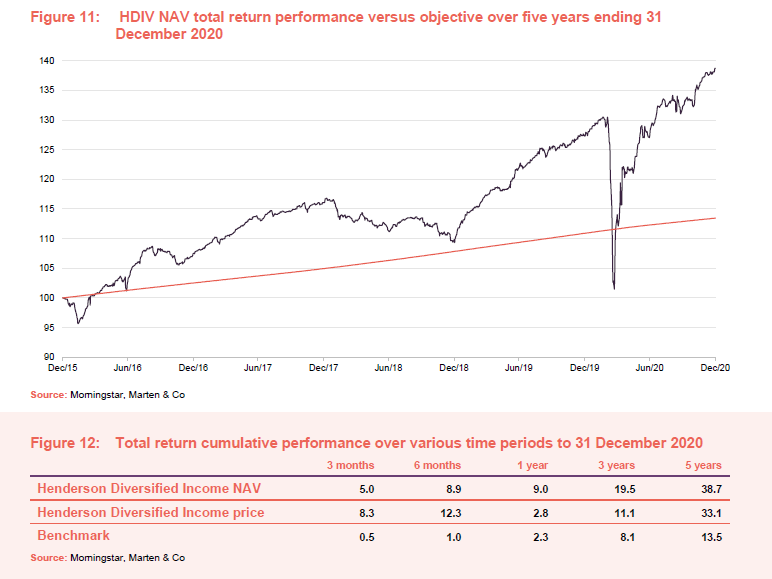

HDIV’s objective is to seek income and capital growth such that, on a rolling annual basis, the total return on the NAV exceeds three-month sterling LIBOR plus 2%. It invests in a diversified portfolio of global assets including secured loans, government bonds, high-yield (sub-investment grade) corporate bonds, unrated corporate bonds, investment grade corporate bonds and asset-backed securities.

The trust may also invest in high-yielding equities and derivatives. The managers use gearing (borrowing and synthetic – see page 8) to enhance returns.

Dividends, which make up the bulk of returns for investors, are paid quarterly.

Fund profile

Henderson Diversified Income Trust (HDIV) invests selectively across the full spectrum of fixed-income asset classes, including – but not limited to – secured loans; government bonds; asset-backed securities; investment-grade corporate bonds; high-yield corporate bonds; unrated bonds; preference and selective high-yield equity shares; hybrid securities; convertible bonds; and floating-rate notes.

Its objective is to seek income and capital growth such that, on a rolling annual basis, the total return on the NAV exceeds three-month sterling LIBOR plus 2% (but see below). It has a global mandate and the managers use gearing (borrowing and synthetic – see page 8) to enhance returns. The company was redomiciled to the UK from Jersey with effect from 27 April 2017.

The managers

Henderson Investment Funds Limited is HDIV’s AIFM and Henderson Global Investors Limited (Henderson) is the delegated investment manager. Parent company Janus Henderson Investors had $358.3bn of assets under management at the end of September 2020. The named fund managers for HDIV are John Pattullo and Jenna Barnard. They have been managing the fund since it was launched in 2007, and have been working together at Henderson since 2002. John and Jenna are part of a six-strong Strategic Fixed Income team, including Nicholas Ware, who has been working closely with them on HDIV since he joined the team in 2012. They are supported by Janus Henderson’s wider fixed-income team and its seven-strong specialist secured-loan team. Responsibility for the selection of suitable secured loans is delegated to the specialist secured-loan team, led by David Millward.

More rigorous benchmark proposed

In HDIV’s interim report published 8 December 2020, the chairman outlined proposals for a new performance benchmark to replace HDIV’s current three-month sterling LIBOR+2% target. The board feels that the present benchmark does not reflect the risks and rewards of investing in bonds and other instruments across the cycle. It proposes the adoption of a benchmark comprised of 60% global high yield credit (represented by the ICE BofA Global High Yield Constrained Index), 25% global investment grade corporate credit (represented by the ICE BofA Global BBB Corporate Bond Index) and 15% European loans (represented by the Credit Suisse Western European Leveraged Loan Index). Returns will be calculated in sterling.

The report included a comparison of returns on the new versus the old benchmark. Over 10 years, the returns on the replacement benchmark would have been 43.5 percentage points higher than the existing benchmark. HDIV would have outperformed over most time periods; although it would have lagged over the six months ended 31 October 2020 for the reasons discussed on page 5.

Shareholders will be asked to approve this proposal at the next AGM (which will likely be held in September this year).

Market background

In our last note, published in July 2020, it was already evident that the managers’ focus on credit issued by companies with sustainable business models had allowed HDIV to escape the worst of the problems created by the pandemic. The trust was not exposed to airlines, high street retailers and oil and gas companies, for example.

The actions that the managers took, aided by HDIV’s closed-end structure, to gear up the portfolio and buy decent quality bonds at bargain prices helped the trust’s performance as investors’ initial panic subsided. It was also an opportunity to lock in additional income to support the trust’s revenue account, giving the managers’ confidence in HDIV’s ability to sustain its dividend for the next couple of years at least.

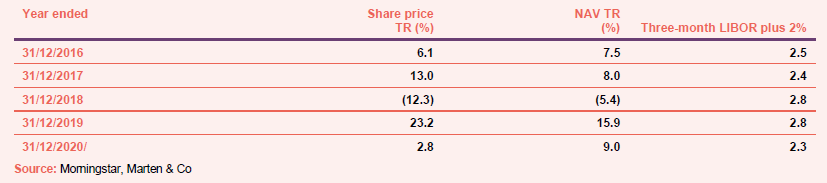

The investment grade bonds that they were able to buy rallied fairly quickly. Issues from the likes of HSBC and Disney that were added close to the bottom of markets had been traded out at a profit by the summer. The proceeds were reinvested into higher-yielding names.

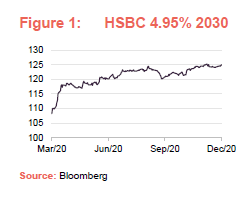

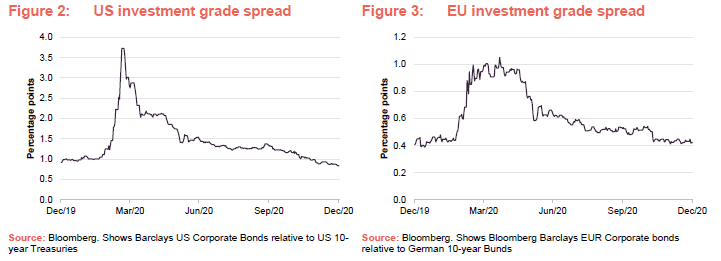

Investment grade spreads (the gap between yields on bonds rated as investment grade and yields on equivalent government bonds) have continued to tighten and are now close to their level at the start of 2020. Figure 2 shows the spread between US corporate bonds and 10-year Treasuries, Figure 3 shows the gap between Euro corporate bonds and German Bunds.

The managers feel that the discovery of a number of vaccines to protect against COVID-19 is clearly good news for markets, but in the short term this has triggered a surge in ‘value’ style names (bonds issued by the sorts of companies that a value-style equity manager would buy). They do not feel that this will persist; rather, business fundamentals will reassert themselves in time.

In the US, Joe Biden’s election win, coupled with a failure (so far, at least) for the Democrats to secure control of both Houses of Congress, is also good news in the managers’ view. A clean sweep might have heightened the risk of big spending programmes and higher taxation.

‘Japanification’

The managers liken the policy response to the crisis to putting the economy on a war footing. Rates were slashed, quantitative easing rekindled and significant fiscal stimulus injected into the global economy. This was a necessary move to avoid a prolonged economic slump.

Even without COVID-19, in retrospect, the US Federal Reserve’s attempts to raise interest rates in 2019 were a clear mistake. The actions that it took in March fixed the liquidity shortages that had threatened to derail markets. The central bank backstopped the market by buying corporate debt and bond ETFs.

This was not a repeat of 2008, when the survival of many banks was called into question. This crisis was one of liquidity not solvency. Banks were well capitalised, as we discuss later. Effectively, the Federal Reserve provided bridge financing to the economy. Even companies with severely impacted business models, such as Carnival Cruises and cinema chain AMC, were able to refinance their debt, albeit at higher than normal yields. (HDIV did not back the AMC issue; the managers believe that its business model is threatened by the rise of streaming services such as Netflix.)

Central bank balance sheets have ballooned, but the managers think that this just entrenches the low growth, low inflation, low return ‘Japanification’ of the global economy. Just as Japan has struggled with for decades, most developed countries now have substantial government debt burdens that are sustainable only as long as interest rates stay low. Modest inflation may relieve the pressure in time; some of the stimulus has been funded by printing money. Real yields (yields after adjusting for inflation) on government debt are negative now – investors know they will lose money by buying these bonds after adjusting for inflation, yet they do it anyway – and may stay that way for some time.

Defaults were manageable (especially for HDIV)

In an environment where equity income investors were faced with substantial dividend cuts, income from bonds proved much more reliable.

The managers’ investment style meant that the trust was not exposed to many of the sectors hit hardest by the pandemic, such as energy, airlines and retail. This is where defaults have been concentrated.

As markets panicked in March last year, credit rating agency Moodys was predicting that the default rate would hit 14%. The managers strongly disagreed with this. They placed more reliance on bottom-up analysis by analysts at JP Morgan, for example, that suggested that default rates would peak around 6% and fall off quite rapidly to around 3.5% for US high yield bonds and 3.0% for European high yield bonds by 2021. This gave them the confidence to gear up HDIV’s portfolio. You can see how this was achieved on page 8.

Quite a few companies that failed early on in the crisis were teetering on the edge beforehand. One such example is Intelsat, which filed for Chapter 11 in May. The spike in defaults that occurred in the period from April to June was worse in the US, which had more energy and retail exposure, than in the EU, which also has a higher proportion of BB-rated debt.

Across the market as a whole, recovery rates on defaulted debt (the money that lenders can recover from defaulted debt by selling off the collateral pledged against the loan, for example) are running at low levels, but this is skewed by problem sectors that were already facing long term structural challenges. The managers are expecting a ‘K’-shaped recovery (think of a K lying on its side) – where growing, high-quality businesses recover quite quickly but sectors in decline stay in the doldrums for some time yet. HDIV’s portfolio is focused on the former.

Investment process – unusually sensible

The managers are responsible for the portfolio’s asset allocation and have the freedom to invest across the whole spectrum of debt markets. However, unlike the vast majority of professional credit investors, the managers have adopted an investment style which emphasises an analysis of the long-term sustainability of the business that is borrowing the money.

The large credit investors tend to have teams of analysts covering the whole market, invest in line with the index and, subject to their credit analysis, buy whatever is being issued without a filter.

However, HDIV’s managers actively avoid issuers operating in commoditised and declining/strategically challenged industries, those with cyclical and operational leverage and issuers heavily exposed to emerging markets. This means that around half of the high-yield market and a third of the investment grade market is un-investable in their view.

They are influenced by the thinking of people like the fund manager Terry Smith and Aswath Damodaran (of NYU Stern), who emphasise cash generation over profitability, returns on capital employed, and backing businesses in sectors delivering secular growth.

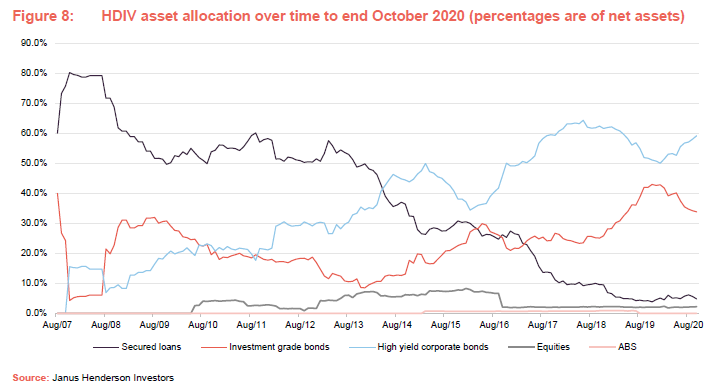

Theoretically, the portfolio will be biased to fixed income when rates are high, at the top of the interest-rate cycle, and secured loans towards the bottom of the interest-rate cycle. In practice, rates fell sharply early in the fund’s life and have not recovered. This has had an impact on portfolio construction ever since.

Emphasis on capital preservation

The emphasis of the team is on preserving capital as well as generating attractive income returns. That means focusing on the quality of credit, security and collateral. Chasing yield by investing in poor-quality credits may appear to be an attractive strategy in the good times, but these can be difficult to trade out of when the market turns – sometimes there is nobody looking to buy at any price.

The portfolio is weighted towards defensive businesses that can cope with low economic growth rates and away from investments that might be described as ‘value traps’ – companies with declining business models, no pricing power and excessive borrowings.

The managers will look to exploit mispricing opportunities when they arise, switching between junior and senior tranches of debt in the same issuer, for instance – senior tranches get repaid first.

Proprietary, fundamental credit analysis

The management team carries out proprietary fundamental credit analysis with the aim of preserving capital by minimising default losses.

The managers’ focus is on identifying good-quality credit and exploiting opportunities for carry, given the spreads available over HDIV’s borrowing costs.

Indices play no part in informing portfolio construction. The US offers the deepest markets, but this is not a factor in determining HDIV’s asset allocation. The managers are firmly of the view that bond markets need stock pickers. Passive investment in bond markets – through bond ETFs, for example – results in having your largest exposures to the biggest borrowers, and this is not a recipe for success.

Risk management

Non-sterling assets are hedged back to sterling using rolling, forward foreign currency contracts.

The managers emphasise the importance of a strong sell discipline, saying that avoiding the worst-performing bonds is key to performance. They also point out that towards the end of the cycle in bonds, rates are squeezed and covenants eased, debt is issued to fund mergers and acquisitions at the top of the market; and balance sheets are stretched thin through buybacks and special dividends. The managers try to avoid ‘investing with the crowd’ in these situations. Areas that they consider to be riskier include emerging market debt and the energy, mining, materials, automotive and shipping sectors. Wherever possible, they like to keep the portfolio invested in ‘vanilla’, lower-risk and liquid debt.

ESG – environmental, social and governance – issues

Increasingly, the managers are incorporating ESG criteria into their decision-making process. The conscious bias away from highly cyclical sectors helps avoid some of the worst offenders on the environmental front, but the managers also have a list of companies that they will not invest in on social and governance grounds.

Investment restrictions

HDIV invests in unlimited amounts of secured loans, government bonds, and investment-grade and high-yield bonds. Up to 10% may be invested in unrated corporate bonds; up to 40% may be invested in asset-backed securities; and up to 10% may be invested in high-yielding equities. No more than 10% of the fund will be invested in any one issuer.

Derivatives

Gearing is used to arbitrage between the cost of debt and the yields available from investments. HDIV can also boost its income through investment in credit default swaps (CDS). These are used to provide gearing to the portfolio alongside the trust’s borrowing facilities (see page 18).

The managers can use derivatives (CDS, interest-rate futures and swaps) in the management of the portfolio – it lets them manage exposures without buying or selling the underlying securities. Exposure to credit derivatives (synthetic gearing) is capped at 40% of net assets and the combination of synthetic gearing and more traditional gearing is also capped at 40% of net assets. Forward currency contracts are used to hedge foreign currency exposures.

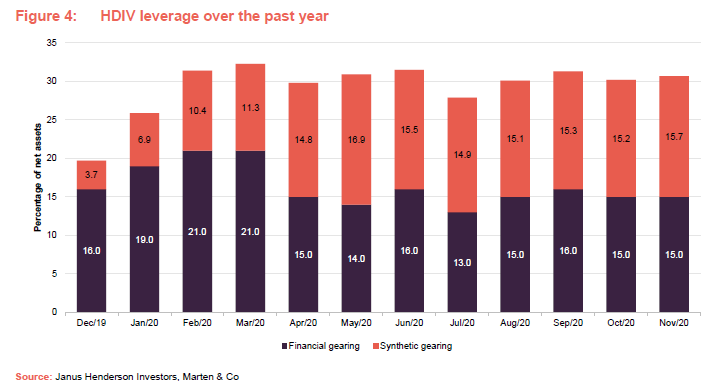

Leverage was ramped up in the general market panic, hitting 31.4% at the end of March 2020. At those levels, there is a substantial contribution to revenue coming from the margin between the cost of borrowing and coupons (interest payments) from the portfolio. This should be helping to build HDIV’s revenue reserves.

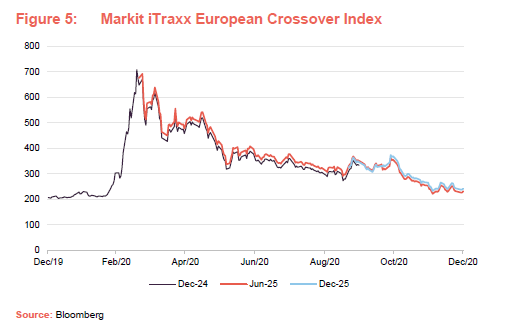

Initially, the managers raised HDIV’s financial gearing but from April onwards an increasing proportion of the gearing was synthetic. The managers were shorting the Markit iTraxx European Crossover Index (i.e. were long synthetic credit risk). This index comprises 75 equally weighted credit default swaps on the most liquid sub-investment grade European corporate entities. The index rolls every six months in March and September.

Asset allocation

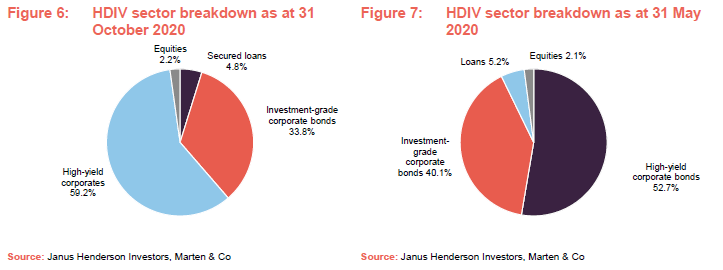

The major change in the asset allocation since we last published is the reduction in the exposure to investment grade bonds, as the managers booked profits on the positions that they had taken in February and March, and the redeployment of that cash into high-yield bonds.

Figure 8 shows how HDIV’s asset allocation has evolved since its launch in 2007 and illustrates the dramatic reduction in secured loans and the corresponding increase in exposure to high-yield bonds.

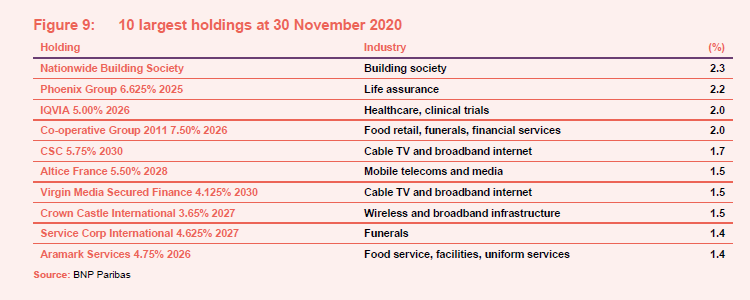

10 largest exposures to individual issuers

There are no changes of note to HDIV’s list of the 10-largest holdings, since we last published. Since the end of June 2020, TransDigm has fallen out of the list, to be replaced by Virgin Media. The former is still held within the portfolio.

Virgin Media will be loved or loathed by those readers who are its customers, depending on the quality and reliability of your broadband connection. It forms part of the Liberty Global group of businesses, which also includes Ziggo, a similar business in the Netherlands (HDIV also owns Ziggo bonds).

The managers like the predictable stable cashflows generated by these sorts of businesses, which is why they feature so highly within the portfolio.

Service Corporation International (sci-corp.com) is North America’s leading provider of funeral, cremation and cemetery services. It used to own Dignity in the UK, but divested that some time ago. The company’s bonds have been a longstanding feature of HDIV’s portfolio and, sadly, the US’s mishandling of COVID-19 has been beneficial for its business.

New additions to the portfolio

The managers highlight a few new additions to the portfolio which illustrate their approach of backing companies whose business models pass muster rather than chasing high coupons. These include Verisure, Avantor, Iron Mountain and Black Knight.

Verisure

Verisure is the brand name for Securitas Direct’s consumer-facing alarms business. The business was bought out by private equity firms Bain Capital and Hellman and Friedman in 2011. Hellman & Friedman then became the majority shareholder in 2015. The company operates across Europe and South America. The managers say that the business has been growing despite the crisis. It has long-term contracts with its customers and high recurring revenue.

Avantor

Avantor Inc (avantorsciences.com) is a $16.3bn market cap listed US company supplying products and services to customers in the biopharma, healthcare, education & government, and advanced technologies & applied materials industries. The fight against COVID-19 has been beneficial to its business as it supplies firms providing testing, treatments and developing vaccines.

It operates across 180 countries and about 85% of its revenues are recurring. Its numbers for the third quarter of 2020 showed free cash-flow of $266m, up 44% over the equivalent period in 2019, and adjusted net leverage (net debt as a multiple of EBITDA) of 4.2x – it is targeting a long-term range between 2x and 4x.

Iron Mountain

Iron Mountain (investors.ironmountain.com) is an $8.5bn market cap document storage and data centre company. It operates from over 90m sq ft of space (about 30% of which it owns) across 1,450 facilities in 50 countries. It has been expanding its margins by extracting costs from its business. COVID has meant that revenue and EBITDA have been flat recently but the company is still highly cash-generative. Net lease-adjusted leverage was about 5.3x at the end of September 2020, within its long-term target range of 4.5x – 5.5x.

Black Knight

Black Knight (investor.blackknightinc.com) is a $13.9bn software company serving mortgage and real estate businesses in the US. The managers say that it has ‘sticky’ revenues (once integrated into a company’s systems, switching software is hard and expensive). The company’s leverage is about 3.6x but it owns a significant stake in Dun and Bradstreet which, if monetised, would allow it to pay off about half of its outstanding debt.

Banks – adding to COCOs (contingent capital bonds)

In the view of the managers, banks look to have over-provisioned against defaults on average. The actions of central banks and governments have helped many businesses stave off bankruptcy. In addition, regulatory constraints forced banks to rebuild their balance sheets since the credit crunch of 2008. Consequently, banks restricted their lending, and the slack was taken up by the high-yield market and alternative lenders. Banks are not heavily exposed to some of the worst-hit companies.

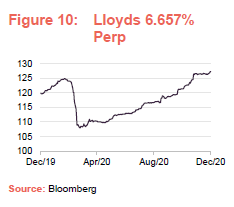

The managers see an opportunity in contingent capital bonds issued by a range of European banks, including Lloyds, Barclays, NatWest, UBS, Credit Suisse and ING. They have also added exposure to some insurance companies.

The managers note that Swiss regulation has been particularly tough, as a result their banks have a lot of capital.

Performance

In the depths of the market panic in February/March 2020 selling was indiscriminate. However, as the dust settled, it became clear that HDIV’s portfolio had fared relatively well. At the end of March, HDIV had just 4.84% of its portfolio in bonds trading at stressed levels (83 cents in the dollar/euro or lower). That compared to 16.69% of all US high-yield bonds and 24.09% of European high yield.

By October, most of HDIV’s stressed bond positions had rallied. The remainder of these were sold: the managers sold about 1% of the portfolio in anticipation of a second wave of the virus. As noted on page 5, announcements about vaccines have triggered a resurgence in the equity and bond prices of more challenged companies. HDIV, with its quality bias, has lagged some of its peers in this environment. The managers are unworried. They feel that COVID-19 has accelerated the disruption of certain industries and, over the long term, a focus on sustainable business models will serve the fund better than chasing short-term returns.

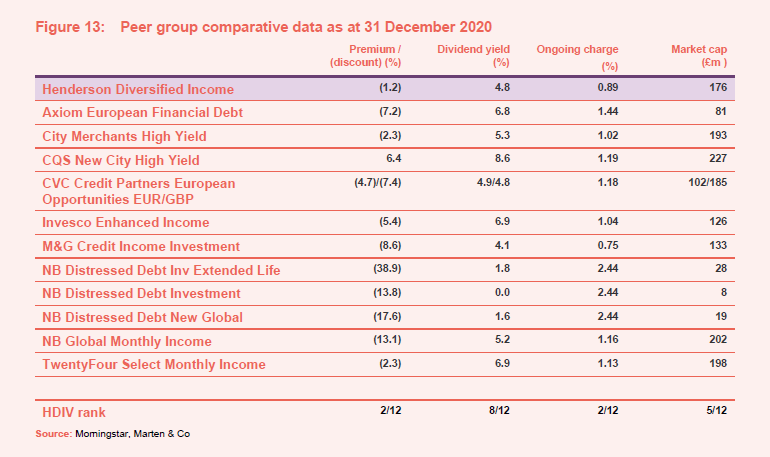

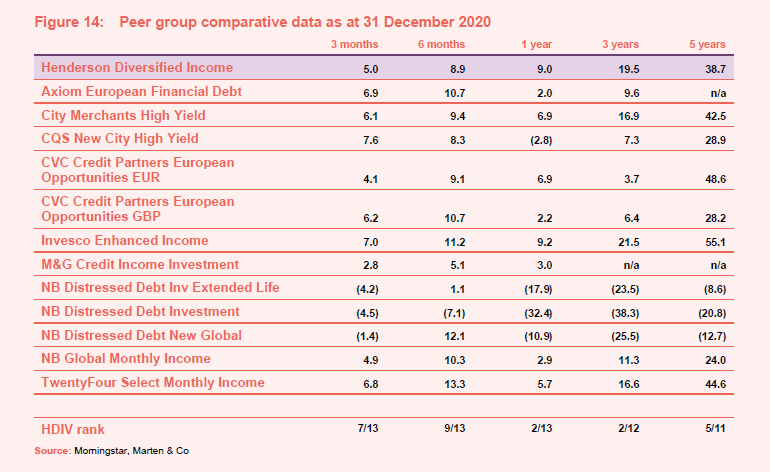

Peer group

HDIV is a constituent of the AIC’s debt – loans and bonds sector, and we have used this as a comparator. Since we last published on HDIV, Alcentra European Floating Rate Income has been put into liquidation and NB Global Floating Rate Income has become NB Global Monthly Income.

The funds within the debt – loans and bonds sector encompass a variety of investment objectives and strategies not all of which compare well with HDIV’s investment strategy.

HDIV’s discount has tightened up recently, reflecting perhaps the strength of its long-term returns. Its yield is less aggressive than some of the other funds in its peer group and this is a factor of the managers’ focus on quality rather than yield within the portfolio. HDIV’s ongoing charges are competitive, particularly for a fund of its size.

In recent weeks, HDIV has lagged some other funds within its peer group. The rally in lower quality issues that we discussed on page 5 might be the cause of this. Nevertheless, over the longer term, HDIV’s focus on credit issued by companies with sustainable business models has worked well. Quarterly dividend

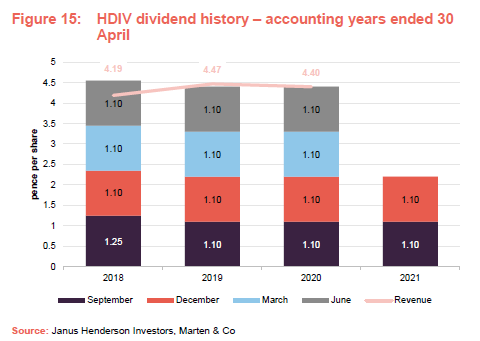

HDIV’s accounting years end on 30 April, and it pays quarterly dividends in September, December, March and June. The rebasing of HDIV’s dividend to 1.1 pence per quarter, which took effect for payments made in December 2017, was the main topic of our November 2017 note. The low yields available in the market left the managers with a stark choice between cutting the dividend or raising the risk profile of the fund (at an increased risk of a permanent loss of capital). They chose the former route, which has served the fund well.

Against dividends totalling 4.4p for the year ended 30 April 2020, the revenue per share was also 4.40p (down from 4.47p for the prior year). The revenue reserve stood at £2.3m at the end of April 2020 – enough to cover one quarter’s dividend.

The managers say that, whilst not seeking to forecast the trust’s financial results for the current year, the actions that they took in Spring 2020 to increase the trust’s gearing and lock in attractive yields should help ensure that the dividend is covered by earnings this year, allowing it to increase its revenue reserve.

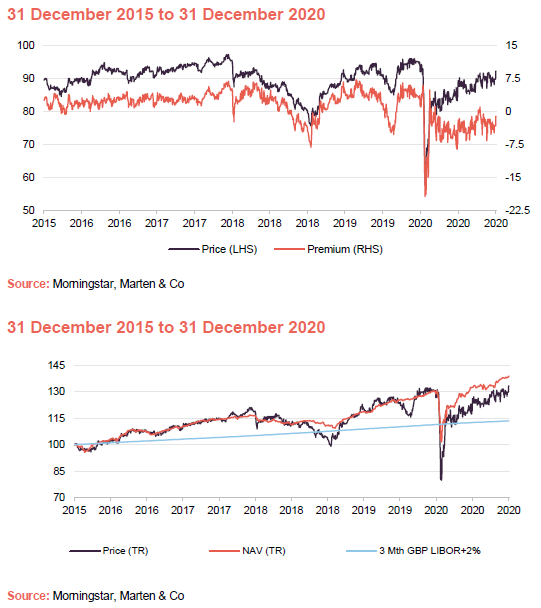

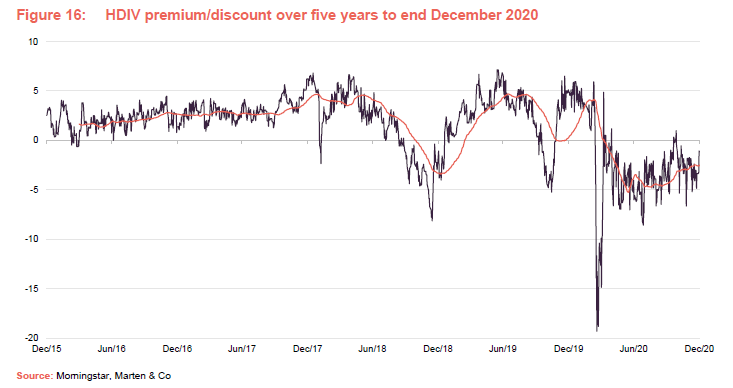

Premium/(discount)

Over the year ended 31 December 2020, HDIV’s discount moved within a range of a discount of 19.3% (as markets panicked in March on COVID-19 fears) to a premium of 6.0% and averaged 2.5%. At 4 January 2021, HDIV was trading at a discount of 0.3%.

Following the general market panic in March 2020, it has taken some time for HDIV’s share rating to settle down, but it is now trading close to asset value. We think the trust’s long-term performance record and the actions that the managers took to gear up close to the bottom of the market mean that HDIV should return to trading at a premium.

Each year, the directors ask shareholders for permission to allot new shares and buyback existing ones. At the AGM on 15 September 2020, shareholders approved the issuance of up to 10% of HDIV’s then-issued share capital (19,131,824 shares) and the repurchase of up to 14.99% of its then-issued share capital (28,678,604 shares). No shares have been issued or repurchased since.

Should it repurchase shares, HDIV may hold these in treasury and re-issue them at a later date. Shares will only be issued at a premium to asset value.

Fees and costs

Janus Henderson provides HDIV with investment management, accounting, administrative and company secretarial services. BNP has been subcontracted by Janus Henderson to provide the accounting and administration services. HDIV pays Janus Henderson a fee of 0.65% of net assets (calculated and paid quarterly in arrears). There is no performance fee.

The trust also makes a contribution to the manager’s marketing expenses. The contract with the managers can be terminated on six months’ notice.

The only other expenses of note in the year ended 30 April 2020 were the directors’ fees (see below) and the auditor’s remuneration of £45,000. The ongoing charges ratio for the year ended 30 April 2020 was 0.89%, unchanged from the year before. As noted on page 14, this is one of the lowest of any fund in HDIV’s peer group.

The trust’s management expenses are charged 50% against capital and 50% against revenue. All other expenses are charged against revenue.

Capital structure and life

HDIV has 191,318,240 shares in issue and no other classes of security. Gearing is provided through a multicurrency overdraft facility provided by BNP Paribas Securities Services, and through the use of derivatives (synthetic gearing, as described on page 8). HDIV’s year end is 30 April and its AGMs are held in September. It has an unlimited life.

Board

HDIV has five directors, all of whom are non-executive, independent of the manager and who do not sit together on other boards. The board was refreshed when the company moved onshore in 2017, and only two pre-existing directors (the chairman and Ian Wright) were appointed to the new board.

Angus Macpherson

Angus is chief executive of Noble & Company (UK) Limited. He is also a director of Pacific Horizon Investment Trust Plc, a director of Schroder Japan Growth Fund Plc and Southern Pentland Shooting Club Limited, and trustee of The Scottish Policy Foundation. Previously he worked for Merrill Lynch in London, New York, Singapore and Hong Kong, latterly as head of Capital Markets and Financing in Asia. He was also chairman of JP Morgan Elect Plc until January 2018, chairman of the Belhaven Hill School Trust Limited, and a member of the Scottish Government’s Financial Services Advisory Board.

Denise Hadgill

Denise was managing director and head of the UK Product Strategy Group at BlackRock until 2015, and was responsible for delivering the firm’s investment message and economic outlook to an extensive range of UK pension fund and charity trustee boards. Prior to this, she spent 14 years at Schroder Investment Management Limited where she was UK equity fund manager and director responsible for the firm’s relationship with 21 UK pension fund and charity clients with multi-asset portfolios valued at £2 billion.

Win Robbins

Win has extensive investment management experience, having held various senior positions including eight years as director of Credit Suisse Asset Management Limited from 1996 until 2004 and managing director and head of Non-US Fixed Income at Citigroup Asset Management from 2004 to 2006. She is a non-executive director and chairman of the remuneration committee at Polar Capital Holdings Plc. Win is also a non-executive member of the Investment Committee of St. James Place Partnership Plc and an independent trustee of the Institute of Cancer Research Pension Fund. She holds a Diploma in Investment Management from the London Business School, and was formerly a non-executive director of City Merchants High Yield Trust Limited.

Stewart Wood

Stewart Wood has been a Labour member of the House of Lords since 2011 and is a member of its Select Committee on the European Union. He was Shadow Minister without Portfolio and a strategic adviser to Ed Miliband (leading Ed Miliband’s Labour leadership campaign). Prior to that, he was a special advisor to the Chancellor of the Exchequer and led the assessment of the UK’s entry to the euro. He then served as senior special adviser on foreign affairs, culture and media policy, and Northern Ireland between 2007 and 2010.

In 2016, he became the chair of the United Nations Association (UK), was appointed to the board of the Marshall Scholarships Commission, and is a director of the Good Law Project. He has been a Fellow at Magdalen College, Oxford University since 1995, and is Professor of Practice at the Blavatnik School of Government at the University of Oxford.

Ian Wright

Ian is deputy chairman of the Jersey Financial Services Commission, a director of the Jersey Heritable Property Company Limited and a policeman in the Parish of St. Brélade. He is a Chartered Accountant. Previously he was an audit partner in Price Waterhouse and then PricewaterhouseCoopers, including serving as the senior partner of the firm’s international accounting consulting group. A founder member of the IFRS Interpretations Committee, he has also served on professional committees of the ICAEW and FEE. He was also a panel member of the Financial Reporting Review Panel, which is part of the UK Financial Reporting Council. He is resident in Jersey, having previously worked in the Channel Islands, London and Bahrain.

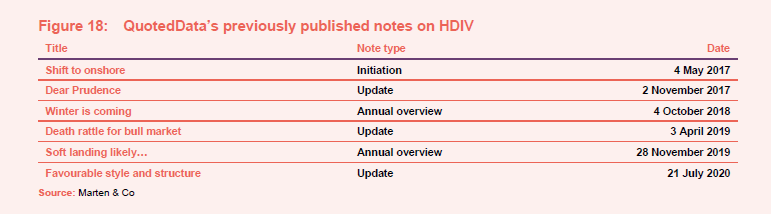

Previous publications

Readers interested in further information about HDIV may wish to read our last note, which was published on 21 July 2020, as well as our previous notes (details are provided in Figure 18 above). You can read the notes by clicking on them in Figure 18 or by visiting our website.

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Henderson Diversified Income Trust plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.