Henderson High Income / Henderson Diversified Income

Investment companies | Flash note | 4 October 2023

Merger terms agreed

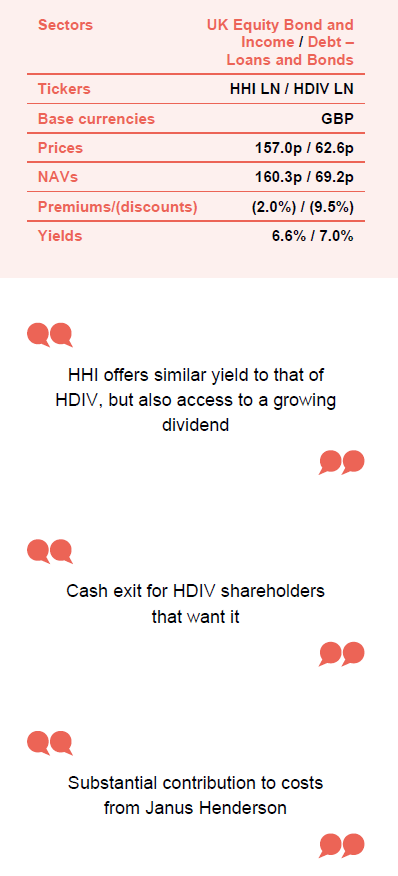

Henderson Diversified Income (HDIV) has agreed heads of terms for a combination with Henderson High Income (HHI). As part of the deal, shareholders in HDIV will have the option to take cash for all or part of their holding if they choose.

In July 2023, HDIV’s chairman noted (see our news story here) that the trust had shrunk through share buybacks, and that this was inflating its average running costs and affecting liquidity in its shares. More importantly, he also made some observations about the fund’s investment approach (devised at launch in 2007) and the impact that this might be having on the sustainability of HDIV’s income and shareholders’ total returns (see page 4).

The HDIV board invited proposals from a number of investment companies with alternative investment processes, and believes that a combination with HHI offers numerous benefits. There are also benefits for HHI shareholders if HHI is able to expand. In addition, as we detail on page 7, Janus Henderson (manager of both trusts) is making a considerable contribution towards the costs of the scheme.

It will be a shame to see HDIV go, but a combination with HHI looks like a sensible option to us. There is little-to-no income dilution for HDIV shareholders, a small immediate capital uplift, and better prospects for capital growth. HHI will still offer some exposure to the higher yields that are now available from bonds, and it should be a bigger, more appealing, more liquid, and more efficient trust.

At a glance

The proposed combination

The combination of HDIV and HHI needs approval from both sets of shareholders if it is to proceed. It would be effected by way of a scheme of reconstruction and winding up of HDIV under section 110 of the Insolvency Act 1986, which is the most common method for merging two UK listed investment companies.

HDIV shareholders will have the option of rolling over their entire investment into HHI (this will be the default option), or electing to take cash in exchange for part or all of their holding.

Formula asset values (FAVs) would be calculated for each trust. For HDIV, this would be the net asset value (NAV) less its respective costs after the contribution from Janus Henderson (see below) of effecting the transaction. For HHI, this would be the NAV plus a 1% premium, less its respective costs after the Janus Henderson contribution.

The ratio of HHI shares that holders of each HDIV share would be entitled to would be calculated on a FAV:FAV basis.

The cash option would be at a discount of 1% to HDIV’s NAV.

All HDIV shareholders, including those electing for the cash option, would be entitled to receive a pre-liquidation interim dividend (equivalent to any net income available after expenses for the current financial year).

Timetable

The current plan:

- Shareholder circulars published in December 2023

- Meetings of each trust held in January 2024

How did we get here?

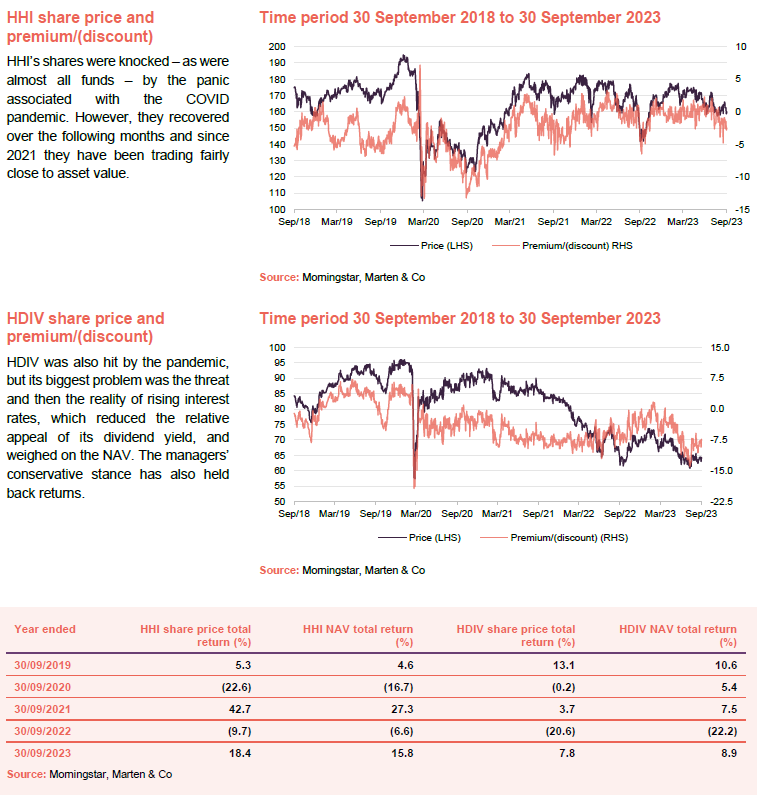

Back in July 2022, when reporting on HDIV’s results for the accounting year ended 30 April 2022, its chairman noted that the trust was established with a view that secured loans would form a significant part of the portfolio, particularly when interest rates rose. It was envisaged that this would help protect shareholders from capital losses in times of rising rates and provide some capital growth when rates were falling.

In the event, as Figure 1 shows, exposure to secured loans has fallen over time as the managers became convinced that the returns on offer did not reflect a deterioration in the credit quality of these loans.

A year later, in July 2023, the chairman reiterated this point, highlighted the challenge of sustaining HDIV’s yield and the risks necessary to achieve that, pointing out that HDIV’s revenue reserves were much diminished (HDIV’s dividend was uncovered by earnings in its financial year that ended on 30 April 2023).

In addition – against a backdrop of rising rates, Liz Truss and Kwasi Kwarteng’s ‘mini-budget’ in the UK in September 2022 (which triggered a big jump in gilt yields), and the managers’ caution on the global economy – HDIV’s NAV total return had been negative for two successive financial years, underperforming its benchmark in each case. The discount had also widened, and share buybacks undertaken to tackle that had shrunk the trust, which has impacted on its ongoing charges ratio and liquidity in trading its shares.

The board concluded that “the structure of the company as originally envisaged does not allow the fund managers to preserve the real value of the capital of its shareholders, and it feels that perhaps an alternative investment process could offer greater scope to provide a more consistent return”.

Benefits of the proposals

The announcement notes a number of benefits for HDIV’s shareholders which we summarise here:

- The unlimited cash exit option at a 1.0% discount to NAV.

- The ability to retain some exposure to HDIV’s managers’ through HHI’s fixed income allocation, while gaining access to the expertise of Janus Henderson’s well-regarded equity income team.

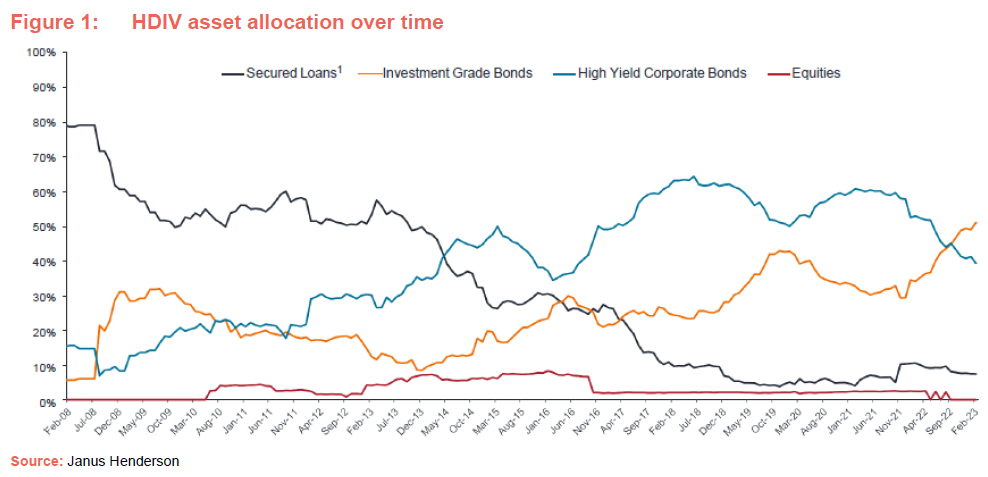

- A potential uplift, given that HHI’s shares have tended to trade at a tighter discount than HDIV’s in recent years – as you can see in Figure 2.

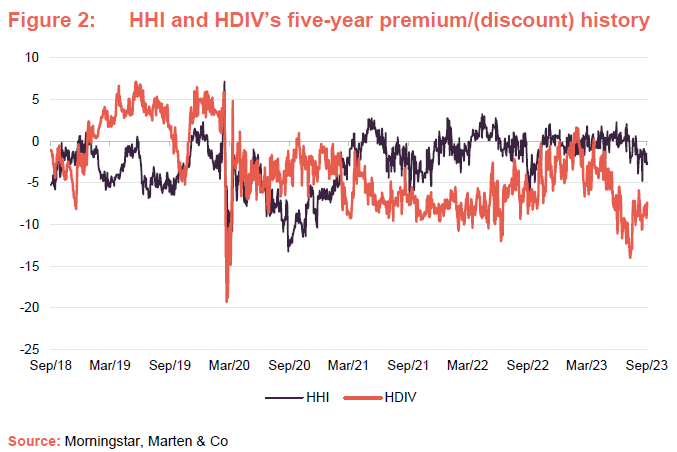

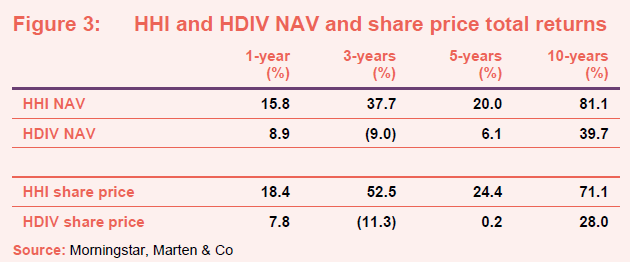

- HHI has better long-term total returns, as is evident from Figure 3.

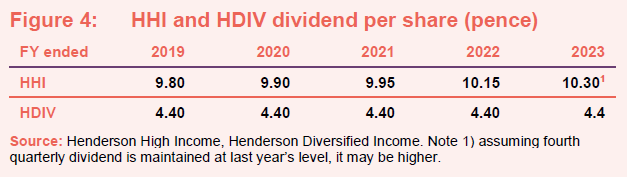

- Similar high yield, but HHI has a better record of dividend growth (an average of 2% per year over 10 years, and 10 consecutive years of growing dividends). At close of business on 3 October 2023, HHI was yielding 6.6% and HDIV 7.0%.

- A lower ongoing charges ratio – HHI’s management fee is 0.50% on gross assets up to £325m and 0.45% above, while HDIV’s is 0.65% of net assets. HHI’s latest ongoing charges ratio is 0.84% to HDIV’s 0.98%. As HHI expands, its ongoing charges ratio should fall.

- An enlarged HHI should help improve liquidity in its shares and make the trust more appealing to some investors.

- A significant contribution to costs from Janus Henderson. It will contribute an amount equal to 1.25% of the assets rolling over to HHI, up to a maximum of £1.1m, while waiving the fee due in respect of the termination of HDIV’s investment management agreement. The first £550,000 of any contribution will be allocated to covering HHI’s costs, with the balance allocated to HDIV.

- The deal gives HDIV shareholders the option of a rollover into HHI without triggering capital gains tax.

HHI’s fund profile

This is taken from our recent note on HHI, which can be read here.

Henderson High Income Trust (HHI) invests in a prudently diversified selection of both well-known and smaller companies, to provide investors with a high income stream while also maintaining the prospect of capital growth.

The majority of HHI’s assets are invested in the ordinary shares of listed companies, with the balance in listed fixed interest stocks (no unquoted investments). Investee companies should have strong balance sheets that are capable of paying dividends. There is a focus on well-managed companies whose qualities may have been temporarily overlooked by investors and which offer the potential for capital appreciation over the medium term. A maximum of 30% of gross assets may be invested outside of the UK.

A portion of gearing is invested in fixed interest securities.

Gearing is used to enhance income returns, and to help achieve capital growth over time. A portion of gearing is usually invested in fixed-interest securities.

Janus Henderson Fund Management Limited is the company’s AIFM and it delegates investment management services to Henderson Global Investors (both are subsidiaries of Janus Henderson Group Plc). The lead fund manager assigned to the trust is David Smith. He was made co-manager of the trust in 2014 and has been sole manager since 2015.

Blended benchmark

HHI benchmarks itself, for performance measurement purposes, against a blend of 80% of the FTSE All-Share Index return and 20% of the ICE Bank of America Merrill Lynch Sterling Non-Gilts Index.

Legal

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Henderson High Income Trust Plc and Henderson Diversified Income Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.