Vote against Saba to protect your investment

Herald Investment Trust (HRI) exemplifies the benefits of the closed-end structure, allowing its manager to take a long-term view and tap into up-and-coming technology stocks at an early stage of their development, thus providing its shareholders with a differentiated source of alpha.

We believe that Saba Capital’s recent attempt to wrestle control of HRI, change its mandate, and install itself as manager represents a significant risk to its shareholders’ investment and could see them missing out on significant upside. We side with HRI’s board, believing very strongly that shareholders of all sizes should ensure that they vote to reject all of Saba’s resolutions at the upcoming general meeting, details of which can be found here.

Despite the unwelcome distraction of Saba’s antics, HRI generated decent returns over 2024, with several of its holdings reporting triple-digit returns. In part, this reflects HRI’s exposure to the themes of AI-based services or their critical infrastructure. HRI’s share price has also benefitted from the recent narrowing of its discount.

Small-cap technology, telecommunications, and multi-media

HRI’s objective is to achieve capital appreciation through investments in smaller quoted companies in the areas of telecommunications, multimedia, and technology. Investments may be made across the world, although the portfolio has a strong position in UK stocks.

| 12 months ended | Share price total return (%) | NAV total return (%) | Numis ex IC plus AIM (%) | B’berg US 2000 Tech TR (%) |

|---|---|---|---|---|

| 31/12/2020 | 51.7 | 37.4 | 4.9 | 43.9 |

| 31/12/2021 | 11.6 | 19.0 | 20.0 | 12.9 |

| 31/12/2022 | (28.9) | (23.1) | (21.9) | (25.4) |

| 31/12/2023 | 7.9 | 5.4 | 3.2 | 18.2 |

| 31/12/2024 | 26.4 | 12.2 | 5.0 | 19.9 |

Source: Morningstar, Marten & Co

Saba looking to profit at your expense

Saba Capital has made an ill-advised attempt to attack seven UK investment trusts, HRI included

HRI has recently become the target of Saba Capital, a US-based hedge fund that has built substantial stakes in seven investment trusts. Saba has 25.5% of HRI as at 15 January 2025, but in some cases owns just shy of 30% of the trusts’ outstanding shares. In an announcement made on 18 December, Saba Capital declared its intention to remove all members of the existing boards of these trusts and replace them with just two members each – both Saba nominees, one of whom is a Saba employee. Furthermore, Saba plans to dismiss the current investment managers and substitute them with its own team.

Saba’s ultimate objective is to merge these trusts into a single entity and operate it as a fund of investment trusts, under which your portfolio of promising technology companies would be sold into a market that knows HRI is a seller. We strongly believe that Saba’s claims of creating value for shareholders are deeply flawed and entirely misplaced. Its strategy poses significant risks and has multiple critical weaknesses. We believe that Saba’s intentions, and the timing of its announcements, are self-serving and designed to put it in the best possible light, while intentionally underplaying the advantages of its targeted trusts. We have published several articles outlining our arguments against Saba Capital, with the initial announcement covered here.

HRI’s board has already issued public rebuttals to Saba’s proposals, encouraging shareholders to vote against them at the Extraordinary General Meeting (EGM) to be held on 22 January. Having reviewed Saba’s proposals, we believe that they are sufficiently adverse for all shareholders other than itself, for us to recommend that other shareholders should vote against them. Similarly, HRI’s board unanimously recommends that HRI shareholders vote against Saba’s resolutions. The board’s rebuttals are detailed here, and here.

Fundamental flaws in Saba’s strategy

We believe Saba’s rationale for targeting HRI is fundamentally flawed. At best, its arguments are unfounded; at worst, they could result in substantial destruction of value for HRI’s shareholders.

1. Liquidity risks and value destruction

HRI’s portfolio comprises over 300 specialist small-cap equities, many of which have limited liquidity. These companies benefit from being held within a pool of permanent capital, such as HRI. However, as many of these trade by appointment, a wholesale sell-off – necessary for Saba’s plans – would see Saba move the market against HRI as it would be recognised as a forced seller. We think that, if HRI’s shareholders want its portfolio to be liquidated, the existing management team is far better placed to achieve this while minimising value destruction. However, we believe that the best way to prevent the destruction of shareholder value is to allow the existing management team to continue to run the trust with the current mandate, given its long-term track record and future return potential.

Saba could end up destroying value for HRI’s shareholders if it gets its way

2. Loss of unique risk-return profile

HRI is a distinctive strategy with an idiosyncratic risk-return profile. Converting it into a portfolio of investment companies would fundamentally alter this profile, potentially rendering it unsuitable for many existing shareholders.

- HRI has delivered impressive long-term returns for its shareholders, having increased its NAV by more than three-fold over the last 10 years on a total return basis, and 27 times since its inception in February 1994.

- HRI has a good record of returning cash to shareholders. Having raised just £95m in capital since its launch – £65m at its IPO in 1994 which was topped up with an additional £30m in 1996 – HRI has, to date, returned over five times this amount to shareholders (£480m) via buybacks. This is while still retaining some £1.25bn of net assets for shareholders.

- Saba refers to its ETF of closed-ended funds (CEFS) several times in its recent announcements. We would observe that CEFS is not a closed end fund; the two closed end funds that Saba manages in the US trade at discounts to NAV (which makes us question Saba’s ability to add long-term value by tackling the discounts of closed ended funds); and CEFS has a far more complicated and opaque strategy than HRI’s.

- CEFS utilises leverage in its investment approach (11% as of 30 November), which may be unpalatable for some investors given its increased risk when compared to HRI’s unleveraged position (with HRI currently having 8.4% in cash).

- The leverage that CEFS employs is complex and makes extensive use of derivative instruments. We think that, if Saba were to be successful in converting HRI into a fund of investment trusts and ran it in a similar way to CEFS, this complexity would make it unsuitable for most if not all of its existing investors.

- Investors in CEFS also incur far higher fees than shareholders in HRI. CEFS has an annual management fee of 1.1% which, when combined with 1.39% in other expenses, gives ongoing charges equivalent to 2.49%, which is more than twice HRI’s 1.07% ongoing charges ratio.

3. Misleading performance comparisons

Saba claims that CEFS has outperformed HRI over all relevant time periods since CEFS’s launch in 2017. This bold assertion is a cornerstone of its argument for being able to improve shareholder outcomes. However, on inspection, the claim is demonstrably false and highlights the dangers of sampling bias.

Saba’s performance comparisons rely on selective timeframes that support its narrative but do not reflect reality. Whilst CEFS outperformed HRI over its chosen time periods (all ending 13 December 2024), prior to 2020, HRI had outperformed CEFS.

There are also issues in even using CEFS as a comparable as it is only sold in the US market, and as such its returns are not impacted by currency effects.

CEFS’s performance is also calculated based on the market value of its investments, not their reported NAVs. If we were to compare the share price returns of HRI to CEFS’s price returns (since CEFS’s inception on 21 March 2017), we would find that HRI outperformed CEFS by 39.4% in sterling terms as of 31 December 2024. Even if we calculate HRI’s performance at the end of September, before the recent narrowing of HRI’s discount on the back of Saba’s own buying activity, HRI’s share price returns would have still exceeded CEFS’s by 15.2%.

4. Inappropriate benchmarking

Saba has also compared HRI’s performance to the Russell 2000 Technology Index in its public announcement, which is an entirely-US-focused index. This comparison is inappropriate, as HRI has a global remit, making it akin to comparing apples to oranges. Even then, HRI has, over the longer term, been able to outperform the US market – generating higher NAV returns than the Bloomberg US 2000 Technology Index since its inception, as we point out on page 13.

If we stick with Saba’s benchmarking, a fairer comparison would be to compare Herald’s North American allocation to the US Small Cap Technology index. As can be seen in Figure 1, HRI’s North American allocation has not only beaten the US index over 2024, but also since HRI first invested in the region in July 1996.

Figure 1: HRI North American portfolio performance versus index to 31 December 2024.

| One-year | Three-year (ann.) | Five-year (ann.) | Since US portfolio inception (ann.)1 | |

|---|---|---|---|---|

| HRI | 35.2 | 12.6 | 20.1 | 10.7 |

| Russell 2000 Technology Index | 25.9 | 2.9 | 11.7 | 7.3 |

We note that, despite Saba’s claims of strong performance, CEFS has also failed to beat its own benchmark, the S&P 500, over the last five years. As of 31 December 2024, the S&P 500 had outperformed CEFS by 28.7 percentage points over the previous five years.

5. On the cash offer

In an attempt to get shareholders on side, Saba has said that it “would encourage the new board to offer all shareholders a 100% cash exit at 99% of the trust’s NAV” and “as a result, Saba expects that shareholders will have the opportunity to sell their entire position at 99% of NAV, if they wish”.

However, reading the fine detail, we can see that this is not 99% of today’s NAV as it is suggesting that this exit would be after “at least a year” during which significant value could be lost from the underlying portfolio. This is highly pertinent for Herald given the illiquid nature of many of its underlying holdings and that the market would see Saba as a forced seller. Any shareholders hoping for a quick return of capital should also note that the time frame for achieving this is currently open ended.

We continue to think there is seriously flawed logic in Saba’s statement in that it is claiming to know what an independent board might want to do in the future. This only really stands if Saba believes it will have control of the board. However, the board is legally required to be independent of the manager. We reiterate our view that shareholders should not rely on Saba’s proposed cash return as it is demonstrably not Saba’s to grant. In addition, shareholders would find this difficult, if not impossible, to enforce after the event, and certainly not without cost or a delay.

We note that HRI has generated substantial capital gains for many of its investors, and a cash exit would lead to an unavoidable, and likely unwanted, tax liability particularly for its long-term shareholders.

We observe that HRI already has a continuation vote scheduled for April 2025 and every three years thereafter.

Furthermore, if shareholders are to be presented with a choice of investing in a fund of investment trusts or cash, that cash exit should be at NAV less costs, not at a discount designed to transfer value to investors who stick with the fund of funds option, particularly when there is a question mark over what constitutes that NAV.

In conclusion, Saba Capital’s proposed strategy for HRI poses significant risks to shareholder value. We urge shareholders to carefully consider these flaws and vote against Saba’s proposals.

Herald – like nothing else

With the surge of headlines surrounding technology companies and the anticipated impacts of AI, we believe it is worth reminding readers of the genuinely unique aspects of HRI.

HRI’s unique investment focus

HRI’s is a truly unique investment strategy amongst those available to UK investors

HRI stands out as the only investment trust that focuses exclusively on global small-cap technology stocks. While there are open-ended funds with similar approaches, none offer the distinct benefits of a closed-ended structure, principally the attractions of having access to permanent capital.

Permanent capital is particularly crucial to HRI’s investment philosophy, as it allows the trust to invest in small, quoted companies whose lack of liquidity typically prevents open-ended funds from holding them. This unique flexibility enables HRI to identify and invest in the next generation of listed small-cap technology firms earlier and often at more attractive valuations than equivalent open-ended funds.

Moreover, HRI’s structure allows it to take a strategic approach to capital allocation. The trust can act as a vital source of liquidity or funding for small tech firms when others cannot, creating opportunities to acquire shares at unique discounts, particularly in periods when open-ended funds are forced sellers. This strategic edge is a direct consequence of its closed-ended nature.

HRI’s specialist portfolio

HRI’s distinctiveness is evident in the composition of its portfolio. According to Morningstar’s assessment of its investment “style”, the average company size within Herald’s portfolio is significantly smaller than that of any open-ended technology fund available in the UK (as classified by the Investment Association).

This uniqueness also defines HRI’s role within an investor’s portfolio. It offers a differentiated source of alpha, enabling investors to capitalise on transformative trends within the technology sector without overexposure to the large-cap technology firms that dominate most technology funds – and, by extension, the wider global equity market.

Performance analysis

HRI’s offers a differentiated source of alpha

Whilst recent market trends have favoured large-cap technology firms over small-caps, historical data supports HRI’s position as a specialist source of alpha. Figure 2 illustrates that, since its inception in 1994, HRI has delivered superior NAV returns and alpha, with a lower correlation and higher Sharpe ratio, than the open-ended technology sector, proxied by the Investment Association technology sector averages (note that Figure 2 reflects the average five-year value for statistics, sampled weekly).

While these figures may initially appear marginal, it should be noted that HRI has achieved these figures while not being able to invest in the mega-cap technology stocks that have dominated global equity market returns recently – implying that the skills of HRI’s managers have more than compensated for this. Furthermore, reflecting the uniqueness of its approach, there is little risk of overlap between Herald’s offering and other technology funds.

Figure 2: HRI risk-return data vs open-ended peers

| Average five-year return | Average Sharpe ratio | Average Alpha | Average Correlation | |

|---|---|---|---|---|

| HRI | 90.1 | 0.09 | 0.07 | 0.75 |

| IA technology & technology innovation | 83.7 | 0.07 | 0.02 | 0.83 |

| IA Global | 42.9 | 0.05 | -0.02 | 0.75 |

Market update

Although it has only been seven months since our last publication, several significant developments have occurred across the technology sector and the wider global economy.

The technology sector: AI at the forefront

The returns from AI have begun to spread across the wider technology sector

Artificial intelligence (AI) continues to dominate the technology industry, both in terms of development and adoption. The demand for AI and the infrastructure required to sustain it have become key drivers for many major technology firms. In the third quarter of 2024 alone, leading companies such as Microsoft, Amazon, Alphabet, and Meta collectively spent $67bn on AI – a 47% year-on-year increase. Total AI spending for 2024 is on track to exceed $200bn.

Despite being in its relative infancy, AI adoption is already delivering measurable returns across the sector. While semiconductor giant Nvidia has been the poster child of the AI boom due to its pivotal role in developing AI-enabling hardware, its growth has slowed in recent months – rising just 10% compared to its remarkable 158% surge in the first half of the year. Instead, the past six months have seen a broader range of AI “winners”, including companies not only facilitating AI development, but also successfully commercialising its integration.

For example, CRM software firm Salesforce has gained 43% over the last six months, driven by strong demand for its AI-powered tool, “Agentforce”. This diversification of returns has also benefitted HRI, as several of its holdings, such as Celestica and Pegasystems (detailed on page 12), have reported improved outlooks due to heightened demand for their AI-related services.

AI has also been a catalyst in the private equity sector, attracting significant capital deployment. The second quarter of 2024 set a record for AI-related private equity deals, with 53 transactions totalling $8bn. Notably, two outsized investments – Safe Superintelligence and World Labs – were valued at $5bn and $1bn respectively, earning them “unicorn” status. Within HRI’s portfolio, 11 companies have been acquired over the past six months, five of which were in December alone, and have raised £63.7m for HRI. A prominent example of this is its investment in Esker (also detailed on page 13).

Political developments

The most pivotal event since our last note has been the conclusion of the US presidential election, which saw Donald Trump elected as the new president. The Trump administration could bring notable changes to technology policy, potentially including AI deregulation, increased onshoring of US chip production, and reduced scrutiny of antitrust issues, such as the dominance of mega-cap tech firms in industries like web search and social media.

The election of Trump may continue the dominance of US tech firms

It is still too early to do anything other than speculate, as Trump will take power on 20 January 2025, though one could expect that the new administration would favour the continual dominance of US technology firms (given the president elect’s “America first” attitude), which may help proliferate current sector trends, such as a rapid expansion of America’s AI sector.

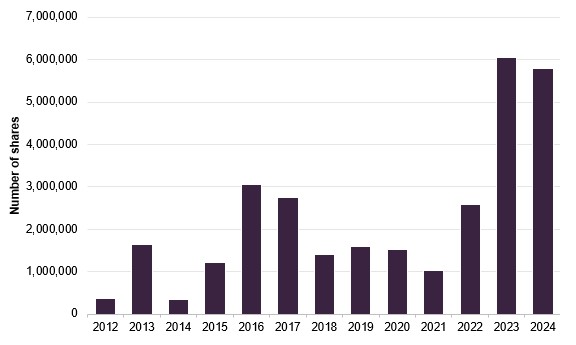

Meanwhile, the UK experienced its own political milestone, with a Labour government taking power for the first time in 14 years. Labour’s recently unveiled budget includes expanded public spending funded by increased taxation, raising concerns about near-term stagflation. Markets have reacted cautiously, with 2024 marking a record year for investor withdrawals from UK funds. The HRI team has previously noted the lack of depth in the UK market, with limited liquidity driving a strategic shift away from UK-based investments (illustrated in Figures 3 and 4 on page 10).

However, this lack of liquidity can also present opportunities. HRI maintains a large pool of liquid capital, enabling it to act swiftly to take advantage of mispriced securities when these occur.

Interest rate policy and market expectations

Global interest rate policy continues to play a critical role in influencing the technology sector. High-growth technology firms are inherently sensitive to interest rate changes, making shifts in rate expectations a key factor in investor sentiment towards them.

Although our last note highlighted a dampening of global rate expectations, recent months have seen a shift in sentiment, particularly in the aftermath of the US presidential election. Inflationary pressures, driven also by factors such as the UK Labour government’s budget and a more resilient US economy, have led central banks to reconsider their plans for further rate cuts, and the yield of government bonds has been on the rise.

On 18 December, the US Federal Reserve implemented a 0.25% rate cut. However, the more significant development was its revised forecast for 2025, reducing the anticipated number of rate cuts to just two. This announcement prompted a retreat in US markets, reflecting tempered optimism around future monetary easing.

Asset allocation

HRI’s portfolio continues to tilt further towards the US

Whilst HRI retains some of the characteristics noted in our previous update, such as a substantial cash allocation, there has been a notable shift in its geographical exposure. HRI’s allocation to the UK has decreased by 4%, while its exposure to the US has risen by 2.5%.

This shift reflects the relative performance of these regions, with US technology companies continuing to outpace their international counterparts – a trend also highlighted in our last note. The recent growth in US technology firms can be partly attributed to the fervour surrounding AI, with the US commanding the lion’s share of the ‘AI winners’.

The decline in HRI’s UK allocation aligns with broader trends in investor activity. UK equity markets have experienced long-term declines in participation, as investors increasingly favour more-liquid international markets. In contrast, the US boasts the world’s deepest and most liquid market, even amongst smaller companies. Many US smaller firms have market capitalisations in the billions, making them more likely to meet the minimum size thresholds required by institutional investors.

HRI’s cash levels and its exposure to Asia Pacific and EMEA (Europe, the Middle East, and Africa) remain largely unchanged from the previous note. Despite maintaining a flat overall cash allocation, the HRI team has been proactive in managing liquidity.

Substantial gains were realised from the team’s investment in Super Micro Computer (detailed on page 15), with a significant portion of the proceeds used to fund share buybacks (outlined on page 18).

Figure 3: Geographic allocation as at 30 November 2024*

Figure 4: Geographic allocation as 30 April 2024*

Source: Herald Investment Management *Note: as a proportion of gross assets

Source: Herald Investment Management *Note: as a proportion of gross assets

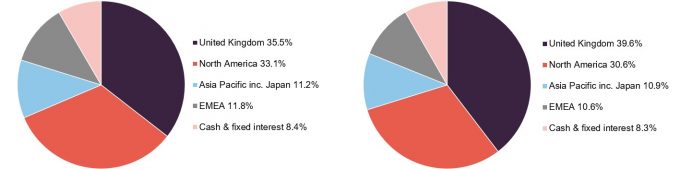

Valuations remain consistent

HRI’s valuations remain consistent despite the share price growth of AI-related companies

HRI and the broader technology sector have delivered impressive nominal gains over the past 12 months, largely driven by demand for AI-related stocks. The technology sector was among the best-performing sectors in 2024.

Despite the significant capital inflows into technology stocks, HRI’s price-to-earnings (P/E) ratio has remained consistent with its long-term average, as illustrated in Figure 5. This suggests that the market’s enthusiasm for “AI winners” has been supported by growing earnings, preventing valuations from becoming excessively inflated.

Figure 5: HRI P/E ratio versus market

| 2017 (x) | 2018 (x) | 2019 (x) | 2020 (x) | 2021 (x) | 2022 (x) | 2023 (x) | Q3 2024 (x) | |

|---|---|---|---|---|---|---|---|---|

| HRI | 20.7 | 17.7 | 23.2 | 30.7 | 25.9 | 17.8 | 19.6 | 19.8 |

| MSCI World Small Cap Technology Index | 29.8 | 21.8 | 33.0 | 43.9 | 30.9 | 21.1 | 28.1 | 29.4 |

It is also worth highlighting that HRI’s valuations remain more attractive than those of the broader global small-cap technology universe. This is a result of its greater diversification as HRI has less exposure to the highly valued US sector. The team also tends to focus on companies with higher quality earnings. This can reduce HRI’s exposure to the more aggressively valued segments of the technology market, which tend to have inflated P/E ratios, meaning HRI offers a more balanced and resilient portfolio.

These attractive valuations are significant not only for potential upside, but also for mitigating interest rate sensitivity, particularly in the current environment of rising bond yields. HRI’s prudent approach positions it well to navigate these macroeconomic challenges while maintaining strong performance prospects.

Top 10 holdings

Figure 6 shows HRI’s top 10 holdings as at 30 November 2024 and how these have changed since our last note. We detail the three largest new entrants below.

There has been heightened level of turnover in HRI’s top 10 compared to our past publications. This can in part be attributed to individual trading activity by the team, as is the case with Super Micro Computer, but also in the improving performance of some stocks, such as Celestica. We note that none of the new entrants are new positions for HRI, as the team typically initiates positions with smaller position sizes, with these building over time as its thesis plays out.

Figure 6: Top 10 holdings as at 30 November 2024

| Holding | Sector | Country | Allocation 30 November 2024 (%) | Allocation 30 April 2024 (%) | Percentage point change |

|---|---|---|---|---|---|

| Celestica Inc | Tech hardware and semiconductors | US | 2.3 | 1.2 | 1.1 |

| Fabrinet | Tech hardware and semiconductors | US | 2.3 | 1.7 | 0.6 |

| Trustpilot | Media | UK | 2.2 | 1.6 | 0.6 |

| Diploma | Support services | UK | 2.0 | 1.7 | 0.3 |

| BE Semiconductor Industries | Tech hardware and semiconductors | Netherlands | 1.9 | 2.2 | (0.3) |

| Pegasystems Inc | Software & computer services | US | 1.7 | 1.1 | 0.6 |

| Esker SA | Support services | France | 1.7 | 1.2 | 0.5 |

| Super Micro Computer | Technology hardware & equipment | US | 1.6 | 4.3 | (2.7) |

| GB Group | Support services | UK | 1.4 | 1.1 | 0.3 |

| Descartes Systems | Software & computer services | Canada | 1.4 | 1.3 | 0.1 |

| Total of top 10 | 18.5 | 18.8 | (0.3) |

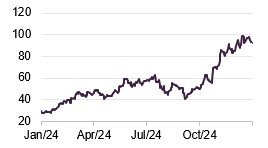

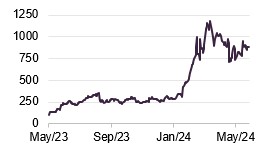

Celestica Inc

Figure 7: Celestica Inc (USD)

Source: Bloomberg

Celestica (www.celestica.com) is an American-Canadian firm that designs, manufactures, and provides hardware platforms and supply chain solutions. Its services are split into two segments: Advanced Technology Solutions and Connectivity & Cloud Solutions. As the name implies its Advance Technology Solutions arm services complex industries life defence and health technology, offering products such as semiconductors and robotics equipment. While Connectivity & Cloud Solutions typically services the telecommunications and enterprise sectors.

Celestica reported a blockbuster third quarter for 2024, with revenues increasing 22% year on year to $2.5bn, surpassing its management’s expectations. The growth was primarily driven by Connectivity & Cloud Solutions, which saw revenue increase by 42%, while the Advanced Technology Solutions saw a 5% decrease.

More impressively, Celestica’s profitability saw a sharp increase, with its earnings per share increasing 60% year on year (YoY), while its profit margin increased to 6.7% from 5.7% a year previously. Celestica’s returns reflected the growth of the AI market, as Celestica benefitted from the huge increase in capital expenditure by the wider technology sector, with Google being its largest customer. A new example of this is Celestica’s recent strategic relationship with AI company Groq to manufacture AI/machine learning servers and rack solutions.

Capitalising on opportunities presented by the AI boom, Celestica’s management have raised its full-year revenue guidance to $9.6bn, up from the previous forecast of $9.4bn. They are also targeting $10.4bn in revenue for 2025.

This improving outlook has been reflected in Celestica’s share price, which surged 221% over the course of 2024, with 93% of that growth occurring in the last quarter alone. As a result, Celestica has been one of HRI’s most significant contributors to returns.

Pegasystems

Figure 8: Pegasystems (GBP)

Source: Bloomberg

Pegasystems (www.pegasystems.com) develops enterprise software designed to enhance business agility, enabling organisations across various industries to better adapt to change. Based in America, its core product is a platform that facilitates the automation of customer interfaces, streamlining operations and improving customer experiences.

Pegasystems has been a long-held position for HRI and was previously one of its top 10 holdings. Thanks to the recent integration of AI into its product suite, Pegasystems’s share price more than doubled in 2024, propelling it back into HRI’s top 10 holdings.

In its most recent performance update, Pegasystems’s management highlighted the robust growth of both its cloud and AI services. The company reported a 16% year-on-year (YoY) increase in annual contract value, with its Pega Cloud service – encompassing AI and automation offerings – growing by an impressive 30%.

This growth has translated into a substantial improvement in financial performance. Pegasystems’s free cash flow nearly doubled YoY, reaching $246m by the end of the third quarter. Gross margins have also expanded significantly, now standing at 78% – just shy of the management’s 80% target.

Pegasystems’s management emphasised its continued focus on transitioning more of the business to its cloud services platform. This strategy not only provides the benefits of a recurring revenue model, but also aims to sustain the company’s leadership in AI and automation.

Esker

Figure 9:Esker (EUR)

Source: Bloomberg

Esker (www.esker.co.uk) is a French software developer whose products allow firms to eliminate the use of paper from their business management processes. Its products are split into three suites: source-to-pay, order-to-cash, and global invoicing. In September 2024 Esker announced that Bridgepoint, a US private equity firm, had made a bid for the company, paying €262 per share, and valuing the company at €1.6bn, a 30% premium on the day of the announcement. Bridgepoint commented that Esker is a “leading global player” with cutting-edge products and technology as well as market leadership in its home country of France, as a strong presence in Europe, the Asia-Pacific region, and North America.

GB Group

Figure 10: GB Group (GBP)

Source: Bloomberg

GB Group (www.gbgplc.com) is a British software developer whose products split along three distinct segments: identity verification, location intelligence and fraud prevention. GB Group has roughly 20,000 clients across the global, ranging from major banks, to ecommerce, to the public sector; with the majority of its revenues generated outside of the UK.

Its recent half-year results for its 2025 financial year indicated that the firm is on track for steady – albeit single-digit – growth, reporting £137m in revenues in the first six months, up 3.4% YoY. This growth was primarily driven by growth in its identity verification (up 6.0%) and location intelligence segments (up 8.6%), partially offset by a decline in fraud prevention (down 9.2%), which was due to timing of licence renewals rather than reduced demand.

More impressively, GB Group reported profits increasing by 21.3% YoY to £29.0m, representing a margin of 21.2% (up from 18.1%). This profit growth was due to a combination revenue growth and successful cost-reduction initiatives implemented in the prior financial year. GB Group’s management have also taken steps to improve its balance sheet, reducing net debt by £9.0m to £71.9m, representing a leverage ratio of 1.05x EBITDA.

Its management has maintained the same outlook from the start of the financial year, expecting mid-single-digit revenue growth and high-single-digit profit growth.

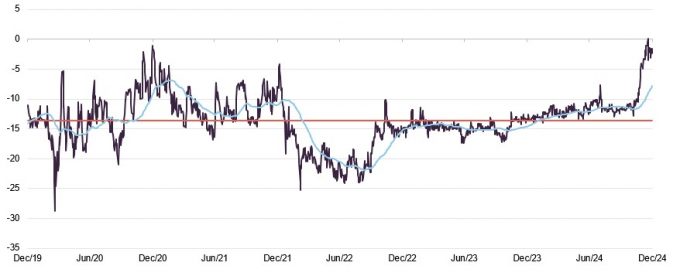

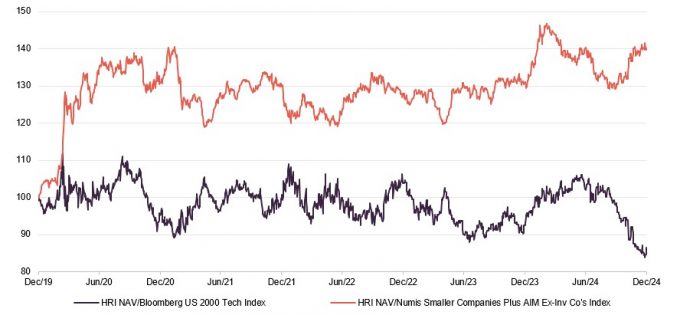

Performance

As can be seen in Figures 11 and 12, HRI has been able to generate returns which have exceeded the Deutsche Numis Smaller Cos plus AIM ex Investment Companies Index (which captures the performance of the wider UK small-cap market). Prior to the second half of 2024, HRI was also ahead of the Bloomberg US 2000 Technology Index (a proxy for the US small-cap technology space that is also a close proxy for the Russell 2000 Index), though it has begun to lag over the last six months, leading it to underperform. Although it has still been able to exceed the US market over the longer term, since the Bloomberg US 2000 Technology Index’s inception on 31 March 2015, HRI has generated a 291.6% NAV total return compared to the index’s 269.6%. Furthermore, as we mention on page 5, HRI’s US investments have outperformed the US small cap technology sector in 2024 and the longer term.

HRI remains well ahead of the UK market, though it has begun to lag the US in recent months

HRI’s overall underperformance relative to US small-cap technology stocks can partly be attributed to the relative dominance of US tech companies to their international peers. Investors have shifted their focus beyond mega-cap AI winners to smaller firms whose returns are now being driven by demand for AI services or by providing the ancillary solutions required for AI development.

Whilst many of HRI’s top contributors (detailed on page 15) are among this cohort of the US’s AI winners, the trust’s regional diversification and substantial UK exposure have weighed on its performance relative to the US market overall – as the region has been the main driver of returns in the global technology market.

Figure 11: HRI’s NAV total return relative to various indices, over five years to 31 December 2024

Source: Morningstar, Marten & Co

Figure 12: Cumulative total return performance over periods ending 31 December 2024

| 1 month (%) | 3 months(%) | 6 months (%) | 1 year (%) | 3 years(%) | 5 years(%) | 10 years(%) | |

|---|---|---|---|---|---|---|---|

| HRI NAV | 0.8 | 5.5 | 0.5 | 12.2 | (9.0) | 48.8 | 204.6 |

| HRI share price | 3.2 | 16.5 | 11.2 | 26.4 | (3.0) | 64.2 | 268.7 |

| Deutsche Numis Smaller Cos plus AIM ex IC | (0.1) | (2.4) | 0.8 | 5.0 | (15.4) | 6.6 | 62.4 |

| Bloomberg US 2000 Technology | 1.0 | 19.4 | 18.6 | 19.9 | 5.8 | 71.8 | n/a* |

Source: Morningstar, Bloomberg, Marten & Co. * The Bloomberg US 2000 Technology was launched on 31 March 2015. Since its inception it has generated a total return of 269.6%, compared to the 291.6% NAV total return of HRI.

Key contributors

The HRI team have highlighted a few major contributors to the trust’s returns over the last 12 months: Celestica (which we covered on page 12), Fabrinet, Trustpilot and Super Micro Computer.

Super Micro Computer

Figure 13: Super Micro Computer (USD)

Source: Bloomberg

Super Micro Computer (SMC) (www.supermicro.com) is one of the largest producers of high-performance and high-efficiency servers. Based in Silicon Valley, SMC provides servers and platforms for a wide range of markets, including enterprise data centres, cloud computing, artificial intelligence (AI), fifth-generation (5G) technology, and edge computing.

SMC was a significant contributor to HRI’s returns at the time of our last publication, given its pivotal role in developing AI infrastructure, with Nvidia as one of its major suppliers. However, SMC’s share price peaked in March 2024, following a series of negative news announcements related to its accounting practices and governance. This was further compounded by the company being publicly targeted by a prominent short-seller.

Despite these challenges, the HRI team remains optimistic about SMC’s long-term prospects, believing that much of the negative press has been overstated. The concerns around SMC’s accounts were raised by its previous auditor, who resigned after being unable to sign off on its accounts. However, a new auditor has since been appointed and has not identified any material issues.

The HRI team has also noted that none of the operational and accounting concerns initially raised about SMC have been substantiated. The only credible issue relates to the company’s hiring practices, which are being addressed.

Regardless of the controversies surrounding SMC, it exemplifies the HRI team’s prudent approach to portfolio management. Recognising the previous strength in SMC’s share price, the team had been actively trimming its position. From an initial investment of £7m, HRI has realised over £100m in gains. The trust continues to hold an approximately £17m position in SMC, reflecting its significant unrealised gains and the team’s confidence in the company’s long-term potential while mitigating risk.

Fabrinet

Figure 14: Fabrinet (USD)

Source: Bloomberg

Fabrinet (www.fabrinet.com) is an EMS provider, constructing other companies’ products on their behalf. Fabrinet offers solutions for the entire manufacturing process – from design and engineering to final assembly and testing. It focuses on low-volume production for a wide variety of complex products. The majority of its assets are based in East, and Southeast Aisa, with a substantial presence in Thailand.

Fabrinet’s recent results (for the first quarter of its current financial year) demonstrated the resilience of its business model, having sustained its double-digit profit margins, current 10.7%, as well as generating 17% YoY revenue growth. Having reported quarterly revenues of $804m, Fabrinet’s management expect its revenues to increase over the next quarter, with a top-end guidance of $820m.

Whilst Fabrinet reported revenue growth across all of its segments, its largest earner was its telecommunications arm, which generated 61% of Fabrinet’s revenues. With a strong balance sheet – zero debt, and $909m is cash – and increasing demand for high-speed optical equipment, Fabrinet’s management team remains confident in meeting its top-end earnings target.

Trustpilot

Figure 15: Trustpilot (GBP)

Source: Bloomberg

Trustpilot (www.uk.trustpilot.com) is the UK-listed and Danish-headquartered online review provider. Trustpilot IPOd in 2021; however, the HRI team delayed investing until 2023, believing it was mispriced when it entered the market. They initiated position after its post-IPO selloff, with Trustpilot falling c.50% in the first six months. Trustpilot’s share price saw major gains over 2024, doubling over the year and closing out the year at a share price that finally exceeded its IPO level.

Trustpilot’s growth was underpinned by a strong half-year performance announcement, with earnings coming in 10% ahead of expectations and EBITDA reaching $10.6m. This was driven by a 28% YoY growth in monthly users, reaching 67m per month, with the number of reviews need nearing 300m, a 24% YoY growth. Confident in its momentum, Trustpilot’s management upgraded its earnings guidance for the 2024 financial year, now expecting results to land at the top end of market consensus (approximately $22m) – roughly a 10% increase from its initial projection.

Trustpilot’s share price was further supported by management’s ongoing commitment to share buybacks. In addition to returning $25.6m to shareholders during the first half of the financial year, the company announced an additional £20m share buyback programme.

Dividend

HRI is focused primarily on generating capital growth, and dividend income makes up only a small part of returns. The consequence of this is that HRI only declares a dividend where this is necessary to retain investment trust status, and in practice, no dividend has been declared since 2012.

Fund profile

More information can be found at the trust’s website: www.heralduk.com.

Established in 1994, HRI invests globally in small technology, communications, and multimedia companies with the aim of achieving capital growth. It is the only listed fund of its type. The trust invests globally, but has a strong bias towards the UK, which further distinguishes it from other global technology funds, which tend to be biased towards the US.

New investments in the fund will typically have a market capitalisation of $3bn or less but are generally much smaller when the first investment is made. If successful, these can grow to be a multiple of their original valuation. This type of investing is longer-term in nature and so the trust’s portfolio tends to have low turnover. Reflecting the risks inherent in this type of investing, and the liquidity constraints of having a small-cap investment remit, the trust maintains a highly diverse portfolio of investments (typically in excess of 250) to help mitigate this risk.

Experience is important in markets such as these

HRI’s lead fund manager, Katie Potts, has managed HRI since its launch. Her track record shows how important experience is in markets such as these.

Aside from the numerous advantages of HRI we outline in this note, one notable benefit has been the considerable experience provided by Katie and her team. Katie was a highly-regarded technology analyst at SG Warburg (later UBS) prior to launching the fund. She has built of a team of considerable skill around her that now manages a large proportion of HRI’s portfolio – Katie is supported by 8 dedicated professionals.

Noteworthy members of the Herald team include: Fraser Elms – HRI’s deputy manager – who joined Herald Investment Management in 2000 and covers Herald’s Asian portfolios and the semiconductor sector; Taymour Ezzat, who joined in 2004 and covers Heralds European investments and media; Hao Luo, who also joined in 2004 helps cover Asia and manufacturing sectors alongside Peter Jenkin, who joined Herald in 2015, and also covers Herald’s North American and software investments.

Katie owns a substantial stake in the company and a significant minority stake in the management company, and therefore is clearly motivated to ensure the success of the fund.

HRI’s closed-ended structure can be advantageous during market selloffs

The HRI team has navigated several downturns and has benefitted from its ability to select companies capable of weathering difficult conditions. HRI’s closed-ended structure has also been used to great effect. Whilst open-ended funds are often forced sellers, HRI can capitalise on its ability to gear and to pick up lines of stocks at attractive prices, though it has been keeping a net cash allocation more recently.

HRI’s size, focus on smaller companies, and the depth of expertise within the management team all mean that it plays an important role as a provider of much-needed capital to listed technology companies looking for expansion capital. This is particularly valuable in a downturn and has offered HRI further opportunities to generate alpha when others may not have been able to.

HRI offers a liquid subcontract for any investor looking to gain access to this part of the market, and we believe that an investment in HRI complements an investment in one of the large-cap technology funds.

Previous publications

Readers interested in further information about HRI may wish to read our previous notes (details are provided in Figure 18 below). You can read the notes by clicking on them in Figure 18 or by visiting our website.

IMPORTANT INFORMATION

This marketing communication has been prepared for Herald Investment Trust Plc by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.