Herald Investment Trust

Investment companies | Update | 13 November 2023

Patience and power

Herald Investment Trust (HRI) illustrates why patience can sometimes be important when it comes to investing. The manager says that there is a drought of funding for small cap technology stocks, but its team has ensured that HRI has sufficient liquidity to take advantage of opportunities should they arise. HRI can find itself operating in a buyers’ market, where it is able to dictate terms. HRI’s performance also reflects the bifurcation of global technology markets, whereby US stocks, especially those with larger market caps, have driven both HRI’s, and the wider market’s, near-term return.

Small-cap technology, telecommunications and multi-media

HRI’s objective is to achieve capital appreciation through investments in smaller quoted companies in the areas of telecommunications, multimedia and technology. Investments may be made across the world, although the portfolio has a strong position in UK stocks. The business activities of investee companies include information technology, broadcasting, printing and publishing and the supply of equipment and services to these companies.

Market update

In the face of rising interest rates, lacklustre global growth (outside of the US), and a myriad of other factors like US-China trade spats, the global technology sector has seems to have been quite resilient over 2023 since our last note (which was published at the start of the year).

Developed market inflation growth rates have finally started to stagnate

Be it the result of higher interest rates, lower energy prices, or simply an adaptation to the supply chain issues that resulted from COVID-19 and the Ukrainian conflict, inflation figures are coming down to what could be seen as more manageable levels. Recently, this fall in inflation has been seen in both core and non-core inflation (the latter excluding the more volatile energy and food costs) decline, which should reduce the pressure on central banks for further rises. Interest rate expectations have eased since our last note – in the UK forecasted peak-rates are now around 50bps lower, with the average pundit expecting another 0.25% rise, to 5.50%.

For HRI, and the wider technology market, the single most important factor may turn out to be the rate-setting policy in the US, as determined by the Federal Reserve (Fed), which unlike the UK’s central bank has a dual mandate for both inflation control and economic growth. The Fed appears to be further ahead of the curve than the UK and has signalled a possible pause to interest rate rises in the near term, though it is open to increasing interest rates by another 0.25bps before the end of the year (to 5.50%). Some pundits even speculate that the Fed could cut rates by the end of the year, at the earliest, but bond markets have shown volatility. Given the apparent sensitivity of highly valued tech companies to interest rate policy, a cut in rates could be a boon for the industry’s valuations.

AI in charge

The tech sector could prove to be more defensive than markets expect if growth continues to be sluggish. Be it the disruptive nature of their products, like digital payment providers, the critical services they provide, like cloud computing or security, or the simple need for ever more powerful semiconductors, there could be a path to growth that allows the sector to progress regardless.

The proliferation of AI has been a powerful secular tailwind for the technology sector

In recent months, a big secular growth story has been artificial intelligence (AI), seemingly instigated by the launch of Open AI, the generative AI tool. This seems to have revitalised interest in the tech sector, reversing its post-rate rise selloff and sending companies with strong exposure to the AI industry to all-time highs. While the flurry of interest around AI has come off recently, along with the valuations of the wider technology sector, technology still remains the winner of 2023, and has eclipsed the returns of other sectors.

HRI’s manager thinks that the AI story represents a material shift in the dynamics of the technology sector. It expects that there will be major ramifications in the demand for certain components, such as AI-oriented semiconductors (which was the primary reason for NVIDIA’s skyrocketing share price), as well as the need for faster physical components like cables and switches to keep up with the rapid increase in computational capacity. The HRI team believe that outcome of the proliferation of AI will also lead to a much more efficient software development cycle, with companies also being able to deploy AI software into non-tech industries such as healthcare and law. The question the HRI team asks is not whether or not AI will be a driver of share price growth, but who will be the winners and losers of AI, and what are the new markets that it will open up? While investors flocked to large cap names exposed to the AI theme, the HRI team believes that in time some of the big winners will probably emerge from amongst the smaller companies.

The defence sector may offer another avenue of growth, while consumer-exposed stocks may stall out

Beyond AI, HRI’s manager has noticed growing tailwinds behind companies associated with the defence sector – it cites increased defence spending by western governments in light of the war in the Ukraine – though it notes that there are fewer tech companies directly associated with this industry than AI. Conversely, the team is increasingly cautious around consumer sensitive tech sectors, as a possible weakness in the end consumer (be it through weaker GDP or a decline in real purchasing power) could directly affect this sector. The manager thinks that this could be more of an issue in China, which HRI has limited direct exposure to. The UK, on the other hand, where HRI’s traditional focus is, has little to no consumer tech, it adds.

HRI team view

In our recent conversation with the HRI team, they raised their concerns around the fundamental shifts in global market dynamics. Specifically, how greater government indebtedness, which is leading to rises in taxation – the tax burden in Europe, for example, is at its highest level for at least 25 years – coupled with tight labour markets, which are pushing up costs, is putting a significant brake on GDP growth. As can be seen from Figure 1, debt to GDP across the major economies has increased, and for certain countries this has appears to have been fuelled in a large part by the central banks expanding their balance sheets, especially in the case of the Eurozone. Very tight labour markets seem to be leaving governments with less room to stimulate their domestic economies, they believe.

The manager thinks that this indebtedness could have more nuanced implications for equity investors than simply stalling economic growth. It says that the rise in the volumes of debt present in the economy has warped market liquidity, as excess debt in the market has reduced the relative volumes of cash available to fund equity market transactions. Even more recently, the manager highlights that the increasing attractiveness of bond yields (considering the sudden sharp rises in interest rates) combined with the huge volumes of debt in circulation has only drawn more investors out of equity markets, as they can gain sufficient returns by holding bonds, or even cash deposits. Within tech, the manager observes that liquidity is often withheld for earnings announcements, as investors are delaying trades until companies give greater clarity around earnings, which it thinks is a cause and symptom of the declining lack of liquidity. We do note that while declining liquidity appears to be an issue for the wider equity market, it could be beneficial for HRI as its closed ended structure allows it to hold less liquid positions and it can take advantage of forced sellers or buyers should these emerge.

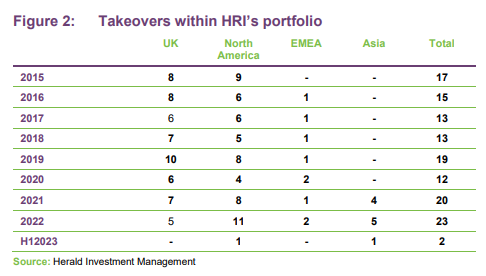

M&A activity has died out over 2023, while liquidity has also started drying up

The manager comments that there has been a marked reduction in private market activity, and participation in the funding rounds in general. Where M&A activity had once been rife in the tech sector, possibly thanks to cheap capital and the relative cheapness of UK equities, it has almost completely dried up. This can be seen in Figure 2 which shows the number of takeovers of HRI’s invested companies.

In the US, venture capital fundraising has fallen by more than 50% year on year (based on Q1 2023).

Asset allocation

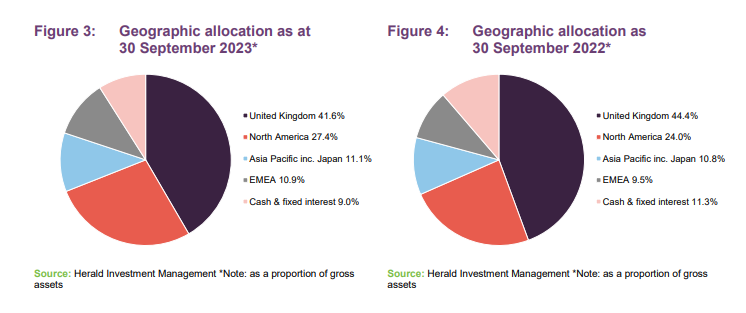

For the reasons that we have discussed above, Herald has about 9% of its portfolio in cash and fixed interest, a little less than it did in September 2022, but still a significant weighting. Investors may be encouraged that this is earning better returns in this higher interest environment.

HRI is sitting on considerable ‘dry powder’ to capitalise on the lack of market liquidity

On a geographical level there has been a shift towards the US within HRI’s portfolio, at the expense of its UK exposure. Two possible drivers behind this shift are that the US is becoming the easier market to navigate – with it having superior liquidity versus other markets, as well as more companies within the ‘sweet spot’ of a $3bn market cap, a threshold which draws increased investor attention and thus liquidity – as well as that US technology stocks have blazed ahead of other regions, meaning there has been a natural increase in the size of their US equity position due to the increase in comparative value.

Top 10 holdings

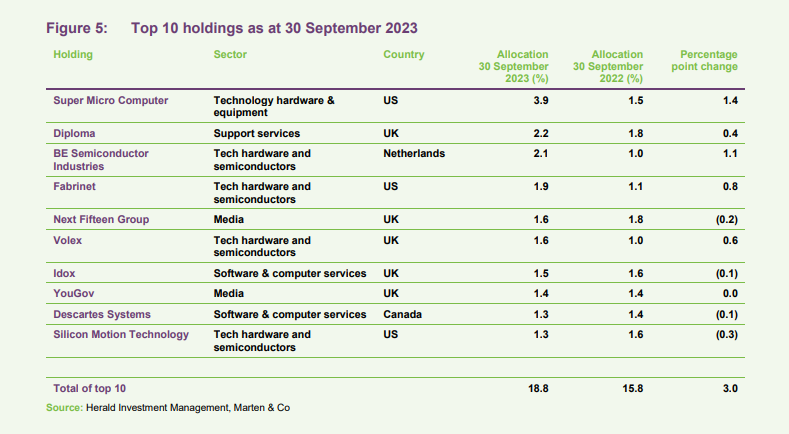

Figure 5 shows HRI’s top 10 holdings as at 30 September 2023 and how these have changed over the previous 12 months.

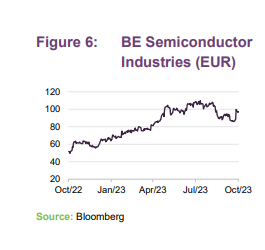

BE Semiconductor Industries

BE Semiconductor Industries (Besi) is a holding company that is engaged in the development, manufacturing, sales, and service of semiconductor assembly equipment. Besi does not produce semiconductor chips, but rather the niche equipment used by other companies in their own semiconductor production. Besi operates in three segments: Die Attach, Packing, and Plating.

Besi’s share price has increased significantly since COVID-19, as the proliferation of technology adoption has increased the demand for semiconductors. HRI’s manager comments that Besi’s systems are also becoming increasingly integrated into semiconductor manufacturing, which is helping to solidify its position as a market leader. For example, Besi’s hybrid bonding technology is expected to go mainstream with smartphone processor makers around 2027.

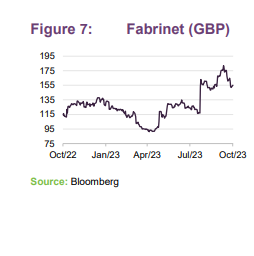

Fabrinet

Fabrinet is a Cayman Islands-based company, which provides advanced precision optical/electronic/mechanical manufacturing services. The company provides advanced optical packaging and precision optical, electromechanical and electronic manufacturing services to original equipment manufacturers of complex products, such as industrial lasers, medical devices and sensors, to name a few. Fabrinet offers a range of advanced optical and electromechanical capabilities across the whole manufacturing process, from the process design and engineering, to manufacturing, then final assembly and testing. Its primary focus though is on the production of low volume, high-mix products.

In its recent results, Fabrinet has been able to post robust earnings for its fourth quarter 2023 (for its financial year), thanks to recent surge in AI-driven demand. The surge in demand from AI-linked firms, with NVIDIA accounting for 13% of revenues, was more than enough to offset a falling demand from telecoms, which has traditionally been Fabrinet’s largest business – something which demonstrates the importance of sectoral growth opportunities (the advancement of AI in this case) in offsetting cyclical slowdowns.

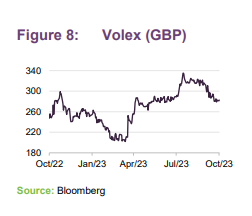

Volex

Volex is a UK based firm that is engaged in integrated manufacturing of performance-critical applications and power products. Volex’s range of products, capabilities, and solutions includes power cords, connectors, integrated manufacturing services, electric vehicle charging solutions, consumer cable harnesses and power products, higher speed internet and data transfer cables, and data centre power cables.

Volex has recently become a licensed charging system partner of Tesla and has also acquired Murat Ticaret, a maker of wire harnesses, which it believes will provide it with immediate entry into a new growth market. These developments come after Volex reported a FY 2023 performance ahead of market consensus, growing its profits by 17% on the prior year, which lifted its share price in April. HRI’s manager says that the results point to Volex’s ability to control costs and improve its margins, as well as its strategy of targeting structural growth industries like electric vehicles, complex industrial technologies, and the medical sector.

YouGov

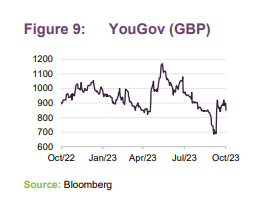

YouGov is a UK based international research and data analytics company, providing its clients with data to help them explore, plan, activate and track the impact of their marketing and communications activities. UK readers will likely recognise the company for the polling data, which is frequently referred to by the UK’s press, especially during election periods. YouGov operates in three divisions: Data Products, Data Services, and Custom Research. YouGov’s data products division comprises its syndicated data products, such as its ‘BrandIndex’ and ‘Profiles’ products suites, which are offered to clients on a subscription basis. Its data services division provides clients with fast-turnaround and cost-effective survey solutions for national and specialist sample sizes. Its custom research division offers a range of quantitative and qualitative research tailored to fit each client’s specific requests.

YouGov’s recent activity includes the acquisition of the GfK’s Consumer Panel Business, a leader in European household purchase data, for €315m. The purchase was partially funded by a £51m equity issuance by YouGov, which may in part explains the weakened share price over the year, given the diluting effect. YouGov’s shares were also impacted by the company’s announcement in July that while its 2023 operating profit would be in line with expectations, its revenues were on track to come in at the lower end of its estimates. We note that YouGov has begun to look at the idea of listing in the US, which could dramatically increase the liquidity around the stock, and may be a future tailwind for its share price.

Performance

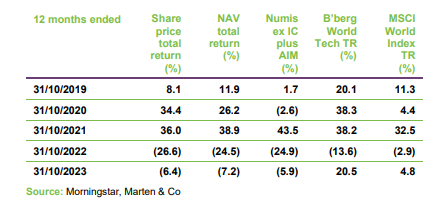

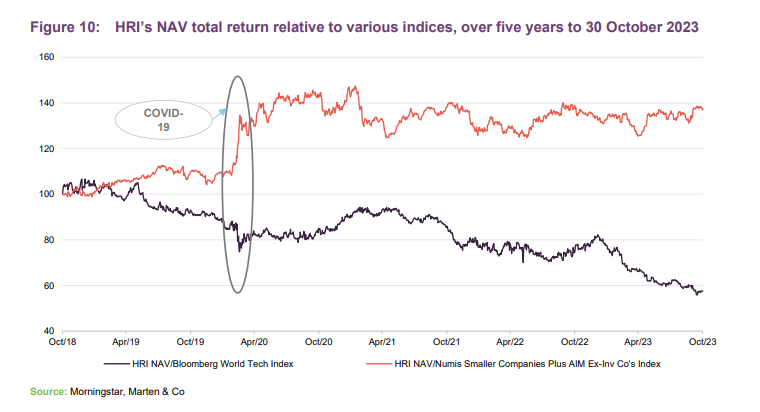

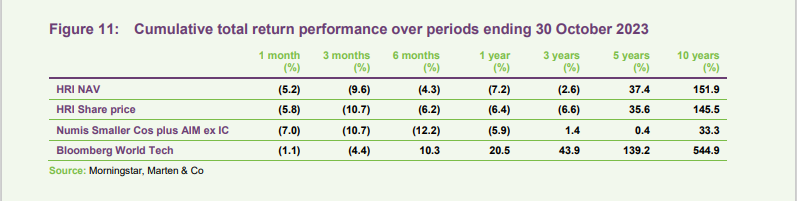

Despite the recent headwinds global investors have faced, HRI has still more than doubled its shareholders’ capital over the last 10 years, as well as generating a nearly 40% total return over five. This compares favourably to the domestic UK small cap market, as the Numis small cap index, which returned 0.4%.

HRI has however lagged global markets over the long term, falling behind the Bloomberg World Technology Index over nearly all sampled periods. This is mainly due to its relative underexposure to the US and its zero allocation to large caps.

North American equities, in particular their technology stocks, have accounted for the lion’s share of the growth in global equities. While this has been a significant benefit to the US small and mid-cap sector, its greatest impact has been in the US mega cap sector.

Generally speaking however, the US’s equity market returns, and by extension global equity market returns, have been driven by the ‘magnificent seven’, seven of Americas largest technology companies: Apple, Amazon, Alphabet, Microsoft, Nvidia, Tesla, and Meta, which performed particularly strongly towards the end of 2022 and during 2023. This appears to have been in part due to their earnings but also possibly due to the frenzy around AI, with investors tending to favour well-known companies, hoping to capitalise on the expected growth of a complex sector. The Bloomberg Technology Index also surpasses HRI for similar reasons, as while it does not hold the consumer-focused technology companies (like Amazon or Facebook) Apple, Microsoft, and NVIDIA account for 47% of the index alone.

These very high concentrations in the largest stocks seem to be a significant challenge for any strategies that are benchmarked against them. Many strategies do not allow managers to have allocations close these levels and, even if permitted, many would avoid this as it would not generally be considered to be good portfolio management. As a consequence, in periods where mega cap technology outperforms, actively managed technology funds may underperform.

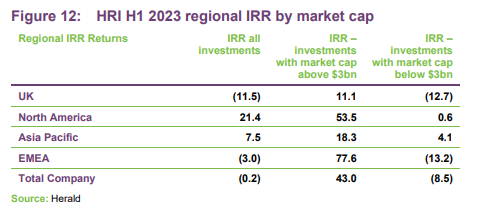

H1 2023 – A tale of two halves

Data and commentary provided by the HRI’s manager suggests that the first half of 2023 has been a story of two distinct groups, as can be seen by Figure 12. The manager says that HRI’s returns have been driven overwhelmingly by its North American exposure. Asia Pacific was also a positive contributor but, at only c.10% of HRI’s allocation, its effect is muted versus that of North America’s. Another important factor has been size – the larger market cap stocks within HRI’s portfolio generated far greater returns than the smaller caps.

Market returns during H1 2023 seemed to be largely driven by macro or sector wide events. There has been a lot of excitement around AI, which has placed the spotlight on the US tech market once again as most of the major AI names, like Chat GP, have come out of the region. The macroeconomic outlook has also showed signs of improving.

US equity gains have offset HRI losses in the UK market

Through the first half of 2023, there were signs of a sustained reduction in US inflation, and what appeared to be a softening in the language used by the Fed, as well as a reduction in interest rate expectations by the wider market, with talk of a possible interest rate cut early next year. The US economy also appears relatively robust. GDP growth is better than most other developed market and both businesses and consumers appear buoyant. This robustness and a tempering interest rate expectations seems to have brought about renewed investor confidence in US markets, as shown in Figure 12. The strength of performance from the Asia Pacific region may also be due to similar factors, as the region has far lower inflation expectations that developed markets, although it has likely been weighed down by the economic woes of China.

The size effect present within HRI’s portfolio, whereby its larger market cap holdings outperformed the smaller market caps, may be due to the liquidity advantage larger companies have. As we outlined on page 5, there are signs of decline in market liquidity since 2022, as investors retreated from the small cap equity market. Given the dramatic shifts we have seen in both macro and sector trends in 2023, investors may be favouring liquid stocks as they offer advantages in navigating more volatile market environments.

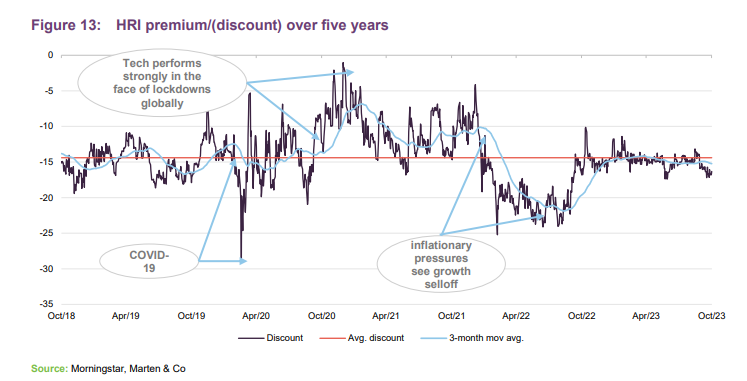

Discount

While HRI has traded at a continual discount across all of the last five years, the size of its discount has tended to be a reflection of the outperformance of technology stocks, narrowing during periods of strong relative performance. For example, this occurred during the post-pandemic-crash period, which saw an outperformance of technology stocks, with HRI trading at its narrowest discount of the last five years at the end of 2020.

HRI’s discount trades in line with its long-term average

HRI currently trades on a 15.2% discount and over the past year, HRI has traded on a discount ranging between 11% and 17%, with an average discount of 14.4%.

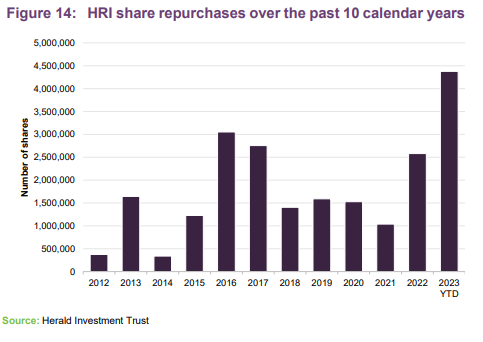

The board has increased its share repurchases over 2023, as can be seen by Figure 14. Whilst HRI’s policy is not to attempt to control the discount, because it is not considered appropriate given the limited liquidity available within the underlying portfolio companies, the trust will repurchase shares opportunistically. Where repurchases are undertaken, the aim is to enhance the NAV per share for remaining shareholders.

Dividend

HRI is focused primarily on generating capital growth, and dividend income makes up only a small part of returns. The consequence of this is that HRI only declares a dividend where this is necessary to retain investment trust status, and in practice, no dividend has been declared since 2012.

Fund profile

Established in 1994, HRI invests globally in small technology, communications and multimedia companies with the aim of achieving capital growth. It is the only listed fund of its type. The trust invests globally, but has a strong bias towards the UK, which further distinguishes it from other global technology funds, which tend to be biased towards the US.

New investments in the fund will typically have a market capitalisation of $3bn or less but are generally much smaller when the first investment is made. If successful, these can grow to be a multiple of their original valuation. This type of investing is longer-term in nature and so the trust tends to have low turnover. Reflecting the risks inherent in this type of investing, and the liquidity constraints of having a small cap investment remit, the trust maintains a highly diverse portfolio of investments (typically in excess of 250) to help mitigate this risk

Experience is important in markets such as these

HRI’s lead fund manager is Katie Potts, who has managed HRI since its launch. She was a highly-regarded technology analyst at SG Warburg (later UBS) prior to launching the fund. Katie owns a substantial stake in the company and a significant minority stake in the management company, and therefore is incentivised to ensure the success of the fund.

HRI’s close-ended structure allows effective use of gearing during market selloffs

Under Katie’s stewardship, HRI has navigated several downturns and has benefited from the team’s ability to select companies capable of weathering difficult conditions. HRI’s closed-ended structure has beneficial. Whilst open-ended funds may be often forced sellers, HRI has the flexibility to gear to pick up lines of stock at attractive prices (we discuss this further on page 9), though in practice it has seldom made use of this facility in recent years.

HRI plays an important role as a provider of much-needed capital to listed technology companies looking for expansion capital. This is particularly valuable in a downturn and could offer HRI further opportunities to generate alpha.

HRI offers a liquid subcontract for any investor looking to gain access to this part of the market, and an investment in HRI might complement an investment in one of the large-cap technology funds.

Previous Publications

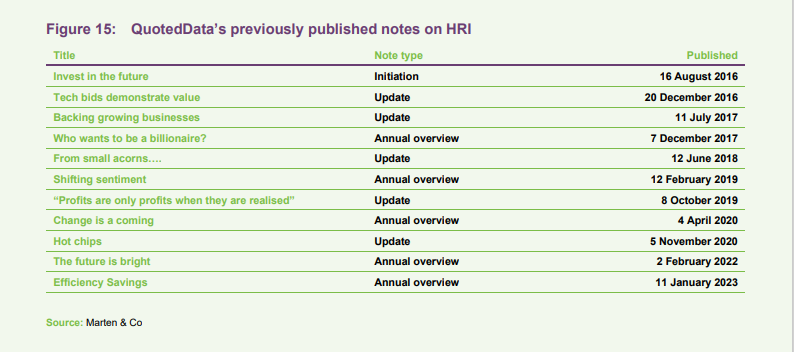

Readers interested in further information about HRI may wish to read our previous notes (details are provided in Figure 15 below). You can read the notes by clicking on them in Figure 15 or by visiting our website

IMPORTANT INFORMATION

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Herald Investment Trust Plc. This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it. Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it. The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note. This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.