Trust in biotech

Trust in biotech

The biotechnology sector is proving to be relatively resilient in this COVID-19 related market sell-off. International Biotechnology Trust (IBT) adopts a conservative approach to investing in what can be a quite volatile, if rewarding, sector and has fared better than its peers in this environment.

Some delay to drug development and testing programmes and product launches may be inevitable as the world focuses on tackling the coronavirus. However, the underlying picture is one of strong growth as companies bring forward cures for previously untreatable diseases, based on advances in the likes of gene therapy and immunotherapy. The race for the White House, which was one source of uncertainty, seems likely to be between Trump and Biden, which could mean business as usual for the drug companies.

Access to the fast-growing biotech sector

Access to the fast-growing biotech sector

IBT is the longest-established of the London-listed funds specialising in the biotech/healthcare sector. It aims to achieve long-term capital growth by investing in biotechnology and other life sciences companies, and offers investors the highest yield in the sector. The portfolio is invested primarily in quoted companies, but IBT also has exposure to unquoted companies through a well-diversified investment fund.

Fund profile

Fund profile

IBT aims to achieve long-term capital growth by investing in biotechnology and other life sciences companies. Notably, it also provides a dividend equivalent to 4% of NAV, making it the highest-yielding fund in its peer group. This is despite it investing exclusively in a sector where companies do not usually provide income.

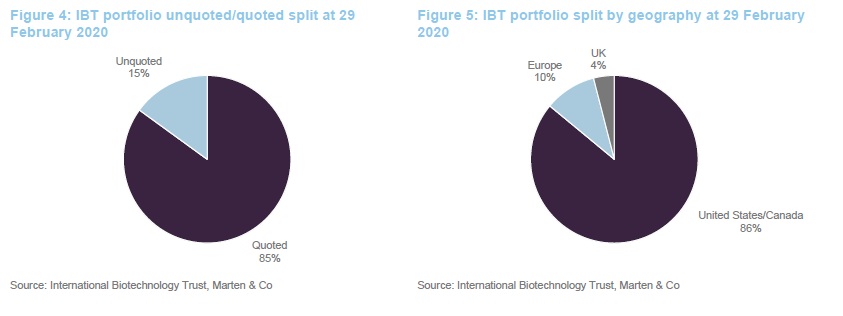

A small portion of IBT’s portfolio is invested in unquoted stocks.

For the quoted portion of the portfolio, the manager seeks to provide returns to shareholders ahead of the NASDAQ Biotech Index (NBI). The NBI is a market-cap weighted index where the four largest positions are capped at 8%.

The manager

The manager

IBT is managed by SV Health Managers LLP, which is part of the wider SV group, advising and managing seven healthcare/life sciences venture capital funds with over $2bn in capital under management. It is also the manager of the £250m Dementia Discovery Fund and has offices in Boston and London.

The lead manager is Carl Harald Janson, who joined SV Health in September 2013. He is assisted by Ailsa Craig (investment manager) and Marek Poszepczynski (portfolio manager). Kate Bingham (one of SV Health’s managing partners) manages the trust’s unquoted portfolio.

Sector overview

Sector overview

Until a few weeks ago, the dominant external influence on the biotech sector was the upcoming US Presidential election. Now, unsurprisingly, all eyes are on the progress of COVID-19.

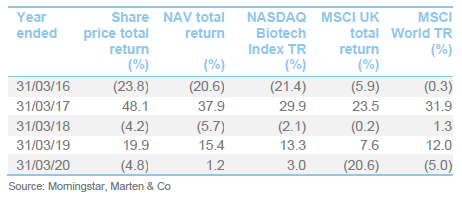

Clearly, the biotech sector has proved relatively defensive in the current environment, with the NBI outperforming broader equity indices by a considerable margin. These are growth companies; demand for their products is not cyclical neither is the primary determinant of success in the sector – drug discovery. This does not mean that these companies are unaffected by current events, however.

In the race for the Democratic nomination, Joe Biden seems to be close to beating Bernie Sanders and may stand a decent chance of winning the Presidential election. In theory, a Biden versus Trump election removes the ‘threat’ of Medicare for All (a shift in the way that the US healthcare system operates to bring it closer to the NHS, although still with considerable involvement of the private sector). It also reduces the likelihood of stringent controls on drug prices, although late last year, the managers highlighted a USC report that indicates that 41% of the cost of drugs in the US goes to middlemen. The managers felt that these middlemen would have been squeezed far harder than the drug companies. One other idea that has been mooted is linking US drug prices to those in other markets (international reference pricing). In this case, the managers felt that this was a prospect that the drug companies could live with.However, it seems possible to us that, as COVID-19 drives increasing government intervention in the US healthcare sector, this could have a lasting impact on the structure of the industry.

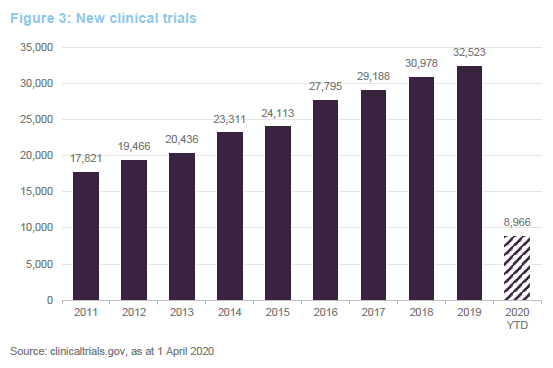

In the short-to-medium term, COVID-19 is distorting the sector in various ways. Some drugs, therapies and over-the-counter medicines are in high demand. By contrast, many hospitals are suspending clinical trials, postponing non-essential operations and even cancer treatments as resources are diverted towards tackling the virus.

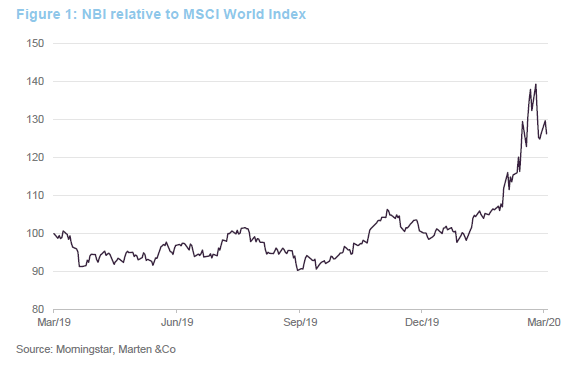

Ahead of COVID-19, we were seeing an uptick in approvals for new drugs. Absent COVID-19, this faster pace of drug approvals looked likely to be maintained. Greater understanding of the human genome is allowing the development of novel therapies based on replacing defective genes, redirecting the immune system to attack specific targets or tailor-making therapies to tackle specific disorders. This has the potential to allow cures for many conditions for the first time. Given this, the FDA has fast-tracked some approvals for new therapies. There is a quid-pro-quo, however – companies that sell or market therapies that alleviate the symptoms associated with these conditions could see their market disappear.

The 48 new approvals in 2019 included Trikafta, Vertex’s treatment for cystic fibrosis; Skyrizi, a psoriasis treatment from AbbVie; Rinvoq, a treatment for rheumatoid arthritis, again from AbbVie; and Enhertu, a treatment for metastatic breast cancer developed by AstraZeneca.

Developing new therapies and bringing them to approval is an expensive business. Fund raising for cash-strapped companies is unlikely to be possible in this environment. Fortunately, IBT’s managers have actively sought to ensure that its portfolio companies are all well-financed, in the light of COVID-19. A fuller description of the investment approach is available on pages 6 to 8 of our annual overview note.

COVID-19 vaccinations and treatments

COVID-19 vaccinations and treatments

A wide range of companies are working on vaccinations and treatments for COVID-19, aided by the swift sequencing of the genome of the virus, initially by China and then replicated in many other countries. The news on this front is changing almost daily. It seems unlikely to us that any company would seek to profit from discovery of an effective treatment.

There are many promising potential vaccines in development and very early-stage trials have already started. Regulatory bodies will no doubt do what they can to speed up the approval process. However, trials must demonstrate that the vaccine does not do more harm than good – by triggering side effects or ultimately encouraging patients to develop the disease, and this process takes time. The consistent message seems to be that it will take about 18 months before a vaccine is generally available.

Treatments divide roughly into two parts – anti-virals, to control the spread of the virus in the body, and therapies that influence the inflammatory immune response, dealing with the complications that arise in severely affected patients.

Gilead, which is one of IBT’s largest holdings, is known for its anti-viral therapies, for HIV in particular. It was developing a drug, remdesivir as a treatment for Ebola and is now trialling this as a treatment for COVID-19. Two placebo-controlled trials are underway in China (with readouts due in April 2020) and Phase 3 trials are underway in the US.

Drugs that are already approved for the treatment of HIV are also being evaluated as treatments for COVID-19. Amongst these are ritonavir/lopinavir (marketed as KALETRA by Abbvie) and darunavir/cobicistat (marketed as PREZCOBIX by Janssen). Initial results (from a trial of ritonavir/lopinavir conducted in Wuhan) were not promising.

Patients with the severe form of COVID-19 tend to develop an immune-related inflammation of the respiratory system. Effective treatment of this would reduce the mortality rate considerably. Interleukin cytokine IL6 is thought to have a role in this and drugs already exist that seek to counter this in cases of cancer and rheumatoid arthritis. Roche and Sanofi/Regeneron have approved monoclonal antibody therapies (Actemra and Kevraza, respectively), which are being trialled for COVID-19, and Regeneron also has several antibody candidates, which the managers say will be subject to clinical testing over the summer.

Another treatment that has been touted is hydroxychloroquine, maybe in conjunction with the antibiotic azithromycin. Again, a range of trials are underway or planned to evaluate this approach. However, it is associated with a number of side effects, some of which can be severe, and the trial in France that generated excitement around the approach was too small to be conclusive.

Asset allocation

Asset allocation

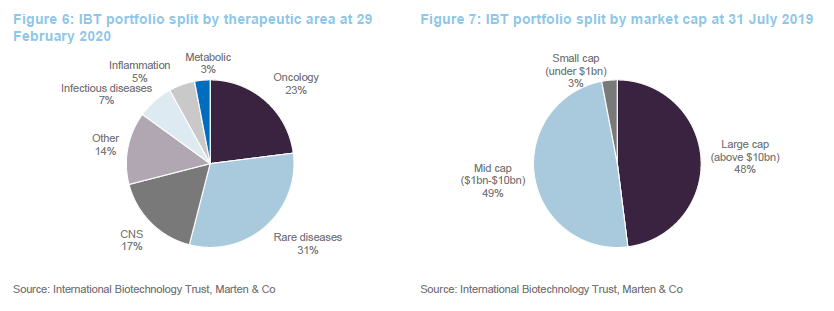

As at the end of February 2020, IBT had 78 direct investments in companies and exposure to a further 22 companies through its investment in SV Fund VI.

The split of the portfolio between quoted and unquoted companies has barely changed since we last published on the company (when we used data from the end of July 2019). Similarly, the geographic split is unchanged.

One significant change to the make-up of the portfolio over the last six or seven months is a reduction in the trust’s exposure to smaller companies (those with a market cap of less than $1bn). These accounted for 20% of the quoted portfolio last July and just 3% at the end of February 2020.

Sector exposures are determined by stock selection decisions.

Fairly early on in the COVID-19 story, IBT’s managers reduced the trust’s gearing to zero. This is consistent with the managers’ ambition to be the low risk trust in the sector.

10 largest quoted holdings

10 largest quoted holdings

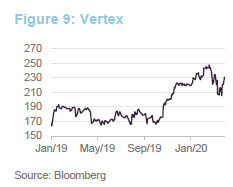

Vertex Pharmaceuticals

Vertex Pharmaceuticals

Securing approval for Trikafta in October 2019 was a significant milestone for Vertex. The managers say that this cystic fibrosis treatment can address 90% of cases and it is estimated to have the highest sales potential of any of last year’s new crop of drugs. The boost that this gave to the share price is evident in Figure 9. However, the managers also say that, in addition to building on its success in cystic fibrosis, the company has a promising pipeline of other products. These include potential curative therapies for sickle cell disease, beta thalassemia, Duchenne muscular dystrophy and type 1 diabetes.

Gilead Sciences

Gilead Sciences

Gilead is best-known for its antiviral franchise, with a series of therapies aimed at HIV, hepatitis C. Gilead is allowing Teva Pharmaceuticals to manufacture a generic version of Truvada, used as Pre-exposure Prophylaxis (PrEP) to prevent the spread of HIV. However, Gilead appears to be successfully shifting patients onto Descovy (27% of the market in the US at the end of 2019). It is also preparing to launch filgotinib as a therapy for rheumatoid arthritis. In recent times, Remdesivir, which was being developed as a treatment for Ebola, has shown some early promise in the fight against the coronavirus, as we discussed on page 4. This triggered a spike in Gilead’s share price. However, Gilead has warned that it is not ready to manufacture this in large quantities.

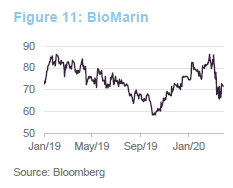

BioMarin Pharmaceuticals

BioMarin Pharmaceuticals

In 2019, BioMarin’s share price benefited from the approval of Valrox as a gene-therapy treatment for haemophilia A. This was one of the therapies that the FDA chose to fast track in 2019. Launch of the treatment was expected in the second half of 2020. Linked to this, BioMarin was predicting that it would report its first full-year profit in 2020. The recent weakness in the share price may reflect fears that the launch will be delayed as resources are diverted towards dealing with COVID-19.

BioMarin has a number of other products in development. The closest to market is vorsoritide, a treatment for achondroplasia, a genetic disorder that causes dwarfism.

Acadia Pharmaceuticals

Acadia Pharmaceuticals

Acadia is focused on developing therapies for disorders of the central nervous system. It has a product (NUPLAZID) that launched in 2016 and is used to treat hallucinations and delusions associated with Parkinson’s disease psychosis. The active ingredient is being evaluated for use in the treatment of dementia-related psychosis, depression and some symptoms of schizophrenia. Acadia also has an exclusive licence to develop and commercialise Trofinetide in North America. Trofinetide is used to treat Rett syndrome.

Elsewhere in the portfolio, Biogen fought off an attempt by Mylan to launch a generic version of its multiple sclerosis drug Tecfidera. Last year, despite initial disappointment, the FDA approved further trials of Biogen’s Alzheimer’s drug and the hope is that aducanumab wins FDA approval. There is huge unmet need for an Alzheimer’s therapy.

The managers say that Stemline, a stock we wrote about last July, has disappointed. Its product ELZONRIS (tagraxofusp), which aims to treat a form of blood cancer, hasn’t sold as well as expected.

Performance

Performance

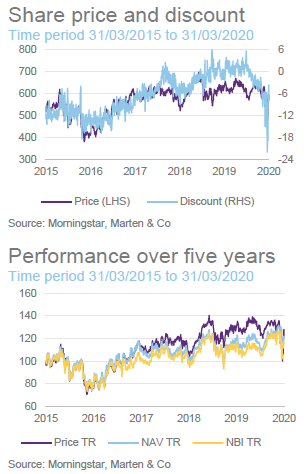

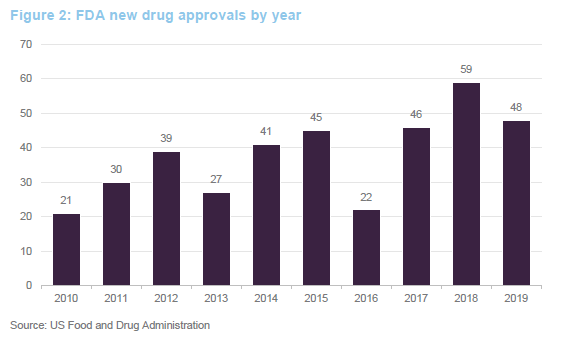

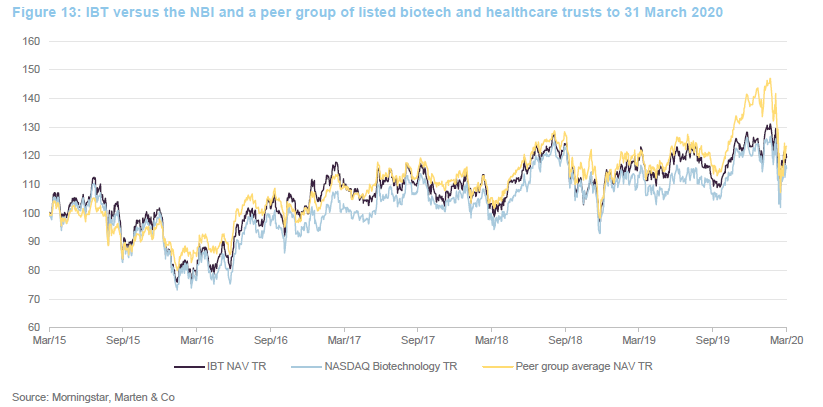

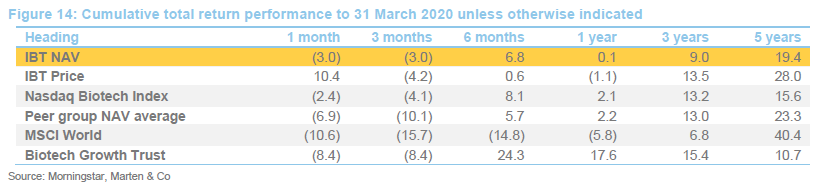

The chart compares IBT with its benchmark and a peer group average of Biotech Growth Trust, BB Healthcare, Polar Capital Global Healthcare and Worldwide Healthcare. Of these, Biotech Growth Trust is the closest comparator. The others also invest in the wider healthcare sector, including the large pharmaceutical stocks. Biotechnology stocks lagged the wider healthcare sector for the last couple of years and this is the reason that the peer group average did better for a while.

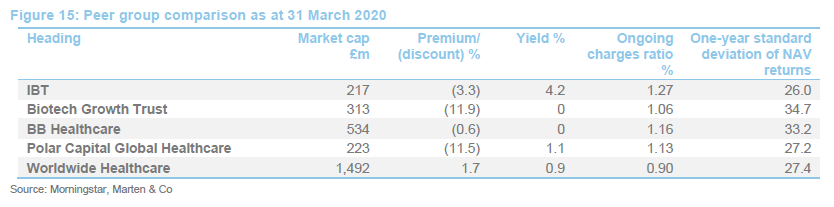

IBT’s conservative approach means that it has a lower volatility of returns relative to Biotech Growth and the wider peer group.

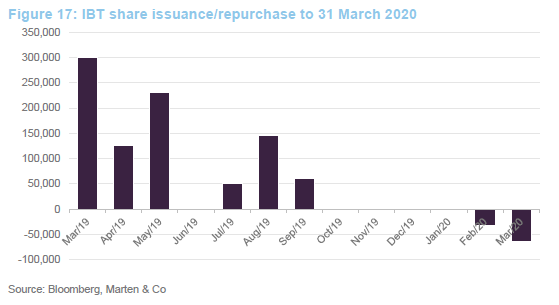

IBT was expanding last year but, when the discount widened briefly, the trust bought back stock. Its ongoing charges ratio is reflective of its size. IBT’s enhanced yield is attractive to some investors and it remains the only meaningful way for investors to access income from a healthcare portfolio.

Premium/discount

Premium/discount

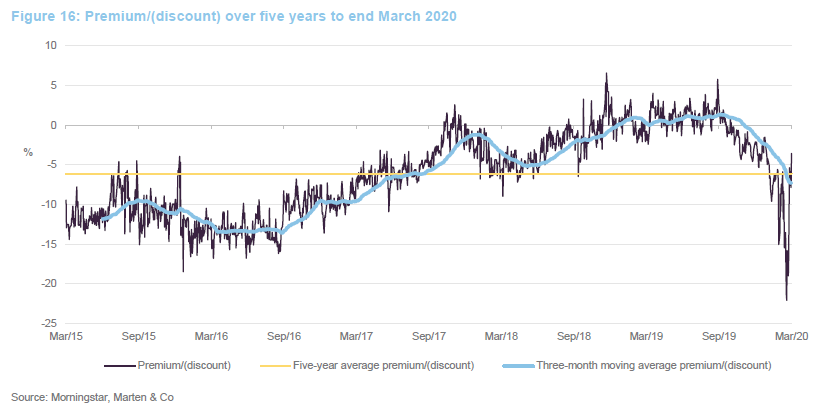

Over the 12 months ended 31 March 2020, IBT’s shares traded between a premium of 5.8% and a discount of 22.1%. The average for this period was a discount of 1.7%. The recent widening of the discount can be attributed to the general uncertainty created by COVID-19.

It seemed a little unfair that IBT saw such a sharp widening of its discount over a period when it has been the best-performing investment company and in a sector that has proved relatively resilient. Investors had a brief opportunity to pick up stock relatively cheaply, but it may be that the share price moves back towards trading at asset value or a small premium now.

The trust stepped up to the plate and bought back shares when the discount spiked out. Shareholders benefited as repurchases at these levels boost the NAV for ongoing investors.

Previous publications

Previous publications

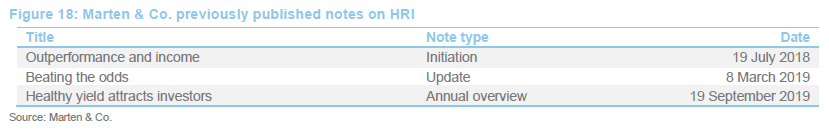

The various notes that we have published on IBT are listed in Figure 18. You can access the notes by clicking on the links below or by visiting our website, www.martenandco.com.

The legal bit

The legal bit

This marketing communication has been prepared for International Biotechnology Trust by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it but, in practice and in accordance with our internal code of good conduct, will refrain from doing so. Nevertheless, they may have an interest in any of the securities mentioned in this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.