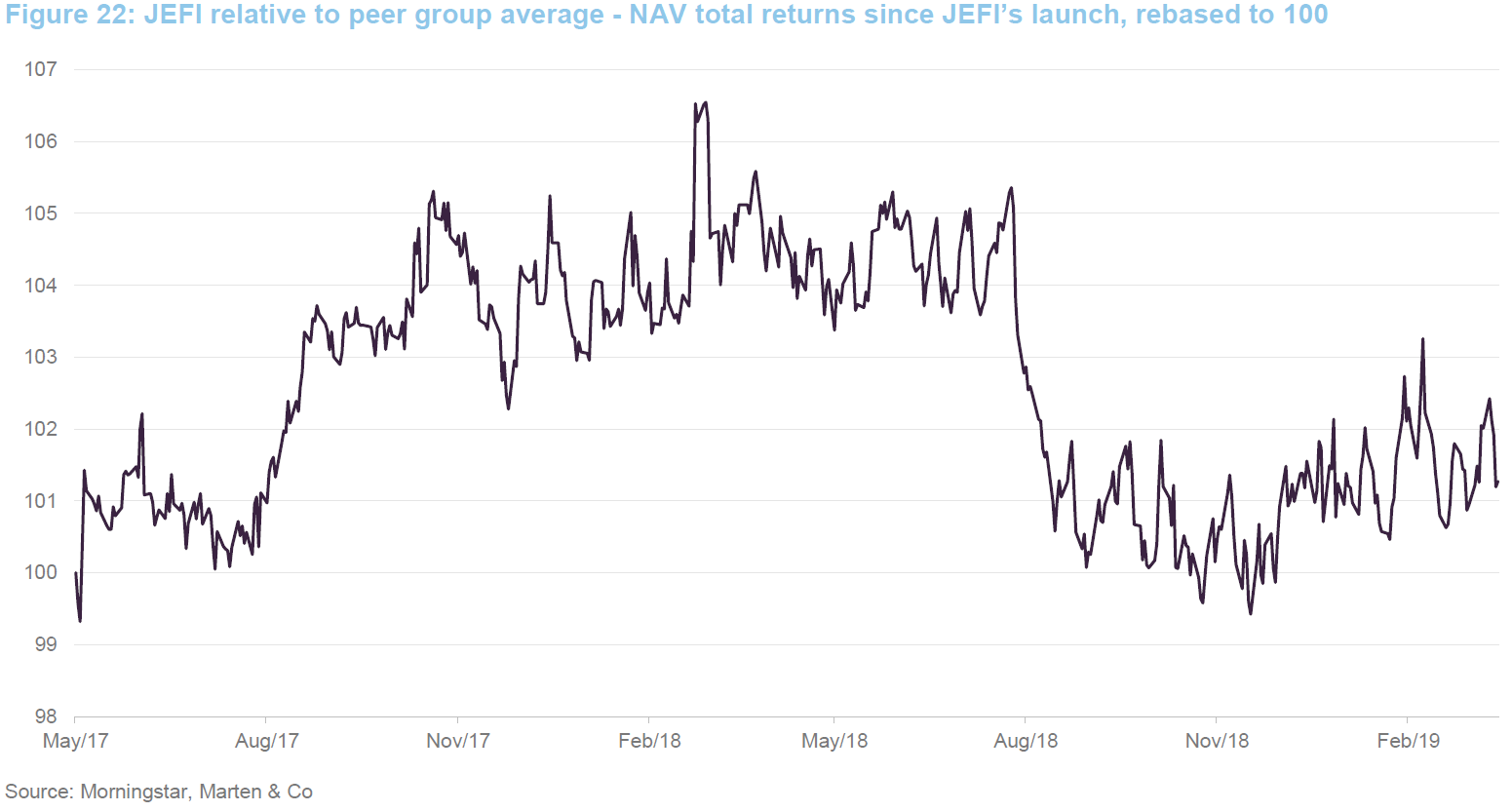

Jupiter Emerging & Frontier Income (JEFI) has outperformed its peer group average since launch. In 2018, JEFI’s exposure to smaller and medium-sized companies and frontier markets acted as a drag on performance, relative to the MSCI Emerging Markets Index.

Jupiter Emerging & Frontier Income (JEFI) has outperformed its peer group average since launch. In 2018, JEFI’s exposure to smaller and medium-sized companies and frontier markets acted as a drag on performance, relative to the MSCI Emerging Markets Index.

With US rate hikes no longer on the table for 2019, investors’ interest in emerging and frontier markets may be rekindled. JEFI’s focus on companies benefitting from positive change, and the managers’ willingness to follow their conviction rather than hugging a benchmark, could provide a platform for outperformance. In addition, JEFI has comfortably exceeded the dividend objectives that were set at launch, putting it on an attractive yield, the highest of any fund in its listed peer group.

Long-term capital and income growth

Long-term capital and income growth

JEFI aims to generate capital growth and income over the long term, through investment predominantly in companies exposed directly or indirectly to emerging markets and frontier markets worldwide.

Contents

Contents

- Fund profile

- A more benign environment?

- Investment process

- Asset allocation

- Performance

- Dividend

- Premium/(discount)

- Fees and costs

- Capital structure and life

- The management team

- Board

- Previous publications

Fund profile

Fund profile

Jupiter Emerging & Frontier Income Trust (JEFI) launched in May 2017. It invests globally in stocks that provide exposure to emerging and frontier markets (any country that is not classified as developed or emerging). The aim is to generate both capital growth and income over the long term, using an investment approach that is essentially benchmark agnostic, unconstrained and focused on identifying positive change.

Investment managers

Investment managers

JEFI’s portfolio is managed by Ross Teverson and Charles Sunnucks (together, the managers), both of Jupiter Asset Management (Jupiter), who subcontract the job of managing the portfolio from the AIFM, Jupiter Unit Trust Managers Limited. More information on the eight-strong emerging markets team is provided on page 18. The emerging markets team had £2.1bn under management at the end of March 2019. The managers can also draw on the expertise of Jupiter’s wider pool of asset managers and analysts.

A more benign environment?

A more benign environment?

In general, markets were weak at the end of 2018, as concerns started to build that Chinese growth was faltering. Part of the blame for that was laid at the ongoing tariff dispute between China and the US. The US Federal Reserve, which had been quite hawkish, reversed its position and said that US interest rates are unlikely to rise further in 2019. This could weaken the US dollar, which would be beneficial for emerging markets. However, investors will also have an eye on Chinese economic data. In this regard, an uptick in China’s March PMI to 50.5 (indicating economic expansion) may be encouraging.

Frontier markets and smaller companies underperforming

Frontier markets and smaller companies underperforming

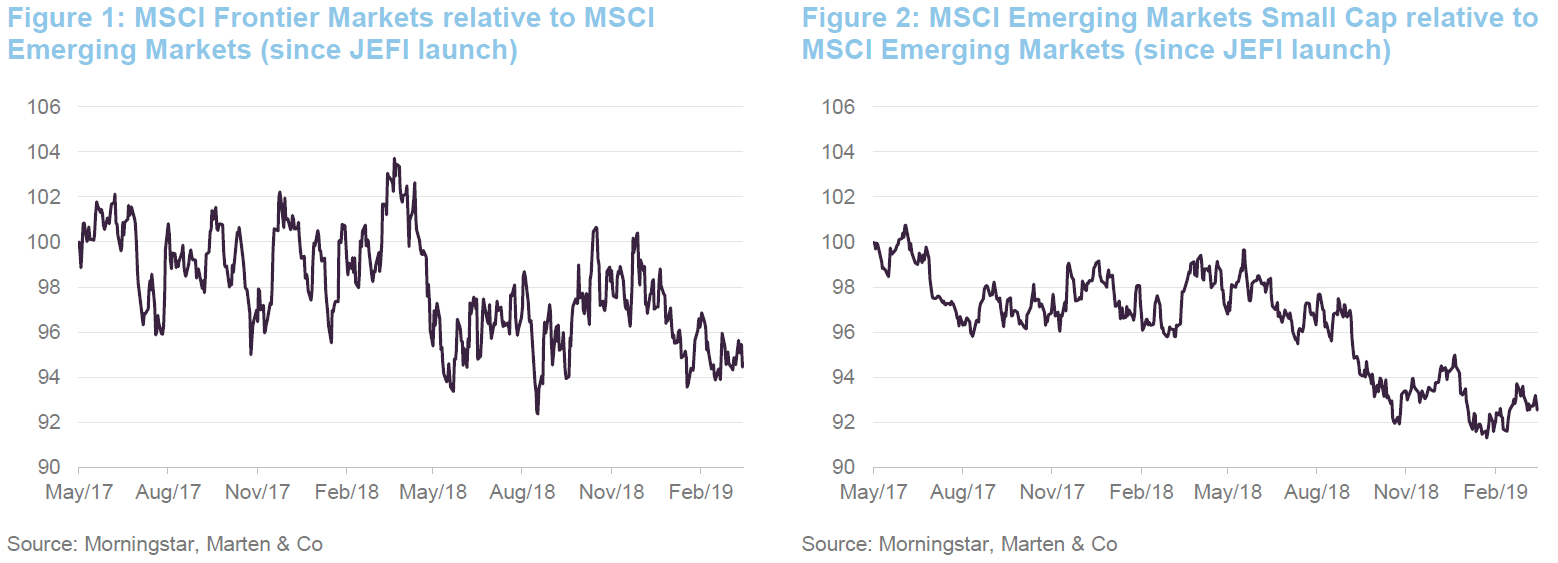

As is clear from Figures 1 and 2, frontier markets and smaller companies have been underperforming the MSCI Emerging Markets Index since JEFI was launched. Given that, JEFI has done well to more or less hold its own, relative to the MSCI Emerging Markets Index (see Figure 15 on page 11).

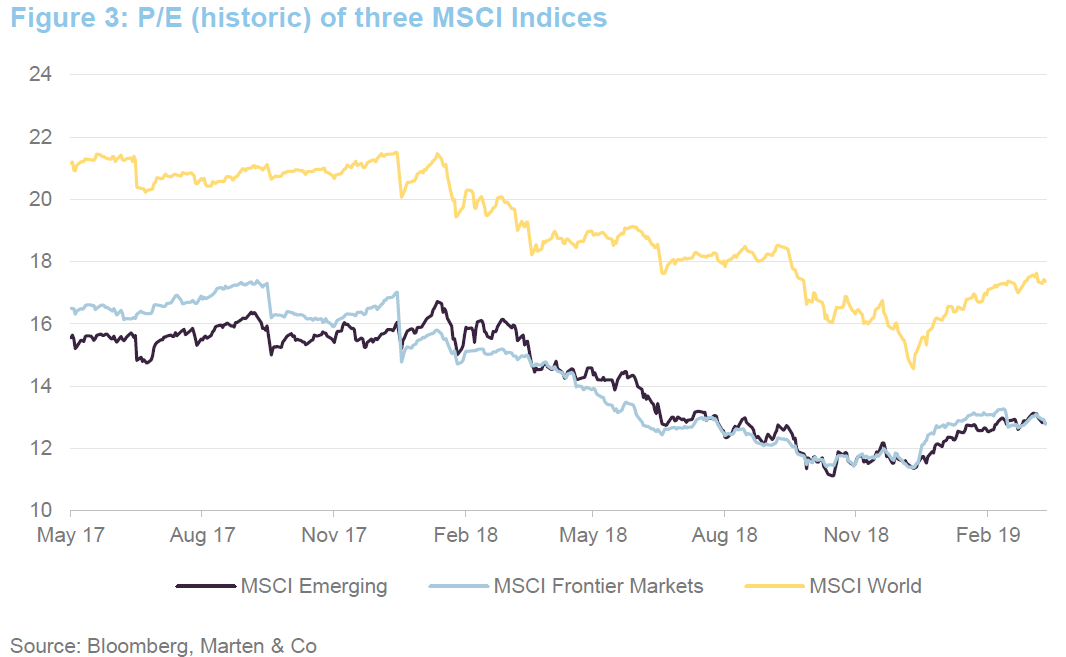

A combination of weak markets and reasonable earnings growth has meant that price/earnings multiples have fallen since JEFI was launched.

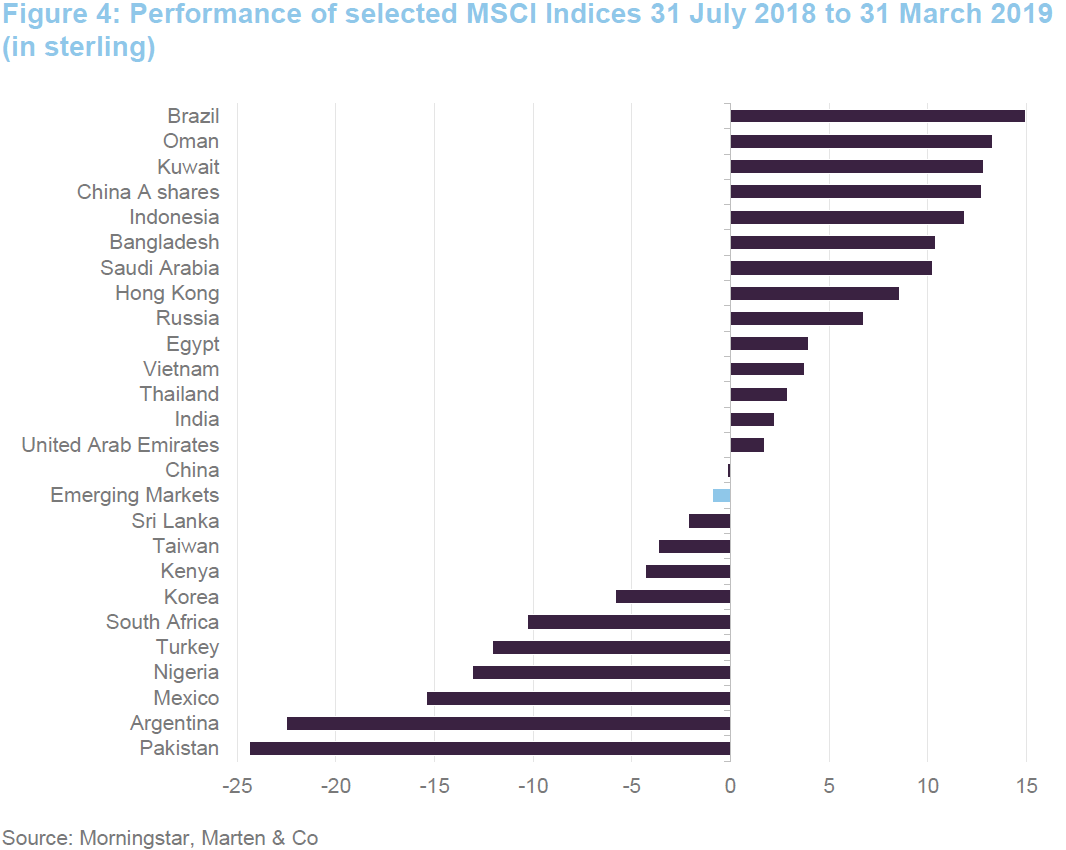

Figure 4 shows the performance of a selection of emerging and frontier indices. There has been quite a wide dispersion of returns since 31 July 2018 (the data used in our last note on JEFI).

Brazil rose after the election of President Jair Bolsonaro, seen as the business-friendly candidate. The gulf countries did well generally, buoyed by a recovering oil price and the possibility that Saudi Arabia would be upgraded to the MSCI Emerging Markets Index. The UAE has been underperforming other gulf markets. The managers note, for example, that port owner and operator DP World is trading at a discount to peers andEmirates Bank has been underperforming Saudi peers such as Al Rajhi Bank. JEFI’s exposure to the gulf countries comes through holdings in Emaar Malls, the UAE company that owns Dubai Malls. The managers say that the market is not giving credit for this asset’s world-class location. The company offers a 6% yield from revenue that is largely dollar-denominated/linked. They think there is scope for positive rent reviews and the addition of new retail space, both elsewhere in Dubai and within Dubai Malls (Fashion Avenue was expanded in March 2018).

The domestic Chinese market has been particularly strong so far in 2019, on news that MSCI would accelerate the inclusion of China A and ChiNext (a Chinese technology index) constituents within the MSCI Emerging Markets Index (the inclusion factor will rise from 5% to 20% by November 2019). In the run-up to elections, MSCI India has been fairly flat, putting the disruptive events of demonetisation and the introduction of a Goods and Services Tax behind it, but mid and small-cap stocks have underperformed larger ones.

At the other end of the table, Pakistan’s stock market ran up in advance of its promotion to the MSCI Emerging Markets Index but has fallen sharply since, in part as an IMF bailout looms. Charles made a visit to the country in 2018 and sees potential there. In our last note, we discussed the managers’ purchase of United Bank (UBL).

Financial inclusion

Financial inclusion

One of the big themes in JEFI’s portfolio is increasing financial inclusion within emerging and frontier economies. JEFI offers a much more diverse set of exposures than its benchmark. Instead of buying the Chinese banks that dominate benchmark indices, the managers have been looking elsewhere for stocks that will benefit from greater financial inclusion. These may provide insurance, savings and pension products, as well as banking services and may include fintech companies.

The Chinese banks may offer high dividends, but also come with low growth and potential asset problems. The Chinese banking sector is fairly heavily regulated, but some banks have been circumventing the rules by dressing up loans as asset management products. The regulator is clamping down on this, increasing scrutiny of the shadow banking sector and reining in lending to state-owned enterprises. The managers think China can work its way through the problems that have arisen from the rapid growth of debt within its economy. However, it will be hard for the financial sector to make progress against this backdrop. The Chinese economy is still dependent on property prices and consumer sentiment. The managers see credit card lending as an emerging problem in China. A recent uptick in unemployment may exacerbate this.

By contrast, the stocks that JEFI owns, such as UBL in Pakistan, KCB in Kenya, Guaranty Trust in Nigeria and Bank of Georgia, are relatively inexpensive, have better growth prospects and are operating in markets with low levels of penetration of financial products. This is even true of Grupo Financiero Banorte, the Mexican banking and financial services group, a recent addition to JEFI’s portfolio. Just one third of the adult Mexican population have bank accounts.

The managers say that many of these banks have simple business models. Assets are relatively low-risk, with revenue being derived from corporate lending and government bond holdings. A high proportion of current accounts means that the cost of financing is low.

Investment process

Investment process

The managers’ investment approach for JEFI is clearly differentiated from that of its peer group. It can be summed up as ‘change-based investing’. It involves identifying a change or an improvement in a business that is not already reflected in its share price, but where the managers can pinpoint a catalyst for a re-rating.

The managers acknowledge that the approach, which combines both value and growth elements, and is style agnostic, makes the fund hard to pigeonhole. That means, though, that the performance of the portfolio should not be dependent on where we are in the cycle.

The process revolves around stock selection. The managers do not formulate macro views or incorporate them into portfolio construction. The only top-down element to portfolio construction is in ensuring adequate risk diversification.

Types of change

Types of change

- Company-specific change: the most common type of change that the managers identify is that which is within the power of company management. Examples would include the launch of new products and services, or changes to capital structure.

- Industry change: typically about improving competitive structure within an industry. The managers cite the example of the IT hardware sector, where a fragmented industry has become an oligopoly, with greater pricing discipline.

- Structural change: which tends to be very long-term.

The managers have no target in mind for allocations to each ‘bucket’, but want a reasonable spread of the different types of change within the portfolio.

Catalysts

Catalysts

There are many catalysts for a rerating but the managers cite examples such as the publication of sales data; earnings announcements; investor roadshows; and announcements of returns of capital.

Selecting stocks

Selecting stocks

A proprietary quantitative model, which scores stocks on factors such as earnings growth and valuation metrics, is used to highlight opportunities. This provides approximately a quarter of ideas for the portfolio. The model includes a liquidity threshold of turnover of $1m but the managers say that JEFI’s closed-end structure allows them to hold stocks that are less liquid than those in the equivalent open-ended funds and they can include stocks in the JEFI portfolio that don’t meet the threshold.

Other ideas come from a variety of sources, notably from the breadth of investment management and analytical support offered by the rest of Jupiter’s team (each manager specialises in research into specific sectors). For example, Jupiter’s UK small-cap manager has some holdings in common with the fund by virtue of companies operating within emerging or frontier markets but having a listing in London.

The managers ensure they talk to company management before they make an investment. They will meet them when they can – they travel extensively. The team has around 1,000 face-to-face or telephone meetings with companies in a typical year.

The managers also try to find independent evidence that supports their investment thesis for each stock. For example, interviewing both local and international competitors and customers before investing.

Income

Income

The managers say that the companies that the fund owns will often have strong balance sheets (about half of the portfolio has net cash). Companies will also tend to have high income visibility and above-average levels of dividend growth. Notionally, the managers allocate stocks to one of three dividend ‘buckets’.

About 10% of the fund will be in stocks with future income potential. Typically, these will have a yield between 0% and 2%. The managers feel that it is important not to have a minimum yield threshold for the inclusion of stocks within the portfolio. They do not mind buying some low-yielding companies with the prospect of above-average dividend growth.

About 50% of the fund can be classified as income growth stocks. These have a yield between 2% and 6%, have an established track record of paying dividends, and demonstrate positive change that supports dividend growth.

The balance of the portfolio, about 40% of the fund, is classified by the managers as ‘high income visibility’ stocks. These will typically have yields in excess of 6%, predictable dividend streams and may have some associated dividend growth from gradual structural change.

Portfolio construction

Portfolio construction

Position sizes in the portfolio will vary between 1% and 5%. The managers want each stock to make a meaningful contribution to performance; this helps set the minimum position size. The maximum position size helps avoid a situation where an individual stock becomes the main driver of portfolio performance and a concentration risk.

New position sizes depend on largely on the strength of the managers’ conviction, but are also influenced by liquidity and the extent that the position will diversify fund factor risk. The portfolio should comprise, therefore, about 40-45 stocks and the managers aim to operate a ‘one in, one out’ policy.

There are no explicit risk limits, apart from having a maximum 25% exposure to frontier markets.

Jupiter’s standalone risk team reviews the portfolio on a quarterly basis. It seeks to identify the sources of risk within the portfolio, including currency exposures and the like. Benchmark weights are not taken into consideration. The managers believe the MSCI Emerging Markets Index is a flawed measure of returns/component of risk analysis in that it has a significant and expanding exposure to China. By contrast, the managers say that there is a greater diversification of country exposures in JEFI’s portfolio.

Sell discipline

Sell discipline

For each holding there is a review price, and if that is reached, the managers will revisit the investment case. A stock reaching its review price is not an automatic trigger to sell, but it does prompt a re-evaluation of what is changing for the company and whether that change has now been priced in by the market.

If a position drops below 1% of the trust, it is automatically put up for review, and the covering analyst is expected to conclude if the investment case is still attractive and the position should be added to, or if the investment case is broken and it should be removed from the trust. This discipline avoids having a long-tail of ‘hope stocks’ which the managers might hope will turnaround but have no supporting evidence that this will happen.

Risk controls

Risk controls

The managers operate with the following risk controls which were outlined within the prospectus:

- up to 30% of the fund can be invested in developed markets;

- the maximum exposure to frontier markets is 25%;

- up to 5% of the fund can be invested in unquoted companies;

- no more than 10% can be invested in any single holding at the time of investment;

- no limits on geographic exposures;

- hedging, using index futures, options and forward currency contracts is permitted; and

- contracts for difference are permitted as is the use of bonds, warrants and equity-related securities including participation notes.

In addition, the managers work within the following parameters:

- maximum and minimum position sizes of 5% and 1%;

- while hedging is permitted, they are very unlikely to hedge currencies in practice, preferring instead to maintain diversified currency exposures;

- derivatives may only be used if direct market access is an issue; and

- while the portfolio may include a number of less liquid companies (benefitting from its closed-end structure), the managers will not buy illiquid companies (i.e. no stocks that can go for multi-day periods without trading).

JEFI does not intend to use derivatives or other financial instruments to take short positions, nor to increase gearing in excess of the limit set out in the company’s borrowing policy (see page 17). Currency exposures will not be hedged routinely.

Asset allocation

Asset allocation

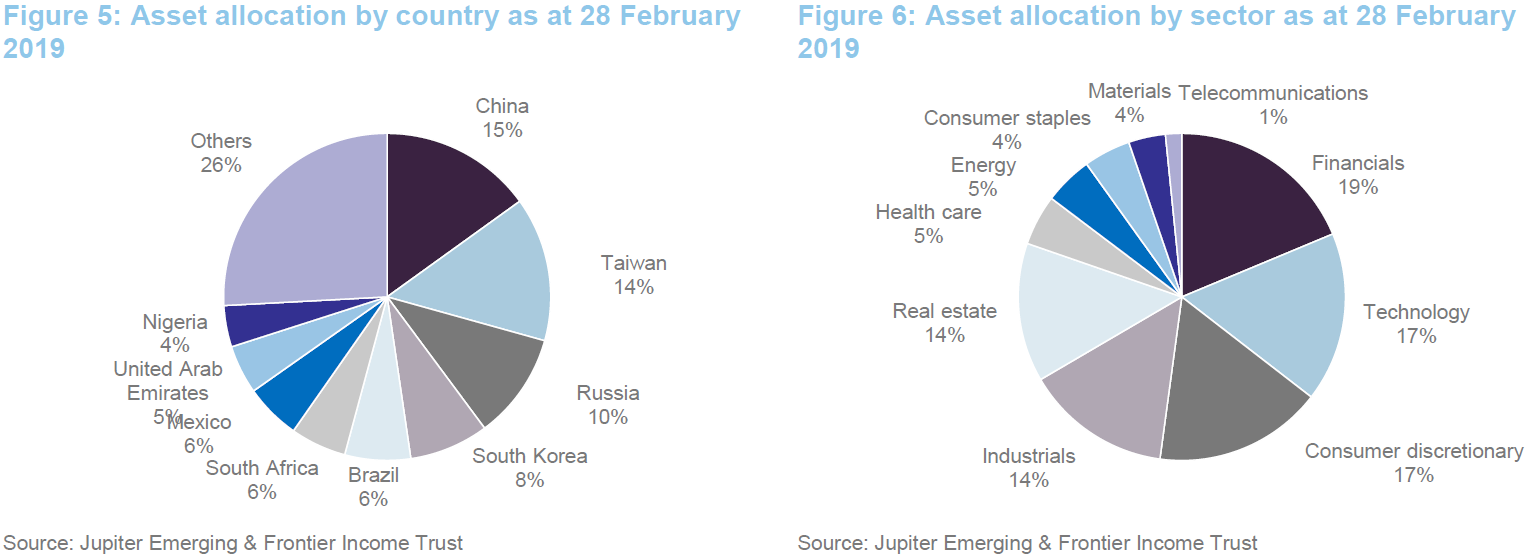

JEFI’s portfolio is very different to most other funds in its peer group. The company has no exposure to Alibaba and Tencent, the two dominant stocks within the MSCI Emerging Markets Index (9.2% of the index at the end of February 2019). This gives JEFI a high active share versus its benchmark. The only major benchmark constituents that feature in JEFI’s portfolio are Samsung (4.2%) and TSMC (c3%).

In addition, the free-ranging, stock-picking style favoured by the managers means that there are significant differences in the geographic and sector makeup of JEFI’s portfolio, relative to the benchmark index. For example, China’s weighting in the benchmark was 32% at the end of February 2019 while, as Figure 5 shows, it was 15% of JEFI’s portfolio.

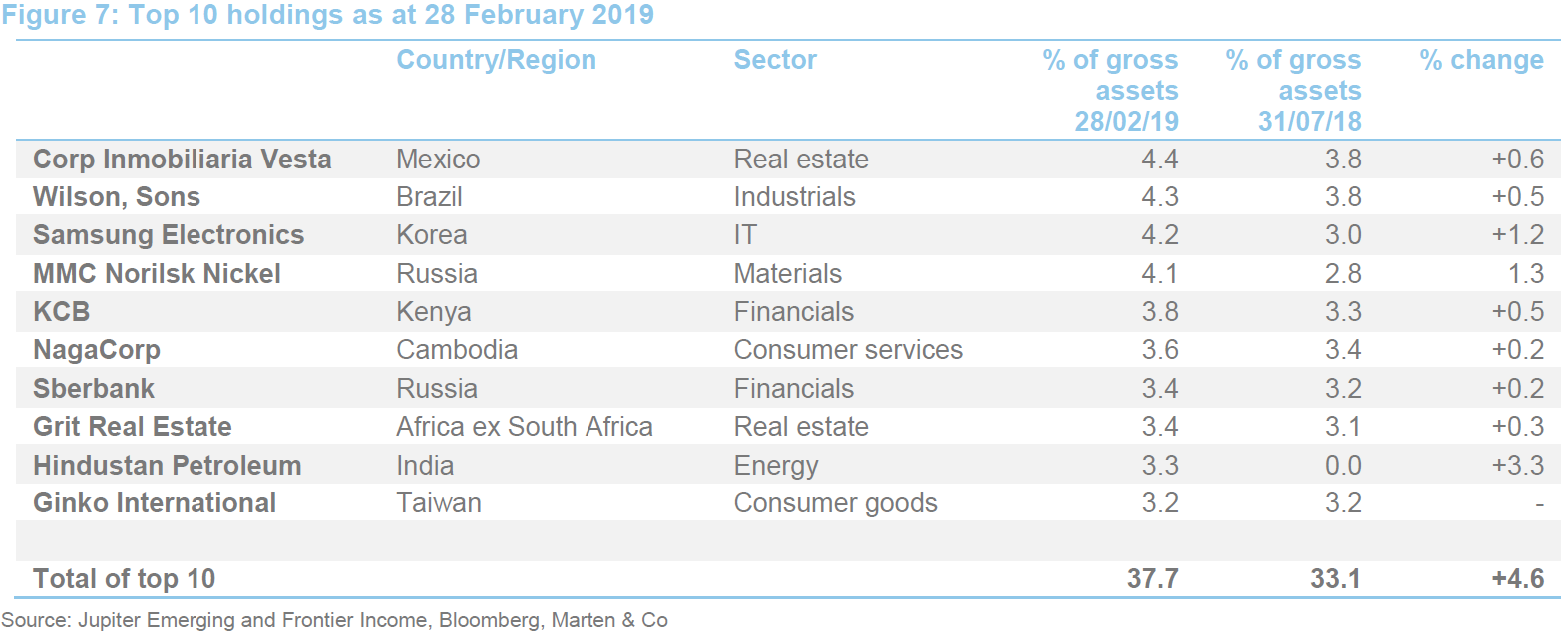

Top 10 holdings

Top 10 holdings

Many of these stocks were discussed in our last note. Wilson & Sons has been a beneficiary of the rally in the Brazilian market following elections in that country. The managers are attracted to the stock because they feel its port assets are both undervalued and underutilised, relative to global competitors.

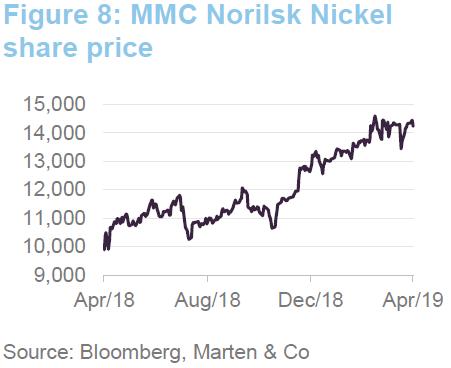

MMC Norilsk Nickel (4.1%)

MMC Norilsk Nickel (4.1%)

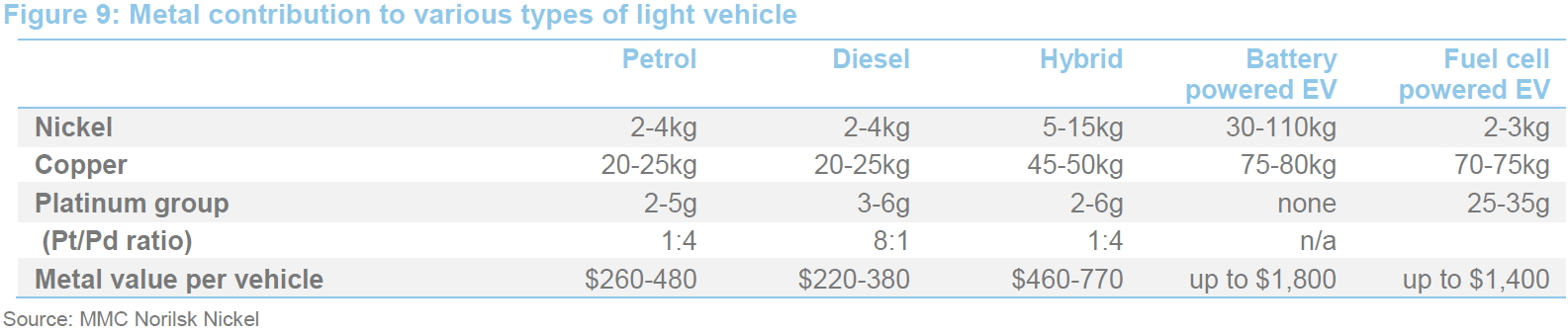

MMC Norilsk Nickel (www.nornickel.com) is a leading producer of nickel, palladium, platinum (and other platinum group metals) and copper. Its results for 2018 show strong improvements in revenue and EBITDA. Debt has been cut by reducing the company’s stockpile of palladium, and the company is paying significant levels of dividend. Nickel demand is growing, driven by its use in batteries aimed at the electric vehicle market, but there is a long way to go in this regard.

MMC Norilsk Nickel has published estimates of the demand for its metals in various types of vehicle, which we have reproduced below. Clearly, as the market evolves, demand for its products could rise significantly.

Grit Real Estate (3.4%)

Grit Real Estate (3.4%)

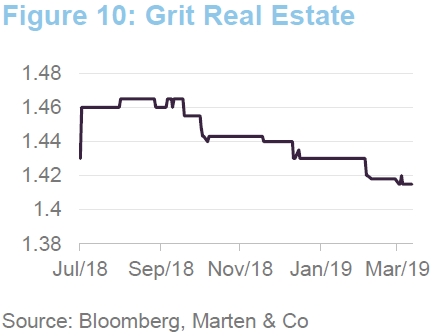

Grit Real Estate (www.grit.group) occupies an interesting niche within the African property market. At the end of 2018, it held 25 assets in seven countries (Mozambique, Mauritius, Morocco, Zambia, Ghana, Kenya and Botswana). The fund began to build its portfolio in 2014, and in July 2018 it raised an additional $132m and listed in London. The IPO proceeds were used to pay down debt and expand its portfolio. Its tenants are predominantly ‘blue chip’ and multinational. These customers are prepared to pay a bit more for peace of mind and for turnkey solutions in these countries. The one area of weakness in the portfolio is in its retail investments. A redevelopment is underway at its AnfaPlace shopping centre in Morocco. Once this is complete, Grit’s retail vacancy rate should fall and the company sees “significant upside potential” in the valuation of this asset. The shares trade close to NAV and offer more than an 8% yield.

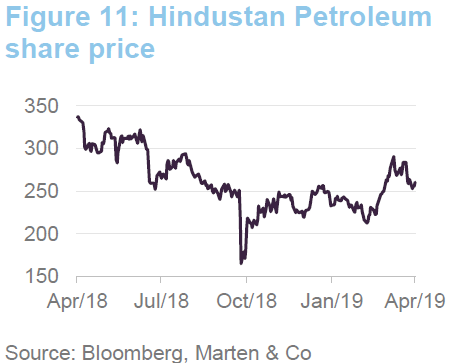

Hindustan Petroleum (3.3%)

Hindustan Petroleum (3.3%)

Hindustan Petroleum (www.hindustanpetroleum.com) was JEFI’s first Indian acquisition. The company has a network of petrol stations across India, the second largest, and there is an opportunity for the company to build upon its associated retail offering. At the other end of the scale, it is engaging in more complex refining activities, which can attract higher margins. The Indian market has been a laggard and this is especially true of its mid- and small-cap companies. As the country prepares for elections, the government has been ramping up the rhetoric. In October 2018, it suggested that petroleum distributors give up some of their margin to cushion the blow of rising oil prices on Indian consumers. This bit of electioneering triggered falls in share prices and gave the managers an opportunity to build the position. The yield on Hindustan Petroleum is now about 6%.

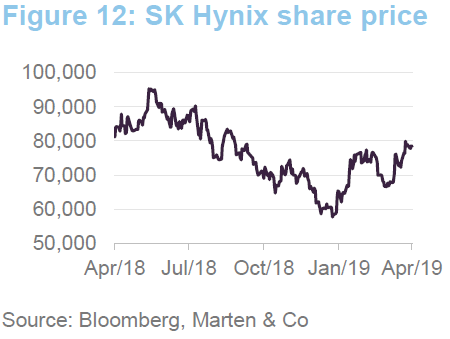

Outside of the top 10 – SK Hynix

Outside of the top 10 – SK Hynix

Korean chipmaker (one of the world’s largest) SK Hynix (www.skhynix.com) was a recent addition to the portfolio. It had been a holding within their non-income-focused mandates, but the stock delivered dividend growth that made it worthy of inclusion in JEFI’s portfolio. SK Hynix offers a 2.5% yield, a growing pay-out ratio and considerable cash on its balance sheet, and the managers feel that there is the prospect of industry consolidation. The company has announced long-term plans to invest over $100bn to maintain its competitive advantage. Demand for chips has been slowing as smartphone sales plateau; this was a factor in Samsung Electronics reporting a sharp fall in quarterly operating profits on 5 April. Investors seem to be looking beyond this cycle,however. SK’s new production facilities are thought to be aimed at 5G telecoms and artificial intelligence.

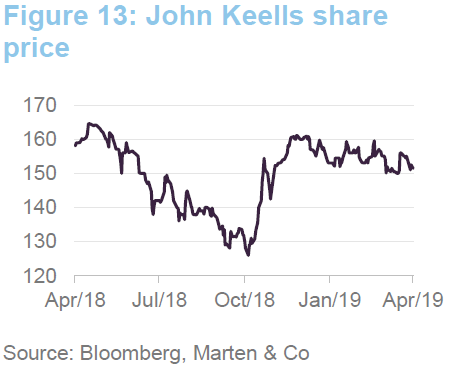

John Keells

John Keells

JEFI now has a stake in Sri Lankan conglomerate, John Keels (www.keells.com). Its business is diversified across more than 70 companies. The conglomerate’s share price was weak last summer. Its consumer business was hit by a sugar tax on fizzy drinks that was introduced in November 2017 and which triggered nearly 40% price hikes for its products. Penetration of these products is much lower in Sri Lanka than in more-developed Asia countries.

A significant property development, Cinnamon Life, is underway in Colombo. Due for completion in 2020, the project includes a hotel, conference facilities, retail, offices and residential (one of a number of residential projects in and around Colombo that John Keells is planning). The company’s existing leisure assets include a number of hotels in Sri Lanka and the Maldives. More are planned and the company is predicting that occupancy rates will rise from current low levels as the country attracts more tourists. John Keells is also optimistic on the growth prospects for its ports operations, and its financial services businesses are seeing strong profit growth.

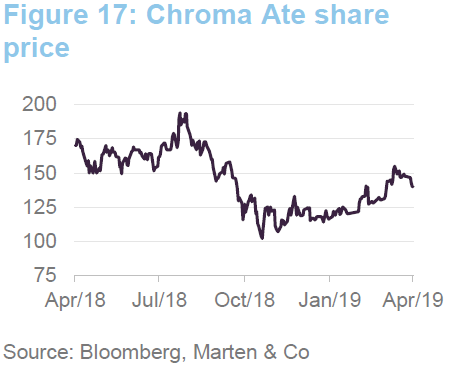

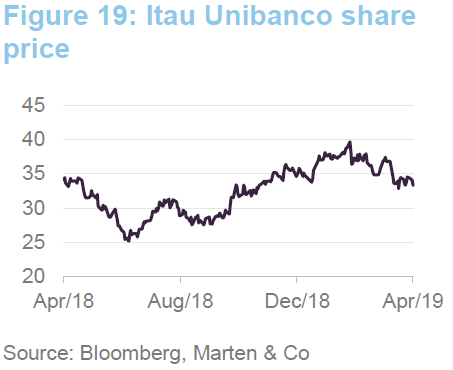

Positions that have been reduced/eliminated include Saudi Telecom, whose shares rose strongly, in part on rumours of an upgrade of Saudi Arabia to an emerging market within the MSCI family of indices. The managers have also reduced the positions in Chroma Ate, at one point JEFI’s largest holding, and Itau Unibanco (see page 12).

Performance

Performance

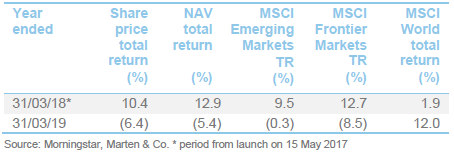

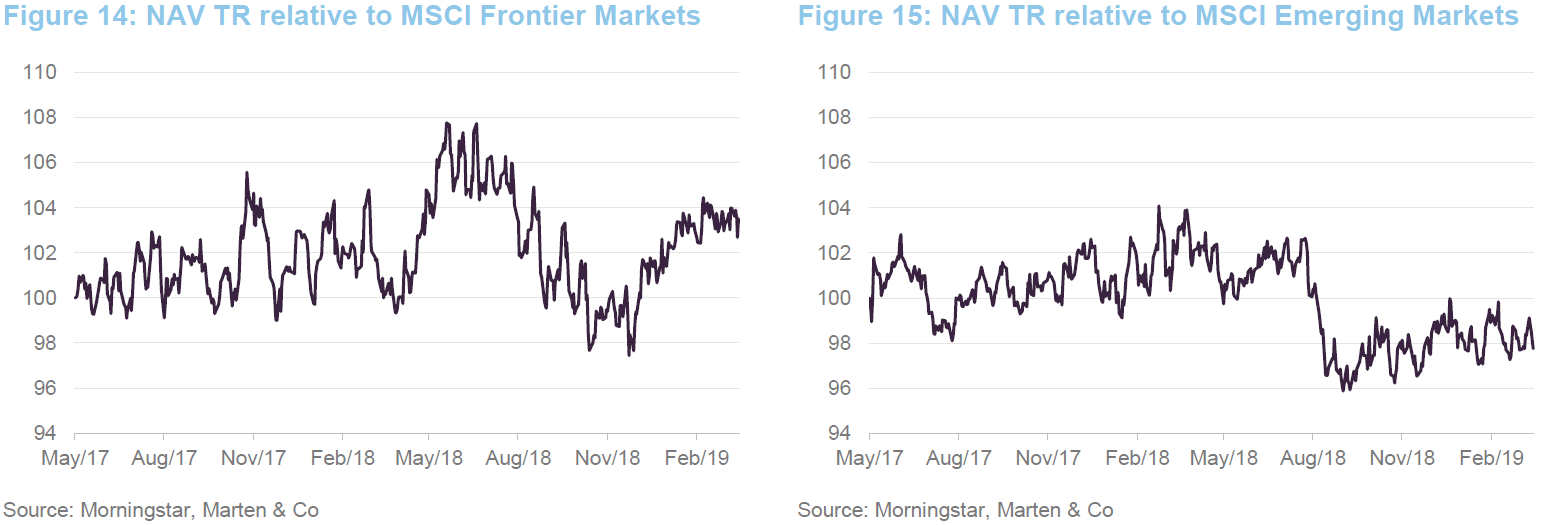

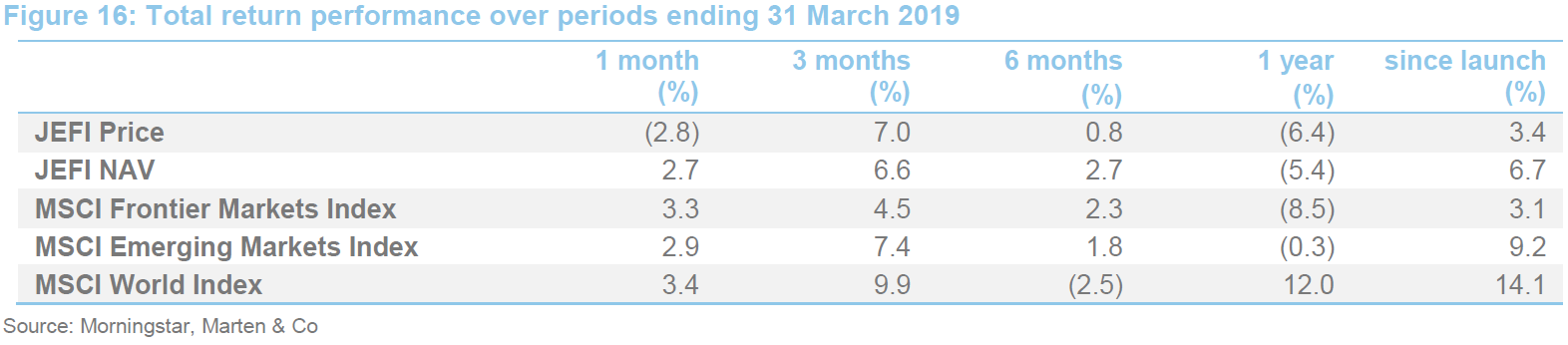

Figures 14, 15 and 16 demonstrate the fund’s outperformance of the MSCI Frontier Markets Index and narrow underperformance of the MSCI Emerging Markets Index from launch to the end of March 2019.

As Figure 16 shows, emerging and frontier markets have lagged developed markets (as represented by the MSCI World Index) since JEFI’s launch. As we discussed on page 3, small-cap stocks and frontier markets stocks – areas to which JEFI has an overweight exposure to relative to the benchmark index – have both lagged the MSCI Emerging Markets Index.

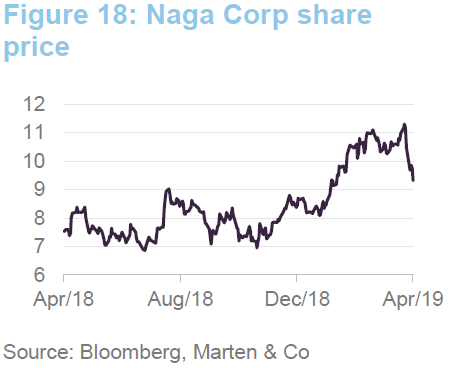

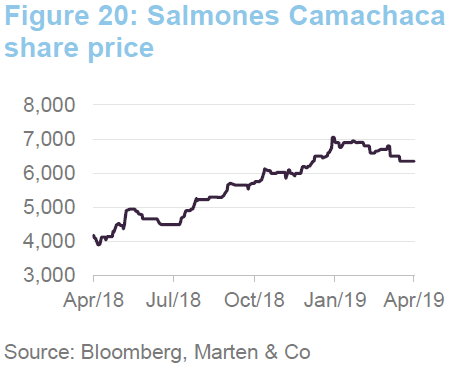

From launch to the end of 2018, strong positive contributions to performance have come from Norilsk Nickel, Chroma Ate, Naga Corp, Itau Unibanco and Salmones Camachaca. On the downside, the stocks that have held back returns from launch to the end of 2018 were Ascendis Health (discussed in our last note), LSR Group (a Russian housebuilder whose shares fell along with those of competitors when the government banned the pre-sale of uncompleted apartments), UBL, Bank of Georgia and Almacenes Exito (South America’s largest retailer).

Chroma Ate

Chroma Ate

Based in Taiwan, Chroma Ate (www.chromaate.com) describes itself as a world-leading supplier of precision test and measurement instrumentation, automated test systems, intelligent manufacturing systems and turnkey solutions. The share price doubled between May 2017 and August 2018 and the managers took some profits. For 2018, Chroma Ate’s revenues rose by 14% but were weak in the fourth quarter of 2018 (down 17% year-on-year). Its gross margin slipped in 2018 and the company reduced its dividend.

Naga

Naga

We discussed Naga (www.nagacorp.com) in our last note. The Cambodian gaming company’s new extension, Naga 2, has been ramping up its operations. The managers note that, even though the share price has risen, the valuation multiple is not expanding, reflecting earnings growth. Chinese tourism firms are working with the company, helping to drive an increase in Chinese guests.

Itau Unibanco

Itau Unibanco

Brazilian bank Itau Unibanco (www.itau.com) is a stock that JEFI has owned since launch. In common with many other Brazilian stocks, Itau’s share price had a strong run on the back of the election of Jair Bolsonaro as Brazil’s president. The managers decided to take profits and reinvest some of the proceeds in Mexico’s Banorte. That stock had de-rated on what the managers thought were unreasonable concerns about the impact of the new Mexican administration under Andrés Manuel López Obrador.

Salmones Camanchaca

Salmones Camanchaca

Salmones Camanchaca (www.camanchaca.cl/en) was discussed in our last note. The managers note that it is still undervalued relative to rival salmon producers based in Norway. This is despite Salmones having better access to more immature markets, notably the US and China. The managers have trimmed the position but say that they are still very comfortable with JEFI’s holding.

Peer group

Peer group

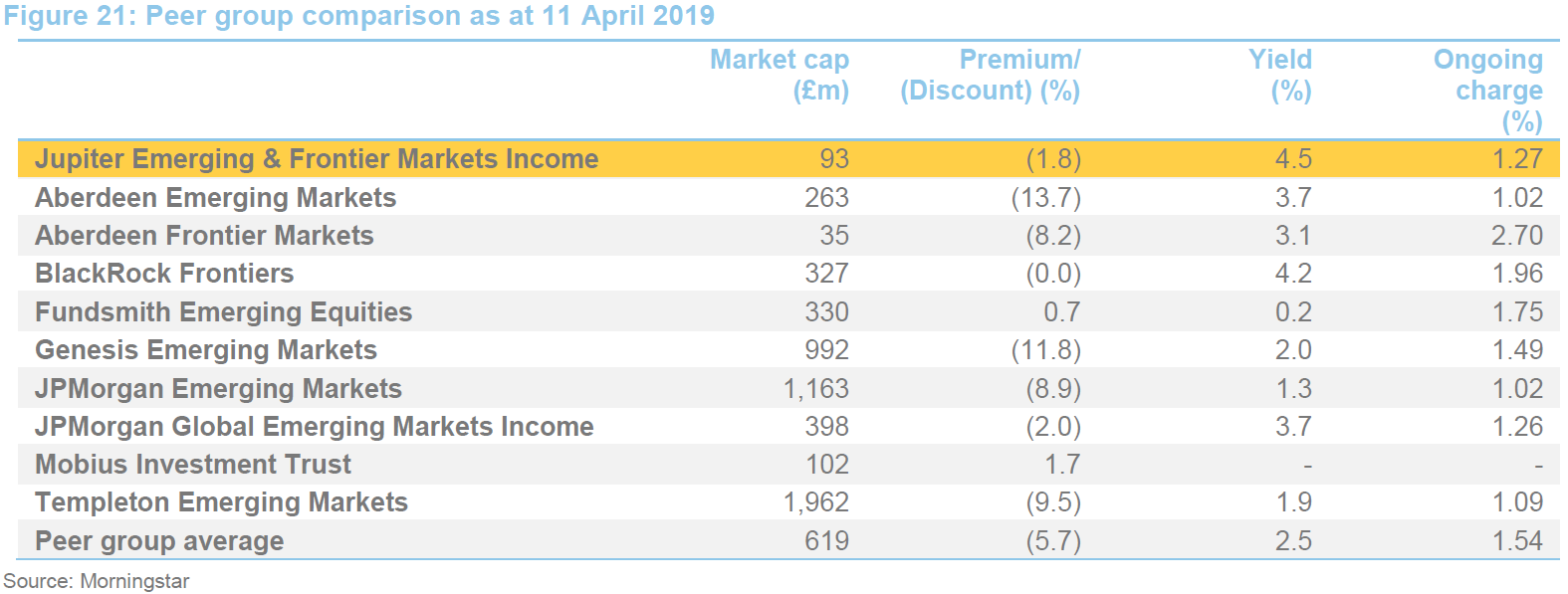

JEFI sits within the AIC’s global emerging market sector. Only one other London-listed investment company has a policy of investing across both emerging and frontier markets (Mobius Investment Trust) and only one other company (JPMorgan Global Emerging Markets Income Trust) invests in a portfolio of predominantly above-average yielding equities. Other trusts in the sector that pay a high dividend yield manufacture a significant part of this by distributing capital.

JEFI trades fairly close to asset value (see page 15) and this might allow the fund to grow. JEFI has expanded a little since launch, but is still at the smaller end of this peer group. This impacts on its ongoing charges ratio somewhat (as fixed costs are spread over a smaller base), but this is still lower than the peer group average. JEFI’s yield (which we have based on a 4.5p annualised dividend rather than the 6.2p paid since launch – see page 14) is the highest of the peer group.

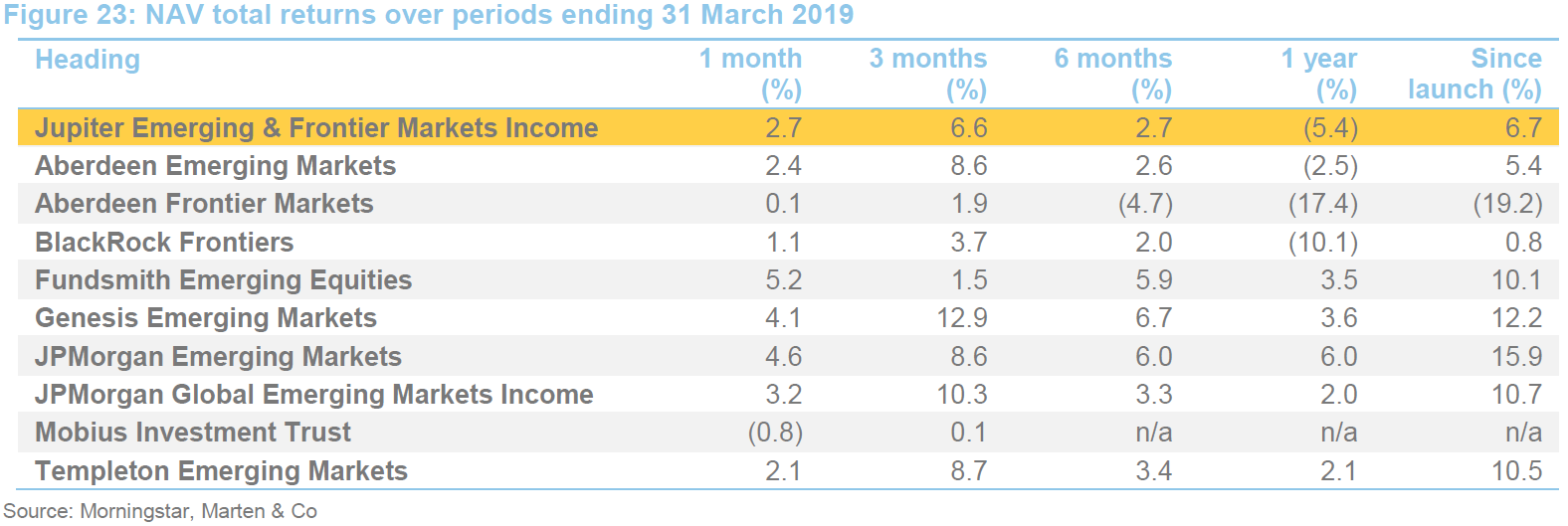

JEFI has outperformed the average of the peer group since launch.

JEFI’s frontier market exposure may have acted as a drag on returns. Figure 23 shows that, since launch, JEFI has outperformed the funds focused on frontier markets but has lagged most emerging markets-focused funds.

Dividend

Dividend

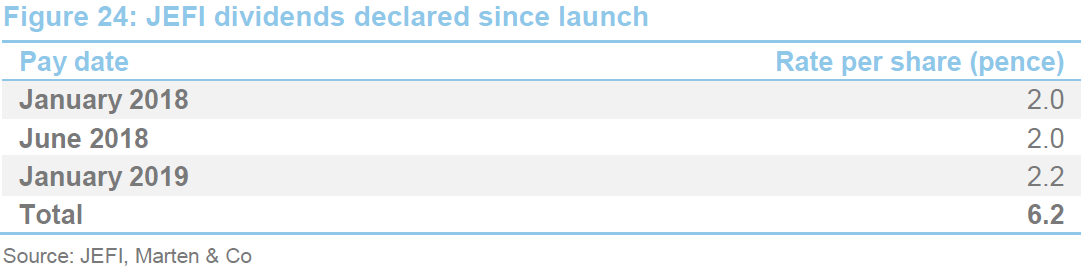

In its initial prospectus, JEFI was targeting a dividend of 5.5p for the period from launch until 30 September 2018; 4p for the period to 31 May 2018 and 1.5p for the period from end May to end September 2018. The prospectus said that, for the financial period ending 30 September 2019, the company intended to pay three interim dividends, declared in December 2018, June 2019 and December 2019 and paid in January 2019, July 2019 and January 2020. Thereafter, all dividends would be made semi-annually, payable in January and July.

In its interim accounts, the board said that the third dividend would be at least 2p, making a total of 6p for the period from launch to 30 September 2018. In the event, JEFI declared dividends totalling 6.2p, which were covered by earnings of 6.54p. These dividends and earnings relate solely to the period ended 30 September 2018.

The board made no comment about future dividends in JEFI’s annual report, beyond reiterating that the target was for a minimum annualised dividend of 4% at launch. However, extrapolating from the company’s revenue generation in its first accounting period might suggest that JEFI could pay 5p in dividends for the year ending 30 September 2019 in two dividends payable in July 2019 and January 2020.

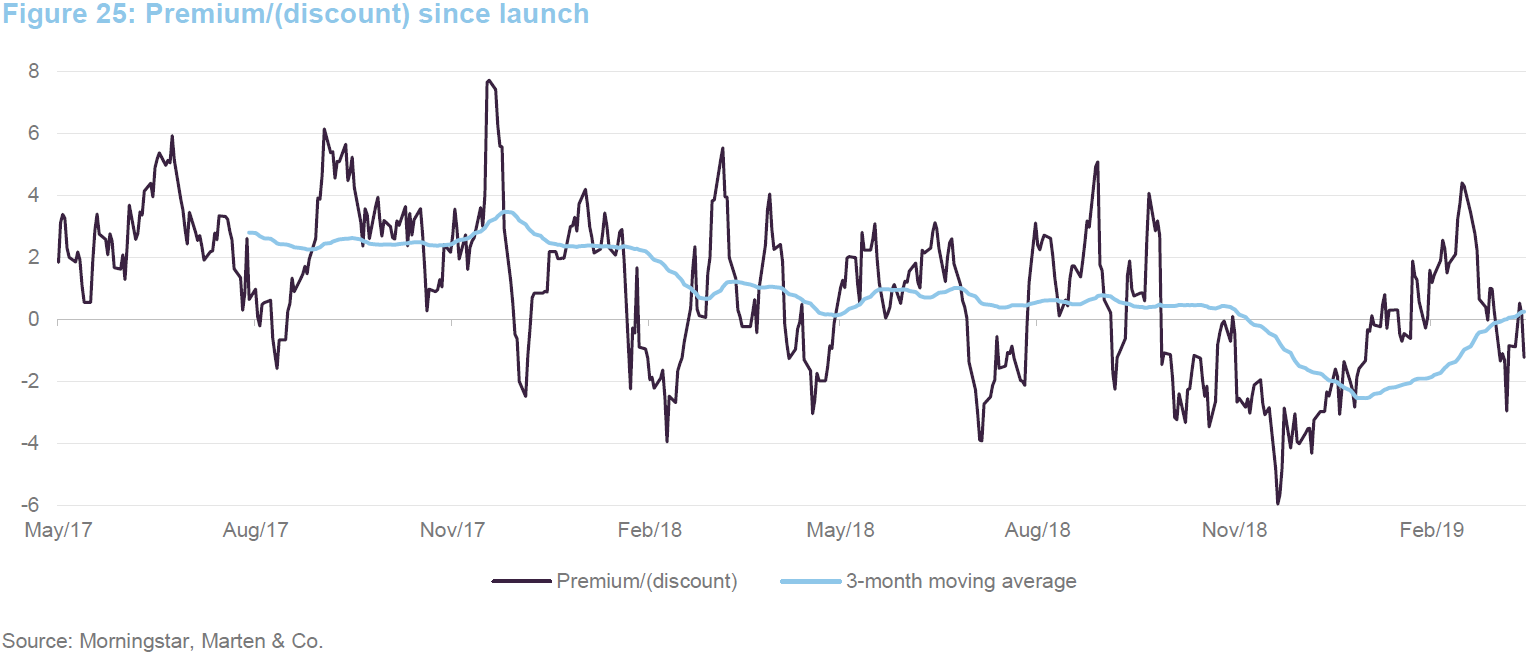

Premium/(Discount)

Premium/(Discount)

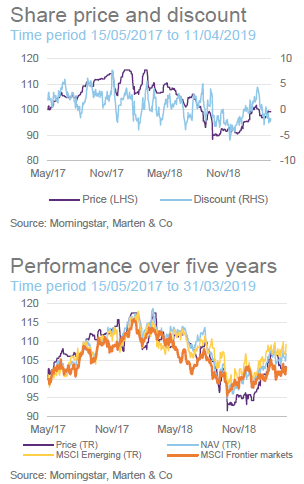

Over the year to the end of March 2019, JEFI traded within a range of -5.9% to 5.1% and an average of 0.1%. At 11 April 2019, JEFI was trading on a discount of 1.8%.

JEFI’s discount widened temporarily at the end of 2018, in-line with many other trusts, but the shares have now moved back to trading at a small premium. The discount control mechanism (see below) should help reinforce this, as should the attractive yield and the growing dividend.

Annual redemption facility

Annual redemption facility

JEFI has an annual redemption facility that allows shareholders to request that the company redeems all or part of their shareholding. The operation of the redemption facility and the number of shares that will be redeemed are at the discretion of the board.

At the date of the first redemption opportunity in June 2018, redemption requests were made in respect of 176,173 shares. All of these were sold onto other buyers and JEFI did not have to repurchase any shares.

Fees and costs

Fees and costs

Jupiter Unit Trust Managers Limited, a subsidiary of Jupiter Investment Group Limited, is JEFI’s AIFM. It is entitled to a management fee of 0.75% of NAV, payable quarterly in arrears. Any investment by JEFI in other funds managed or advised by any part of Jupiter Investment Group Limited (would be excluded from the calculation of the NAV for the purposes of calculating the management fee. There is no performance fee. The investment management agreement can be terminated on 12 months’ written notice from either party.

25% of the management fee is charged against JEFI’s revenue account and the balance against capital.

JPMorgan Europe is the depositary. It earns a fee of 0.015% of NAV per annum, which falls to 0.01% of NAV in excess of £250m. JPMorgan Chase acts as custodian and administrator and earns an additional fee for this service.

For the period ended 30 September 2018, JEFI’s ongoing charges ratio was 1.35%. If the company can continue to expand, this should fall, as fixed costs are spread over a larger base.

Capital structure and life

Capital structure and life

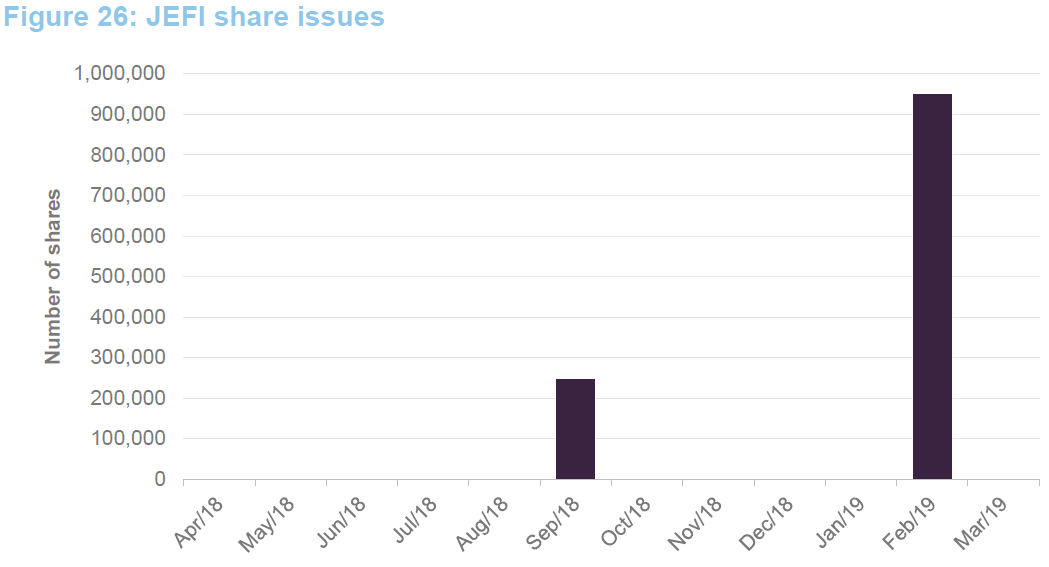

There are 94,044,240 ordinary shares in issue and no other classes of share capital. JEFI has issued 1.2m shares since we last wrote on the trust.

At the last AGM, shareholders granted the company permission to issue up to 10% of the issued share capital at any time up to the conclusion of the 2020 AGM. Permission was also granted for the repurchase of up to 14.99% of the issued share capital. Repurchased shares may be held in treasury.

Gearing is permitted up to 20% of NAV, at the time of borrowing. This could be via derivatives as well as bank borrowings. As at the end of February 2019, JEFI had gearing of 12%, courtesy of a loan facility provided by Scotiabank (Europe) Designated Activity Company. This allows JEFI to borrow up to £20m. Over JEFI’s life it has been drawing down short-term loans of $15m under this facility. The last disclosed matured on 28 December 2018, but it is likely that this has been renewed.

JEFI’s year end is 30 September and its first AGM was held in February 2019.

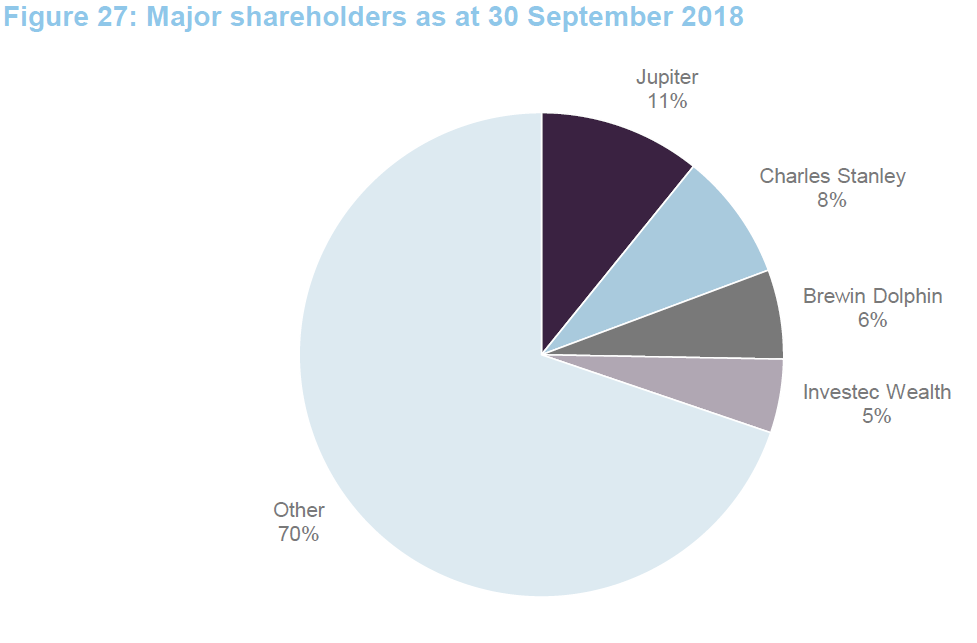

Major shareholders

Major shareholders

The management team

The management team

Ross Teverson

Ross Teverson

Ross Teverson has been managing an unconstrained emerging markets portfolio since 2012. He joined Jupiter in 2014 as head of strategy, Global Emerging Markets. Prior to joining Jupiter, Ross worked for 15 years at Standard Life Investments, where he managed a global emerging markets equity fund. Ross spent seven years in Standard Life Investments’ Hong Kong office, where he managed an Asian equity fund, and was a director of the business. Ross is a graduate of Oxford University and is a CFA charterholder.

Ross is also manager of Jupiter Global Emerging Markets Fund, an open-ended fund with a similar strategy to JEFI but without the same focus on income.

Charles Sunnucks

Charles Sunnucks

Charles Sunnucks joined Jupiter in 2010 as an analyst. He specialises in financials, internet and utilities stocks. Experience within the financial sector includes time spent on secondment at a local Chinese brokerage. Charles graduated from university in Beijing, where he studied Economics and Trade in Chinese. He is a fluent Mandarin speaker.

Board

Board

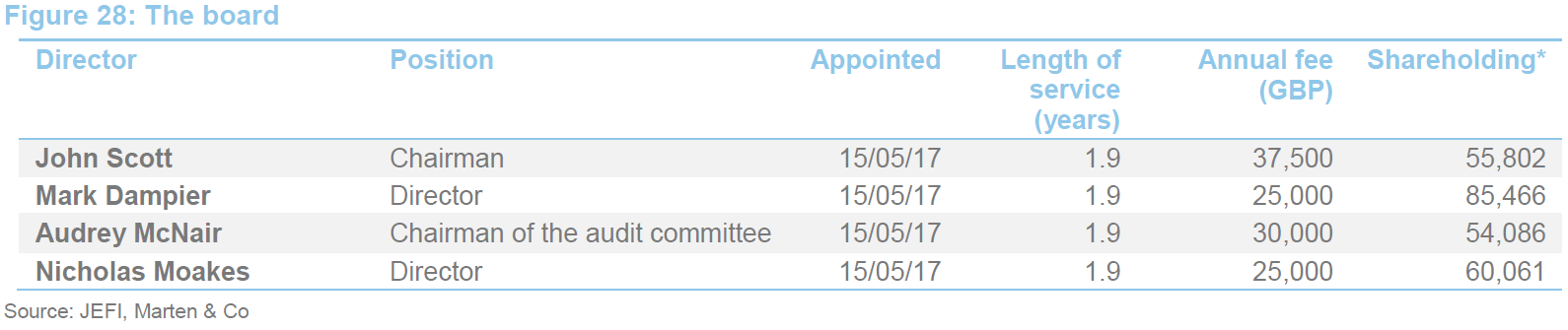

JEFI has four directors, all of whom are non-executive and independent of the manager. All the directors acquired shares at launch and have topped up their holdings since. The directors committed to investing all of their first two years’ net earnings in JEFI shares, and have exceeded that commitment. The directors offered themselves for re-election at the AGM in February 2019.

John Scott is a former international investment banker. John was appointed a director of Scottish Mortgage Trust Plc in 2001 and became chairman at the end of 2009. He is a former executive director of Lazard Brothers & Co., Limited. During his 20 years with Lazard, he was involved with the merchant bank’s corporate advisory activities and its Asian businesses. He is currently chairman of Impax Environmental Markets Plc and Alpha Insurance Analysts Limited, as well as being a director of various companies, including Bluefield Solar Income Fund Limited and CC Japan Income & Growth Trust Plc.

Mark Dampier is head of investment research at Hargreaves Lansdown, a position he has held since 1998; a director of Hargreaves Lansdown Asset Management Limited;and a member of Hargreaves Lansdown Plc’s Executive Management Committee. He has over 30 years’ experience in the fund management industry, including managing and marketing investment trusts and unit trusts, has published a book on effective investing, and is a leading commentator on the investment sector. He was appointed to the board of Invesco Income Growth Trust Plc in March 2016.

Audrey McNair has been a non-executive director of Earl Shilton Building Society since February 2015 (and is currently chair of its audit, compliance and risk committee) and a non-executive director of British Friendly Society since April 2016 (and is currently chair of its risk committee). In her executive career across the buy and sell side in the City of London, she has gained extensive knowledge of regulatory governance and investment management processes and products. Her experience includes having worked at Aberdeen Asset Management Plc from May 2008 to March 2016, starting as head of internal audit (EMEA) and becoming global head of Business Risk (including Operational, IT and strategic risk) and responsible for the Group’s Risk Management Framework and Internal Adequacy Capital Assessment.

Nicholas Moakes is chief investment officer of The Wellcome Trust, one of the world’s largest charitable foundations. He is on the board of the Investor Forum, an investor-led organisation established for the purpose of improving long-term investment returns through collective shareholder engagement. He also chairs the Imperial College Endowment Fund and was appointed to the board of Foreign & Colonial Investment Trust Plc in March 2011. Nick has nearly 30 years’ experience in Asia and 25 years’ experience in global equity markets. He started his career in the diplomatic service, where he specialised in Hong Kong and China. Before joining Wellcome in 2007, he was head of the Asia Pacific investment team and co-head of emerging markets at BlackRock Investment Management.

Previous publications

Previous publications

Readers may wish to read our initiation note, A very successful fundraise, published on 28 November 2017 and our update note, Off to a great start, published on 29 August 2018. You can read the notes by clicking on the link above or by visiting our website.

The legal bit

This marketing communication has been prepared for Jupiter Emerging & Frontier Income Trust by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.