When the going gets tough

Reports suggest emerging markets have struggled to make headway over the course of 2021, but Jupiter Emerging & Frontier Income (JEFI), helped by its frontier market exposure, has been one of the winners within its peer group. Manager Ross Teverson’s long-held view that better value is available outside of China has worked in the trust’s favour, while its allocation to frontier markets offers an opportunity otherwise not available in the majority of its peers’ portfolios.

Potential headwinds in the form of inflation, rate rises and rising energy prices do appear to exist, but the manager says his bottom-up approach – which combines value and growth elements – offers some resilience from the strength of the underlying portfolio’s balance sheets and earnings growth. We also note that JEFI is the top-yielding trust within the AIC’s Global Emerging Markets sector.

Long-term capital and income growth

JEFI aims to generate capital growth and income over the long term, through investment predominantly in companies exposed directly or indirectly to emerging markets and frontier markets worldwide.

Fund profile

Launched in May 2017, JEFI invests in stocks that provide exposure to emerging and frontier markets (any country that is not classified as developed or emerging). The aim is to generate both capital growth and income over the long term, using an investment approach that is benchmark agnostic, unconstrained and focused on identifying positive change.

Investment manager

JEFI’s portfolio is managed by Ross Teverson of Jupiter Asset Management (Jupiter), who subcontracts the job of managing the portfolio from the AIFM, Jupiter Unit Trust Managers Limited. Ross works closely with Matthew Pigott and Colin Croft, as well as the broader nine-person emerging markets equity team. The team has approximately £1.1bn under management. The manager can also draw on the expertise of Jupiter’s wider pool of asset managers and analysts.

Ross Teverson

Ross has been managing an unconstrained emerging markets portfolio since 2012. He joined Jupiter in 2014 as head of strategy, Global Emerging Markets. Before joining Jupiter, Ross worked for 15 years at Standard Life Investments, where he managed a global emerging markets equity fund. Ross spent seven years in Standard Life Investments’ Hong Kong office, where he managed an Asian equity fund and was a director of the business. He is a graduate of Oxford University and a CFA Charterholder.

Market backdrop

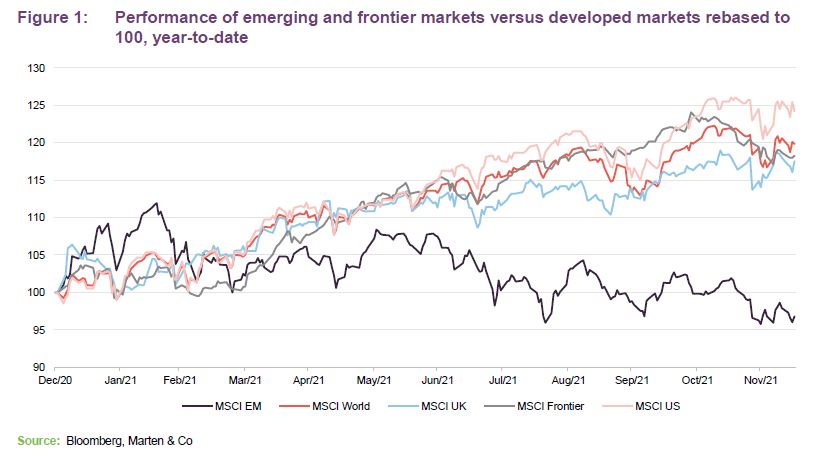

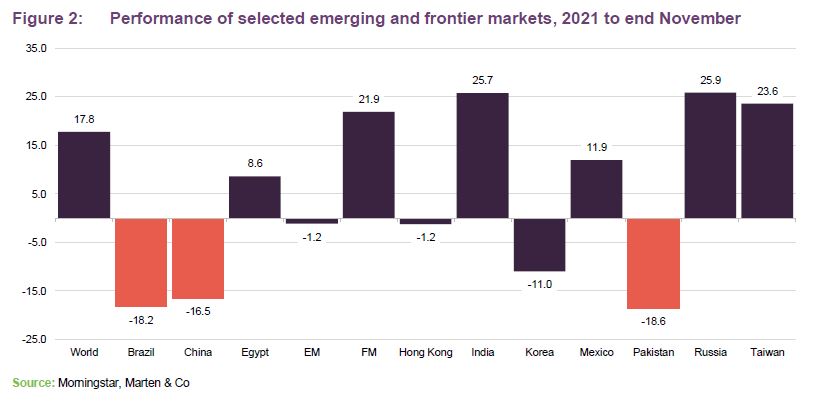

MSCI Emerging Market index performance has been essentially flat for 2021 in US dollar terms, with a return of 3.6% over the 12 months ended 30 November 2021. Meanwhile, developed markets, as measured by the MSCI World Index, have delivered returns of 20% or more, bolstered by gains in US and European equities. Some investors may also fret that global tightening in monetary policy will trigger a flight away from the emerging markets asset class, hitting performance further.

Frontier market equities have performed better, delivering 25.8% over one year to 30 November 2021, but still lag certain developed markets by some margin.

After strong post-COVID rebounds, policymakers in many emerging markets began tightening earlier this year. Some have been aggressively raising interest rates to combat accelerating inflation, which could, alone, put a brake on growth.

Meanwhile, some emerging economies are in a particular bind because one of the factors that seems to be driving inflation is rising energy prices, caused partly by pandemic-related disruptions. Some countries such as Russia may stand to do well from this, but many others will be hurt by higher fuel prices in a world of slower growth, with India, Turkey and Egypt being particularly vulnerable in the manager’s view.

China’s regulatory clampdown on some of its biggest stocks, worries over the fate of its heavily indebted property development sector and heightened regional tensions appear to have weighed on that market, which is the largest component of the MSCI Emerging Markets Index.

Manager’s view

JEFI did well as markets bounced following the good news on vaccines in November 2020. However, the rally seemingly petered out as new variants of COVID and, in some countries, low vaccination rates, created new uncertainty. Ross feels that there are a number of markets that will do very well once COVID’s influence starts to wane and companies’ earnings start to recover, such as Mexico, emerging Europe, large parts of Africa, and Pakistan.

On a valuation basis, the manager feels that many emerging and frontier markets are looking attractive. However, some caution is warranted on extrapolating earnings growth numbers based on 2020 comparisons.

Focus remains on financial inclusion

While the pandemic has created multiple challenges for emerging and frontier market banks, Ross and the team believe that most have managed risk admirably, have continued to innovate, and have weathered the impact of COVID-19 much better than many had expected. They say the structural opportunity for these businesses remains intact and is not currently reflected in valuations, which remain below pre-pandemic levels.

Meanwhile, the manager says, digital innovation has accelerated in both emerging and developed markets due to the pandemic, forcing companies to think quickly about how to operate in a stay-at-home world. Online-only banks have been around for some time in developed markets and have previously been seen as a disruptive threat to established banks. However, he adds this is more of an opportunity for incumbent banks in emerging and frontier economies.

Ross says that even though many of the world’s unbanked individuals live in remote areas, where the nearest physical bank branch may be prohibitively far away from homes and places of work, rising mobile phone ownership and internet penetration is changing the way the world gains access to financial products.

According to the manager, in emerging and frontier markets, gradually increasing penetration of financial products, combined with supportive demographics, should create a backdrop that, for well-placed financial institutions, proves conducive to strong and sustained earnings growth for a long time to come.

JEFI has identified several companies where it believes this change is underappreciated by the market: KCB in Kenya, United Bank in Pakistan, and Bank of Georgia. Ross says while all three are small-cap companies, they are large players in their home markets and are all embracing fintech opportunities to create new avenues for growth.

Technology enablers

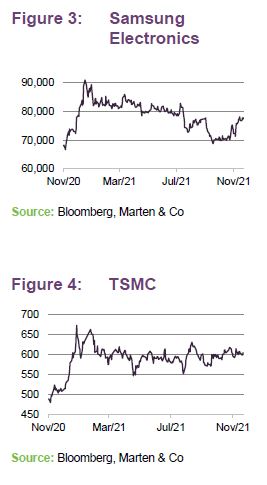

The manager says there is plenty to be excited about in the technological space in emerging and frontier markets, with certain names cementing their positions as global leaders at the top of their game, and as ‘tech enablers’. Leading memory chip manufacturer Samsung Electronics and Taiwan Semiconductor Manufacturing Corporation (TSMC), the world’s largest contract logic chip manufacturer, which represent the trust’s first and fourth largest holding respectively as at 31 October 2021, are just two examples of such investments.

While neither Samsung nor TSMC have been immune from cyclicality in equity markets, since 2000, Ross says shareholders of these companies have been rewarded with a remarkable compound total return of 14.4% and 14.5% per annum respectively. Moreover, he adds that current share price valuations look undemanding, at 12 times 2021 forecast earnings for Samsung Electronics and 26 times for TSMC. Both companies also have net cash on their balance sheets and the financial capacity to reinvest for growth while paying dividends.

Ross highlights that both companies enjoy very high technological barriers to entry. For example, SMIC, a Chinese company that listed in 2003 with the promise of becoming “China’s TSMC” failed to reach anywhere near TSMC’s scale despite investing vast sums of cash into expensive semiconductor equipment.

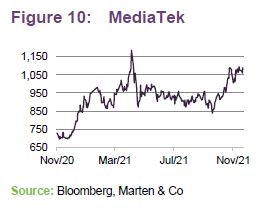

What makes companies such as Samsung and TSMC more compelling, Ross adds, is that they supply to such a broad range of customers that they are positioned to capture the benefits of rising spend on emerging technologies, regardless of which companies ultimately win the battle for the end user. For example, TSMC is the principal manufacturing partner for Apple’s handset chips but also supplies Mediatek, the world’s largest supplier of chips for Android-based handsets.

Capturing change in consumption

Another investment theme to be found within JEFI’s portfolio looks at the opportunities presented by changing trends among emerging and frontier market consumer behaviour.

Ross says the allure of the ‘emerging market consumer’ has for years enticed companies, governments, and investors to the emerging world. Emerging and frontier markets are home to 85% of the world’s population, an ocean of future consumers. According to data from the IMF, emerging markets’ contribution to global consumption growth has risen from 14% in the late 1970s to more than 60% today.

The best example of this can be seen in China, whose share of global consumption growth rose from 9% between 2000 and 2005 to 23% between 2013 and 2018. But Ross notes that as penetration rises across the consumer landscape in China, the hallmarks of the emerging market consumer – low current income, young, part of a growing population – are no longer particularly Chinese.

The manager believes the prospects for the emerging market consumer remain a highly attractive long-term opportunity. As the Chinese market begins to mature and offer different investment characteristics, there is a new generation of countries with rising incomes, young populations, and low penetration of consumer products. He adds that the case for structural change to consumer habits in these markets is exciting and the runway for growth is substantial.

Investment process

The manager’s investment approach for JEFI is based on ‘change-based investing’. It involves identifying a change or an improvement in a business that is not already reflected in its share price, but where the manager can pinpoint a catalyst for a re-rating.

The manager acknowledges that the approach, which combines both value and growth elements and is style agnostic, makes the fund hard to pigeonhole. That means, though, that the performance of the portfolio should not be dependent on where we are in the cycle.

The process revolves around stock selection. The manager does not formulate macro views or incorporate them into portfolio construction. The only top-down element to portfolio construction is in ensuring adequate risk diversification.

Types of change

- Company-specific change: the most common type of change that the manager identifies is that which is within the power of company management. Examples would include the launch of new products and services or changes to capital structure.

- Industry change: typically about improving competitive structure within an industry. The manager cites the example of the IT hardware sector, where a fragmented industry has become an oligopoly, with greater pricing discipline.

- Structural change: which tends to be very long-term.

The manager has no target in mind for allocations to each ‘bucket,’ but wants a reasonable spread of the different types of change within the portfolio.

There are many catalysts for a re-rating but the manager cites examples such as the publication of sales data; earnings announcements; investor roadshows; and announcements of returns of capital.

Take advantage of biases

Mispricing of companies is more prevalent in emerging and frontier markets, presenting opportunities to invest in robust companies with attractive secular growth potential. The manager highlights some of the emotional and cognitive biases that create opportunities to profit from underappreciated change.

- Anchoring – the tendency of markets to be preoccupied with past performance and perceptions of a company;

- Institutional inertia – the tendency for investors to overlook attractive opportunities in favour of familiar widely owned companies; and

- Short-termism – the over-emphasising of short-term news, which can come at the expense of grasping long-term structural change.

Selecting stocks

A proprietary quantitative model, which scores stocks on factors such as earnings growth and valuation metrics, is used to highlight opportunities. The model helps to provide ideas on a universe of 6,000 stocks, which compares with around 1,100 within the universe of the MSCI Emerging Markets Index. This provides approximately a quarter of ideas for the portfolio. The model includes a liquidity threshold of turnover of $1m, but the manager says that JEFI’s closed-end structure allows it to hold stocks that are less liquid than those in the equivalent open-ended funds, and that stocks that do not meet the threshold can be included in the JEFI portfolio.

Other ideas come from a variety of sources, notably from the breadth of investment management and analytical support offered by the rest of Jupiter’s team (each manager specialises in research into specific sectors). For example, Jupiter’s UK small-cap manager has some holdings in common with the fund by virtue of companies operating within emerging or frontier markets but having a listing in London.

The manager ensures that talks can he held with company management before JEFI invests. They will meet them when they can – they travel extensively. The team has around 1,000 face-to-face or telephone meetings with companies in a typical year.

The manager also tries to find independent evidence that supports the investment thesis for each stock. For example, interviewing both local and international competitors and customers before investing.

Income

The manager says that the companies that the fund owns will often have strong balance sheets (about a third of the portfolio has net cash). Companies will also tend to have high-income visibility and above-average levels of dividend growth. Notionally, the manager allocates stocks to one of three ‘dividend buckets’.

About 10% of the fund will be in stocks with future income potential. Typically, these will have a yield between 0% and 2%. The manager feels that it is important not to have a minimum yield threshold for the inclusion of stocks within the portfolio. They do not mind buying some low-yielding companies with the prospect of above-average dividend growth.

About 50% of the fund can be classified as income growth stocks. These have a yield between 2% and 6%, have an established track record of paying dividends, and demonstrate positive change that supports dividend growth.

The balance of the portfolio, about 40% of the fund, is classified by the manager as ‘high-income visibility’ stocks. These will typically have yields above 6%, predictable dividend streams and may have some associated dividend growth from gradual structural change.

Ross notes that the focus on income gravitates the portfolio towards companies that recognise that they have to treat investors fairly.

Portfolio construction

Position sizes in the portfolio will vary between 1% and 5%. The manager wants each stock to make a meaningful contribution to performance; this helps set the minimum position size. The maximum position size helps avoid a situation where an individual stock becomes the main driver of portfolio performance and a concentration risk.

New position sizes depend largely on the strength of the manager’s conviction but are also influenced by liquidity and the extent that the position will diversify fund factor risk. The portfolio should comprise, therefore, about 40–45 stocks and the manager aims to operate a ‘one in, one out’ policy.

There are no explicit risk limits, apart from having a maximum 25% exposure to frontier markets.

Self discipline

For each holding, there is a review price, and if that is reached, the manager will revisit the investment case. A stock reaching its review price is not an automatic trigger to sell, but it does prompt a re-evaluation of what is changing for the company and whether that change has now been priced in by the market.

If a position drops below 1% of the trust, it is automatically put up for review, and the covering analyst is expected to conclude whether the investment case is still attractive and the position should be added to, or whether the investment case is broken and it should be removed from the trust. This discipline avoids having a long tail of ‘hope stocks’ which the manager might hope will turnaround but has no supporting evidence that this will happen.

Risk controls

The manager operates with the following risk controls, which were outlined within the prospectus:

- up to 30% of the fund can be invested in developed markets;

- the maximum exposure to frontier markets is 25%;

- up to 5% of the fund can be invested in unquoted companies;

- no more than 10% can be invested in any single holding at the time of investment;

- no limits on geographic exposures;

- hedging, using index futures, options and forward currency contracts is permitted; and

- contracts for difference are permitted as is the use of bonds, warrants and equity-related securities including participation notes.

In addition, the manager works within the following parameters:

- maximum and minimum position sizes of 5% and 1%;

- while hedging is permitted, they are very unlikely to hedge currencies in practice, preferring instead to maintain diversified currency exposures;

- derivatives may only be used if direct market access is an issue; and

- whilst the portfolio may include a number of less liquid companies (benefiting from its closed-end structure), the manager will not buy illiquid companies (i.e. no stocks that can go for multi-day periods without trading).

JEFI does not intend to use derivatives or other financial instruments to take short positions, nor to increase gearing over the limit set out in the company’s borrowing policy. Currency exposures will not be hedged routinely.

ESG and change-based investing

Stewardship forms a core component of JEFI’s change-based investment process and the manager aims to understand ESG risks and opportunities for every investment considered, paying particular attention to management alignment (including areas such as equity-based compensation) and capital management, as well as environmental and social risk mitigation.

In some instances, the under-appreciated change that they seek to invest in relates to corporate governance – for example, JEFI may decide to invest in a company where improving governance practices and shareholder returns are yet to be reflected in the share price.

Where a company has failings of environmental or social aspects, the approach is to engage with those companies with the aim of securing improvements rather than the automatic exclusion of certain stocks and sectors from the portfolio. For example, one of JEFI’s larger positions is in Hindustan Petroleum, which is an oil refining, distribution and marketing, gas distribution and lubricants business. Ross notes that the company is carbon intensive but says that it is likely to play an important role in India’s transition toward net zero. He feels that engaged shareholders are a more powerful force for change than a policy of disinvestment in problem sectors.

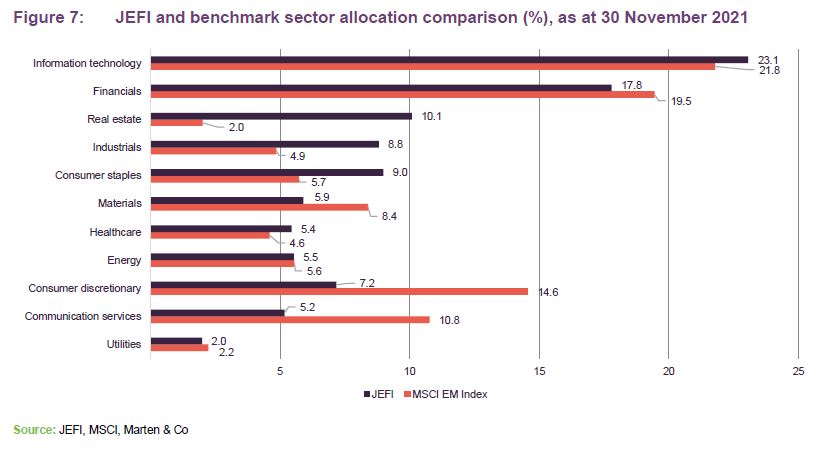

Asset allocation

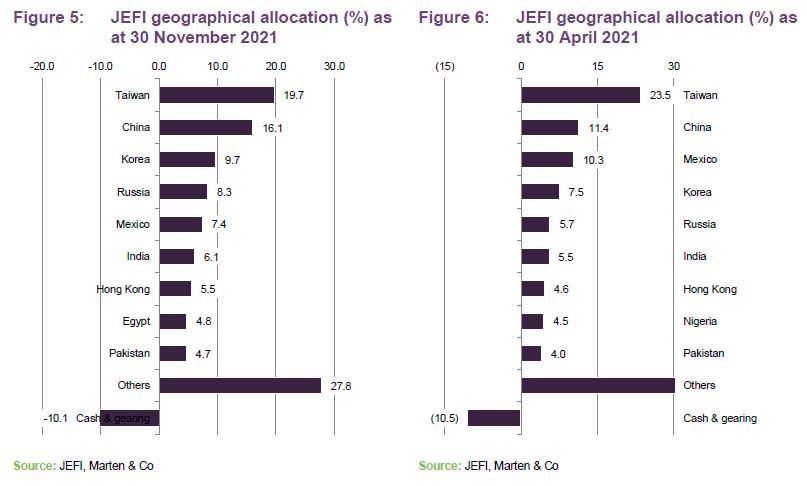

The stock-picking style favoured by JEFI’s manager means that the portfolio only loosely resembles the benchmark, this is most clearly illustrated by its sector weighting (as presented in Figure 7) but also by its geographical allocation, with the trust’s much lower allocation to mainland China. As at 30 November 2021, JEFI had a 16% allocation towards China while the MSCI Emerging Markets index China weighting was more than double at 34%.

Additionally, as its name suggests, JEFI also has a focus on frontier markets and so countries otherwise overlooked in more general emerging markets trusts such as Pakistan and Egypt are often among the top ten weightings. This frontier markets exposure gives access to many stocks that offer very high growth rates but trade on very low valuations, especially relative to developed markets like the US.

Since our last note, which looked at the geographical allocation for JEFI as at 30 April 2021, there have been some substantial changes. While Taiwan remains the largest country weighting at 19.7%, this is smaller than the 23.5% figure for the country in April. On the other hand, exposure towards China has increased from 11.4% to 16.1%. As at 30 November 2021, JEFI is 10.1% geared, a small decrease from 10.5% at the end of April 2021.

The trust’s weighting towards India has increased over the course of the year, though not by much considering the strong performance the country has experienced. Ross said this is because it is important to be mindful of valuations, which look high in India – he has been booking some profits. A lot of Indian companies more than reflect a good outlook for India, he adds, with some trading more than 60 times earnings.

The manager feels the country poses a good top-down story, buoyed by a strong post-COVID recovery and the incredible rate at which IPOs are coming to market. But he feels when the market becomes too active, this suggests valuations have become stretched.

Sector allocation

JEFI’s allocation by sector is strikingly different to its benchmark as shown in

Figure 7. While its largest exposures – to information technology and financials – are broadly the same, the trust has almost half the exposure of consumer discretionary and communication services in the MSCI EM and almost six times that of its exposure towards real estate.

Top 10 holdings

Since we last published, using data as at the end of April 2021, Bolsa Mexicana de Valores and Sberbank have replaced Norilsk Nickel and Hon Hai Precision in the top 10. Otherwise there has been little change.

Hindustan Petroleum (India)

Hindustan Petroleum Corporation Ltd (www.hindustanpetroleum.com), or HPCL, has been one of JEFI’s largest holdings for some time and one the manager is particularly excited about. The company is due to install 5,000 EV charging points in its garages and is backing India’s Prime Minister Modi’s 2070 carbon-zero climate pledge. Ross says HPCL’s shares offer a 10% dividend yield and trade on 6 times earnings and he sees potential for its retail arm, which has 19,000 outlets. Though he notes that rising fuel prices are putting pressure on the Indian economy, positive forces such as the recovery from COVID and the measures that the government has taken to make the economy more efficient are more than compensating for that. Nevertheless, it is important to be selective. The manager says the market looks expensive and much of the growth is priced in, as is the case for many other stocks in the Indian consumer staples sector.

MediaTek (Taiwan)

MediaTek (www.mediatek.com), held by JEFI since launch, has been going from strength to strength ever since. Ross says the company used to be one or two years behind competitor Qualcomm but now its product is superior and the two effectively run a duopoly, which, he says, gives them more pricing power. The company is currently going through the 5G upgrade cycle, which Ross thinks should support its ongoing growth, and it has also been expanding into building smart chips for Amazon and Google’s range of smart speakers and laptops. The manager adds that MediaTek benefits from having the pick of Taiwan’s engineering talent, while its proximity to customers in mainland China is a strategic advantage. The company has also committed to paying a special dividend.

Wilson Sons (Brazil)

Brazilian shipping company Wilson, Sons (www.wilsonsons.com) is going through a long-awaited restructuring which Ross says will be an important change for its future. Having initially been domiciled in Bermuda and indirectly listed in Brazil via a Brazilian depositary receipt (BDR), the manager says the company often fell through the cracks for index inclusion and local investor attention. However, its plan to redomicile in Brazil should see its liquidity significantly improve. Ross adds that operationally, the company is doing well, and is not as leveraged as shipping companies tend to be. Interestingly, it has not been impacted by the recent surge in freight rates.

Other interesting plays

Integrated Diagnostics Holdings (Egypt)

Integrated Diagnostics Holdings (www.idhcorp.com), or IDH, is a London-listed, Egyptian diagnostic testing business with 60% market share along with one other brand. Ross highlights that there is no GP network in Egypt (and similar markets) which means patients go to a diagnostics company instead, which is often the best and only choice for non-emergency medical needs. IDH is a cash generative business with good management alignment and a long track record of paying out high proportions of its earnings. The manager adds that the company, which offers a 4.5% dividend yield, has been a big beneficiary of the COVID pandemic, attracting new customers coming in for COVID-related tests. Customers are equally split between walk-ins and corporate customers.

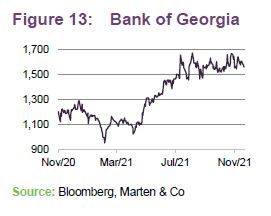

Bank of Georgia (Georgia)

Bank of Georgia (www.bankofgeorgiagroup.com) was the last of JEFI’s banking holdings to return to paying dividends, which it did in July 2021. The company is one of the manager’s high conviction plays, currently making 20% returns on equity which he believes will persist. It has a duopoly in the country while offering a fintech opportunity as discussed at the start of this note. 96% of the bank’s transactions are already carried out digitally rather than in-branch; and its mobile banking app, mBank, saw active user numbers increase by 33.6 per cent over the course of 2020. Meanwhile, Ross says its acquisition of Georgian e-commerce platform extra.ge shows that the company has been able to identify ways to benefit from its market position and technological capability. Much of the innovation and progress delivered by Bank of Georgia has been overshadowed in the short term by concerns about the impact of COVID on the Georgian economy but the manager says Bank of Georgia remained profitable and well capitalised, leaving the bank positioned to resume a strong growth trajectory, once the impact of COVID subsides.

Indus Motor Company Ltd (Pakistan)

Indus Motor (www.toyota-indus.com) operating as Toyota Indus, is a joint venture between the House of Habib of Pakistan and Toyota Motor Corporation and Toyota Tsusho Corporation of Japan. Ross says the key part of the investment thesis behind this company is that the Toyota brand is so strong in Pakistan that it has the pricing power you might associate with a consumer staple brand. People aspire to have a Toyota in Pakistan, he adds. There is low auto-penetration in the country at only one-tenth of what it is in China. Ross says this is likely to rise and that the brand gives a good level of assurance that investors can participate in that growth. Pakistan was downgraded from an emerging to a frontier market on size and liquidity grounds, and the company’s valuations suggest Pakistan is overlooked, but Ross insists that low value doesn’t mean low growth.

Engagement in action

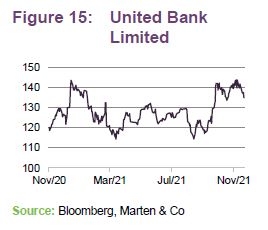

United Bank Limited (Pakistan)

United Bank Limited (www.ubldigital.com), or UBL, is a Pakistani bank which Ross believes should benefit from rapidly rising financial inclusion in the country. He says the company has a clear digital strategy, centred on offering innovative solutions to existing customers through its UBL Digital app, and on promoting financial inclusion through the provision of basic banking facilities to the mass population. In mid-2020, UBL appointed a new CEO, Mr Shazad Dada, who has stressed the importance of expanding the bank’s digital offerings while there is scope for strong loan growth over the medium to long term, and for that growth to generate returns well above the cost of equity.

JEFI recently utilised its ESG methods with UBL as the business was scoring poorly on a sustainability assessment carried out by a third-party data services provider, having raised concerns about the potential for money laundering. After speaking with them, the manager found UBL has been engaged on a two-year programme with Ernst & Young to re-examine controls within the business. JEFI has since talked to the data services company and asked them to reassess the company to reflect the improved reality.

Performance

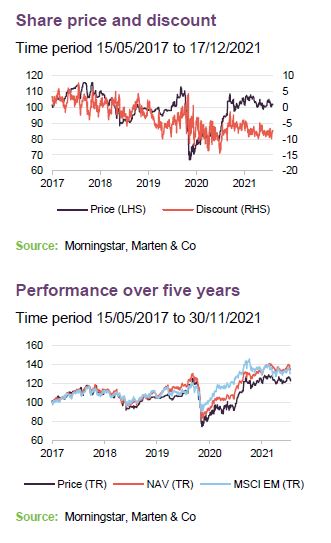

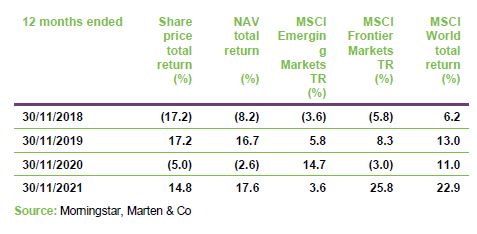

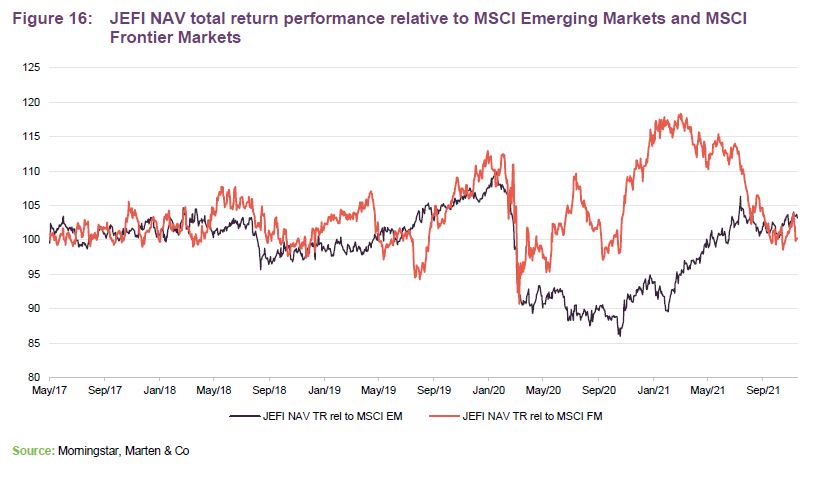

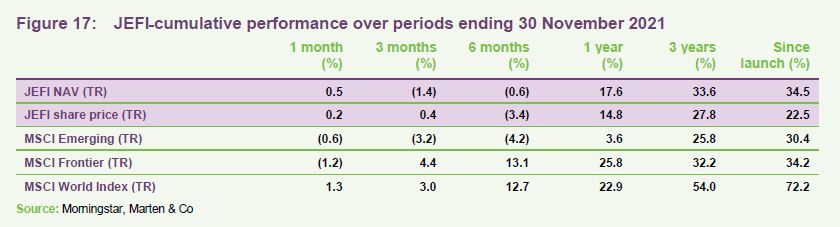

Since launch, JEFI has returned 34.5% in NAV terms, outperforming both the MSCI Emerging Markets and MSCI Frontier indices, which have delivered 30.4% and 34.2% respectively over the same period. The trust’s share price returns reflect the emergence of a discount, however.

The table in Figure 17 clearly shows the underperformance of emerging and frontier markets relative to developed world markets since launch.

In March 2020, when markets panicked in response to the pandemic, JEFI underperformed, reflecting its gearing and the underweight exposure to China, which did relatively well at this time. The outperformance of frontier markets versus emerging markets over the past year is also evident in the chart – JEFI’s frontier markets exposure has aided its outperformance of the MSCI Emerging Markets Index and vice versa.

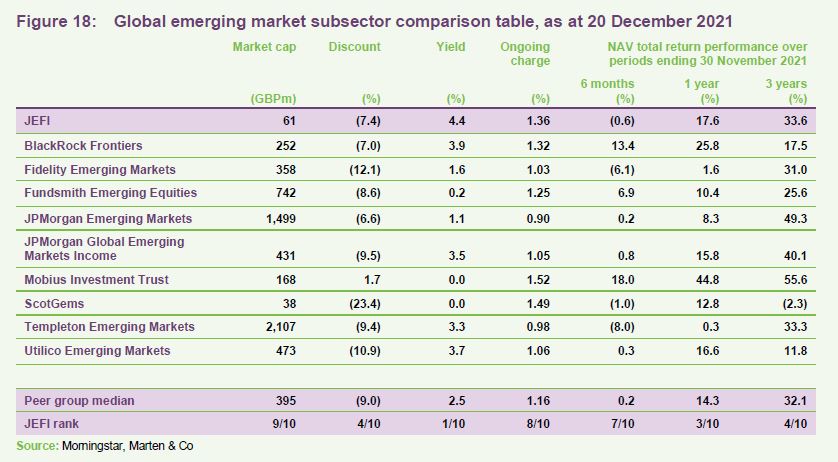

Peer group comparison

The peer group includes all the funds in the AIC’s global emerging markets sector, with the exceptions of Africa Opportunity, Barings Emerging EMEA Opportunities and Gulf Investment Fund, which are not global funds.

JEFI has some unique traits when compared to the peer group shown in Figure 18. Among the subset of the AIC’s global emerging markets funds shown, JPMorgan Global Emerging Markets Income (JEMI) is the only other company to invest in a portfolio of predominantly above-average yielding equities, but does not invest in frontier markets.

Meanwhile Mobius is the only other fund that invests across both emerging and frontier markets. The similarities largely end there. Around a quarter of the Mobius fund is invested in healthcare and, with respect to geography, India and Brazil account for over a third of its portfolio. Mobius is also almost entirely growth-focused. BlackRock Frontiers invests purely in frontier markets, excluding the ‘top eight’ emerging market countries including India and China.

It’s worth noting here that frontier markets represent approximately 30% of the world’s population and 10% of total gross domestic product yet only account for 1% of world indices. These overlooked markets also have typically low correlations with developed markets as well as each other. Low trade and economic linkages mean problems in Kazakhstan are unlikely to cause the Vietnamese market to fall, for example.

JEFI’s NAV is less volatile than the S&P 500 and MSCI EM indices.

JEFI is one of the better performing trusts among its peer group, ranking in third and second place in NAV terms over one and three years respectively. Though it is one of the smaller trusts, with a market cap of £61m, JEFI currently offers the highest yield at 4.4%.

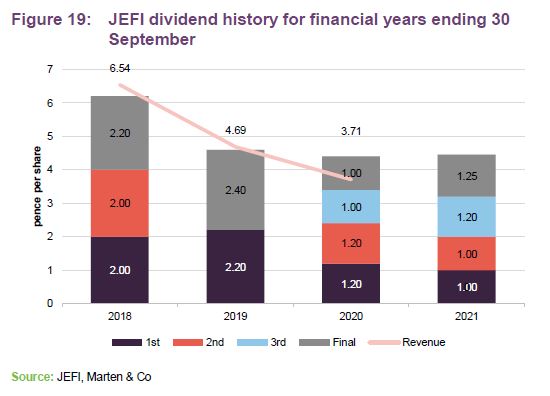

Dividend

JEFI’s manager targets an annual dividend yield that is at least 20% higher than its benchmark’s. JEFI made three payments for its first, extended financial period (which ran from launch in May 2017 to 30 September 2018), two for the 2019 financial year and now pays quarterly dividends which are paid in April, July, October, and January.

The 2020 and 2021 financial years have been impacted by the effects of COVID-19. Some companies in the portfolio cut or, as in the case of some banks for example, were prevented from paying dividends. Revenue per share fell sharply, but the board resolved to make up some of the shortfall from distributable reserves.

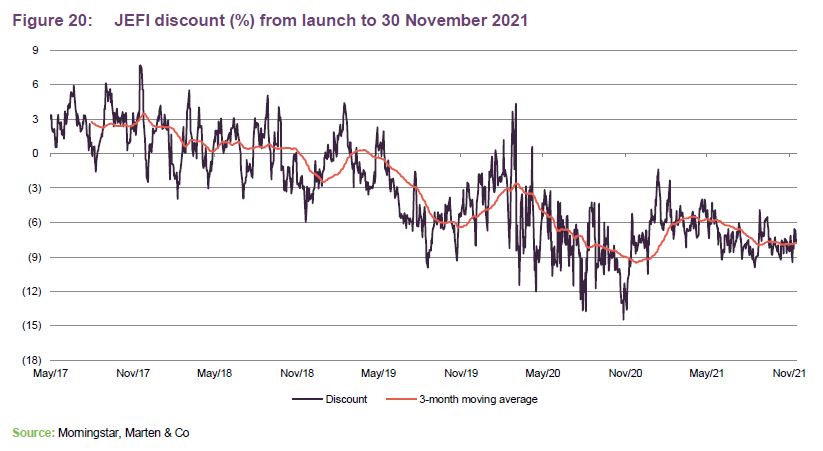

Premium/(discount)

Over the year to 30 November 2021, JEFI’s discount moved within a range of 10.5% discount to 1.4% and an average discount of 6.9%. As at 17 December 2021, JEFI was trading on a discount of 7.4%.

JEFI operates a discount control mechanism using share buybacks and new issues of shares with the aim of ensuring that, in normal market conditions, the price of its shares will closely track the underlying NAV.

At the last AGM held in March 2021, shareholders granted JEFI permission to repurchase of up to 14.99% of the issued share capital.

Annual redemption facility

As a discount control measure, JEFI has an annual redemption facility that allows shareholders to request the redemption of all or part of their holding on an annual basis. The operation of the facility and the number of shares that will be redeemed are at the discretion of the board.

The most recent redemption opportunity took place in June 2021, and saw valid redemption requests received amounting to a total of 25,670,791 ordinary shares (representing 30% of the issued share capital at the time). The board resolved to effect the redemption using the redemption pool method set out in JEFI’s articles of association.

The board is of the belief that the 30% redemption event in June 2021 was extreme and out of line with the level of participation in in previous years, in large part the result of the discount volatility experienced during the 2020 pandemic.

Fees and costs

Jupiter Unit Trust Managers Limited (JUTM), a subsidiary of Jupiter Investment Group Limited, is JEFI’s AIFM. It is entitled to a management fee of 0.75% of NAV, payable quarterly in arrears. Any investment by JEFI in other funds managed or advised by any part of Jupiter Investment Group Limited would be excluded from the calculation of the NAV for the purposes of calculating the management fee. There is no performance fee. The investment management agreement can be terminated on 12 months’ written notice from either party.

Investment management fees, as well as finance costs, are charged 75% to capital and 25% to revenue. JEFI’s ongoing charges ratio is 1.36%.

Capital structure

As at 20 December 2021, there were 59,794,380 ordinary shares in issue and no other classes of share capital.

JEFI’s financial year end is 30 September, and its annual general meetings are usually held in March at Jupiter’s offices in London. JEFI has an unlimited life.

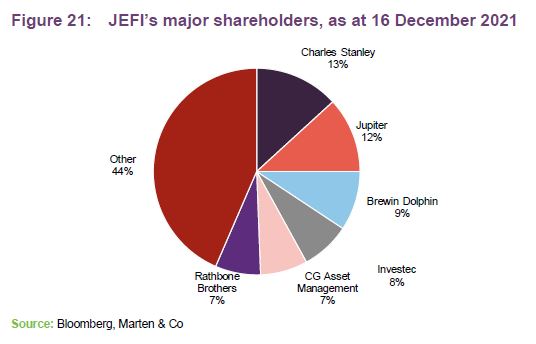

Major shareholders

Ross Teverson’s personal shareholding in the company is 960,000 ordinary shares.

Board

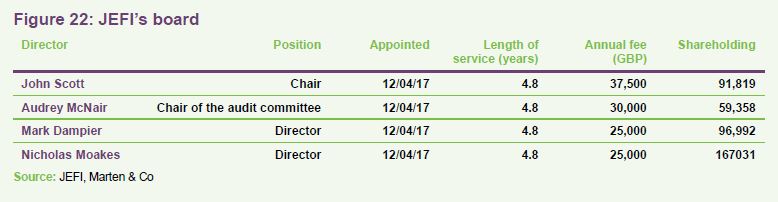

JEFI has four directors, all of whom are non-executive and independent of the manager. All the directors acquired shares at launch and have topped up their holdings since. The directors committed to investing all of their first two years’ net earnings in JEFI shares and have exceeded that commitment. It is JEFI’s policy for all directors to stand for re-election annually.

John Scott (chair)

John is a former international investment banker. He was appointed a director of Scottish Mortgage Trust in 2001 and became chairman at the end of 2009. John is a former executive director of Lazard Brothers & Co. During his 20 years with Lazard, he was involved with the merchant bank’s corporate advisory activities and its Asian businesses. He is currently chairman of Impax Environmental Markets and Alpha Insurance Analysts, as well as being a director of various companies, including Bluefield Solar Income Fund, and CC Japan Income & Growth Trust.

Audrey McNair (chair of the audit committee)

Audrey has been a non-executive director of Earl Shilton Building Society since February 2015 (and is currently chair of its audit, compliance and risk committee) and a non-executive director of British Friendly Society since April 2016 (and is currently chair of its risk committee). In her executive career across the buy and sell-side in the City of London, she has gained extensive knowledge of regulatory governance and investment management processes and products. Audrey’s experience includes having worked at Aberdeen Asset Management from May 2008 to March 2016, starting as head of internal audit (EMEA) and becoming global head of Business Risk (including Operational, IT and strategic risk) and responsible for the group’s risk management framework and internal adequacy capital assessment.

Mark Dampier (director)

Mark was head of investment research at Hargreaves Lansdown, from 1998 until his retirement in 2020, as well as a director of Hargreaves Lansdown Asset Management and a member of Hargreaves Lansdown’s executive management committee. He has over 30 years’ experience in the fund management industry, including managing and marketing investment trusts and unit trusts, has published a book on effective investing, and is a leading commentator on the investment sector. He was appointed to the board of Invesco Income Growth Trust in March 2016.

Nicholas Moakes (director)

Nick is chief investment officer of The Wellcome Trust, one of the world’s largest charitable foundations. He is on the board of the Investor Forum, an investor-led organisation established to improve long-term investment returns through collective shareholder engagement. He also chairs the Imperial College Endowment Fund and was appointed to the board of Foreign & Colonial Investment Trust Plc in March 2011. Nick has nearly 30 years’ experience in Asia and 25 years’ experience in global equity markets. He started his career in the diplomatic service, where he specialised in Hong Kong and China. Before joining Wellcome in 2007, he was head of the Asia Pacific investment team and co-head of emerging markets at BlackRock Investment Management.

Previous publications

Readers interested in further information about JEFI may wish to read our earlier notes. You can read the notes by clicking on them below.

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Jupiter Emerging & Frontier Income Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.