A coiled spring?

Charles Montanaro, the manager of Montanaro UK Smaller Companies Investment Trust (MTU), has remained stalwart in the face of a UK market that has been underperforming international peers. His bullishness is based on what he believes is the increasingly attractive valuations being assigned to UK equities, as several of MTU’s holdings have reported their highest ever revenues.

He thinks that there may also be catalysts forthcoming for a positive shift in investor sentiment in the form of declining UK inflation (which he thinks could soon lead to lower interest rates), higher than expected GDP growth, and generally robust UK businesses and consumers.

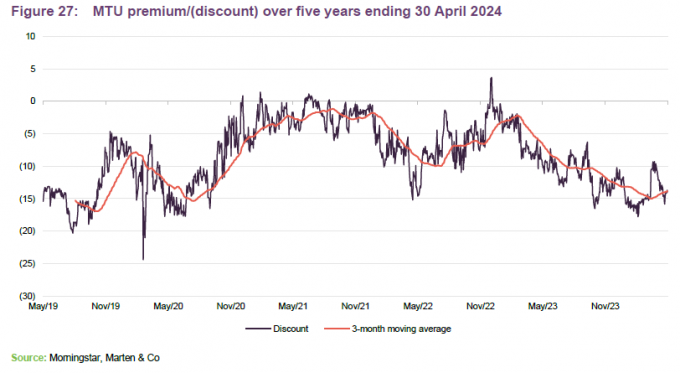

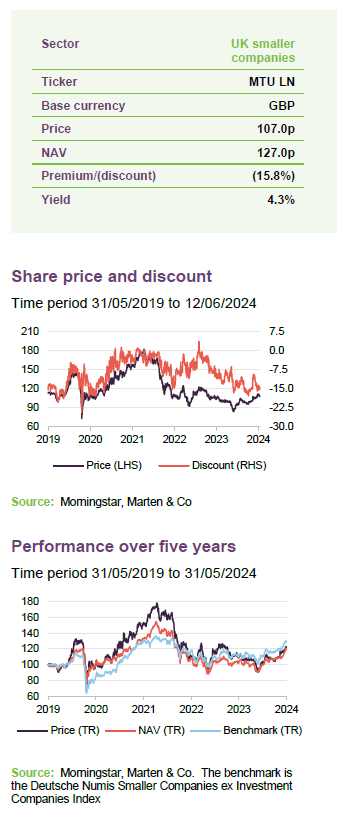

Improving sentiment might provide a tailwind for MTU shareholders’ returns, if its wide (currently 15.8%) discount were to narrow. MTU’s own management have seen fit to purchase another 1% of MTU’s outstanding shares, believing MTU’s discount to be a sufficiently attractive entry point.

UK small cap with a bias to quality

MTU aims to achieve capital appreciation through investing in small quoted companies listed on the London Stock Exchange or traded on AIM, and to outperform its benchmark, the Deutsche Numis Smaller Companies Index (excluding investment companies).

Fund Intro

More information is available at the manager’s website www.montanaro.co.uk/muscit

MTU is a UK smaller companies trust with a focus on capital growth. Montanaro Asset Management Limited (MAML) is the trust’s AIFM. Charles Montanaro established MAML in 1991, and MTU was launched in March 1995 with Charles as its lead manager. He has been the trust’s named manager for over three-quarters of its life, most recently returning in 2016. However, Charles has assured the board that he is happy to remain as MTU’s named manager until at least 2026. Nonetheless, Charles is cognisant of the eventual need for a well-managed transfer of responsibilities.

The trust raised £25m at launch in 1995 and topped that up with a £30m C share issue the following year. Today, the trust has a market cap of £179m. While it has always retained the same focus on UK small-cap opportunities, it has evolved its dividend policy and pays out c.4% of its NAV each year (see page 25).

Readers may wish to refer to our last note

MAML has one of the largest teams in Europe (and the largest in the UK) focused on researching and investing in quoted small- and mid-cap companies. It boasts 39 team members, including 18 analysts and portfolio managers. The team is experienced, multi-lingual, multi-national (12 different nationalities), and there is relatively little turnover of staff. MAML’s managers believe that the company is best served by operating with a maximum of 40 staff members, so as to preserve the culture of a boutique outfit.

MAML has AUM of more than £3.3bn. Charles Montanaro and his family together own 95% of the business, and head of investments Mark Rogers owns 5%. However, the wider team has options over about half of the equity.

The trust is benchmarked against the Deutsche Numis Smaller Companies Index (excluding investment companies), and we have also used the MSCI UK Index as a performance comparator in this report. The benchmark plays no part in determining which stocks are selected for the portfolio, or how large positions are as a percentage of net assets.

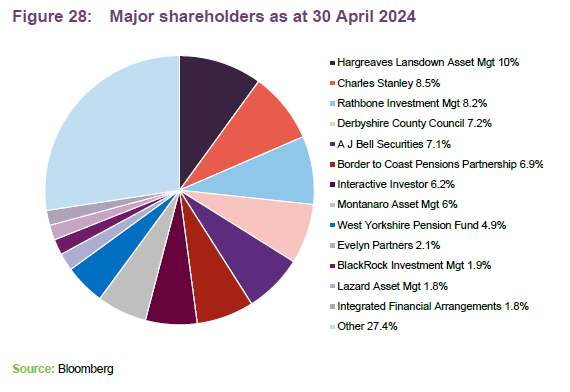

MAML owns around 6% of the trust, having recently repurchased an additional 1% of the outstanding shares, with Charles Montanaro and family owning a further 2.4%, which he feels helps align its interests with those of other shareholders.

Market backdrop

Whilst we do risk sounding like a broken record, the valuations of the UK small-cap market may have further deviated from their intrinsic value since we last wrote on MTU in June 2023; a possible consequence of the market’s seeming aversion to UK equities and the underperformance of smaller companies’ shares in most parts of the globe versus their large-cap peers. This sell-off may have been driven more by investor sentiment than by a deteriorating outlook, as the earnings of UK smaller companies remain robust, with some of MTU’s holdings reporting their highest-ever nominal earnings.

Some misplaced doom?…

UK equities have seen near-consistent outflows since we last published, extending the trend that started eight years ago. 2023 was the worst year for outflows from UK open-ended funds, with investors withdrawing £13.6bn in assets over the year, as well as pulling billions out so far in 2024 as well.

Investors have been pulling money out of the UK

Political risk may have also been a long-term drag on investor confidence in the UK, with arguably little having been done to reverse the decline in confidence that began with the Brexit vote. The UK market largely missed out on the AI-driven rally in technology companies of the past year, and more recently, investors may have begun to dwell on the impact of falling numbers of market participants. Not only has this reduced the liquidity in the market, but it has also possibly complicated financing efforts for UK companies, specifically in the context of raising money via IPOs, given the lack of capital available in the UK relative to some overseas markets.

Several companies have already made headlines over 2024 having chosen a US listing over the UK or discussing the idea of dropping their UK listing for a US one (with Shell recently making headlines for mulling a shift of listing, given that it trades on about a 35% discount to US-listed peers). This trend could also be self-reinforcing, driving more participants out of the market and further reducing liquidity.

Arguably, the FTSE 100 Index has had a good 2024, as cyclical sectors such as miners and banks have staged a rally. However, once again, small caps have trailed this. We note that this trend has been repeated in Europe, US, and Japan.

… but no reason for gloom?

What matters most for Charles, though, is not top-level or statistical narratives, but rather the opportunity represented by the current fundaments of small UK companies, which in his mind currently present some of the most attractively priced earnings in recent memory.

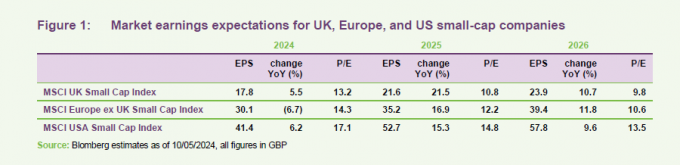

As can be seen in Figure 1, the market expects the UK to generate double-digit earnings growth over 2025 and 2026, with its compounded growth exceeding that of the US. Yet the UK is expected to trade on an ever-widening discount, dipping down into single digits based on current projections. Note that Figure 1 excludes companies with negative earnings, as they would not typically be part of MTU’s investable universe.

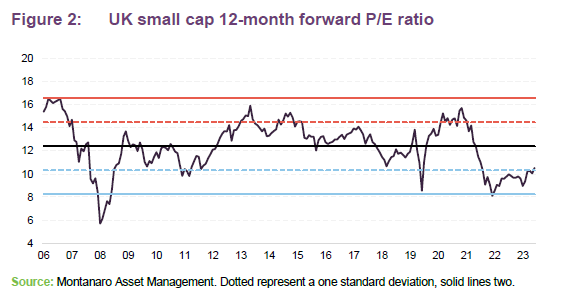

It is this increasing valuation gap that excites Charles, as despite the growth in UK earnings, the market had been pricing the UK at levels that were commensurate with COVID-19 and the global financial crisis, as can be seen in Figure 2. In fact, the UK has only just recovered from its two standard deviation P/E ratio. Whilst there may have been some country-specific risks within the UK, one could argue that its outlook is not comparable to that of the UK during two of the worst recessions in recent memory.

To that end, the IMF expects that the UK economy will grow by 0.4% in real terms over 2024, marginally behind a figure of 0.7% for the Eurozone, though considerably behind the 2.6% real GDP growth forecast for the US. However, the IMF forecast was published in May, ahead of June’s announcement of stalled UK economic growth in April.

And still silver linings to be found

One possibly major issue facing global markets since early 2022 has been tightening monetary policy in the US, Europe, and the UK. MTU’s focus on growing companies may have increases its sensitivity to rising interest rates, and these have been a possible headwind for the trust.

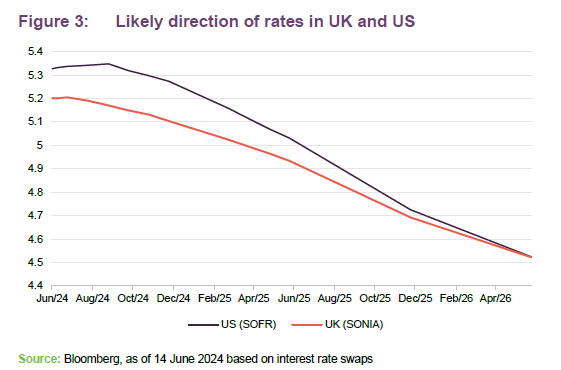

From about mid-October 2023, the market became more bullish on the prospect of multiple interest rate cuts being implemented over 2024. However, stickier-than-expected inflation combined with strong growth from the US have dampened these expectations as Figure 3 shows.

The BoE’s MPC has, in its most recent meeting, kept rates at 5.25%; however, it did not formally rule out a possible rate cut at its next meeting. The market currently expects the BoE to make one 0.25 percentage point cut by December.

The UK’s forthcoming election could be another turning point, as it may take a degree of political risk off the table, given the revolving door of leadership seen under the Tory party. Labour is the bookies’ firm favourite to take power, and given the centrist shift in its policies, we may not be facing a major economic upheaval.

The UK’s economy may also be supported by consumer spending, buoyed by some of the highest levels of wage growth in the last two decades, as well as declining consumer debt levels, although April’s retail sales figures fell by 4%. UK businesses are positive in their outlook, with the UK Composite PMI reporting a recent print of 53.0 for May.

Process

MAML’s purpose is to deliver strong and sustainable investment returns to investors by investing responsibly in quoted, high-quality growth smaller companies. It aims to invest conservatively and for the long term, and does not invest in derivatives or lend the stock in its portfolios. It avoids loss-making companies, highly-leveraged companies, and unquoted/illiquid stocks. MAML’s staff are encouraged to invest in its funds, to better align their interests with those of the underlying investors.

MAML has a strong emphasis on proprietary research

The company has a strong emphasis on proprietary research. The manager believes that the size of the team makes that achievable and gives MAML a competitive edge.

MAML is designed to be an entrepreneurial boutique with a flat structure that allows for quick decision-making and avoids the politics that bog down more bureaucratic large asset managers.

Turnover and transaction costs are kept low, and the team follows its companies closely over many years. The manager says he would rather pay more for what he believes is a higher-quality, more predictable company that can be valued with greater certainty than a more speculative business.

MAML does not encourage the development of “star” fund managers, but is focused on staff retention, helped by the granting of staff options over MAML equity. MAML’s “back office” functions are carried out in-house rather than being outsourced (as they are in many smaller investment management boutiques).

The underlying philosophy

MAML’s core values underpin its business and its approach to investing. They are:

- “My word is my bond.”

- “Look after your clients and they will look after you.”

- “Share the same investment risks that your clients do.”

- “You cannot be good at everything – stick to what you are good at.”

- “Stay humble.”

- “Treat your team as you would your family.”

The company invests in simple businesses it can understand

MAML invests in:

- simple businesses that it can understand;

- niche businesses in growth markets (non-cyclical companies, growing organically);

- market leaders (strong, defensible market positions and pricing power);

- companies with high operating margins and high returns on capital (barriers to entry/a sustainable competitive advantage);

- profitable companies trading at sensible valuations;

- good management that it trusts (aligned to shareholders and demonstrating sound ESG practices); and

- companies that can deliver self-funded organic growth and remain focused on their core areas of expertise, rather than businesses that spend a lot of time on acquisitions.

This could be summed up as investing in high-quality growth businesses at sensible prices.

In addition, MAML believes that it is easier to add value through stock selection for a small and mid-cap portfolio, especially given the relative paucity of research available on these companies.

Selecting the underlying companies

An internal investment committee reviews the portfolio every quarter

An internal investment committee, chaired by Charles, reviews the portfolio every quarter, which reduces the dependence on any one individual – including Charles – for performance.

The trust, by virtue of its structure, can have exposure to less-liquid stocks and MAML has permission to hold up to 40% in AIM stocks. This is less than some of its competitors. In practice, though, it is unlikely that it would hold more than 30%.

Within its portfolios, including MTU’s, MAML will not invest in tobacco companies; companies manufacturing weapons; those facilitating gambling or manufacturing alcohol; companies engaged in oil and coal-related E&P; companies involved with pornography; and those making high-interest-rate loans. MAML’s corporate governance checks include an assessment of a company’s remuneration policy. The application of this ethical screen, combined with MAML’s minimum liquidity requirements, reduces the target list to about 415 stocks.

MAML has always generated its own investment ideas rather than relying on brokers, which is fortunate as research coverage of MTU’s target universe continues to fall. A team of analysts, each with their own sector expertise, continually screens the investable universe for new ideas. Research responsibilities are distributed amongst the team on a sector basis (although analysts may also compare and contrast UK companies to global peers). Emphasis is placed on being well-prepared for meetings with potential investee companies, which is possible as the research team is well-resourced. MAML’s analysts can then set the agenda, challenge management and get the information that they need. Site visits are encouraged (another perk of having a large team is that it is not desk-bound).

On average, each analyst will seek to identify 20 stocks within their sector coverage worthy of closer scrutiny

On average, each analyst will seek to identify around 20 stocks within their sector coverage worthy of closer scrutiny. These will form the pool from which portfolio constituents are drawn.

The first part of the process is to eliminate poor-quality companies. These stocks are identified by applying a quantitative screen to the wider universe. Stocks are ranked based on 14 quality criteria:

Growth

- Five-year sales growth

- Five-year EBIT growth

- Five-year EPS growth

Profitability

- EBIT margin

- Return on assets

- Return on equity

- 5-year average RoE

Leverage

- Net debt/equity

- Interest cover

Cash

- Cash ratio

- Cash conversion ratio

Volatility

- Five-year sales growth

- Five-year EBIT growth

- Five-year EPS growth

Loss-making companies, those with poor cash-flow, and highly indebted businesses are rejected. Stocks that fit structural growth themes that the team has identified may be prioritised. Each company within the universe is assigned a quality rating (D to AAA).

Both management and the board of potential investee companies are closely examined, as MAML looks to predict where a company might be in five to ten years.

- Management’s track record is analysed to understand their goals and aspirations.

- The board structure is examined, as are the corporate governance and remuneration policies.

- The level of insider ownership is evaluated.

On site visits, the team will meet employees who have often not met investors before, believing that doing so allows them to gain a better insight into the products and services provided and observe the culture of the company in a way that is hard to decode from reading an annual report.

Various valuation tools are considered and the team operates with a time horizon of five to 10 years

Then the analysts build a financial model and conduct a “SWOT” analysis on each stock. They also check whether a stock meets MAML’s ESG criteria (see overleaf). Then the idea is put before MAML’s investment committee, who challenge assumptions and ask for more information if they feel this is warranted. Stocks that pass these quality thresholds may then go on to an approved list of over 250 companies (which includes non-UK companies). No fund manager can buy a company that is not on the approved list.

Then attention turns to valuation, which is considered as a distinct, second step in the investment process. In this second step, the team has to give consideration to the question of will the good company that it has identified actually make a good investment? These are two separate issues. Various valuation tools are considered (primarily discounted cash flows but also P/E, free cash flow yields, and dividend yields relative to peers) and the team operates with a time horizon of five to 10 years. The ideal investment should provide a margin of safety in excess of 25% over its intrinsic value.

Analysts will also look at risk factors. Analysts will then assign a recommendation to each stock. These will be presented to the whole team at weekly meetings and the fund managers will then decide which stocks make it into portfolios. Once a stock makes it into a portfolio, it will usually remain there for many years.

Portfolio construction

MTU’s investment policy is more fully described in its annual report. It only invests in listed or quoted securities, and unquoted companies are not eligible for consideration.

Some other rules apply:

- MTU does not hedge its currency exposure;

- at the time of initial investment, a potential investee company must be profitable and no bigger than the largest constituent of the Deutsche Numis Smaller Companies (ex IC index), the cutoff for which is a market cap of £1.7bn;

- for risk management purposes, the manager limits any one holding to a maximum of 4% of MTU’s investments at the time of initial investment; and

- MAML will hold no more than 10% of the share capital of any company (across all funds managed by MAML).

The total number of holdings is typically around 35

Typically, the target weighting for a new position will be between 1% and 3.5%, depending on both the strength of conviction that the manager has in the stock, and its liquidity. The target number of holdings is typically around 35 to 40 (currently 35). There is no obligation to sell a company if its market cap exceeds £5bn, but these will be gradually recycled into lower-market-cap companies. The manager will ensure that a single position does not exceed 7.5% of the portfolio, and he also cannot increase the size of a position once its weight exceeds 4%.

The manager adds that when entering into a new position, he typically buys 50% of the target weight initially. If the investment grows to the target weight organically, it is left alone. If it declines following the investment, the manager will add to the investment to take it to its target, if it still meets the required criteria.

ESG analysis

Sustainability is embedded within the culture of the firm

ESG analysis has been part of MAML’s investment process for well over 20 years, and sustainability is embedded within the culture of the firm. MAML has been a certified B Corporation since June 2019. Certified B Corporations are legally required to consider the impact of their decisions on their workers, customers, suppliers, community, and the environment. MAML has committed to achieving net zero emissions by 2030 (including a full offset of its past emissions), offsets its business travel in conjunction with ClimateCare, supports a number of charities and promotes diversity, equality and wellness within the team.

Having become a signatory to the Net Zero Asset Managers initiative, MAML was the only UK investment boutique to be invited to join the Glasgow Financial Alliance for Net Zero (GFANZ) taskforce. It was also invited to co-chair the B Corporation Investment & Working Group and led a group of investment boutiques to the UN Climate Change Summit COP26 in Glasgow to discuss the benefits of being a B Corporation in the financial sector. MAML has won several ESG & Impact awards and has most recently been awarded the “Best Small & MidCap Sustainable Investment Boutique” award by Ethical Finance.

MAML has an eight-member internal sustainability committee, chaired by Christian Albuisson, which meets quarterly and oversees MAML’s efforts in this area. MAML also has its own ESG handbook, policies, and checklists (an ESG checklist is completed for every company, ranking stocks from 1–10 on a range of criteria). It votes on the shares it controls, and engages with companies. MAML expects the companies that it invests in to improve their ESG awareness, and it monitors their progress.

According to MAML, MTU’s portfolio has a scope 1 & 2 carbon intensity of 27.3 tonnes per million USD of sales, lower than the 82.7 of its benchmark.

MAML has recently announced that it will aim to be carbon-negative and remove 100% of its historical emissions by 2030. A critical step in achieving this is its partnership with Danish Carbon Removal Platform company Klimate. Together they will implement projects such as direct air capture; deep storage bio-oil; ocean kelp; and restorative tree-planting; all of which will reduce the carbon footprint of MAML.

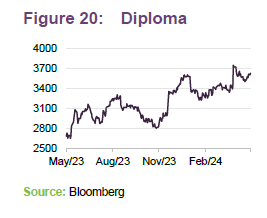

The team also engages with the management teams of their investments in regards to their governance practices. One recent example of this has been its engagement with Diploma, addressing pay disparities between their executives and their wider workforce.

Sell discipline

Stocks will be sold if they no longer pass MAML’s quality threshold

Stocks exit the portfolio for a variety of reasons – for example, when they become significantly overvalued, if they become too big, or due to takeovers.

Furthermore, stocks may leave the portfolio if the analysts identify unfavourable changes in the fundamentals of the business, or an unfavourable management change.

Stocks will also be sold if they no longer pass MAML’s quality threshold, or if a new opportunity comes along that offers better prospects.

Portfolio

At the end of March 2024, MTU had 35 holdings, down from 40 in April 2023 (the last time we published a note), and the median market cap of the companies in which it was invested was £707m. Reflecting the investment style, on average, MTU’s stocks tend to be higher-rated but faster-growing than typical UK smaller companies, with balance sheets that are also strong.

Looking at consensus estimates for the next financial year, the P/E ratio on the portfolio was 18.4x at end March 2024 EV/EBITDA 13.3x, and average EPS growth was estimated at 4.4%. Net debt/equity was forecast at -3.5% (i.e. more cash than debt). Since our last note, MTU’s P/E and EV/EBITDA ratios have fallen, in line with the general trend of the wider UK small cap market, as we demonstrated in Figure 2 on page 6. However, MTU’s EPS growth and net debt to equity have improved since our last note, which could be viewed as reinforcing the notion that the market is mispricing the fundamental strength of UK companies.

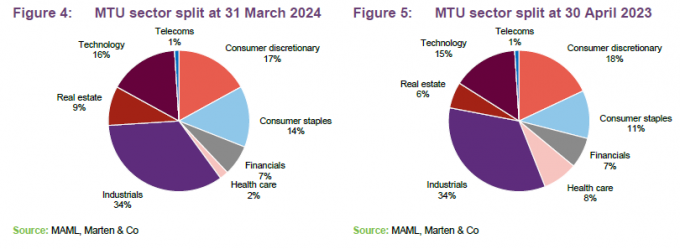

The sector split is driven by MAML’s stock selection decisions. At the end of March 2024, there was no allocation towards energy, basic materials, or utilities. Industrials, consumer, and technology stocks remain MTU’s largest sectoral allocations. The most notable shift has been the 6% reduction in healthcare, which reflects the takeovers of Ergomed and Dechra Pharmaceuticals.

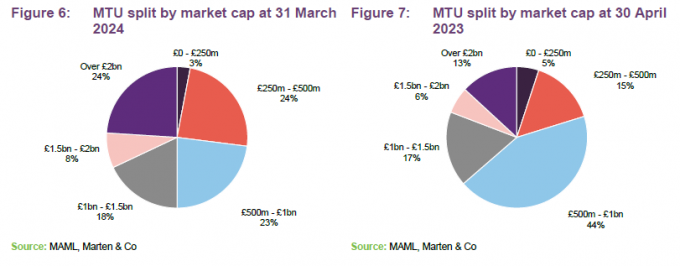

On a market-cap level, the largest change has been the reduction in exposure to £500m to £1bn cap companies, reflecting both recent trading activity but also Charles’s intention to slightly reduce MTU’s AIM stock exposure to 21%, a level he feels more comfortable with. MTU’s allocation to sub £1bn market cap companies has fallen from 64% to 50%.

Top 10 holdings

MTU has settled on a 35-stock portfolio

The list of MTU’s 10-largest holdings has been more stable since our last note, with the top seven holdings reappearing. The turnover in MTU has begun to normalise since our last publication, which covered a period in which MTU was transition to a more concentrated portfolio. All of the new entrants in the top 10 have been the result of strong performance rather than trading activity.

Since we last published, Charles has sold out of four companies (Keystone, Strix Group, FDM, and Integrafin) and added one other (Bytes Technology). MTU’s current 35-holding portfolio is likely to be the number that investors can expect it to hold going forward, as the fund will likely operate on a one-in-one-out basis.

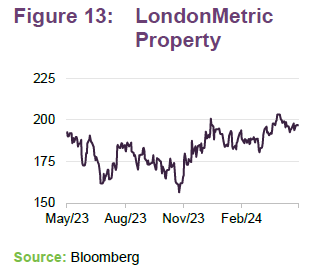

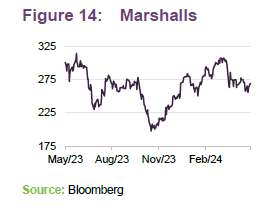

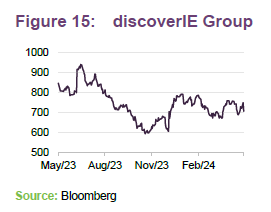

Charles added to MTU’s holdings of discoverIE Group, Marshalls, and LondonMetric Property Group, and Bytes Technology.

Two positions were lost to takeovers during the last 12 months, Ergomed and Dechra Pharmaceuticals. Both of which were amongst MTU’s top contributors to performance, and as such are covered in the performance section on page 19. Spirent Communications, a telecommunications firm, will follow them out of the portfolio shortly, as after a bidding war between US rivals Keysight Technologies and Viavi Solutions, Keysight triumphed with a £1.16bn offer.

Looking at the three new entrants to the top 10 since we last published:

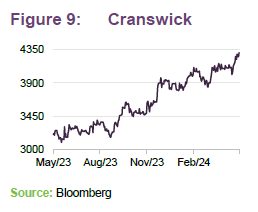

Cranswick

Cranswick (www.cranswick.plc.uk) is a producer and supplier of meat products, typically serving a British clientele. Cranswick has a diverse product offering, a result of it focusing on chicken and pork meat, versatile foodstuffs. The company also benefits from vertical integration, increasing its investment into its pig farms and food milling operations. Cranswick now has self-sufficiency for over half of its pork production. Its capacity has been further expended by its recent acquisition of Froch Foods, a poultry and pork processor.

For the six months ending September 2023, its most recent interim results, Cranswick reported double-digit growth across multiple key metrics, including revenue and operating profits. Its management comment that the catalyst for this growth being both the increased volumes of sales and the ability to pass on inflation to its end retailers. Its strongest core product was its gourmet line, which comes despite the ‘cost of living’ crisis in the UK. Cranswick not only utilised its strong revenues to fund further investment (expecting c.£100m in capex over their 2024 FY), but also to bolster shareholder returns, having grown its dividend by 10% over the period. Cranswick’s management has also highlighted the strong performance of the company over Christmas, in an unscheduled trading update. Its performance was bolstered by strong-than-expected sales over the Christmas period, indicating that they are expecting stronger pre-tax profits for 2024 FY than initially anticipated.

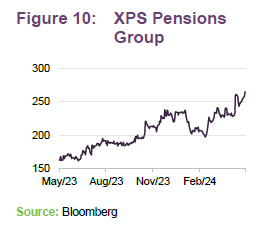

XPS Pensions Group

XPS Pensions Group (www.xpsgroup.com) is an employee benefit consultancy firm, largely focusing on providing pension advice in the UK. XPS Pensions has delivered consistent, compounding growth based on its past reporting, leading it to report record earnings and profits for its 2023 FY. Whilst pension actuarial and consulting remain the largest nominal components of its revenues, its investment arm has seen the largest percentage growth in revenue over the last five years.

While the quality of XPS’s services looks to have been a major driver of its growth (having reported consistent year-on-year revenue growth over the last five years) it has also benefitted from external factors. Charles highlighted that the mini budget from Liz Truss in September 2002 caused a dramatic sell-off in gilts, sparking a liability-driven investment crisis as pension funds were forced to liquidate assets. Demand for XPS’s services increased as a result. XPS’s management has improved its outlook, now expecting 20% YoY growth over its 2024 FY. The company is also hopeful that this growth can be repeated again over 2025, highlighting a number of new client wins that it says will help propel revenues.

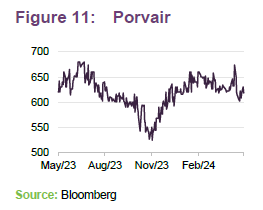

Porvair

Porvair (www.porvairfiltration.com) is a specialist filtration an environmental technology firm based in the UK, but with operations in the US, Germany, and China. Its products are niche and service complex industries such as aviation, molten metal filtration, and laboratories. Charles comments that due to the very nature of filters, Porvair’s products have a limited life and require regular replacement, allowing the company to generate strong recurring revenues; compounded by the fact that the complexity of its end markets makes switching suppliers difficult.

2023 was a record year for Porvair, reporting record revenues and profits. The report highlights that figures were driven the same structural tailwinds that have supported past earnings, such tightening environmental regulation, and the desire for greater emission efficiency, where, for example, Porvair’s recent earnings benefitted from the rebound in air travel. Its management also remains positive for 2024, commenting that it has promising acquisitions on the horizon and a strong orderbook already locked in. It does note that given the company’s overseas operations, stronger sterling could weigh on the company’s earnings.

New purchases

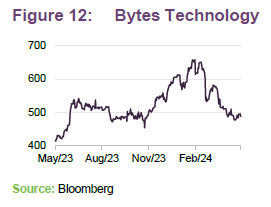

Bytes Technology Group

Bytes Technology Group (www.bytes.co.uk) is a top 10 UK re-seller of software such as Oracle, Citrix, Mimecast, Check Point. Half of its business can be attributed to Microsoft and half of that in Microsoft 365, its suite of productivity software (e.g. word, excel). In 2022, Bytes was named Microsoft Partner of the year for Operational Excellence out of 3,900 partner entries globally.

Some two thirds of their c. 5,000 clients are in the private sector (e.g. Linklaters, M&S, the BBC, Thames Water, Bupa, Asos, William Hill) and one third to the public sector (e.g. the NHS, Liverpool City Council, Ofgem, University of Aberdeen). The largest single client is 1.5% of gross profits, thus Charles believes that there is no customer concentration risk. Bytes’s revenues are effectively recurring – as all their clients need to renew their licenses – so its business model is non-cyclical and predictable.

Charles has provided us with a detailed description as to why he believes Bytes Technology is a classic “Montanaro” stock. In his mind the business is simple to understand and ticks his quality and growth boxes:

- Quality: it is focused; simple to understand; non-cyclical; no client concentration or inventory risk; negative working capital ensures a strong balance sheet (net cash); must have products so “non-discretionary” and predictable revenues;

- Growth: Bytes’s addressable market is forecast to grow by 8% – 10% over the next five years driven by price increases by Microsoft (5% – 10% p.a.) which itself is forecast to grow double digits organically; the migration to the cloud; the structural shift to the hybrid office and working from home; and increasing demand for cyber security software.

The icing on the cake for Charles is that he believes that Bytes Technology offers a play on AI on two fronts: firstly, their internal staff are reviewing greater internal efficiencies and productivity gains; secondly, clients will be upgrading to 365 Co-Pilot (Microsoft’s AI product)- making Microsoft a stickier, more attractive product. Charles believes that by bundling Co-Pilot into every product – Excel, e-mail, Powerpoint etc. – Microsoft will be able to grow faster and increase prices which will benefit Bytes.

Bytes Technology also satisfies Charles’s criteria for superior management and culture. He comments that previous entrepreneurial CEO Neil Murphy had more than 30 years’ experience in the IT sector. He had a Glassdoor rating of 4.4* meaning 95% approval rating and he was one of the most responsive to our questions. Unfortunately, Neil has recently left the company, though due to reasons not associated with Bytes. Of the top 50 fee earners, only one has left in the last six years.

On 24 May 2023, Montanaro’s investment committee approved Bytes Technology to go on its approved list (of highest quality stocks). The first investment was made in June 2023 at a price of 506p. Although a core long-term holding, partial profits have already been taken. At the time of writing, the share price is 542p.

LondonMetric Property

LondonMetric Property (www.londmetric.com) is a FTSE 250-listed REIT, whose portfolio operates across a diverse range of sectors, though its largest sectoral allocation is in logistics properties and makes up 41% of its portfolio. Its management intends for it to capitalise on ‘emerging consumer behaviour’, such as the evolving trends in demand for online shopping, convenience, healthcare and staycations. LondonMetric’s assets have recently increased on the back of two successful mergers, taking over CT Property Trust and LXi REIT. Charles purchased LondonMetric in January, prior to LXi REIT agreeing to the takeover.

LondonMetric’s recent semi-annual results for the six months ending 30 September 2023, indicated a positive period of growth for the company, with earnings up 5.8%, thanks to a 6.7% increase in rental income. The biggest driver of this was its urban logistics assets, which reported rental uplifts of 43%. LondonMetric also made headway in improving its balance sheet over the period, selling down £157m in assets (at a negligible discount-to-book value) and using the proceeds to reduce its loan-to-value (i.e. its debt ratio) to 29.5%.

Marshalls

Marshalls (www.marshalls.co.uk) is a manufacturer of natural stone and concrete landscaping products and has recently its annual results for its 2023 financial year, ending 31 December 2023. Marshalls faced a tough 2023 given its revenues fell 13% YoY and profits fell by 30%. Its management attributed its performance to weak macro-economic conditions impacting the activity in its end markets, such as lower house-building activity over the years, feeding through to demand for its goods.

Marshalls’ management made proactive changes to the company to offset these losses, reducing capacity and lowering overheads. They also continued to invest in its operations, bringing a plant in St Ives to operation, as well as investing in a new product development. However, its management expects a gloomier outlook for 2024, anticipating lower revenues than initially forecasted and profits in line with its 2023 level. Given the weakening outlook, its board saw fit to cut its 2023 dividend by half, compared to its 2022 level. Charles has confidence in the recovery of Marshalls’ end markets (as does its board, highlighting structural trends supporting the demand for its products), and took recent share price weakness as an opportunity to increase MTU’s holding.

discoverIE Group

discoverIE Group (www.discoverie.com) is a UK-based designer and manufacturer of customised and niche electronic components for industrial use across the world. It released a trading update in April 2024, in advance of its annual results for its year ending 31 March 2024. The company outlined that it has made ‘good financial and strategic progress’ and is on track to deliver results in line with its own expectations. While its sales were up only 1% YoY, it follows two years of strong sales growth (up 48% in total), perhaps signalling that the company successfully navigated a more difficult 2023. Its management has stated that its second half will be stronger than its first, returning to positive organic growth as well as expending its margins relative to the first half. It also reported that the acquisitions made in 2023 are performing as expected.

Sales

Charles sold out of Keystone Law, a UK law firm, as he believed that the company had realised its growth potential, with its future outlook no longer looking sufficiently attractive.

He sold Strix Group, a manufacturer of kettles and water control systems, due to his concerns around the quality of its management. In 2023 its CFO unexpectedly left the company, and the company reported a decline in EPS of 16% in its 2023 full year results, despite also reporting a 35% increase in revenues and 28% increase in profits.

Charles sold out of FDM Group, a technology consultancy, as he believed that his other holdings offered better upside.

His final outright sale was of Integrafin, an asset manager. He decided to exit his position as he felt the portfolio had too high an exposure to asset managers, which can be viewed as a highly market-sensitive asset class, and favoured other holdings such as Liontrust.

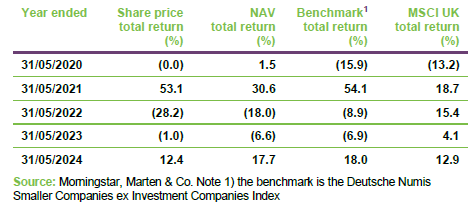

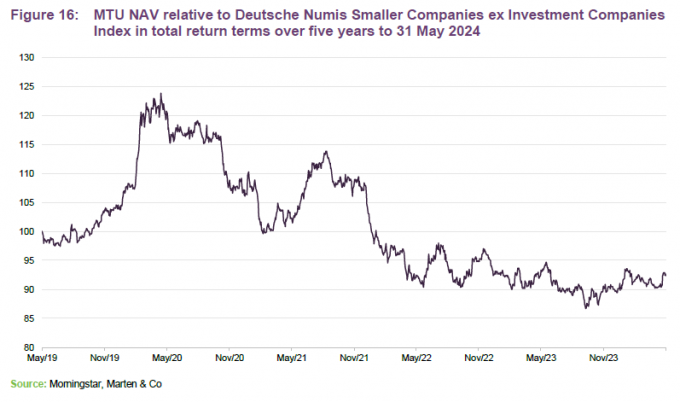

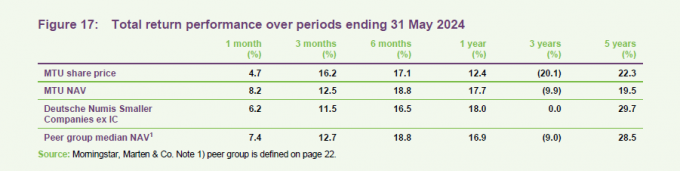

Performance

As can be seen in Figure 16, MTU’s long-term NAV underperformance reflects the painful sell-off over the end of 2021, the catalyst for which seemed to be the start of the current interest rate hiking cycle. While this pain was shared across most of the UK small-cap sector, it was arguably felt hardest by growth-focused strategies such as MTU’s, offsetting the outperformance it had generated in the prior years.

This period of underperformance was arguably due to macro-level factors and, given the bottom-up nature of Charles’s approach, these would not typically be factors he would consider when constructing his portfolio, preferring performance to be driven by the long-term success of portfolio companies rather than trying to time macro events.

The relative performance of MTU looks to have stabilised over the last year.

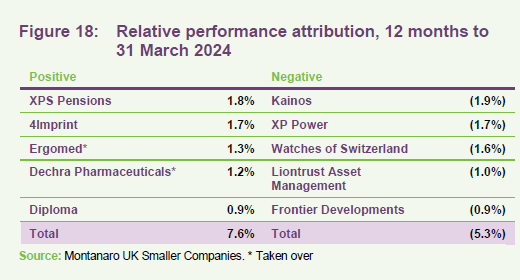

Attribution

The top and bottom five performers are listed in Figure 18, and more information about some of them is detailed in the following pages.

Positive contributors

XPS Pensions was discussed in the asset allocation section above.

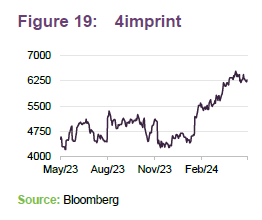

4imprint

4imprint (4Imprint.co.uk) is one of the UK’s leading promotional merchandise manufacturers with operations around the world, including a strong presence in the US, but with its headquarters in the UK. 4imprint has seen growth momentum post-COVID-19, thanks to its marketing efforts, increasing its market share of a fragmented market.

4imprint’s share price gains (up 39% over the 12 months to end April) might reflect its record results over its 2023 FY, ending December 2023, with revenue increasing 16% YoY to $1.33bn and operating profit rising a considerable 32% to $136m. Its EPS also grew an impressive 32%. The performance was driven by continued market share gains, with total orders up 12% despite what its managers believe was a more challenging H2.

As per its recent results reports, 4imprint’s results can be attributed to several factors, one being its ability to improve its margins, up by over 2% thanks to price adjustments, supplier rebates, stable input costs and lower freight expenses. Its marketing expenditure also continues to reward the company, with revenue per marketing dollar remaining above $8 for the full year, well above pre-pandemic norms.

4imprint’s operating margin exceeded 10% in 2023, a possible reflection of its productive marketing and operating leverage in their asset-light business model. Its management believes that their ‘drop-ship’ model, whereby suppliers hold inventory and ship directly to customers, enables strong cash generation and low capital intensity, a hallmark of a high-quality business. A possible example of its ‘quality’ is its balance sheet, which includes year-end cash of $104.5m and no debt. Looking ahead, 4imprint’s management remains confident in its ability to continue gaining market share, preferring organic growth to acquisitions.

Diploma

Diploma (Diplomaplc.com) is a provider of specialist products and services, largely operating in three sectors: controls, seals, and life sciences. Diploma is an amalgamation of more than a dozen business units each operating in niche segments, with Windy City Wire, a low-voltage cable specialist, being its biggest business and largest contributor to its profits. Its managers highlight the strong, long-term relationships it builds with its customers, which reduces the likelihood of the switching providers.

Diploma reported another year of positive results for its 2023 FY. Revenue grew 19% to £1.2bn, driven by 8% organic growth (ahead of the 5% predicted by its management) and an 8% contribution from acquisitions, with 12 companies joining the group. Operating profits increased by 24% to £237m, with margins expanding 0.8% points to a comfortable 19.7%. Its management attributes its robust margins to its differentiated value-add distribution model, disciplined cost control, and accretive acquisitions. They also highlight that the key factors behind the earnings growth were strong organic performance across its three sectors and strategic initiatives to diversify revenues and penetrate new markets.

Diploma’s net debt reduced to £254.7m (fully covered by its 2023 EBITDA) due to strong free cash flow generation and proceeds from an equity raise.

Takeovers – Ergomed & Dechra Pharmaceuticals

In September 2023, Permira, a global private equity firm, announced its acquisition of Ergomed, a UK-based clinical research service provider. The takeover was worth £700m, or £13.5 a share, and was completed in November. The deal represented a 28.3% premium to Ergomed’s share price on 1 September. Permira was possibly attracted to Ergomed’s ‘pick and shovel’ approach, whereby it provides the services and facilities to run the pharmaceutical trails without actually being involved in the research itself.

Dechra Pharmaceuticals is an international veterinary company that was purchased by private equity firm EQT on 23 June 2023 for £4.46bn or £38.75 per share, a premium of around 45% on the day. Prior to its sale Dechra ranked seventh in the world for veterinary product distribution, offering a wide range of products and service to vets: 75% to dogs and cats; pigs and cows 11%; horses 7% and pet foods 5%. Charles believes that Dechra was also a good example of a successful investment, having first invested in the company when it floated in September 2000 at £1.20p per share. Entering the market with a capitalisation of £60m; Charles believes that it was too small for many of the larger financial institutions, but perfect for MTU.

Negative contributors

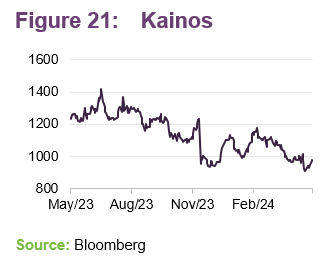

Kainos

Kainos (www.Kainos.com) is a UK-based digital services and platforms provider. Kainos has been grappling with increased competition in the digital transformation space, putting pressure on its market share and pricing power. Charles believes that more recently, the market has also punished Kainos due to its political risk exposure, as its primary client is the UK Government. With a forthcoming change in Government, investors may be concerned that fewer contracts will be awarded, and whilst Kainos has been able to sustain a strong balance sheet and investment momentum, its recent results have pointed to a slowdown in revenue growth and a decline in profitability, which has further weighed on its share price.

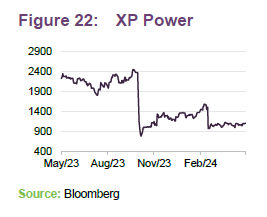

XP Power

XP Power (www.xppower.com) is a provider of power converter solutions that ensure critical electrical and electronic equipment is powered safely and reliably. XP Power focuses on three divisions: industrial technology, healthcare, and semi-conductors. There are several possible factors attributing to its recent share price decline. The company issued a profit warning in January 2024, reflecting the challenging market it was operating in. This warning would be realised in its full-year results for the year ending 31 December 2023, which reported a 14% decline in revenues and an 11% fall in operating profits. The company attributed this decline to the ongoing challenges in the market and weaker demand from the healthcare sector, with the loss of a single client reducing revenue by c.5%. On a macro level, the company has highlighted the increased competition from Chinese manufacturers who have been undercutting XP Power. In addition to a profit warning, the company announced a fund raising of over £40m to reduce gearing in which MTU participated.

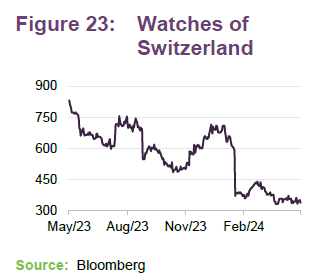

Watches of Switzerland

Watches of Switzerland (www.watches-of-switzerland.co.uk) the international retailer of luxury Swiss watches such as Rolex, faced two unexpected disappointments in the year. In August, Rolex bought Bucherer, their distributor in Switzerland. Charles comments that overnight, Rolex became a competitor for the first time as well as a key supplier, raising questions about Watches of Switzerland’s long-term strategy, given how critical Rolex is as a brand. In addition, he also notes that this year it surprised investors by announcing a poor Christmas selling season, which might relate to unsuccessful purchasing practices running up to the season, with the company stocking less-desirable models.

Peer group comparison

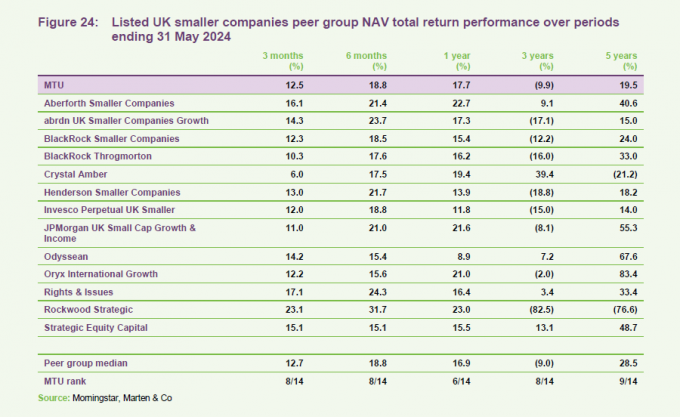

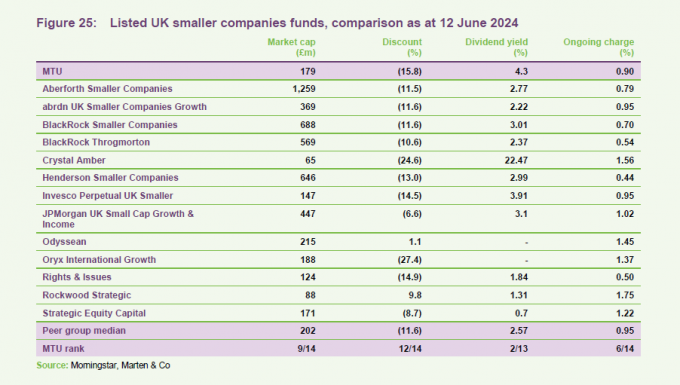

The peer group that we have used in this note is a subset of funds within the AIC’s UK smaller companies sector. We have omitted split-capital companies, trusts with a small market capitalisation, and those with an exclusive focus on micro-cap companies.

MTU’s performance, both near- and long-term, sits on, or just either side of, the median return of its wider peers, as can be seen in Figure 24. MTU’s relative long-term performance has improved since our last note as the impact of the 2021 sell-off starts to fall out of the three-year numbers.

Comparing MTU on other measures as shown in Figure 25, it is once again sitting roughly middle of the pack for this peer group. MTU’s discount has widened since our last note, though this has been the case for virtually all UK-listed trusts. MTU’s sell off was so intense that its current 12-month negative z-score of (1.3) is amongst the largest of its peer group. Most of MTU’s peers’ discounts sit roughly within the low-to-mid teens.

MTU is the second-highest-yielding trust in the sector after Invesco Perpetual UK Smaller. JPMorgan UK Small Cap Growth & Income has adopted a similar dividend policy to MTU.

MTU has an ongoing charges ratio that is marginally above the peer group median. MTU’s ongoing charges ratio is comparable to those of much bigger funds in the peer group.

Dividend

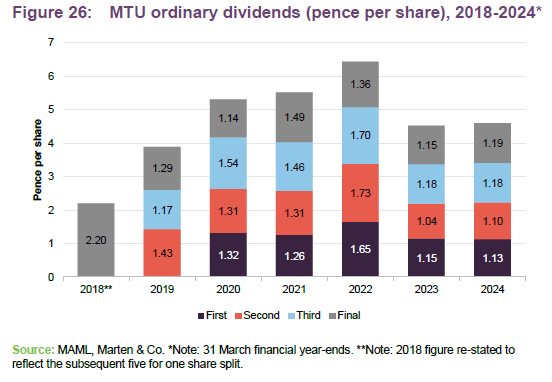

In accordance with a policy introduced in July 2018, MTU pays out 1% of its NAV each quarter as a dividend – a level it considers to be meaningful for investors. Dividends are paid each quarter equivalent to 1% of the company’s NAV on the last business day of the preceding financial quarter, being the end of March, June, September and December. As a result of this dividend policy, the nominal payout will shift with market performance, with 2024’s total dividend being marginally ahead.

The enhanced dividend policy has had no impact on the way in which the trust is managed, or the yield on the underlying portfolio. To the extent that MTU’s revenues are insufficient to cover the dividend, the balance is met from reserves. MTU’s primary objective is to generate capital growth, with the income generation of the underlying portfolio considered to be a by-product of the stock selection process.

Structure

MTU has 167,379,790 ordinary shares in issue and no other classes of share capital.

At the AGM held on 12 August 2021, over 99% of shareholders voted in favour of the continuation of MTU for a further five years. The next continuation vote is scheduled to be held in 2027.

MTU’s financial year ends on 31 March. It tends to announce annual results in June and hold its AGMs in July, with this year’s date yet to be announced.

Gearing

The board is responsible for setting the company’s gearing strategy and approves the arrangement of any gearing facilities. Montanaro Asset Management, the Company’ Alternative Investment Fund Manager (the “AIFM”) is responsible for determining the net gearing level within the parameters set by the Board.

On 17 December 2021, the borrowing facilities with ING Bank were renewed for a period of three years. The interest rate on the £20m fixed rate term loan was reduced by approximately 0.2% per year to 2.49%, which represents a saving for shareholders. Similarly, the £10m revolving credit facility (RCF) was renewed with a lower commitment fee.

At 30 April 2024, MTU was 7.1% geared.

Major shareholders

Board

MTU is managed with a board of four non-executive directors, all of whom are independent of the manager and do not sit together on other boards. Arthur Copple, the chairman, was elevated to that position in July 2019 following the retirement of Roger Cuming. The trust believes a smaller board to be appropriate for its size, allowing it to keep costs down – ongoing charges have been falling.

Having spent more than nine years with MTU, James Robinson announced his intention to retire from the company at the July 2023 AGM. He was succeeded by Barbara Powley as chair of the Audit and Management Engagement Committee. On 1 January 2024, the board added Yuuichiro Nakajima as a non-executive director and replacement for James.

Arthur Copple (chair)

Arthur has specialised in the investment company sector for over 30 years. He was a partner at Kitcat & Aitken, an executive director of Smith New Court Plc, and a managing director of Merrill Lynch. Arthur was previously a non-executive chairman of Temple Bar Investment Trust Plc and was formerly the vice-chair of the University of Brighton Academies Trust.

Catriona Hoare (independent director)

Catriona’s experience includes having been an investment partner at Veritas Investment Management (now known as Meridiem Investment Management) in London since 2013. Before joining Veritas, Catriona held the position of fund manager at Newton Investment Management.

Barbara Powley (chair of the audit and management engagement committee, and the nomination and remuneration committee)

Barbara was appointed to the board as an independent director in November 2020 before being made chair of the nomination and remuneration committee in April 2021. She was then appointed as chair of the audit and management engagement committee in July 2023. She has more than 30 years of experience in the investment trust industry, combined with a strong corporate governance and accountancy background.

Yuuichiro Nakajima (non-executive director)

Yuuichiro is founder and Managing Director of Crimson Phoenix, a specialist cross-border M&A advisory firm, providing advice on Japan-related transactions and a range of corporate strategy initiatives from offices in Tokyo, London and Frankfurt. He is a former member of the Executive Board of the British Chamber of Commerce in Japan and of the Council of the Japanese Chamber of Commerce and Industry in the UK. Yuuichiro spent 10 years with S.G. Warburg (later SBC Warburg) and four years with PricewaterhouseCoopers. He is Chairman of Japan H.L. Limited, which operates Japan House London. For nine years until July 2023, Yuuichiro was a non-executive Director of JPMorgan Japan Small Cap Growth & Income Plc.

Previous publications

Readers interested in further information about MTU may wish to read our previous notes listed below. You can read them by clicking on the links or by visiting the QuotedData website.

| IMPORTANT INFORMATION | ||

|---|---|---|

| Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Montanaro UK Smaller Companies Investment Trust Plc.This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.Marten & Co is not authorised to give advice to retail clients. The research does not have | regard to the specific investment objectives financial situation and needs of any specific person who may receive it.The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note | until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited. |

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.

| QuotedData is a trading name of Marten & Co, which is authorised and regulated by the Financial Conduct Authority.50 Gresham Street, London EC2V 7AY0203 691 9430www.QuotedData.comRegistered in England & Wales number 07981621, 2nd Floor Heathmans House, 19 Heathmans Road, London SW6 4TJ | Edward Marten ([email protected])Nick Potts ([email protected])Colin Edge ([email protected])Eiman Ali ([email protected])Aiman Shaikh ([email protected])INVESTMENT COMPANY RESEARCH:Matthew Read ([email protected])James Carthew ([email protected])David Johnson (dj@quoteddata.com)Andrew Courtney (ac@quoteddata.com)Richard Williams ([email protected])Harry Hartigan ([email protected]) |

|---|