December 2022

Monthly roundup | Investment companies

Winners and losers in December 2022

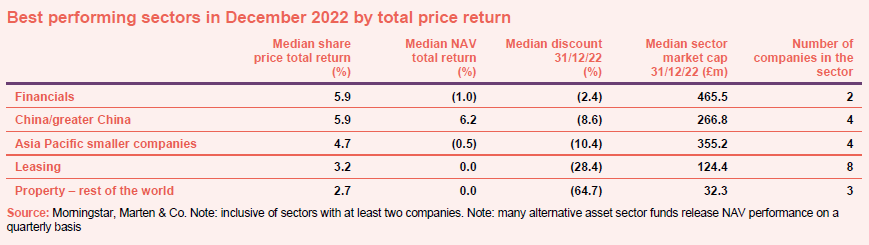

The Financials sector only has two constituents, one of these – Trian Investors 1 – has seen its discount narrow since it promised to return cash to investors by next June, and it has also benefited from underlying NAV appreciation. Last month’s winner – China – continued to rebound as the economy reopened. This probably contributed towards more positive sentiment for Asia Pacific smaller companies. It also helped drive up the price of Macau Property Opportunities on hopes of a resurgence in Chinese tourism and this was the main driver of higher prices within the property – rest of the world sector. Leasing funds moved higher as Doric Nimrod Air One’s plan to sell its only asset reached a conclusion and SLF Realisation’s discount narrowed, possibly in anticipation of a further a return of capital following one early in December.

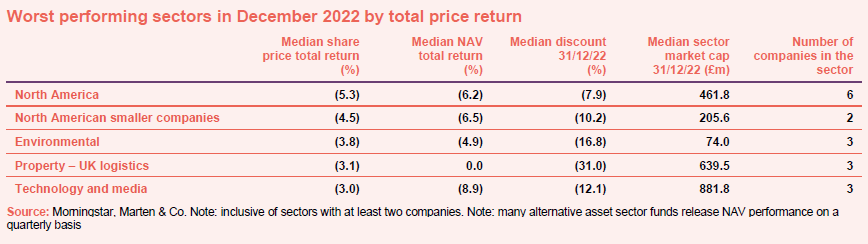

US stocks fell on fears of rising interest rates, hitting growth stocks in particular – Baillie Gifford US Growth was the worst-performing fund in the sector in price terms – and this also had an impact on the environmental, and technology and media sectors. Worries about the strength of demand and a possible recession were other factors weighing on markets. Investors appear to be factoring in further NAV weakness in the property – UK logistics sector.

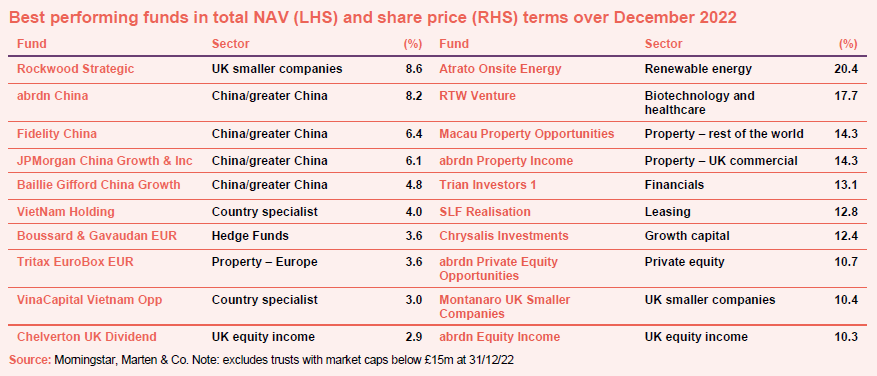

Rockwood Strategic is benefitting from bids for two of its holdings, accounting for almost a third of its portfolio in aggregate. The next four best-performing funds in NAV terms are all focused on China, which (as discussed above) has seen its stock market rise as the government lifts COVID restrictions. Two Vietnamese funds make the list as that market recovers some of the ground that it lost in the autumn. One of these – Vietnam Enterprise – is being interviewed on our weekly show on 13 January and the other was the subject of a recent note. The Euro strengthened relative to the pound over December which accounts for the presence of Boussard and Gavaudan and Tritax EuroBox in the table. UK value stocks had a good month; Chelverton UK Dividend’s NAV rose as a result, with the move amplified by the gearing provided by its zero dividend preference shares.

In price terms, the surprise winner was Atrato Onsite Energy. Its interim results (published at the end of November) reflected the slow deployment of its IPO proceeds. However, investors seem to have embraced the positive message that new investments will be made on more attractive terms, as yields have risen since the fund listed. RTW Venture had some good news as Prometheus Biosciences, its third-largest holding, announced encouraging clinical trial data. Macau Property Opportunities, Train Investors 1 and SLF Realisation were all discussed above. abrdn Property Income refinanced its debt (we also published a note on the trust just before Christmas). Chrysalis Investments continues to re-rate following its well-received capital markets day, in which it introduced analysts and investors to a number of its portfolio companies. We wrote an article for Investment Trust Insider on the back of it. We have also been highlighting the very wide discounts that many private equity trusts are trading on. abrdn Private Equity Opportunities still looks oversold to us despite December’s price move.

Worst-performing

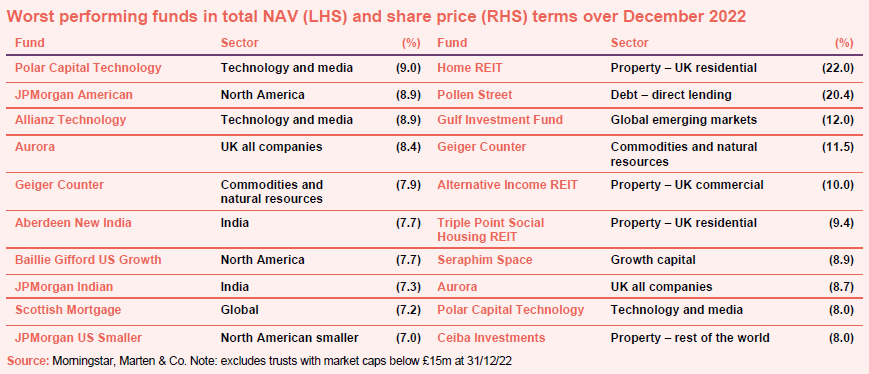

Funds with significant US technology exposure dominate the list of worst-performing funds in NAV terms. Funds with holdings in stocks such as Tesla (off 37%), Apple (off 12%), and Amazon (off 13%) were hit. This includes JPMorgan American, Baillie Gifford US Growth and Scottish Mortgage as well as the two large cap technology funds – Polar Capital Technology and Allianz Technology.

Aurora has a large position in Frasers Group (the former Sports Direct) and its shares fell after the publication of its interim results on falling margins and a poor outlook for the UK consumer. The Uranium price remains volatile, affecting Geiger Counter. Large cap Indian funds were hit by profit-taking, allowing India Capital Growth to extend its lead over Aberdeen New India and JPMorgan Indian.

In price terms, the big casualty for the second month running was Home REIT, which now trades on about a 67% discount. After last month’s short-seller attack, an activist investor called for the board to step down, then a law firm launched a litigation claim on behalf of shareholders. Since the year end, the trust’s shares have been suspended as additional audit work is delaying the publication of its results. We had figured that Pollen Street would leave the sector after Honeycomb merged with its management company, but as yet, this has not happened. A trading update published at the end of November tried to sound an upbeat note, but we think investors are concerned about the possibility of higher defaults, and the dividend cut that accompanied the merger removes some of the stock’s attractions.

Gulf Investment Fund’s shares moved to trade on a discount in December, as the region has given back some of its earlier strong performance, perhaps triggered by a weaker oil price. However, since the middle of December, the share price and the NAV have been moving in different directions and we would reiterate the message of our last note – the region is much more than just about oil and gas. Alternative Income REIT’s discount widened over the month and is now about average for the sector. Triple Point Social Housing REIT has exposure to a registered provider of social housing – My Space – which is in rent arears and has been criticised by the Regulator.

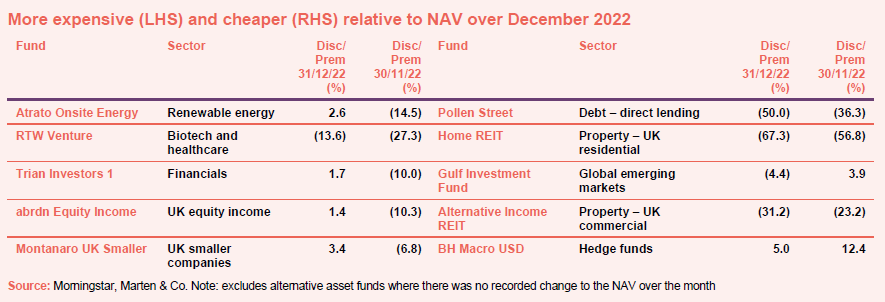

Moves in discounts and premiums

Atrato Onsite Energy was discussed above as was Trian Investors 1. RTW Venture is yet to announce its end December NAV and so its discount does not reflect the 167% jump in Prometheus Biosciences’ share price over December.

The elimination of the discounts on abrdn Equity Income and Montanaro UK Smaller Companies over the course of December likely reflects steady buying by retail investor fans of these trusts.

The reasons behind the widening discounts in the table have largely been discussed already. BH Macro’s shift to a more modest premium looked sensible to us. However, the premium has re-expanded since the end of the year. Its NAV has been fairly flat since the end of August, some of investors’ enthusiasm for the trust may yet wane.

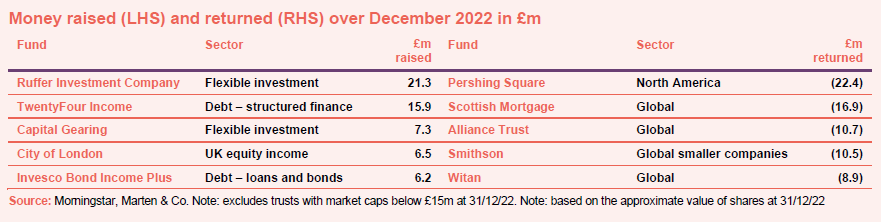

Money raised and returned

This month we said goodbye to JPMorgan Elect as that trust was absorbed by JPMorgan Global Growth and Income.

Issuance and shrinkage in the above table largely reflect tap issues (dripping stock into the market to match ongoing demand) and share buy backs. The names are the usual suspects with the exception of Invesco Bond Income Plus. We have been suggesting that investors’ interest in debt/bond funds may grow as the yields that they generate rise. We talked to Rhys Davies, manager of the trust, in our weekly show at the beginning of December.

Major news stories and QuotedData views over November 2022

Upcoming events

Here is a selection of what is coming up. Please refer to the Events section of our website for updates between now and when they are scheduled:

Interviews

Have you been listening to our weekly news round-up shows? Every Friday at 11 am, we run through the more interesting bits of the week’s news and we usually have a special guest or two answering questions about a particular investment company.

| Friday | The news show | Special Guest | Topic |

| 30 September | BSIF, discount rates | Masaki Taketsume | Schroder Japan Growth |

| 7 October | VNH, SONG | Simon Farnsworth | Life Science REIT |

| 14 October | TMI, HEIT | Jonathan Maxwell | SDCL Energy Efficiency |

| 21 October | HICL, DORE | Ross Driver | Foresight Solar Fund |

| 28 October | JPE, JRS | Joe Bauernfreund | AVI Japan Opportunity |

| 4 November | ROOF, CYN, PEY | Jason Baggaley | abrdn Property Income |

| 11 November | MAJE, TLEI, CRS | James de Uphaugh | Edinburgh Investment Trust |

| 18 November | Long Term Assets, Renewables | Jeff O’Dwyer | Schroder European Real Estate |

| 25 November | Renewables, DGI9, NBMI, HOME | Bruce Stout | Murray International |

| 2 December | CHRY, SYNC | Rhys Davies | Invesco Bond Income Plus |

| 9 December | VSL, RTW, SYNC | Stuart Widdowson | Odyssean |

| 16 December | HOME, API, FSF | Richard Aston | CC Japan Income and Growth |

| Coming up | |||

| 6 January | Andrew McHattie | Review of 2022 | |

| 13 January | Thao Ngo | Vietnam Enterprise | |

| 20 January | Stephanie Sirota | RTW Venture Fund | |

| 27 January | Eileen Fargis | Ecofin US Renewables | |

Guide

Our independent guide to quoted investment companies is an invaluable tool for anyone who wants to brush up on their knowledge of the investment companies’ sector. Please register on www.quoteddata.com if you would like it emailed to you directly.

Research

Weakened risk appetite among investors as macroeconomic headwinds persist has seen the technology sector suffer. As investors retreated to the sector titans (stocks such as Microsoft and Apple), Polar Capital Technology’s (PCT’s) underweight position in these companies has seen it underperform its benchmark over the 12 months to the end of November, while its exposure to ‘next-generation’ software companies has also been a source of underperformance versus legacy stocks as IT budgets are disproportionately squeezed.

Pacific Horizon (PHI) has in 2022 found itself at a convergence of both negative sentiment towards Asia and growth stocks more generally (a function of lockdowns in China, a slowing global economy and rising interest rates). While this has dented its performance in the short term and pushed it down its peer group rankings, the manager remains confident in the portfolio, highlighting that many of its companies are cheap (Asia Pacific ex Japan equities are trading at close to their five-year lows on a price-earnings (P/E) basis, and look cheap versus global equities more generally), are cash generative and retain their strong growth prospects.

It has been a busy few months for NextEnergy Solar Fund (NESF) and the listed renewable energy sector. The share price may have come under pressure from the threat of windfall taxes – see page 6 – and rising discount rates (used to discount NESF’s future cash flows into a present-day valuation for its net asset values – NAVs), but the picture on these points is clearer, and – as the latest results show – NESF’s NAV is still making positive progress.

Despite having coped well with COVID and offering very strong growth prospects over the next five years (see page 6), the Vietnamese stock market has been weighed down by severe negative sentiment towards Asia in recent months. This is likely a function of lockdowns in China, slowing global economic growth and rising interest rates in the West.

Share price discounts to net asset values (NAVs) amongst commercial real estate companies has widened dramatically since the end of September after the disastrous ‘mini’-budget spooked gilt markets and sent bond yields above property yields (implying that property yields will rise, and values fall). Things have since calmed down to some degree and even though the repricing of real estate has further to play out, the near 50% discount to NAV that abrdn Property Income Trust’s (API – formerly Standard Life Investments Property Income Trust) shares trade on seems excessiv.

Pan-African property company Grit Real Estate Income Group (Grit) is on track to complete the acquisition of a controlling stake in developer Gateway Real Estate Africa (GREA) by May next year, which would unlock considerable potential for net asset value (NAV) and income growth for the fund.

Whilst 2022 has been a harrowing year for many trusts, Henderson High Income Trust (HHI) has generated a positive 12-month NAV return and still offers an attractive dividend yield, one of the highest amongst its peers.

Its investment manager David Smith remains quietly confident about the medium-term prospects for the UK, believing that the country will experience a mild recession, and has begun to rotate HHI’s portfolio into economically cyclical companies, where valuations are particularly attractive.

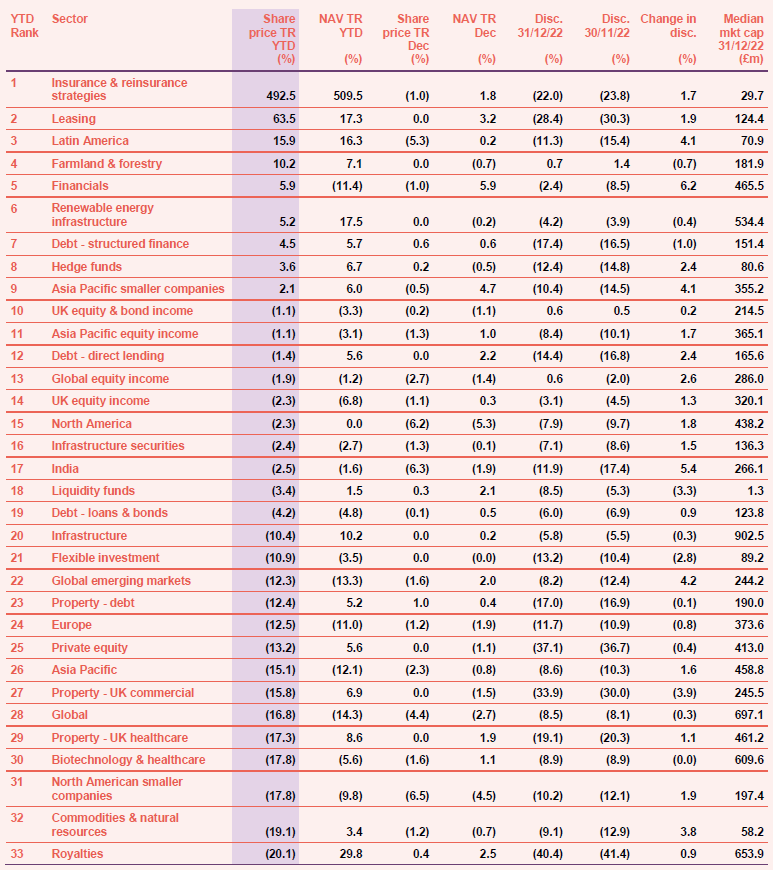

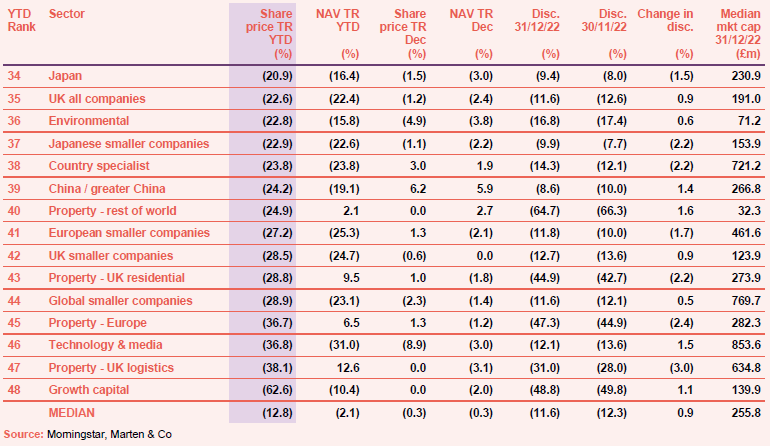

Appendix 1 – median performance by sector, ranked by 2022 year to date price total return

The Legal Bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

The analysts who prepared this note may have an interest in any of the securities mentioned within it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.