NextEnergy Solar Fund

Investment companies | Update | 13 December 2022

Earnings visibility underpins dividend target

It has been a busy few months for NextEnergy Solar Fund (NESF) and the listed renewable energy sector. NESF’s share price may have come under pressure from the threat of rising discount rates (as interest rates rise, its NAV falls) and windfall taxes, but the picture on both fronts is clearer, and – as the latest results show – NESF’s NAV is still making positive progress.

The board says that strong earnings cover and NESF’s forward sales of power give it confidence to maintain its policy of at least matching dividend hikes with inflation. If shareholders approve, a push into energy storage offers another potential route to earnings growth.

Income from solar-focused portfolio

NESF aims to provide its shareholders with attractive risk-adjusted returns, principally in the form of regular dividends, by investing in a diversified portfolio of primarily UK-based solar energy infrastructure assets.

NAV continues to climb

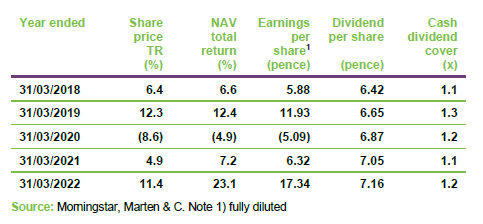

NESF’s NAV rose by 8.3% or 9.4p per share over the six months ended 30 September 2022. Its first two interim dividends for the current financial year totalled 3.76p, up from 3.58p from the year before, putting NESF on track to meet its target of 7.52p for the year. The interim dividend cover was 1.8x and the board reckons that the full-year dividend may be on the upper limit of a range of 1.3x–1.5x. The company is sticking by its ambition of growing dividends at least in line with inflation though maintains a progressive dividend policy. The main factors affecting NESF’s NAV progression are power prices, inflation, discount rates, the performance of the portfolio, and taxation.

Power prices

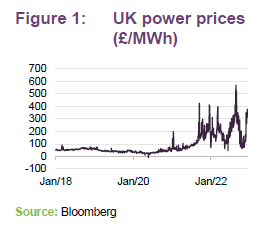

Our last note was published ahead of Russia’s invasion of Ukraine. As gas supplies to Europe were cut, gas prices soared and so did UK power prices. Warm weather and full gas storage facilities in Europe appeared to help gas prices ease recently, although the cold snap seems to have reversed this. Nevertheless, forecast power prices are a long way above where they were a year ago.

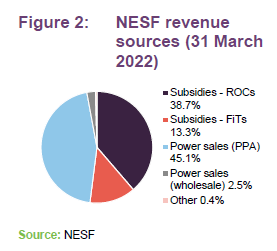

In addition to the comfort of having around 50% of revenue come from government subsidies, NESF aims to mitigate the effect of volatile power prices through hedging forward prices. As at 10 November 2022, 93% of its budgeted UK generation for the current financial year had been sold forward at an average price of £86/MWh. For FY24 the figures were 74% of generation at £73/MWh, FY25 44% at £90/MWh and FY26 13% at £147/MWh. This policy greatly increases the board’s visibility of NESF’s forecast revenues, supports the dividend policy and feeds directly into the NAV calculation.

For budgeted power generation that has not been sold forward, the NAV is based on a blend of power price projections from independent consultants. Unsurprisingly, these have risen sharply – from £105.2/MWh for 2022-26 to £139.1/MWh, and from £44.3/MWh for 2027-41 to £45.6/MWh (all in real terms).

The board has the final say on the assumptions used in the NAV calculation. The timing of the interims meant that it was not possible to include the effect of the windfall tax in the end-September NAV. The board opted to apply a steep discount to the power price forecasts supplied by the independent consultants, taking 50% off the forecast for Q1 2023, 35% off forecasts for FY24, 25% off summer 2024, 20% off winter 2024, and 10% off FY26.

Without the board’s power price discount, the uplift in the independent consultants’ forecasts would have increased the NAV by 19.5p between 31 March 2022 and 30 September 2022. However, the power price discount reduced that by 7.5p. This ended up being quite close to the actual impact of the proposed windfall tax.

Based on the portfolio at the end of September, NESF estimates that a further 10% uplift in power prices would increase the NAV by 6.4% or 9.1p per share, whereas a 10% reduction would translate into a 6.6%/9.4p decrease in NAV.

Inflation

As Figure 2 shows, just over half of NESF’s income (based on the portfolio as at the end of March 2022) comes from subsidies in the form of ROCs (including NIROCs) and FiTs (some of which relate to NESF’s Italian assets). The vast majority of this subsidy income is derived from the UK, and this is indexed in line with UK RPI, which was running at 14.2% at the end of October 2022.

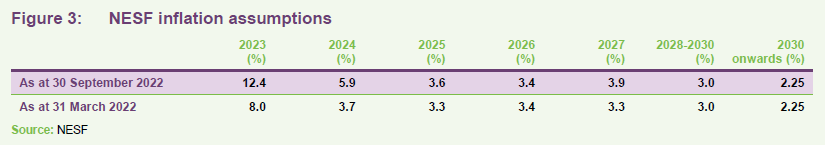

The company’s inflation forecasts for the UK are based on data from HM Treasury and the Bank of England, and for international assets it uses IMF forecasts.

Changes in inflation forecasts added 7.5p per share to the NAV over the six months ended 30 September 2022.

Based on the portfolio at the end of September, NESF estimates that a further 3% uplift in inflation rates would increase the NAV by 23.8% or 33.6p per share, whereas a 3% reduction would translate into a 16.9%/23.9p decrease in NAV.

Discount rates

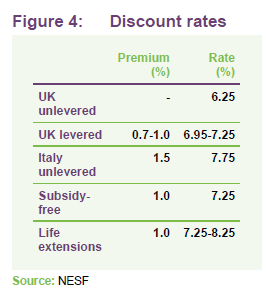

As central banks hike interest rates to tackle the inflation problem, that seems likely to put upward pressure on the discount rates used to value NESF’s future cash flows when calculating its NAV. There is no linear relationship between interest rates and discount rates, rather discount rates are informed by the valuations observed in the secondary market for renewable assets. At 30 September 2022, the board chose to increase discount rates by 50bp across the board. This took the weighted average discount rate to 6.8%.

Based on the portfolio at the end of September, NESF estimates that a further 0.5% uplift in discount rates would reduce the NAV by 2.4% or 3.4p per share, whereas a 0.5% reduction would translate into a 2.6%/3.6p increase in NAV.

Portfolio performance

Average outperformance of generation budget of 4.8% since IPO.

The portfolio generated 639GWh of energy over that six-month period, helped by +6.1% outperformance of budgeted generation. This follows a pattern of consistent outperformance that amounts to an average outperformance of budget of 4.8% since NESF’s IPO.

Part of the reason for that track record may be the depth of resource and expertise within the NextEnergy Group. In addition to the adviser NextEnergy Capital, which manages or advises on over $3bn/1.3GW in solar assets, the group encompasses the asset management business Wise Energy (1,350 solar assets/1.8GW under management), and the development arm Starlight which has developed over 100 utility-scale projects.

The scale of NextEnergy Group’s business gives it significant purchasing power, and greater influence over its supply chain than some of its peers. This includes managing the ESG aspects of this (the adviser’s head of ESG, Giulia Guidi, chairs the SEUK task group on Responsible Sourcing). It is able to stockpile high-use components, enabling faster response times for fixing equipment failure.

Windfall taxes

The UK’s new windfall tax, technically an electricity generator levy, was announced on 17 November 2022. The levy applies from 1 January 2023 and runs until

31 March 2028. Non-fossil fuel generators, such as NESF, are required to pay a tax of 45% of their excess revenue from sales of power above a level of £75/MWh. The tax does not apply to generators producing less than 100GWh per year and also does not apply to the first £10m of excess revenue.

The levy is not applied to NESF’s subsidy income, and assets that have sold power on a CfD basis through the UK’s current support scheme for renewable generation projects (see below). It does not impact revenues from energy storage assets, which are intended to form an increasingly important proportion of NESF’s revenues.

Not much more downside to NAV from windfall tax.

The board believes that the impact of the levy on NESF’s NAV is broadly equivalent to the power price discount that it has already applied – in other words there should not be much more downside. The actual figure will be known once the legislation has been finalised and may be incorporated within the end-December NAV.

Portfolio developments

Energy storage

NESF has made a significant additional commitment to expanding its energy storage exposure, whose revenue stack offers multiple streams. The advisers are enthused about the prospects for this part of NESF’s portfolio and are consulting leading shareholders about attitudes to increasing the current 10% of GAV limit on energy storage exposure within NESF’s portfolio.

New £200m joint venture energy storage partnership with Eelpower.

Since we last published, NESF has entered into a new £200m joint venture partnership with Eelpower Limited, supplementing the pre-existing £100m jv. Under the second jv, NESF’s share is 75% with Eelpower holding the remaining 25%. In both cases, Eelpower will provide EPC and ongoing specialist asset management services.

In addition, at the end of October NESF announced that it had bought the development rights, permits, and initial grid milestones for a 250MW portfolio of battery storage projects and grid connections in the east of England for £32.5m. The project is a two-hour (500MWh) duration system and is expected to be energised in 2025, targeting an asset life of at least 50 years.

NESF’s first 50MW battery storage project (under the first jv) is currently under construction in Fife, Scotland, and is expected to be energised and grid-connected in the first half of 2023. At the outset, this will be a one-hour duration system but is being prepped for a shift to a two-hour system.

First co-located battery project has planning permission.

Finally, the advisers are evaluating the potential for co-located energy storage at each of NESF’s 99 operating solar sites. For the most part, this means securing an import connection to the grid; securing grid connections is the biggest constraint to the rollout of energy storage across the UK. The most advanced of these, a 6MW/12MWh project co-located with NESF’s 11MW North Norfolk solar farm, has secured planning.

The near-term programme is likely to be focused on short-duration (up-to-two-hour) lithium-ion battery storage facilities. However, the advisers are looking closely at the rapid technological advances being made within the longer-duration energy storage sector in areas such as flywheel, gravity-driven, compressed air and hydrogen storage.

New subsidised solar

Two NESF plants won support through government’s CfD scheme.

On 3 August 2022, NESF announced that it had secured subsides, in the form of CfDs, for 100% of the generating capacity of Whitecross (36MW) and Hatherden (50MW), the company’s latest new-build UK solar projects. The CfDs last for 15 years, are index-linked to inflation (CPI) annually, and are scheduled to commence from 31 March 2025 at the AR4 solar PV strike price of £45.99/MWh (set in 2012 equivalent prices).

Whitecross solar farm is currently under construction in Lincolnshire and is expected to be energised in the first quarter of 2023. The original construction date of the asset was pushed back from the second half of 2021 “due to material volatility in the solar PV module supply chain post covid which has since stabilised”. It was intended to form part of NESF’s portfolio of subsidy-free projects, comprised of Staughton (50MW), High Garret (8.4MW), and Hall Farm 2 (5.4MW). The Whitecross project is going to benefit from the latest available solar technology from Jinko Solar called “N-type solar cells”, a bi-facial solar technology which offers superior power density and efficiency with a recently-set world record for solar cell efficiency. NESF will receive long-term benefits from this technology as it decreases the land footprint necessary for Whitecross’s installed capacity, optimising land use and performance of the solar plant.

Grid connection and construction mobilisation works are underway for Hatherden solar farm in Hampshire, which is expected to be energised in the first half of 2023.

NextPower III

Of the $50m committed to NextPower III, $33.5m had been drawn down by the end of September 2022. The first investment – the Agenor 50MW solar plant in Cadiz – is now expected to be energised in 2023. A second project – a 13.6% stake in a 210MW solar asset in Santarém Portugal, acquired for €22.5m – is now underway. Once energised, the plan is to sell power under a long-term PPA.

Balance sheet

At 30 September 2022, NESF’s gross asset value was £1,258m, comprised of equity of £725m (589,698,643 shares with an NAV per share of 122.9p), £200m nominal of preference shares with a fixed preferred dividend of 4.75%, and financial debt totalling £336m, with a weighted average cost of debt of 3.1%.

£55m of headroom under existing facilities.

NESF had £11.7m of cash reserves at the end of September, £2.4m of which was used to fund the latest quarterly dividend. It also has £54.8m of headroom under its existing facilities. This equates to net dry powder of £64.1m that is available to fund new investments.

Other industry Developments

Review of Electricity Market Arrangements (REMA)

Launched ahead of the windfall tax, REMA is intended to provide an appropriate framework for all non-retail electricity markets to deliver security of supply, cost effectiveness, and decarbonisation. Within this, there is a clear desire to move away from a system whereby the national power price is set by the marginal producers – which in the UK tends to be gas-powered plants – to one which sees consumer prices for power produced by renewable generators better reflect the cost of producing that power.

That could also include a shift towards regional/local power prices and a more decentralised power grid, with increased energy storage. Energy-intensive industry could be encouraged to relocate closer to sources of renewable power, for example. The advisers also highlight the additional strain on the grid as areas such as transportation and domestic heating shift to electric power.

We should expect to hear more about the outcome of the consultation, which closed on 10 October 2022, early next year.

Solar versus agriculture

Could we see another U-turn on restricting use of agricultural land for solar?

In her brief spell as Prime Minister, Liz Truss used her speech at the Conservative Party conference to promise to outlaw the development of new solar plants in the UK on agricultural land classified as 3b. Thérèse Coffey, secretary of state for Environment, Food and Rural Affairs, confirmed on 17 November that Defra is continuing with these plans. However, it is possible that we may see another U-turn. The advisers note that solar accounts for less than 0.1% of available land today, and even at 50GW (the target for 2050) this would still be about 0.3% – less than the amount of land used for golf courses and airfields. In fact, more land is used to grow Christmas trees.

Solar is not incompatible with agriculture – many of NESF’s sites (47% of the total) are grazed by sheep, for example. It also has a policy of creating biodiversity ‘hubs’ at its sites, acting as havens for protected species, allowing farmers to meet their biodiversity targets. Agrivoltaics – growing crops under or around panels – is not yet a feature of the UK market, but could be in time.

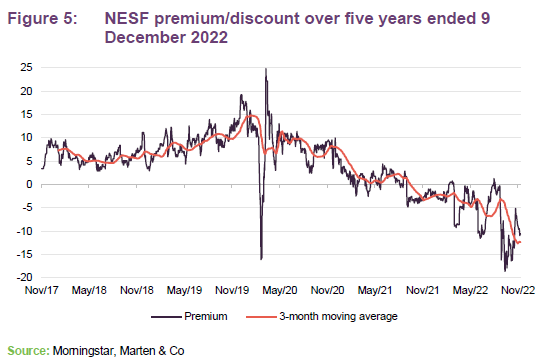

Premium/discount

Over the 12 months ended 30 November 2022, NESF’s shares traded within a range of a 18.6% discount to a 1.3% premium and averaged a 5.4% discount. On

9 December 2022, the shares were trading at a discount of 10.7%.

Rising discount rates and uncertainty around windfall taxes appear to have hit the ratings of almost all funds in the listed renewable energy sector (the principal exception being the three energy storage funds, an area that NESF hopes to grow its exposure to). NESF’s latest NAV announcement could have allayed some fears on both these fronts.

More information is available at the trust’s website www.nextenergysolarfund.com

Board

We note that, as part of its succession planning, Helen Mahy CBE is joining the board in April 2023 and will succeed Kevin Lyon as chairman next August. Helen recently retired as chairman of The Renewables Infrastructure Group and she currently sits as a non-executive director of SSE Plc and Gowling WLG (UK) LLP, whilst also serving as a Commissioner for The Equality and Human Rights Commission. Helen has previously served as group general counsel and company secretary of the National Grid Plc.

Previous Publications

Readers may wish to refer to our initiation note – Climbing inflation and power prices driving NAV uplift – which can be accessed through the QuotedData website or by clicking the link above.

Legal

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on NextEnergy Solar Fund Limited.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.