NextEnergy Solar Fund

Investment companies | Update | 7 March 2024

High- and growing-income opportunity?

NextEnergy Solar Fund (NESF) is almost 10 years old. Since launch, it has built a £1.2bn, 933MW portfolio of 100 operating solar assets, powering the equivalent of over 330,000 homes, declared dividends totalling £333m, and avoided the emission of about 2.2 Mt CO2e.

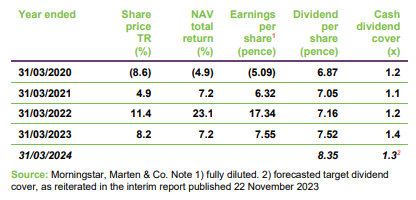

NESF is on track to pay 8.35p in dividends, with forecast dividend cover of about 1.3x. Share price weakness that has afflicted the whole sector means that dividend translates to a yield of 11.1%, one of the highest in its sector, and the near 30% discount provides the prospect of capital appreciation if sentiment towards the sector recovers.

Interest rates may have peaked, which seems to be improving sentiment, but there could be further to go. NESF has a nine-year track record of growing covered dividends in line with inflation. NESF also has one of the largest capital recycling programmes of its peer group, to free up cash to reduce debt, and fund buybacks and existing and potential construction projects. Those projects are, on the manager’s projections, both NAV- and earnings-enhancing.

Income from solar-focused portfolio

NESF aims to provide its shareholders with attractive risk-adjusted returns, principally in the form of regular dividends, by investing in a diversified portfolio of primarily UK-based solar energy infrastructure and complementary energy storage assets.

10th birthday imminent

NESF is just a few weeks off the 10th anniversary of its launch. From the start, NESF was helped by its ability to secure access to a portfolio of projects being developed by NextEnergy Capital’s development arm (now called Starlight) and engaging NextEnergy Capital’s experienced operational asset manager, WiseEnergy, with the aim of keeping the portfolio operating smoothly. The capital that it raised was deployed swiftly and was soon generating income to cover the dividend.

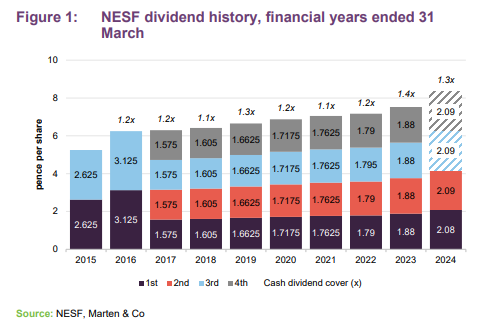

This year’s dividend target is 11% ahead of last year

NESF’s board maintains a progressive annual dividend policy, and in line with that the trust has grown its dividend each year since launch. Since its 2016 financial year, NESF’s dividends have always been covered by cash generated from its portfolio. NESF is targeting an 8.35p dividend for its financial year ended 31 March 2024 (FY24) that is 1.3x covered by cash flow. The target was an 11% increase on the total dividend for FY23.

With the share price where it is, that 8.35p translates to a yield of 11.1%.

Keeping the cash flowing

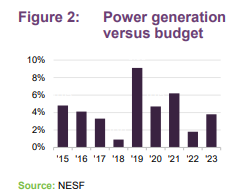

Since launch, NESF has built a track record of generating more power than budgeted. In part, that likely reflects a pattern of sunnier weather in the UK. However, WiseEnergy’s work to keep plants up and running plays a part in this too. It is responsible for 1,500 solar and battery assets with an installed capacity in excess of 2.5GW, in nine countries.

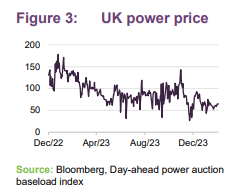

At 30 September 2023, around half of NESF’s revenues were coming from inflation-linked, government-backed subsidies, and these had a weighted average life of 11.4 years. In addition, as at 31 December 2023, NESF had pre-sold 98% of its FY24 generation at an average price of £79.2/MWh, 74% of FY25’s generation at £84/MWh, and 29% of FY26’s at £101.2/MWh.

Power prices have been volatile but remain well above pre-COVID averages. NESF’s power price forecasts (which combine prices for the pre-sold power with forecasts from three independent energy market consultants) were adjusted at end December to reflect a decrease in short-term (2023-2027) UK power price forecasts provided by the consultants, mainly as a result of lower gas price futures, influenced by above-average gas storage levels and milder weather across winter 23/24.

Adding value with new investments

c.£500m pipeline of new solar projects and battery storage projects

At end December 2023, NESF had identified a pipeline of new solar projects and battery storage projects totalling about £500m. Assets under construction tend to be written up in value once they are de-risked by becoming operational. In addition, the extra revenue that they generate contributes to NESF’s cash flows. Starlight, the development arm of the wider NextEnergy group and an important source of potential investments for NESF, has 8.3GW of projects under development across five markets, underpinning NESF’s long-term investment pipeline.

The December 2022 note remarked that NESF was partnering with battery storage specialist Eelpower to build on the perceived opportunity in that area. At that time, NESF’s first standalone battery project was under construction and the advisers were looking at the potential for co-locating batteries at NESF’s then 99 operating solar sites. There has been some progress since then.

Portfolio

100th operational solar asset

NESF energised its 100th operating solar asset in the summer of 2023. Whitecross is a 36MW solar fam in Lincolnshire. It is contracted to sell power through a CfD in the government’s fourth auction round that concluded in 2022. Whitecross is one of the five subsidy-free assets that NESF decided to put up for sale in its capital recycling programme – see below.

Camilla battery project nearing completion

On the energy storage front, NESF is on track to energise its first (and – the manager notes – outside of the battery storage specialists, the peer group’s first) standalone battery project, Camilla, a 50MW project in Fife, Scotland shortly. Camilla is expected to offer high single-digit returns. It will benefit from some grid-related revenues, including £202k of contracted revenue for the period 1 October 2024 through to the end of September 2025, secured through the National Grid ESO’s latest T-1 capacity auction. However, the bulk of its earnings are expected to come from arbitraging fluctuations in power prices. NESF also has a 6MW storage project under construction that is co-located with its North Norfolk solar farm.

In addition, planning applications are underway for a number of other co-location projects, and NESF has a 250MW pre-construction battery-storage project in the East of England (near the Walpole substation that handles inbound power from three offshore wind farms) that NESF bought in October 2022. The project will be developed in a joint venture with Eelpower, with a target energisation date in 2025.

NESF’s £50m stake in the NextPower III ESG fund (NPIII) gives it exposure to a 1.9GW globally diversified portfolio of 173 solar assets. That fund committed the last of its capital in Q4 last year, including deals to add a 140MW portfolio in Italy and a 55MW portfolio in Spain. NESF has two co-investments that it has made alongside NPIII that are due to come online in H1 (these were on a no fee, no carry basis alongside other institutional investors); Agenor (50MW in Spain – NESF owns 24.5%) & Santerem (210MW in Portugal – NESF owns c.13%).

Capital recycling programme

Our last note, published in July 2023, focused on NESF’s plan to recycle capital from its portfolio of subsidy-free solar assets, with the proceeds of disposals used to reduce borrowings and fund a potential share buyback.

Hatherden disposal is a first step in capital recycling programme

As a first step towards this, the company has sold its ready-to-build Hatherden solar farm project for £15.2m (twice what NESF was valuing it at). The disposal added 1.27p to the NAV. The proceeds were used to reduce the outstanding balance on NESF’s revolving credit facility, which was £177m before the disposal. The uplift reflects the work that the adviser’s team had been doing to enhance the project, including upscaling it from 50MW to 60MW, securing permission for a 7MW co-located energy storage project, and securing a CfD for power produced along the same lines as for Whitecross. The managers say that it would be wrong to expect similar uplifts for the other four assets, all of which are operational.

The capital recycling programme is ongoing. The managers say there is interest from multiple parties and expect that the programme will be completed in two further phases (each comprising two assets).

Gearing

Paying down floating rate debt

As at end December 2023, NESF had £163.8m of long-term debt at fixed rates.

The RCFs provided by Banco Santander (£70m) and NatWest (£135m) mature in June 2024. The interest rate on these is at 1.60% and 1.20% over SONIA respectively. The board says it expects the RCF to be refinanced on terms similar to the existing facilities.

The weighted average interest rate on NESF’s debt was 3.9% at end December 2023. In addition, NESF has £200m of long-term preference share finance at a fixed cost of 4.75%. This is an attractive source of finance in the current environment, when costs of capital have risen considerably, and the managers believe that they are a great form of non-amortising debt.

Following the Hatherden disposal, there was a £41.2m undrawn balance on the Banco Santander facility at end December 2023.

Sustainability and biodiversity

As a reminder, NESF is an Article 9 fund under EU SFDR and Taxonomy. At end September 2023, its renewable generation had avoided the production of 2,181ktCO2e since IPO.

Shortly after we published our last note in July 2023, NESF published its latest sustainability and ESG report, which you can read here.

NESF is keen to highlight its commitment to biodiversity and has commissioned a new report on this, which should be published soon.

Performance

The end-December NAV fell to 107.7p from 114.3p on 31 March 2023. The main negative drivers of this were higher discount rates used to value the portfolio, and lower forecasted power prices. Offsetting this was an upward move in short-term inflation forecasts and a 1.3p uplift on the sale of Hatherden.

NAV fall driven by higher discount rate

On 17 August 2023, NESF said that it had increased the discount rate for unlevered operating UK solar assets by 0.75% to 7.50%. This reflected the higher-interest-rate environment. The weighted average discount rate on the portfolio is now 8.0%. The rate of UK inflation peaked in October 2022 and, barring a small wobble in December 2023, has been declining steadily since, although it remains above target.

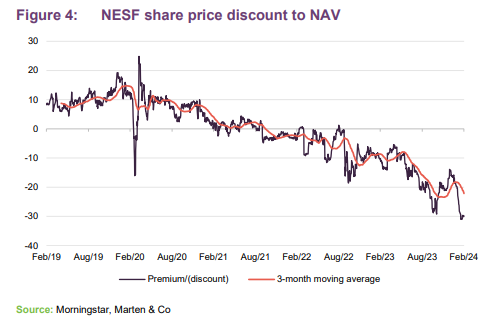

Share price discount

Discount has been narrowing

NESF’s discount hit a low point at end October 23 and narrowed steadily until the December 2023 inflation figure was announced. However, over February, the discount has widened again.

Another factor at play may be the cost disclosure issues that have affected the investment companies sector and may have led to selling by professional investors – you can read more about this on our website.

Board

Kevin Lyon stepped down as chair of the company and as a director on 20 July 2023, and was succeeded by Helen Mahy. On 3 October 2023, NESF said that Paul Le Page would join its board as a non-executive director. He succeeded Vic Holmes as the company’s senior independent director on 1 January 2024 when Vic retired from the board.

Paul is a non-executive director of RTW Biotech Opportunities Fund Limited, TwentyFour Income Fund Limited, and Highbridge Tactical Credit Fund Limited. He stepped down as director and chair of the Audit and Risk Committee of Bluefield Solar Income Fund Limited at the end of September 2023.

On 12 December 2023, NESF announced that a new non-executive director, Caroline Chan, had been recruited. She will take up the role with effect from 1 April 2024. Caroline was a corporate lawyer for over 30 years, working across London, Hong Kong, and Guernsey, where she specialised in investment funds, mergers and acquisitions, financing, and financial services regulatory work. She served previously as a non-executive director of Round Hill Music Royalty Fund Limited and currently serves as a non-executive director of BH Macro Limited.

Previous publications

Readers may wish to refer to our previous notes.

Figure 5: QuotedData’s previously published notes on NESF

| Title | Note type | Date |

| Climbing inflation and power prices driving NAV uplift | Initiation | 9 February 2022 |

| Earnings visibility underpins divided target | Update | 13 December 2022 |

| Recycling champion | Update | 12 July 2023 |

Source: Marten & Co

IMPORTANT INFORMATION

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on NextEnergy Solar Fund Limited.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.