About OCI

OCI gives its shareholders access to private equity investments made by Oakley Capital (Oakley). Oakley is a private equity investor with a focus on European mid-market investments (€100m – €1bn plus enterprise value). It invests in high-growth private companies and has built up an impressive track record, with NAV and share price returns of about 111% over the five years ended 28 February 2025.

Much of this can be attributed to the EBITDA (earnings before interest, tax, depreciation, and amortisation) growth that Oakley helps to drive within the portfolio. Over the course of 2024 this averaged 15%, up from 14% in 2023.

Four key sectors – technology, digital consumer, education, and business services

Oakley takes controlling stakes in companies that are operating in one of four key sectors – technology, digital consumer, education, and business services. These companies should be benefiting from ‘mega-trends’ that will help drive revenue growth such as growing global demand for quality education; business shift to the cloud; digital consumer shift to digital search and online spending; increased regulation; and outsourcing.

Partnering with business founders

Where it can, Oakley seeks to partner with business founders, backing proven leaders and running businesses with a high potential for value creation, through structures that ensure alignment with Oakley’s goals (72% of all Oakley’s deals have been founder-led). Often, founders will introduce Oakley to new opportunities, and they are also often prepared to entrust their own money to Oakley funds, having contributed more than €300m to Oakley funds to date.

First through the door

Building a rapport with these business founders is key. Oakley is often the first outside institution to provide capital to these businesses. It is bringing expertise to help them professionalise and providing the capital that they need to grow.

Uncontested deals

74% of the deals that Oakley does are uncontested. The entry multiple (valuation paid relative to earnings or revenue) is not inflated by a competitive process, but rather reflects the trust that the founder is placing in Oakley, and the fact that they are prioritising culture over price.

Leveraging new technology

Typically, Oakley will take a controlling stake, which gives it greater ability to apply its proven value creation strategies to deliver positive outcomes. These include M&A: to date, Oakley has helped its portfolio companies to complete over 250 bolt-on acquisitions (smaller complementary acquisitions), enabling them to add scale, expand into new verticals (new product or service categories beyond their existing offerings) and new regions; talent acquisition, where Oakley will help founders to recruit and retain the best management to support their growth plans; and business transformation, for example helping a company shift its business model to recurring revenues, bringing greater cash flow visibility and often a higher valuation.

Oakley’s Portfolio Team of in-house experts helps founders and their management teams to execute these value creation drivers, as well as support other priorities. For example, the Capital Markets team can help portfolio companies to diversify their sources of funding or hedge against interest rate risk, while Oakley’s head of data & analytics helps management teams to identify, plan, and implement data and artificial intelligence (AI) initiatives.

Cross-fertilisation of ideas in areas such as AI

Oakley’s Touring Fund, backed by OCI, is investing behind the next generation of software powered by AI, providing early-stage growth capital to revenue-generating businesses, typically at Series B and C funding rounds (stages in venture capital investing when companies have proven product-market fit and are scaling up operations). Insights gained through these investments are shared across the portfolio.

Modest NAV growth of 2% in 2024 (or 6% before the impact of foreign exchange movements) reflects conservative valuations and a younger portfolio: Oakley has invested the equivalent of 40% of the year-end NAV over the last two years, most of this into new businesses, as the macro-economic uncertainty created favourable conditions for doing deals and deploying capital. These additions to the portfolio are already performing well and delivering EBITDA growth. As they mature, they will quickly become more significant contributors to OCI’s performance, as valuation uplift typically accelerates through the duration of an Oakley investment.

Technology portfolio

Figure 1: Split of the technology portion of OCI’s portfolio at 31 December 2024

Source: OCI

Record number of new investments in 2024, including five in technology

Of OCI’s £299m of investments in 2024, £214m was in eight new investments, a record number. This includes five new tech deals, underlining the importance of this sector to Oakley. At the end of December 2024, the technology sector made up 28% of OCI’s NAV. This consisted of 12 companies, spread across six Oakley funds. The sector has long been a staple for Oakley and the knowledge and experience that it has built up over many years underpins OCI’s current crop of technology investments. These cover a diverse range of subsectors, but a particular focus has been webhosting and cloud based SAAS solutions (software-as-a-service – cloud software provided via subscription), which look to deliver efficiency and productivity gains through digitisation. More recently, Oakley has identified significant opportunities in cybersecurity.

The structural drivers for these technologies are well understood, particularly in terms of the shift towards cloud technology and online consumption, however this does not mean the underlying growth trajectory is any less significant. The increasing reliance on these technologies has also strengthened the need for ancillary services, such as cybersecurity.

The opportunity in cybersecurity and adjacent technologies is considerable

As we discuss below, the opportunity in cybersecurity and adjacent technologies is considerable, driven by cloud adoption, AI, the internet of things (IoT), 5G, remote working, edge computing (data processing close to the source of data generation) and other dynamics, making it one of the fastest-moving industries in the technology space.

This rapidly changing technology backdrop has created a wellspring of innovation, leading to an extremely fragmented marketplace with best of breed start-ups able to take considerable market share from much larger competitors. These conditions create an exciting backdrop for Oakley which, as we will see, has been able to leverage its entrepreneurial foundations to identify and develop a select group of early market leaders. Next, we take a look at Oakley’s newest tech investments, before reviewing the rest of the technology portfolio.

I-TRACING (2.9%)

Cybersecurity firm I-Tracing (i-tracing.com) is one of Oakley’s more recent acquisitions, with Oakley Fund V completing the £36m purchase in November 2024. The investment highlights Oakley’s long-term perspective. Having identified the sector as an increasingly attractive opportunity, Oakley took time to identify a partner which aligned with its investment framework and entrepreneurial values. Its patient approach was rewarded when Oakley secured an exclusive deal to acquire a co-controlling stake in I-Tracing.

The ability to be selective has also been crucial from an operational perspective due to the fast-moving nature of the cybersecurity market, which has traditionally followed somewhat of a winner takes all approach.

In the UK alone, cyber-attacks have tripled in the last three years and are expected to grow in frequency and severity as criminals leverage AI to sharpen their lines of attack. This has dramatically increased the sophistication required by security systems.

These dynamics have worked in the favour of I-Tracing, which offers its blue-chip client base (large, well-established corporations with stable earnings) a one-stop-shop service including cyberdefence, managed detection & response services, identity & access management, cloud security, and data protection and audit. The ability to provide these wrap-around services (comprehensive solutions bundled together) has allowed I-Tracing to take considerable market share from competitors, enabling organic revenue growth of around 30% per annum. This has been boosted further by bolt-on acquisitions which have further entrenched its competitive advantage in mission-critical cybersecurity services.

Over the last three years, the company has more than doubled in size, and now employs around 700 cybersecurity experts across France, Canada, Hong Kong, Malaysia, China, Switzerland, and the UK.

The company has maintained its momentum into 2025, announcing a partnership with leading UK cybersecurity provider Bridewell, further growing its position as a dominant player in the western European market. Its impressive growth trajectory provides further evidence of I-Tracing’s competitive advantage, and there exists a clear runway for growth in this rapidly developing market.

Bridewell

On 21 February 2025, Oakley announced that I-TRACING would join forces with Bridewell (bridewell.com), a leading provider of cybersecurity services in the UK, with the ambition of creating an independent European champion in the sub-sector.

Bridewell was founded in Reading in 2013 and provides managed and professional cybersecurity security services across information technology and operational technology environments. Its services range from architecture and design, governance, risk, and compliance, to fully managed security operations centre, penetration testing (ethical hacking to find vulnerabilities) and data privacy. A significant point of differentiation is its focus on critical national infrastructure and other highly regulated and complex enterprise clients, over 200 of them. Bridewell has operations in the UK and the USA and employs over 300 employees globally.

Bridewell’s founder and CEO Anthony Young is staying on in the combined business.

Assured Data Protection (2.2%)

Having identified the growing opportunity in cybersecurity, Oakley has doubled down with Fund V acquiring UK based Assured Data Protection (assured-dp.com) for £26m in October 2024. Although not at the coal face of direct security, the managed services provider offers highly sought-after backup, disaster recovery and cyber resilience services.

These technologies improve business resilience by providing data protection continuity, with near-zero server recovery time in the event of a significant IT failure or cyber-attack. The specialist nature of this software has allowed the company to disrupt traditional ransomware defences, enabling it to take market share globally from more established players. As companies’ data architecture becomes more complex and the prevalence and severity of cyber threats grow, this highly lucrative market is expected to expand rapidly, at almost 5x over the next five years.

Unsurprisingly given the growth of the sector, Assured Data Protection is one of the fastest growing companies in the Oakley Capital portfolio on an organic LTM (Last twelve months) EBITDA basis, with revenue and adjusted EBITDA increasing 47% and 19% respectively versus the prior year. To support this, the business has been making material investments in areas such as sales, research and development (R&D), and finance. The focus for 2025 is on building out the team. Reviews of systems and the structure of the business are designed to allow it to scale.

vitroconnect (1.4%)

vitroconnect (vitroconnect.com) is another recent investment made by Oakley. In July 2024, the Origin II fund, Oakley’s first fund dedicated to the lower mid-market, made its first investment acquiring a £16m majority stake in the German software company whose proprietary brokerage platform (a custom-built system that links different stakeholders in the telecoms industry) links together infrastructure owners, carriers, service providers, utilities, and municipal associations. By integrating these platforms, the company is able to streamline business operations, helping customers utilise broadband networks more efficiently, and greatly reducing transaction costs.

This unique platform has enabled the company to expand rapidly, capitalising on the highly fragmented German broadband market. Currently, only around 3m German homes are connected to fibre broadband, one of the lowest rates in Europe, however this is predicted to grow rapidly to around 39m by 2035. The opportunity to capture this long growth runway is what first attracted Oakley to vitroconnect, with the founder-led company, in turn, recognising Oakley’s strong track record in the software and telco space. Discussing the transaction, founder Dirk Pasternack specifically noted Oakley’s proven ability to guide companies through inflection points. Arguably one of the most crucial periods of development, the ability to help companies scale and capitalise on their initial competitive advantages is an area in which Oakley has developed particular expertise over years of investment.

This vitroconnect deal is a perfect real-world example of what we mean by Oakley being the partner of choice for founders, and as we discussed in our previous note, this enables it to become a first mover when it comes to new deals. Around 90% of the time, Oakley will be the first outside investor to provide external capital to a business, and more than 75% of its deals are uncontested, allowing Oakley to be highly selective when choosing which companies to back.

Alerce (0.8%)

Founded in 1989, Alerce (alerce-group.com/en) is a Spanish software business serving the transport, logistics, and courier service markets. It offers a product suite centred around its Alertran transport management system (TMS), with a comprehensive and modular portfolio of adjacent products such as ‘Senda’, which is designed to optimise last-mile deliveries.

In 2023, Oakley Capital Origin Fund I bought a majority stake in the company, investing alongside Alerce’s founding family, including CEO Pablo Pardo Garcia. The family held onto a significant stake in the business. OCI’s look-through share of the deal was about £9m.

Oakley says that Alerce’s solutions are mission-critical to its customers as evidenced by minimal churn and high levels of net retention. Alerce has market leading positions, working with around 200 blue-chip companies across Europe and Latin America. Around 60 of those have opted for Alerce’s ASPA SaaS solution.

In September 2024, Oakley supported Alerce as it made its first bolt-on acquisition, WeMob, a leading provider of fleet management and telematics SaaS solutions in Iberia. This was a business that was founded in 2014 and has since grown to support over 500 clients and over 15,000 vehicles.

Horizons Optical (0.8%)

In March 2024, Origin Fund I acquired Horizons Optical (horizonsoptical.com), a medical software business focused on software used for the manufacture of premium spectacle lenses.

Oakley partnered with Santiago Soler, CEO of the company while buying out the interests of the original private equity backer. Horizons Optical was founded in Barcelona in 2017, but operates globally.

Horizons’ software is used to design lenses and coatings used by independent ophthalmic laboratories and optical chains. Lenses can be customised to the needs of individual users; Horizon’s Mimesys virtual reality headset helps produce accurate measurements that are used to produce bespoke lenses. 10m lenses were produced with Horizons’ technology in 2023.

Oakley observes that this is a market with strong, long-term growth prospects underpinned by an ageing population and increased use of screens and mobile devices.

R&D is key to keeping Horizons Optical at the forefront of its market. Oakley will provide support for both investment in R&D and in sales and marketing.

Cegid (8.1%)

Cegid (cegid.com), the largest investment in OCI’s technology portfolio, valued at £99.2m, is a European leader in enterprise management software and cloud services. The company provides a good example of the value proposition created by Oakley, and its ability to identify and scale complimentary assets through network effects and the identification and delivery of bolt on-acquisitions.

In 2022, Fund III facilitated the strategic combination of Cegid with Group Primavera, which was itself the beneficiary of a number of acquisitions that enabled it to scale into Iberia’s largest enterprise management software and cloud services platform. The company is now a European leader in this area. In addition to finance, tax, and human resources, it also provides industry-specific cloud solutions for retailers, accountants, manufacturers, and other service-sector professionals.

Cegid has been able to leverage its increased size and global footprint to accelerate its growth strategy, benefiting from an expanded offering. Its suite of SaaS solutions are provided to over 350,000 customers globally.

Despite the operational changes and developments in recent years, the company has continued to perform well, driving strong EBITDA and revenue growth. OCI says that over 90% of Cegid’s revenues are now recurring with the installed base having largely migrated to SaaS, primarily driven by a strong uptake of cloud solutions by SMEs (small- and medium-sized enterprises) across its core markets of France, Spain, and Portugal.

WebPros (6.1%)

WebPros (WebPros.com) is another company that illustrates the benefits of the Oakley ecosystem. Steven Tredget and his team have long championed the benefit that Oakley derives as the partner of choice for business founders. The relationships that it has established have created a conduit for deal origination and value creation. Nowhere is this clearer than its relationship with Thomas Strohe and Jochen Berger, with Oakley now on its fifth collaboration with the webhosting entrepreneurs.

After a number of successes, including Fund III’s backing of Intergenia which later became part of GoDaddy, Oakley backed the team with Fund III to carve out Swiss-based Plesk from Parallels Group and later supported its purchase of cPanel, bringing together operations in Europe (Plesk) with North America (cPanel). The combined business, bolstered by further bolt-on acquisitions and a revitalised sales effort, was later renamed WebPros. Now a global SaaS hosting platform for server management, it comprises two of the most widely used webhosting automation software platforms, supporting over 85m domains and 33m users across over 900,000 servers.

The WebPros deal provides an excellent case study of Oakley’s value creation process, first leveraging its entrepreneurial foundations to identify long term potential, then applying its sector specific expertise and financial flexibility to unlock value.

While WebPros has undergone a period of consolidation (i.e. merging or acquiring to reduce competition and increase scale) in recent years, revenue and EBITDA growth in the mid to high single digits have provided steady momentum. Oakley says that WebPros’ growth is expected to pick up again in 2025, driven by continued higher average revenue per licence across the business. Increased levels of recurring revenue have provided WebPros with clear revenue visibility. The business also continues to achieve strong EBITDA margins of c.62% and remains highly cash generative.

Contabo (3.2%)

Contabo (Contabo.com) is a leading cloud infrastructure provider offering hosting services to developers and SMEs, with over 330,000 customers from c.180 countries. As noted above, this was another business introduced to Oakley by Thomas Strohe and Jochen Berger, in conjunction with Thomas Vollrath, once again highlighting the ongoing value of these relationships.

Fund IV bought a stake in Contabo in 2019 after a competitive sales process failed. Now, with Oakley’s backing, a couple of significant acquisitions have been completed (VSHosting in 2020 and G-Portal in 2021), and, through leveraging the expertise of the entrepreneurial investors, it is now a leading player. In June 2022, with the business firing on all cylinders, it was acquired by KKR in a competitive auction process. The management team was keen that Oakley retained some exposure and Oakley wanted to take advantage of Contabo’s future growth prospects, so Fund V bought a stake in the business as part of the transaction.

Contabo delivered revenue growth of 10% and EBITDA growth of 7% in the 12-month period to December 2024, versus the prior year. Growth was held back by higher-than-expected customer churn, but the business is working to address this.

Asset allocation

At 31 December 2024, OCI had net assets of £1,226m. The net value of the individual fund investments plus the direct investments totalled £1,432m and OCI had cash of £103m offset by £310m of drawings on the revolving credit facility and other working capital (the numbers do not quite add up due to rounding).

At 31 December 2024, the underlying portfolio was valued at an average EV/EBITDA ratio of 16.4x (in line with that of end December 2023); the EBITDA growth on the portfolio over 2024 was 15% on average; and the net debt/EBITDA ratio was 4.1x – Oakley points out that the industry average is about 5–6x.

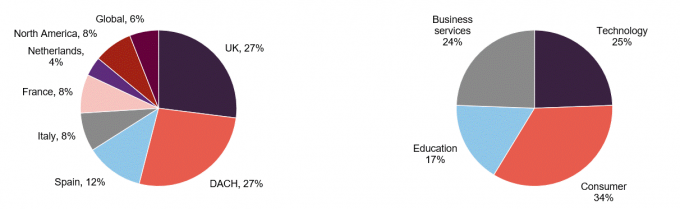

Figure 2: Geographic split of portfolio at 31 December 2024

Figure 3: Sector split of private equity funds and direct investment portfolio at 31 December 2024

Source: OCI, Marten & Co

Source: OCI, Marten & Co

Funds

Figure 4: OCI by fund at 31 December 2024

| Total size m | Year launched | Realised gross money multiple | Realised gross IRR | OCI commitment €m | OCI outstanding commitment £m | |

|---|---|---|---|---|---|---|

| Fund II | €524 | 2013 | 3.1x | 59% | 190 | 10 |

| Fund III | €800 | 2016 | 6.4x | 64% | 326 | 39 |

| Fund IV | €1,460 | 2019 | 3.4x | 44% | 400 | 75 |

| Origin I | €458 | 2021 | 129 | 23 | ||

| Fund V | €2,851 | 2022 | 800 | 301 | ||

| Fund VI1 | €4,500 | 2025 | 500 | 500 | ||

| PROfounders III | €77 | 2022 | 30 | 18 | ||

| Touring | $238 | 2023 | $100 | 33 | ||

| Origin II | €791 | 2023 | 190 | 148 | ||

| Total | 1,1462 |

On 24 March 2025, OCI announced that it had made a €500m commitment to Oakley’s new Fund VI. Fund VI is about 58% bigger than its predecessor. It will follow the same strategy as Fund V.

Cash and commitments

Figure 8 gives more information on OCI’s commitments by fund – both the original commitment and the amount outstanding at end December 2024 (adjusted for the new commitment to Fund VI), and – where appropriate – the realised returns generated. As at 24 March 2025, OCI’s outstanding commitments stood at £1,075m. The board believes that about £300m of this is not likely to be drawn. The balance should be deployed over the course of the next five years.

Against that, OCI has £103m of cash and an undrawn credit facility totalling £122m. OCI is negotiating to refinance this credit facility with a larger one and longer dated maturity.

New transactions

Since we last published, new investments have been made in Assured Data Protection (see page 7) and Konzept & Marketing. OCI’s preferred equity position in North Sails has been converted into ordinary equity.

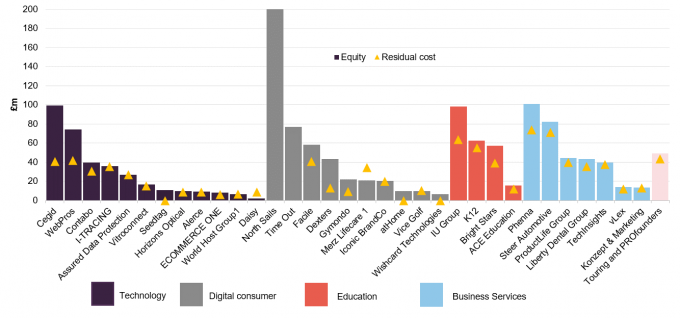

Figure 5: Portfolio split by company as at 31 December 2024

Source: OCI, Marten & Co. Note 1) Merz Lifeca

Konzept & Marketing

Konzept und Marketing Gruppe (k-m.info – in German) operates as a managing general agent (MGA – a specialised type of insurance intermediary that has underwriting authority from insurers) in Germany for private non-life insurance products (in areas such as property, accident, and liability). This is a €28bn market that continues to expand. The company was founded in 2001 and is based in Hanover.

Big insurance companies delegate insurance underwriting decisions to MGAs. Konzept & Marketing is developing, marketing, and administering tailored insurance products on behalf of insurance companies in an asset light model (a business strategy that avoids owning heavy physical assets to keep overheads low and margins high).

Oakley says that Germany’s insurance distribution market is highly fragmented and less efficient than markets such as the UK and US. It sees the potential for Konzept & Marketing to create considerable value by consolidating this market.

Oakley’s partner in this business is its chairman Joachim Müller, ex chief executive of Alliance Commercial and the recently installed chief executive of wefox Holding AG. Oakley says that it will support the Konzept & Marketing management team to expand its product offering, strengthen the distribution function of the business, and pursue further M&A opportunities.

Schülerhilfe

One disposal has been made since we last published. In October 2024, OCI announced that Fund III had agreed to sell its majority stake in Schülerhilfe to Levine Leichtman Capital Partners.

We discussed Schülerhilfe in our last note. Oakley invested in this professional tutoring business in 2017 and backed it to strengthen its business and expand. As a result, it was able to pivot its teaching programme online when COVID hit, launch “Kira” (an online AI learning chatbot), acquire a tutoring firm in Switzerland, and grow its addressable market with language courses for adults including on-site, online and B2B (business-to-business).

The £42m share of the proceeds due to OCI from the sale represented a 2.2x gross money multiple (the investment returned 2.2 times the original capital before fees and expenses) on OCI’s investment.

Performance

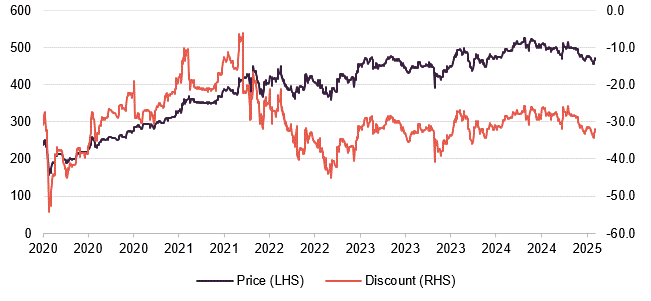

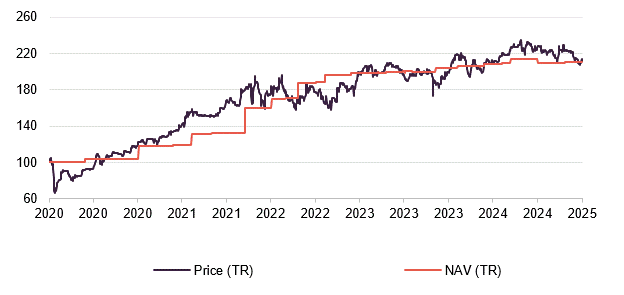

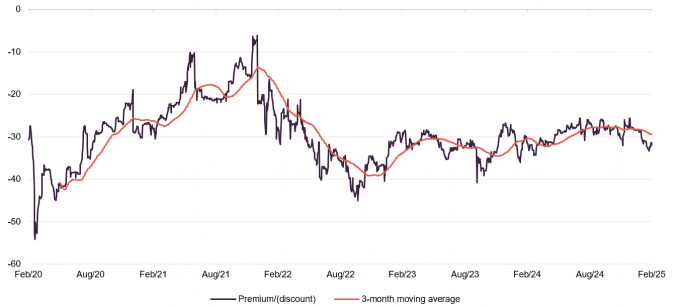

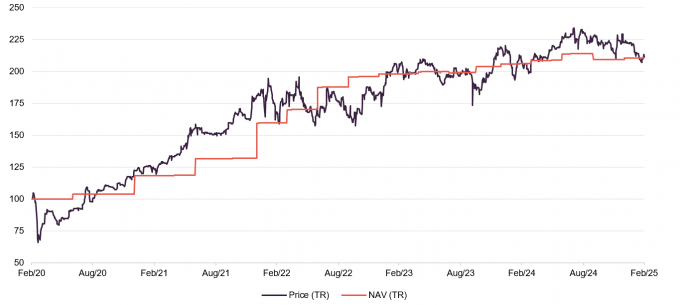

OCI has continued to make progress in both share price and NAV terms over the past year, albeit at a slower pace than in the earlier part of the five-year chart shown in Figure 6. The primary reason for this is the slowdown in the pace of exits. During this period of consolidation, Oakley has been busy deploying OCI’s capital into the next generation of new opportunities, which it believes will bear fruit in due course.

Figure 6: OCI performance over the five years ended 28 February 2025

Source: Morningstar, Marten & Co. Note: NAV based on Morningstar estimates which incorporate the last published NAV of 695p as at 31 December 2024.

Figure 7: Cumulative performance over various time periods ended 28 February 2025

| 3 months(%) | 6 months(%) | 1 year(%) | 3 years(%) | 5 years(%) | |

|---|---|---|---|---|---|

| Share price | (1.4) | (8.4) | 2.1 | 25.7 | 111.7 |

| NAV | 0.6 | (1.5) | 2.3 | 31.9 | 110.9 |

| Peer group share price median | (0.6) | 1.6 | 3.2 | 17.9 | 75.3 |

| Peer group NAV median | 1.5 | 3.5 | 4.9 | 22.0 | 94.0 |

| MSCI UK | 6.9 | 6.2 | 19.3 | 33.3 | 61.6 |

| LPX Europe1 | 3.8 | 4.4 | 10.4 | 10.5 | 38.0 |

| MSCI World | 1.1 | 9.1 | 16.2 | 42.7 | 94.6 |

Note 1) LPX Europe is an index of the share prices of listed private equity companies and therefore is most comparable to OCI’s share price returns.

Annual results for the period ended 31 December 2024

On 13 March 2025, OCI announced its annual results for the year ended 31 December 2024. The company delivered a NAV total return of 2% (15p) or 6% (+40p) excluding the impact of foreign exchange, and a total shareholder return of 2%. The full year total NAV return includes 45p of net valuation gains, c. 75% of which were driven by earnings growth. The largest contributors were IU Group, Phenna Group, Dexters, Bright Stars, and Steer Automotive Group.

Although returns in 2024 were relatively muted verses OCI’s historic performance, the company appears increasingly well positioned, having capitalised on the ongoing macro and geopolitical uncertainty with a record period of investment activity over 2024. In total, OCI made look-through investments of £299m, equivalent to c.25% of NAV at year-end. This included £214m of new platform deals (Steer Automotive Group – £64m, ProductLife Group – £40m, I-TRACING – £36m, Assured Data Protection – £27m, vitroconnect – £16m, Konzept & Marketing – £13m, Alerce – £9m and Horizons Optical – £9m); follow-on investments of £54m including bolt-on acquisitions by Steer, Phenna Group, Bright Stars, Affinitas; and venture investments of £31m including Safely You, SafeBase, Daloopa, Netradyne. This follows an equally active 2023; collectively over the last 24 months an amount equivalent to c.40% of OCI’s NAV has been deployed.

OCI also converted $107m of its North Sails preferred equity position into ordinary equity (preferred equity has priority over common equity in dividends and liquidation; converting it gives greater participation in growth and upside) “to better participate in the future returns of the leading action sports business”.

As the manager highlights, the prospects of these investments are significant, however the majority have so far made limited contribution to the NAV growth at this stage in their ownership. As these investments mature, they will likely become more significant contributors to OCI’s performance, as valuation uplift typically accelerates through the duration of an investment.

Over the period, three investments were also realised in line with their carrying values, underlining the robustness of OCI’s valuations and generating an average 2.3x gross money multiple.

OCI’s look-through share of proceeds from exits and refinancings during the period totalled £179m, consisting of £159m of realisations (idealista – £68m, Ocean Technologies Group – £49m and Schülerhilfe – £42m); and refinancings of £20m (Wishcard, GlobeTrotter and Schülerhilfe).

Previous publications

You can read these notes by clicking the links or visiting our website, quoteddata.com.

Figure 9: QuotedData’s previously published notes on OCI

| Title | Note type | Date |

|---|---|---|

| The best-performing UK-listed private equity fund | Initiation | 4 April 2023 |

| Walking the walk | Update | 15 December 2023 |

| Getting down to business | Update | 2 April 2024 |

| In a class of its own | Update | 19 September 2024 |

IMPORTANT INFORMATION

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Oakley Capital Investments Limited.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it. Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.