Oakley Capital Investments

Investment companies | Update | 15 December 2023

Walking the walk

Despite broader economic challenges, Oakley Capital Investments (OCI) continues to deliver market beating shareholder returns. A focus on cash-generative companies with recurring revenues and asset-light business models means the portfolio appears to be well insulated as financial conditions have tightened, which the managers note is highlighted by double digit earnings growth over the last financial year. The staggered nature of its investments appears to provide a consistent stream of realisations (at an average premium of 35%), validating NAVs. The latest of these, the £240m sale of its stake in IU group, crystalising an 85% IRR. Despite this execution and track record, OCI’s shares remain at a considerable discount. The managers believe that while this reflects broader market weakness across unlisted assets, it is difficult to see how it can be justified over the long term given the strength of the company’s NAV growth.

Consistent long-term returns from private equity

OCI aims to provide shareholders with consistent long-term returns in excess of the FTSE All-Share Index by providing exposure to private equity returns, where value can be created through market growth, consolidation and performance improvement.

Framework for success

As we covered in our previous note, the managers highlight that OCI’s outperformance of both its private equity peer group and broader market benchmarks over the last five years has been built on its relationship with its investment adviser, Oakley Capital (Oakley), allowing it to benefit from Oakley’s foundation based on an entrepreneurial culture, and its ability to create long term value by accelerating growth and improving or transforming business models’.

Readers may wish to refer to our initiation note, which covered aspects such as OCI’s investment process in great detail

They add that its track record speaks for itself in this regard, and Oakley continues to invest for future growth with new investments including Alerce, WebCentral, and Liberty Dental Group, all founder-led businesses.’

The managers believe that the cornerstone of Oakley’s success is the ability to identify untapped opportunities through its existing networks and this has allowed it to regularly be a first mover when it comes to new deals. Around 90% of the time, the firm will be the first outside investor to provide external capital to a business, and more than 75% of deals are secured uncontested. Oakley is then able to help reposition these businesses, developing the internal infrastructure and management reporting that a larger private equity investor would expect to see.

The firm targets sought after investments in markets ripe for disruption and consolidation, notably in business software, information platforms, and education. The managers add that it is these areas that Oakley has developed particular expertise over years of investment which companies are then able to leverage to unlock considerable value at a crucial and challenging stage of their lifecycle. They believe that this explains much of the reason why investee companies place such a high regard on relationships with Oakley and why it is able to win these deals in the first place.

One of the most recent examples is the integration with Thomas’s London Day Schools, which the managers note is one of Europe’s most prestigious private schools’ group. The owners were quoted recently in The Times as saying: “We had never seriously considered bringing on board a financial partner for Thomas’s, until we met Oakley. We have found that they understand the long-term nature of education and are aligned with our values”.

The managers note that Its framework of deal origination and value creation has been built up over many years, creating a ‘repeatable playbook’ to inform capital allocation and growth strategies which have served it well over market cycles including volatile periods like we are experiencing today. In addition, they add that thanks to the stability of the firm’s balance sheet, broader market turmoil is actually seen as an opportunity to reinforce its position as the partner of choice for founders, and Oakley is unashamedly investing for future growth, putting money to work in new deals.

Certainly, the managers are sure to stress that there is also an exhaustive quantitative aspect to Oakley’s investments, and the ability to identify developing mega trends has been crucial to its success, however they believe its hands on approach and the ability to work alongside a special selection of investee companies has proven time and time again to be the key to consistently unlock long term value.

Market backdrop

To recap, despite outperforming peers and broader market benchmarks, the managers note that it has not all been completely smooth sailing over the last few years for OCI, although the turbulent market conditions have provided an opportunity to further prove the resilience of the company’s business model. In terms of OCI’s share price, 2022 appears to have been particularly challenging as markets sold off while the managers add that listed private equity funds were continually forced to justify the credibility of NAVs.

The also point out that growth-focused strategies found themselves out of favour, although companies purely focused on top line expansion suffered the biggest declines as the market dialled in on the rising costs of financing this growth. However, they continued, while OCI also targets fast growing sectors of the market, the majority of its investments are in cash-generative companies with, asset-light business models, thus insulating the portfolio from the worst of the selling.

Over this period, the underlying companies in the portfolio generated double-digit earnings growth, which the managers say accounted for two thirds of the increase in the portfolio’s NAV. Valuations appear to have been further supported by five realisations at an average c.70% premium to the current book value, extending the c.50% average uplift in valuations on exit since inception

Looking ahead

Over 2023, the managers believe that the market focus has shifted to how the private equity sector will deal with rapidly tightening financial conditions and the potential for structurally higher interest rates and slower economic growth. Certainly, they add, that these factors would make it harder for companies to borrow money to fund growth, and it is clear that deal making activity has suffered, providing the example that IPOs are now languishing near their GFC lows. However, thanks to Oakley’s approach, they do not believe that these issues will have minimal bearing on the company’s performance.

Earnings increased by 21% on a weighted average basis over the twelve months to 30 June, 2023

The managers note that Oakley places low reliance on leverage. To date, only 1% of realised returns across all of its investments have been driven by debt, and leverage within the portfolio is well below broader sector averages (net debt to EBITDA is around 4x, well compared to 6-7x for the wider sector). Supporting companies to grow their earnings is, in the manager’s view, a far superior way to drive NAV growth. As evidence of this, they point out that the average EBITDA of the underlying portfolio increased by 21% on a weighted average basis over the 12 months to 30 June 2023.

Regarding deal making activity, the managers note that Oakley has never relied on the IPO market, adding that that while the aggregate value is certainly lower, the low and mid-level buyout market – where Oakley focuses – is actually very active and deal making activity here is as good as it has ever been.

In fact, the managers continue, current market conditions and repricing driven by overleverage are actually creating opportunities for Oakley’s funds to deploy capital towards buy and build and bolt on acquisitions. These strategies, which they say include roll ups and consolidations, have always been a prominent component of Oakley’s process, providing examples such as TICC and Phenna, and more recently with Liberty Dental Group (discussed on page 7), While these developments, they say, have proven to be successful irrespective of market cycle, recent dislocations have certainly increased the number of opportunities available.

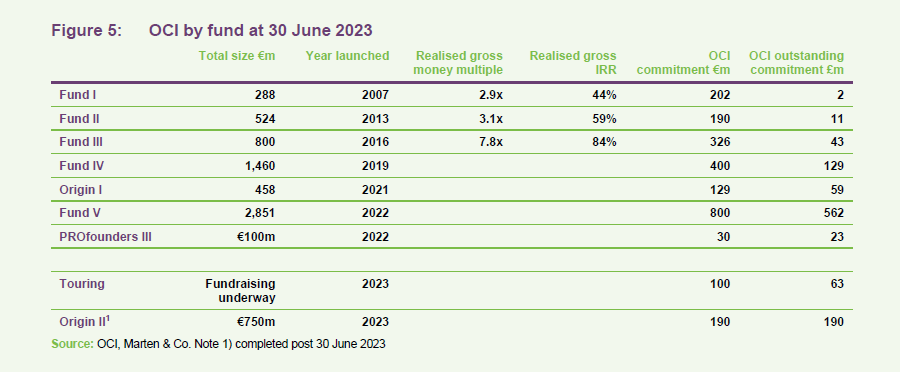

The managers add that the environment also means that Oakley’s Fund V, Touring I, and Origin Fund II (to which OCI recently committed €800m, £100m, and €190m, respectively – see pages 9–10) will be deployed into more of a buyers’ market, allowing Oakley to be nimble, picking up opportunities from failed auctions, for example.

Interim results & September trading update

The managers point out that OCI’s results for the six months to 30 June 2023 highlight the stability of the fund in the face of ongoing macro turbulence and rising foreign exchange headwinds. Total NAV return per share for the period was 0.5% with valuation gains on the underlying portfolio companies lifting NAV by 2.5%, offset by FX movements of 2%.

OCI’s total shareholder returns were 5% in the first half of the year, more than double the rise of its comparative benchmark

Valuations were also impacted by recent activity with approximately half of the period-end NAV comprised of either cash or underlying investments that were valued based upon a transaction within the last 12 months.

Helped by a narrower discount, OCI’s total shareholder returns were 5% in the first half of the year, more than double the rise of its comparative benchmark.

The managers also note that Oakley has also maintained its M&A momentum from 2022, completing more than 15 bolt-on acquisitions and several large investments and realisations which are discussed on page 7, with the realisation of Fund III’s stake in IU group appearing the most notable.

OCI’s trading update for the three-month period to 30 September showed an NAV total return of 2.5% (4.5% year-on-year). The bulk of the returns (14p of the 16p per share NAV return) were thanks to valuation gains in the underlying portfolio, in addition to a partial reversal of the adverse FX moves of the first six months of the year.

Asset allocation

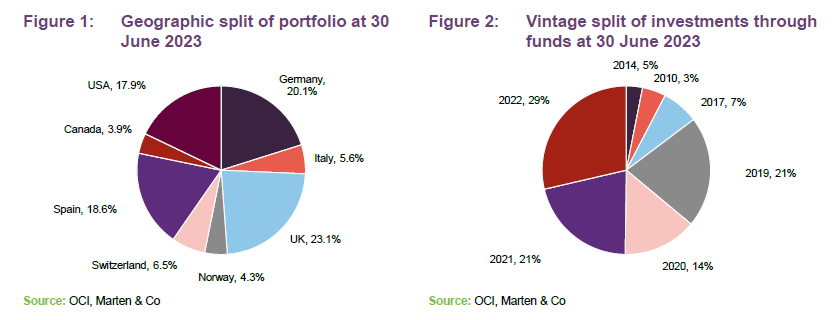

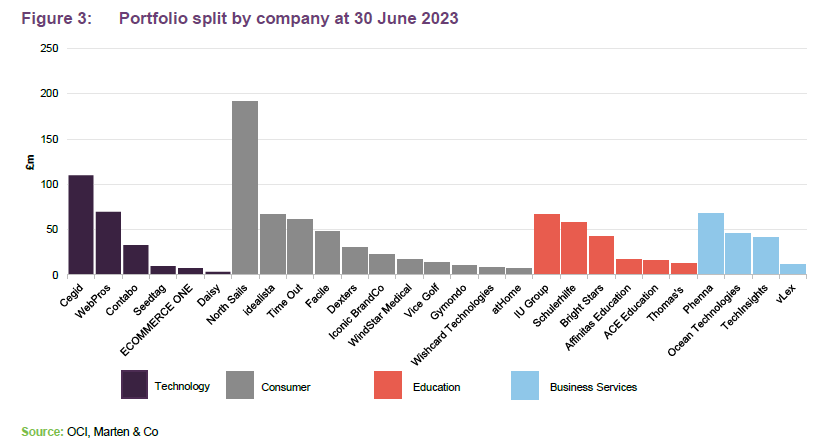

At 30 September 2023, the OCI portfolio was valued at £1,197m including £222m in cash and other assets. On a portfolio basis, the sector split was: 20% in technology, 41% in consumer, 18% in education, and 14% in the recently segmented fourth sector, business services (tech-enabled services).

Business services sector

The managers note that the recently segmented business services sector allows Oakley to highlight the increasing scale and successful track record of its information platforms and testing, inspection, certification, and compliance (TICC) investments. In addition, the sector focuses on companies with stable, recurring revenues and market drivers such as outsourcing and regulation.

Sale of and reinvestment into IU

Fund III’s realisation of its stake in IU Group, totalled £240m. for gross IRR of 85% IRR on its exit

They also highlight that Oakley has remained active over 2023, with the most notable transaction being the realisation of Fund III’s stake in IU Group, with OCI’s share of the proceeds totalling £240m. for an 85% IRR on exit. In order to extend its partnership with the German university-level education technology business, which the company continues to view as having an enormous opportunity to disrupt global education, Oakley then raised a continuation vehicle, backed by Oakley Fund V and other investors who are acquiring the business. OCI’s share of the new Fund V investment in IU totalled about £66m. See page 11 for more info on IU Group.

Investments

Since our last note, OCI has added exposure to several new investments made up of founder led companies with what the managers describe as strong growth trajectories. They also note that the continued activity also highlights the company’s ability to put money to work despite macro headwinds, and the increased potential for buy and build opportunities that these have created.

Thomas’s London Day Schools

New investments since we published our initiation note in April included a £14m contribution towards a Fund IV deal to take a minority stake in, premium schools group, Thomas’s London Day Schools (thomas-s.co.uk). The business is run by Tobyn and Ben Thomas, the sons of the founders. Over its 50-year history, it grew from a kindergarten in a local church hall into a group of five prestigious, over-subscribed and interconnected independent day schools teaching more than 2,000 children, notably including Prince George and Princess Charlotte. The funding will be used to finance the organic growth of the business.

Elsewhere in OCI’s portfolio of educational companies Affinitas Education, which is backed by Fund IV, spent £2m on the bolt-on purchase, of XIC, a single-site school in Spain.

Liberty Dental Group

The company also made progress on several pipeline deals. The first of these opportunities, signed in the period and expected to complete in December 2023, is the acquisition of Flemming Dental, Excent and Artinorway Group, to form what the managers describe as one of the leading dental laboratories groups in Europe. OCI’s look-through investment in the business is anticipated to be c.£35m.

While turbulent market conditions create challenges, they also bring about opportunities

Oakley sees potential for considerable value creation through a buy and build process, in what they view as a highly fragmented sector. The three businesses are being carved out from European Dental Group, which they see as a leading pan-European oral care and services provider. Oakley is partnering with Hidde Hoeve, the co-founder of Excent Tandtechniek, a group of dental laboratories acquired by European Dental Group in 2018.

Pixis

Pixis (pixis.ai) is an AI-powered marketing platform based in India and California. It was the first transaction from the newly developed Oakley Touring Venture Fund (discussed on page 9). Oakley led the $85m Series C1 funding round for the company, bringing the total invested in the business to $209m. Pixis will use the proceeds to invest in R&D and accelerate its expansion globally.

Webcentral

Oakley Capital Origin Fund has bought a stake in Webcentral DEH, a Australian domains, hosting and e-mail provider. This was Oakley’s fifth collaboration with webhosting entrepreneurs Jochen Berger and Tom Strohe, which, the managers believe, highlights the value of building long term relationships. We have discussed this in more detail in our initiation note in the context of Jochen and Tom’s role in building a number of other hosting businesses, including WebPros – see page 14 of that note.

OCI’s indirect contribution via Origin will be c.£3m. The deal is a carve-out from Webcentral Limited, an Australia-based digital solutions company listed on the Australia Securities Exchange. Webcentral offers a portfolio of digital services to over 330,000 small and medium businesses and 2,500 enterprises across Australia and New Zealand.

Alerce

Oakley Capital Origin Fund I is buying a majority stake in Alerce, a Spanish provider of transport and logistics software solutions, with the manager hopeful of building on its track record of successful software company investments such as Grupo Primavera.

Origin will invest alongside Alerce’s founding family, including CEO Pablo Pardo Garcia, who will retain a significant stake in the business. OCI’s share of the deal is expected to be about £9m. Alerce was founded in 1989 by the Pardo family, and is now a leading transport management software provider to Spanish courier, carrier and haulage businesses. The manager notes that Alerce has market leading positions across Spain, Latin America and France through longstanding relationships with blue-chip customers.

Other

In addition, vLex completed the bolt-on acquisition of Fastcase, a US legal intelligence business for £7m, while the company also relaunched their AI-powered legal assistant. Fund IV increased its investment in early learning provider Bright Stars to the tune of £5m.

The impact of these transactions on OCI’s balance sheet and commitment profile is discussed on page 16.

Commenting on the activity over the past 18 months, the adviser highlighted that whilst turbulent market conditions create challenges, they also bring about opportunities, and these should provide a lucrative runway for growth.

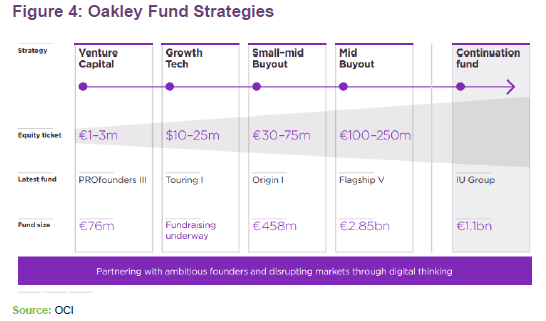

Funds

As Figure 4 highlights, Oakley invests across the spectrum from venture and startup capital to mid buyout and continuation funds, although, as the managers would reiterate, OCI is not a venture fund, with only a relatively small allocation to early-stage capital. The manager suggests that generally speaking, this provides an excellent balance for investors looking to gain exposure across all stages of a company’s life cycle.

Oakley Touring Venture Fund

The managers note that one of the reasons Oakley has been able to maintain such a consistent track record over the years is its ability to identify and participate in generational technology shifts such as the advent of smart phones, and cloud computing. These investments have not happened by chance, and in order to develop the capability to invest in new cutting-edge technology, Oakley launched the Oakley Touring Venture Fund to target what it sees as the coming AI revolution, working alongside the team behind Microsoft’s highly successful M12 venture fund.

OCI has committed $100m to gain exposure to primarily Series B and C venture opportunities, investing in what they few as proven businesses with strong growth prospects. Additionally, the managers state, the new fund adds considerable resource to the new fund team and the broader portfolio suite who can tap into their insights and expertise on the rapidly advancing AI sector.

Oakley Origin Fund II

Oakley Origin Fund II will, like the first Origin fund, target the lower mid-market of deal sizes. Origin II will pursue the same strategy as its predecessor fund, investing in tech-enabled businesses with enterprise values of up to €200m. The fund hit its hard cap of €750m in just four months, with OCI contributing €190m of that. The managers highlight that the speed of this uptake is noteworthy as it demonstrates the firm’s strong reputation in the market.

Oakley says that Origin II received strong demand from institutional investors, including 18 new LPs in Europe, US and Asia, as well as from entrepreneurs from across Oakley’s network.

Top 10 holdings

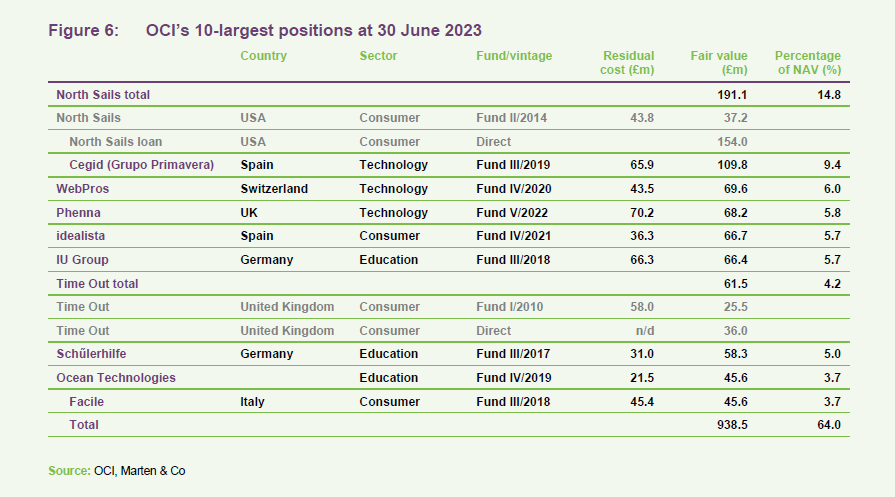

Following the IU Group transaction, there have been several changes to the rankings of the top 10 largest positions since our last note, although the featured companies remain the same.

Over the course of 2023 the managers note that there have been a number of positive updates from the OCI portfolio.

North Sails

North Sails (northsails.com) is a US sailmaker and sailing apparel business. Its sails powered the winning yacht in the 2022 Sydney Hobart race, but perhaps more impressively, they have powered every single Americas Cup winner since 1987 and will power all five entries in 2024’s race. Those credentials underpin the company’s apparel brand, which is sold online and through over 700 chain and independent retailers across Europe and Asia.

North Sails has bounced back strongly, with revenue and EBITDA growth of 17% and 53% respectively

Oakley has a long history with the company, first backing it in 2014 with the aim of building its global apparel brand. As of June 30, 2023, OCI held direct investments of £153.9m and indirect investments of £37.2m via Fund II.

Following what the managers describe as ‘a down year’ in 2022 due to supply chain constraints and rising costs, North Sails appears to have bounced back strongly, with revenue and EBITDA growth of 17% and 53% respectively. The managers note that whilst these returns are against relatively soft comps, almost all of its divisions are performing ahead of expectations.

Cegid

Oakley remains incredible positive on the outlook for deal flow in Spain with the region growing as a source of interest following its first investment in 2019. The bulk of its current exposure, and its second-largest investment is Cegid (cegid.com) a provider of enterprise management software and cloud-based solutions.

The company recently undertook a strategic combination with Grupo Primavera a business management software platform and now offers a suite of SaaS solutions to over 350,000 customers in France, Iberia, and globally.

The newly combined company appears to have hit the ground running, with year-to-date consolidated revenue and EBITDA growth of 26% and 22% respectively, a solid improvement on its 2022 performance of 23% and 18%. Recurring and SaaS revenues contributed 85% and 71% of total revenues, respectively.

Phenna/CTS Group

In August 2022, Fund V announced that it would invest in testing, inspection, certification, and compliance (TICC) platform Phenna Group (phennagroup.com). At the same time, Oakley bought CTS Group – a provider of testing, inspection and geoengineering consulting services in the UK, focused on the infrastructure market – which is being merged into Phenna.

The managers note that the company has continued its impressive performance, both through strong organic EBITDA and revenue growth, which was up 7% and 9% respectively, and active M&A, acquiring a further seven business. This follows 10 bolt-on acquisitions made the previous year, bringing total businesses in the group to 44. They add that the M&A pipeline remains robust for the second half of the year with a number of opportunities in due diligence.

IU Group

IU Group (iu-group.com) is Germany’s largest private university group, with over 100,000 students enrolled, and over 15,000 corporate partners. The managers note that it has been a significant driver of OCI’s returns in recent years, providing a prime example of how these relationships can develop, with Oakley playing a role in the company’s global expansion, ongoing strategic M&A, and talent acquisition, all of which has helped drive student growth, including widening access for females and students from non-academic backgrounds. Oakley stresses that IU Group has no direct listed comparator in terms of scale and focus.

As noted, the structure of the IU investment has changed considerable from our previous note following the £240m realisation from Fund III and consequent reinvestment through Fund V of £66m.

The managers that the company itself has continued its impressive trajectory, through the first half of 2023, with revenue and adjusted EBITDA up 30% and 50% against the prior year. Uptake in its native Germany remains particularly strong, with B2C Core growing 25% and B2B growing 18% with AI being effectively leveraged to accelerate its education offering and therefore its mission to widen access to quality education globally. They add that this should be augmented further with international growth, which is expected to accelerate thanks to two recent add-ons, LIBF in the UK and UFred in Canada, which will launch online degrees developed by IU Group.

Schűlerhilfe

Schülerhilfe (schuelerhilfe.de) is a provider of after-school tutoring across Germany and Austria. Oakley has invested in the company since 2017, which the managers note required helping it navigate the COVID-related lockdowns with the company pivoting its entire operation to remote learning.

The company serves over 125,000 students through 1,100 locations and has seen what the managers describe as remarkable growth over the last few years. Enrolments almost doubled in 2022 and are now over 50% higher than pre-COVID levels, aided by a voucher scheme supported by the German government. Despite what appear to be challenging comps, and the wind down of these voucher programmes, this momentum looks to have continued through the first half of 2023 with enrolments trending more than 40% above pre-COVID levels. Total company revenues over the last 12 months are up 15% year-on-year while the online tutoring business is growing at over 40%.

Bright Stars

The managers note that early learning provider, Bright Stars continues to go from strength to strength. The company, which saw an additional £5m in investment from Fund IV, delivered impressive EBITDA growth of 50% through the half of the year, along with six nursery acquisitions, bringing the total number of nurseries acquired under Oakley’s ownership to 48. In April 2023, Bright Stars acquired a small group of settings in Ireland. This represented the first acquisition outside of the UK and will be used as the Irish platform from which to continue to expand.

Ocean Technologies Group

Ocean Technologies Group (oceantg.com) is a provider of online education and operational software in the maritime sector. Oakley’s history dates back to 2019 through Fund IV, with the integration of multiple bolt-on acquisitions, which has helped enable the business to serve more than 20,000 ships and installations with and up-to-date compliance, risk and safety training.

The managers note that the company has been a stable performer over the past few years which continued through the first half of 2023 H1, delivering run-rate revenue and EBITDA growth of 3% and 9% respectively. Product development also continued, with key product hires (including a CPO) and new e-learning and software products in the pipeline to meet the evolving needs of ship managers and crew worldwide.

Valuation

OCI’s underlying investments are revalued on a quarterly basis, and the board seeks to publish NAVs within about six weeks, sometimes less.

The managers note OCI’s relatively conservative approach to valuing investments, which is evidenced by the substantial premiums to previous valuations that buyers are prepared to pay for them. The latest example being Fund III’s gross return of 85% IRR on its exit of IU Group. Adding that this continued a spate of successful premiums with recent transactions of Contabo, TechInsights, Facile, Wishcard and Seedtag (partial exit) fetching an average premium to carrying value of about 70%.

Performance

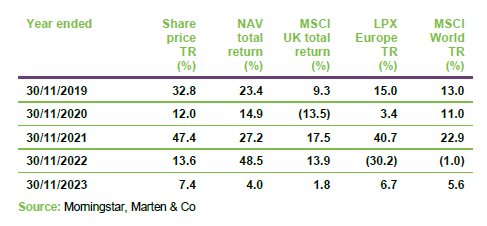

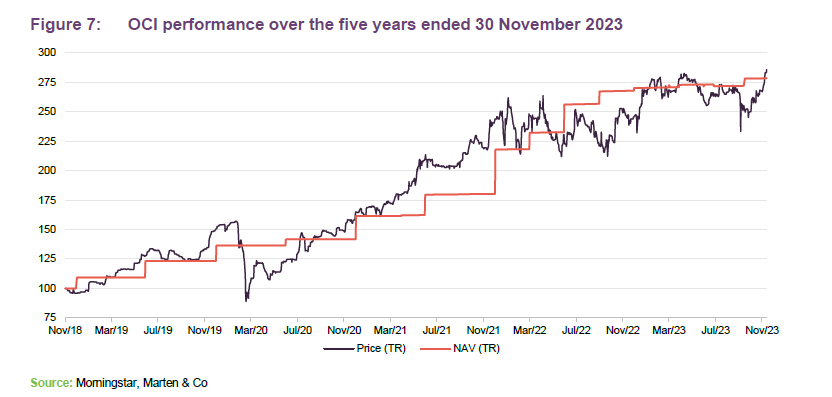

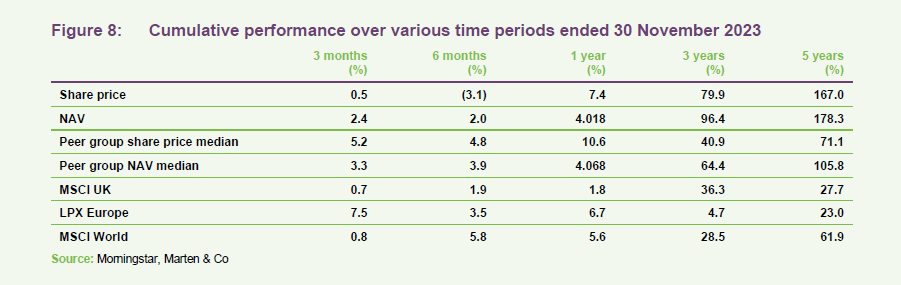

Despite slowing from last year’s rate of performance, where NAV grew 24%, OCI has continued to generate positive returns over the course of 2023 with year-on-year NAV growth of 4.5% to September 30. The managers also note that portfolio execution has also remained impressive despite broader macro headwinds, with earnings increasing by 21% on a weighted average basis over the twelve months to 30 June 2023, sustaining the company’s track record of double-digit, bottom-line growth that in turn drives NAV growth.

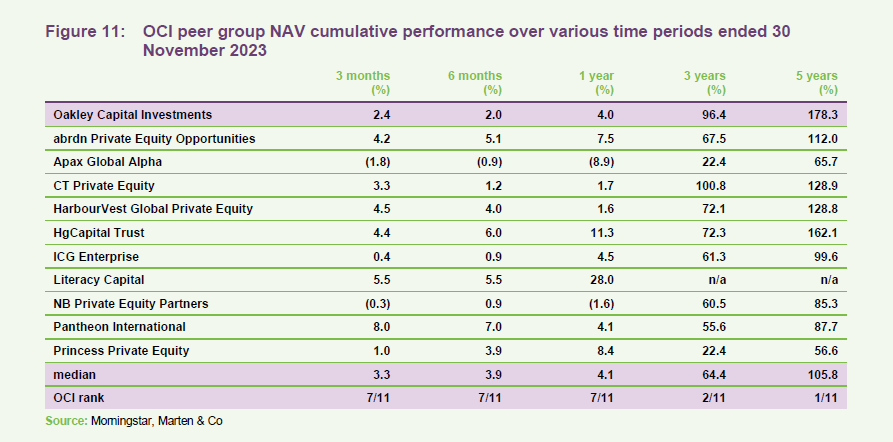

Figure 8 compares OCI with the MSCI UK index, which we have used as a proxy for the All-Share, OCI’s peer group (which is defined below), LPX Europe (which is an index of the share prices of European – including UK – listed private equity companies) and the MSCI World Index. Over three and five years, OCI outperforms everything both in terms of share price and NAV performance. Over the past year, NAV returns have slowed, which the managers say is in part due to a cautious approach to the trading outlook and valuation multiples for the operating investee companies. In addition, approximately half the period-end NAV was comprised of either cash or underlying investments that were valued based upon a transaction within the last 12-months.

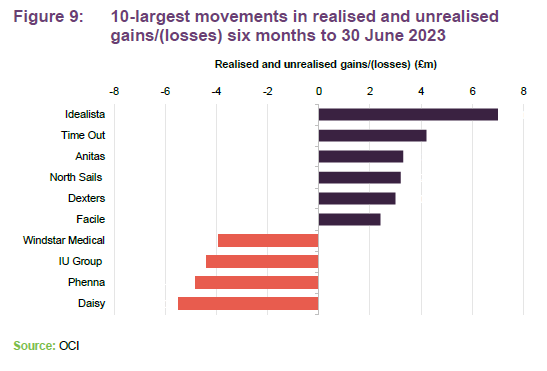

Figure 9 shows the underlying contributions to NAV. Spanish online real estate provider idealista lead the way following growth out of its core markets, while media and hospitality company Time Out also saw momentum. B2B communications provider Daisy provided the largest drag.

Peer group

Up to date information on OCI and its peers is available on the QuotedData website

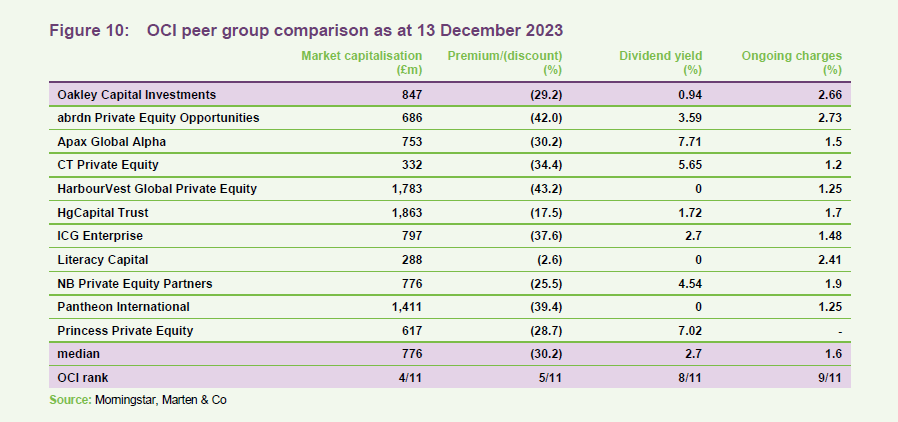

For the purposes of this note, we have constructed a peer group composed of the constituents of the AIC’s private equity peer group, excluding those with a market capitalisation of less than £50m. Hg Capital’s portfolio is heavily skewed towards technology, which creates an overlap with OCI. It could be perceived as its closest comparator, although there are some similarities between OCI and Apax Global Alpha.

OCI sits in the middle of its peer group in terms of both its market cap and discount. As figure 11 highlights, OCI is the best performing trust in the entire private equity sector over the last five years.

Given its track record, and the ongoing performance of its portfolio companies, the manager notes that it is difficult to see how a 29% discount can be justified.

One factor they believe may have contributed is the long-term blow back from the company’s decision to issue shares at a discount back in January 2017. The board recognises that this was an error on its part and since then has strived to improve its corporate governance. As such, they feel that this should no longer be a factor in OCI’s rating relative to peers.

OCI’s ongoing charges ratio ranks as the second-most expensive compared to the rest of its peers. However, its returns are stated post-fees.

Cash and commitments

As at September 30, 2023, OCI cash and net borrowings stood at £222m, thanks predominantly to the proceeds from the realisation of IU group from Fund III. The manager also points out that the staggered nature of the Oakley Fund investments should continue to generate regular proceeds. Fund IV is also moving into its realisation phase, and we saw its first full exit and a partial exit completed over the course of 2022, although the manager adds that current market conditions appear to be more supportive of strategic acquisitions rather than realisations, which they say is witnessed by Oakley’s recent market activity outside of IU group. As the portfolio matures, they expect to see an increasing number of disposal proceeds.

During the period, OCI made a €190m commitment to Oakley Capital Origin Fund II, which targets tech-enabled businesses across Europe’s lower mid-market. Including this commitment, total outstanding Oakley Fund commitments at the period end were £1,053m.

Although it remains undrawn, the company also extended its revolving credit facility to £175m which, the manager states, is a further vote of confidence in the fundamentals of the fund and its ability to add value.

Premium/discount

OCI has consistently traded on a discount over the last five years. Over the 12 months ended 30 November 2023, the discount ranged between 40.8% and 28.4%, averaging 32.8%. As of publishing, the discount was 29%.

Whilst OCI has traded on a sustained discount since 2010, this is a trait which is not unique to OCI. Its closest peers have on average traded at a discount over the whole period since OCI launched in August 2007. A number of reasons have been put forward for this, including the lack of liquidity within the underlying portfolio, uncertainty over the true levels of NAVs, and concerns about overcommitment policies. As has been mentioned throughout this note, OCI’s valuation process appears robust and is repeatedly justified by regular realisations above carrying value.

In the adviser’s view, OCI’s discount is the least compelling reason to buy the trust. They believe that discounts across the private equity sector appear to have become entrenched. However, ultimately, they continue, OCI’s NAV growth drives the share price. OCI does repurchase shares, to the benefit of the NAV, however the advisers feel that it has much more control over its underlying asset growth than its share price. At best, they believe there is substantial upside if the discount closes, which may happen if OCI’s current run of strong performance increases the gap between its returns and those of funds investing in listed equities.

The adviser cautions that investors expecting a direct read across from moves in public markets on OCI’s NAV should remember that its portfolio is not representative of the public market.

Previous publications

Our initiation note – The best-performing UK-listed private equity fund – was published on 4 April 2023. You can read this by clicking the link or visiting our website quoteddata.com.

IMPORTANT INFORMATION

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Oakley Capital Investments.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction:These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.