Oakley Capital Investments

Investment companies | Initiation | 4 April 2023

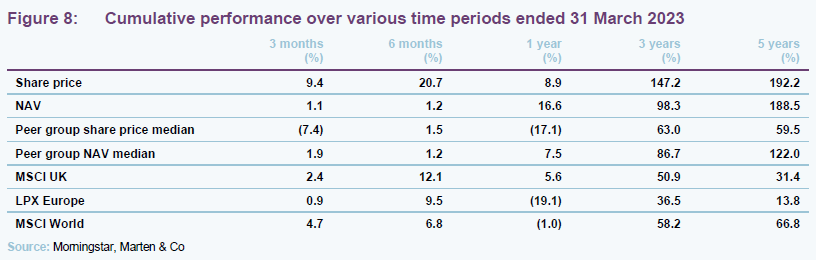

The best-performing UK-listed private equity fund

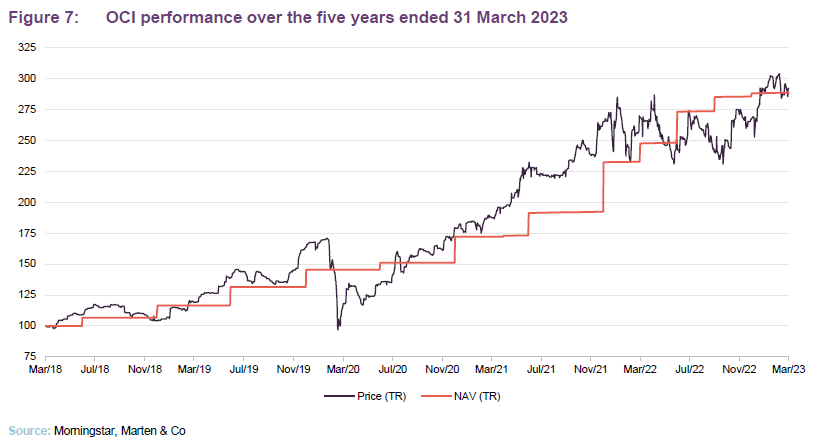

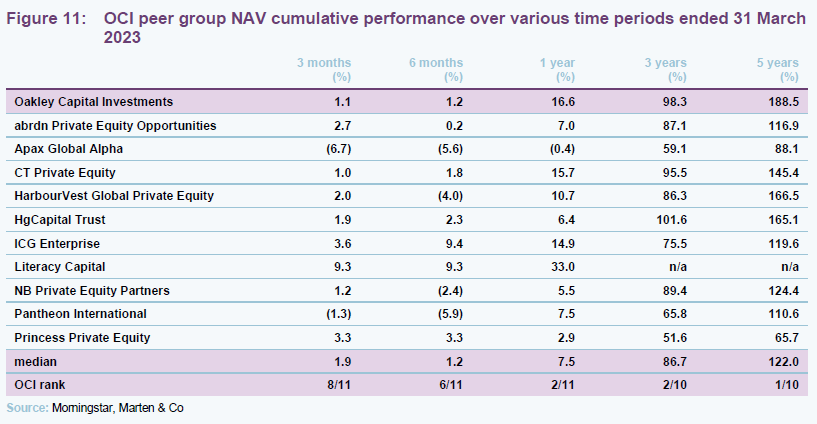

Oakley Capital Investments (OCI) invests in private equity funds managed by Oakley Capital Limited (Oakley). OCI is, as we show on page 21, the best-performing fund in its peer group over five years. As evidenced by its latest full-year results, this has been achieved in spite of a difficult macro backdrop.

OCI believes that this can be attributed to three core factors: the expertise that it has built in a focused group of sectors (technology, consumer, education) over 20 years of investing; a unique origination strategy, which continues to unearth opportunities that others cannot access (seven new investments made last year); and a set of proven value-creation strategies that help accelerate the earnings growth of the companies that OCI backs (22% EBITDA growth on average over 2022, accounting for around two-thirds of OCI’s NAV growth over 2022). The success of the approach is evidenced by OCI’s 23% CAGR of NAV over five years.

Consistent long-tern returns from private equity

OCI aims to provide shareholders with consistent long-term returns in excess of the FTSE All-Share Index by providing exposure to private equity returns, where value can be created through market growth, consolidation and performance improvement.

Oakley – Backing high-growth, profitable businesses across Europe

More information is available at: oakleycapitalinvestments.com.

OCI aims to provide shareholders with consistent long-term returns in excess of the FTSE All-Share Index by providing exposure to private equity returns, where value can be created through market growth, consolidation and performance improvement. In this note we have substituted the MSCI UK index for the All-Share.

Backing Oakley funds to get access to private equity.

OCI approaches this by investing in funds managed by Oakley Capital Limited (Oakley), the investment adviser. The Oakley funds invest primarily in unquoted, pan-European businesses where the business is a market leader or has the potential to become one, and across three sectors: technology, consumer and education, with a focus on buy-out opportunities in industries with the potential for growth, consolidation and performance improvement.

Private equity is an exciting asset class.

The team makes the point that public markets are shrinking, but private equity is an exciting asset class. Companies are staying private for longer and many may never list as founders prefer to partner with private equity. While the IPO market is relatively subdued, private equity funds are sitting on substantial dry powder, approaching $2trn at the end of 2022 according to Preqin Pro. That should help keep the exit market fairly buoyant.

Access a diverse range of businesses that are not represented in public markets.

OCI offers a liquid route for all other investors to access Oakley’s expertise and to access a diverse range of businesses that are not represented in public markets. In addition, an investment in OCI offers exposure to parts of the economy that are not represented in public markets. OCI’s investments in the education sector offer a good example of this.

Entrepreneurial heritage.

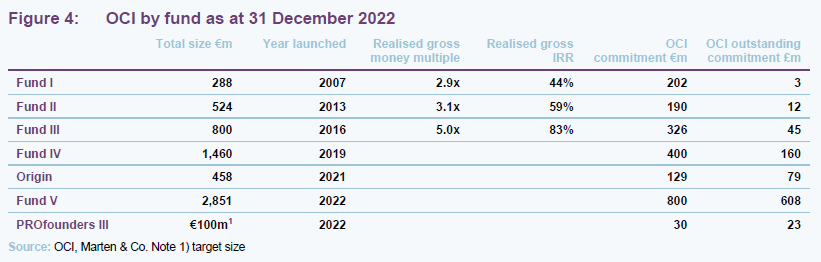

Oakley was founded in 2002 by Peter Dubens and David Till. Over the following five years, they built and sold two successful businesses – 365 Media and Pipex Communications – this entrepreneurial heritage is reflected in the firm’s culture and approach to investing today, and led to launch of Oakley Fund I in 2007. The firm has raised six funds to date, deploying capital to back over 40 businesses. While some firms are said to be finding it harder to raise funds, that has not been true in Oakley’s case, its latest Fund V hit its hard cap of €2.85bn, roughly double the size of Fund IV. Fund V was backed by more than 50 limited partners (LPs) from across Europe and the US (including North American pension funds), 25 of these institutional investors were new to Oakley’s funds.

Oakley’s main funds can write cheques of between £50m and £200m, in the mid-range for most private equity deals. For smaller but attractive situations, OCI has exposure to Oakley’s Origin fund; a €455m fund that closed in January 2021, which makes investments in the €10m-€50m range, in lower mid-market businesses.

Today Oakley has a 12-strong partner group, supported by a c.40 strong investment team distributed across offices in London, Munich, Milan and Luxembourg, and a wider, well-invested platform of professionals across ESG, investor relations, talent acquisition, legal & compliance and other functions.

Great track record.

Across its flagship funds, Oakley has been able to generate gross realised returns of 4x money multiple and an average 67% IRR across all funds since inception.

What differentiates Oakley’s Approach?

Sector focus – technology, consumer and education

Oakley’s current focus is on consumer, technology and education.

Over 20 years, Oakley has built up expertise in a core set of sectors. Today, Oakley’s funds appear to have a relatively-narrow sector focus on technology, consumer and education, but the firm did not start that way and is able to evolve beyond this if opportunities present themselves.

For example, 10 years ago there was no exposure to the education sector within Oakley’s funds, but now this is an important part of the portfolio. The team saw an opportunity to build significant businesses within a fragmented market where reputation and trust are crucial (it says that the entrepreneurs behind these businesses are very selective about who they partner with).

The education sector provided last year’s best-performing investment, IU Group. Oakley’s investments in the sector span early years (Bright Stars) to K-12 (Affinitas), and tertiary (IU Group, ACE Education). Generally, these are areas that can be harder to access through public markets.

Lessons learned from backing one business can often be applied to future investments. For example, in the area of technology, Oakley has developed considerable expertise in webhosting, leveraging the knowledge and expertise it gained as an owner of Intergenia (Host Europe) to its later investments in Web Pros and then Contabo (see page 14).

Elsewhere in the tech sector, Oakley has backed SaaS businesses such as business software company Cegid, and B2B information platforms such as Techinsights and vLex.

In the consumer sector, Oakley has considerable experience of building digital marketplaces, and here it has been able to apply knowledge gained from one region to building similar businesses in another.

Price comparison sites are a good example of this. A service that is now ubiquitous in the UK is still only just being embraced in Europe. In 2014, Oakley’s Fund II made an investment in Italy in Facile, which built upon the knowledge that Oakley gained in Germany with Verivox (Germany’s largest independent consumer portal for energy, which was an investment in Fund I and Fund II and made 14.9x the amount invested). In 2014, online penetration of the Italian car insurance market was at only 10%, versus 80% in the UK.

Oakley notes that even today, only 45% of the Italian population have made an ecommerce transaction. Now, Facile is the leading Italian online motor insurance broker, and offers price comparison services across gas & power, broadband, mortgages, consumer loans. A new addition to its services is a new car sales marketplace platform.

Other examples include digital marketplace idealista, and internet consumer businesses Vice and 7NXT.

Oakley’s target businesses tend to have similar characteristics; a market leader or potential to become one, growing markets, strong recurring and defensible revenues, often the ability to exploit the growth of SaaS, and potential for business-enhancing bolt-on acquisitions.

Oakley’s funds target at least double their money in a worst-case scenario.

When evaluating what it will pay for a business, the assumption is that Oakley’s funds at least double their money in a worst-case scenario. Organic growth, M&A, multiple expansion and debt are all drivers of returns, but they rank in that order. Debt has driven just 2% of returns to date, Oakley does not over-lever its companies. Oakley has supported its portfolio companies with over 130 bolt-on acquisitions.

About 70% of businesses deliver their products and services digitally and 70% of revenues are recurring or subscription based, which lends resilience and predictability to the portfolio. Of those companies that didn’t share these characteristics at the point of investment, e.g. Alessi, Time Out and Dexters, an opportunity has been identified to digitalise them and enhance their product delivery.

The team says that each Oakley company provides an opportunity to invest behind a megatrend providing an opportunity for long-term, enduring growth irrespective of the macro cycle. These include: the consumer shift online, a growing movement of business to the cloud, and the global demand for quality, accessible education.

Oakley tends to avoid heavily cyclical businesses.

Oakley tends to avoid heavily cyclical businesses. Even estate agent Dexters (an investment in Fund IV) derives 75% of its revenue from lettings, which tends to be less volatile than selling houses/commercial space. Oakley is helping the business grow through M&A (in a property market downturn, opportunities may become available) and is bringing digital expertise to the business based on Oakley’s experience with businesses such as European property portal idealista.

New sectors are always being explored.

New sectors are always being explored. For example, business services is an area in which they are finding more opportunities currently. Such businesses operate within secular growth markets and are able to expand organically. Oakley’s investment team maps interesting sectors in depth, enabling it to identify interesting new niches which share characteristics that it likes and where it can deploy its value creation playbook. A good, and relatively recent, example of this has been the investment made in the area of Testing, Inspection, Certification and Compliance (TICC) with Phenna (see page 13). Customer spend is non-discretionary, the market is highly fragmented, and Oakley sees an opportunity to deploy its expertise in buying and building business.

A different approach to origination

The team says that finding the right deals at the right price is only the start of the story, but it is very important as it lays foundation for future investor returns.

Around 90% of the time, Oakley will be the first outside investor to provide external capital to a business, and this provides further opportunity to add value. The team says that there is no fixed playbook; the approach adapts to each business and that is part of the reason why business founders and entrepreneurs want to do deals with them.

Oakley says that Alessi (Iconic BrandCo) is a good example of this. Often, founder-run/founder family-run companies are very reluctant to talk to private equity. In Alessi’s case, a third-generation, wholly-owned family business founded in 1921 was looking for a way to navigate globalisation and the shift to ecommerce. Having made an investment in 2019, Oakley was able to bring a fresh eye. Working with the management team, the number of SKUs halved, but sales rose, and online sales rose in particular.

Over the years, 88% of Oakley’s investments have been primary deals, 75% of these were uncontested deals. The average entry multiple was 9.4x.

The team says that success begets success, as each deal reinforces its expertise and track record in a specific niche sector, attracting entrepreneurs and management teams in similar industries.

At the core of Oakley’s success is its network, made up of business founders that the firm has previously backed, who go on to invest in Oakley funds (€200m in its latest fund) and who also introduce fresh investment opportunities. These relationships open doors to deals that most private equity firms would not be able to access.

The team says that Oakley’s entrepreneurial ethos and heritage are attractive to entrepreneurs. Oakley tends to exit an investment with the same founder/management team it went in with, demonstrating its partnership approach.

Oakley acts as a bridge between entrepreneurs and other private equity investors.

Oakley is prepared to roll up its sleeves and work with these businesses to develop the internal infrastructure and management reporting that a larger private equity investor would expect to see. Consequently, many of the exits that Oakley’s funds have achieved have been to well-known private equity names. However, even if they sell to a bigger player, Oakley aims to maintain its relationships with management, and often the management like Oakley to retain an investment in the business, thereby maintaining a link with the entrepreneur-focused investor they first partnered with. As such, Oakley often acts as a bridge for founders, helping them build and professionalise their businesses to a point that attracts the attention of blue-chip investors.

The transactions that Oakley undertakes might be viewed as too small or too complex by most large private equity players. However, Oakley see this as a strength as it improves its negotiating position and creates more opportunities to unlock value.

Value creation – driving NAV growth

Historically, the largest driver of NAV growth has been the underlying earnings growth within OCI’s portfolio. In 2022, EBITDA growth was responsible for around two thirds of OCI’s NAV uplift over the year. The team also thinks that the investment it makes in value creation also increases attraction of Oakley businesses to external investors, as demonstrated by the average roughly 70% premium on exits achieved in 2022. The 70% premium should also reassure investors about the integrity of valuations, which are further validated through quarterly revaluations of the entire portfolio.

Oakley aims to accelerate growth within portfolio companies by leveraging four key strategies: business transformation, performance improvement, leadership development, and buy-and-build.

Business transformation may involve the complete overhaul of a business model. Oakley cites examples of shifting sales to a SaaS/recurring model to improve the quality of earnings (as it did with TechInsights); or building an entire standalone organisation following a corporate carve-out (as was the case with WebPros, which was carved out of Plesk).

Performance improvement is achieved by improving management information, data analysis and reporting – allowing management teams to make better-informed decisions – and embracing new sales and marketing channels. The example that the team gives is Alessi, which we discussed above.

In leadership development, Oakley can leverage its extensive network to help businesses strengthen and deepen their management teams.

Strategic M&A can be transformative too. Oakley has demonstrated the success of a buy and build approach with ACE Education, Bright Stars and Affinitas. Over the years, Oakley has supported its portfolio companies as they have made over 130 bolt-on acquisitions, assisting in identifying, executing and integrating acquisitions.

Frequently, Oakley’s relationships with its investee companies are more long-term than a typical private equity limited partnership structure can accommodate – this is one of the arguments in favour of OCI’s evergreen closed-end structure. It is also evident in the relatively high number of reinvestment deals that Oakley’s funds make.

ESG

Oakley is a signatory of the UN Principles for Responsible Investment and encourages its portfolio companies to think about ESG considerations and identify improvements to their businesses. It believes that taking actions to address ESG concerns can create additional value and reduce risk, creating more robust businesses.

ESG is embedded into Oakley’s investment approach and integrated into its due diligence. Initial screening seeks to identify any businesses or sectors which may require further ESG scrutiny. If needed, additional due diligence is conducted by the Oakley team, supported by its head of sustainability. Any significant areas of concern may require further specialist due diligence, which may be undertaken with support from independent experts. Findings are included in the investment documents presented to Oakley’s investment committee.

Once Oakley has made an investment, it usually has significant influence over the strategy and culture of investee companies. As such, it acknowledges that it has responsibilities to promote best practice in aspects of ESG.

In 2021, Oakley launched a formal portfolio ESG monitoring and reporting platform incorporating every investment. ESG webinars are being held annually each December at which portfolio companies share details about ESG aspects of their business.

OCI has a corporate social responsibility programme which supports charities and youth programmes in Bermuda (where it is domiciled).

Practical examples

Oakley cites a number of practical examples of ESG in action on its website. We would highlight Contabo and IU Group.

Contabo’s three data centres are the largest contributors to its carbon emissions. It is switching its power sources for these centres to renewable energy, which should allow it to cut its scope 2 (indirect) emissions in half.

IU’s focus on online education also allows students to access its services from anywhere on the globe. It aims to make education accessible to everyone – a clear social good. IU Group offers scholarship programmes to students from vulnerable groups, supporting the Study Access Alliance programme, which aims to offer 100,000 full scholarships for online degrees at top universities to people in African countries, for example.

Cushioned from the worst of the macroeconomy

In recent years, businesses have had to cope with the effects of COVID lockdowns, supply chain issues, inflation, higher interest rates and now the possibility of recession. Oakley’s general aversion to cyclical businesses has helped cushion some of the impact.

The nature of the businesses in the portfolio – asset-light, sticky revenues, digital delivery of services – should make them more resilient in a downturn. The experience with COVID was encouraging; the underlying portfolio continued to deliver double-digit revenue growth over this period. It helps that Oakley’s businesses tend to be exploiting ‘megatrends’ that might even accelerate in a downturn. SaaS models, digital marketplaces, tools that help businesses all offer routes to cut overheads and reach a wider customer base. Education is an area of spend that parents will prioritise and vocational training offers a route for students and professionals to boost their chances in tough jobs market.

The impact on Oakley’s property portals may be more nuanced. The team believes that in many markets, sellers of property will feel that a listing on an OCI-backed portal is a must-have, certainly in preference to local advertising. In addition, many legal digital marketplaces operate in regions with lower digital penetration rates, providing a long runway for further growth.

Nevertheless, consumer-facing investments such as Alessi and North Sails may be affected by an economic slowdown and inflation pressures. On the flip side, OCI’s various price comparison websites could even be net beneficiaries as customers become more cost-conscious.

Oakley tends to buy investments using equity and refinance these over time. The average net debt/EBITDA ratio on the portfolio is about 4.3x.

The team acknowledges that a higher cost and a lower availability of debt will have an impact on its investments, but does not feel that this will be a material issue. Oakley tends to buy investments using equity and refinance these over time. The average net debt/EBITDA ratio on the portfolio is about 4.3x. These businesses are generally profitable and growing their EBITDA, so are inherently able to support higher leverage levels than more venture style investments, and leverage multiples are declining naturally.

To some extent, a slower economy and its impact on public market valuations is good news in that it reduces the price – and may even increase the availability – of bolt-on acquisitions for existing businesses. It may also help that Fund V (to which OCI committed €800m) will be deployed into more of a buyers’ market. Oakley can be nimble, picking up opportunities from failed auctions, for example. It may also consider take-private situations where listed companies look oversold.

Oakley’s main funds only buy profitable businesses.

Oakley may target stressed companies, but would not look at distressed opportunities – Oakley does not operate turnaround strategies and its main funds only buy profitable businesses. That means that venture-type investments are also excluded from the remit of its main funds.

OCI now has some small venture exposure through Oakley Capital PROfounders Fund III.

Oakley does have a venture business PROfounders Capital, which has backed over 50 companies to date. OCI has made a €30m commitment to the new Oakley Capital PROfounders Fund III, a venture capital fund focused on investments in entrepreneur-led, private businesses across Europe. This accounts for about 3% of OCI’s outstanding commitments.

As a practical example, whilst Oakley was happy to take a close look at travel companies that were being affected by COVID during 2020, it did not make a move on one. Instead, Oakley’s funds bought schools businesses, which were experiencing slower growth and pressure on fee income, but which Oakley felt would recover strongly when restrictions eased.

Oakley’s funds are the majority owner of more than 15 of OCI’s portfolio companies. This control offers greater opportunity to direct strategy, increasing the team’s ability to take decisive action when needed.

From the viewpoint of the impact on OCI’s NAV, it is worth highlighting that the biggest sell off in listed markets has occurred in low-to-zero-profits businesses, particularly in technology, which are not the sorts of companies that Oakley’s main funds are targeting. Potential buyers for their businesses are also more prepared to take a longer-term view on a company’s earnings outlook when making decisions and will be less impacted by short term volatility in public markets. The buyers for OCI’s businesses tend to be the larger private equity funds, many of which are sitting on substantial dry powder.

In its outlook statement that accompanied the announcement of its end-December 2022 NAV, the company said that its combination of disruptive business models targeting long-term megatrends, including the shift online for businesses and consumers, and global demand for quality education, is expected to continue delivering resilient trading in 2023.

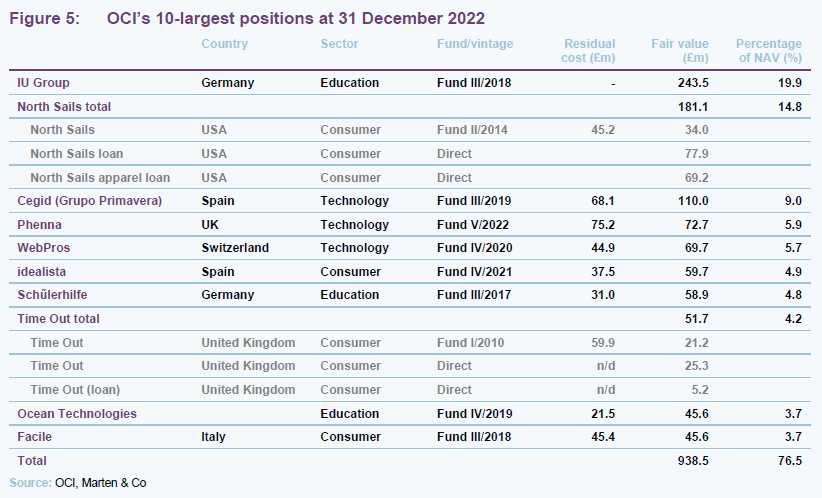

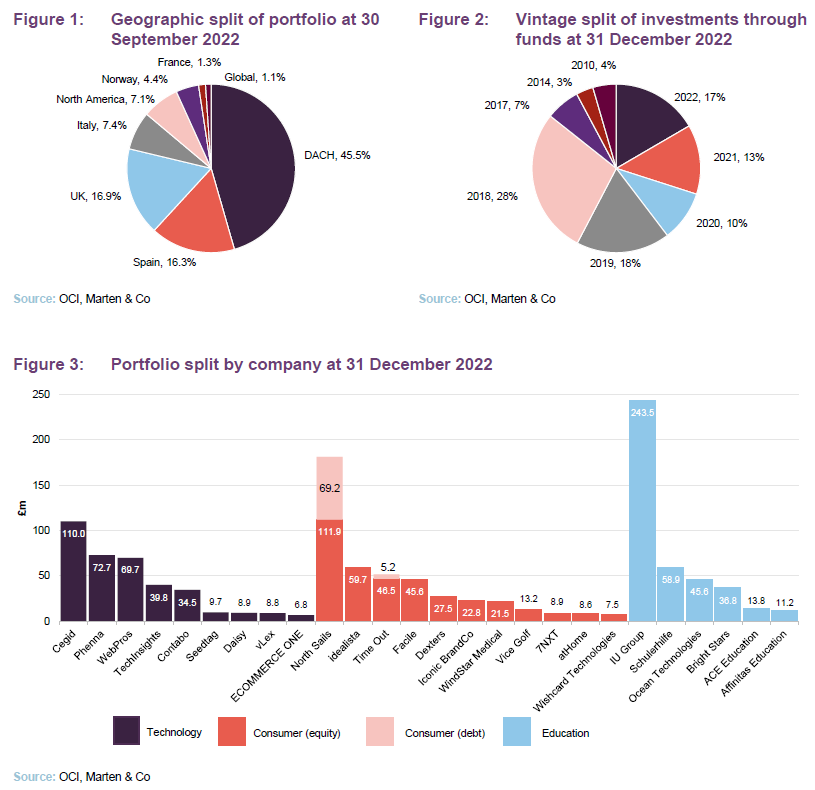

Asset allocation

With the exception of Figure 1, the charts below show the composition of OCI’s portfolio at the end of December 2022. At that date, the portfolio was valued at £1,226.3m. This included £7.5m of fund facilities. Of the remaining £1,218.8m, £152.3m related to debt provided to Time Out (£5.2m) and North Sails (£147.1m). The balance (£1,066.5m) represented equity investments in 26 companies. On a portfolio basis, the sector split was: 29.4% in technology, 33.4% in education and 36.5% in consumer.

Over the course of 2022, OCI invested £216m into new investments, including Affinitas and the reinvestment in TechInsights in Fund IV; Phenna Group & CTS, and reinvestments in Contabo and Facile in Fund V; and vLex and Vice Golf in the Origin Fund.

This was in addition to £55m of follow-on investments including increased exposure to Grupo Primavera (now part of Cegid) and Alessi in Fund III, TechInsights’ acquisition of Strategy Analytics in Fund IV, and Time Out and North Sails direct investments.

Realisations achieved in 2022 at an average 5x gross money multiple and an average premium to carrying value of about 70%.

Realisations achieved by OCI in 2022 totalled £234m, with five exits or partial exits – Contabo, TechInsights, Facile, Wishcard and Seedtag – at an average 5x gross money multiple and an average premium to carrying value of about 70%. In addition, OCI freed up £10m from the refinancings of Wishcard and idealista.

The impact of these transactions on OCI’s balance sheet and commitment profile is discussed on page 17. Each of the companies mentioned above is discussed in more detail over the following pages.

Top 10 holdings

IU Group

IU Group (iu-group.com) is Germany’s largest private university group, with over 100,000 students enrolled, and offering online, part-time and on-campus education, and vocational studies (over 15,000 corporate partners) in German and English. It has been a significant driver of OCI’s returns in recent years. Oakley stresses that IU Group has no direct listed comparator in terms of scale and focus.

Oakley acquired a majority stake in the company, then-called Career Partner Group, in November 2017 (recorded as a 2018 vintage investment in the charts above) as a carve out from Apollo Education Group. It saw an opportunity for the business to disrupt the traditional educational model, using technology to scale at relatively low cost.

IU Group wants to be the world’s largest university and is targeting significant growth, aiming to have in excess of 175,000 students enrolled in 2024, having achieved a CAGR for student intake of 63% between 2019 and 2021.

The wide range of courses offered (around 200) is responsive to student demand, affordable and more accessible to students who might struggle to get places at traditional universities. From an ESG perspective, this means that the company delivers strong social benefits; online learning helps reduce carbon emissions too.

North Sails

North Sails (northsails.com) is a US sailmaker and sailing apparel business. It sails powered the winning yacht in the 2022 Sydney Hobart race, but perhaps more impressively, they have powered every single Americas Cup winner since 1987 and will power all five entries in 2024’s race. Those credentials underpin the company’s apparel brand, which is sold online and through over 700 chain and independent retailers across Europe and Asia.

Oakley backed the business in 2014, with the aim of helping it build the apparel brand globally and has advanced loans to the business over the years since that totalled £147.1m at 31 December 2022. OCI has not disclosed the coupon on this debt or what it is secured against. Oakley has helped North Sails build its product range with the acquisition of a number of licensee companies. COVID-19 impacted the company, but sales have recovered since, with revenue growth of 13% over 2022 and an EBITDA margin of 9%, despite some supply chain issues and adverse foreign exchange movements.

Cegid

In March 2019, Fund III made an investment into Ekon, a Spanish provider of enterprise resource planning (ERP) business software. This was Oakley’s first investment in Spain. The company grew both organically and by acquisition, becoming Grupo Primavera in 2021. In July 2022, Fund III agreed to combine Grupo Primavera with Cegid, a leading provider of cloud-based management solutions. Fund III rolled over its equity into Cegid and increased its stake at that time.

The combined Cegid (cegid.com) offers a suite of SaaS solutions to over 350,000 customers in France, Iberia, and globally. Oakley says that is a European leader in enterprise management software and cloud services. In addition to finance, tax, and human resources, the company also provides industry-specific cloud solutions for retailers, accountants, manufacturers, and other service-sector professionals.

In 2022, Cegid’s consolidated revenue and EBITDA grew by 23% and 18% respectively versus the prior year. Recurring revenue and SaaS revenue accounted for 85% and 70% of total revenue, respectively.

Phenna/CTS Group

In August 2022, Fund V announced that it would invest in testing, inspection, certification, and compliance (TICC) platform Phenna Group (phennagroup.com). At the same time, Oakley bought CTS Group – a leading provider of testing, inspection and geoengineering consulting services in the UK, focused on the infrastructure market – which is being merged into Phenna.

Phenna has achieved about 100% CAGR in revenue over the last three years and (pre-CTS) now (following 10 bolt-on acquisitions since the deal was signed) comprises 37 independent businesses which provide specialist TICC services across infrastructure, built environment, niche industrial, pharmaceutical and certification and compliance divisions. For its customers, the expenditure tends to be non-discretionary. The business operates across 12 countries in four continents.

Oakley says that since acquisition, Phenna has performed well, with organic revenue and EBITDA up 14% and 9% respectively versus the prior year.

WebPros

WebPros (webpros.com) is a global SaaS hosting platform for server management, supporting 85m domains and 33m users across over 900,000 servers.

Oakley has a long history of investing in this market segment that begins with it backing Thomas Strohe and Jochen Berger, founders of Intergenia – one of Oakley’s success stories from Fund II – and now part of Oakley’s network of business founders and entrepreneurs. Intergenia was acquired by HostEurope, which later became part of GoDaddy.

Oakley then backed the team with Fund III to carve out Swiss-based Plesk from Parallels Group and later supported its purchase of cPanel, bringing together operations in Europe (Plesk) with North America (cPanel). The combined business, bolstered by further bolt-on acquisitions and a revitalised sales effort, was later renamed WebPros.

In 2019, Fund III sold its stake to CVC Fund VII, generating overall gross returns to Fund III of 6.7x MM and c.140% IRR. However, the management team were keen that Oakley remain involved. Fund IV invested $200m into the business at this stage.

In 2022, WebPros delivered revenue and EBITDA growth of 6% and 4% respectively versus the prior year. Average revenue per licence was up 15% but this was offset by a reduction in the total number of licences (which Oakley says was attributable to customer specific issues).

idealista

idealista (idealista.com) is an online property listings business with operations in Spain, Portugal and Italy. Oakley has a stake in the business through Fund IV, but it came about because in 2015, Fund III backed a management team to buy out Casa.it (the no.2 online real estate portal in Italy) and atHome.lu (the leading player in Luxembourg) from REA Group.

In 2020, EQT agreed to buy Casa.it and later sold the business on to another of its investments, idealista. As part of that deal, EQT agreed to sell a 10% stake in the combined business to Fund IV.

Oakley says that the business had a strong year of performance in 2022, with revenue and EBITDA up versus the prior year in all three of its core geographies.

Schűlerhilfe

Schülerhilfe (schuelerhilfe.de) is the leading provider of after-school tutoring across Germany and Austria. Founded in 1974, the business was acquired by Oakley in 2017 from Deutsche Beteiligungs. It serves over 125,000 students through 1,100 locations, tutoring them in small groups. Its tutoring centres were closed during COVID-related lockdowns, but the company’s recovery has been aided by a voucher scheme supported by the German government. Enrolments almost doubled in 2022 and now over 50% higher than pre-COVID levels.

Time Out

Time Out (timeout.com) is OCI’s oldest investment. Operating in seven markets and reaching an audience of 72m, Time Out offers information on events, restaurants, bars and cultural experiences. It also operates Time Out Markets, physical locations for eating, drinking, shows and events in four US cities as well as Dubai, Lisbon, Prague, Montreal, and soon Osaka, Cape Town, Vancouver, Riyadh and Barcelona.

COVID-19 hit the company hard, accelerating the demise of the print magazine, but the business is recovering. All seven markets have now reopened, with a further seven scheduled to launch over the next few years. This translated into positive Group Adjusted EBITDA over the 12 months ending 30 June 2022.

Ocean Technologies Group

Ocean Technologies Group (oceantg.com) is a global leader in the provision of online education and operational software (SaaS-based crew and fleet management) to the maritime sector. Oakley says that Ocean Technologies Group continued to perform well in 2022, with run rate revenue up 4% versus the prior year. It has been upselling higher priced packages to customers. Since 2019 – when Oakley made its investment by combining two e-learning providers to the maritime industry, Seagull and Videotel – Ocean Technologies Group has made five bolt-on acquisitions. Oakley says that new potential additions to the group are being assessed.

Facile

Facile (www.facile.it) is Italy’s leading price comparison platform We discussed Facile on page 4. Oakley first made an investment in the business in 2014. It sold a majority stake to EQT in June 2018 but retained an investment through Fund III. Then, in June 2022, Fund III agreed to sell its stake to Facile to Silver Lake. Finally, in September 2022, Fund V made an investment in the company.

Oakley says that Facile ended 2022 with revenue and EBITDA growth of 14% and 13% respectively versus the prior year. In its mortgages, gas & power and stores verticals it achieved revenue growth in excess of 40% versus the prior year.

Other portfolio developments

Affinitas Education

Affinitas Education (affinitasedu.com) funds international and bilingual private schools in Europe and the Americas, providing education to children between Kindergarten and year 12. Its first three acquisitions were in Spain and Mexico, and currently Affinitas has equity investments in nine private schools with over 9,000 students between them.

Oakley says that since it was acquired, the business has performed well. The latest quarterly financial results were 2% and 3% up on revenue and EBITDA budgets, respectively.

Contabo

Contabo (contabo.com/en) is a cloud hosting business operating over 300,000 servers on behalf of more than 150,000 customers. It was another business introduced to Oakley by Thomas Strohe and Jochen Berger (see WebPros above), in conjunction with Thomas Vollrath.

Fund IV bought a stake in the business in 2019 after a competitive sales process failed. Now, with Oakley’s backing, a couple of significant acquisitions have been completed (VSHosting in 2020 and G-Portal in 2021), and, through leveraging the expertise of the entrepreneurial investors, it is now a leading player. In June 2022, with the business firing on all cylinders, it was acquired by KKR in a competitive auction process. The management team was keen that Oakley retained some exposure and Oakley wanted to take advantage of Contabo’s future growth prospects, so Fund V bought a stake in the business as part of the transaction.

Oakley says that Contabo reported revenue and EBITDA growth of 40% and 42%, respectively, in 2022, but towards the end of the year it began to see some effects of more difficult macroeconomic conditions.

Seedtag

Seedtag (seedtag.com) is a contextual advertising platform in Europe and Latin America. Its business should benefit as advertisers look for alternatives to third-party cookies as a way of marketing to consumers. The company’s clients include blue chip brands such as Universal and Adidas, as well as agencies such as WPP and Havas. Oakley bought a minority stake in the company in September 2021.

Oakley supported Seedtag’s North American launch and its strategic acquisition of KMTX (previously Keymantics), a leading French company specialising in building AI models to optimise and automate performance marketing campaigns. In July 2022, following strong growth in the business, Seedtag had grown to a size where mainstream private equity buyers were interested; the Origin Fund agreed to sell part of its stake to Advent International.

Oakley says that Seedtag saw strong performance continue through 2022, with revenue and EBITDA growth up 61% and 33% respectively versus the prior year.

TechInsights

TechInsights (techinsights.com) is a content information platform for the semiconductor and microelectronics markets. OCI describes it as the world’s leading provider of advanced technology analysis and intellectual property services, providing content and services to the world’s most successful technology companies. Part of the plan when Oakley made its investment through Fund III in 2017 was to transition the business to a subscription-based model, and currently over 65% of its revenues are recurring.

In March 2022, Fund III sold its stake as part of a deal that saw CVC Growth Funds invest in the business and Fund IV take some exposure.

Oakley says that TechInsights grew its run rate revenues and run rate EBITDAC (EBITDA plus the effects of coronavirus) by 5% and 12% respectively, on a proforma basis. It notes that recurring revenues were 72% of total run rate revenues, up from 66% in the prior year. During Q4, TechInsights completed the acquisitions of the McClean Report and IC Knowledge (adding about $2m of revenue in aggregate).

vLex

vLex (vlex.com) is an AI-powered, cloud-based legal information subscription platform which grants subscribers access to over 120m documents (including case law, legislation, journals and dockets) from over 100 countries. It serves over 2m users and OCI says that it has consistently generated double-digit revenue growth in recent years.

Origin Fund acquired a majority stake in vLex in September 2022, in partnership with vLex founders, Lluis and Angel Faus. vLex is now looking to build its business through M&A, with one target under advanced exclusivity and three others engaged.

Oakley says that the business has been focused on growing sales, with annual recurring revenue growth at about 20% versus the prior year.

Vice Golf

Vice Golf (vicegolf.com) is an online retailer of golf balls through a direct-to-consumer model. Without the overhead of physical stores, it is able to offer premium golf balls at significantly lower price points than comparable providers.

Vice Golf was able to generate more than a 40% CAGR in revenue between FY18 and FY21, while making about a 20% EBITDA margin. In 2022, it achieved revenue and EBITDA growth of 34% and 21%, respectively.

Origin Fund took a stake in the business in May 2022 and hopes to accelerate the international growth of the business as well as supporting a diversification of its product range (golf bags and apparel are already appearing on the Vice Golf website).

Wishcard Technologies

Wishcard Technologies Group (wishcardgroup.com) is a European gifts and rewards platform, selling around 9m gift cards each year on behalf of around 500 redemption partners including Amazon, iTunes, IKEA, Zalando, and H&M. Oakley says that after tracking the business over several months, Fund IV bought a majority stake in August 2019, partnering with the founders to create a sustainable platform to continue the company’s strong growth and leadership in product innovation. In the event, under Oakley’s ownership, Wishcard more than quadrupled its revenues in under three years. Oakley expects to see ongoing 15% per annum growth in the gift card market in Germany.

In October 2022, Fund IV agreed to sell most of its stake to EMZ Partners and IK Partners, realising £37m from the transaction.

Commitments

We broke down OCI’s outstanding commitments by fund in Figure 4 on page 11. Like other listed private equity companies, OCI runs an overcommitment strategy as a way of minimising cash drag on returns. Typically, committed cash is drawn down over the first three to four years of the life of each limited partnership vehicle – the investment phase.

Typically, some money is held back to nurture the growth of the underlying companies where necessary. Some committed capital will never be drawn down.

At 31 December 2022, OCI had cash of £110m and an unused £100m revolving credit facility (see page 24).

Balanced against that were outstanding commitments to Oakley funds totalling £929m, including a €30m commitment made in December to Oakley Capital PROfounders Fund III, a venture capital fund focused on investments in entrepreneur-led, private businesses across Europe. The expectation was that, to the extent that these commitments are drawn down, that would happen over a five-year period.

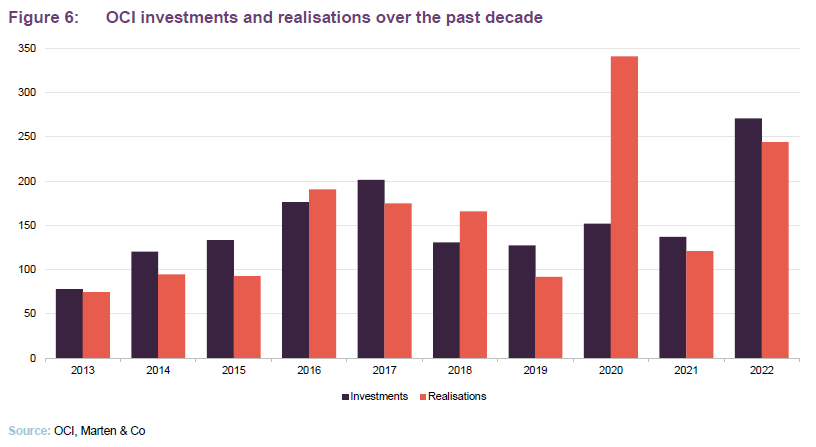

Oakley has complete control over the pace of drawdowns. As Figure 6 shows, in most years, realisations and investments are fairly evenly matched.

Oakley estimates that about £210m will be called down over the next 12 months, £519m will be called down over a one-to-five-year period, and about £200m of its current commitments may never be called.

Valuation

OCI’s underlying investments are revalued on a quarterly basis, and the board seeks to publish NAVs within about six weeks, sometimes less.

OCI takes a relatively conservative approach to valuing its investments, as is evidenced by the substantial premiums to previous valuations that buyers are prepared to pay for them. For example, over the course of 2022, five exits – Contabo, TechInsights, Facile, Wishcard and Seedtag (partial exit) – were achieved at an average premium to carrying value of about 70%.

Typically, in the first year of ownership, the value stays at cost. There is a clear logic to this in that all parties have just been through a significant price discovery process. Nevertheless, valuations will be written down where appropriate.

Thereafter, valuations are informed by comparisons with similar businesses and incorporate information around trading and earnings performance. Earnings multiples also reflect the quality of the business and the maturity of Oakley’s investment plan. By year three or four of an investment, the likely exit route is clearer.

Oakley points out that, contrary to popular belief, private equity houses are in no way incentivised to mark up valuations. Unrealised gains have no impact on its management fee and performance fees are only earned on realised returns.

Prices derived from subsequent investments into portfolio companies may be reflected in valuations, but only to the extent that the transaction involves a third-party investor. This applies to assets that are sold from one Fund to another. Oakley maintains different deal teams within the different funds and holds separate investment committee meetings to review deals. Recent reinvestments have followed a rigorous auction process which helps ensure competitive price discovery as well as identifying the optimal new investor, often a larger private equity firm (see page 6 re Oakley acting as a ‘bridge’) that brings capital but also particular sectoral and/or geographic expertise.

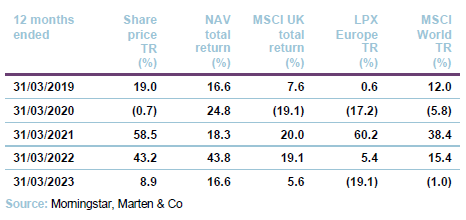

Performance

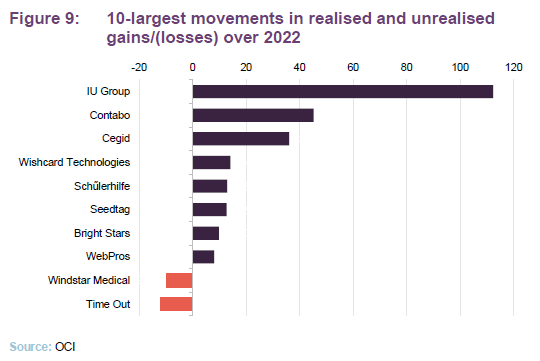

OCI’s impressive long-term track record was boosted by a year of significant outperformance of comparative indices and peers in 2022. Over the course of 2022, OCI’s NAV grew by 24% or 128p per share. OCI says that 65% of the increase was driven by EBITDA growth, and 35% as a result of multiple expansions driven primarily by exits.

Figure 8 also compares OCI with the MSCI UK index, which we have used as a proxy for the All-Share, OCI’s peer group (which is defined below), LPX Europe (which is an index of the share prices of European – including UK – listed private equity companies) and the MSCI World Index. In NAV terms, OCI outperforms everything except over the very short term. In share price terms, OCI’s returns are also ahead of indices and peers over most time periods.

In its annual report, Oakley says that the largest contributions came from the growth achieved by IU Group (as discussed on page 12), the uplift in the value of Contabo as its sale was agreed in June at a 105% premium to its carrying value, and an uplift in the value of Grupo Primavera, following its combination with Cegid.

Peer group

Up to date information on OCI and its peers is available on the QuotedData website.

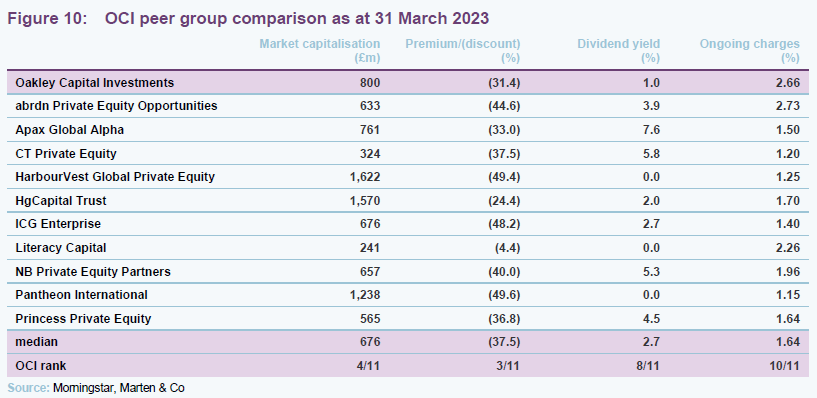

For the purposes of this note, we have constructed a peer group composed of the constituents of the AIC’s private equity peer group, excluding those with a market capitalisation of less than £50m. Hg Capital’s portfolio is heavily skewed towards technology, which creates an overlap with OCI. It could be perceived as its closest comparator although we also see some similarities between OCI and Apax Global Alpha.

OCI is a decent size, and its discount is one of the lowest of this peer group, but still wider than we think it deserves. In market capitalisation and discount terms, OCI ranks around the midpoint of this group. We believe that the two highest-ranked funds in discount terms are perceived as amongst the best-performing in the sector. HgCapital’s recent performance runs contrary to this, however. We believe that OCI deserves to be re-rated given its strong track record.

Back in January 2017, OCI upset many market participants (us included) by issuing shares at a discount. The board recognises that this was an error on its part and since 2017 has striven to improve OCI’s corporate governance. We feel that this should no longer be a factor in OCI’s rating relative to peers.

OCI’s ongoing charges ratio ranks as the second-most expensive compared to the rest of its peers. However, its returns are stated post-fees.

Dividend

OCI operates with a bi-annual dividend policy. In theory, the level of the distribution is based around the forecasted profitability and underlying performance of OCI. However, since its 2017 financial year, OCI has paid two dividends of 2.25p per share, and has done so for every subsequent financial year. Based on the 4.5p per annum dividend OCI has a yield currently of about 1.0%. The static and arguably low level of OCI’s dividend is a reflection of the board’s preference for share buy-backs as a method of returning capital to shareholders. We think this makes sense while OCI, along with many of its peers, continues to trade at marked discounts.

Though not all of the 16 private equity trusts in the AIC private equity peer group pay a dividend, of the 12 that do, OCI has the lowest yield. Whilst OCI’s c.1% yield may not be particularly attractive to income-focused investors, some investors prefer it to a strategy of manufacturing higher dividends by paying them out of capital.

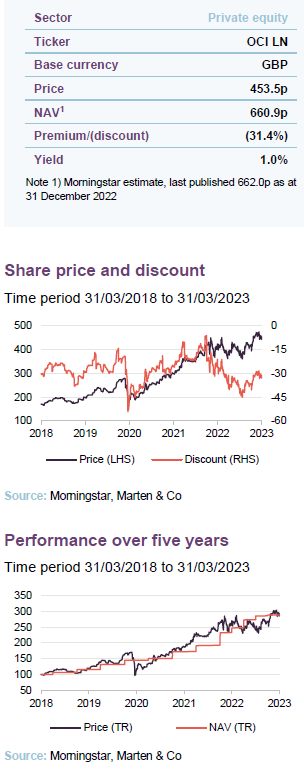

Premium/discount

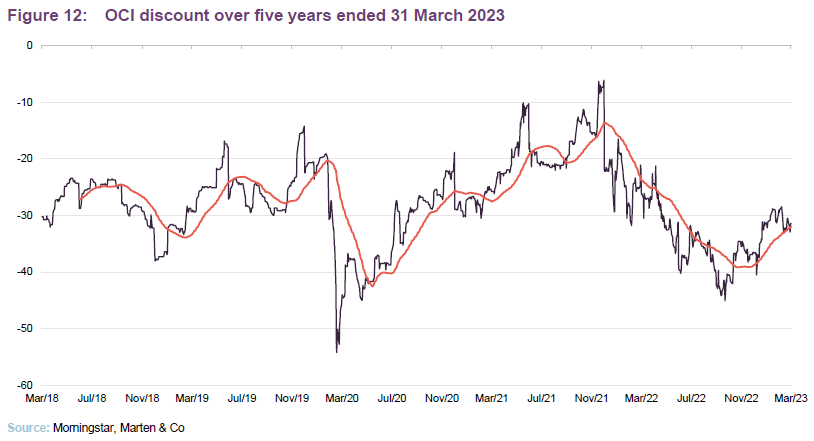

OCI has consistently traded on a discount over the last five years. Over the 12 months ended 31 March 2023, the discount ranged between 45.1% and 21.3% and averaged 34.2%. At 3 April 2023, the discount was 31.4%.

Whilst OCI has traded on a sustained discount since 2010, this is a trait which is not unique to OCI. Its closest peers have on average traded at a discount over the whole period since OCI launched in August 2007. A number of reasons have been put forward for this, including the lack of liquidity within the underlying portfolio, uncertainty over the true levels of NAVs, and concerns about overcommitment policies.

In the adviser’s view, OCI’s discount is the least compelling reason to buy the trust. Discounts across the private equity sector appear to have become entrenched. However, ultimately, OCI’s NAV growth drives the share price. OCI does repurchase shares, to the benefit of the NAV, but Oakley feels that it has much more control over OCI’s underlying asset growth than its share price. At best, there is substantial upside if the discount closes, which may happen if OCI’s current run of strong performance increases the gap between its returns and those of funds investing in listed equities.

The adviser cautions that investors expecting a direct read across from moves in public markets on OCI’s NAV should remember that its portfolio is not representative of the public market.

The board may authorise share repurchases where it feels there is an obvious imbalance in the supply and demand for OCI’s shares, to increase the NAV, and/or to assist in maintaining a narrow discount. OCI bought back and cancelled 2.2m shares over the course of 2022 at an average price of 407p. This added about 2p per share to the NAV.

Should it prove necessary, by a special resolution passed at the September 2022 AGM, the directors were authorised to issue shares and/or sell shares from treasury for cash on a non-pre-emptive basis, provided that such authority shall be limited to the issue and/or sale of shares of up to 5% of the issued share capital as at the date of that meeting.

Fees and costs

Oakley is OCI’s investment adviser, operational services provider and administrative agent. It charges fees on the underlying funds which we believe are 2% of committed capital plus a 20% performance fee on realised gains over an 8% hurdle.

Oakley, acting as the administration agent, may charge an advisory fee of up to 2% of the value of any direct equity investments made by OCI. Such advisory fees would be negotiated on a case-by-case basis between OCI and Oakley. No such fees were negotiated in 2021 or 2020.

For the year ending 2022, OCI reported an ongoing charges fee (OCF) of 2.66% (up from 2.22% for FY 2021).

OCI’s 2022 OCF reflects fees charged to the underlying funds by Oakley as well as other operating expenses incurred by the trust. In most instances, OCI’s relationships with key third-party service providers are managed by Oakley’s employees on OCI’s behalf. The management engagement committee and the board oversee the performance of providers of legal, financial advisory, brokerage, communications and administration services.

Oakley recharges OCI for services such as compliance, accounting and investor relations. For the year ended 31 December 2022, the amount recharged was £2,808,000 (FY2021: £1,556,000).

Capital structure and governance

OCI is a self-managed AIF. OCI’s investment decisions are taken by the board in light of recommendations made by the investment adviser. However, the board has no role in the management of Oakley’s funds.

OCI has 176,418,438 ordinary shares outstanding and no other classes of share capital.

The company’s financial year end is 31 December and AGMs are held in September. OCI also holds an annual capital markets day each May, at which investors can receive presentations from senior members of Oakley and selected management teams of portfolio companies.

Gearing

OCI has no outstanding borrowings. It has the power to borrow money in any manner, but the directors have stated that they do not intend to borrow more than 25% of the net asset value of the company determined at the time of drawdown.

On 24 June 2022, OCI entered a £100m multicurrency revolving credit facility agreement with a consortium of lenders. The facility has a term of 12 months with the option for all parties to agree to extend for a further 12 months. The facility remains undrawn.

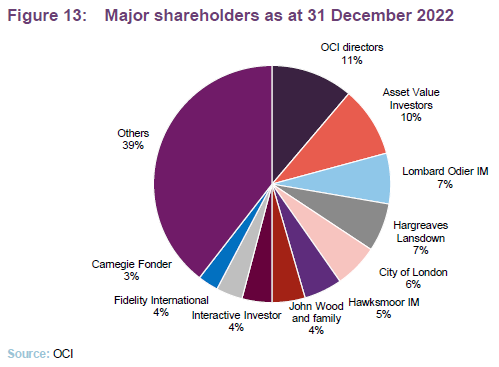

Major shareholders

The OCI directors increased their percentage stake in the company from 10.8% to 11.2% over 2022. The company notes that the aggregate voting rights of the top ten shareholders have fallen from 70% in 2019 to 60% in 2022.

Management team

Oakley has over 150 employees, 47 of whom are members of Oakley’s investment team. As a demonstration of the alignment between Oakley Capital and OCI, around 12% of OCI’s outstanding shares are owned by Oakley employees and board members.

Oakley Capital was founded by Peter Dubens (who is also an OCI board member) and David Till in 2007.

Peter Dubens

Peter is Oakley’s managing partner and was appointed to OCI’s board at launch in July 2007. He founded Oakley in 2002 to be a best-of-breed, entrepreneurially-driven UK investment house, creating an ecosystem to support the companies in which it invests, whether they are early-stage companies or established businesses.

David Till serves as an alternate director to Peter on OCI’s board.

David Till

David was Oakley’s co-founder. He has overall responsibility for its operations, finance, due diligence, compliance and fund formation.

David worked with Peter Dubens on the development of 365 Media Group Plc and Pipex Communications Plc where he led all the 26 acquisitions and disposals between 2002 and 2007.

David holds a BA (Hons) in Economics from Essex University. He started his career in the British Army, then later qualified as a chartered accountant with Coopers & Lybrand and worked in industry as a finance director, before returning to the profession holding senior M&A roles.

Partners

Oakley’s 11 partners have worked with the firm for an average of 6.8 years and, on average have more than 20 years’ relevant experience. In addition, Vicente Castellano acts as an operating partner, leveraging his experience in managing, developing and co-ordinating global leading retail brands, and working closely with North Sails Apparel and the Iconic BrandCo (Alessi).

Steven Tredget, who has worked for Oakley since 2017, is the partner with a focus on fund raising, communications and investor relations for Oakley and its portfolio companies.

The newest addition to the partner team is Jan Woods, who brings 32 years’ experience of helping businesses develop and execute impactful HR strategies.

More information on Oakley’s team is available on its website.

Board

Currently, the board has five directors, four of whom are non-executive and considered by the board to be independent of the investment adviser. Peter Dubens is a shareholder and a director of a number of the Oakley Group entities and cannot vote on any board decision relating to these entities. We note that Stewart Porter was an employee of Oakley until 2018, and while he is considered to be independent by the board, he does not sit on the audit, risk, management engagement or remuneration committees.

With the exception of Peter Dubens, who receives no renumeration for his role, the directors are paid a fixed fee subject to a minimum shareholding requirement, which should represent a minimum of one year’s worth of renumeration.

The annual fees for non-executive directors who served in the period from 1 January 2022 to 31 December 2022 were reviewed in November 2022 and any change was applied retroactively from 31 March 2022. Directors are paid fixed fees in US dollars. An additional fee is paid to the chair of the board and to the audit committee chair (as premium in recognition of extra workload and responsibility, in line with market practices). The total amount of remuneration paid by the company to its directors during the year ended 31 December 2022 was £473,000 (2021: £370,000).

Caroline Foulger

Caroline is an independent non-executive director who was appointed to the board in June 2016 (and as chair in September 2018), and has been an independent non-executive director in the financial services industry since 2013. She was previously a partner with PwC for 12 years, primarily leading the insurance practice in Bermuda and servicing listed clients, with 25 years’ experience in public accounting. Caroline is a Fellow of the Institute of Chartered Accountants in England and Wales, a member of CPA Bermuda and a member of the Institute of Directors. Caroline is a resident of Bermuda.

Peter Dubens

(see above).

Richard Lightowler

Richard is an independent non-executive director who was appointed to the board in December 2019, He has 25 years’ experience in public accounting, having been previously a partner with KPMG in Bermuda and was head of the KPMG Insurance Group in Bermuda for almost 14 years until retiring from the firm in 2016. Richard was a member of the firm’s Global Insurance Leadership Team and global lead partner for large international insurance groups listed on the New York and London Stock Exchanges. He is a resident of Bermuda and is a Chartered Accountant in England and Wales.

Fiona Beck

Fiona is an independent non-executive director who was appointed to the board in September 2020. She has over 20 years’ leadership experience in listed and unlisted companies within the technology, telecoms, infrastructure and fintech sectors. Previously, she was CEO of Southern Cross Cable Networks, a multinational telecommunications company, for 14 years. She holds a Bachelor’s degree in Management Studies (Honours), is a Chartered Accountant (Australia and NZ) and is a member of the Institute of Directors (both UK and Australia). Fiona is a resident of Bermuda.

Stewart Porter

Stewart was appointed to the board in September 2018. He has over 40 years of operational experience, both within private equity and technology businesses, the latter being one of Oakley’s three core sectors for investment. Stewart worked as chief operating officer of Oakley from 2010 until his retirement in 2018. During his career, he has held positions as COO and CFO at Wilkinson Sword and TI Group. He was a founder and CFO of Pipex Communications Plc and was instrumental in the development and successful sale of the Pipex Group.

Legal

This marketing communication has been prepared for Oakley Capital Investments Limited by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this not.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.