Silent revolution Vietnam Holding (VNH) has quietly undergone a major overhaul during the last two years, making it more shareholder-friendly and putting it on a stronger footing (see pages 4 and 5 in the PDF version). However, in a world that is increasingly conscious of corporate responsibilities, it is VNH’s strongly-held environmental, social and corporate […]

Table of contents Tyking over…nicely Data summary Investment summary Company profile: Virtual development TYK2 – autoimmune disease SRA737 development affected by Sierra’s strategic change Investment thesis – valuation Stock catalysts Investment sensitivities Management & shareholders Financials Appendix – JAK licensing deals Previous publications The legal bit Tyking over… nicely Sareum’s investment case centres on the […]

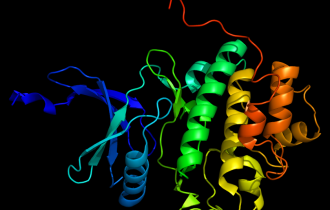

Tyking over… nicely Sareum’s core investment proposition is focused on the development and potential out-licensing of its two internal, preclinical-stage TYK2/JAK1 inhibitors, which are proceeding towards IND filings in 2020. Development of the Sareum-originated Chk1 inhibitor, SRA737, is, however, likely to enter a state of abeyance, while partner Sierra Oncology attempts to secure a sub-licensing […]

Real Estate Roundup Performance data November’s biggest movers in price terms are shown in the chart below. November saw a host of companies report interim and full year results with varying outcomes. CLS Holdings, which owns a diverse portfolio split between the UK, Germany and France, gave a positive trading update that outlined its capital […]

Economic & Political Roundup Kindly sponsored by Polar Capital and Allianz A collation of recent insights on markets and economies taken from the comments made by chairmen and investment managers of investment companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you […]

Investment Companies Roundup Kindly sponsored by Baillie Gifford Table of contents New research In this issue Performance data Discounts and premiums Money in and out Income Events New research Here is a list of research we published over November: An initiation note on Henderson High Income “We have initiated coverage on Henderson High Income (HHI). Since […]

Macro driven market is creating opportunities Fran Radano, the manager of North American Income Trust (NAIT), comments that the US market has been very macro-driven this year, frequently outweighing company fundamentals. Whilst it can be challenging to trade through such environments, increased market volatility creates opportunities for investors who are able to look through the […]

Macro driven market is creating opportunities Fran Radano, the manager of North American Income Trust (NAIT), comments that the US market has been very highly driven by macroeconomic sentiment this year, with the effects of this frequently outweighing company fundamentals. He notes that, whilst it can be challenging to trade through such environments, increased market […]

Soft landing likely… …but caution is required. The managers of Henderson Diversified Income (HDIV) stuck to their guns in the face of a consensus view of rising interest rates and inflation. This stance, and their focus on high-quality credits, has been rewarded in 2019, as central banks around the world have cut interest rates to […]

Soft landing likely… …but caution is required. The managers of Henderson Diversified Income (HDIV) stuck to their guns in the face of a consensus view of rising rates and inflation. This stance, and their focus on high-quality credits, has been rewarded in 2019, as central banks around the world have cut rates to tackle a […]

The trust that delivers Henderson High Income Trust (HHI) launched in November 1989, with an objective of generating a high income from a portfolio consisting primarily of UK equities complemented by a modest weighting in fixed interest investments to enhance income. Investors might have been forgiven for thinking that the second half of the objective, […]

The trust that delivers Henderson High Income Trust (HHI) launched in November 1989, with an objective of generating a high income from a portfolio consisting primarily of UK equities complemented by a modest weighting in fixed interest investments that have been used to enhance income. Investors might have been forgiven for thinking that the second […]

Supply deficit unsustainable 2018 saw a strong recovery in the uranium price. This has stalled this year, but with the uranium market now in supply deficit, Geiger Counter’s (GCL’s) managers see the potential for a resurgence in the price as more reactors come online (particularly in China and India), while major producers hold off from […]

Supply deficit unsustainable 2018 saw a strong recovery in the uranium price. This has stalled this year, but with the uranium market now seeing more demand than supply, Geiger Counter’s (GCL’s) managers see the potential for a resurgence in the uranium price, as more nuclear reactors come online (particularly in China and India), while major […]

Significant latent value? Aberdeen Frontier Markets (AFMC)’s manager has been re-positioning the portfolio by reducing exposure to Sub-Saharan Africa, adding companies in new markets and re-introducing the momentum factor. There is a now a greater tilt to the Asia Pacific region, where Vietnam accounts for over a quarter of the portfolio. AFMC holds a concentrated […]

Significant latent value? Aberdeen Frontier Markets (AFMC)’s manager has been re-positioning the portfolio by reducing exposure to Sub-Saharan Africa, adding companies in new markets and looking to capture more of the momentum in markets. There is a now a greater tilt to the Asia Pacific region, where Vietnam accounts for over a quarter of the […]

Real Estate Roundup Performance data October’s biggest movers in price terms are shown in the chart below. For the second month running, Capital & Regional topped the list for share price growth: up 30.5% in the month – admittedly off a low base. The shopping centre landlord’s shares continued to rise after it agreed a […]

Investment Companies Roundup Kindly sponsored by Baillie Gifford New research Over October, we published notes on Pacific Horizon, Seneca Global Income & Growth, Premier Global Infrastructure, Polar Capital Global Financials, Ecofin Global Utilities and Infrastructure, Aberdeen Standard European Logistics Income and Herald. Additionally, as part of our enhanced coverage of the property sector, we launched […]

2018 re-calibration paying off Moves by Pacific Horizon’s (PHI) manager Ewan Markson-Brown to re-position the portfolio by lowering its allocation to technology stocks, and excellent returns to-date from stock picks made in 2018, are paying off. PHI is the best-performing Asia Pacific fund in net asset value (NAV) terms over the year-to-date. Following a poor […]

2018 re-calibration paying off Moves by Pacific Horizon’s (PHI) manager Ewan Markson-Brown to re-position the portfolio by lowering the allocation to technology, and excellent returns to-date from stock picks made in 2018, are paying off. PHI is the best-performing Asia Pacific fund in net asset value (NAV) terms over the year-to-date. Coming off a poor […]

Pausing on equity reductions Over the last couple of years, Seneca Investment Managers (Seneca IM), the manager of Seneca Global Income & Growth Trust (SIGT), has been reducing the trust’s equity weighting, in advance of a global recession that it now expects in 2021. Consistent with this view, the manager has increased SIGT’s weighting to […]

Pausing on equity reductions Over the last couple of years, Seneca Investment Managers (Seneca IM), the manager of Seneca Global Income & Growth Trust (SIGT), has been reducing the trust’s equity weighting, in advance of a global recession that it now expects in 2021. Consistent with this view, the manager has increased SIGT’s weighting to […]

Strong income growth Aided by the significant gearing provided by its ZDP shares, Premier Global Infrastructure Trust’s (PGIT’s) ordinary shares have provided an NAV total return of 34.4% during the last 12 months. The returns have been achieved despite PGIT having a significant allocation to Asia, and particularly China, which has faced a headwind from […]

Strong income growth Premier Global Infrastructure Trust’s (PGIT’s) ordinary shares have provided an NAV total return of 34.4% during the last 12 months, boosted by the trust’s split capital structure (see page 13). The returns have been achieved despite PGIT having a significant allocation to Asia, and particularly China, which has faced a headwind from […]

Banks too cheap to ignore US rate cuts and a slowing global economy have overshadowed the financials sector and banks in particular so far this year. With banks trading close to multi-year lows, Polar Capital Global Financial (PCFT)’s managers have been adding to positions in their favoured stocks. The managers believe that banks boast far […]

Banks too cheap to ignore? US interest rate cuts and a slowing global economy have overshadowed the financials sector and banks in particular so far this year. With banks trading close to multi-year lows, Polar Capital Global Financial (PCFT)’s managers have been adding to positions in their favoured stocks. The managers believe that banks boast […]

Compelling three-year track record Ecofin Global Utilities and Infrastructure Trust (EGL) has just had its third birthday, and it has much to celebrate. Since launch, the trust has built a compelling track record (NAV and share price total returns of 44.9% and 50.8% respectively) while outperforming a range of comparable indices, including MSCI World Utilities, […]

Compelling three-year track record Ecofin Global Utilities and Infrastructure Trust (EGL) has just had its third birthday, and it has much to celebrate. Since launch, the trust has built a compelling track record (NAV and share price total returns of 44.9% and 50.8% respectively) outperforming the MSCI World Utilities, S&P Global Infrastructure, MSCI World and […]

Investment Companies Quarterly Roundup Kindly sponsored by Baillie Gifford New research Over the third quarter, we published notes on India Capital Growth, Jupiter Emerging & Frontier Income, Montanaro European Smaller Companies, JLEN Environmental Assets, Civitas Social Housing, JPMorgan Russian Securities, International Biotechnology Trust, Aberdeen Emerging Markets, Seneca Global Income & Growth, Standard Life Investments Property Income […]