Polar Capital Global Financials Trust

Investment companies | Annual overview | 30 November 2022

Don’t fear the dog that is yet to bark

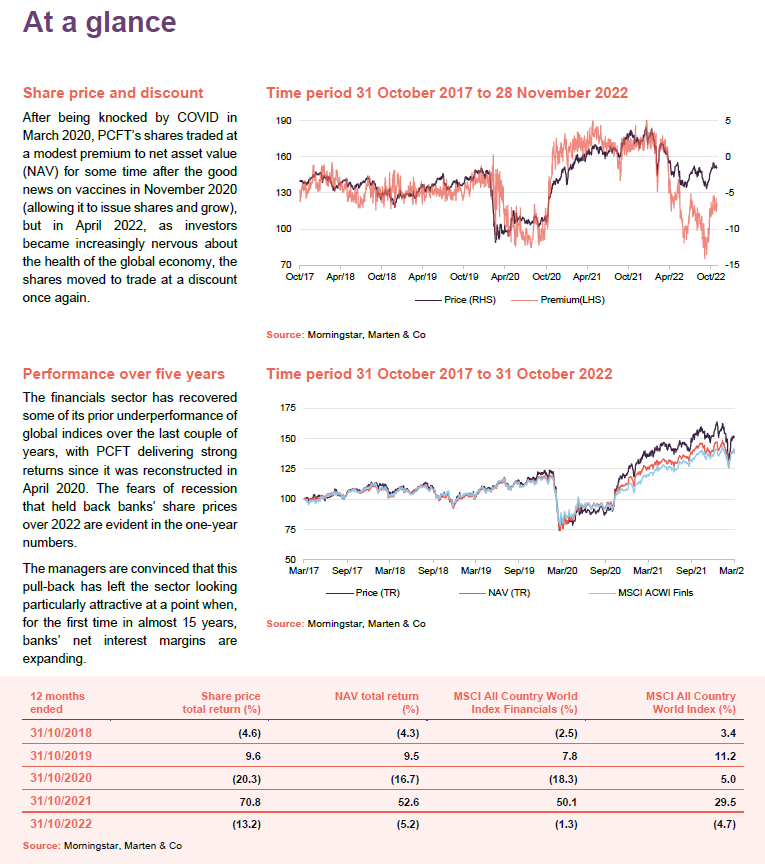

There has been a distinct shift in sentiment towards financials stocks and Polar Capital Global Financials Trust (PCFT) since Spring 2022. As fears of economic recession grew, initial enthusiasm about the positive effects of rising interest rates on banks’ profit margins gave way to concern about the prospect of higher loan defaults. However, these have not materialised, and PCFT’s managers think it is likely that they will not.

As we discuss on page 7, they feel that the sector’s sell-off is overdone, banks’ valuations are more than pricing in a worst-case scenario, and the strong balance sheets and cautious lending practices adopted by banks in the wake of the financial crisis will cushion the economic blow.

In addition, there are positive developments in areas such as insurance and reinsurance, and new opportunities to acquire fixed interest stocks on attractive yields, all of which bode well for PCFT’s future.

Growing income and capital from financials stocks

PCFT aims to generate a growing dividend income, together with capital appreciation. It invests primarily in a global portfolio, consisting of listed or quoted securities issued by companies in the financial sector. This includes banks, life and non-life insurance companies, asset managers, stock exchanges, speciality lenders and fintech companies, as well as property and other related sub-sectors.

Fund profile

PCFT looks to grow investors’ income and their capital. More information on the trust is available on its website www.polarcapitalglobalfinancialstrust.com.

Polar Capital Global Financials Trust (PCFT) has twin objectives of growing both investors’ income and their capital. Its global mandate makes it a useful alternative for UK-based investors looking to diversify their financials exposure.

PCFT launched on 1 July 2013 with a fixed life. In April 2020, in conjunction with a vote on prolonging the life of the trust, shareholders were offered a cash exit. Holders of 39.1% of PCFT’s then-issued share capital opted to sell their shares. The portfolio was reconstructed to facilitate this. Shareholders overwhelmingly approved an extension of the trust’s life beyond May 2020 and the trust now has an unlimited life, but with five-yearly tender offers, the first of which is scheduled for 2025.

Predominantly, the portfolio is invested in listed/quoted securities. The trust may have some exposure to unlisted/unquoted securities, but this is not expected to exceed 10% of total assets at the time of investment.

Benchmarked against MSCI ACWI Financials.

Since April 2020, the trust’s performance benchmark has been the MSCI All-Countries World Financials Net Total Return Index in sterling (MSCI ACWI Financials). A history of earlier benchmarks is given in previous notes. We have used MSCI ACWI Financials for comparison purposes in this note.

PCFT’s AIFM is Polar Capital LLP, which had assets under management (AUM) of £18.8bn at 30 September 2022 and employs 15 investment teams, spread across offices in Europe, the US and Asia.

PCFT’s lead managers are Nick Brind, John Yakas and George Barrow.

Market backdrop – recession fears

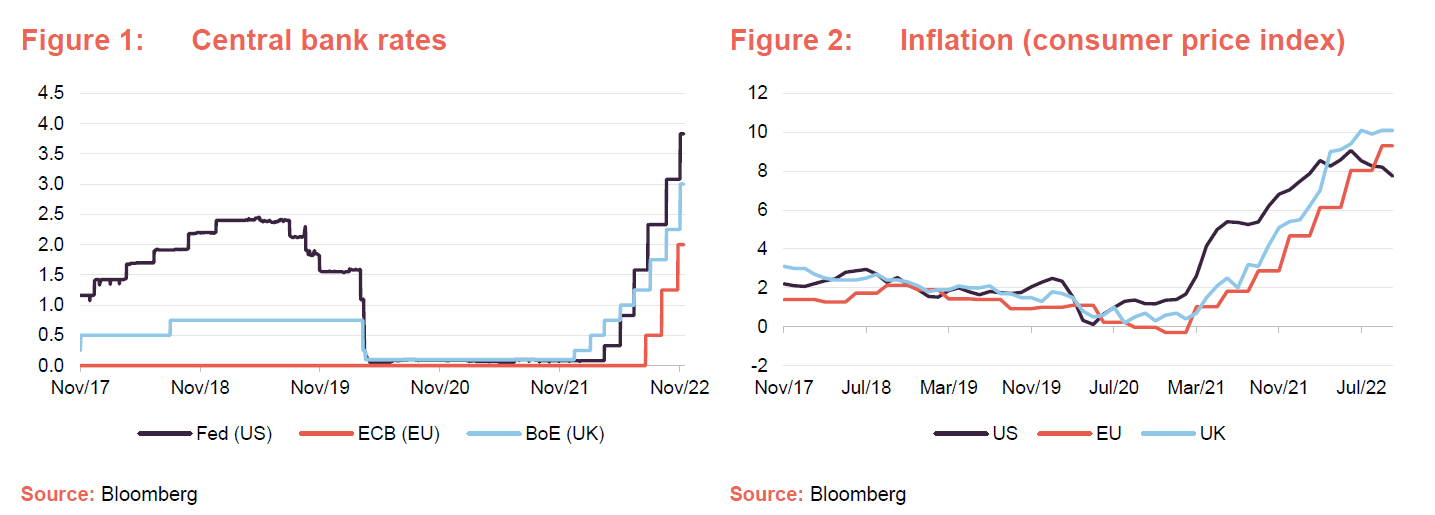

Russia’s invasion of Ukraine amplified and extended pre-existing inflationary pressures in the global economy. Central banks have raised interest rates fairly aggressively year to date (as shown in Figure 1, which charts official interest rates from the US Federal Reserve, European Central Bank and the Bank of England), but a recent softening of US inflation has raised hopes of more gradual monetary tightening in that market at least.

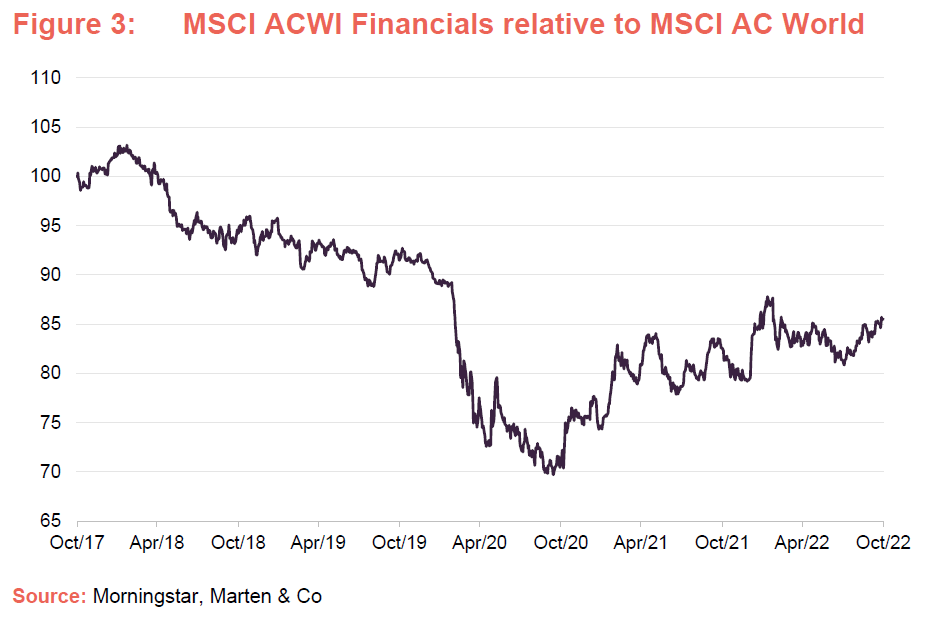

The sector has outperformed over 2022, as Figure 3 shows, but there is a long way to go to recover the ground that it has lost over the longer-term.

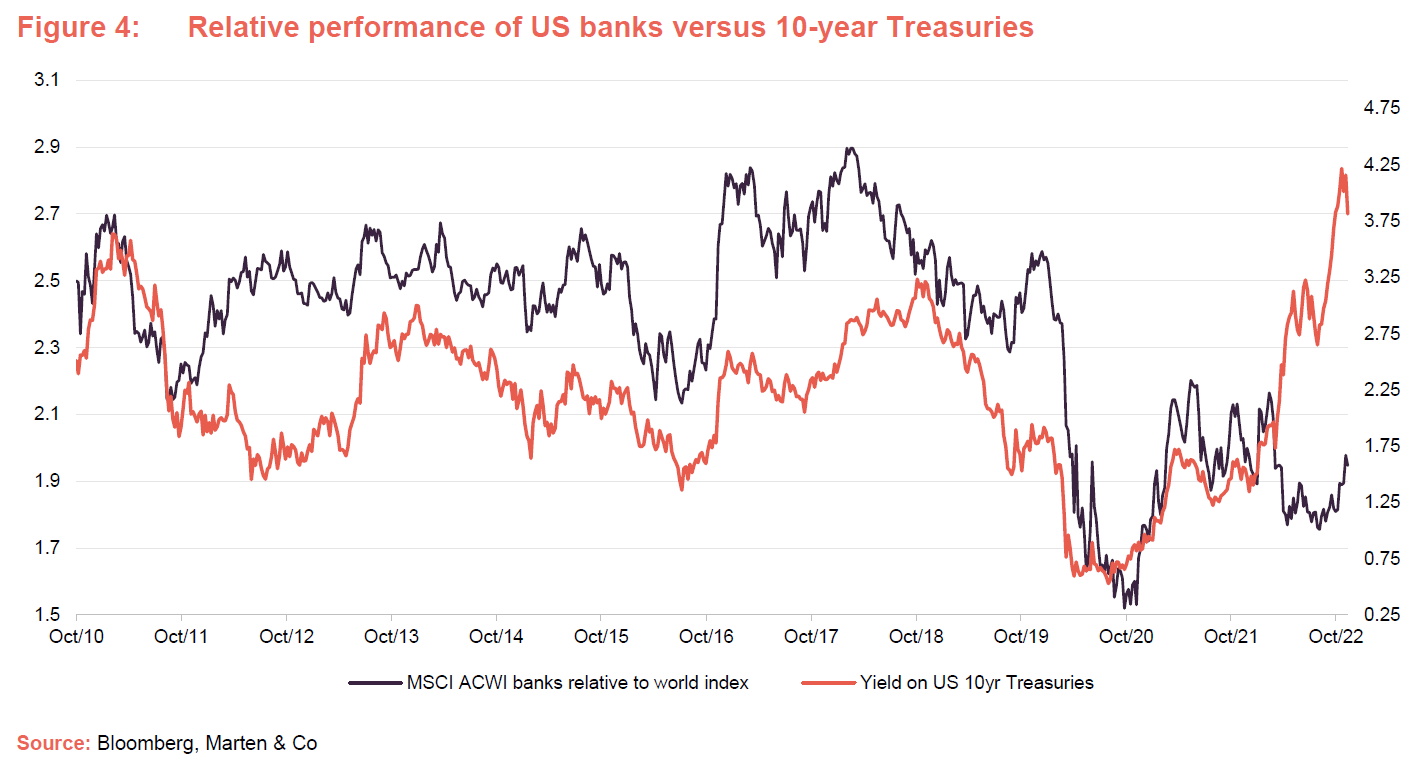

Banks are benefitting from interest rate rises, which leads to widening margins on the deposit side of their balance sheets (as they do not pass all of this onto customers), but this is not yet reflected in valuations. Figure 4 demonstrates good correlation between bank valuations and government bond yields. However, over the last couple of quarters this has broken down, which might suggest that banks’ share prices should be playing catch up.

Investors are concerned about rising debt defaults and loan losses, but this is the dog that is yet to bark.

Banks have sold off in anticipation of a more challenging economic environment and this has held back the financial sector’s returns. This is despite good earnings figures from the banks. Investors are concerned about rising debt defaults and loan losses, but as the managers say, this is the dog that is yet to bark. The managers comment that, on current valuations, banks are not only discounting a deep downturn but one in which profitability remains depressed into perpetuity. In their estimation, the risk/reward opportunity presented by current bank valuations is, on any reasonable timeframe, very much one favouring buyers.

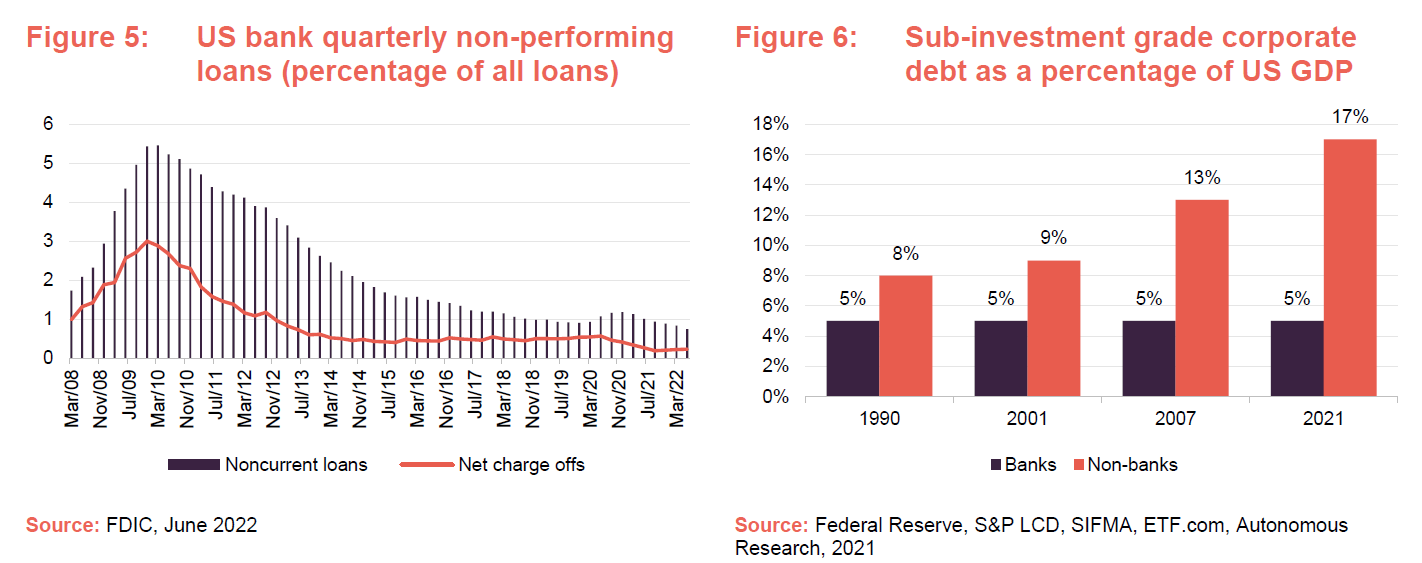

There are, as we have highlighted in previous notes, good reasons why the banks should be less affected than they were in the global financial crisis. For the most part, they have been disciplined about their lending. The non-bank financial sector has been taking on risk instead as is clear from Figures 5 (which shows that problematic loans are nowhere near the levels of the global financial crisis) and 6 (which shows that non-banks are responsible for the growth in lending to riskier borrowers).

The managers note that savings built up during the pandemic (boosted by government hand-outs) are still cushioning the impact of the slowdown. This may have delayed the emergence of defaults.

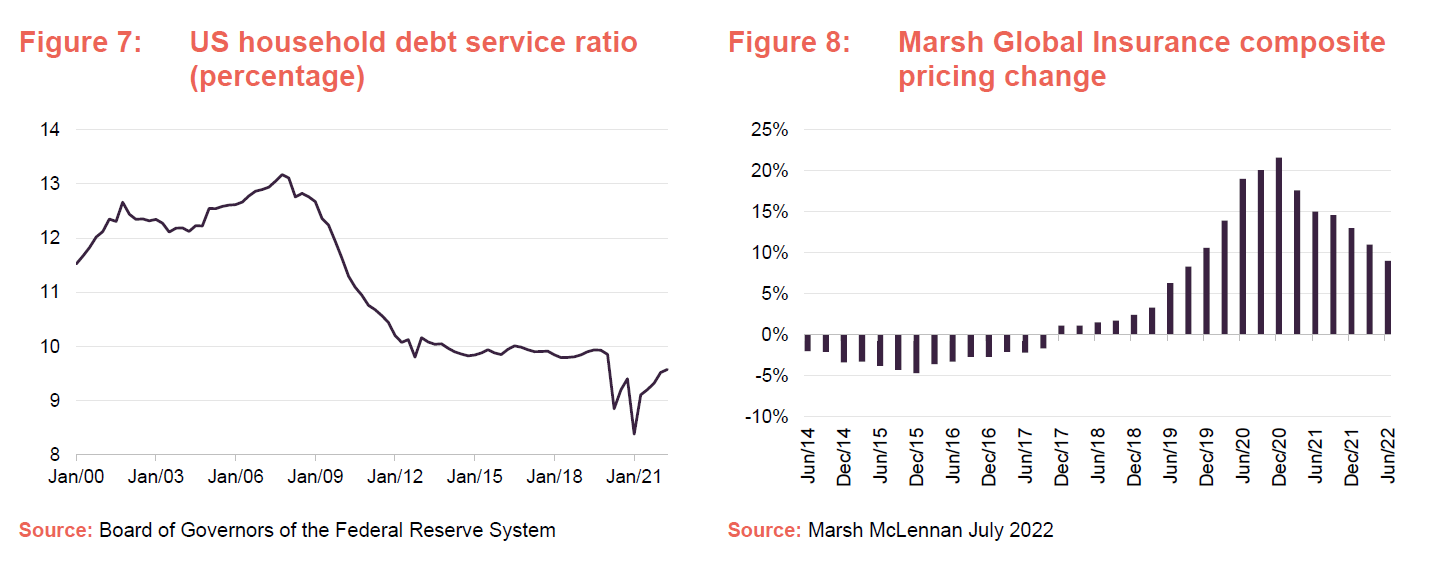

Figure 7 (overleaf) charts the US household debt service ratio – how much of total disposable income is given over to paying interest and repaying debt as it falls due.

Evidence from the 1970s suggests that in periods of persistent high inflation, corporates make increasing use of bank borrowing.

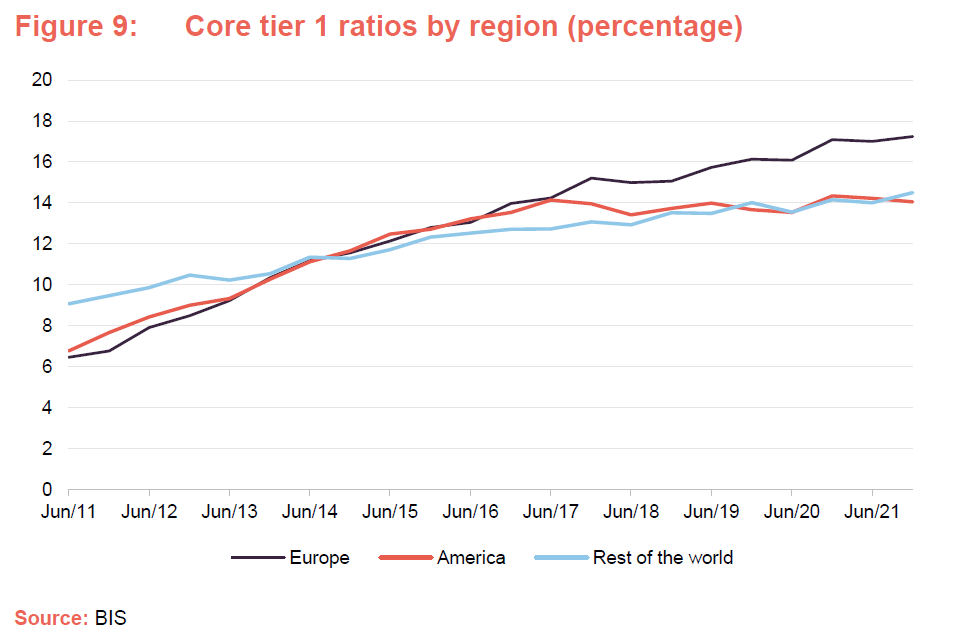

The managers also highlight that evidence from the 1970s suggests that in periods of persistent high inflation, corporates make increasing use of bank borrowing as non-bank lenders withdraw from the market. Reduced competition allows banks to build loan books at attractive margins. It helps that bank’s balance sheets are in reasonably good shape, as Figure 9 shows.

Banks have been building their reserves. 95% of the loss reserves set aside for COVID were later written back. That COVID buffer is now being replaced by a cost-of-living impact buffer. However, as we enter recession, banks’ balance sheets are about as strong as they have been at any time over the past decade. In a recent article, the managers noted that banks’ exposure to residential and commercial real estate is at much lower loans-to-value ratios than in 2008 or 1990, in part driven by regulation, and that their exposure to riskier areas such as real estate development loans, construction or energy loans is similarly much lower.

Elsewhere in the sector, insurers are continuing to see premiums increase (see Figure 8 above). The managers say that in the US, commercial insurance rates are rising faster than domestic insurance rates.

Reinsurance rates bottomed in 2017. After four years of losses, capacity has come out of the market, and the managers feel that it is reasonable to expect that rates will rise from here. Retrocession capacity has also shrunk. There continues to be some unhelpful inflation in court awards (for insured damages) and the war in Ukraine has also had an impact.

Diversified financials have underperformed, mainly as falling markets reduce AUM for both platforms and asset managers. The managers say that platforms are now trading on more sensible multiples and look more attractive. Exchanges have held up well, but information services companies have been hit by lower bond issuance and weak markets.

Markets are not pricing in any hope of economic recovery, despite the recent fall in US inflation.

Overall, the managers note that markets are not pricing in any hope of economic recovery, despite the recent fall in US inflation. Commentators suggest that we are unlikely to return to the extremely low interest rates of the past few years. That bodes well for the sector’s long-term prospects.

Investment process

PCFT’s managers are stock-pickers and geographic and sector allocations are driven by their stock selection decisions. However, the breadth of opportunity is highest in the US, which dominates the benchmark. The maturity of the industry in that country is coupled with a fragmentation of the banking market.

Emphasis on proprietary research.

The managers are actively involved in researching opportunities. Proprietary research is a core part of the investment process. The managers feel that, while some of it is useful, external research is too often short-term in focus. They prefer to take a medium- to long-term view. Access to companies’ management is an important part of the process.

The approach seeks to identify stocks with the potential to create strong risk-adjusted returns. An analysis of balance sheet strength plays a part in this.

Focus on limiting the downside.

Short-term profitability and rapid top-line growth may mask underlying problems with asset quality. Most financials stocks are very highly geared, and consequently there is a real need to focus on limiting the downside.

PCFT’s remit is global and includes emerging markets. The universe is about 500 stocks (typically, the smallest stock that the managers would consider for PCFT’s portfolio would have a market cap of around $500m). There are no limits on the exposure of the investment portfolio to either smaller or mid-cap companies, but the majority of the portfolio is invested in companies with a market capitalisation greater than US$5bn.

The managers say that this is a manageable number of stocks for the team to cover. The likes of Goldman Sachs and JPMorgan are complex beasts, but most banks have relatively simple business models. In many areas, pricing is commoditised and so the sector is quite generic, but research is nonetheless essential to sort the good from the bad.

The managers use a scoring system to look at a range of variables around risk, growth and value. These include balance sheet strength; how the company is funded; the composition of the loan book; historical quality of the loan book; and trends in margins. This model is a framework for analysis rather than an engine to produce a buy list.

The team meets about 400 companies a year.

The team meets about 400 companies each year, but a lot of this is double-checking their research findings, talking to both customers and competitors, for example.

For banks and similar companies, any assessment of value is based on a variation of CAPM – using returns on equity and price to book. The managers find that, for the reasons outlined above, price/earnings (P/E) ratios and measures of growth do not work as well.

The sector is not just about balance sheet businesses, however, and it is evolving. The managers use a more earnings-driven, traditional approach to valuing other companies.

Restrictions

The investment manager has discretion to invest up to 10% of the portfolio in debt securities.

PCFT may have a small exposure to unlisted and unquoted companies, but in aggregate, this is not expected to exceed 10% of total assets at the time of investment.

PCFT will not invest more than 10% of total assets, at the time of investment, in other listed closed-ended investment companies and no single investment will normally account for more than 10% of the portfolio at the time of investment.

PCFT may employ levels of borrowing from time to time with the aim of enhancing returns, currently subject to an overall maximum of 20% of net assets.

ESG

Environmental, social and governance (ESG) factors are integrated into the investment process, and the managers believe that they are a critical driver of long-term returns. Governance and risk management has always been an important component of the investment process as it sets the tone, along with culture, for how a business is managed and will perform in a stressed environment. The managers now also put more emphasis on environmental and social issues; for example, carbon emissions, financial inclusion, whistleblowing, diversity and so forth.

The process uses third-party sources of ESG information, such as MSCI, Bloomberg, TrustPilot (customer satisfaction), Glassdoor (employee satisfaction), and complaints data from the likes of the Financial Ombudsman Service. The managers do their own research too, using published information and insights from meetings that the team has with management and investor relations.

The team may also conduct in-depth research on topics of ESG. For example, it undertook a review of bank loan books to analyse exposures to thermal coal. For the majority of banks there was no data available, reflecting the likelihood that their exposure was negligible but for those for which there was, it was significantly less than 0.5% of loan books, with the exception of a couple of South African banks where the exposure was 0.6% and 0.7%, respectively. In PCFT’s portfolio, only HSBC disclosed any meaningful exposure at US$1.35bn or 0.1% of its assets and it has since announced it would phase out all of its investment in coal by 2040 at the latest.

More information should soon be available to the team. For example, the EU’s SFDR requires EU banks to disclose qualitative information on taxonomy-eligible assets from 2022, with quantitative disclosure, such as the Green Asset Ratio, from 2024.

Based on a weighted average of MSCI ESG scores, PCFT’s portfolio was assigned an AA rating. It helps that, as a financials fund, PCFT’s stocks tend to have relatively low carbon emissions.

Asset allocation

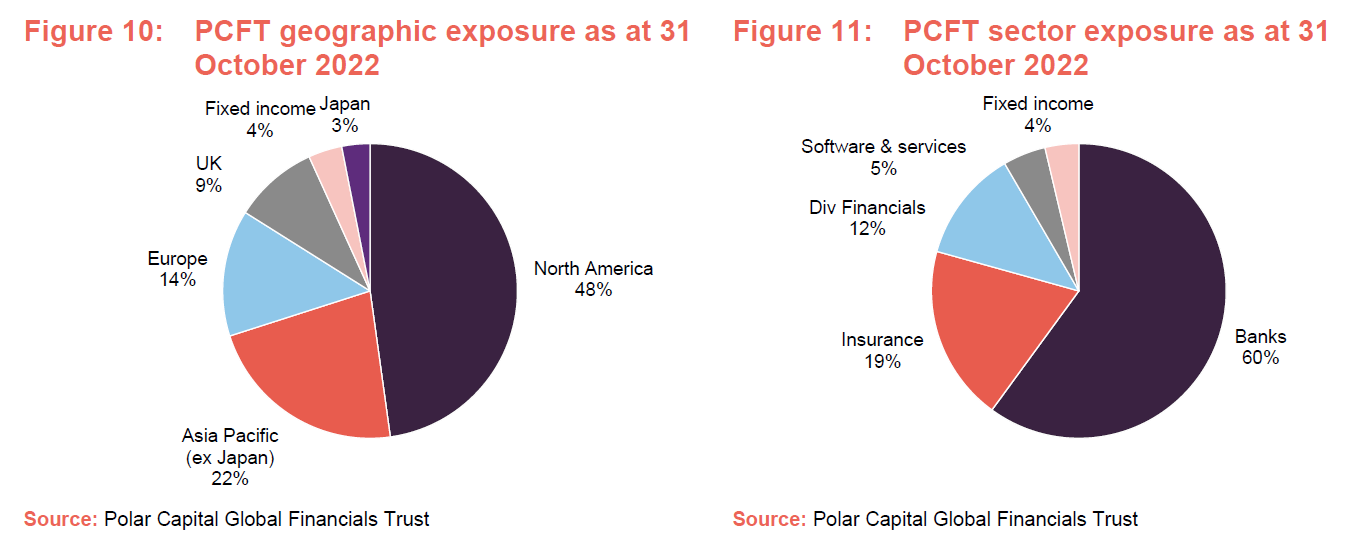

At the end of October 2022, there were 88 positions in PCFT’s portfolio and 90.5% of the portfolio was in stocks with market caps above $5bn. PCFT had an active share of 68.25% relative to the benchmark at end October 2022.

Since end February 2022 – the data that we used when we last published a note on PCFT – the trust has a little more in Asia and fixed income and a little less in North America and the UK.

In Asia, whilst the portfolio has no direct exposure to China, the managers have reduced exposure to Hong Kong and Taiwan on heightened tensions and a weak economic outlook for the mainland.

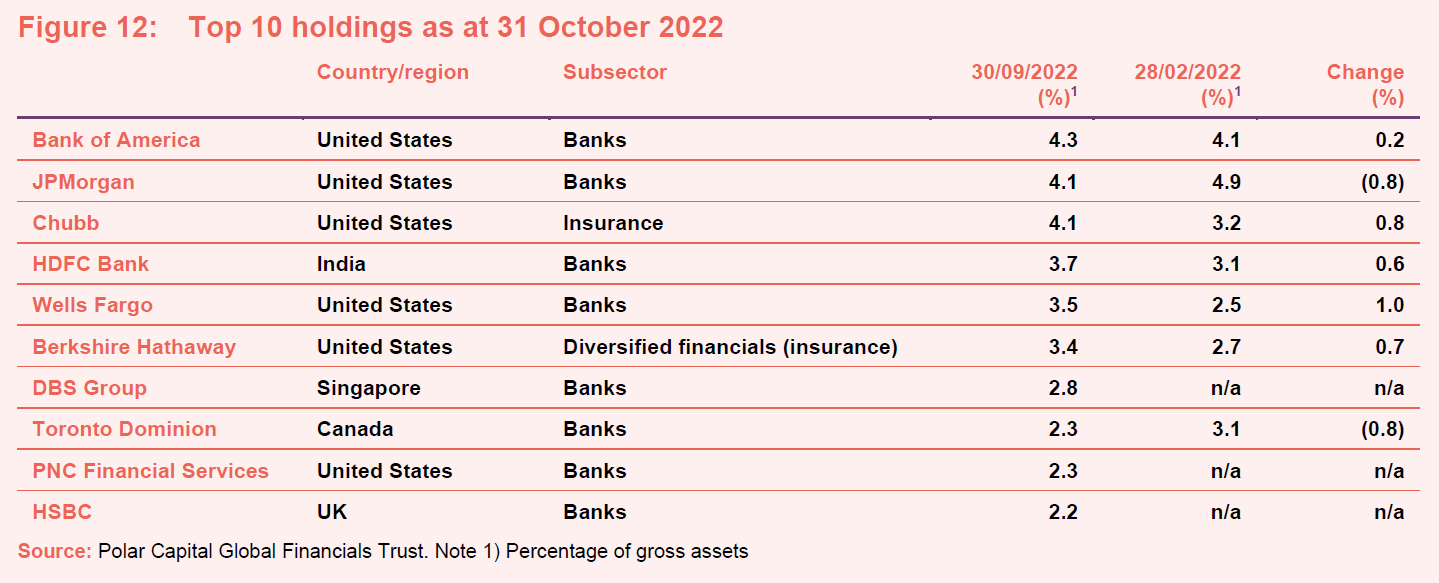

Top 10 holdings

Since 28 February 2022 (the data we used for the last note), Arch Capital, Citizens Financial, and Sumitomo Mitsui Financial have dropped out of the list of the 10 largest holdings and have been replaced by DBS Group, PNC Financial Services and HSBC.

We have discussed most of these companies in previous notes. Picking up a few portfolio changes from the managers’ recent reports:

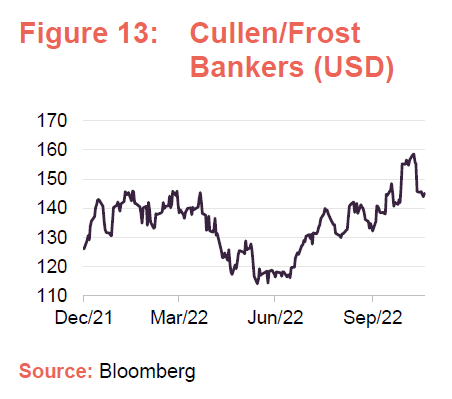

Cullen/Frost Bankers

Outside of the top 10, PCFT has recently acquired a stake in Cullen/Frost Bankers (frostbank.com) a San Antonio, Texas-based bank with $52.9bn of assets, making it one of the 50-largest banks in the US. Its third-quarter results were notable for significant year-on-year growth in its deposit base, thanks – says its chief executive officer (CEO) – to sharing interest rate rises with customers, and a 41% year-on-year uplift in net interest income, illustrating the impact that higher rates can have on banks’ profitability. At 30 September 2022, Cullen/Frost’s net interest margin was 3.01%, up from 2.47% a year earlier. It may also be interesting that there has been no credit loss expense at the bank over the first three quarters of 2022.

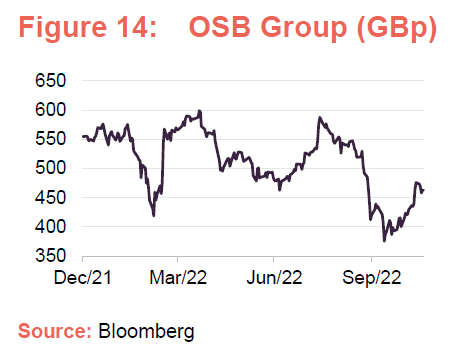

OSB Group

Reflecting the challenges faced by the UK housing market, the managers have reduced PCFT’s holding in OSB Group (osb.co.uk), the holding company for buy-to-let mortgage specialist One Savings Bank. On historic figures, OSB is doing well, with growth in its loan book, an expanding net interest margin, stable arrears and significant growth in its profitability. However, notwithstanding a weighted average loan-to-value ratio of 61% for the mortgage book (which gives it a healthy cushion against losses even if borrowers hand back the keys), the managers are cognisant that sentiment is going to be against the stock in the current environment.

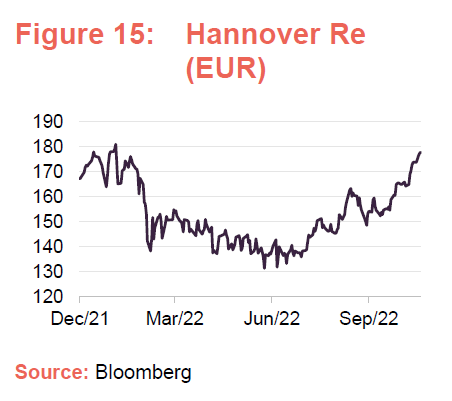

Hannover Re

On the back of the managers’ optimism about the outlook for the reinsurance sector, they have initiated a position in Hannover Re (hannover-re.com) one of the largest and most profitable reinsurers globally. It is proud of its relatively stable return on equity, which suggests that it is good at risk management.

Year-to-date (YTD) to 30 September 2022, premium income is up 21.4% year-on-year. Its most recent results statement draws attention to the challenges posed by inflation. However, it notes that macroeconomic challenges are increasing the demand for reinsurance.

Shareholders’ equity has been impacted by rising rates, which have driven down the value of its fixed interest portfolio. Longer-term, however, the company can expect higher returns from its investment portfolio which will help its profitability.

Fixed income

The managers have also been adding to PCFT’s positions in fixed income. The spike in yields created an opportunity to add to subordinated bonds issued by banks and insurers at yields of between 8% and 12%.

Performance

Up to date information on PCFT is available on the QuotedData website.

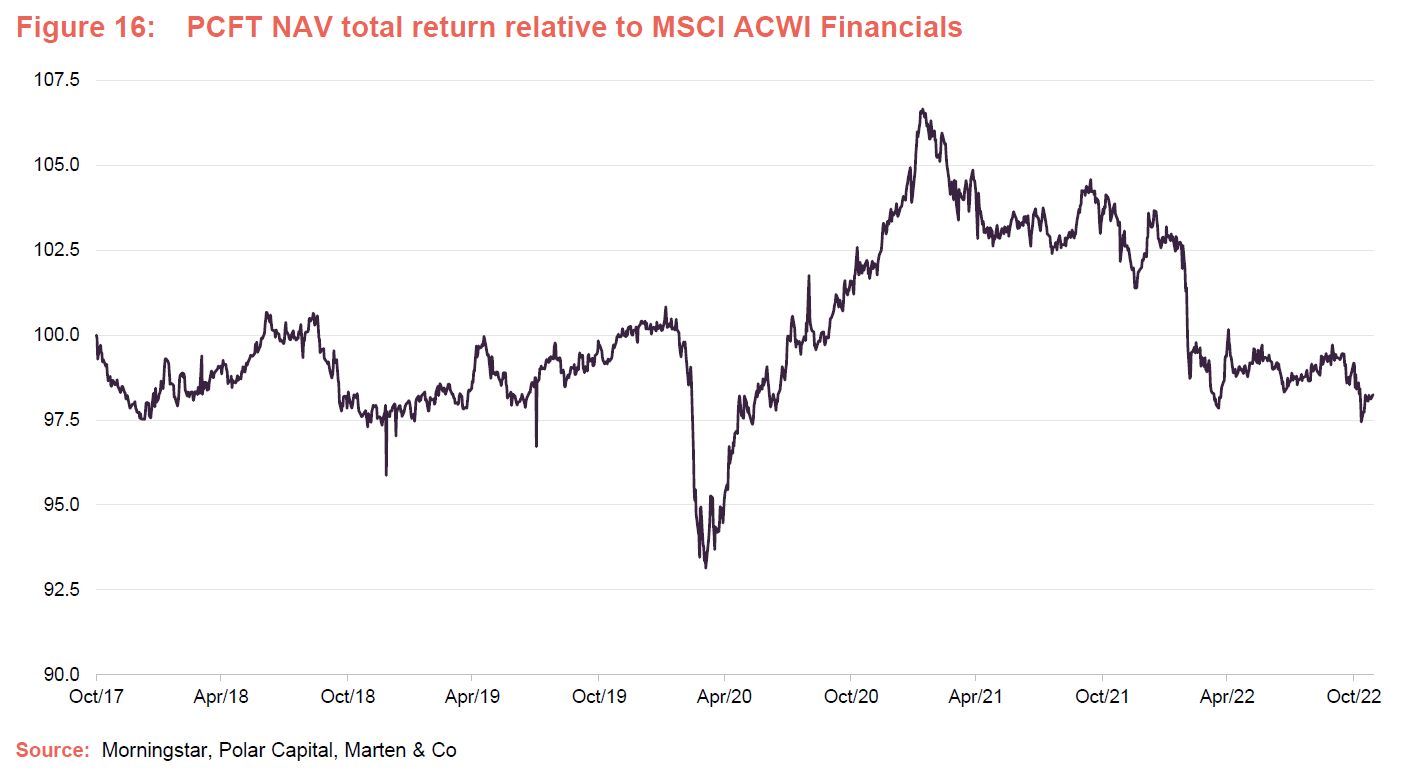

The drivers of PCFT’s long-term performance have been discussed in earlier notes. These include the impact of the pandemic panic in March 2020 and the subsequent recovery. The sell-off in highly-rated growth stocks hit returns early in 2022; PayPal was a notable contributor to the fall in PCFT’s relative performance over that period, for example. More recently, the trust’s returns have matched those of the MSCI ACWI Financials Index more closely.

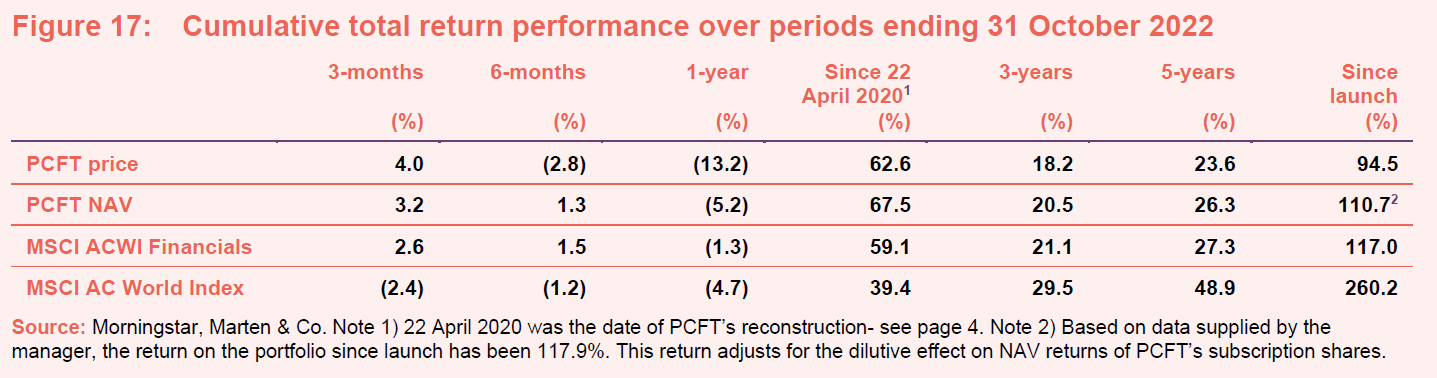

It is clear in Figure 17 that the financials sector has recovered some of its earlier underperformance of global indices over the last couple of years, with PCFT delivering strong returns since it was reconstructed in April 2020. The fears of recession that that held back banks’ share prices over 2022 are evident in the one-year numbers.

The managers are convinced that this pull-back has left the sector looking particularly attractive at a point when, for the first time in almost 15 years, banks’ net interest margins are expanding. Much will depend on the sector’s loan loss experience, but the managers think that the worst is more than priced in.

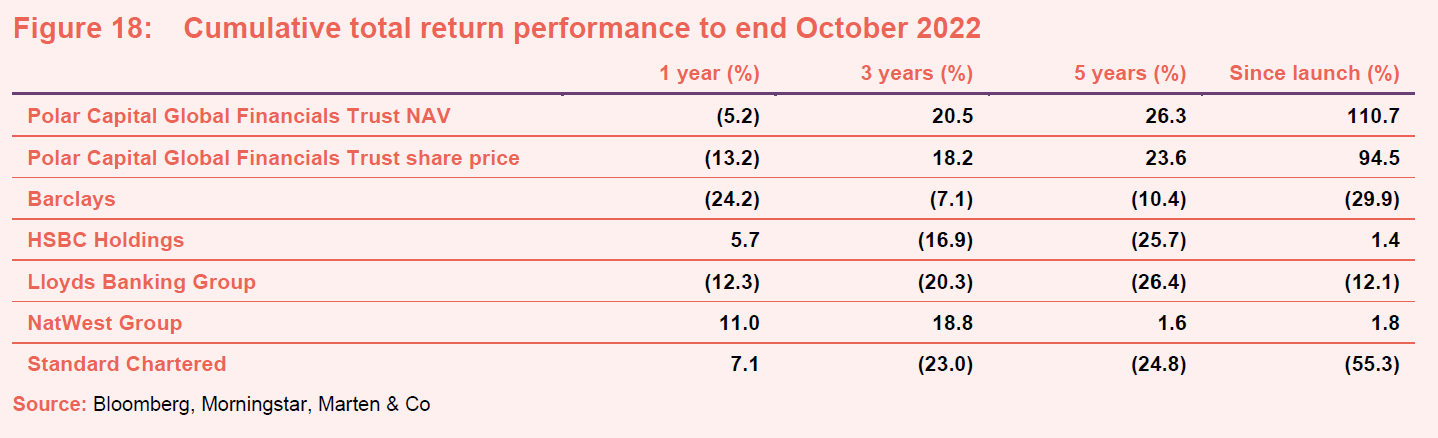

One of the drivers behind the launch of PCFT in 2013 was that it would provide UK-based investors with a relatively lower-risk exposure to the financial sector. Since then, PCFT has delivered returns well ahead of the major UK banks, as is evidenced in Figure 18.

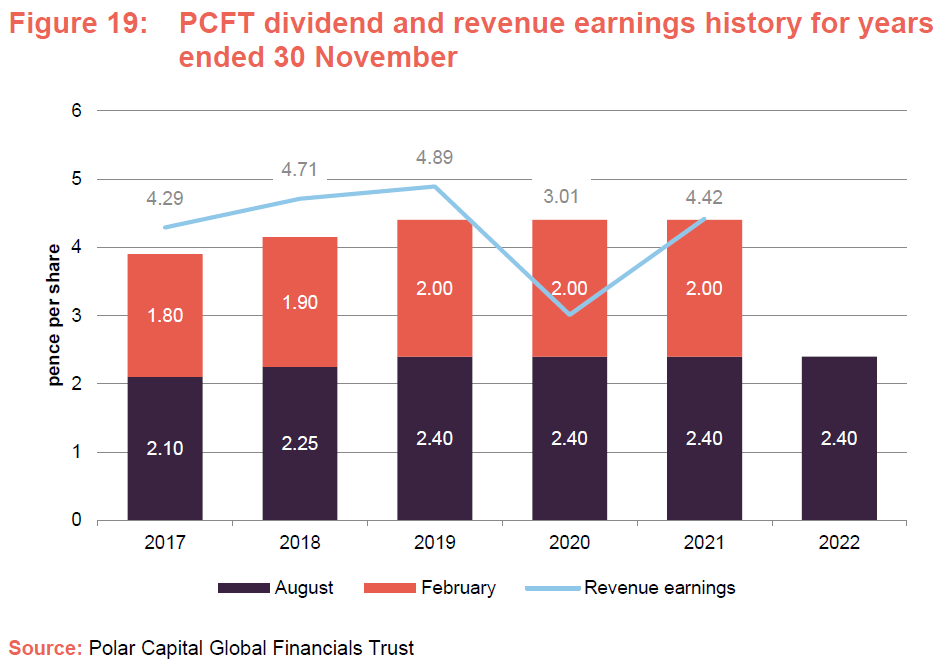

Dividend

PCFT pays dividends semi-annually on its ordinary shares in February and August. All dividends are paid as interim dividends. The payments are not necessarily of equal amounts. The company does not pay a final dividend.

Reserves help support the dividend .

Until its 2020 financial year, PCFT had a good track record of paying dividends that were covered by revenue. COVID-19 triggered the suspension or cutting of many dividends in the financial sector. However, the revenue reserves that PCFT had built up gave the board confidence to maintain the dividend in 2020.

Now, with the economic outlook looking cloudier once again, the board decided to maintain the interim dividend at 2.4p per share. It continues to pursue a long-term policy of dividend growth, although there is no guarantee that this can be achieved. PCFT has income reserves available to support dividend payments until the sustainable longer-term level can be determined. At the end of May 2022, the revenue reserve stood at £12.7m (3.9 per share).

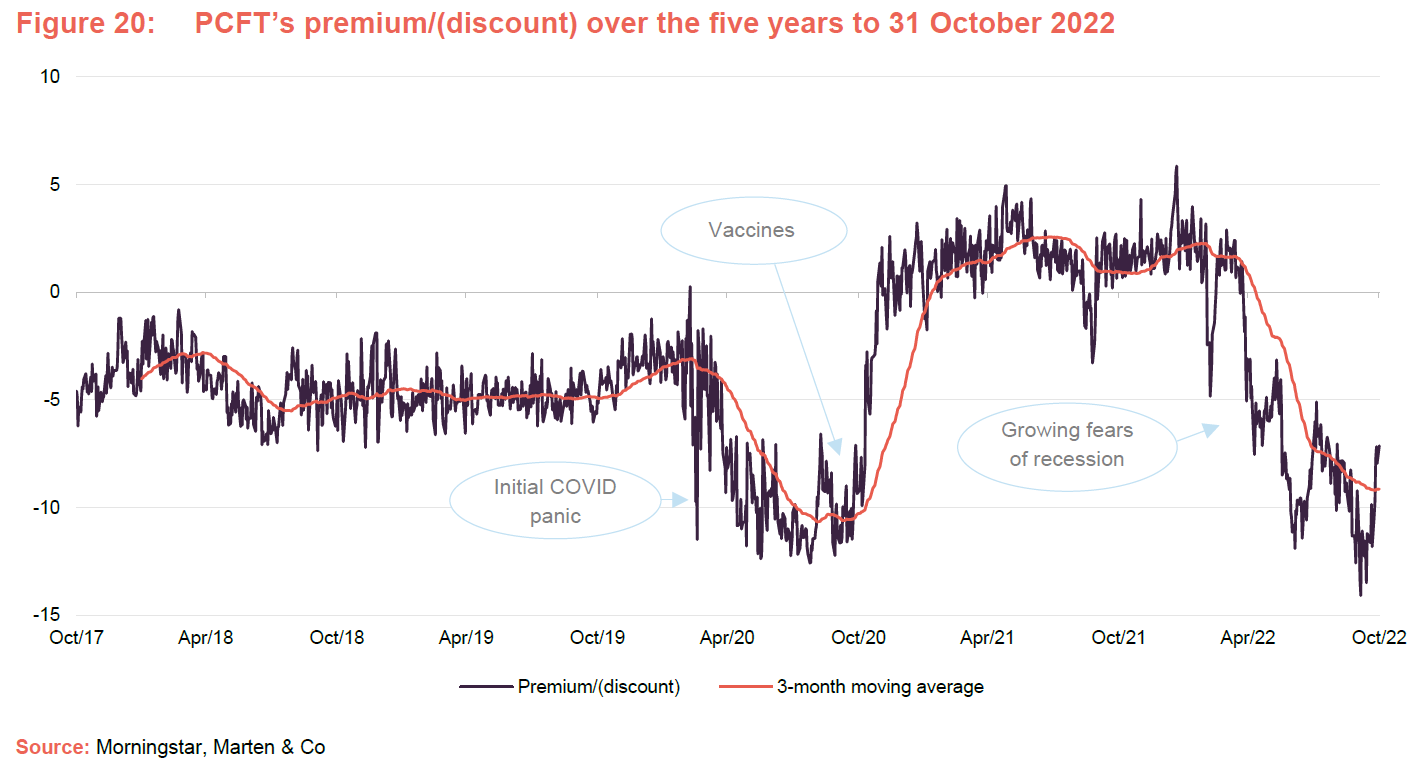

Premium/discount

Over the year to the end of October 2022, PCFT’s share price moved within a range of a 14.1% discount to a premium of 5.9% and has traded at an average discount of 7.1%. At 28 November 2022, the discount was 6.5%.

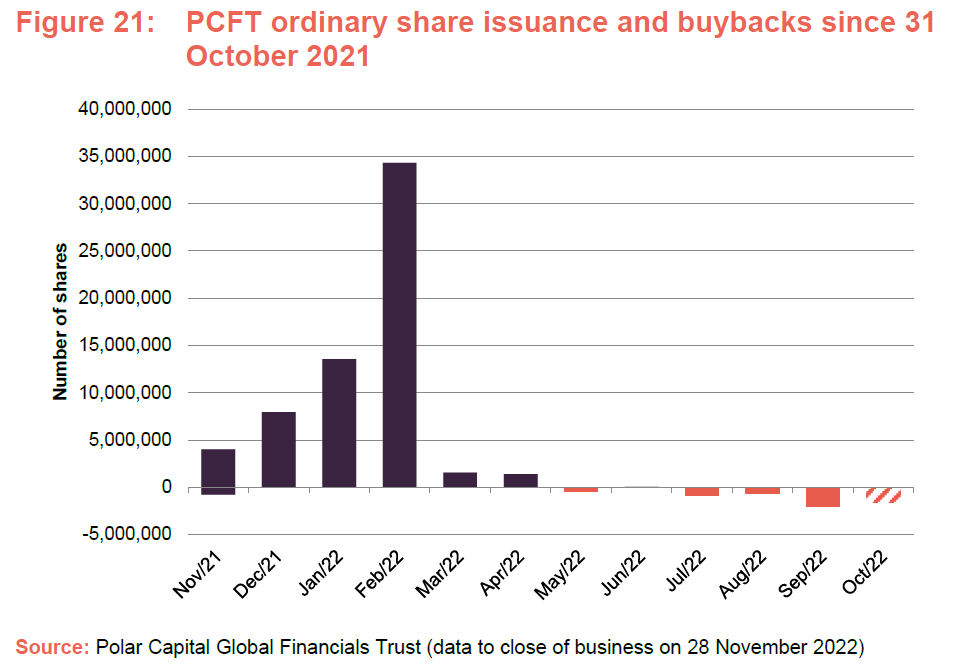

The dramatic change in sentiment toward the sector following the positive news on vaccine development in November 2020 is clear from Figure 22. The shares traded at a modest premium to NAV for some time after that, but in April 2022, as investors became increasingly nervous about the health of the global economy, the shares moved to trade at a discount once again.

The board seeks to moderate fluctuations in the discount and premium through buybacks and issues of shares. On 1 February 2022, PCFT raised gross proceeds of £29.4m through the issue of 16,869,893 new ordinary shares at 174.31p per share, then a 1.5% premium to the NAV as at 31 January 2022. On 25 February 2022, PCFT raised gross proceeds of £16.6m through the issue of 9,905,427 new ordinary shares at 167.75p, again equivalent to a 1.5% premium to the prevailing NAV.

Fees and costs

PCFT’s manager is Polar Capital LLC (Polar). PCFT pays Polar a base management fee of 0.70% of NAV per annum. The investment management agreement may be terminated by either party giving 12 months’ notice. The base management fee is charged 80% to revenue and 20% to income.

In addition, the manager has the opportunity to earn a performance fee. This is calculated over five-year periods, the first of which runs from 7 April 2020 to 30 June 2025. The performance fee will be 10% of the total return generated by PCFT in excess of a hurdle. The hurdle is the benchmark (MSCI ACWI Financials) plus 1.5% per annum.

For the year ended 30 November 2021, PCFT’s ongoing charges ratio fell from 1.09% to 1.02%, helped by the increased size of the trust (as fixed costs are spread over a wider base). If the performance fee is included, the ongoing charges fee was 0.98% (as previously accrued performance fees were written down), which compared to a figure of 1.74% for the financial year ended 30 November 2020.

Capital structure and life

PCFT has a simple capital structure with a single class of ordinary shares in issue and trades on the Main Market of the London Stock Exchange. At 28 November 2022, there were 325,419,000 ordinary shares with voting rights and a further 6,331,000 shares held in treasury.

Five-yearly tender offers.

PCFT has an unlimited life. With effect from 2025, the board intends to propose tender offers at five-yearly intervals. These would allow any shareholder who wishes to exit the company to do so at a price close to NAV.

Shares bought back as part of the tender offer process and any other shares bought back in the normal course of discount control may be held in treasury and reissued at a premium to asset value.

PCFT’s accounting year end is 30 November and annual general meetings are usually held in April.

Gearing

PCFT may now borrow up to 20% of net assets at the time of drawdown. Since July 2022, PCFT has had access to a three-year revolving credit facility up to £50m plus a three-year term loan of £30m. Both have been made available by RBS.

At end October 2022, PCFT had net gearing of 3.9% of NAV.

Management

The five-strong global financials team at Polar Capital LLC was managing £611m, as of end October 2022.

Nick Brind

Nick joined Polar Capital following the acquisition of HIM Capital in September 2010, and is co-manager of PCFT. He has 28 years’ investment experience across a wide range of asset classes including UK equities, closed-end funds, fixed-income securities, global financials, private equity and derivatives. Before joining HIM Capital, Nick worked at New Star Asset Management. While there, he managed the New Star Financial Opportunities Fund, a high-income financials fund investing in the equity and fixed-income securities of European financials companies, which outperformed its benchmark index in all six years that Nick managed it. Previous to that, he worked at Exeter Asset Management and Capel-Cure Myers. At Exeter Asset Management, Nick managed the Exeter Capital Growth Fund from 1997 to 2003, which over this period was in the top decile of the IMA UK All Companies Sector. Nick has a Masters in Finance from London Business School.

John Yakas

John joined Polar Capital in September 2010 and is the manager of the Polar Capital Financial Opportunities Fund and co-manager of PCFT. John has 34 years’ experience in the financial services industry. Previously, he worked for HSBC as a banker, based in Hong Kong, and was the head of Asian research at Fox-Pitt, Kelton. In 2003 he joined Hiscox Investment Management, which later became HIM Capital. John won Lipper awards in the equity sector banks and other financials sector in 2010, 2011, 2012 and 2013. He has an MBA from London Business School and studied at the London School of Economics (BSc Econ).

George Barrow

George was appointed as co-fund manager of PCFT in December 2020, alongside Nick Brind and John Yakas. He joined Polar Capital in September 2010 and is the co-manager of the Polar Capital Financial Opportunities Fund. George has 14 years’ industry experience and over 10 years’ experience analysing Europe, Asia and emerging markets. Prior to joining Polar Capital, he was an analyst at HIM Capital from 2008, where he completed his IMC. He has a Master’s Degree in International Studies from SOAS, where he graduated with merit.

Nabeel Siddiqui

Nabeel joined the Polar Capital Financials team as an analyst in August 2013 working closely with John Yakas and Nick Brind, focusing on the US, Latin America & Australia.

Prior to this, Nabeel worked as an operations executive at Polar Capital. He began his career in August 2008 with Habib Bank, where he worked within a variety of functions. He has a Master’s Degree in Money and Banking and has passed all three levels of the CFA.

Jack Deegan

Jack joined the Polar Capital Financials team as an analyst in October 2017 working closely with Nick Brind on the Income Opportunities Fund.

Prior to this, he worked at DBRS Ratings, covering the Swiss market as a lead analyst, as well as UK, Dutch, Japanese and Australian banks. Before DBRS, Jack worked in the Markets Division of the Bank of England for four years, assessing financial institutions with a view to determining access to the Bank’s Sterling Monetary Framework (SMF) facilities, and internal counterparty trading limits. He has a BA in Classical Archaeology & Ancient History from Oxford University and a Master’s Degree in Islamic Politics from SOAS.

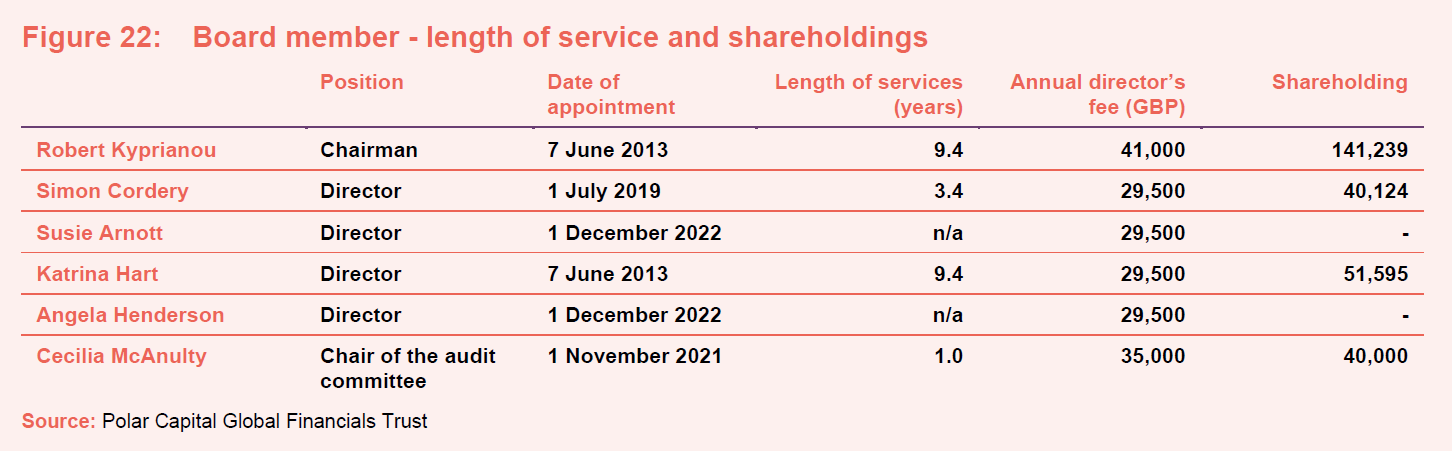

Board

The board currently comprises six non-executive directors, all of whom are independent of the investment manager and who do not sit together on other boards.

Following PCFT’s reconstruction in 2020, the board formulated a succession plan which gave due regard to the recommended maximum of nine years’ tenure for a non-executive director and a formal tenure policy, allowing for a reasonable extension to the nine years for the role of chairman. Following on from Cecilia McAnulty’s appointment last year, the board recently recruited two new directors – Susie Arnott and Angela Henderson. Their appointments will become effective on

1 December 2022, and Katrina Hart will step down from the board on the same date. The chairman has confirmed that he intends to step down as chair of the company following the next Annual General Meeting of the company due to be held in 2023.

Robert Kyprianou (non-executive chairman)

Robert was formerly the CEO of AXA Framlington until his retirement in September 2009. Previous appointments include: independent non-executive director of Gartmore Group Limited and Aviva Investors; global head of fixed income, and later deputy CEO and global head of securities at AXA Investment Managers SA; business head and global head of fixed income at ABN AMRO Asset Management Ltd and head of portfolio management at Salomon Brothers Asset Management Ltd.

Robert is a director of Eurobank Cyprus Ltd, Eurobank Private Bank Luxembourg SA and senior independent non-executive director of Pimco Europe Limited.

Simon Cordery (non-executive director)

Simon has almost 40 years’ experience working within financial services, of which nearly 30 years have been focused on the wealth management industry. Most recently he was head of Investor Relations and Sales at BMO Global Asset Management, where he spent almost 25 years in senior roles, and previously he held roles with Invesco Fund Managers, Jefferies & Co, Kleinwort Benson Securities and Rea Bros Merchant Bank. Simon has considerable and detailed knowledge of the investment trust industry and remains actively involved with the AIC. He is a Chartered Fellow of the Chartered Institute for Securities and Investment.

Susie Arnott (non-executive director)

Susie started her career in fund management over 20 years ago. She was primarily focused on the financial sector; including periods focused on emerging markets investments and global financials portfolios. Susie also spent a number of years working in ‘Impact Investing’, combining her experience and passion for social investment and impact measurement. In her current role, she continues to focus on investment with a global impact incorporating ESG as a mainstream consideration. This will be Susie’s first non-executive director role.

Katrina Hart (non-executive director)

Katrina spent her executive career in investment banking, advising, analysing and commentating on a broad range of businesses. Initially working in corporate finance at ING Barings and Hawkpoint Partners, she then moved into equities research at HSBC, covering the general financials sector. Latterly, Katrina headed up the financials research teams at Bridgewell Group Plc and Canaccord Genuity, specialising in wealth and asset managers.

Katrina was a non-executive director of Premier Miton Group Plc, an AIM-listed asset management group, from 2011 to 2020. She is currently a non-executive director of Keystone Positive Change Investment Trust Plc, Blackrock Frontiers Investment Trust Plc and AEW UK REIT Plc.

Angela Henderson (non-executive director)

Angela qualified as a solicitor and initially focused her career on corporate law before moving into financial services where she spent time as an in-house lawyer and a director of global equities. She is currently a non-exec and chair of risk for Macquarie Capital (Europe) Limited, non-exec and chair of the Management and Service Provider Engagement Committee of Hargreave Hale AIM VCT plc and has various other private interests.

Cecilia McAnulty (non-executive director)

Cecilia is an experienced non-executive director and Chartered Accountant with almost 30 years’ investment and financial services experience. Her executive career included senior investing roles at Royal Bank of Scotland, Barclays Capital and Centaurus Capital and encompassed a broad range of asset classes including public and private debt and equity.

Cecilia is a non-executive director and audit chair of Northern 2 Venture Capital Trust Plc. She is also an independent non-executive director of Alcentra Ltd (a global investment manager of sub investment grade credit), and a member of the Industrial Development Advisory Board of the Department of Business, Energy and Industrial Strategy.

Previous publications

Figure 23: QuotedData’s previously published notes on PCFT

| Don’t fear a slowing economy | Initiation | 30 April 2019 |

| Banks too cheap to ignore | Update | 29 October 2019 |

| New lease of life | Update | 22 February 2020 |

| Too much pessimism? | Annual overview | 22 October 2020 |

| The tide has turned | Update | 25 February 2021 |

| More to go for | Annual overview | 18 November 2021 |

| Riding out the storm | Update | 5 April 2022 |

Source: Marten & Co

Legal

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Polar Capital Global Financials Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.