Polar Capital Global Financials Trust

Investment companies | Annual Overview | 12 December 2023

Pessimism overdone, time to buy

As inflation eases and its looks increasingly like interest rates have peaked for now, the only major potential negative overhanging the financials sector is the thought that central banks may have overdone their tightening, which will precipitate a recession that leads to a sharp rise in defaults on the loans that banks have been making. The managers of Polar Capital Global Financials Trust (PCFT) believe both that the sector is more than pricing in a worst-case scenario and that we are more likely to experience a shallow recession.

The consensus seems to be shifting in their direction on the latter point, but this is not yet reflected in the ratings of financials stocks, which are at or close to historic valuation lows. The managers suggest that if you couple this with a share price discount to net asset value (NAV) on the trust that is relatively wide, this looks like a good time to back PCFT.

Growing income and capital from financials stocks

PCFT aims to generate a growing dividend income, together with capital appreciation. It invests primarily in a global portfolio, consisting of listed or quoted securities issued by companies in the financial sector. This includes banks, life and non-life insurance companies, asset managers, stock exchanges, speciality lenders and fintech companies, as well as property and other related sub-sectors.

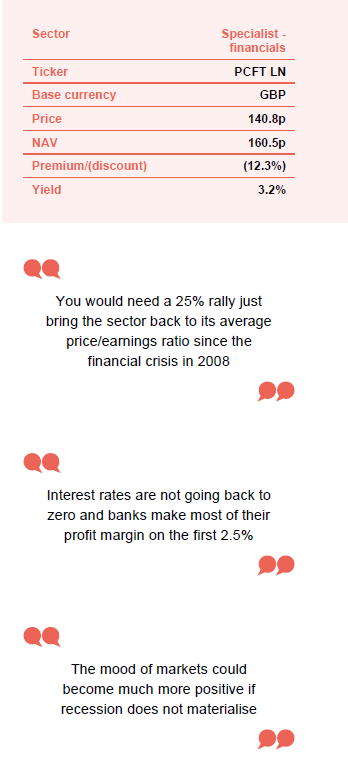

At a glance

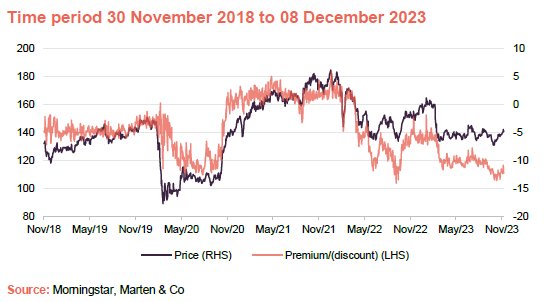

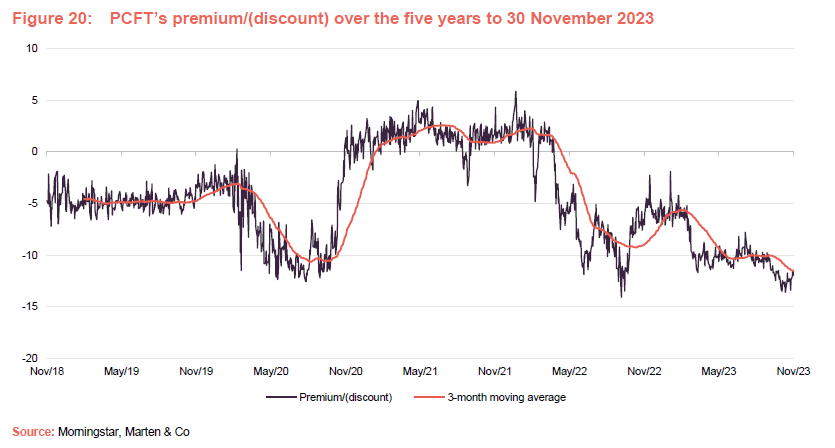

Share price and discount

In common with many other trusts, PCFT’s share price discount to NAV has widened over the course of 2023.

Over the 12 months to the end of November 2023, PCFT’s share price moved within a range of a 13.6% discount to NAV to a discount of 1.9% and has traded at an average discount of 9.2%. On 8 December 2023, the discount was 12.3%.

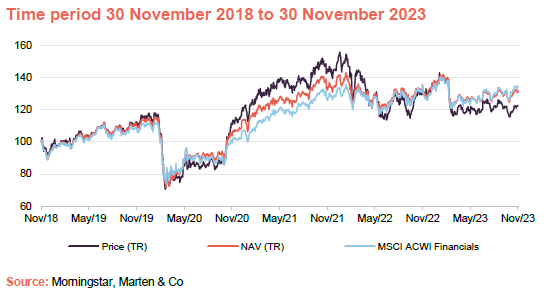

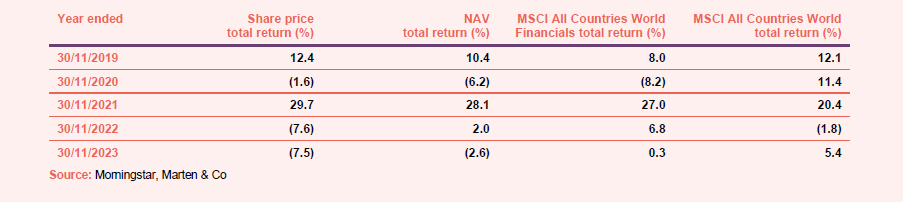

Performance over five years

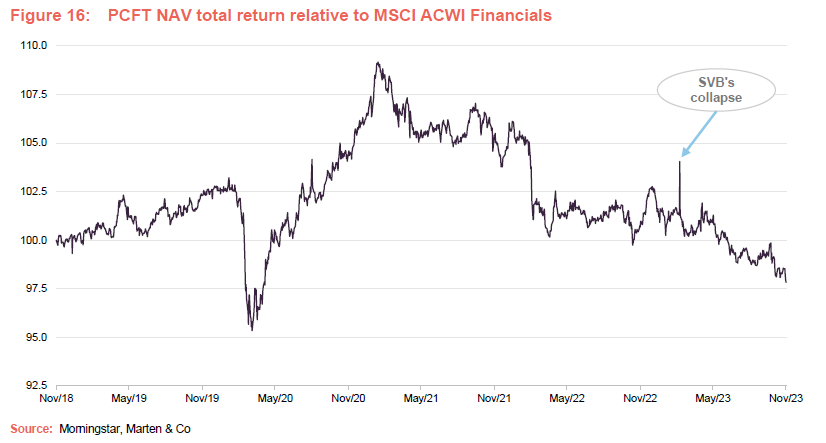

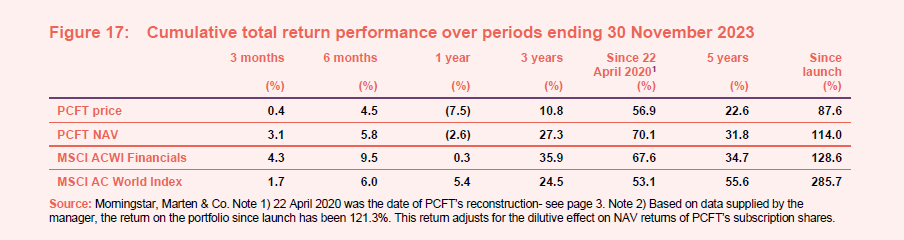

A strong post-COVID recovery helped drive PCFT’s outperformance of its MSCI All Countries World Financials Index benchmark over 2020/21, but the trust’s exposure to growth stocks, exposure to emerging markets, modest gearing and, in 2022, an overweight exposure to US banks stocks, has weighed on its relative returns since.

Fund profile

PCFT looks to grow investors’ income and their capital More information on the trust is available on its website www.polarcapitalglobalfinancialstrust.com

Polar Capital Global Financials Trust (PCFT) has twin objectives of growing both investors’ income and their capital. Its global mandate makes it a useful alternative for UK-based investors looking to diversify their financials exposure.

PCFT launched on 1 July 2013 with a fixed life. In April 2020, in conjunction with a vote on prolonging the life of the trust, shareholders were offered a cash exit. Holders of 39.1% of PCFT’s then-issued share capital opted to sell their shares and the portfolio was reconstructed to facilitate this. At the same time, shareholders overwhelmingly approved an extension of the trust’s life beyond May 2020 and the trust now has an unlimited life, but with five-yearly tender offers, the first of which is scheduled for 2025.

Predominantly, the portfolio is invested in listed/quoted securities. The trust may have some exposure to unlisted/unquoted securities, but this is not expected to exceed 10% of total assets at the time of investment.

Benchmarked against MSCI ACWI Financials

Since April 2020, the trust’s performance benchmark has been the MSCI All-Countries World Financials Net Total Return Index in sterling (MSCI ACWI Financials).

PCFT’s AIFM is Polar Capital LLP, which had assets under management of £18.9bn at 30 November 2023 and employs 13 investment teams, spread across offices in Europe, the US and Asia. PCFT’s lead managers are Nick Brind and George Barrow.

Market backdrop

You would need a 25% rally just bring the sector back to its average price/earnings ratio since the financial crisis in 2008

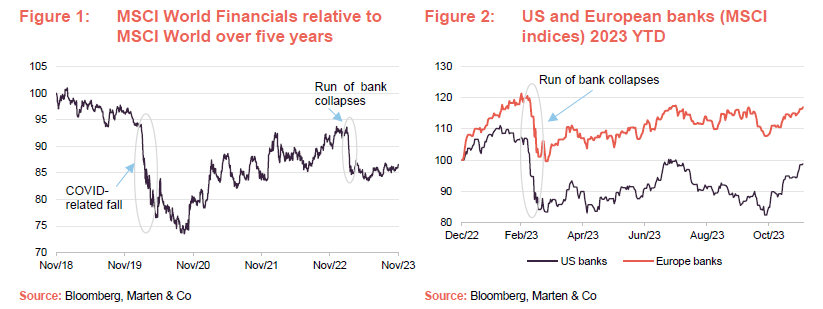

When we last published on PCFT, the sector was still reeling from the collapse of Silicon Valley Bank (SVB) and the bail out and eventual takeover of Credit Suisse. However, while both US and European banks have made up most of the ground that they lost since the SVB news on 8 March 2023, relative to the wider market, the sector has lost ground. In addition, banks were cheap even before SVB went bust and the managers suggest that you would need a 25% rally just bring the sector back to its average price/earnings ratio since the financial crisis in 2008.

Figure 1 shows the performance of the financials sector relative to the wider global index over the past five years. Figure 2 looks just at the performance of US and European banks since the beginning of 2023. In both charts, we have used MSCI indices and highlighted the point where SVB ran into trouble.

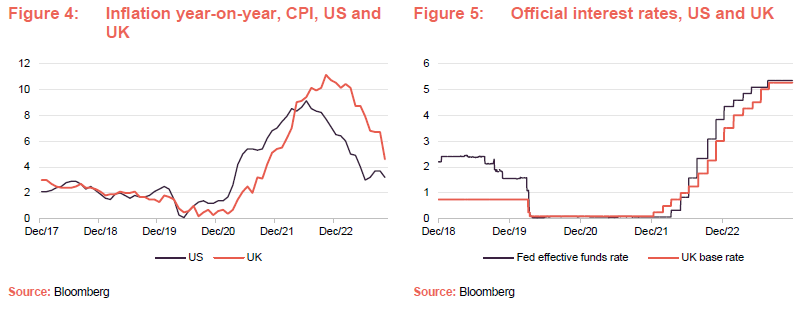

Inflation and interest rates have been the dominant influences on markets. However, the benefit of higher rates is not fully reflected into valuations. To illustrate the scale of the benefit, PCFT’s managers point out that HSBC has $1.6trn of deposits that have added $13bn to its profits in this era of higher interest rates.

At the end of October 2023, the MSCI All Countries World Banks Index was trading on a forecast P/E of 7.5x and a price/book of 0.91x

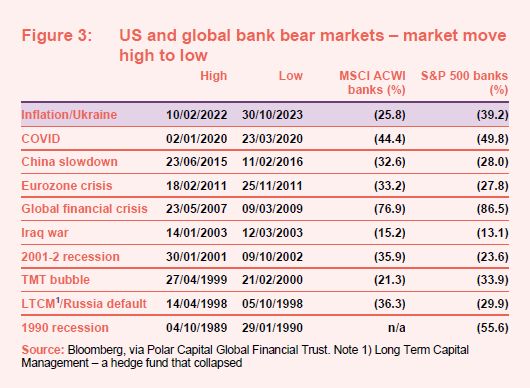

Despite this, as Figure 3 shows, from the point when the prospect of higher interest rates first started to weigh on valuations in February 2022, US banks have only fallen more during the global financial crisis, COVID and the 1990 recession. At the end of October 2023, the MSCI All Countries World Banks Index was trading on a forecast price/earnings (P/E) ratio for the coming 12 months of 7.5x and a price/book ratio of 0.91x.

In Figure 3, for each bear market in banks, we show when it started, when it hit the low point, and the return for global banks (MSCI) and US banks (S&P500) over that period.

Sharp declines in inflation rates have given rise to optimism that we have seen the peak in interest rates. However, the market’s focus is increasingly on the likelihood or not of a recession. While a consensus appears to be shifting towards a soft landing/shallow recession, PCFT’s managers feel that their part of the market is priced as though defaults are going to soar. They say that, if there is a soft landing, then the sector is very cheap.

Interest rates are not going back to zero and banks make most of their profit margin on the first 2.5%

In Europe, falling interest rates might affect banks’ profitability as interest margins (the gap between what they pay on deposits and what they earn from lending etc) contract, but it depends how far rates fall from here and valuations are cheap relative to their own history and equities more generally. The managers note that interest rates are not going back to zero and banks make most of their profit margin on the first 2.5%.

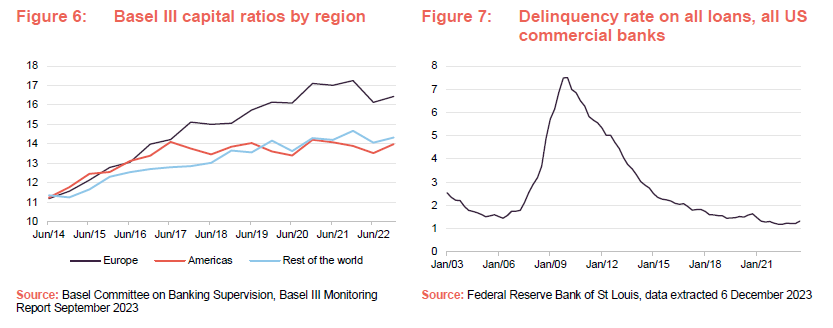

In our last note, we mentioned the concerns in the US over weakness in the commercial real estate sector and its impact on some smaller regional banks. The managers remain fairly sanguine about this. While delinquency rates (the amount of debt that is past due) are rising, they remain well below long-term averages.

PCFT’s managers repeat their message that, for the most part, the banking sector is well capitalised, as Figure 6 (which shows banks’ capital as a percentage of their risk-weighted assets – as defined by the Basel III rules that were introduced after the global financial crisis in 2008) illustrates – the minimum level is 8%. The final stage of the Basel reforms – Basel 3.1 – is due to be implemented soon. However, there has been considerable pushback against these. The feeling is that the extra provisions that it demands are overkill, particularly in the US. For example, Jamie Dimon, chief executive of JP Morgan Chase, has warned that the US interpretation of the rules would require the bank to hold 30% more capital than an equivalent European bank. The beneficiary of this might be the non-bank lending sector. However, the managers observe that US legislators appear to be listening to banks’ concerns.

In Asia, Japanese banks have performed well as hopes grow of an end to yield curve control (a policy that seeks to hold down interest rates in the country with the aim of stimulating economic growth and some modest inflation) and hence improved interest rate margins for banks. The Bank of Japan has been easing restrictions gradually, however, and that has kept the yen weak.

PCFT has no exposure to domestic Chinese banks, but it does hold HSBC. The position has been trimmed on concerns about the bank’s Chinese real estate risk. China’s economy is still bumping along the bottom and its real estate crisis is ongoing, although recently HSBC’s chief executive has suggested (after the bank made a $500m provision against its Chinese commercial property exposure) that we are at the nadir.

PCFT’s managers note that investors are taking more of an interest in Latin America, especially Brazil. This is still a small part of PCFT’s portfolio.

As one indication of the improved outlook for the sector, governments have been placing stakes in banks that they bailed out after the global financial crisis. These include Greek (National Bank), Irish (Allied Irish) and Italian (Monte dei Paschi di Siena) names and the UK government has indicated that it wants to sell the rest of its stake in NatWest next year as well.

Reinsurance fundraising remains well shy of levels in previous hard markets

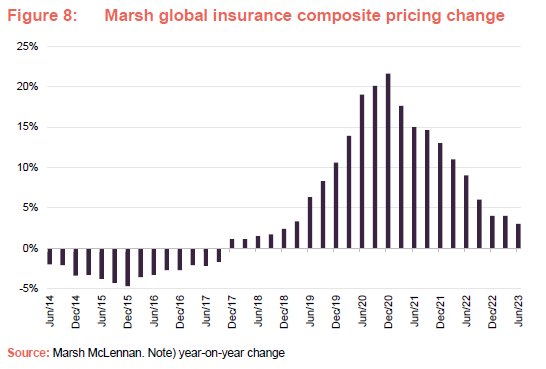

Insurance rate rises continue as Figure 8 shows, but at a slower pace. PCFT’s managers observe that insurance stocks have made some progress.

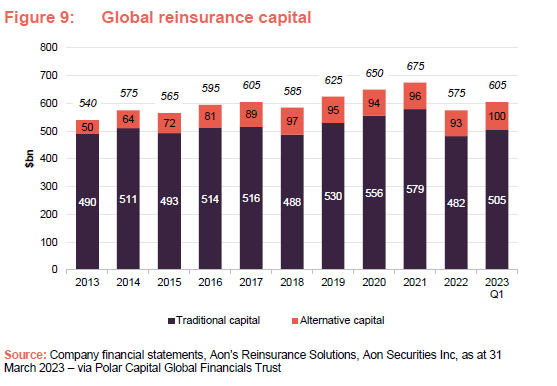

In the reinsurance market, fundraising remains well shy of levels in seen in previous hard (relatively low availability of capital) markets, as opposed to 2019–2021. PCFT’s managers think that with capital tight, pricing should be good as a result.

The managers say that over the past couple of years, Fintech has experienced a bloodbath, which they attribute to an unwinding of exuberance/COVID effects. The subsector is undergoing a period of retrenchment and consolidation. The managers observe that customers are increasingly focused on pricing, and it is harder to differentiate through the level of service on offer. Nevertheless, as fears of further interest rate rises recede, growth names have been picking up.

In the payments sector, the largest players – such as Visa and Mastercard (a PCFT holding) – still seem to have the advantage. Established players such as PayPal and Worldline have de-rated (the latter after missing earnings expectations) but Adyen’s share price has rallied since it posted an encouraging business update early in November.

As far as the challenger banks are concerned, PCFT has no exposure to Metro Bank, which is implementing cost cuts following a refinancing deal. It does hold a small position in Atom Bank, which recently raised £100m at a discounted valuation, However, the managers are optimistic that this should be its last fundraise.

The mood of markets could become much more positive if recession does not materialise

Aided by lower rate expectations, managers of alternative investments have seen positive share price moves, even though their fund raising has been well below that of previous years. In addition,

PCFT has acquired some BlackRock on expectations that the mood of markets could become much more positive if recession does not materialise.

PCFT’s exposure to fixed income is about 10%. The managers have been able to take some profits from positions on the back of falling yields. Interestingly, given the objections that investors made about the wipe out of holders of Credit Suisse’s AT1 bonds, this already seems to have been forgotten as the market has swallowed confirmation of the Swiss government’s right to determine the ranking of AT1 bonds within the capital structure of Swiss banks. The managers note that spreads on subordinated (lower-ranked) bank bonds have normalised.

Investment process

PCFT’s managers are stock-pickers and geographic and sector allocations are driven by their stock selection decisions. However, the breadth of opportunity is highest in the US, which dominates the benchmark. The maturity of the industry in that country is coupled with a fragmentation of the banking market.

Emphasis on proprietary research

The managers are actively involved in researching opportunities. Proprietary research is a core part of the investment process. The managers feel that, while some of it is useful, external research is too often short-term in focus. They prefer to take a medium- to long-term view. Access to companies’ management is an important part of the process.

The approach seeks to identify stocks with the potential to create strong risk-adjusted returns. An analysis of balance sheet strength plays a part in this.

Focus on limiting the downside

Short-term profitability and rapid top-line growth may mask underlying problems with asset quality. Most financials stocks are very highly geared, and consequently there is a real need to focus on limiting the downside.

PCFT’s remit is global and includes emerging markets. The universe is about 500 stocks (typically, the smallest stock that the managers would consider for PCFT’s portfolio would have a market cap of around $500m). There are no limits on the exposure of the investment portfolio to either smaller or mid-cap companies, but the majority of the portfolio is invested in companies with a market capitalisation greater than US$5bn.

The managers say that this is a manageable number of stocks for the team to cover. The likes of Goldman Sachs and JPMorgan are complex beasts, but most banks have relatively simple business models. In many areas, pricing is commoditised and so the sector is quite generic, but research is nonetheless essential to sort the good from the bad.

The managers use a scoring system to look at a range of variables around risk, growth and value. These include balance sheet strength; how the company is funded; the composition of the loan book; historical quality of the loan book; and trends in margins. This model provides a framework for further analysis rather than producing a buy list.

The team meets about 400 companies a year

The team meets about 400 companies each year, but a lot of this is double-checking their research findings, talking to both customers and competitors, for example.

For banks and similar companies, any assessment of value is based on a variation of CAPM – using returns on equity and price to book. The managers find that P/E ratios and measures of growth do not work as well.

The sector is not just about balance sheet businesses, however, and it is evolving. The managers use a more earnings-driven, traditional approach to valuing other companies.

Restrictions

The investment manager has discretion to invest up to 10% of the portfolio in debt securities.

PCFT may have a small exposure to unlisted and unquoted companies, but in aggregate, this is not expected to exceed 10% of total assets at the time of investment.

PCFT will not invest more than 10% of total assets, at the time of investment, in other listed closed-ended investment companies and no single investment will normally account for more than 10% of the portfolio at the time of investment.

PCFT may employ levels of borrowing from time to time with the aim of enhancing returns, currently subject to an overall maximum of 20%.

ESG

Environmental, social and governance (ESG) factors are integrated into the investment process, and the managers believe that they are a critical driver of long-term returns. Governance and risk management has always been an important component of the investment process as it sets the tone, along with culture, for how a business is managed and will perform in a stressed environment. The managers now also put more emphasis on environmental and social issues; for example, carbon emissions, financial inclusion, whistleblowing, diversity and so forth.

The process uses third-party sources of ESG information, such as MSCI, Bloomberg, TrustPilot (customer satisfaction), Glassdoor (employee satisfaction), and complaints data from the likes of the Financial Ombudsman Service. The managers do their own research too, using published information and insights from meetings that the team has with management and investor relations.

PCFT has an AA MSCI ESG rating

As at 30 November 2022, PCFT had an AA MSCI ESG rating, with a weighted average ESG quality score of 6.80 versus 6.74 for PCFT’s benchmark. The trust’s holdings have a low carbon intensity, which to a large extent reflect the nature of the financials sector. The trust has a strong record of voting at meetings of the companies it invests in, and at over a third of them, the fund’s vote was not cast in favour of resolutions put forward at these meetings.

Asset allocation

90.8% of portfolio invested in stocks with market caps above $5bn

At the end of October 2023, there were 96 positions in PCFT’s portfolio and 90.8% of the portfolio was in stocks with market caps above $5bn (a bit less than was the case six months earlier). PCFT had an active share of 62.6% relative to the benchmark at end October 2023.

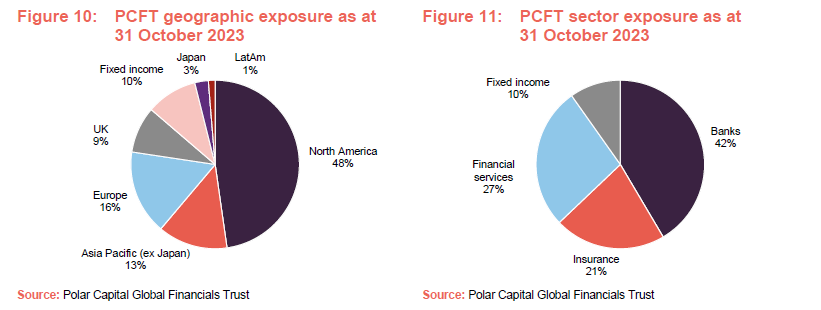

Since end April 2023 – the data that we used when we last published a note on PCFT – the exposure to North America has risen by about 7% at the expense of Asia, and the exposure to banks has fallen with financial services rising by about the same amount. The managers have moved the portfolio from under to overweight US banks (adding to Bank of America, for example) and reduced the underweight exposure to EU banks.

Other notable portfolio changes are some profit-taking on the position in Berkshire Hathaway and additions to positions in reinsurance/insurance companies to take advantage of the attractive rates on offer. We discuss RenaissanceRe below; the managers also added to the position in Hiscox.

The extreme undervaluation of the UK market has thrown up some bargains. The managers added to positions in One Savings Bank (OSB), IG Index, and Intermediate Capital. Given the fears about the impact of higher interest rates on the housing market, which helped create the valuation opportunity in OSB, the managers stress-tested the outlook for OSB and determined that realistic loss scenarios were more than discounted in the current price.

The managers also bought some out-of-the-money put options on the S&P and STOXX indices and then closed these out for a small gain.

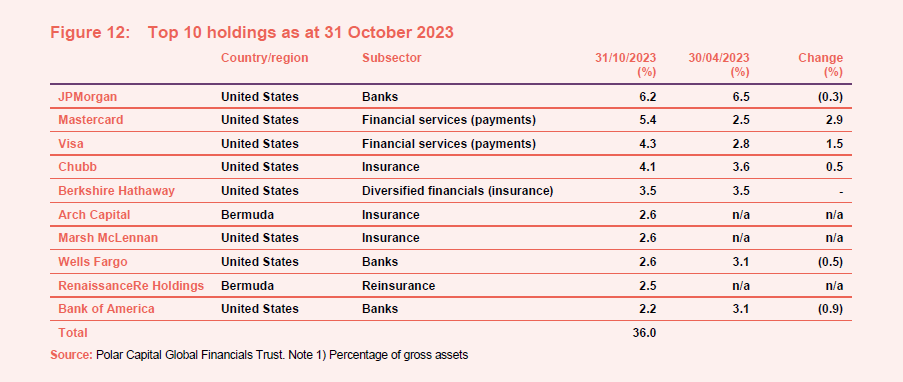

Top 10 holdings

Since 30 April 2023 (the data we used for the last note), HDFC Bank, HSBC and AIA have dropped out of the list of the 10 largest holdings (but are still sizeable positions) and have been replaced by Arch Capital, Marsh McLennan and RenaissanceRe Holdings (the first two of which are longstanding positions within the portfolio, the position in RenaissanceRe was initiated in April 2023).

The trust’s Indian exposure has not changed, but the position in HDFC was reduced in favour of ICICI and IndusInd. As noted above, the position in HSBC was reduced on fears of the impact of a weak Chinese real estate sector. The weak Chinese economy has weighed on AIA and the managers have been reducing the position.

We have discussed most of these companies in previous notes. The new entrants to the top 10 reflect the manager’s assessment of the attractions of the reinsurance/insurance markets that we discussed earlier in the note.

Arch Capital

https://quoteddata.com/wp-content/uploads/2023/12/f14.png

Arch Capital (archgroup.com) was a top 10 position in the fund when we published our note in April 2022. Bermuda-based Arch writes insurance, reinsurance and mortgage insurance on a worldwide basis with a focus on specialty lines. It is a constituent of the S&P500 Index.

Figures for Q3 2023 published at end October showed a sharp increase in year-on-year net income to shareholders, driven in part by a meaningful uplift in premium income in both its insurance and reinsurance business lines. Comparative figures for its reinsurance business were distorted by the impact of Hurricane Ian in Q3 2022 (one of the reasons why conditions in the reinsurance market have been favourable in 2023).

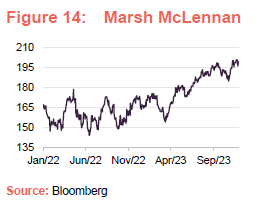

Marsh McLennan

Marsh McLennan (marshmclennan.com) describes itself as the world’s leading professional services firm in the areas of risk, strategy and people. It operates through four key businesses – Marsh, Guy Carpenter, Mercer and Oliver Wyman – and is the world’s largest insurance broker ($140bn of annual premiums), health and benefits broker (revenues of $3.6bn) and retirement advisory business ($379bn of asset under delegated management). It is an S&P500 constituent with a market cap just shy of $100bn and has a strong record of growth of earnings and free cashflow (13.0% and 17.6% CAGR over 2010 to the third quarter of 2023, respectively).

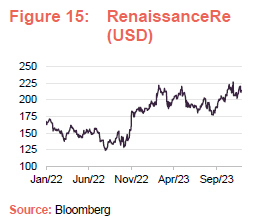

RenaissanceRe Holdings

RenaissanceRe (renre.com) is a reinsurance business based in Bermuda, but with offices around the globe. As we highlighted on page 7, rates should be buoyed by a lack of capital in the sector.

At the end of September 2023, with events such as earthquakes in Turkey and Syria, Typhoon Doksuri, Storm Daniel, Italian flooding, and a drought in Argentina, it looked likely that annual insured losses would exceed $100bn. In August, with a number of catastrophes weighing on the sector, and a fundraise connected to RenaissanceRe’s $3.3bn purchase of AIG’s Validus business weighing on its share price, the managers felt that the stock had been oversold and added to the position.

Performance

Up to date information on PCFT is available on the QuotedData website

A strong post-COVID recovery helped drive outperformance of PCFT’s benchmark over 2020/21, but the trust’s exposure to growth stocks, exposure to emerging markets, modest gearing and in 2022 an overweight exposure to US banks stocks has weighed on relative returns.

The odd blip March 2023 was at the time of SVB’s collapse. When we last wrote, we could point to some stabilisation in PCFT’s relative performance. However, since then it has given up more ground. PCFT was caught by the collapse in the share price of CAB Payments Holdings. The managers note that CAB announced a very disappointing update in October, primarily due to intervention by the central banks of two currencies that it trades in Africa. The managers say that, while revenues are still expected to grow, even if the central banks in question do not reverse their intervention, management credibility has been damaged so it will take time for them to rebuild credibility, given the downgrade to guidance so soon after the IPO.

There was also some weakness in the share price of HDFC Bank post its merger with HDFC Limited; as mentioned earlier in the note, the managers reduced the position.

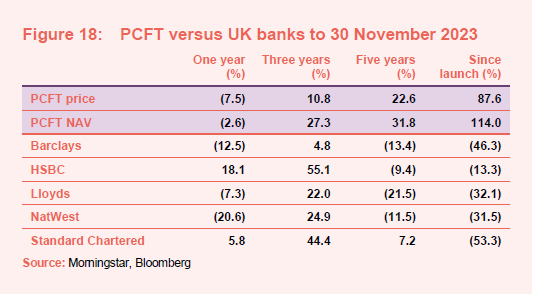

We have made the point in past notes that PCFT was established in part to provide UK-based investors with an alternative to a narrow group of relatively unexciting domestic financial stocks. Whilst the UK banks have rallied a bit over the past three years, since launch, PCFT’s returns are well ahead.

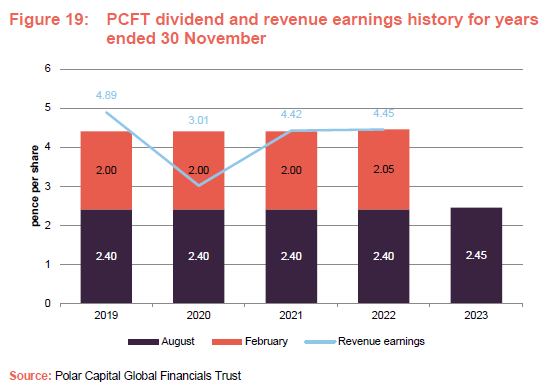

Dividend

PCFT pays dividends semi-annually on its ordinary shares in February and August. All dividends are paid as interim dividends. The payments are not necessarily of equal amounts. The company does not pay a final dividend.

Reserves help support the dividend

PCFT has edged up its dividends in recent years. Most years, these have been covered by earnings. However, the events of COVID – when many companies were prevented from paying dividends – meant that it had to dip into revenue reserves to maintain its dividend in 2020. PCFT pursues a long-term policy of dividend growth, although there is no guarantee that this can be achieved. At the end of May 2023, the revenue reserve stood at £13.5m (4.2p per share).

Premium/discount

Over the 12 months to the end of November 2023, PCFT’s share price moved within a range of a 13.6% discount to NAV and a discount to NAV of 1.9% and has traded at an average discount of 9.2%. On 8 December 2023, the discount to NAV was 12.3%.

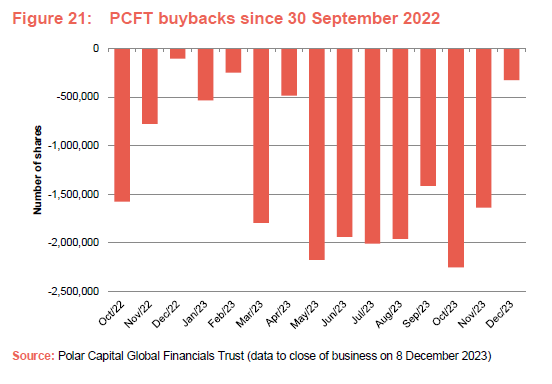

Looking at the long-term picture, PCFT’s discount widened as fears grew about the impact of COVID on the global economy and then narrowed following the vaccine news in November 2020. The shares traded at a modest premium to NAV for some time after that, but in April 2022, as investors became increasingly nervous about the health of the global economy, the shares moved to trade at a discount once again. Rising rates – with positive implications for banks’ margins – encouraged the discount to narrow. However, in common with many other trusts, PCFT’s discount has widened over the course of 2023.

The board seeks to moderate volatility in the discount and premium by repurchasing and issuing shares to help manage fluctuations in demand. Over the 12 months ended 30 November 2023, PCFT has bought back 16.6m shares or over 5% of its share capital. The shares repurchased are being held in treasury.

Fees and costs

PCFT’s manager is Polar Capital LLC (Polar). PCFT pays Polar a base management fee of 0.70% of NAV per annum. The investment management agreement may be terminated by either party giving 12 months’ notice. The base management fee is charged 80% to revenue and 20% to income.

In addition, the manager has the opportunity to earn a performance fee. This is calculated over five-year periods, the first of which runs from 7 April 2020 to 30 June 2025. The performance fee will be 10% of the total return generated by PCFT in excess of a performance hurdle. The hurdle is set as the return on the benchmark (MSCI ACWI Financials) plus 1.5% per annum.

For the year ended 30 November 2022, PCFT’s ongoing charges ratio fell from 1.02% to 0.87%. If the performance fee is included, the ongoing charges fee was 0.65% (it is lower as previously accrued performance fees were written down), which compared to a figure of 0.98% for the financial year ended 30 November 2021.

Capital structure and life

PCFT has a simple capital structure with a single class of ordinary shares in issue and trades on the Main Market of the London Stock Exchange. 8 December 2023, there were 308,536,687 ordinary shares with voting rights and a further 23,213,323 shares held in treasury.

Five-yearly tender offers from 2025 onwards

PCFT has an unlimited life. With effect from 2025, the board intends to propose tender offers at five-yearly intervals. These would allow any shareholder who wishes to exit the company to do so at a price close to NAV.

Shares bought back as part of the tender offer process and any other shares bought back in the normal course of discount control may be held in treasury and reissued at a premium to asset value.

PCFT’s accounting year end is 30 November and annual general meetings (AGMs) are usually held in April.

Gearing

PCFT may borrow up to 20% of net assets at the time of drawdown. Since July 2022, PCFT has had access to a three-year revolving credit facility of up to £50m plus two three-year term loans one of £15m and the other of $18.4m. The facilities have been made available by RBS and all mature on 8 July 2025.

At end October 2023, PCFT had net gearing (borrowing less cash, as a proportion of net assets) equivalent to 3.4% of NAV.

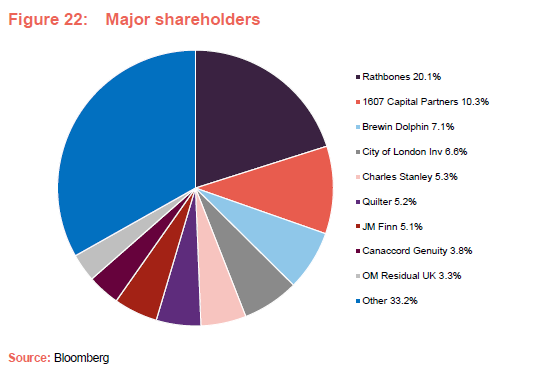

Major shareholders

Management

The five-strong global financials team at Polar Capital LLC was managing £523m, as of end October 2023.

Nick Brind

Nick joined Polar Capital following the acquisition of HIM Capital in September 2010, and is co-manager of PCFT and the Polar Capital Income Opportunities Fund. He has 29 years’ investment experience across a wide range of asset classes but since 2003 has focused on global financials. Before joining HIM Capital, Nick worked at New Star Asset Management. While there, he managed the New Star Financial Opportunities Fund, a high-income financials fund investing in the equity and fixed-income securities of European financials companies. Previous to that, he worked at Exeter Asset Management and Capel-Cure Myers. Nick has a Masters in Finance from London Business School.

George Barrow

George has been co-fund manager of PCFT since December 2020. He joined Polar Capital in September 2010 and is also the co-manager of the Polar Capital Income Opportunities Fund. George has 15 years’ industry experience and over 10 years’ experience analysing Europe, Asia and emerging markets. Prior to joining Polar Capital, he was an analyst at HIM Capital from 2008, where he completed his IMC. He has a Master’s Degree in International Studies from SOAS, where he graduated with merit.

Nabeel Siddiqui

Nabeel joined the Polar Capital Financials team as an analyst in August 2013 working closely with John Yakas and Nick Brind, focusing on the US, Latin America & Australia.

Prior to this, Nabeel worked as an operations executive at Polar Capital. He began his career in August 2008 with Habib Bank, where he worked within a variety of functions. He has a Master’s Degree in Money and Banking and has passed all three levels of the CFA.

Jack Deegan

Jack joined the Polar Capital Financials team as an analyst in October 2017 working closely with Nick Brind on the Income Opportunities Fund.

Prior to this, he worked at DBRS Ratings, covering the Swiss market as a lead analyst, as well as UK, Dutch, Japanese and Australian banks. Before DBRS, Jack worked in the Markets Division of the Bank of England for four years, assessing financial institutions with a view to determining access to the Bank’s Sterling Monetary Framework (SMF) facilities, and internal counterparty trading limits. He has a BA in Classical Archaeology & Ancient History from Oxford University and a Master’s Degree in Islamic Politics from SOAS.

John Yakas

John joined Polar Capital in September 2010. In July 2023 he stepped back to an advisory role. John has 35 years’ experience in the financial services industry. Previously, he worked for HSBC as a banker, based in Hong Kong, and was the head of Asian research at Fox-Pitt, Kelton. In 2003 he joined Hiscox Investment Management, which later became HIM Capital. John won Lipper awards in the equity sector banks and other financials sector in 2010, 2011, 2012 and 2013. He has an MBA from London Business School and studied at the London School of Economics (BSc Econ).

Board

The board comprises four non-executive directors, all of whom are independent of the investment manager and who do not sit together on other boards.

The board has been refreshed in recent years, with two directors – Robert Kyprianou and Katrina Hart – stepping down at the last AGM.

Simon Cordery (chair)

A director since 2019, Simon was appointed chair of PCFT on 30 March 2023. He has over 40 years’ experience working within financial services, of which nearly 30 years have been focused on the wealth management industry. Most recently he was head of Investor Relations and Sales at BMO Global Asset Management, where he spent almost 25 years in senior roles. Previously Simon held roles with Invesco Fund Managers, Jefferies & Co, Kleinwort Benson Securities and Rea Bros Merchant Bank. He has considerable and detailed knowledge of the investment trust industry and remains actively involved with the AIC. He is a Chartered Fellow of the Chartered Institute for Securities and Investment.

Susie Arnott (non-executive director)

Susie started her career in fund management over 20 years ago. She was primarily focused on the financial sector; including periods focused on emerging markets investments and global financials portfolios. Susie also spent a number of years working in ‘Impact Investing’, combining her experience and passion for social investment and impact measurement. In her current role, she continues to focus on investment with a global impact incorporating ESG as a mainstream consideration.

Angela Henderson (non-executive director)

Angela qualified as a solicitor and initially focused her career on corporate law before moving into financial services, where she spent time as an in-house lawyer and a director of global equities. Angela invested in and held non-executive board seats at small UK companies in the technology and asset management sectors and has previously served on the governing body of a London hospital foundation trust. She is currently a non-executive director and chair of risk for Macquarie Capital (Europe) Limited, non-executive director and chair of the Management and Service Provider Engagement Committee of Hargreave Hale AIM VCT plc and has various other private interests.

Cecilia McAnulty (chair of the audit committee)

Cecilia is an experienced non-executive director and Chartered Accountant with almost 30 years’ investment and financial services experience. Her executive career included senior investing roles at Royal Bank of Scotland, Barclays Capital and Centaurus Capital and encompassed a broad range of asset classes including public and private debt and equity.

Cecilia is a non-executive director and audit chair of Northern 2 Venture Capital Trust Plc. She is also an independent non-executive director of Alcentra Ltd (a global investment manager of sub investment grade credit), and a member of the Industrial Development Advisory Board of the Department of Business, Energy and Industrial Strategy.

Previous publications

QuotedData has published a number of notes on PCFT. You can read these by clicking the links in the table below or by visiting the QuotedData.com website.

Polar Capital Global Financials Trust – Don’t fear a slowing economy

Polar Capital Global Financials Trust – Banks too cheap to ignore?

Polar Capital Global Financials Trust – Riding out the storm

Polar Capital Global Financials Trust – Don’t fear the dog that is yet to bark

IMPORTANT INFORMATION

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Polar Capital Global Financials Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.