Handful of themes to drive performance

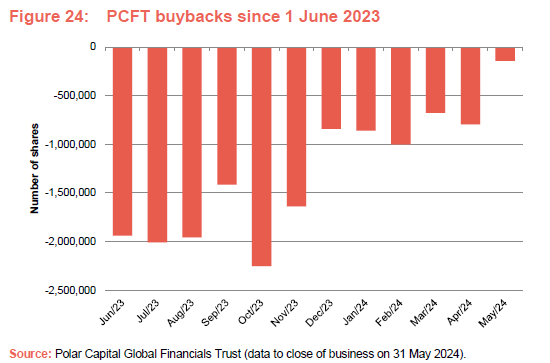

Polar Capital Global Financials Trust (PCFT) has had a good six months both in net asset value (NAV) terms, where returns have been ahead of both its MSCI All-Countries World Financials Index performance benchmark and the global MSCI All Countries World Index, and in share price terms, as the share price discount to NAV has narrowed. Next year’s liquidity opportunity (see page 12) ought to help the discount narrow further.

It is early days, but the team reviewed the investment process with the recent hiring of new co-manager Tom Dorner (see page 14). Active share has increased, and the trust has reduced its exposure to banks (which has been a headwind to performance historically). The managers are cautiously optimistic.

As we explore in this note, they have identified five core themes that they feel will help drive further outperformance: alternative asset managers; a strong pricing environment for reinsurance companies; growth and reform within emerging markets; undervalued small- and mid-caps; and a need to be selective in PCFT’s exposure to banks.

Growing income and capital from financials stocks

PCFT aims to generate a growing dividend income, together with capital appreciation. It invests primarily in a global portfolio, consisting of listed or quoted securities issued by companies in the financial sector. This includes banks, life and non-life insurance companies, asset managers, stock exchanges, speciality lenders and fintech companies, as well as property and other related sub-sectors.

| Domicile | England & Wales |

|---|---|

| Inception date | 1 July 2013 |

| Manager | Nick Brind, George Barrow and Tom Dorner |

| Market cap | 507.9m |

| Shares outstanding (exc. treasury shares) | 304.498m |

| Daily vol. (1-yr. avg.) | 688,201 shares |

| Net gearing | 3.6% |

At a glance

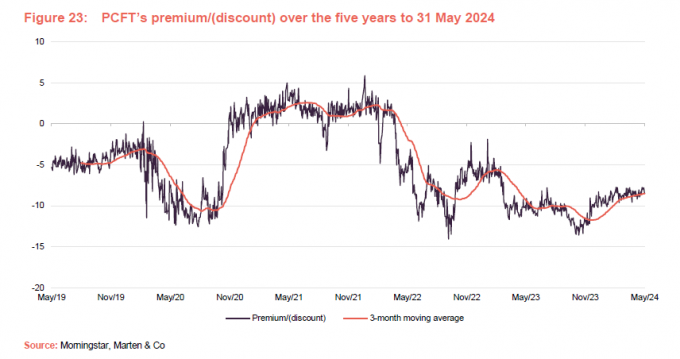

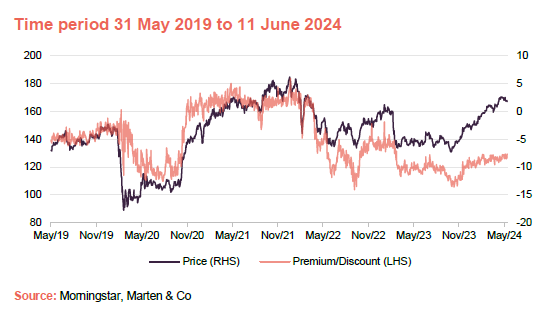

Share price and discount

The improvement in PCFT’s share price relative to its NAV since we last published has mirrored the improvement in PCFT’s NAV returns relative to its benchmark.

The managers also highlight next year’s liquidity opportunity (the first of a series of five-yearly tender offers), which ought to mean that the share price discount to NAV continues to narrow between now and then.

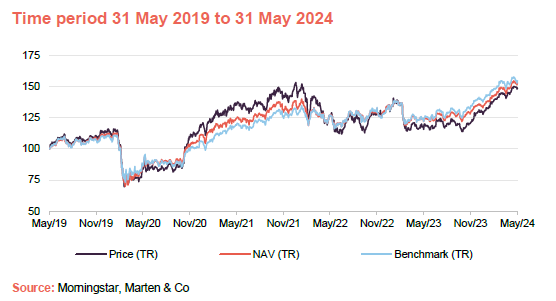

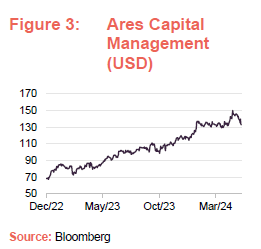

Performance over five years

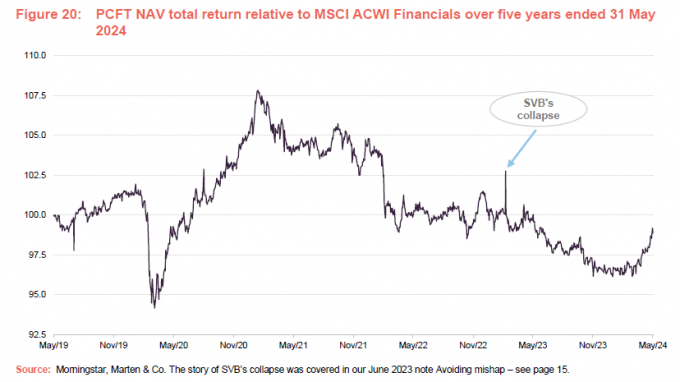

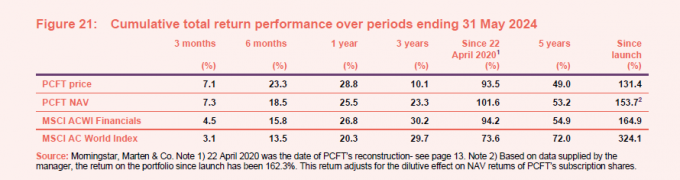

Since we last published a note, there has been a recovery in PCFT’s performance relative to its benchmark.

PCFT is now well ahead of its benchmark since the trust was restructured in April 2020. Encouragingly, the sector has also outperformed the wider global index over that period as well, despite the distorting effect that AI-related mega caps have had on returns over the past year or so.

Market backdrop – five themes

Currently, PCFT’s managers are expressing five main themes within the portfolio: alternative asset managers; a strong pricing environment for reinsurance companies; growth in financial services and reform within emerging markets; undervalued small- and mid-caps; and a need to be selective in PCFT’s exposure to banks.

Good outlook for alternative asset managers

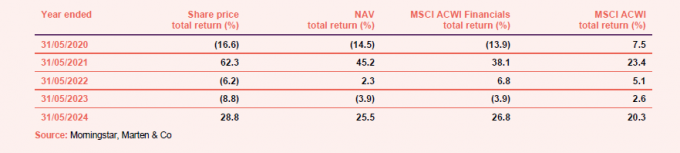

The first of these themes aims to capture the structural tailwinds that are favouring alternative asset managers and driving the growth of assets under management (AUM) in this area. This is represented within the portfolio with positions in stocks such as Ares, CVC, ICG, KKR, and Macquarie.

PwC’s 2023 global asset and wealth management survey reckoned that the fastest-growing parts of the asset management industry between then and 2027 would be low profit margin passive (usually index-tracking) investments, such as ETFs, and relatively high margin alternative investments such as private equity and debt, property, and infrastructure.

Data from Ares Capital Management’s latest presentation, based on Preqin’s Future of Alternatives 2028 report published in October 2023, is even more optimistic, suggesting that AUM in the areas that it focuses on could grow by 70% between 2022 and 2028.

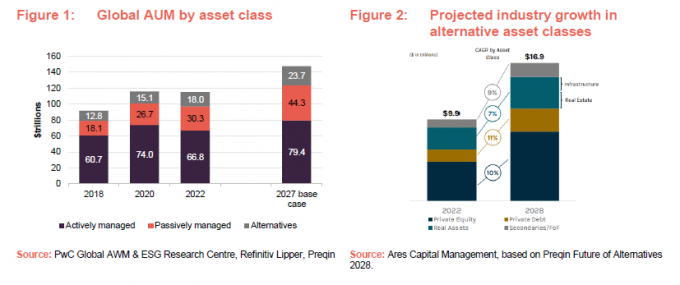

Ares Management (aresmgmt.com) offers exposure to credit, real estate, private equity, and infrastructure. It is a global business with about $428bn of AUM and around 2,900 employees distributed across 39 offices. It has grown both organically and by acquisition, most recently buying AMP Infrastructure Debt in 2022 and Landmark Partners and Black Creek Group in 2021.

Ares feels that in addition to benefitting from the underlying growth of the alternatives market, it has an opportunity to take market share in what remains a fragmented market. Even with $428bn of AUM, its share of the addressable market in each of its chosen specialities is less than 1%.

Good pricing environment for reinsurance stocks

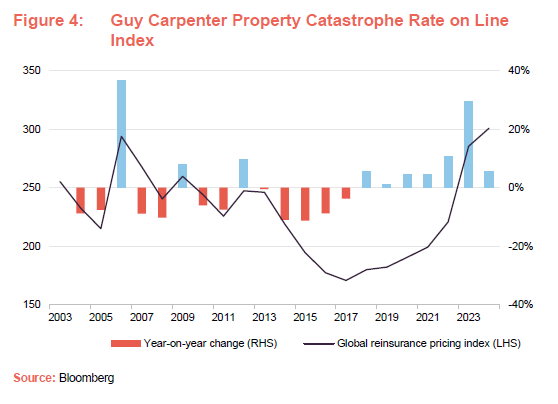

As natural disasters proliferate, reinsurance rates have been climbing. As reinsurers have to pay out on claims on a more regular basis, the number of people willing to reinsure risks is affected and the price that they demand for putting up capital rises too. Rates in Asia and the US have been hitting new all-time highs, and the rate in Europe is as high as it has been since the global financial crisis in 2008. The line Figure 4 shows the global reinsurance pricing index, the bars show the change from one year to the next. A run of blue bars in recent years illustrates the strength of pricing in this market.

PCFT has exposure to this theme through positions in stocks such as Munich Re, Arch, Renaissance Re, Everest, and Berkshire Hathaway.

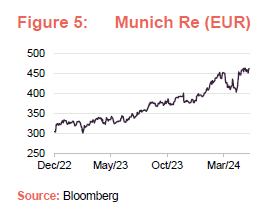

In addition to its reinsurance activities, Munich Re (munichre.com/en) owns ERGO, one of the largest insurance groups in Europe. Profitability has improved significantly thanks to higher investment returns (a positive side-effect of higher rates) and strong pricing. This fed through into 34% earnings per share (EPS) growth in 2023 and return on equity (ROE) of 15.7%, towards the top end of the company’s target range for 2025. That momentum has continued into 2024, with earnings coming in well ahead of analysts’ estimates.

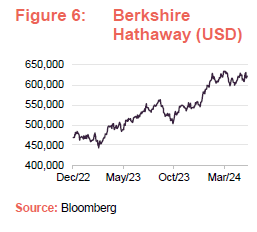

Berkshire Hathaway (berkshirehathaway.com) will be well known to many readers. Its insurance and reinsurance activities are a key part of its business (42% of profits for 2023), but the full portfolio also includes freight rail transportation, utilities and energy, manufacturing services and retailing, as well as an investment portfolio with stakes in many other companies.

It is the largest stock in PCFT’s benchmark, larger even than JPMorgan Chase and Visa. The managers observe that the insurance operations and the investment portfolio have been driving returns while the railroad network and the utilities and energy divisions have been detractors, the latter on lawsuits linked to Californian wildfires.

PCFT’s position has been trimmed recently as the managers say that they see a lack of catalysts for further outperformance outside of a sharp correction in equity markets. If markets did crack, Berkshire Hathaway should be buoyed by its high liquidity position ($182bn), and it may be that Warren Buffet would then see more value in markets and seek to take advantage of this.

Ongoing growth and structural reforms in emerging markets

PCFT’s managers like emerging markets for their structural growth potential. Demographic trends are often favourable (a growing population means more customers), but much of the growth opportunity comes from selling financial services to customers who have never had access to these products in the past. Embracing technology (such as mobile banking) and a lack of legacy infrastructure enhances the profitability of these services.

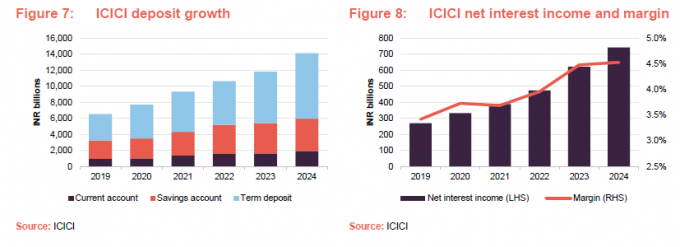

As one example, ICICI (icicibank.com), which PCFT has favoured in place of HDFC recently, is India’s second-largest bank (behind HDFC). As Figure 7 illustrates, it has experienced fairly rapid growth in recent years, and – as can be seen in Figure 8 – its profitability has been enhanced by expanding margins.

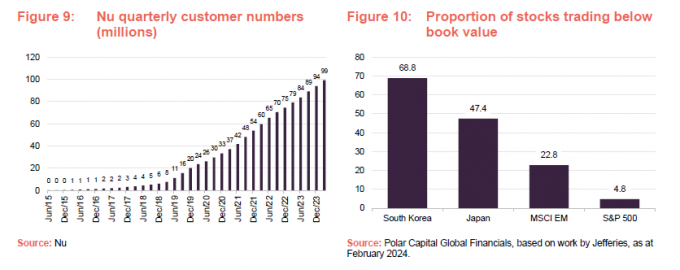

Another good example of this phenomenon is Brazil’s Nu (investidores.nu/en), which serves customers across Brazil, Mexico, and Colombia. From its launch in 2014, Nu has grown to be the largest digital banking platform in the world outside of Asia. It broke through the 100m customer mark in May 2024. Remarkably, it now serves 54% of the adult population of Brazil. That growth has fed into a tripling of revenue over the past two years, and a shift from losses of $45.1m in the first quarter (Q1) of 2022 to profits of $378.8m in Q1 2024.

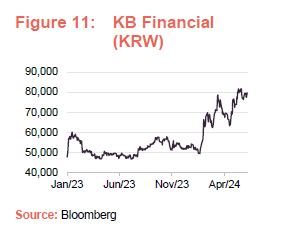

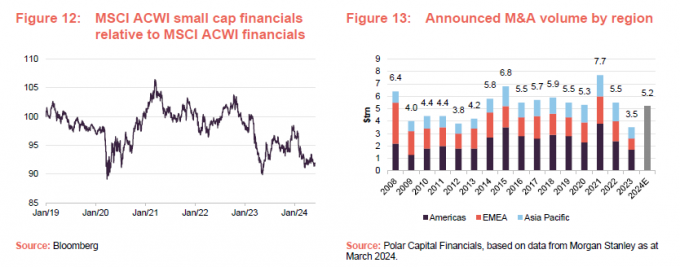

The story in emerging markets is wider than just fast-growing companies, however. PCFT has a stake in KB Financial Group (kbfg.com/eng), which offers a broad range of financial services to customers in South Korea. Here part of the attraction was Korea’s corporate governance reforms, which are focused on driving up returns to shareholders. Figure 10 shows what percentage of stocks were trading at valuations lower than book value in various markets. As in Japan, too many companies in Korea were trading far below book value. KB Financial is trading on a price/book ratio of 0.52x.

With a tier 1 capital ratio of 15.3%, KB Financial has one of the strongest balance sheets in the Korean banking sector and, by implication, scope to increase distributions to investors. 2023’s dividend was covered 3.8x by earnings and buybacks over the year were quite modest, with just 2.8% of shares in issue retired at a cost of KRW600bn.

KB Financial says that it has made environmental, social and governance (ESG) a core part of its business, making it into the Dow Jones Sustainability Index (DJSI) World Index for eight consecutive years and becoming the first Korean financial institution to achieve the highest rating (AAA) in the MSCI (Morgan Stanley Capital International) ESG evaluation.

Opportunities in unloved small- and mid-caps

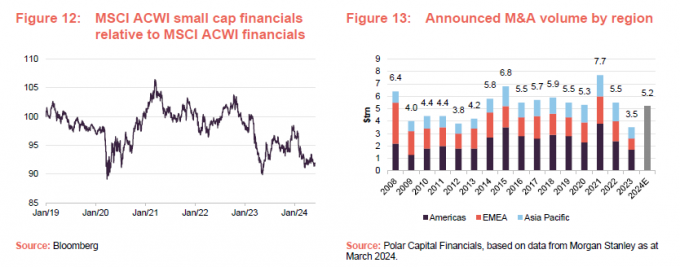

While small- and mid-cap banks have de-rated relative to their larger peers, PCFT’s managers see an opportunity in this part of the market as mergers and acquisitions (M&A) activity picks up.

Last month, PCFT’s managers highlighted the bid approach by BBVA for Banco de Sabadell (which faces political opposition in Spain and so may not proceed), the potential for consolidation amongst the Italian banks, and a string of other possible deals in Europe, including bancassurance-type consolidations as regulations allow lower capital requirements against insurance business than banking activities.

Selective in exposure to banks

The boost that higher interest rates provided has worked its way through into banks’ profit margins, and now analysts are anticipating interest rate cuts. How far and how fast rates fall is very much up for debate, however. In the US, stubborn inflation and a strong economy have delayed rate cuts again. By contrast, the European Central Bank (ECB) has already cut rates by 0.25% to 3.75% this month.

PCFT’s managers have said previously that banks make most of their profit margin on the first 2.5% of interest rates, which – as Figure 14 shows – is about as low as members of the US Federal Reserve expect rates to go over the longer term.

The Fed dot plot in Figure 14 shows where the members of the Federal Reserve think that official US interest rates are headed over the next few years. Each dot represents a prediction for that time period. The line is the median of these projections.

It is also notable that most banks have not been much affected by defaults on the loans that they have made. Nevertheless, the managers are cautious about banks’ exposure to commercial real estate and office properties, in particular. In the US, this is more of a potential problem for smaller banks, and this was one reason why PCFT’s exposure to this part of the sector has been cut.

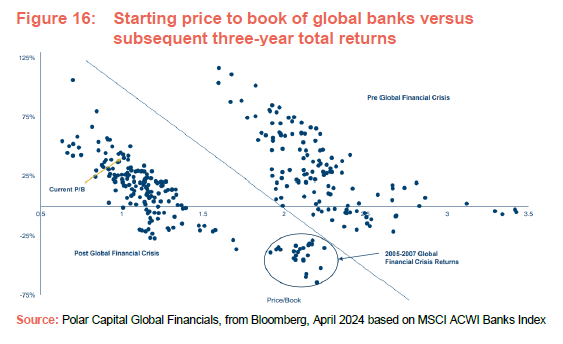

PCFT’s managers recognise these challenges and therefore remain cautious on banks. However, as illustrated by the chart in Figure 16, which shows the relationship between price/book ratios (on the bottom axis) and subsequent three-year share price performance (on the left-hand axis), the indication is that banks are offering decent upside based on current valuations.

The chart also illustrates that there has been a big shift in the typical price/book ratio that banks tend to trade at since the global financial crisis. That most likely reflects the additional capital that banks have to hold and the other restrictions that were imposed on them in the wake of 2008.

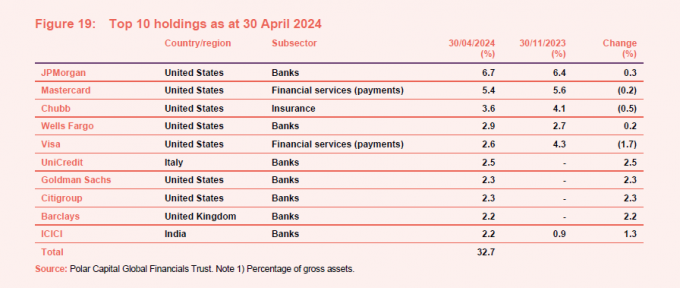

As the list of PCFT’s 10-largest holdings shows in Figure 19, PCFT has recently increased its exposure to Goldman Sachs, Barclays, Citigroup. The managers feel that there is greater opportunity for these banks to profit from their investment banking activities currently. In Barclays’ case, investors’ disillusionment with the story (and perhaps the general lack of interest towards UK stocks) means that the shares are trading on a price/book ratio of just 0.56x.

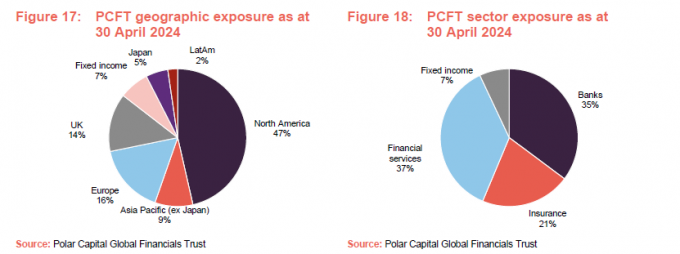

Portfolio – asset allocation

At the end of April 2024, there were 81 positions in PCFT’s portfolio. Since we last published (using data as at 30 November 2023), the trust’s exposure to Asia has reduced in favour of the UK and, to a lesser extent, Japan. There has also been quite a big shift out of PCFT’s exposure to banks in favour of financial services, reflecting the managers’ more selective approach to the sector discussed above.

Top 10 holdings

Since we last published (using data as at end October 2023, Berkshire Hathaway, Arch Capital, Marsh McLennan, RenaissanceRe Holdings, and Bank of America have dropped out of the top 10 holdings, to be replaced by UniCredit, Goldman Sachs, Citigroup, Barclays, and ICICI.

Unicredit

Whilst it is headquartered in Italy, Unicredit (unicreditgroup.eu/en) is a pan-European bank with 15m customers and a presence in Italy, Germany, Central and Eastern Europe. It owns HypoVereinsbank, Bank Austria, and Zagrebačka banka.

Q1 2024 results showed net revenue up 7% year-on-year, net profit up 24% helped by an improvement in its cost/income ratio, and EPS up 41.8% helped by buybacks. The bank’s common equity tier one capital ratio rose to 16.2%, well above its target of 12.5%–13% and despite €8.6bn of distributions in 2023.

Goldman Sachs

Over the first quarter of 2024, Goldman Sachs (goldmansachs.com) was the leading player in announced and completed M&A, according to Dealogic. For that quarter, Goldman Sachs reported net revenues of $14.2bn (up 16% year-on-year) and net earnings of $4.13bn (up 28%).

Citigroup

By contrast, Citigroup’s (citigroup.com) first quarter results showed falling revenues (down 2% year-on-year) and EPS (down 28%). However, within that, and reflecting the managers’ thesis, its investment banking fees were up strongly – by 62% in debt capital markets and by 57% in equity capital markets. The bank is seeking to improve its profitability through cost savings – targeting a reduction in annual expenses of $2bn–$2.5bn in the medium term (on forecast expenses of about $53.5bn–$53.8bn for its 2024 financial year).

Performance

PCFT’s performance has been covered in our previous notes, a list of which is provided on page 14. Since we last published a note, there has been a recovery in PCFT’s performance relative to its benchmark.

As Figure 21 shows, PCFT is now well ahead of its benchmark since the trust was restructured in April 2020. Encouragingly, the sector has also outperformed the wider global index over that period as well, despite the distorting effect that AI-related mega caps (the so-called magnificent seven of Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla) have had on returns over the past year or so.

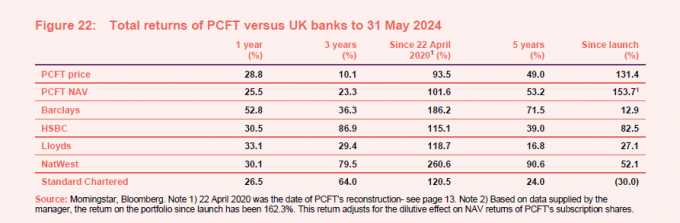

Part of the pitch for PCFT at launch was that it offered an easy way for UK investors to diversify their banks exposure away from the narrow clutch of UK banks that were facing a number of strategic challenges. Since then, the outlook for some of these banks has changed – as is reflected in the managers’ decision to include Barclays within the portfolio. However, the original premise worked well.

Fund intro

PCFT looks to grow investors’ income and their capital

More information on the trust is available on its website www.pcgft.com

Polar Capital Global Financials Trust (PCFT) has twin objectives of growing both investors’ income and their capital. Its global mandate makes it a useful alternative for UK-based investors looking to diversify their financials exposure.

PCFT launched on 1 July 2013 with a fixed life. In April 2020, in conjunction with a vote on prolonging the life of the trust, shareholders were offered a cash exit. Holders of 39.1% of PCFT’s then-issued share capital opted to sell their shares and the portfolio was reconstructed to facilitate this. At the same time, shareholders overwhelmingly approved an extension of the trust’s life beyond May 2020 and the trust now has an unlimited life, but with five-yearly tender offers, the first of which is scheduled for 2025.

Predominantly, the portfolio is invested in listed/quoted securities. The trust may have some exposure to unlisted/unquoted securities, but this is not expected to exceed 10% of total assets at the time of investment.

Benchmarked against MSCI ACWI Financials

Since April 2020, the trust’s performance benchmark has been the MSCI All-Countries World Financials Net Total Return Index in sterling (MSCI ACWI Financials).

New team member – Tom Dorner

PCFT’s AIFM is Polar Capital LLP, which had AUM of £21.9bn at 31 March 2024 and employs 13 investment teams, spread across offices in Europe, the US and Asia. PCFT’s lead managers are Nick Brind, George Barrow, and Tom Dorner.

Tom is a recent recruit, having joined the team in December 2023 from abrdn, where he was a senior investment director in the developed markets team and managed the abrdn Europe ex UK Income Equity Fund. Tom was responsible for analytical coverage of European financials and managed a number of other European investment funds during his nine years there. Prior to this, he was an analyst specialising in the European Insurance sector at Citi and Lehman Brothers in London. He qualified as a Chartered Accountant with Ernst & Young in the Insurance Audit practice and has a BA (Hons) in War Studies from Kings College London, and an MA in Philosophy from the University of Nottingham.

Previous publications

QuotedData has published a number of notes on PCFT. You can read these by clicking the links in the table below or by visiting the QuotedData.com website.

| Don’t fear a slowing economy | Initiation | 30 April 2019 |

| Banks too cheap to ignore | Update | 29 October 2019 |

| New lease of life | Update | 22 February 2020 |

| Too much pessimism? | Annual overview | 22 October 2020 |

| The tide has turned | Update | 25 February 2021 |

| More to go for | Annual overview | 18 November 2021 |

| Riding out the storm | Update | 5 April 2022 |

| Don’t fear the dog that is yet to bark | Annual overview | 30 November 2022 |

| Avoiding mishap | Update | 7 June 2023 |

| Pessimism overdone, time to buy | Annual overview | 12 December 2023 |

| IMPORTANT INFORMATION | ||

|---|---|---|

| Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Polar Capital Global Financials Trust Plc. This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.Marten & Co is not authorised to give advice to retail clients. The research does not have | regard to the specific investment objectives financial situation and needs of any specific person who may receive it.The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note | until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited. |

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.