Polar Capital Global Healthcare

Investment companies | Initiation | 5 March 2024

Healthy returns and a rosy outlook

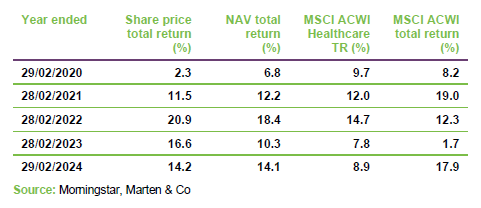

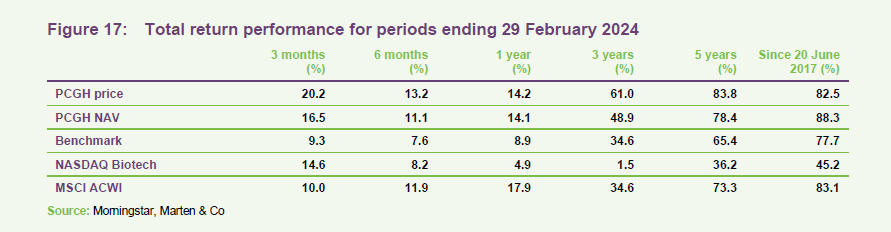

Polar Capital Global Healthcare (PCGH) is, as we show on page 16, the leading performer within its peer group over the long term. Its managers’ feel that their high-conviction approach and stock-picking skills have helped the trust navigate a period of relative underperformance by the healthcare sector. The managers believe that the sector is overdue a re-rating.

PCGH’s managers point to the long-term secular trends that are driving growing demand for healthcare. They say that higher utilisation is fuelling revenue growth and encouraging developments in areas such as the way in which healthcare is delivered and the take-up of preventative medicine. In addition, they note that innovative drugs and medical technologies are opening up new frontiers for the sector. Cheap valuations relative to history, especially amongst small-cap and biotech names, appear to be encouraging M&A activity. The managers say that all of this points to a rosy long-term outlook for the sector, which PCGH is well-positioned to benefit from.

Long-term capital growth from healthcare stocks

PCGH aims to deliver long term capital growth to its shareholders by investing in a diversified global portfolio of healthcare stocks.

Fund profile

PCGH aims to generate capital growth through investments in a global portfolio of healthcare stocks which is diversified by geography, industry subsector and investment size.

More information is available on the trust’s website polarcapitalglobalhealthcaretrust.co.uk

PCGH started life in 2010 as Polar Capital Global Healthcare Growth and Income Trust with an issue of ordinary shares and subscription shares. The subscription shares were exercised in full in July 2014 and this distorts the trust’s NAV returns for that early period. In June 2017, the trust was reconstructed and adopted its current name. About 26.3m shares were bought back and 27.8m shares issued around that time. The trust also took on gearing in the form of zero dividend preference shares (see page 19).

PCGH has a fixed life but this might be extended

As discussed on page 19, unless shareholders instruct otherwise, the board is obligated to put forward a liquidation vote for the trust in 2025/26. However, there may be a proposal put to shareholders to extend the fund’s life in some way, ahead of that time.

The team has considerable real-world experience of the pharma and biotech industry

PCGH’s investment manager and AIFM is Polar Capital LLP. The lead managers on the trust are James Douglas and Gareth Powell (more information on the managers is available on page 20). The management team has considerable real-world experience of the pharma and biotech industry.

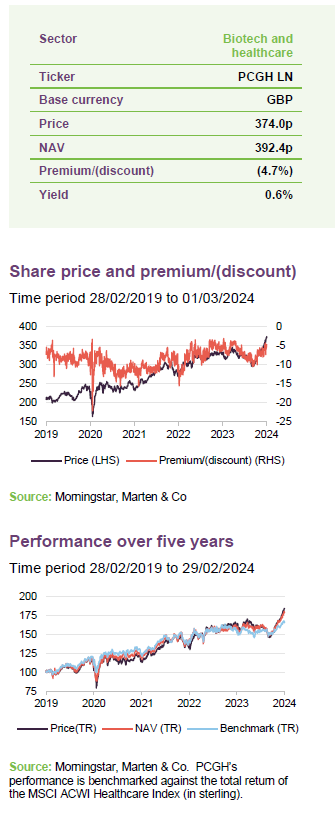

PCGH’s performance is benchmarked against the total return of the MSCI ACWI Healthcare Index (in sterling).

Market background

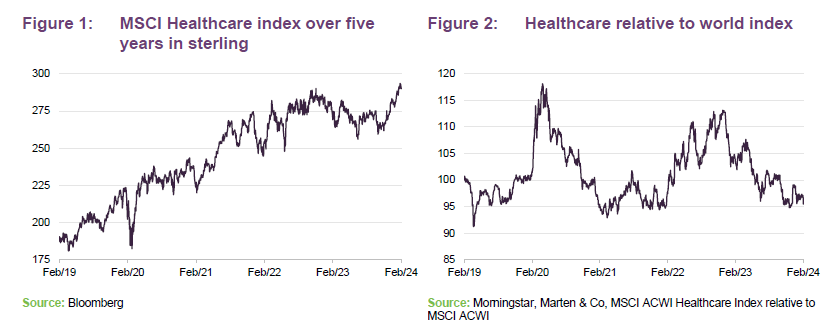

Until recently, the healthcare sector had been tracking sideways for quite a while now and, relative to the wider global index, has lagged a rising market. COVID had a profound effect upon the sector, both positive and negative. Although, some clinical trials and non-urgent operations were delayed, the managers comment that money poured into the sector as excitement rose about the potential of vaccines, and then dried up again.

Healthcare selloff overdone?

The managers feel that at the end of 2020 there was overexuberance in the sector, but this has now swung the other way. At the end of December 2023, the forward P/E on S&P 500 Health Care sector was lower than that of the wider S&P 500 Index, despite the healthcare sector’s multi-year track record of delivering superior earnings growth.

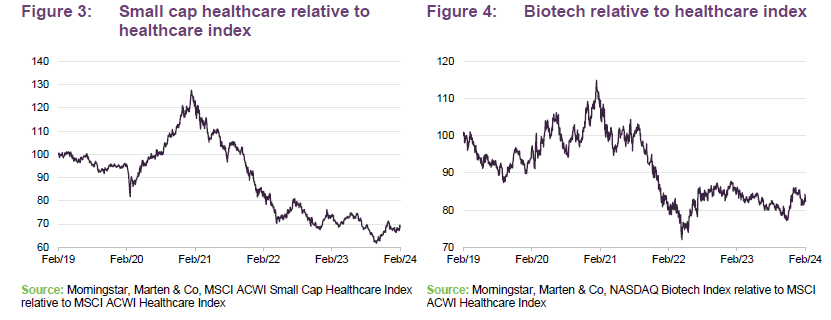

Small cap and biotech have lagged behind

Within this, small-cap healthcare stocks have lagged large ones by a considerable margin. A lot of that is reflective of the underperformance of biotech stocks, which began in Q4 2021 but accelerated most likely as rising interest rates turned investors off growth stocks, and particularly loss-making and cashflow negative stocks. More recently, there has been a modest rebound in biotech, which appears to be in response to growing expectations grow that the next move in rates is downward.

The sell-off in biotech valuations was so severe that, when the managers were putting together a presentation on PCGH at the start of November 2023, the average small/mid-cap biotechnology stock was trading on just 1.1x EV/Cash.

Long-term drivers

Demographics

The world’s population is ageing. There were 1bn people aged 60 or over in 2020, by 2030 that is expected to be 1.4bn and by 2050 2.1bn. It is an unfortunate fact of life that as we age, our healthcare needs tend to grow. Demand growth for the healthcare sector’s products and services seems inevitable, therefore, and the managers say the bigger question becomes, what is affordable?

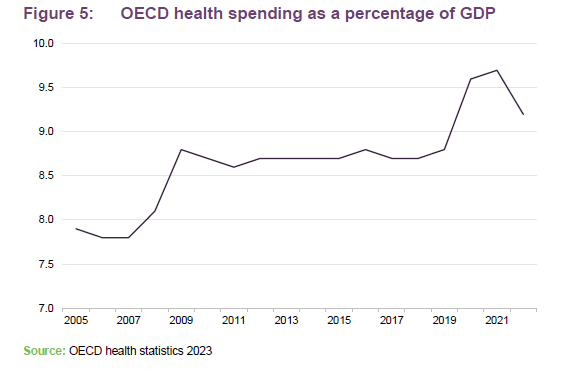

Economics

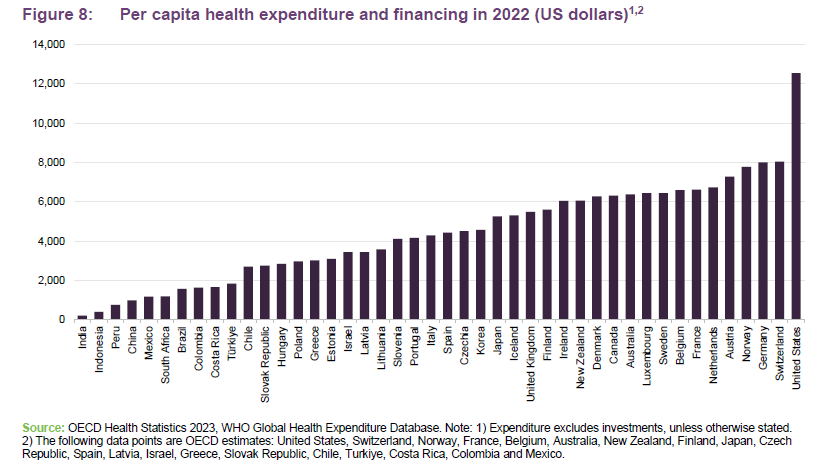

As countries become richer, the proportion of income spent on healthcare tends to grow, although the quantum may be heavily influenced by the choice of healthcare model – the managers cite the example of the US, where national health expenditure accounted for 17.3% of GDP in 2022 – far higher than comparable countries. Given the size of its GDP, that makes the US the most important market for healthcare products and services. That demand is also reflected in the composition of the MSCI ACWI Healthcare Index, where almost 70% of the index by market cap was in US companies at the end of January 2024.

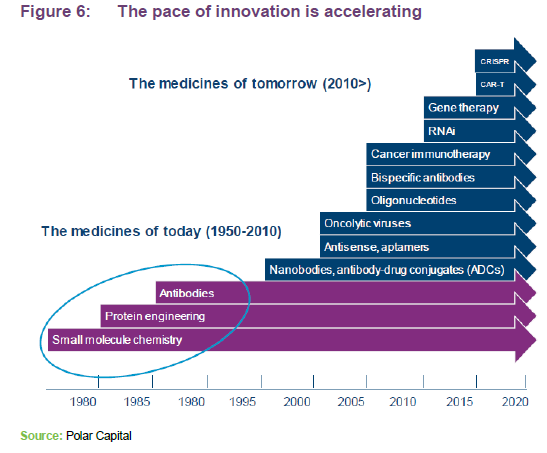

Innovation

As countries become richer, the proportion of income spent on healthcare tends to grow, although the quantum may be heavily influenced by the choice of healthcare model – the managers cite the example of the US, where national health expenditure accounted for 17.3% of GDP in 2022 – far higher than comparable countries. Given the size of its GDP, that makes the US the most important market for healthcare products and services. That demand is also reflected in the composition of the MSCI ACWI Healthcare Index, where almost 70% of the index by market cap was in US companies at the end of January 2024.

Politics

Given the importance of the US market to the sector, political threats to curb healthcare spending, by driving down drug prices, for example, may have a big impact on investor sentiment. Any long-term chart of the sector’s performance appears to show the effects of Bill Clinton’s efforts to control drug prices in the ‘90s; the 2010 passing of the Affordable Care Act (Obamacare); and presidential candidate Hilary Clinton’s comments on drug pricing in the mid-2010s.

Most recently, 2022’s Inflation Reduction Act has introduced a cap on out-of-pocket spending for those enrolled in Medicare. Effectively, this limited price rises to the rate of inflation for drugs used by those in Medicare; extended insurance premium subsidies; and required the government to negotiate prices on certain drugs from 2026 (although the managers make the point that many of these are nearing the end of their patented life in any case). The Congressional Budget Office estimates that these measures would reduce government expenditure on healthcare by $237bn between 2022 and 2031.

As we are in an election year, that may have some influence on sentiment. However, the managers reason that the most likely outcome is a President with a split Congress, which tends to limit the scope for radical change. They observe that Trump’s threats to look again at the Inflation Reduction and Affordable Care Acts need to be viewed in light of his failure to reform Obamacare during his earlier term in office. However, there is a chance that this would be taken as a net positive for the sector.

Given the importance of US government policy on the sector, the managers use an external consultant to gain additional insight into this area.

Six investment themes

The managers have identified six themes that they feel will be the most important drivers of returns over the next five to 15 years. These have been in place for about three to four years now. The following summarises their views:

Healthcare delivery disruption

PCGH’s managers say that, as more people want access to healthcare and their healthcare needs grow, there is pressure to increase efficiencies within the system. Staffing pressures, which are not unique to the UK and seem likely to worsen as the workforce shrinks relative to the proportion of retirees, are another driver for this theme, in their view.

There is pressure to increase efficiencies in the healthcare system

Hospitals are expensive to run and minimising in-patient stays, treating more conditions at home, and the use of specialist walk-in (ambulatory surgery) centres are all a more efficient use of resources. So, too, is the shift to remote GP consultations – telehealth, remote monitoring of conditions and the use of online pharmacies. The managers say that the industry was already moving in this direction, but COVID accelerated this process. Part of the attraction of outpatient facilities is that they can be run more on a 9–5 basis, without the need for expensive and hard-to-staff night shifts.

Ambulatory surgery centres are already handling hip- and knee-replacement surgeries. Telemedicine services offer a much more efficient use of doctors’ time.

AI and machine-learning will have applications in enhancing the delivery of healthcare; in managing revenue collection, for example.

A top-10 position within PCGH’s portfolio (see page 12), Elevance Health, formerly Anthem (elevancehealth.com) is a play on the healthcare delivery disruption theme. The company offers commercial, Medicare, and Medicaid plans. COVID increased demand for its virtual primary care (telemedicine) services, with 1m Medicare health plan members now signed up to its Sydney Health app and web services, for example.

Innovation

Embracing AI and machine-learning has the potential to increase the pace of drug discoveries and provide better-targeted treatments, according to the managers.

Obesity drugs could be a $100bn market by 2030

Recently, new obesity drugs have garnered headlines and are tapping into a significant new market (42% of US adults are said to be obese according to the CDC). Novo Nordisk’s Ozempic (semaglutide) has been used to treat Type 2 diabetes since 2017, but its approval as a weight loss drug by the FDA in June 2021 gave a considerable boost to demand. Goldman Sachs has suggested that obesity drugs could be a $100bn market by 2030. Another big new treatment area is Alzheimer’s; here Biogen/Eisai’s Leqembi, which was approved by the FDA in July 2023, builds on (and replaces) its earlier success with Aducanumab. Veoza (fezolinetant), a new non-hormonal therapy for menopause from Astellas Pharma, was approved by the FDA in May 2023 and the EMA and the UK’s MHRA in December 2023.

Gene therapy is helping to address areas of high unmet medical need. Novartis has Zolgensma for the treatment of spinal muscular atrophy (SMA), for example. However, the cost of some of these treatments may mean that take-up is low.

The managers think that the area of cell therapies such as CAR-T is interesting, especially in the treatment of blood cancers.

In the area of devices, robotic surgery techniques are gathering increased acceptance. They are more accurate than surgeons working alone, which means there is less risk of revisions. Intuitive Surgical has sold a number of its da Vinci surgical systems to the NHS, for example. Boston Scientific is supplying its PFA (pulsed field ablation) systems too; these are used to treat arterial fibrillation through electrical pulses.

The managers are conscious that innovation can create losers as well as winners. There is a chance that greater use of obesity drugs reduces the need for bariatric surgery, for example.

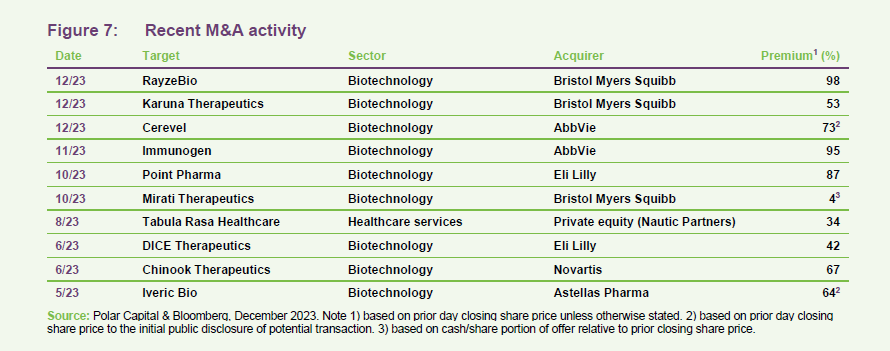

Consolidation

M&A activity was elevated in 2022, slowed as we entered 2023, but picked up again strongly in the final quarter of the year. The managers say that cash-rich pharma companies have been taking advantage of the slump in biotech to strengthen their pipelines, but there has been activity in other healthcare sectors too. PCGH’s managers expect this trend will continue.

Emerging markets

Within the Polar Capital Global Healthcare team, Brett Pollard (see page 22) is focused on identifying opportunities in emerging markets.

As Figure 8 shows, healthcare spending per capita in emerging markets, especially in the enormous potential markets of India and China, is well below developed-world norms. Both countries are encouraging the development of home-grown biotech businesses, but they are also significant players in the outsourcing sector.

Much like the rest of its stock market, the Chinese biotech industry is in the doldrums currently, but the managers feel that it does have recovery potential.

When evaluating emerging market stocks, the managers stress that the attractions of different markets are quite dependent on their choice of healthcare model. However, the main message is that there is huge pent-up demand for healthcare, and as citizens become wealthier, their budget for healthcare grows disproportionately.

The managers note that there is price pressure on mature products in these markets. However, they do represent an opportunity to add considerable additional volume.

PCGH can access growth in emerging markets either directly or through the multinationals

PCGH can access growth in emerging markets either directly or through the multinationals

Outsourcing

In a drive to improve margins, healthcare companies are increasingly outsourcing non-core parts of their operations, and this has been a growing part of the healthcare sector.

COVID had an adverse impact on some clinical trials, as hospitals’ resources were refocused on fighting the pandemic. One response was to switch from using a single contract research organisation (CRO) to a decentralised model across multiple CROs. The managers say that, once the pandemic receded, the industry needed to readapt.

Biotech’s funding constraints have led to them cutting spending, sometimes bringing work back in-house, for example. Overall, the managers are cognisant of the slowdown in this part of the healthcare market but say that they are not bearish, given the long-term drivers for growth.

Prevention

The growing vaccines market is an important part of the prevention theme. The success of mRNA technology is opening up opportunities to vaccinate against a much wider spread of conditions as well as novel cancer treatments, in the managers’ view.

Beyond COVID, there have been successes such as the 2021 approval of Glaxo’s Shingrix vaccine to prevent shingles in immunocompromised adults, following on from its 2017 approval for over-50s; Pfizer’s Penbraya, a recent approval for a vaccine aimed at preventing meningitis and septicaemia; and both companies’ recent launches of vaccines (Arexvy and Abrysvo) aimed at preventing respiratory virus RSV.

Increased remote monitoring of conditions is helping to reduce the need for medical intervention in areas such as remote glucose monitoring for diabetics. By avoiding the need for inpatient treatment of long-term complications associated with the disease, better management of diabetes can translate into considerable cost savings.

There is also a recognition that money spent on earlier diagnosis of conditions would translate into cost savings over time. The managers suggest the infrastructure established for COVID testing could be adapted for this purpose, for example.

Investment policy and process

PCGH’s manager allocates its portfolio between ‘growth’ and ‘innovation’ stocks. The growth part of the portfolio makes up the majority of the company’s assets and is comprised mainly of large-cap companies.

Portfolio split between growth and innovation stocks

Innovation stocks tend to be small and mid-cap companies that are driving disruptive change. This applies to the creation and development of new drugs and surgical treatments, and also to innovative solutions to the management and delivery of healthcare. Once an innovation stock’s market cap exceeds $5bn, it will usually be classified as a growth stock.

Maximum 20% in innovation

The split of the portfolio between growth and innovation will vary, based on the managers’ perception of the risk/reward opportunity. However, there is a cap of 20% of gross assets in small-cap innovation stocks.

In total, there will usually be between 25 and 60 stocks in the portfolio, with no single investment accounting for more than 10% of gross assets at the time of investment.

While the innovation portfolio may include unlisted/unquoted stocks, such exposure is limited to 5% of gross assets at the time of investment, and in practice PCGH has no exposure to unquoted/unlisted stocks currently.

The manager uses a qualitative filter to build up a watch-list of securities that is monitored on a regular basis. Due diligence is then carried out on the individual securities on the watch-list.

Stock selection decisions are based primarily on bottom-up fundamental analysis and are not influenced by benchmark weightings. Analysis of ESG criteria forms part of this process. Based on the portfolio as at end September 2023, the company has been awarded an ESG rating of ‘A’ by Morningstar.

Assessments of valuation depend on the type of stock being evaluated. P/E and EV/EBITDA ratios are used for profitable companies. However, the managers comment that the innovation stocks have to be looked at differently, using measures such as the addressable market and an assessment of the competitive landscape.

Asset allocation

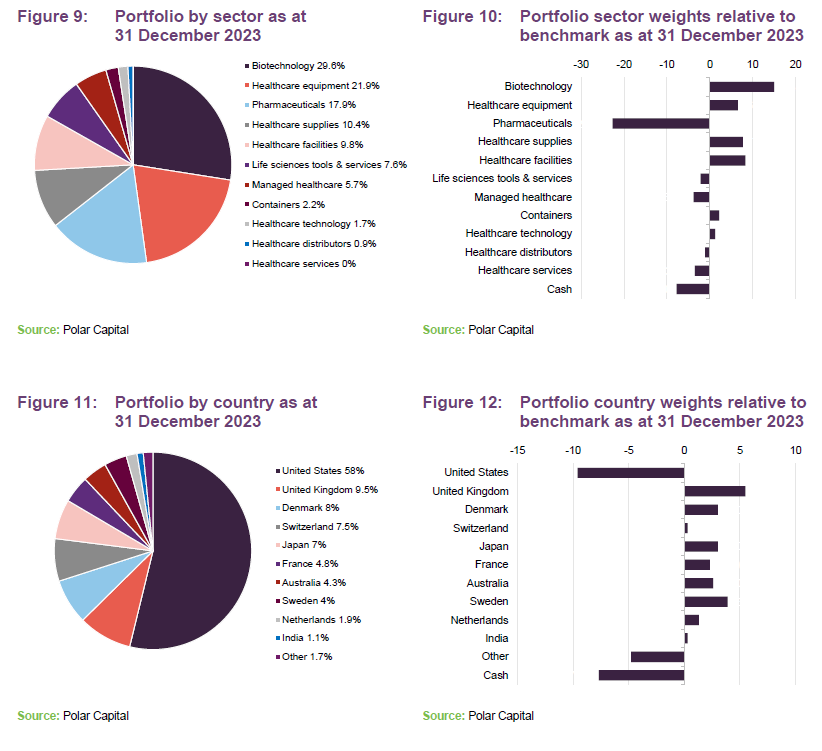

There were 42 positions in PCGH’s portfolio, and it had an active share of 80.54% relative to its benchmark at end December 2023. The bias to large cap within the portfolio is reflected in a 28% exposure to mega caps ($100bn+), and a 46% exposure to large cap ($10bn–$100bn).

The portfolio has an underweight exposure to large-cap pharmaceuticals (reflecting the potential negative impact of patent expiries) and an overweight exposure to biotech. There is also an overweight exposure to supplies and equipment on expectation of increased utilisation of healthcare by US seniors in particular, a theme that is also reflected in the overweight exposure to facilities. The counterweight to this is increased medical loss ratios, which is also reflected in the portfolio with the underweight exposure to UnitedHealth Group, which is discussed on page 14.

The managers say that life sciences and tools stocks have been impacted by the cash constraints being experienced by the biotech sector.

Top 10 holdings

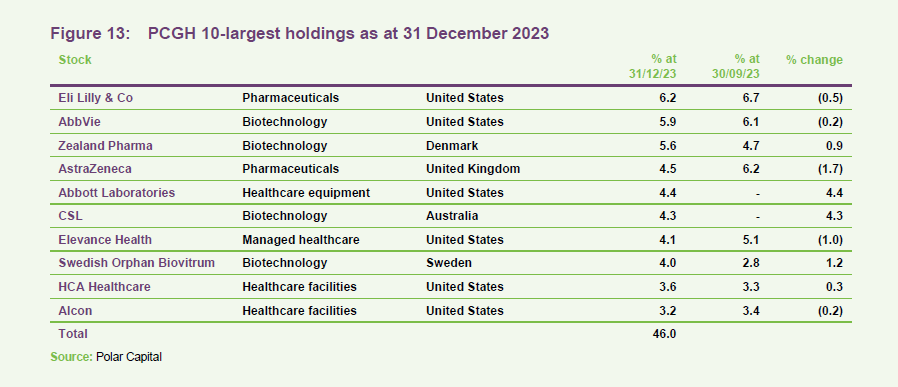

Over the final quarter of the year, Johnson & Johnson, which was the second-largest position in the portfolio at the company’s financial year end on 30 September 2023, dropped out of the list of the 10-largest holdings and is now one of the largest underweight exposures relative to the benchmark index, as Figure 15 shows. Other exits from this list were medical device company Intuitive Surgical and health insurance business Humana. These were replaced by Abbott Laboratories, CSL and Swedish Orphan Biovitrum.

In addition, PCGH’s managers have supplied us with data on the 10-largest under- and overweight exposures in the portfolio relative to the benchmark.

Looking at some of these in more detail:

Overweights

Zealand Pharma

Zealand Pharma (zealandpharma.com) is a Danish business focused on the discovery and development of peptide-based medicines. It has two products targeting rare diseases – Zegalogue, to tackle congenital hyperinsulinism, that is now on sale, and Glepaglutide for short bowel syndrome, which was submitted to the FDA for approval in December 2023. It also has a potential obesity product (survodutide) that it is developing with Boehringer Ingelheim (currently enrolling patients for a phase III trial), which seems to be attracting attention from investors including PCGH.

Swedish Orphan Biovitrum

Swedish Orphan Biovitrum (sobi.com/en), or Sobi, is focused on rare diseases with programmes in haematology (including haemophilia), immunology (including RSV), and speciality care. It has been experiencing revenue growth (up 18% in 2023).

Sobi is benefitting from sales of Elocta and Alprolix (factor VIII and factor IX clotting agents) for haemophilia; anti-cancer drug Vonjo; Doptelet, which is used to prevent excessive bleeding in adults with thrombocytopenia due to long-standing liver disease (the company has recently applied for approval to market the drug in China); Gamifant, which is used to treat a severe systemic inflammatory syndrome related to an over-active immune system; plus royalties on Beyfortus (nirsevimab), which was approved by the FDA for RSV in babies and young children in July 2023. In the US, the drug is being marketed by Sanofi. Sobi is getting royalty payments from Sanofi that start at 25% and rise to 35% by 2028. These are offsetting slowing sales of Sobi’s competing product, Synagis.

CSL

CSL (csl.com) is an Australian business with strengths in plasma products and vaccines. The company suffered during the pandemic when plasma collection was disrupted. The managers say that using as much of the plasma collected as possible for products is key to the company’s profitability. In that regard, they think that recent approval of a new product, TAVNEOS (avacopan) which is used to treat some forms of vasculitis (inflamed blood vessels) could help.

On the vaccines side, CSL and Acturus Therapeutics have developed a self-amplifying (sa) mRNA vaccine for COVID-19, which has been approved in Japan. This is the first approval for this type of vaccine. sa-mRNA vaccines can be used at lower concentrations than conventional mRNA vaccines.

HCA Healthcare

HCA Healthcare (hcahealthcare.com) is a healthcare facilities business with hospitals, free-standing emergency rooms, urgent care centres, ambulatory surgery centres and imaging centres. It offers a pure play on the growth of demand for healthcare in the US, which is estimated (by the Centers for Medicare & Medicaid Services) to grow at 6.1% CAGR between 2023 and 2031. HCA is also aiming to grow its market share, to capture more of that growth.

Alcon

Alcon (alcon.com) is the market leader in eyecare (ophthalmology) with a range of products and services including contact lenses, cataract surgery, and ophthalmic pharmaceuticals. The managers like its high-single-digit revenue growth and growing margins. They feel that the company’s strengths are underappreciated by investors.

Underweights

UnitedHealth Group

UnitedHealth Group (unitedhealthgroup.com) is the biggest health insurance company in the US. Optum is the care delivery part of the business, which encompasses Optum Health (physician groups), OptumRx (pharmacy benefit management), and Optum Insight (data, analytics, research, consulting, technology, and managed services solutions). UnitedHealthcare manages healthcare plans.

Increased utilisation of healthcare services is driving up medical loss ratios and this is the main reason that PCGH does not have a holding. The Q4 2023 results show that the company’s operating margins have been falling year-on-year.

Johnson & Johnson

Johnson & Johnson (jnj.com) was a top-10 holding until recently. The managers like the company, which has a strong presence in both medicines and medtech. However, they were growing increasingly worried about the potential claims related to the company’s legacy talc business.

Novo Nordisk

The managers like Novo Nordisk (novonordisk.com) and admit that, in retrospect, this should have been in PCGH’s portfolio. The company has benefitted strongly from its obesity-management drugs, but the managers were concerned about the potential for competing products to reduce the profitability of this business and what impact this would have on the company’s relatively full valuation.

Merck & Co

Merck & Co (merck.com) has a blockbuster product – Keytruda – which is one of the world’s best-selling drugs. However, its main Keytruda patent expires in 2028, which will leave a big hole in its revenues. Recent trials looking at the benefits of combining Keytruda with other therapies (one possible way of extending the product life) have ended in failure.

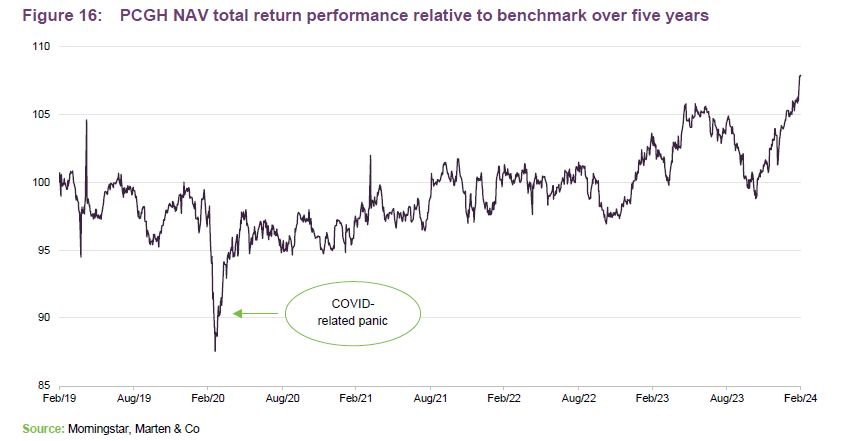

Performance

As Figure 16 shows, the COVID-related selloff caught the managers off guard in March 2020 (something that affected many other funds) and there were some real-world impacts on areas such as medtech. The managers quickly repositioned the portfolio and PCGH saw a strong recovery over the summer of 2020.

More recently, the managers observe that there has been a big dispersion of returns within the sector, and stock selection has been key to performance.

PCGH’s managers say that it has benefitted from its bias to large caps. However, the weakness in the biotech sector has been a headwind to the performance of the innovation portion of the portfolio. They have kept the proportion of the portfolio invested in innovation stocks at around 15–20% in recent years, despite the volatility in valuations in this part of the market. However, they have been pleased with the outcome of this as, generally, their stock picking has been good.

The current material underweight exposure to large-cap pharma reflects a long-held stance. However, the underweight was reduced materially for a while in 2022/3, reflecting the managers’ views on valuations of those stocks and investors’ likely preference for the perceived defensive qualities of big pharma stocks.

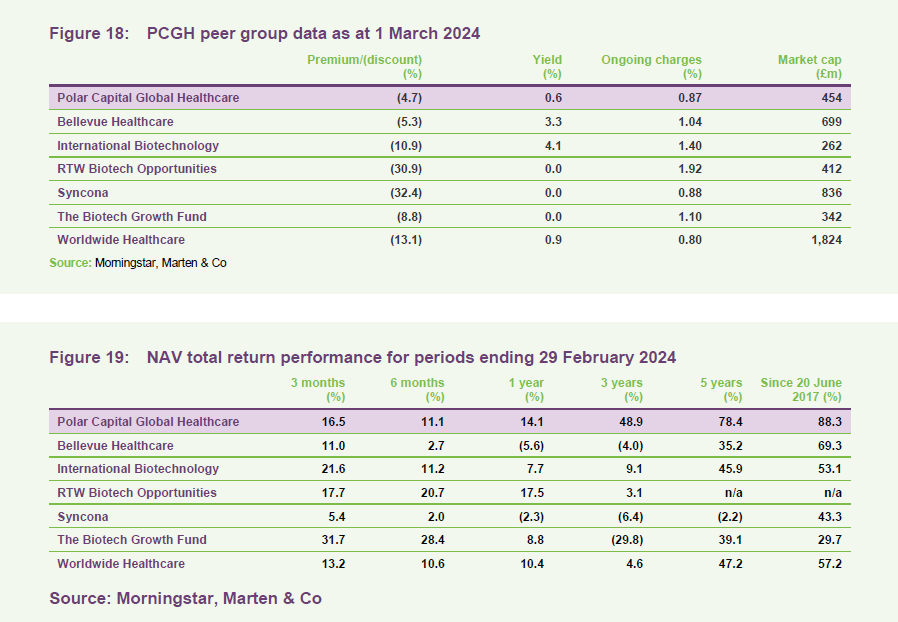

Peer group

Excluding minnow Adams (a £10m market cap fund) and Intuitive Investments (a recent listing which, through a reverse takeover, has now switched its attention from biotech to a Chinese lottery business), there are seven constituents of the investment company biotechnology and healthcare sector. These are listed in Figure 18.

PCGH’s market cap is close to the sector median and it has one of the lowest ongoing charges ratios within this peer group. Many of these discounts are wide, but PCGH’s is the lowest of these. PCGH’s yield reflects the managers’ focus on what is essentially a growth strategy.

PCGH’s NAV returns are sector-leading over most longer-term time periods. The managers say that another distinguishing feature of PCGH is that its mandate aims for more cautious, steady compounding growth when compared to its peers. They suggest that PCGH, with its bias to large and mega caps, is inherently one of the more defensive offerings in the space.

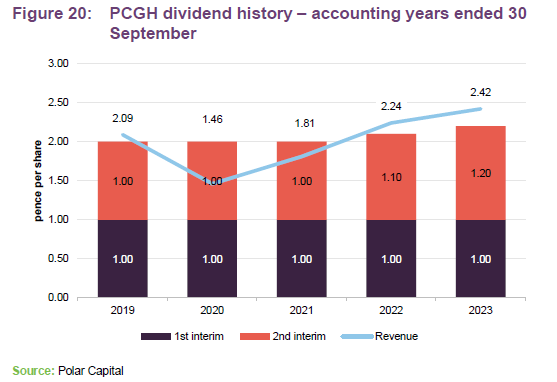

Dividend

PCGH’s focus is on capital growth, and whilst the company continues to aim to pay two dividends per year, these are expected to be a small part of shareholders’ total return.

At 30 September 2023, PCGH had a revenue reserve of £2.465m, equivalent to 2.0p per share. There is also an additional special distributable reserve of £3.672m (3.0p per share).

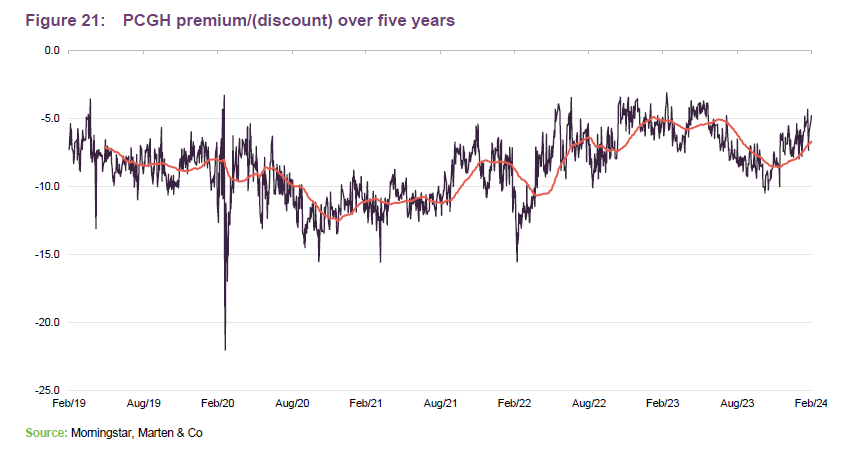

Premium/(discount)

Over the 12 months ended 29 February 2024, PCGH’s discount moved within a range of 10.5% to 3.1% and averaged 6.7%. At 1 March 2024, PCGH was trading on a discount of 4.7%.

As Figure 21 shows, the discount has been moving within a relatively narrow range for some time now. There has been a general widening of discounts across the investment company sector in recent years, but PCGH has not participated in this.

If the board finds that it needs to respond to a wider discount or to a premium, at its AGM, PCGH shareholders approve the issuance of up to 10% of its share capital and the repurchase of up to 14.99%. Shareholders are asked to renew this authority at each AGM.

Fees and costs

The base management fee is calculated as 0.75% of the lower of group market capitalisation (i.e. including the zeros) and adjusted NAV.

There is a performance fee which will be paid in cash at the end of the company’s expected life. It is 10% of the outperformance of the total return of the benchmark plus 1.5%, compounded annually. This fee is capped at 3.5% of the terminal NAV. There is a high watermark of 215.9p. No performance fee has been paid or accrued to date.

The investment management agreement can be terminated by either party with 12 months’ notice, or earlier subject to the occurrence of various events including a vote approved to liquidate PCGH.

For accounting purposes, the management fees are allocated 20% against revenue and 80% against capital. Overdraft interest (if any) is allocated in the same way, but the cost of the zero dividend preference shares (see page 19) is allocated against capital.

Aside from the directors’ fees, which are detailed on page 23, the only other significant items of expenditure in PCGH’s FY23 accounts were £208k for the administration fee to HSBC and £60k for the auditor PricewaterhouseCoopers LLP.

For the year ended 30 September 2023, PCGH’s ongoing charges ratio was 0.87%, marginally up on the prior year figure of 0.84%.

Capital structure

PCGH’s capital structure is comprised solely of ordinary shares. However, PCGH has issued zero dividend preference shares (zeros) through a wholly-owned subsidiary PCGH ZDP Plc, which has lent the proceeds to PCGH.

Zeros

PCGH ZDP Plc has a prior claim to the trust’s assets. Its 32,128,437 zeros outstanding were issued in June 2017 at 100p each and, having grown at an annualised rate of 3.0%, will be redeemed on maturity on 19 June 2024 at a final redemption price of 122.99p each.

With an initial gross redemption yield of 3.0%, the zeros provide fixed cost finance to the company at an attractive rate. No decision has yet been made as to what, if anything, will replace them. However, the board’s intention is to put PCGH ZDP Plc into liquidation on 19 June 2024. The company has no current intention to refinance the loan made by the subsidiary company and says that it remains in a strong position to repay the outstanding amount at the time of redemption of the ZDP shares.

Ordinary shares

There are 121,270,000 ordinary shares in issue with voting rights and a further 2,879,256 ordinary shares held in treasury.

Gearing

PCGH’s gearing is provided by the zeros. There is an overdraft arrangement, but no other form of borrowing is in place. PCGH is normally managed to be fully or substantially invested, but the manager is free to raise the cash weighting in anticipation of adverse market conditions.

Scheduled liquidation vote

In the absence of any prior proposals, at the first AGM following 1 March 2025, the directors will ask shareholders to vote on a resolution to liquidate the company. The voting arrangements are such that if anyone votes in favour of liquidation, it will go ahead. If the board think that it is in the best interests of shareholders to continue, it seems likely that an earlier vote would be called that asks if it is acceptable to remove the requirement to hold the scheduled liquidation vote. The board may put forward some proposals as to what any ongoing vehicle would look like at or around that time.

PCGH’s accounting year runs to 30 September each year and its most recent AGM was held on 8 February 2024.

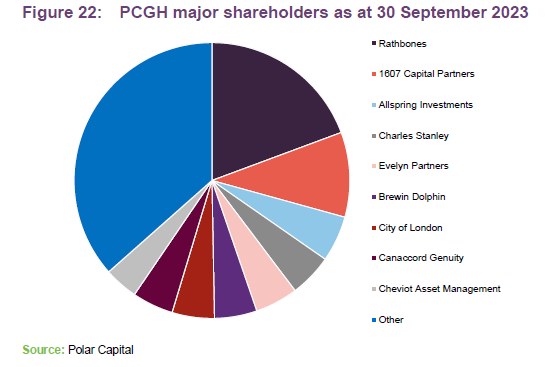

Major shareholders

PCGH has a relatively concentrated share register. However, many of the names listed are holding shares on behalf of multiple underlying clients.

Managers

PCGH’s co-managers are James Douglas and Gareth Powell. They form part of an eight-strong team.

James Douglas

James joined Polar Capital in September 2015 and was appointed co-manager for PCGH in August 2019.

James has 24 years’ experience having worked in equity sales specialising in global healthcare at Morgan Stanley, RBS and HSBC, prior to joining Polar Capital. He also has equity research experience garnered from his time at UBS, where he worked as an analyst in the European pharmaceutical and biotechnology team. Before moving across to the financial sector, James worked as a consultant for EvaluatePharma.

James has a PhD and BSc (1st Class Hons) in Medicinal Chemistry from Newcastle University. He also holds the ACCA diploma in financial management (DipFM).

Gareth Powell

Gareth joined Polar Capital in 2007 to set up the Healthcare team. Prior to Polar Capital, he worked at Framlington, where he began his career in investment management in 1999. Soon afterwards, he joined the Healthcare Team in 2001 and helped launch the Framlington Biotech Fund, which he managed from 2004 until his departure.

Gareth took a Masters in Biochemistry at Oxford, during which time he worked at Yamanouchi, a leading Japanese pharmaceutical company (later to become Astellas). As well as this, he worked for the Oxford Business School and various academic laboratories including the Sir William Dunn School of Pathology and the Wolfson Institute for Biomedical Research.

Gareth is a CFA Charterholder.

Daniel Mahony

Daniel joined Polar Capital to set up the Healthcare team in 2007. From 2019 he focused on leading healthcare strategy and business development and, since October 2021, has worked with the team on an advisory basis. Prior to joining Polar Capital, he was head of the European healthcare research team at Morgan Stanley, covering the European biotechnology, medical technology and healthcare services sectors.

Previously, Daniel worked in New York for ING Barings Furman Selz following the US biotechnology sector. Before working in the investment field, Daniel worked as a research scientist for seven years, with the majority of his time at Schering Plough Corporation in California.

Daniel has a BA (1st Class Hons) in Biochemistry from the University of Oxford, and a PhD in Developmental Biology from the University of Cambridge.

David Pinniger

David joined Polar Capital in August 2013 as a portfolio manager within the Healthcare team, to launch the Polar Capital Biotechnology Fund. Prior to joining Polar Capital, David was portfolio manager of the International Biotechnology Trust at SV Life Sciences.

Previously, David spent three years working at venture capital firm Abingworth as an analyst managing biotechnology investments held across the firm’s venture and specialist funds, and four years at Morgan Stanley as an analyst covering the European pharmaceuticals and biotechnology sector.

David has a BA (1st Class Hons) in Human Sciences from the University of Oxford and is a CFA Charterholder.

Deane Donnigan

Deane joined Polar Capital in June 2013 and is the lead manager of the Polar Capital Healthcare Discovery Fund.

Prior to joining Polar Capital, she began her career at the Medical College of Georgia, before becoming a clinical specialist in Drug Information and Adult Internal Medicine with Emory University Hospital in Atlanta, Georgia. After several years, she moved to the UK to join Framlington (now AXA Framlington) as an analyst for the healthcare unit trust, led by Anthony Milford. She went on to become lead portfolio manager of the Framlington Healthcare and Framlington Biotechnology funds. Deane is both a US and UK citizen.

Deane is a Doctor of Pharmacy (PharmD), Clinical Pharmacy, University of Georgia in conjunction with the Medical College of Georgia. She is also a board-certified and licensed pharmacist, ACCP board certified pharmacotherapy specialist, and is IMRO qualified.

Damiano Soardo

Damiano joined the Polar Capital Healthcare team as an investment analyst in October 2020. He started at the company in 2016 as part of the operations team before moving to the risk team in 2019. Prior to joining Polar Capital, he worked as a technical consultant at a fintech company. Damiano has an MSc in Mathematics and Foundations of Computer Science from the University of Oxford and is a CFA charterholder.

Tara Raveendran

Tara joined Polar Capital in September 2021, as a consultant focused on independent research for the team. Prior to joining Polar Capital, she was the head of Healthcare & Life Sciences Research at Shore Capital.

Previously Tara spent over 15 years working in equity research, specialising in European pharmaceuticals, biotechnology and medtech at Lehman Brothers and Jefferies. She has also worked with a number of healthcare-focused startups through her life sciences consultancy, SSquared Consulting, most recently working with the UK government’s Vaccine Taskforce.

Tara has a BSc in Biochemistry and a PhD in Structural Biology from Imperial College, London.

Brett Pollard

Brett joined the Polar Capital Healthcare team in September 2021 and has 22 years of healthcare industry experience, 13 of which have been in healthcare investing.

After completing a PhD in Molecular Virology at the University of St. Andrews, he worked as a healthcare research analyst, covering stocks in pharmaceutical, biotechnology, medical device and healthcare service subsectors. In 2008, he cofounded an in vitro diagnostics business where he initially led corporate and business development before taking on the role of chief operating officer.

After time spent in strategic advisory services, Brett moved back into corporate development and investor relations’ roles before joining the Polar Capital Healthcare team. His extensive industry and investment experience has allowed him to rapidly build up detailed coverage of the healthcare sector in emerging markets.

Brett studied cell and molecular biology at the University of St. Andrews, and has a PhD in molecular virology.

Board

PCGH has four directors, all of whom are non-executive and independent of the manager. All directors submit themselves for re-election at each AGM. The policy is that directors retire after nine years’ service. However, the board is content that a director who is subsequently promoted to the role of chairman can serve up to 12 years in total (including nine as a non-executive director).

Lisa Arnold

Lisa was formerly a global pharmaceuticals and healthcare analyst for NatWest Markets from 1987 and continued her healthcare career in roles with UBS Warburg, Commerzbank and Lehman Brothers. Lisa has held a number of independent adviser and non-executive roles, including nine years with the Medicines and Healthcare Products Regulatory Agency (MHRA) and eight years as a non-executive director of Futura Medical Plc.

Lisa is a non-executive director of Rothesay, the life insurance company and of Pimco Europe Limited, the asset manager, where she chairs the audit committee. She also chairs the Allied Domecq pension fund and is a trustee director of Whitbread Pension Fund.

Neal Ransome

Neal is a chartered accountant with an MA in Modern History from Oxford University. He was a partner at PwC from 1996 to 2013 and led PwC’s Pharmaceutical and Healthcare M&A practice for 17 years. He was also chief operating officer of PwC’s Advisory Services business.

Neal is currently chair of Octopus AIM VCT Plc and ProVen VCT Plc.

Andrew Fleming

Andrew is chair of Saltus Asset Management Limited and was previously chief executive of Waverton Investment Management. He started his career at Gartmore where he was a main board director and head of equities. Andrew went on to hold senior positions at ABN Amro and was chief executive of Kames Capital for nine years. He was a director and chairman of JP Morgan Japanese Investment Trust Plc retiring in December 2018.

Andrew is a non-executive director of Keystone Positive Change Investment Trust Plc. Andrew is also involved with a number of social enterprises including acting as chair of CTVC Limited and Hillside Productions Limited, both affiliated with The Rank Foundation; where he is a trustee. He is also advisor to the Volant Charitable trust and a member of the investment advisory committee of AMIH Holdings and Azalea Trust.

Jeremy Whitley

Jeremy was formerly head of UK and European Equities at Aberdeen Asset Management, a position he held from 2009 to 2017. Previous roles there included being a senior investment manager on the Global equities team as well as on the Asian equities team, based in Singapore, where he was lead manager of the Edinburgh Dragon Trust. He began his investment career at SG Warburg & Co in 1988.

Jeremy is currently a non-executive director and chairman of the audit committee of The Scottish Oriental Smaller Companies Trust Plc, and chairman of JP Morgan Indian Investment Trust Plc.

IMPORTANT INFORMATION

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Polar Capital Global Healthcare Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.