AI caramba!

Polar Capital Technology’s (PCT’s) manager remains all in on the artificial intelligence (AI) investment theme, having fine-tuned the portfolio towards the ‘AI enablers’ and ‘AI beneficiaries’ that it considers will outperform the wider sector over the long-term. 2024 is set to be a profound moment for AI and a showcase for the rapid rise in its use and capability – with several new large language model launches expected, including OpenAI’s GPT-5. These launches will not only act as progress waypoints, but could also turbo-charge already-impressive adoption rates and help embed AI into everyday life.

Technology company capital expenditure (capex) – one of the manager’s most important data points for gauging future growth prospects – has ballooned, with the cloud hyperscalers (the collective term for the largest cloud companies such as Amazon Web Services and Microsoft Azure) revising up projections and sending a clear signal about the potential size of the AI market. With one of the largest technology investment teams in Europe and a private fund that has been dedicated to AI for almost seven years, PCT’s manager’s expertise ought to be reflected in the trust’s rating, a discount to NAV of 6.7% seems attractive.

Global growth from tech portfolio

PCT aims to maximise long-term capital growth through investing in a diversified portfolio of technology companies around the world, diversified across both regions and sectors within the overall investment objective to reduce investment risk.

At a glance

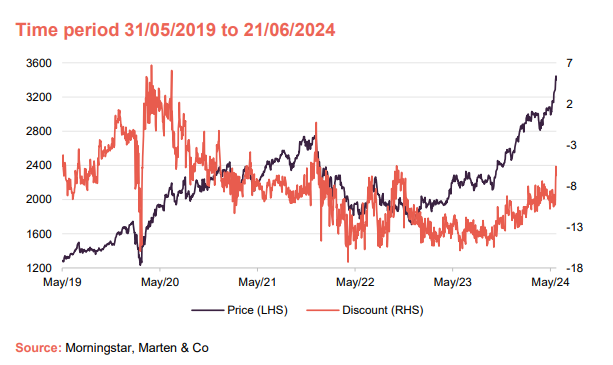

Share price and discount

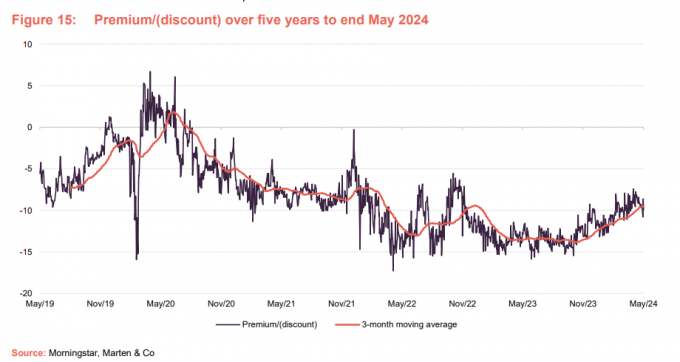

Over the 12 months to 31 May 2024, PCT’s shares traded between a discount to NAV of 7.4% and 15.9%. The average discount to NAV over this period was 12.0%. At 14 June 2024, PCT’s shares were trading at a discount to NAV of 10.0%. This still feels like good value, especially given the substantial upside potential in the portfolio’s exposure to AI enablers and beneficiaries.

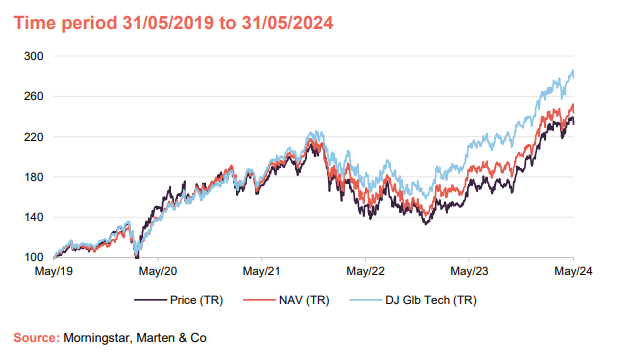

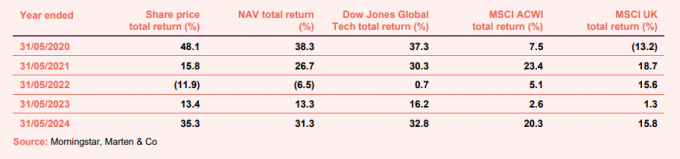

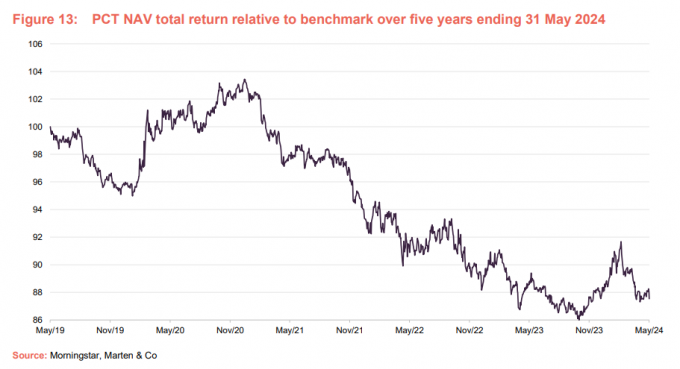

Performance over five years

PCT’s underperformance of its Dow Jones Global Technology benchmark since early 2021 has largely been due to the effect of its two largest underweight exposures – Apple and Microsoft – performing strongly. The considerable outperformance by large-cap versus mid- and small-cap technology companies continues to play out. PCT’s manager expects the spread to narrow when interest rates start to fall, which would benefit PCT over the benchmark due to PCT’s greater portfolio weighting to mid- and small-cap stocks.

Market backdrop

Fed indicates just one interest rate cut for 2024

As inflation proves stubbornly sticky at the final portion of its downward trajectory back to the US central bank’s (the Federal Reserve – the Fed) 2% target, the Fed has signalled that just one interest rate cut will come this year. Inflation eased to 3.3% in May, and core CPI (which strips out changes for food and energy prices) came in at 3.4% – both slightly below market forecasts.

At the start of 2023, the market had predicted up to six or seven interest rate cuts to come in 2024, while in March, the Fed said that it expected to make three cuts this year.

There was brighter news in Europe, with the European Central Bank (ECB) making a 0.25% cut to borrowing costs in the eurozone. However, with the US interest rate cut cycle being pushed out again, the investment landscape remains challenging.

The higher-interest-rate environment seems to be having the desired effect of cooling the US economy, with signs of softening consumer demand, reduced excess consumer savings and a weaker labour market. The Advance Estimate of US real gross domestic product (GDP) grew by less than expected in the first quarter of 2024, increasing at an annual rate of 1.6% (below forecasts of 2.5%).

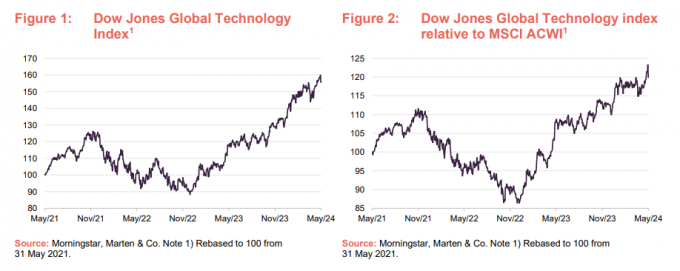

The challenging investment environment has been reflected in global equity markets, where gains have continued to be driven by technology (and the colossal share price performance of a handful of mega-cap technology stocks in particular). As reflected in Figures 1 and 2, over the first five months of 2024, the Dow Jones Global Technology Index was up 26.9%, while the MSCI All Country World Net Total Return Index was up 11.3% (both dominated by the same mega-cap stocks).

Figure 1 shows how PCT’s benchmark index has performed over three years. Figure 2 shows the benchmark’s performance relative to the broader MSCI All Countries World Index (MSCI ACWI) over the same period.

Despite the challenging investment environment, nothing has changed in PCT manager Ben Rogoff’s outlook for the sector. He remains extremely bullish on artificial intelligence (AI), with innovation, adoption, and capex all experiencing rapid progression.

AI innovation continues apace

New large language models, including GPT-5, to launch this year

We detailed the evolution of AI and the vast improvements in the capability of the technology in previous notes on PCT (see page 14 for links), and innovation has continued apace in 2024. A number of new and vastly improved iterations of large language models (LLM) are expected to be launched this year, including Open AI’s GPT-5, Meta’s Llama 3 model, and Amazon’s ‘Olympus’ model.

GPT-5, which could launch as early as this summer, is expected to build on the capabilities of its predecessor and be able to perform real-world tasks such as scheduling appointments, managing emails, or making online purchases — all without human oversight.

These will act as waypoints for the speed of progress being made

These products will act as important waypoints to assess the fundamental progress in the underlying AI technology. Far less significant was the launch earlier this month of ‘Apple Intelligence’ – Apple’s catch-all term for a suite of models that will be embedded in its newer phones, iPads, and Macs. The company has not built generative models (a type of AI which can create new content based on data they were trained on) of the complexity and scale offered by rivals and instead opted to partner with them (OpenAI, for example) to act as a gateway to other products on the market.

Hardware upgrades expected to incorporate AI functionality

Other product innovations to launch this year include enhanced AI PC models. AI PCs have the ability to learn, adapt and make decisions autonomously, through machine learning algorithms. The computers analyse vast amounts of data, identify patterns, and derive insights without explicit programming. An expectant hardware refresh or upgrade cycle to incorporate AI functionality saw PCT’s manager buy back into Dell, having been underweight the legacy hardware company for a number of years.

PCT’s manager says that a particularly exciting thought is that the new models will be as bad as they will ever be – i.e. they will only improve from here.

Promising adoption rates

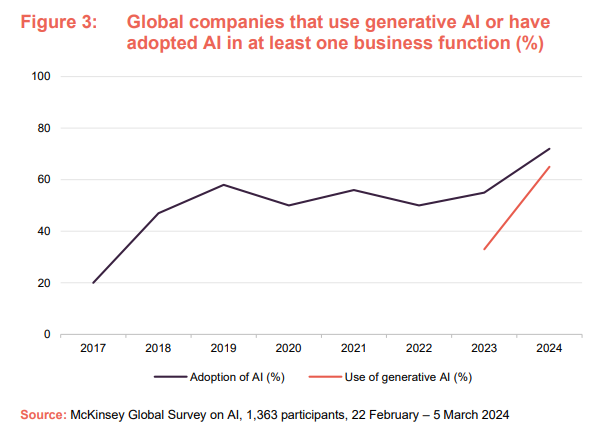

Two-thirds of businesses surveyed say they regularly use generative AI – up from 33% in 2023

Adoption rates are growing just as impressively as innovation. According to the latest McKinsey Global Survey, almost two-thirds of respondents (65%) report that their organisation regularly uses generative AI (AI that is capable of generating text, images, or other media, using generative models that learn the patterns and structure of their input training data and then generate new data that has similar characteristics), almost double the 33% from the 2023 survey. Furthermore, AI adoption in at least one business function has jumped up to 72%, from a rate floating around 50% for the past six years.

This tallies with the findings of tech companies. Both Microsoft and ServiceNow have recently reported that the adoption of their AI products is faster than any previous product.

An intriguing example of AI adoption and the productivity improvement capability of the technology comes from law enforcement software and hardware provider Axon Enterprise. The AI-powered report-writing software ‘Draft One’, which can auto-draft reports based on police body-camera footage and sound, was launched to help reduce the length of time police officers spend writing reports (which can be up to 40% of their time). It is saving police officers an hour per day on average on paperwork in the first trials, while a police force in Colorado reported an 82% decline in time spent writing reports and a “substantial” improvement in quality. PCT’s manager says that this is just an early glimpse into the kind of AI-driven innovation to come.

AI capex explodes

Hyperscaler capex expected to grow 44% year-on-year – upgraded from previous forecasts of 26% and 18%

The manager argues that the most important AI datapoint to gauge progress and future growth prospects is the capex numbers. The scale of positive capex revisions at the largest cloud companies such as Amazon Web Services, Microsoft Azure and Google Cloud – named collectively “the hyperscalers” – for this year is enormous. Hyperscaler capex in 2024 is now expected to grow 44% year-on-year to more than $170bn in aggregate, up from expectations of 26% (which itself was upgraded from a previous forecast of 18%). This represents the fastest growth since 2018. Technology research firm Gartner states that almost 60% of the hyperscalers’ total server spend will be on AI servers.

This gives PCT’s manager added confidence in the future of AI, especially given the hyperscalers’ visibility into AI product roadmaps. The meaningful step up in capex in AI sends a clear signal about the potential size and scope of the AI market in the future, the manager adds.

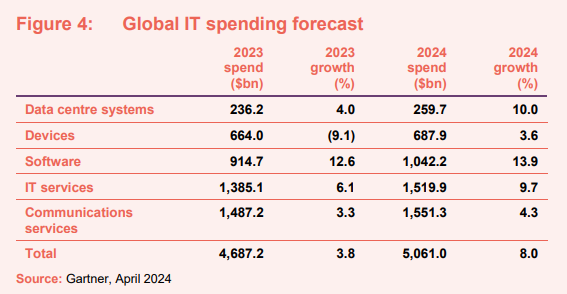

Global IT spending forecast to break $5trn in 2024

The AI infrastructure buildout continues at a frantic pace. Gartner has revised higher its 2024 global IT spending growth expectations from 6.8% to 8%, surpassing $5trn in the process, as shown in Figure 4.

Data centre spending is expected to see significant acceleration, from 4% in 2023 to 10% in 2024, in large part due to planning for generative AI, according to Gartner. It adds, however, that there are capacity constraints in the semiconductor and data centre markets, as well as bottlenecks around sufficient power and labour supply.

PCT’s manager also points to the substantial uplift in spend required on AI servers. For example, the GPU (graphics processing unit) required in an AI server is up to 25x more expensive than the CPU (central processing unit) used in a general-purpose server.

In the semiconductor market, Advanced Micro Devices suggests that the AI chip total addressable market (TAM) could be $400bn by 2027. This implies a CAGR of around 70% from the $45bn AI chip market in 2023. There are a number of assumptions used in this estimate, including a quadrupling of the user base and a 5x uplift in usage per user from current numbers, but a $400bn AI chip market implies 10m AI servers by 2027 (1.9m today) and $1.1trn total data centre spend in 2027.

Despite a 13.9% forecast growth in spend on software in 2024, as shown in Figure 4, PCT’s manager believes that the software sector looks increasingly exposed as a loser in the AI race. Investment in AI, the manager argues, is crowding out spend on other technology sectors, including software, and this is likely to heighten as the prevalence of AI grows. Capex spending will be focused on semiconductors, networks, and infrastructure at the likely expense of software, the manager says, adding that it is unsure if the benefits of AI will translate to applications and whether ‘pre-AI’ software companies are best placed to capture them. This has been reflected in PCT’s portfolio, with software now making up just 18.4% of exposure (down from 25.1% at the end of 2023, with the company exiting Workday and Salesforce) and semiconductors exposure growing to 38.6% (from 26.9%). The exception to the manager’s software concerns is cybersecurity, with AI broadening threats and cybersecurity stocks the likely beneficiaries.

AI risks continually evolving

The manager believes that it is still very early days in the AI growth story, but is very mindful of the risks to the speed of progress. GPT-5 will be a key indicator of the rate of progression being achieved. It is possible that the intensity of demand for – and the speed of adoption of – AI will subside, and monetisation of AI products disappoint.

Heightened regulation remains a risk to growth of AI, as AI-fuelled cyber-attacks rocket

A major risk is also that heightened regulation is introduced that may slow AI proliferation. As well as the potential impact on the employment market, governments may act to curb cyber-attacks. Incidence of ransomware attacks was up almost 70% year-on-year in 2023, as hackers used AI tools to create malware. According to Microsoft, the number of password attacks per second went up from 579 in 2021 to 1,287 in 2023, while phishing attacks (incorporating elements such as deepfakes and voice cloning) have become more sophisticated with the use of AI.

Government scrutiny of the use of AI, and its impact on privacy and jobs, is likely to come in some form or another. The Artificial Intelligence Act came into effect in the EU this year, setting rules to establish obligations for providers and users depending on the level of risk from AI. There is also the ongoing risk of legal challenges around the ownership of copyright and IP (intellectual property) of material that is used to train AI models that have yet to be resolved.

Portfolio

At the end of May 2024, there were 97 stocks in PCT’s portfolio (marginally down from 100 six months ago as the manager narrows in on AI beneficiaries or enablers). The portfolio remains benchmark-aware to express the best that the index has to offer, and to help manage risk.

The portfolio’s active share has trended higher over recent years, in part due to higher concentration in the index, as well as larger individual stock bets. The portfolio may be managed in a benchmark-aware style, but the manager is happy to have zero weightings in index names when he feels that their growth prospects do not merit their inclusion within the portfolio.

Cash and equivalents, which includes puts on the Nasdaq, was 4.9% of the portfolio at the end of May.

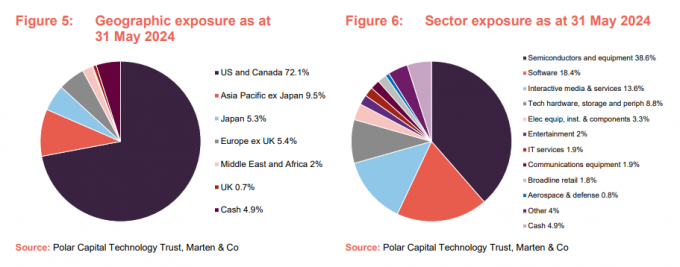

The most significant change in sector exposure, as shown in Figure 6, has been an uplift in exposure to the semiconductor sector at the expense of software – reflecting the fund’s amplified focus on AI spend. The manager does not try to add value through geographic asset allocation and its exposure here has remained relatively static over the last six months.

All in on AI

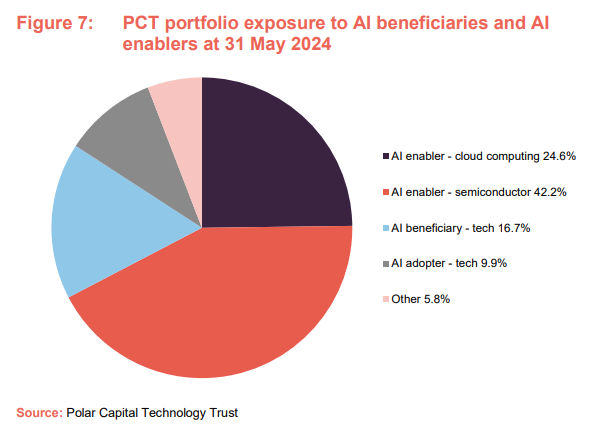

In our previous note, published in January 2024, we showed how PCT’s portfolio exposure had evolved and narrowed overwhelmingly towards stocks that are AI enablers (leaders in AI innovation) or beneficiaries (companies expected to benefit from the ascent of AI).

As Figure 7 illustrates, 83.5% of stocks in the portfolio are now categorised in this way (up from 79.5% six months ago), which increases to 93.4% when stocks that are classified as ‘AI adopters’ (companies aggressively adopting AI but it is not clear whether this will provide sufficient competitive differentiation in the longer term) are included. The manager stresses the importance of remaining liquid and open-minded on all technology stocks, cognisant of potential valuation traps (as multiples such as P/E ratios run much higher than long-term averages) developing as the AI narrative rapidly shifts.

10 largest holdings

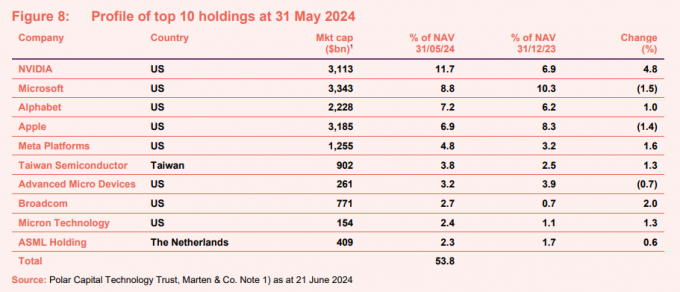

There have been a number of changes to the constituents of PCT’s top 10 holdings over the past six months, as the manager continues to make tweaks to the portfolio to reflect its conviction on AI and its views on the likely winners and losers. NVIDIA’s extraordinary growth over the last year (reflecting its leading role in supplying the high-power chips needed for the parallel processing that AI requires as the technology expands) has seen it become PCT’s largest holding by some margin. The higher-for-longer interest rate environment has meant that a broadening out of AI winners to the small- and mid-cap sector, which we wrote about in our last note, published in January 2024, has yet to play out. When rates finally do start to fall, a small- and mid-cap reversion should occur, the manager says.

We have discussed the manager’s views on many of PCT’s largest holdings in previous notes (links to which can be found on page 14). Some noteworthy portfolio exposure movements since our last note six months ago include:

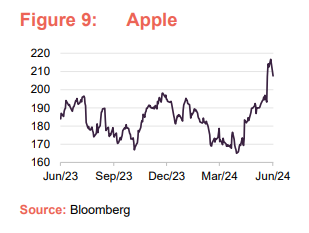

Apple

Apple is one of PCT’s largest underweight positions relative to the benchmark, reflecting the manager’s view that Apple has been a laggard in AI. As touched upon earlier, the company is adopting a partnership strategy when it comes to AI – with OpenAI announced this month and a later tie-up with Google’s Gemini rumoured – that will complement its own (far smaller) models, which will run on Apple devices. In launching Apple Intelligence and a range of AI features controlled from Siri (including interacting with GPT-4o), the manager says that Apple did not announce anything particularly unexpected or differentiated in terms of AI. Despite this, the share price shot up, as shown in Figure 9. The new AI features will only be available for the latest iPhones (iPhone 15 Pro and beyond), which make up around 5% of iPhone’s in operation, and could prompt a multi-year refresh cycle of Apple devices (and upward revisions to numbers) as consumer demand for the latest (and constantly improving) AI features grows.

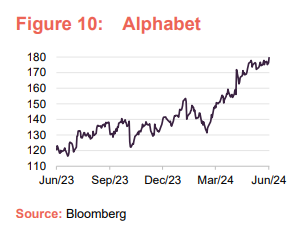

Alphabet

PCT’s holding in Alphabet has increased 100 basis points (bps – equivalent to 1.0%) to 7.2% since our last note, due to a marked share price uplift. A promising first-quarter earnings update included a 14.4% growth in core search and YouTube growth accelerating to 21% year-on-year – both above consensus estimates. The company has made significant progress in incorporating generative AI into its suite and announced a decrease in query costs for its Search Generative Experience offering, now down 80% since introduction. Although Google has lost just 20bps share in search in past 12 months, the manager says that it faces threat from AI rivals – especially OpenAI, which poses a credible threat as a direct replacement. The manager also believes that Google’s position as a ‘gateway to the internet’ will become much harder to sustain in an AI world. The knock-on effect could be a reduction in price per query.

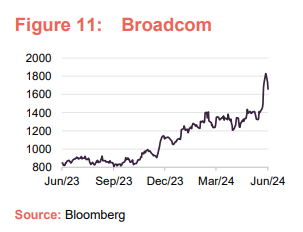

Broadcom

Having not featured in PCT’s portfolio for a number of years, the manager bought back into Broadcom at the back end of 2023 due to its position as a leading supplier of AI-linked chips, and has participated in an enormous share price gain, as shown in Figure 11. In a recent earnings update, the company raised its forecast for annual revenue from AI chips to $11bn from $10bn and raised its core profit projections. Broadcom makes next-generation, custom AI chips for two hyperscaler clients, and earlier this year added a third custom AI chip customer. The company’s shares have risen 95.7% in the past 12 months and it is attempting to make its stock more affordable through a 10-for-1 split, which should have the effect of further increasing demand for its shares. Broadcom had previously struggled to fit PCT’s manager’s investment process, due mainly to its merger and acquisition (M&A) track record, but that all changed due to the inflection in demand for its AI chips.

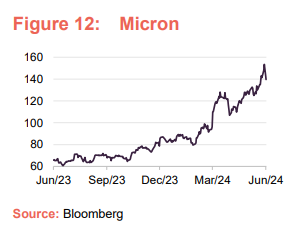

Micron Technology

Another new entrant to PCT’s top 10 holdings, and one of its largest overweight positions relative to the benchmark, is memory supplier Micron Technology. Recent earnings results and guidance were well ahead of expectations, driven by both AI and non-AI products. The manager expects improving demand for memory, combined with supply constraints, to drive prices higher in 2024 and 2025, leading to greater revenue and profitability going forward.

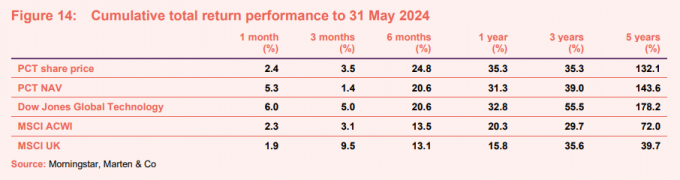

Performance

PCT’s underperformance of its Dow Jones Global Technology benchmark since early 2021 has largely been due to the effect of its two largest underweight exposures – Apple and Microsoft – performing strongly. This underperformance has seen its three- and five-year NAV returns fall significantly below the benchmark, as shown in Figure 14. However, over one year to the end of May 2024, PCT’s NAV returns were more in line with the benchmark – 1.5 percentage points lower.

Visit QuotedData.com for up-to-date information on PCT and its peer group

The considerable outperformance by large-cap versus mid- and small-cap technology companies continues to play out, as we have discussed in previous notes. PCT’s manager expects that the spread should narrow when interest rates start to fall, which would benefit PCT over the benchmark due to PCT’s greater portfolio weighting to mid- and small-cap stocks that it has categorised as AI enablers/beneficiaries.

Fund intro

More information can be found at the trust’s website: www.polarcapitaltechnologytrust.co.uk

PCT aims to maximise long-term capital growth through investing in a diversified portfolio of technology companies around the world, diversified across both regions and sectors. PCT launched in December 1996 as Henderson Technology Trust and, following a change of manager, became Polar Capital Technology Trust in 2001.

Management arrangements

PCT’s AIFM is Polar Capital LLP and the lead manager assigned to the trust is Ben Rogoff, a partner in Polar Capital LLP. He is supported by a team of 10 technology specialists, including another partner, Nick Evans, and deputy fund manager Alastair Unwin. Polar believes that this is one of the best-resourced teams dedicated to this sector within Europe. In addition to PCT, the team also manages two open-ended funds, Polar Capital Global Technology Fund and the Artificial Intelligence Fund. Collectively, these funds had assets under management of $12.3bn at 31 May 2024.

Ben joined the team from Aberdeen in 2003, having started his career in the years running up to the technology boom. The events surrounding the collapse of the tech bubble have influenced the way in which he manages money. One important lesson is that there is limited permanence in the technology sector; it is forever engaged in a process of creative disruption. Change in the sector is a non-linear process. Once-great companies can disappear, and minnows can become giants.

Nick Evans joined the team from Framlington in 2007. He complements Ben in having a more bottom-up approach to selecting stocks, whereas Ben has a bias to a top-down stance.

Previous publications

Readers interested in further information about PCT may wish to read our earlier notes. You can read them by clicking on the links below or by visiting our website.

| Title | Note type | Publication date |

|---|---|---|

| Confidence building | Initiation | 12 May 2020 |

| More to go for | Update | 15 December 2020 |

| Exciting times | Annual overview | 7 July 2021 |

| Eyes on the prize | Update | 10 May 2022 |

| Jockeying for position | Annual overview | 8 December 2022 |

| Me, myself and AI | Update | 14 June 2023 |

| The AI’s have it | Annual overview | 9 January 2024 |

| IMPORTANT INFORMATION | ||

|---|---|---|

| Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Polar Capital Technology Trust Plc.This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.Marten & Co is not authorised to give advice to retail clients. The research does not have | regard to the specific investment objectives financial situation and needs of any specific person who may receive it.The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note | until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited. |

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.