Polar Capital Technology

Investment companies | Update | 14 June 2023

Me, myself and AI

An inflection point in artificial intelligence (AI) – which combines computer science and datasets to enable problem-solving – is close to being reached. Major improvements in output and rapid adoption make the likelihood that it will become a general purpose technology – technologies that can affect an entire economy, like the computer and internet before it – and impact on all parts of everyday life an inevitability.

Polar Capital Technology’s (PCT’s) manager, Ben Rogoff, has a steadfast conviction in the all-encompassing potential of AI and has been positioning the portfolio towards AI winners, with the majority of PCT exposure now in companies that he believes will be AI beneficiaries.

It is estimated that between a quarter and two-thirds of jobs are exposed to AI automation, with a meaningful uptick in productivity and economic output expected as a result. A higher-than-usual cash position puts PCT in a good position to take advantage of volatility in the market and any buying opportunities that are thrown up in AI beneficiaries.

PCT’s shares are currently trading at an excessively wide discount to net asset value (NAV) of 13.4%, which seems attractive given the substantial upside potential in the portfolio’s exposure to AI beneficiaries.

Global growth from tech portfolio

PCT aims to maximise long-term capital growth through investing in a diversified portfolio of technology companies around the world, diversified across both regions and sectors within the overall investment objective to reduce investment risk.

Market overview

Higher interest rates having desired effect on inflation in most markets.

Aggressive quantitative tightening over the past 12 months is starting to have its desired impact on inflation in most markets. Data in the US has indicated that inflation has cooled, supporting the narrative that the US central bank (the Federal Reserve – the Fed) is getting closer to the point where interest rate rises will cease and we may start to see interest rates fall.

The headline Consumer Price Index (CPI) in the US rose 0.4% month-on-month in April (and 4.9% annually). Most leading indicators point to a further reduction in CPI, with headline Producer Price Inflation (PPI) Index falling 0.2% in April (translating to annual inflation of 2.4%) and the core metric (excluding food, energy, and trade services) rose 0.2% in the month.

The surge in interest rates over the last year appears to be weighing on businesses, however. The US economy remains relatively resilient but appears to be slowing. First quarter GDP grew by an annualised 1.1%, below market forecasts of 2%, slowing from a 2.6% expansion in the previous quarter, as business investment growth slowed, inventories declined and the housing market continued to suffer in the high interest rate environment. Consumer spending growth is still strong, however, accelerating to 3.7% (from 1% in the final quarter of 2022). The unemployment rate also remains at record lows (which is a concern as this tends to lead to wage inflation, which can lead to further price inflation creating a wage-price spiral).

Stress in the banking sector saw three small-to-mid-sized US banks – most notably Silicon Valley Bank (SVB) – fail, as well as a government-brokered deal to save Credit Suisse in Europe. The Fed has noted that developments in the banking sector were likely to result in tighter credit conditions for households and business and weigh on economic activity. Whether it was the first or the last thing to break remains to be seen, but the banking crisis may have had the effect of bringing forward the turning point in the interest rate cycle.

This would be welcome news for the technology sector, which has witnessed the most intense compression in valuations ever over the past year due to the higher interest rate environment (higher interest rates generally imply higher discount rates which tends to impact the valuations of growth sectors such as technology which have a higher proportion of their value discounted from some point in the future) and weakened risk appetite among investors. Equities are competing with bonds and cash in a way that they have not had to for a long time, with depressed investor sentiment resulting in the highest volume invested in bonds for decades.

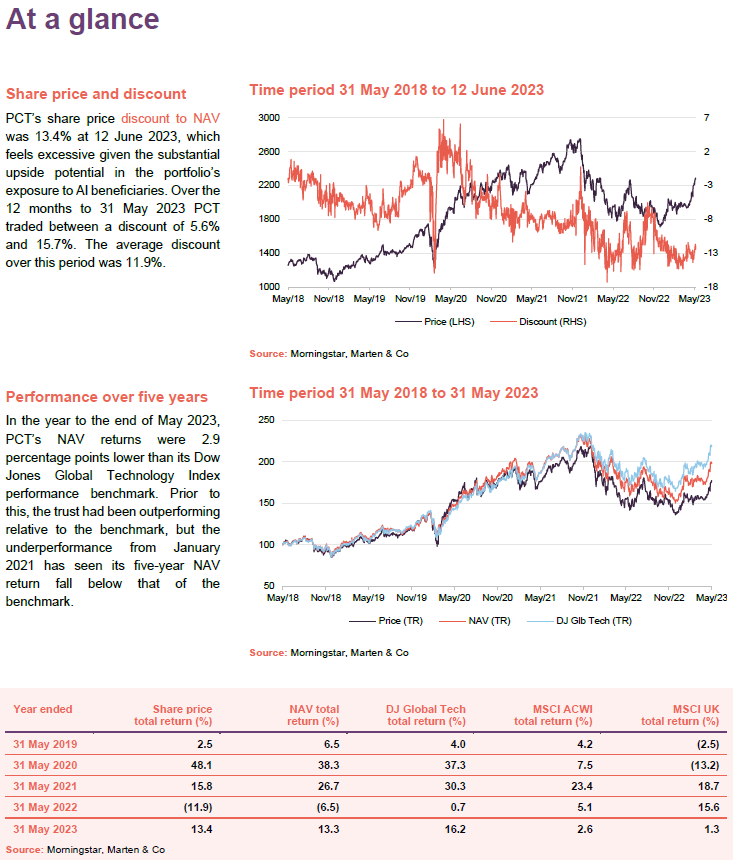

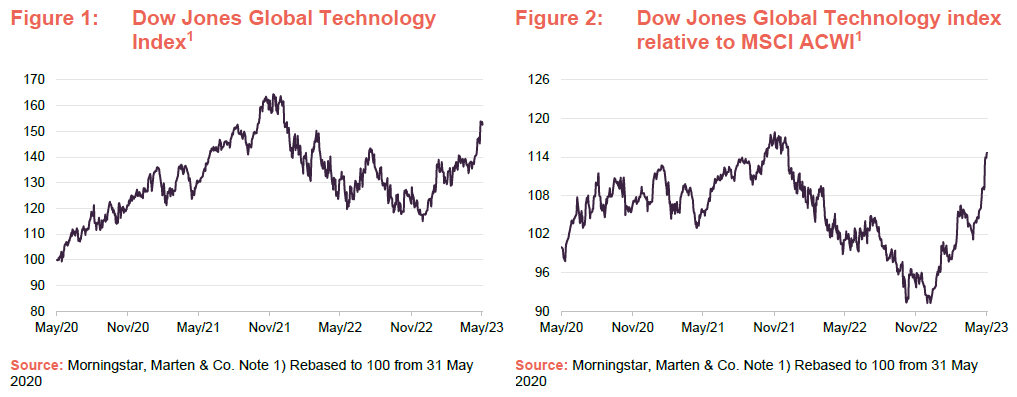

Investor sentiment towards the technology sector has picked up in recent months, having been extremely negative over 2022 as central banks tightened financial conditions to contain inflation, as shown in Figure 2. This may be down to investors’ ‘flight to safety’, with the five largest technology stocks (Microsoft, Apple, Amazon, Alphabet and Meta) having returned 31% this year to the end of April (versus a 3% return for the other 495 companies in the S&P 500).

Figure 1 shows how PCT’s benchmark index has performed over three years. Figure 2 shows the benchmark’s performance relative to the broader MSCI All Countries World Index (MSCI ACWI) over the same period.

With the macroeconomic backdrop improving (albeit it remains fragile), and sentiment and valuations recovering, the beginnings of a bull case are starting to emerge for PCT’s manager, Ben Rogoff. Although we are not out of the woods yet, and with plenty of bear cases lingering, Ben is bullish about the sector for one particular reason – artificial intelligence (AI).

It’s all about AI

Inflection point in AI close to being reached with rapid adoption.

Ben believes that we are close to reaching an inflection point with AI that will see it rapidly move from being a technological breakthrough to a general purpose technology (technologies that can affect an entire economy) with mass adoption, as was the case with earlier general purpose technologies such as electricity and more recently the internet.

PCT (and Polar Capital’s unlisted $345m Automation & Artificial Intelligence Fund) has been focused on AI for many years, but such is Ben’s conviction that AI will be all-encompassing in everyday life, he has started to pivot PCT’s portfolio to reflect the likely AI beneficiaries.

The potential of AI (which combines computer science and datasets to enable problem-solving) is enormous and somewhat incomparable, and certainly not a ‘hype cycle’ that has seen the clamour around previous tech cycles being massively overdone. Vast improvements in the capability of AI have been witnessed over a short space of time. It has moved from early incarnations driven by deep learning (which was used by Moderna to speed up the development of its COVID-19 vaccine, increasing the production of mRNA molecules from 30 to around 1,000 per month) to recent breakthroughs based on transformer models.

Transformers (launched by Google in 2017) are a type of neural network primarily used for natural language processing tasks. The model can weigh the importance of different parts of the input (by applying a set of mathematical techniques called self-attention) and allows for massive parallel processing. Unlike other models, transformers can handle longer documents and maintain longer conversations without context being lost. Most importantly, performance does not plateau as model complexity becomes exponentially larger. This is a significant improvement over earlier models that had a tendency to unlearn when trained to undertake new tasks.

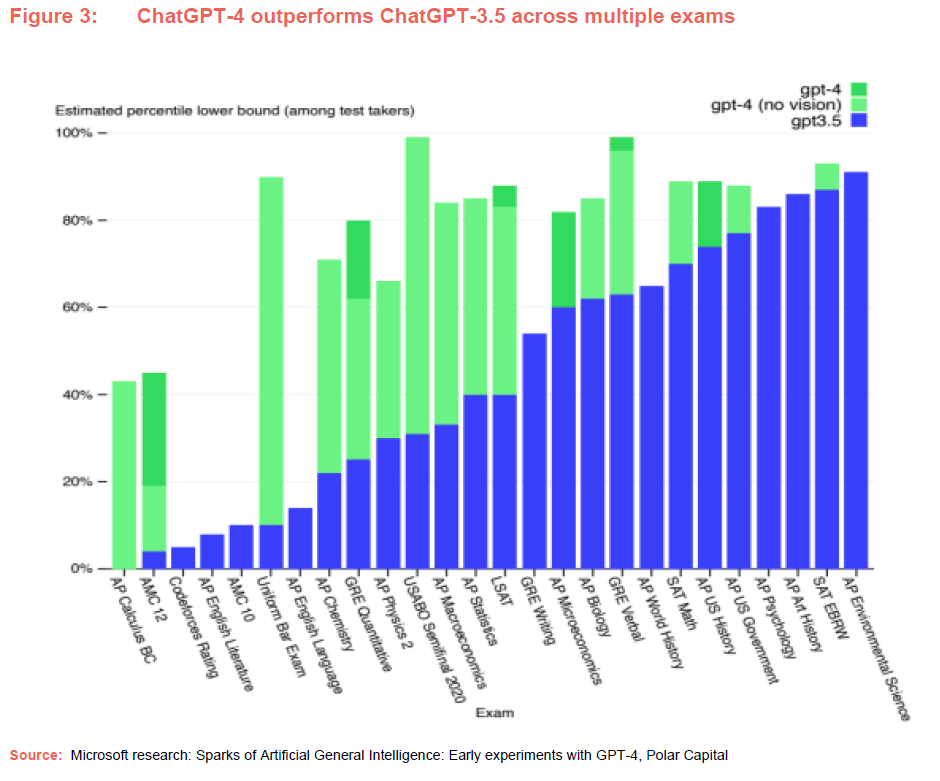

The improvement in performance observed in ChatGPT (short for Generative Pre-Trained Transformer, which is a language model developed by OpenAI) between its 3.5 version and ChatGPT-4 iteration (launched in March) is stark. GPT-4 is estimated to be trained on 100 trillion parameters, versus the 175 billion in the 3.5 version. It is larger, smarter and more efficient than its predecessor model, with a longer memory and better context size and window. It can also process image inputs, making it more reliable, creative, and able to handle more nuanced instructions.

In a Microsoft research paper on ChatGPT-4, published in April 2023, it said that beyond its mastery of language, “GPT-4 can solve novel and difficult tasks that span mathematics, coding, vision, medicine, law, psychology and more, without needing any special prompting. Moreover, in all of these tasks, GPT-4’s performance is strikingly close to human-level performance”. Figure 3 illustrates the improvement in the performance of ChatGPT-4 when sitting a series of exams, versus that of GPT-3.5.

The Microsoft researchers also tested the GPT-4 on the LeetCode’s Interview Assessment platform, a simulated coding interview for software engineer positions at major tech companies. GPT-4 solved all questions from all three rounds of interviews using only 10 minutes in total, against the allotted time of 4.5 hours. According to LeetCode, GPT-4 achieved 8.96/10, 8.69/10 and 10/10 scores in the three rounds and beat 93%, 97%, and 100% of all users, respectively.

The research concluded that it could “reasonably be viewed as an early (yet still incomplete) version of an artificial general intelligence (AGI) system” – one that can learn to accomplish any intellectual task that human beings can perform.

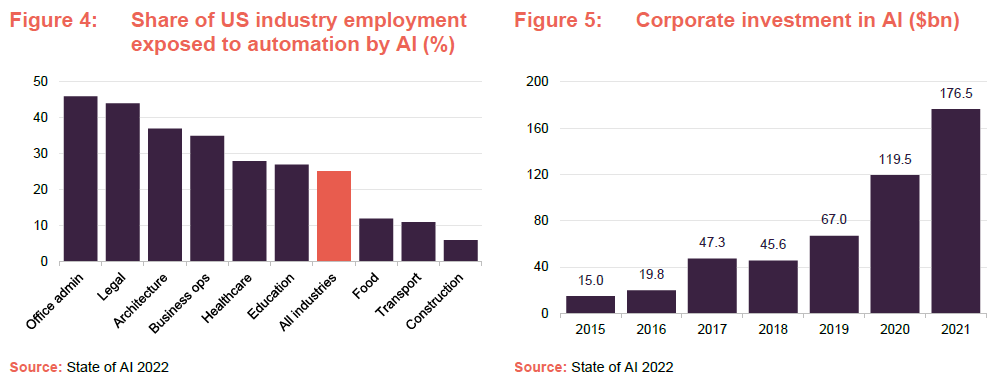

This may have profound implications for the labour market, especially around productivity. Goldman Sachs estimates that two-thirds of US jobs are exposed to AI automation. A further study, the State of AI, published in October 2022, estimates that a quarter of current employment tasks across industries in the US could be automated by AI, as shown in Figure 4.

Job roles in back-office administration, the legal profession, and architecture and engineering are most at risk, according to the research. Ben says that the education sector, which is already being disrupted through the essay-writing and exam capability of AI, could positively benefit from introducing AI into the classroom. The healthcare sector is another potential beneficiary, with Gartner stating that more than 30% of new drugs and materials could be systematically discovered using generative AI, up from 0% today.

The Goldman Sachs report also estimates that AI could raise annual US labour productivity growth by nearly 1.5 percentage points over 10 years following the widespread adoption of AI, potentially boosting annual global GDP by 7%.

Conviction in the future of AI by the big tech companies is reflected in the size and allocation of their capital expenditure. Morgan Stanley’s Cloud Capex Tracker suggests an 11% annual growth in capex in 2023, up three points from pre-earnings expectations, and management commentary in recent earnings calls has suggested higher capex was primarily related to AI investments. For example, Microsoft capex was up 15% in the first quarter, with investment expected to increase further to capitalise on the AI opportunity.

AI winners and losers

Majority of PCT exposure in companies that Ben believes will be AI beneficiaries.

PCT has broad exposure to AI with the majority of the trust exposed to what Ben calls ‘AI beneficiaries’, which have the potential to capture the benefit from AI innovation via new products, total addressable market (TAM) expansion, competitive advantage or more efficient operations.

An AI war has kicked off and the stakes are high for the tech giants. Ben believes that there will be more losers than winners in this war. Microsoft is an obvious winner, he adds, and is playing a leading role in the growth and development of AI. The company owns a 49% stake in OpenAI, through a series of investments since 2019, which has proved to be a shrewd move.

Microsoft has already integrated ChatGPT-4 within its Bing search engine and announced the limited release of Microsoft 365 Copilot, which effectively brings OpenAI technology to the core Microsoft Office suite to drive significant productivity enhancements across its Office products including Word, Excel, PowerPoint and Outlook. This is a substantial opportunity given Office’s 370 million users; one that Ben says could be monetised through a premium charge for these enhancements.

On the Azure cloud side of the business, customer numbers for Azure OpenAI reached 2,500 in the first quarter, up 10-fold quarter on quarter. Many of these were new to Azure, which Ben says suggests that the partnership and Microsoft’s AI leadership is driving market share gains. Azure cloud grew 31% year on year in the first quarter and has guided 26%-27% growth in the June quarter, with 1 percentage point of growth coming from AI services.

Apple has been weaving purpose-built machine-learning algorithms into its software for years, including object, face, and scene identification to the photos app, adding machine-learning techniques to biometric security identification, and electrocardiogram (ECG) tests on the Apple Watch that can be used to check your heart’s rhythm and electrical activity, as well as fall and crash detection on both the iPhone and Apple Watch.

Semiconductor stocks are secondary beneficiaries of AI.

There will be secondary beneficiaries to AI, too, mainly in the compute and storage sectors. Semiconductor stocks (like NVIDIA and Advanced Micro Devices) stand to benefit from the compute-intensive nature of large language model training and inference. NVIDIA, especially, is a company that Ben believes will be an AI winner. It is leading in the type of chip development that is used in coding language and is capable of meeting demand from across the industry to build generative AI.

Ben believes that Alphabet could be in a vulnerable position in the AI war. The search engine market, for which Google has a 90% share, is exposed to disruption, with Microsoft looking to eat away at this market share with the OpenAI backed Bing platform. Alphabet has launched its Bard chatbot in the UK and US in response to Bing Chat and ChatGPT, and Ben believes it has many AI cards up its sleeve that it has so far been careful about playing.

Amazon is another of the US tech giants that on the surface looks vulnerable. It does not have a consumer application (unlike Microsoft), but does have half of the cloud market, which gives it significant exposure to AI. The company is adamant that AI is a bedrock of all that it does, and Ben believes that it could benefit from the likely scale and data needed in the evolution of AI.

Adoption

Rapid adoption likely due to very few barriers.

There are very few barriers in stopping the rapid adoption of AI. Unlike previous general purpose technologies, such as electricity and the computer, the infrastructure and cost barriers to adoption do not exist. To access AI, users need a smartphone and internet, which puts the technology in the hands of 6 billion people worldwide. There is no upfront cost and the cloud infrastructure is in place. Reflecting this, ChatGPT took just five days to reach one million users in 2022 and just two months to reach 100 million in January 2023. By comparison, Instagram took two-and-a-half years to reach 100 million users.

The potential negative impacts of AI, such as disinformation and deep fake news, and the effect on the employment market could result in a slowdown in its adoption if governments attempt to regulate its use. Italy was the first western country to ban ChatGPT over privacy concerns. It quickly lifted this ban, but its data protection authority, Garante, now plans to review other AI platforms and hire experts to ramp up scrutiny of the technology. More government scrutiny is likely to follow, especially given the potential impact on privacy and jobs.

Having said that, Ben says the AI war is not just being waged in the western world, and that the US government will likely be encouraging Microsoft and Google in their AI developments as a vanguard against Chinese firms.

Asset allocation

At the end of April 2023, there were 89 stocks in PCT’s portfolio (down from 95 six months ago as the manager whittles down its positions in stocks that are not deemed AI beneficiaries). The portfolio remains benchmark-aware to express the best that the index has to offer, and to help manage risk. The portfolio’s active share has trended higher over recent years, in part due to higher concentration in the index as well as larger individual stock bets. At the end of April 2023, the active share was 51.7%. Due to their leading position in AI, unique market positions and strong cash flow generation, PCT has increased its exposure to Apple and Microsoft stocks (see Figure 8). Nevertheless, at the end of April, these two stocks were still PCT’s largest underweights. The portfolio may be managed in a benchmark-aware style, but the manager is happy to have zero weightings in index names when he feels that their growth prospects do not merit their inclusion within the portfolio.

Cash and equivalents, which includes puts on the Nasdaq, was higher than usual at 5.3% of the portfolio at the end of May, as Ben looks to take advantage of volatility in the market and any buying opportunities that are thrown up in companies that he perceives to be AI beneficiaries.

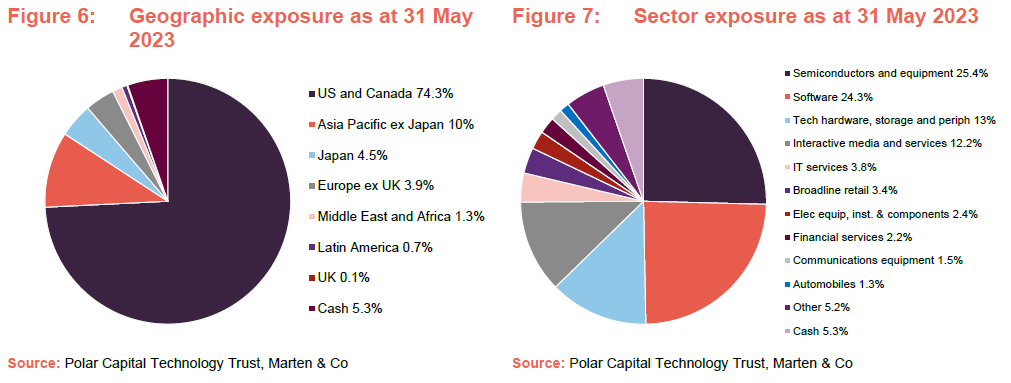

Ben does not try to add value through geographic asset allocation. PCT’s exposure to the US and Asia has grown at the expense of all other regions since we last published (using data as at the end of May 2023). In Figure 7, the most significant change is a reduction in exposure to IT services.

10 largest holdings

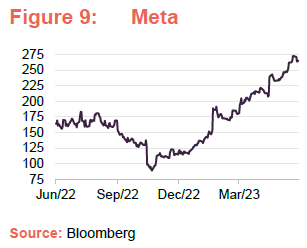

Reflecting the manager’s focus on AI, there have been some significant changes to the constituents of the top 10 list over the past six months, with exposure to both Microsoft and Apple increasing. As mentioned earlier, Ben believes that NVIDIA stands to benefit from the intensification of computing application as AI expands. Meanwhile, Meta Platforms (Facebook) has moved into the top 10 list of stocks due to Ben’s belief in its status as an AI leader.

We have discussed Ben’s views on Microsoft, Apple and NVIDIA in previous sections. Other noteworthy exposure movements since our last note six months ago include:

Meta platforms

Meta Platforms had been one of PCT’s largest underweight positions, but its exposure has grown in recent months on Ben’s belief that the risk-reward scenario is now much better. Although still underweight, Ben thinks that Meta will be an AI beneficiary due to its scale. For example, its PyTorch platform, which is a framework used for building deep learning models and is commonly used in applications like image recognition and language processing, is used by ChatGPT. Ben says that the company has been down the “hubristic” path and has successfully changed course. He also adds that the bear cases – the changes to IDFA (Identifier for Advertisers – which allows apps to track user behaviour on Apple mobiles for the purposes of ad targeting, personalisation and measurement) privacy settings that make advertising less effective (potentially taking $10bn out of its revenue) and the impact of rival social media app Tiktok (which took usage time out of the Meta family of social media apps) – have both peaked and will have smaller incremental impact going forward. In the recent quarterly earnings update, Meta reported all metrics coming in above market forecasts. Revenue was driven by higher advertising volume (but pricing continues to be impacted by advertising market softness), while engagement metrics were positive, with the number of daily active users (DAU) across the company’s family of apps topping three billion for the first time. Capital expenditure guidance was not raised, as sufficient AI infrastructure has already been put in place and management highlighted that they were already seeing returns on several AI initiatives.

Amazon

Amazon is PCT’s 9th-largest holding, with a 2.1% exposure at the end of May, and is one of the fund’s largest overweight exposures. Ben admits that it has been a drag on performance, with its share price hit by slowing growth of Amazon Web Services (AWS) – down five percentage points to 11% year-on-year in April. He believes that the pace of the deceleration may be a reflection of the stress in the banking system in the wake of Silicon Valley Bank and AWS’s higher exposure to start-ups than Microsoft. It has also been hit by issues with the expansion of its fulfilment centre footprint (which it has had to look to sub-let). Ben says that it may have also been impacted by a perception that it may be an AI loser; however, he insists that this is unlikely to be the case, especially if scale and data are going to be important in the evolution of AI.

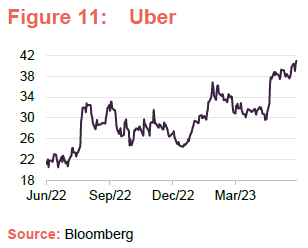

Uber Technologies

Having previously exited its position in Uber, PCT’s exposure at the end of April was 1.0%. Ben says this is a rate rise play, with the end of free money making it hard for its competitors in the ride hailing sector to grow. Many such competitors have been the victims of consolidation or have fallen by the wayside. Ben believes that the company continues to benefit from the re-opening of the economy, with the supply of drivers improving and demand strong (15% of revenue is airport runs). In its recent quarterly earnings update, the company reported gross bookings up 19% year-on-year. Revenue is likely to be boosted by the increasing contribution of advertising on its app, the company says. Ben notes that the performance of the company in a recessionary environment remains uncertain, but management stated that previous experience of localised recessions gives it confidence in the defensive characteristics of the business.

Alphabet

PCT’s holding in Alphabet has increased 30 basis points (bps – the equivalent of 0.3%) to 7.0% over the past six months, but Ben is still deliberating over the company’s ability to maximise revenue growth from AI (compared to peers such as Microsoft) as the Google search engine comes under threat from AI. Alphabet raised its capital expenditure guidance in its recent earnings update due to the build out of further AI capabilities, but unlike Microsoft, it gave no commentary about corresponding revenue growth attached to it. AI will be further integrated into existing products – which, Ben says, feeds the narrative that AI is a driver of higher costs/capital intensity for Alphabet without any obvious incremental revenue opportunities in the near term.

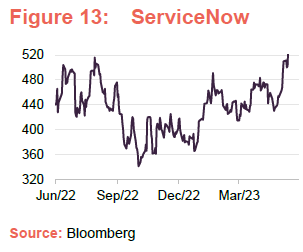

ServiceNow

ServiceNow, a software automation platform that helps companies manage digital workflows and automate work, now makes up 1.9% of the fund (down 40bps over six months). Ben admires ServiceNow’s business model and believes in its future growth potential, noting that management commentary regarding the strength of their sales pipeline and demand is encouraging. However, management have suggested that they may lower their longer-term targets to account for the current macroeconomic environment and FX (foreign exchange rates) headwinds.

Performance

Source: Morningstar, Marten & Co

Visit QuotedData.com for up-to-date information on PCT and its peer group.

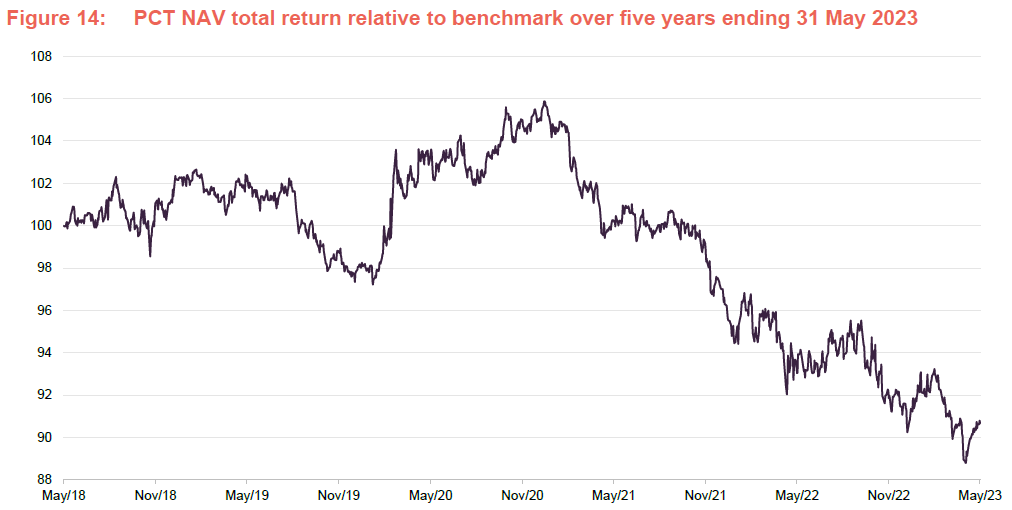

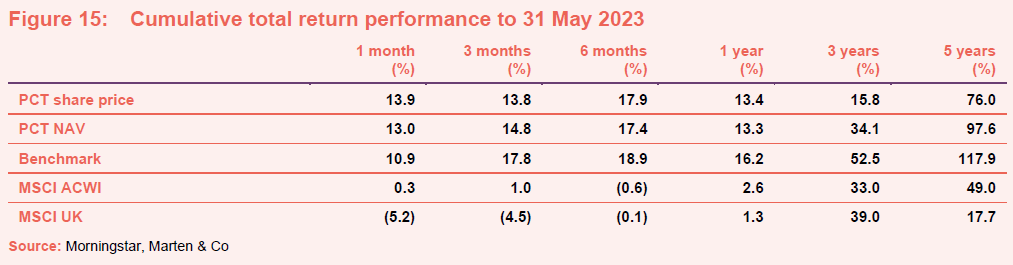

PCT’s underperformance of its Dow Jones Global Technology benchmark since early 2021 has largely been due to the effect of its two largest underweight exposures – Apple and Microsoft – performing strongly against a falling technology sector. In the year to the end of May 2023, PCT’s NAV returns were 2.9 percentage points lower. Prior to this, the trust had been outperforming relative to the benchmark, but the underperformance from January 2021 has seen its five-year NAV return fall below that of the benchmark, as shown in Figure 14.

The manager points out that there has been a vast outperformance by large cap versus mid and small cap technology companies – it notes that the Russell 1000 index (the top 1000 companies by market cap in the US) has returned 131.3% and the Russell 2000 index (the small cap index of US companies) 38.0% over the last five years. The magnitude of divergence is highly unusual and puts into context PCT’s performance.

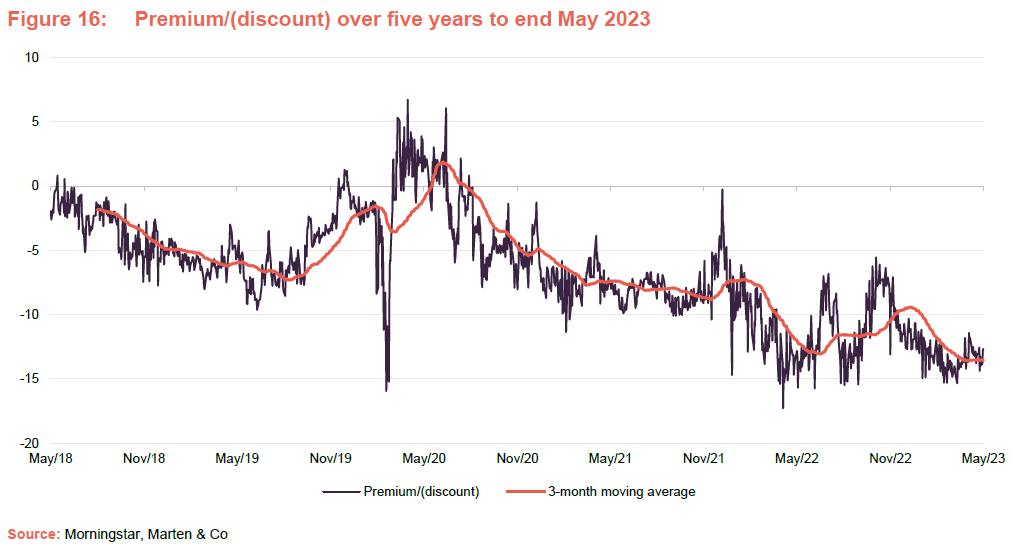

Premium/discount

Over the 12 months to 31 May 2023 PCT’s share price traded between a discount to NAV of 5.6% and 15.7%. The average discount over this period was 11.9%. At 12 June 2023, PCT’s shares were trading at a discount of 13.4%. This feels excessive to us, given the substantial upside potential in the portfolio’s exposure to AI beneficiaries.

Fund profile

More information can be found at the trust’s website: www.polarcapitaltechnologytrust.co.uk.

PCT aims to maximise long-term capital growth through investing in a diversified portfolio of technology companies around the world, diversified across both regions and sectors. PCT launched in December 1996 as Henderson Technology Trust and, following a change of manager, became Polar Capital Technology Trust in April 2001.

Hear about the fund

Management arrangements

PCT’s AIFM is Polar Capital LLP and the lead manager assigned to the trust is Ben Rogoff, a partner in Polar Capital LLP. He is supported by a team of eight technology specialists, including another partner, Nick Evans, and deputy fund manager Alastair Unwin. Polar believes that this is one of the best-resourced teams dedicated to this sector within Europe. In addition to PCT, the team also manages two open-ended funds, Polar Capital Global Technology Fund and the Automation & Artificial Intelligence Fund. Collectively, these funds had assets under management of $8.5bn at 30 April 2023.

Ben joined the team from Aberdeen in 2003, having started his career in the years running up to the technology boom. The events surrounding the collapse of the tech bubble at the start of the 21st Century have influenced the way in which he manages money. One important lesson is that there is limited permanence in the technology sector; it is forever engaged in a process of creative disruption. Change in the sector is a non-linear process. Once-great companies can disappear and minnows can become giants.

Nick Evans joined the team from Framlington in 2007. He complements Ben in that Nick has a more bottom-up approach to selecting stocks, whereas Ben has a bias to a top-down stance.

Hear about the manager

Previous publications

Readers interested in further information about PCT may wish to read our earlier notes. You can read them by clicking on the links below or by visiting our website.

Figure 17: QuotedData’s previously published notes on PCT

Source: Marten & Co

Legal

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Polar Capital Technology Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.